If you're selling an investment property and rolling the gains into a new short-term rental (STR) or Airbnb rental, understanding the 1031 exchange timeline isn't optional. It's the difference between deferring capital gains taxes and writing a check to the IRS.

A 1031 exchange (named after IRS Code Section 1031) lets you defer capital gains by reinvesting sale proceeds into like-kind real estate. But there's a catch: you must follow strict timing rules. Miss a deadline by even one day and you lose the tax deferral and face the full tax bill.

This guide breaks down the 45-day identification period and 180-day closing deadline, explains what happens at each stage, and shares practical tips to execute your exchange on time. Whether you're exchanging from a long-term rental into an Airbnb investment or moving between STR properties, you'll know exactly what to do and when.

What Are the Two Critical 1031 Exchange Deadlines?

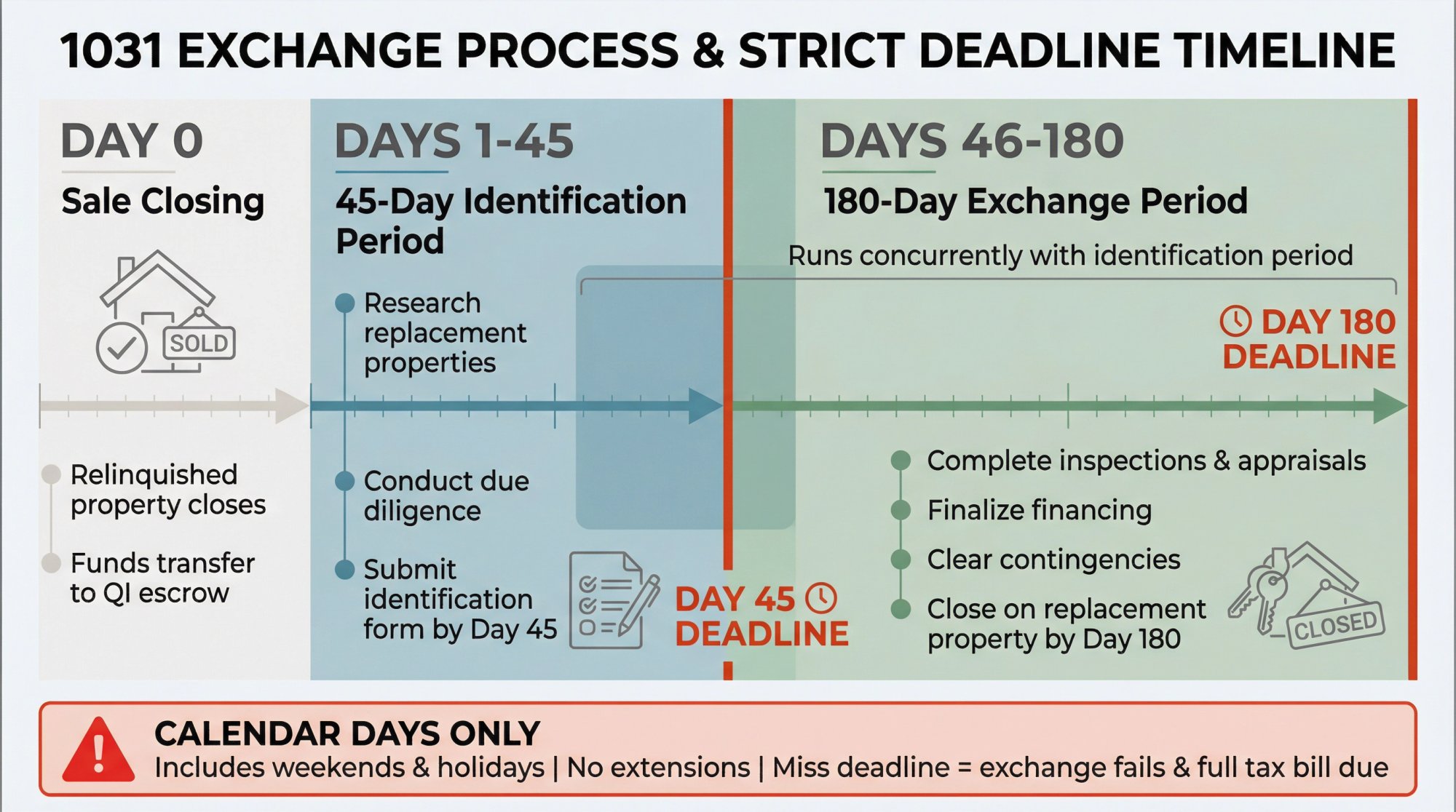

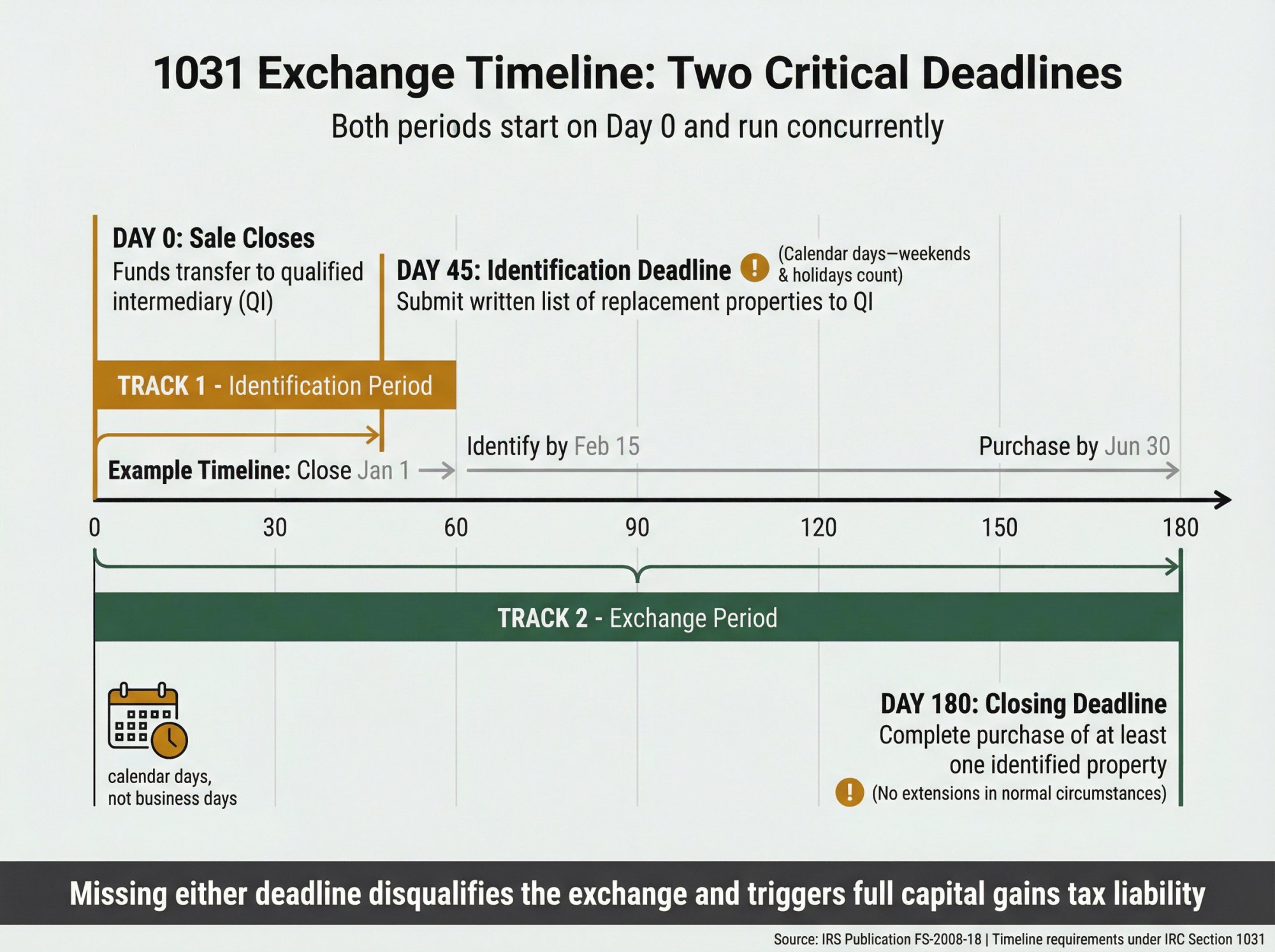

At the core of every 1031 exchange are two non-negotiable IRS deadlines:

45-Day Property Identification Rule: What You Must Do

Within 45 calendar days of selling your property, you must formally identify replacement properties in writing. This identification goes to your qualified intermediary (QI) or another authorized party. Most investors list up to three potential properties under the "3-property rule".

180-Day Exchange Closing Deadline: When You Must Buy

You have 180 days from your sale closing to complete the purchase of at least one identified property. The clock starts the day your relinquished property closes (Day 0), and the identification and purchase periods run concurrently.

These deadlines include weekends and holidays. They're calendar days, not business days. If you close on January 1, your identification is due February 15, and your purchase must close by June 30.

What happens if you miss a deadline?

The exchange fails completely. Your sale becomes fully taxable as if no exchange occurred. There are virtually no extensions under normal circumstances. (The IRS has granted relief during federally declared disasters, but those are rare and case-by-case.)

Time is everything in a 1031 exchange, which is why careful planning matters more than almost anything else.

How to Prepare for a 1031 Exchange Before Day 1

A successful 1031 exchange starts before the clock begins. Once your sale closes, the countdown is immediate. Here's how to prepare:

How to Choose a Qualified Intermediary for Your 1031

By law, you can't touch the sale proceeds. A QI must hold the funds in escrow during the exchange. If you or your agent receive the cash, the exchange is disqualified and you'll owe taxes.

Identify and arrange a reputable QI before closing your sale. The QI handles paperwork and money transfers to ensure compliance. Using a QI isn't optional.

How to Find Replacement Properties Before You Sell

Don't wait until after selling to start looking. Research markets and properties early so you have targets lined up. If you're buying an Airbnb rental, you need to know which areas allow STRs (local regulations matter) and which property types fit your strategy.

Chalet's free market analytics can help you identify high-yield STR markets and screen investment properties before Day 1 even hits. You can start informally touring or underwriting candidates while you're still selling the original property. Being ready to move quickly makes the difference between hitting deadlines comfortably and scrambling.

Who You Need on Your 1031 Exchange Team

You need professionals who understand that speed and precision matter. This includes:

→ Real estate attorney or CPA familiar with 1031 rules

→ 1031-experienced real estate agent who knows the 45/180-day deadlines

→ Lender who can work within the exchange timeframe (DSCR loans are common for rental investors and can expedite closing)

Having an Airbnb-friendly agent who knows the timeline constraints is invaluable. They can help you find suitable replacement properties fast and navigate local STR regulations. Chalet connects you with vetted agents specializing in 1031 exchanges and STR investments.

How to Get Pre-Approved for 1031 Exchange Financing

If you need a mortgage for the replacement, talk to your lender ahead of time. Make sure they understand you must close by Day 180. Consider lenders experienced with investment properties or DSCR loans for short-term rentals, as they can often expedite closing.

Being pre-approved (or even underwriting early) prevents financing delays from jeopardizing your timeline. Once Day 1 hits, you want to be identifying properties confidently, not scrambling to line up basic infrastructure.

What Happens on Day 0: Closing Your Relinquished Property

Day 0 is when you close the sale of your current investment property (the "relinquished property" in 1031 terminology). This event kicks off the timeline.

Day 0 Closing Process: How Funds Transfer Works

Closing and funds transfer

You finalize the sale and transfer title. Instead of proceeds going to your account, funds must transfer directly to your QI's escrow at closing. This ensures you don't have constructive receipt of the money (which would invalidate the exchange).

Clock starts ticking

Most practitioners consider the next day "Day 1" for counting purposes. If your sale closed June 1, then June 2 is Day 1 of your 45-day window. Always count calendar days inclusive of weekends, starting the day after closing.

Deadline documentation

Your QI should provide you with your exact deadline dates. If you closed June 1, your Day 45 deadline falls on July 16, and Day 180 lands on November 28. Mark these on your calendar immediately.

At this point, the exchange period is officially underway. You have 45 days from Day 1 to identify replacements and 180 days to close.

Days 1-45: How to Identify Replacement Properties

The first 45 days are the most intense part of a 1031 exchange. By the end of Day 45, you must formally identify in writing the property or properties you intend to buy.

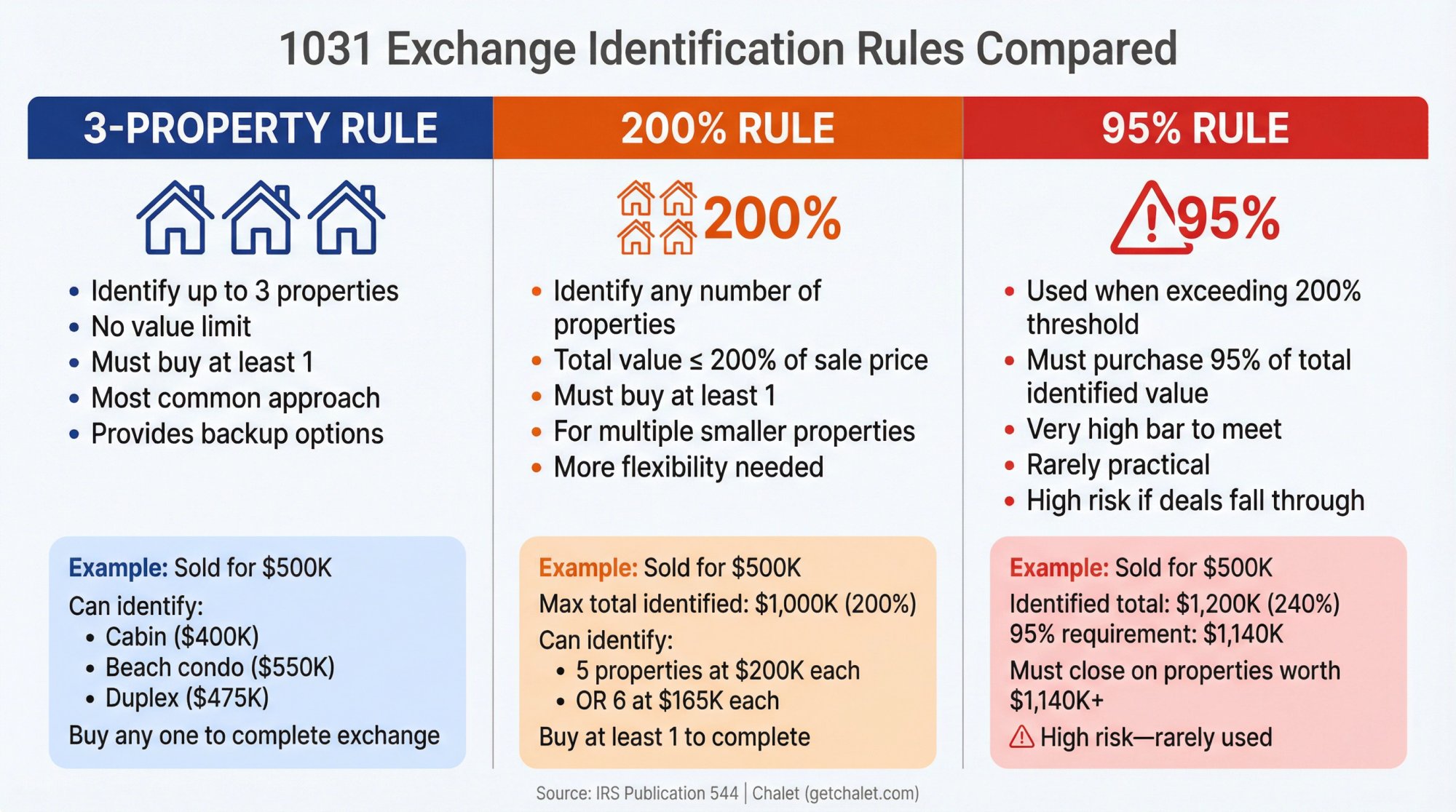

What Is the 3-Property Rule for 1031 Exchanges?

Most investors list one to three candidate properties on their identification form. The IRS's "3-property rule" lets you name three potential replacements regardless of value.

For example, if you sold a house for $500,000, you might identify three possible replacements: an Airbnb-worthy cabin, a beach condo, and a duplex. You're not obligated to buy all three. The rule just caps the normal list at three.

The smart move? List three strong candidates whenever possible. It gives you backup options if your top choice falls through.

1031 Exchange 200% Rule vs 95% Rule: When to Use Each

What if you need to identify more than three properties? The IRS provides alternatives:

| Rule | How It Works | When to Use |

|---|---|---|

| 200% Rule | Identify any number of properties as long as total value doesn't exceed 200% of your sale price | Multiple smaller properties or more flexibility needed |

| 95% Rule | If total identified value exceeds 200%, you must purchase at least 95% of total identified value | Rarely used; very high bar to qualify |

For instance, if you sold for $500,000, you could list five or six potential replacements provided their combined value is $1,000,000 or less (200% rule). But if you exceed that, you need to close on 95% of everything you listed (which is rarely practical).

Most exchangers stick to three or fewer identified properties or stay within the 200% limit.

How to Submit Your Day 45 Identification Form

The identification must be submitted in writing by midnight of Day 45. No exceptions. You'll fill out a form provided by your QI. It should clearly describe each property (street address or legal description) so there's no ambiguity.

You must sign and deliver the identification letter to your QI by the deadline.

Pro tip: Don't wait until Day 45 if you can help it. Once you're confident, get the form in. But double-check for accuracy. If the address or description is wrong, that property might not count, which can invalidate your exchange.

Can You Change Properties After Day 45?

The list you submit on Day 45 is locked in. You generally can't identify new properties or swap them out after that. If an identified property becomes unavailable on Day 50 and you have no backups, your exchange could fail.

If you fail to acquire at least one property from your 45-day list by Day 180, you'll owe capital gains tax. This is why multiple candidates matter.

Example: Sarah sells her rental March 1. By April 15 (Day 45), she identifies three replacements: Property A (top choice), Property B (backup), and Property C (backup). On April 20, Property A's inspection reveals issues. She pivots to Property B. Because B was on the original list, her exchange can succeed. If she'd only listed A, she'd have no valid replacement after Day 45.

When Is the Day 45 Deadline Exactly?

Day 45 is not a postmark date; it's an absolute receipt deadline. The IRS requires identification by the 45th day even if it falls on a weekend or holiday. Mark the due date and aim to be ready a day or two early.

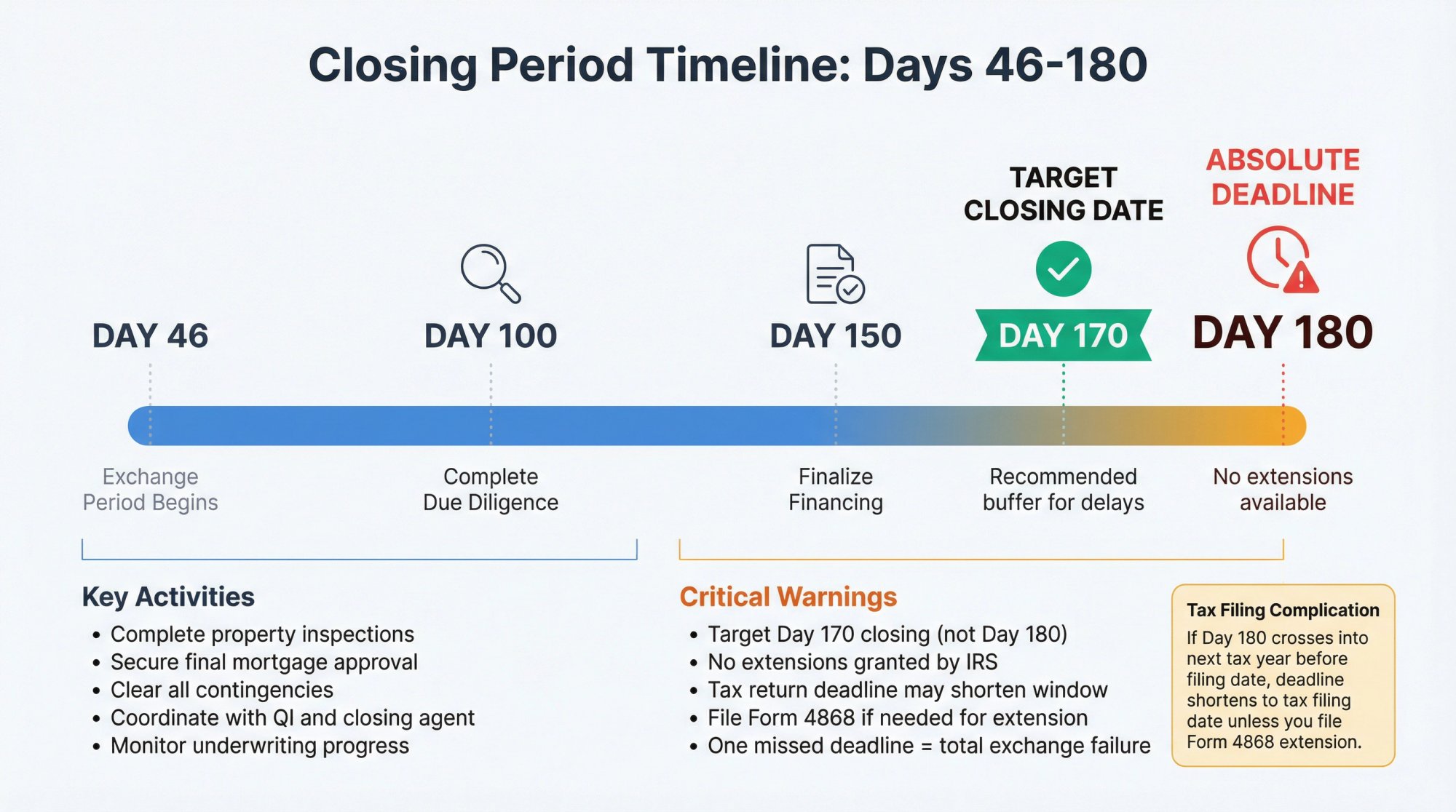

Days 46-180: How to Close Your Replacement Property

Once identification is done, you move into the Exchange Period: Day 46 up to Day 180. This is the window to close on your new property. By the end of Day 180, the exchange must be completed.

How to Complete Due Diligence Within the 180-Day Window

If you went under contract during the first 45 days, now's the time to finish inspections, secure final mortgage approval, and clear contingencies. Work closely with your lender to ensure underwriting stays on schedule. Remind them of your hard deadline.

If issues arise (low appraisal, title problems), you still have time to adjust or move to a backup property before Day 180.

Why You Should Never Wait Until Day 180 to Close

While you legally have until the end of Day 180, don't cut it that close unless necessary. Unforeseen delays (permit issues, lender holdups, escrow complications) could push closing past the deadline, killing the exchange.

A good rule: target closing by Day 170 or earlier. This gives a cushion for last-minute hiccups. If the clock strikes midnight on Day 180 and you haven't closed, there are no do-overs.

How to Buy Multiple Replacement Properties in a 1031

Some investors split proceeds and acquire multiple properties (sell one for $1M, buy two at $500k each). This is allowed as long as all were properly identified. All purchases must close within the 180-day window. Coordinate with all parties to meet deadlines. Your QI can disburse funds to each closing as needed.

1031 Exchange Tax Return Deadline: How It Affects Your 180 Days

The 180-day period is counted from the sale closing, inclusive of Days 1-45. Here's the tricky part: if your 180th day lands in the next calendar year before you file that year's tax return, the deadline effectively shortens unless you file for an extension.

Example: You sold October 20. 180 days would be around April 17 of the next year. But if your tax return is due April 15, the IRS requires completion by your tax filing due date (unless you extend).

The solution? File Form 4868 for a tax extension, which preserves the full 180 days. Check with your CPA, but be aware tax day can cut the exchange period short if not addressed.

Outside the tax-day issue, no extensions past 180 days are granted in normal situations.

What Happens at Your Final 1031 Exchange Closing

By or before Day 180, you'll close on the replacement. Purchase funds (your exchange proceeds, plus any additional cash or financing) wire from your QI to the seller. Title transfers to you, completing the exchange.

Make sure the vested buyer name matches the seller of the old property (same taxpayer/entity), as required by 1031 rules. Once closed, inform your QI so they can issue final paperwork.

If you successfully close on time, you've completed the 1031 exchange. You've deferred capital gains and carried your cost basis into the new property. Your tax advisor will help you file IRS Form 8824 to report the exchange.

Special 1031 Exchange Types and Timeline Variations

Most 1031 exchanges are "delayed" exchanges (sell first, buy within 180 days). But there are special scenarios:

Reverse 1031 Exchange: How to Buy Before You Sell

In a reverse exchange, you acquire the replacement before selling your current property. Because you can't own both simultaneously in a 1031, a third-party accommodator "parks" title of one property.

The timelines still apply: you have 45 days from purchase to identify which property will be sold, and 180 days to complete that sale. It's the mirror image. But you need financial means to buy the new property without having sold the old one (often requiring all-cash or special financing). The 45/180 clock remains the same.

1031 Construction Exchange: How to Build or Improve

Also called build-to-suit or construction 1031, this is when you use exchange funds to improve the replacement property as part of the exchange. The timeline is still 180 days total, and all exchange funds must be spent on improvements by Day 180.

Any unspent money after 180 days could become taxable boot. The property you receive must be "substantially the same" as what you identified by Day 45, meaning you outline the scope of improvements early.

Construction exchanges require careful coordination with your QI and contractors to hit deadlines. They're useful if you want to buy a fixer-upper and renovate it, but everything must wrap up in the 180-day window.

Simultaneous 1031 Exchange: Same-Day Swap

This is the old-school swap: you sell your relinquished property and buy the replacement on the same day (or deed them in one concurrent closing). 45-day and 180-day limits aren't an issue because the exchange happens instantaneously. But true simultaneous exchanges are rare (both transactions have to line up perfectly). Most people opt for the delayed exchange with a QI for flexibility.

Can You Get a 1031 Exchange Deadline Extension?

The IRS can grant deadline extensions in cases of major disasters or emergencies. During COVID-19 in 2020, exchangers got extra time via IRS Notice 2020-23. Similarly, if there's a federally declared disaster affecting either property's region, the IRS may announce extended deadlines.

These are case-by-case and relatively rare. Unless you hear of an official IRS extension for your area, assume no relief and plan to meet the normal 45/180-day deadlines regardless of external events.

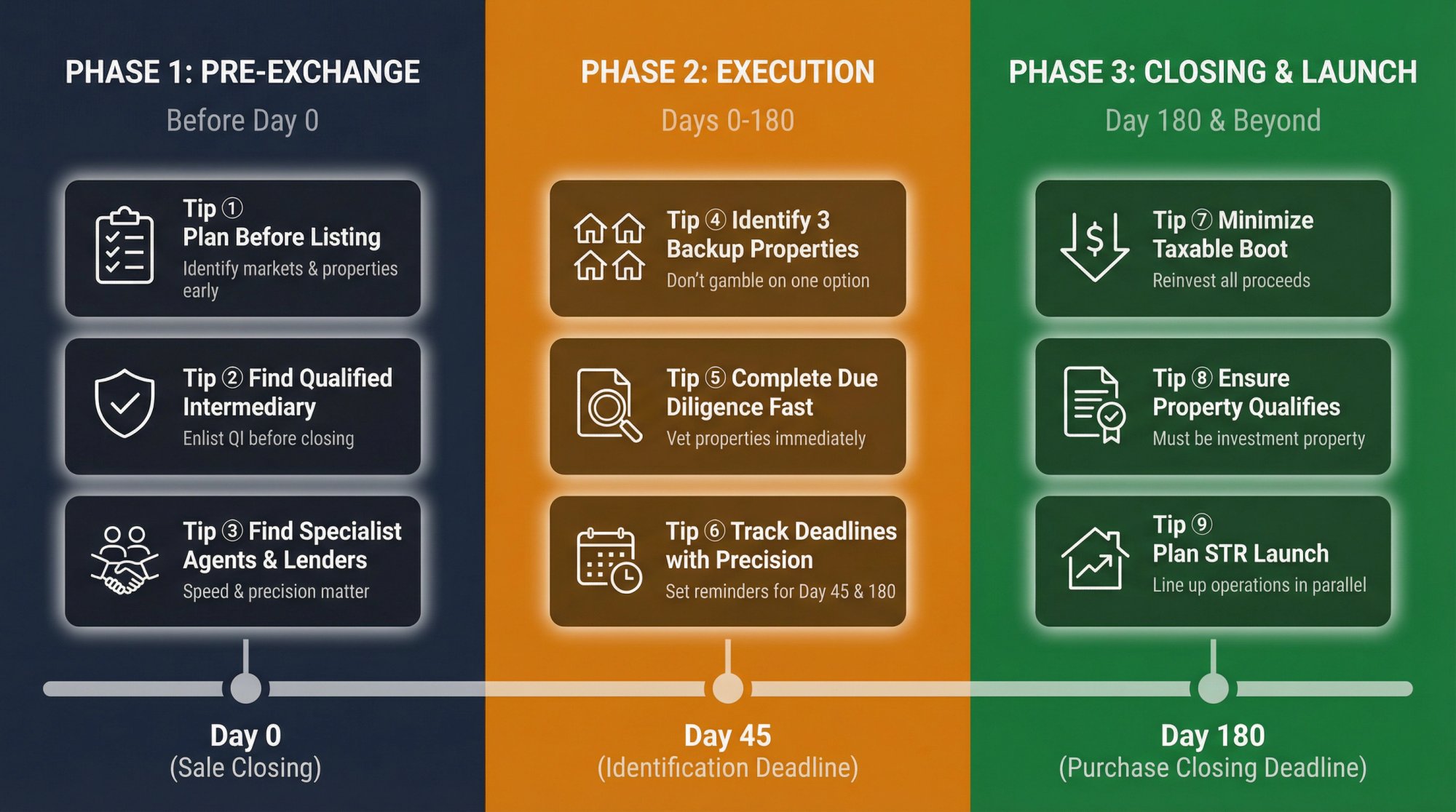

9 Tips to Execute Your 1031 Exchange on Time

Given how strict these deadlines are, what can you do to stay on track? Here are battle-tested strategies:

① How to Plan Your 1031 Exchange Before You List

The moment you consider a 1031 exchange, start planning. Identify target markets and properties. You can make offers "subject to 1031 exchange" before your sale closes. The more legwork done upfront, the smoother your identification will be.

Many savvy investors have a replacement property picked out well before selling the old one.

② How to Find a Qualified Intermediary Before You Sell

Enlist a reputable QI early. They're an absolute requirement for a valid exchange. A good QI guides you through the process, reminds you of deadlines, and ensures paperwork is in order. Consult a tax advisor or attorney beforehand if you're unsure about any rules. Their expertise prevents costly mistakes.

③ How to Find 1031-Specialist Agents and Lenders

Time is tight, so you need professionals who understand speed and precision matter. An experienced real estate agent who knows 1031s can help you find exchange-friendly properties quickly. If your goal is an Airbnb investment, you need someone who knows which areas allow STRs so you don't waste time on properties you can't legally operate.

Chalet can connect you with vetted agents who specialize in 1031 timelines and STR investing. Use lenders who can hit your closing date. Some offer specialized DSCR loans for rental investors that streamline financing.

④ Why You Should Always Identify 3 Backup Properties

Don't gamble your exchange on one property. Even if you're in love with one replacement, always list one or two backups (up to three total) on your Day 45 identification.

Deals can fall apart unexpectedly: financing issues, failed inspections, seller cold feet. If you have backups identified, you still have a shot at completing the exchange with an alternate property. Without them, your exchange could collapse if Plan A fails after the identification period.

⑤ How to Complete Due Diligence Fast in a 1031 Exchange

In a tight timeline, you must vet properties fast. During the 45-day period, schedule inspections immediately on any property under contract. Check condition, run numbers, review HOA or permit requirements (especially for STR usage), and ensure the property meets your criteria.

Use tools like Chalet's Airbnb ROI calculator to project income for potential short-term rentals. You don't want to exchange into a property that doesn't perform because you rushed. By Day 45, you should feel confident your identified options are solid. By Day 180, there should be no surprises that could derail closing.

⑥ How to Track Your 1031 Exchange Deadlines

Keep track of your Day 45 and Day 180 deadlines with absolute precision. Set reminders a week before each. If Day 45 or 180 falls on a weekend, it's still the deadline (you might need to complete things by the preceding business day since offices might be closed).

The only wiggle room is the tax-return issue (and the solution is filing an extension). Don't assume you'll get mercy for personal delays or miscounting days.

⑦ How to Minimize Taxable Boot in a 1031 Exchange

If you suspect you won't reinvest all sale proceeds, know that leftover cash ("boot") will be taxable. Sometimes an exchanger intentionally only uses part of the funds (maybe you couldn't find a property expensive enough). That's okay, but be prepared to pay tax on the portion not reinvested. The exchange still shelters the rest.

Consult your CPA on how to minimize taxable boot through strategic use of financing or improvements. This often factors into planning what replacement property price to target (to fully defer tax, you typically need to buy equal or greater value and use all proceeds).

⑧ How to Ensure Your Replacement Property Qualifies

The replacement must be like-kind real estate. Almost all real property qualifies, including virtually all short-term rentals (they're investment real estate). But it must be an investment property. You can't immediately move into it as your personal home.

If you're buying a vacation rental or Airbnb, that's fine as long as you'll primarily use it as a rental. Plan to hold it as an investment for a period of time (many aim for at least a year or more of rental use to be safe).

Don't identify a property that wouldn't legally or practically qualify for 1031, or you risk the exchange falling apart. When in doubt, verify with your advisor that properties you're eyeing fit the criteria.

⑨ How to Plan Your STR Launch During Your 1031 Exchange

Once you close on the replacement, your exchange is done, but your work as an investor isn't. Especially if this is a new Airbnb rental, you want to start generating income as soon as possible.

While not part of the exchange timeline, it's wise to line up operational needs in parallel. If the property needs furnishing, you can start ordering during the exchange period. If a local permit or license is required for short-term rentals, work on that application right after closing.

Use your 180-day period not just for closing the sale, but for planning the launch. The sooner it's renting, the sooner you're profiting from your tax-deferred upgrade. Chalet's STR directory can help you line up furnishing, property management, cleaning services, and other operational vendors.

How Chalet Helps You Navigate the 1031 Timeline

The 1031 exchange timeline may be strict, but with the right approach you can navigate it successfully and defer capital gains while acquiring a prime new property. The key: 45 days to identify, 180 days to close.

By understanding the rules, preparing early, and moving deliberately through each phase, you'll execute a tax-deferred exchange that builds wealth.

If you're planning a 1031 exchange into an Airbnb or short-term rental, Chalet streamlines every step from research to closing:

→ Free Market Analytics

Pinpoint high-return STR markets before your clock starts. Analyze ADR, occupancy, and revenue trends across multiple cities so you know where to focus during your 45-day identification period.

→ Vetted 1031-Savvy Agents

Connect with real estate agents who specialize in 1031 exchanges and short-term rentals. They know how to find eligible properties fast and navigate local STR regulations within tight deadlines.

→ Property Listings

Browse Airbnb rentals for sale in your target markets. Filter by areas with favorable STR regulations so you don't waste your 45-day window on properties you can't legally operate.

→ ROI Analysis Tools

Use our STR ROI Calculator to evaluate income potential of any property you're considering. Make sure the deal not only defers taxes but also meets your cash flow and return goals.

→ Coordinated Vendor Network

Get connected to exchange-friendly lenders (including DSCR loan specialists), insurance providers, and property managers. All in one place, all familiar with 1031 timelines.

→ Local Regulation Guidance

Check STR regulations for any market you're considering. Don't waste your 45-day identification period on properties you can't legally operate as short-term rentals.

We designed Chalet to streamline the exact journey you're on: selling, buying, and setting up a successful short-term rental investment, seamlessly and on schedule. When you're racing against a 45-day or 180-day deadline, having the right tools and professionals makes the difference between success and a failed exchange.

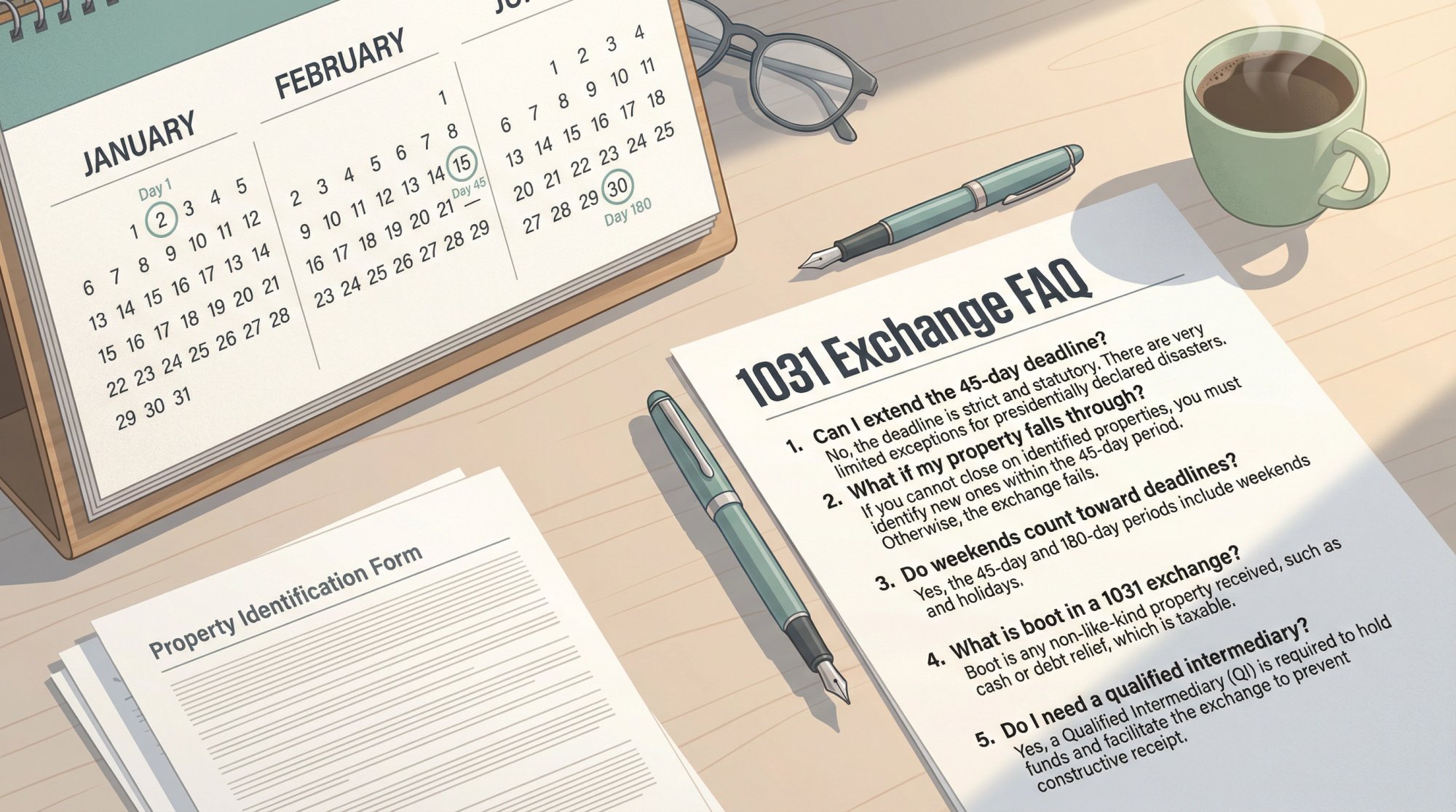

1031 Exchange Timeline FAQs

Can I extend the 45-day or 180-day deadlines?

In normal circumstances, no. The IRS does not grant extensions for personal delays or miscalculations. The only exceptions are rare, such as federally declared disasters where the IRS issues specific relief. Outside of those, the deadlines are absolute. If you need the full 180 days and your exchange crosses into the next tax year, file for a tax extension to preserve the full timeline.

What happens if I identify a property but it falls through after Day 45?

If the property you identified becomes unavailable after the 45-day identification period ends, you can't add a new replacement property. This is why identifying multiple backup properties (up to three under the 3-property rule) is strongly recommended. If you have no other identified properties, your exchange could fail.

Can I change my identified properties after submitting the list?

Generally, no. Once you submit your identification by Day 45, that list is locked in. You can't swap properties or add new ones after the deadline passes. This makes the quality of your initial identification critical.

Do weekends and holidays count toward the 45-day and 180-day deadlines?

Yes. The IRS uses calendar days, not business days. If Day 45 or Day 180 falls on a weekend or holiday, that's still your deadline. You may need to complete submission by the preceding business day to ensure your QI or other party receives it in time.

What if I sell my property late in the year and my 180-day deadline crosses into tax season?

If your 180-day deadline falls in the next calendar year before you file that year's tax return, the IRS requires your exchange to be completed by your tax filing due date (typically April 15) unless you file for an extension. Filing Form 4868 for a tax extension preserves the full 180-day period. Consult your CPA to ensure this is handled correctly.

Can I do a 1031 exchange into multiple replacement properties?

Yes. You can identify and purchase multiple replacement properties as long as they were all properly identified by Day 45 and all purchases close within the 180-day window. Your QI can disburse funds to each separate closing as needed. Just ensure all transactions meet the timeline requirements.

How do I ensure my replacement property qualifies for 1031?

The replacement must be like-kind real estate held for investment or business purposes. Almost all U.S. real property qualifies. For short-term rentals, the property must be used primarily as a rental investment (not your personal residence). Plan to hold and operate it as a rental for at least a year or more to be safe. Verify with your tax advisor that your intended use qualifies.

What is "boot" and how does it affect my exchange?

Boot refers to any value or cash received that's not like-kind property. This includes cash left over from your sale proceeds that you don't reinvest, debt relief, or non-qualifying property. Boot is taxable. To achieve a completely tax-deferred exchange, you should reinvest all proceeds and acquire replacement property of equal or greater value. Consult your CPA about minimizing or eliminating boot.

Do I need a qualified intermediary for a 1031 exchange?

Yes. Using a QI is mandatory. You can't touch the sale proceeds directly. The QI must hold the funds in escrow during the exchange. If you or your agent receive the cash, the exchange is disqualified and you'll owe taxes.

Can I use a 1031 exchange to buy my next personal residence?

No. The replacement property must be held for investment or business purposes. You can't immediately move into it as your primary home. If you're buying a vacation rental or Airbnb, it must be operated primarily as a rental property. Some investors eventually convert a 1031 property to personal use after several years of rental operation, but that requires careful planning and timing. Consult a tax advisor for guidance.