If you're hunting for an off-market Airbnb rental, you're trying to do two things at once: find inventory other buyers never see, and buy it on terms that still make financial sense for short-term rental (STR) operation.

Most content treats off-market deals like they're some kind of magic trick. They're not.

Off-market deals happen when a seller values speed, privacy, certainty, or convenience over maximum public exposure. Your job? Build a repeatable process that makes it easy for motivated sellers to say yes while you stay disciplined about underwriting and local regulations.

This guide gives you a complete playbook whether you're a first-time STR buyer, a 1031 investor racing the clock, or a portfolio builder creating consistent deal flow.

What You Need to Know About Off-Market Airbnb Deals

Why Off-Market Doesn't Always Mean Discount Pricing

A seller choosing the off-market path might want:

• Less disruption (no showings, no photographer appointments, no strangers touring)

• More control over timing (who sees it, when it gets marketed, how the process flows)

• A cleaner close (fewer contingencies, flexible timelines, simpler terms)

• Privacy for personal reasons (divorce, inheritance, tenant drama, financial urgency)

Sometimes that motivation leads to below-market pricing. Other times it commands a premium. The real "win" often comes from terms rather than sticker price: seller financing, timing flexibility, included furnishings, or booking calendar transitions that conventional deals can't accommodate.

The insight: Off-market success isn't about finding secret discounts. It's about being the buyer who can move quickly on favorable terms when a motivated seller appears.

How Common Are Pocket Listings?

Off-market inventory is real, but it's not the majority.

Zillow's 2025 analysis of a substantial transaction sample found that most sales were standard MLS listings, with pocket listings representing roughly 2% of their sample. That context matters because it should fundamentally shape your acquisition strategy.

What this means for your approach:

You should absolutely build off-market deal flow. But you shouldn't bet your entire acquisition plan on "secret inventory" as if the hidden market is where all the good deals live. It's one channel in a diversified sourcing strategy that also includes exploring on-market STR listings.

Why Sellers Choose Off-Market Deals (And How to Use That Ethically)

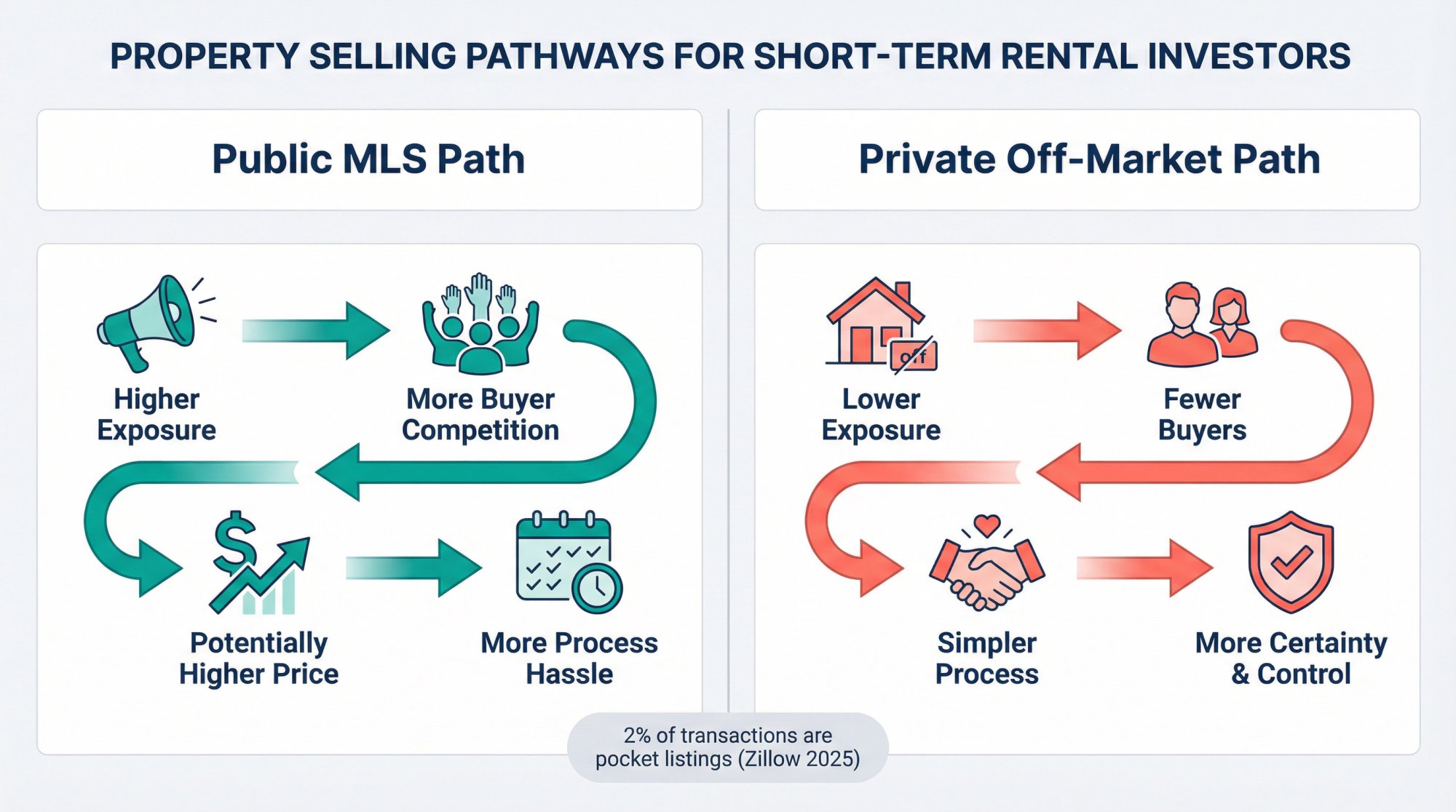

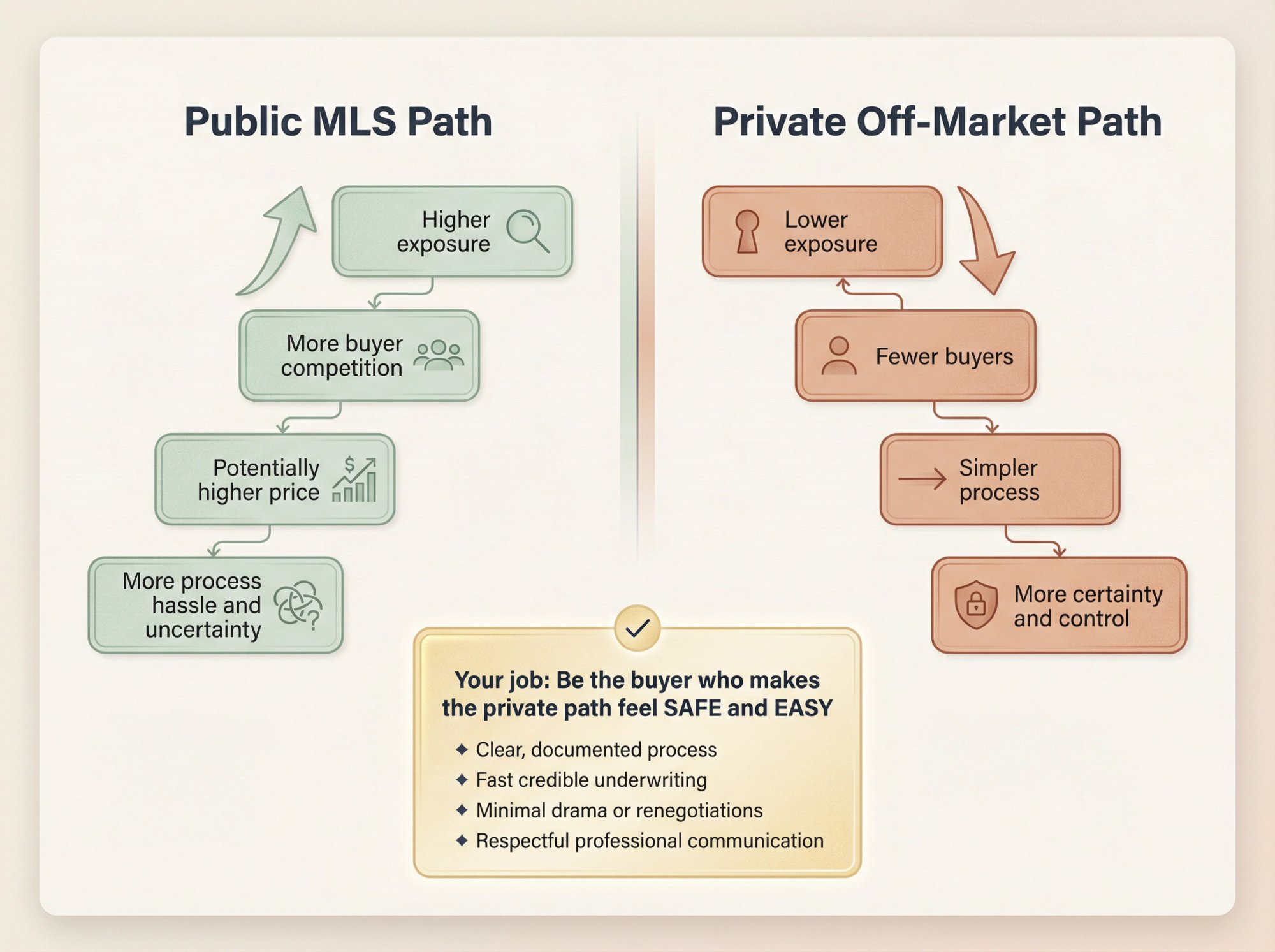

Think of a seller's decision framework like this:

Public MLS path

Higher exposure → more buyer competition → potentially higher price → more process hassle and uncertainty

Private off-market path

Lower exposure → fewer buyers → simpler process → more certainty and control

Your job is to be the buyer who makes the private path feel safe and easy:

→ Clear, documented process

→ Fast but credible underwriting using tools like Chalet's ROI calculator

→ Minimal drama or renegotiations

→ Respectful, professional communication

→ Clean paperwork coordinated through proper channels (agent, attorney, title)

That's what gets you callbacks and referrals.

3 STR Filters That Save Months Before You Start

Skip these foundational checks and you'll waste time locking up deals you legally or practically can't operate.

Verify Regulations and Permit Requirements

A property isn't an Airbnb deal if you can't legally run it as a short-term rental.

Do this first:

Check whether STRs are allowed in the specific city and county. Confirm permit caps, license waitlists, or zoning restrictions that could block you. Verify whether existing permits transfer when property changes hands (many jurisdictions don't allow this).

Chalet shortcut: Start with regulation research and organize notes per market using our rental regulations library. Then analyze baseline market performance with our free analytics dashboard.

Check Year-Round Demand, Not Just Peak Season

Off-market sellers love saying "it's booked all summer." That's not the same as year-round operational durability.

You want seasonality you can survive and a demand driver you can explain in one clear sentence: ski access, beach proximity, hospital system, major university, recurring events, national park gateway, or corporate travel hub. Use Chalet's market dashboards to validate seasonal patterns before making offers.

Confirm You Can Actually Operate This Property

If you can't realistically clean it, maintain it, and insure it, the projected numbers are fantasy.

Quick feasibility checklist:

• Cleaning access logistics and laundry plan

• Parking availability and neighborhood noise sensitivity

• Hot tub or pool maintenance requirements (if applicable)

• Winter road access (for mountain properties)

• HOA rules that might restrict STR operation (massive deal killer)

Chalet shortcut: Set up your STR operations stack with vetted vendors in our STR directory covering property managers, cleaners, furnishing services, and insurance specialists.

7 Steps to Find Off-Market Deals Consistently

Step 1: Define Your Buy Box So Tight It Feels Boring

Boring is good. Boring means repeatable.

Write this down:

| Criteria | Your Answer |

|---|---|

| Market(s) | 1-3 maximum (don't dilute focus) |

| Property type | Condo / cabin / single-family / duplex |

| Bedroom range | Your specific range |

| Maximum price | Hard ceiling you won't exceed |

| Must-have features | Parking, views, walkability, etc. |

| Deal structure flexibility | Furnished? Seller finance? Timeline needs? |

If you can't describe your buy box in two sentences, your outreach will sound vague. Vague outreach doesn't get callbacks. Use Chalet's analytics platform to narrow down high-performing markets before defining your box.

Step 2: Build Your Lead Universe (3 Owner Categories)

Most off-market STR deals come from one of these groups.

Bucket A: Existing STR operators (best for "ready-to-run")

Why they sell:

Burnout from guest management. Regulation anxiety as rules tighten. Major life changes. They want to cash out after a strong run and move capital elsewhere.

How to find them:

Identify high-performing active listings in your target area using platforms or manual research. Then work backward to find ownership through public records, local assessor sites, or deed searches. Chalet's market data helps you identify which properties are likely top performers.

Bucket B: Second-home owners and "accidental" landlords (best for gentle outreach)

Why they sell:

They don't use the property enough to justify ownership. Maintenance feels burdensome from a distance. They're exhausted by long-distance property management.

How to find them:

Absentee owner mailing lists (properties where the mailing address differs from the property address). Targeted neighborhood outreach. Local community groups (just be careful not to spam).

Bucket C: "Pain" owners (best for favorable terms, higher complexity)

Examples include:

Vacant or inherited homes sitting unused. Properties with code violations or deferred maintenance. Owners facing tax delinquency. Difficult tenant situations creating stress.

These can be genuine deals, but they require sharper due diligence and a more experienced closing team.

Step 3: How to Access Private Inventory Through Agents and Brokers

This is often the fastest way to access off-market-adjacent inventory without building an entire direct-to-owner outreach machine.

Understand the MLS policy reality in 2026

NAR's "Multiple Listing Options for Sellers" policy became effective in 2025 and required MLS implementation by September 30, 2025. It includes exemptions such as office exclusives and delayed marketing options, and clarifies that one-to-one broker communications don't automatically trigger Clear Cooperation requirements.

What this means for you:

Some properties may be known inside broker networks before they hit public listings. Access often depends on relationship quality and response speed. You need an agent who actually works investor deals and understands STR-specific constraints like permit transferability and operational feasibility.

The buyer-side reality after 2024

Post-2024 industry changes mean buyers may be asked to sign agreements before touring properties, and buyer agent compensation is no longer displayed uniformly on MLS. You should establish a clear buyer-agent relationship early so you can move quickly when a pocket listing or delayed-marketing opportunity appears.

Chalet connection: Meet an STR-friendly agent who understands your specific needs at our agent directory.

Copy/paste: The exact message to send agents

Subject: Off-market STR buyer (ready to move fast) in [Market]

Hi [Name] – I'm actively buying an Airbnb-style short-term rental in [Market]. Here's my buy box:

• Budget: up to $[X]

• Type: [cabin/condo/single-family], [2-4] bedrooms

• Non-negotiables: [parking, no HOA restrictions / HOA allows STR, etc.]

• Timing: can close in [30-60] days (flexible based on your seller's needs)

• I'm underwriting each deal as an STR and verifying regulations before making offersIf you have office exclusives, delayed-marketing listings, or sellers who prefer a quiet process, I'm a clean buyer. I'll respond same day and won't waste your time with low offers or endless renegotiations.

Can you add me to your private distribution list and let me know what you're currently seeing?

Thanks,

[Your Name]

[Phone] | [Email]

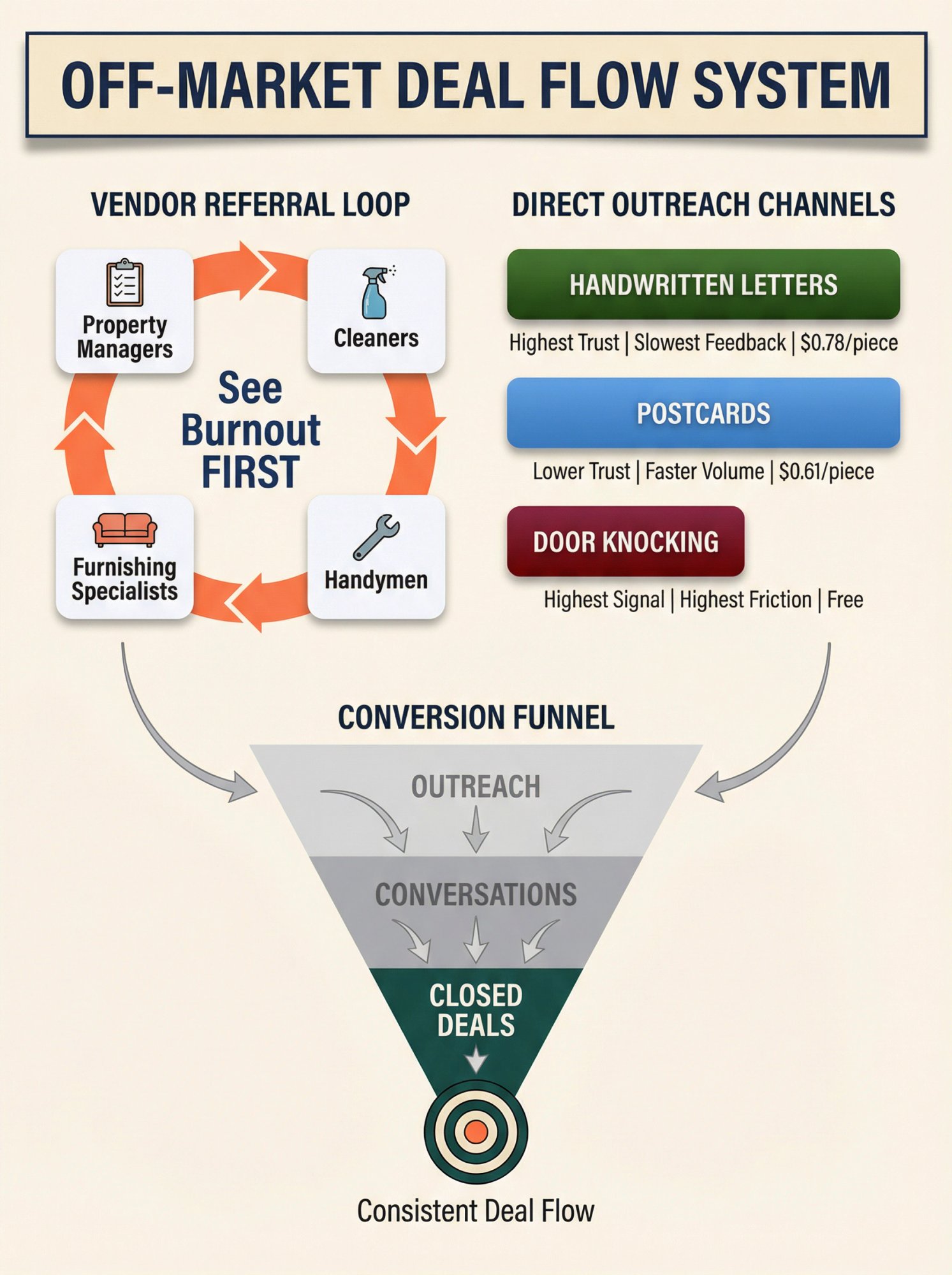

Step 4: Build a Property Manager and Vendor Referral Loop

Property managers, cleaners, handymen, and furnishing specialists see ownership stress before the broader market does.

What to ask for:

"Do you have any owners who seem burned out?"

"Any clients struggling with cleaning coordination or maintenance?"

"Have any owners mentioned possibly selling?"

How to make it worth their while (ethically):

Offer to hire them if you buy the property (assuming they're a good fit). Ask for warm introductions rather than just dumping contact lists on you.

Chalet connection: Find vetted STR managers, cleaning services, furnishing vendors, and insurance specialists in our resource directory.

Step 5: How to Run Direct-to-Owner Outreach Without Legal Trouble

Direct outreach works, but it's not "one letter equals one deal."

It's about:

① List quality

② Consistent follow-up over time

③ Legal compliance

④ Simple, respectful messaging that doesn't feel aggressive

Compliance matters (especially phone and text)

If you're cold calling or texting, you must respect telemarketing laws and do-not-call registries. The FTC Telemarketing Sales Rule includes calling time restrictions, generally 8:00 a.m. to 9:00 p.m. local time without prior consent.

NAR's telemarketing guidance emphasizes scrubbing call lists against the National Do Not Call Registry when no exemption applies.

This guide isn't legal advice. Talk to an attorney if you plan scaled calling or texting campaigns, especially across state lines.

3 Direct Outreach Channels That Still Work

1) Handwritten-style letters (highest trust, slowest feedback)

Best for second homes, legacy owners, inherited properties where trust matters most.

2) Postcards (cheaper, faster, lower trust)

Best for broad neighborhood farming where you want volume and visibility.

3) Door knocking (highest friction, highest signal)

Best for "driving for dollars" lists and properties with obvious deferred maintenance.

What it costs (realistic planning numbers)

Direct mail costs move with postage rates. USPS currently lists $0.78 for a 1-oz First-Class Mail letter and $0.61 for a postcard stamp as of early 2026.

Direct mail response rates vary massively by list quality and message relevance. Industry benchmarks report real estate response rates around 3-4%, but treat this as directional rather than a guarantee.

Copy/paste: The letter that gets callbacks

Hi [Name],

I'm looking to buy a home in [Neighborhood/Area]. I'm not a wholesaler and I'm not sending this to everyone.

If you've ever considered selling [Property Address], I'd love to talk. I can buy as-is, and I can work around your timing preferences.

If you're not interested, no worries. If you are, text or call me at [Phone].

Thanks,

[Your Name]P.S. If now isn't the right time but you might consider it later this year, tell me what "later" looks like and I'll respect your timeline.

Copy/paste: The first phone call script (simple, non-pushy)

"Hi [Name], my name is [Your Name]. I'm calling because I'm interested in [Address]. I know this is out of the blue. Did I catch you at an okay time?"

If yes:

"I'm buying a home in the area and wondering if you'd ever consider selling. If not, I completely understand."

If maybe:

"Totally fair. Two quick questions so I don't waste your time:

If you did sell, what timing would work for you?

What would need to be true for a sale to feel worth it?"

Your goal isn't to "close" on the first call. Your goal is to uncover motivation and understand constraints.

Step 6: How to Work With Wholesalers Without Getting Burned

Wholesalers can bring you inventory fast. They can also bring you junk deals with unclear title situations or wildly misrepresented revenue claims.

Also, wholesaling rules are evolving state by state. A legal commentary on 2025 changes notes several new state laws with varying licensing and disclosure requirements. For example, Tennessee's Wholesale Real Estate Transaction Transparency and Protection Act took effect January 4, 2025.

What you do with that information:

Assume rules differ by state. Use a local real estate attorney and title company for every wholesaler deal. Require clear written disclosures and clean paperwork before you commit.

Wholesaler red flags (deal-killers)

→ "No inspection access, but trust me on condition"

→ "Here's the Airbnb revenue" with zero documentation

→ Assignment fee hidden until closing

→ Seller refuses to speak directly with you (sometimes normal, often not)

Wholesaler green flags

→ You can physically inspect the property

→ You can review the full contract chain and assignment terms upfront

→ They provide honest condition notes and disclose known issues

→ They connect you to title company early in the process

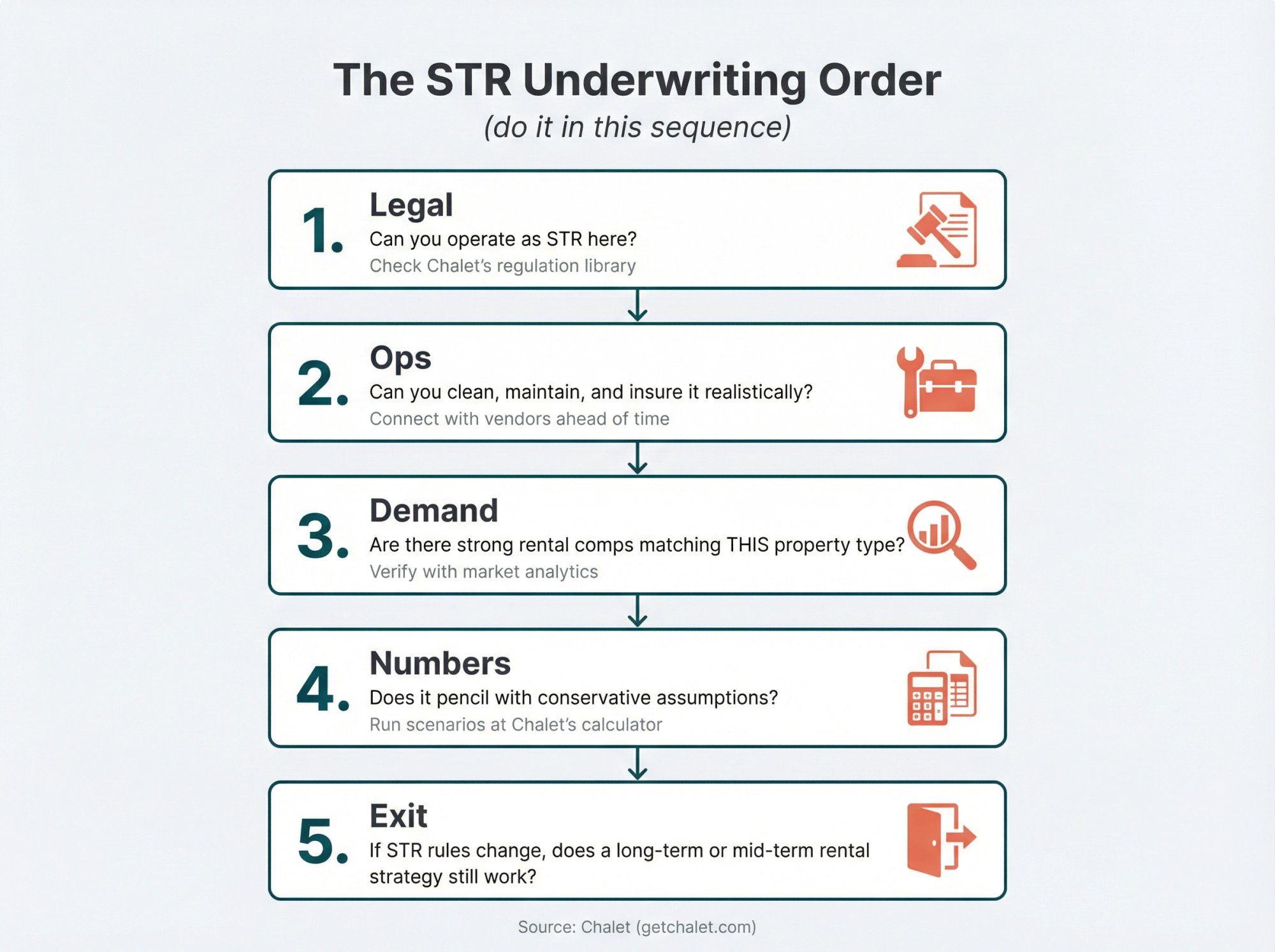

Step 7: How to Underwrite Off-Market STR Deals Like a Pro

Off-market deals reward speed, but speed without discipline is how investors massively overpay.

The STR underwriting order (do it in this sequence)

1. Legal: Can you operate as STR here? Check Chalet's regulation library

2. Ops: Can you clean, maintain, and insure it realistically? Connect with vendors ahead of time

3. Demand: Are there strong rental comps matching THIS property type? Verify with market analytics

4. Numbers: Does it pencil with conservative assumptions? Run scenarios at Chalet's calculator

5. Exit: If STR rules change, does a long-term or mid-term rental strategy still work?

Chalet underwriting tools: Run ROI projections and DSCR scenarios for any address. See real market performance data at our analytics platform.

What to ask a seller claiming "it makes $X on Airbnb"

Ask for documentation you can actually verify:

| Request | Why It Matters |

|---|---|

| Last 12 months booking revenue (platform export) | Proves actual income, not estimates |

| Occupancy by month (not just annual) | Reveals seasonality risks |

| Operating expenses (cleaning, utilities, repairs, supplies) | Shows true net income |

| Management agreement and fees | Clarifies if owner was self-managing |

Then rebuild the financial model yourself with conservative assumptions using Chalet's calculator.

Use Chalet's tools to underwrite faster:

Run complete financial scenarios at Chalet's ROI calculator to model any property with realistic revenue assumptions, operating costs, and financing structures. See exactly how the numbers pencil before making an offer.

Can You Buy an Existing Airbnb and Keep the Reviews?

This is where many buyers get burned.

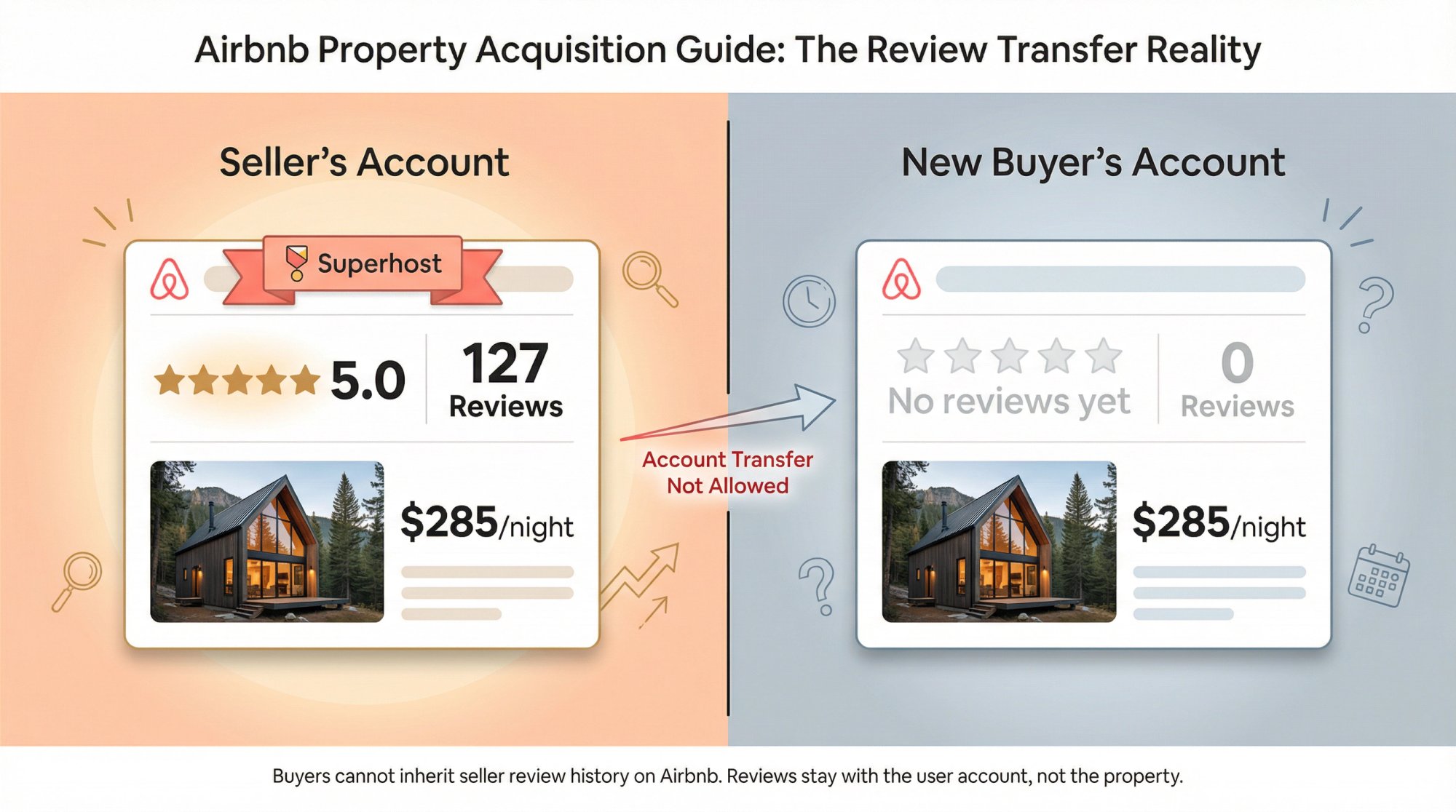

You can't just "buy their Airbnb account"

Airbnb's Terms of Service explicitly state you may not transfer your account to someone else. Airbnb's help guidance also confirms there isn't a way to transfer ownership of an Airbnb account, and you cannot merge or move information between accounts.

So the safe operating assumption is:

You will create your own listing under your own account. You will not "own" the seller's reviews or rating history.

What you can do instead (clean transition plan)

1) Buy the real estate, not the profile

Structure the purchase agreement around the physical property, furnishings, and transferable business assets (like a direct booking website, business phone number, or property management relationships). Don't try to "buy the Airbnb account" in the contract.

2) Handle future bookings ethically

If guests already have reservations on the books, work with the seller on a transition plan. Many buyers choose to close after peak season bookings expire, or the seller blocks the calendar before closing.

3) Use co-hosting as a transition tool (optional)

Co-hosting can help you learn the property's operations during a handoff period, but it doesn't mean you "own" the seller's account. Airbnb has separate co-host terms governing these arrangements.

4) Recreate the listing with permission

Get written permission to reuse professional photos, guidebook text, and copy. Or reshoot everything and rewrite for a completely clean start.

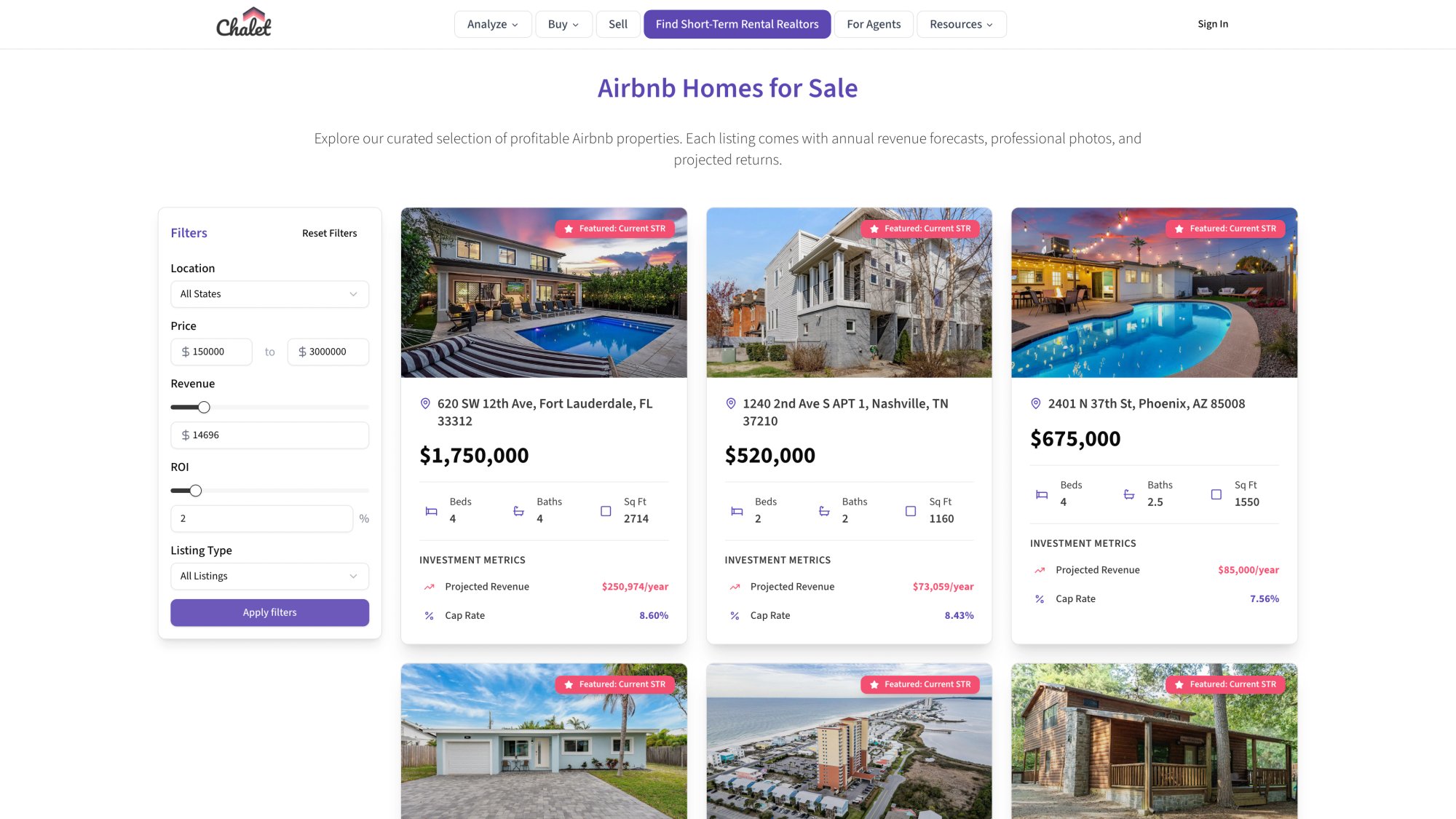

How Chalet Streamlines Your Off-Market Deal Flow

Most investors waste hours switching between market research tools, agent outreach, regulation checks, and vendor coordination. We built Chalet to consolidate everything into one platform.

Free analytics that power your deal decisions

Our market analytics dashboard shows ADR (average daily rate), occupancy trends, and revenue projections across hundreds of markets. You can quickly compare multiple cities, identify seasonal patterns, and spot emerging markets before they get saturated.

Our ROI calculator lets you model any property address with realistic assumptions: mortgage terms, operating expenses, occupancy scenarios, and DSCR requirements. You get instant feedback on whether a deal pencils before you make an offer.

The vendor network you actually need

Off-market deals move fast. You can't afford to spend days researching agents, lenders, insurance brokers, property managers, and cleaning services separately.

Chalet's STR directory connects you with vetted specialists who understand short-term rental operations:

→ STR-savvy real estate agents who know how to find pocket listings and office exclusives

→ DSCR lenders who can close in 30 days for 1031 buyers on tight deadlines

→ Property managers experienced with Airbnb and Vrbo coordination

→ Insurance specialists who write proper STR coverage (not just homeowner's policies)

→ Furnishing services that understand guest expectations and durability needs

Critical insight: When you're competing on an off-market deal, having your financing, insurance, and operations lined up in advance means you can make clean offers with fast closes. That's often the difference between getting the property and losing it to another buyer.

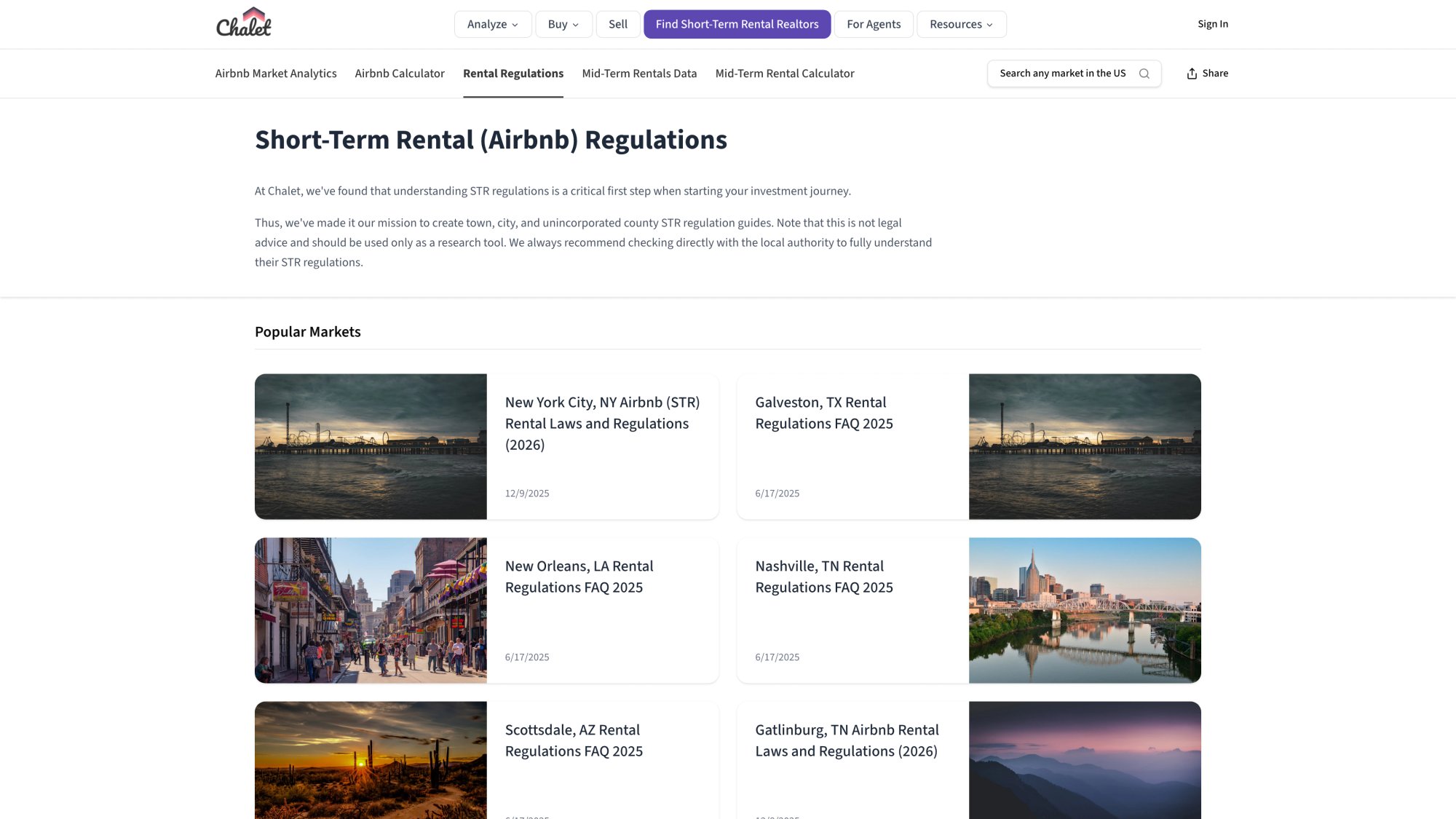

Regulation research that protects you from costly mistakes

One of the biggest off-market deal killers? Buying a property in a market where STRs are restricted or banned.

Our rental regulations library documents local STR rules, permit requirements, and operational restrictions for major markets nationwide. You can verify whether your target property is legally operable before you waste time and money on due diligence.

Built for 1031 exchange speed

If you're doing a 1031 exchange, your timeline isn't flexible. You have 45 days to identify replacement property and 180 days to close after selling your relinquished property.

Off-market deals are actually perfect for 1031 investors if you start early. You can build your pipeline before you sell, tour properties, and line up financing in advance. When you sell and the clock starts, you're selecting from a pre-vetted shortlist instead of starting from zero.

• Fast market selection with analytics dashboards

• Regulation risk assessment with our compliance library

• Agent connections who understand exchange deadlines at our directory

• Properties already listed and available at our listings platform

1031 Exchange: How to Find Off-Market Deals Without Blowing the Clock

If you're executing a 1031 exchange, your timeline is legally rigid.

IRS guidance for deferred exchanges is unambiguous:

Identify replacement property within 45 days of transferring the relinquished property. Receive replacement property within 180 days (or by the tax return due date including extensions, whichever comes first).

The 1031-friendly off-market strategy

Off-market sourcing is excellent for 1031 buyers, but only if you start early.

Best practice timeline:

Before you sell the relinquished property: Build your off-market pipeline, tour candidate properties, establish relationships with agents and lenders, verify regulation compliance.

Day 1 after sale: You're not "starting your search." You're selecting from a prepared shortlist and moving immediately to offers.

Chalet tools for 1031 execution speed:

• Market selection and performance comparison: analytics platform

• Regulation and permit verification: compliance library

• Exchange-experienced agent introductions: agent directory

• Pre-qualified property options: listings database

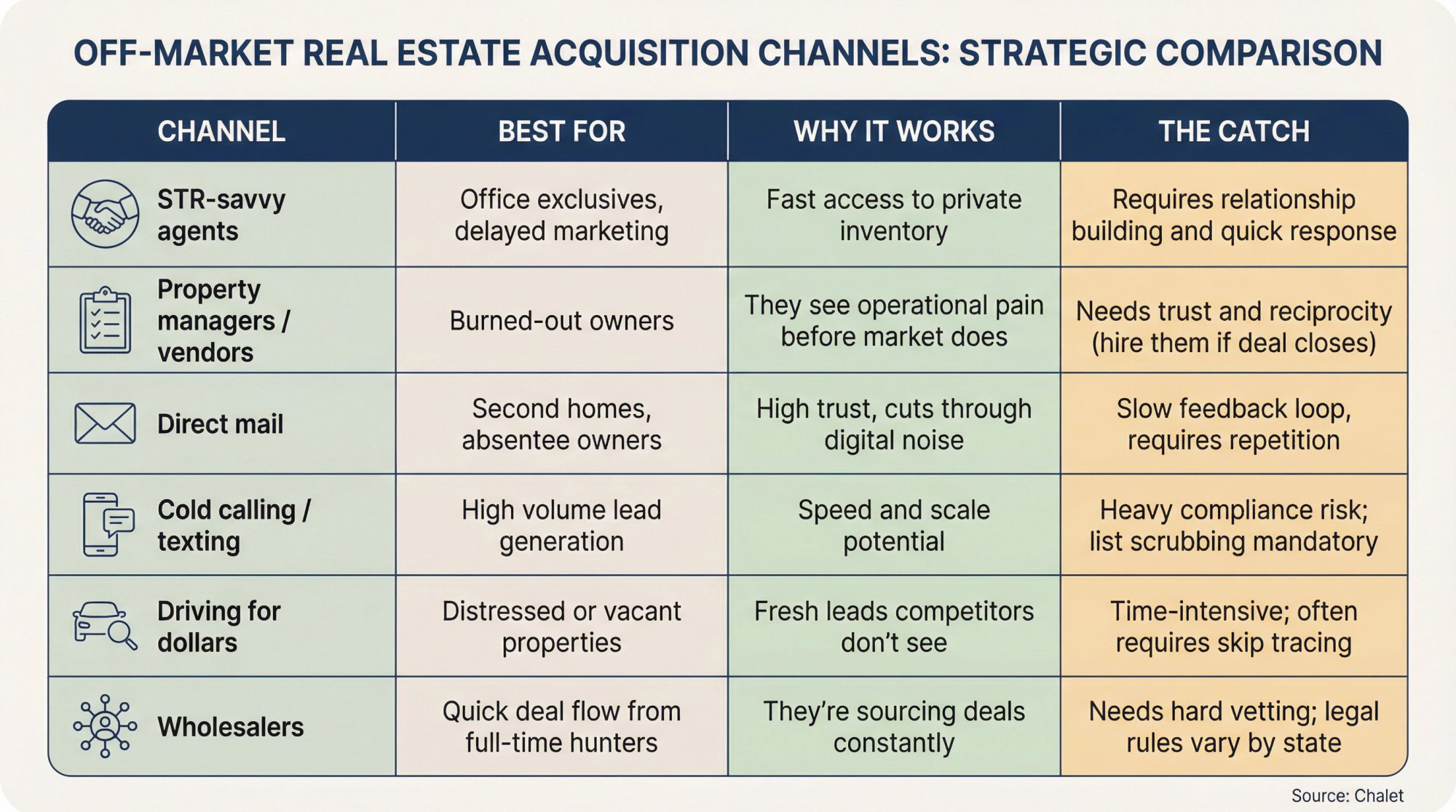

Which Off-Market Channels Should You Focus On? (Pick 2-3)

| Channel | Best For | Why It Works | The Catch |

|---|---|---|---|

| STR-savvy agents | Office exclusives, delayed marketing | Fast access to private inventory | Requires relationship building and quick response times |

| Property managers / vendors | Burned-out owners | They see operational pain before the market does | Needs trust and reciprocity (hire them if deal closes) |

| Direct mail | Second homes, absentee owners | High trust, cuts through digital noise | Slow feedback loop, requires repetition |

| Cold calling / texting | High volume lead generation | Speed and scale potential | Heavy compliance risk; list scrubbing mandatory |

| Driving for dollars | Distressed or vacant properties | Fresh leads competitors don't see | Time-intensive; often requires skip tracing |

| Wholesalers | Quick deal flow from full-time hunters | They're sourcing deals constantly | Needs hard vetting; legal rules vary by state |

Source: Chalet

5 Mistakes That Kill Off-Market Airbnb Deals

1. Assuming STR legality instead of verifying

You can't just "figure out permits later." Research regulations before you make offers.

2. Chasing "secret deals" without a defined buy box

Vague criteria = wasted time on properties you'll never actually close. Use market data to define realistic targets.

3. Believing seller revenue claims without rebuilding the model

Screenshots aren't financial documentation. Verify every number independently using Chalet's calculator.

4. Failing to plan operations before closing

If you don't have cleaning, management, and maintenance lined up, your first month will be chaos.

5. Trying to do everything alone

Use specialists. Get an experienced agent, a solid lender, proper STR insurance, and operational vendors in place before you need them.

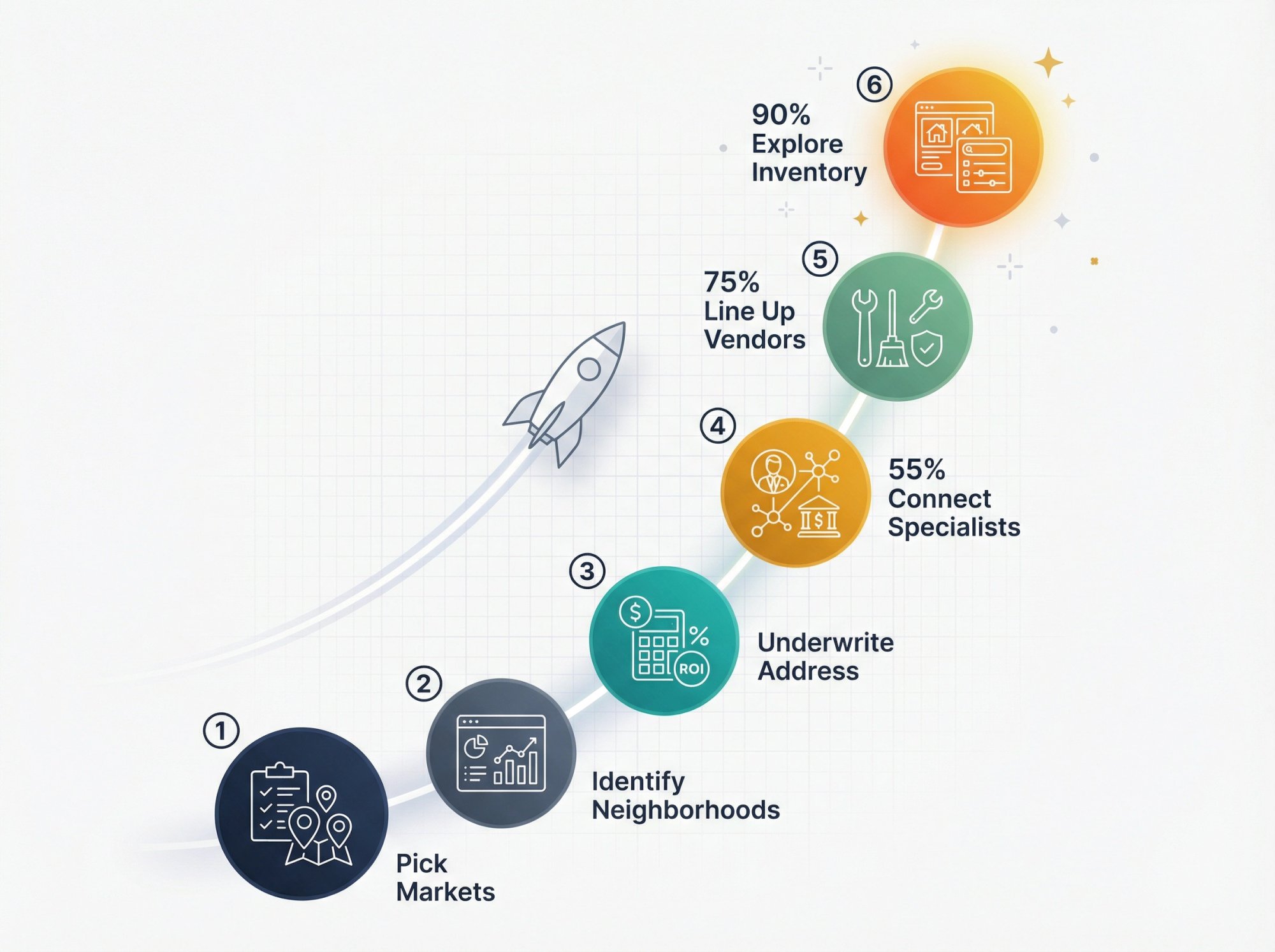

Your Action Plan: What to Do Right Now

If you want to act on this today, follow these steps in order:

① Pick 1-3 markets and verify STR rules

Check local regulations at Chalet's compliance library

② Identify high-potential neighborhoods

Use free performance dashboards at Chalet's analytics platform

③ Underwrite any address in minutes

Run ROI and DSCR projections at Chalet's calculator

④ Connect with specialists who understand off-market

Meet STR-friendly agents at Chalet's agent directory

⑤ Line up operational vendors before you close

Find property managers, cleaners, insurance, and furnishing services at Chalet's resource directory

⑥ Explore on-market inventory too

See active STR listings at Chalet's property marketplace

Frequently Asked Questions

How long does it typically take to find an off-market STR deal?

It depends entirely on your market, buy box specificity, and channel consistency. If you're running multiple channels (agent relationships, direct mail, vendor referrals), most investors see their first serious conversation within 30-60 days. Closing an actual deal usually takes 3-6 months from when you start building pipeline. 1031 buyers who start early can compress this significantly.

The key is treating off-market as a process rather than hoping for one lucky connection.

Can I really compete with cash buyers if I'm financing?

Yes, but you need speed and credibility. Get pre-approved with a DSCR lender who can close in 30 days. Prove you've closed similar deals before (or provide strong financial documentation if this is your first). Minimize contingencies where possible.

Off-market sellers often value certainty of close more than an extra $10K in purchase price. A financed buyer who can demonstrate they'll actually close beats a cash buyer who feels unreliable.

Do I need a real estate license to do direct mail or cold calling?

Laws vary by state, but generally you don't need a license to buy property for yourself as a principal. If you're wholesaling (putting properties under contract and assigning them to other buyers), many states now require licensing or have specific wholesaling regulations.

For direct mail and calling, the bigger concern is telemarketing compliance (Do Not Call Registry, calling time restrictions, etc.). Consult a local attorney before running scaled campaigns.

What if the seller doesn't have documentation of their Airbnb revenue?

Walk carefully or walk away. Without verified platform exports showing actual booking income, you're gambling on the seller's memory or intentional exaggeration.

You can use Chalet's analytics tools to model what similar properties in that market earn, but if the seller claims they're beating market averages by 40% with no proof, that's a massive red flag.

How do I know if an off-market deal is actually a good deal?

Use the same underwriting discipline you'd use for any property, just faster:

• Verify STR legality first (non-negotiable)

• Model realistic revenue using market data and conservative occupancy assumptions

• Calculate true operating expenses (cleaning, utilities, maintenance, supplies, software, insurance)

• Run scenarios with different financing structures at Chalet's calculator

• Confirm your operational feasibility (can you actually manage this property with available vendors?)

• Check your exit strategy (what if STR rules change?)

A good off-market deal isn't just "below list price." It's a property that makes financial sense with realistic assumptions and fits your actual operational capacity.

Should I hire a property manager before I close?

You should talk to property managers before you close, but you don't necessarily need to hire one immediately.

What you want pre-close:

• Understand local management costs and what's included

• Get realistic expense estimates for your underwriting

• Confirm a manager is available if you decide you need one

• Understand typical owner-manager agreements in your market

Chalet's STR directory connects you with property managers who specialize in short-term rentals and understand the operational differences from long-term property management.

What's the best way to build relationships with agents who have off-market inventory?

Be a serious, responsive buyer who respects their time:

① Send a clear, specific buy box (not "I want to invest somewhere")

② Respond quickly when they send opportunities (same day if possible)

③ Actually view properties and provide real feedback

④ Don't waste time with lowball offers on properties that meet your stated criteria

⑤ Close deals when you say you will

Agents share off-market inventory with buyers they trust to execute. Prove you're that buyer and you'll get more opportunities.

Chalet can help you connect with STR-specialist agents who already work with investors and understand short-term rental constraints.

Is it legal to buy an Airbnb property specifically to run it as an STR?

Buying property to operate as an STR is completely legal assuming STRs are allowed in that jurisdiction. What's critical is verifying local regulations before you close.

Some cities ban STRs entirely. Some require permits with waitlists. Some restrict STRs to specific zones or property types. Some allow them freely with simple registration.

Always verify current rules using local regulation resources and confirm any required permits or licenses before you finalize a purchase.

How do I handle an off-market property that already has future Airbnb bookings?

Work with the seller on a transition plan before you close. Common approaches:

Option 1: Close after existing reservations complete (cleanest but slower)

Option 2: Seller honors bookings through their account, you take over operations afterward

Option 3: Use a co-hosting arrangement during transition (requires seller cooperation and understanding of platform policies)

Never assume you'll just "take over" the seller's account. Airbnb doesn't allow account transfers, so plan accordingly.

What's the biggest mistake first-time STR buyers make with off-market deals?

Skipping regulation verification because they're excited about finding a "deal."

You can get an off-market property under contract fast, spend money on inspections and due diligence, then discover two weeks before closing that STRs are banned in that zone or the permit waiting list is two years long.

Always verify STR legality first. Everything else is irrelevant if you can't legally operate the property as a short-term rental. Use Chalet's regulation library to check rules before making offers.

Chalet is the one-stop platform for short-term-rental investors. We pair free market analytics with a vetted vendor network so you can research, buy, and operate in one place. Explore the data and connect with pros at Chalet.