You've found the perfect vacation rental property. The numbers work. The location is solid. But before you make an offer, you're stuck on a question that trips up almost every first-time STR investor: Should you buy this property in your personal name or set up an LLC?

It's not a simple question. The answer affects your legal protection, your financing options, your tax situation, and how much paperwork you'll deal with for years to come. And the frustrating truth is that there's no universal "right" answer.

Buying in your personal name keeps things simple. You get access to better mortgage rates, skip the formation fees, and avoid ongoing compliance headaches. But if something goes wrong with a guest or the property, your personal assets are exposed.

Buying through an LLC creates a legal shield between your Airbnb rental business and your personal finances. Your savings account and primary home are generally protected if someone sues over the rental. The tradeoff? Financing gets harder, costs go up, and you'll have more administrative work.

This guide walks through everything you need to weigh. By the end, you'll know which structure fits your situation, your risk tolerance, and your long-term plans.

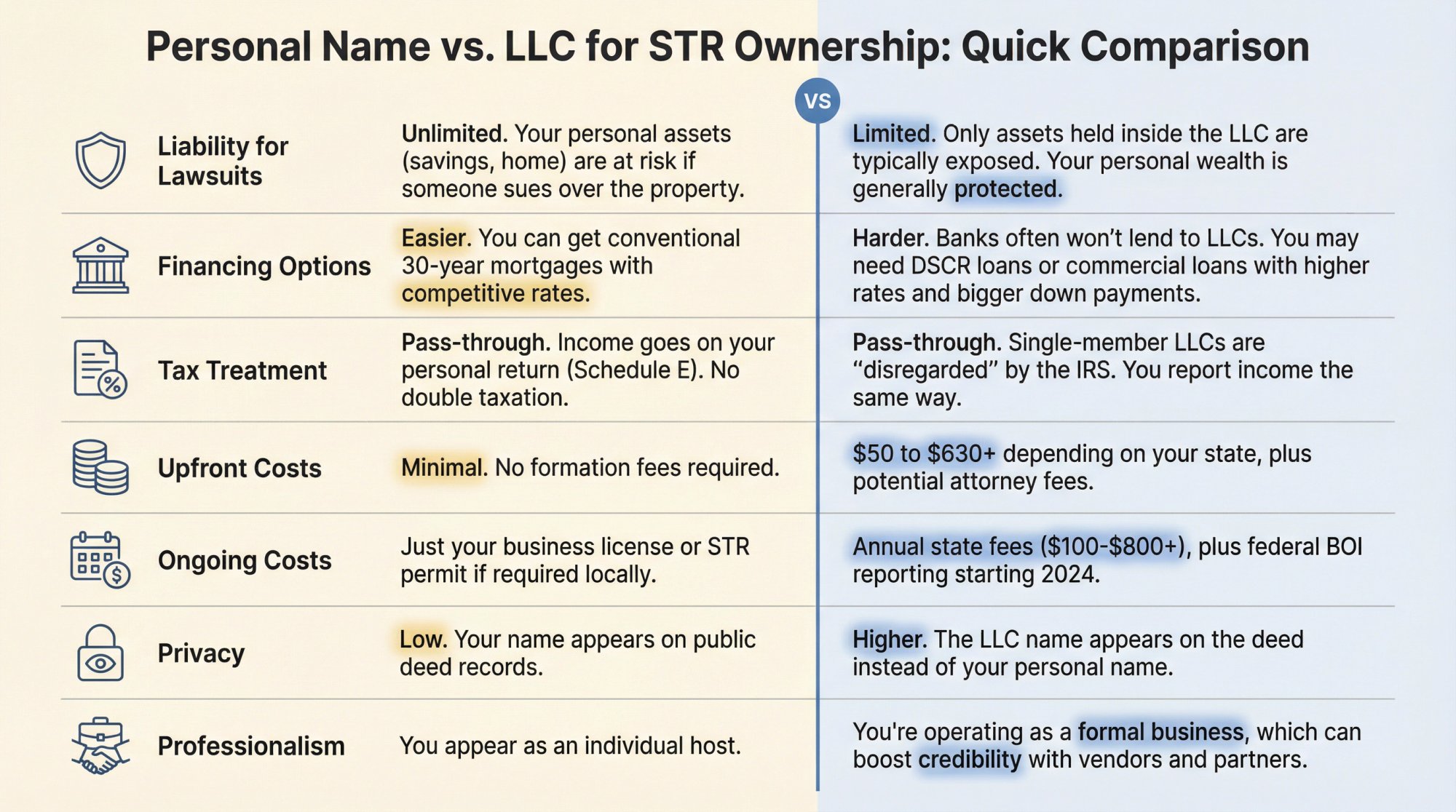

Personal Name vs. LLC for STR Ownership: Quick Comparison

Before we get into the details, here's a side-by-side view of how these two ownership structures stack up:

| Factor | Personal Name | LLC |

|---|---|---|

| Liability for lawsuits | Unlimited. Your personal assets (savings, home) are at risk if someone sues over the property. | Limited. Only assets held inside the LLC are typically exposed. Your personal wealth is generally protected. |

| Financing options | Easier. You can get conventional 30-year mortgages with competitive rates. | Harder. Banks often won't lend to LLCs. You may need DSCR loans or commercial loans with higher rates and bigger down payments. |

| Tax treatment | Pass-through. Income goes on your personal return (Schedule E). No double taxation. | Pass-through. Single-member LLCs are "disregarded" by the IRS. You report income the same way. |

| Upfront costs | Minimal. No formation fees required. | $50 to $630+ depending on your state, plus potential attorney fees. |

| Ongoing costs | Just your business license or STR permit if required locally. | Annual state fees ($100-$800+), plus federal BOI reporting starting 2024. |

| Privacy | Low. Your name appears on public deed records. | Higher. The LLC name appears on the deed instead of your personal name. |

| Professionalism | You appear as an individual host. | You're operating as a formal business, which can boost credibility with vendors and partners. |

Both options can work. The question is which tradeoffs matter most to you.

What Liability Protection Does an LLC Actually Provide?

This is usually the biggest reason investors consider forming an LLC.

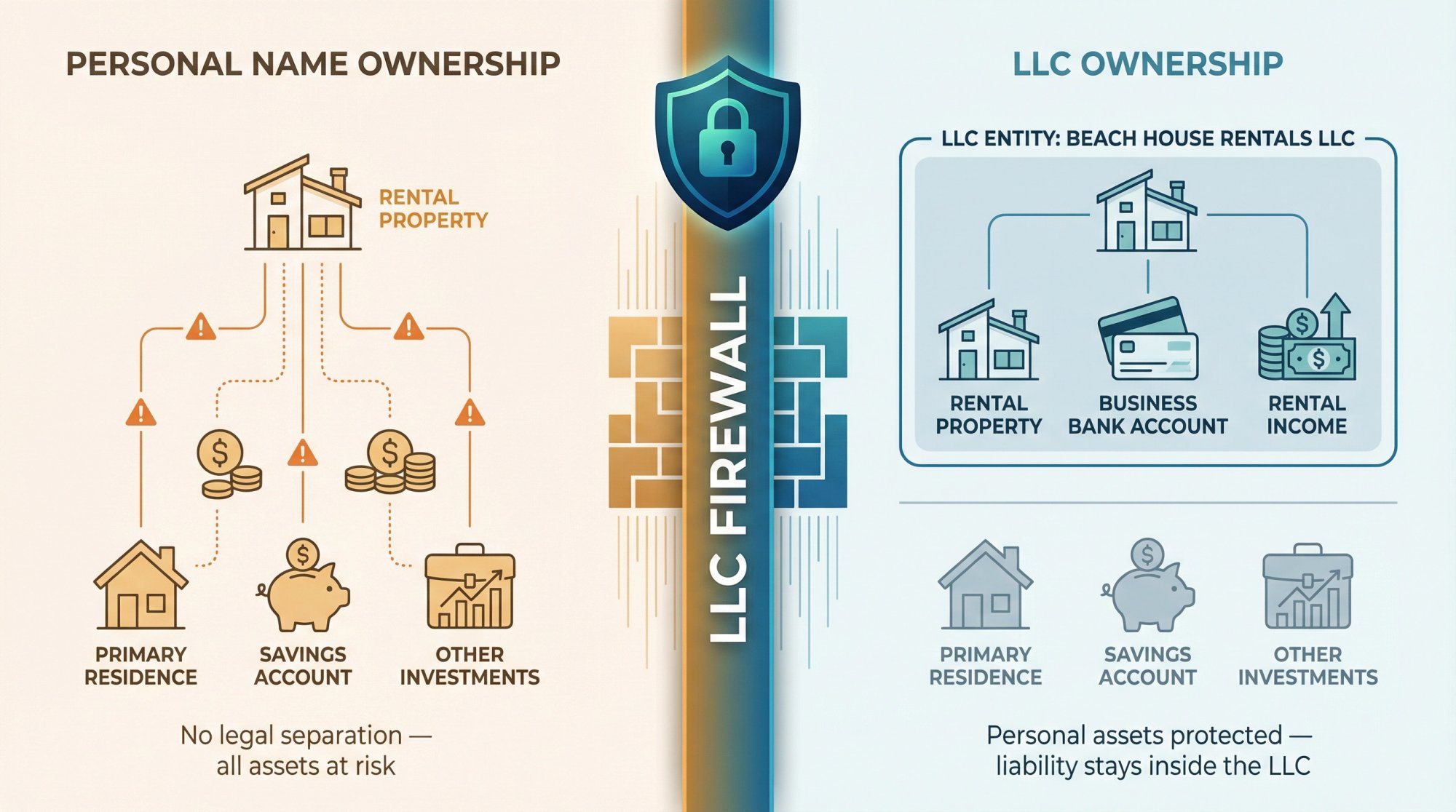

When you own a short-term rental in your personal name, you are the business. There's no legal separation between you and the rental operation. If a guest trips on a loose stair and sues, if a contractor claims you didn't pay them, if anything goes wrong, a court judgment could potentially target your savings, your primary residence, your other investments.

An LLC creates a legal wall. The property and all its operations belong to a separate entity. If someone sues over the rental, they're suing the LLC, not you personally. Only the assets inside that LLC (the property itself, the business bank account, any rental income sitting there) are typically at risk. Your personal finances stay on the other side of that wall.

That protection is the core value of an LLC. It's a firewall that keeps a rental disaster from becoming a personal financial catastrophe.

Why an LLC Is Not a Magic Shield

You can't just file some paperwork and consider yourself bulletproof. An LLC has real limitations:

You still need insurance. An LLC and good insurance coverage are not interchangeable. They work together. Your short-term rental insurance handles most claims (property damage, guest injuries, liability issues). The LLC is there as a backup if something exceeds your coverage or falls through a policy gap. Think of it as a belt and suspenders.

Personal guarantees defeat the purpose. If you personally guarantee a mortgage or loan on the property (which lenders often require), you're on the hook for that debt regardless of the LLC. The lender can come after you personally if the LLC defaults. This is a common exception to LLC protection.

You can lose the protection. If you don't treat the LLC as a real, separate business, a court can "pierce the corporate veil" and hold you personally liable anyway. This happens when owners mix personal and business money, skip required filings, or treat the LLC like a personal piggy bank rather than a distinct entity. You have to actually run it like a business for the protection to hold up.

Can an Umbrella Insurance Policy Replace an LLC?

Some investors figure they'll skip the LLC and just buy an umbrella insurance policy for extra coverage. Umbrella policies are relatively cheap (often $200 to $400 per year for $1-2 million in additional coverage) and they're a solid first line of defense.

But insurance policies have limits. They also have exclusions. If you face a worst-case lawsuit that exceeds your coverage limits or falls into a policy gap, an LLC prevents that excess from reaching your personal assets.

The smartest approach? Most experienced STR investors do both. They carry solid short-term rental insurance with an umbrella policy on top, and they structure ownership through an LLC. Multiple layers of protection for multiple types of risk.

How Does Ownership Structure Affect Your Financing Options?

Here's where things get practical. For many first-time buyers, financing is the deciding factor.

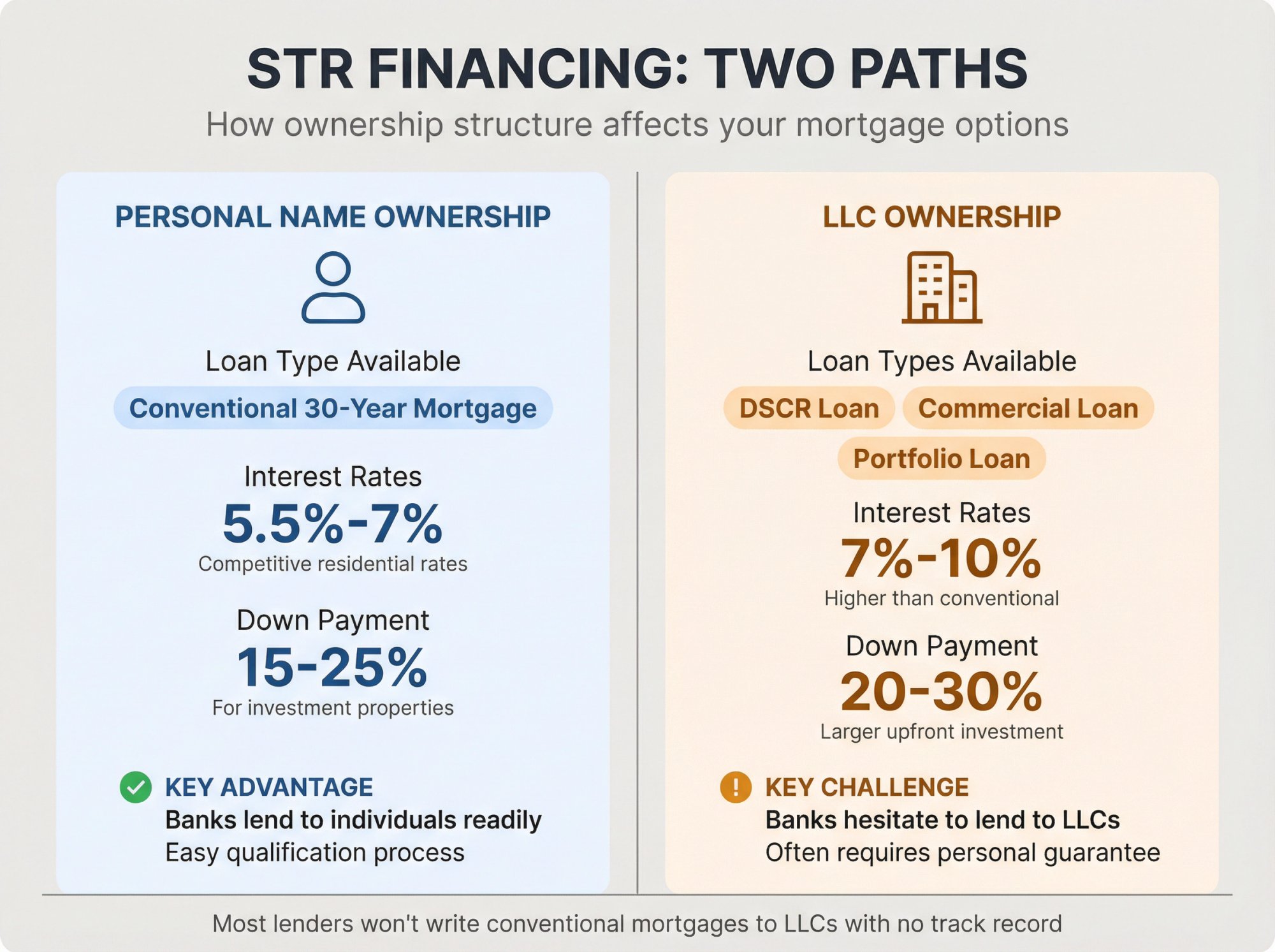

Why Conventional Mortgages Favor Personal Name Ownership

If you're planning to finance your purchase (most people are), buying in your personal name gives you access to regular residential mortgages. That means 30-year fixed rates, competitive interest rates, and down payments as low as 15-25% for investment properties.

Banks want a human being on the other end of that loan. They want someone personally responsible for repayment. Most lenders simply won't write a conventional mortgage to an LLC with no track record.

How to Finance an Airbnb Rental Through an LLC

If you want the LLC to own the property from day one, your options shrink. You'll likely need:

→ A DSCR loan (Debt-Service Coverage Ratio loan), which qualifies based on the property's rental income rather than your personal income

→ A commercial loan with shorter terms and higher rates

→ Portfolio lending from a local bank that keeps loans on their own books

These products exist, but they typically come with higher interest rates, larger down payments, and stricter terms. And many lenders will still require you to personally guarantee the loan, which undermines some of the liability protection you're trying to achieve.

How to Transfer Your Property to an LLC After Buying

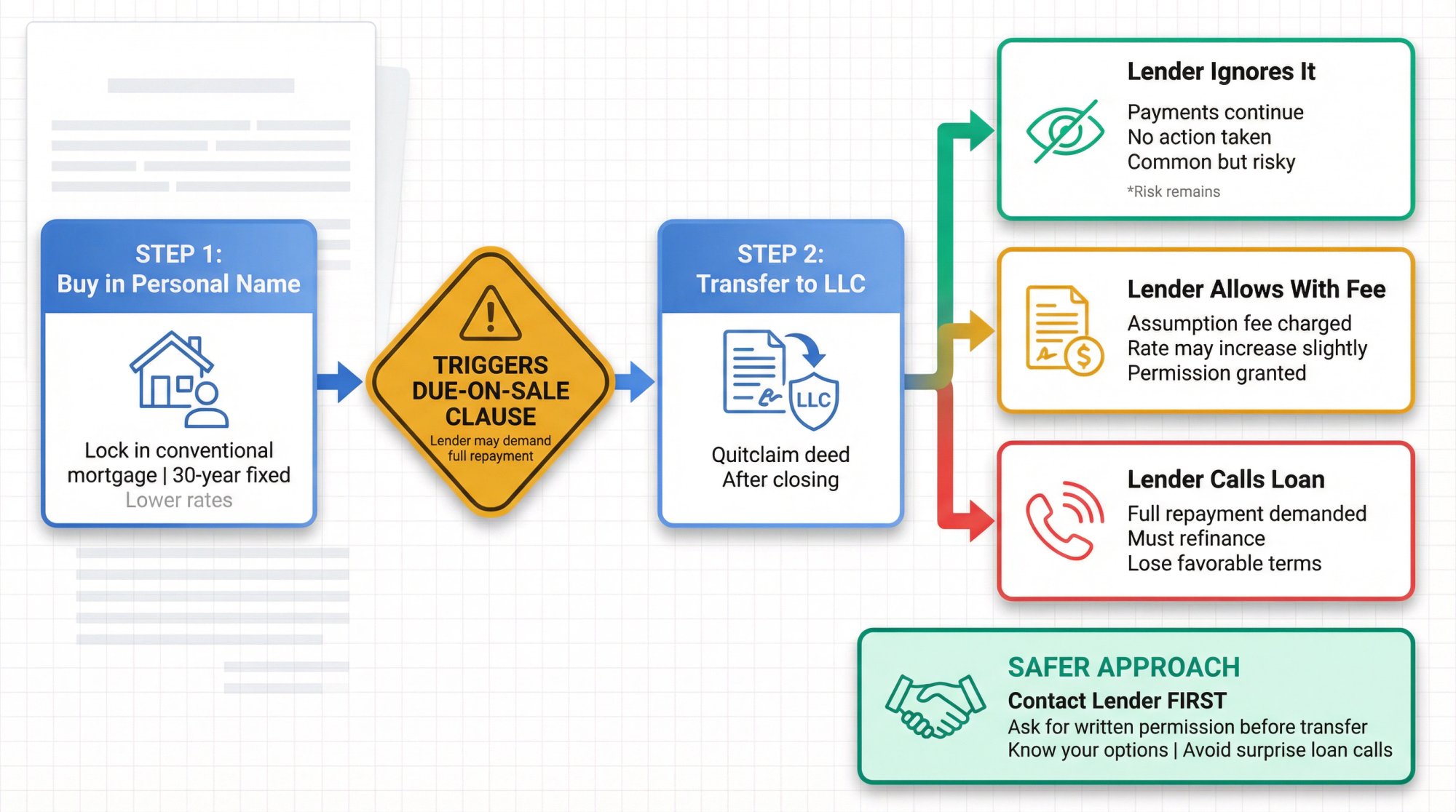

A common workaround: buy the property in your personal name to lock in good financing, then transfer the deed to your LLC after closing.

It works, but it carries a risk. Most mortgage contracts include a due-on-sale clause. That clause lets the lender demand full repayment if ownership changes without their consent. Transferring to your LLC technically triggers that clause, even if you're the sole owner of the LLC.

In practice? Some lenders never notice or don't care as long as payments keep coming. Others will call the loan. You're betting they won't enforce the clause.

A safer approach: Contact your lender before transferring and ask for written permission. Some will grant it. Some will charge an assumption fee or bump your rate slightly. Some will say no. If they say no, you'll need to decide whether the LLC protection is worth refinancing into a commercial or DSCR loan at likely higher rates.

At Chalet, we can connect you with STR-savvy lenders who understand these nuances. Some specialize in DSCR loans for vacation rentals and can work with LLC ownership from the start. Before you make any decisions, it helps to know what financing is actually available for your situation.

Does an LLC Save You Money on Taxes?

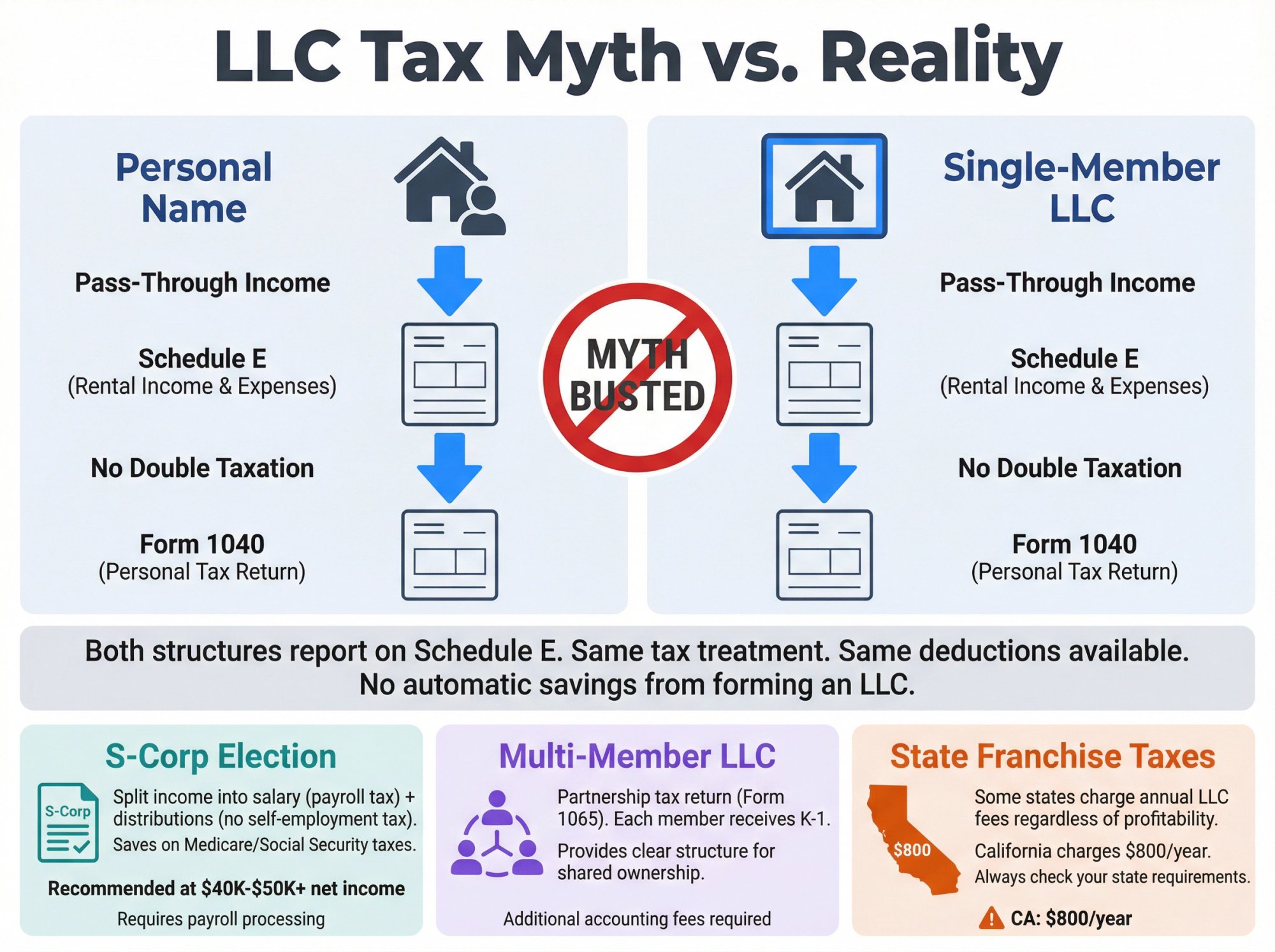

Let's bust a common myth right here: Forming an LLC does not automatically reduce your taxes. It's one of the most persistent misconceptions in real estate investing, and it trips up a lot of first-timers.

How Pass-Through Taxation Works for STR Owners

Whether you own the property in your personal name or through an LLC, rental income "passes through" to your personal tax return. There's no separate tax at the company level.

-

Personal ownership: You report rental income and expenses on Schedule E of your 1040.

-

Single-member LLC: The IRS treats it as "disregarded". You still report on Schedule E, the exact same way.

Either way, your net rental profit gets taxed at your individual income tax rate. And here's a nice benefit for rental investors: passive rental income is not subject to self-employment tax (that 15.3% Social Security and Medicare tax that hits active business income). You get that benefit with or without an LLC.

Can You Deduct More Expenses With an LLC?

Another myth: "I need an LLC to write off my expenses." Not true. Both sole proprietors and LLC owners can claim the same deductions for mortgage interest, property taxes, insurance, maintenance, management fees, depreciation, and everything else related to the rental. The LLC doesn't give you access to anything extra.

When Does Tax Strategy Matter for LLC Owners?

While forming an LLC won't automatically save money, it can become a platform for tax optimization as your business grows:

S-Corp Election. If your short-term rental generates substantial net income (particularly if the IRS considers it active business income rather than passive rental income), you can elect to have your LLC taxed as an S-Corporation. This lets you split income into a "reasonable salary" (subject to payroll taxes) and distributions (not subject to self-employment tax). It can save thousands in Medicare and Social Security taxes, but only once profits are high enough to justify the extra complexity. Most CPAs recommend waiting until net income hits $40,000-$50,000+ before this makes sense.

Multi-Member LLC = Partnership Return. If you bring in a partner or co-investor, your LLC will need to file a Form 1065 partnership return each year. Each member gets a K-1 reporting their share of income. It's extra paperwork (and usually accounting fees), but it provides clear structure for shared ownership.

State Franchise Taxes. Don't forget to check your state. Some impose annual LLC taxes or fees that add up. California charges $800 per year just for the privilege of having an LLC in the state, regardless of whether the business makes money. If you're running a small rental with thin margins, that fee alone might not be worth it.

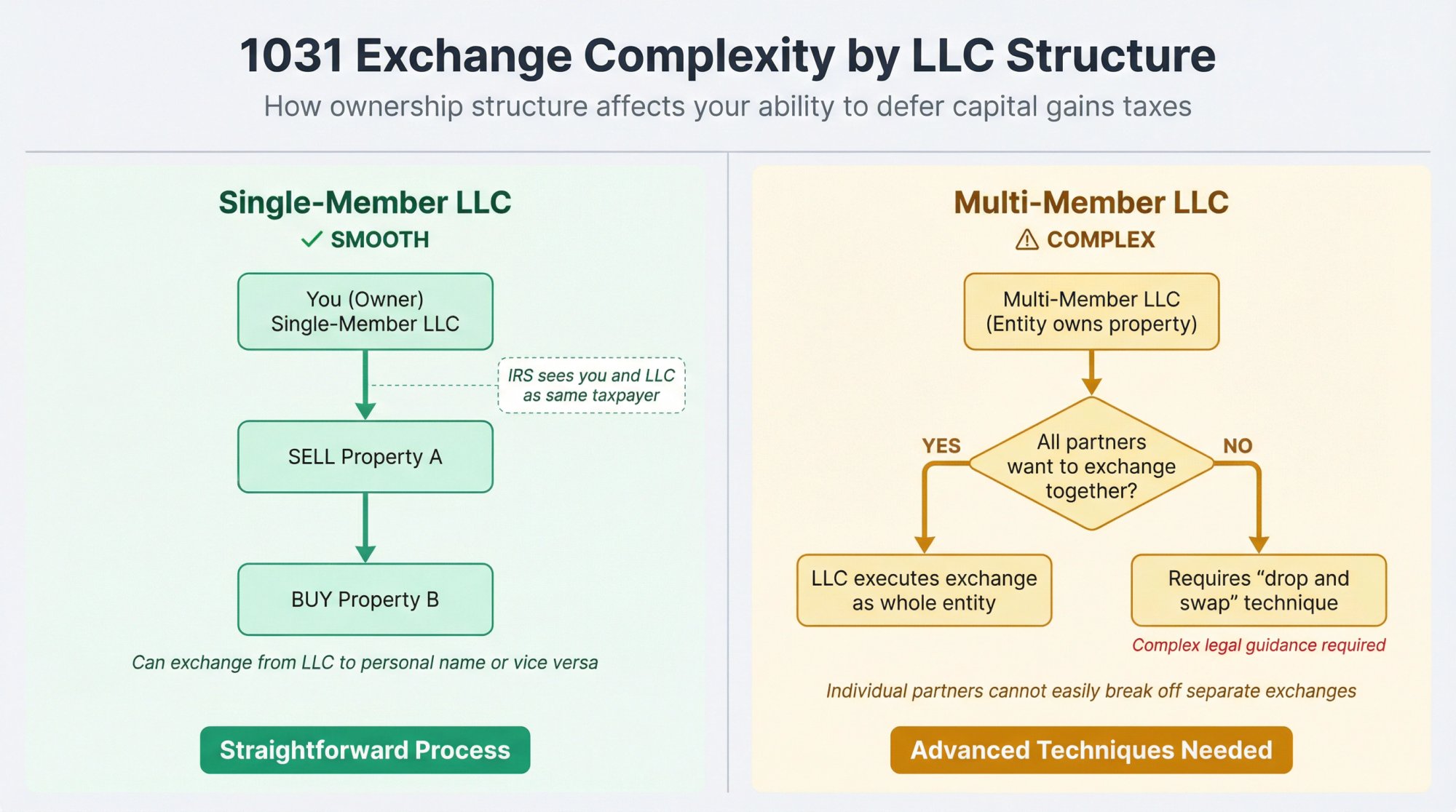

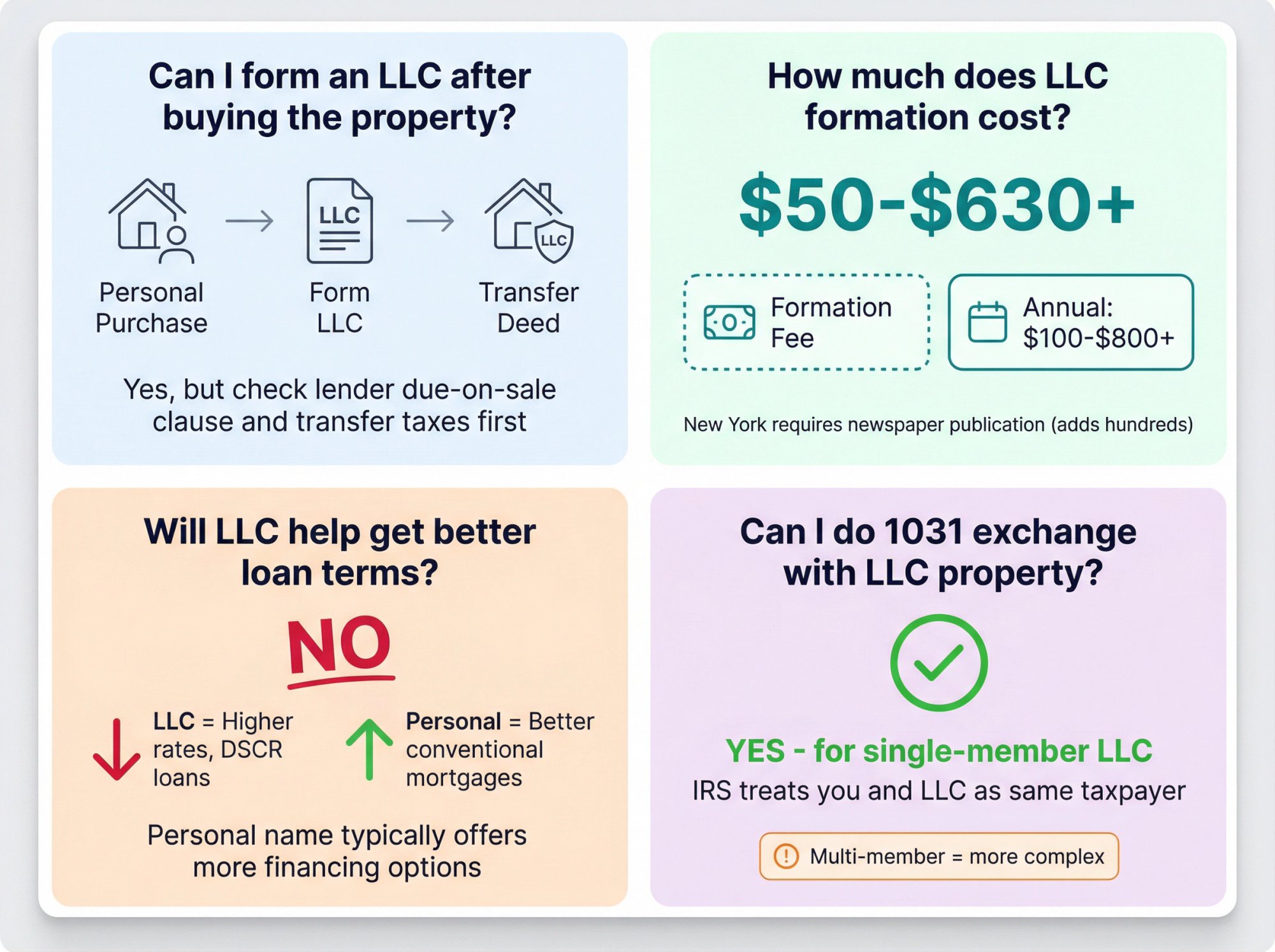

How Does an LLC Affect 1031 Exchanges?

Planning to sell this property eventually and roll the gains into another investment? Like-kind exchanges under Section 1031 let you defer capital gains taxes, but there's a catch: the same taxpayer must sell and buy.

Single-member LLC: Generally smooth. The IRS sees you and your single-member LLC as the same taxpayer. You can sell from your LLC and buy into your personal name (or vice versa) without issue.

Multi-member LLC: More complicated. The entity owns the property, so the LLC would need to do the exchange as a whole. Individual partners can't easily break off their share into separate exchanges. If one partner wants out and another wants to exchange, you're looking at advanced techniques like "drop and swap" that require careful legal guidance.

Bottom line for taxes: Don't let tax savings be the primary reason you form an LLC. They're usually not there for a single property. Choose your structure based on liability protection and financing first. Consult with a CPA if your situation gets complex.

At Chalet, we can connect you with STR-savvy CPAs who specialize in vacation rental taxation. They'll help you figure out whether an S-Corp election makes sense or how to structure a 1031 exchange properly.

How Much Does It Cost to Form and Maintain an LLC?

So what does an LLC actually cost? It's more than just the filing fee.

LLC Formation Fees by State

Every state charges a fee to file your Articles of Organization. The range is wide:

| Cost Tier | States | Filing Fee |

|---|---|---|

| Low | Arizona, Kentucky, Mississippi | $40-$50 |

| Mid | Florida, Texas, Colorado | $50-$300 |

| High | Massachusetts, Illinois, California | $150-$500+ (plus annual taxes) |

Most states fall somewhere between $50 and $300. A few outliers like New York also require newspaper publication that can run several hundred dollars extra.

If you hire an attorney or use a formation service, add those fees on top. Many investors do it themselves using state websites or affordable online services.

What Are the Annual Costs of Maintaining an LLC?

Most states charge an annual report or renewal fee. Typical range: $100 to $300 per year.

Then there's California, with its $800 annual franchise tax. If your Airbnb rental only nets a few thousand in profit, that one fee can eat a significant chunk of your returns.

What Is Beneficial Owner Reporting for LLCs?

Starting in 2024, the Corporate Transparency Act requires most LLCs to file a Beneficial Ownership Information (BOI) report with FinCEN. New LLCs must file within 90 days of formation. Existing LLCs had until January 1, 2025.

This report discloses who actually owns and controls the company. It's not a huge burden (one-time filing unless ownership changes), but it's one more thing individual property owners don't have to deal with. And the penalties for non-compliance are significant.

How Much Does It Cost to Transfer Property to an LLC?

Moving an existing property into an LLC means recording a new deed. Depending on your location, you might face:

→ Recording fees ($10-$50 typically)

→ Potential transfer taxes based on property value

→ Title insurance endorsement fees

→ In some states like California, possible property tax reassessment

The safest approach is forming the LLC before you purchase. But if you already own the property, factor these costs into your decision.

How Much Administrative Work Does an LLC Require?

Beyond dollars, there's time and attention. You'll need to:

① Maintain a separate bank account for the LLC

② Keep clean books separating personal and business expenses

③ File annual reports and renewals on time

④ Track the BOI report and any updates

⑤ Potentially file a partnership return if multi-member

None of this is overwhelming, but it does require treating the rental as a real business rather than a casual side income.

The practical reality: Many investors start in their personal name while "testing the waters" with their first STR property. If things go well and they decide to scale, they form an LLC later. This keeps startup costs low, though you're exposed to more risk during that initial period. If you go this route, make absolutely sure your insurance coverage is rock-solid.

Does an LLC Improve Privacy and Credibility?

These factors are less tangible than liability protection or financing, but they matter to some investors.

How an LLC Protects Your Personal Information

When a property is owned by an individual, your name appears on the public deed. Anyone can look it up through county records. If you're a high-profile professional, you might not want your name easily connected to an investment property.

An LLC puts the company name on the deed instead. It's not complete anonymity (most states require listing owners or managers in formation documents), but it adds a layer. Someone would need to dig deeper to connect you to the property.

How Operating as an LLC Affects Your Professional Image

Operating under a business name like "Sunset Vista Rentals LLC" can signal that you're a serious investor rather than someone who occasionally rents out a spare room. This can boost credibility when working with property managers, contractors, vendors, and even potential partners or lenders.

Will it change your mortgage rate? Probably not. But it shapes how others perceive your operation.

Do Guests Care If Your Rental Is Owned by an LLC?

Most vacation rental guests don't care who owns the property. They care about reviews, photos, amenities, and responsive communication. Whether "John Smith" or "Mountain Retreat Properties LLC" owns the cabin doesn't factor into their booking decision.

But if you're doing direct bookings, sending rental agreements, or handling payment processing outside the major platforms, a business name can feel more professional.

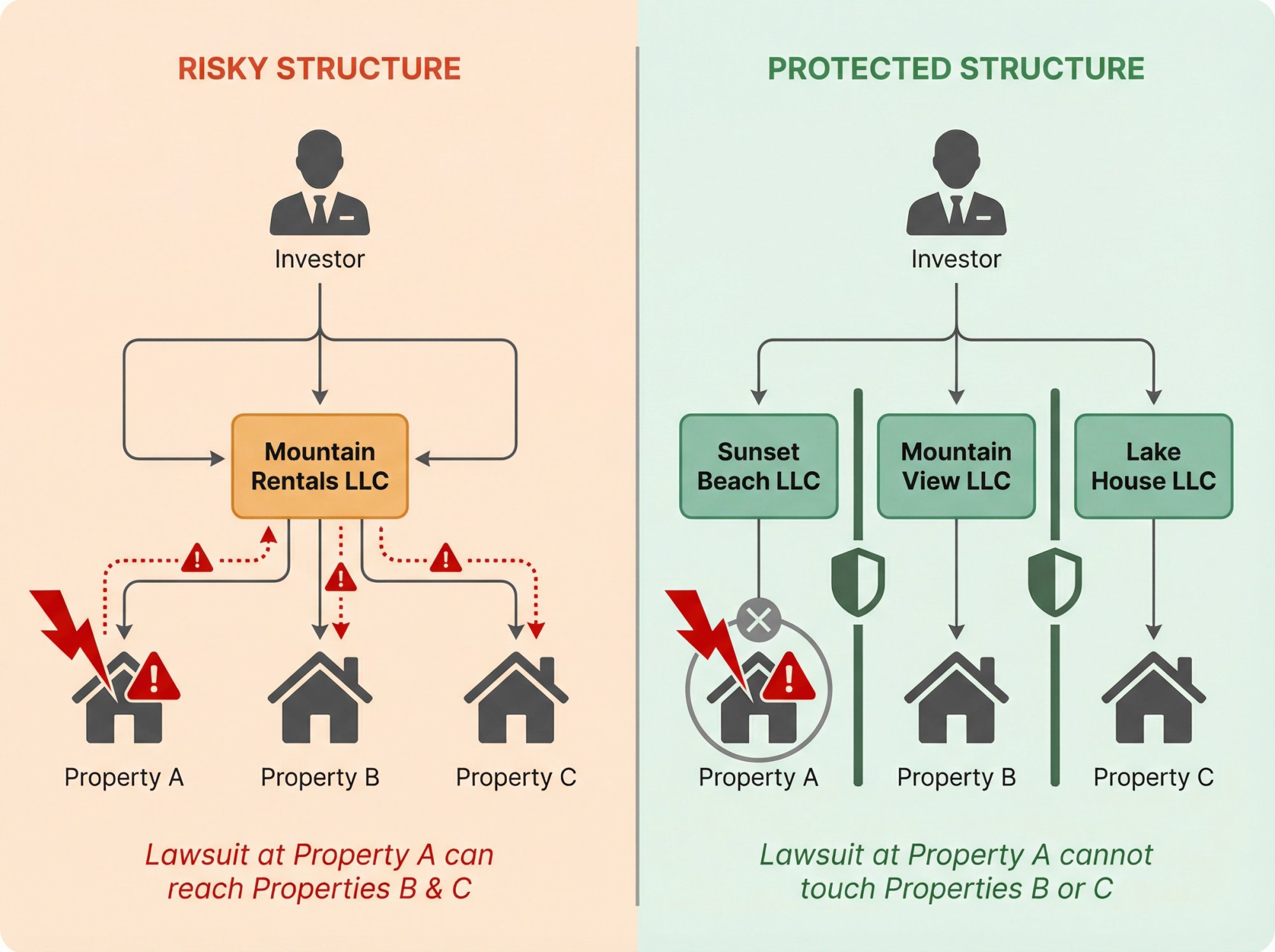

How to Use Separate LLCs for Multiple Properties

As you scale, you might use different LLCs for different properties or groups of properties. This keeps liabilities completely compartmentalized. A lawsuit related to Property A can't touch Property B if they're in separate LLCs. Some investors put each property in its own LLC for maximum protection.

For your first Airbnb rental, you probably don't need that level of complexity. But it's good to know the option exists.

How Local STR Regulations Affect LLC Ownership

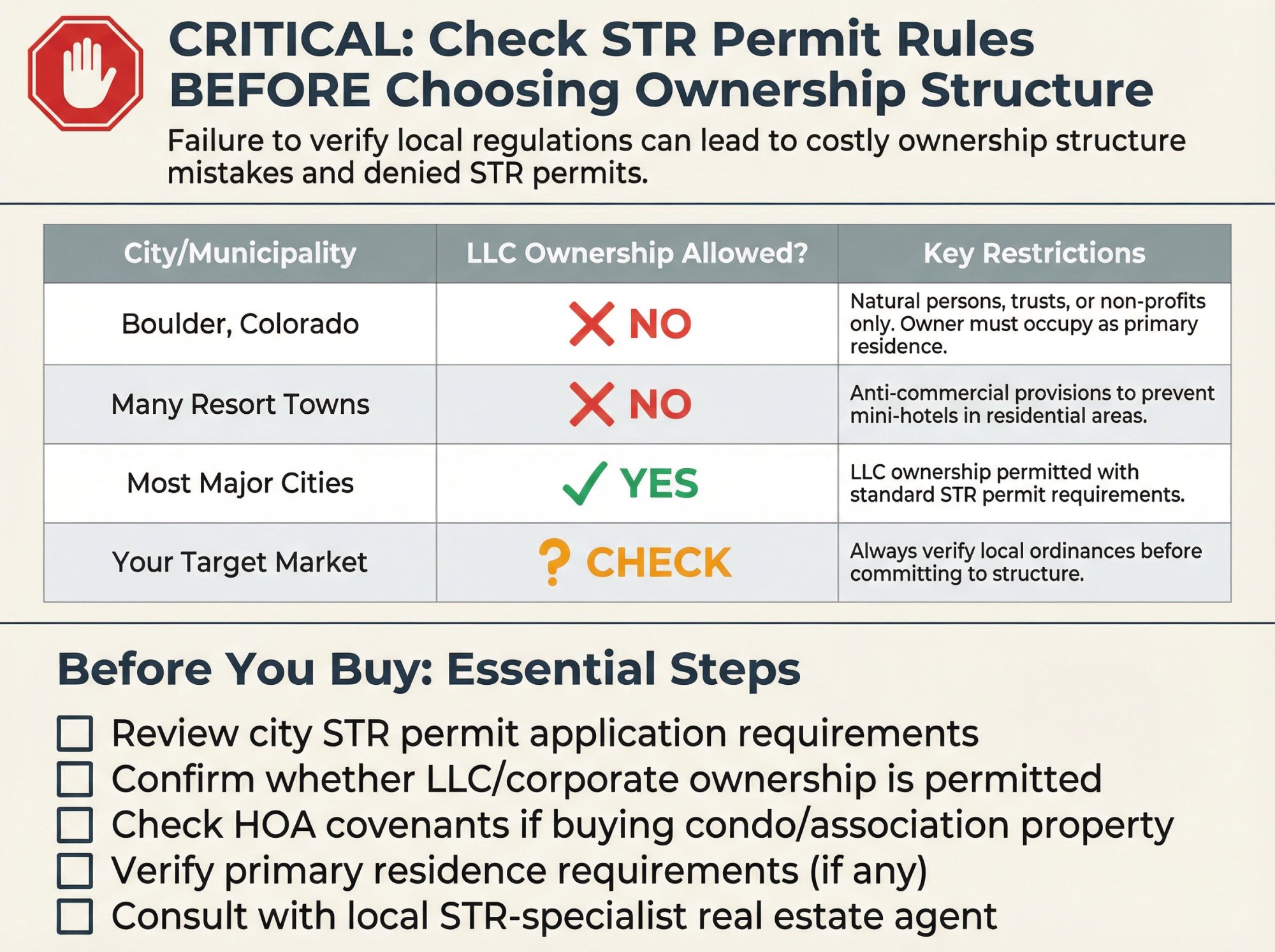

Here's something many investors overlook: Some cities don't allow LLC ownership for short-term rental permits.

Why You Should Check STR Permit Rules Before Choosing a Structure

Certain municipalities, especially those with strict vacation rental regulations for short-term rentals, require the property owner to be a "natural person" rather than a corporate entity.

Boulder, Colorado is a clear example. Their STR license application explicitly states that only natural persons, trusts, or non-profits can qualify. LLCs, corporations, and limited partnerships are not eligible. Plus, the owner must live there as their primary residence.

This isn't unique to Boulder. Other cities have similar provisions designed to prevent businesses from running mini-hotels in residential neighborhoods.

If you form an LLC, buy a property, and then discover your city won't issue an STR permit to an LLC, you're in a bind. You'd need to either transfer the property back to your personal name (triggering all those costs and complications) or find a creative workaround (some investors use trusts in certain jurisdictions).

Always check local ordinances before committing to a structure. Our STR regulations research at Chalet is a good starting point for researching specific markets.

Can an HOA Prevent You From Using an LLC?

If you're buying a condo or property in a homeowners association, review the covenants carefully. Some HOAs prohibit ownership by LLCs or corporations to maintain a residential character. Others might restrict short-term rentals entirely. Don't assume you can work around these rules just because you own through an entity.

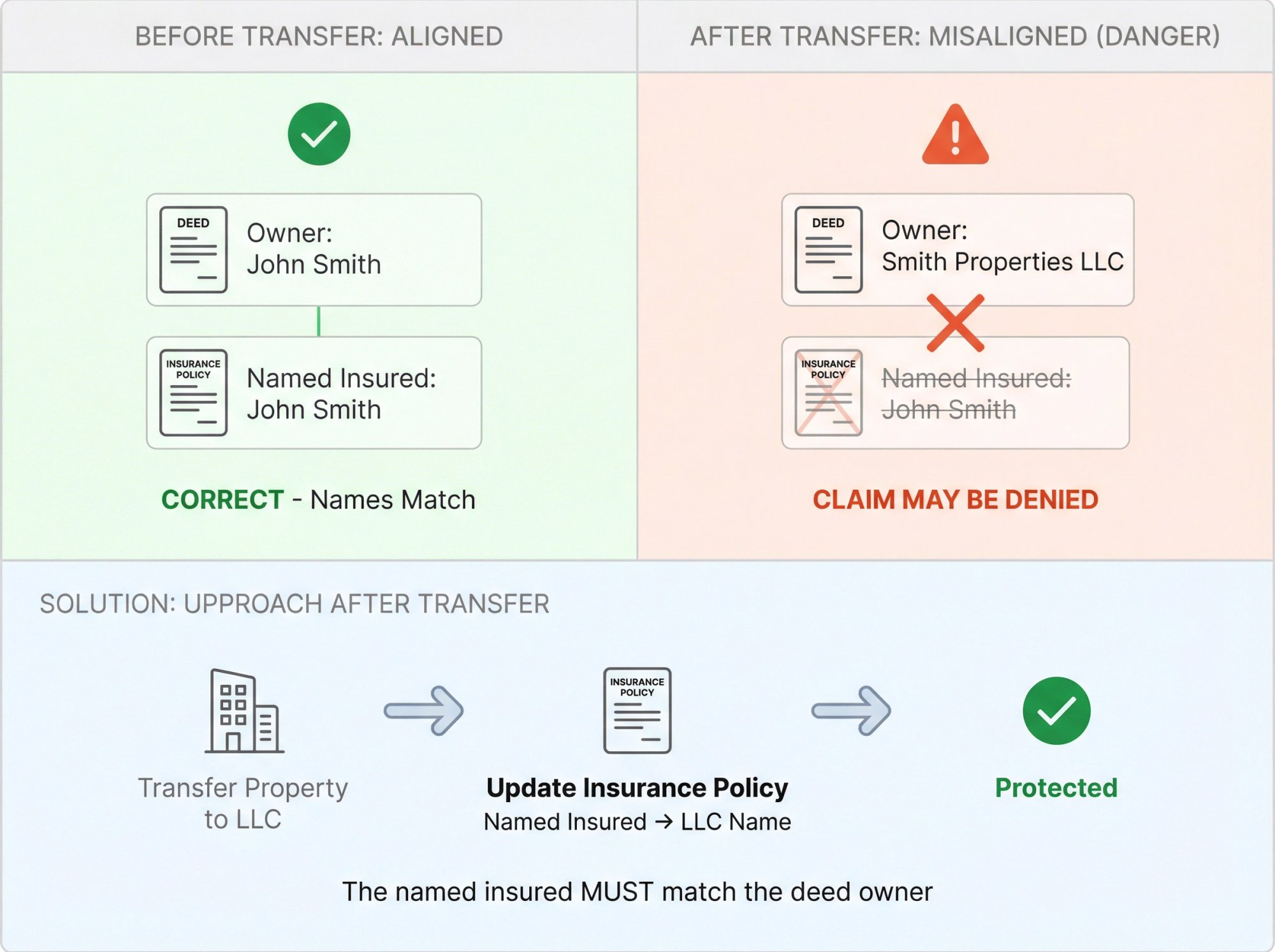

How to Update Your Insurance After Transferring to an LLC

When you transfer a property to an LLC, your insurance policy needs to reflect the new ownership. The named insured must match the deed owner. If the policy is still in your personal name but the LLC owns the property, a claim could be denied.

Most insurers can add the LLC as the named insured or issue a new policy under the LLC name. Premiums typically don't change much, but you need to coordinate this with any ownership transfer.

How Chalet Helps You Choose the Right Ownership Structure

The personal name vs. LLC question is just one piece of a much bigger puzzle. You also need to find the right property, secure financing, get insurance, set up operations, and eventually manage bookings. Trying to coordinate all of that alone can feel overwhelming.

That's where Chalet comes in. We're a one-stop platform for short-term rental investors, pairing free analytics with a vetted vendor network so you can research, buy, and operate in one place.

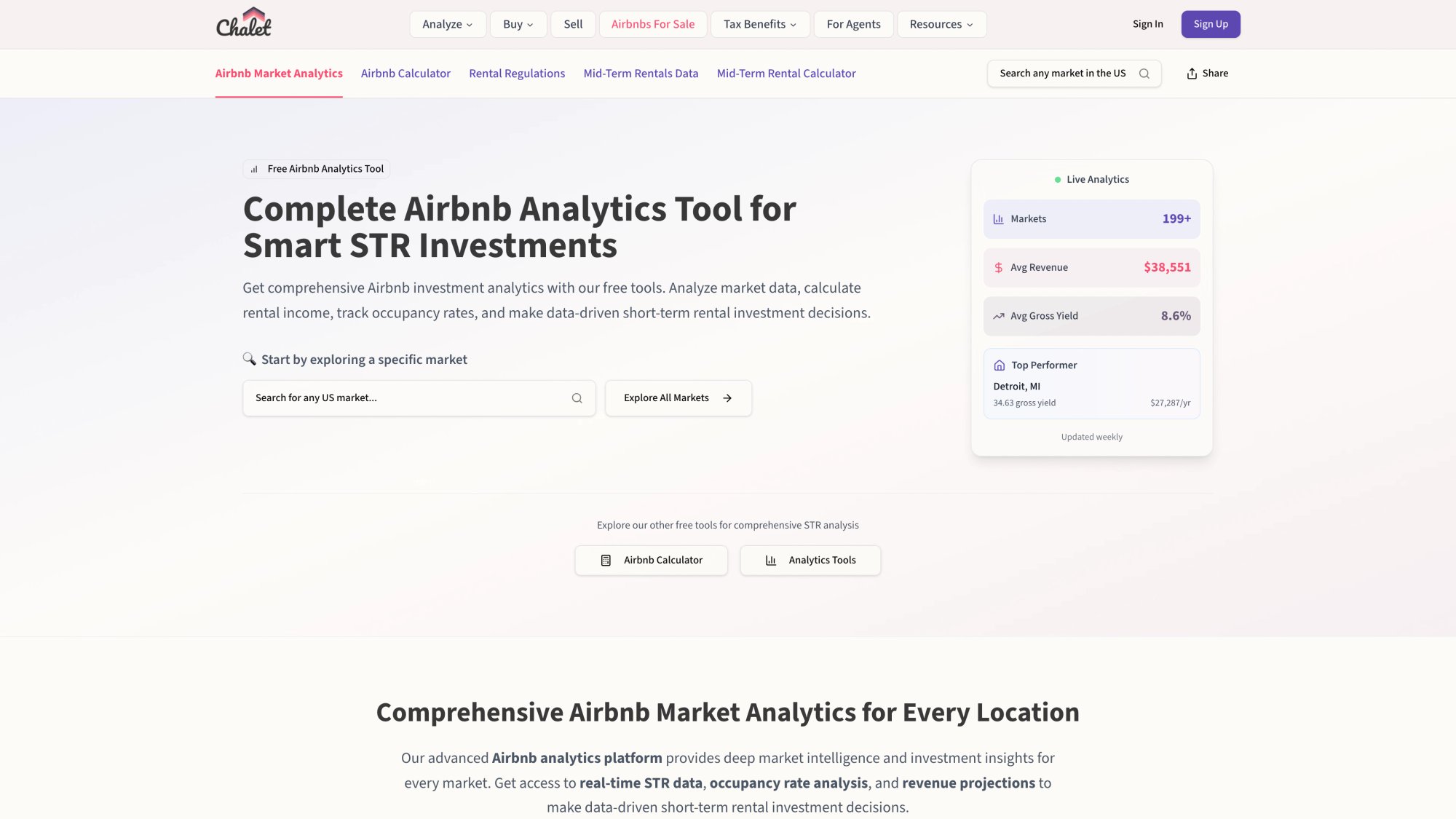

Free STR Analytics to Run Your Numbers

Use our Airbnb ROI Calculator to model different scenarios. What does cash flow look like with a conventional mortgage vs. an investor loan based on rental income? How do different markets compare? Having solid projections makes the financing decision (and therefore the LLC decision) much clearer.

Our market analytics dashboard shows ADR, occupancy, and revenue trends across markets. All free. No subscription required.

How to Connect With STR-Savvy Professionals

We've built a network of vendors who specialize in vacation rental investing:

→ Real estate agents who understand STR-specific factors and can guide you through the purchase process

→ Lenders who offer DSCR loans and can work with LLC ownership structures

→ Insurance providers who write policies specifically for short-term rentals

→ CPAs who specialize in rental taxation, S-Corp elections, and tax-deferred property exchanges

→ Property managers, cleaners, and furnishing specialists when you're ready to set up operations

You can explore Airbnbs currently for sale through our platform, check vacation rental rules by market, and access our STR directory of resources.

Why Vendor Connections Matter for the LLC Decision

The "should I use an LLC" question is deeply connected to financing, insurance, and tax strategy. Having the right professionals in your corner makes the decision easier. A DSCR lender might tell you financing through an LLC is no problem for your situation. An insurance broker might explain which policy structures work best for entity ownership. A CPA can run the numbers on whether an S-Corp election would actually save you money.

We connect you with those professionals so you're not making these decisions in a vacuum.

When Should You Use an LLC for Your Short-Term Rental?

We've covered a lot of factors. Let's distill them into some practical guidance.

Signs an LLC Is the Right Choice for Your Rental

You're in this for serious, long-term business. If you're consistently earning rental income and plan to continue for years, the protections of an LLC become more valuable. You're treating your rentals as a real business, so structure them like one.

You own (or will soon own) multiple properties. The more properties you have, the more exposure to risk. Many investors form an LLC by their second or third property if not sooner. You can even put each property in a separate LLC to compartmentalize liability.

You have significant personal assets to protect. If you've built substantial savings, own your primary home outright, or have other investments, an LLC helps ensure a rental problem can't domino into personal financial ruin.

You're bringing in partners or outside investors. The moment it's not just you, an LLC provides essential structure. It defines ownership percentages, decision-making authority, and profit distribution. Never hold a shared investment casually in one person's name.

You need a business bank account or credit lines. Having an LLC makes it straightforward to open a true business account and start building a credit profile for your rental operation.

You're hiring employees or contractors regularly. Once you have cleaning crews, handymen, or a co-host on payroll, operating under an LLC adds a layer of protection and professionalism.

When Personal Name Ownership Is the Better Option

You're just testing the waters with your first STR. If this is your first property and you're not sure how it'll go, starting simple is reasonable. You can always form an LLC later once you're committed to scaling.

Your annual revenue (and profit) is modest. A small cabin renting occasionally or a room in your house probably isn't generating enough income to justify the cost and hassle of an LLC. Make sure you have solid insurance coverage and an umbrella policy.

You're in a jurisdiction with restrictive rules. If your city requires individual ownership for an STR permit, or your HOA prohibits LLCs, the decision is made for you.

Financing is your top priority. If you need the very best mortgage terms to make the numbers work (especially as a first-time investor with limited capital), buying in your personal name gets you there without lender complications.

You're disciplined about insurance and risk management. A person with no LLC but a $2 million umbrella policy, proper STR coverage, and a well-maintained property might be just fine. If you're confident in this approach, you might reasonably decide an LLC is overkill.

When Most Investors Decide to Form an LLC

For many investors, the answer evolves as they scale. The first property might be in their personal name. By the second or third, the case for an LLC becomes much stronger.

There's no shame in starting lean. Just set a checkpoint for yourself: "If I earn over $X per year or buy a second property, I'll form an LLC at that time." That way you're making a conscious choice, not procrastinating indefinitely.

How to Put Your LLC Decision Into Action

Once you've weighed everything, it's time to execute.

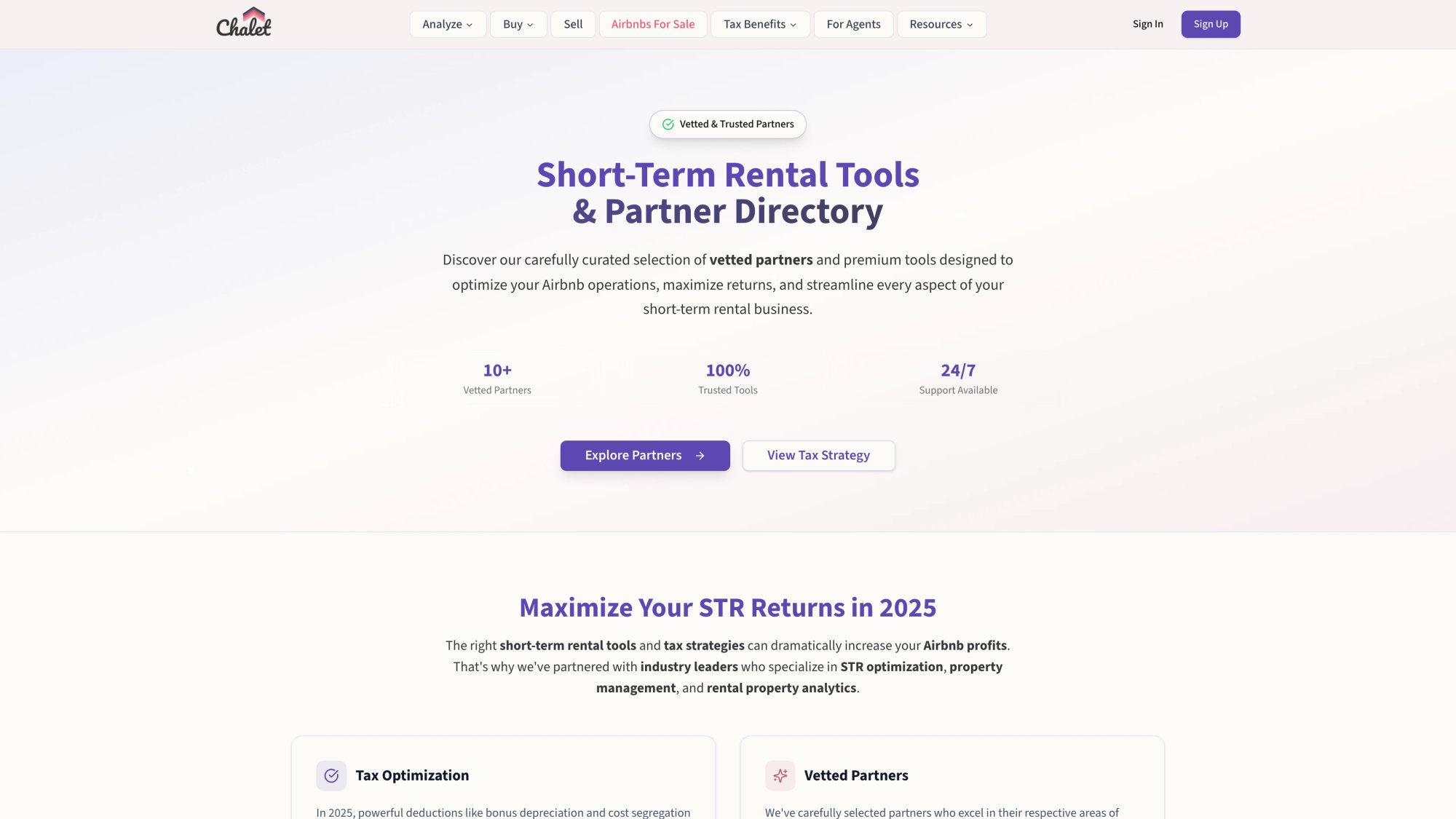

Steps to Take When Buying in Your Personal Name

Set up your insurance properly. Since you won't have the LLC shield, your insurance is doing all the heavy lifting. Get a specialized short-term rental insurance policy that covers liability, property damage, and loss of income. Add a personal umbrella policy for extra protection (often $200-$400 per year for $1-2 million in additional coverage).

Keep good records anyway. Even without an LLC, treat the rental like a business. Maintain separate bank accounts or at least detailed tracking for all rental income and expenses. This makes taxes easier and positions you for a smooth LLC transition if you decide to form one later.

Consider your exit strategy. If you might want to defer capital gains through a like-kind exchange into another property down the road, ownership consistency matters. You can still exchange from your personal name, but keep it in mind.

Steps to Take When Forming an LLC Before Purchase

Form before closing when possible. It's cleaner to take title in the LLC's name from day one rather than transferring later. You'll avoid due-on-sale concerns and transfer costs.

Register in the right state. In most cases, register your LLC in the state where the property is located. This keeps things simple and avoids extra filings.

Get an EIN. Apply for an Employer Identification Number from the IRS (it's free and can be done online). You'll need this for the business bank account.

Open a dedicated bank account. Keep all rental income and expenses flowing through the LLC's account. This separation is essential for maintaining liability protection.

Update everything post-closing. Insurance policies, rental permits, Airbnb/VRBO accounts, vendor contracts. Everything should reflect the LLC as owner or operator.

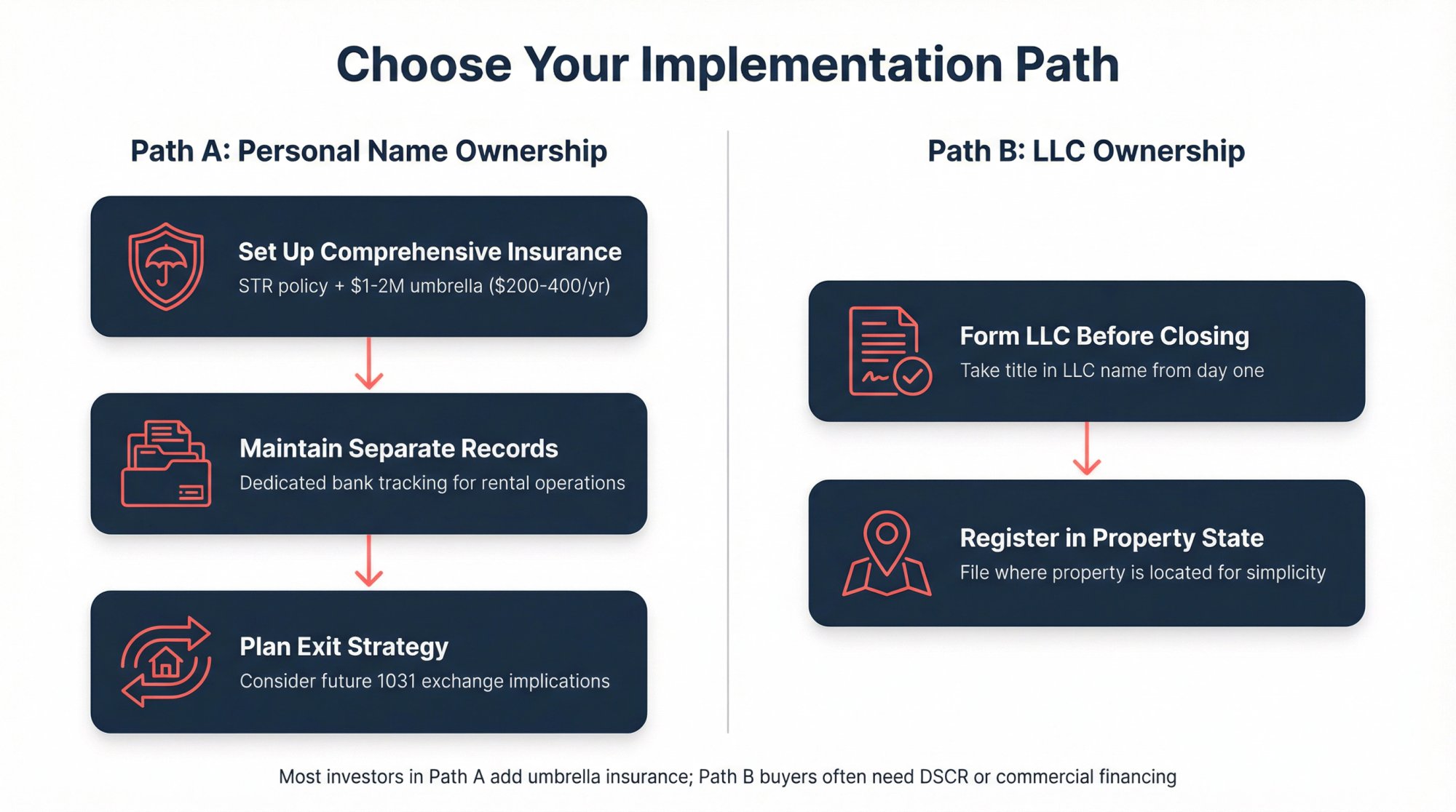

Steps to Transfer an Existing Property to an LLC

Talk to your lender first. Get written permission before transferring the deed. Find out if they'll allow it, what fees might apply, or if you'll need to refinance.

Coordinate with a title company or attorney. They'll prepare the deed and handle recording. In some states, you may need title insurance endorsements or other documentation.

Time it thoughtfully. Do the transfer during a slow booking period if possible. And handle all the notification steps (insurance, permits, accounts) promptly afterward.

Budget for potential costs. Recording fees, transfer taxes in some areas, possible insurance adjustments. Small amounts individually, but they add up.

Frequently Asked Questions

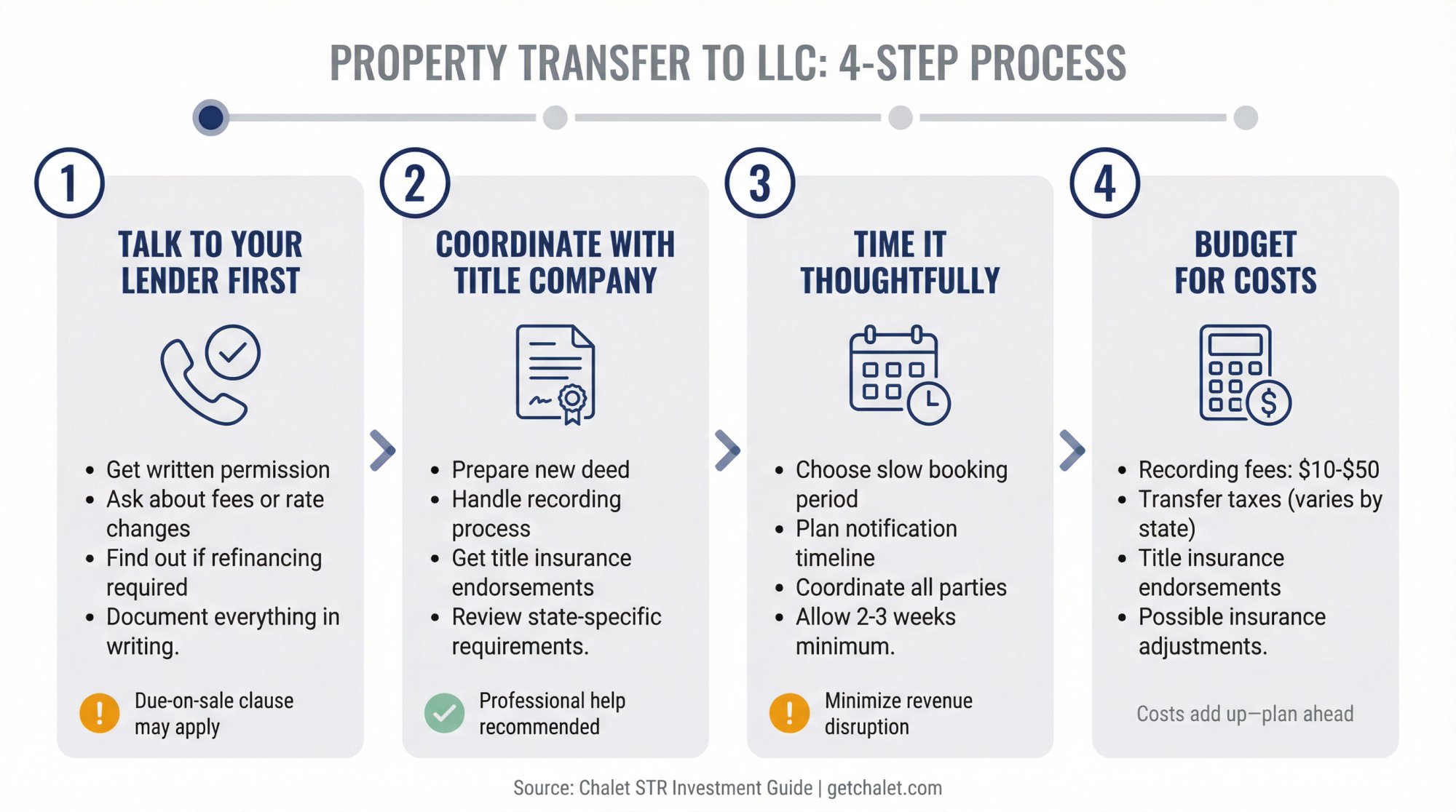

Can I form an LLC after I already bought the property in my personal name?

Yes. You can transfer the deed to your LLC at any time. The main concerns are: (1) your mortgage may have a due-on-sale clause that could be triggered, so check with your lender first, and (2) some states or counties charge transfer taxes. It's often cleaner to form the LLC before buying, but midstream transfers happen all the time.

How much does it actually cost to form an LLC?

Formation fees range from about $50 to $630+ depending on your state. Some states like New York also require newspaper publication that adds a few hundred more. If you hire an attorney or use a formation service, add those fees. Annual costs (state fees, potential franchise taxes) run $100 to $800+ per year depending on location.

Will having an LLC help me get better loan terms?

Usually no. In fact, it can make financing harder. Most conventional lenders won't lend to LLCs without personal guarantees, pushing you toward DSCR or commercial loans with higher rates. If getting the best mortgage is your priority, buying in your personal name typically gives you more options.

Can I do a 1031 exchange if my property is in an LLC?

Yes, if it's a single-member LLC. The IRS treats you and your single-member LLC as the same taxpayer, so exchanges work normally. Multi-member LLCs are more complicated because the entity (not individual partners) owns the property. Consult a 1031 specialist if you're planning to exchange from a multi-member LLC.

Do I need an LLC for just one rental property?

Not necessarily. Many investors start with personal ownership for their first property, especially if it's modest in scale and they have solid insurance. The case for an LLC gets stronger as you scale to multiple properties, generate higher income, or accumulate more personal assets to protect.

What's the difference between an LLC and an S-Corp?

An LLC is a legal entity type. An S-Corp is a tax election. You can have an LLC that's taxed as a sole proprietorship (default for single-member), a partnership (default for multi-member), or an S-Corp (by election). The S-Corp election can save on self-employment taxes once your profits are high enough to justify the extra complexity.

How do I maintain my LLC properly to keep the liability protection?

The key is treating it as a real, separate business. Keep a separate bank account. Don't mix personal and LLC funds. File all required annual reports and fees. Keep records of major decisions. If you treat the LLC like an afterthought, a court could "pierce the veil" and hold you personally liable anyway.

Does an LLC replace the need for insurance?

Absolutely not. Insurance and an LLC serve different functions. Insurance pays claims and covers damage. An LLC limits which assets can be reached if a lawsuit exceeds your coverage or falls outside it. Most experienced investors have both. Think of them as complementary layers of protection.

The ownership structure question is important, but it's just one part of building a successful short-term rental investment. At Chalet, we help you navigate all of it: finding the right market, analyzing the numbers, connecting with the right professionals, and setting up operations that actually work.

Whether you decide to buy in your personal name or through an LLC, we're here to help you move from research to action with confidence. Explore Airbnb rentals for sale, run the numbers with our free calculator, or meet an Airbnb-friendly agent who can guide your next steps.

Here's to smart investing and many booked nights ahead.