Florida isn't just a vacation destination. It's the proving ground for short-term rental investors who want real returns backed by real demand. According to Visit Florida's 2023 data, the state welcomed 140.6 million visitors that year alone. And in 2024, Orlando hit a record 75 million tourists, cementing Florida's position as the country's most visited state.

The numbers translate to opportunity. A 2024 national study ranked Tampa, Orlando, and Jacksonville as the #1, #2, and #3 short-term rental markets in the entire United States. These aren't theoretical picks. They're data-backed conclusions drawn from occupancy rates, rental yields, and home price growth.

This guide breaks down Florida's best STR markets for 2025. We cover the metrics that matter, the regulations you'll need to navigate, and the specific characteristics that make each market work for different types of investors. Whether you're buying your first Airbnb rental or rolling a 1031 exchange into vacation property, you'll find actionable intelligence here.

What Makes a Good Florida STR Market?

Not every "best" market is the same. Some deliver high cash yields on affordable properties. Others command premium nightly rates from luxury travelers. A few offer year-round stability that makes your projections predictable. Understanding what drives STR performance helps you match markets to your goals.

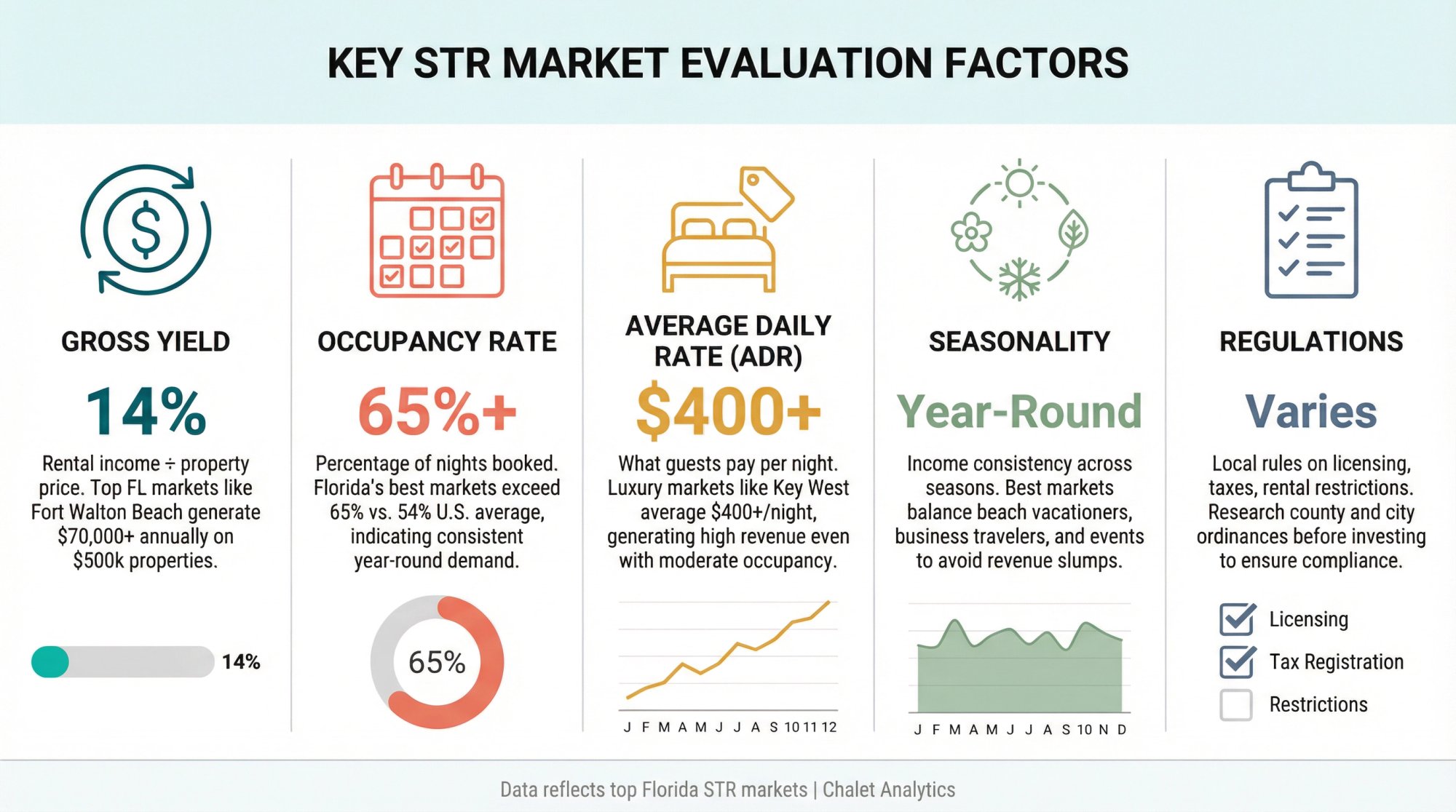

Gross Yield is your rental income divided by property price. It tells you how hard your money works. Markets like Fort Walton Beach show gross yields around 14%, meaning you could generate $70,000+ annually on a $500,000 property. That's exceptional compared to most real estate investments.

Occupancy Rate signals demand consistency. The U.S. average sits around 54% according to Chalet's market analytics. Florida's top markets often hit 65% or higher, indicating steady bookings beyond just peak seasons. Year-round tourist appeal (beaches, theme parks, business travel) keeps properties earning when other markets go quiet. You can compare average Airbnb occupancy rates by city across the country.

Average Daily Rate (ADR) measures what guests actually pay per night. Luxury destinations like Key West average over $400/night, generating substantial revenue even with moderate occupancy. Other markets trade lower ADRs for higher booking volume. Neither approach is wrong, but they suit different investment strategies.

Seasonality affects your cash flow timing. Florida's peak seasons (spring break, summer, holidays) can be extremely profitable, but markets with diversified demand avoid the big slumps. A mix of beach vacationers, business travelers, and event-goers keeps income more predictable throughout the year.

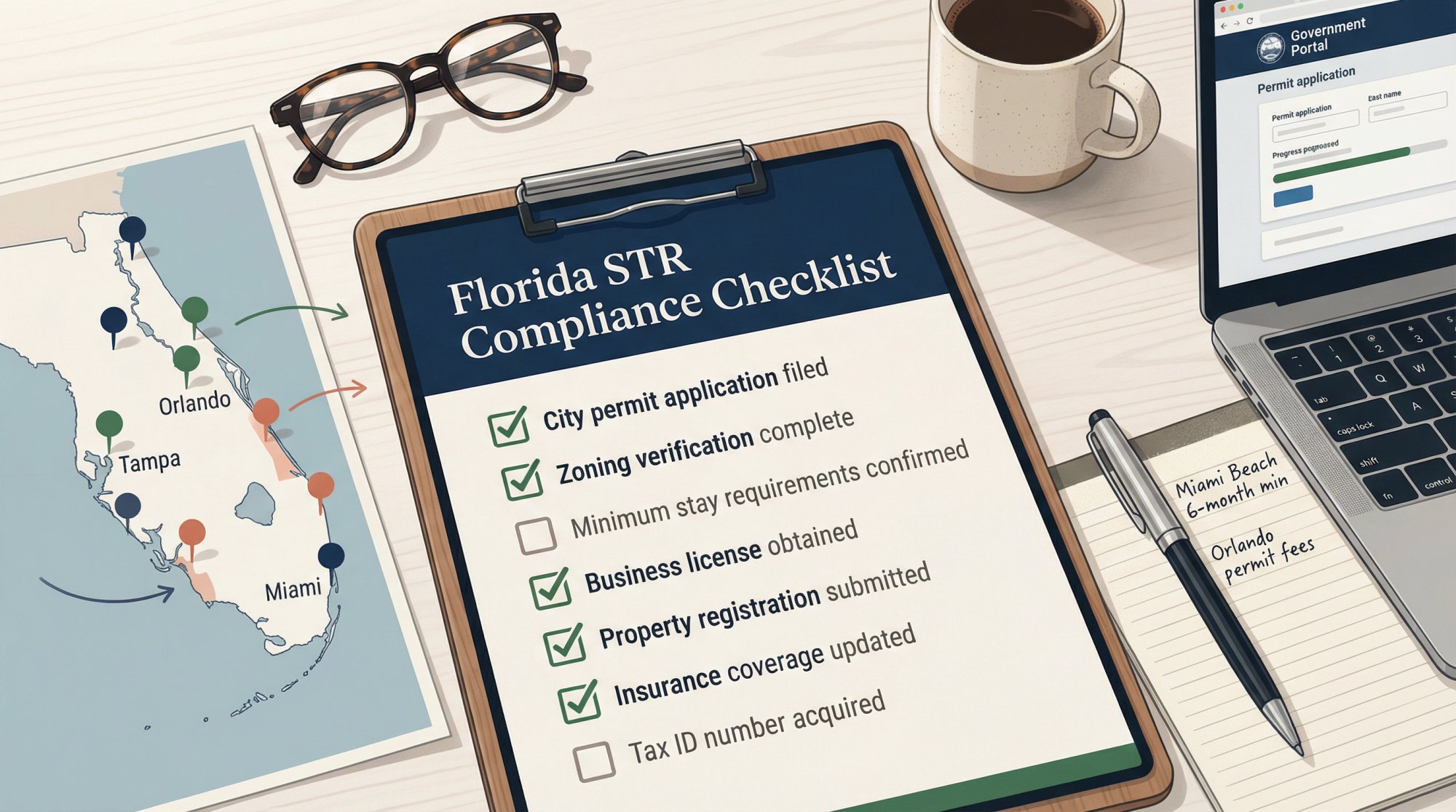

Regulations can make or break your investment. Some Florida cities welcome STRs with minimal restrictions. Others impose strict licensing requirements, minimum stay lengths, or outright bans in residential zones. Miami Beach, for example, prohibits most rentals under six months in residential areas. Always verify local rules before committing capital. Learn more about navigating rental regulations.

Pro tip: Chalet's regulation library tracks STR rules across Florida markets so you can check permit requirements and restrictions before you start shopping for properties.

Why Tampa Ranks #1 for STR Investment

Tampa earned the top spot in that 2024 national ranking, and the fundamentals explain why. This isn't a one-dimensional beach town. Tampa combines urban amenities with Gulf Coast access, creating demand from multiple traveler segments year-round.

The metro area sees bookings from NFL and NHL fans, convention attendees, cruise passengers departing from the port, spring training baseball crowds, and families heading to Busch Gardens. The Gasparilla Festival alone draws hundreds of thousands of visitors each January. That diversity keeps occupancy strong even in shoulder seasons when pure beach markets slow down.

Tampa STR Data: Revenue, Occupancy, and Yields

| Metric | Value |

|---|---|

| Active Rentals | ~2,500 |

| Average Daily Rate | $160-$200 |

| Annual Revenue (typical) | $34,000-$50,000 |

| Occupancy Rate | 66% |

| Gross Yield | 9-10% |

| Median Home Price | ~$372,000 |

That 66% occupancy beats the national average significantly. And while Tampa's home values have surged (up over 70% in five years), prices remain more accessible than South Florida's coastal markets. A $372,000 median gives you entry into a market generating $34,000-$50,000 annually per property.

Tampa's regulations are relatively investor-friendly. The city requires registration and lodging tax collection, but short-term rentals are broadly permitted in many areas. Some neighborhood associations have restrictions, so always verify at the property level. Read our complete guide on the best places to invest in Tampa short-term rentals.

Don't overlook the beaches. St. Petersburg and Clearwater sit just across the bay. Clearwater Beach ranked #6 on Tripadvisor's 2025 list and sees occupancy above 70%. Many investors pair a Tampa urban property (for consistent year-round income) with a beach property (for premium summer returns). The combination leverages the best markets in the Tampa Bay area.

Explore Tampa's full market analytics on Chalet

Orlando and Kissimmee: Theme Park STR Markets

You can't discuss Florida STRs without addressing the elephant in the room: Disney World. Orlando and its surrounding areas form the largest vacation rental market in the state, powered by Walt Disney World, Universal Studios, SeaWorld, and dozens of smaller attractions that keep 75 million annual visitors spending nights in the region.

What makes Orlando unique: Most "Orlando" Airbnbs aren't actually in Orlando city limits. They're in adjacent communities like Kissimmee, Davenport, and Lake Buena Vista. These areas sit closer to the theme parks and have zoning that explicitly welcomes vacation rentals. Entire residential developments were built specifically for STR investors.

Kissimmee and Davenport Revenue and Occupancy

| Market | Active Rentals | Occupancy | Annual Revenue | Gross Yield |

|---|---|---|---|---|

| Kissimmee | ~2,000 | 68% | $47,000 | Strong |

| Davenport | Varies | ~65% | $40,000+ | 12.9% |

| Orlando (city) | Large | 50-65% | $30,000-$35,000 | Moderate |

Kissimmee short-term rentals generate higher per-property revenue than Orlando proper because of large vacation homes that cater to families visiting the parks. A 5-bedroom pool home can command $200-$300+ per night, significantly more than a downtown Orlando condo. Davenport's 12.9% gross yield reflects affordable home prices combined with solid rental demand.

The demand in Central Florida is remarkably resilient. Holidays, school breaks, and summers all bring strong bookings. Even the traditionally slower fall season has events (Halloween Horror Nights, Epcot festivals, Food & Wine) that fill properties. Investors who market for mid-term stays to snowbirds or traveling nurses during winter months can boost their occupancy further.

Regulation considerations: Osceola County (Kissimmee regulations) and Polk County (Davenport regulations) are accommodating to STRs. Orlando city proper is more restrictive, allowing short-term rentals only in primary residences with day limits. Before buying, confirm the property's location allows the rental strategy you're planning.

For 1031 exchange investors, Central Florida's theme park market offers high-demand assets that satisfy exchange requirements while generating immediate income. The mature ecosystem of property managers, cleaners, and services makes operations straightforward.

Browse Orlando-area vacation rentals for sale

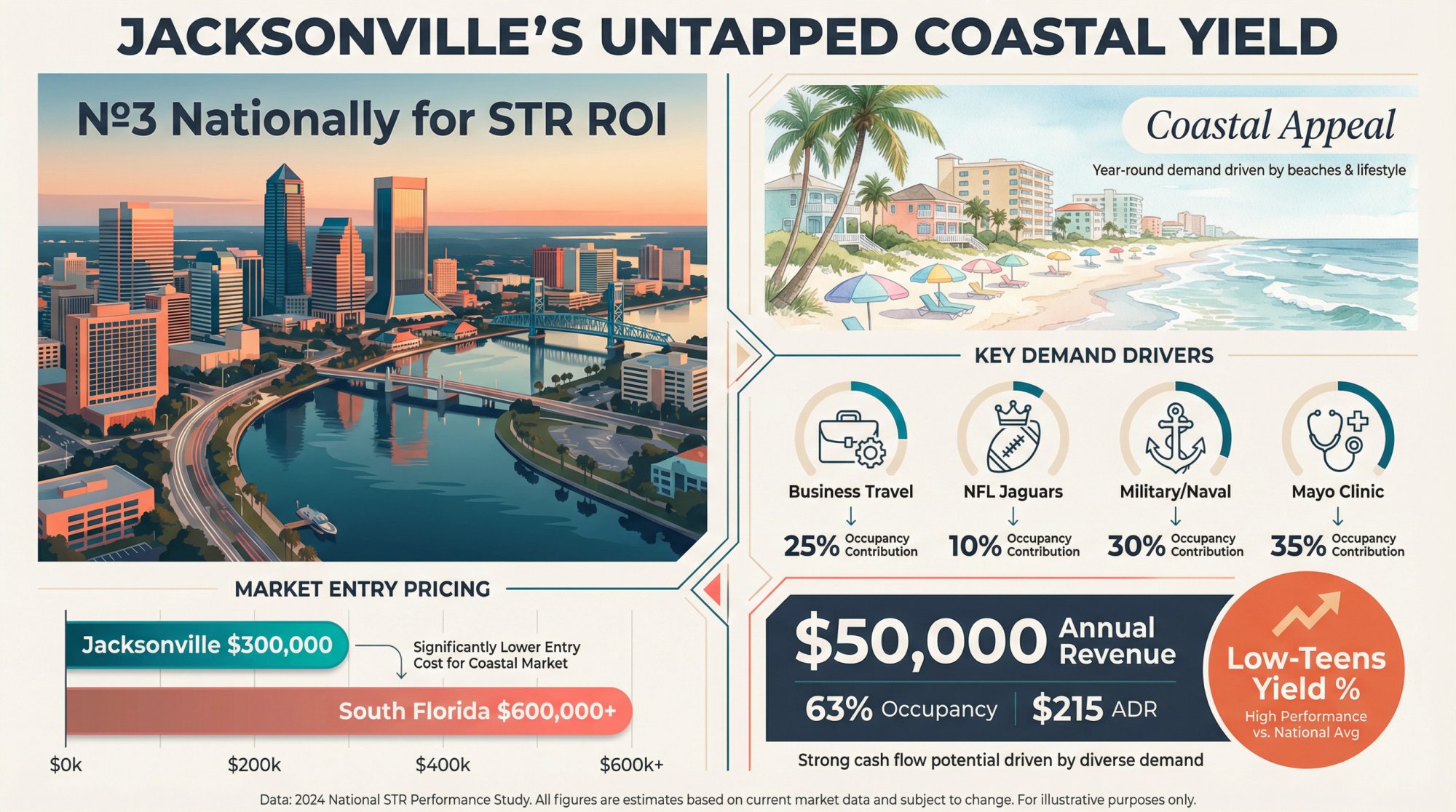

Jacksonville: High STR Yields with Low Entry Costs

Jacksonville gets overlooked. It's not a beach resort town or a theme park destination, so it doesn't generate the same buzz as Orlando or Miami. But that lack of attention creates opportunity for ROI-focused investors who understand the fundamentals.

Jacksonville ranked #3 nationally in that 2024 study, largely because of its compelling math: solid rental income on significantly cheaper properties. The median home price hovers around $300,000, well below South Florida's $600,000+ entry points. Yet investors are generating $50,000 annual revenue per listing with 63% occupancy and $215 average daily rates.

That translates to gross yields in the low teens percentage-wise. Few markets in America offer that combination of cash flow and affordability.

What Drives Airbnb Demand in Jacksonville?

The market isn't dependent on any single demand source. Business travelers fill properties during the week. The Jaguars NFL team brings weekend crowds for home games. Nearby beaches (Jacksonville Beach, Neptune Beach) attract leisure travelers. The substantial military presence at Naval Station Mayport creates consistent demand for short-term housing from families visiting personnel or attending flight school graduations.

Jacksonville's ~9,000 active Airbnb listings indicate a mature market with proven demand, but the metro is large enough that supply hasn't overwhelmed the opportunity. Jacksonville regulations remain lenient, with few of the restrictive ordinances that limit operations in other cities.

Sub-market opportunities:

Jacksonville Beach/Neptune Beach command the highest nightly rates in the region

St. Augustine (40 miles south) blends beach and historic tourism with ~64% occupancy and $220 average nightly rates

Downtown/medical district properties see consistent demand from Mayo Clinic visitors and business travelers

Some investors diversify with one urban Jacksonville property (steady year-round bookings) and one coastal property (higher ADRs during peak seasons). The strategy captures different demand segments while spreading risk.

Check Jacksonville's STR regulations

Miami and South Florida: Premium Returns with Strict Rules

South Florida represents the high end of Florida's STR market. Miami, Fort Lauderdale, and West Palm Beach offer some of the highest visitor demand and nightly rates in the state. International tourists, cruise passengers, business conventions, and cultural events (Art Basel, Ultra Music Festival) create year-round booking opportunities.

Miami City (the mainland, not Miami Beach) has become increasingly STR-friendly, allowing short-term rentals in certain zones and buildings. The numbers are strong: approximately 70% occupancy and $50,000+ annual revenue per listing. During major events, nightly rates can spike well above the $190-$200 average. Learn more about the best places to invest in Miami short-term rentals.

But South Florida comes with complications.

Miami STR Regulations by City

| Market | Regulation Status | Occupancy | ADR | Annual Revenue |

|---|---|---|---|---|

| Miami rules (city) | Permissive (in allowed zones) | 70% | $190-$200 | $50,000+ |

| Miami Beach rules | Strict (6-month minimum in residential) | 64% | High | Limited |

| Hollywood | Lenient | 69% | $214 | Strong |

| Fort Lauderdale rules | Registration required, generally allowed | 68% | $212 | Strong |

| West Palm Beach | Permits required, zone restrictions | 75% | Varies | Strong |

Miami Beach STR investing is not Miami. This distinction matters enormously. The city of Miami Beach (the barrier island) prohibits most rentals under six months in residential areas unless the property has specific condo-hotel zoning. Many condo associations throughout South Florida also ban short-term subleasing regardless of city rules. Always verify both municipal regulations and HOA/condo association rules.

Hollywood and Fort Lauderdale STR investing offer more accessible alternatives. Hollywood (between Miami and Fort Lauderdale) averages 69% occupancy with $214 ADRs and a strong beach/boardwalk tourist draw. Fort Lauderdale allows vacation rentals with registration and benefits from being a major cruise port.

The luxury opportunity: South Florida's high-end segment can generate extraordinary returns. Waterfront villas and luxury condos command several hundred to thousands of dollars per night. But acquiring these properties requires significant capital (Miami's median home price exceeds $600,000), and managing upscale Airbnbs comes with elevated guest expectations. Professional management is common in this segment.

Miami ranked #5 in the country for STR investment in 2024. Even with high entry costs, the rental demand and revenue potential justify the premium for investors who can afford it.

Search Miami-area STR listings

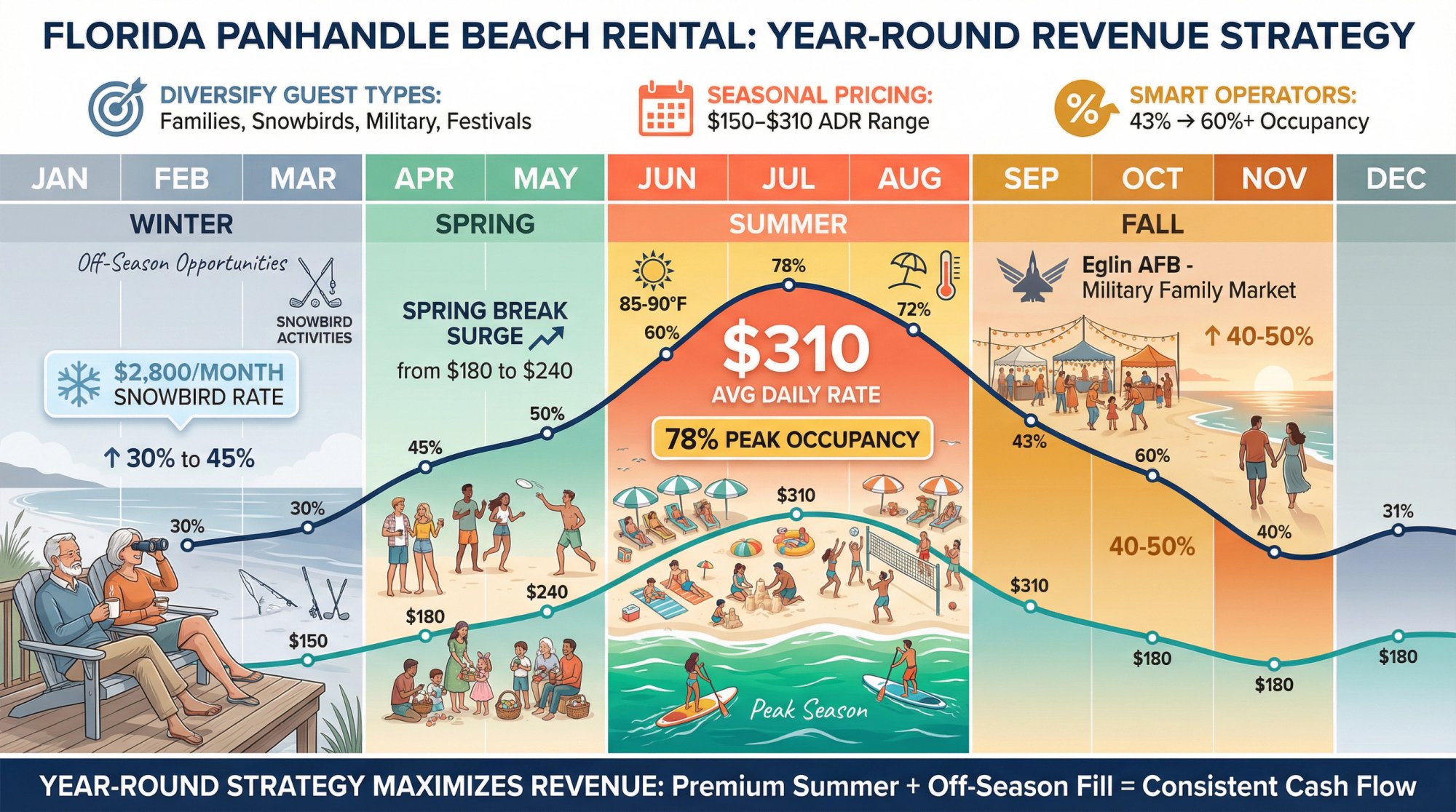

Fort Walton Beach and Destin: Top Panhandle STR Markets

Florida's Panhandle doesn't get the national attention of South Florida, but investors who know the numbers focus heavily on this region. Fort Walton Beach and the adjacent Destin/Miramar Beach corridor deliver some of the highest gross yields in the state.

The Emerald Coast's appeal is simple: stunning white-sand beaches and clear Gulf waters without the price premiums of Naples or Key West. Tourists flock here for beach vacations, deep-sea fishing, and family attractions. The demand is concentrated but intense.

Fort Walton Beach: Highest Gross Yields in Florida

| Metric | Fort Walton Beach | Destin |

|---|---|---|

| Gross Yield | 14.5% | ~12% |

| Median Home Price | ~$510,000 | Higher |

| Annual Revenue | $73,800 | $78,000 |

| Average Occupancy | 43% | 68% |

| Average Daily Rate | High | $310 |

That 14.5% gross yield in Fort Walton Beach is exceptional. You're looking at $73,800 in annual rental income on a roughly $510,000 property. The math works because summer weeks fill at near 100% occupancy with premium rates. Families book months in advance for July and August.

Yes, the 43% annual occupancy looks low. But Panhandle markets operate differently than year-round destinations. A stellar summer can carry the entire year. During peak weeks, 4-bedroom beach houses easily command $400+ per night. The concentrated income compensates for slower shoulder seasons.

Destin regulations and Miramar Beach are more widely recognized names and attract similar tourists. Destin's $310 average daily rate is among the highest in the Panhandle, generating $78,000 annual revenue per property. Real estate costs more than Fort Walton Beach, so percentage yields are lower, but absolute income is strong.

Seasonal strategy matters here. Smart operators actively market off-season options: fall festival visitors, snowbird monthly rentals at reduced rates, and military families from nearby Eglin Air Force Base. These approaches push that 43% occupancy higher.

Insurance costs and hurricane preparedness are real considerations on the Gulf Coast. Budget accordingly when underwriting deals. Learn about how hurricanes impact Florida's Airbnb market.

Run revenue projections for Panhandle properties

Pensacola: An Underrated Gulf Coast STR Market

Pensacola sits at Florida's western edge, often overshadowed by Destin's marketing and Miami's glamour. But for investors focused on cash-on-cash returns rather than name recognition, Pensacola delivers quietly impressive numbers.

The city combines beautiful beaches (Pensacola Beach is genuinely stunning) with historic downtown character, a lively restaurant scene, and the Naval Air Station Pensacola, home of the Blue Angels. That mix creates diversified demand that extends beyond summer beach season.

Pensacola STR Data: Revenue and Yields

| Metric | Value |

|---|---|

| Gross Yield | 12.5% |

| Average Property Value | ~$424,000 |

| Annual Revenue | ~$53,000 |

| Occupancy | 42-45% |

Like Fort Walton Beach, Pensacola's occupancy is concentrated in peak seasons. But the 12.5% gross yield means your capital works hard during those months. Lower property prices than most coastal Florida markets keep the entry barrier reasonable.

Year-round demand drivers:

National Naval Aviation Museum (free admission, major attraction)

Blue Wahoos minor league baseball

Pensacola Seafood Festival and other events

Military families visiting Naval Air Station personnel

Growing snowbird contingent taking monthly winter rentals

If your rental sits on Pensacola Beach, you'll cater primarily to summer tourists and should optimize for family-friendly amenities. Properties in downtown or midtown Pensacola capture more weekend getaway travelers and event visitors, allowing different marketing approaches. See our complete guide on the best places to invest in Pensacola short-term rentals.

The local government and Escambia County generally embrace vacation rentals. Tax collection is required, but restrictive ordinances haven't materialized. Check the Pensacola STR regulations for specific requirements. For ROI-focused investors, Pensacola offers strong returns without the competition and pricing of more famous beach towns.

Connect with Pensacola-area STR agents

Sarasota and Siesta Key: Beach and Cultural Tourism

Sarasota occupies a sweet spot on Florida's Gulf Coast. It's upscale without being exclusive. It's a beach destination with legitimate cultural depth. And for STR investors, it generates some of the state's strongest revenue numbers.

Siesta Key Beach was named Tripadvisor's #1 beach in the United States for 2025. The powdery quartz sand and gorgeous sunsets draw vacationers from across the Midwest and Northeast, particularly during winter and spring. But Sarasota's appeal extends beyond the beach. The arts scene (opera, theater, galleries), upscale dining, and temperate weather attract affluent travelers and snowbirds year-round.

Sarasota STR Revenue and Occupancy Data

| Metric | Value |

|---|---|

| Average Occupancy | 68% |

| Average Daily Rate | $230 |

| Annual Revenue | ~$58,000 |

| Active Rentals | ~5,800 |

| Gross Yield | 10-12% |

That $58,000 average annual revenue ranks among Florida's highest. The 68% occupancy is exceptional for a market that could easily be seasonal. Cultural tourists and retirees fill properties during months when beach-only destinations slow down.

Siesta Key and Lido Key properties command premium rates. ADRs for 2-bedroom condos often reach $250-$350+, with larger homes pushing $400+ in peak season. Annual occupancy on the keys frequently exceeds 70%. These are premium properties generating premium returns. Learn more about the best places to invest in Sarasota short-term rentals.

One important note on regulations: Sarasota's rules vary by jurisdiction. The city of Sarasota has minimum stay requirements in certain residential zones. Siesta Key, Lido Key, and Longboat Key each have their own regulations. Longboat Key, for instance, requires 30-day minimums in many areas, effectively eliminating traditional STR operations. Research the specific property's location before making offers.

Sarasota properties aren't cheap. Median prices run $450,000-$600,000, with Siesta Key beachfront commanding significantly more. But the combination of high nightly rates, extended high season (January through July are all strong), and affluent guest demographics makes this a reliable income generator for investors who can afford the entry cost.

Check Sarasota-area STR regulations

Key West and the Florida Keys: High Revenue, High Costs

Key West occupies a category of its own in Florida's STR landscape. The revenue potential is staggering. Top-performing properties generate $220,000+ in annual gross revenue. Even the market average hits around $113,000 per year with 72% occupancy and a $423 nightly rate.

Those numbers dwarf other Florida markets. A successful Key West STR can earn what two or three properties elsewhere might.

Key West STR Revenue and Property Prices

| Metric | Key West | Marathon (Middle Keys) |

|---|---|---|

| Average Occupancy | 72% | 68% |

| Average Daily Rate | $423 | $370 |

| Annual Revenue (average) | ~$113,000 | ~$90,000 |

| Top Property Revenue | $220,000+ | High |

| Median Home Value | ~$1.9 million | ~$1 million |

The high revenue comes with correspondingly high barriers. Key West's median home value hovers around $1.9 million. This isn't a market for first-time investors testing the waters with $300,000 down payments.

Regulations add complexity. Key West requires transient rental licenses (vacation rental permits) for short-term stays, and the city caps the number of these licenses. Many properties for sale don't include the necessary permit, meaning you'd be restricted to 28-night minimum stays. That's a completely different (and less profitable) business model.

Buying an Airbnb in Key West typically means acquiring an existing licensed STR or a condo in a complex that permits short stays.

The constrained supply is exactly why returns are so high. Limited licenses plus enormous tourist demand equals pricing power. Properties with active permits command premium purchase prices because buyers are paying for access to that revenue stream.

Who should invest here? Key West makes sense for luxury investors or 1031 exchangers who can deploy seven figures for a trophy property with massive cash flow potential. First-timers on a budget should look elsewhere. The management requirements are also elevated. Guests paying $400-$600+ per night have high expectations, so professional management or serious personal attention to hospitality is essential.

Beyond Key West: Marathon and Key Largo offer (slightly) more accessible entry points with strong returns. Marathon averages 68% occupancy and $370 ADRs, generating around $90,000 annually. Homes still cost around $1 million, and the same licensing requirements apply, but the price points are less extreme than Key West proper.

Connect with agents specializing in Keys properties

Other Florida STR Markets to Consider

The markets above represent Florida's top tier, but the state offers additional opportunities depending on your investment criteria. Here are honorable mentions worth researching:

| Market | Occupancy | ADR | Annual Revenue | Notable Feature |

|---|---|---|---|---|

| Deerfield Beach | ~65% | ~$200 | Strong | 13.5% gross yield |

| Cape Coral | 59% | $232 | $51,000 | Waterfront canals, boating culture |

| St. Augustine regulations | 64% | $220 | $53,000 | Historic + beach tourism |

| Daytona Beach | 59% | Event-driven | Varies | NASCAR, Bike Week booms |

| Panama City Beach | 61% | $257 | $58,000 | Spring break + family summers |

Fort Lauderdale and Deerfield Beach offer Miami-adjacent beach access without Miami's extreme pricing. Deerfield Beach's 13.5% gross yield reflects modest property values paired with solid vacation demand. Broward County provides a nice middle ground.

Cape Coral (near Fort Myers) has emerged as a popular STR market thanks to its canal system and boating culture. Regulations are lenient and prices remain affordable relative to coastal peers. Fort Myers Beach and Sanibel Island (recovering from Hurricane Ian) also offer potential once fully rebuilt.

St. Augustine combines 450 years of history with Atlantic beaches. The dual attraction creates booking opportunities beyond typical beach seasons. Daytona Beach trades on events (Daytona 500, Bike Week, spring break) that generate intense short-term demand. Properties are inexpensive, so investors who can maximize event-week revenue do well.

Panama City Beach and the upscale 30A corridor (Seaside, Rosemary Beach) serve different ends of the Panhandle market. PCB offers strong spring break and summer family volume. 30A caters to affluent vacationers willing to pay premium rates for curated beach towns.

Each market has distinct characteristics. The key is matching your investment goals (maximum yield vs. premium branding vs. year-round stability) to the right location.

Free Tools for Finding the Right Florida STR Market

Analyzing multiple Florida markets manually isn't sustainable. Comparing occupancy rates, revenue projections, home prices, and regulations across ten cities would take weeks. That's why we built Chalet as the one-stop platform for Airbnb and short-term rental investors.

Free STR Analytics and Resources

Market Analytics Dashboards

Our free analytics show you ADR, occupancy, and revenue trends across Florida markets. No subscription. No paywall. Just data you can use to compare opportunities. Learn more about free AirDNA alternatives for market research.

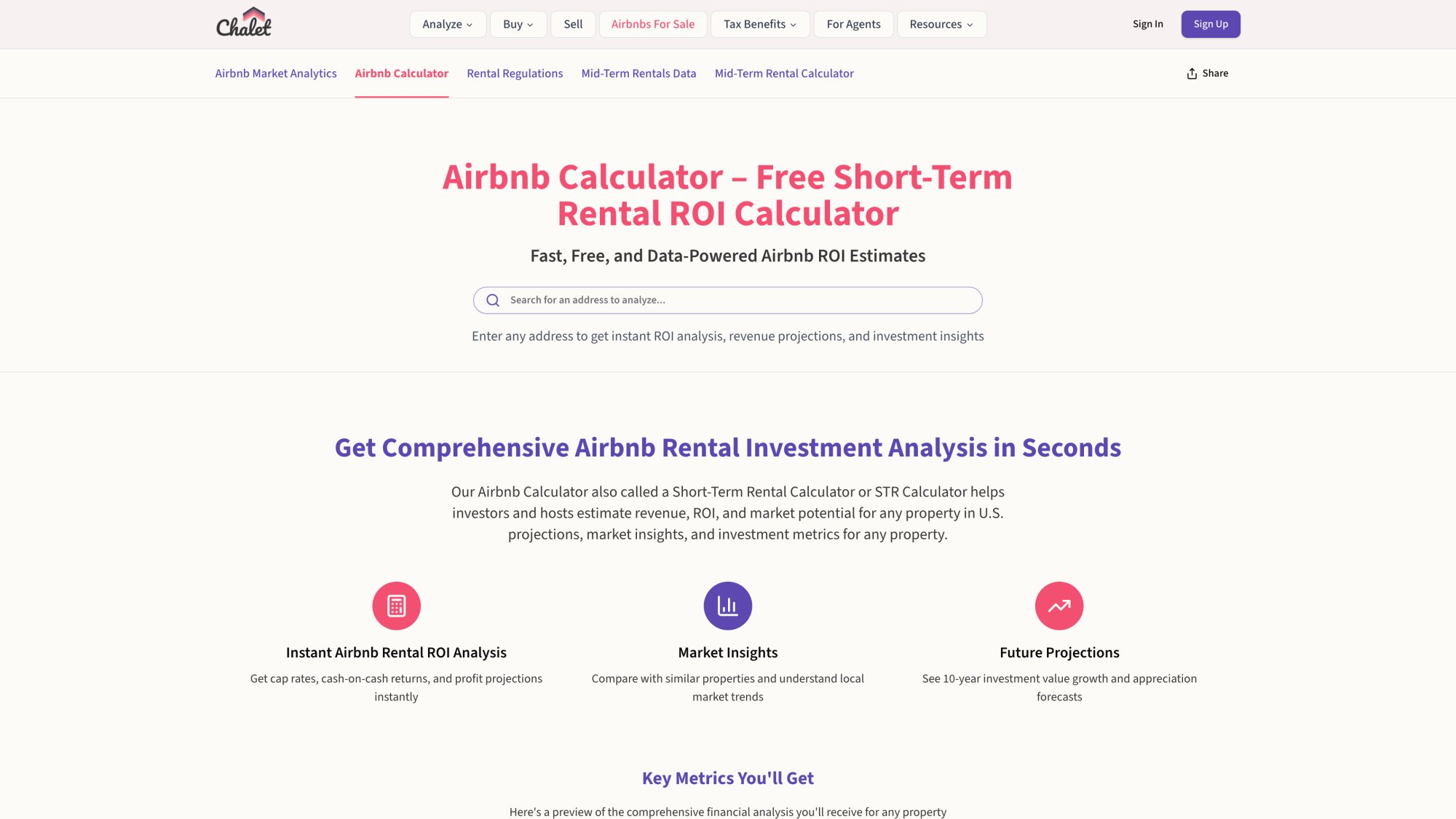

ROI Calculator

Plug any Florida address into our Airbnb calculator to see projected annual revenue, estimated expenses, and potential cash flow. Run scenarios with different occupancy assumptions. Compare DSCR loan terms against conventional financing. It's the best Airbnb calculator available.

Regulation Library

Our rental regulations database tracks permit requirements, zoning restrictions, and minimum stay rules across Florida jurisdictions. Check before you buy.

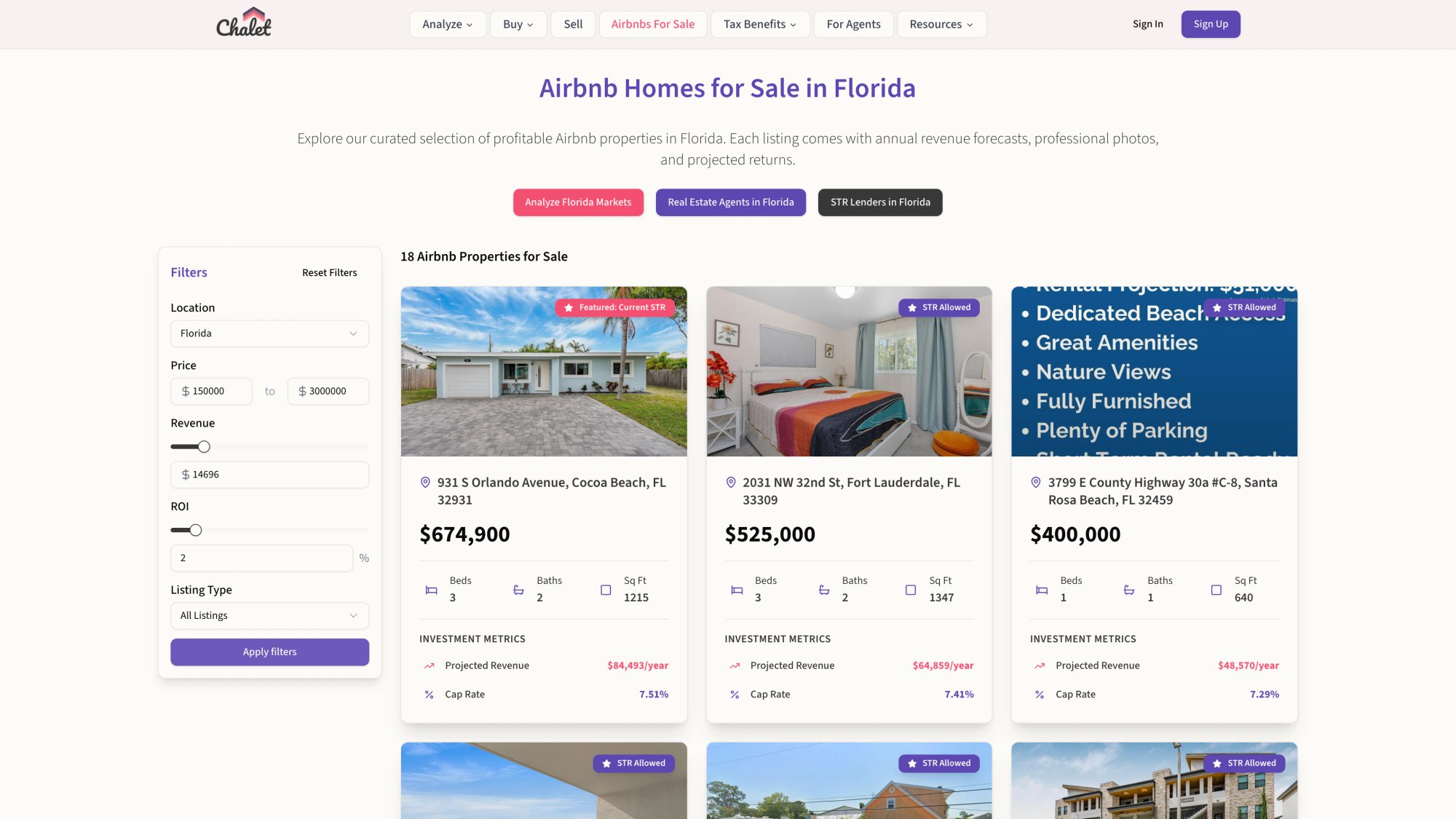

Listings You Can Actually Analyze

Browse Airbnbs for sale across Florida with integrated analytics. See projected revenue alongside listing price so you can underwrite deals in minutes instead of hours.

Connect with STR Professionals

We connect you with vetted professionals who specialize in STR transactions:

Airbnb-friendly real estate agents who understand investor priorities and local market nuances

Lenders offering DSCR loans, conventional financing, and 1031 exchange strategies coordination

Insurance agents familiar with Florida's hurricane and flood zone requirements

Property managers in your target market for hands-off operations

Support vendors for furnishing, cleaning, and maintenance

The introductions are free. We only earn when you choose to work with a professional we've connected you with, so our incentives align with your success.

How to Start Your Florida STR Investment

You've identified Florida's best short-term rental markets. Now it's time to move from research to action. Here's the practical path forward:

Step 1: Narrow Your Focus

Pick 2-3 markets that match your investment profile:

High yield, lower entry cost? Jacksonville, Pensacola, Fort Walton Beach

Year-round stability? Tampa, Orlando suburbs

Step 2: Run the Numbers on Specific Addresses

Use Chalet's ROI calculator to project returns on actual properties. Plug in addresses from listings you're considering. See how different scenarios (varying occupancy, with or without management fees) affect cash flow.

Step 3: Verify Regulations Again

Before making any offer, confirm the property's zoning allows short-term rentals. Check our regulation library and verify with local county websites. Some properties that look perfect on paper sit in restricted zones.

Step 4: Connect with Local Experts

Florida's markets vary street by street. An agent who specializes in vacation rentals can identify which condos allow Airbnb, which neighborhoods get the best occupancy, and what properties are overpriced. Meet an Airbnb-friendly agent in your target market through Chalet.

Step 5: Explore Active Listings

Start looking at what's actually available. Browse Florida STR properties for sale and underwrite the ones that fit your criteria. Project expenses (management, utilities, maintenance, insurance) and model different occupancy scenarios.

Step 6: Decide on Management

Will you self-manage or hire a property manager? In high-tourism Florida markets, professional managers (typically 15-25% of gross rents) handle guest turnover, cleanings, and local issues. Many first-time owners successfully self-manage remotely with cleaning teams and reliable handymen. Factor this into your projections.

Florida's short-term rental markets offer something for every investor type. The Sunshine State delivers high cash yields, property appreciation, and even personal enjoyment if you vacation at your property. By focusing on data-backed decisions and verifying local regulations, you'll be well-positioned for Airbnb investment success.

Ready to move forward? Meet an Airbnb-savvy agent who can pinpoint the right Florida property, or browse available STR listings on Chalet. With the right guidance and tools, your Florida STR investment can move from research to income-generating reality.

Frequently Asked Questions

Which Florida Market Has the Highest Airbnb Yields?

Fort Walton Beach currently leads Florida with approximately 14.5% gross yield, meaning annual rental income divided by property price. Pensacola (12.5%), Deerfield Beach (13.5%), and Davenport (12.9%) also deliver double-digit yields. These markets combine solid rental demand with more affordable home prices than premium destinations.

What Occupancy Rate Should I Expect in Florida?

It depends heavily on the market. Year-round destinations like Tampa, Miami, and Orlando suburbs typically achieve 65-70% occupancy. Seasonal beach markets (Pensacola, Fort Walton Beach) may average 40-45% annually because income concentrates in summer months. The U.S. average is around 54%, so most Florida markets outperform national norms.

Are Short-Term Rentals Legal Everywhere in Florida?

No. Regulations vary dramatically by city and even by neighborhood. Miami Beach prohibits most rentals under 6 months in residential areas. Orlando city limits STRs to primary residences. On the other hand, Tampa, Jacksonville, and most Panhandle communities permit vacation rentals with registration and tax collection. Always verify local rules and HOA/condo association policies before purchasing.

How Much Does a Florida STR Property Cost?

Entry points range widely. Jacksonville offers median home prices around $300,000. Tampa sits near $372,000. Fort Walton Beach and Pensacola run $400,000-$510,000. Upscale markets like Miami exceed $600,000, and Key West reaches $1.9 million median. Your budget largely determines which markets are accessible.

What's the Best Florida Market for First-Time STR Investors?

Jacksonville and Tampa offer excellent combinations of solid returns, manageable entry costs, and investor-friendly regulations. Both have diversified demand (reducing seasonal risk), mature rental ecosystems, and year-round occupancy above national averages. The Orlando suburbs (Kissimmee, Davenport) also work well for first-timers due to consistent theme park demand.

How Do I Finance a Florida Vacation Rental?

DSCR (Debt Service Coverage Ratio) loans are popular for STR purchases because qualification is based on the property's rental income rather than your personal income. Conventional investment property loans work if you can meet the income documentation requirements. For 1031 exchanges, specialized lenders coordinate timing and compliance. Chalet connects you with lenders experienced in STR financing.

When Is Peak Season for Florida Short-Term Rentals?

South Florida (Miami, Keys): December through April, when northern visitors escape winter.

Central Florida (Orlando): Year-round peaks around holidays, spring break, and summer vacation, with events filling shoulder seasons.

Panhandle beaches (Destin, Pensacola): March through August, with intense summer demand.

Gulf Coast (Tampa, Sarasota): January through July, with snowbird traffic and spring break creating extended high seasons.

Should I Self-Manage or Hire a Property Manager in Florida?

Both approaches work in Florida. Self-management is feasible with reliable cleaning teams, local handymen, and modern guest communication tools. You'll keep more revenue but invest significant time. Professional managers (15-25% of gross) handle turnover, cleaning coordination, maintenance, and guest issues. Many out-of-state investors prefer management, while local owners often self-manage initially. Factor management costs into your projections either way.

Data in this guide reflects 2024-2025 market conditions. Vacation rental metrics (occupancy, rates, revenue) fluctuate with market conditions. Always verify current statistics and regulations before making investment decisions.