If you're thinking about starting an Airbnb rental business (what we call short-term rentals, or STRs), you're not just buying a property. You're launching a small hospitality operation. Most first-time investors make the same mistake: they budget for the down payment and then get blindsided by everything else. The furniture bill. The license fees. The insurance upgrade. The smart lock. The professional photos. The initial supplies. The cash reserve so you don't panic after one slow month.

This guide breaks down every cost you'll face, using real 2026 data. No hand-wavy ranges. Just the actual numbers you need to build a budget that won't surprise you later.

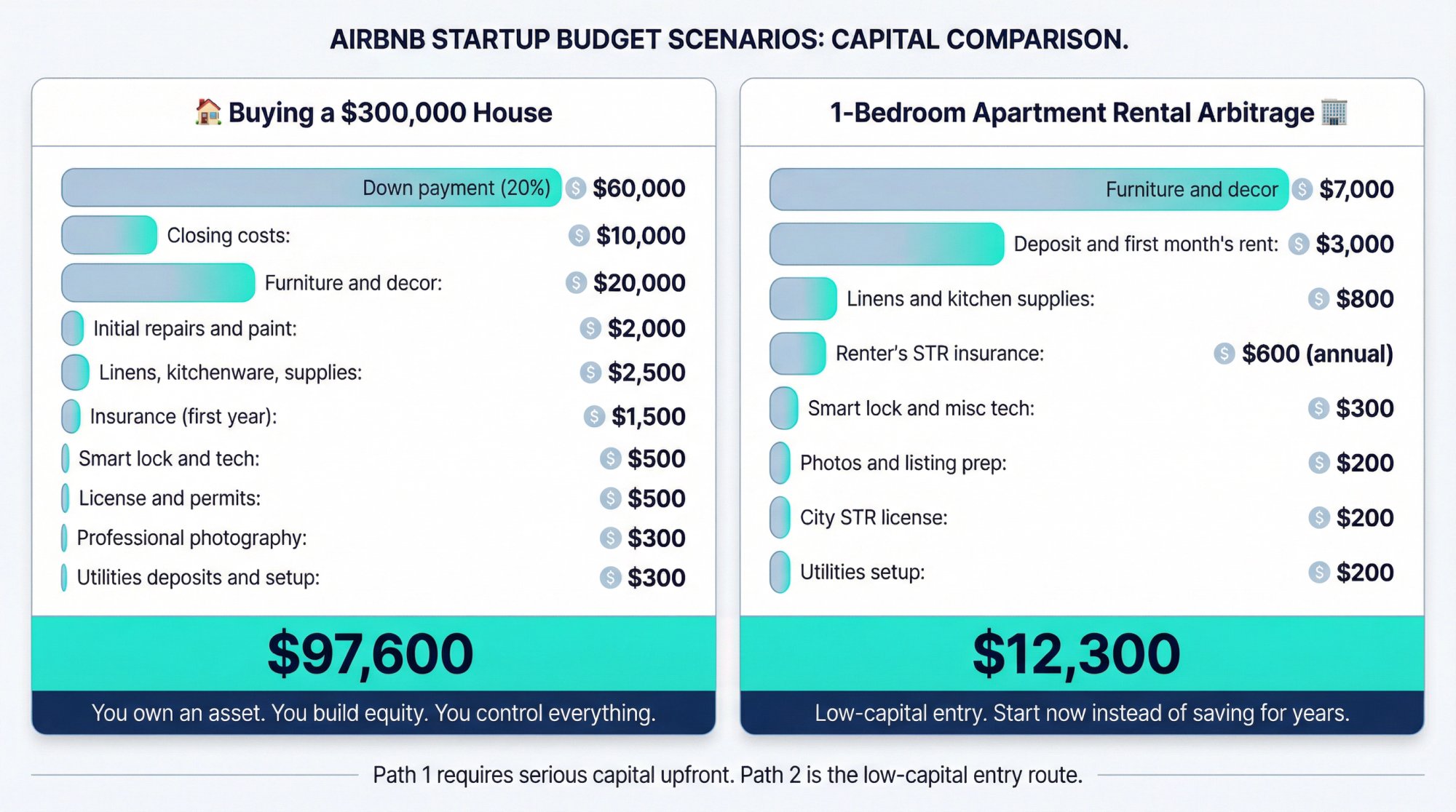

Buying Property vs Renting: Which Path Costs Less?

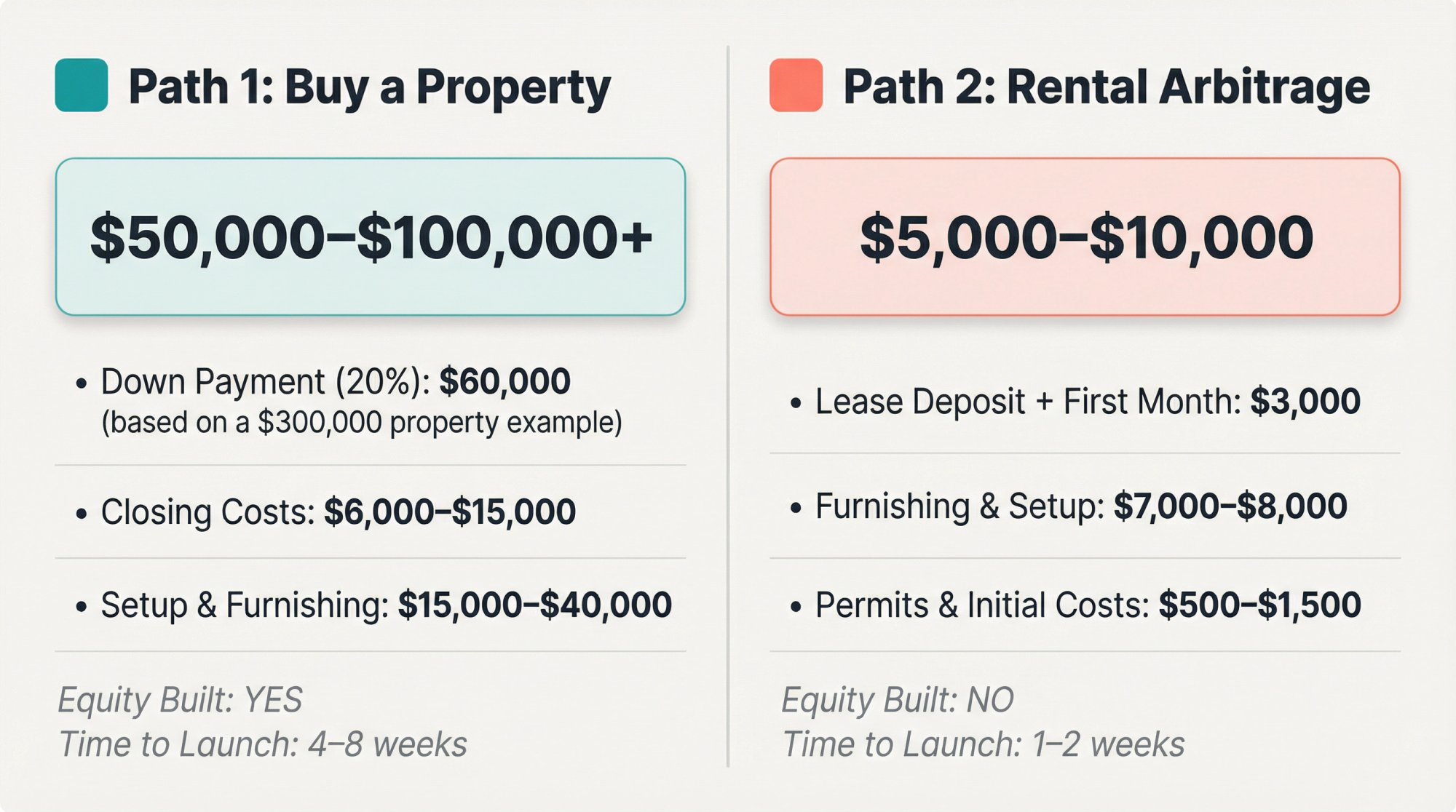

Before we get into line items, understand that your startup budget depends entirely on which path you take:

Path 1: Buying a property. This requires serious capital upfront. Think $50,000 to $100,000 or more just to get the keys. You're looking at a down payment of 15-25% (20% is standard for investment properties), plus closing costs that typically run 2-5% of the loan amount. On a $300,000 home, you're writing checks for $60,000 down, another $6,000 to $15,000 in closing costs, and then all the setup expenses we'll cover below.

The payoff? You own an asset. You build equity. You control everything.

Path 2: Rental arbitrage (leasing to sublet). This is the low-capital entry route. You're typically looking at $5,000 to $10,000 total to secure a lease and furnish a unit. First month's rent, security deposit, maybe last month upfront. Then basic furnishing. That's it.

The catch? You own nothing. No equity. And you absolutely need explicit landlord permission plus local rule compliance. But you can start now instead of saving for years.

At Chalet, we help investors analyze both paths with free market data and ROI calculations. Whether you're buying or leasing, the real question is: what does it actually cost to go from empty space to bookable listing?

What Are the Total Startup Costs for an Airbnb?

When you search "Airbnb startup costs," you're not just looking for a number. You're trying to figure out:

• How much cash do I need before my first guest checks in?

• What's one-time versus ongoing?

• What's optional versus non-negotiable? (Spoiler: licenses, safety gear, and insurance aren't optional.)

• What are the hidden costs that wreck my pro forma?

• How do I build a budget I can actually trust?

By the end of this guide, you'll have exact numbers for your launch budget, your monthly operating costs, and your minimum cash reserve (the runway that keeps you from panicking).

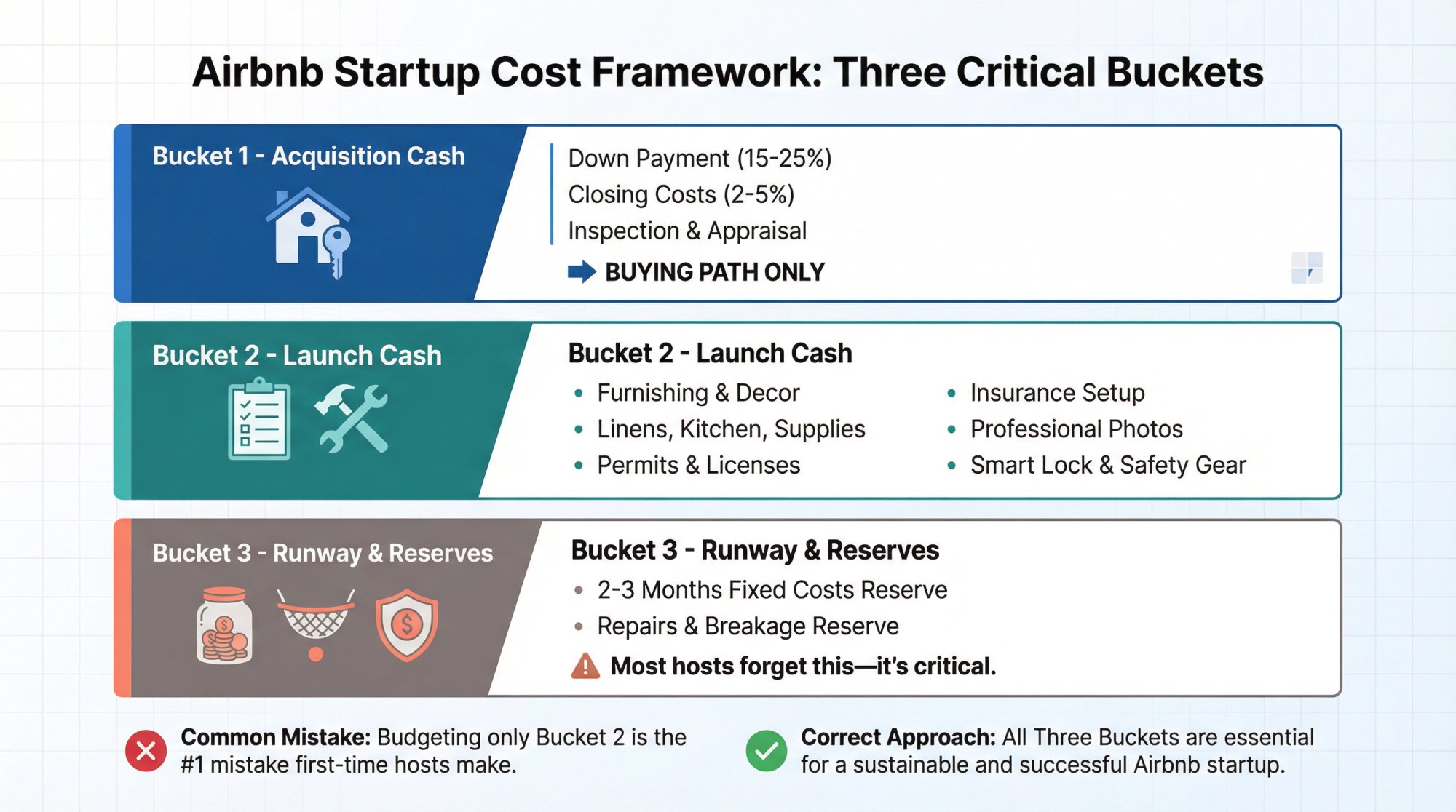

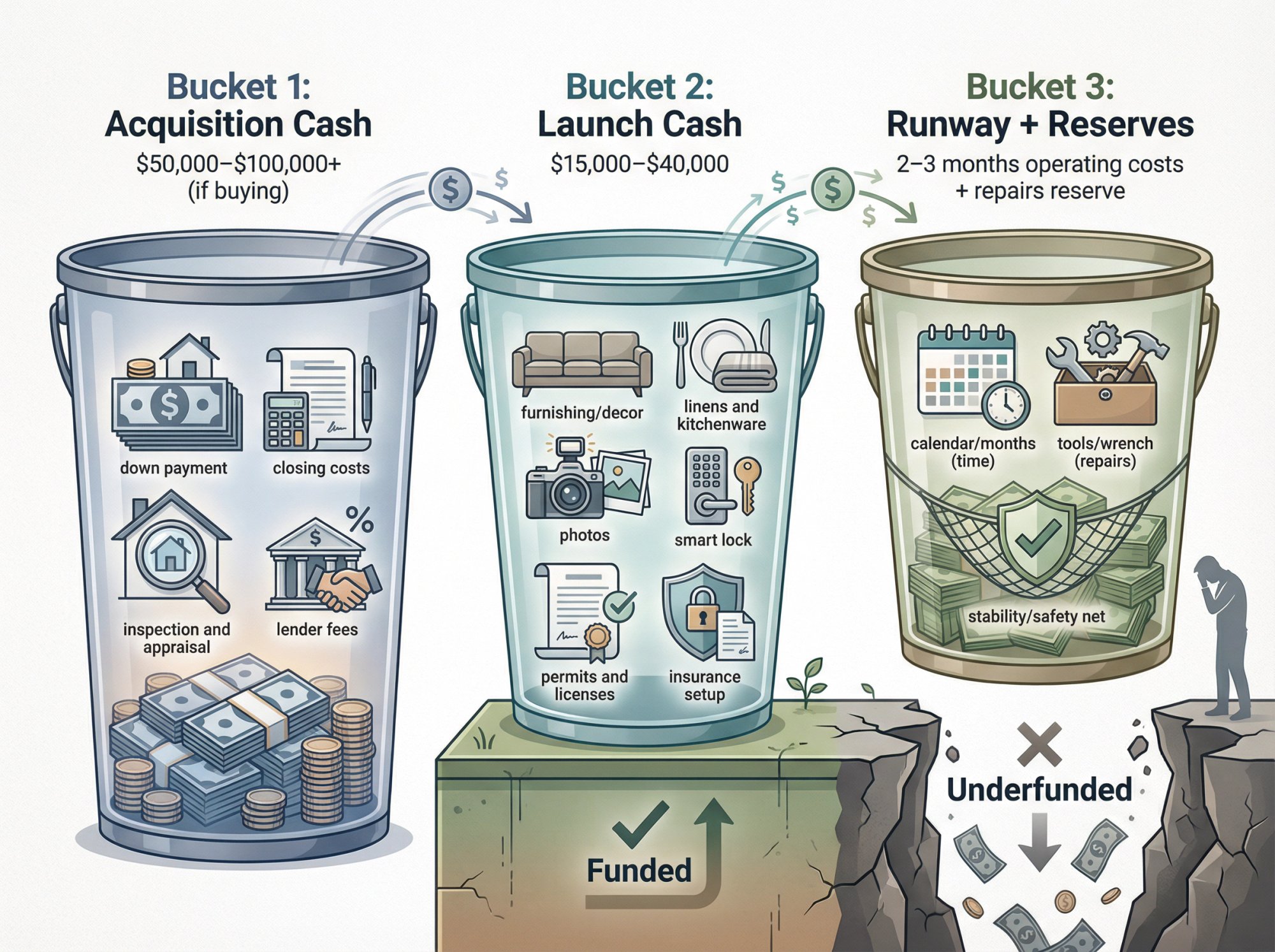

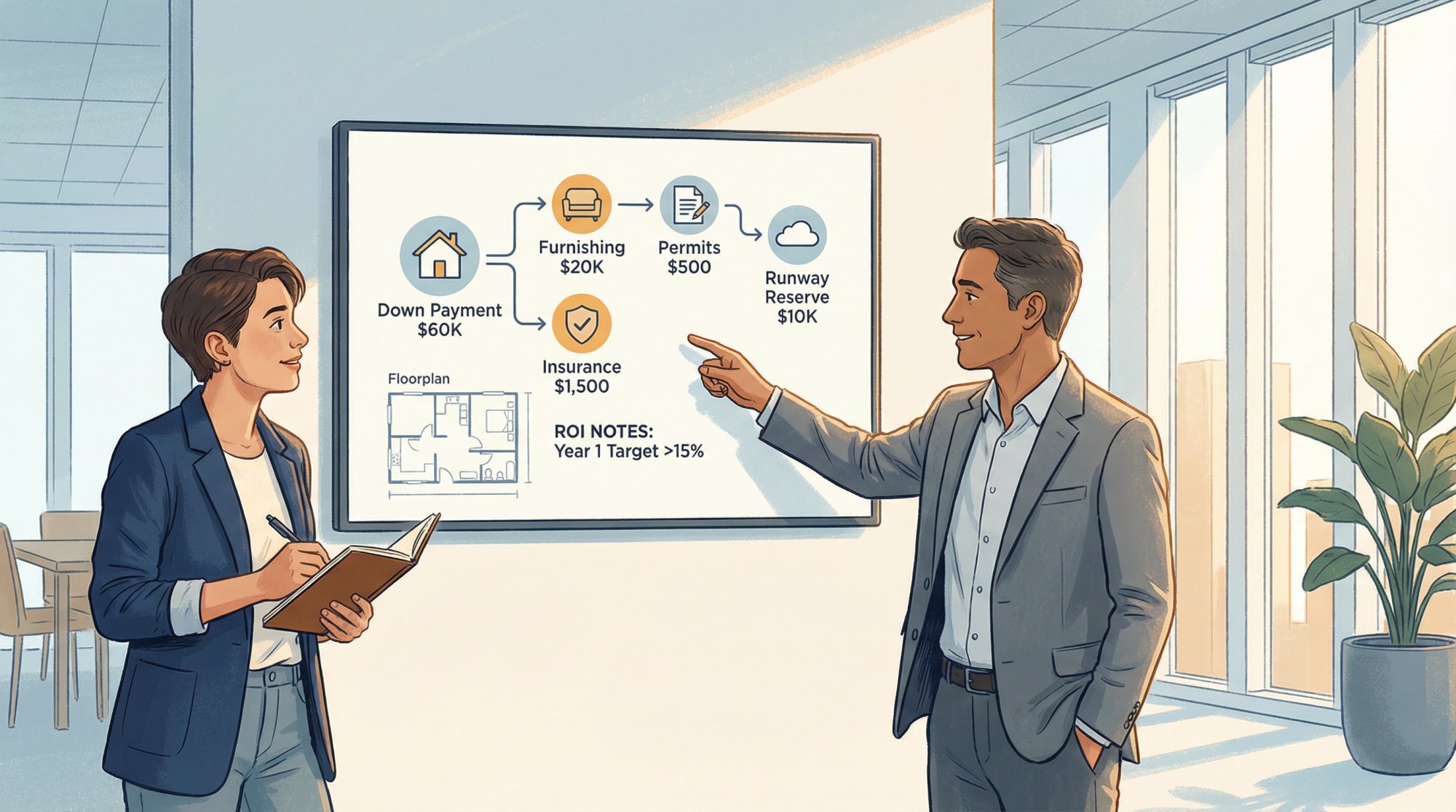

How to Budget for Airbnb Startup Costs

Most startup cost articles only cover furnishing. That's why people run out of money. The reality is you need to budget for three distinct buckets:

Bucket 1: Acquisition Cash (only if buying)

-

Down payment

-

Closing costs, inspection, appraisal, lender fees

Bucket 2: Launch Cash (getting from empty to bookable)

-

Furnishing and decor

-

Linens, kitchenware, all the small stuff

-

Photos, smart lock, initial supplies

-

Permits and licenses

-

Insurance setup

Bucket 3: Runway + Reserves (so you don't die in month two)

-

One to three months of fixed costs

-

Repairs and breakage reserve

Critical insight: Most hosts only budget for Bucket 2. Investors get wrecked by forgetting Buckets 1 and 3. Your safety margin is what separates a profitable first year from a panic sale.

How Much Is an Airbnb Down Payment and Closing Costs?

If you're purchasing a property, these are usually your first real checks.

What Is the Down Payment for an Airbnb Investment Property?

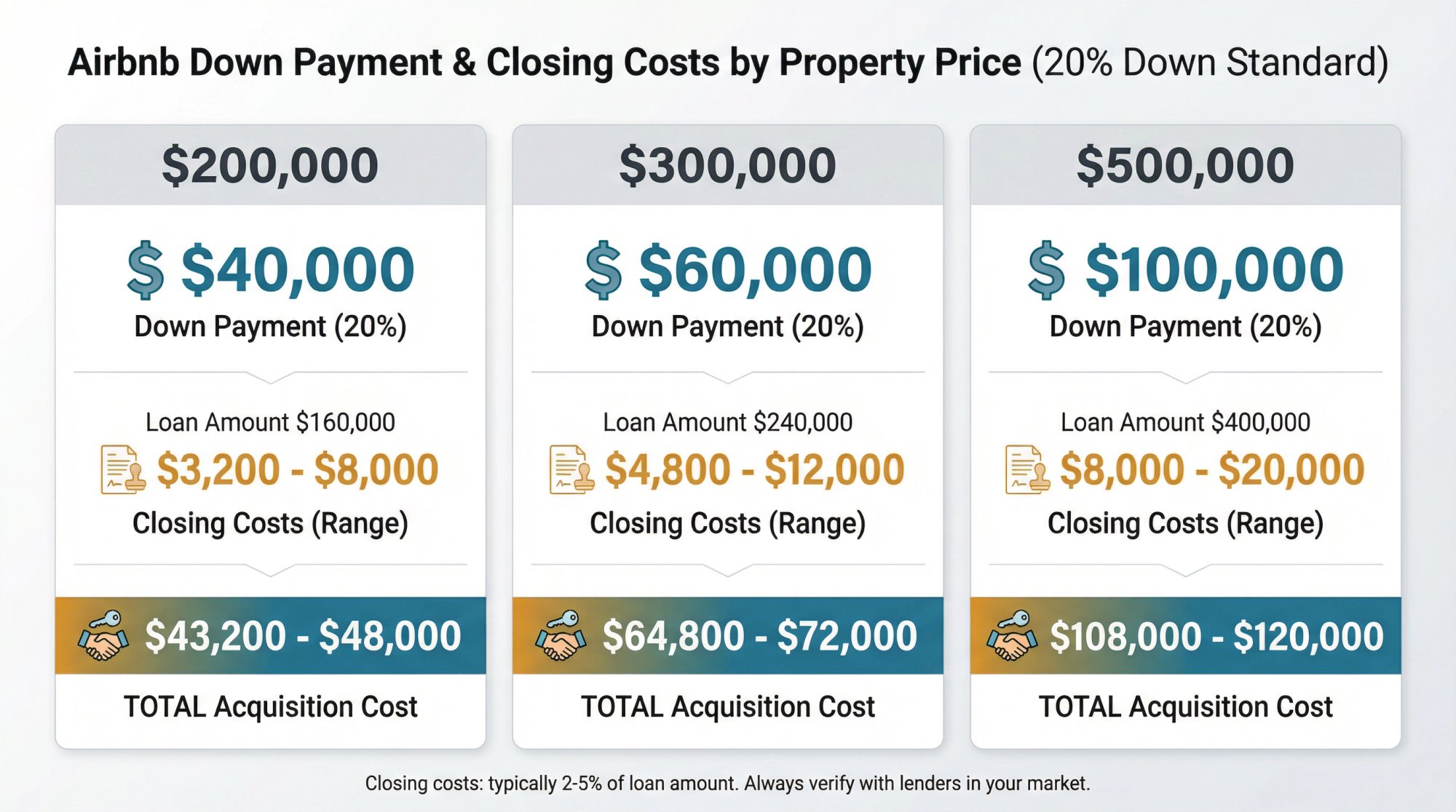

Investment property lenders typically want 15-25% down, with 20% being the standard. Do the math:

| Property Price | Down Payment (20%) |

|---|---|

| $200,000 | $40,000 |

| $300,000 | $60,000 |

| $500,000 | $100,000 |

This is the biggest barrier for most people. And it's why rental arbitrage has become popular (you can skip this entirely if you're leasing).

How Much Are Closing Costs on an Airbnb?

Closing costs run 2-5% of the loan amount. What's inside that number?

→ Appraisal (typically $314 to $423)

→ Home inspection (average $296 to $424)

→ Title insurance and escrow

→ Lender fees

→ Recording fees

→ Prepaid items (taxes, insurance)

On a $300,000 purchase with a $240,000 loan (after your 20% down), closing costs might be $4,800 to $12,000.

Don't skip the inspection trying to save $350. You'll pay for it later.

Should I Calculate Airbnb Costs Before Making an Offer?

Before you make an offer, use our STR calculator to model realistic upfront costs. Then talk to one of our Airbnb-friendly agents who can help you understand what properties in your target market actually cost to close.

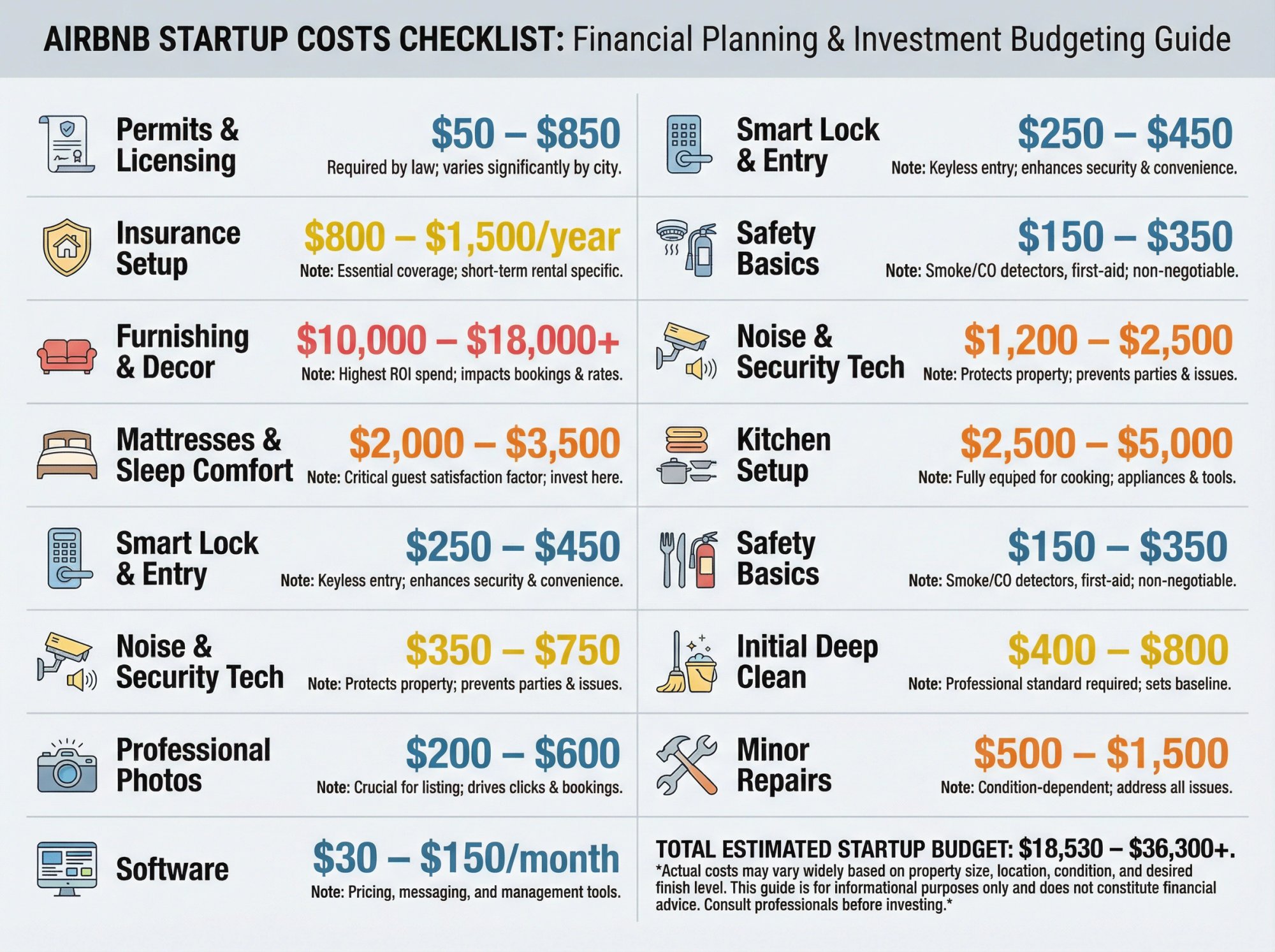

Complete Airbnb Launch Costs Checklist

This is where most people underestimate. Badly. Below is every line item you need to budget before you can accept your first booking.

| Cost Category | What It Covers | Typical Range (2026) | Notes |

|---|---|---|---|

| Permits & Licensing | City/county STR license, registration, renewal | $50 to $850+ | Real examples below |

| Insurance Setup | STR policy or upgrade | $2,000 to $3,000/year | Varies by state, property type, amenities |

| Furnishing & Decor | Beds, seating, dining, outdoor furniture, decor | $10,000 to $40,000 | Size and quality drive the range |

| Mattresses & Sleep Comfort | Quality mattresses, pillows, protectors | $800 to $4,000+ | Don't cheap out here |

| Linens & Towels (duplicates) | 2-3 full sets per bed, towels, bath mats | $300 to $2,000 | Depends on bed count |

| Kitchen Setup | Plates, glasses, cookware, coffee maker, knives | $400 to $2,000 | Needs to support real cooking |

| Smart Lock & Entry | Keyless entry system, backup lockbox | $150 to $450 | Plus installation if needed |

| Safety Basics | Smoke/CO detectors, fire extinguisher, first aid | $75 to $250 | Usually required by platform and local codes |

| Noise & Security Tech | Noise monitor, exterior camera, WiFi sensors | $200 to $600 | Optional but helpful |

| Initial Deep Clean | First turnover clean and staging | $150 to $400+ | Sets the baseline |

| Professional Photos | Interior/exterior shots, maybe drone | $150 to $400+ | Best ROI spend you'll make |

| Minor Repairs | Paint, handyman fixes, lock issues | $0 to $10,000+ | Condition-dependent |

| Software (first month) | PMS, automation, pricing tool | $30 to $100+/month | Start lean, add later |

Source: Chalet estimates, January 2026. External benchmarks cited inline.

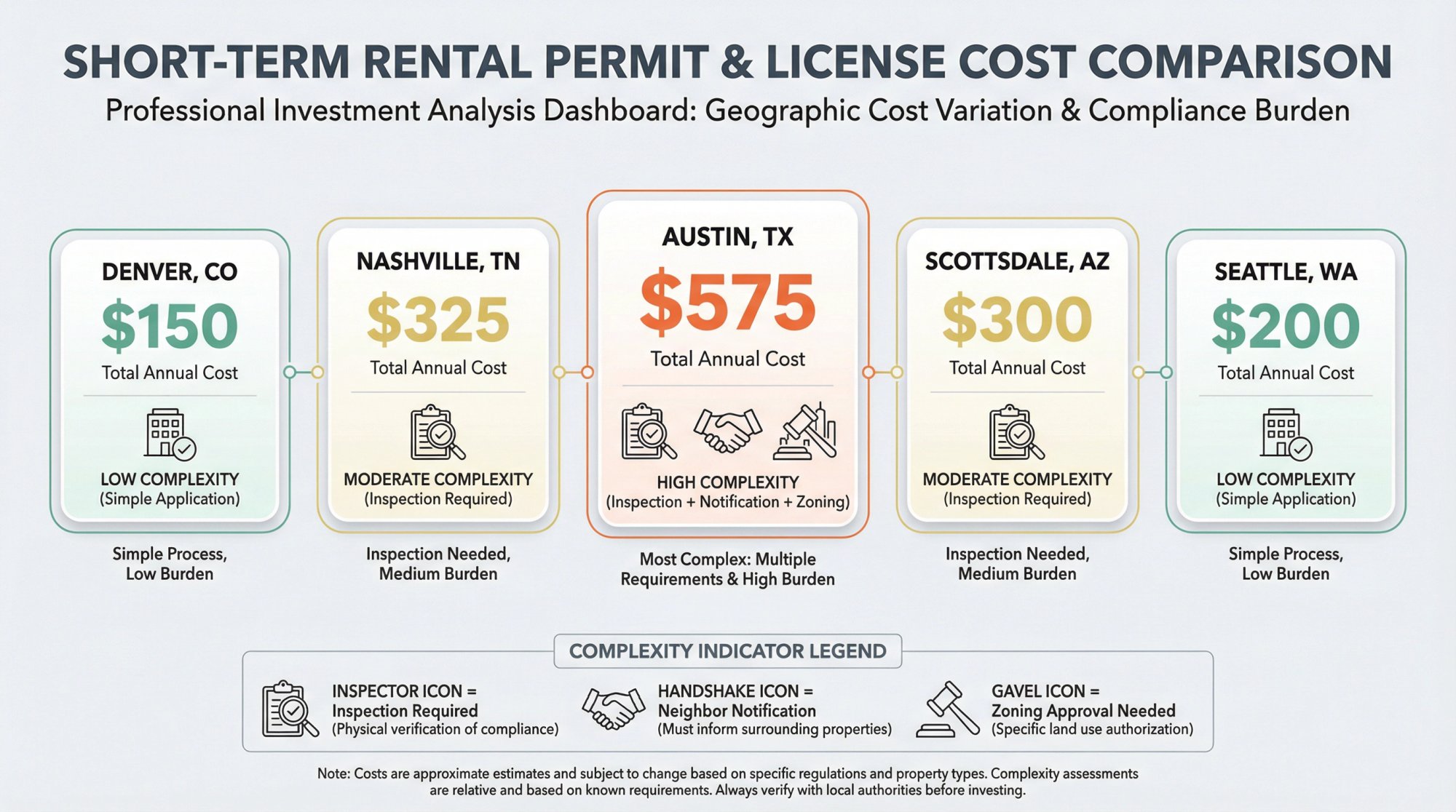

How Much Do Airbnb Permits and Licenses Cost by City?

Permit costs vary wildly. Here are actual examples from 2026:

① Denver, CO: Application fee $50 + license fee $100 = $150 total

② Nashville, TN: Permit fee $313 (paid after inspection approval)

③ Austin, TX: New STR operating license $836.30 (includes license fee and notification fee); renewal $385.30

④ Scottsdale, AZ: Annual city license $250 per property

⑤ Seattle, WA: $75 per year per unit plus $55 business license tax certificate

This isn't just about money. Some markets require inspections, neighbor notifications, or zoning approval. Factor in time and compliance risk, especially if you're doing a 1031 exchange with tight timelines.

Always check local rules before you buy. We maintain a regulation library covering major markets. Use it.

How Much Does It Cost to Furnish an Airbnb?

This is where budgets go to die. Why? Because people forget three things:

1. You're furnishing for durability, not Instagram. Guests are hard on furniture. You need commercial-grade sofas, washable covers, and things that survive spills.

2. You're buying duplicates. Two to three full sets of linens per bed. Extra towels. Backup kitchen items. It adds up fast.

3. You're furnishing for sleep capacity. That's your revenue driver. More beds means more linens, more laundry, more wear, more cost.

Airbnb Furnishing Cost by Property Size

HomeAdvisor's 2025 data shows furnishing a home typically costs $10,000 to $40,000 (average $16,000). But that's not STR-specific.

For short-term rentals, you need more:

→ Studio or 1-bedroom: $10,000 to $15,000

→ 2-bedroom home: $15,000 to $24,000

→ 3-bedroom home: $20,000 to $35,000

→ 4+ bedroom house: $30,000 to $50,000+

These ranges include major furniture pieces plus all the decor and essentials.

What Furniture and Supplies Do I Need for an Airbnb?

Major furniture:

• Beds and mattresses (every bedroom)

• Sofa and seating (living room)

• Dining table and chairs

• Dressers and nightstands

• Outdoor furniture (if applicable)

The "Small Stuff" That Isn't Small:

• Bed linens: $200 to $800 for multiple sets

• Bath linens: $150 to $500 (towels, bath mats)

• Kitchen essentials: $400 to $2,000 (dishes, cookware, utensils, appliances)

• Decor items: $300 to $1,500 (art, mirrors, lamps, rugs, throw pillows)

• TV and electronics: $300 to $800

• Cleaning supplies: $100 to $200 initial stock

The trick? Budget by sleep capacity, not square footage. Every bed you add creates costs in four places: mattress, frame, linens (with duplicates), and bedroom furniture. Every guest you add increases kitchen needs, towel inventory, and wear.

Pro tip: Match your furnishing level to your market. Check which cities have the best ROI potential before deciding your budget. A high-end resort property should be furnished to a higher standard than a budget urban studio. But don't overspend on luxury touches that won't actually increase your nightly rate or occupancy.

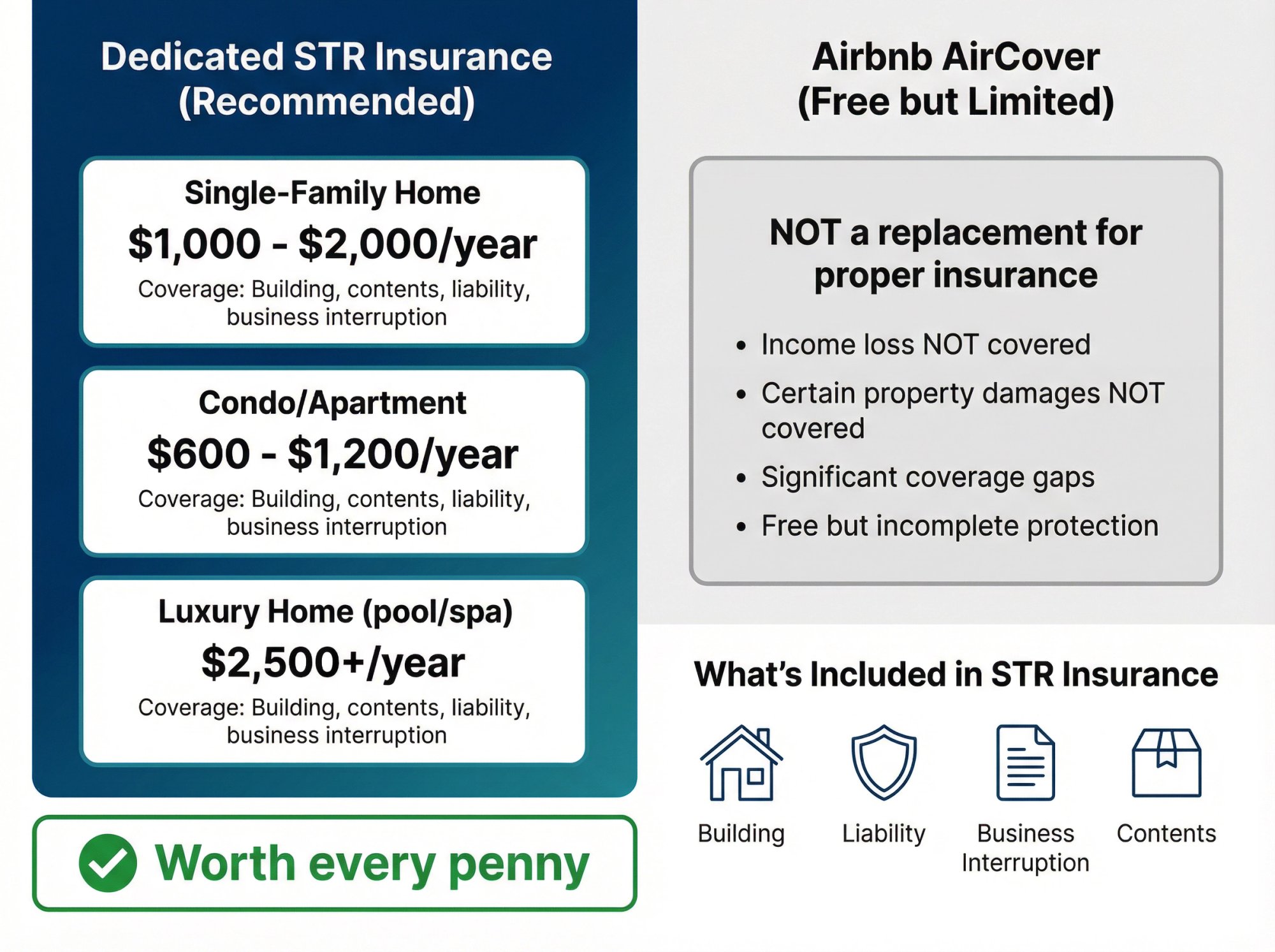

How Much Does Airbnb Insurance Cost?

Standard homeowner's insurance does not cover short-term rental activity. You need specialized coverage.

What Is the Cost of Short-Term Rental Insurance?

Dedicated STR insurance for a single-family home runs $1,000 to $2,000 per year (about $85 to $170/month). Smaller condos or apartments might be $600 to $1,200/year. Larger luxury homes with pools or hot tubs can hit $2,500+ annually.

What does this cover? The building, contents, liability, and business interruption. If a guest causes major damage or sues over an injury, you're protected. Worth every penny.

Important: Airbnb's free "AirCover" host program is not a replacement for proper insurance. It has significant limitations and won't help with many scenarios like income loss or certain property damages.

Is Umbrella Insurance Worth It for Airbnb Hosts?

Some hosts add a personal umbrella liability policy for about $200 to $400 per year for an extra $1-2 million in coverage. If you have significant assets to protect, it's cheap peace of mind.

What Safety Equipment Does Airbnb Require?

Budget about $75 to $250 for:

• Smoke and CO detectors (about $20 to $50 each)

• Fire extinguishers ($30 each for kitchen and each floor)

• First-aid kit ($25)

These are usually mandated by Airbnb and local codes. Not expensive, but required from day one.

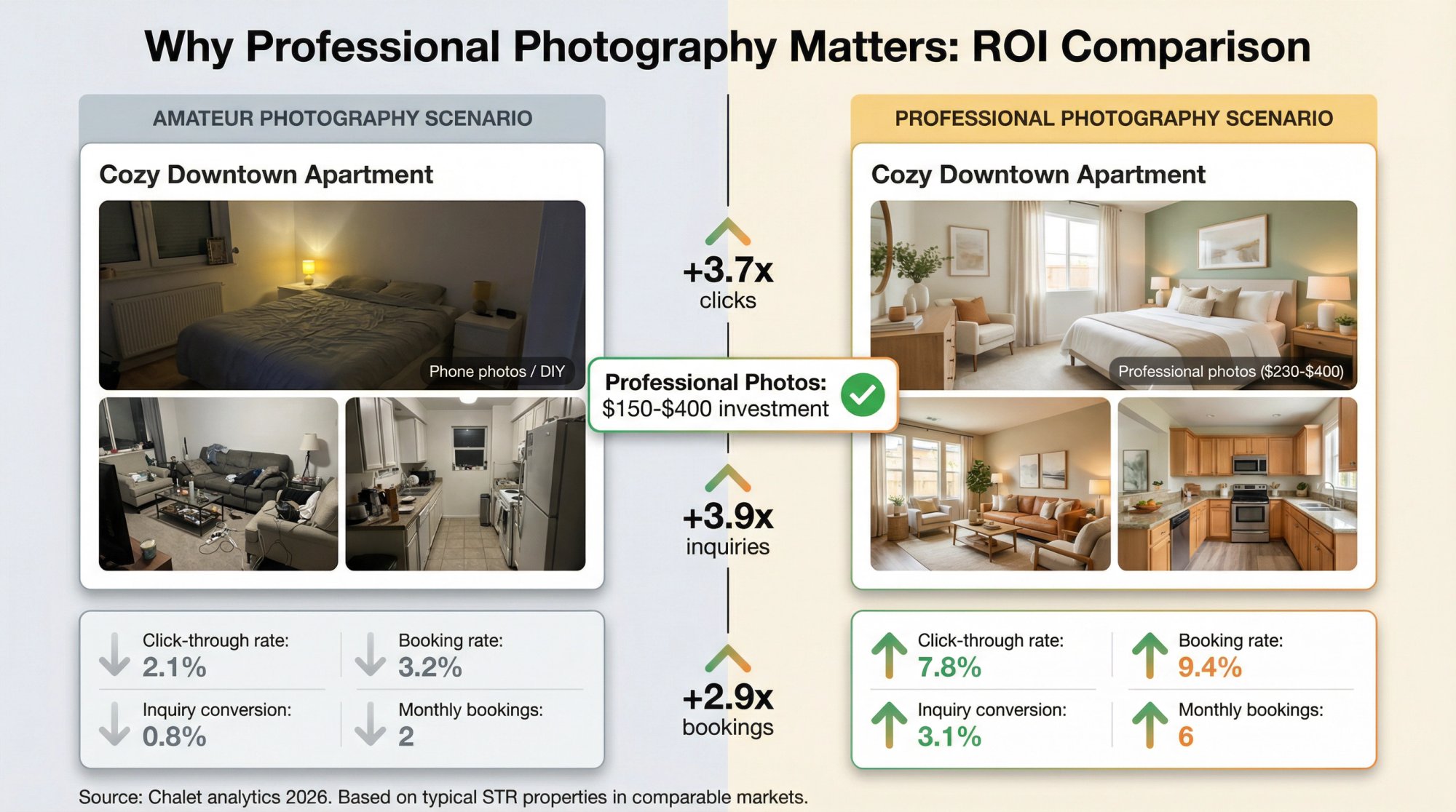

How Much Do Professional Airbnb Photos Cost?

Professional photos are not optional. They're your first (and often only) chance to convert a browser into a booker.

One 2025 pricing guide cites about $230 average for standard photo packages nationwide. Premium markets or packages with drone shots, twilight photos, or virtual tours will cost more.

Budget $150 to $400+ depending on your property size and market. This might be the highest-ROI spend in your entire setup.

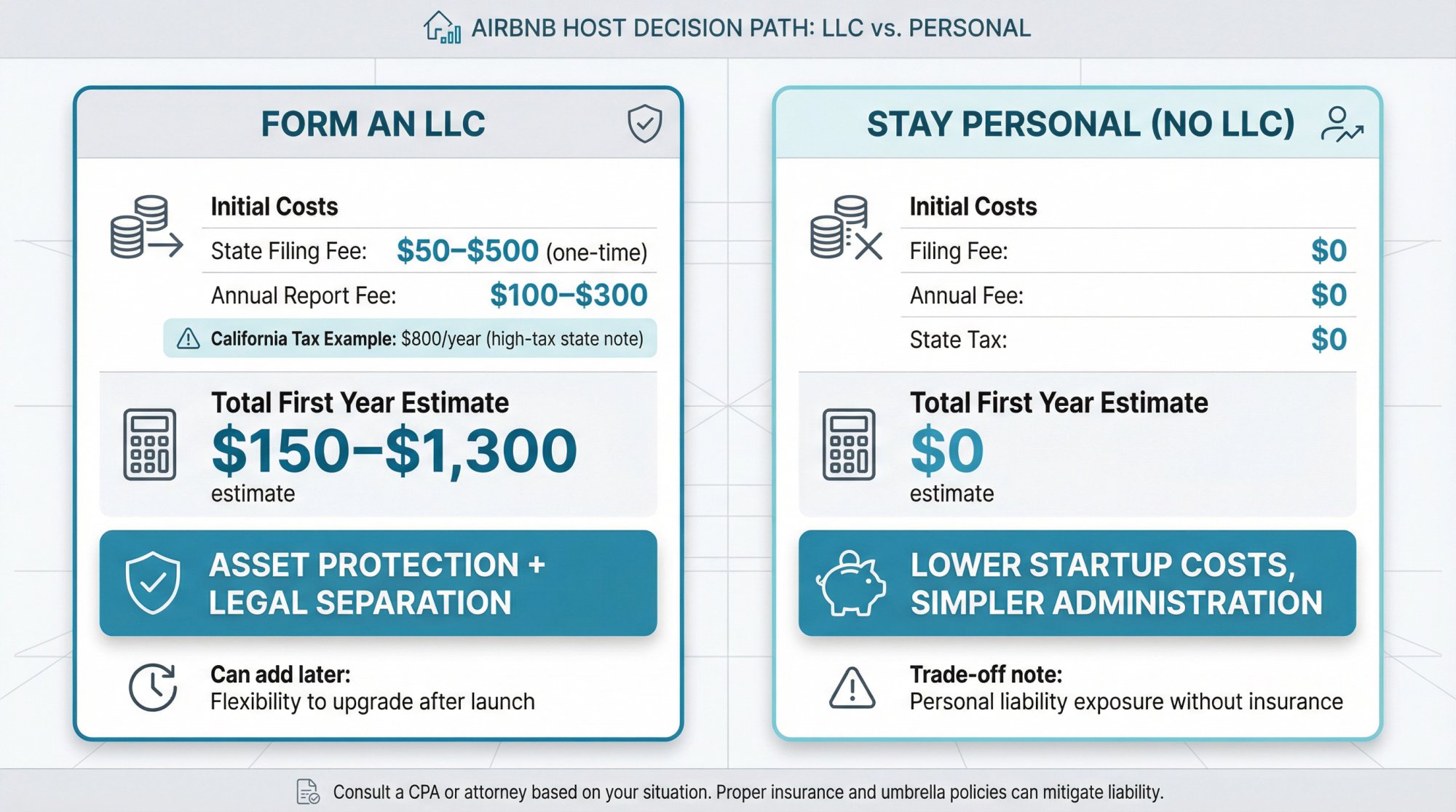

Should I Form an LLC for My Airbnb?

Many hosts wonder if they should set up an LLC. Here's the cost reality:

If you form an LLC:

• State filing fee: $50 to $500 (varies widely by state)

• Annual report fee: $100 to $300 to maintain it

• Some states (like California) charge an $800/year LLC tax regardless of income

Many first-time hosts skip the LLC initially to save on these costs. If asset protection is a priority for you, budget a few hundred dollars for entity setup and annual fees. You can always add an LLC later.

What Are the Monthly Operating Costs for an Airbnb?

Startup costs get you live. Operating costs decide if you stay live.

Here's what you'll be paying every month:

| Expense | How It's Priced | Typical Range | Notes |

|---|---|---|---|

| Property Management | % of gross revenue | 15% to 25% average | Can go up to 40% in some cases |

| Cleaning | Per turnover | $161 avg per stay (2025 benchmark) | Your actual cost may differ; you can offset with cleaning fee |

| Software (PMS/tools) | Per listing per month | $10 to $50+ per listing | Pricing tools available |

| Dynamic Pricing Tool | Per listing per month | $20 to $50+ per listing | Optional but saves time and boosts revenue |

| Utilities | Fixed monthly | Varies heavily | Guests use more than long-term tenants |

| Consumables | Per stay | $5 to $20+ equivalent | Coffee, paper goods, soap, trash bags |

| Maintenance | % of revenue or value | Varies | Budget a reserve |

| Insurance | Annual or monthly | Often $2,000 to $3,000/year | Plus umbrella if needed |

| Occupancy/Sales Taxes | % of rent or flat | Jurisdiction-specific | Airbnb collects in some areas, not all |

Source: Chalet operating model, January 2026.

How Much Does Airbnb Charge Hosts in Fees?

Airbnb fees aren't upfront, but they absolutely affect your operating margin. According to Airbnb's help center, there are two common structures:

• Split fee: Host typically pays about 3%, guest pays a service fee

• Host-only (single fee): Airbnb charges the host 15.5% on this structure

That 15.5% isn't small. Your management fee, cleaning strategy, and pricing all interact with platform fees. Build it into your pro forma using our calculator.

Does Airbnb Collect Occupancy Taxes?

In many places, Airbnb does collect and remit local occupancy taxes. But even when they do, you may still have other obligations like business license taxes, state filings, or registration requirements.

Treat taxes as a compliance workflow, not just a line item. Always check local regulations before you launch.

What Hidden Costs Do Airbnb Hosts Forget?

These are the usual landmines that blow up budgets:

Window coverings. Guests hate bright rooms at 6am. Budget for blackout curtains or blinds in bedrooms.

Owner storage. You need a lockable closet for your supplies, tools, and backup inventory. Plan for it.

Trash can math. Bigger groups generate more trash. Make sure you have enough capacity and pickup frequency.

Outdoor maintenance. Yard care, snow removal, pool or spa service. These aren't free.

Replacement cycles. Linens wear out. Kitchen items break. Towels get stained. Budget for ongoing replacements.

Compliance creep. Annual license renewals, periodic inspections, neighbor complaints that require response.

Platform fee changes. Airbnb has updated host fee structures in recent years. Stay current.

Real Airbnb Startup Budget Examples

Now we'll put this all together with real scenarios.

How Much Does It Cost to Start an Airbnb by Buying a House?

You're purchasing a $300,000 house in an STR-friendly market:

| Cost Category | Amount |

|---|---|

| Down payment (20%) | $60,000 |

| Closing costs | $10,000 (about 3.3% of loan amount) |

| Initial repairs and paint | $2,000 |

| Furniture and decor | $20,000 (mid-range for 3BR) |

| Linens, kitchenware, supplies | $2,500 |

| Smart lock and tech | $500 |

| Professional photography | $300 |

| License and permits | $500 (market-dependent) |

| Insurance (first year) | $1,500 |

| Utilities deposits and setup | $300 |

| TOTAL ESTIMATED UPFRONT | $97,600 |

The vast majority is the property purchase itself. But don't forget that $37,600 in setup costs on top of your down payment and closing.

How Much Does Airbnb Rental Arbitrage Cost to Start?

You're leasing a 1-bedroom apartment at $1,500/month to operate as an STR:

| Cost Category | Amount |

|---|---|

| Deposit and first month's rent | $3,000 |

| Furniture and decor | $7,000 (1BR setup, decent quality) |

| Linens and kitchen supplies | $800 |

| Smart lock and misc tech | $300 |

| Photos and listing prep | $200 |

| City STR license | $200 |

| Renter's STR insurance | $600 (annual) |

| Utilities setup | $200 |

| TOTAL ESTIMATED UPFRONT | $12,300 |

Dramatically different entry point. No equity, but you can start now instead of saving for years.

Where Should I Spend More vs Save Money on Airbnb Setup?

Not all costs are equal. Here's where to prioritize based on actual guest reviews and ratings:

Spend Here (High Impact)

① Mattresses and pillows. Sleep quality directly drives your star rating. Don't cheap out.

② Cleaning quality. Not just the fee you charge. The actual quality of the clean. This makes or breaks reviews.

③ Professional photos. Clicks turn into bookings. Bad photos cost you more than you'll ever save.

④ Insurance that matches your risk. Especially if you have a pool, hot tub, or fire pit.

⑤ Smart lock with clear entry instructions. Late-night check-ins need to be seamless.

Save Here (Without Killing the Experience)

Decor. Target "clean and cohesive," not showroom perfect. Guests care more about comfort than style.

Some furniture pieces. Secondhand is fine if it's clean and durable. Facebook Marketplace, estate sales, outlet stores.

Tech stack. Start lean. You can always add fancy automation tools later once you're generating revenue.

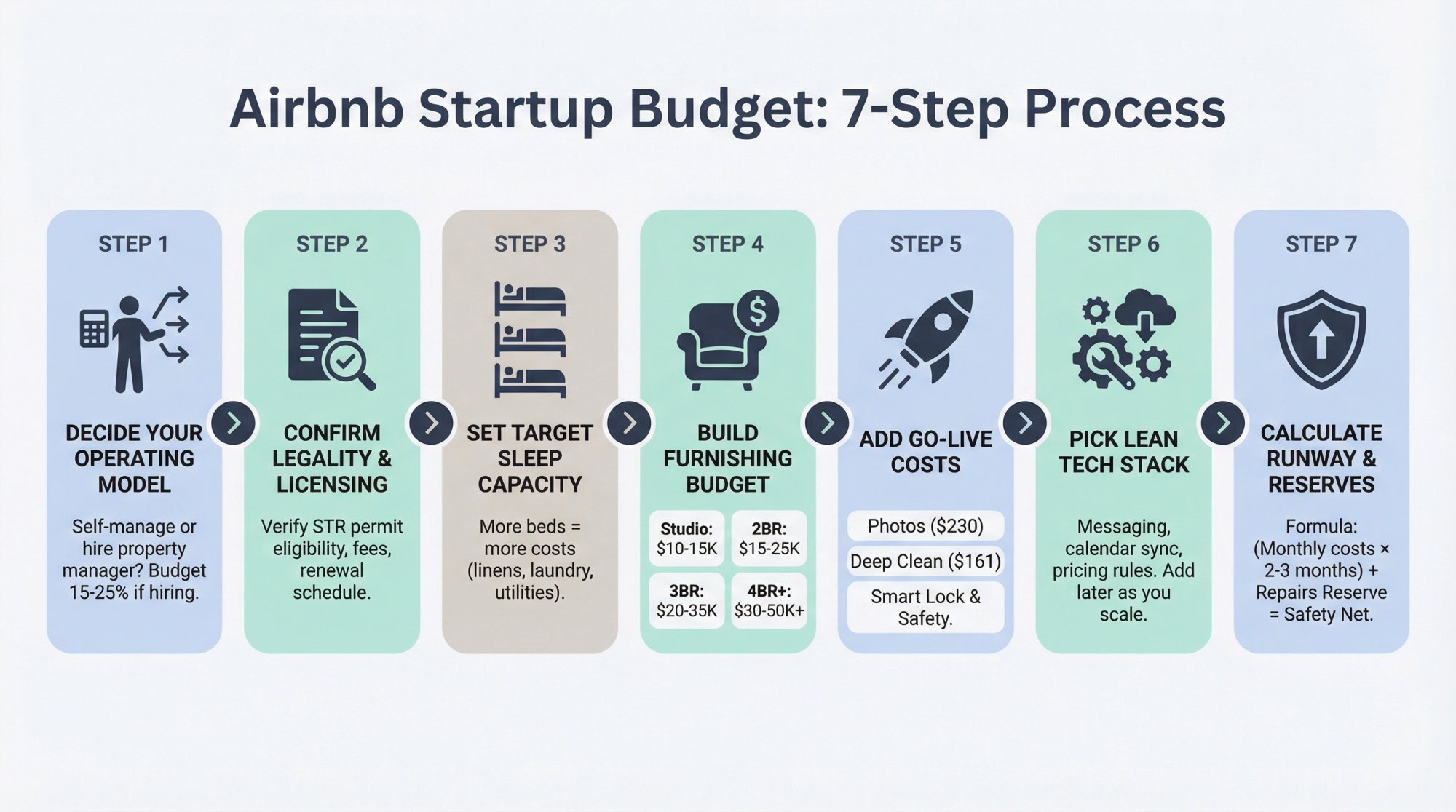

How to Create an Airbnb Startup Budget Step-by-Step

Here's the process that produces a budget you can defend:

Step 1: Decide your operating model. Self-manage or hire a property manager? This changes your entire cost structure. If you're hiring a manager, budget 15-25% of revenue as a starting point, then confirm scope (does that percentage include guest messaging, pricing, restocking, minor maintenance?).

Step 2: Confirm legality and licensing costs. Before you close on a property or sign a lease, verify you can actually get an STR permit. Is it owner-occupied only? Are there caps or a lottery? What's the fee and renewal schedule? Use our regulation library to check.

Step 3: Set your target sleep capacity. You're not furnishing "a 2BR." You're furnishing "sleeps 6." Sleep capacity drives revenue, but it also adds costs. More beds means more linens, more laundry, more wear. More guests means higher utilities and faster supply burn.

Step 4: Build your furnishing budget from benchmarks. Start with the ranges above (studio $10-15K, 2BR $15-25K, 3BR $20-35K, 4BR+ $30-50K+), then adjust for your market and quality tier. Add STR-specific items: duplicates, lockable owner closet, spare bulbs and batteries, basic tools.

Step 5: Add your go-live costs. Photos (around $230 average), initial deep clean (around $161 average), smart lock and safety gear. These are the last-mile expenses you can't skip.

Step 6: Pick a lean tech stack. Start with tools that remove labor or prevent mistakes: messaging automation, calendar sync, pricing rules. Add fancy stuff later once you're profitable.

Step 7: Calculate your runway and reserves. This is your safety net. Minimum formula: (monthly fixed costs × 2-3 months) + repairs reserve. If you're using DSCR financing, ask your lender about reserve requirements upfront.

Airbnb Startup Costs for 1031 Exchange Investors

If you're doing a 1031 exchange into an STR, you don't just need a budget. You need a timeline.

You're trying to avoid:

• Buying a place that can't legally operate

• Losing weeks to furnishing delays

• Missing "speed-to-operate," which matters when you're coordinating a bigger transaction under tight IRS deadlines

Practical moves:

• Prioritize markets where licensing is clear and predictable

• Line up furnishing, cleaning, and property management before closing

• Use the permit fee examples above as a reality check (some cities are simple, some are slow)

• Run DSCR and reserves calculations early

How Chalet Helps You Launch Your Airbnb with Lower Costs

At Chalet, we built our platform around the problems real investors face. Here's how we help with startup costs:

Free market analytics. Use our market dashboards to identify cities and neighborhoods with strong rental demand before you invest. See ADR, occupancy rates, and revenue potential.

Deal underwriting. Our STR calculator lets you run ROI and DSCR calculations on specific addresses. Model different down payments, interest rates, and occupancy scenarios. Make sure the numbers actually work before you commit.

Regulation research. Check local STR rules for your target market so you know licensing requirements and timelines upfront. No surprises.

Vetted vendor network. When you're ready to buy, meet an Airbnb-friendly real estate agent who knows STR investing. Browse Airbnb-ready homes for sale. Get connected with STR-specialist lenders, insurance providers, furnishing services, cleaners, and property managers through our vendor directory.

We pair free analytics with the professionals you'll actually need. One platform, from research to ROI to real-world operations.

Airbnb Startup Costs Checklist: Are You Ready to Launch?

Before you launch, make sure you've budgeted for:

-

Property acquisition or lease (down payment/closing OR deposit/first month)

-

Furnishing and decor (sized for your sleep capacity)

-

All the small stuff (linens, kitchen, supplies, decor)

-

Permits and licenses (confirmed costs in your specific market)

-

Insurance upgrade (STR-specific policy, not standard homeowner's)

-

Safety equipment (smoke/CO, fire extinguisher, first aid)

-

Smart lock and security

-

Professional photos

-

Initial deep clean

-

Runway reserve (2-3 months of fixed costs minimum)

-

Repairs reserve (because something will break)

The Bottom Line

Starting an Airbnb in 2026 isn't cheap. But it's also not as scary as it looks if you budget properly.

The real danger isn't the cost. It's underestimating the cost and running out of cash before you hit your stride.

Budget for everything. Then add 10% for the stuff you forgot. Build your runway so one slow month doesn't force you into panic mode. And always run the numbers before you commit to a property.

When executed properly, a short-term rental can generate strong cash flow and, if you bought, build long-term equity. When rushed or underfunded, it's expensive. The difference is planning.

Frequently Asked Questions

Q: What's the absolute minimum I need to start an Airbnb?

It depends on your path. For rental arbitrage (leasing), you might launch with $5,000 to $10,000 total if you're extremely lean. For buying a property, you need $50,000 to $100,000+ just for acquisition, then another $15,000 to $40,000 for setup depending on property size.

Q: Can I furnish cheaper than these ranges?

Yes, but be careful. You can absolutely find deals on Facebook Marketplace, estate sales, and outlet stores. Many successful hosts do. Just make sure everything is clean, durable, and doesn't look cheap in photos. Bad furniture hurts your reviews, which costs you more than you saved.

Q: Do I really need professional photos?

Yes. This is the highest-ROI spend in your entire budget. Bad photos mean fewer bookings, which means less revenue, which means longer payback on every other investment you made. Spend the $200 to $400. It's worth it.

Q: Should I self-manage or hire a property manager from the start?

It depends on your time, location, and skills. Self-managing saves you 15-25% of gross revenue but requires real work (messaging guests, coordinating cleaners, handling maintenance). If you're local and have time, start by self-managing. If you're remote or busy, hire a manager. You can always switch later.

Q: What's the biggest mistake first-time hosts make with startup costs?

Forgetting the runway reserve. They budget for acquisition and furnishing, then run out of cash after one slow month. Always have 2-3 months of fixed costs in reserve minimum. More if you're risk-averse or launching in a seasonal market.

Q: How long does it take to recoup my startup costs?

Highly variable. Depends on your nightly rate, occupancy, operating costs, and how much you invested upfront. A well-located rental in a strong market might recoup furnishing costs in 12-24 months. A poorly performing property might never break even. This is why you run the numbers first.

Q: Do I need an LLC for my first Airbnb?

Not necessarily. Many first-time hosts start without one to save on setup and annual fees. An LLC provides liability protection, but proper insurance and an umbrella policy can cover a lot. Consult with a CPA or attorney based on your specific situation and risk tolerance.

Q: What if local regulations change after I launch?

This is a real risk. Some cities have tightened rules or banned STRs entirely. The best protection is to stay informed and diversify if possible. Join local host groups. Monitor city council meetings. Consider having an exit strategy (long-term rental, sale) if regulations become unworkable. And always verify regulations before buying by checking our regulation library.

Q: Can I use my current furniture to save money?

Maybe. If it's clean, durable, and photographs well, sure. But remember you'll need duplicates of linens and towels, plus full kitchen setup. Most people find they need to buy more than they expected even if they start with some furniture. And personal items (family photos, sentimental pieces) should be removed or locked away.

Q: How much should I budget for repairs in the first year?

Plan for surprises. Even new properties have issues. A good rule of thumb is 1-2% of the property value annually for maintenance and repairs, but frontload it. Budget at least $2,000 to $5,000 in your first year as a reserve. HVAC failures, plumbing issues, and appliance replacements aren't cheap.

Ready to Launch Your Airbnb?

Now you have the numbers. You know what it costs. You know what to budget for. You know where to spend and where to save.

The next step is execution. Here's how Chalet helps you move from planning to action:

Start here: Use our free market analytics to identify the best cities for STR investing. See real ADR, occupancy, and revenue data.

Run the numbers: Use our ROI calculator to model specific properties. Plug in your actual costs from this guide and see if the deal works.

Check regulations: Verify you can legally operate by reviewing local STR rules in your target market.

Find your property: Browse Airbnb-ready homes for sale or connect with one of our Airbnb-friendly agents who specialize in STR investment properties.

Set up operations: Once you have a property, tap into our vendor network for cleaners, property managers, furnishing services, insurance providers, and everything else you need to launch successfully.

One platform. Free analytics. Vetted vendors. From research to revenue.