If you're reading this, you probably fall into one of these camps: you're trying to figure out if now's the right time to buy your first Airbnb rental, or you're wondering how much the current rate environment will actually squeeze your cash flow.

Maybe you're staring at a deal and asking yourself whether waiting another six months makes sense, or you've heard people say "just refinance later" and you want to know if that's actually realistic.

What we'll cover: This isn't a finance theory lecture. It's a practical guide to understanding how mortgage rates change the economics of short-term rental investing in 2026, what forecasters are actually saying (not what clickbait headlines promise), and most importantly, how to underwrite deals that survive without counting on a rate miracle.

We'll start with where rates actually are right now, then work through the math that matters (not just monthly payment, but DSCR, occupancy requirements, and exit options), and finish with what you should do based on whether you're a first-timer, a 1031 buyer, or a portfolio builder.

Quick resources (all free from Chalet):

• Run ROI and cash flow on any property: Airbnb Calculator

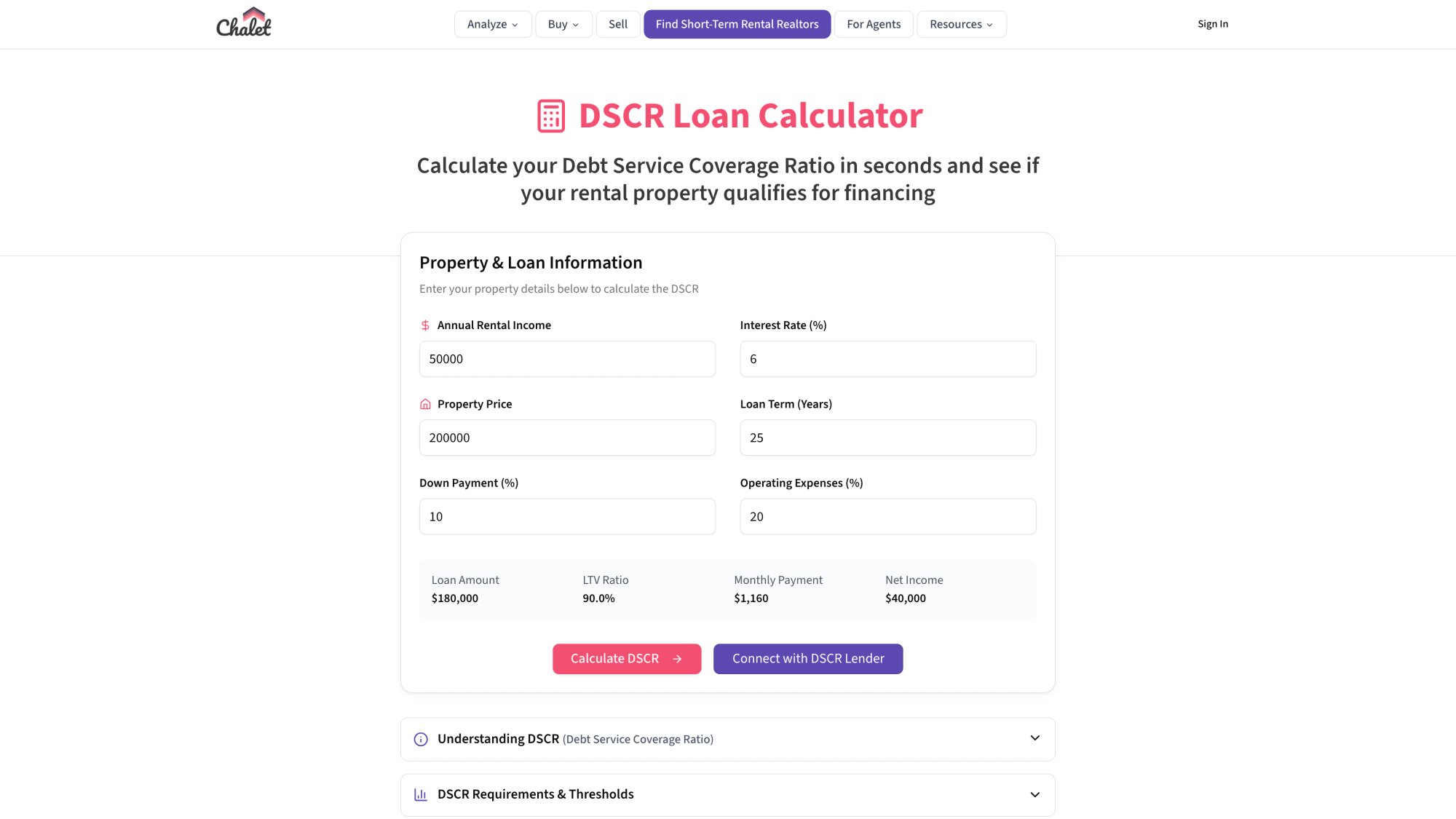

• Check DSCR instantly: DSCR Calculator

• Compare markets and see seasonal patterns: Airbnb Analytics

• Research local regulations before you commit: Rental Regulations

The calculator above is exactly what you'll use throughout this guide to validate deals in a 6% rate environment. It's free, shows realistic expense assumptions, and lets you stress-test every variable that matters.

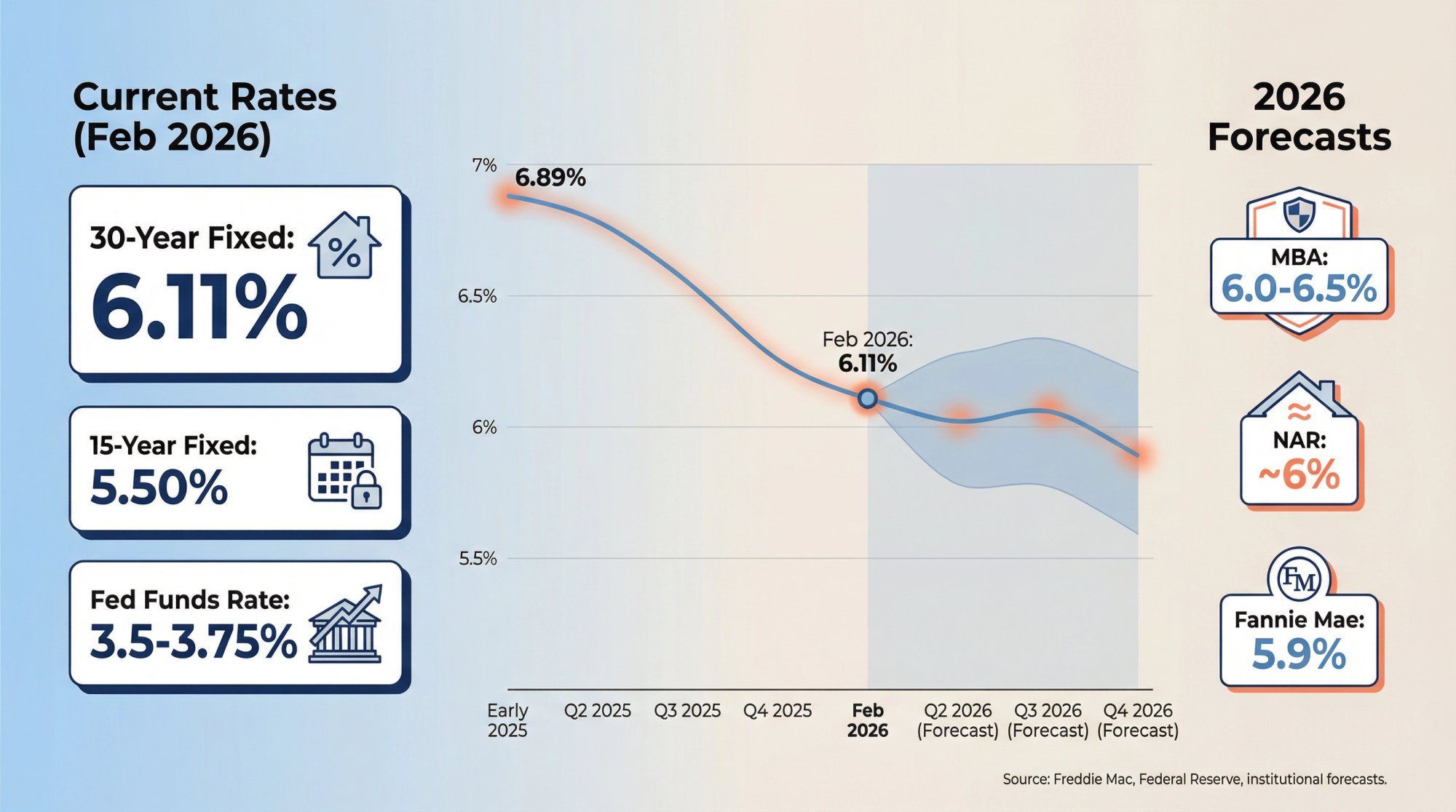

Where Are Mortgage Rates in Early 2026?

The headline number you've probably seen is that rates are hovering around 6%.

The specifics from the most recent data:

• According to Freddie Mac's weekly survey for the week ending February 5, 2026, the 30-year fixed rate sits at 6.11% and the 15-year fixed at 5.50%. A year ago, the 30-year was sitting at 6.89%.

• The Federal Reserve's target range for the federal funds rate is 3.5% to 3.75% as of January 29, 2026.

It's worth understanding what Freddie Mac's survey actually measures. It's based on thousands of loan applications for conventional conforming purchase loans, so it's a decent temperature check for the overall market. But your actual rate can be quite different depending on credit score, down payment size, whether it's an investment property, how many points you pay, and which lender you use.

What Are 2026 Mortgage Rate Forecasts?

Nobody has a crystal ball, but major institutions recently projected:

| Organization | 2026 Rate Forecast | Date Published |

|---|---|---|

| MBA (Mortgage Bankers Association) | 6% to 6.5% | October 19, 2025 |

| NAR (National Association of REALTORS®) | Around 6% | December 10, 2025 |

| Fannie Mae | 5.9% by year-end | September 23, 2025 |

Bottom line: Some forecasts point to rates drifting into the mid-5s by late 2026, but the center of gravity is still around 6%. The smart play is to underwrite deals that work at 6% and treat anything lower as a bonus, not a requirement.

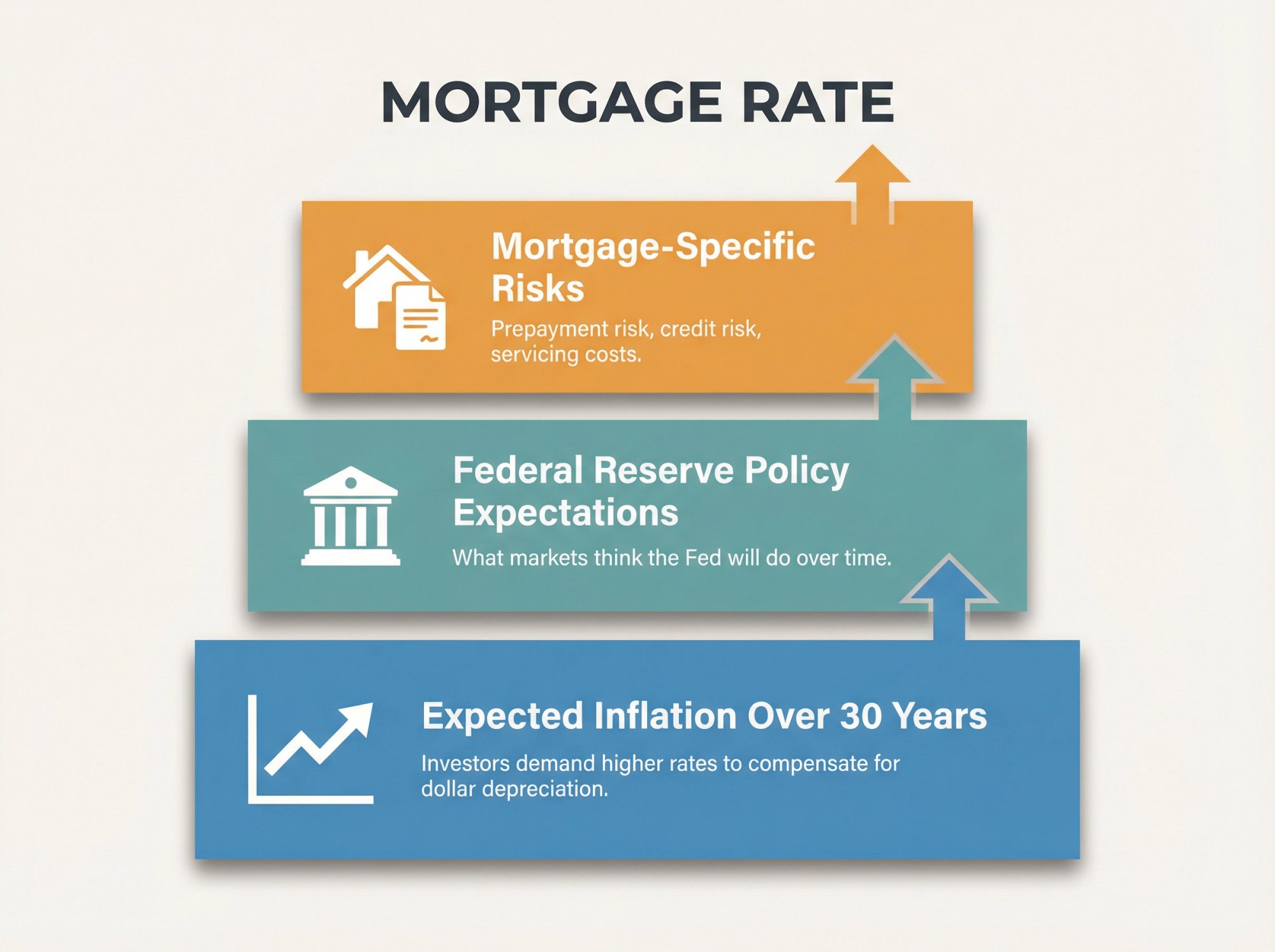

How Do Mortgage Rates Work? (Simple Explanation)

A mortgage rate is the "price of long-term money." Three things drive that price:

① Expected inflation over 30 years

If investors think their dollars will lose purchasing power, they demand higher rates to compensate.

② What the Fed might do

The Fed controls short-term rates directly. Mortgage rates are long-term, but they still reflect what markets think the Fed will do over time. When the Fed signals it won't cut as aggressively as markets hoped, long-term rates can stay sticky even if inflation improves.

③ Mortgage-specific risks

Mortgages have unique quirks. Prepayment risk (people refinancing when rates drop), credit risk, servicing costs, and the complexity of securitization all add a "spread" above what you'd see on safe government bonds like Treasuries.

Why this matters for STR investors specifically: even when the Fed cuts its policy rate, mortgage rates don't automatically drop one-for-one. According to the Fed's December 2025 projections, the median policy rate sits around 3.4% by end of 2026, but that doesn't mean mortgage rates will be 3.4%. The spread exists for a reason.

How Mortgage Rates Affect Airbnb Rental Cash Flow

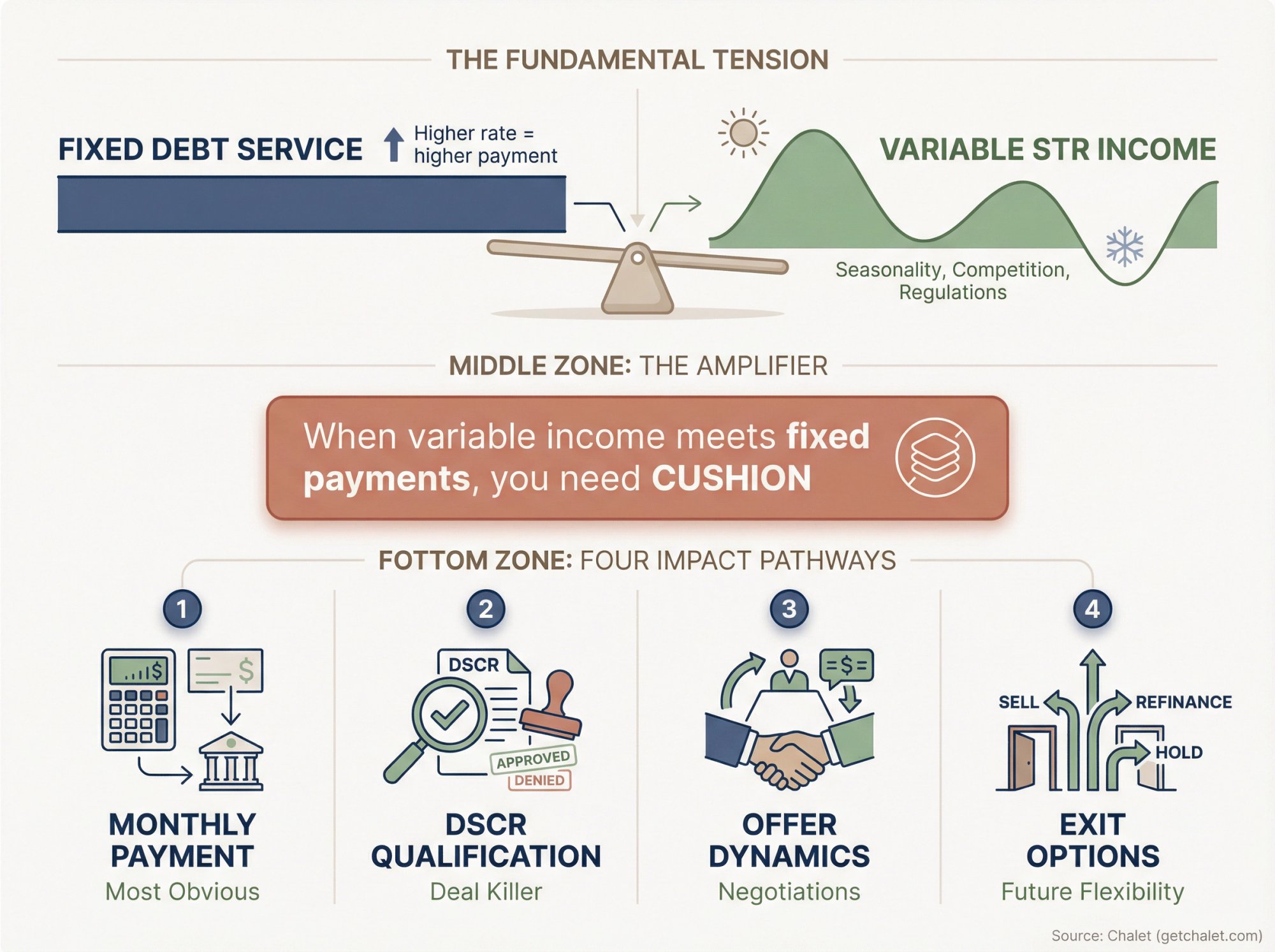

The mental model you need:

Your rate sets your debt service.

Debt service sets your minimum required income.

And short-term rentals have variable income.

That last part is what makes STR investing different from long-term rentals. A traditional rental might give you steadier income but lower upside. A short-term rental can earn significantly more, but it comes with real seasonality, competitive pressure, and regulation risk.

When you combine variable income with a fixed monthly mortgage payment, you need cushion. More cushion than most first-time buyers realize.

Mortgage rates hit your deal in four places:

① Monthly payment (obvious)

② DSCR qualification (sneaky, and often the actual deal-killer)

③ Offer dynamics (seller credits, rate buydowns, price negotiations)

④ Exit options (refi feasibility, size of your buyer pool, valuation)

Now we'll turn that into actual numbers.

3 Numbers That Matter More Than the Mortgage Rate

If you only remember three concepts from this article, make it these:

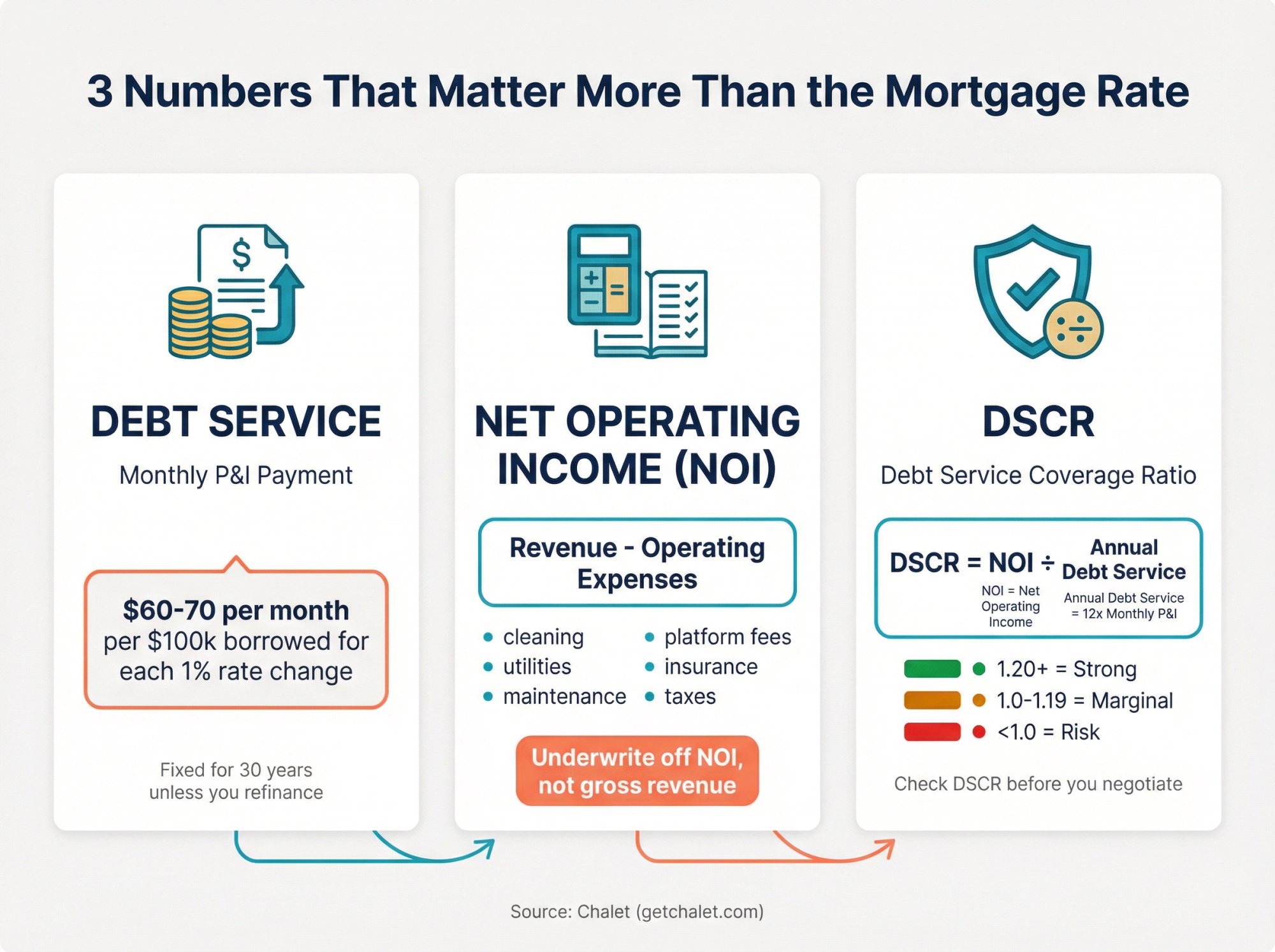

1) What Is Debt Service on an STR Property?

This is your monthly principal and interest payment (and sometimes taxes, insurance, and HOA depending on how you or your lender measures it).

Mortgage math is deterministic. For a fixed-rate amortizing loan, your payment is fully determined by three inputs:

• Loan amount

• Interest rate

• Term length (usually 30 years)

That means a 0.5% rate change is not "small." It's a permanent change to every single month for 30 years unless you refinance.

Rule of thumb: In the 5% to 7% range, a 1.0% rate increase changes your payment by roughly $60 to $70 per month per $100,000 borrowed.

2) What Is Net Operating Income (NOI)?

This is what's left after you pay all operating expenses but before debt service and depreciation.

Operating expenses include:

• Cleaning and turnover

• Utilities and internet

• Maintenance and repairs

• Supplies and replacements

• Platform fees (Airbnb, Vrbo, etc.)

• Insurance and property taxes

• Property management (if applicable)

• Local compliance costs

If you do nothing else with this article, stop underwriting off gross revenue. Underwrite off NOI. Gross revenue is a vanity metric. NOI is reality.

Want to get started fast? Run a property address through Chalet's free Airbnb Calculator and customize the expense assumptions. The defaults are only starting points.

3) What Is DSCR (Debt Service Coverage Ratio)?

DSCR is a lender's way of asking:

"Does the property's income cover the debt payments, with a margin of safety?"

The basic formula:

DSCR = NOI / Annual debt service

In practice, DSCR underwriting varies by lender and product. Many use PITIA (principal, interest, taxes, insurance, and HOA). Some haircut income, some use appraisal rent schedules, and some apply other adjustments. That's why you should check your DSCR before you negotiate seriously on a property.

Use Chalet's free DSCR calculator to run your numbers early.

How Rate Changes Impact STR Investment Deals

A realistic example showing how rate changes ripple through everything else.

Assumptions (illustrative):

• Purchase price: $500,000

• Down payment: 25%

• Loan amount: $375,000

• Term: 30 years

• We're modeling principal and interest only first (you can add taxes and insurance later in your own calculator)

• Target DSCR: 1.20 (common investor comfort level even if a lender allows lower)

Payment and DSCR Sensitivity Calculator

Source: Chalet calculations

| Interest rate | Monthly P&I | Annual P&I | DSCR if NOI = $40,000 | NOI needed for DSCR 1.20 |

|---|---|---|---|---|

| 5.50% | $2,129 | $25,551 | 1.57 | $30,661 |

| 6.00% | $2,248 | $26,980 | 1.48 | $32,376 |

| 6.50% | $2,370 | $28,443 | 1.41 | $34,132 |

| 7.00% | $2,495 | $29,939 | 1.34 | $35,926 |

What this means in plain English:

Going from 6.0% to 6.5% increases your payment by about $122/month on this loan size. That might not sound like much, but notice what happens to your DSCR. Even if your NOI stays exactly the same, your coverage ratio drops. If your deal was "barely qualifying," that small-looking rate move can flip it from financeable to dead.

How Rates Change Required Occupancy Rates

Now connect this to short-term rental reality. Assume:

• ADR (average daily rate): $250 (check rates in your market)

• Expense ratio: 45% (so your NOI margin is 55%)

• Target DSCR: 1.20

• Same loan as above

You can estimate the occupancy you need to hit that NOI target.

Source: Chalet calculations

| Interest rate | NOI needed (DSCR 1.20) | Gross revenue needed (at 55% NOI margin) | Occupancy needed (ADR $250) |

|---|---|---|---|

| 5.50% | $30,661 | $55,747 | 61% |

| 6.00% | $32,376 | $58,865 | 65% |

| 6.50% | $34,132 | $62,058 | 68% |

| 7.00% | $35,926 | $65,321 | 72% |

The point: Higher rates quietly raise your minimum required occupancy (or your ADR, or your expense efficiency). And because STR income is seasonal, you need cushion above the break-even line. You can't run at exactly 65% occupancy and expect to sleep well at night.

Action step: Run your actual ADR, seasonality, and expense assumptions in Chalet's calculator, then re-run with rates at +0.50% and +1.00%. That sensitivity analysis is where the truth lives.

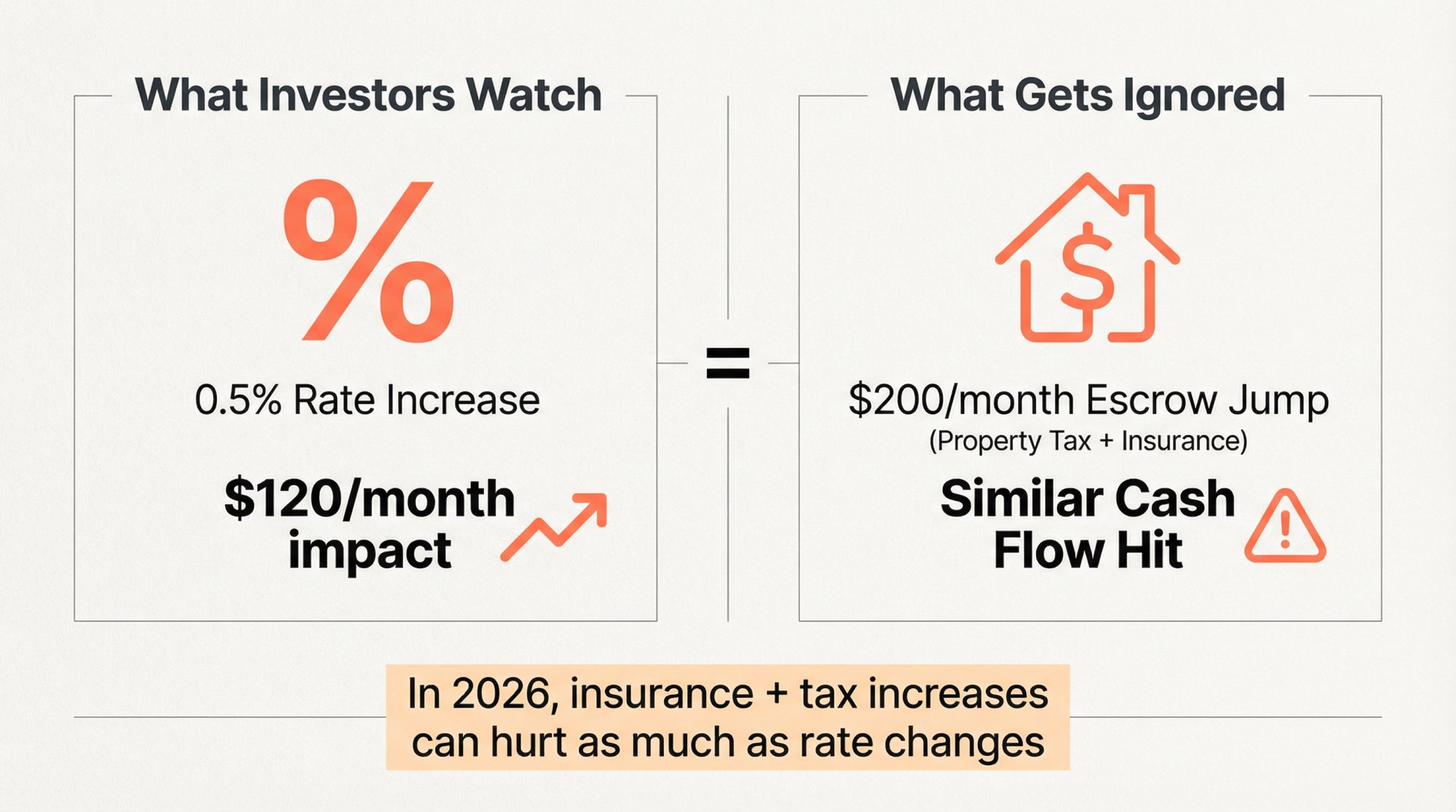

Why Property Taxes and Insurance Matter as Much as Rates

Something that doesn't get enough attention: investors obsess over the note rate, then get blindsided by escrow items.

If your insurance or property taxes jump by $200/month, that can hit your cash flow about as much as a meaningful rate change on a mid-sized loan.

This matters in 2026 because many markets are seeing rising insurance costs and higher carrying costs overall. Even the MBA's 2026 outlook highlights that increasing taxes and homeowners' insurance are part of the affordability squeeze.

Practical takeaway: When you stress test a deal, stress test all of these:

→ Interest rate

→ Occupancy

→ Insurance and property taxes

→ Major maintenance and capex

Don't just toggle the rate and call it done.

Short-Term Rental Market Outlook for 2026

Mortgage rates affect housing broadly, but STRs have their own supply and demand dynamics.

Recent STR market research from AirDNA (released December 16, 2025) points to a market that's stabilizing:

• U.S. short-term rental occupancy expected to ease by about 1% in 2026

• Available listings projected to grow 4.6%

• ADR forecast to grow 1.5% in 2026 (with faster growth expected in 2027)

They also call out demand tailwinds in certain 2026 FIFA World Cup host city areas, with some metros showing stronger RevPAR growth expectations.

How to interpret this as an investor:

If supply grows faster than demand in your specific micro-market, occupancy pressure is real. If rates stay near 6%, your margin of safety needs to come from buying well and operating well, not hoping for a refinance bailout.

This is where Chalet's approach matters. We combine rate math, market data, and local regulation research in one workflow:

① Market first: Analyze markets

② Rules second: Check local STR regulations

③ Deal third: Run ROI/DSCR

④ Financing reality check: DSCR calculator

⑤ Then: Meet an Airbnb-friendly agent and explore financing options

STR Financing Options in 2026: What You Need to Know

The main financing buckets. This isn't a recommendation, just the map.

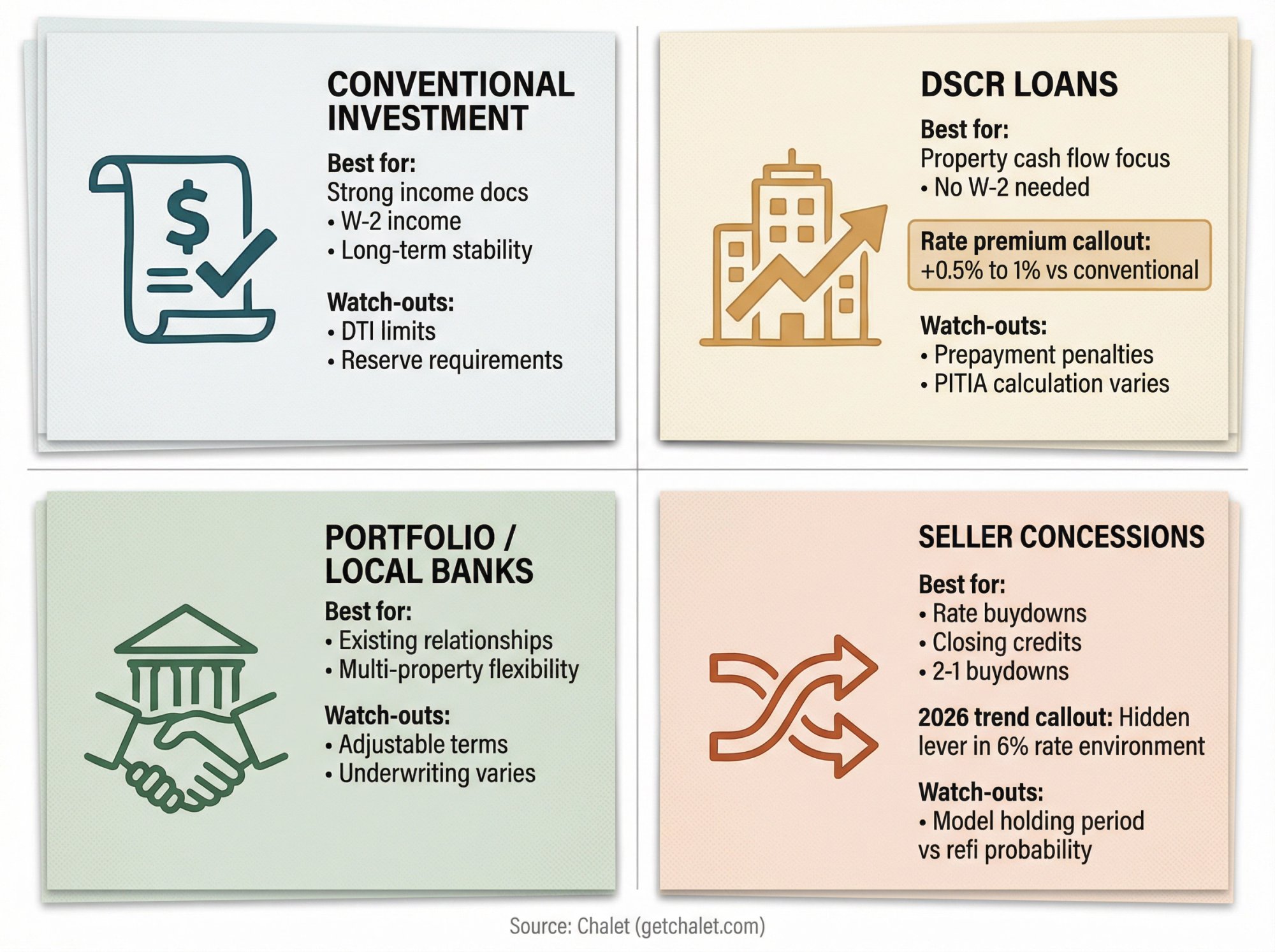

Conventional Investment Mortgage for STRs

Best when:

• You have strong income documentation and good credit

• You want long-term fixed stability

• You want to avoid DSCR quirks

Watch-outs:

• Debt-to-income constraints

• Investment property pricing adjustments

• Reserve requirements

DSCR Loans for Short-Term Rentals

DSCR loans underwrite mainly based on property cash flow, not your personal W-2 income. That's why STR investors use them.

In 2026, DSCR rates are often priced above conventional rates. Chalet's DSCR guide notes DSCR rates tend to run about 0.5% to 1% higher than conventional, depending on flexibility and risk factors.

Watch-outs:

• DSCR calculation method (some use PITIA, some haircut income)

• Prepayment penalties

• Higher rates and points than owner-occupied loans

If you're even considering DSCR: Run your DSCR now before you negotiate. Don't find out your deal doesn't qualify after you're under contract.

Second Home Financing for STRs

Some buyers try to qualify as second-home if the property and usage fit that category. This is highly fact-specific and lender-specific. Misclassifying occupancy is a serious problem. If you're not truly using it as a second home, don't play games here.

Portfolio Loans, Local Banks, and Credit Unions

Can be great when:

• You have existing relationships

• You have multiple properties and want cross-collateral flexibility

• You want a bank that understands your specific market

Watch-outs:

• Often adjustable or shorter terms

• Underwriting varies wildly

Seller Concessions and Rate Buydowns

This is the 2026 "hidden lever."

If rates hover near 6%, sellers often have to compete on payment affordability, not just price. Concessions can be more powerful than a small price cut because buyers feel payments every single month.

Common concession uses:

→ Closing cost credits

→ Points to buy down the rate

→ Temporary buydowns (like a 2-1 buydown, depending on program)

You should model concessions in both cash terms and payment terms. The best answer depends on your holding period and refi probability.

How Chalet Helps You Navigate 2026 Mortgage Rates

We built Chalet specifically for STR investors who need to make smart decisions in environments like this. Mortgage rates aren't going back to 3% anytime soon, so you need better tools and better execution.

What we offer (all free):

Free STR Market Analytics

Our market dashboards show ADR, occupancy, and revenue trends across multiple cities. You can compare seasonality, see supply growth, and identify which markets are stabilizing vs overheating.

ROI and DSCR Calculators

→ Airbnb Calculator: Run ROI, cap rate, and cash flow projections for any property

→ DSCR Calculator: Check if your deal qualifies for financing before you negotiate

Both tools let you stress test rates, occupancy, and expenses so you know what happens if things don't go perfectly.

STR Regulation Library

Before you buy, you need to know if you can legally operate. Our regulation guides cover permit requirements, occupancy limits, and compliance costs in major STR markets.

Vetted STR Vendor Network

Once you've identified a market and validated the numbers, you need execution. We connect you with:

• Airbnb-friendly real estate agents who understand STR investing

• Lenders who specialize in investment properties

• Property managers, insurance, furnishing, cleaning, and more through our STR Directory

The point: We're not just giving you data. We're giving you the full execution stack so you can go from research to close to operations without juggling 15 different platforms.

Explore Chalet's free tools here.

STR Deal Checklist for 6% Mortgage Rates

This is the underwriting sequence that prevents expensive mistakes.

① Start with Market Research, Not a Listing

Analyze:

• Demand drivers (seasonality, events, employer base, family travel patterns)

• Supply growth (new listings coming online)

• Regulation stability (can you actually get permitted?)

Use: Analyze markets and check local STR regulations

② Use Conservative Revenue Projections

Underwrite with:

• Conservative occupancy in the shoulder season

• ADR that doesn't assume endless demand

• A realistic cleaning and turnover pattern

Use: Run ROI/DSCR for specific addresses and override the default assumptions with your own research

③ Overestimate Operating Expenses

Most first-time buyers miss these:

• Utilities and internet

• Supplies and replacements (linens, kitchen items, toiletries)

• Maintenance and repairs

• Insurance (both property and liability)

• Property taxes

• Local compliance costs (permits, licenses)

• Platform fees (Airbnb service charges, channel manager fees)

If your deal only works with optimistic expenses, it doesn't work.

④ Stress Test Multiple Variables Together

Don't stress test only one variable. That's amateur hour.

A simple three-scenario model:

• Base: Today's rate and realistic occupancy

• Downside: Occupancy -10%, ADR -5%, expenses +10%

• Ugly: Downside scenario plus rate +0.50% (if not locked) or insurance jump

If the ugly scenario breaks your DSCR and drains your cash reserves, you're over-leveraged. Don't do the deal.

⑤ Plan Your Exit Strategy Before Buying

Exit options matter more when rates are higher because the buyer pool for investment properties shrinks as financing gets more expensive.

Your exit options might include:

• Keep operating as STR (main plan)

• Pivot to mid-term rental (30+ day stays)

• Pivot to long-term rental (annual lease)

• Sell to an owner-occupant (bigger buyer pool, easier financing)

• Refinance (optional bonus, not guaranteed)

Tool pair if you want to explore pivots:

→ STR numbers: Airbnb Calculator

→ Mid-term numbers: Mid-Term Rentals Analytics

What to Do in 2026 Based on Your Investor Type

First-Time Short-Term Rental Buyers

Your biggest risk isn't the rate. It's buying a deal with no margin of safety because you got excited about gross revenue projections.

Focus on:

• Conservative underwriting (don't trust seller proformas)

• Regulation clarity (can you get permitted without drama?)

• Properties that can pivot to long-term or mid-term if needed

• Sufficient reserves (at least 6 months of PITIA)

Do this next:

① Analyze markets to identify 3-5 candidates

② Check local STR regulations for each market

③ Run ROI/DSCR for specific addresses on your short list

④ Meet an Airbnb-friendly agent who can help you find compliant properties

1031 Exchange Investors

Your constraint is time: 45-day identification window and 180-day close deadline.

Rates matter because they can change quickly while your timeline cannot. A rate jump during your ID period can kill deals you thought were safe.

Focus on:

→ Pre-approval and lender responsiveness (speed matters)

→ Fast DSCR validation (don't wait until day 40 to check if it qualifies)

→ Markets with clear permitting (no regulatory surprises)

→ Operational speed-to-launch (furnish, clean, PM lined up before you close)

Do this next:

• Meet an Airbnb-friendly agent who understands 1031 timelines

• Explore financing options and get pre-approved

• Set up your STR operations (vendors in place before close)

Portfolio Builders (1 to 5+ Properties)

Your edge is operational, not theoretical. You've already learned the basics. Now it's about execution.

Rates matter, but your bigger levers are:

• ADR strategy (dynamic pricing, direct booking channels)

• Occupancy optimization (shoulder-season discounts, minimum stay strategies)

• Expense control (maintenance efficiency, insurance shopping)

• Refinance readiness (clean books, DSCR headroom)

Do this next:

• Re-underwrite each property at "today's rates" and "renewal insurance rates"

• Identify which properties are refinance-ready and which need operational fixes

• Use Chalet's calculator as your standardized underwriting template across all properties

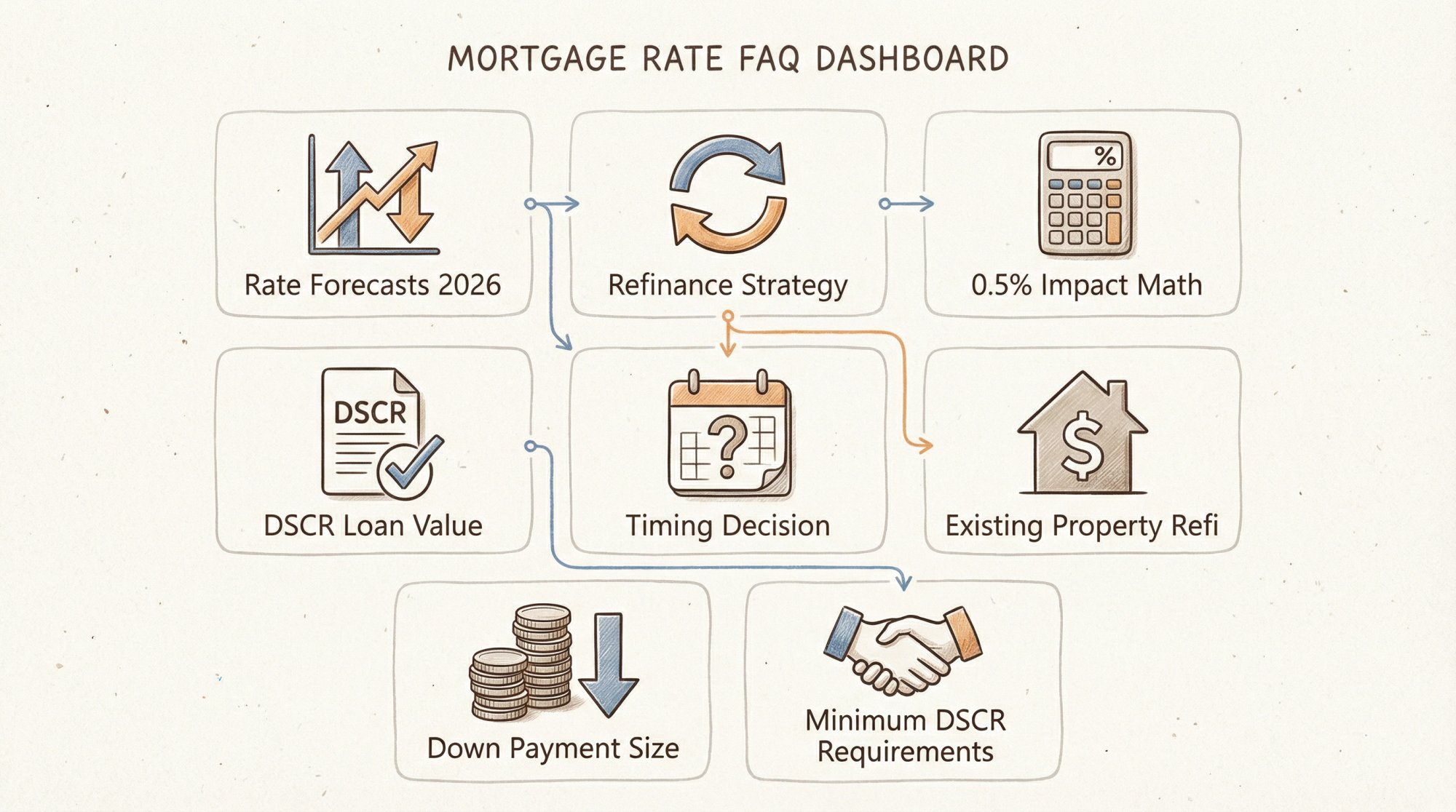

Frequently Asked Questions About Mortgage Rates and STRs

Are mortgage rates expected to fall in 2026?

Some forecasts suggest modest improvement, but the cluster is still around 6%. Fannie Mae projected 5.9% by end of 2026, NAR discussed a 6% scenario, and MBA described a band of 6% to 6.5% in its 2026 outlook. Don't underwrite deals assuming rates will drop to 4%.

If rates drop later, should I just buy now and refinance?

Treat refinancing as a bonus, not a plan. You can't control future rates, spreads, underwriting rules, appraisal values, or your own income profile at that future date. Underwrite the deal so it survives without a refinance.

How much does a 0.5% rate change actually matter?

On a 30-year loan, it often changes your payment by roughly $30 to $35 per month per $100,000 borrowed (in the 5% to 7% rate zone). On bigger loans, that stacks up fast. The more leveraged you are, the more it matters.

Are DSCR loans worth it in 2026?

They can be, because they're built specifically for income-producing properties and don't require W-2 verification. But expect pricing above conventional in many cases, and pay close attention to how DSCR is calculated. Chalet's DSCR guide notes DSCR rates often run about 0.5% to 1% higher than conventional in 2026.

Should I wait for rates to drop before buying?

That depends on your specific situation. If you're waiting for rates to drop to 4%, you might be waiting years. If you're waiting for them to drop from 6.5% to 5.5%, that's possible but not guaranteed. The better question is: Can you find a deal that works at 6%? If yes, execute. If no, either improve your search criteria or build more capital.

What if I already own a property at a higher rate?

If you bought at 7%+ and rates are now 6%, you might be refinance-ready depending on your LTV, DSCR, and property performance. Run the numbers on Chalet's calculator to see if a refi makes sense after costs.

Do I need to put more money down in 2026?

Not necessarily, but more equity reduces your monthly payment and improves your DSCR, which makes qualification easier and gives you more cushion. If you're choosing between 20% and 25% down, run both scenarios in Chalet's calculator and see which one gives you better sleep-at-night margin.

What's the minimum DSCR most lenders require?

Many DSCR lenders want to see 1.0 to 1.25, but requirements vary. Some will go lower with higher rates or more down payment. The right answer is: call a lender early and understand their specific criteria before you waste time on deals that won't qualify.

Your Next Step: Run a Rate Reality Check in 10 Minutes

The DSCR calculator above is where you validate financing qualification before you waste time negotiating. It's the exact tool referenced 15+ times in this guide.

Do this workflow on any property you're seriously considering:

① Run ROI/DSCR for the address

② Switch the rate to: today's quote, +0.50%, and +1.00%

③ Reduce occupancy by 10% and re-check DSCR

④ Add a realistic insurance and property tax estimate

⑤ If it still works in all three scenarios, move to execution:

• Meet an Airbnb-friendly agent

That's the workflow. Market research, deal validation, execution partners. All in one place at Chalet.

About Chalet:

We're the one-stop platform for short-term rental investors. We pair free market analytics with a vetted vendor network so you can research, buy, and operate in one place. Whether you're buying your first Airbnb rental or building a portfolio, we give you the tools and connections you need to make smart decisions in any rate environment.

Explore our free tools and connect with STR-specialist pros at Chalet.com.