So you're thinking about buying an Airbnb rental property but have zero experience. You're probably asking yourself: Can I actually do this? Will it make money? What if I mess everything up?

Thousands of first-time investors buy their first short-term rental (STR) every year with no prior hosting experience. The difference between those who succeed and those who lose money comes down to how well they plan before buying.

This guide walks you through every practical step (from picking the right market to setting up operations) so you can go from complete beginner to confident owner without the expensive mistakes.

What You're Actually Getting Into (Beyond Real Estate)

When you buy an Airbnb rental, you're not just buying property. You're buying a small hospitality business that happens to sit on real estate.

The business works like this:

Profit = Revenue − Operating Costs − Debt Costs − Reserves

What makes it challenging for first-timers is the uncertainty in each piece:

Revenue fluctuates. Bookings change with seasons, competition, reviews, and local regulations.

Costs arrive in bursts. Repairs don't happen smoothly. They hit when you least expect them.

Debt payments stay fixed. Your mortgage doesn't care if it's slow season.

Your job isn't to become a perfect host overnight. Your job is to design a deal that survives normal beginner mistakes.

A good first purchase is one where you can:

• Operate legally without regulatory surprises

• Cover fixed costs even with conservative occupancy

• Pivot to mid-term or long-term rentals if short-term rules change

• Run operations yourself or hire someone competent

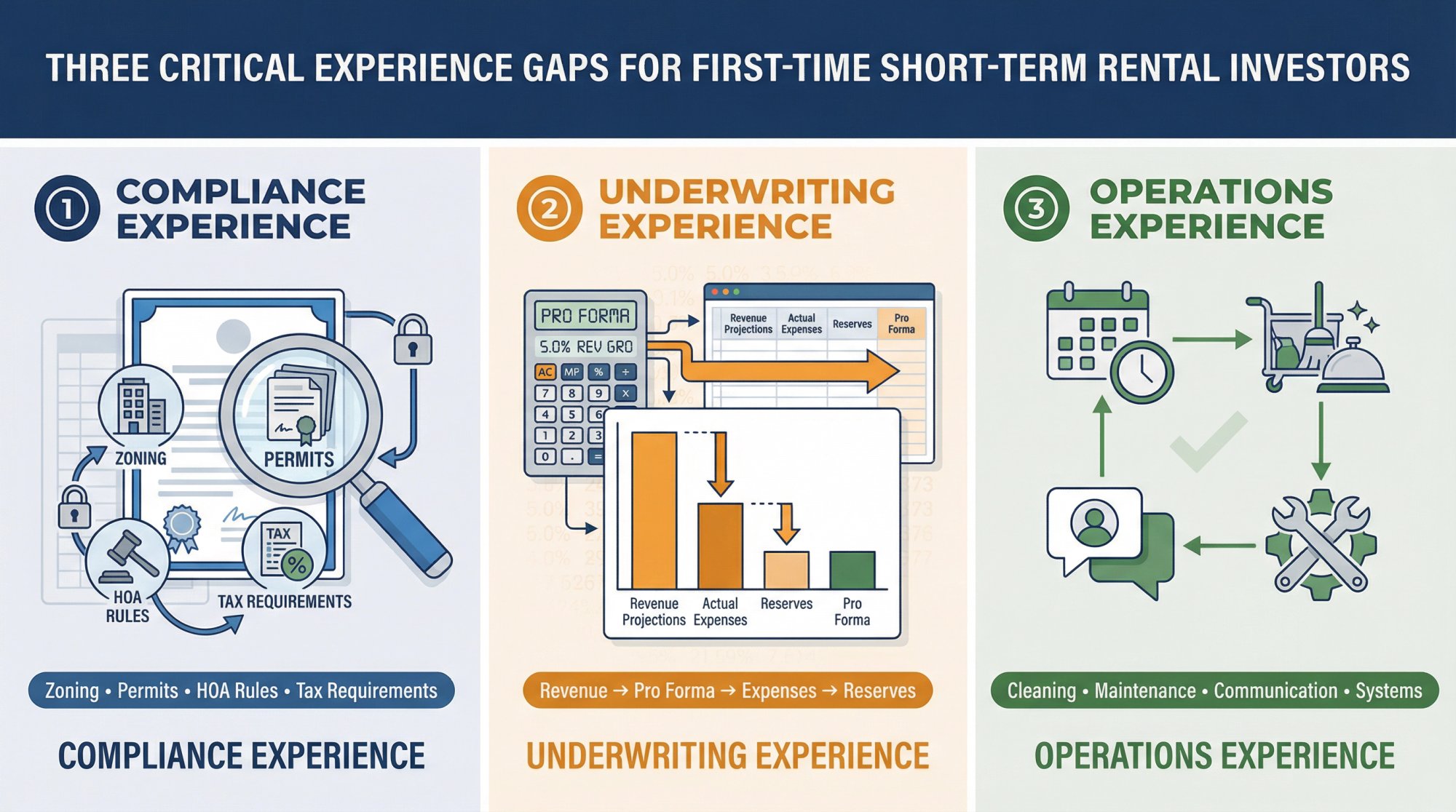

3 Experience Gaps Every First-Time STR Buyer Has

Most first-time buyers are missing three kinds of experience:

① Compliance experience

You don't yet know how to quickly verify zoning, permits, HOA rules, and tax requirements at the address level.

② Underwriting experience

You don't yet know how to turn "revenue projections" into a realistic pro forma with actual expenses and reserves.

③ Operations experience

You don't yet have systems for cleaning, maintenance, and guest communication that won't fall apart under pressure.

This guide is built around closing those gaps with checklists and decision rules.

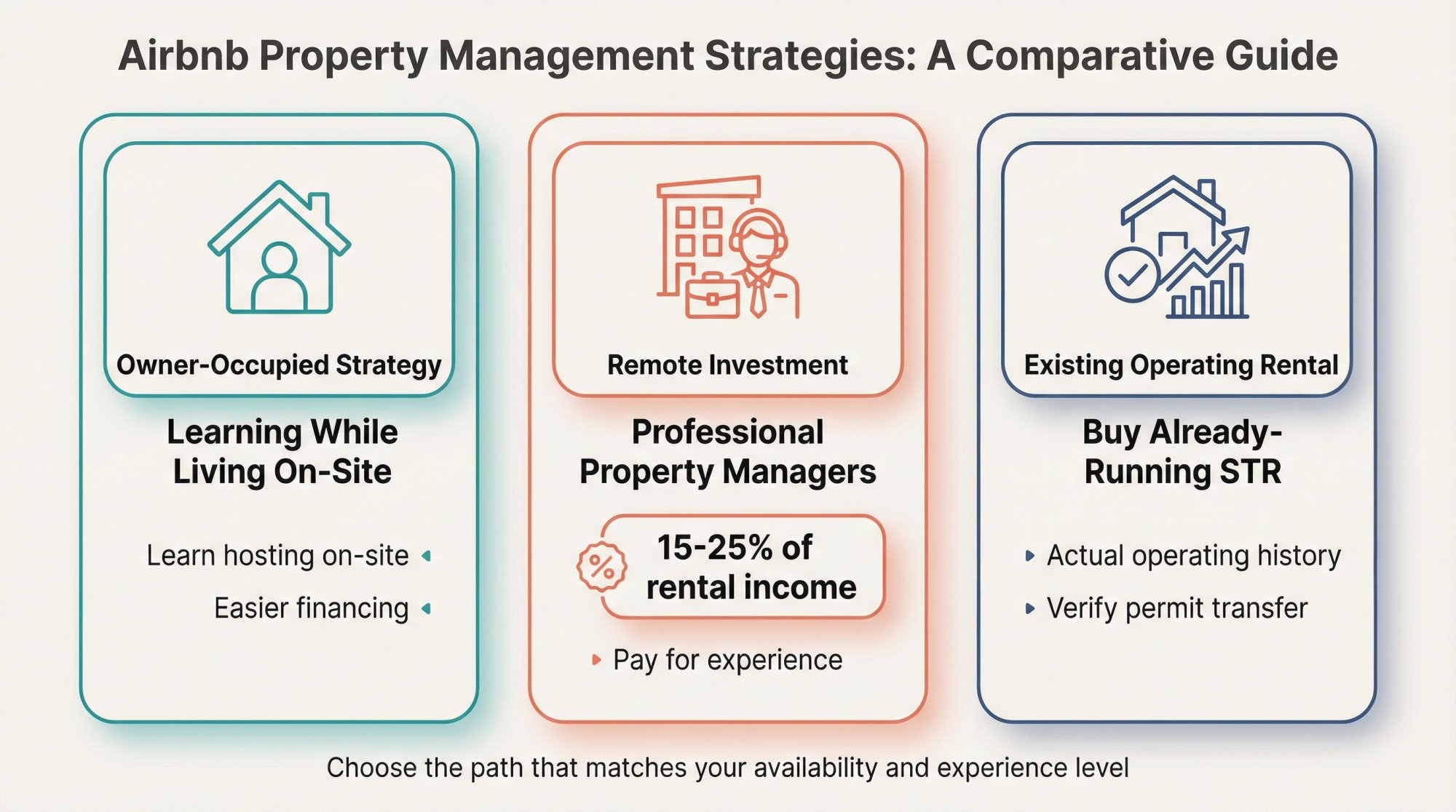

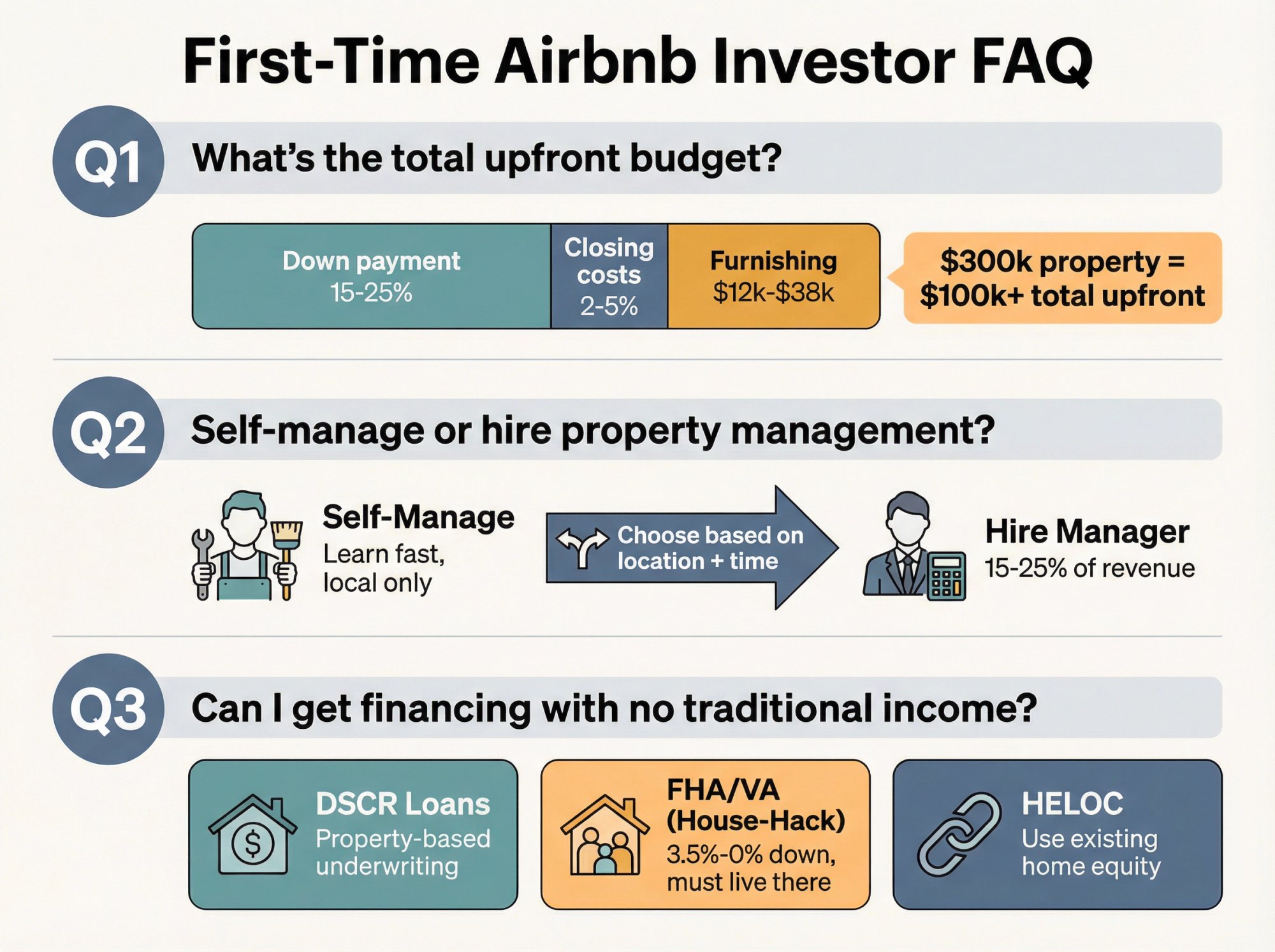

Should You Self-Manage or Hire Property Management?

Before you start browsing listings, pick a strategy that matches your life:

Owner-Occupied Strategy: Learning While Living On-Site

Buy a home you live in and rent part of it (a room, basement unit, or ADU). Or live there initially and move out later.

Why it works for beginners:

You can learn hosting while on-site. When something breaks at 2am, you can fix it fast. Financing is often easier when you're occupying the property.

Main trap:

You must follow occupancy and usage rules for both your loan type and local STR regulations.

Remote Investment With Professional Property Managers

Buy an investment property and hire a short-term rental manager from day one.

Why it works for beginners:

You're paying for experience instead of earning it through trial and error. Better for busy professionals or out-of-state investing.

Main trap:

Management fees typically run 15% to 25% of rental income. That's real money coming out of your cash flow.

Buying an Existing Operating Airbnb Rental

Purchase a property already running as a short-term rental and continue operating it.

Why it's attractive:

You can underwrite based on actual operating history instead of projections.

Main trap:

Just because it operated before doesn't mean you can operate it after closing. Permits may be non-transferable. Rules may have changed. HOAs may enforce differently.

If you have no operating history, Strategy C works best only when you can verify the license transfers, confirm current rules, and validate financials with real statements (not spreadsheets).

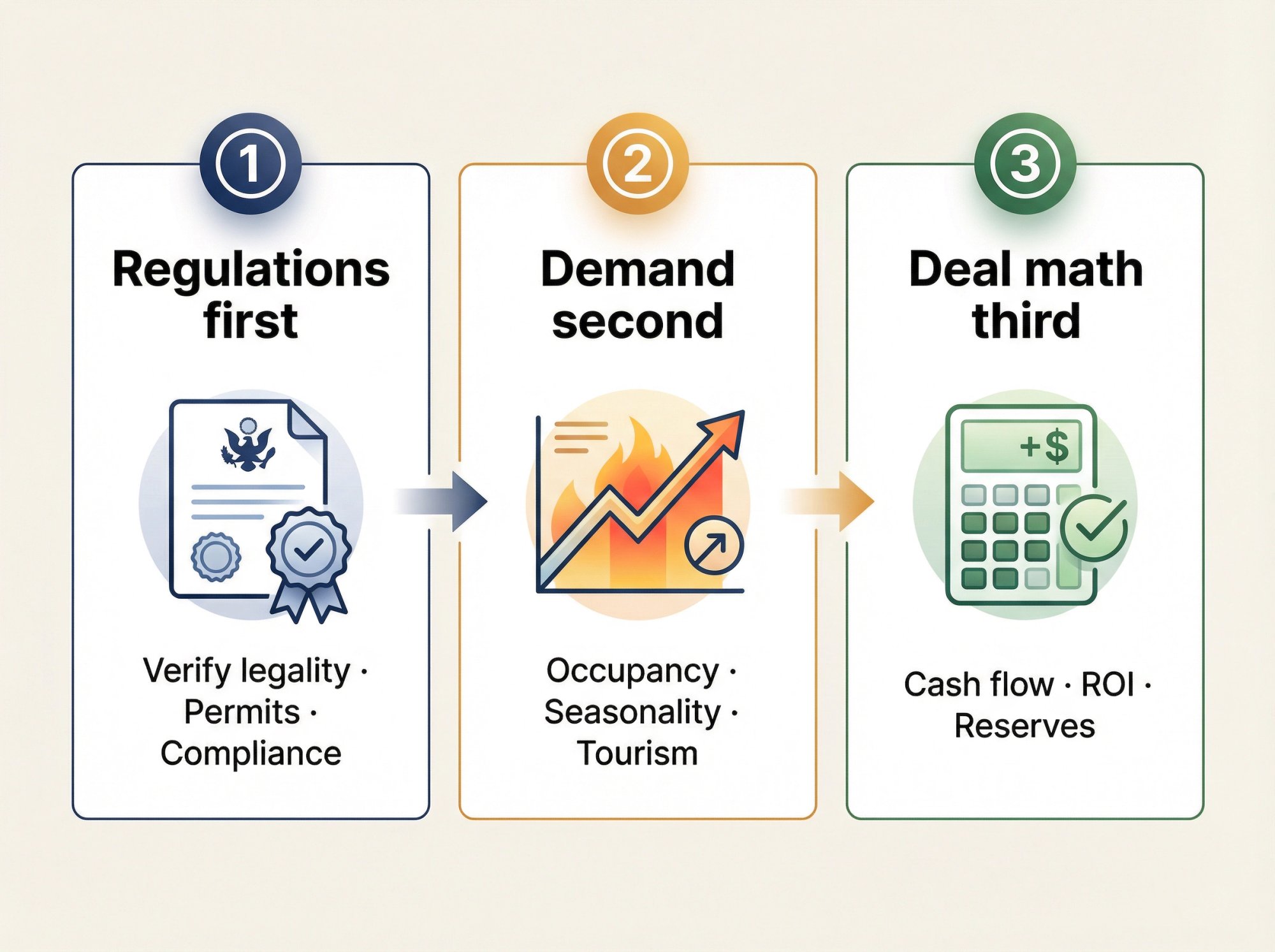

How to Choose Markets With Low Regulatory Risk

A lot of beginners research markets backwards. They start with "cool vacation towns" and then discover the place banned STRs two years ago.

Do it in this order:

① Regulations first

② Demand second

③ Deal math third

Why STR Regulations Matter More Than Ever in 2026

Regulation tightening isn't theoretical anymore. It's an active trend across many destinations, driven by housing affordability concerns and neighborhood pressure.

Even governments outside the U.S. are cracking down. Reuters reported in January 2025 that Spain ordered Airbnb to take down tens of thousands of listings operating illegally.

You don't need to panic. You need a process.

Market Scorecard: How to Evaluate STR-Friendly Cities

| Factor | What "Good" Looks Like | What to Watch |

|---|---|---|

| Legal status | STRs clearly allowed with defined permit process | Bans, caps, waitlists, primary-residence requirements |

| Enforcement | Rules exist but are stable and consistently administered | Rapid rule changes, complaint-driven enforcement |

| Demand shape | Year-round demand or predictable seasonality | One-season markets with long dead periods |

| Supply pressure | New listings growing slowly | Explosive listing growth compressing pricing |

| Backup plan | Property works as mid-term or long-term rental | Properties that only work for weekends |

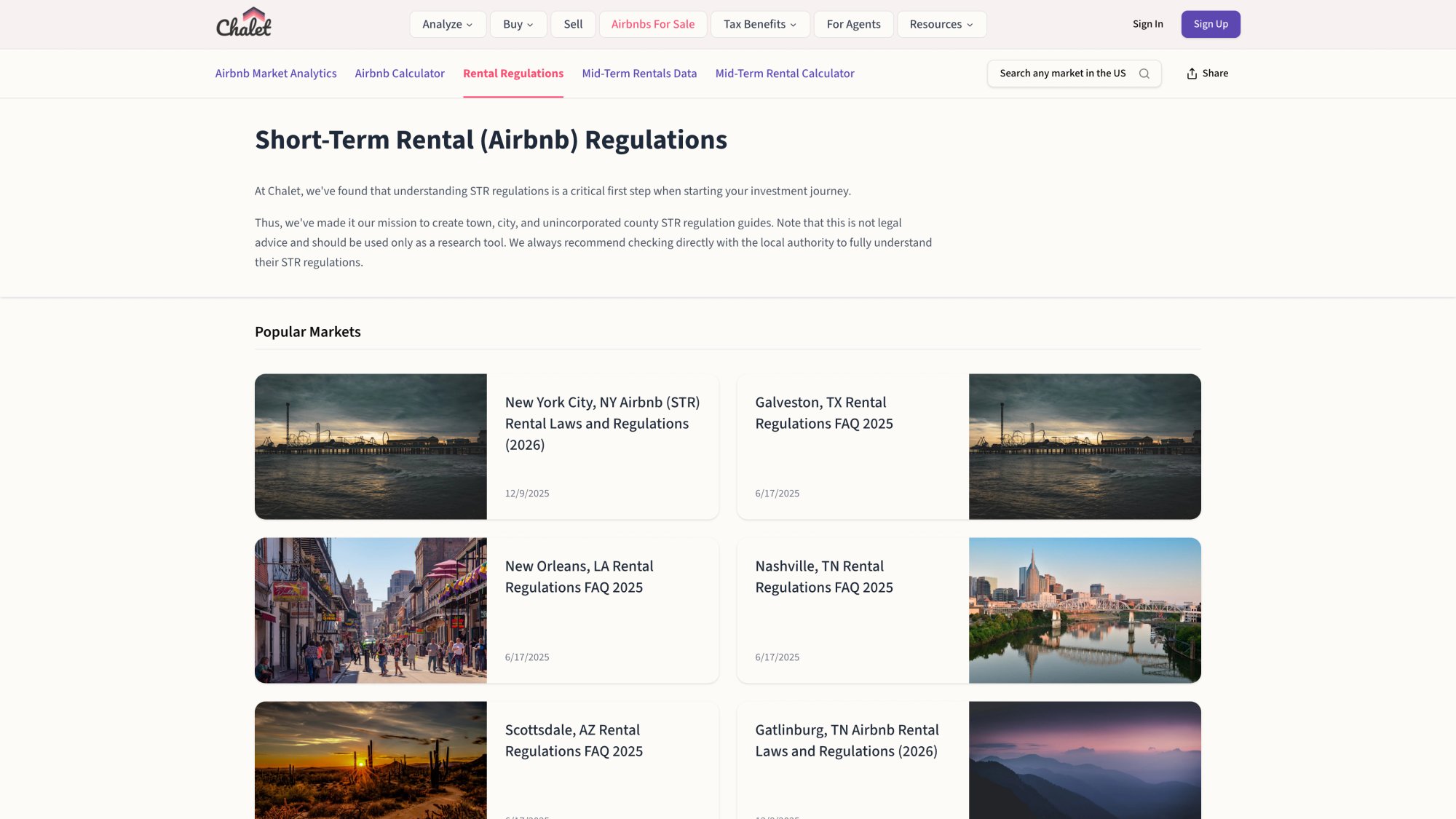

Check local STR regulations for any market you're considering using Chalet's regulation library before you fall in love with a listing.

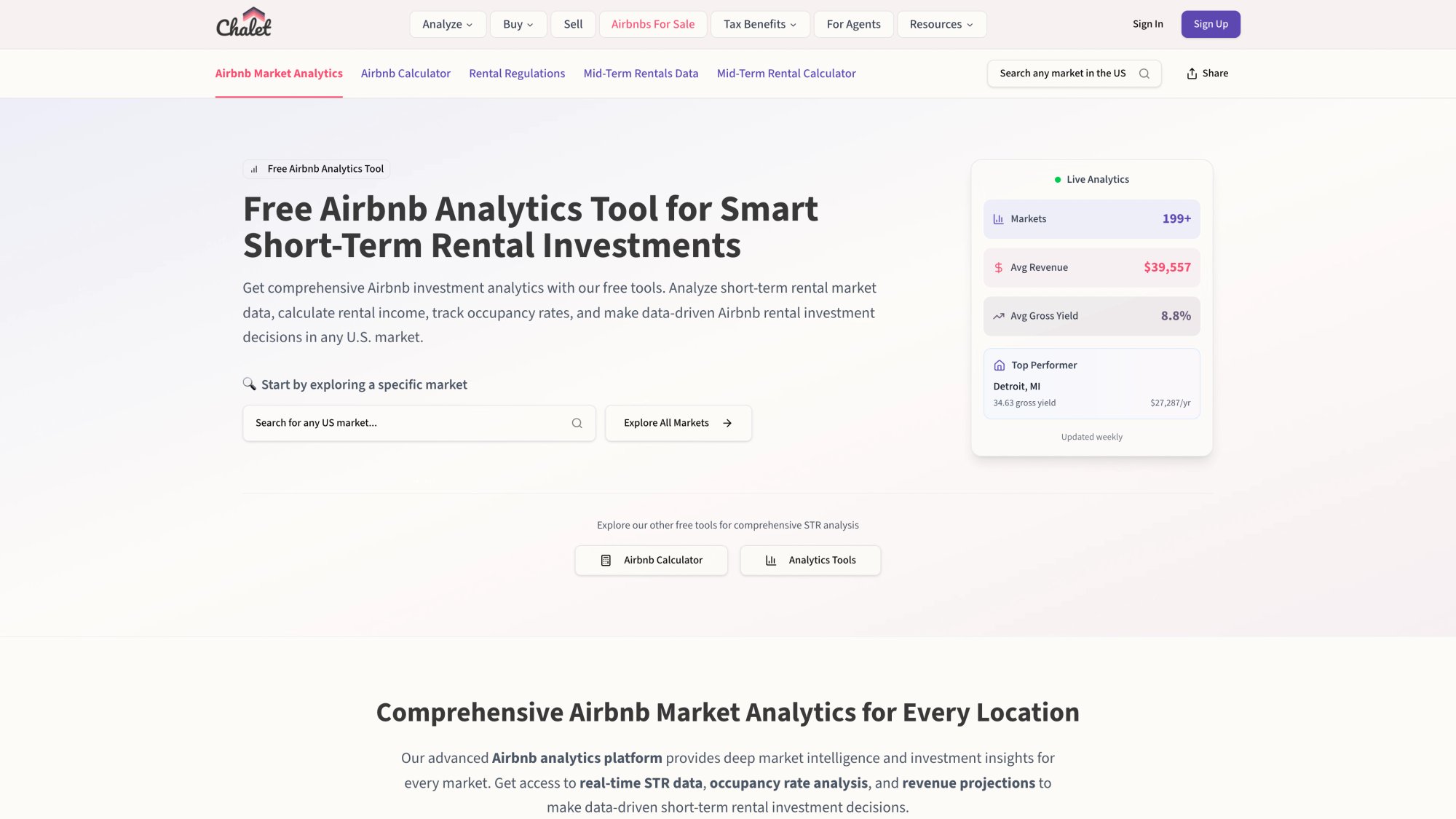

How Chalet Helps First-Time Buyers

Here's where Chalet becomes your advantage as a beginner.

We built the platform specifically for first-time STR investors who need education and execution in one place. Instead of juggling 10 different tools and hoping you didn't miss something critical, you get:

→ Free market analytics that show you occupancy rates, average daily rates, and revenue potential across markets (so you can make data-backed decisions instead of guesses).

→ An ROI calculator where you can plug in any address and see if the numbers actually work with conservative assumptions.

→ A vetted vendor network including STR-specialist real estate agents, DSCR lenders, insurance providers, property managers, and furnishing companies (so you're not calling random people from Google).

→ A regulation library that compiles STR rules by market, so you can quickly filter out markets where you can't legally operate.

The goal is simple: help you move from research to execution without the coordination chaos that stops most beginners.

Explore Chalet's free analytics to start evaluating markets, or connect with an STR-specialist agent who understands the compliance and underwriting nuances you'll face.

How to Analyze Airbnb Rental Income Like a Pro

Here's the mindset shift that separates successful investors from those who lose money: A homeowner asks "Can I afford the payment?" An operator asks "Can this asset reliably produce net income after all costs, even when things go wrong?"

3 Metrics That Drive Airbnb Rental Profits

ADR (Average Daily Rate) – What you charge per night

Occupancy – Percentage of nights booked

RevPAR – ADR × Occupancy (revenue per available rental)

Your annual revenue is basically:

Annual gross = ADR × Occupancy × 365

This isn't "Airbnb math." This is just unit economics.

Variable Costs vs Fixed Costs for STR Properties

Variable costs (scale with bookings):

• Cleaning labor (even if guests pay a cleaning fee, you still pay cleaners)

• Consumables (toiletries, coffee, paper goods)

• Platform fees

• Property management (if % of revenue)

Fixed costs (hit every month):

• Mortgage payment (PITI: principal, interest, taxes, insurance)

• HOA (if any)

• Utilities and internet

• Baseline maintenance

And the most ignored line item: Reserves

Set aside money monthly for repairs, replacements (linens, appliances, furniture wear), and vacancy buffers.

Airbnb Cash Flow Calculator Template

Copy this into a spreadsheet:

REVENUE

• ADR

• Occupancy %

• Nights booked

• Gross annual rent

VARIABLE EXPENSES

• Management fee (% of revenue)

• Platform fees (3-5%)

• Consumables per stay

• Monthly maintenance baseline

FIXED EXPENSES

• PITI (principal + interest + taxes + insurance)

• HOA

• Utilities

• Internet

• Landscaping/snow removal

RESERVES

• Repairs reserve (monthly)

• CapEx reserve (for big replacements)

• Vacancy buffer (2-3 months expenses)

OUTPUTS

• Net operating income (NOI)

• Cash flow after debt

• Debt service coverage ratio (DSCR)

• Cash-on-cash return

Run this quickly on any address using Chalet's calculator to see if the deal pencils out.

Financing Options for First-Time STR Investors

Most beginners get stuck here (not because they can't qualify, but because they don't understand what lenders are underwriting).

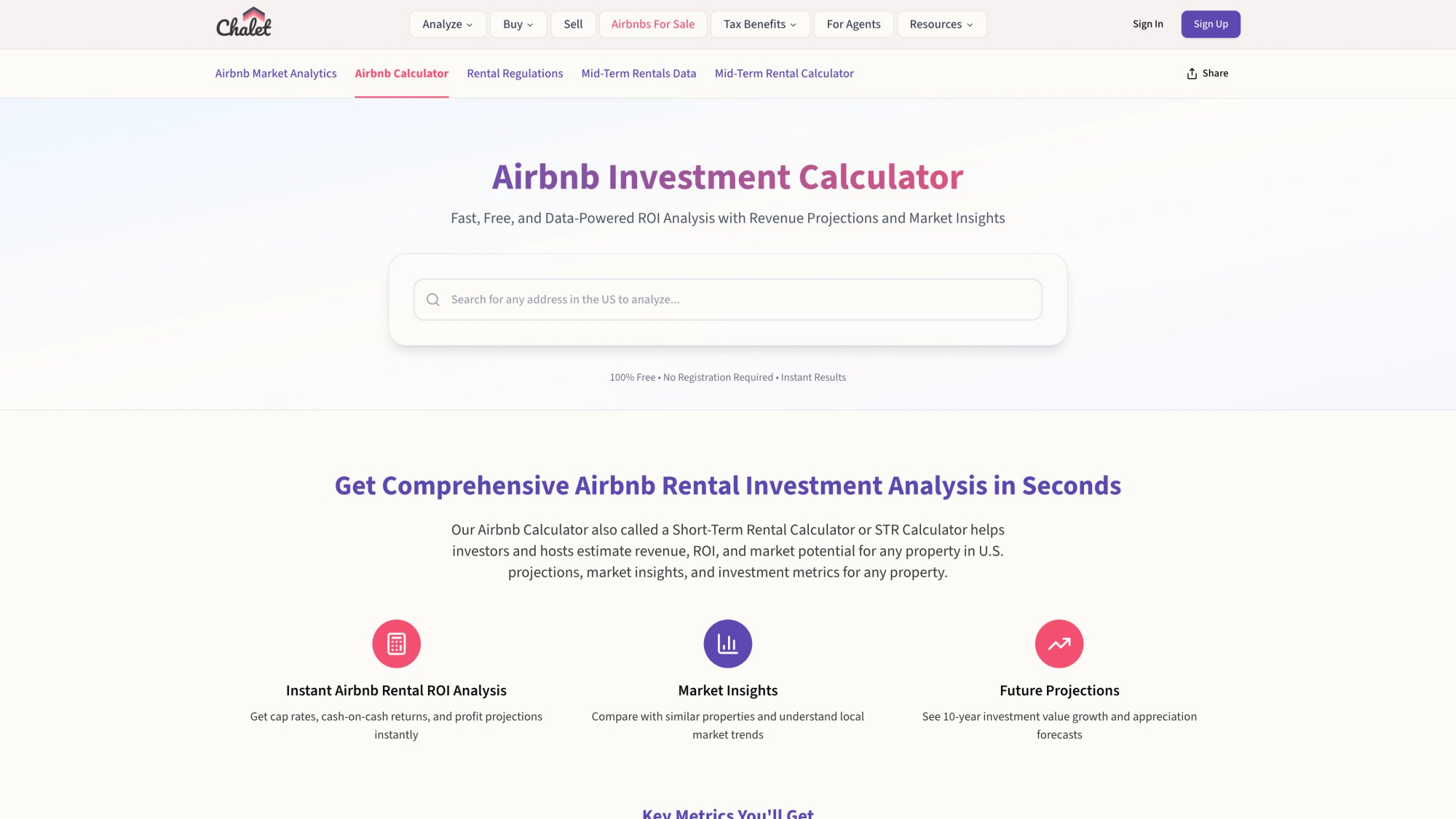

| Loan Type | Down Payment | Best For | Key Advantages | Watch Out For |

|---|---|---|---|---|

| Conventional Investment | 20-25% typically | Strong W-2 income, good credit | Lower rates if you qualify | Based on long-term comps, not STR income |

| DSCR Loans | 15-25% typical | Property with strong cash flow | Underwrites the property, not you | Higher rates, need meaningful reserves |

| Owner-Occupied (FHA/VA) | 3.5% (FHA) or 0% (VA) | House-hackers living on-site | Lowest down payment | Must occupy at least 1 year, residency rules |

Conventional Investment Property Mortgages for STRs

Often requires larger down payments (typically 20-25%) than owner-occupied loans. Many lenders underwrite based on long-term rental comps, not projected short-term rental income.

If you have strong income documentation and enough down payment, conventional loans can still work. Connect with STR-experienced lenders who understand short-term rental underwriting.

What Are DSCR Loans and How Do They Work?

A DSCR loan underwrites based on the property's ability to cover debt rather than your personal income.

Core concept:

DSCR = Net Operating Income ÷ Debt Service

A DSCR of 1.0 means the property produces exactly enough to cover the debt payment. Griffin Funding explains that ratios above 1.0 indicate positive cash flow, while below 1.0 indicates negative cash flow.

Down payment expectations vary, but common patterns across lenders show:

• Park Place Finance describes DSCR down payments often in the 15-20% range, with practical limits around 80% LTV (20% down)

• HouseMax Funding states DSCR loans typically require 20-25% down

• Kiavi notes max LTVs can range 70-80% depending on DSCR, credit, and property type

Beginner takeaway: DSCR can be a clean path if you want to move fast without personal income paperwork being the bottleneck. Expect meaningful down payment, reserves, and slightly higher rates.

Explore DSCR lenders in Chalet's network who specialize in short-term rental financing.

House-Hacking With FHA and VA Loans

If you're open to living in part of the property, consider a duplex or multi-unit.

FHA loans (3.5% down) or VA loans (0% down for veterans) allow you to buy a 2-4 unit property, live in one unit, and rent the others short-term. You must reside there at least a year (FHA) or intend it as primary residence (VA).

This drastically lowers upfront cash needed. But you'll be a live-in landlord, and these loans require you to occupy the home.

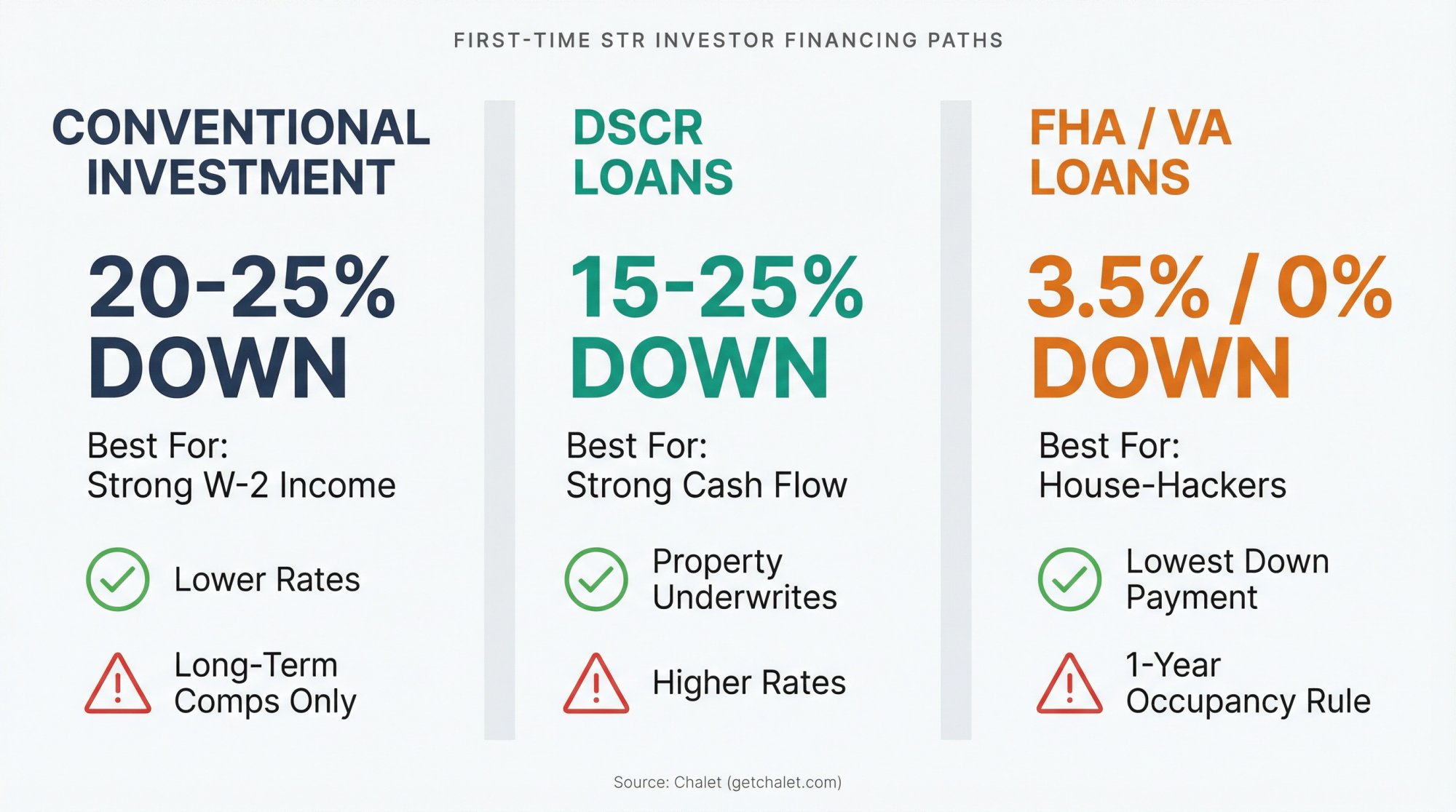

How to Verify STR Legality at the Address Level

"Market allows STRs" isn't enough. You must confirm:

• City or county zoning rules

• Permit or registration requirements

• HOA or condo restrictions

• Occupancy limits and parking rules

• Tax collection and remittance requirements

Real Examples: NYC Local Law 18 and SF Fee Schedules

New York City requires hosts to comply with its registration framework for short-term rentals (Local Law 18), administered through the Office of Special Enforcement.

San Francisco publishes specific short-term rental fee schedules and renewal requirements (application fees can be surprisingly high in some cities).

These aren't fun facts. They're reminders that compliance is address-specific, not market-specific.

Call Script: Questions to Ask Your City Planning Office

Call the city or county office handling STRs (often planning, zoning, or dedicated STR office). Ask:

① Are short-term rentals legal at this specific address?

② Is a permit required? Is there a cap, lottery, or waiting list?

③ What's the fee, renewal schedule, and approval timeline?

④ Are there minimum-stay rules?

⑤ Are there occupancy, parking, or trash restrictions?

⑥ Are there primary-residence requirements?

⑦ Is the permit transferable if I buy an existing STR?

⑧ Where is the ordinance published?

Write down the name of who you spoke with and the date. You're creating a paper trail for your own risk management.

Start with Chalet's regulation library, then verify with the city directly.

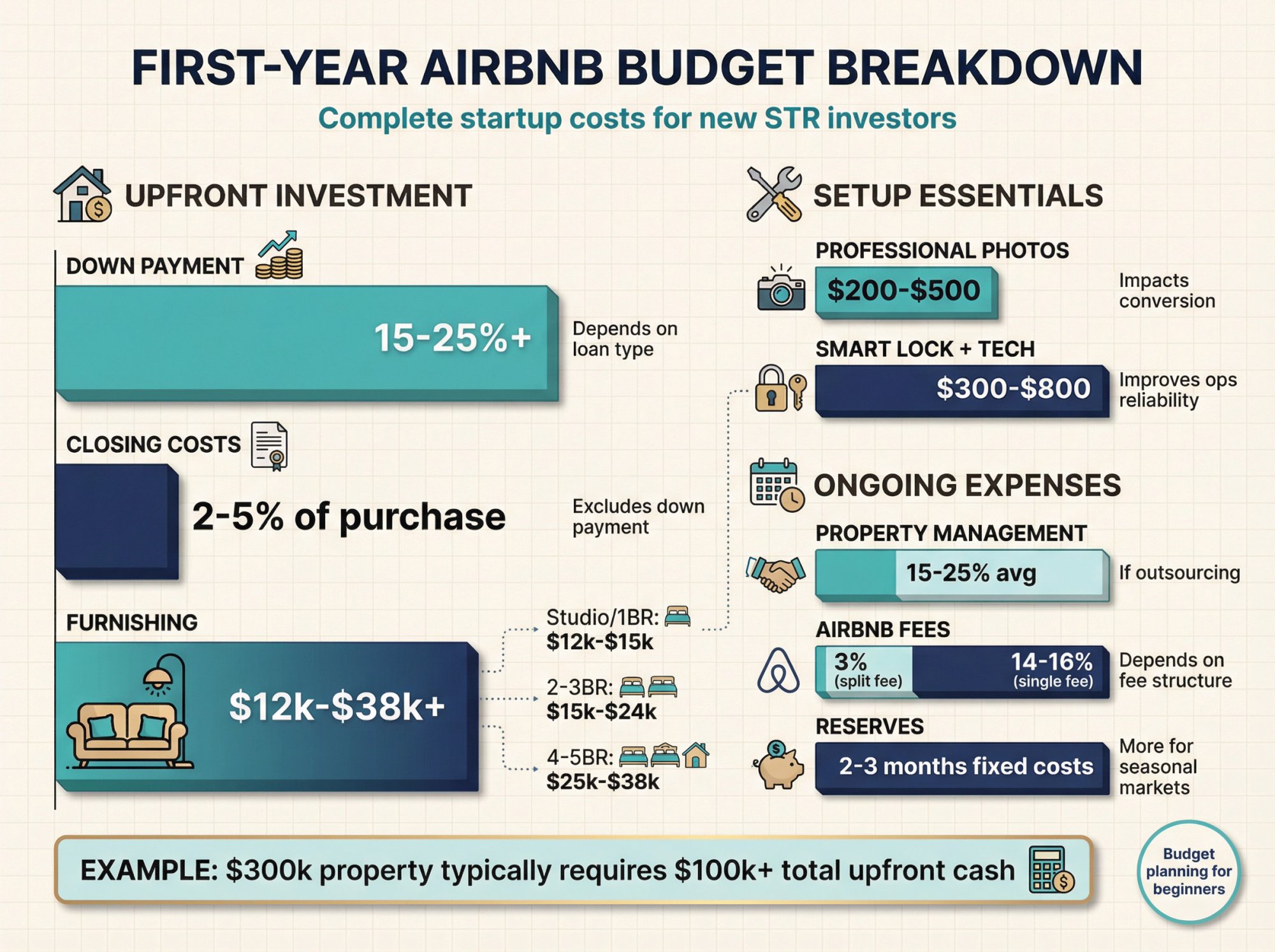

First-Year Budget: Actual Costs to Start an Airbnb

Beginners usually underestimate two things: cash needed to get live, and cash needed to survive the first slow season.

Down Payment and Closing Costs for STR Purchases

For investment purchases, you'll typically need at least 15% down. LendingTree notes you'll need at least 15% down in many cases to purchase a rental property.

Closing costs are the other check you can't ignore. The CFPB's homebuying guide says closing costs typically range 2-5% of the home purchase price, excluding the down payment.

How Much Does Airbnb Furnishing Cost in 2026?

Furnishing budgets vary by size and design goals, but recent benchmarks provide reality checks:

Bee Setups' breakdown suggests rough ranges like $12,000-$15,000+ for a studio or 1-bedroom, $15,000-$24,000+ for 2-3 bedrooms, and $25,000-$38,000+ for 4-5 bedrooms.

Their 2025 benchmark report (dataset 2022 to Nov 2025) reports an average furnishing cost around $18,400 (median $15,900) in 2025.

You don't need perfect numbers. You need conservative numbers.

Browse furnishing vendors in Chalet's directory for professional setup services.

Platform Fees and Property Management Costs

Two frequently missed line items:

Platform fees

Airbnb's fee structure varies. Under the "split fee," Airbnb typically charges hosts around 3% and guests 14.1-16.5%. Under "single fee," the entire fee comes from the host payout and is typically 14-16% (changing to 15.5% for many hosts starting late 2025).

Property management

Most Airbnb management companies charge roughly 15-25% of rental income on average. Find vetted property managers through Chalet who understand short-term rental operations.

Complete First-Year Budget Breakdown

| Category | Typical Range | Notes |

|---|---|---|

| Down payment | 15-25%+ | Depends on loan type |

| Closing costs | 2-5% of purchase | Excludes down payment |

| Furnishing | $12k-$38k+ | Strongly size-dependent |

| Professional photos | $200-$500 | Don't skip (impacts conversion) |

| Smart lock + tech | $300-$800 | Improves ops reliability |

| Management | 15-25% avg | If outsourcing |

| Airbnb fees | 3% or 14-16% | Depends on fee structure |

| Reserves | 2-3 months fixed costs | More for seasonal markets |

Building Your STR Team Before You Buy

"No experience" becomes a non-issue when you hire experience. You want the right experience.

Who You Need on Your First Airbnb Rental Team

• STR-savvy real estate agent – Understands compliance and STR-specific property features

• Lender who understands your strategy – DSCR or conventional

• Insurance provider – Will actually cover STR use (many standard policies won't)

• Cleaner – Or cleaning company with STR experience

• Handyman or maintenance vendor – For repairs that can't wait

• Property manager – If not self-managing

Connect with an Airbnb-friendly agent through Chalet or set up your operations with vetted vendors.

7 Questions to Ask Before Hiring Property Managers

Before you sign anything:

① What's your all-in fee and what's excluded?

② Do you coordinate cleaning and restocking?

③ Who handles guest messaging and response times?

④ Do you use dynamic pricing or manual pricing?

⑤ What's your onboarding timeline to go live?

⑥ How do you handle maintenance approvals and markups?

⑦ What's your contract length and cancellation policy?

A manager isn't just a cost. They're your operating system.

Find experienced STR property managers in Chalet's vetted network.

How to Verify Airbnb Revenue When Buying Existing STRs

If you're buying a property advertised as "Airbnb-ready," you need proof.

Ask for:

• 12 months of platform payout statements

• Channel manager reports (if they use one)

• Bank statements showing deposits (redact sensitive info)

• Utility bills (to sanity-check operating costs)

• Copy of the STR permit and renewal status

• Confirmation of transferability (if applicable)

Then run reality checks:

• If revenue is high, does it match seasonality for that market?

• Is occupancy plausible without suspiciously low cleaning gaps?

• Are there one-off events inflating revenue?

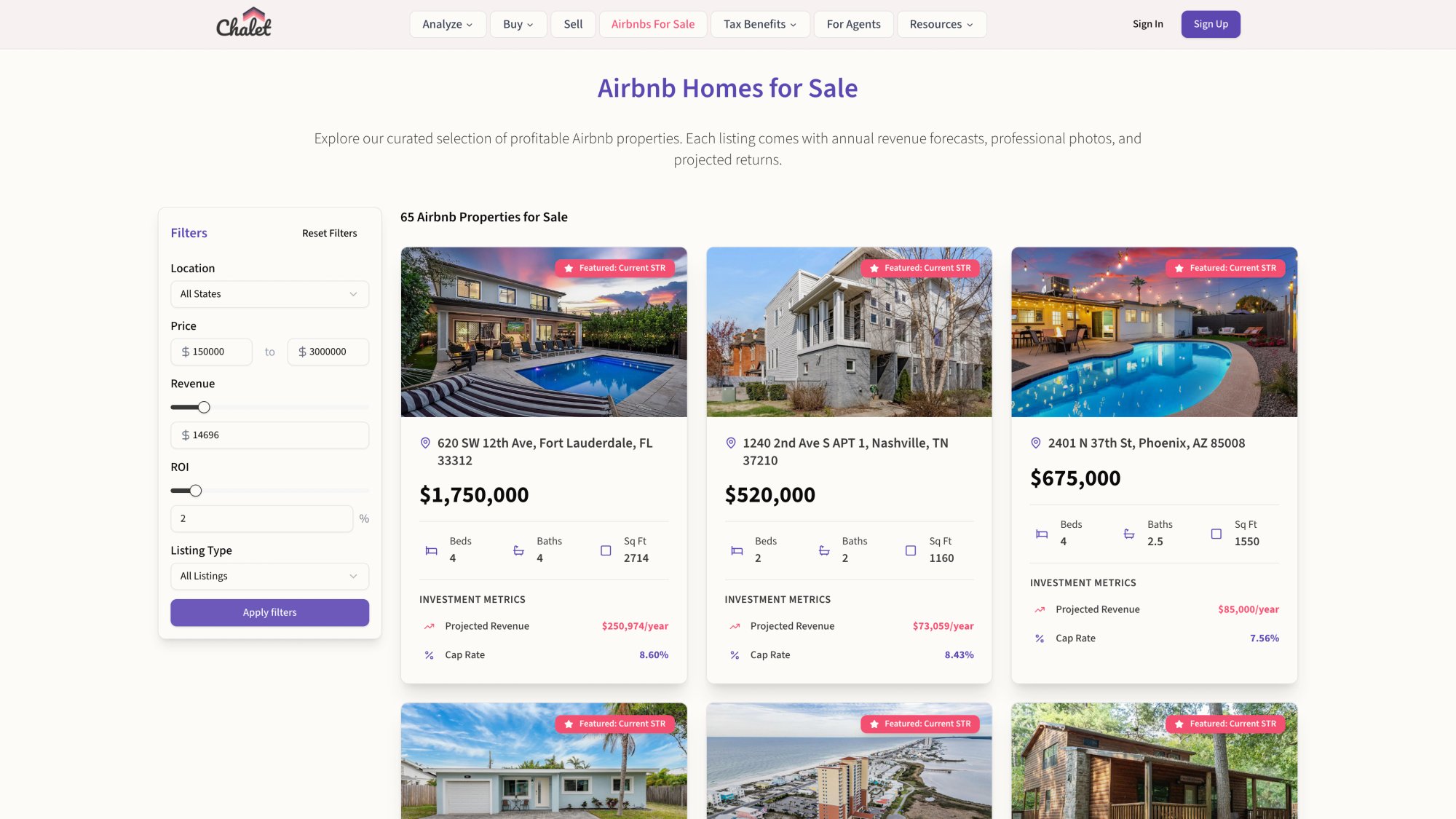

Run your own underwriting on the address using Chalet's calculator or browse vetted listings with projections at Chalet's marketplace.

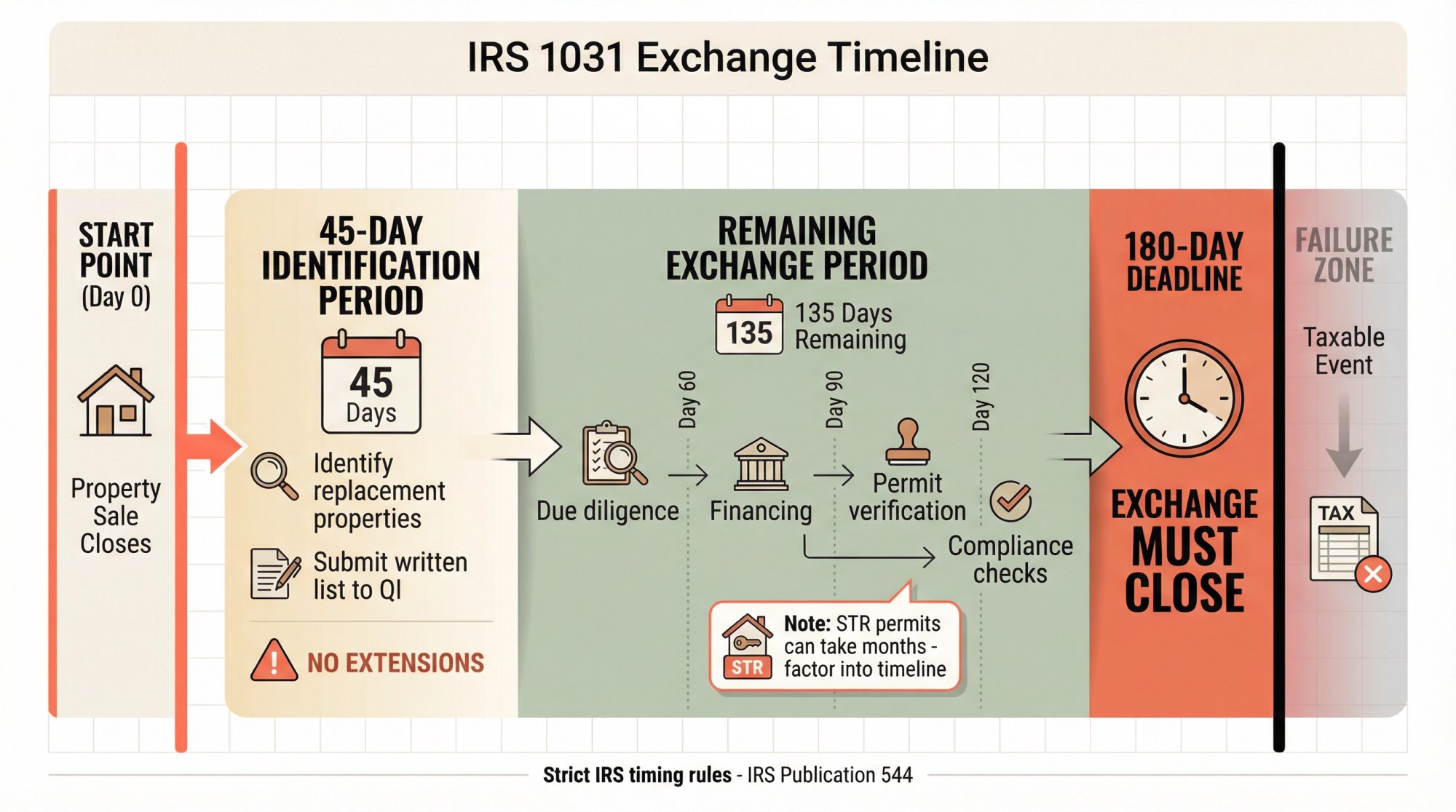

1031 Exchange Buyers: Timeline and Compliance Tips

A lot of 1031 investors aren't new to real estate. They're new to short stays.

Your main risk is timeline plus compliance.

IRS Deadlines You Cannot Miss for 1031 Exchanges

The IRS requires strict timing rules for like-kind exchanges, including a 45-day identification period and a 180-day exchange period. (IRS Publication 544, updated Dec 8, 2025)

Practical consequence:

You don't have time for markets where permits take months or where legality is murky.

If you need a dedicated timeline guide, Chalet has one. You can also explore 1031-friendly markets and connect with exchange-experienced agents who understand the tight timeline requirements.

Airbnb Tax Benefits: Bonus Depreciation in 2026

You don't need to be a tax expert to buy your first Airbnb rental. But you should understand the big levers so you can talk to a CPA intelligently.

100% Bonus Depreciation Returns Under New Law

The IRS published guidance on the One Big Beautiful Bill Act, describing permanent 100% additional first-year depreciation for qualified property acquired and placed in service on or after January 19, 2025. (Chalet's bonus depreciation guide)

Important nuance:

This generally applies to qualifying components (often identified via cost segregation), not the structural building itself. Tax outcomes depend on your situation and participation rules.

Learn the basics before talking to a CPA at Chalet's tax benefits overview. You can also connect with tax professionals who specialize in STR through Chalet's vendor network.

Common Questions About Buying Your First Airbnb

Can I buy an Airbnb rental with zero hosting experience?

Yes, but only if you replace experience with systems: conservative underwriting, clear compliance verification, a dependable ops team, and reserves.

If you plan to "figure it out later," you're not investing. You're gambling.

What's the biggest mistake first-time Airbnb buyers make?

Skipping the legality gate. The second biggest is underestimating reserves.

Use Chalet's regulation library to verify rules before buying.

Does Airbnb collect and remit local occupancy taxes?

Sometimes. Airbnb's documentation explains that in some jurisdictions Airbnb facilitates collection and remittance of certain occupancy taxes, but hosts may still be responsible for other obligations depending on location.

Treat tax handling as market-specific and confirm locally.

Should I self-manage or hire property management?

If you're local, have time, and want to learn: Self-managing can teach you fast.

If you're remote or busy: A good manager can save you from expensive mistakes. Just price the 15-25% fee into your underwriting.

Connect with experienced property managers through Chalet.

Can I get financing with no traditional income?

Explore these alternatives:

• DSCR loans (property-based underwriting)

• House-hacking with FHA/VA loans (if you'll live there)

• Using a HELOC on your current home for the down payment

Talk to multiple lenders. Chalet's network includes STR-specialist lenders who understand creative financing.

Total budget for my first Airbnb rental in 2026?

Plan for:

• Down payment (15-25%)

• Closing costs (2-5%)

• Furnishing ($12k-$38k depending on size)

• Plus 2-3 months of operating expenses in reserves

A $300,000 property typically requires $100k+ in total upfront cash when you factor in everything.

Use Chalet's calculator to model your specific scenario.

Can I use a second home loan for an STR?

Only if you genuinely intend to use it as a vacation home yourself. Second-home mortgages require personal use and usually prohibit hiring property managers or having rental contracts.

Misrepresenting an investment as a second home is mortgage fraud. Don't go there.

Your Next Step

If you want to go from "I'm curious" to "I'm ready," do these in order:

① Analyze markets to find areas with strong demand and clear rules

Explore Chalet's free analytics

② Check local STR regulations before you fall in love with a listing

Use Chalet's regulation library

③ Run ROI and DSCR on a specific address with conservative assumptions

④ Meet an Airbnb-friendly agent who understands STR underwriting and compliance

Connect through Chalet's agent network

⑤ Browse properties with income projections to speed up deal flow

Check Chalet's marketplace

⑥ Set up your operations with vetted tools and vendors

Visit Chalet's vendor directory

Why Chalet Exists

We built Chalet because the short-term rental industry makes first-time buyers piece together information from 15 different sources, hope they didn't miss anything critical, and then cross their fingers.

That's not a system. That's chaos.

Chalet gives you free analytics, vetted pros, and clear execution paths in one place. From research to ROI to real-world action, you get the data and network you need without the coordination headache.

Thousands of investors have used Chalet to find their first property, connect with the right agent, and build their STR business with confidence.

Ready to start? Explore Chalet's platform and take the first step from research to real investment.