If you're investing in short-term rentals (STRs), war headlines probably feel more threatening than they should. Not because conflicts don't matter (they absolutely do), but because the connection between geopolitical chaos and your property's numbers isn't as straightforward as most people assume.

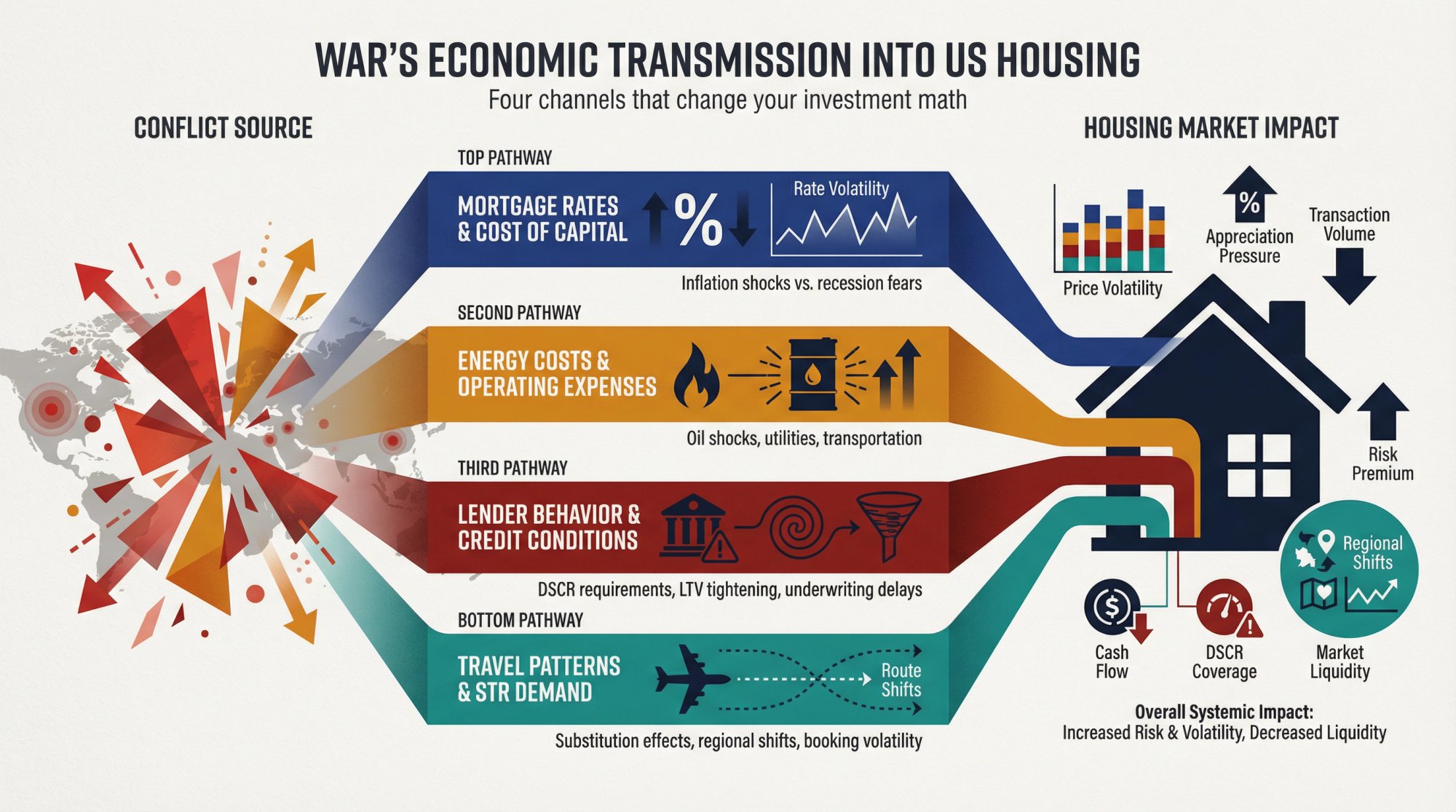

War doesn't typically reduce the number of bedrooms in America. It changes the cost of money, the price of energy, and how confident lenders and travelers feel about the future. That's why the same conflict can simultaneously push mortgage rates up (through inflation) or down (through recession fears), freeze transaction volume, or create surprising regional winners and losers.

This guide exists to answer the real question behind your search: *"How does war actually change the numbers on my Airbnb rental, and what should I be doing differently right now?"*

You'll get a first-principles breakdown of how conflicts transmit into US housing markets, a snapshot of where we stand in early 2026, specific scenario playbooks for different shock types, and actionable checklists for first-time buyers, 1031 exchange investors, and portfolio builders.

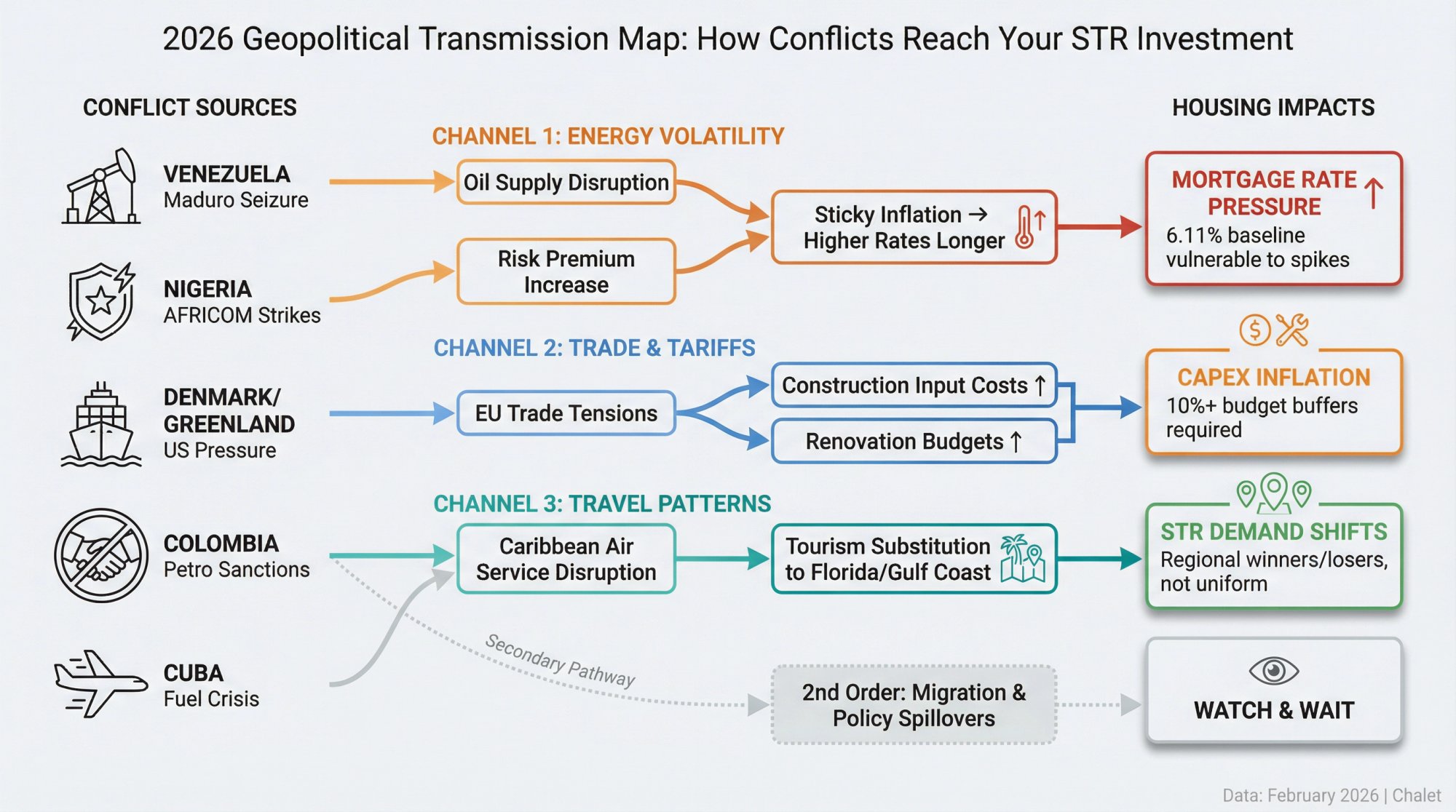

We'll also tackle the 2026 geopolitical questions investors keep asking about: Venezuela, Nigeria, Denmark (Greenland), Colombia, and Cuba. Not from a "who wins" perspective, but through the lens of which economic channels they're hitting.

Who Should Read This Guide

If you're buying your first short-term rental:

You're trying to avoid two mistakes. First, buying a deal that only pencils out in a perfect macroeconomic environment. Second, panicking and sitting out genuinely good opportunities because the news cycle feels scary.

If you're executing a 1031 exchange:

Your biggest risk isn't necessarily price or occupancy. It's execution risk: lending delays, appraisal gaps, insurance surprises, and timeline compression inside those 45/180-day rules. Understanding the 1031 exchange timeline is critical during volatile periods.

If you already own 1–5 properties:

You're thinking about refis, insurance renewals, CapEx timing, and demand volatility across your markets.

How War Actually Affects US Housing Prices

Think of housing as a cash-flowing asset with three core inputs:

Cost of financing (mortgage rate plus lending terms)

Cash flows (rent, occupancy, operating expenses)

Replacement cost and supply (what it costs to build or rebuild)

War impacts housing when it pushes on one of these inputs hard enough to change the math on your deal.

How Do Wars Change Mortgage Rates?

Housing is what economists call "long duration." Most of a home's price reflects the present value of future housing services. When the discount rate rises (meaning mortgage rates go up), prices face downward pressure.

In plain terms: most US buyers shop by monthly payment. That payment is extremely sensitive to the mortgage rate. War can move inflation expectations, Treasury yields, and central bank decisions, which in turn move mortgage rates.

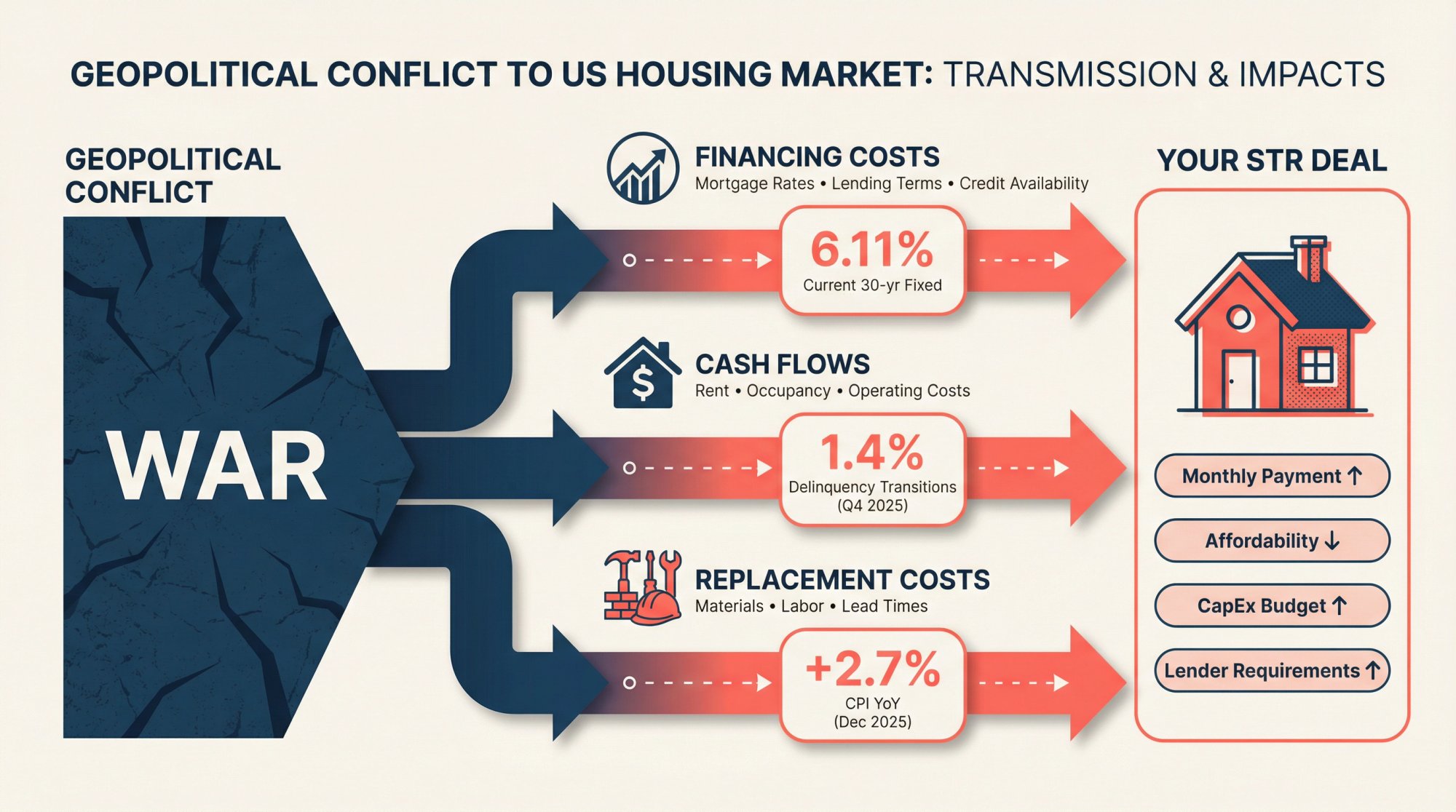

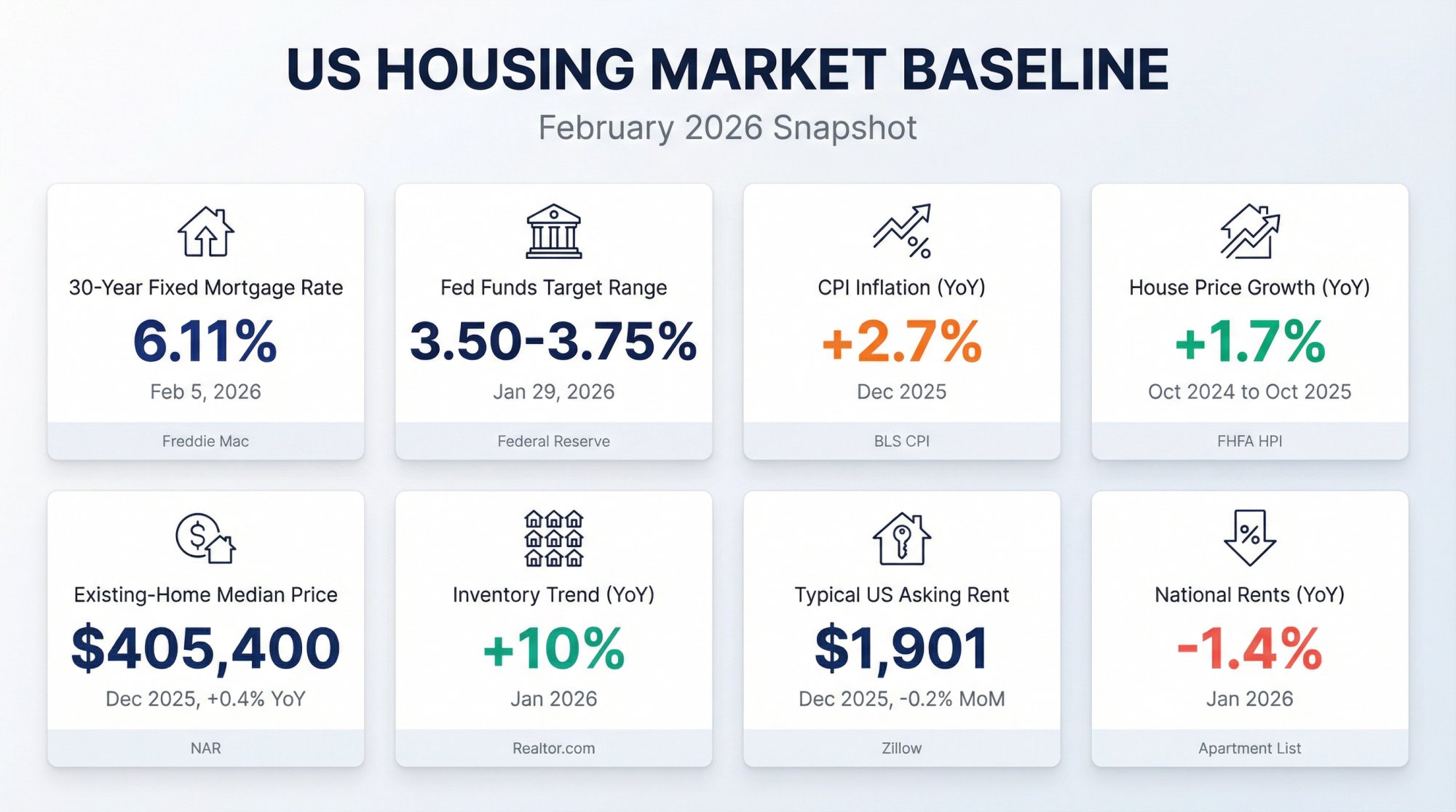

Where rates are right now: Freddie Mac's weekly survey shows the average 30-year fixed mortgage rate at 6.11% as of February 5, 2026.

Why that matters: at roughly 6%, the payment on the same house is dramatically higher than it was when rates were near 3%. So even if prices "stall," affordability still feels brutal.

Also worth noting: the Federal Reserve's policy rate sits at 3.50% to 3.75% as of January 29, 2026. This affects broader financial conditions and Treasury yields.

Investor upgrade: Stop asking "Will war crash house prices?" Start asking "Does this conflict create an inflation shock (rates up) or a growth shock (rates down)?"

The most important question for your underwriting right now.

How War Affects Energy Costs and Housing

Energy hits housing two ways:

• Operating costs (utilities, heating and cooling, fuel for driving to manage properties, cleaning crews' gas expenses)

• Macro inflation (energy price spikes feed into CPI and inflation expectations, which can keep rates higher for longer)

The latest CPI snapshot: in December 2025, overall CPI was up 2.7% year-over-year, and energy was up 2.3% year-over-year (with electricity and natural gas notably higher over 12 months).

War matters here because many conflicts are energy-adjacent. You get:

• Oil supply disruptions

• Sanctions

• Shipping chokepoint closures

• Refinery and pipeline risk

• Elevated risk premia in energy markets

How War Impacts Construction Costs

Even if US houses aren't being physically destroyed, war can raise the replacement cost of housing through:

Steel, copper, and aluminum input prices

Appliances and HVAC equipment lead times

Freight rates and shipping insurance costs

Labor availability (especially if the economy pivots toward defense or industrial production)

One clean way to track this is the BLS Producer Price Index (PPI). The December 2025 release shows final demand prices rising month-over-month, which filters into construction-input cost models.

For investors, the practical takeaway: CapEx is not a fixed number during geopolitically noisy periods. Your replacement reserve assumptions need more slack.

What Do Lenders Do When War Creates Uncertainty?

War increases uncertainty. Uncertainty makes lenders conservative.

Common tightening behaviors include:

→ Higher DSCR requirements

→ Lower maximum LTV

→ More reserve requirements

→ More conservative rent and occupancy assumptions

→ Slower underwriting, more conditions, more appraisal scrutiny

We can see early signs of stress in household credit. The New York Fed reported that mortgage delinquency transitions into serious trouble increased to 1.4% in Q4 2025 (still historically manageable, but rising).

That matters because lenders watch delinquencies closely. Rising stress can tighten credit even without a full-blown crash. If you're planning to use DSCR financing for your short-term rental, understanding how lenders respond to volatility is essential.

How War Shifts STR Demand by Location

War can shift demand regionally through:

① Defense spending and contractor hiring (certain metros benefit)

② Immigration and refugee flows (regional rental pressure)

③ Changes in tourism patterns (huge for STRs)

④ Trade disruptions hitting specific industries (port cities, manufacturing corridors)

This is why "US housing" is never one market. Analyzing individual markets becomes even more critical during geopolitical turbulence.

US Housing Market Baseline: Where Are We in 2026?

You can't judge "impact" without knowing the starting point. Here's the most useful baseline for investors.

| Metric | Latest datapoint (as of Feb 10, 2026) | Why it matters for investors | Source |

|---|---|---|---|

| 30-year fixed mortgage rate | 6.11% (Feb 5, 2026) | Payment sensitivity, cap rates, refi math | Freddie Mac PMMS |

| Fed funds target range | 3.50% to 3.75% (Jan 29, 2026) | Sets tone for credit conditions | Federal Reserve |

| CPI inflation (YoY) | 2.7% (Dec 2025) | Rates and cost pressure | BLS CPI |

| House price growth (YoY) | +1.7% (Oct 2024 to Oct 2025) | "Stalling" prices change equity outcomes | FHFA HPI |

| Existing-home median price | $405,400 (Dec 2025, +0.4% YoY) | National price level for comps | NAR |

| Inventory trend | +10% YoY (Jan 2026) | More inventory shifts negotiation power | Realtor.com |

| Typical US asking rent | $1,901 (Dec 2025, -0.2% MoM) | Rent growth cooling in many markets | Zillow |

| National rents (YoY) | -1.4% YoY (Jan 2026) | Supply pressure in some metros | Apartment List |

Data currency note: These figures are current as of February 10, 2026, using the most recent releases available at the time of writing.

If you want to dig into specific market-level data for any city you're considering, Chalet's free analytics dashboards let you compare ADR, occupancy, and revenue trends across multiple metros without a subscription or paywall.

Four War Scenarios That Change Your Investment

Most investors make a hidden assumption: all wars affect housing the same way. They don't.

Here are the four scenarios worth modeling if you're serious about stress-testing your deals.

Oil Shock: What Happens to Housing When Oil Prices Spike?

When conflicts threaten oil supply or major shipping lanes, the chain often looks like this:

Oil prices rise sharply

Inflation expectations increase

The Fed stays restrictive longer

Mortgage rates rise or stay elevated

Housing affordability falls

Transaction volume slows

STR demand can soften if travel gets expensive

This is the scenario most people intuitively associate with war, and it's probably the most common transmission path.

Recession Shock: Do Wars Lower Mortgage Rates?

Sometimes war increases fear and slows global demand without spiking energy prices:

Businesses pause hiring and investment

Recession risk rises

Treasury yields fall (flight to safety)

Mortgage rates can fall

BUT unemployment risk rises and consumer spending falls

Rents can weaken in overbuilt markets

This scenario can be good for refinancing existing properties but terrible for occupancy.

Trade War: How Tariffs Increase Construction Costs

A conflict that spills into tariffs and trade restrictions tends to:

Raise the cost of imported building products

Create price pressure for repairs and renovations

Potentially keep "replacement cost" high even if demand cools

Travel Shock: How War Changes STR Demand Patterns

This is critical for STR investors: travel shocks don't always reduce travel. They often redirect it.

→ International travel falls, domestic travel rises

→ Certain destinations see substitution demand

→ Big events and conferences relocate

→ Airline routing and fuel constraints change travel patterns

For short-term rental investors, this is the scenario that creates the biggest regional divergence.

If you're trying to identify which of your markets might benefit from substitution effects, Chalet's market dashboards let you track seasonality, demand trends, and supply growth across multiple cities in one place.

Venezuela War: How It Affects US Housing Market

You asked about these specifically. Here's the clear-eyed way to think about them: not as "who wins," but as which economic channel they're hitting.

Venezuela Conflict Impact on Oil Prices and Housing

In January 2026, Reuters reported a major escalation: the United States seized Venezuelan leader Nicolás Maduro, and Venezuela's leadership shifted to interim President Delcy Rodríguez.

Why it matters for US housing:

Venezuela is primarily an energy story. More stability and higher oil output can relieve global oil pressure. More conflict and sanctions can do the opposite.

The Congressional Research Service summarized aspects of US sanctions policy, including licensing constraints related to Chevron's operations in Venezuela.

What to do with this as an investor:

Treat Venezuela-linked news as an energy volatility signal, not a direct housing signal. If you're underwriting thin-cash-flow deals, oil volatility matters because it can keep inflation sticky and rates higher for longer.

Nigeria Conflict: Security Risk in Oil-Producing Regions

Nigeria is facing serious security challenges, and there's been recent US military involvement against militant targets. CSIS analyzed why the US conducted strikes in Nigeria after AFRICOM announced strikes in collaboration with the Nigerian government.

Why it matters:

Nigeria is a major oil producer. Instability in oil-producing regions can push global energy risk premia, which feeds into inflation risk and interest rates.

Investor action:

If your deal only works at a tight DSCR, assume "energy-driven expense surprises" can happen. Keep larger reserves than you think you need. Use Chalet's DSCR calculator to model how much cushion you actually have.

Denmark Greenland Tensions: Trade and Tariff Risk

"War with Denmark" isn't really the right frame here. The relevant risk channel is diplomatic conflict and potential trade spillovers.

In January 2026, the UK Parliament's Commons Library described increased US pressure on Greenland (a constituent part of Denmark) and the broader political situation.

Why it matters for housing:

If US-EU trade tensions escalate, tariffs can raise the cost of certain building inputs and consumer goods. That tends to show up as higher renovation and rebuild budgets plus elevated cost-of-living pressure for tenants.

Investor action:

For value-add STR projects, lock contractor bids early, add buffer to rehab budgets, and avoid deals that require "perfect budget" execution.

Colombia Sanctions: Regional Spillover Effects

Reuters reported that the US sanctioned Colombian President Gustavo Petro in October 2025, alleging expansion of the drug trade. The Atlantic Council has discussed paths to repair US-Colombia ties and how Venezuela factors into the relationship.

Why it matters:

Colombia itself is not a primary driver of US housing dynamics, but regional instability can affect migration patterns and US foreign policy posture. It can also impact specific US industries and metro labor markets (logistics, trade, certain energy and defense nodes).

Investor action:

This is a "second-order" signal. Watch it more for policy and sanctions knock-on effects than for direct housing demand changes.

Cuba Energy Crisis: How It Affects Travel to Florida

In February 2026, AP reported that Cuba announced it could no longer provide jet fuel at multiple airports amid an intensifying energy crisis tied to US sanctions actions. TIME covered the intensifying crisis, and legal summaries describe a January 2026 executive order authorizing tariffs on goods from countries that provide oil to Cuba.

Why it matters:

This is primarily a travel pattern and energy policy story. Reduced air service can shift tourism flows toward substitute destinations. For STRs, substitution can create micro-winners, but it's rarely "everyone wins."

Investor action:

If you're in Florida, the Gulf Coast, or Caribbean-adjacent markets, monitor demand seasonality shifts and airline capacity changes closely. Track your local market's performance to identify any emerging trends early.

How War Changes Short-Term Rental Performance

Here's what actually changes for STR investors when geopolitics heats up.

Here's the connection between geopolitical shocks and the actual STR numbers you care about.

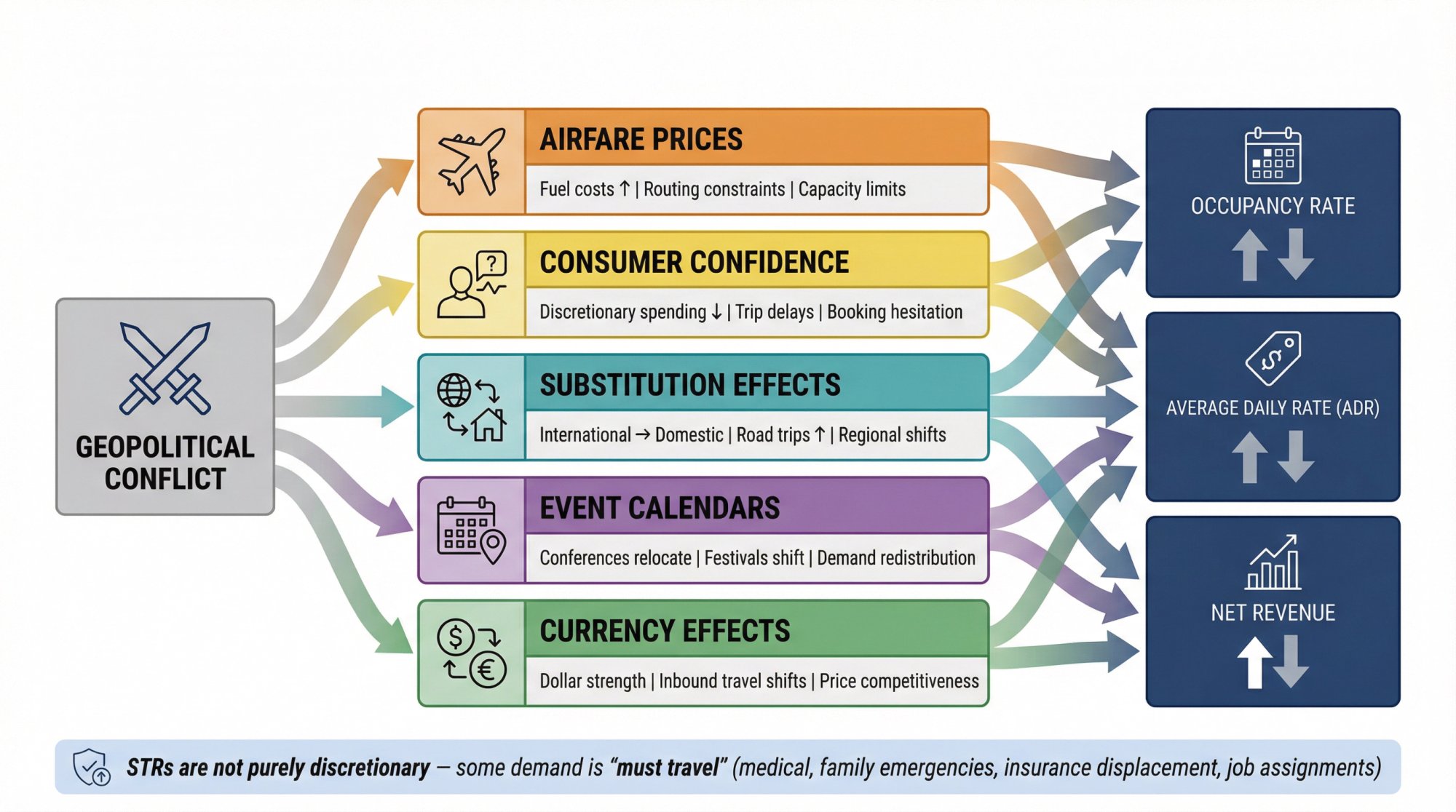

What STR Demand Factors Do Wars Change?

Airfare prices (fuel costs, routing changes, capacity constraints)

War-driven energy spikes can make flights more expensive, which reduces discretionary travel volume.

Consumer confidence (people delay non-essential trips)

Uncertainty makes people cautious with spending, especially on leisure experiences.

Substitution effects (international trips become domestic road trips)

Sometimes the total amount of travel doesn't drop. It just redirects. International bookings fall, domestic bookings rise.

Event calendars (conferences and festivals relocate)

Major events can shift locations if security concerns spike in certain regions or countries.

Currency effects (can shift inbound travel)

Dollar strength relative to other currencies changes the attractiveness of US destinations for international visitors.

The important nuance: STRs are not purely discretionary. Some demand is "must travel" (medical appointments, family emergencies, insurance displacement, job assignments). In volatile periods, STRs can behave like a hybrid of hospitality and housing.

If you want the most robust strategy during uncertain times, consider underwriting both a traditional nightly rental model and a mid-term rental fallback (30+ day stays) for travel-soft scenarios.

You can run both cases quickly using Chalet's calculator tools:

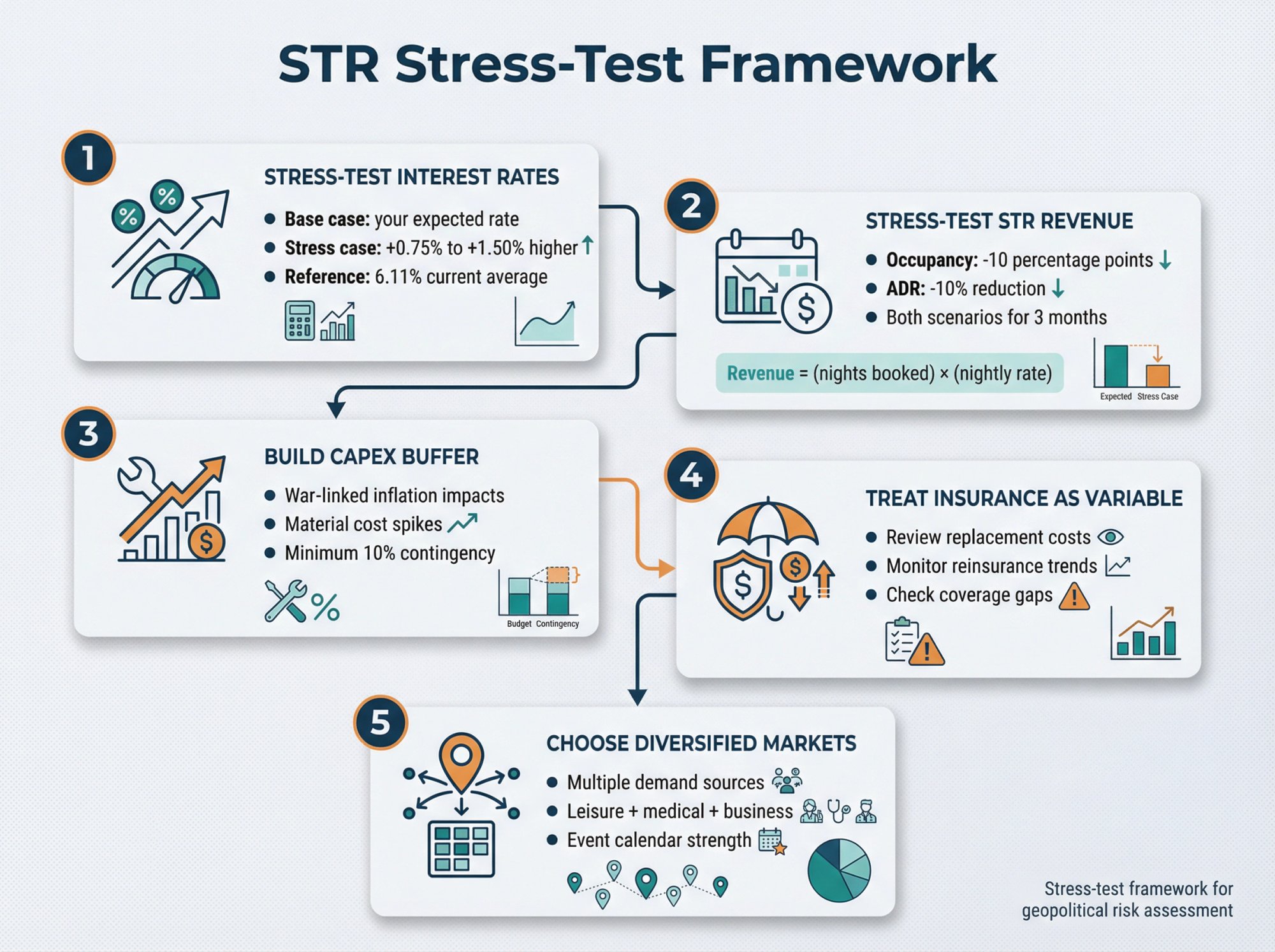

How to Stress-Test Your STR Investment for War Risk

This is where most content gets vague and hand-wavy. Let's make it mechanical.

Step 1: Stress-Test Interest Rates, Not Your Opinion

Even if you genuinely believe rates will fall over the next six months, underwrite as if you might close during a worse week.

• Base case: your expected rate

• Stress case: +0.75% to +1.50% higher rate (depending on how long your lender lock window is)

Reference point: the average 30-year fixed is around 6.11% right now.

Action inside Chalet:

Use the DSCR calculator to see how sensitive your debt service coverage is to rate changes. If your DSCR breaks with a 1% rate move, you don't have a "war risk" problem. You have an overleveraged deal problem.

Step 2: Stress-Test STR Revenue with Two Dials

Revenue = (nights booked) × (average nightly rate)

Your stress test should answer:

What if occupancy drops 10 percentage points?

What if ADR drops 10%?

What if both happen at once for three consecutive months?

Then check whether you can still cover mortgage, utilities, insurance, property tax, cleaning and turns, and a real maintenance reserve (not a fake one).

Action inside Chalet:

Run ROI and Cap Rate for the address, then use the "edit assumptions" options to build out a downside case. See what breaks first.

Step 3: Build a CapEx Buffer for Rising Costs

War-linked inflation shows up as higher appliance costs, longer lead times, higher contractor bids, and cost spikes in specific materials.

Use official inflation data as a reality check. CPI and PPI releases show whether cost pressure is heating up again.

Rule of thumb that stays honest: if your rehab budget has less than roughly 10% contingency built in, you don't actually have a contingency.

Step 4: Treat Insurance Like a Variable Expense

Insurance pricing is affected by catastrophe losses, reinsurance pricing, rebuilding costs, the litigation environment, and (yes) some war-related risk perceptions in global insurance markets.

Cotality has warned that reconstruction costs can outpace general inflation, increasing the chance of coverage gaps if policies lag behind rebuilding costs.

Action inside Chalet:

If you're about to close on a property, line up insurance early and double-check replacement cost estimates. If you already own properties, review your policy limits before renewal season.

Step 5: Choose Markets with Multiple Demand Sources

In uncertain periods, single-driver markets are fragile.

Examples of "multiple legs" that create resilience:

Leisure + medical + university + regional business travel

Leisure + strong in-migration + diverse employers

Leisure + robust event calendar + proximity to a major metro

Action inside Chalet:

Explore market dashboards and compare not just last month's revenue, but seasonality patterns and supply growth trends over time.

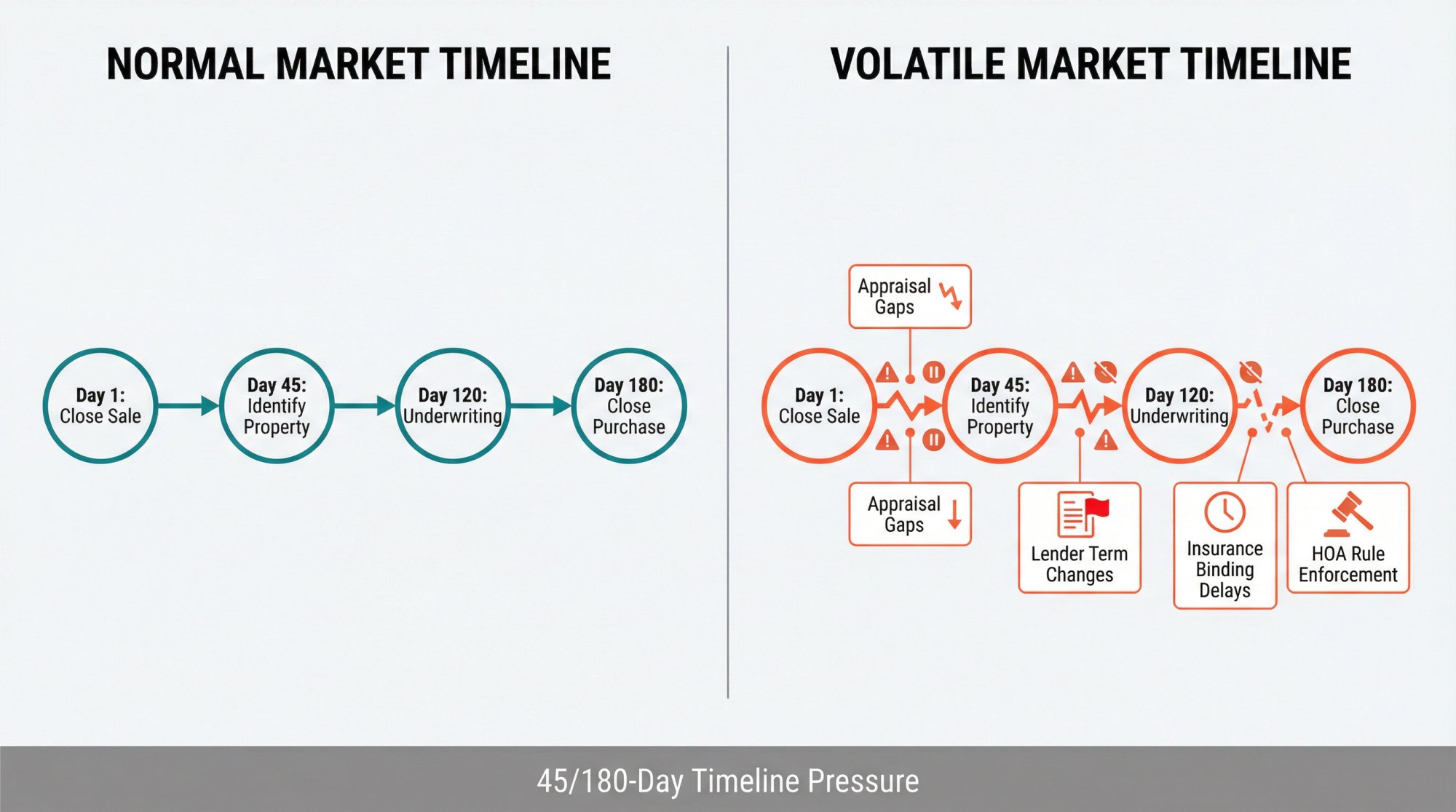

1031 Exchange During War: Timeline Risk Is Bigger Than Price Risk

If you're doing a 1031 exchange into an STR, the biggest war-linked failure mode is not "price drops." It's execution friction.

What can slow you down during volatile periods:

• Lenders tightening terms mid-process

• Appraisal values coming in low in softening metros

• Insurance binding delays

• Sudden HOA or municipal rule enforcement (especially in STR-heavy markets under pressure)

Practical countermeasures:

Identify three replacement properties, not just one

Get pre-underwritten with a lender who can actually close under stress conditions

Use markets with clearer STR rules and predictable permitting

Chalet shortcuts for 1031 execution:

If you're navigating 1031 exchanges during the current administration, understanding the policy landscape and timing considerations is especially important.

Portfolio Builders: Your Edge Is Optionality

If you already own multiple properties, you're not trying to "predict war outcomes." You're trying to stay liquid and flexible enough to capitalize on whatever environment emerges.

Three Portfolio Upgrades That Matter in Geopolitical Noise

1. Refi optionality

If rates drop in a risk-off recession scenario, you want clean financials and a clear path to refinance quickly without scrambling. Connect with DSCR lenders who understand short-term rentals before you need them.

2. Demand optionality

Can you pivot at least one property to mid-term rentals (30+ days) if leisure travel softens? That flexibility creates a floor under your cash flow. Use the mid-term rental calculator to model both scenarios.

3. Operational optionality

Can you reduce variable costs quickly without tanking your review scores? (Think negotiable cleaning contracts, dynamic pricing tools, flexible utility management.) Connect with property management and operational vendors who can scale with your needs.

A useful backdrop: major housing institutions are forecasting slower or flat price growth in 2026 across many markets, with significant market-level dispersion. (JPMorgan Chase research) That means the "easy appreciation" mindset is a weaker strategy than "cash flow and execution."

Frequently Asked Questions

Does War Always Make US Home Prices Fall?

No. War can be inflationary (pushing rates up, which pressures prices) or recessionary (pushing rates down, but weakening demand). The direction depends on which channel dominates.

Is the US Housing Market Weak Right Now in 2026?

It's mixed. Prices are closer to flat nationally than they were during the 2020-2022 boom. FHFA showed roughly 1.7% year-over-year price growth in late-2025 data, while some Sun Belt metros have cooled sharply. Transaction volume is below peak levels, but not collapsing.

Are Rents Rising or Falling Right Now?

National rent growth is soft. Apartment List shows -1.4% year-over-year in January 2026, and Zillow reported typical asking rents around $1,901 in December 2025 with affordability improving for renters in many markets. But your local market can still be up or down a lot depending on supply dynamics. Check your specific market for accurate local trends.

What's the Most Important War Impact Variable for Housing?

Mortgage rates. Freddie Mac's survey rate around 6.11% is the starting point for all affordability math. Everything else flows from there.

What Should I Do If I'm About to Buy an STR?

Don't freeze. Tighten the underwriting instead:

Stress-test rate, ADR, and occupancy assumptions

Build bigger cash reserves

Favor markets with diversified demand sources

Make absolutely sure your local regulations are stable

If the deal only works in the best-case scenario, you don't have a "war problem." You have a bad deal problem. Use Chalet's comprehensive calculator to stress-test multiple scenarios.

How Can I Compare Multiple Markets Quickly?

Chalet's free analytics platform lets you compare ADR, occupancy rates, revenue trends, and supply growth across dozens of markets without needing expensive subscriptions or piecing together data from multiple sources.

Where Can I Find STR-Specialist Lenders?

Chalet's financing directory includes DSCR lenders and conventional options that work specifically with Airbnb and short-term rental investors. Many understand 1031 exchange timelines and can move quickly when you need speed. For ultra-high-net-worth investors, explore specialized financing options tailored to portfolio-scale acquisitions.

A Simple "Next 7 Days" Action Plan

① Pick one target market and run both a baseline case and a downside case.

Start here: Airbnb Calculator

② Check your DSCR under a higher interest rate scenario.

Use: DSCR Loan Calculator

③ Validate the market's supply trend and seasonality patterns.

Use: Airbnb Analytics

④ Confirm local STR rules before you fall in love with a property.

⑤ If you're ready to move forward:

Meet an Airbnb-friendly real estate agent and explore financing options through Chalet's vetted vendor network.

Next Step: Translate Headlines into Real Numbers

If you want to move from theory to actual numbers on a property you're considering, Chalet lets you stress-test it in about 10 minutes. The platform combines free market analytics with a vetted vendor network so you can research, underwrite, and execute your STR investment in one place.

With Chalet's analytics tools, you can:

Chalet pairs free market analytics with a vetted vendor network (real estate agents, lenders, insurance, property managers, and more) so you can research, underwrite, and execute your STR investment in one place. No subscriptions, no paywalls, no guesswork.