The FIFA World Cup is coming to North America in 2026. If you're looking to buy a short-term rental in a host city, you're probably wondering which markets actually make sense as investments, and which ones are just hype.

Here's the honest truth: a mega-event like the World Cup can create massive demand spikes. But it can also be a trap. A one-time event won't save a bad deal. The investors who win are the ones who buy properties that work in a normal year and treat World Cup weeks as bonus upside.

We pulled data from Chalet's internal market analytics (January 2026) to rank seven host-city markets by gross yield. These numbers are market-level averages, meant for initial screening. They're not your final underwriting, but they'll tell you where to start looking.

Which World Cup Host Cities Offer the Best Investment Returns?

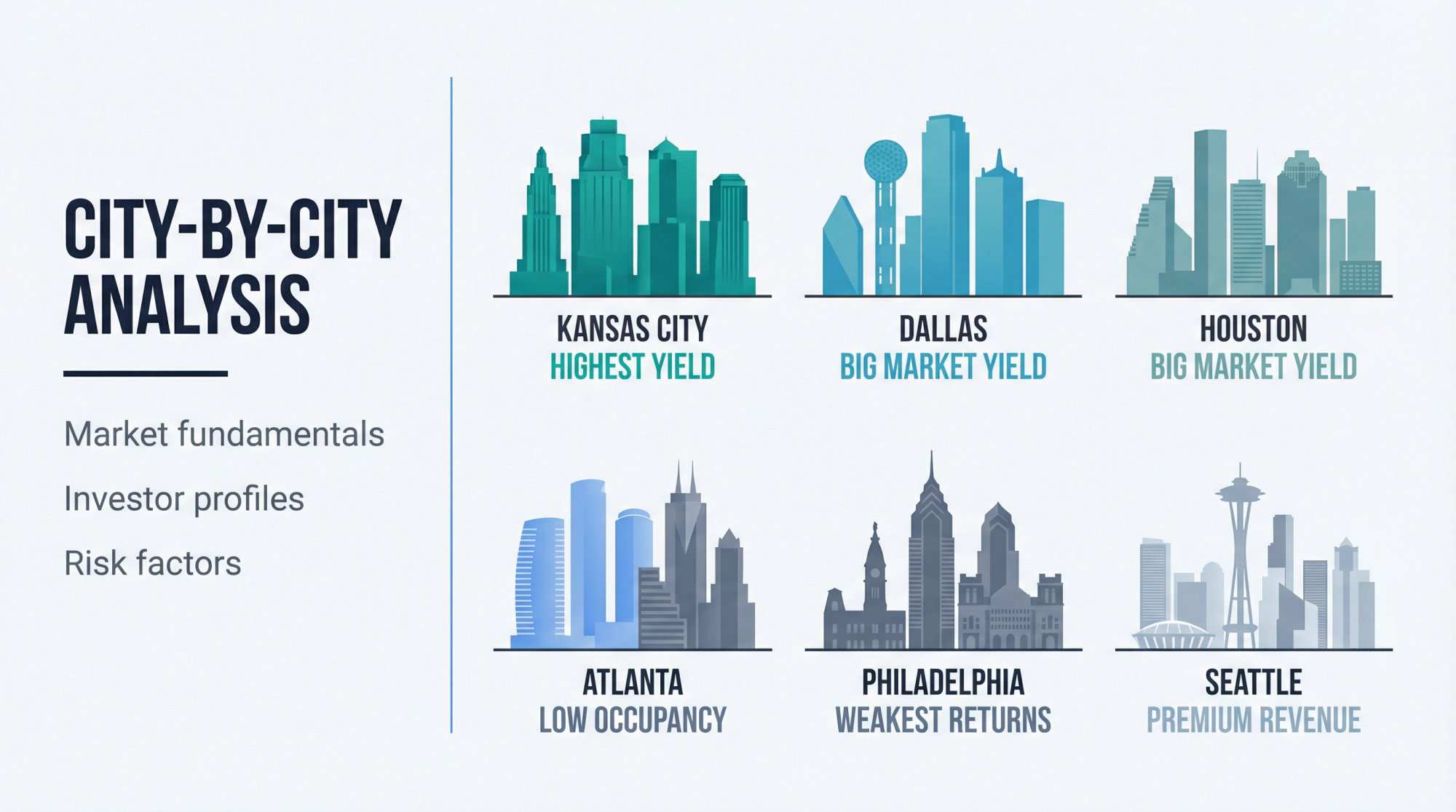

If you want the quick version:

Best "value + yield" combo: Kansas City

Best big-market yields: Dallas, Houston

Best premium revenue plays (higher buy-in): Miami, Seattle

Markets that need strong operations to win: Atlanta, Philadelphia

Where This World Cup Investment Data Comes From

All numbers below come from Chalet's internal market analytics dataset (January 2026). These are market-level averages for screening purposes.

Source: Chalet (getchalet.com), January 2026.

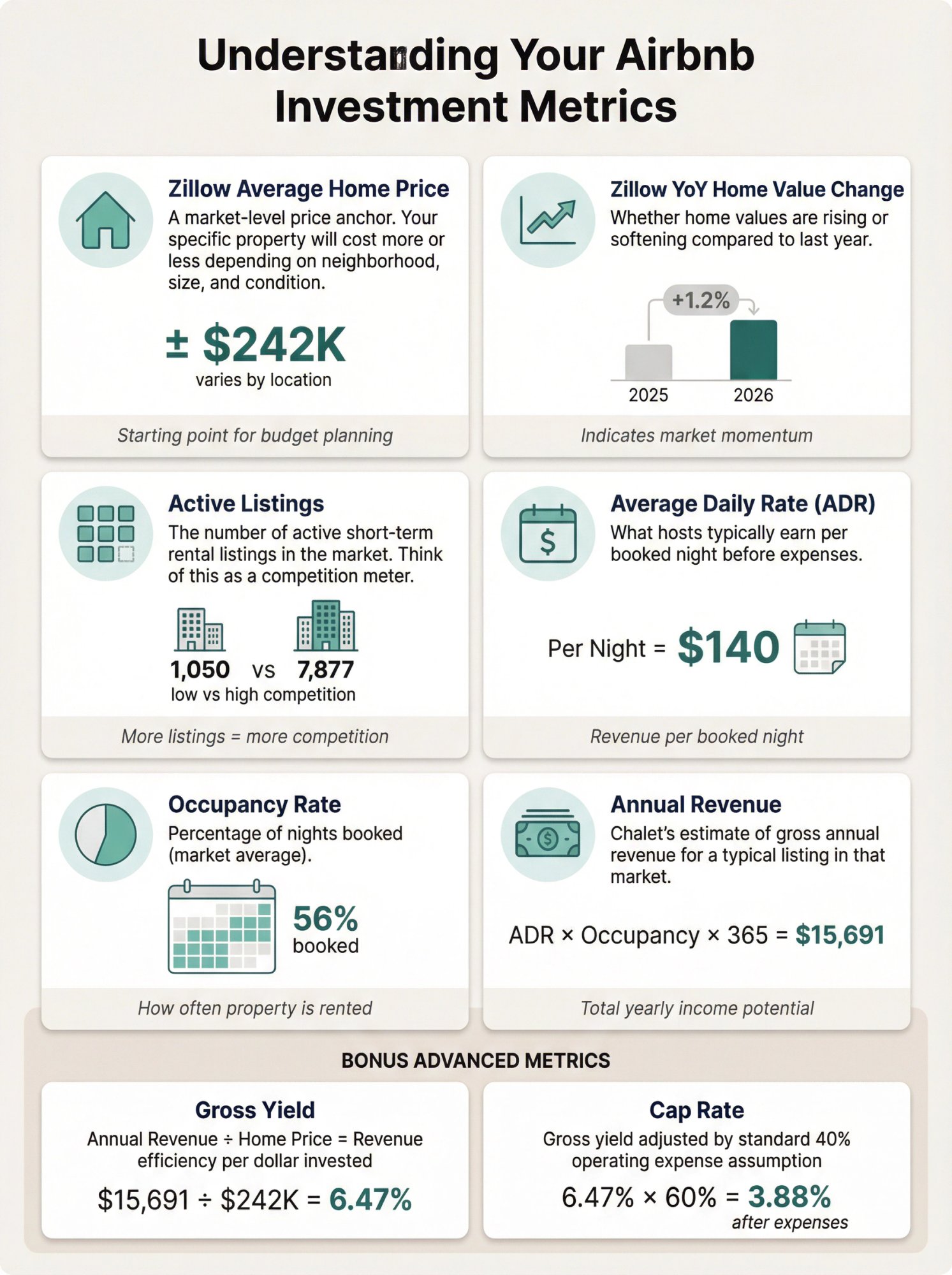

What These Airbnb Investment Metrics Actually Mean

Before we get into the numbers, here's what each metric actually means:

Zillow Average Home Price: A market-level price anchor. Your specific property will likely cost more or less depending on neighborhood, size, and condition.

Zillow YoY Home Value Change: Whether home values are rising or softening compared to last year.

Active Listings: The number of active short-term rental listings in the market. Think of this as a competition meter.

Average Daily Rate (ADR): What hosts typically earn per booked night before expenses.

Occupancy Rate: Percentage of nights booked (market average).

Annual Revenue: Chalet's estimate of gross annual revenue for a typical listing in that market. Learn more about estimating your Airbnb income potential.

Gross Yield: Annual revenue divided by home price. This tells you revenue efficiency per dollar invested.

Cap Rate: In this dataset, cap rate equals gross yield adjusted by a standard 40% operating expense haircut. Your real expenses could be higher or lower depending on how you manage the property.

Property Tax: Annual property tax rate for the market. Check out markets with low property tax if this is a concern.

FIFA World Cup 2026 Host City Rankings by Gross Yield

FIFA World Cup 2026 Host City Rankings by Gross Yield

| Market | State | Zillow YoY Change | Avg Home Price | Active Listings | ADR | Occupancy | Annual Revenue | Gross Yield | Cap Rate | Property Tax | Dashboard |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Kansas City | Missouri | 1.20% | $242,549.97 | 1,050 | $140.38 | 56% | $15,690.81 | 6.47% | 3.88% | 1.19% | View Dashboard |

| Dallas | Texas | -4.58% | $303,486.34 | 2,926 | $146.35 | 56% | $17,241.95 | 5.68% | 3.41% | 1.73% | View Dashboard |

| Houston | Texas | -3.22% | $261,729.86 | 6,601 | $139.16 | 53% | $14,783.00 | 5.65% | 3.39% | 1.77% | View Dashboard |

| Miami | Florida | -3.07% | $575,173.39 | 7,877 | $184.44 | 57% | $20,562.35 | 3.57% | 2.14% | 0.85% | View Dashboard |

| Atlanta | Georgia | -4.69% | $386,566.57 | 5,139 | $173.35 | 46% | $10,269.35 | 2.66% | 1.59% | 0.91% | View Dashboard |

| Philadelphia | Pennsylvania | 3.00% | $228,933.42 | 2,513 | $127.58 | 43% | $5,571.25 | 2.43% | 1.46% | 0.86% | View Dashboard |

| Seattle | Washington | -2.04% | $840,957.13 | 5,178 | $176.13 | 60% | $19,134.77 | 2.28% | 1.37% | 0.85% | View Dashboard |

Source: Chalet (getchalet.com), January 2026.

How to Analyze World Cup Markets Without Losing Money

The biggest mistake investors make with event-driven demand? Underwriting the peak and ignoring the base.

Your first World Cup booking might bring in $800/night. But what about the other 50 weeks of the year? If your "normal year" numbers don't work, that one amazing week won't save you. This is why you should never buy an unprofitable Airbnb.

The simple rule: Buy for the normal year. Treat the World Cup as upside.

That means your "best market" depends entirely on your investor profile.

Which World Cup Market Fits Your Investment Strategy?

| If You Are… | You Usually Care About… | Markets That Fit Best |

|---|---|---|

| First-time buyer | Lower entry price + strong gross yield | Kansas City, Houston, Dallas |

| 1031 exchange buyer | Liquidity + execution speed + stable demand | Dallas, Miami, Seattle |

| Portfolio builder | Revenue scale + operational leverage | Miami, Seattle, Dallas |

Want to run the numbers on a specific address? Use Chalet's free calculator: Run ROI/DSCR for this address

How to Calculate Returns for World Cup STR Investments

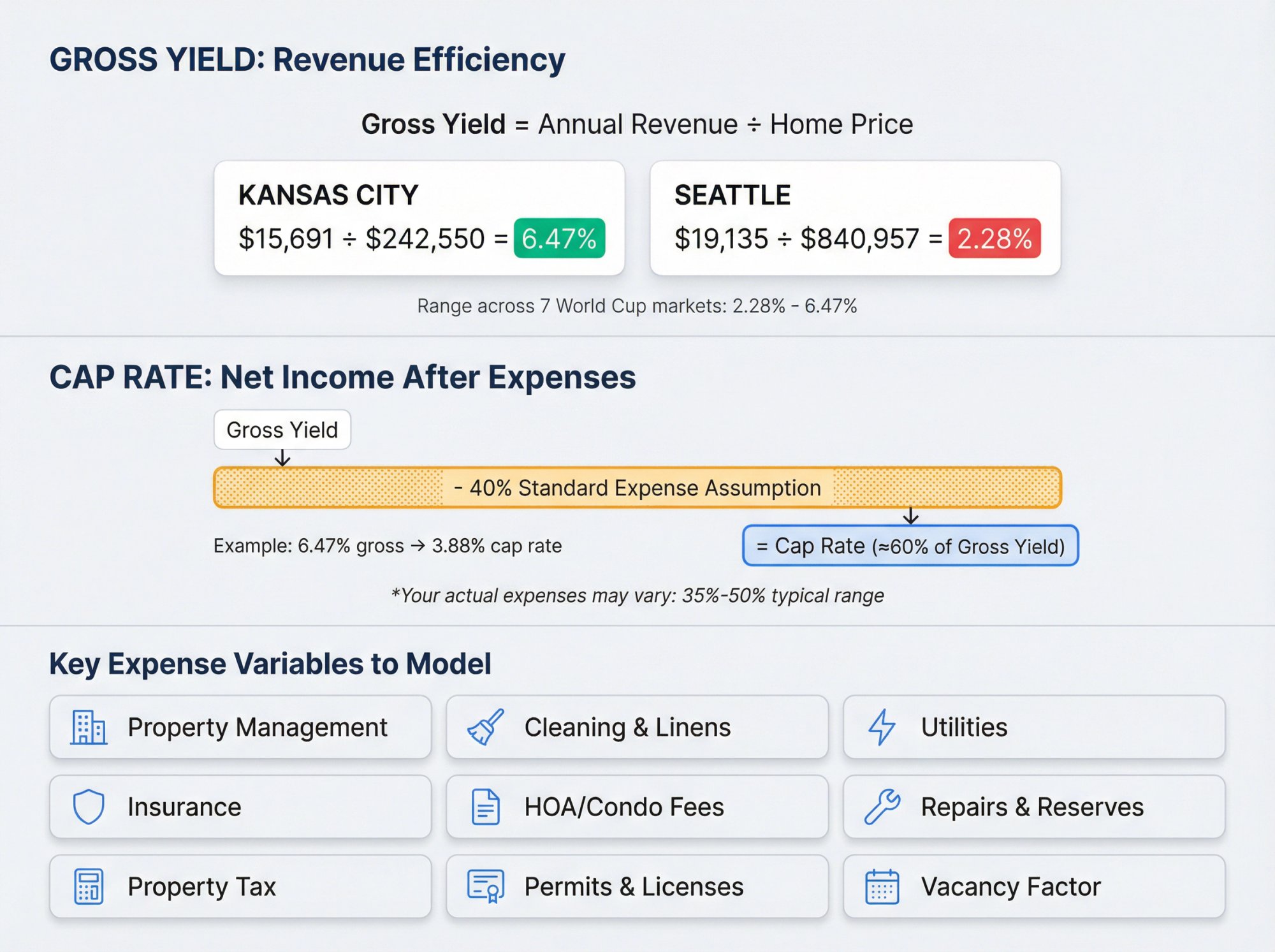

Why Gross Yield Matters for Event Markets

Gross yield answers one question: How much top-line revenue does this market produce relative to buy price?

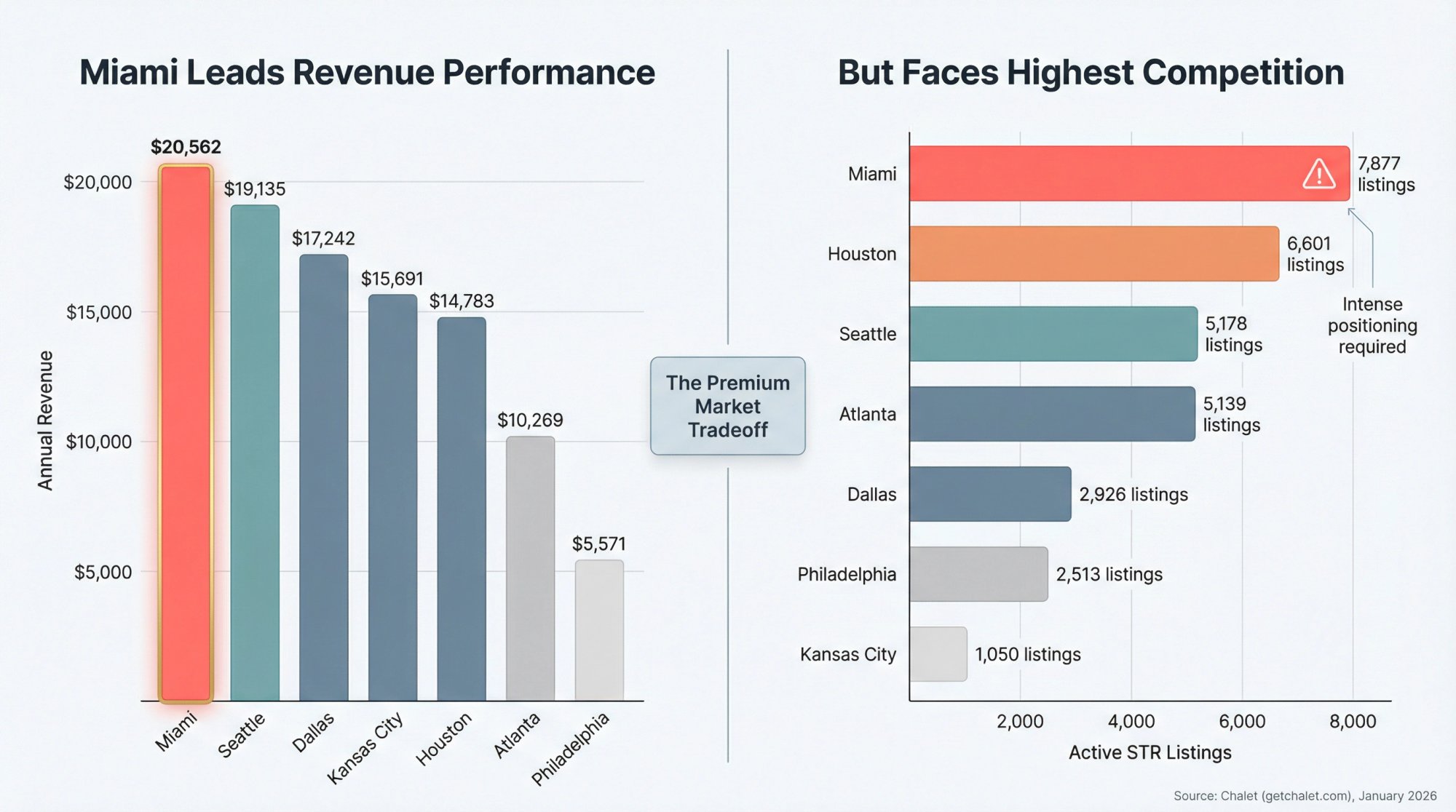

In this dataset, gross yield ranges from 2.28% (Seattle) to 6.47% (Kansas City). That's a wide spread. But gross yield is just step one in your analysis. For a deeper dive, check out how profitable is Airbnb: real investor experiences.

How to Calculate Real Cap Rates for Your STR

Notice how every cap rate in the table is roughly 60% of gross yield? That's because the dataset applies a standard 40% expense assumption to all markets.

This works for comparisons, but your actual expense load depends on:

-

Professional management vs. self-manage

-

Cleaning frequency and linen costs

-

Utilities (especially in extreme climates)

-

Insurance premiums

-

HOA or condo fees

-

Repairs and reserves

-

Local taxes and permit fees

Your next move: Screen markets with the dashboard, then run address-level math with your own expense assumptions.

What High Competition Means for World Cup Bookings

More active listings usually means:

① More competition for ranking and reviews

② More price pressure during off-peak months

③ Greater importance on differentiation (design, amenities, operations)

It doesn't automatically mean "avoid." But it does change the playbook. In high-competition markets, you need to stand out. Learn how to optimize your Airbnb listing for better visibility.

Why World Cup Demand Won't Be Even Across Markets

Market averages smooth everything out. But World Cup demand will be spiky based on:

-

Week of the match: Some weeks will be insane. Others will be normal.

-

Proximity and transit convenience: Guests will optimize for easy stadium access.

-

Unit type: Groups prefer multi-bedroom properties.

-

Quality: The best listings capture pricing power first.

Your strategy should assume normal-year performance for underwriting, with event weeks as a separate pricing optimization project.

Best World Cup 2026 Markets: City-by-City Analysis

Below are the details on each host-city market. We're keeping this practical: what the numbers say, who each market fits best, and what to watch for.

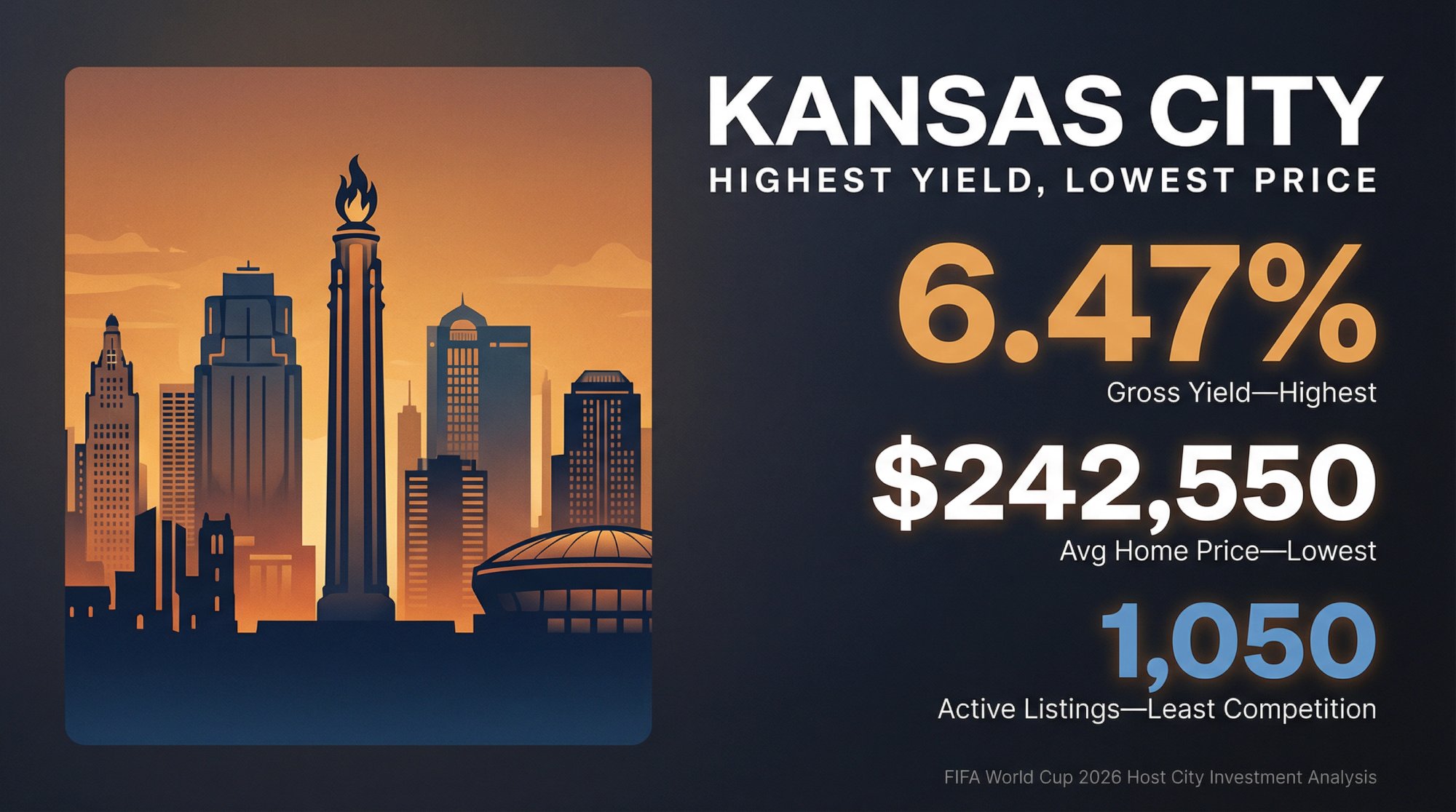

Kansas City Airbnb Investment: Highest Yield at Lowest Price

Why it's on the list: Highest gross yield combined with the lowest buy-in.

Kansas City STR Market Data (January 2026)

| Metric | Value |

|---|---|

| Avg Home Price | $242,549.97 |

| Annual Revenue | $15,690.81 |

| Gross Yield | 6.47% (highest) |

| Cap Rate | 3.88% |

| ADR / Occupancy | $140.38 / 56% |

| Active Listings | 1,050 (lowest supply) |

| Zillow YoY | +1.20% |

| Property Tax | 1.19% |

Who Should Invest in Kansas City for the World Cup?

→ First-time buyers who want a realistic entry point

→ Investors who focus on yield-first screening

Why Kansas City Works for World Cup Investors

You're not fighting a massive supply number here. With only 1,050 active listings compared to Miami's 7,877 or Houston's 6,601, there's significantly less competition for guests.

The price point also makes "learning costs" survivable. Furnishing mistakes, early operational issues, unexpected repairs. They all hurt less when you're not stretched to afford the property.

Kansas City World Cup Investment Risks

The ADR is lower than coastal or premium markets. That means you need to nail the basics: clean space, fast turnovers, solid photos, and responsive messaging. There's less margin for error on operations.

How to Start Investing in Kansas City STRs

Check the market dashboard: Kansas City Analytics

Need financing? Kansas City Airbnb loans

Then: Meet an Airbnb-friendly agent in Kansas City

Dallas Airbnb Market: Strong Yields with Falling Prices

Why it's on the list: High gross yield, strong revenue, and the biggest "price down YoY" signal among top-tier markets. Dallas is also one of the best Airbnb markets in Texas.

Dallas World Cup STR Market Numbers (January 2026)

| Metric | Value |

|---|---|

| Avg Home Price | $303,486.34 |

| Annual Revenue | $17,241.95 |

| Gross Yield | 5.68% |

| Cap Rate | 3.41% |

| ADR / Occupancy | $146.35 / 56% |

| Active Listings | 2,926 |

| Zillow YoY | -4.58% |

| Property Tax | 1.73% (high) |

Who Should Buy Dallas STRs for the World Cup?

-

1031 exchange buyers who need deal flow and transaction velocity

-

First-timers who can handle Texas tax math and want a larger city's demand base

Why Dallas Is a Smart World Cup Investment

Yield is close to Houston's, but supply is much lower. Dallas has 2,926 active listings compared to Houston's 6,601. In the STR game, less competition matters.

That -4.58% YoY pricing trend? It could be a window for disciplined buyers who negotiate well.

Dallas World Cup Investment Warning: Property Taxes

Texas property tax is real. You cannot hand-wave 1.73% and still have clean underwriting. Build it into your numbers from day one, or you'll get surprised.

Resources for Dallas World Cup Investors

-

Shortlist listings: See Airbnb rentals for sale

-

Need financing? Dallas Airbnb loans

-

Run numbers: Run ROI/DSCR for this address

Houston Airbnb Investment: High Yield, High Competition

Why it's on the list: High gross yield at a relatively low buy-in. But the supply number is huge. Houston recently passed a historic Airbnb ordinance, so understanding the local rules is essential.

Houston World Cup Market Data (January 2026)

| Metric | Value |

|---|---|

| Avg Home Price | $261,729.86 |

| Annual Revenue | $14,783.00 |

| Gross Yield | 5.65% |

| Cap Rate | 3.39% |

| ADR / Occupancy | $139.16 / 53% |

| Active Listings | 6,601 |

| Zillow YoY | -3.22% |

| Property Tax | 1.77% (highest) |

Who Should Invest in Houston for the World Cup?

-

Operators who know how to win in competitive markets (or who will hire professionals)

-

Value-seeking buyers who won't ignore carrying costs

Why Houston Works for World Cup Bookings

The buy-in is lower than Dallas, and yields are nearly identical. If you can differentiate your listing and run tight operations, the math works. Check out our guide on best places to invest in Houston short-term rentals.

Houston World Cup Investment Challenges

6,601 active listings. That's competition. The "average listing" in Houston might be mediocre, but your listing needs to be meaningfully better to earn pricing power.

And once again: Texas property taxes. At 1.77%, this is the highest in our dataset. Underwrite them directly.

How to Buy Houston STRs for the World Cup

-

If you want to outsource operations: Set up your STR operations

Miami Airbnb Investment: Highest Revenue, Highest Price

Why it's on the list: Top annual revenue and highest ADR in the dataset. But home prices and competition are equally high. Miami is consistently ranked among the best Airbnb markets in Florida.

Miami World Cup STR Market Numbers (January 2026)

| Metric | Value |

|---|---|

| Avg Home Price | $575,173.39 |

| Annual Revenue | $20,562.35 (highest) |

| Gross Yield | 3.57% |

| Cap Rate | 2.14% |

| ADR / Occupancy | $184.44 / 57% |

| Active Listings | 7,877 (highest) |

| Zillow YoY | -3.07% |

| Property Tax | 0.85% |

Who Should Buy Miami STRs for the World Cup?

-

Portfolio builders looking for revenue scale

-

1031 exchange buyers rolling larger equity who care most about top-line potential

Why Miami Is a Strong World Cup Market

The revenue profile is strong. Miami generates the highest annual revenue and ADR in this entire dataset. During peak demand windows like the World Cup, great execution can really matter here. Explore the best places to invest in Miami short-term rentals.

And that 0.85% property tax rate? Much friendlier than Texas markets.

Miami World Cup Investment Risks

Competition is intense. 7,877 active listings means you need a real positioning strategy: design, amenities, house rules, and professional operations. This isn't a market where "good enough" wins.

The higher entry cost also means mistakes are more expensive. A bad furnishing decision or slow ramp-up hurts more when you're paying a $575K mortgage.

Resources for Miami World Cup Investors

-

Want to assemble your team fast? Meet an Airbnb-friendly agent in Miami

Atlanta STR Market: Low Occupancy, High Potential

Why it's on the list: It's a host city with softened home values. But the data shows lower occupancy and yield compared to the leaders. Atlanta ranks among the best Airbnb markets in Georgia.

Atlanta World Cup Market Data (January 2026)

| Metric | Value |

|---|---|

| Avg Home Price | $386,566.57 |

| Annual Revenue | $10,269.35 |

| Gross Yield | 2.66% |

| Cap Rate | 1.59% |

| ADR / Occupancy | $173.35 / 46% |

| Active Listings | 5,139 |

| Zillow YoY | -4.69% (most negative) |

| Property Tax | 0.91% |

Who Should Invest in Atlanta for the World Cup?

-

Buyers who can negotiate aggressively on price and run tight operations

-

Investors who see upside from improving operations rather than pure yield-buying

Why Atlanta Could Work for World Cup Investors

That -4.69% YoY price trend suggests a market where buyers might find better terms than in a hot uptrend. Motivated sellers exist here.

The ADR of $173.35 is solid. The problem is getting it booked consistently.

Atlanta World Cup Investment Challenge: Occupancy

46% occupancy means you need a plan for the slow months, not just event weeks. World Cup demand will spike certain dates, but what about the other 48 weeks?

If you can outperform the market average on occupancy through better marketing, pricing, and guest experience, Atlanta's numbers look different. But that requires operational skill.

How to Buy Atlanta STRs for the World Cup

-

Don't guess your numbers: Run ROI/DSCR for this address

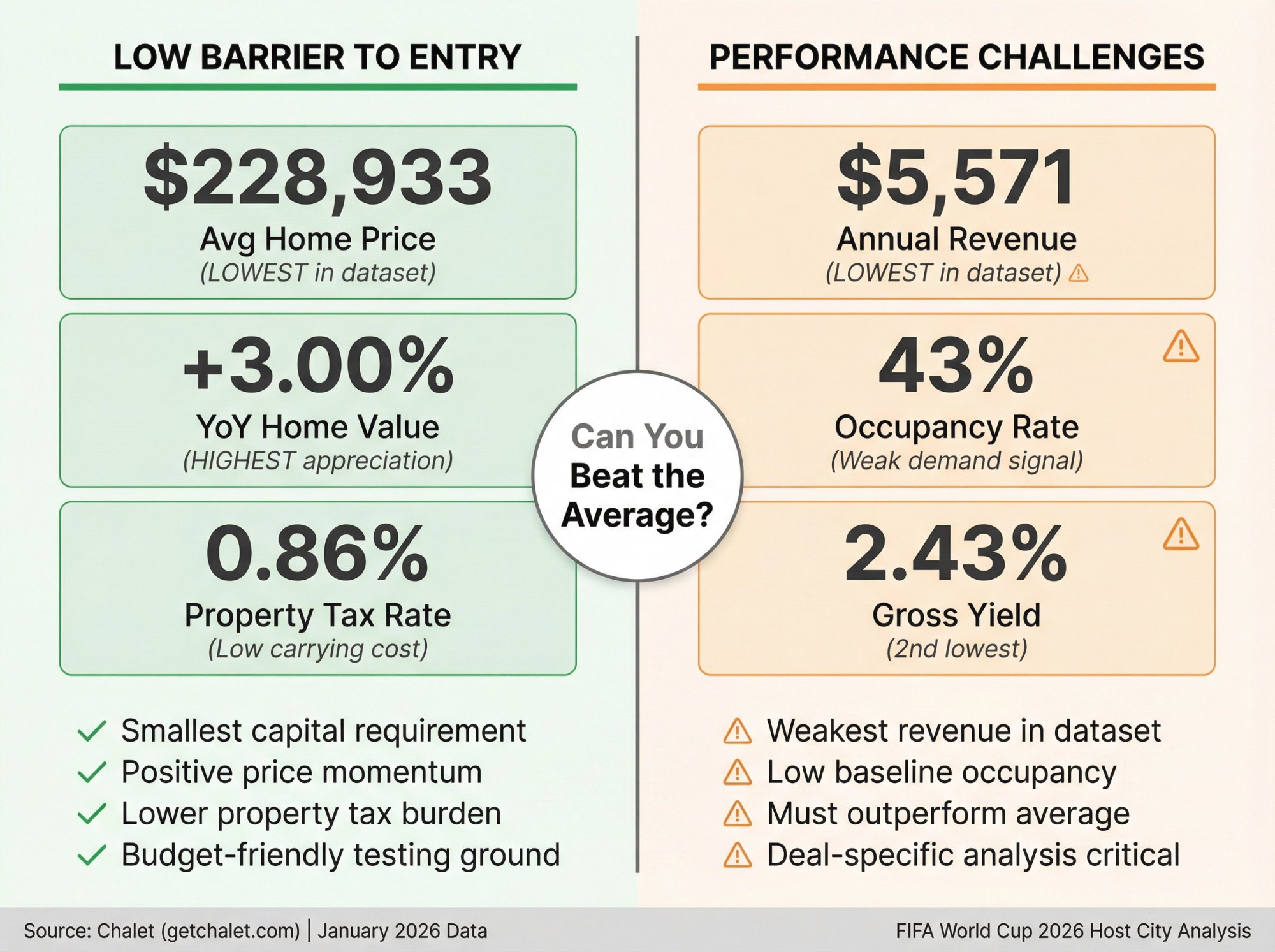

Philadelphia Airbnb Investment: Lowest Price, Weakest Returns

Why it's on the list: Lowest buy-in in the dataset. But the numbers also show the lowest annual revenue and one of the lowest yields.

Philadelphia World Cup STR Market Numbers (January 2026)

| Metric | Value |

|---|---|

| Avg Home Price | $228,933.42 (lowest) |

| Annual Revenue | $5,571.25 (lowest) |

| Gross Yield | 2.43% |

| Cap Rate | 1.46% |

| ADR / Occupancy | $127.58 / 43% |

| Active Listings | 2,513 |

| Zillow YoY | +3.00% (highest positive) |

| Property Tax | 0.86% |

Who Should Invest in Philadelphia for the World Cup?

-

Very conservative buyers who want a low entry point and are willing to be extremely selective on deals

-

Investors who believe they can significantly outperform the average listing

Why Philadelphia Might Work as a World Cup Investment

Low home price makes this a "small bet" market compared to Miami or Seattle. If you're testing STR investment and want to limit downside, Philadelphia's price point allows that. It's often considered one of the best budget-friendly Airbnb rental markets.

The +3.00% YoY appreciation also suggests a different dynamic than the softening Texas markets.

Philadelphia World Cup Investment Warning

43% occupancy and $127.58 ADR. These are the weakest numbers in the dataset. You need to find a property, location, and setup that clearly beats the market average, or the math won't work.

This is a market where deal-specific analysis matters more than market-level averages. The average is not exciting. You need to be better than average.

Resources for Philadelphia World Cup Investors

-

Check rules before you buy: Check Philadelphia STR regulations

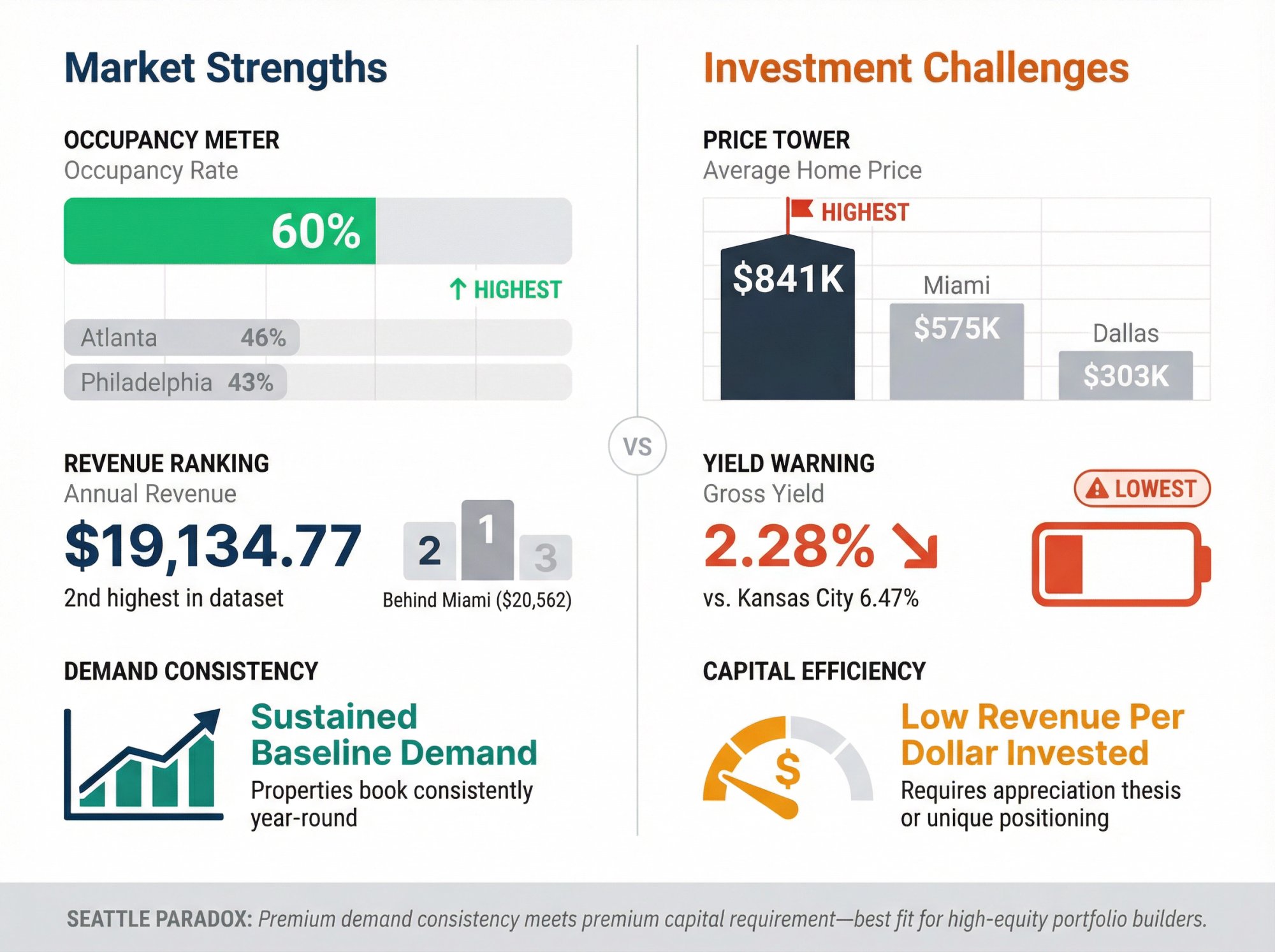

Seattle STR Market: Best Occupancy, Worst Price Point

Why it's on the list: Occupancy is the best in the dataset, annual revenue is second-highest, but the price anchor is massive.

Seattle World Cup Market Data (January 2026)

| Metric | Value |

|---|---|

| Avg Home Price | $840,957.13 (highest) |

| Annual Revenue | $19,134.77 |

| Gross Yield | 2.28% (lowest) |

| Cap Rate | 1.37% |

| ADR / Occupancy | $176.13 / 60% (highest) |

| Active Listings | 5,178 |

| Zillow YoY | -2.04% |

| Property Tax | 0.85% |

Who Should Invest in Seattle for the World Cup?

-

1031 exchange buyers or high-equity investors who can handle the buy-in

-

Portfolio builders optimizing for demand consistency more than yield

Why Seattle Works for World Cup Investors

60% occupancy is a strong signal. In a dataset where Atlanta shows 46% and Philadelphia 43%, Seattle's baseline demand stands out. Properties here get booked more consistently. Seattle is one of the best places to invest in Seattle short-term rentals.

The annual revenue of $19,134 (second-highest) combined with that occupancy rate suggests a market with real, sustainable demand.

Seattle World Cup Investment Challenge: Price

At this price point, "good" isn't good enough. You need a strategy that justifies the capital, or you need to buy exceptionally well below market.

The 2.28% gross yield is the lowest in our dataset. That's a lot of capital working at relatively low efficiency. Make sure your investment thesis accounts for appreciation potential or unique positioning, not just cash flow.

How to Buy Seattle STRs for the World Cup

How to Maximize Profits During the 2026 World Cup

Here's what separates investors who capitalize on event demand from investors who just get lucky.

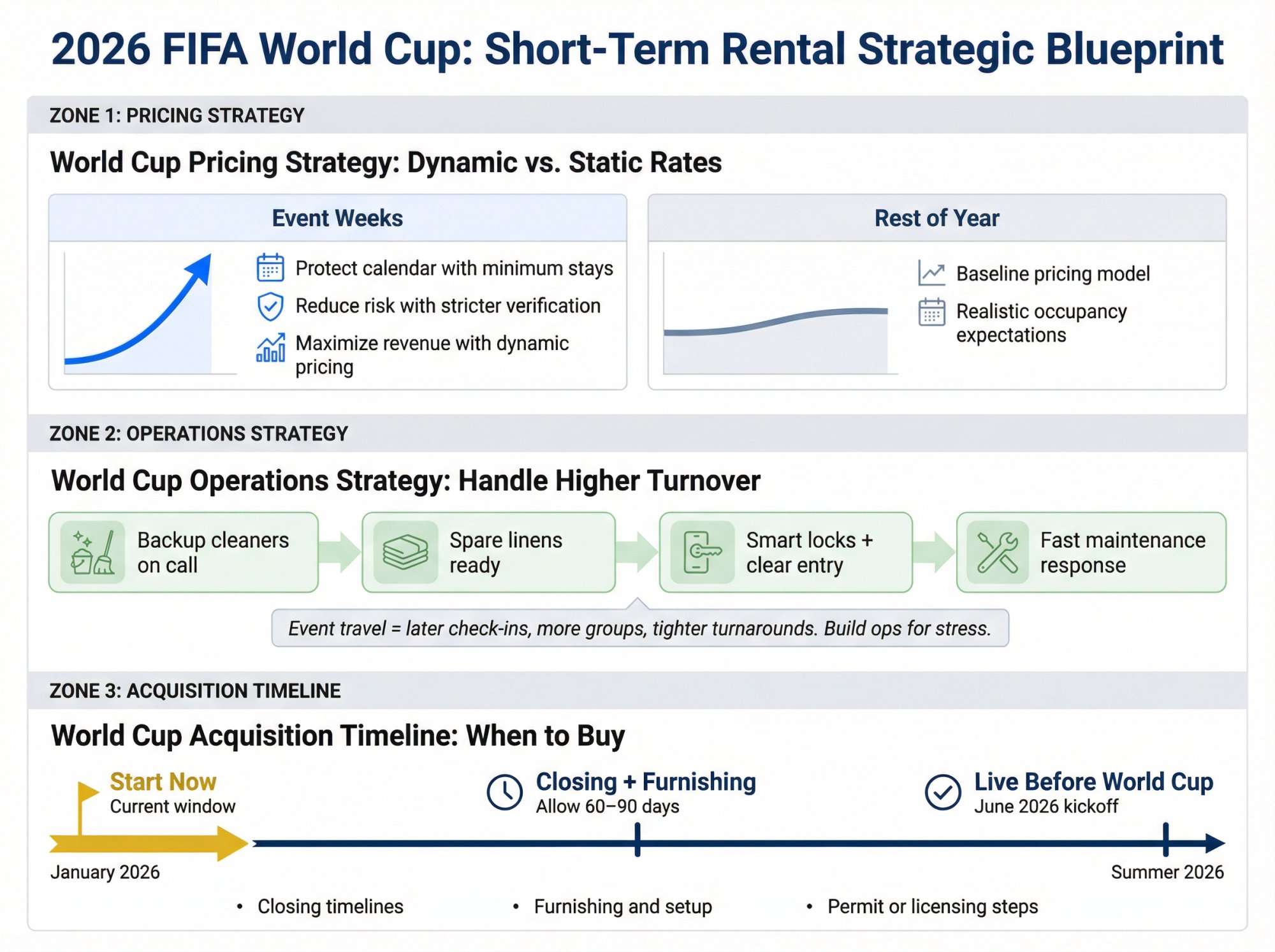

World Cup Pricing Strategy: Dynamic vs. Static Rates

For World Cup weeks, your goals shift:

→ Protect your calendar by using minimum stays to reduce turnover chaos during peak periods.

→ Reduce risk through stricter house rules, security deposits, and guest verification where platforms allow it.

→ Maximize revenue with dynamic pricing, not flat rates. The demand curve during event weeks is steep, and you need to capture it.

But you still need:

-

A baseline pricing model for the rest of the year

-

Realistic occupancy expectations outside peak periods

World Cup Operations Strategy: Handle Higher Turnover

Event travel usually means later check-ins, more groups, more wear and tear, and tighter turnaround windows between guests.

So build operations for stress:

Have backup cleaners on call

Keep spare linens ready

Install smart locks with clear entry instructions

Maintain fast maintenance response

If you don't want to build ops yourself, use Chalet to assemble vendors in one place: Set up your STR operations

World Cup Acquisition Timeline: When to Buy

It's January 2026. If your goal is to be live well before summer 2026, you need to be realistic about:

-

Closing timelines

-

Furnishing and setup

-

Any permit or licensing steps (market-dependent). Use Chalet's rental regulations library to check requirements.

This is why execution support matters. You don't just need data. You need the right agent, lender, and operators aligned and moving together.

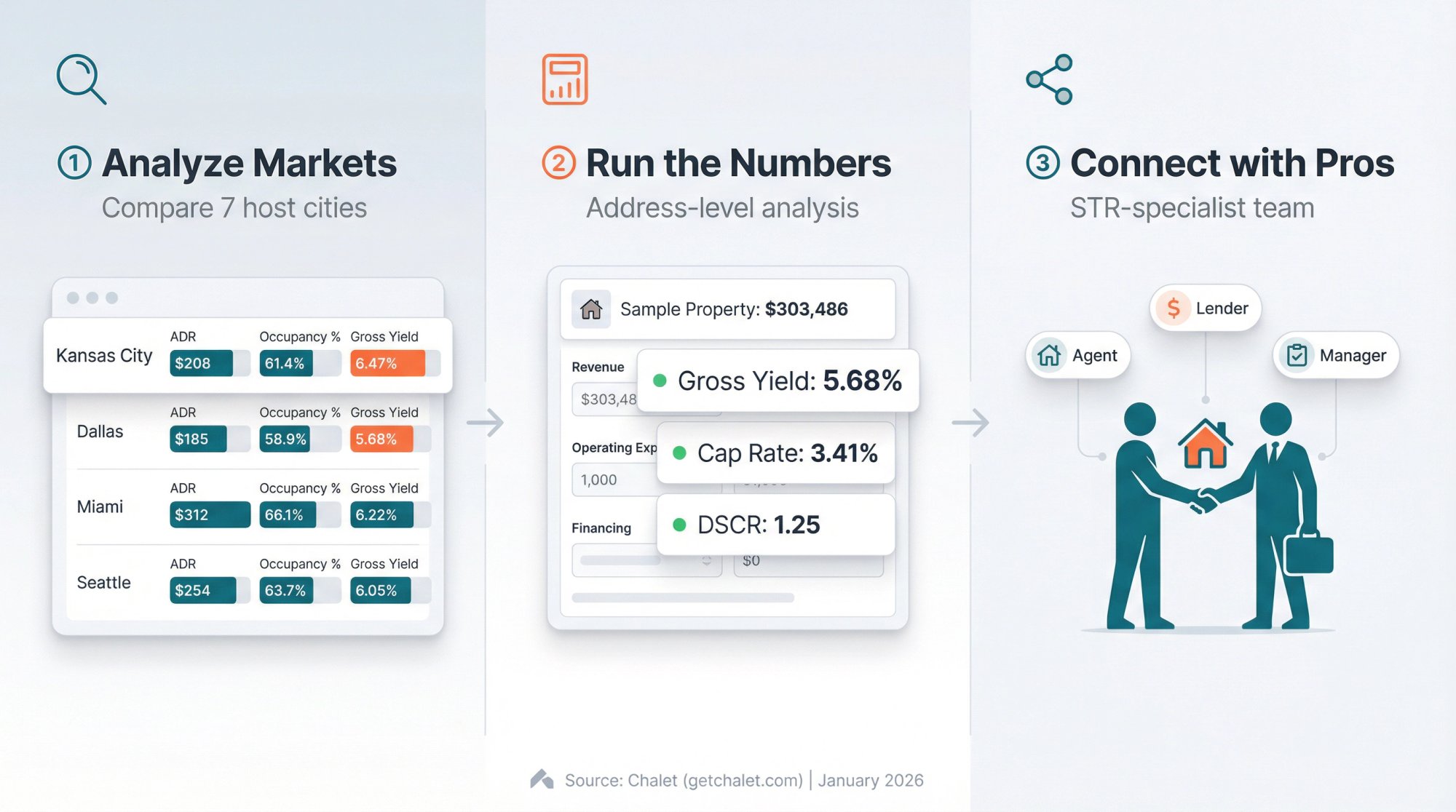

How Chalet Helps World Cup Investors Execute Fast

Chalet is built to take you from "I'm interested in STR investing" to "I'm operating a profitable short-term rental." Here's how the platform works:

1. Find the Best World Cup Markets with Free Dashboards

Every market in our analytics has its own dashboard showing ADR, occupancy, revenue estimates, competition levels, and pricing trends. Start here: Analyze markets

2. Check World Cup Host City STR Regulations

STR regulations vary wildly by city. Some markets require permits. Others restrict rental types. Check before you fall in love with a property: Check local STR regulations. For context, read our guide on how to navigate local regulations and short-term rental licensing.

3. Calculate ROI for Specific World Cup Properties

Market averages tell you where to look. Address-level analysis tells you whether a specific deal works. Run ROI and DSCR calculations for any property: Run ROI/DSCR for this address

DSCR = Debt Service Coverage Ratio. It's how lenders test whether the property's income can cover the mortgage. Learn how to qualify for a DSCR loan.

4. Build Your World Cup Investment Team

Chalet's vetted vendor network includes:

-

STR-specialist agents: Meet an Airbnb-friendly agent

-

Active listings: See Airbnb rentals for sale

-

Airbnb loans and DSCR lenders: Connect with STR-savvy financing

-

Operations vendors: Set up your STR operations

The goal? Go from research to closing to operating in one place, with professionals who understand STR-specific needs.

World Cup 2026 Investment Questions Answered

World Cup 2026 Investment Questions Answered

Is It Too Late to Buy for the 2026 World Cup?

Not automatically. But the closer you get to summer 2026, the more you're buying an execution problem, not just a property. Focus on markets and deals where you can get operational fast.

If you're starting now (January 2026), you're running a tight timeline. Focus on properties that are move-in ready or close to it, and build a team that can execute quickly.

Should I Only Buy in World Cup Host Cities?

Host cities get the spotlight, but your best investment is still the one that works on normal-year math. If a non-host market has stronger fundamentals for your budget, it can be a better long-term play.

This specific analysis only covers the host-city markets in Chalet's dataset. But "World Cup demand" shouldn't override basic investment principles. Explore the full comprehensive analysis of short-term rental markets for investors.

Why Are Cap Rates Lower Than Gross Yields?

The dataset applies a standard operating expense assumption (roughly 40%) to convert gross revenue into a net income proxy. That's why cap rate is approximately 60% of gross yield for every market.

This standardization helps with comparisons, but you should replace it with your real expense model when analyzing a specific property. Your actual expenses might be 35% or 50% depending on how you operate.

Which World Cup Market Will Appreciate the Most?

Based on the YoY data, Philadelphia shows +3.00% growth while Texas markets show softening (Dallas at -4.58%, Houston at -3.22%). But appreciation is notoriously hard to predict, and past performance doesn't guarantee future results.

For STR investing, we recommend underwriting based on cash flow fundamentals, then treating appreciation as potential upside rather than something you count on. Read more about tax implications of selling your Airbnb.

How Do I Know If a Property Will Beat Market Average?

Location within the market matters enormously. A property 5 minutes from the stadium will outperform one 45 minutes away. Design, amenities, and reviews all compound over time.

The best way to estimate is to run address-specific analysis: Run ROI/DSCR for this address

What's the Biggest Risk with World Cup Investing?

Buying a property that only works during event weeks. If your underwriting assumes $800/night ADR year-round because "the World Cup is coming," you're setting yourself up for disappointment.

Buy for the normal year. Then optimize pricing and operations to capture event-week upside. Learn more about how much you can make on Airbnb in different scenarios.

Start Your World Cup Investment Strategy Today

Pick 2-3 markets from the table based on your budget and investor type. Then:

① Open each dashboard and check the full picture

② Run one real address through the calculator

③ Talk to an STR-specialist agent so you stop guessing and start moving

Start here: Analyze markets

Or connect with a pro directly: Meet an Airbnb-friendly agent