You're looking to break into the Airbnb business. You've probably run into two completely different paths: rental arbitrage (leasing someone else's property and subletting it) or buying your own investment property. Both are legitimate short-term rental strategies, but they're after different goals entirely.

One gets you cash flow fast with almost no money down. The other builds long-term wealth through property ownership.

Which one's right for you?

The answer depends. Arbitrage can put money in your pocket within weeks, no mortgage required. Property ownership builds equity and appreciation, but you'll need serious capital and commitment. In 2026, with interest rates hovering around 7-8% and stricter regulations popping up nationwide, the stakes (and the math) look very different from just a few years ago.

This guide breaks down both strategies so you can make an informed call. We'll compare upfront costs, cash flow potential, equity building, control, risks, and long-term wealth creation. Plus, we'll show you exactly how Chalet's free analytics and vetted vendor network can support whichever path you choose.

What Is Airbnb Rental Arbitrage? (The Quick-Start STR Strategy)

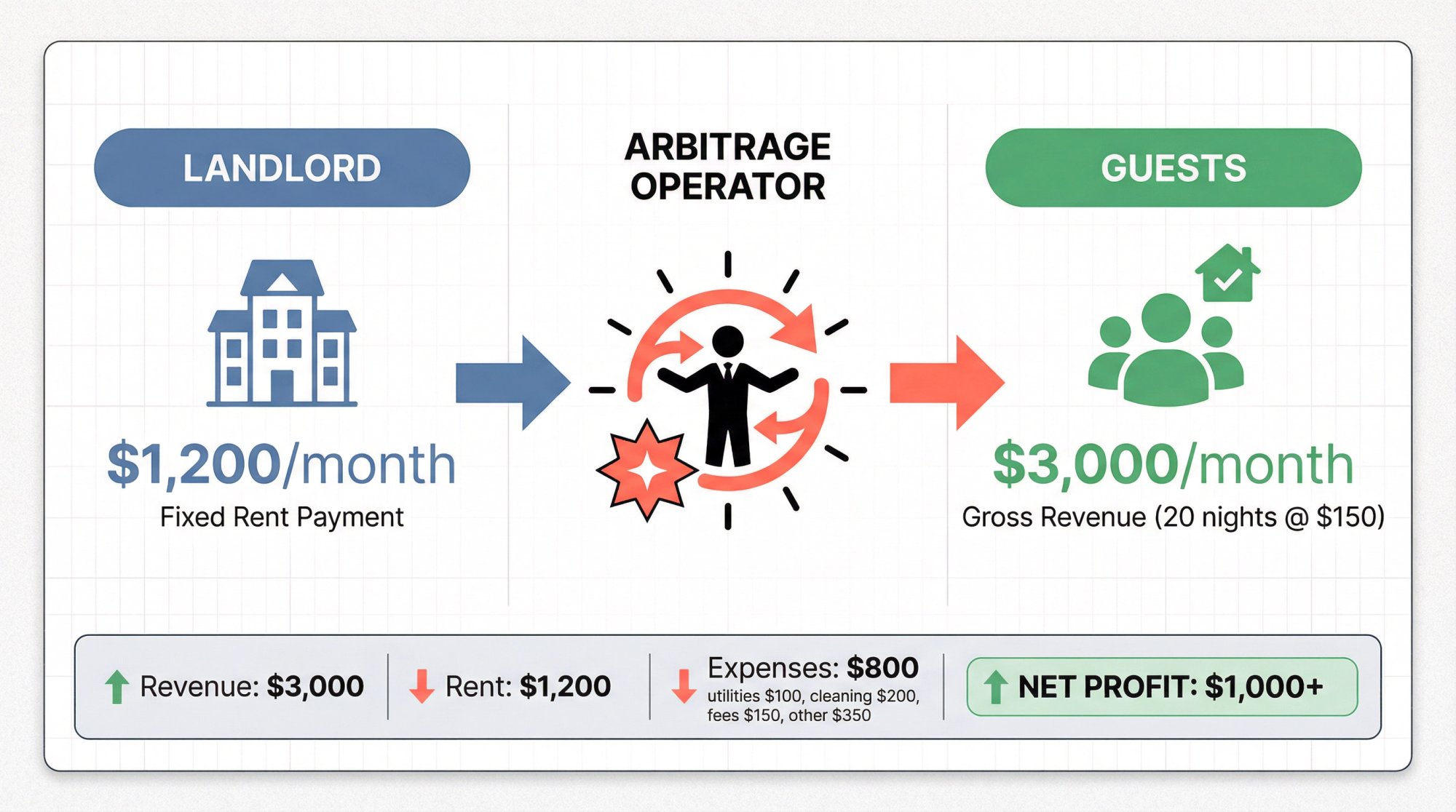

Rental arbitrage means you lease a property as a tenant, then sublet it on Airbnb or other short-term rental platforms. You're basically the middleman. You pay the landlord fixed monthly rent and collect nightly revenue from guests. If your Airbnb income beats your rent and expenses, you pocket the difference.

Simple example:

You lease an apartment for $1,200/month. You furnish it nicely, list it on Airbnb at $150/night, and hit 20 nights booked (about 65% occupancy). That's $3,000 in gross revenue. After paying rent ($1,200), utilities ($100), cleaning ($200), Airbnb fees ($150), and other costs, you might clear $1,000+ in profit for that month. Research shows a well-managed one-bedroom arbitrage unit can generate $800-$1,500/month in net profit with pretty modest startup costs.

Why Did Arbitrage Become Popular With STR Investors?

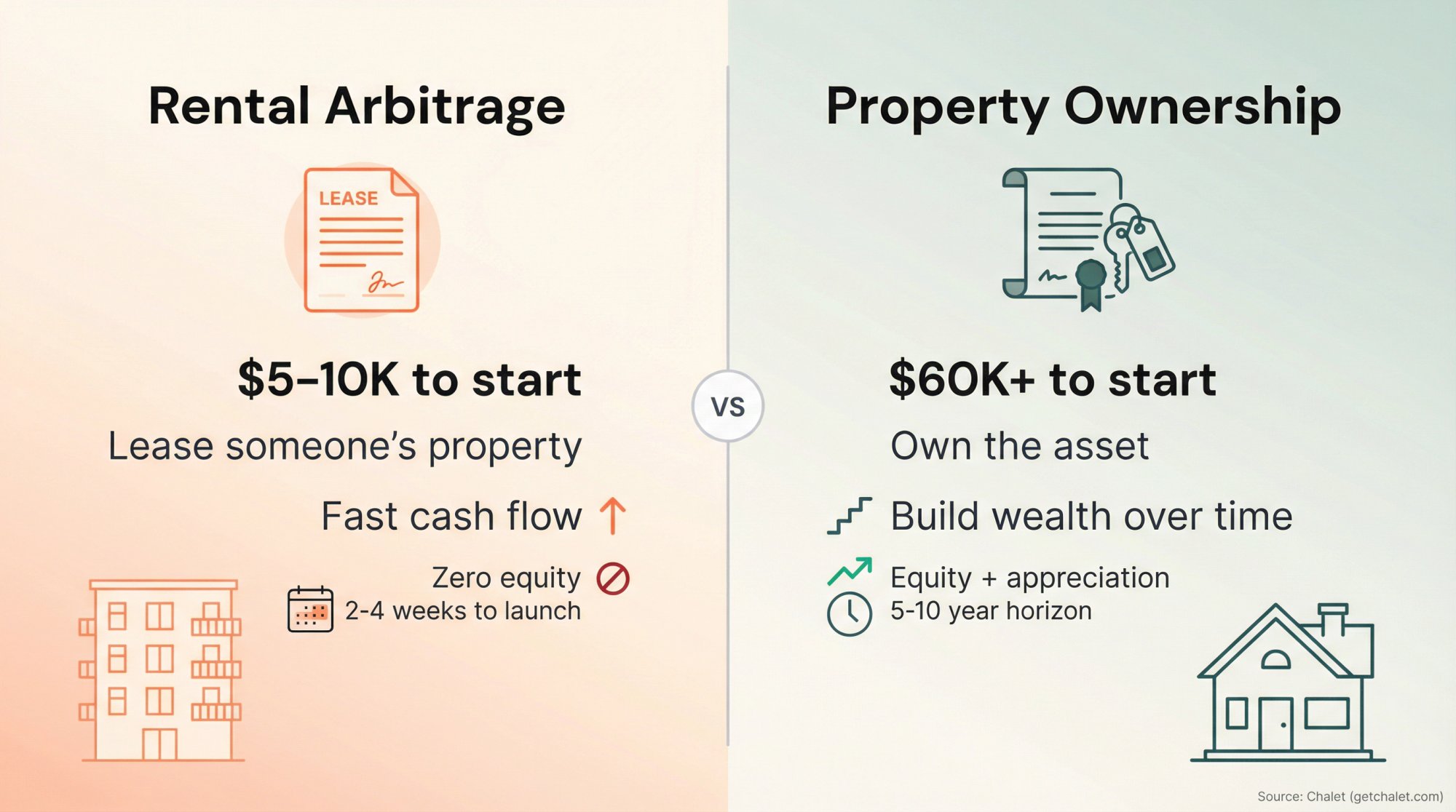

The barrier to entry is ridiculously low compared to buying an Airbnb property. Instead of needing $30,000-$60,000 for a down payment and closing costs, your startup expenses might be just $5,000-$10,000 total. That typically covers first month's rent, security deposit, basic furniture, linens, kitchen supplies, and initial listing setup. Even in moderately expensive markets, you can launch an arbitrage operation for under $10K if you're smart about furnishings.

You don't need a mortgage. You don't need perfect credit. You don't need to qualify for a loan. You just need a willing landlord, some cash for setup, and the hustle to manage guests.

This makes arbitrage particularly attractive for:

• First-time STR investors who want to test the waters without huge risk

• Entrepreneurs with limited capital but strong operational skills

• Anyone wanting to scale quickly without tying up massive amounts of cash per unit

The Catch: What Makes Arbitrage Risky in 2026?

You must have explicit landlord permission to sublet. Most standard leases prohibit subletting, so you'll need to negotiate this upfront. You also have to comply with all local short-term rental regulations, licensing requirements, and tax obligations, just like any STR operator. Attempting arbitrage "under the radar" without permission or in cities where it's banned can get you evicted, fined, or suddenly shut down.

Also, by 2026 the arbitrage game has gotten tougher. The easy days are basically over. Rents are higher, competition is stiffer, and regulations are stricter. Markets that were goldmines in 2020-2021 may not work anymore. Success requires careful market selection using data, professional management, and realistic expectations.

The biggest limitation?

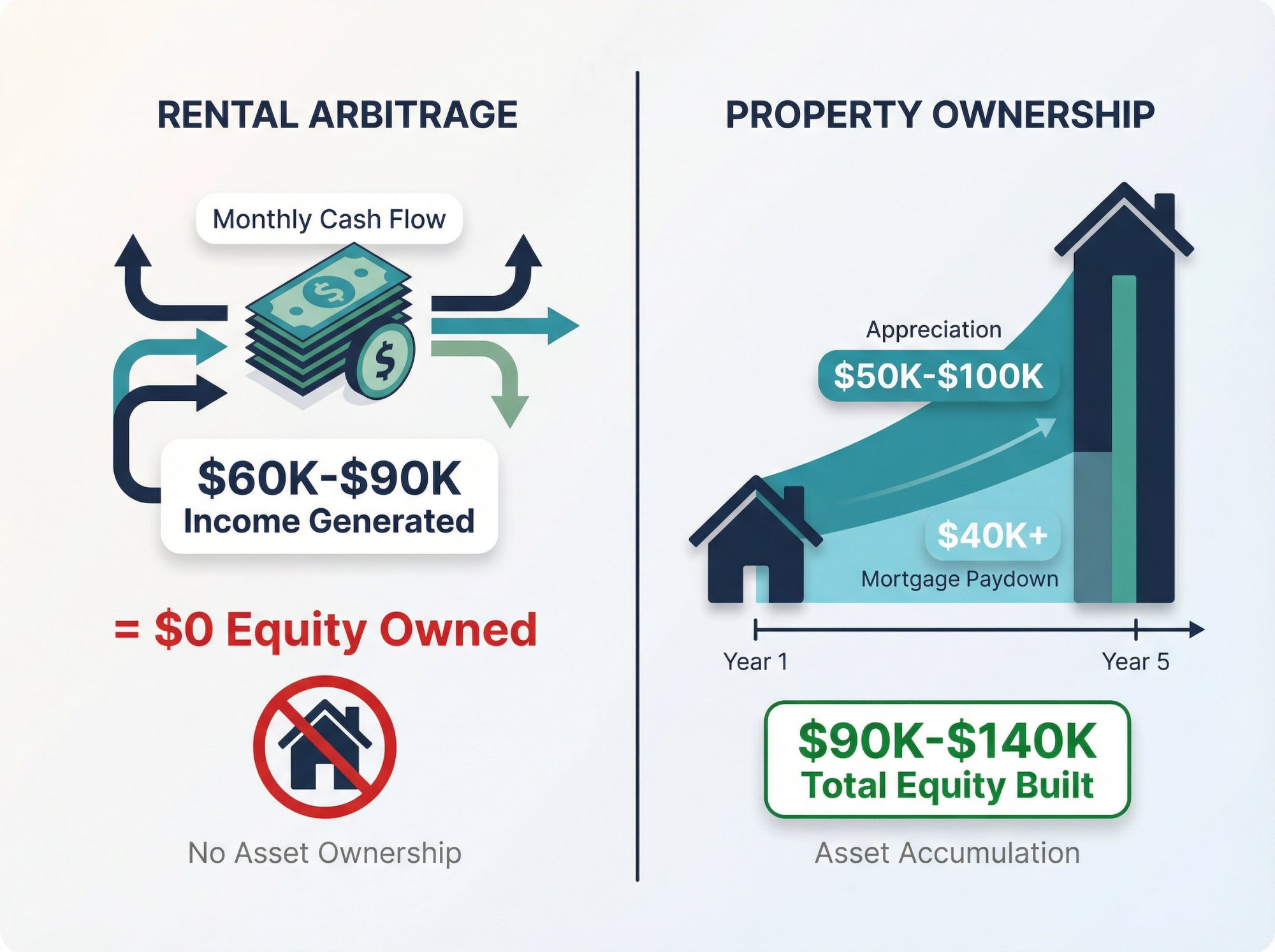

You own nothing. Zero equity. When your lease ends (or if the landlord decides to sell or reclaim the property), your business on that property is over. You've generated income, sure, but you haven't built an asset. Industry analysts note that rental arbitrage creates zero equity and your entire operation can be dismantled if circumstances change. That's the fundamental trade-off: immediate cash flow versus long-term wealth building.

Buying and Owning an Airbnb Investment Property (The Wealth-Building Path)

Buying a property means you purchase a home, condo, or vacation house and operate it as your short-term rental. Instead of paying rent to a landlord, you take on a mortgage (or buy all-cash if you've got the capital) and become the owner.

This requires way more upfront investment. For investment properties, most lenders want 15-25% down (often 20%+ is standard). On a $300,000 property, that's $45,000-$75,000 in cash, plus closing costs (another $6,000-$9,000), furniture, and setup expenses. Realistically, you're looking at $60,000+ in total capital to get started.

The costs don't stop there, either. Mortgage rates for investment properties in early 2026 are running around 7.5% or higher, which means hefty monthly payments. You've also got property taxes, insurance (which is expensive for STRs), maintenance, and repairs. Early on, many STR owners see modest cash flow or even break-even months while their property appreciates and their operations improve.

Why Would Anyone Choose This Harder Path?

Because this is how you build real wealth in real estate.

When you own property, you're stacking equity in two ways:

① Appreciation

Real estate historically increases in value over time. That $300K property might be worth $350K or $400K in 5-10 years (market dependent, of course). That's $50K-$100K in paper gains.

② Mortgage paydown

Every month you make a payment, part of it goes toward reducing your loan principal. After 5 years of payments, you might have $40K+ in equity from paydown alone.

An arbitrage operator five years from now has generated income but owns nothing. An owner has (hopefully) a property worth more than purchase price and significant equity built up. That's the core difference: arbitrage is a cash-flow tactic; ownership is a wealth-building strategy.

Critical insight: If your goal is to eventually have a multi-million dollar real estate portfolio, you need to own assets. Arbitrage can't get you there on its own because you never accumulate equity.

Ownership also provides maximum control and stability:

→ You make all decisions about the property (renovations, furnishings, pricing, house rules)

→ You can't be evicted by a landlord (as long as you pay your mortgage and comply with local laws)

→ You have multiple exit strategies (sell, refinance, convert to long-term rental, use as personal vacation home)

→ You can leverage the property's equity for future investments through 1031 exchanges

Want to add a hot tub to boost nightly rates? Install smart home features? Completely remodel? As the owner, it's your call. With arbitrage, you typically can't make major changes without permission, and even minor renovations might be off-limits.

What Are the Downsides of Owning Airbnb Property?

Higher risk exposure. You're responsible for everything. The water heater breaks? That's $1,500. Roof leak? Could be $8,000. Storm damage? Hopefully your insurance covers it. These unexpected expenses require maintaining cash reserves (most experts recommend 6+ months of expenses saved).

Less liquidity. Selling a property takes months and costs 6-10% in commissions and closing costs. If you need to exit fast or the market turns, you could be stuck or forced to sell at a loss. Converting to a long-term rental is an option, but might yield lower returns than you projected for STR income.

Market risk. If property values decline or new regulations severely restrict short-term rentals in your area, your investment could lose value or profitability. Real estate markets are cyclical, and timing matters.

Still, for investors committed to building a portfolio and growing net worth, property ownership is the proven path. The combination of rental income, tax benefits, appreciation, and equity accumulation has created more millionaires than almost any other investment vehicle.

Rental Arbitrage vs Owning: Head-to-Head Comparison

Let's break down the key differences:

| Factor | Rental Arbitrage | Property Ownership |

|---|---|---|

| Upfront Investment | $5K-$10K (first/last/deposit + furnishings) | $50K-$100K+ (down payment + closing costs + setup) |

| Barrier to Entry | Low (no mortgage needed, easier approval) | High (requires loan qualification or significant cash) |

| Monthly Cash Flow | Potentially higher immediate cash flow if market is right | Often lower early on due to mortgage/expenses, but improves over time |

| Equity Building | None (you own no assets, generate income only) | Yes (appreciation + mortgage paydown = growing net worth) |

| Control | Limited (must follow lease terms, landlord can end arrangement) | Maximum (you decide everything within legal bounds) |

| Flexibility to Exit | Easy (just don't renew lease, relatively short commitment) | Difficult (selling takes time and costs 6-10% in fees) |

| Risk Level | Moderate (fixed rent obligation regardless of bookings, but limited financial exposure) | Higher upfront risk (large capital invested, market fluctuations) but asset provides downside protection |

| Scalability | Fast (can add multiple units with modest capital per unit) | Slower (each property requires substantial capital or new loan) |

| Tax Benefits | Limited (deduct business expenses only, no property depreciation or mortgage interest) | Significant (depreciation, mortgage interest, 1031 exchanges, potential passive loss offsets) |

| Long-term Wealth | Zero asset accumulation (income stops when you stop) | High (own appreciating assets, build equity portfolio) |

The table makes it clear: arbitrage wins on accessibility and speed, while ownership wins on wealth creation and control.

One critical nuance: in 2025's high-interest-rate environment, the monthly cash flow advantage might actually favor arbitrage in some markets. Some investors are picking arbitrage right now precisely because a fixed rent of $1,500/month can pencil better than a $2,400/month mortgage payment on equivalent properties. The mortgage payment includes zero-return principal, high interest, taxes, and insurance, which can eat up a lot of revenue. But that mortgage payment is also building equity, whereas rent is pure expense.

It comes back to your timeline: Are you optimizing for monthly profit today, or net worth 5-10 years from now?

How to Choose the Right Strategy for Your Situation

The decision between arbitrage and buying comes down to four key factors: your capital, your goals, your risk tolerance, and market conditions.

If You Have Limited Capital or Want to Test the Waters First

Rental arbitrage makes sense as a stepping stone. Many experienced investors recommend that aspiring hosts start with arbitrage to learn the business without the weight of a mortgage. You'll figure out pricing, guest communication, cleaning logistics, local regulations, and operational efficiency. Then you can use your arbitrage profits to save up for a down payment on your first property.

Think about it: would you rather learn the hard lessons of STR hosting on a $300,000 asset with a mortgage, or on a leased apartment with minimal capital at risk? Arbitrage lets you make mistakes cheaply and build systems that scale.

Just treat it like a real business. Reinvest profits wisely. Save for that eventual property purchase. Don't get complacent with arbitrage as your endgame, because…

If Your Goal Is Long-Term Wealth and Asset Building

Property ownership is where you need to be.

Real estate creates wealth through:

• Appreciation (property value growth)

• Equity buildup (mortgage paydown)

• Cash flow (rental income after expenses)

• Tax advantages (depreciation, deductions, 1031 exchanges)

• Leverage (controlling a $300K asset with $60K down)

Arbitrage offers exactly one of those benefits: cash flow. And that cash flow evaporates the moment you stop operating. Ownership gives you all five, which compound over time into serious wealth.

If you're in a position to buy and you plan to stay in the STR game for years, own assets. Period.

Many successful investors use a hybrid approach: they arbitrage 1-3 properties to generate monthly cash, then funnel those profits into saving for a down payment. Once they buy their first property, they might maintain some arbitrage units for cash flow while their owned property appreciates. Eventually they sell or refinance the owned property to buy more. This progression from arbitrage to ownership is actually the smartest path for many beginners.

Consider 2026 Market Conditions and Interest Rates

Interest rates are high right now. Investment property mortgages are running 7.5-8%+, which makes monthly payments painful and cash flow tight for owners. This has pushed some investors toward arbitrage as a short-term play.

Here's the thing, though: buying at high rates isn't necessarily bad if you plan long-term. You can refinance later when rates drop. You lock in the property price today. And you start building equity immediately. In hot markets, waiting for rates to fall might mean waiting while property prices rise even faster, costing you more overall.

The math is specific to each market. Some cities are still strong for arbitrage (recent research identified markets like Detroit, Pittsburgh, and Memphis as solid arbitrage plays with reasonable rents and decent STR demand). Other cities have become nearly impossible for arbitrage due to regulations or rent-to-revenue ratios.

This is where doing actual market analysis becomes critical. Don't just pick a strategy. Pick a market where that strategy works.

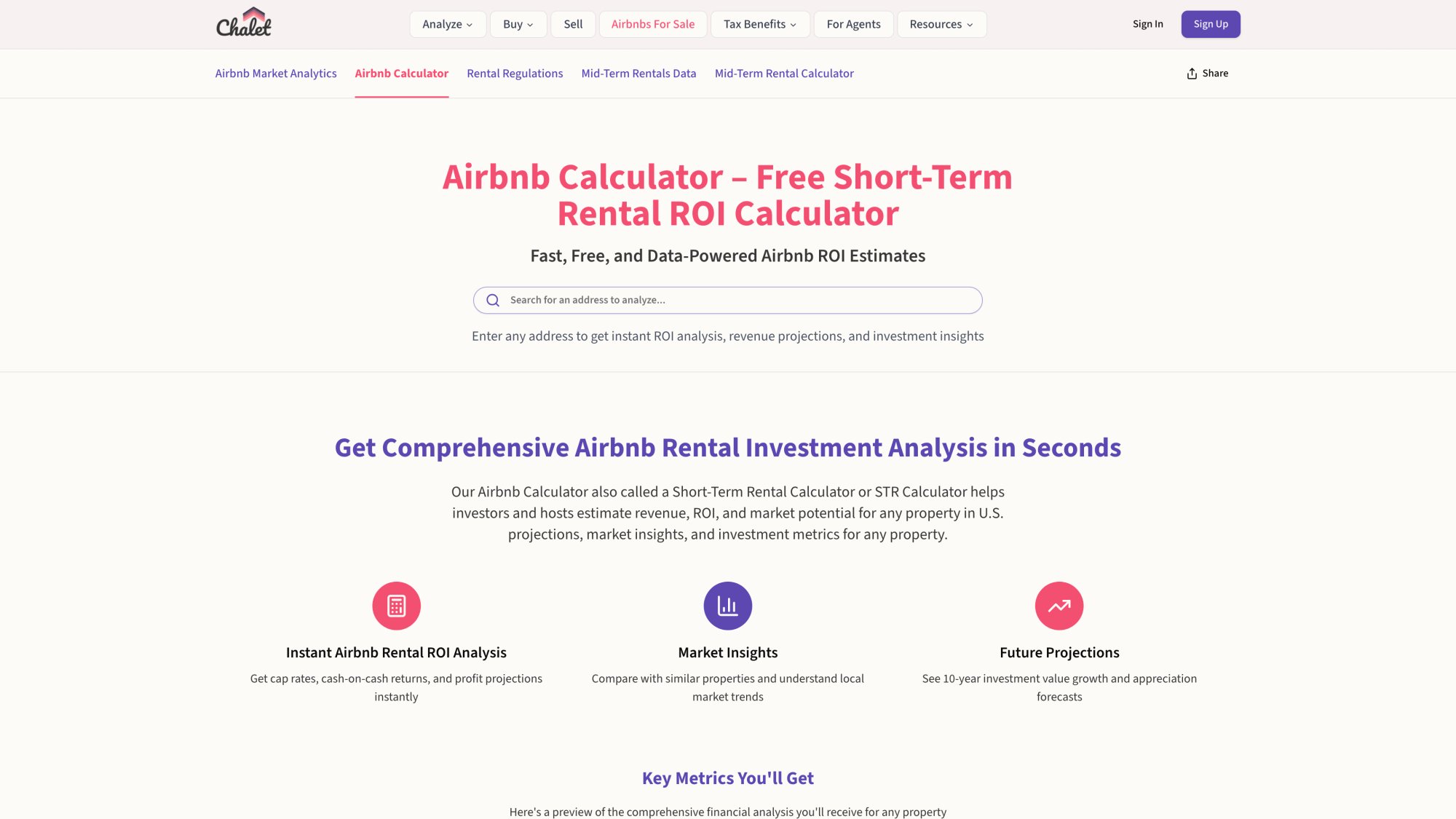

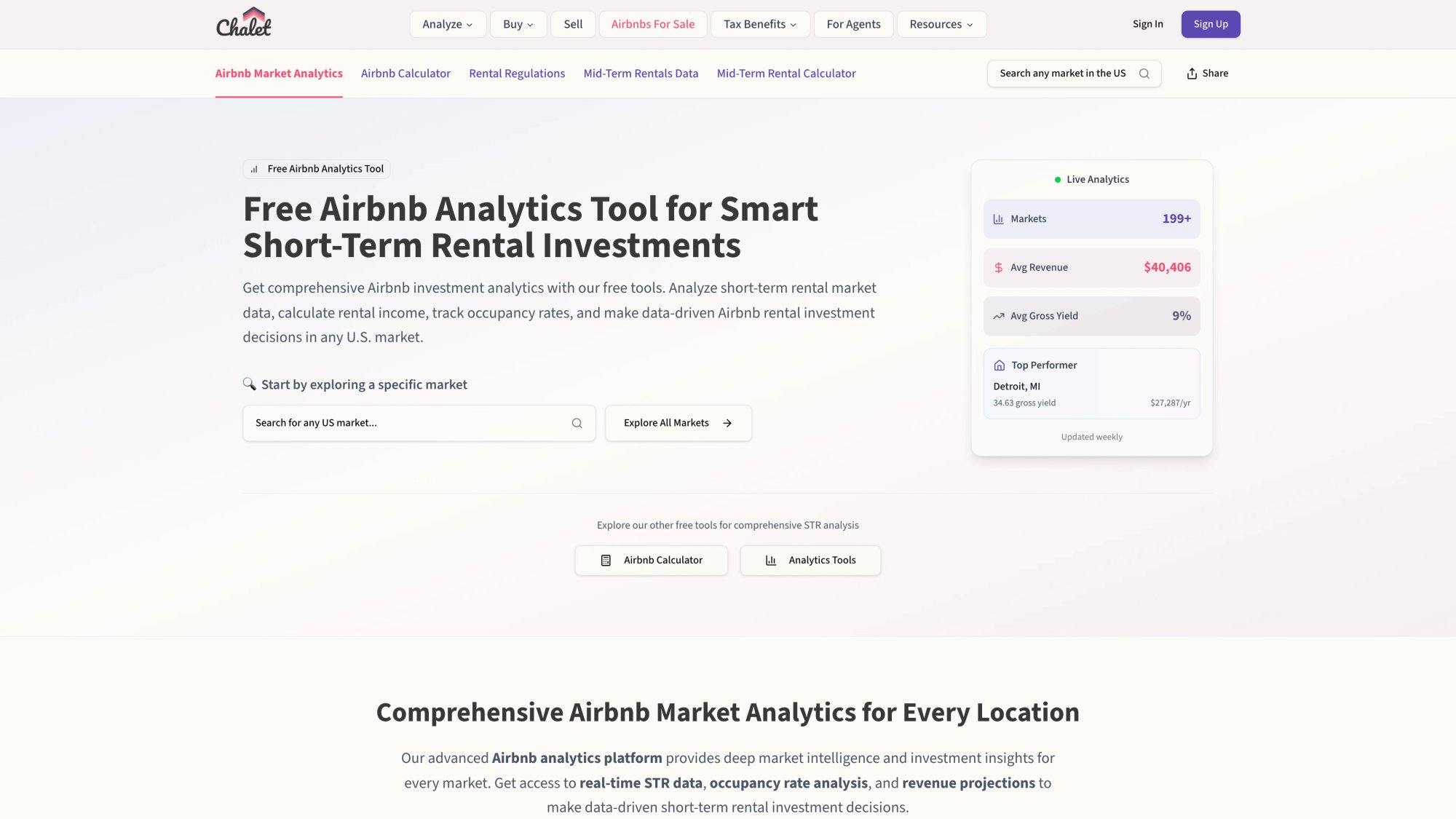

At Chalet, we provide free market analytics showing ADR, occupancy, revenue trends, and seasonality across hundreds of U.S. markets. You can also use our ROI calculator to model both scenarios: what if you arbitrage at $X/month rent, or what if you buy at $Y purchase price with Z% down? Run the numbers before committing.

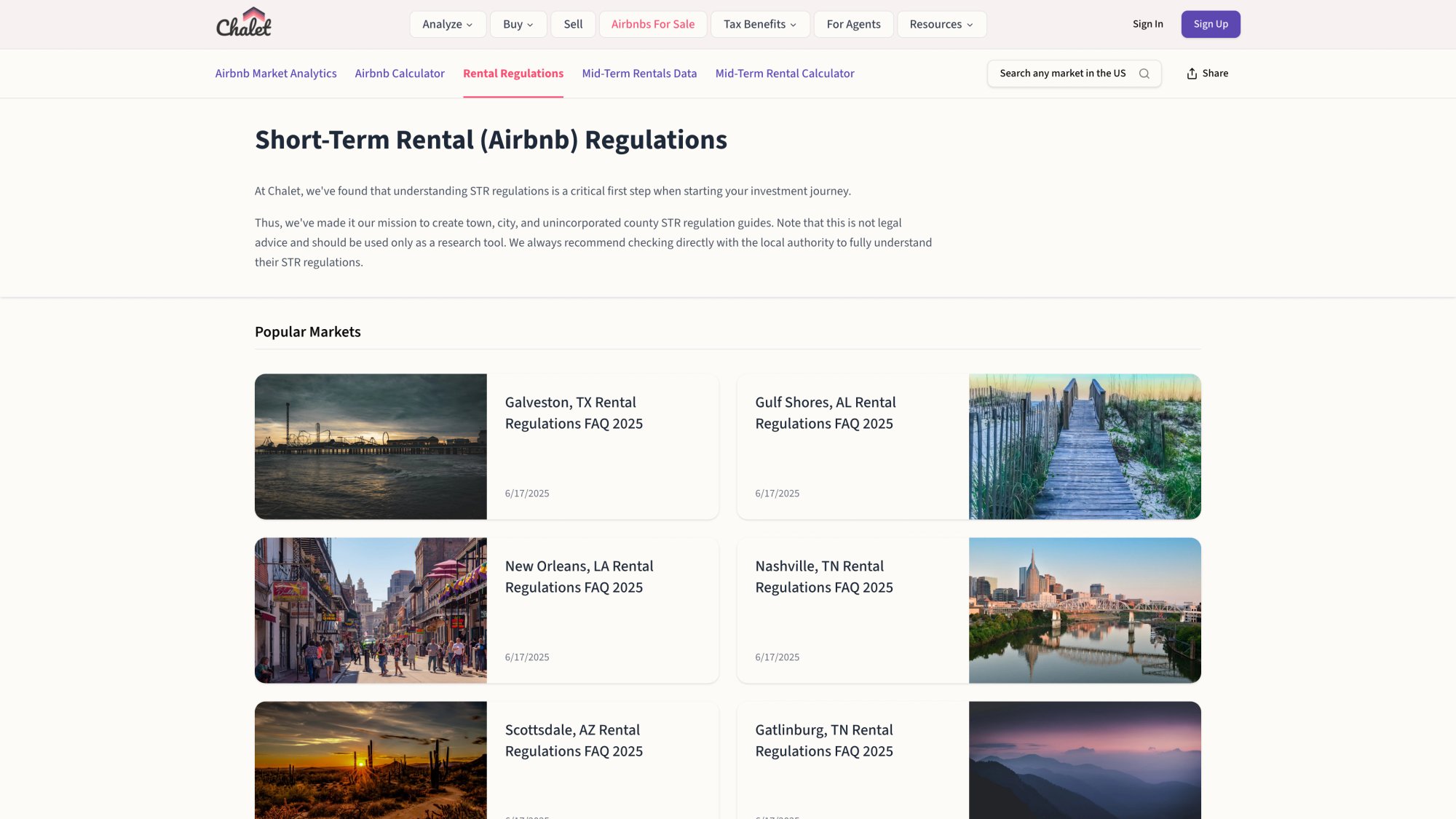

Don't forget regulations, either. Some cities are cracking down hard on non-owner STRs (which can hurt arbitragers). Our rental regulations library helps you understand local rules before you invest time or money.

Match Strategy to Your Personal Risk Tolerance

Arbitrage is higher intensity, lower commitment. You're signing annual leases, constantly hustling for new deals, and one lease termination can shut down a revenue stream. But you're not taking on massive debt or long-term obligations. If the market tanks, you walk away relatively unscathed.

Ownership is higher stakes, more stable. You're committing to a 30-year mortgage (unless you refinance or sell). Unexpected expenses can hit hard. But you can't be kicked out by a landlord, you control the asset, and you're building something that can be sold, passed to heirs, or used for retirement income.

Some people thrive on the flexibility and deal-making of arbitrage. Others prefer the stability and wealth-building of ownership. There's no wrong answer, but there is a wrong mismatch between your personality and your strategy.

Think About Your 5-Year Plan

Where do you want to be in five years?

• If you want to own 10+ STRs: You probably need to own at least a few of them. Arbitrage alone won't build a multi-million dollar portfolio.

• If you want steady income with minimal capital: Arbitrage can work, but understand you're building a job, not assets.

• If you want to do a 1031 exchange someday: You need to own property. We've helped many clients transition from traditional rentals into STR ownership using 1031 exchanges to defer capital gains.

• If you're unsure about STR long-term: Arbitrage lets you test without major commitment.

Most experts suggest: arbitrage to learn and earn, then ownership to build wealth. Use the cash flow from arbitrage to fund your first property purchase. That first property can then be leveraged (through equity or cash-out refinance) to buy more.

How Chalet Supports Both Strategies (With a Focus on Ownership)

Full transparency: Chalet was built primarily to help people buy and operate Airbnb investment properties. Our platform pairs free market analytics with a vetted network of STR-specialist vendors (real estate agents, lenders, insurance providers, property managers, and more) so you can research, buy, finance, and set up your STR in one place.

That said, our tools are valuable regardless of which path you're on:

For Arbitrage Operators

→ Use our free market dashboards to identify cities where rent-to-revenue ratios favor arbitrage

→ Run potential deals through our calculator to ensure profitability before signing a lease

→ Check local STR regulations to confirm arbitrage is allowed and understand permit requirements

→ Connect with property management companies if you need operational help as you scale

Important note: While our analytics and research tools are genuinely useful for arbitrage operators, Chalet's core vendor network (agents, lenders, insurance, and property services) is built primarily for investors who are ready to buy. If you're currently running arbitrage and thinking about transitioning to property ownership, we're here when you're ready to make that move.

For Property Buyers

This is where Chalet really shines.

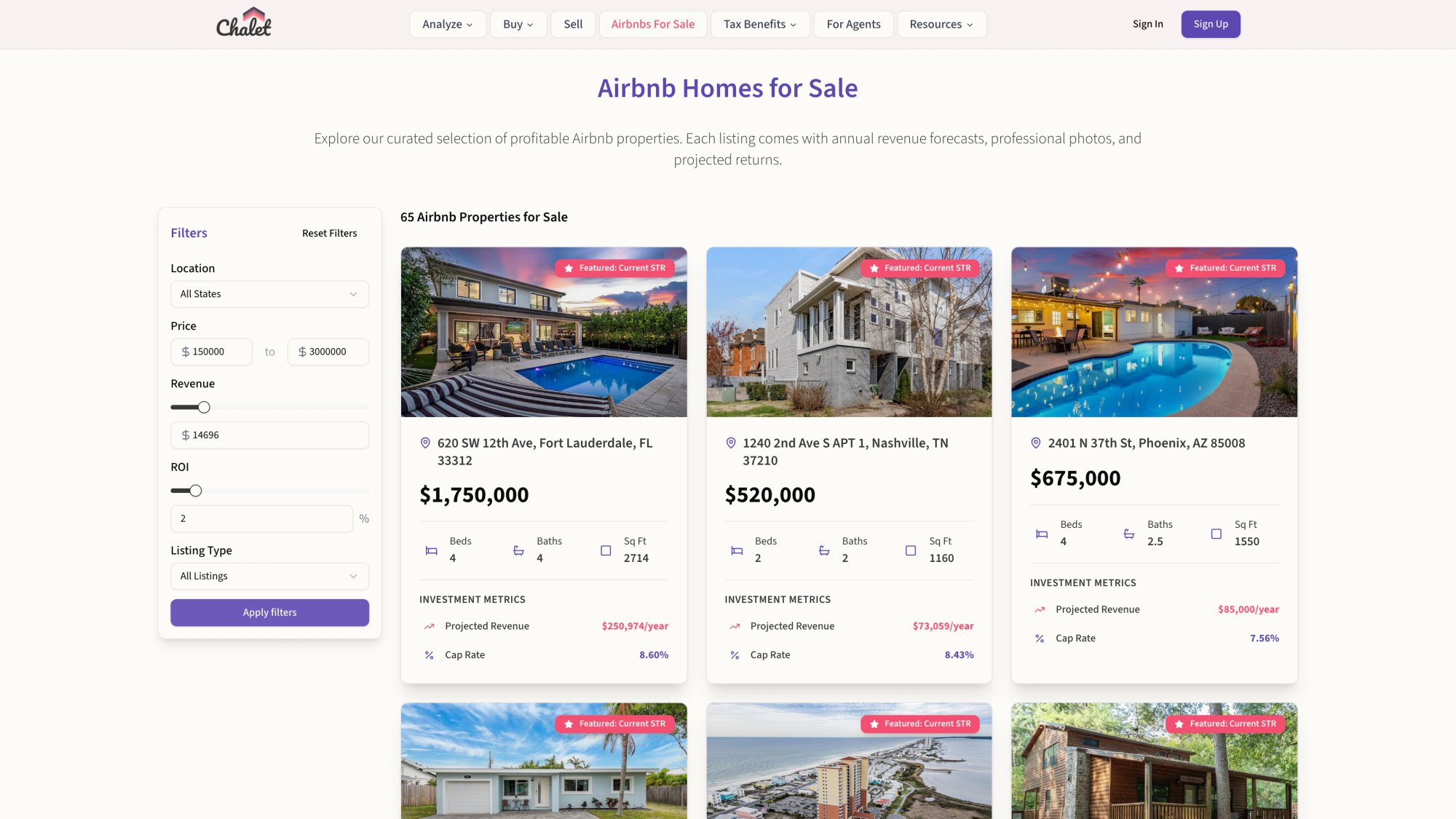

① Explore listings

Browse Airbnbs for sale across the U.S. Many are turnkey with existing bookings and revenue history.

② Analyze deals

Use our ROI calculator to model cash flow, cap rate, cash-on-cash return, and DSCR for any property or address. Understand exactly what your numbers will look like before making an offer.

③ Get financing

We work with STR-savvy lenders who understand DSCR loans, 1031 exchanges, and unique STR financing scenarios. Connect with a lender who specializes in short-term rental investing, or browse our agent network.

④ Set up operations

Once you buy, we help you connect with insurance providers, furnishing services, photographers, cleaners, and property managers to get your STR launched fast.

⑤ Research markets

Our market analytics provide ADR, occupancy, and revenue data across hundreds of markets so you can compare opportunities and make data-driven decisions.

If you plan to transition from arbitrage to ownership, Chalet is your natural next step. We've worked with many investors who started with rental arbitrage, saved up their profits, and then used our platform to find and finance their first property. We understand that journey and we're here to make it as smooth as possible.

Everything starts with data. Whether you're arbitraging or buying, you need to know your market inside and out. Start exploring markets for free and see which strategy makes sense in your target city.

Real Talk: Neither Strategy Is Perfect

Let's be honest about both approaches:

Rental arbitrage can work brilliantly in the right market with the right operator. But it's not passive income. It requires constant hustle, landlord relationships, regulatory awareness, and operational excellence. The data shows that easy arbitrage opportunities are mostly gone, markets are competitive, and margins are thinner than they used to be.

You're also building a business that owns no assets. That's fine for short-term income, but it's not a retirement plan.

Property ownership builds wealth, but it's expensive, slow, and comes with significant responsibility and risk. Not everyone has $60K sitting around for a down payment. Not everyone wants to deal with property maintenance or market volatility.

Most successful STR investors eventually do both. They arbitrage a few properties for cash flow while simultaneously building an owned portfolio for equity. The arbitrage pays the bills and funds growth; the owned properties create wealth.

Or they start with arbitrage, prove the model, save aggressively, and then go all-in on ownership once they can afford it.

The worst thing you can do is not start at all because you're paralyzed by the decision. Pick the strategy you can execute on today. Learn, adapt, and evolve as you grow.

Your Next Steps: Getting Started in Short-Term Rentals

Ready to take action? Here's how to move forward:

If You're Starting with Arbitrage

① Research markets where arbitrage is legal and profitable (check regulations)

② Run the numbers for potential properties using our calculator

③ Find landlords willing to allow subletting (be upfront and professional)

④ Set up operations like a real business (LLC, insurance, systems)

⑤ Save profits aggressively with a goal of buying your first property within 12-24 months

If You're Ready to Buy

① Analyze markets using Chalet's free analytics to identify high-performing STR markets

② Connect with an STR-specialist agent who understands short-term rental investing (find one here)

③ Get pre-approved for financing (we can help connect you with STR-friendly lenders who understand DSCR loans and investment properties)

④ Run deal analysis on every property you consider (use our calculator to model different scenarios)

⑤ Close and set up your property with help from our vendor network (insurance, furnishing, management, etc.)

⑥ Consider 1031 opportunities if you're selling another investment property (we specialize in 1031-to-STR transitions)

Regardless of Which Path You Choose

Treat this like a real business. Whether you're arbitraging or owning, success requires:

• Professional operations and guest experience

• Data-driven pricing and revenue management

• Understanding of local regulations and compliance

• Financial discipline and proper accounting

• Systems that can scale as you grow

Chalet provides the data, tools, and network to support you at every stage. Start by exploring markets and running some numbers. See what's actually possible in your target city. Then make an informed decision about which strategy fits your goals.

The STR industry in 2026 rewards operators who do their homework, pick the right markets, and execute professionally. Don't wing it. Use data.

Frequently Asked Questions (FAQ)

Q: Can I start with arbitrage and then buy property later?

Yes, absolutely. This is actually the most common path for investors with limited capital. Use arbitrage to learn the STR business, generate cash flow, and save up for a down payment. Many of our clients at Chalet started with rental arbitrage and then transitioned to property ownership once they had the capital and confidence. Just be disciplined about saving your arbitrage profits rather than spending them.

Q: How much can I realistically make with rental arbitrage?

It varies significantly by market, property type, and your operational skills. Recent analysis suggests well-run one-bedroom arbitrage units can net $800-$1,500/month after all expenses. Larger units or properties in high-demand tourist areas can generate more. The key is finding markets where the ratio of monthly rent to potential Airbnb revenue is favorable. Use Chalet's analytics to research revenue potential in different markets.

Q: What are the tax implications of arbitrage vs owning?

With arbitrage, you report income and expenses like any business, but you can't depreciate the property or deduct mortgage interest (since you don't own it). With ownership, you get powerful tax benefits: depreciation (which creates paper losses that shelter income), mortgage interest deductions, property tax deductions, and the ability to do 1031 exchanges to defer capital gains when selling. Property ownership is significantly more tax-advantaged. Consult a CPA familiar with STR investing for specific advice.

Q: Is rental arbitrage legal everywhere?

No. Many cities require STR operators (including arbitragers) to have permits, business licenses, or meet specific requirements. Some cities outright ban non-owner STRs. You also need explicit permission from your landlord to sublet. Check local regulations and get everything in writing before starting. Operating without permission or proper licensing can result in fines, eviction, or legal trouble.

Q: How much do I need to buy an Airbnb investment property?

Plan for at least 15-25% down (often 20%+ for investment properties), plus closing costs (2-3% of purchase price), plus furniture and setup ($10K-$20K typically). On a $300K property, you're looking at $60K-$80K+ in total upfront capital. Some lenders offer more creative financing options for STRs; connect with an STR-specialist lender to explore your options.

Q: Which strategy builds more wealth long-term?

Property ownership builds substantially more wealth because you're accumulating equity through appreciation and mortgage paydown. Arbitrage generates income but zero equity. Industry experts consistently note that arbitrage is a cash-flow tactic while ownership is a wealth-building strategy. If your goal is long-term net worth, you need to own assets eventually.

Q: Can I do both strategies at the same time?

Yes, many investors run a hybrid model: they arbitrage 2-5 properties for monthly cash flow while simultaneously owning 1-2 properties for equity building. The arbitrage income can help cover mortgages or fund future property purchases. This approach gives you the best of both worlds, as long as you can manage the operational complexity.

Q: What if interest rates drop in the future?

If you buy property now at high rates, you can refinance when rates decrease to lower your monthly payment and improve cash flow. Many investors are buying properties now specifically to lock in prices and then plan to refinance within 2-3 years. The alternative is waiting for rates to drop, but in hot markets property prices might increase faster than rates fall, costing you more overall. Run different scenarios to see what makes sense for your market.

Q: How does Chalet help with the transition from arbitrage to ownership?

Chalet provides everything you need to make the leap: market data to identify where to buy, an ROI calculator to analyze deals, a network of STR-specialist real estate agents and lenders who understand your background, and vendors to help set up your owned property. We've worked with many investors making this exact transition. Start by exploring markets and listings to see what's possible in your price range.

Q: What are the biggest mistakes people make with rental arbitrage?

The top mistakes are: not getting explicit landlord permission in writing, ignoring local STR regulations, underestimating operational workload, failing to run proper financial projections before signing leases, and treating it as passive income (it's not). Also, many arbitragers don't save their profits for future investment, which keeps them trapped in the arbitrage cycle instead of progressing to ownership. Avoid these by treating arbitrage as a serious business and having a clear exit/growth plan.

Q: Should I buy in my local market or invest remotely?

Both have pros and cons. Local investing lets you physically manage the property and learn firsthand, which is valuable as a beginner. Remote investing opens up better markets with higher returns, but requires more trust in your team (agent, property manager, cleaners). Many investors start local, then expand remotely once they have systems in place. Use Chalet's analytics to compare your local market against other opportunities, then decide what makes sense for you.

The bottom line: Airbnb arbitrage and property ownership serve different purposes. Arbitrage gets you in the game quickly with low capital and teaches you the business. Ownership builds real wealth through equity, appreciation, and long-term asset accumulation.

For most investors, the smartest play is to start where you can (often arbitrage), learn fast, save aggressively, and transition to ownership as soon as you're able. That first owned property is your foundation for everything that follows.

Chalet is here to support you at every stage. Whether you're running numbers on your first arbitrage deal or ready to buy your fifth STR property, we provide the data, tools, and network to help you succeed. Start exploring markets and opportunities today. The sooner you start, the sooner you build real wealth in short-term rentals.