Selling an investment property usually comes with a painful reality: capital gains taxes. When you offload that long-term rental you've held for years, the IRS wants its cut. We're talking 15-20% federal capital gains tax, possible state taxes, and depreciation recapture taxed at 25%. For many investors, that's a quarter of their profits gone before they can reinvest.

But there's a way around this. A 1031 exchange lets you sell one investment property and buy another without triggering immediate taxes. And yes, you can absolutely use it to transition from a traditional long-term rental into an Airbnb rental or other short-term rental (STR).

This guide walks you through exactly how to make that switch. You'll learn the rules, the timelines, and the strategies that successful investors use to defer taxes while upgrading their portfolios. We'll also cover the pitfalls that trip people up and how Chalet can help you execute the exchange smoothly with our network of 1031-savvy agents, lenders, and vendors.

Why Switch from Long-Term to Short-Term Rentals?

The shift from long-term to short-term rentals isn't just a trend. It's a calculated move that many investors are making for solid financial reasons.

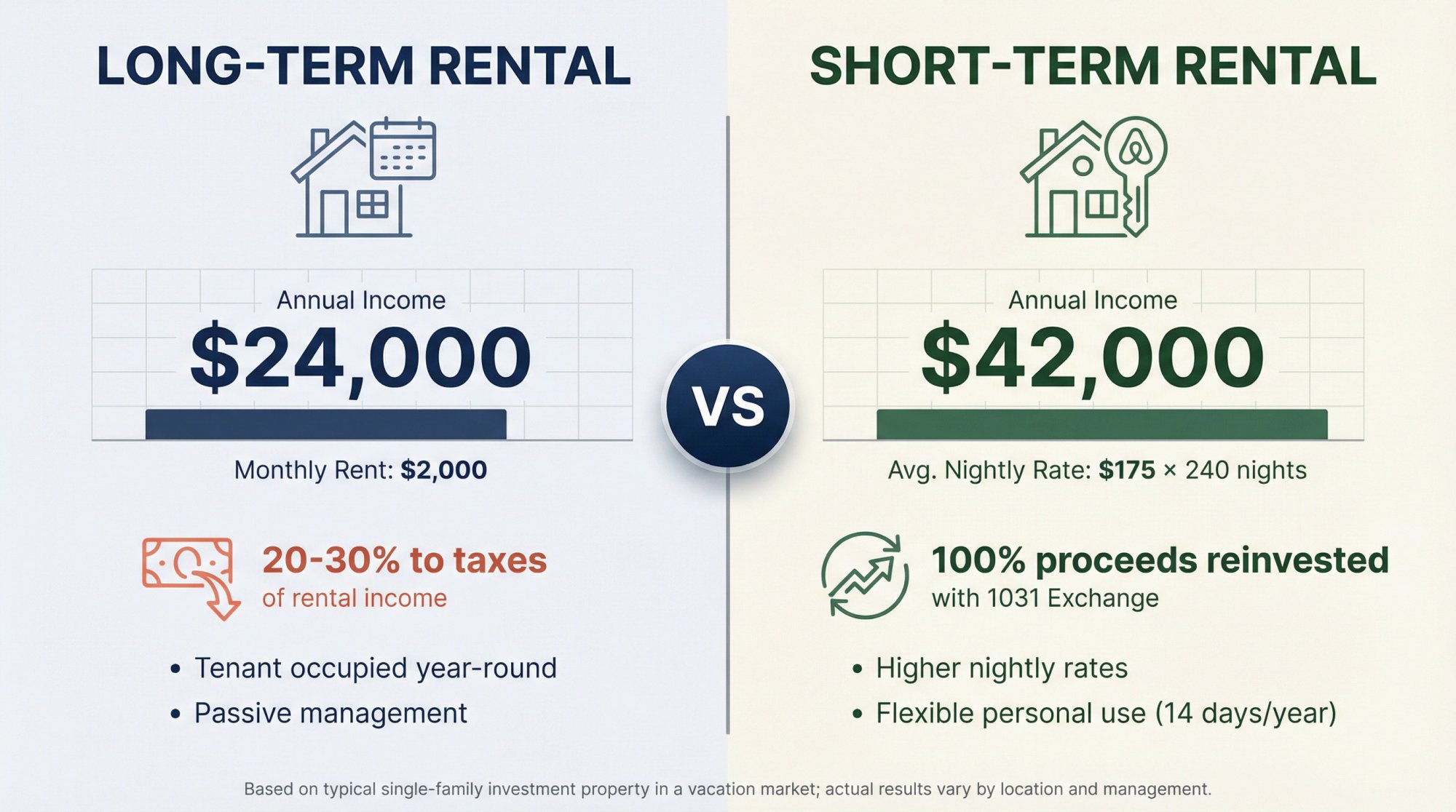

The income potential is hard to ignore. Short-term rentals often generate higher nightly rates than what you'd collect in monthly rent. According to industry research, short-term rental properties grew from about 1.25 million in 2022 to an estimated 1.62 million by 2024. Investors are chasing those yields for good reason. A well-positioned vacation rental in a high-demand market can out-earn a comparable long-term rental's annual income, especially when vacationers pay premium nightly rates.

Flexibility matters too. With a long-term rental, your property is tied up with tenants year-round. With an STR, you can block off a week or two for personal use (though you'll need to stay within IRS limits, which we'll cover later). For some investors, being able to use their beach house or mountain cabin occasionally is a meaningful perk.

Portfolio optimization plays a role. Maybe your current long-term rental sits in a market with stagnant rents or declining demand. A 1031 exchange lets you trade into a vacation market with stronger returns without losing equity to taxes. You could swap an older single-family rental for a newer vacation cabin in a booming tourist destination.

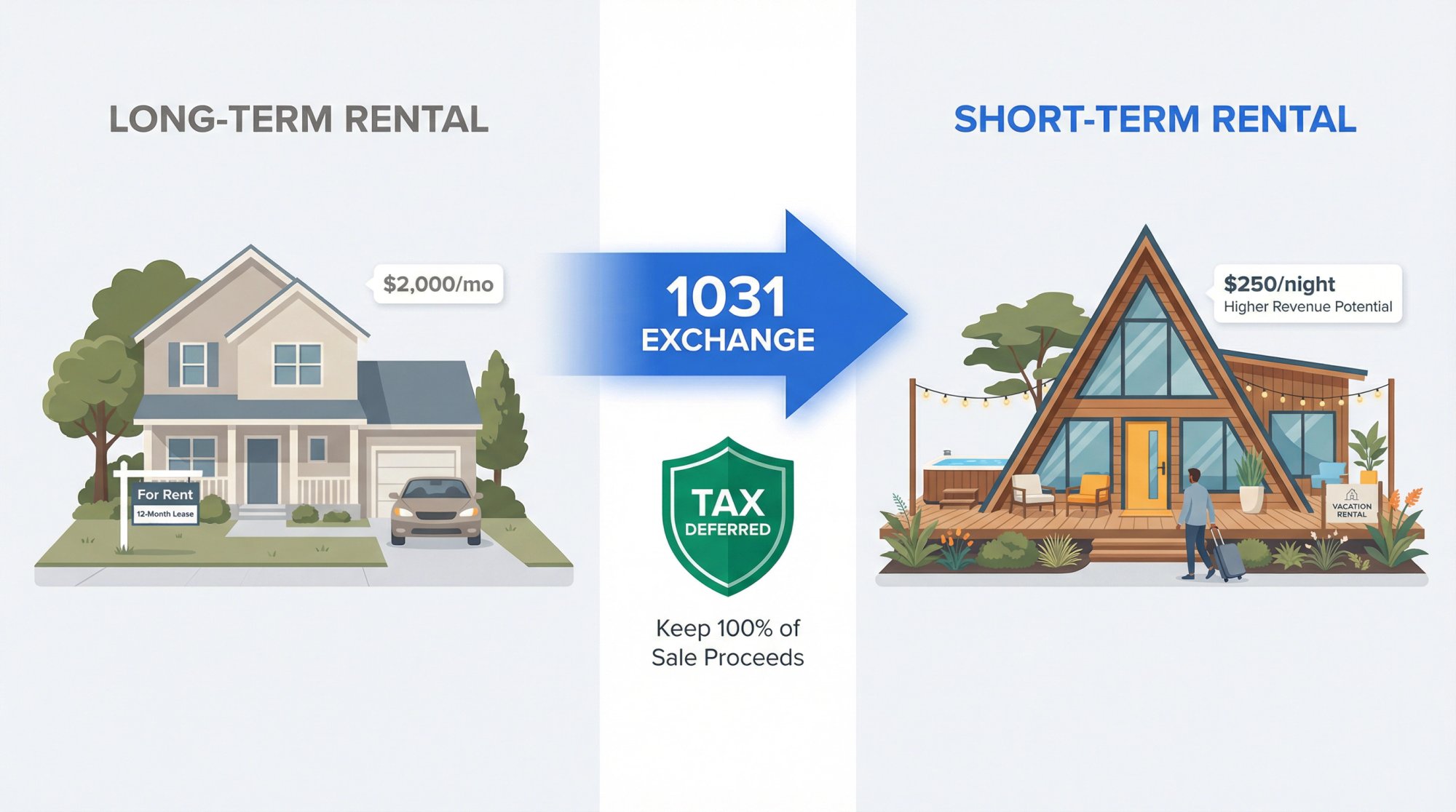

And then there's the tax deferral. This is the big one. A 1031 exchange means you keep 100% of your sale proceeds working for you instead of sending 20-30% to the IRS. This deferral can dramatically accelerate wealth-building for STR investors.

A word of caution: Short-term rentals require more hands-on management than long-term leases. You'll deal with cleaning turnovers, guest communications, dynamic pricing, and local regulations. This isn't passive income in the traditional sense. But for investors willing to put in the work (or hire professional management), the rewards can be substantial.

What Is a 1031 Exchange and How Does It Work?

A 1031 exchange, named after IRS Code Section 1031, is a tax-deferred swap of investment properties. You sell one property and reinvest the proceeds into another "like-kind" property without paying capital gains taxes at the time of sale.

The term "like-kind" sounds restrictive, but it's actually quite broad for real estate. Any real property held for investment can be exchanged for any other real property held for investment. A rental house for a piece of land. An apartment building for a vacation home. A long-term rental for a short-term rental. They're all like-kind in the eyes of the IRS.

The 1031 Exchange Process Step by Step

Here's the basic flow:

You sell your current property with the intent to exchange. A special third party called a Qualified Intermediary (QI) holds the sale proceeds. This is critical: you cannot touch the money yourself. If the cash hits your personal account, even briefly, the exchange is blown.

You then identify potential replacement properties within 45 days and purchase your chosen property within 180 days of the original sale. The QI releases the funds to complete the purchase. If everything is done correctly, you owe $0 in taxes for that year. The tax liability gets deferred into the new property.

45-Day and 180-Day Rules Explained

| Rule | Timeframe | Details |

|---|---|---|

| Identification Period | 45 calendar days | You must formally identify replacement properties in writing to your QI |

| Exchange Period | 180 calendar days | You must close on your replacement property |

| Property Limit | Up to 3 properties | The standard "3-property rule" for identification |

According to Investopedia's 1031 guide, these deadlines are absolute. Day 46 is too late for identification, even if day 45 falls on a weekend or holiday. There are no extensions. Missing either deadline means the exchange fails and your sale becomes immediately taxable.

Tax Deferral vs. Tax Elimination

Important distinction: A 1031 exchange defers taxes; it doesn't eliminate them permanently. Your capital gains and depreciation recapture from the old property carry over into the new property's basis. If you eventually sell for cash without exchanging, you'll owe taxes then.

That said, many investors never pay those deferred taxes. They execute one exchange after another, a strategy sometimes called "swap til you drop." According to Kiplinger, investors who continue exchanging through their lifetime can pass properties to heirs who receive a stepped-up basis. The accumulated deferred gains essentially vanish.

Can You 1031 Exchange into an Airbnb or STR?

Yes. A short-term Airbnb rental can absolutely serve as your replacement property in a 1031 exchange. The IRS doesn't care whether your rental strategy involves year-long leases or nightly bookings. What matters is that both properties are held for investment or business use, not personal use.

But the IRS does scrutinize short-term rentals more closely because they can look like vacation homes in disguise. Here's how to stay compliant:

How to Meet IRS Investment Property Requirements

The IRS has safe harbor guidelines (outlined in Revenue Procedure 2008-16) that clarify what qualifies. To satisfy the safe harbor:

-

Own the property for at least 2 years after the exchange

-

Rent it out at fair market rates for at least 14 days in each of the first two 12-month periods

The 14-day threshold is a low bar, but it establishes that you're running a legitimate rental business. Most STR investors will far exceed this minimum anyway.

Personal Use Limits for 1031 STR Properties

This is where many investors trip up. The IRS caps your personal use at the greater of 14 days per year or 10% of the total days the property is rented.

Here's how that calculation works in practice:

| Days Rented | Max Personal Use |

|---|---|

| 100 days | 14 days (the 14-day floor applies) |

| 150 days | 15 days (10% of 150) |

| 200 days | 20 days (10% of 200) |

Exceeding these limits could jeopardize your 1031. The IRS might reclassify your property as a personal residence rather than an investment, which would invalidate the exchange.

What Disqualifies a Property from 1031 Treatment?

-> Quick flips. Properties held under about 12 months may be viewed as inventory for resale rather than investment. Hold for at least 1-2 years to demonstrate investment intent.

-> Primary residence conversion. Don't buy an STR through a 1031 and immediately move in. Rent it for at least 2 years before any such conversion.

The bottom line? Many investors successfully exchange into vacation rentals. It's a well-established strategy. Just treat the property as a business, not a subsidized vacation home. Learn more about using 1031 exchanges for STR investments.

5 Benefits of Using a 1031 Exchange for Your STR

Why bother with the complexity of a 1031 exchange instead of just selling, paying taxes, and buying fresh? Because the financial advantages compound significantly over time.

1. Keep 100% of Your Sale Proceeds Working

Without an exchange, a sale that triggers $300,000 in gains might leave you with only $230,000 after taxes. With a 1031, you reinvest the full $300,000. That extra $70,000 in your down payment means you can afford a better property, carry less debt, or generate stronger cash flow from day one.

This is essentially an interest-free loan from the government to yourself.

2. Upgrade to Higher-Performing Rental Properties

A 1031 exchange lets you upgrade your portfolio without penalty. Maybe your long-term rental has been underperforming. Now you can swap into a short-term rental with higher income potential in a stronger market. Because you're not losing capital to taxes, you might afford a property that was previously out of reach.

3. Diversify Your Real Estate Portfolio by Location

Real estate markets vary dramatically by location. With a 1031, you can sell in one market and buy in another without tax friction. Nervous about having all your equity in one property? You could split into multiple smaller STRs across different vacation markets, spreading your risk and seasonal income streams.

The 1031 rules allow going from one property to multiple, or vice versa, as long as identification requirements and value thresholds are met.

4. Maximize Depreciation with Cost Segregation

When you exchange into a more expensive property, you get additional basis to depreciate. Many investors combine 1031 exchanges with cost segregation studies on the new property to accelerate depreciation deductions and shelter even more income from taxes.

5. Build Generational Wealth with Unlimited Exchanges

There's no limit to how many 1031 exchanges you can complete over your lifetime. You could continue to defer taxes deal after deal, allowing your equity to compound without interruption. According to Kiplinger, heirs who inherit properties with a stepped-up basis may never pay the accumulated deferred taxes.

Over decades, this strategy can be worth hundreds of thousands of dollars.

How to Complete a 1031 Exchange from LTR to STR

Making a 1031 exchange work requires upfront planning and precise coordination. Here's the roadmap:

Step 1: Hire a Qualified Intermediary Before You Sell

A Qualified Intermediary is the neutral third party who holds your sale proceeds and facilitates the exchange. This isn't optional. If you (or your agent) touch the funds, the exchange fails.

Contact a reputable QI before your sale closes, ideally when you list the property or go under contract. They'll provide exchange agreement language and instructions for your closing. QI fees typically run $800 to $1,500, which is minimal compared to the tax savings at stake.

Also consult with a CPA or tax advisor at this stage to confirm a 1031 makes sense for your situation.

Step 2: Sell Your Long-Term Rental Property

List and sell your property as you normally would, with these critical additions:

Make sure the QI is written into the closing. The sale proceeds flow to the QI's escrow account, not to you.

Mark day 0. Your 45-day and 180-day clocks start on the closing date of the sale.

Notify all parties that this is a 1031 exchange. The title company will have additional paperwork.

Step 3: Identify Replacement Properties Within 45 Days

This is where the pressure kicks in. You have 45 calendar days from your sale closing to formally identify your replacement STR in writing to your QI.

Use the 3-property rule wisely. You can identify up to three potential properties as backups. You don't have to buy all three, but having options protects you if one deal falls through.

Start your search early. Don't wait until after closing to start looking. The 45 days go fast. Ideally, you've been researching STR markets and viewing properties while your old property was on the market.

Work with an exchange-savvy agent. A real estate agent experienced in 1031 exchanges and short-term rentals is invaluable here. They understand the urgency and can help you identify qualifying properties quickly. Chalet's network of Airbnb-friendly agents specializes in exactly this scenario.

Step 4: Complete Due Diligence and Lock In Financing

Once you've identified candidates and gotten an offer accepted:

Inspect the property thoroughly. Analyze the STR potential using an Airbnb calculator, review projections, and verify there are no physical or legal red flags.

Verify local regulations. Confirm the property can legally operate as a short-term rental. Check zoning, permit requirements, and any HOA restrictions. Chalet's STR Regulations library covers many markets, but also check directly with the municipality for the latest ordinances.

Lock in your financing. Let your lender know it's a 1031 exchange. Move quickly because your down payment will come from the QI.

Critical: To fully defer taxes, you generally need to reinvest all the cash and acquire a property of equal or greater value (and replace any debt from the old property). Cash you take out or debt you don't replace could be taxable "boot."

Step 5: Close on Your STR Within 180 Days

Coordinate with your QI and title company to close the purchase. The QI will supply the funds (your down payment from the sale) directly to escrow.

Don't cut it close. Aim to close well before the 180th day. There are no extensions for financing delays or other hiccups.

Once the QI transfers the funds and the purchase closes, your exchange is complete. Your QI will provide documentation for your tax filing.

What Is a Reverse 1031 Exchange?

What if you find the perfect STR before your old property sells? A reverse exchange lets you buy first, then sell. The intermediary parks title to the new property while you complete the sale of the old one. It's more complex and requires cash to close without sale proceeds, but it can be a lifesaver in competitive markets.

How Chalet Helps 1031 Investors Find STR Properties

Executing a 1031 exchange into a short-term rental comes with tight timelines and specialized needs. At Chalet, we've built our platform specifically for investors like you.

Free STR Market Analytics and Revenue Data

Before you commit to a replacement property, you need to know the numbers work. Our free STR analytics dashboards show average daily rates, occupancy trends, and revenue potential across dozens of markets. No paywall, no subscription required.

Use our Airbnb ROI calculator to run projections on specific properties. Input the purchase price, estimated expenses, and projected income to see whether the cash flow justifies the buy. Learn more about estimating your Airbnb income potential.

1031 Exchange Real Estate Agents

The 45-day identification window doesn't leave room for agents who need to learn on the job. Our network of Airbnb-friendly agents understands both STR investing and 1031 exchange requirements. They can help you find qualifying properties quickly, navigate local regulations, and write offers that align with your timeline. Discover the benefits of working with a realtor specializing in STRs and 1031 exchanges.

DSCR Loans and STR-Friendly Lenders

Traditional lenders sometimes hesitate with vacation rental properties. We connect you with lenders who specialize in DSCR (Debt Service Coverage Ratio) loans designed for investment properties. These loans qualify based on the property's projected rental income rather than your personal income, making it easier to scale your portfolio. Learn more about DSCR financing for short-term rentals.

Vetted Vendors for Property Setup and Management

Once you close, you'll need property managers, cleaning services, insurance, furnishing, and possibly cost segregation specialists. Our vendor directory connects you with vetted professionals in each category, so you can get your new STR operational quickly (remember, you need those 14 rental days in year one).

All Coordinated for Tight 1031 Timelines

1031 buyers can't afford dropped balls. We help coordinate agents, lenders, and vendors to keep your exchange on track.

Ready to find your replacement STR? Browse Airbnb rentals for sale or connect with a 1031-savvy agent to get started.

How to Choose the Right STR for Your 1031 Exchange

Not every property makes a good STR. And within your 45-day window, you don't have time for trial and error. Here's how to choose the right investment property:

Find Markets with STR-Friendly Regulations

A great deal in a city that bans short-term rentals isn't a great deal at all. Research local regulations before you buy. Some cities require permits, cap the number of STRs, or prohibit rentals in certain zones entirely. Places like New York City and Honolulu have famously restrictive rules.

Vacation towns (beach communities, ski resorts, national park gateways) generally welcome STRs but may still require business licenses or lodging tax registration. Check Chalet's regulation guides and verify directly with the municipality. You can also explore our guides to top STR-friendly markets in Florida, Texas, and Arizona.

Evaluate Occupancy Rates and Seasonal Trends

Understand what income the property can realistically generate. Factors like location, tourist traffic, nearby attractions, and seasonality all affect occupancy and rates.

A lake house might do 90% of its business in summer. A ski cabin peaks in winter. Make sure the annual revenue still meets your goals after accounting for seasonal lulls.

Use Chalet's free market analytics to see ADR (average daily rate) and occupancy trends in various markets. Run a pro forma on any property you're serious about using our Airbnb calculator.

What Amenities Drive STR Bookings?

In short-term rentals, location and amenities drive bookings. Study top-performing listings in the area to see what features guests value:

-

Hot tubs and outdoor spaces

-

Walkability to attractions or beaches

-

Adequate bedrooms and bathrooms for groups

-

Unique design or experience factors

Match or Exceed Your Sale Price to Avoid Taxable Boot

To defer all taxes, your replacement property's purchase price should be equal to or higher than your sale price. If you had a mortgage on the old property, the new mortgage should be equal or higher too.

If you find a great STR that's cheaper than what you sold, you have options:

-

Pay tax on the difference (partial exchange)

-

Add a second small property to use up excess funds

-

Work with your QI on construction exchange options

Budget 10-15% of Purchase Price for Furnishing

STRs need to be furnished and stocked. Personal property items (furniture, linens, kitchenware) cannot be purchased with 1031 funds because only real estate qualifies for like-kind treatment.

Budget approximately 10-15% of purchase price for furnishing if starting from scratch. Some sellers include furnishings in vacation rental sales, which can save you time and money.

Self-Manage or Hire a Property Manager?

If you're transitioning from an LTR (where you might have collected monthly rent and done occasional repairs) to an STR, prepare for more active management. Every guest means cleaning, communication, pricing adjustments, and maintenance.

Decide early whether you'll self-manage or hire a property manager (typically 20-30% of revenue). If you live far from the property, local management is often essential. Chalet's vendor network includes vetted property managers and cleaners to help you get operational quickly.

1031 Exchange Financing: DSCR Loans and Timing Tips

The 180-day deadline creates real pressure on your financing. Here's how to stay ahead:

Get Pre-Approved Before Your Sale Closes

Talk to lenders before your sale closes. Explain you're doing a 1031 exchange. Being pre-approved (or pre-underwritten) gives sellers confidence in your offers and speeds up closing.

Remember: your new debt should match or exceed your old debt to avoid taxable boot from debt reduction. Learn more about short-term rental loans.

How DSCR Loans Work for STR Investors

Traditional lenders underwrite based on your personal income, which can be limiting if you already have several mortgages. DSCR loans qualify based on the property's income instead.

According to Chalet's loan resources, DSCR lenders look at the projected short-term rental income and typically require a ratio above 1.2 with 20-25% down. These loans let each property stand on its own economics, making it easier to scale.

Make Your 180-Day Deadline Non-Negotiable

When you sign a purchase contract, make sure the closing date falls within your 180-day window. Tell your lender, title company, and everyone involved that this deadline has no flexibility. If bank delays threaten to push you past day 180, you may need to pivot to a bridge loan or private financing to close in time.

How to Use Your 45 Identification Days Wisely

One common pitfall: scrambling near day 45 to identify anything just to have properties on record. This leads to hasty decisions or failed exchanges. Start looking at STR markets before your sale even closes. Get familiar with pricing, returns, and inventory.

Some investors negotiate a longer closing on their sale (60-90 days) to extend their runway before the identification clock starts. If your buyer is flexible, this can reduce pressure significantly.

Backup Plans if You Can't Find a Property

What if you approach day 45 and haven't found the right property?

Identify something anyway and try to close, even if imperfect

Designate a DST (Delaware Statutory Trust) as a backup. DSTs are passive fractional ownership in large real estate portfolios that qualify as like-kind. You can invest in a DST to complete the exchange if no direct property pans out.

Accept the tax. If the exchange truly can't work, the QI returns your funds and you pay taxes on the gain. Not ideal, but sometimes the right call.

Managing Your New STR After the 1031 Exchange

Congratulations on closing. Now your focus shifts to operating successfully and maintaining compliance with the exchange requirements.

Start Renting Your Property Immediately

Don't let your new STR sit idle. Remember the safe harbor: at least 14 days of rental in each of the first two years. Get your listing live on Airbnb, VRBO, or with your property manager as soon as possible. Price competitively to secure initial bookings and start building reviews. Learn how to optimize your Airbnb listing for SEO.

Keep Personal Use Under 14 Days Per Year

For the first two years, be strict about personal stays. Keep them under 14 days per year (or 10% of rental days). Many tax advisors recommend zero personal use in year one to be extra safe.

If you do vacation there, log the days meticulously. And don't convert the property to your primary residence for at least two years.

Keep Records of All Rental Activity

Keep records of all rental activity. Use a separate bank account for the property if possible. Track rental income, expenses, and the number of days rented vs. used personally. This substantiates your investment property status if ever questioned.

Get Permits and Pay Lodging Taxes

Register for any required permits and business licenses. Remit lodging taxes as required (Airbnb may collect some automatically, but know your obligations). Operating illegally could jeopardize both your local standing and the legitimacy of your exchange. Review the regulations in your target market.

How to Maximize Your STR Income

To realize the financial upside that motivated your switch:

-

Invest in professional photography and a compelling listing

-

Use dynamic pricing tools to adjust rates for demand

-

Respond quickly to guest inquiries

-

Maintain excellent cleanliness and reviews

Learn more about maximizing your Airbnb profitability.

Get STR Insurance (Not Landlord Coverage)

Your old landlord policy won't cover short-term rental activity. Get a dedicated STR insurance policy that covers guest-related risks, liability, and more frequent turnover. Expect higher premiums than your previous coverage.

Planning Your Next 1031 Exchange

Already thinking about your next exchange? There's no required holding period beyond demonstrating investment intent (the 1-2 year guideline). When you're ready to sell, you can execute another 1031 into an even better property or multiple properties. Read our guide on the tax implications of selling your Airbnb.

Stay Updated on 1031 Tax Law Changes

As of 2025, 1031 exchanges remain fully intact with no cap on deferrals. But proposals to limit exchanges have been floated before. Keep an ear out for legislative changes that could affect future exchanges. Check out what Trump's tax cut plans could mean for STR investors.

7 Mistakes That Kill 1031 Exchanges (And How to Avoid Them)

Even experienced investors can stumble. Here are the traps that derail exchanges. For a deeper dive, read our guide on 5 common mistakes to avoid in 1031 exchanges:

1. Missing the 45-Day or 180-Day Deadline

The 45-day and 180-day rules are absolute with virtually no exceptions. Yet this remains the #1 reason exchanges fail. Start your search early, identify backup properties, and mark your calendar with countdown reminders.

2. Taking Control of the Sale Proceeds

You must never receive or control the sale proceeds, not even briefly. Always use a Qualified Intermediary and ensure escrow sends funds directly to the QI. Don't try DIY workarounds.

3. Purchasing a Non-Qualifying Property

The replacement must be held for investment, not personal use. Buying a property you intend to primarily live in, or one located outside the U.S. (1031 requires domestic properties), will disqualify the exchange.

4. Buying in a Market That Bans STRs

Buying in a market that prohibits or heavily restricts STRs means you might not generate expected income. Always verify local regulations and have a backup plan for the property.

5. Underestimating STR Operating Costs

New STR operators are often surprised by expenses: cleaning fees, higher utilities, platform commissions, supplies, insurance. Build a realistic budget based on conversations with local operators or property managers. Use our Airbnb calculator to run the numbers.

6. Extracting Cash at the Wrong Time

Receiving cash ("boot") at closing is taxable. Refinancing right before or immediately after the exchange can also be scrutinized if it appears connected to extracting equity. If you want to pull cash out, do it well before listing your old property (so it's unrelated) or wait 6-12 months after the exchange closes.

7. Skipping Professional Tax and Legal Advice

1031 exchanges sit at the intersection of real estate and tax law. A Qualified Intermediary handles the mechanics but doesn't give tax advice. Work with a CPA familiar with 1031s and consider legal help for complex scenarios (partnership splits, reverse exchanges, improvement exchanges).

The remedy for all these pitfalls? Plan methodically, work with experts, and don't cut corners.

1031 Exchange FAQs for STR Investors

Can I exchange a long-term rental for a short-term rental?

Yes. Both are considered like-kind investment properties for 1031 exchange purposes. The IRS doesn't distinguish between rental strategies. What matters is that both properties are held for investment or business use, not personal use.

How long do I have to identify a replacement property?

You have 45 calendar days from the closing of your old property sale to formally identify potential replacement properties in writing to your Qualified Intermediary. You can identify up to three properties under the standard rule.

How long do I have to close on the replacement property?

You must close within 180 calendar days of selling your original property. This deadline runs concurrently with the 45-day identification period. There are no extensions.

What happens if I use my STR as a vacation home?

Limited personal use is allowed. You can stay up to 14 days per year or 10% of the days the property is rented, whichever is greater. Exceeding this could cause the IRS to reclassify the property as a personal residence, potentially invalidating your 1031 exchange.

Do I need a Qualified Intermediary for a 1031 exchange?

Yes. The IRS requires that sale proceeds be held by a QI. If you or your agent receive the funds directly, even temporarily, the exchange is disqualified. QI fees typically range from $800 to $1,500.

Can I do multiple 1031 exchanges?

There's no limit to how many 1031 exchanges you can complete over your lifetime. Many investors use this strategy repeatedly to defer taxes indefinitely, eventually passing properties to heirs with a stepped-up basis.

What is "boot" in a 1031 exchange?

Boot refers to cash or debt relief you receive that doesn't get reinvested. For example, if you sell a $500,000 property and only buy a $400,000 replacement, the $100,000 difference is boot and is taxable. To fully defer taxes, reinvest all proceeds and replace any mortgage debt.

Start Your 1031 Exchange Today

Making the transition from long-term landlord to short-term rental owner is a significant move, but a 1031 exchange makes it financially smart. You've learned how to defer taxes, the rules you must follow, and the strategies that help investors execute successfully.

The key takeaways:

It's absolutely legal to exchange a long-term rental for a short-term rental. Investors are doing it successfully to capitalize on the vacation rental market without paying capital gains tax.

Success depends on planning and execution. Line up your QI, start searching early, and know the 45/180-day rules cold.

Treat your new STR as an investment. Rent it extensively, limit personal use, and follow local regulations.

You can repeat this strategy. Continue deferring taxes deal after deal to compound your portfolio growth.

Chalet is here to help. Our platform exists for investors making moves in the short-term rental space:

-

Analyze markets and properties with our free analytics dashboards

-

Run ROI projections on potential replacement properties

-

Connect with 1031-savvy agents who understand STR investing and tight exchange timelines

-

Browse Airbnb rentals for sale to see what's on the market

-

Access STR-friendly lenders for DSCR and investor financing

-

Check local regulations before you commit to a market

Embarking on a 1031 exchange can feel complex, but with the right knowledge and team, it's very achievable. The reward is substantial: deferring tens of thousands (or more) in taxes while upgrading into a higher-yield investment.

Ready to get started? Meet an Airbnb-friendly agent to kick off your 1031 journey, or explore STR listings in top markets. With expert guidance and a smart strategy, you'll be well on your way to owning a successful short-term rental without paying unnecessary taxes along the way.