Beach properties sit in a sweet spot for short-term rental investors. They attract consistent demand from vacationers, command premium nightly rates, and often appreciate nicely over time. But not all beach markets are created equal. Some deliver exceptional returns on investment, while others look great on the surface but eat into your profits through high purchase prices, strict regulations, or crushing operational costs.

The metric that cuts through the noise? Rental yield. This is the ratio of your annual rental income to the purchase price of the property. A higher yield means stronger cash flow relative to what you paid. According to 2024-2025 industry analyses, certain beach markets deliver yields that far outpace the national average.

What the headline numbers won't tell you: local regulations, seasonal demand patterns, insurance requirements, and management costs can all slice into your actual profit. Hawaii's Big Island, for example, shows yields near 15% on paper. In practice, strict permit laws make it nearly impossible for new investors to capitalize on that potential.

The real opportunity lies in markets that balance strong Airbnb rental income with investor-friendly conditions. We've analyzed the data, checked the regulations, and identified the top 10 U.S. beach markets (including one surprising lakefront contender) where your Airbnb investment can actually perform as well as the numbers suggest.

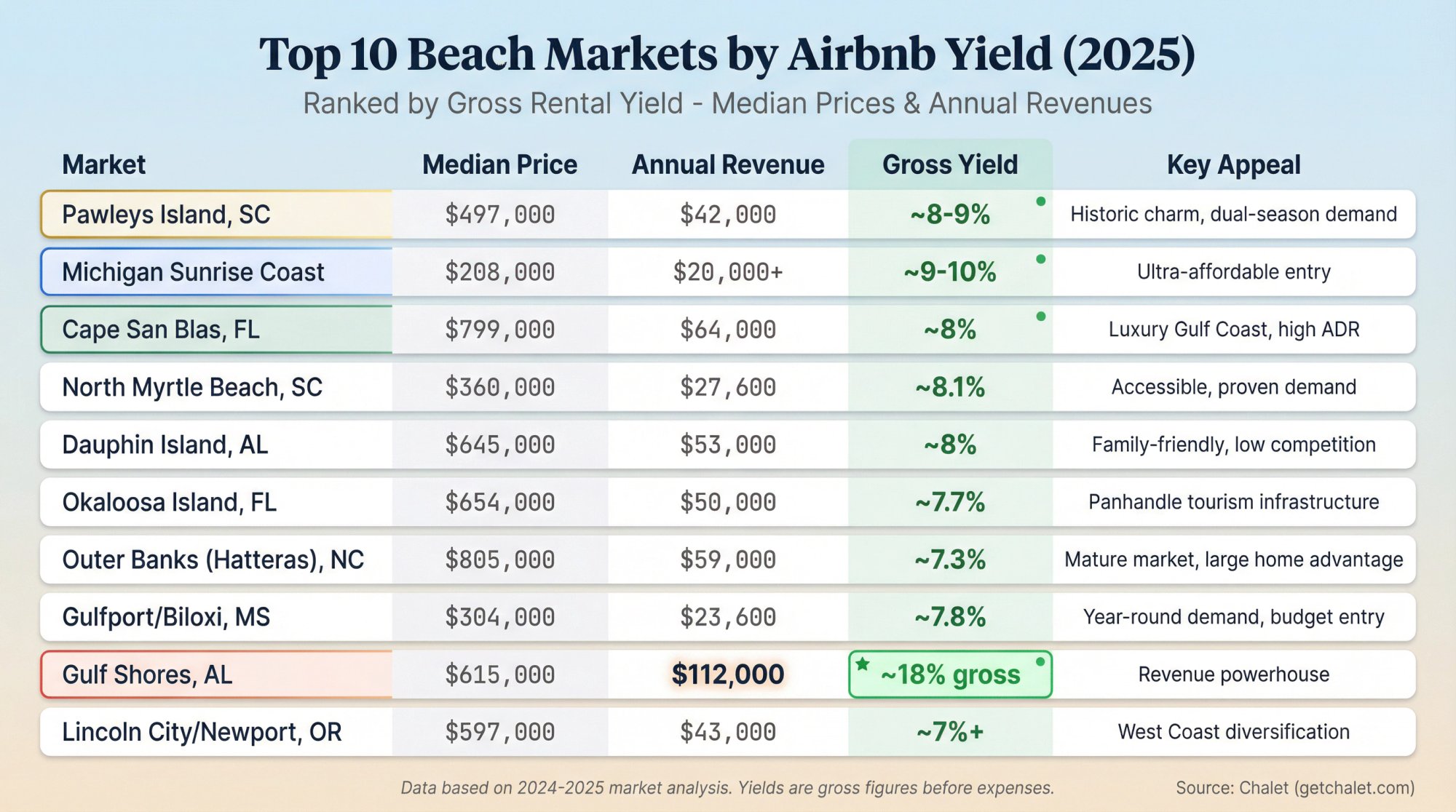

Top 10 Beach Markets for Airbnb Yields Compared

Before we break down each market, here's the full picture at a glance. This table shows gross yields based on median home prices and average annual rental revenues from 2024-2025 data:

| Market | Median Price | Annual Revenue | Gross Yield | Key Appeal |

|---|---|---|---|---|

| Pawleys Island, SC | $497,000 | $42,000 | ~8-9% | Historic charm, dual-season demand |

| Michigan Sunrise Coast | $208,000 | $20,000+ | ~9-10% | Ultra-affordable entry |

| Cape San Blas, FL | $799,000 | $64,000 | ~8% | Luxury Gulf Coast, high ADR |

| North Myrtle Beach, SC | $360,000 | $27,600 | ~8.1% | Accessible, proven demand |

| Dauphin Island, AL | $645,000 | $53,000 | ~8% | Family-friendly, low competition |

| Okaloosa Island, FL | $654,000 | $50,000 | ~7.7% | Panhandle tourism infrastructure |

| Outer Banks (Hatteras), NC | $805,000 | $59,000 | ~7.3% | Mature market, large home advantage |

| Gulfport/Biloxi, MS | $304,000 | $23,600 | ~7.8% | Year-round demand, budget entry |

| Gulf Shores, AL | $615,000 | $112,000 | ~18% gross | Revenue powerhouse |

| Lincoln City/Newport, OR | $597,000 | $43,000 | ~7%+ | West Coast diversification |

Use this as your starting point. If a market catches your eye, you can run the specific numbers on our free Airbnb calculator using actual properties you're considering.

10 Best Beach Markets for Airbnb Investment in 2025

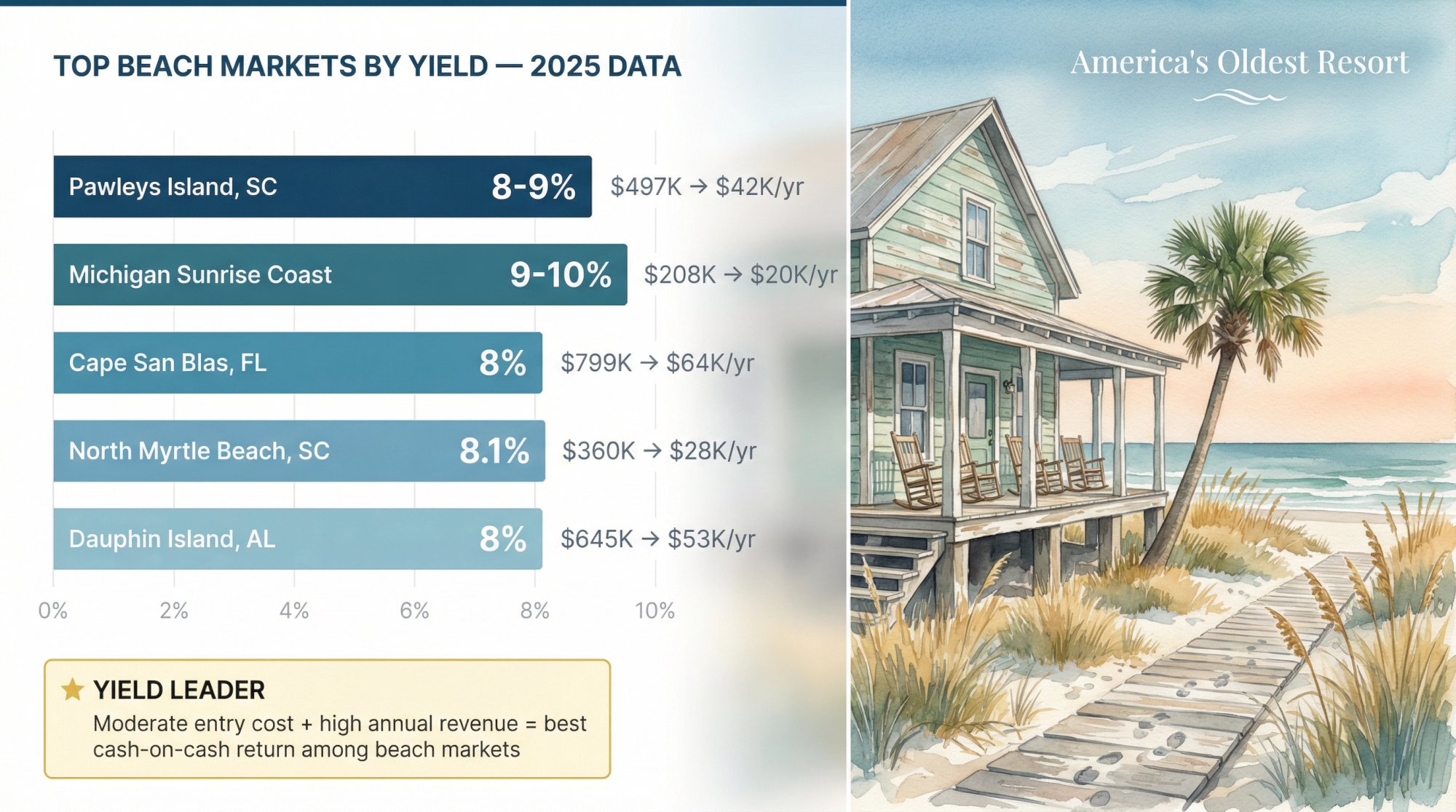

1. Why Pawleys Island, SC Has the Highest Beach Rental Yields

Pawleys Island sits at the top of the list for a reason. This small South Carolina barrier island delivers some of the highest yields in the country for beach house investments.

The numbers tell the story:

-

Median home price: ~$497,000

-

Average annual revenue: ~$42,000

-

Gross yield: approximately 8-9%

What makes Pawleys special isn't just the math. It's one of America's oldest vacation resorts, with a laid-back "arrogantly shabby" charm that attracts both summer beachgoers and winter snowbirds. That dual-season demand is gold for investors.

The catch: Georgetown County officials have considered STR permit caps (potentially 250 permits with licensing fees). This hasn't passed yet, but it's worth monitoring. If you're serious about Pawleys Island, moving sooner rather than later could lock in your position before any regulatory tightening. Understanding how to navigate local regulations is essential for any beach market investment.

Investor insight: Pawleys Island offers something rare in beach investing: moderate entry cost combined with high income potential. It's the yield leader for a reason.

2. Michigan Sunrise Coast: Best Budget Beach Market for STR Investors

You don't need oceanfront property to earn beach rental income. Michigan's east coast along Lake Huron (locally called the Sunrise Coast) is a surprise contender that most coastal investors overlook entirely.

In towns like Au Gres and the surrounding area, the investment profile stands out: a median home price of just ~$208,000 paired with $20,000+ in average annual revenue produces a gross yield of approximately 9-10%. That's one of the highest yields in the country, period.

The reason? Property values remain affordable while summer tourism generates solid booking rates. Vacationers come for boating, fishing, and genuinely beautiful lake beaches.

Why this matters: Michigan currently has no statewide ban on short-term rentals, and state law generally favors property owners' rights to rent. That regulatory friendliness, combined with the low entry point, creates a compelling opportunity.

The tradeoff: Seasonality is real here. Summers are booked solid, but winters in northern Michigan can be quiet. Your revenue is concentrated in roughly five to six months. If that works for your financial model, the Sunrise Coast delivers exceptional yield on an accessible investment. For investors looking for budget-friendly Airbnb markets, Michigan offers standout opportunities.

3. Cape San Blas, FL: Is This Gulf Coast Market Worth the Price?

Florida's Cape San Blas offers the classic Gulf Coast investment profile: higher prices paired with higher revenues, resulting in solid yields despite the steeper entry cost.

Here's what the numbers look like:

-

Median home price: ~$799,000

-

Average annual revenue: ~$64,000

-

Gross yield: approximately 8%

Cape San Blas is a scenic peninsula with miles of white-sand shoreline and a more relaxed atmosphere than Florida's crowded resort towns. Beachfront homes regularly command $600+ per night, and occupancy stays strong through the season. This makes it one of the best coastal markets for Airbnb investing.

Florida's statewide STR environment is generally investor-friendly, but Gulf County has specific requirements you need to know about: an annual STR license, yearly safety inspections, and roughly 5% in bed taxes. Coastal insurance (wind and flood coverage) will also be a meaningful line item in your expense budget.

The fundamentals still hold up. Even with those costs factored in, Cape San Blas ranks among the most profitable beach markets. If you're looking for a luxury Airbnb rental market with strong cash flow potential, this peninsula deserves a spot on your short list.

4. North Myrtle Beach, SC: How to Get Started with Coastal STR Investing

North Myrtle Beach isn't the flashiest market on this list, but it might be the most accessible for first-time beach investors. The combination of moderate prices, proven demand, and reasonable regulations makes it a consistent performer.

According to 2025 vacation rental market rankings, North Myrtle Beach claimed the #1 spot for best vacation home market, with a gross cap rate of approximately 8.1%.

The breakdown:

① Median home price: ~$360,000

② Annual revenue: ~$27,600

③ Cap rate: ~8.1%

The greater Myrtle Beach area attracts over 20 million visitors annually. North Myrtle specifically offers more STR-friendly zoning than the City of Myrtle Beach proper, which has stricter limitations in residential areas.

You'll need to navigate the basics: a business license and STR permit are required, and you must collect state and local accommodation taxes. But these are standard compliance steps, not barriers to entry.

For investors who want a proven coastal market without the $700k+ price tag common elsewhere, North Myrtle Beach offers a balanced opportunity. The entry point is manageable, the demand is established, and the yield is solid.

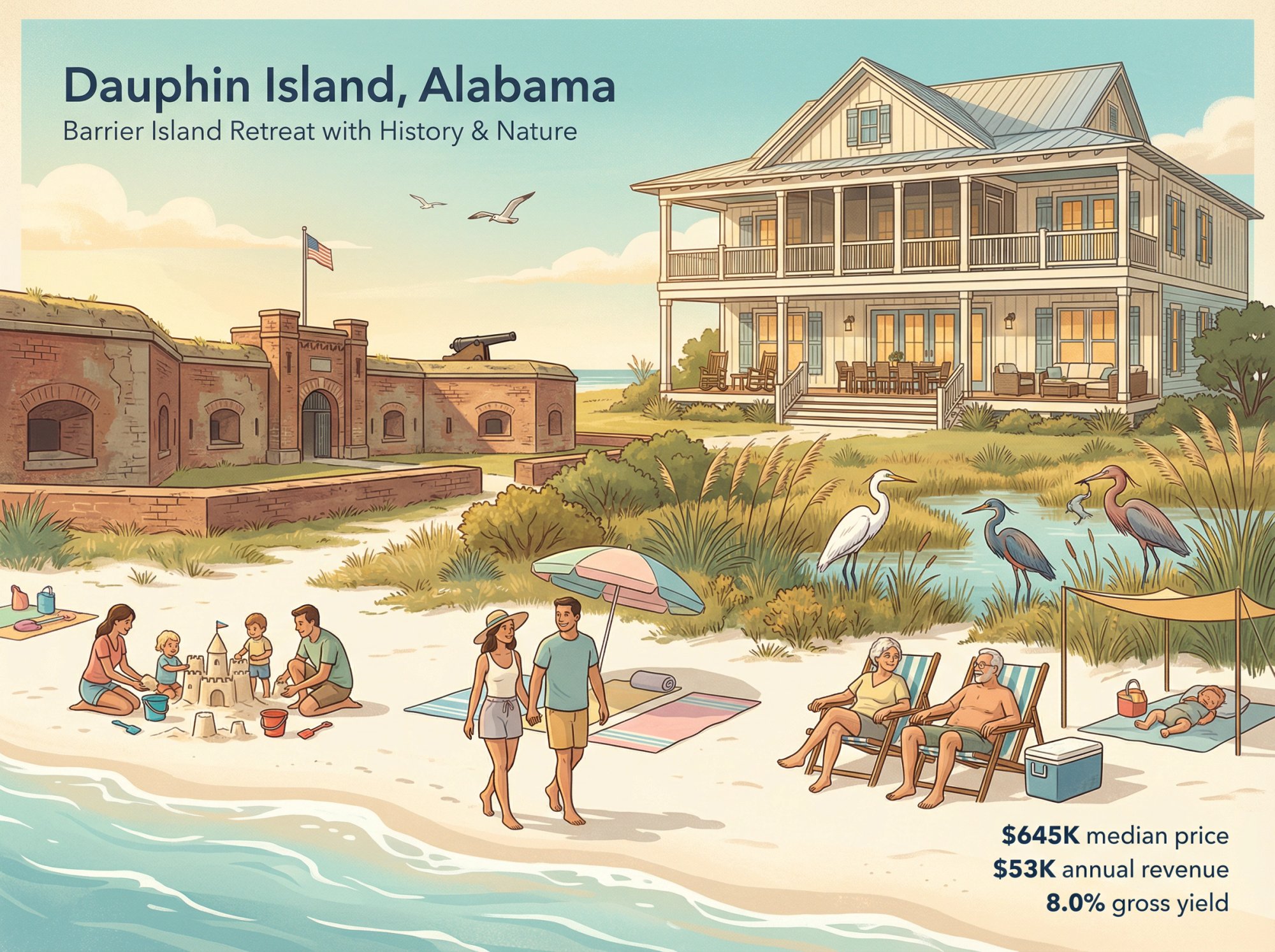

5. Dauphin Island, AL: What Makes This Barrier Island a Strong Investment?

What makes Dauphin Island different: It's not a generic beach resort town. Fort Gaines (Civil War history), the Audubon Bird Sanctuary, and miles of uncrowded beach give it genuine character that appeals to families seeking something beyond the typical crowded shoreline.

Dauphin Island sits off Alabama's Gulf Coast, south of Mobile, and delivers one of the better yield profiles among Gulf beach markets.

The data shows:

-

Gross cap rate: 8.0%

-

Median home price: ~$645,000

-

Annual revenue: ~$53,000

Larger homes that accommodate extended families and multi-generational groups do particularly well here, often hosting 10+ guests with premium per-night rates.

The regulatory environment is straightforward. You'll need a rental business license and must collect lodging taxes, but there aren't aggressive caps or restrictions on STR operations currently. You can explore Alabama 1031 exchange opportunities if you're rolling gains from another property into this market.

One consideration: Like all Gulf Coast properties, hurricane preparedness matters. Factor coastal insurance into your expense projections, and understand the property's flood zone designation before buying.

6. Okaloosa Island, FL: Panhandle Airbnb Returns and What to Expect

Nestled between Destin and Fort Walton Beach, Okaloosa Island offers investors the famous emerald waters of Florida's Panhandle with solid return potential.

The yield picture tells the story clearly. Expect a gross cap rate around 7.7% on properties with a median price of ~$654,000 generating approximately $50,000 in annual revenue. Okaloosa Island is essentially a three-mile strip of condos and resorts lining pristine beachfront. Nearly every rental property has prime location by default.

High-rise beachfront condos with pools, direct beach access, and Gulf views command strong nightly rates from families and groups.

The built-in tourism infrastructure works in your favor. The Destin-Fort Walton area draws reliable crowds from spring break through late summer, with shoulder seasons remaining active due to the mild climate. Check the Fort Walton Beach STR regulations before investing.

The challenge: Competition is real here. The density of condos means your listing needs to stand out through quality furnishings, professional photography, and strong reviews. With good property management and marketing, Okaloosa properties perform well. But this isn't a market where a mediocre listing will coast on location alone.

7. Outer Banks, NC: Are Large Beach Homes Still Worth the Investment?

North Carolina's Outer Banks have been a vacation rental powerhouse for decades. This is a mature market with established demand, strong brand recognition, and yields that remain attractive despite higher property values.

Focusing on Hatteras Island specifically:

| Metric | Hatteras Island | Corolla/Nags Head |

|---|---|---|

| Gross cap rate | ~7.3% | ~6-7% |

| Median price | ~$805,000 | Similar range |

| Annual revenue | ~$59,000 | $50,000-$80,000+ |

| Best performers | 6+ bedroom homes | Large family properties |

The common thread? Large beachfront homes that accommodate multi-family groups. Properties with 6+ bedrooms routinely generate $50,000 to $80,000+ in annual rent. These high annual revenue markets reward investors who can acquire larger properties.

The Outer Banks' appeal is distinctive: 100+ miles of beaches, wild horse sightings, excellent fishing, and family activities that drive a long peak season from spring through early fall.

Critical note: Each town and county in OBX has its own STR rules. Nags Head requires different permits for whole-home versus partial-home rentals. Some towns have permit caps or occupancy restrictions. Due diligence is essential before buying.

If you're willing to invest in a higher-priced property and navigate the varied regulatory landscape, OBX can be a cornerstone holding in a short-term rental portfolio.

8. Gulfport and Biloxi, MS: Cheapest Gulf Coast Beach Markets for STRs

The Mississippi Gulf Coast offers something increasingly rare in beach investing: genuinely affordable entry points with strong yield potential.

The numbers for Gulfport/Biloxi:

→ Expected yield: 12.4% (roughly 7.8% gross)

→ Median price: ~$304,000

→ Annual revenue: ~$23,600

For about half the cost of a Florida beach condo, you can buy a single-family home walking distance from the Mississippi shoreline. The lower purchase price fundamentally changes the math on cash flow.

These cities benefit from year-round demand drivers beyond just beach tourism. Casinos bring visitors. Keesler Air Force Base generates military-related travel. Events and festivals keep occupancy from completely cratering in off-season months.

STR regulations exist but aren't prohibitive. Gulfport requires licensing, safety compliance (smoke detectors, insurance minimums), and neighbor notification protocols. These are reasonable requirements that signal the city is managing STRs sustainably rather than banning them.

The tradeoff: Average daily rates are lower here than in Florida or Alabama. A Gulfport beach house might rent for $200/night versus $300+ in Gulf Shores. But your costs are also lower across the board. For investors seeking high yield on a budget, this market is worth serious consideration.

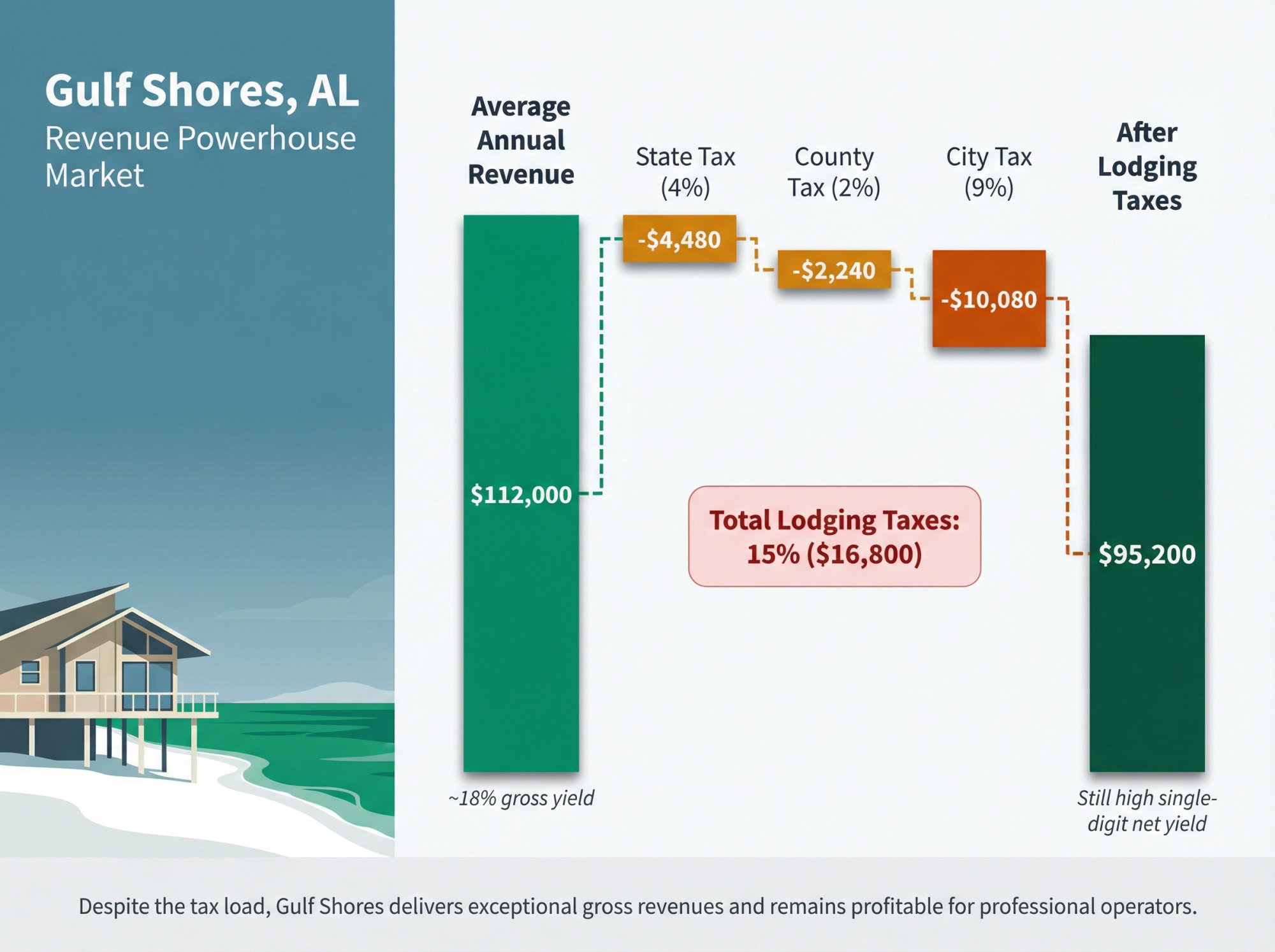

9. Gulf Shores, AL: Highest Revenue Beach Market (and the Tax Tradeoff)

Gulf Shores generates some of the highest gross revenues of any beach market in the country.

The numbers are frankly eye-catching:

The median home price of ~$615,000 paired with an average annual revenue of ~$112,000 produces a gross yield of approximately 18% before costs. That $112,000 average annual revenue reflects a highly developed vacation town with hundreds of beachfront rentals.

Large beach houses bringing in $5,000+ per week during peak summer are common. Events like the Hangout Music Festival and spring break traffic extend the rental season beyond the typical summer window.

The catch: Gulf Shores has significant lodging taxes. Combined state (4%), county (2%), and city (9%) taxes total roughly 15% of your gross income. That eats into your bottom line meaningfully. You'll also face competition from many established listings, requiring professional management to stand out. Review the Gulf Shores STR regulations before investing.

The bottom line on Gulf Shores: Despite the tax load, investors (including many 1031 exchangers from lower-yield markets) find that even after taxes, management fees, and maintenance, net yields can still reach the high single digits. If you're looking for a revenue powerhouse and can manage the operational complexity, Gulf Shores delivers.

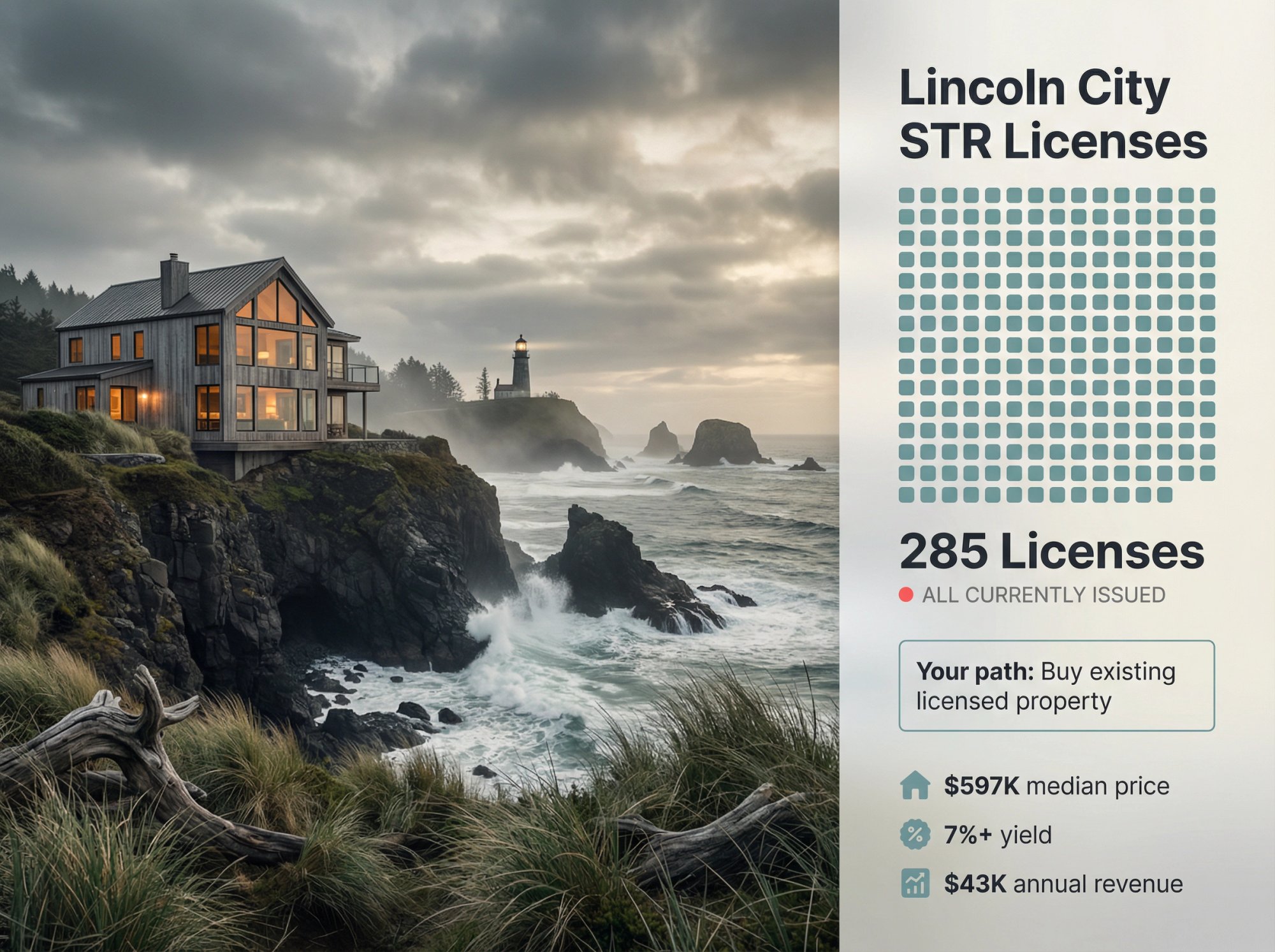

10. Lincoln City and Newport, OR: West Coast Airbnb Beach Investing

Most high-yield beach markets cluster on the East Coast and Gulf. Oregon's Lincoln City (and nearby Newport) offers something different: Pacific Northwest beach investing with yields that compete with anywhere in the country.

The data:

-

Gross yield: 7%+

-

Estimated cap rate: ~11.1% (adjusted for expenses)

-

Median price: ~$597,000

-

Annual revenue: ~$43,000

The Oregon Coast delivers stunning scenery: rugged coastlines, lighthouse views, and cooler weather that attracts tourists seeking an alternative to tropical beach destinations. Lincoln City draws consistent tourism through kite festivals, art scenes, a casino, and year-round beachcombing appeal.

The regulatory reality: Lincoln City has capped STR licenses at 285, and all are currently issued. No new permits are available until existing ones lapse. Your path into this market is buying an existing licensed rental property. Newport is somewhat more permissive in certain zones. Check the Eugene, OR regulations for comparison on Oregon's STR climate.

Why the cap works in your favor: Limited supply means you won't face the oversaturation that plagues some other beach markets. For investors wanting geographic diversification beyond the typical Sun Belt destinations, the Oregon Coast is a compelling option.

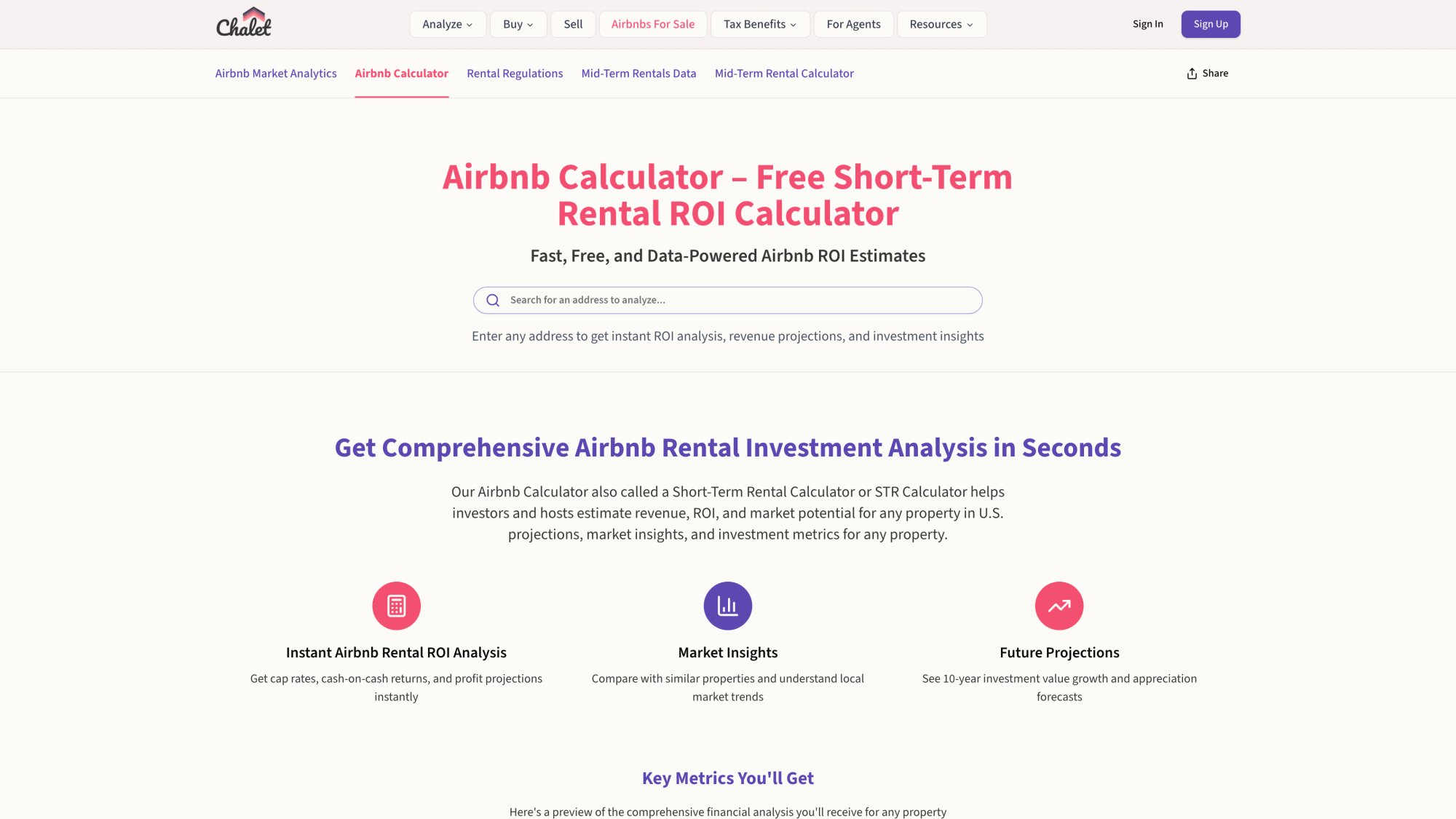

How to Find High-Yield Beach Properties with Chalet

Identifying a promising market is just the first step. Actually finding, analyzing, and acquiring the right property takes work. That's where we come in.

We built a platform specifically for short-term rental investors who need real data and real connections to execute. Here's what's available:

→ Free Market Analytics

Our market dashboards show you ADR (average daily rate), occupancy trends, and revenue benchmarks across markets. You can compare markets side-by-side and drill into the specific data that matters for your investment thesis. No subscription fees, no paywalls. Learn more about comparing the best Airbnb analytics tools.

→ ROI and DSCR Calculators

The Airbnb calculator lets you input actual property details (price, expected rent, expenses, financing terms) to estimate your net yield. It accounts for the variables that headline numbers miss. If you're evaluating DSCR loan scenarios specifically, you can model those too.

→ Regulation Database

Every market has different rules. Our regulation library helps you quickly understand permit requirements, license fees, tax obligations, and zoning restrictions in markets you're considering. This is due diligence you'd have to piece together from scattered sources otherwise.

→ STR-Specialist Agent Network

Real estate agents who specialize in vacation rentals know things general agents don't: which neighborhoods produce the best returns, which condo buildings have lenient rental policies, what the realistic operating expenses look like. We connect you with Airbnb-friendly agents in each of the top markets. Read more about the benefits of investor-friendly realtors.

→ Full Vendor Network

Beyond agents, we have vetted lenders, insurance brokers, property managers, cleaning services, and furnishing companies who understand vacation rentals. When you're ready to move fast on a deal, having your team assembled accelerates everything.

How to Turn Beach Market Data Into a Real Investment

Knowing the best markets is valuable. Knowing what to do with that information is what actually builds wealth. Here's the practical path forward:

Run the Numbers on Specific Properties

Market averages are starting points, not guarantees. Every property is different. Use our calculator to plug in actual listing prices, realistic revenue projections, your financing scenario, and local expense assumptions (including those coastal insurance quotes you'll need). Understanding how much you can make on Airbnb helps set realistic expectations.

Check Regulations Before Making Offers

Even "investor-friendly" markets have rules that matter. Verify current permit availability, license requirements, and tax obligations in your specific target city or county. Our regulation database gives you a head start, but confirm details with local authorities before closing.

Connect with Local Experts

An agent who's done dozens of STR transactions in your target market has knowledge that data alone can't provide. They know which streets have the best booking history, which HOAs are hostile to rentals, and what properties have hidden upside. Find an Airbnb-friendly agent through our network.

Explore Current Listings

Ready to get specific? Browse Airbnb rentals for sale to see real properties with income histories. Look for "established rental history" or "projected annual rent" language. Compare those figures against the market averages in this guide to see if a property is outperforming, meeting, or lagging expectations.

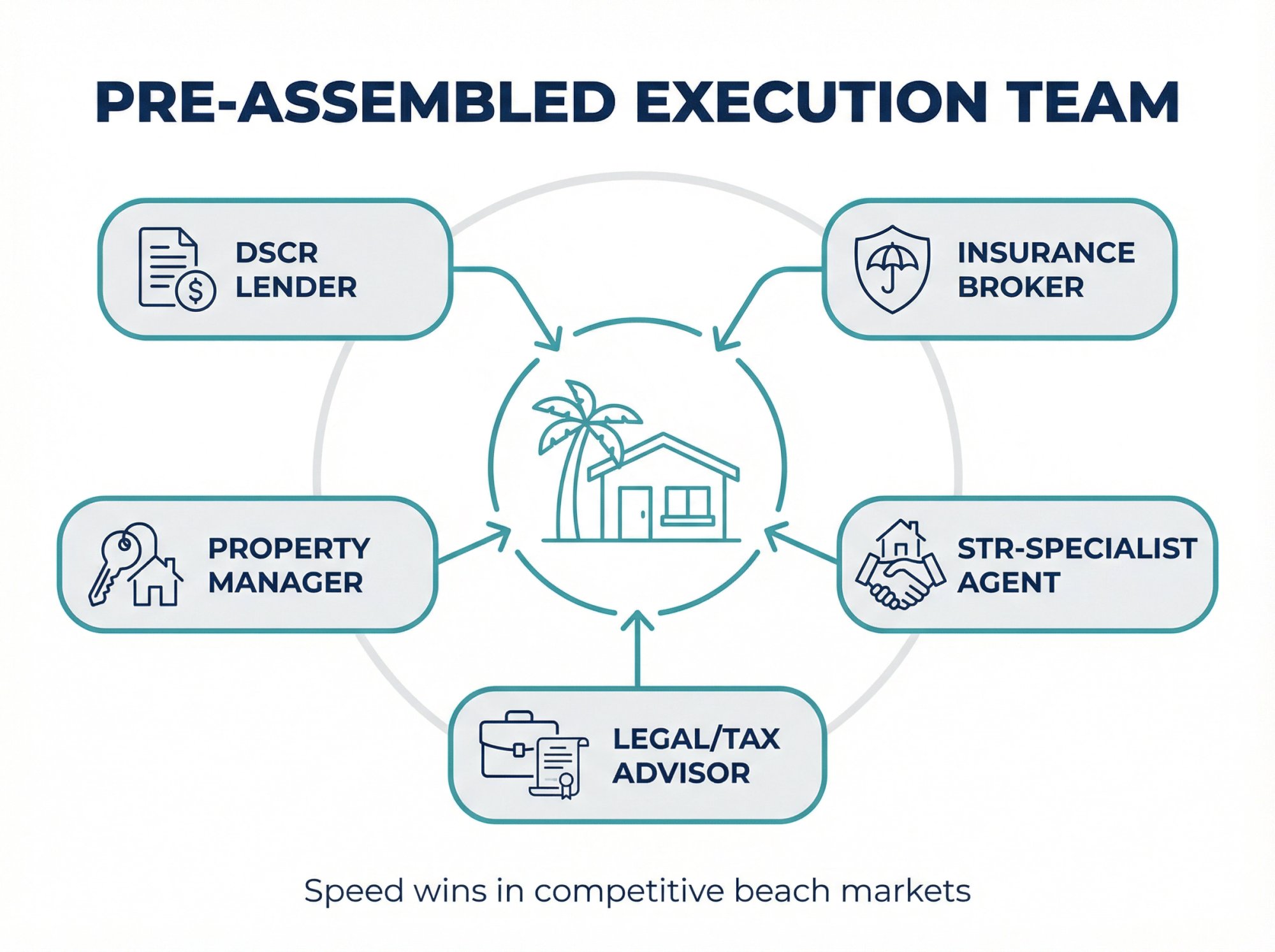

Prepare Your Execution Team

High-yield properties attract competition. When you find the right deal, delays cost money. Line up your financing ahead of time (DSCR loans are popular for STRs because they qualify based on property income rather than personal DTI). Get insurance quotes before you need them. Have property management options identified.

We can connect you with experienced lenders, insurance brokers, and property managers through our vendor network. Using them means you're working with people who understand vacation rentals, not generalists learning on your deal.

Frequently Asked Questions

What Is Rental Yield and How Do You Calculate It?

Rental yield is your annual rental income divided by the property's purchase price, expressed as a percentage. A property generating $40,000/year that costs $500,000 has an 8% gross yield. This measures cash flow relative to investment. Net yield accounts for expenses like management, taxes, insurance, and maintenance. Learn more about key factors affecting Airbnb profitability.

Which Beach Market Has the Highest Airbnb Yield Right Now?

Based on 2024-2025 data, Pawleys Island, SC and Michigan's Sunrise Coast show the highest gross yields at 8-10%. Gulf Shores, AL produces the highest raw revenues ($112k average), though its 15% lodging tax affects net returns. Your best market depends on your specific criteria: entry price, risk tolerance, and preferred geography.

Are Beach Airbnbs a Good Investment in 2025?

Beach properties benefit from consistent vacation demand, premium nightly rates, and often strong appreciation. They can generate higher yields than traditional rentals in many markets. The tradeoffs include seasonality (concentrated revenue windows), higher insurance costs, and regulatory complexity in some areas. For investors who understand these factors, beach STRs can be excellent investments.

How Do STR Regulations Affect Beach Market Investing?

Dramatically, in some cases. Markets like Lincoln City, OR have permit caps that prevent new investors from entering. Others require licenses, safety inspections, and various tax collections. Always verify current regulations before buying. Use resources like our regulation database to start your research.

What Costs Reduce Your Actual Airbnb Yield?

The main categories: property management (typically 20-30% of revenue), lodging taxes (varies by location, up to 15% in some markets), insurance (especially wind and flood coverage on coasts), maintenance and repairs, platform fees, utilities, and periodic furnishing updates. A property showing 8% gross yield might net 4-5% after these expenses.

Should You Use DSCR or Conventional Financing for a Beach STR?

DSCR (Debt Service Coverage Ratio) loans are popular for STR investments because they qualify based on the property's projected income rather than your personal debt-to-income ratio. This lets investors scale without their W-2 income limiting them. Rates are typically higher than conventional mortgages, so run both scenarios in your analysis. We can connect you with lenders experienced in both.

How Do You Find Real Estate Agents Who Understand STR Investing?

Most agents lack experience with short-term rental properties. You need agents who know which neighborhoods produce the best returns, understand local STR regulations, and can evaluate a property's income potential. Our agent network includes Airbnb-friendly specialists in top STR markets.

What Insurance Do Coastal Airbnb Properties Need?

Standard homeowners insurance often excludes wind and flood damage, which are primary risks for coastal properties. You'll likely need separate wind/hurricane coverage and flood insurance (required in many coastal zones). Get quotes during your due diligence phase, not after closing. Premiums vary significantly by location and can meaningfully impact your yield.

Your Next Step

The beach rental markets we've covered deliver real yield potential in 2025. From established destinations like the Outer Banks and Gulf Shores to emerging opportunities in Mississippi and Michigan, the data shows where the numbers work.

But market-level data only takes you so far. The investors who actually build wealth are the ones who translate research into action: running specific property numbers, verifying regulations, connecting with local experts, and executing when the right opportunity appears.

We exist to make that process faster and less complicated. Our free analytics, calculators, regulation database, and vendor network are designed for exactly this: helping you move from "interesting market" to "income-producing property" with the right support at each step.

Start with the data. Explore market analytics. Run the numbers on properties you're considering. Connect with an agent who specializes in STR investments. And when you're ready to see what's actually available, browse Airbnbs for sale in these high-yield markets.

The beaches and returns are waiting.