Mountain towns have always attracted short-term rental investors. The appeal makes sense: scenic views, outdoor recreation, and steady tourist traffic. What separates smart investors from everyone else? Not all mountain markets deliver the same returns.

Some destinations have sky-high home prices that crush your margins. Others look affordable on paper but lack the tourism demand to fill your calendar. The sweet spot? Markets where purchase prices stay reasonable while rental income runs strong.

That combination produces what we call high-yield markets, places where your annual rental revenue represents a significant percentage of your property's purchase price. And in 2025, several mountain and mountain-adjacent towns are delivering gross yields that beat coastal cities, urban rentals, and even many famous ski destinations.

At Chalet, we track these markets constantly through our free analytics dashboards. We've identified seven destinations worth your attention, each offering that rare blend of natural beauty, tourist appeal, and (most importantly) affordable entry points relative to their revenue potential.

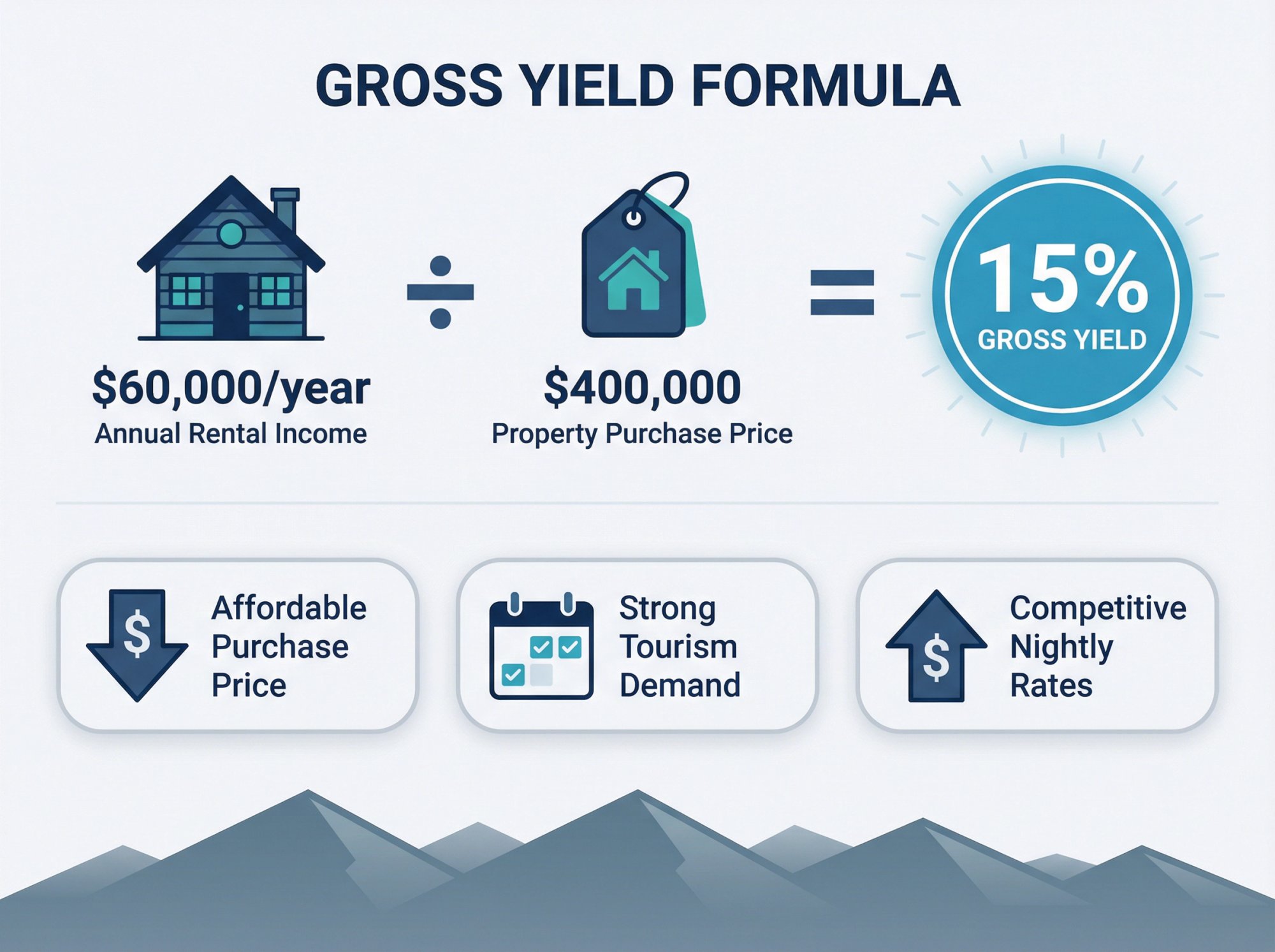

How to Calculate Gross Yield on Mountain Airbnb Rentals

Before jumping into specific markets, you need to understand how investors measure yield on Airbnb rentals.

Gross yield is the simplest calculation: take your annual rental revenue and divide it by the property's purchase price. A cabin generating $60,000 per year that you bought for $400,000 has a 15% gross yield.

Why gross yield matters: It's your first-pass filter for identifying markets worth deeper analysis. A market with 8% gross yield will almost never net positive cash flow after expenses. A market with 15% gross yield? That's worth running the full numbers.

The "high-yield" formula is straightforward. You need:

→ Affordable purchase prices (relative to comparable vacation markets)

→ Strong tourism demand (consistent bookings, not just one peak season)

→ Competitive nightly rates (guests willing to pay for the experience)

Famous ski towns like Aspen or Park City fail this test. They have the demand and the rates, but home prices are so extreme that yields compress to single digits. Lesser-known destinations often deliver double-digit yields because the entry cost hasn't caught up with the rental income potential.

That's exactly what you'll find in the markets below.

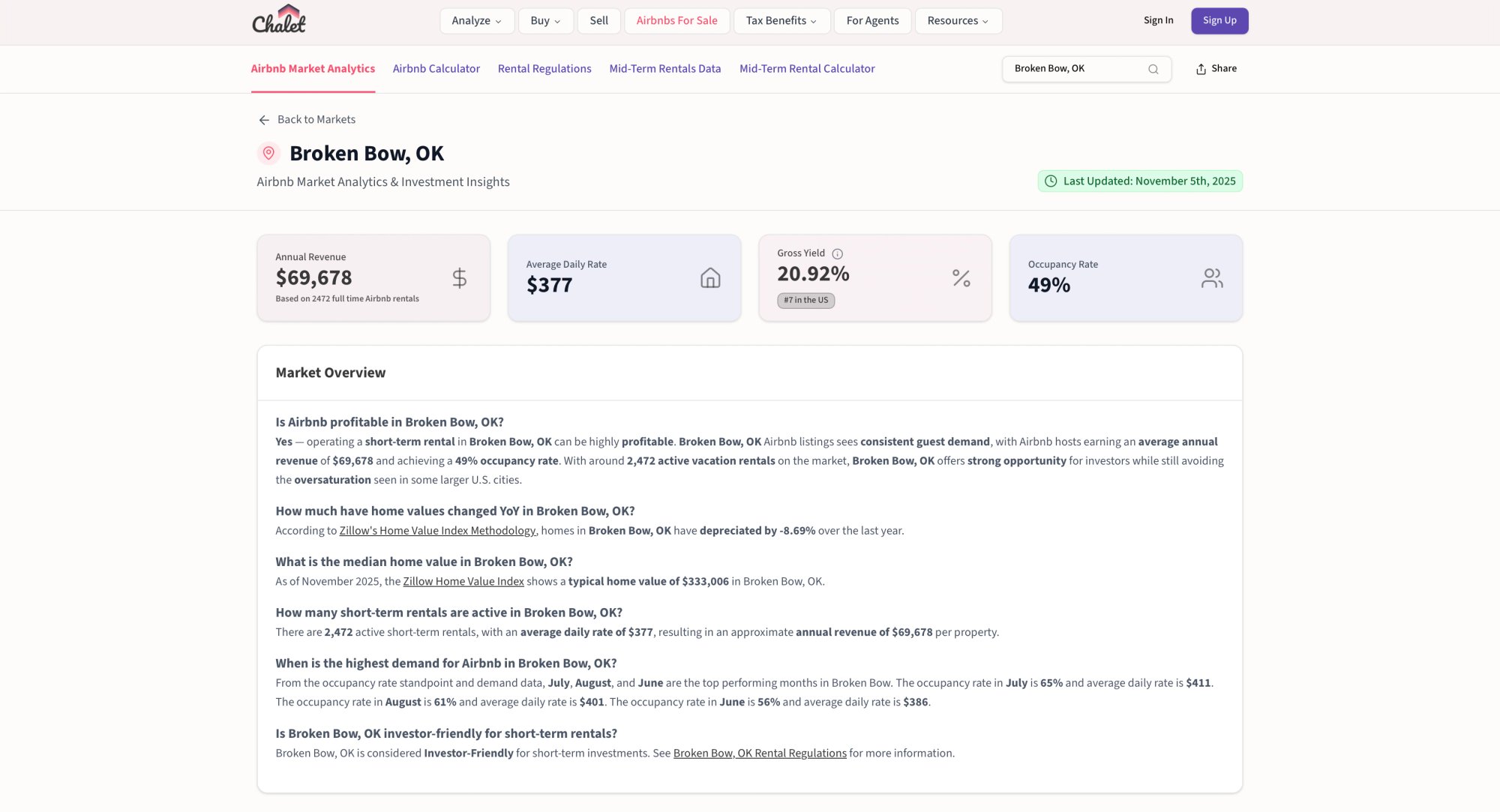

Broken Bow, Oklahoma: Why This Cabin Market Leads in Gross Yield

Tucked into the Ouachita Mountain foothills of southeastern Oklahoma, Broken Bow has quietly become one of the most profitable Airbnb markets in the entire country.

The draw? Rustic luxury. Visitors come for Broken Bow Lake, Beavers Bend State Park, and an endless supply of modern cabins with hot tubs, game rooms, and forest views. It's close enough to Dallas and other Texas metros for easy weekend trips, yet remote enough to feel like an escape.

According to Chalet's Broken Bow market analytics, here's what investors are seeing:

| Metric | Broken Bow Performance |

|---|---|

| Average Annual Revenue | ~$69,700 |

| Occupancy Rate | ~49% (peaks 60-65% in summer) |

| Average Daily Rate | ~$377 (ranges from $386 to $700 in peak months) |

| Median Home Price | ~$333,000 |

| Gross Yield | ~21% |

That gross yield is exceptional. A cabin generating over one-fifth of its purchase price in annual rental income puts Broken Bow among the highest-yielding STR markets nationwide.

The market has grown rapidly. Inventory has quadrupled since 2020, with over 2,400 active short-term rentals now operating. But demand has kept pace. And critically, the area maintains investor-friendly STR regulations, with no major restrictions on vacation rentals.

Investor insight: Broken Bow cabins with premium amenities (hot tubs, game rooms, high-end finishes) consistently outperform. If you're entering this market, don't skimp on the experience you're offering guests.

Compared to the Smoky Mountains, Broken Bow remains less saturated while delivering higher percentage returns. If you're hunting for yield, this Oklahoma gem deserves serious consideration.

Lake Harmony, Pennsylvania: Poconos Airbnb Returns and East Coast Access

Pennsylvania's Pocono Mountains have drawn vacationers for generations. Lake Harmony sits at the heart of this region, offering a four-season playground that's within driving distance of New York, Philadelphia, and other major East Coast metros.

Winter means skiing at Big Boulder Mountain. Summer brings lake activities, waterparks, and hiking. Fall delivers some of the best foliage on the Eastern Seaboard. That year-round appeal translates into bookable nights across the calendar.

What makes Lake Harmony particularly interesting for investors is the combination of surprisingly high nightly rates and moderate home prices:

| Metric | Lake Harmony Performance |

|---|---|

| Average Annual Revenue | ~$42,000 |

| Occupancy Rate | 35-50% (higher on weekends/holidays) |

| Average Daily Rate | ~$557 overall (premium chalets even higher) |

| Typical Home Price | ~$317,000 |

| Gross Yield | ~13% |

That ADR isn't a typo. Large multi-bedroom chalets in Lake Harmony regularly command $500+ per night during peak seasons. Even with occupancy running in the 40-50% range, those rates generate solid annual income.

As noted in Chalet's analysis of top Eastern markets, Lake Harmony represents one of the best yield opportunities in the Northeast.

A few things to watch:

-

Seasonality is real. Winter and summer are your moneymakers. Spring "mud season" and late fall tend to be slower.

-

The township currently permits vacation rentals, but always verify any HOA restrictions before purchasing.

-

Properties with ski-in/ski-out access or lakefront views command premium rates.

If you want a mountain lake vibe without Rocky Mountain prices, Lake Harmony delivers. Looking to explore other Poconos options? Check out Tobyhanna and East Stroudsburg for additional opportunities.

Duluth, Minnesota: Affordable Lakefront STR Investing on the North Shore

Duluth might not scream "mountain town" on a map, but spend a few days there and you'll understand the appeal. This port city on Lake Superior's shore features hilly terrain, dramatic cliffs, and proximity to Minnesota's North Shore wilderness. It feels like a mountain destination.

What makes Duluth stand out for investors? Entry costs are remarkably low, especially compared to destination markets on either coast.

| Metric | Duluth Performance |

|---|---|

| Average Annual Revenue | ~$41,000-$48,000 |

| Occupancy Rate | 55-60% (~215 nights booked annually) |

| Average Daily Rate | ~$200-$280 |

| Median Home Price | ~$250,000-$300,000 |

| Gross Yield | ~13-16% |

The math works because you can find solid properties for under $300,000 while generating $40,000+ annually. That's the kind of spread that produces double-digit yields.

Duluth draws visitors year-round:

① Summer brings hikers and lakefront vacationers

② Fall foliage season packs the scenic North Shore drive

③ Winter attracts skiers and snowmobile enthusiasts heading to Spirit Mountain

④ Year-round, Duluth's craft beer scene has become a destination in its own right

Regulation note: Duluth enforces zoning for vacation rentals, and permits are required in certain districts. Research the specific property location before committing. Check local STR regulations to understand what's allowed.

Why Duluth works: The combination of four-season tourism, affordable real estate, and 55%+ occupancy rates creates a yield profile that rivals markets twice its profile. This is a classic "hidden gem" play for investors willing to look beyond the obvious destinations.

For investors exploring the Midwest, check out our guide to the best markets to invest in the Midwestern US.

Yucca Valley, California: Joshua Tree Area STR Revenue Potential

Just outside Joshua Tree National Park, Yucca Valley has emerged as a short-term rental hotspot in California's high desert. The area's trendy aesthetic (think modern desert cabins, stargazing platforms, yoga retreat vibes) draws a constant stream of visitors from Los Angeles and beyond.

In most of California, STR investing is a tough proposition. Home prices are elevated, regulations are restrictive, and yields compress to single digits. Yucca Valley breaks that pattern.

| Metric | Yucca Valley Performance |

|---|---|

| Average Annual Revenue | ~$55,000 |

| Occupancy Rate | 45-50% (spring and fall peaks) |

| Average Daily Rate | ~$346 |

| Median Home Price | ~$350,000-$400,000 |

| Gross Yield | ~13-15% |

Those numbers represent exceptional performance for a California market. A 46% occupancy rate at nearly $350/night produces mid-five-figure annual income. Against property prices in the low-to-mid $300,000s, you're looking at yields that outperform most of the state.

What to know before investing:

→ Seasonality: Summer is the slow season in the desert. Temperatures can exceed 100 degrees, and bookings drop significantly. Build your pro forma around spring/fall strength.

→ Unique expenses: Desert properties have specific costs. Pool maintenance, high AC bills during summer months, and dust management are real line items.

→ Regulations: San Bernardino County requires STR permits. The process is navigable, but factor permit costs into your acquisition timeline. Check Yucca Valley rental regulations for current requirements.

If you've ruled out California for STR investing, Yucca Valley might change your mind. Nature tourism plus relatively affordable prices equals returns that are hard to find elsewhere in the state. Nearby Joshua Tree offers similar opportunities worth exploring.

Gatlinburg and Pigeon Forge: What Smoky Mountain Cabins Actually Earn

No mountain rental conversation is complete without the Smoky Mountains. Gatlinburg and neighboring Pigeon Forge sit at the gateway to Great Smoky Mountains National Park, the most visited national park in America with over 12 million visitors annually.

This is arguably the most mature short-term rental market in the country. Tourists arrive year-round for hiking, Dollywood, ski areas, and the region's famous roadside attractions. The local ecosystem of property managers, cleaning services, and maintenance vendors is fully developed.

| Metric | Gatlinburg/Pigeon Forge Performance |

|---|---|

| Average Annual Revenue | ~$50,000+ (typical 2-3BR cabin) |

| Occupancy Rate | 50-60% (summer/October peaks) |

| Average Daily Rate | ~$337 |

| Median Home Price | ~$500,000 ($400K-$600K typical range) |

| Gross Yield | ~10-12% |

Those yields are lower than some emerging markets on this list, and there's a reason. Home prices in the Smokies have climbed significantly over the past five years. A surge of new cabin construction has also normalized occupancy rates from previous highs to the current 50% range.

But here's what you get in exchange: a proven track record and exceptional liquidity. The Smokies have delivered consistent returns for decades. If you need to sell, there's an active market of buyers. And the vendor infrastructure means you can set up operations quickly with experienced local partners.

Critical regulation note: Sevierville County (which includes Pigeon Forge) allows STRs in many areas. But Gatlinburg city has its own permit rules. Jurisdictions overlap in this region, so check the exact property location before you buy. Use our regulations tool to verify compliance requirements.

The trade-off: You're accepting a lower percentage yield for lower risk. For investors prioritizing stability over maximum returns, the Smokies remain a dependable choice.

If you're exploring this market, connect with one of our Airbnb-friendly agents who specialize in Smoky Mountain cabin investments.

Traverse City, Michigan: Wine Country STR Yields and Seasonal Trends

Traverse City offers a different flavor of mountain-adjacent investing. Known for its wineries, Lake Michigan shoreline, and growing foodie scene, this northern Michigan town has evolved from a regional getaway into a nationally recognized destination.

It's not technically in the mountains. But forested hills, nearby ski areas, and outdoor recreation give it that same appeal. And the numbers work.

| Metric | Traverse City Performance |

|---|---|

| Average Annual Revenue | ~$41,000 |

| Occupancy Rate | 45-55% |

| Average Daily Rate | ~$283 |

| Median Home Price | ~$350,000 |

| Gross Yield | ~10-12% |

The tourism calendar is varied: wine festivals in summer, cherry blossom season in spring, fall foliage trips, and winter sports. That diversity helps spread bookings across more of the year than single-season destinations.

Something to watch: Traverse City's popularity has attracted more STR inventory. Local reporting indicates occupancy has softened from about 90% during the 2022 peak down to roughly 61% in 2024 as more rentals entered the market. This is a competitive environment.

Seasonality is also pronounced. July can see 80%+ booking rates. April might drop below 30%. Build your financial model around realistic monthly fluctuations, not annual averages. Run detailed projections for any specific property you're considering.

For Midwestern investors looking for an alternative to coastal or mountain west markets, Traverse City offers solid yields with a distinct regional character. Learn more about Michigan's best Airbnb markets.

Santa Fe, New Mexico: Year-Round Cultural Tourism and Steady Occupancy

Santa Fe stands apart on this list. It's a small city (and New Mexico's capital) rather than a resort town. Home prices are higher. But what you gain is exceptional stability and year-round demand that many seasonal mountain markets can't match.

The draw is cultural tourism. Art markets, the Santa Fe Opera, world-class cuisine, adobe architecture, and Sangre de Cristo Mountain views create a unique destination that attracts affluent visitors throughout the year. There's no single "peak season" dependency here.

According to Chalet's Santa Fe market analytics, here's the current picture:

| Metric | Santa Fe Performance |

|---|---|

| Average Annual Revenue | ~$56,000 |

| Occupancy Rate | ~60% (steady month-to-month) |

| Average Daily Rate | ~$300 (premium casitas $300-$400) |

| Median Home Price | ~$600,000 |

| Gross Yield | ~9-10% |

That yield isn't as eye-catching as Broken Bow or Lake Harmony. But 60% occupancy that stays consistent across seasons is valuable. You're not riding a roller coaster of boom months and dead months.

What to know:

-

Santa Fe has implemented a permit system for short-term rentals.

-

Limits exist on non-owner-occupied rentals in certain residential areas.

-

STR-friendly zones do exist, and working through the regulations is manageable with local expertise from an experienced agent.

The Santa Fe case: This is a "high-end meets high-yield" market. You're paying more upfront for a property that delivers reliable, consistent cash flow in a premium destination. For investors prioritizing dependability over maximizing percentage returns, Santa Fe deserves consideration.

Mountain Airbnb Market Comparison: Revenue, Occupancy, and Yields

Here's how these seven markets stack up side-by-side:

| Market | Annual Revenue | Occupancy | ADR | Median Price | Gross Yield |

|---|---|---|---|---|---|

| Broken Bow, OK | ~$69,700 | ~49% | ~$377 | ~$333,000 | ~21% |

| Lake Harmony, PA | ~$42,000 | 35-50% | ~$557 | ~$317,000 | ~13% |

| Duluth, MN | ~$41,000-$48,000 | 55-60% | ~$200-$280 | ~$250,000-$300,000 | ~13-16% |

| Yucca Valley, CA | ~$55,000 | 45-50% | ~$346 | ~$350,000-$400,000 | ~13-15% |

| Gatlinburg/Pigeon Forge, TN | ~$50,000+ | 50-60% | ~$337 | ~$500,000 | ~10-12% |

| Traverse City, MI | ~$41,000 | 45-55% | ~$283 | ~$350,000 | ~10-12% |

| Santa Fe, NM | ~$56,000 | ~60% | ~$300 | ~$600,000 | ~9-10% |

The pattern is clear: emerging or lesser-known markets like Broken Bow and Lake Harmony deliver higher percentage yields because purchase prices haven't caught up with rental revenue potential. Established destinations like the Smokies and Santa Fe offer lower yields but come with proven track records, liquidity, and robust local service networks.

Emerging STR Markets vs. Established Destinations: How to Choose

Choosing between these market types comes down to your investment goals and risk tolerance.

Emerging markets (Broken Bow, Lake Harmony, Duluth, Yucca Valley) offer:

-

Higher gross yields (often 13-20%+)

-

Lower entry costs

-

Less competition (for now)

-

Potentially faster appreciation as the market matures

-

But also: Less historical data, thinner resale markets, and evolving local regulations

Established markets (Gatlinburg, Traverse City, Santa Fe) offer:

-

Proven, multi-year performance records

-

Active resale markets if you need to exit

-

Developed vendor ecosystems (property managers, cleaners, maintenance)

-

More predictable demand patterns

-

But also: Lower percentage yields, more competition, and higher entry costs

Neither approach is wrong. Some investors chase maximum yield and accept more uncertainty. Others prefer the stability of a mature market, even at the cost of a few percentage points.

The best strategy aligns with your capital, timeline, and how actively you want to manage risk.

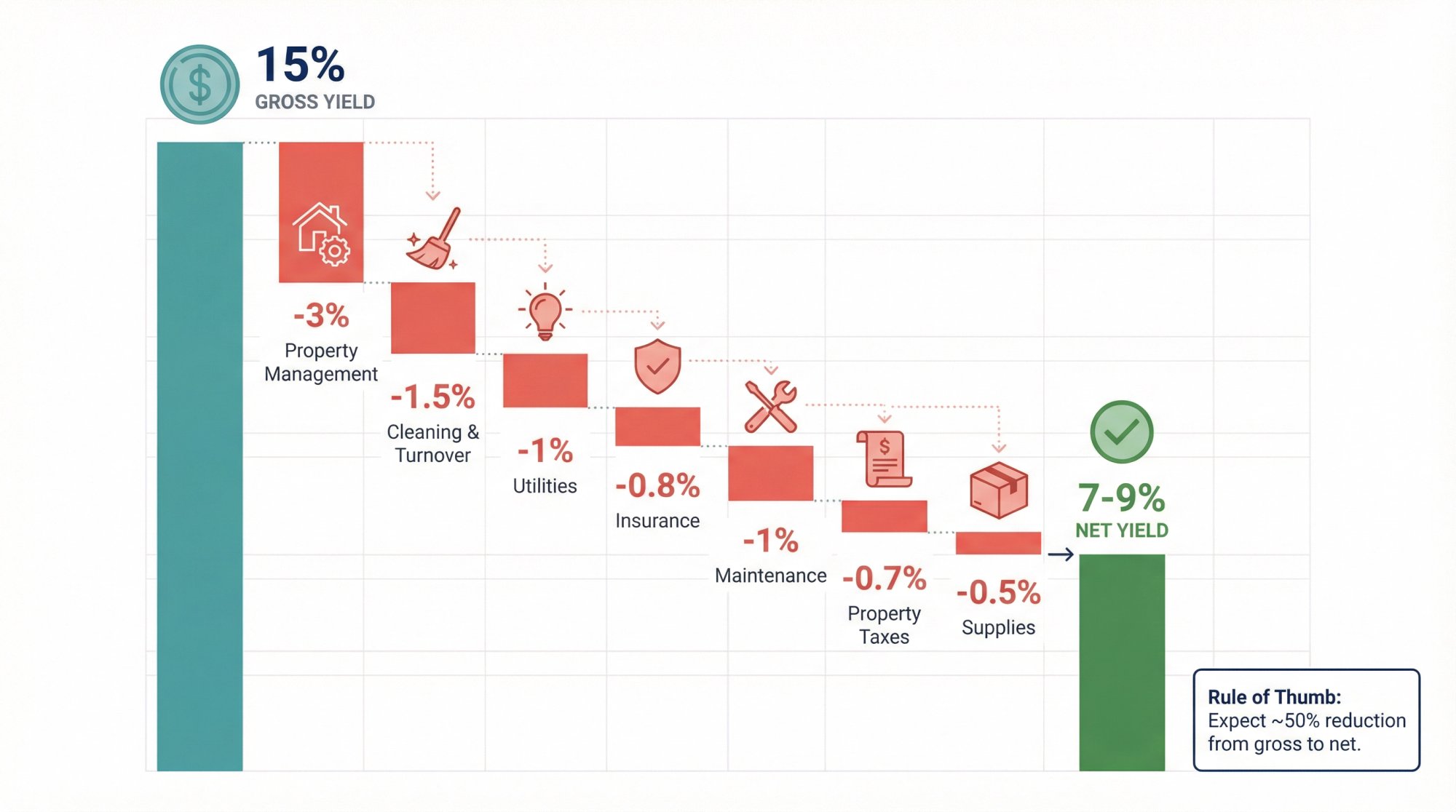

How to Calculate Net Yield After Airbnb Expenses

Before getting too excited about double-digit gross yields, remember: gross yield is just the starting point.

Your actual net return (what you keep after all expenses) depends on costs like:

-

Property management fees (typically 20-30% of gross revenue if you're not self-managing)

-

Cleaning and turnover costs (can run $100-$300+ per booking depending on property size)

-

Utilities (especially high in markets with extreme temperatures or pools)

-

Insurance (STR-specific policies often cost more than standard homeowners coverage)

-

Repairs and maintenance (budget 5-10% of revenue annually)

-

Property taxes (varies wildly by jurisdiction)

-

Supplies and restocking (toiletries, linens, kitchen essentials)

A realistic rule of thumb: a market with 15% gross yield might net around 7-9% after expenses. Still excellent. But make sure your pro forma accounts for real costs, not wishful thinking.

If you want to stress-test a specific property, use our free Airbnb calculator to run projections including purchase costs, operating expenses, and even DSCR loan qualification ratios.

How Chalet Helps You Find High-Yield Mountain Rentals

Identifying a high-yield market is only step one. The real work starts when you need to analyze specific properties, work through local regulations, and coordinate the vendors who will help you close and operate.

That's where Chalet comes in. We're a one-stop platform for short-term rental investors, pairing free analytics with a vetted vendor network so you can move from research to reality without the scattered, overwhelming process most investors face.

Here's how we help:

→ Free Market Analytics: Explore ADR, occupancy rates, revenue trends, and yield estimates for any market. No subscription required. Check out our market dashboards.

→ ROI and DSCR Calculator: Plug in any address to project revenue, cash flow, and loan qualification. It's a quick way to vet deals before going deeper. Run the numbers.

→ Airbnb Properties for Sale: Browse listings in top STR markets filtered for investor-friendly neighborhoods. See what's available.

→ STR-Specialist Real Estate Agents: Connect with agents who actually understand vacation rental investing and local market dynamics. Meet an Airbnb-friendly agent.

→ Vetted Vendor Network: Once you're under contract, we can introduce you to DSCR lenders, STR insurance providers, property managers, cleaning services, furnishing companies, and more. Explore our vendor directory.

We only earn when you engage with one of our referred professionals. There's no subscription, no paywall, no upsell. Just free tools and a network designed to help you execute.

Frequently Asked Questions

What is a "high-yield" Airbnb market?

A high-yield market is one where annual rental revenue represents a significant percentage of the property's purchase price. You calculate gross yield by dividing annual revenue by purchase price. Markets with gross yields above 10-12% are generally considered high-yield in the vacation rental space. The best mountain markets featured here range from 9% (Santa Fe) to 21% (Broken Bow).

Which mountain town has the highest gross yield for Airbnb?

Based on current 2024-2025 data, Broken Bow, Oklahoma delivers the highest gross yield at approximately 21%. This is driven by relatively affordable home prices (median $333,000) combined with strong annual revenue ($69,700) from the area's popular cabin rental market.

How much can you make with an Airbnb in Broken Bow, Oklahoma?

According to Chalet's Broken Bow market analytics, the average Airbnb in Broken Bow generates approximately $69,700 in annual revenue. Occupancy runs around 49% on average, with summer peaks reaching 60-65%. Average daily rates hover around $377, climbing as high as $700 during peak periods for premium cabins.

Are mountain town Airbnbs a good investment in 2025?

Mountain towns can be excellent investments when you select markets with the right price-to-revenue dynamics. What matters most is finding destinations where purchase prices remain reasonable while tourism demand supports strong nightly rates and occupancy. The markets in this guide all demonstrate this balance, with gross yields ranging from 9-21%. Read more about whether Airbnbs are profitable.

What should I factor in beyond gross yield?

Gross yield is your starting filter, not your final analysis. You need to account for property management fees (20-30% if not self-managing), cleaning costs, utilities, insurance, maintenance, property taxes, and supplies. A market with 15% gross yield might net 7-9% after realistic expenses. Use a tool like Chalet's Airbnb calculator to run full projections.

How do I check if a mountain town allows short-term rentals?

Regulations vary significantly by municipality, county, and even neighborhood. Some areas require permits, some have caps on non-owner-occupied rentals, and some restrict STRs to certain zones. Always verify local rules before purchasing. Chalet's regulation guides provide market-specific information to help you understand what's allowed.

How does Chalet help with mountain Airbnb investments?

Chalet offers free market analytics, ROI calculators, and property listings, combined with a vetted network of STR-specialist real estate agents, lenders, insurance providers, and property managers. We help you move from market research to closed deal to operating rental, all through one platform with no subscription fees.

Your Next Steps for Mountain STR Investing

Mountain markets offer some of the strongest yield opportunities in short-term rental investing. The numbers speak for themselves: gross yields from 9% in premium destinations like Santa Fe to 21% in emerging markets like Broken Bow.

But the right market for you depends on your strategy. Are you chasing maximum percentage returns and willing to accept some uncertainty in a newer market? Or do you value the stability, liquidity, and vendor infrastructure of an established destination?

Either path can work. What matters is doing the research, running realistic numbers, and having the right team to help you execute.

At Chalet, we're here for all three.

Analyze your target market. Run projections on a specific property. Connect with an agent who knows STR investing. And when you're ready, browse properties for sale in the mountain towns that fit your criteria.

Your high-yield cabin is out there. Let's find it.