If you're googling "Airbnb down payment requirements," you're probably trying to figure out one of these questions:

• "How much cash do I actually need to buy a property I can run as a short-term rental?"

• "Can I do this with 10% down? 15% down? Is there a 0% down option?"

• "Should I use a conventional loan or a DSCR loan?"

• "What's the real story with 'second home' financing if I plan to rent it?"

• "What's the actual cash I need beyond just the down payment number?"

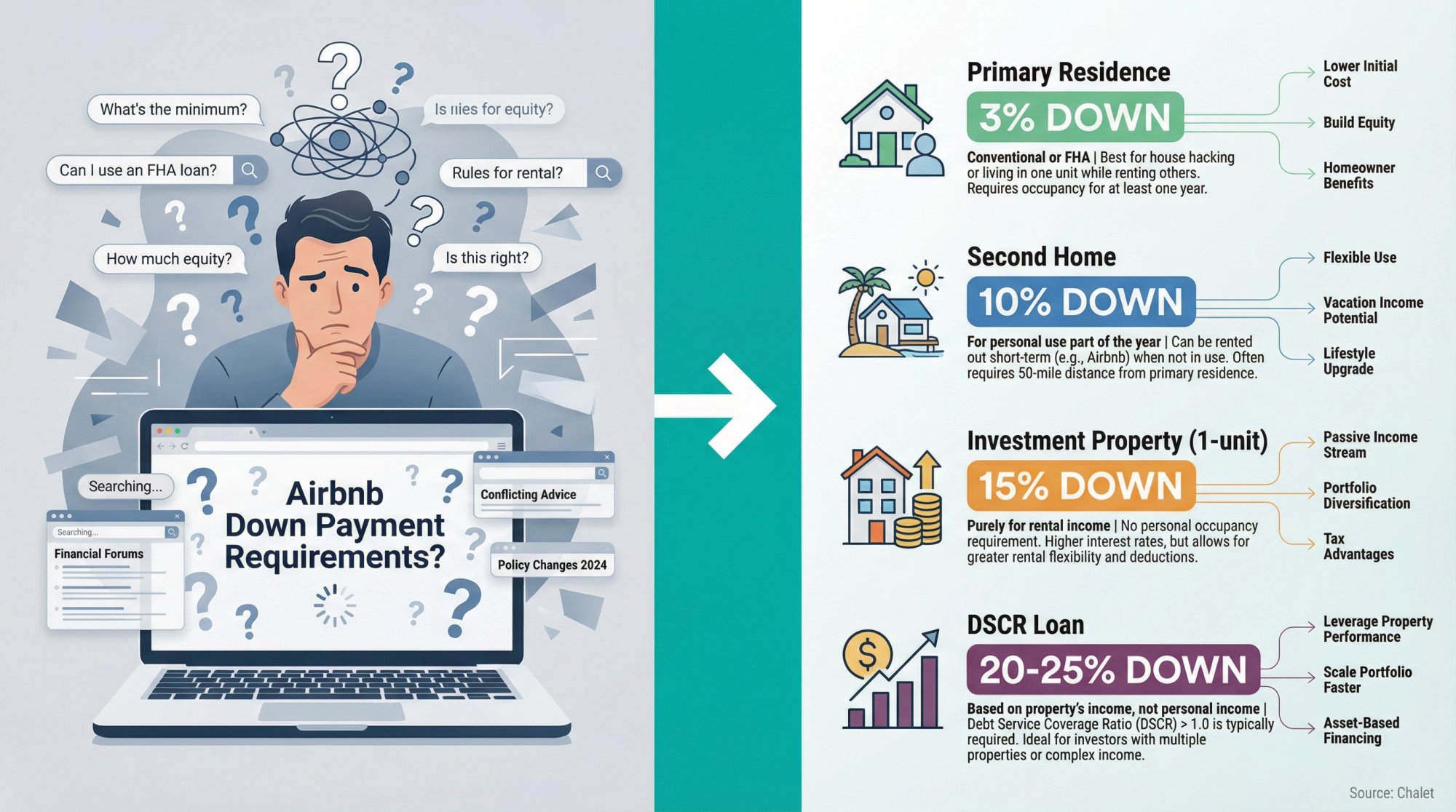

The important part: Airbnb (the platform) doesn't set down payment requirements. Your lender does. And your down payment depends entirely on how the loan classifies your property (primary residence, second home, or investment property) and which loan program you qualify for.

This guide is written for U.S. buyers planning an STR investment in 2026. We'll focus on what actually matters: minimum down payments by loan type, what's legally allowed, and how to calculate your real "cash to close" without getting blindsided at the closing table.

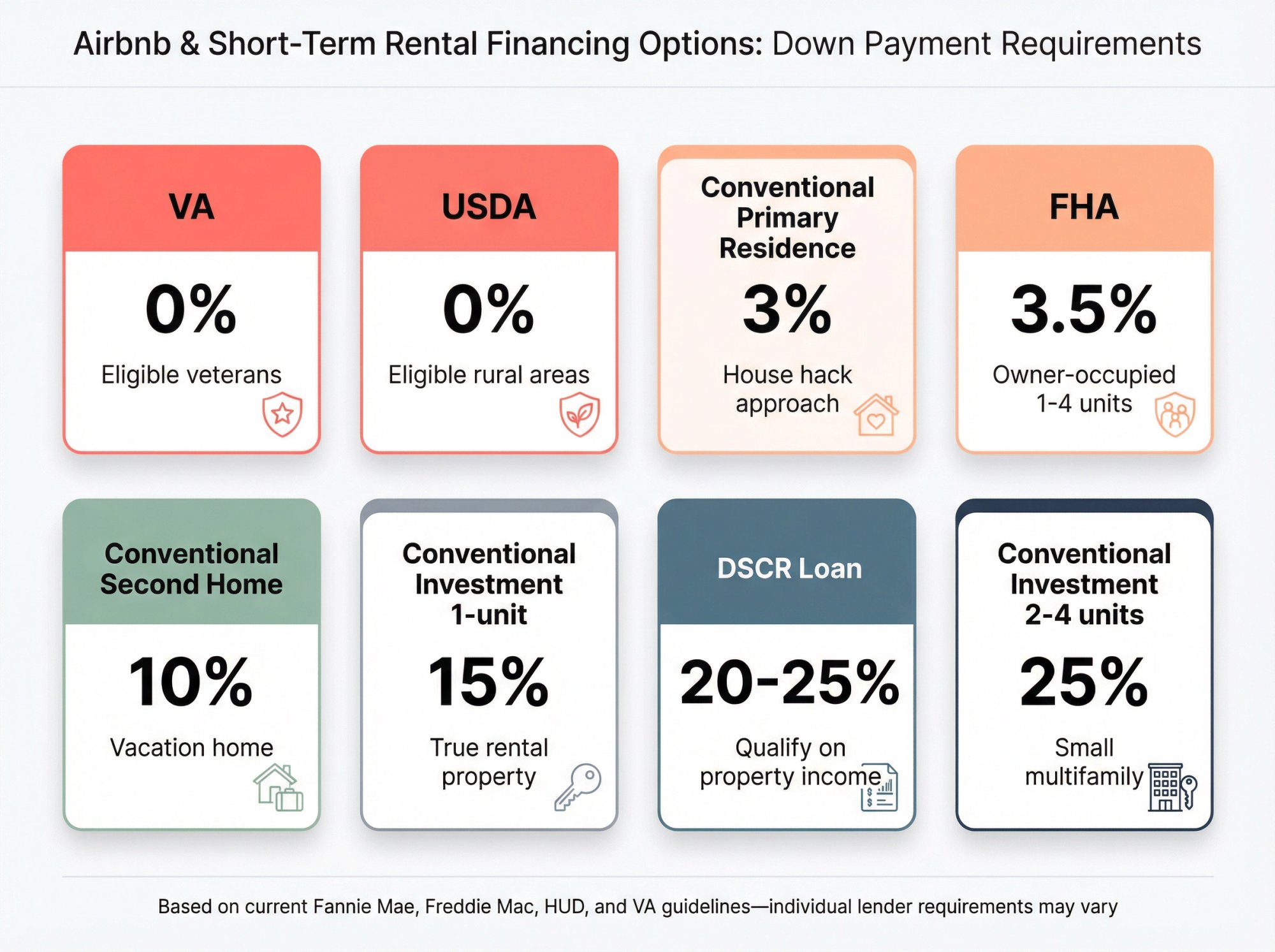

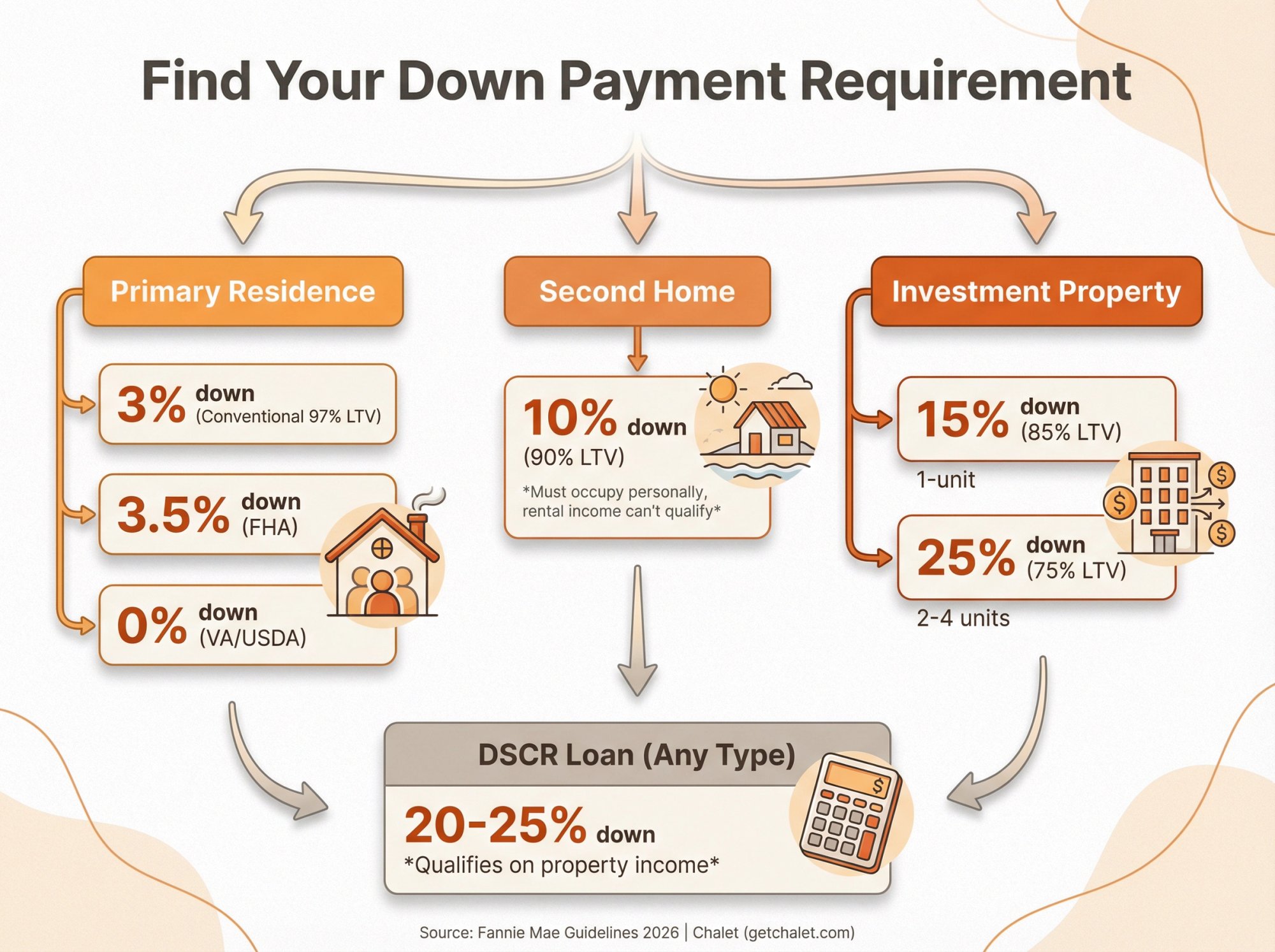

Airbnb Down Payment by Loan Type: Minimum Requirements

Below are the minimums you'll most often encounter if your loan qualifies for standard conventional guidelines or common investor lending programs. Your specific lender can require more based on your credit score, property type, condo association rules, cash reserves, or local market risk factors.

| Property Use / Loan Type | What It's Usually For | Typical Minimum Down Payment |

|---|---|---|

| Conventional Primary Residence (1-unit) | "House hack" approach: live there and rent part of it | As low as 3% down (up to 97% LTV in some cases) |

| Conventional Second Home (1-unit) | Vacation home you use part of the year; can sometimes rent but income can't be used for qualifying | 10% down (90% LTV max) |

| Conventional Investment Property (1-unit) | True rental property where you won't live | 15% down (85% LTV max) |

| Conventional Investment Property (2-4 units) | Non-owner occupied small multifamily | 25% down (75% LTV max) |

| DSCR Loan (non-QM investor loan) | Qualify based on property income instead of your W-2 | Often 20-25% down (industry standard for investor-focused programs) |

| FHA | Owner-occupied only (1-4 units) | As low as 3.5% down |

| VA | Owner-occupied, eligible veterans | 0% down required by VA (though some lenders may add requirements) |

| USDA | Owner-occupied, eligible rural areas with income limits | 0% down (100% financing) |

Sources: These figures are based on current Fannie Mae eligibility guidelines, Freddie Mac conforming requirements, HUD FHA minimums, VA benefits information, USDA rural development programs, and common DSCR lending standards.

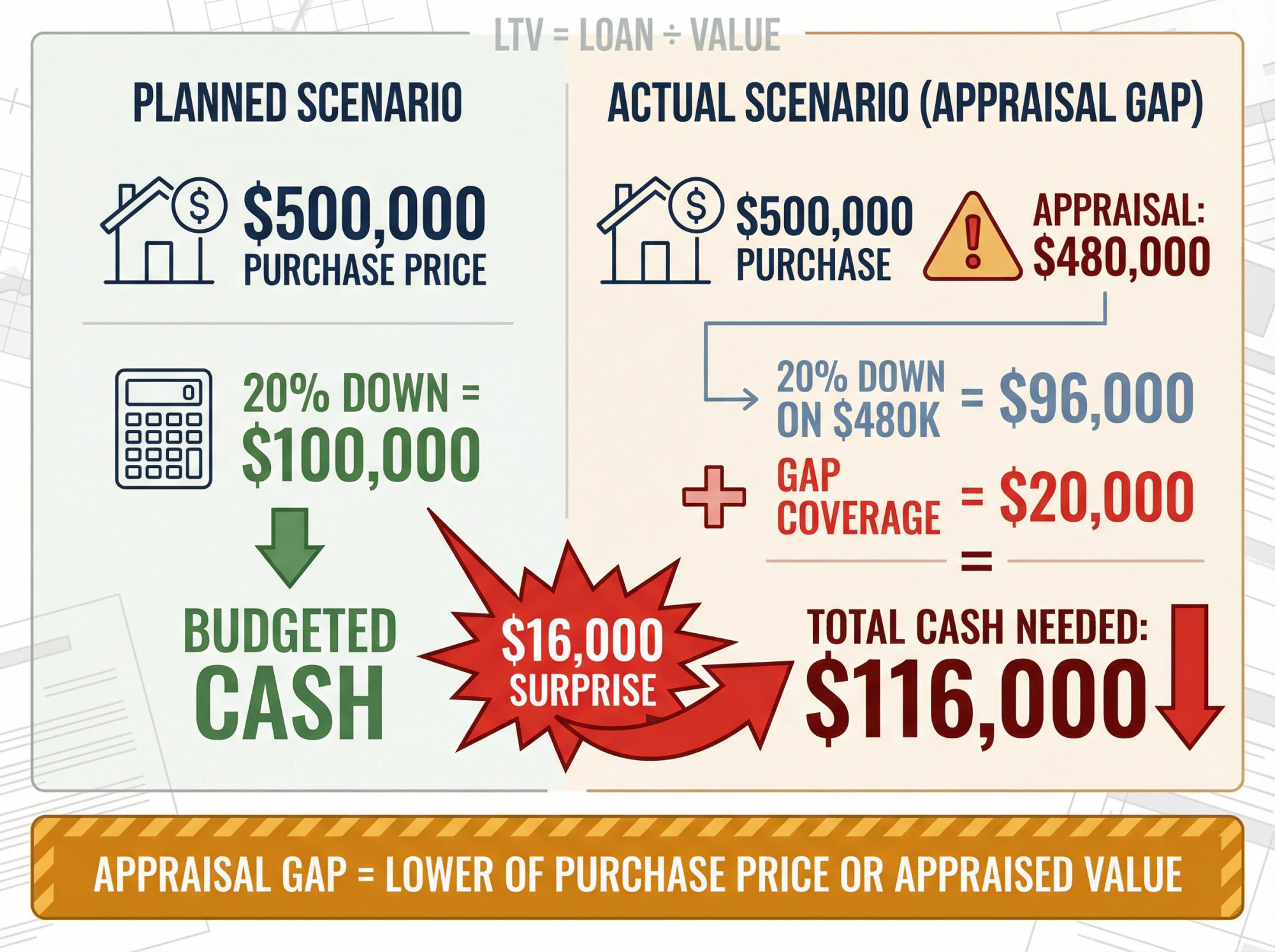

What Is a Down Payment and Why the Appraisal Matters

A down payment is the portion of the purchase price you're paying in cash instead of borrowing.

The math looks simple:

Loan-to-value (LTV) = loan amount ÷ property value

For purchases, "value" is typically the lower of your purchase price or the appraised value.

That last detail is where investors get caught.

How Appraisal Gaps Affect Your Down Payment

Real-world scenario:

→ You agree to buy a property for $500,000

→ The appraisal comes in at $480,000

→ Your lender calculates LTV based on the $480,000 appraisal

If you planned for 20% down on $500,000 (that's $100,000 in cash), your lender will now require 20% down on the $480,000 appraised value (that's $96,000). But you still need to cover the $20,000 gap between the purchase price and the appraisal value.

Net result: You need $116,000 in cash, not the $100,000 you budgeted.

Critical reality check: The appraisal gap is one of the most common surprises at closing. Your "down payment" isn't just a percentage. It's tied to the lower of purchase price or appraised value, and you're still responsible for covering any gap in cash.

This is why smart investors don't just plan their "down payment." They plan their cash to close (which we'll break down in detail later).

Quick tip: Before you start shopping for properties, run your target purchase price through Chalet's free Airbnb Calculator to model different down payment scenarios and see what actually cash-flows after you account for worst-case appraisal adjustments.

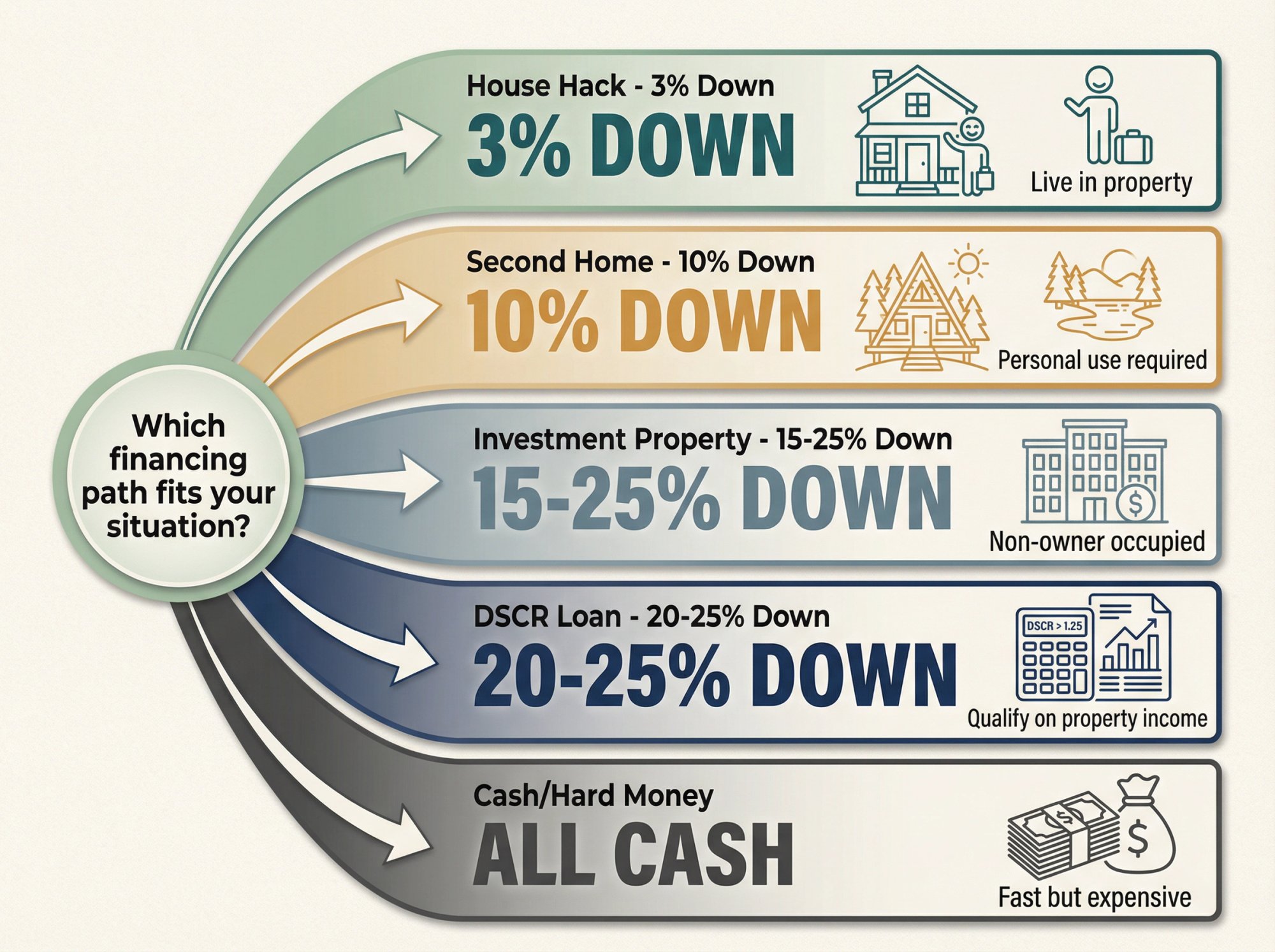

5 Ways to Finance a Short-Term Rental Property

There are basically five ways investors finance a property they plan to run as an Airbnb-style rental. Your down payment requirement depends entirely on which path you choose.

How to Buy an Airbnb with 3% Down: The House Hack Strategy

If you're going to actually live in the home as your primary residence, you unlock access to the lowest down payment programs available.

Your options:

① Conventional primary residence: Maximum LTV can reach 97% on a 1-unit purchase under certain eligibility paths (that's as low as 3% down)

② FHA: Down payment can be as low as 3.5% and works on 1-4 unit properties when you're owner-occupied

③ VA: The VA itself doesn't require a down payment for eligible veterans purchasing an owner-occupied home

④ USDA: 100% financing available for eligible rural primary residences (subject to income and area restrictions)

What this means for your Airbnb plans:

You can often rent part of your primary residence (think: a spare room, an ADU, or another unit in a 2-4 unit property). But lender rules, insurance requirements, and local STR regulations all come into play.

Legal warning you can't ignore: Occupancy misrepresentation is mortgage fraud. If you're not genuinely planning to live there, don't use a primary-residence loan. The consequences aren't worth the "savings." Period.

When Path 1 wins:

You're a first-time investor and want the absolute lowest cash requirement

You're legitimately open to living in the property for at least a year

You want the best interest rates and easiest qualification standards

Chalet move: Run your target address through our Airbnb Calculator and stress-test "live there + rent part" versus "full investment property" scenarios to see which gives you better long-term cash flow.

Second Home Loan Down Payment: 10% Down with Strict Restrictions

Second home loans are probably the most misunderstood part of "Airbnb down payment requirements."

The headline: Conventional second home loans can reach up to 90% LTV (that's 10% down).

The catch: To qualify as a second home under Fannie Mae's rules, the property must:

• Be occupied by you (the borrower) for some portion of the year

• Be a one-unit dwelling

• Be suitable for year-round occupancy

• Remain under your exclusive control

• Not function as a rental property or a timeshare arrangement

Fannie Mae adds an important nuance: if rental income is identified, the loan can still be classified as a second home as long as that income isn't used for qualifying and all other second-home requirements are met (including your personal occupancy).

The loan also can't be structured where a management company controls occupancy schedules (that essentially turns it into a hotel asset).

Translation (plain English):

Second home financing is designed for "I use this property personally, and I might rent it occasionally," not "this is a full-time business asset with professional property management."

When Path 2 makes sense:

You genuinely plan to use the home for personal vacations

You don't need the rental income to qualify for the mortgage

You want a lower down payment than pure investment property financing

Chalet move: Before you even start shopping for lenders, verify the market is legally workable by checking Chalet's rental regulations library. A cheap mortgage is worthless if you can't legally operate an STR in that city.

Investment Property Down Payment: 15-25% Down for Non-Owner Occupied

If you won't be living in the property at all, this is where most investors start.

Fannie Mae's eligibility matrix allows these maximum LTV levels for purchases:

• 1-unit investment property: Max 85% LTV (15% down)

• 2-4 unit investment property: Max 75% LTV (25% down)

Freddie Mac's conforming requirements match the same LTV structure.

Important reality check: Just because the guidelines allow these LTV levels doesn't mean your lender will automatically approve them.

Many lenders add their own overlays (stricter requirements) for:

Condos in resort or vacation markets

High-risk STR cities with uncertain regulations

Unique or non-standard properties

Borrowers with multiple financed investment properties

Lower credit scores or high debt-to-income ratios

When Path 3 wins:

You have strong W-2 or self-employed income and can qualify based on personal debt-to-income ratio

You want conventional loan terms (typically no prepayment penalties)

You're buying in your personal name (many conventional loans won't lend to LLCs)

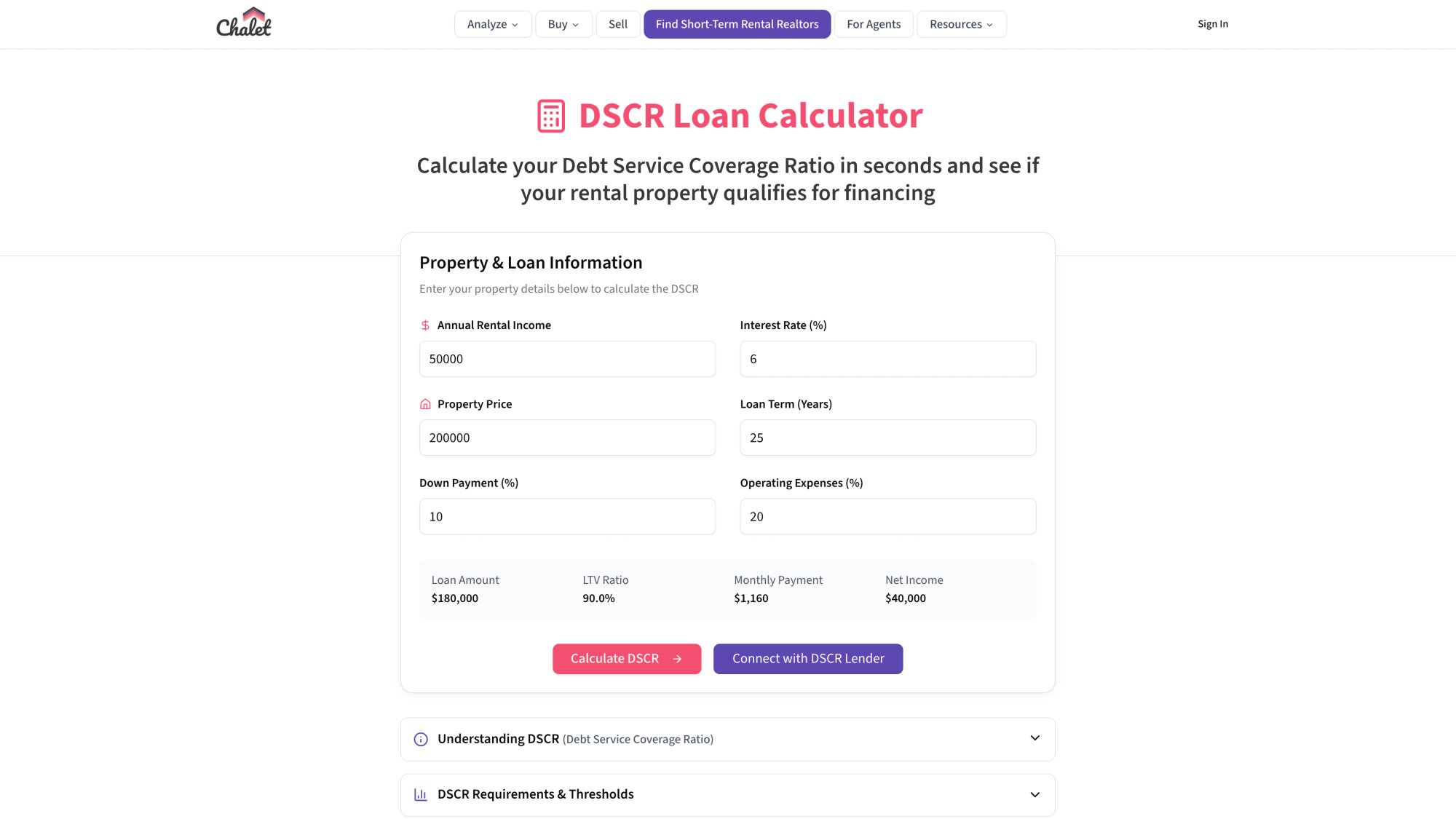

Chalet move: If you're comparing "15% down conventional" versus "20-25% down DSCR," plug both scenarios into our DSCR Calculator and compare the cash flow after debt service, not just "down payment saved." Sometimes the "cheaper" option costs you more in monthly payments. Learn more about short-term rental financing options before making your decision.

DSCR Loan Down Payment: 20-25% Down to Qualify on Property Income

DSCR (Debt Service Coverage Ratio) loans are specifically built for real estate investors, especially those buying short-term rentals.

Instead of focusing primarily on your W-2 income, lenders evaluate whether the property's income can cover the mortgage payment. This is typically expressed as:

DSCR = rental income ÷ PITIA (principal, interest, taxes, insurance, association fees)

Down payment reality:

• Many DSCR programs require around 20-25% down, depending on the property's projected cash flow and your financial profile

• Real-world DSCR lending often ends up at 20-25% down once you factor in DSCR targets, credit requirements, reserve expectations, and how the lender underwrites short-term rental income

Don't ignore reserve requirements:

DSCR lenders commonly require significant liquidity reserves (cash or investments) in addition to your down payment. Industry standards often cite 6-12 months of PITIA reserves as a common range for DSCR programs.

When Path 4 wins:

You're self-employed, high-income but "tax return poor," or scaling properties quickly

You want to hold the loan in an LLC (some DSCR lenders allow this)

You want underwriting focused on the property's performance instead of your personal income

Chalet move: Start by getting matched with STR-savvy lenders through Chalet's Airbnb Loans & Financing network. Then validate their income underwriting assumptions using our free Airbnb Analytics platform to see real market data for your target city. Understanding how to qualify for DSCR loans can help you prepare the right documentation.

All Cash Purchase or Hard Money Bridge Loans

Some investors buy properties in cash and refinance later. Others use bridge or hard money loans for the initial purchase.

This approach can be fast, but it comes with trade-offs:

• Interest rates and fees can be steep

• Cash-out refinancing timing and LTV limits matter

• You still need reserves and setup capital after closing

For most first-time buyers, this isn't the easiest or cheapest route unless you're facing a time crunch (like certain 1031 exchange situations) or buying a property that needs major rehab work and won't qualify for traditional financing upfront.

Total Cash Needed to Buy an Airbnb: Beyond the Down Payment

Most "down payment" articles stop way too early. Investors get blindsided at closing because they didn't budget for the complete cash requirements stack.

Here's what you actually need to plan for:

| Cash Requirement Category | Typical Amount | What It Covers |

|---|---|---|

| Down Payment | 3% to 25%+ of purchase price | Portion you're paying in cash instead of borrowing |

| Closing Costs | 2-5% of loan amount | Origination, appraisal, title, escrow, recording, prepaid taxes/insurance |

| Reserves | Varies by loan type | Cash you need after closing (often 6-12 months PITIA for DSCR) |

| Furnishing & Setup | $10,000 to $50,000+ | Furniture, décor, linens, smart locks, safety compliance, photos, staging |

| Appraisal Gap Buffer | Variable (depends on market) | Cash to cover difference if appraisal comes in low |

What Are Closing Costs for an Airbnb Purchase?

Closing costs are separate from your down payment. According to Fannie Mae's closing cost guidance, these costs commonly fall in the 2% to 5% range of the mortgage amount (though this can vary by location, loan type, and property specifics).

Closing costs typically include:

Loan origination fees

Appraisal and inspection fees

Title insurance and escrow fees

Recording fees and transfer taxes

Prepaid property taxes and insurance

How Much Cash Reserve Do You Need After Closing?

Reserves are the "extra" money you still have in your accounts after paying the down payment and closing costs.

• DSCR programs commonly require meaningful reserves, with many programs expecting 6-12 months of PITIA in liquid reserves after closing.

• Conventional loans have reserve requirements that vary by scenario and can increase for second homes, investment properties, and borrowers with multiple financed properties.

Lenders want to know you can handle a few months of vacancy or unexpected repairs without immediately defaulting.

Airbnb Furnishing and Setup Costs: The Hidden Expense

This is the big one that's unique to short-term rentals:

Furniture and décor

Quality linens and supplies

Smart locks, thermostats, security cameras (where legally allowed)

Safety compliance (smoke detectors, CO detectors, fire extinguishers, emergency signage if required)

Initial repairs, painting, and touch-ups

Professional listing photos

Initial cleaning and staging

The honest answer? It depends. You'll see ranges from $10,000 to $50,000+ depending on property size and target finish level. Check out our Airbnb furnishing budget guide for detailed breakdowns by property size. The only way to know for sure is to model it line-by-line in your underwriting spreadsheet.

Chalet move: After you run the numbers through our Airbnb Calculator, treat furnishing and setup as a separate "capex at launch" bucket. Don't pretend year-one cash flow is real until you've accounted for this upfront investment. Also review our Airbnb startup costs breakdown for a complete checklist.

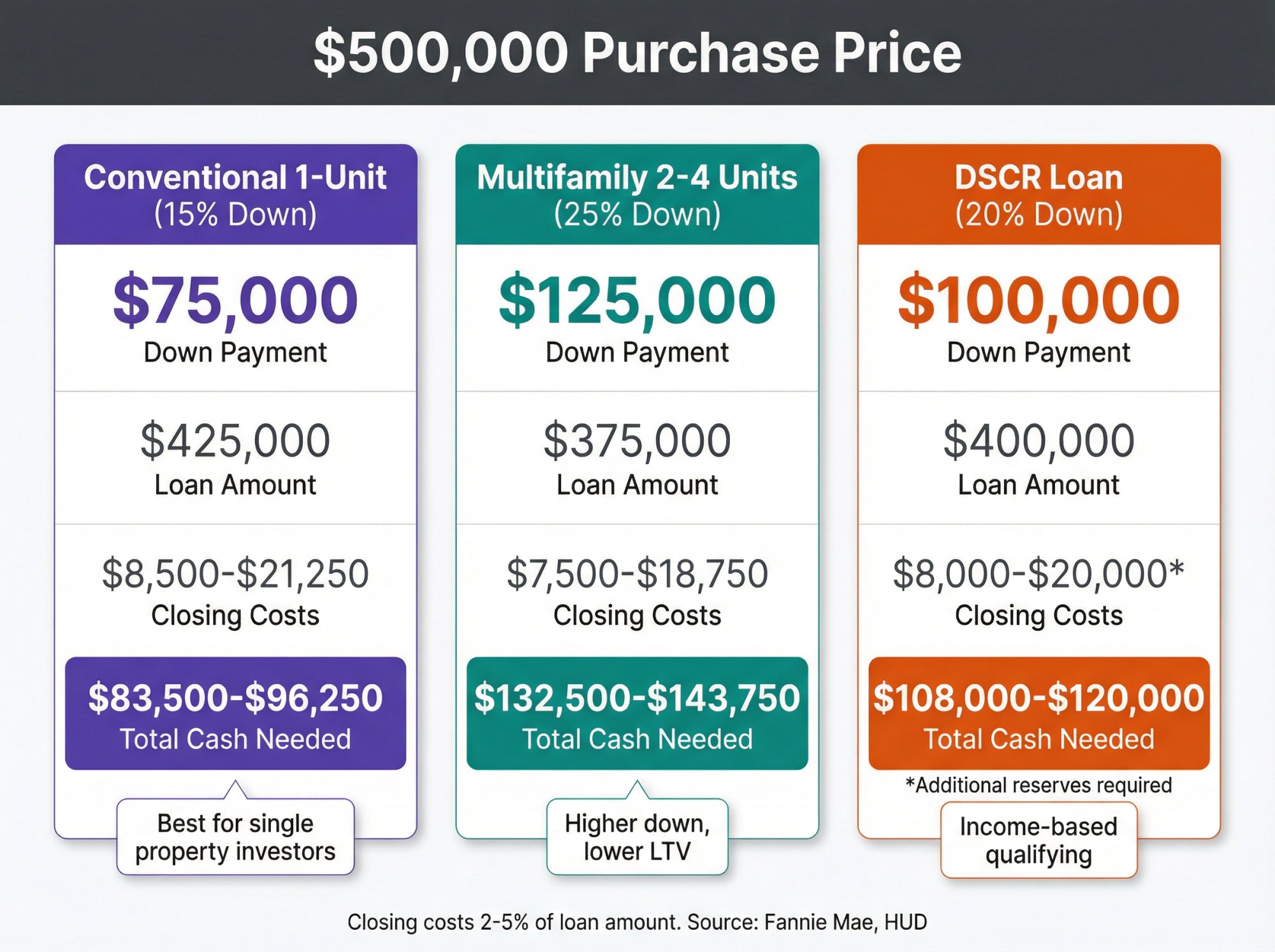

Real Cash-to-Close Examples (So You Stop Guessing)

Let's use a clean example purchase price: $500,000

We'll apply conservative planning ranges based on the sources cited above:

Closing costs: 2-5% of mortgage amount

DSCR reserves: Often requires significant reserves (varies by lender)

Example A: Conventional Investment (1-Unit) at 15% Down

Down payment (15%): $75,000 (source)

Loan amount: $425,000

Closing costs (2-5% of $425,000): ~$8,500 to $21,250 (source)

Furnishing/setup: (your custom number; don't skip this)

Cash planning takeaway: Even before furniture and setup, you're looking at roughly $83,500 to $96,250 in cash needed at closing.

Example B: Conventional Investment (2-4 Units) at 25% Down

Down payment (25%): $125,000 (source)

Loan amount: $375,000

Closing costs (2-5% of $375,000): ~$7,500 to $18,750 (source)

Cash planning takeaway: You're roughly at $132,500 to $143,750 before furniture, setup, and reserve requirements.

Example C: DSCR Loan at 20% Down

Down payment (20%): $100,000 (industry standard for investor-focused programs)

Loan amount: $400,000

Closing costs (2-5% of $400,000): ~$8,000 to $20,000 (source)

Reserves: Often required, sometimes measured in months of PITIA (varies widely by lender and property)

Cash planning takeaway: DSCR loans can look like "only 20% down," but they frequently require large cash-on-hand reserves that can push your total cash needed significantly higher. Explore building an Airbnb empire with DSCR loans to understand the scaling potential.

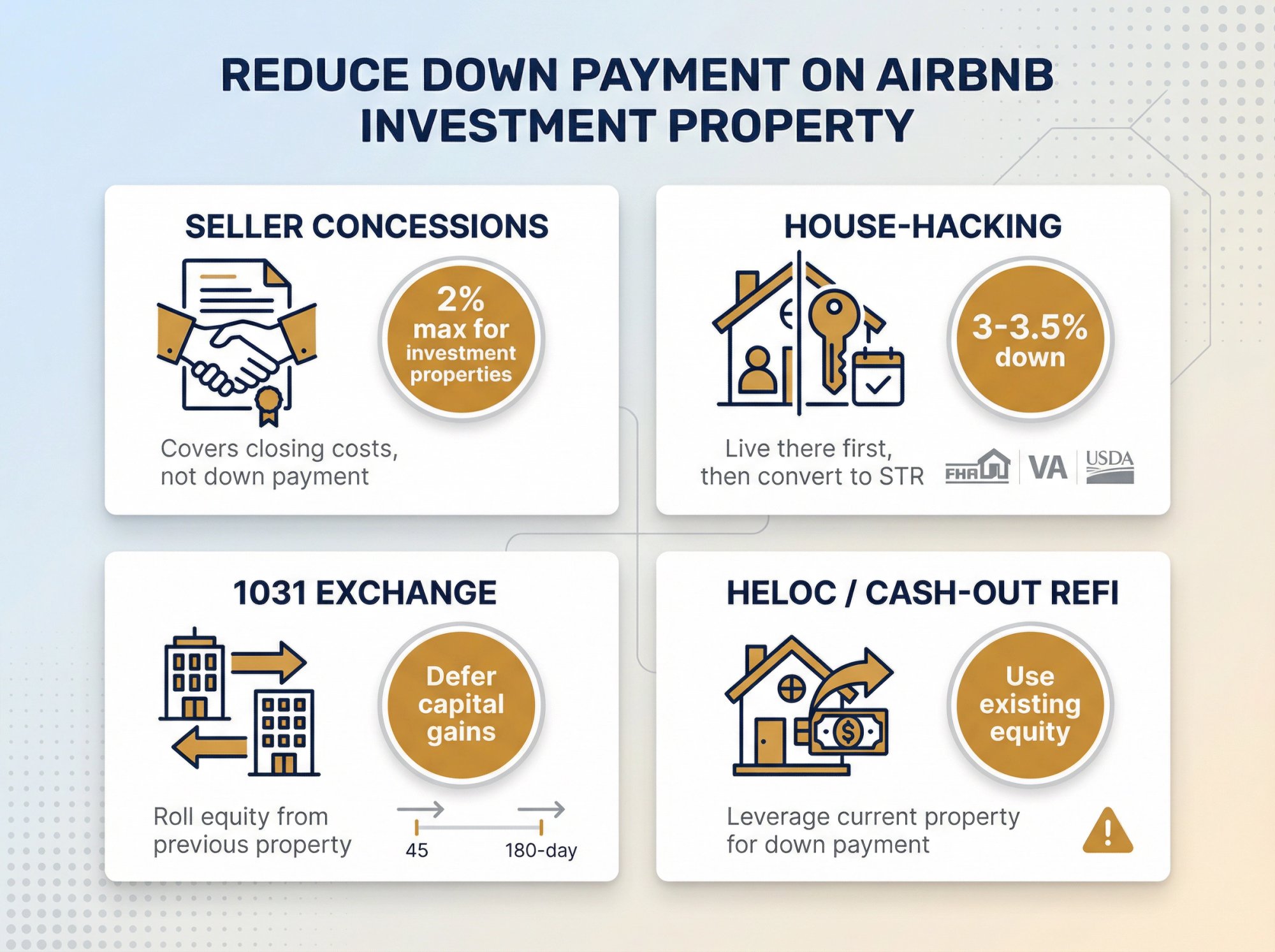

How to Lower Your Airbnb Down Payment (Legally)

Using Seller Concessions to Reduce Closing Costs

Seller credits can often cover part of your closing costs, within specific limits. But they can't be used for the down payment on Fannie Mae loans.

Also, investment properties typically have tighter concession caps. For example, Fannie Mae's table shows a 2% maximum financing concession limit for investment property purchases.

Practical move: Negotiate seller credits strategically to free up cash for furnishing and reserves, not to pretend your down payment requirement got smaller.

Live in the Property First Then Convert to STR

For many first-time investors, the cheapest capital stack is:

Buy as a primary residence using a low-down-payment program (FHA, conventional, VA, USDA)

Live there legitimately for the required occupancy period

Rent out part or all of the property later (as allowed by loan terms and local STR rules)

This isn't a hack or a loophole. It's using the programs exactly as intended. But you absolutely must comply with occupancy requirements and local STR regulations. Read our guide on investing in your first Airbnb rental for the complete roadmap.

How 1031 Exchange Can Reduce Cash Needed

If you're selling another investment property, 1031 exchange proceeds can function like your equity or down payment on the replacement property. Lenders still enforce LTV requirements, but your exchange proceeds can dramatically reduce the amount of new cash you need to bring to closing.

Chalet move: Pair tight 1031 exchange timelines with execution-focused help (agent + lender + regulation checks) by starting with Chalet's Airbnb real estate agents and Airbnb loans networks. Learn about common 1031 exchange mistakes to avoid.

Using HELOC or Cash-Out Refinance for Down Payment

If you already own a home, a HELOC or cash-out refinance can supply the down payment for your STR investment. This strategy can work, but it increases your overall leverage and risk profile (you've now financially tied multiple properties together).

Use this option thoughtfully, and make sure you're stress-testing cash flow scenarios where both properties could experience vacancies simultaneously. Consider reading about refinancing your Airbnb into a DSCR loan as an alternative strategy.

4 Biggest Down Payment Mistakes STR Investors Make

These are the errors that cost investors thousands (or kill deals entirely):

| Mistake | Why It Hurts | How to Avoid It |

|---|---|---|

| Assuming "Airbnb Income" Automatically Helps You Qualify | Second home: rental income can't be used for qualifying. Conventional: conservative estimates. DSCR: income haircuts & stricter ratios. | Don't count on STR income unless you know exactly how your lender underwrites it |

| Aiming for Minimum Down Payment When Your DSCR Is Already Tight | Lower down payment = higher mortgage payment = worse cash flow during slow seasons | Model different down payment scenarios to see impact on monthly cash flow |

| Forgetting Investment Property Seller Credits Are Capped Tighter | Investment properties have lower allowable concessions (often 2% max) | Check seller credit limits before you negotiate the purchase contract |

| Ignoring the Market's Regulation Risk | A lower down payment doesn't matter if the city bans STR permits 6 months after you close | Check local STR rules before you commit to any specific deal |

Why You Can't Count on Airbnb Income to Qualify

Second home: Fannie Mae explicitly states that rental income can be identified but can't be used for qualifying if you want second home loan delivery.

Conventional investment: You usually qualify based on your personal income, plus lender-underwritten rental income estimates (and most lenders are conservative when projecting STR income). Learn more about estimating your Airbnb income potential.

DSCR: STR income assumptions matter enormously, and lenders often apply haircuts to your projected income or require stronger DSCR ratios and lower LTV to compensate for short-term rental volatility.

Why Minimum Down Payment Can Kill Your Cash Flow

Down payment isn't just about "cash needed." Your down payment amount directly impacts:

Monthly mortgage payment

Debt service coverage ratio (DSCR)

Interest rate and pricing

How resilient your deal is during slow seasons

The inconvenient truth: Sometimes the "best" financial decision is putting more down to avoid buying a cash-flow-negative asset that bleeds money every winter.

Use our DSCR Calculator to model different down payment scenarios and see the impact on monthly cash flow.

Investment Property Seller Concession Limits

Investment properties typically have lower allowable seller concessions than primary homes.

If you're counting on the seller to cover 5% of your costs, you might discover too late that your loan program won't allow it. Check these limits before you negotiate the purchase contract.

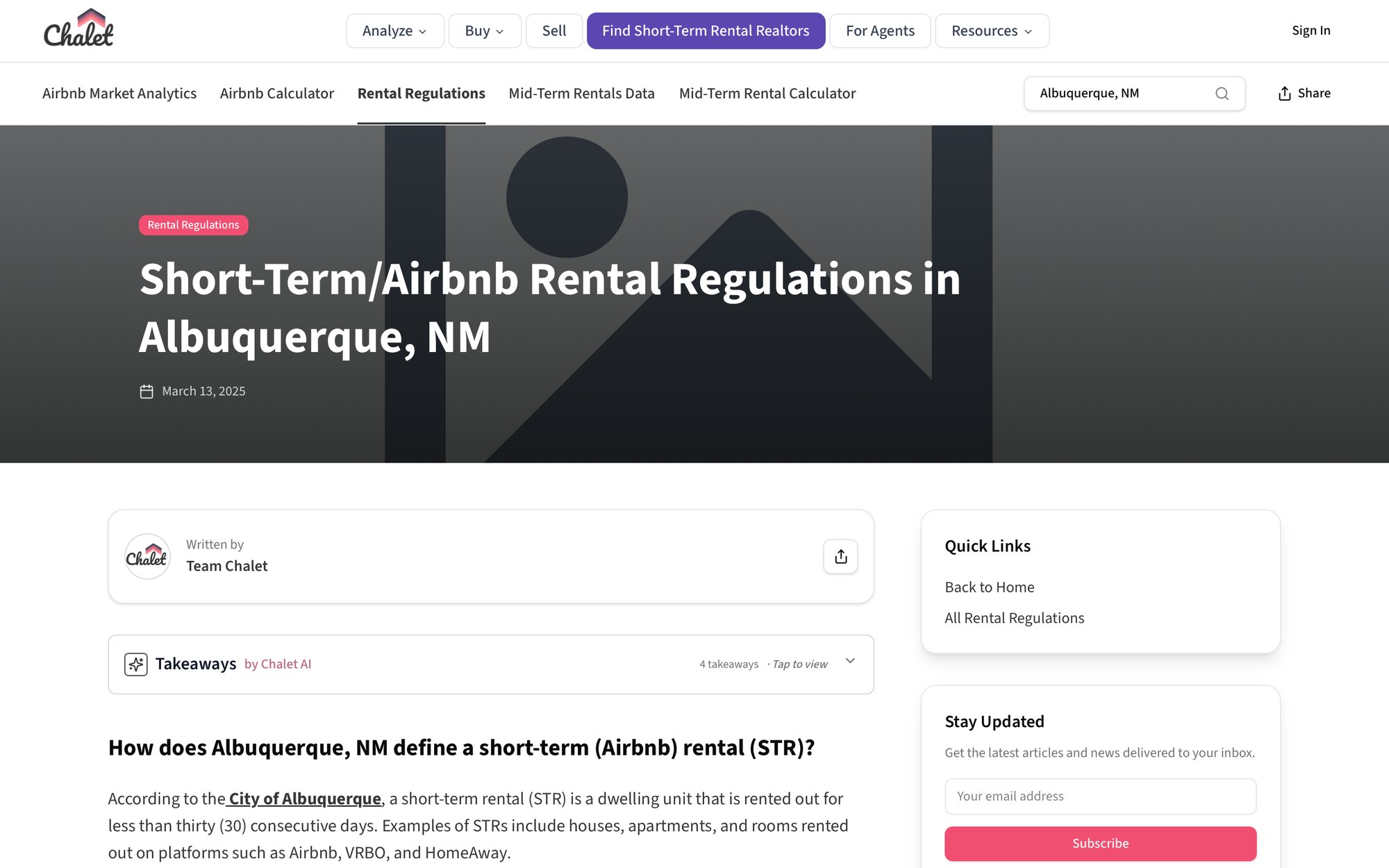

Why Local STR Regulations Matter More Than Down Payment

A lower down payment doesn't matter if the city bans STR permits or caps new registrations six months after you close.

Chalet move: Use Chalet's rental regulations library to check local rules before you get emotionally (or financially) committed to a specific deal. Read our guide on navigating local STR regulations for practical tips.

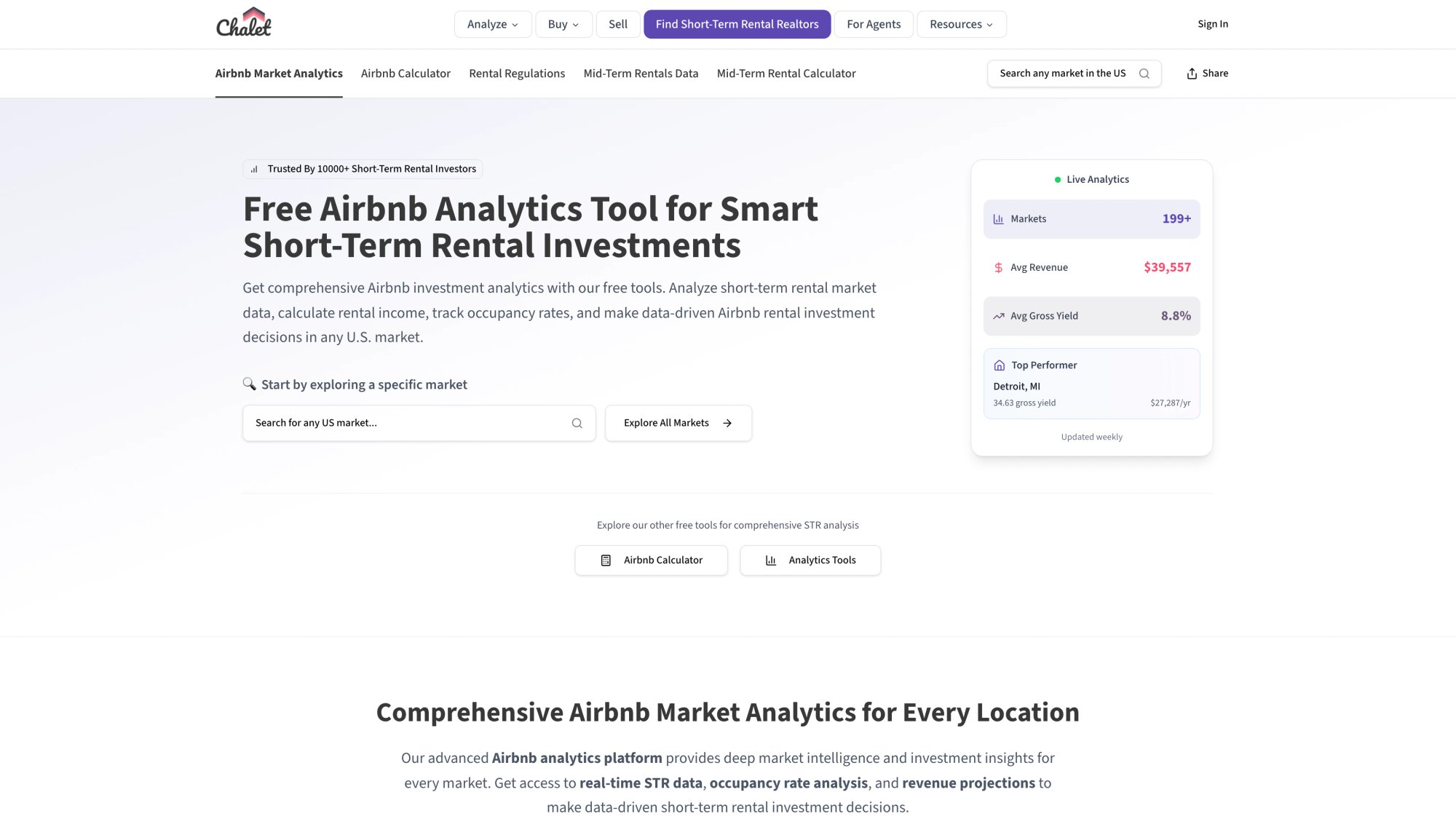

How Chalet Makes This Entire Process Smoother

Figuring out down payments, cash-to-close calculations, and loan types is just the beginning. The real challenge is coordinating market analysis, financing, legal compliance, agent selection, property management setup, and furnishing logistics without losing your mind.

That's where Chalet comes in.

What Chalet Actually Does

Chalet is the one-stop platform for short-term rental investors. We pair free market analytics with a vetted vendor network so you can research, buy, finance, and operate in one place.

Here's how it works:

1) Free Analytics & Tools (No Paywall, Ever)

- Airbnb Calculator: Model revenue, expenses, and cash flow for any address. Toggle different down payment scenarios to see what actually cash-flows. See why it's considered the best Airbnb calculator in the industry.

- DSCR Calculator: Compare conventional vs DSCR financing side-by-side to see which loan structure gives you better monthly cash flow.

Airbnb Analytics: Access market dashboards with real ADR, occupancy, and revenue trends across multiple cities. It's the best free alternative to AirDNA (no subscription required).

Rental Regulations Library: Check local STR laws, permit requirements, and registration processes before you make an offer.

2) Vetted Vendor Network (STR Specialists, Not Generalists)

Finding the right professionals is half the battle. Chalet connects you with:

- Airbnb Real Estate Agents: Agents who actually understand STR markets, comps, and zoning rules. Discover the benefits of working with investor-friendly realtors.

Airbnb Loans & Financing: Lenders who specialize in DSCR, 1031 exchanges, and short-term rental underwriting. Learn about DSCR financing for short-term rentals.

STR Operations Directory: Property managers, cleaning services, furnishing companies, insurance providers, and more.

3) One-Stop Execution (From Research to Revenue)

Instead of coordinating five different tools, three lender conversations, and a dozen vendor introductions yourself, Chalet handles the orchestration:

• Research markets using free analytics

• Run deal scenarios with real calculators

• Get matched with STR-savvy agents and lenders

• Verify legal compliance through our regulation library

• Connect with property managers and setup vendors

All in one platform. No subscriptions. No upsells. No runaround.

Why Investors Choose Chalet

Transparency: Clear assumptions. No hidden fees. No subscription paywalls for analytics.

Breadth: Everything you need under one roof instead of juggling five different platforms.

Execution focus: We're not just giving you data. We're connecting you with professionals who can actually close your deal.

STR-specific: Unlike general real estate portals, every tool and vendor is vetted specifically for short-term rental investing. Learn more about what Chalet is and why thousands of investors trust our platform.

Ready to Get Started?

→ Run your first deal scenario: Airbnb Calculator

→ Compare financing options: DSCR Calculator

→ Explore markets: Airbnb Analytics

→ Check local rules: Rental Regulations

→ Find your agent: Airbnb Real Estate Agents

→ Get financing: Airbnb Loans

→ Browse properties: Airbnbs for Sale

Chalet exists to make STR investing less chaotic and more profitable. Start exploring the platform today.

Frequently Asked Questions

Is there an Airbnb-specific down payment requirement?

No. Airbnb (the platform) isn't your lender. Your down payment is determined by the mortgage program you qualify for and how the property is classified (primary residence, second home, or investment property). Source: Fannie Mae Eligibility Matrix

Can I buy an Airbnb property with 10% down?

Sometimes, but usually only if it qualifies as a second home (1-unit) with genuine borrower occupancy and strict adherence to Fannie Mae's second home requirements. You also can't use rental income to qualify under second home delivery rules.

If you're not planning to use the property personally, treat it as an investment property and plan for a higher down payment.

Can I buy an investment property with 15% down?

Yes. 1-unit conventional investment properties can be approved up to 85% LTV (15% down) under Fannie Mae guidelines.

Your specific lender may require 20% or more based on overlays (additional lender requirements for credit, property type, market risk, etc.).

Do I need 20% down for an investment property?

Not always. Conventional guidelines allow 15% down for 1-unit investment purchases.

But many investors voluntarily choose 20% or more for better interest rate pricing, stronger DSCR, and improved margin-of-safety during slow seasons.

Can I buy an Airbnb with 0% down?

0% down programs (like VA loans and USDA loans) are designed for primary residences where you'll actually live.

If you're not planning to occupy the property, you'll need to use investment property or DSCR financing (which requires 15-25%+ down depending on loan type).

Can the seller pay my down payment?

On Fannie Mae loans, no. Interested party contributions (seller concessions) can't be used for the down payment, reserves, or minimum borrower contribution.

They can often help with closing costs, within specific limits (which are tighter for investment properties).

What's a "normal" down payment people actually make right now?

According to the National Association of Realtors' 2025 Home Buyers and Sellers Profile (covering transactions from July 2024 to June 2025):

Median down payment overall: 19%

First-time buyers: 10%

Repeat buyers: 23%

That's not STR-specific data, but it's a reality check: most buyers in today's market aren't doing 3% down deals.

What if my credit score isn't perfect?

Lower credit scores typically mean:

Higher down payment requirements

Higher interest rates

Stricter reserve requirements

More limited loan program options

DSCR loans can sometimes be more flexible with credit (since they focus on property income), but you'll still face higher rates and potentially 25%+ down payment requirements.

Work on improving your credit score before you start shopping if possible. Even a 20-30 point improvement can unlock better loan terms.

How do I know if DSCR or conventional is better for me?

Use conventional if:

You have strong W-2 or documented self-employed income

You want lower interest rates

You qualify comfortably on personal debt-to-income ratio

You're comfortable with 15-25% down

Use DSCR if:

You're self-employed and "tax return poor"

You're scaling quickly and personal income is maxed out

You want to qualify based on the property's income potential

You're comfortable with 20-25%+ down and higher rates

Run both scenarios through Chalet's DSCR Calculator to compare monthly cash flow and total cost of capital. Also review our guide on getting a mortgage for an Airbnb property.

Can I buy in an LLC with these loan programs?

Conventional (Fannie/Freddie): Generally no. Most conventional loans require personal borrowers.

DSCR: Some DSCR lenders allow LLC borrowers. This varies by lender.

Portfolio lenders: May allow LLC purchases but often with higher rates and down payments.

If LLC ownership is important to you (for liability protection or tax planning), DSCR or portfolio lending is typically your best path. Read about deciding whether to buy in your name or through an LLC. Consult with your attorney and CPA before making this decision.

What about portfolio lenders or local banks?

Portfolio lenders (banks that keep loans on their own books instead of selling to Fannie/Freddie) can offer more flexibility:

Custom loan structures

LLC borrowers sometimes allowed

More lenient on property types

May consider non-traditional income

But trade-offs usually include:

Higher interest rates

Larger down payments (often 25-30%+)

Shorter loan terms or balloon payments

Geographic restrictions

If you're dealing with unique property types, complex tax situations, or need LLC ownership, portfolio lenders are worth exploring. Connect with STR-focused lenders through Chalet's Airbnb Loans network to find portfolio options.

Your Next Steps: Turn Down Payment Guesswork Into an Actual Plan

Step 1: Run the property numbers first

Use Chalet's free Airbnb Calculator to model revenue, expenses, and cash flow. Toggle different loan types and down payment scenarios until you see what actually produces positive cash flow. Also explore our comprehensive analysis of STR markets.

Step 2: Check legality before underwriting gets serious

Use Chalet's rental regulations library to confirm STRs are allowed in your target market and understand permit requirements, caps, or registration processes.

Step 3: Get financing options tailored to your strategy

If you're leaning toward investor financing, start with Chalet's Airbnb Loans & Financing network. We'll match you with STR-savvy lenders (not spam you with generic mortgage offers).

Step 4: Find properties and agents with STR context baked in

Browse Airbnb properties for sale or connect with a short-term rental specialist through Chalet's Airbnb Real Estate Agents network.

About Chalet: We're the one-stop platform for short-term rental investors. Chalet pairs free market analytics with a vetted vendor network (STR-specialist agents, lenders, insurance, managers, and more) so you can research, buy, and operate in one place. Explore the data and connect with pros at getchalet.com.