Written by: Sanjin Hadziomerovic

The short-term rental (STR) market is constantly evolving, and as we step into 2025, our latest analysis reveals valuable insights for real estate investors. By leveraging proprietary data from Airbnb calendar tracking, Zillow, and MLS insights, we’ve explored key trends for full-time Airbnb listings available more than 180 days a year.

Key Market Trends and Insights

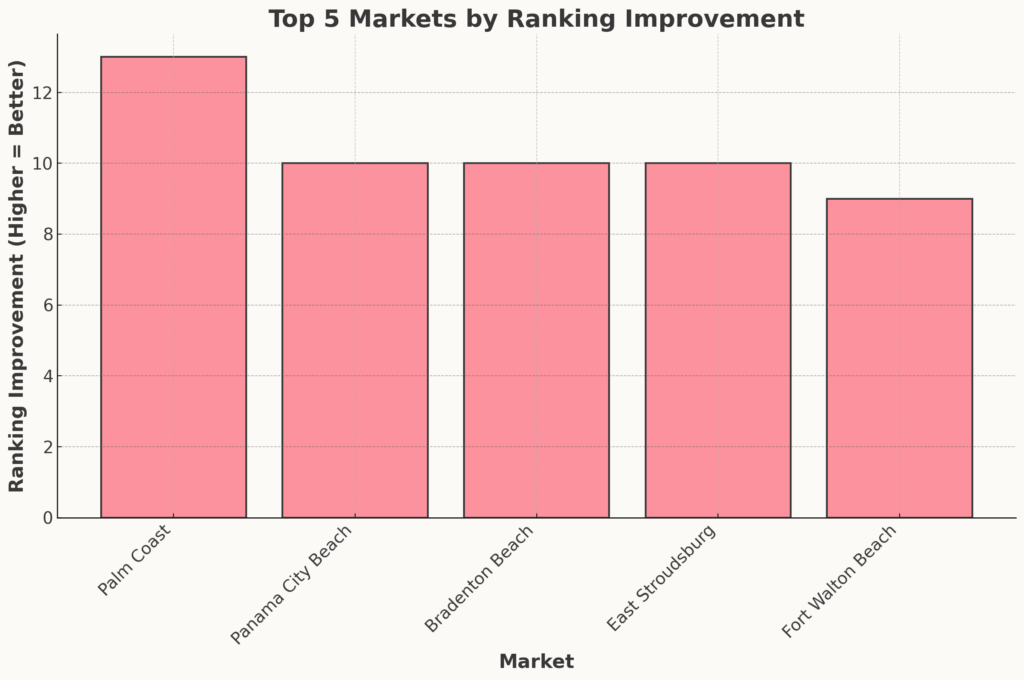

1. Ranking Improvements Across Markets

The greatest ranking improvements were observed in:

- Palm Coast: Improved by 13 spots (ranked 33rd as of March 2025)

- Panama City Beach: Improved by 10 spots (ranked 32nd as of March 2025)

- Bradenton Beach: Improved by 10 spots Improved by 10 spots (ranked 56th as of March 2025)

- East Stroudsburg: Improved by 10 spots (ranked 73rd as of March 2025)

- Fort Walton Beach: Improved by 9 spots (ranked 13th as of March 2025)

These improvements often reflect rising investor interest, increased profitability, or seasonal demand shifts. Markets like Blue Ridge and Joshua Tree, known for their scenic appeal, have likely benefited from targeted marketing or improved tourism infrastructure.

2. Gross Yield Leaders

Gross yield remains a critical metric for investors. The top-performing markets in March 2025 were:

- Detroit: 41.72%

- Cleveland: 29.50%

- South Bend: 28.19%

- Birmingham: 24.29%

- Memphis: 23.05%

These markets exhibit strong returns relative to property prices, often driven by affordable home prices and steady rental demand. For example, Detroit’s high gross yield reflects its affordability combined with consistent rental revenue.

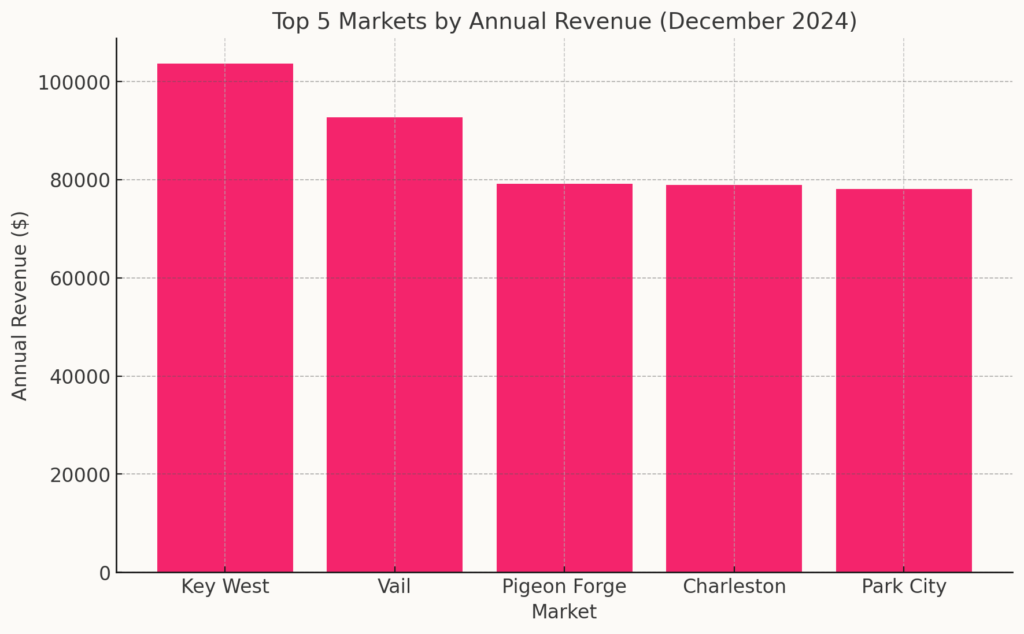

3. Annual Revenue Giants

Some markets generated exceptional median annual revenues in December:

- Key West: $103,633

- Vail: $92,646

- Pigeon Forge: $79,176

- Charleston: $78,905

- Park City: $78,080

These markets typically cater to high-spending tourists or feature premium accommodations. Key West and Vail, for instance, capitalize on their year-round appeal and affluent visitors.

4. Revenue Growth vs. Decline

Out of all the markets analyzed:

- 50.5% experienced revenue growth.

- 49.5% saw a revenue drop.

The chart below illustrates this split, showcasing the resilience of most markets even as seasonality impacted others.

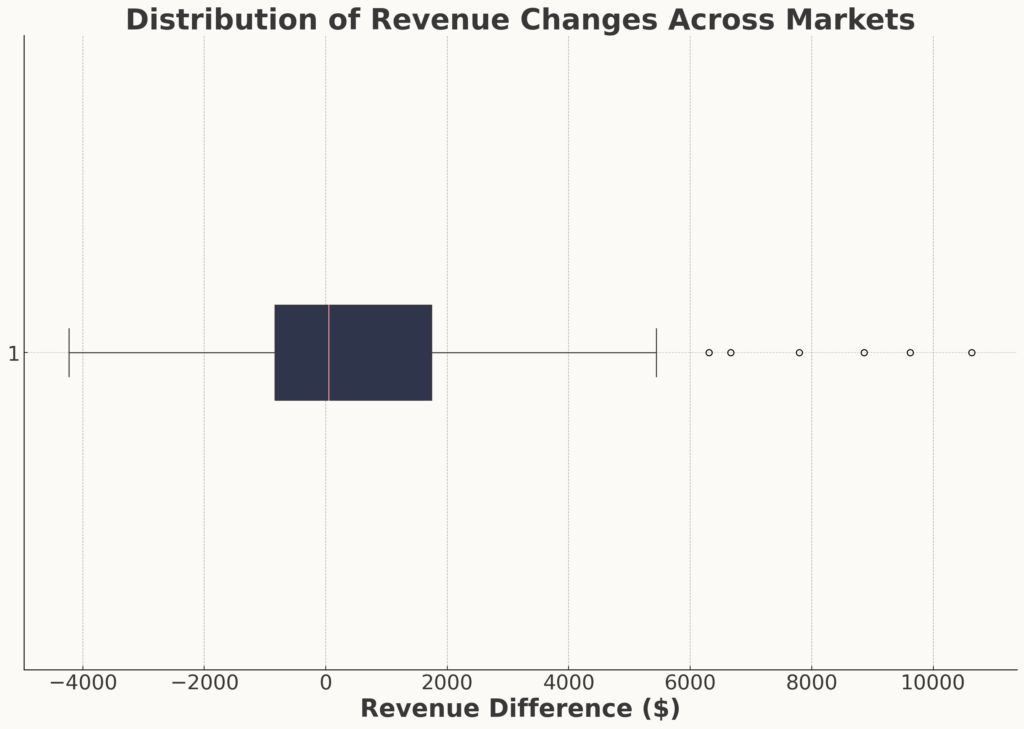

5. Distribution of Revenue Changes

A box plot of revenue changes across markets reveals the variability in performance:

- Outliers: Markets like Park City and Banner Elk showed significant revenue growth, while Lake Arrowhead and Blue Ridge saw notable declines.

- Median Change: Most markets experienced modest fluctuations, highlighting stable demand.