You typed "best Airbnb markets in Texas 2026" because you need answers to one of three things:

-

Which market should I actually buy in (without making a $300K mistake)?

-

Where does the cash flow actually pencil out?

-

How do I move fast with the right agent, lender, and property manager once I pick a market?

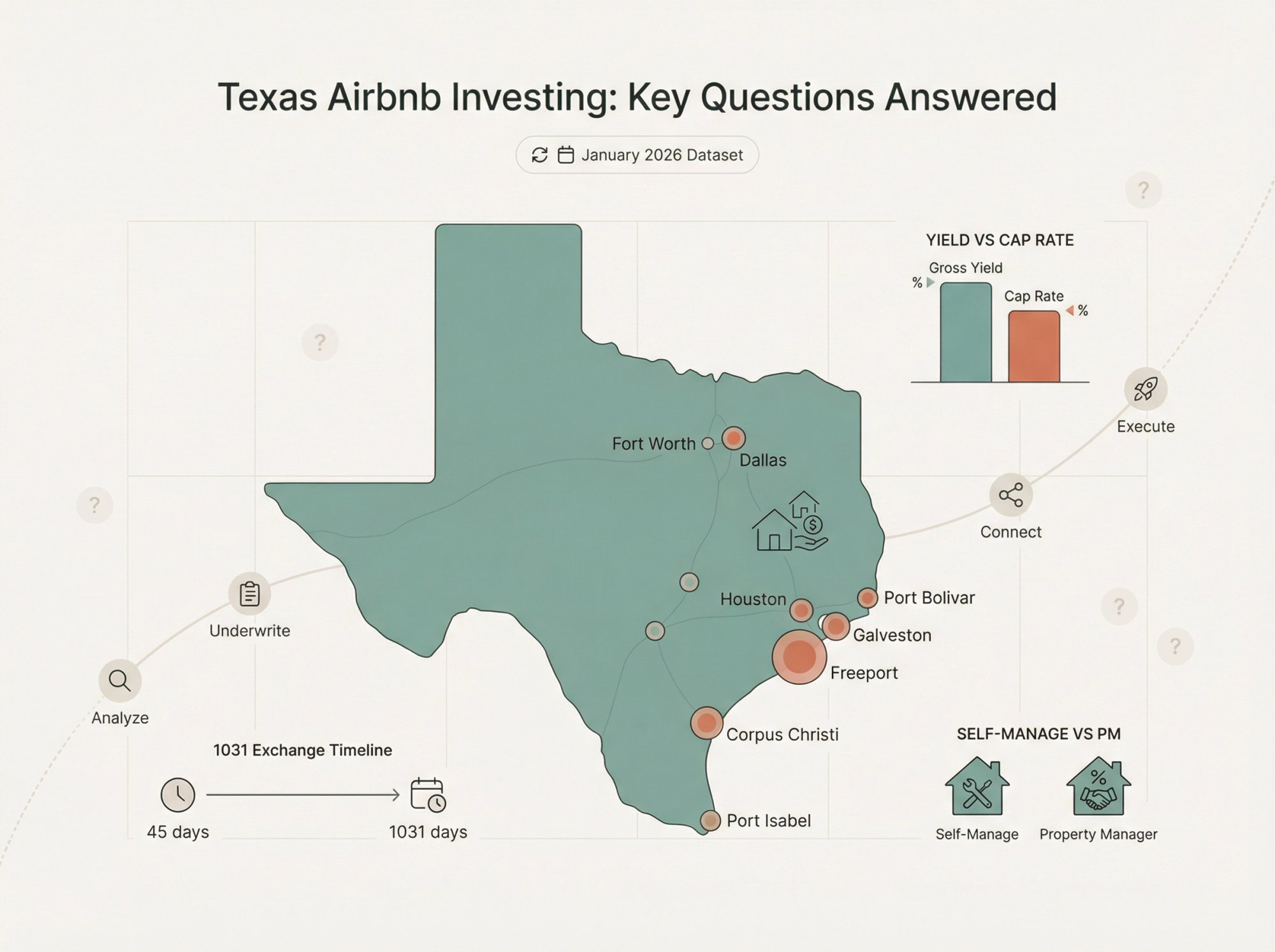

This guide tackles all three. We've pulled together our January 2026 dataset to give you a data-backed comparison of Texas short-term rental markets, ranked by yield. You'll also get a framework for interpreting these numbers and matching them to your investment goals.

Quick terminology before we get into the data: Airbnb rentals (also called short-term rentals or STRs) are properties you operate with nightly stays instead of long-term leases. Same asset, different business model.

Where Does This Texas Airbnb Market Data Come From?

Everything in this analysis comes from our proprietary January 2026 dataset at Chalet. The metrics include:

-

Average home price

-

Year-over-year home value change

-

Active listing count

-

Property tax rate

We're using this data to give you a real snapshot of what Texas Airbnb investing looks like right now, not recycled stats from 2024.

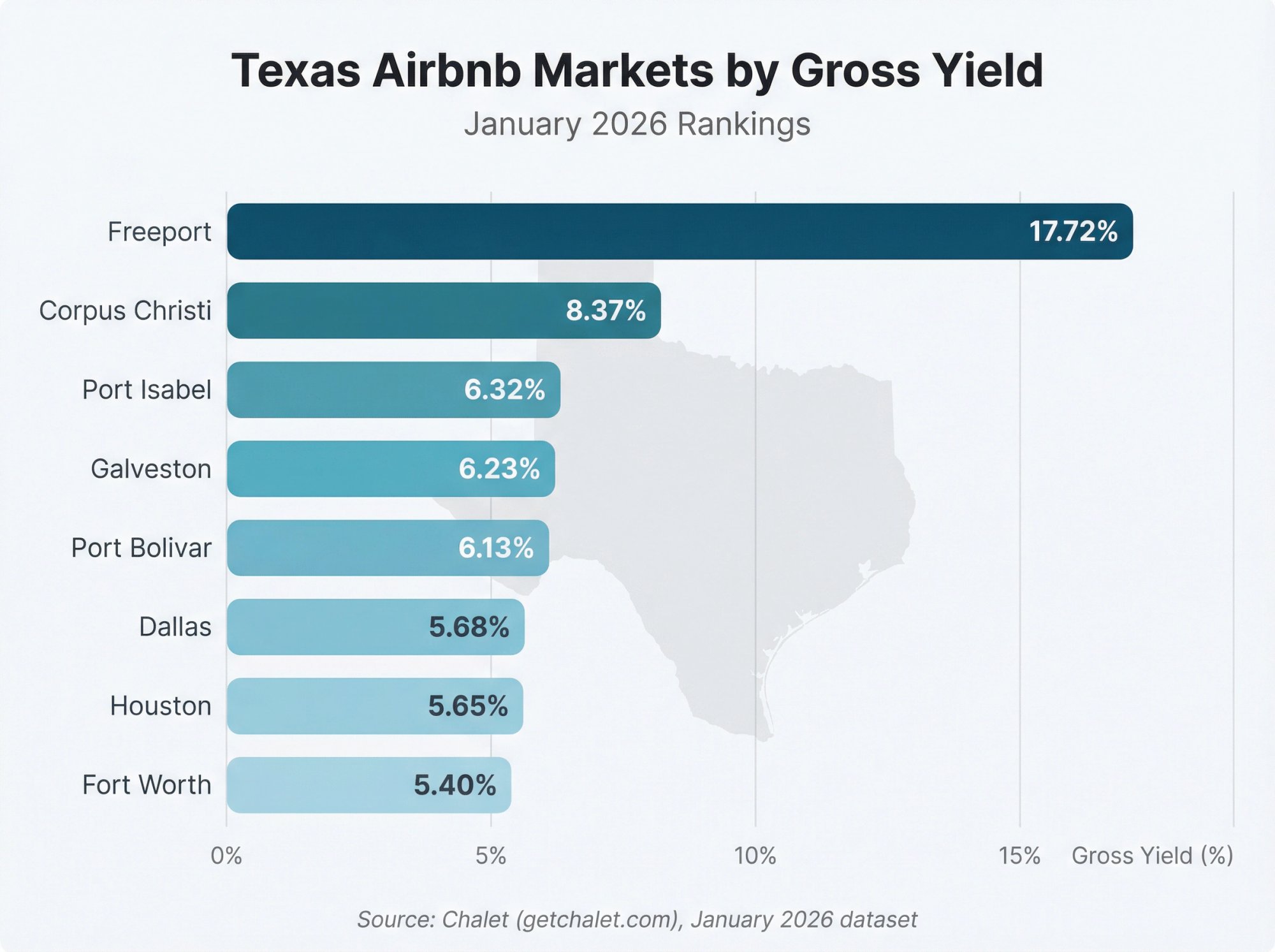

Which Texas Cities Have the Highest Airbnb Yields?

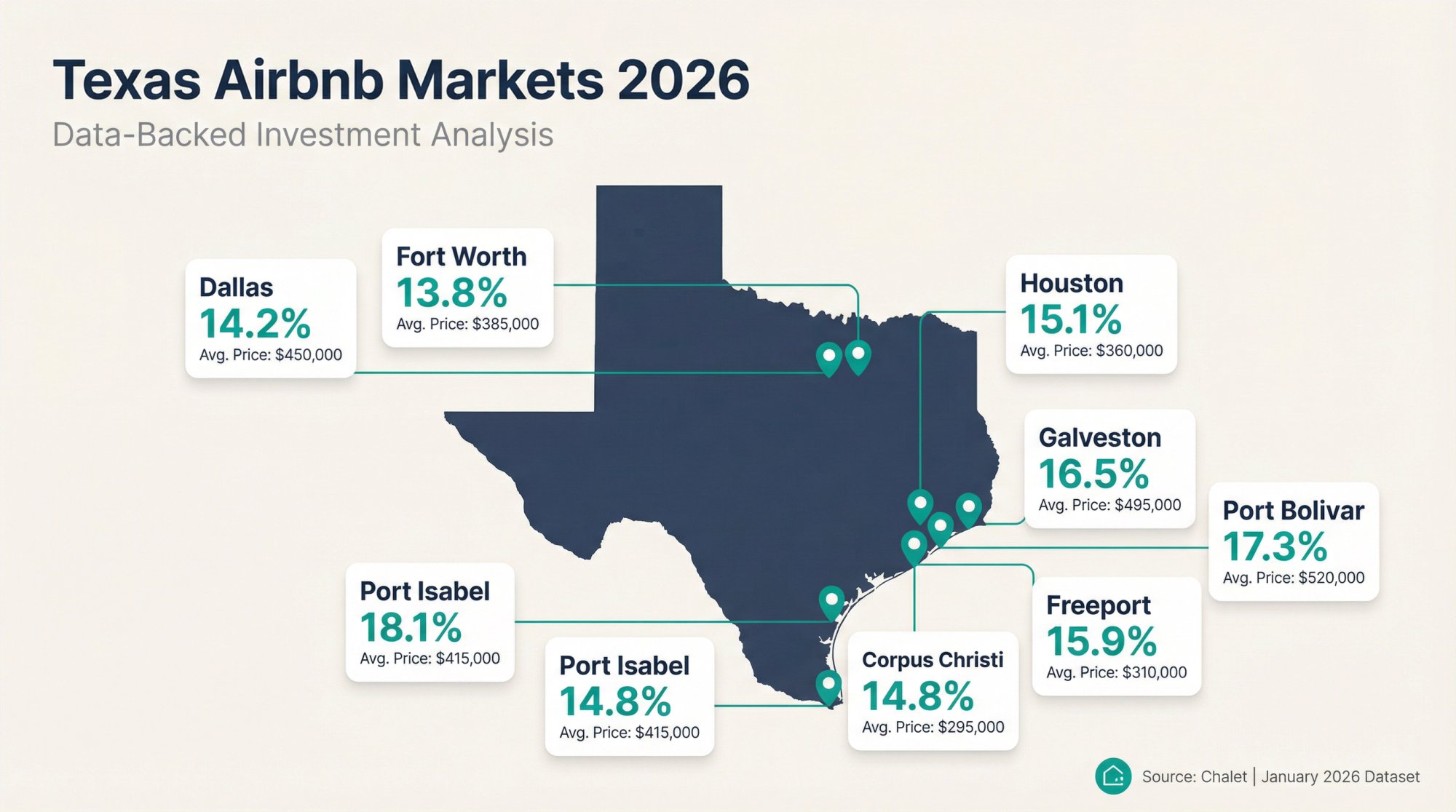

If you want the short version, here are the eight best-performing Texas markets ranked by gross yield (annual revenue divided by average home price):

| Rank | Market | Gross Yield | Avg Home Price |

|---|---|---|---|

| 1 | Freeport | 17.72% | $141,062 |

| 2 | Corpus Christi | 8.37% | $218,331 |

| 3 | Port Isabel | 6.32% | $257,176 |

| 4 | Galveston | 6.23% | $320,448 |

| 5 | Port Bolivar | 6.13% | $397,671 |

| 6 | Dallas | 5.68% | $303,486 |

| 7 | Houston | 5.65% | $261,730 |

| 8 | Fort Worth | 5.40% | $293,827 |

Source: Chalet, January 2026 dataset

The "best" market for you depends on what you're optimizing for. Max cash yield? Stability and consistent occupancy? Speed of execution? We'll break that down below.

Texas Airbnb Market Data: Complete Rankings 2026

Here's the full picture with all the metrics that matter:

| Rank | Market | Avg Home Price | YoY Home Value | Active Listings | ADR | Occupancy | Annual Revenue | Gross Yield | Cap Rate | Property Tax |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Freeport | $141,062 | +4.44% | 448 | $336.94 | 36% | $24,997 | 17.72% | 10.63% | 1.76% |

| 2 | Corpus Christi | $218,331 | -3.12% | 1,492 | $180.30 | 50% | $18,275 | 8.37% | 5.02% | 1.75% |

| 3 | Port Isabel | $257,176 | -3.13% | 302 | $206.00 | 37% | $16,259 | 6.32% | 3.79% | 1.69% |

| 4 | Galveston | $320,448 | -8.81% | 3,318 | $252.21 | 38% | $19,971 | 6.23% | 3.74% | 1.53% |

| 5 | Port Bolivar | $397,671 | -11.63% | 774 | $370.00 | 33% | $24,383 | 6.13% | 3.68% | 1.53% |

| 6 | Dallas | $303,486 | -4.58% | 2,926 | $146.35 | 56% | $17,242 | 5.68% | 3.41% | 1.73% |

| 7 | Houston | $261,730 | -3.22% | 6,601 | $139.16 | 53% | $14,783 | 5.65% | 3.39% | 1.77% |

| 8 | Fort Worth | $293,827 | -3.70% | 313 | $164.73 | 53% | $15,878 | 5.40% | 3.24% | 1.82% |

Source: Chalet, January 2026 dataset

The screenshot above shows Chalet's actual analytics platform where you can filter markets, compare metrics, and drill into any Texas city with live data. This is the same free tool you'll use to validate market selection and track performance over time.

-> Explore our free market analytics to dig deeper into any of these markets.

What Do Airbnb Investment Metrics Actually Mean?

Before you start comparing markets, you need to know what these numbers actually tell you. And what they don't.

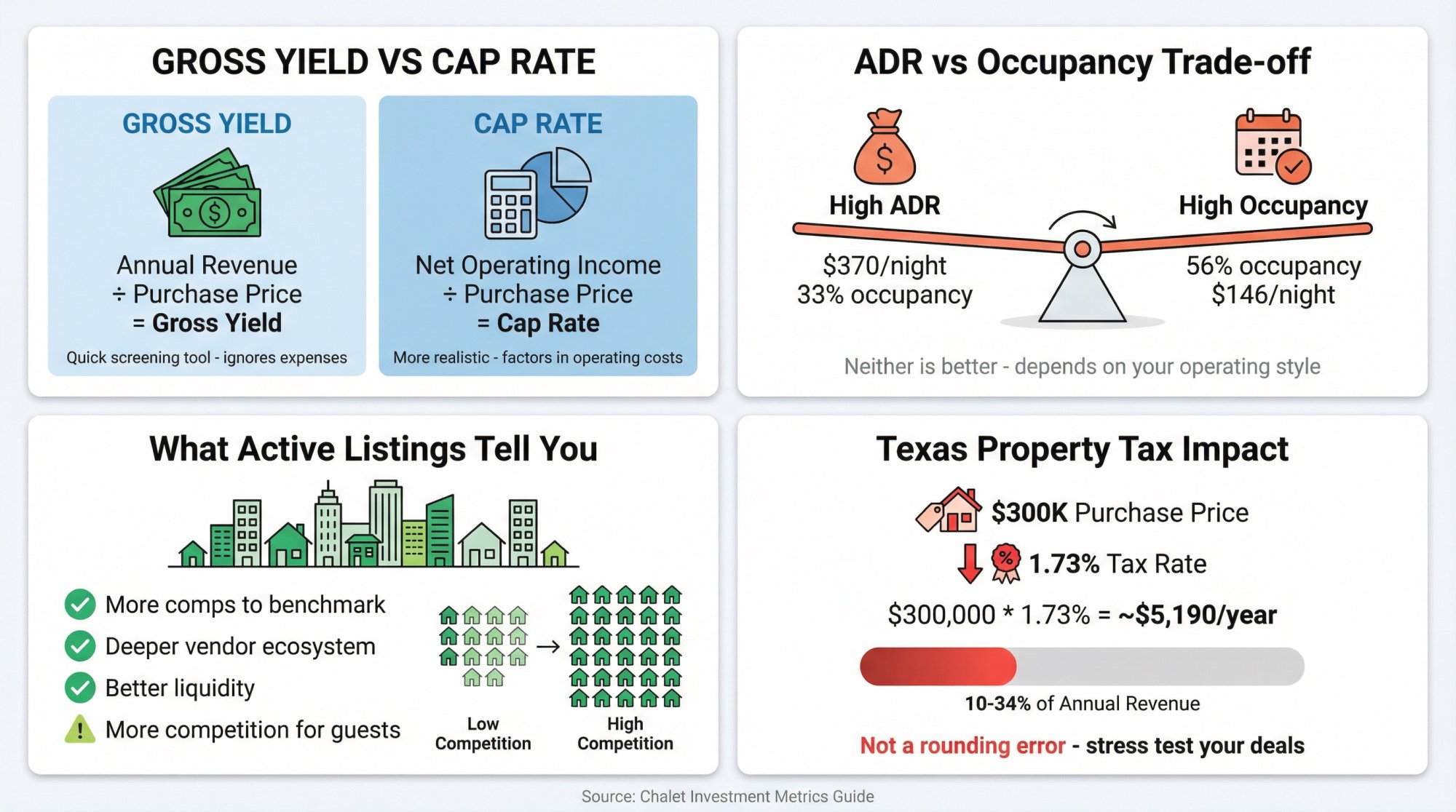

What's the Difference Between Gross Yield and Cap Rate?

Gross yield is the simplest screening tool:

Annual Revenue / Purchase Price = Gross Yield

It tells you how much revenue a property generates relative to what you paid. Great for quick comparisons. But it ignores operating costs entirely.

Cap rate gets you closer to reality:

Net Operating Income / Purchase Price = Cap Rate

This factors in expenses (still before debt service). In our dataset, cap rate runs about 60% of gross yield across all markets. That implies a modeled operating expense load around 40%. Your actual expenses will vary based on insurance, utilities, whether you self-manage or use a property manager, and a dozen other factors.

Use gross yield to screen, cap rate to sanity-check, and your own underwriting to decide.

How Do ADR and Occupancy Rate Affect Airbnb Profits?

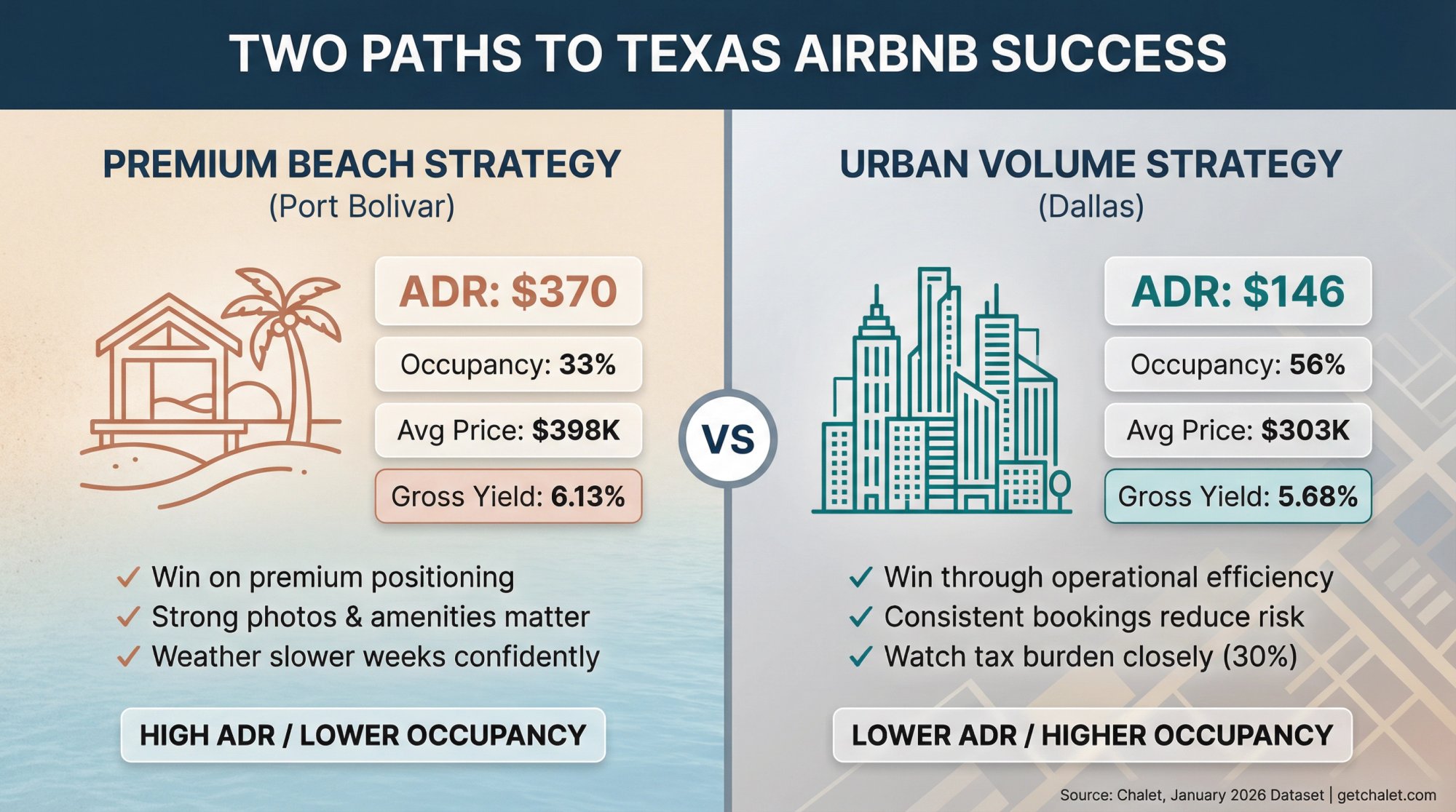

ADR (Average Daily Rate) is your price per booked night. Occupancy is how often you're actually booked. These two metrics pull against each other, and markets tend to cluster into two distinct buckets:

→ High ADR, Lower Occupancy (like Port Bolivar or Freeport)

You win by commanding premium rates. But you need strong listing quality, sharp pricing strategy, and the ability to survive slower weeks.

→ Lower ADR, Higher Occupancy (like Dallas or Houston)

You win through volume and operational efficiency. Consistent bookings, lower turnover costs, tighter margins.

Neither is inherently better. It depends on your operating style.

What Does Active Listings Count Tell You About Competition?

More active listings usually means:

-

More comps to benchmark against

-

Better liquidity if you need to sell

-

But also more competition for guests

Fewer listings can mean less competition in raw numbers. But it also means fewer data points and sometimes a "winner takes most" dynamic where the top 2-3 listings get most of the bookings.

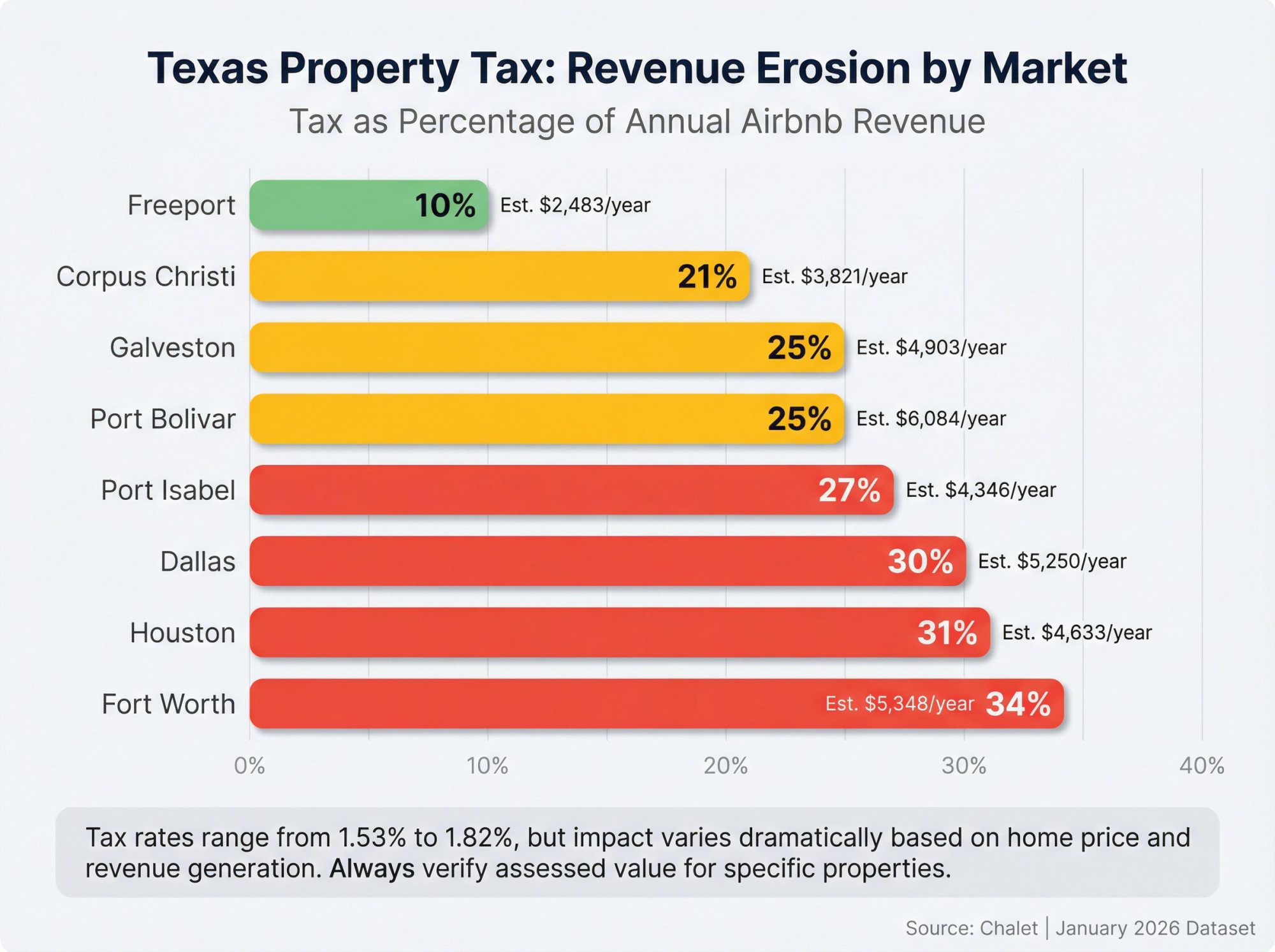

How Much Do Texas Property Taxes Affect Airbnb Returns?

Texas property tax isn't a rounding error. It's a fixed expense tied to assessed value, and it can eat a serious chunk of your gross revenue.

We'll break this down in detail below, but here's the quick version: always stress-test your deal with actual tax estimates before you fall in love with a market's yield numbers.

Texas Airbnb Property Tax by Market: What You'll Actually Pay

This table estimates what you'd owe annually in property taxes, and what percentage of your revenue that represents:

| Market | Avg Home Price | Tax Rate | Est. Annual Tax | Annual Revenue | Tax as % of Revenue |

|---|---|---|---|---|---|

| Freeport | $141,062 | 1.76% | ~$2,483 | $24,997 | ~10% |

| Corpus Christi | $218,331 | 1.75% | ~$3,821 | $18,275 | ~21% |

| Port Isabel | $257,176 | 1.69% | ~$4,346 | $16,259 | ~27% |

| Galveston | $320,448 | 1.53% | ~$4,903 | $19,971 | ~25% |

| Port Bolivar | $397,671 | 1.53% | ~$6,084 | $24,383 | ~25% |

| Dallas | $303,486 | 1.73% | ~$5,250 | $17,242 | ~30% |

| Houston | $261,730 | 1.77% | ~$4,633 | $14,783 | ~31% |

| Fort Worth | $293,827 | 1.82% | ~$5,348 | $15,878 | ~34% |

How to use this: These are estimates based on average home price times the tax rate. Your actual bill depends on your property's assessed value. But this gives you a clean way to compare tax drag across markets before you get too deep into underwriting.

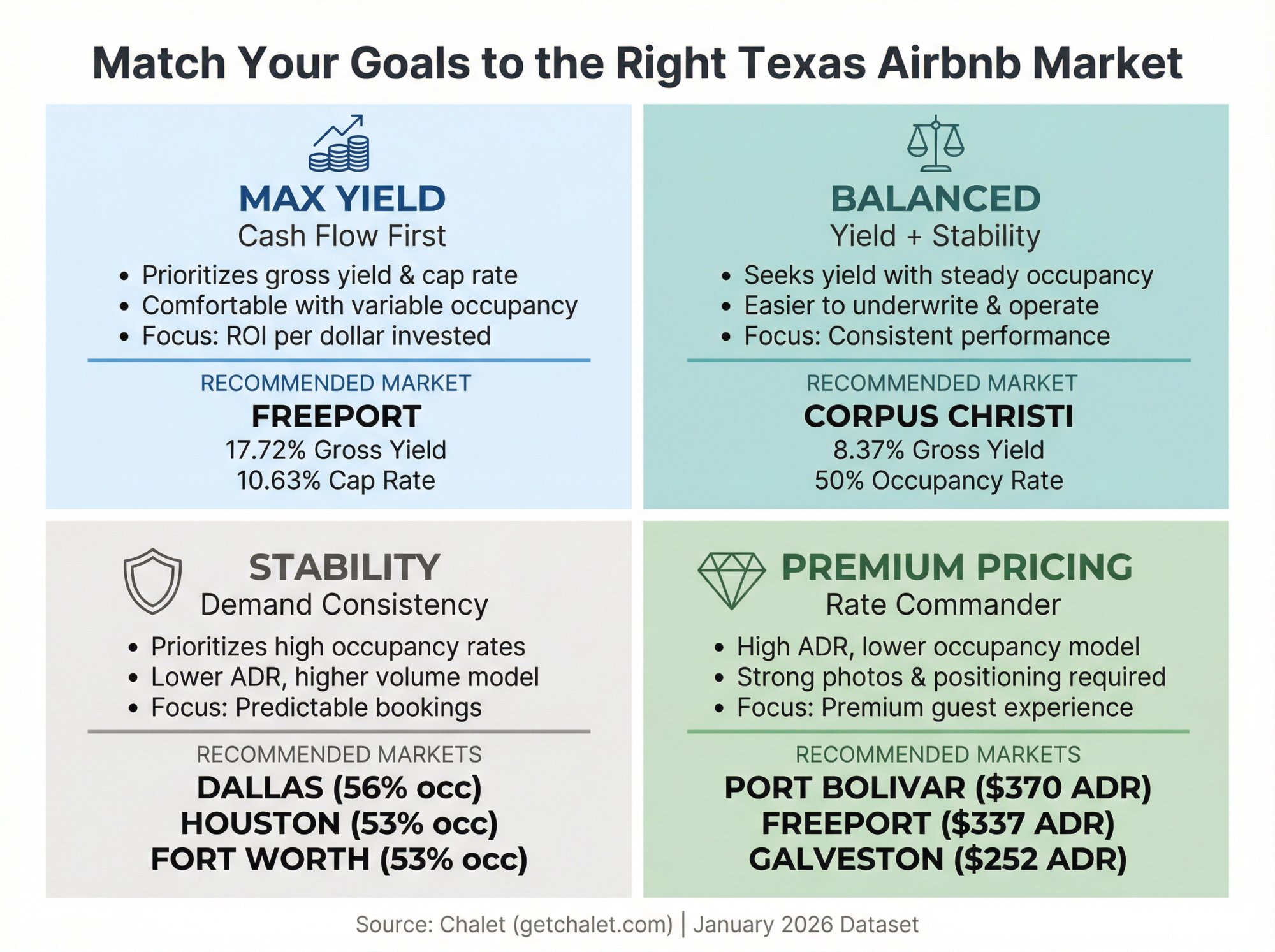

How to Pick the Best Texas Airbnb Market for Your Goals

Different investors need different things. Here's a quick filter to narrow your focus:

Best Texas Market for Maximum Airbnb Yield

-> Freeport stands alone at 17.72% gross yield and 10.63% cap rate. The lowest entry price in the top 8, combined with strong revenue.

Best Texas Market for Balanced Yield and Occupancy

-> Corpus Christi offers 50% occupancy with 8.37% gross yield. Many first-time investors find this profile easier to underwrite and operate.

Which Texas Cities Have the Most Consistent Airbnb Demand?

-> Dallas (56% occupancy), Houston (53%), and Fort Worth (53%) show the highest occupancy rates. The tradeoff: heavier tax burden relative to revenue, and lower yield.

Best Texas Markets for Premium Airbnb Pricing Strategy

-> Port Bolivar ($370 ADR, 33% occupancy), Freeport ($337 ADR, 36% occupancy), and Galveston ($252 ADR, 38% occupancy) require you to earn your rate. Strong photos, sharp pricing, standout amenities.

The 8 Best Airbnb Markets in Texas for 2026 (City-by-City Breakdown)

Now let's go market by market. For each one, we'll cover:

-

What makes it attractive

-

What's the catch

-

Who this market actually fits

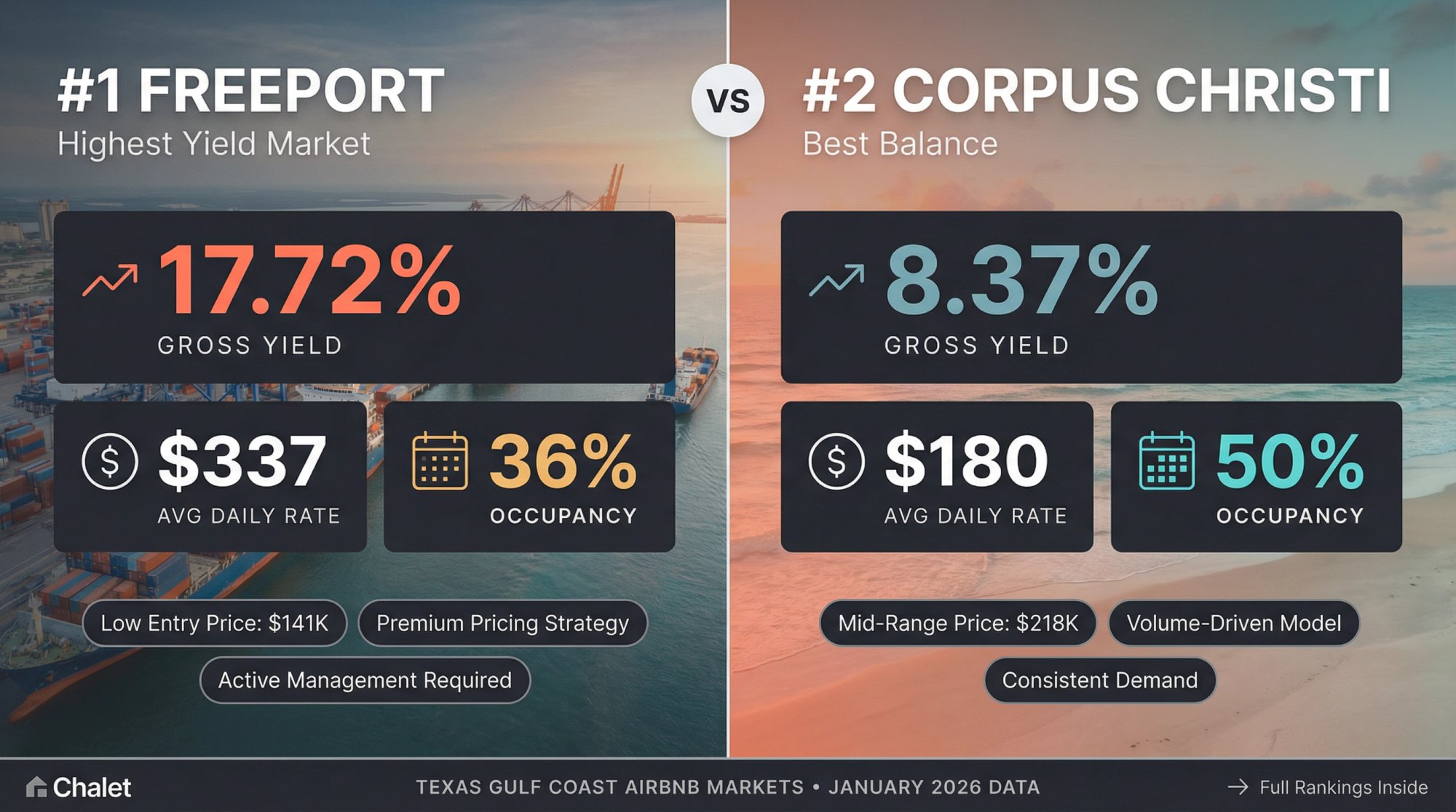

1. Freeport, TX: Highest Airbnb Yield in Texas

Why It Ranks #1: The highest gross yield in our dataset, driven by the lowest average home price combined with strong annual revenue.

| Metric | Value |

|---|---|

| Avg Home Price | $141,062 |

| YoY Home Value | +4.44% |

| Active Listings | 448 |

| ADR | $336.94 |

| Occupancy | 36% |

| Annual Revenue | $24,997 |

| Gross Yield | 17.72% |

| Cap Rate | 10.63% |

| Property Tax | 1.76% |

What the numbers are saying:

This is the classic "cheap asset + decent revenue" combination that makes yield numbers pop. Occupancy sits at 36%, which isn't high. But ADR is strong at $337. That means your results depend heavily on your positioning, your photos, your reviews, and your pricing discipline.

Property tax relative to revenue looks lighter here than other markets (around 10% of annual revenue).

The catch: Lower occupancy means you can't coast. You need to actively manage your listing and earn those bookings.

Who it fits:

→ First-time buyers: Good entry point if you're willing to learn hospitality basics and don't need hand-holding

→ 1031 exchange buyers: Interesting for yield, but verify deal flow and operational readiness so you can close and stabilize fast

→ Portfolio builders: Strong cash yield candidate if you already have systems

-> Meet an Airbnb-friendly agent in Freeport

2. Corpus Christi: Best Balance of Yield and Occupancy

Why It Ranks #2: The best mix of higher occupancy (50%) and solid gross yield (8.37%) at a mid-range price point.

| Metric | Value |

|---|---|

| Avg Home Price | $218,331 |

| YoY Home Value | -3.12% |

| Active Listings | 1,492 |

| ADR | $180.30 |

| Occupancy | 50% |

| Annual Revenue | $18,275 |

| Gross Yield | 8.37% |

| Cap Rate | 5.02% |

| Property Tax | 1.75% |

What the numbers are saying:

This market looks more volume-driven than price-driven. ADR is moderate, but occupancy is the second-highest in the top 8. Active listings are healthy (1,492), which means more comps and operational benchmarks to learn from.

YoY home value is slightly negative. Could be an entry opportunity. Could also mean you should underwrite conservatively.

The catch: You're not commanding premium rates here. Operational efficiency matters.

Who it fits:

→ First-time buyers: Arguably one of the more forgiving profiles. Higher occupancy reduces "dead month" risk.

→ 1031 exchange buyers: Inventory looks healthier than tiny markets, which helps execution timelines

→ Portfolio builders: Good "base hit" market for repeatable underwriting

-> Open the Corpus Christi market dashboard

-> Meet an Airbnb-friendly agent

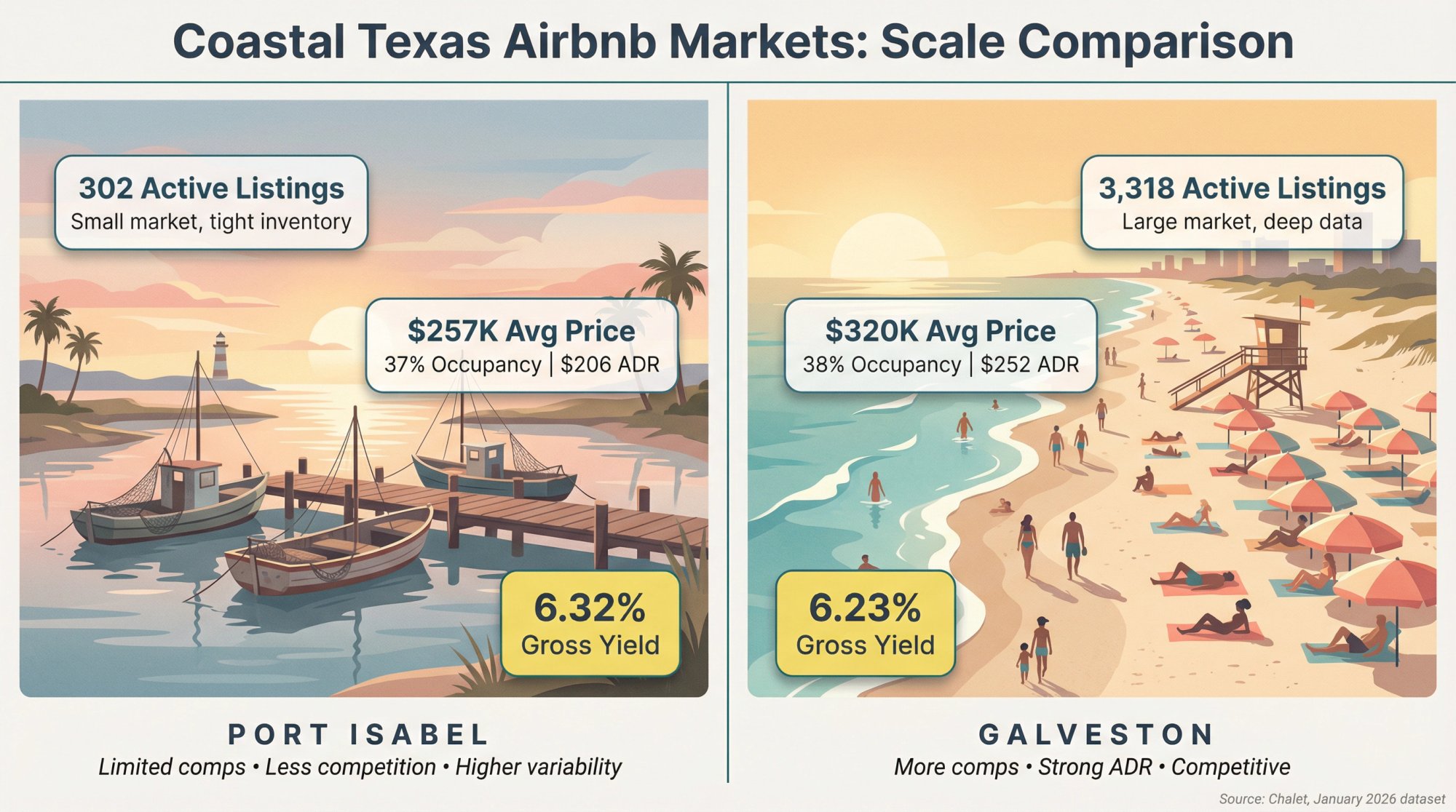

3. Port Isabel: Mid-Price Texas Airbnb Market

Why It Ranks #3: A mid-price market with decent ADR, but lower occupancy and limited inventory. Execution and deal selection matter here.

| Metric | Value |

|---|---|

| Avg Home Price | $257,176 |

| YoY Home Value | -3.13% |

| Active Listings | 302 |

| ADR | $206.00 |

| Occupancy | 37% |

| Annual Revenue | $16,259 |

| Gross Yield | 6.32% |

| Cap Rate | 3.79% |

| Property Tax | 1.69% |

What the numbers are saying:

This is a lower-occupancy market. Your underwriting needs to assume slower weekdays, and you'll have to earn your ADR through strong guest experience.

Only 302 active listings. Less competition on paper, but also fewer comps. Don't guess on revenue here. Validate at the address level.

The catch: Tight inventory can make deal-finding harder. Variability is higher.

Who it fits:

→ First-time buyers: Only if you're comfortable with variability and learning curves

→ 1031 exchange buyers: Tighter inventory could slow down deal flow

→ Portfolio builders: Better if you're already strong at listing optimization

-> Meet an Airbnb-friendly agent in Port Isabel

-> Run ROI/DSCR for a target property

4. Galveston: High Competition Texas Airbnb Market

Why It Ranks #4: A larger market by listing count (3,318) with strong ADR and moderate occupancy. Lots of data, lots of competition.

| Metric | Value |

|---|---|

| Avg Home Price | $320,448 |

| YoY Home Value | -8.81% |

| Active Listings | 3,318 |

| ADR | $252.21 |

| Occupancy | 38% |

| Annual Revenue | $19,971 |

| Gross Yield | 6.23% |

| Cap Rate | 3.74% |

| Property Tax | 1.53% |

What the numbers are saying:

This isn't a mystery market. With 3,318 active listings, there's plenty of data, plenty of comps, and plenty of competition.

YoY home value is meaningfully negative (-8.81%). Don't assume appreciation. Focus on cash performance.

Property tax rate is on the lower end of the list (1.53%), which helps relative to similarly-priced markets.

The catch: Competition is real. You need intentional differentiation.

Who it fits:

→ First-time buyers: Good if you want lots of comps and a market that's easier to benchmark

→ 1031 exchange buyers: More liquidity can help you hit tight timelines

→ Portfolio builders: Strong market, but your edge must be intentional

-> Open the Galveston market dashboard

-> Check local STR regulations before you buy

5. Port Bolivar: Premium ADR Texas Airbnb Market

Why It Ranks #5: The highest ADR in the top 8 ($370), but also the highest average home price and lowest occupancy.

| Metric | Value |

|---|---|

| Avg Home Price | $397,671 |

| YoY Home Value | -11.63% |

| Active Listings | 774 |

| ADR | $370.00 |

| Occupancy | 33% |

| Annual Revenue | $24,383 |

| Gross Yield | 6.13% |

| Cap Rate | 3.68% |

| Property Tax | 1.53% |

What the numbers are saying:

You're paying the most for an average property in this top 8. Even with high revenue, yield gets compressed because of the entry price.

At 33% occupancy, you can't be average. You need to win on guest appeal and pricing strategy.

Property taxes in dollars will be heavy simply because the asset price is high (even at a lower tax rate).

The catch: Not beginner-friendly. You need capital, operational chops, and the ability to command premium rates.

Who it fits:

→ First-time buyers: Not recommended unless you have strong cash reserves and a clear plan

→ 1031 exchange buyers: Could work, but underwriting needs to be conservative

→ Portfolio builders: Fits experienced operators who know how to earn premium rates

-> Open the Port Bolivar market dashboard

-> Meet a lender and run DSCR scenarios

6. Dallas: Highest Occupancy Texas Airbnb Market

Why It Ranks #6: The highest occupancy in the dataset (56%) with mid-level yield. The tradeoff is a heavier property tax burden.

| Metric | Value |

|---|---|

| Avg Home Price | $303,486 |

| YoY Home Value | -4.58% |

| Active Listings | 2,926 |

| ADR | $146.35 |

| Occupancy | 56% |

| Annual Revenue | $17,242 |

| Gross Yield | 5.68% |

| Cap Rate | 3.41% |

| Property Tax | 1.73% |

What the numbers are saying:

This looks like a "steady demand" profile. Lower ADR, higher occupancy. You're not relying on big weekends to survive.

Tax Warning: When you multiply average price by property tax rate, the estimated tax is a large fraction of annual revenue (around 30%). Taxes can make or break your net cash flow here.

Who it fits:

→ First-time buyers: Good if you want higher occupancy and plan to run a tight operation

→ 1031 exchange buyers: Lots of listings usually helps deal flow and timeline execution

→ Portfolio builders: Strong for systems and repeatability, but watch tax and expense creep

-> Open the Dallas market dashboard

-> Meet an Airbnb-friendly agent

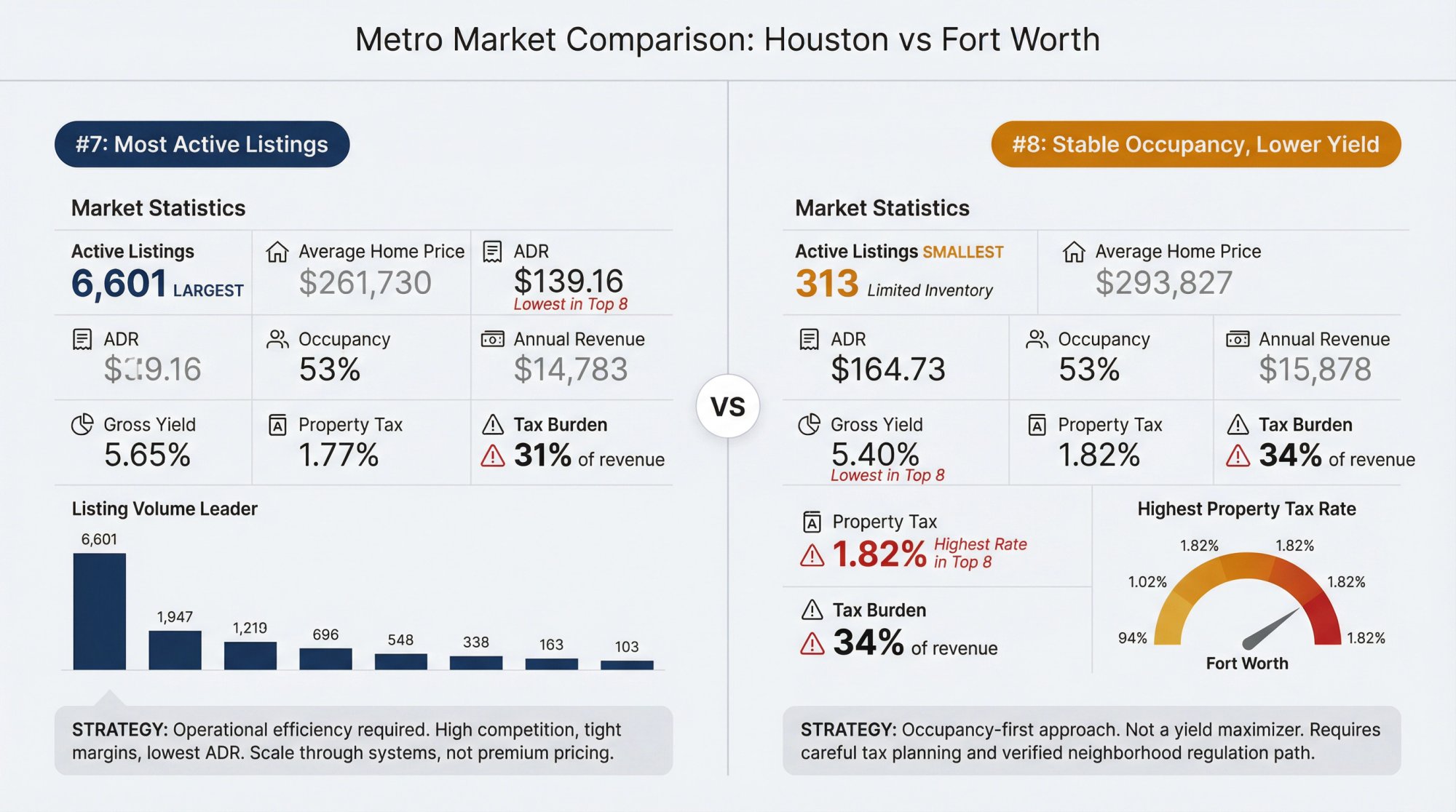

7. Houston: Most Active Texas Airbnb Listings

Why It Ranks #7: The most active listings in Texas (6,601), solid occupancy (53%), but also the lowest ADR in the top 8 and significant tax drag.

| Metric | Value |

|---|---|

| Avg Home Price | $261,730 |

| YoY Home Value | -3.22% |

| Active Listings | 6,601 |

| ADR | $139.16 |

| Occupancy | 53% |

| Annual Revenue | $14,783 |

| Gross Yield | 5.65% |

| Cap Rate | 3.39% |

| Property Tax | 1.77% |

What the numbers are saying:

Massive listing count means lots of comps, lots of competition, and generally better liquidity. ADR is lowest in the top 8, so you don't have much pricing cushion. Operational efficiency matters.

Estimated property taxes are about 31% of annual revenue.

The catch: This market requires you to run your STR like a business. Tight margins, high competition.

Who it fits:

→ First-time buyers: Good if you want a data-rich market and you're committed to optimizing

→ 1031 exchange buyers: Very liquid market, easier to find deals fast

→ Portfolio builders: Works if you can scale systems, harder to win with "just a nice house"

-> Open the Houston market dashboard

-> Set up your operations stack

8. Fort Worth: Stable Occupancy, Lower Yield

Why It Ranks #8: Lowest gross yield in the top 8, but solid occupancy. Also has the highest property tax rate on this list.

| Metric | Value |

|---|---|

| Avg Home Price | $293,827 |

| YoY Home Value | -3.70% |

| Active Listings | 313 |

| ADR | $164.73 |

| Occupancy | 53% |

| Annual Revenue | $15,878 |

| Gross Yield | 5.40% |

| Cap Rate | 3.24% |

| Property Tax | 1.82% |

What the numbers are saying:

Occupancy is strong at 53%, but yield is lowest in this ranking. You're buying for stability more than raw cash return.

The tax rate (1.82%) is the highest in the top 8. That's a direct hit to net performance.

The catch: Lower listing count (313) can make sourcing harder. Not a yield maximizer.

Who it fits:

→ First-time buyers: Only if you're prioritizing occupancy and have verified the neighborhood and regulation path

→ 1031 exchange buyers: Low inventory could slow down sourcing

→ Portfolio builders: Could fit a broader portfolio balance approach, not a pure yield play

-> Meet an Airbnb-friendly agent in Fort Worth

How to Choose the Right Texas Airbnb Market for You

Here's how to go from "interesting market list" to "confident enough to write offers."

Step 1: What Does "Best Market" Mean for Your Investment?

Pick one primary goal:

-

Cash yield first: You care most about gross yield and cap rate

-

Stability first: You care most about occupancy and liquidity

-

Execution speed first: You care most about listings count and vendor depth

If you try to optimize all three equally, you'll end up stuck in analysis paralysis.

Step 2: Use These Filters to Narrow Down Texas Markets

Use the data, not vibes:

-

Want yield? Start at the top of the gross yield column

-

Want stability? Start at the top of occupancy

-

Want liquidity? Start at the top of active listings

Step 3: How to Calculate Estimated Property Taxes

Use the quick proxy:

Estimated Annual Property Tax = Average Home Price x Property Tax Rate

Then ask yourself: "If this is my floor tax cost, does the deal still work after everything else?"

Step 4: How to Underwrite a Specific Airbnb Property

Market averages are for screening. You still need property-level math before any offer.

Use Chalet's free calculator (shown above) to model your specific deal. Input the purchase price, estimated revenue, and operating costs to see projected ROI, cap rate, and DSCR before you make an offer.

Step 5: Match Your Operating Style to Market Profile

High ADR + Lower Occupancy: Your edge must be positioning (design, photos, amenities, pricing discipline)

Lower ADR + Higher Occupancy: Your edge must be efficiency (fast turns, automation, cleaner/PM quality, cost control)

How Chalet Helps You Move From Research to Reality

Researching markets is only step one. The real work starts when you're ready to execute.

That's where Chalet comes in. We're a one-stop platform for short-term rental investors, combining free analytics with a vetted vendor network:

-

Free market dashboards: See ADR, occupancy, and revenue trends across Texas markets

-

ROI and DSCR calculators: Underwrite specific addresses before you buy

-

STR-specialist agents: Connect with agents who actually understand Airbnb investing

-

Lenders, insurance, PMs, and more: Our vendor network covers everything you need to close and operate

You can explore the data on your own. When you're ready to move, we connect you with pros who can help you execute.

-> Explore Chalet's free analytics

-> See Airbnb rentals for sale

-> Meet an Airbnb-friendly agent

Frequently Asked Questions

Is the #1 ranked market always the best deal?

No. It's the best screen by gross yield. Your actual results depend on the specific property, the street, local regulations, and your execution. Market-level data is for filtering. Address-level underwriting is for deciding.

Why are most YoY home value changes negative in this list?

That's what our January 2026 dataset shows for these specific markets. Don't treat it as a prediction. Treat it as a signal to underwrite conservatively and avoid banking on appreciation.

Should I pick based on gross yield or cap rate?

Use gross yield to screen quickly. Use cap rate to sanity-check a more realistic "after expenses" view. And always move to address-level underwriting with your own expense assumptions before you buy.

What if I'm doing a 1031 exchange?

Timeline matters. Look at markets with higher active listings counts (better deal flow) and connect with a Chalet agent who understands 1031 execution. You need to identify within 45 days and close within 180.

How often does this data update?

The numbers in this guide are from our January 2026 dataset. STR performance and home prices change, so treat this as a current snapshot. You can access live dashboards on Chalet for the latest numbers.

Do you have data on markets outside Texas?

Yes. Chalet covers markets across the country. This guide focuses on Texas, but our analytics platform includes data for other states and regions.

What's the difference between self-managing and using a property manager?

Self-managing saves you the PM fee (typically 15-25% of revenue) but requires your time and attention. A PM handles guest communication, turnovers, maintenance, and pricing. The right choice depends on your location, your bandwidth, and how many properties you're operating.

How do I get started?

-> Run ROI and DSCR for a specific address

-> Meet an Airbnb-friendly agent

Your Next Step

If you're ready to turn this research into an actual purchase plan:

-

Analyze markets for free: Chalet Market Analytics

-

Run ROI and DSCR for a specific address: Chalet Calculator

-

Meet an Airbnb-friendly agent: Find Texas agents

-

See Airbnb rentals for sale: Texas properties

All the data in this guide comes from Chalet. We pair free market analytics with a vetted vendor network so you can research, buy, and operate your short-term rental in one place.

Data Currency Note: All prices, rates, and market metrics in this guide are based on the January 2026 dataset provided by Chalet. Short-term rental performance and home prices can change, so treat this as a current snapshot.