If you own a short-term rental (or you're planning to buy one), this is the tax guide you need open while you're prepping your 2025 return.

You're trying to do two things:

Create a big first-year depreciation deduction through bonus depreciation, usually unlocked via cost segregation.

Make sure that deduction isn't trapped as "passive" so it can offset your W-2 or business income.

This guide covers:

• The 2026 tax-season timeline (what to do between now and filing)

• The bonus depreciation timeline (what changed, what counts now)

• The STR "loophole" rules (what they actually require)

• A step-by-step checklist you can hand to your CPA

• Common pitfalls that blow up the strategy

Important: This is educational content only, not tax advice. Tax outcomes depend on your specific facts, entity structure, and state rules. Always consult a qualified tax professional.

Chalet combines free market analytics with a vetted vendor network so STR investors can research, buy, and operate in one place.

What You Need to Know Right Now

Before we get into the details, here's what you need to know right now:

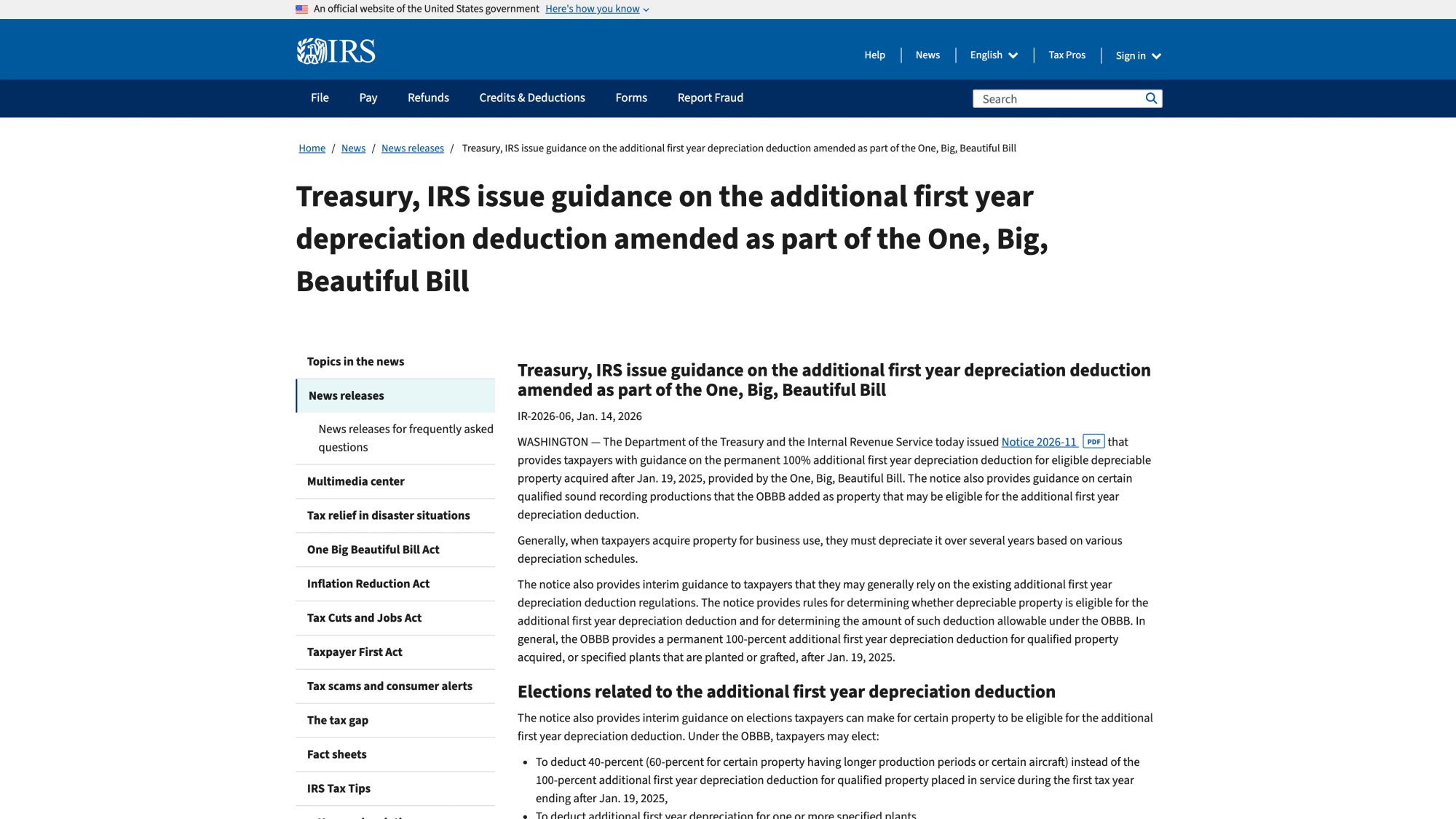

100% bonus depreciation is back, permanently. For eligible property acquired after January 19, 2025, you can claim 100% bonus depreciation. The IRS confirmed this in Notice 2026-11 guidance released January 14, 2026.

But timing still matters. For assets placed in service between January 1 and January 19, 2025, the bonus percentage is 40% under the old phase-down rules.

The STR "loophole" isn't really a loophole. It's how the passive-loss rules work when your average guest stay is short enough. You still need to materially participate and document it properly.

The big trap? You can generate a huge depreciation loss and still not be able to use it this year if you fail either the short-stay test or material participation requirements. Those losses might carry forward, but they won't offset your W-2 income this year.

Filing Deadlines for 2026 Tax Season (2025 Returns)

| Entity Type | Return Form | Due Date | Extension Deadline |

|---|---|---|---|

| Partnerships and S-corps (calendar year) | Form 1065 / 1120-S | March 16, 2026 | September 15, 2026 |

| Individuals | Form 1040 | April 15, 2026 | October 15, 2026 |

March 16 is the deadline because March 15 falls on a Sunday this year.

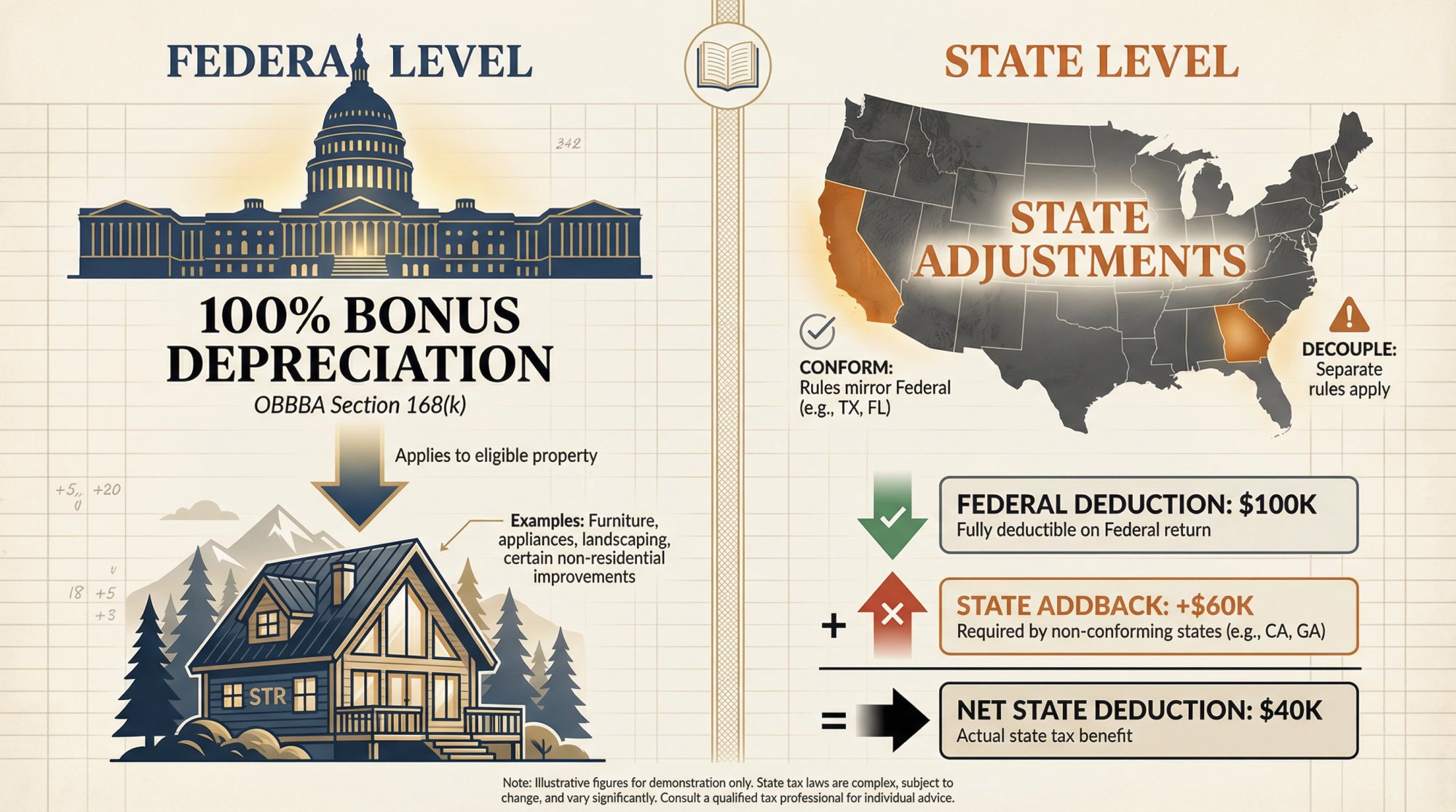

What Changed: 100% Bonus Depreciation Is Now Permanent

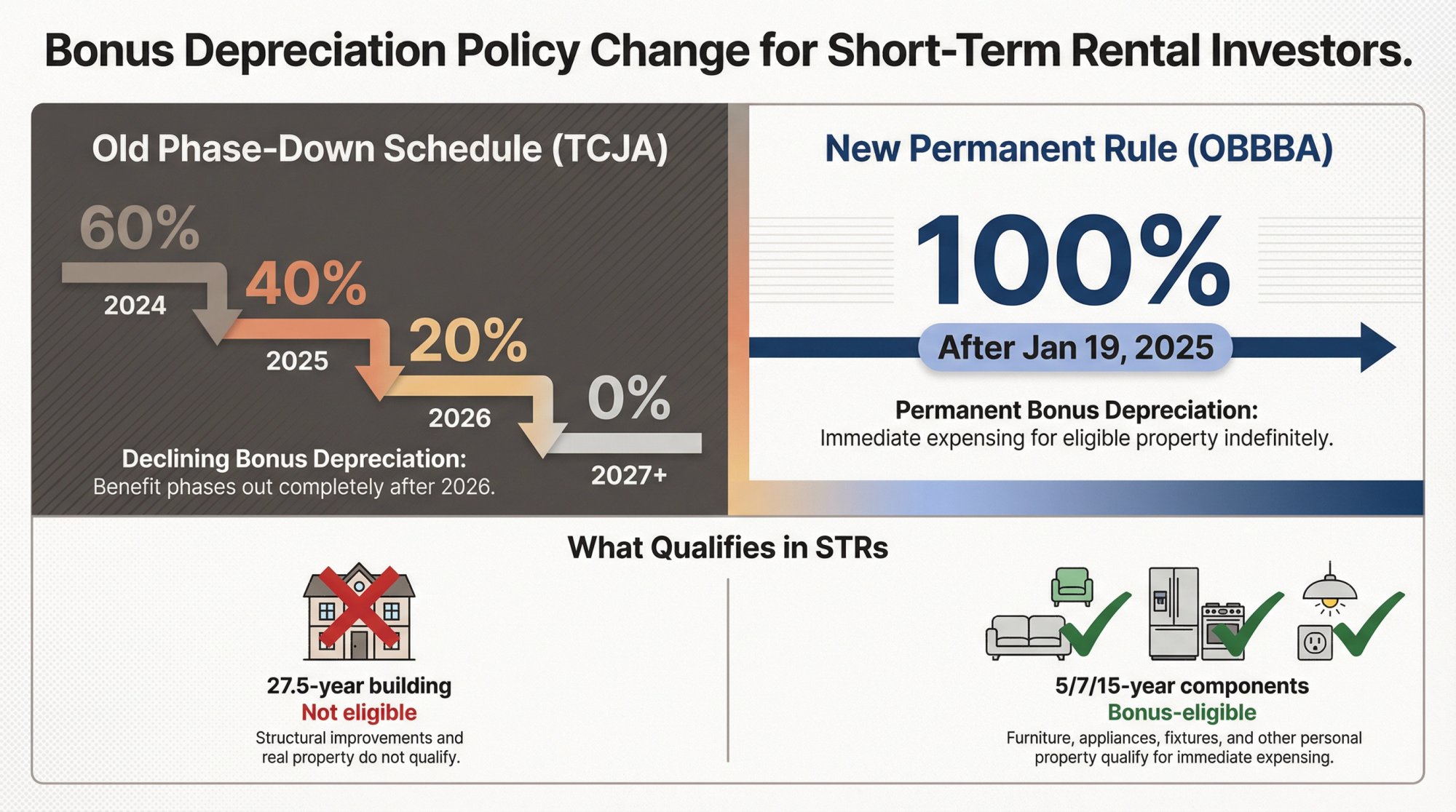

A lot of older content says bonus depreciation is phasing down:

• 2025 = 40%

• 2026 = 20%

• Then it disappears

That was the old phase-down schedule under the Tax Cuts and Jobs Act.

The IRS now confirms a permanent 100% "additional first-year depreciation deduction" for eligible property acquired after January 19, 2025. This is part of the One Big Beautiful Bill Act (OBBBA) guidance.

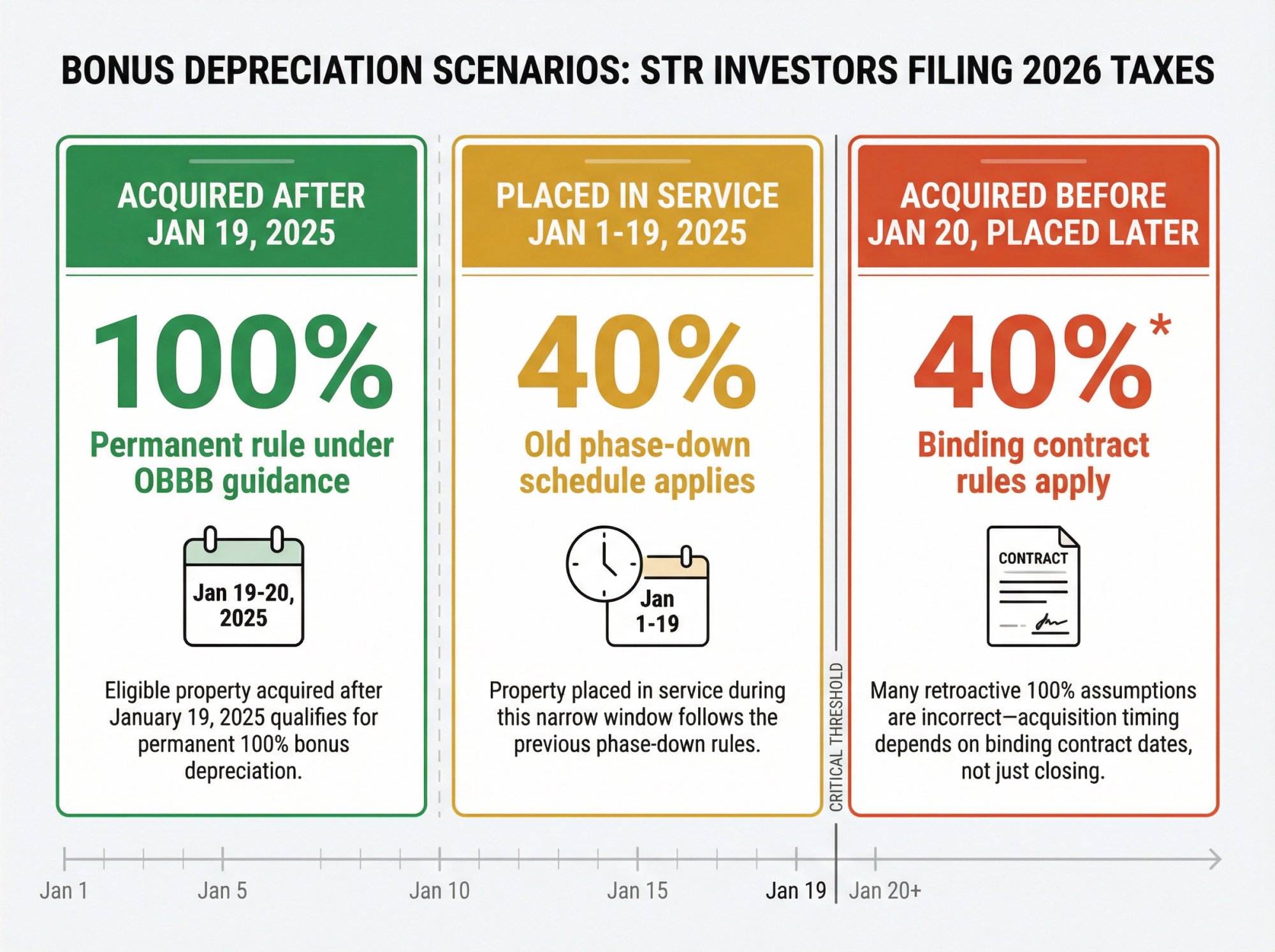

Why Most STR Investors Miss This Acquisition Timing Rule

Acquisition timing isn't always your closing date.

For many assets, "acquired" can depend on when you entered a binding written contract, not the day you got keys. This matters most for deals that were under contract before January 20, 2025 but closed later.

If you signed a contract in December 2024 but closed in February 2025, you might not qualify for the 100% rate. Research indicates that acquisition timing can be based on binding contract dates.

What Qualifies for Bonus Depreciation in STRs

Bonus depreciation generally applies to:

• Tangible property with a recovery period of 20 years or less

• Computer software and certain production costs

• In real estate, it's often unlocked through cost segregation, which identifies shorter-life components inside a building

For STR owners, the key distinction:

The building itself is usually depreciated over 27.5 years (residential) and isn't bonus-eligible.

The stuff inside and around it often is. Furniture, appliances, certain electrical, land improvements. These are identified through cost segregation studies.

Which Bonus Depreciation Rate Applies to Your STR

Here's how to figure out which bonus depreciation rate applies to your situation:

| Your Situation | Bonus Rate | Why It Matters |

|---|---|---|

| Acquired eligible property after Jan 19, 2025 | 100% | Permanent rule under OBBB guidance |

| Placed eligible property in service Jan 1 to Jan 19, 2025 | 40% | Old phase-down schedule applies |

| Acquired before Jan 20, 2025, placed in service later | Often 40% | Many "retroactive 100%" assumptions are wrong |

The Bonus Depreciation Election That Surprises Most Investors

The IRS guidance references an election to take 40% (or 60% for certain property) instead of 100% for qualified property placed in service during the first tax year ending after January 19, 2025.

Why would anyone choose less bonus depreciation?

Tax planning isn't just "maximize deduction." Sometimes you want to:

• Avoid creating losses you can't use this year

• Manage carryforwards strategically

• Coordinate across owners in a partnership

• Smooth income across years

If you're not working with a CPA who can model different scenarios, you're guessing.

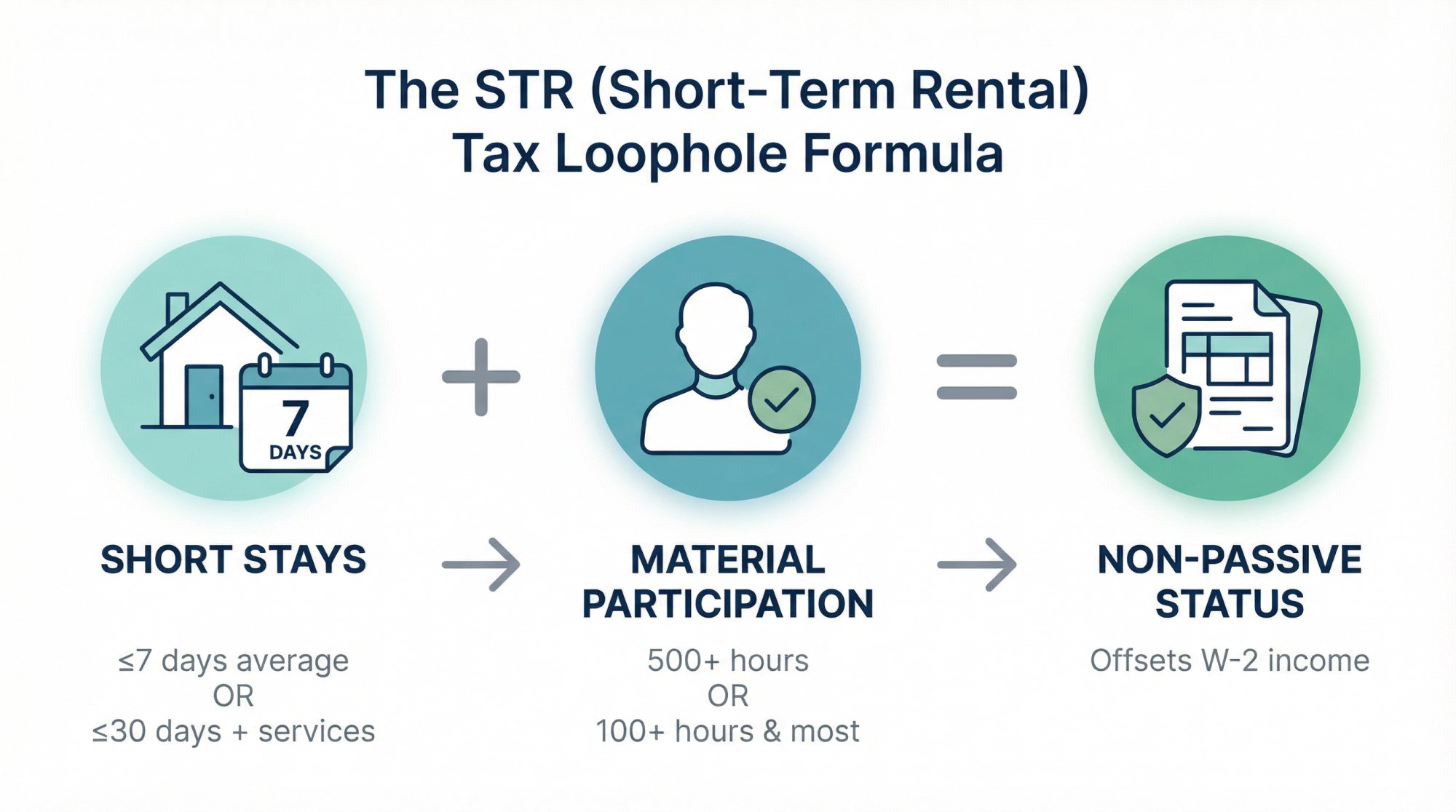

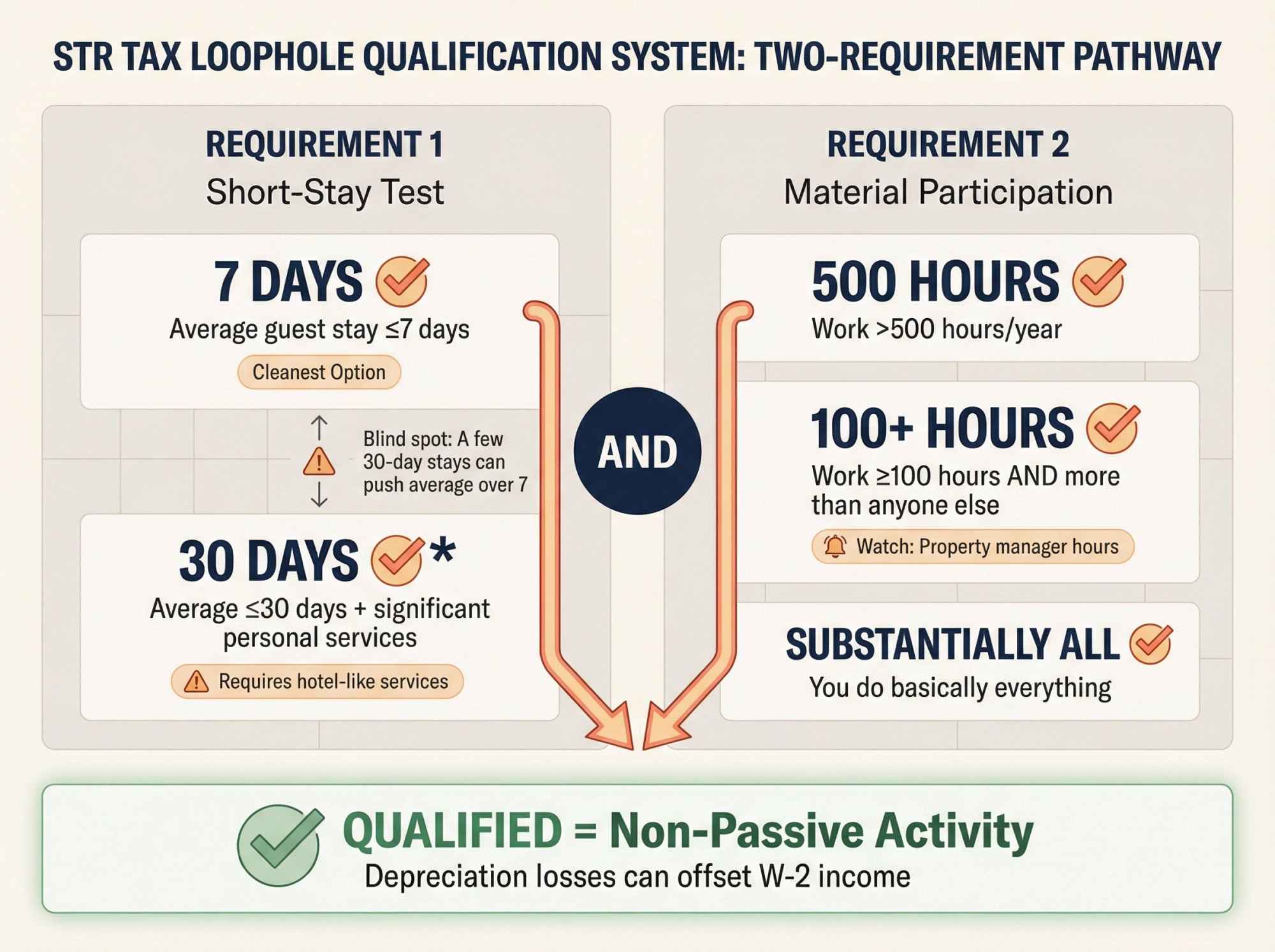

What Is the STR Loophole and How Does It Actually Work?

Let's break down what people actually mean by the "STR loophole."

Why Regular Long-Term Rentals Don't Reduce Your W-2 Taxes

The U.S. tax code treats most rental real estate as a passive activity under the passive activity loss rules. Passive losses typically can't offset active income like wages.

This is frustrating if you're a high-income W-2 employee trying to reduce your tax bill through real estate investing.

What Makes Short-Term Rentals Different

Certain rentals aren't treated as "rental activities" if they meet specific exceptions:

Average period of customer use is 7 days or less, or

Average period of customer use is 30 days or less AND you provide significant personal services

When your STR fits one of these exceptions, it's not automatically passive like a long-term rental.

But that doesn't magically make your losses deductible.

The Second Requirement: Material Participation

To treat the activity as non-passive, you generally need to materially participate. This means meeting one of the IRS tests, like:

• 500 hours of participation, or

• 100+ hours and more than anyone else, or

• Substantially all participation

So the real "loophole" is this two-step chain:

Short stays (7 days, or 30 days with services)

+

Material participation

=

Activity can be non-passive

=

Depreciation losses can offset other non-passive income (subject to other limits)

Do You Qualify for the STR Loophole? 2 Requirements

Requirement 1: Does Your STR Meet the Short-Stay Test?

The 7-Day Test (Cleanest Option)

If your average period of customer use is 7 days or less, you generally meet the exception. According to IRS draft instructions, this is calculated across all stays during the year.

Blind spot: "Average" means you can blow this without realizing it. A few 30-day stays can push your average over 7.

The 30-Day Test (Works, But Requires Services)

If your average is 30 days or less, you can still qualify if you provide significant personal services. Think hotel-like services, not just repairs.

Practical note: Many STR owners don't actually provide "significant personal services." If you're basically providing a clean, safe house, you usually want to aim for the 7-day average.

Requirement 2: How to Prove Material Participation

The IRS has multiple tests for material participation. The ones most STR owners use:

500-hour test: You participated more than 500 hours during the year.

100 hours and more than anyone else: You participated at least 100 hours, which was more than anyone else (including property managers).

Substantially all participation: You did basically everything.

Blind spot: If a property manager logs more hours than you, you lose the "100 hours and more than anyone else" test. That doesn't mean you're doomed. It means you need a different test (like 500 hours), or you need to rethink who's doing what.

What Good Material Participation Documentation Looks Like

If you ever need to defend material participation, you want records that are boring and specific:

• A time log (app, spreadsheet, calendar entries)

• Categories of tasks (guest communications, pricing, scheduling cleaning, purchasing supplies, coordinating repairs, listing optimization)

• Evidence you were the decision-maker (messages, invoices, approvals)

We wrote a complete guide to material participation for Airbnb rentals that goes deeper on documentation strategies.

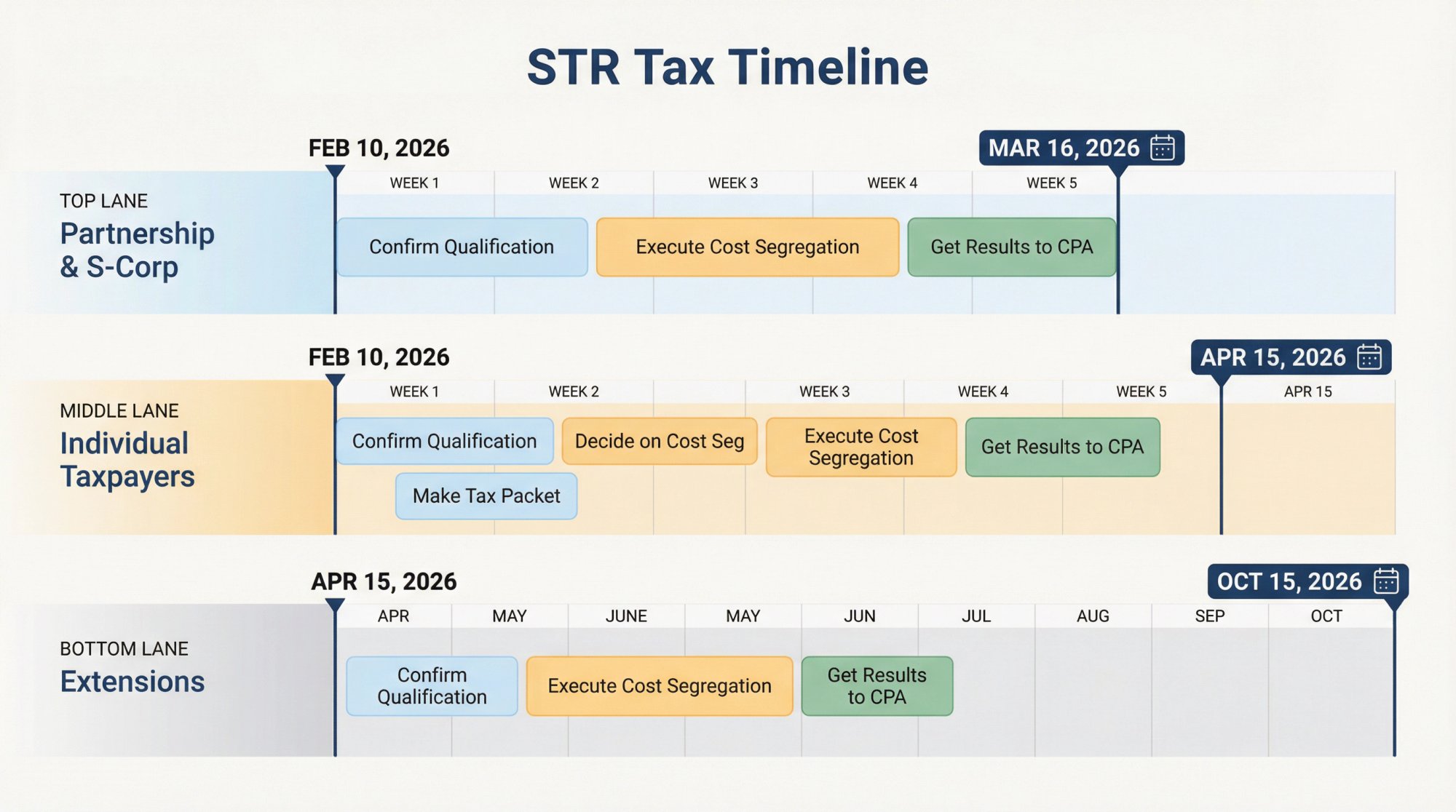

Your 2026 Tax Season Timeline for STR Deductions

This is the practical timeline most STR investors need right now.

February 10 to March 16: Partnership or S-Corp Deadlines

Your deadline is March 16, 2026 (because March 15 falls on Sunday).

Week 1-2: Confirm Qualification

Confirm your STR qualifies under the short-stay test (7-day average, or 30-day with services)

Confirm material participation for 2025

Finalize your depreciation strategy

Week 3-4: Execute Cost Segregation

If you're considering cost segregation, don't wait until March 10.

The provider needs time to complete the study, and your CPA needs time to enter the depreciation detail into your return.

Options:

• No cost segregation (rarely the best choice if you're targeting big deductions)

• Cost segregation now (most common for new STR owners)

• "Catch-up" cost seg via Form 3115 if this isn't the first year (see section below)

Week 4-5: Get Results to Your CPA

Your CPA needs the cost segregation results with enough lead time for Form 4562 and K-1 reporting.

If you're behind, an extension is normal. The mistake is extending without doing the work that determines whether the deduction is usable.

February 10 to April 15: Individual Taxpayer Timeline

You have a little more runway. Use it.

Week 1-2: Make Your "2025 STR Tax Packet"

Gather these documents:

• Closing statement for any 2025 purchases

• Renovation and furnishing invoices

• STR permit/license dates (if applicable)

• Listing "live" date proof (screenshots showing when listing went live and calendar was available)

• Gross receipts by platform (Airbnb, Vrbo, etc.)

• Clean expense list (cleaning, utilities, repairs, supplies, software, insurance, property taxes, interest)

Week 2-4: Decide on Cost Segregation

If you're considering cost segregation, don't wait until April 10.

While you're evaluating cost segregation, you can use Chalet's free analytics to explore market performance data and our ROI calculator to model your property's performance.

Connect with cost segregation providers through Chalet's vetted vendor network.

Week 5-8: Finalize and File

Your CPA prepares and reviews your return. You review, sign, and file by April 15.

April 15 to October 15: If You Extend

An extension can be smart when you need:

• Time to finish cost segregation properly

• Time to reconcile 1099s and platform payouts

• Time to properly document participation and average stay

But don't confuse "more time" with "less work." You still need to gather the facts and documentation.

Real Example: How the STR Loophole Works (And Fails)

Let's use a realistic scenario to see how this actually works.

The Scenario

You bought a cabin in 2025 and operated it as a short-term rental. You furnished it and made it guest-ready in 2025.

Your average stay is 4 nights, and you logged 200+ hours managing it in 2025.

You do a cost segregation study and identify a meaningful portion of the property as 5/7/15-year components.

What Bonus Depreciation Actually Does

Depreciation is the tax system's way of spreading the cost of a long-lived asset over time.

Bonus depreciation lets you take a large part of the eligible pieces right away.

Under current IRS guidance, eligible property acquired after January 19, 2025 can qualify for 100% bonus depreciation.

What Cost Segregation Adds

Cost segregation reclassifies components into shorter lives.

Studies indicate that real estate properties can have 10% to 40% of costs that fall into shorter-life categories, depending on property type.

For an STR, this often includes:

• Furniture and appliances (5-year property)

• Carpet and vinyl flooring (5-year property)

• Certain electrical and plumbing dedicated to non-structural functions (15-year property)

• Land improvements like driveways and walkways (15-year property)

When This Offsets Your W-2 Income (Or Doesn't)

Even if your CPA generates a large depreciation loss, it only offsets your W-2 if:

You meet the short-stay exception (7-day average, or 30-day plus services), AND

If either fails, your loss is likely passive and can carry forward instead of reducing your current-year wages.

This is why documentation matters so much.

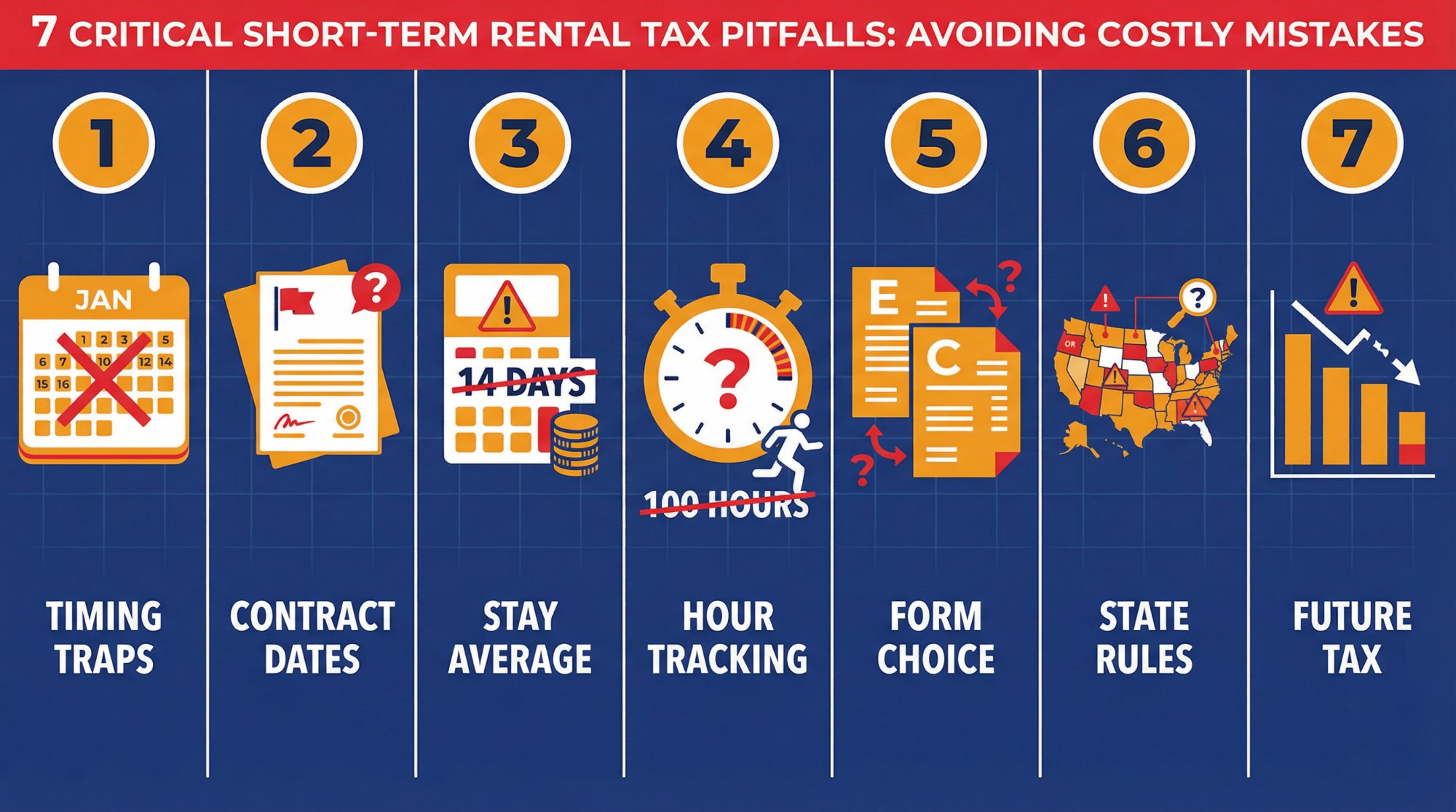

7 Pitfalls That Kill Your STR Tax Deductions

Pitfall 1: Closing in 2025 Doesn't Mean You Can Deduct in 2025

For depreciation, what matters is when the property and assets are placed in service. That means ready and available for use in your business.

If you closed in December 2025 but didn't list the property until January 2026, you probably can't take 2025 depreciation on the STR assets.

You want to document that your property was truly guest-ready and available for rent during 2025 if you're taking 2025 deductions.

Pitfall 2: Your Contract Date Can Disqualify You from 100% Bonus

Acquisition timing can depend on a binding contract date.

This is why two investors who both "closed in February 2025" can get different bonus depreciation treatment.

One might have signed a binding contract in December 2024 (potentially subject to old rules), while another signed in January 2025 (potentially eligible for 100%).

Pitfall 3: A Few Mid-Term Stays Can Blow Your 7-Day Average

A single 30-night booking can move your average significantly, especially if you only have a handful of total stays.

Fix: If you want to rely on the 7-day rule, build your pricing and minimum-night settings around it using Chalet's analytics.

If your market naturally pushes toward 14-30 night stays, you need to understand the 30-day rule and the services requirement.

Pitfall 4: Your Property Manager Logs More Hours Than You

Material participation isn't vibes. It's tests and records.

If your property manager logs 200 hours and you log 150 hours, you fail the "100 hours and more than anyone else" test.

Fix: Either participate enough to meet a stronger test (like 500 hours), or restructure how tasks are split, or accept that the loss might be passive.

Pitfall 5: Schedule E vs. Schedule C Can Trigger Self-Employment Tax

Many STR owners want non-passive losses but don't want self-employment tax.

• Rental income is usually reported on Schedule E

• But if you provide substantial services primarily for the occupant's convenience, you're in Schedule C territory

This distinction affects whether you owe self-employment tax on the income.

IRS Chief Counsel Advice notes that passive-loss classification under Section 469 doesn't control self-employment tax treatment, and services provided can matter.

This isn't an area to freestyle. Ask your CPA to explain, in writing, why your facts belong on E vs. C.

Pitfall 6: State Bonus Depreciation Rules Can Differ from Federal

Even if federal bonus depreciation is 100%, some states decouple from federal rules.

Two examples that affect many STR owners:

California updated its conformity date but state tax rules continue decoupling from bonus depreciation rules.

Georgia has not adopted federal bonus depreciation rules under IRC 168(k).

This means your federal savings can be real while your state return adds back a chunk of the deduction.

Pitfall 7: Bonus Depreciation Is Tax Deferral, Not a Free Pass

Accelerated depreciation front-loads deductions. Over time, your depreciation deductions are smaller.

And when you sell, you can face:

• Depreciation recapture (taxed at up to 25%)

• Higher taxable gain overall

For 1031 investors, there's an extra layer. 1031 exchanges are now limited to real property, so cost segregation reclassification can create complexities.

We wrote guides that go deeper on these topics:

• STR loophole + 1031 strategy

How to Handle State Bonus Depreciation Rules

Don't try to memorize all 50 states. The rules change constantly.

Instead, ask your CPA one simple question:

"Does my state conform to federal bonus depreciation under 168(k) as amended by OBBBA, or do I have an addback and subtraction schedule?"

If you own property in states like California or Georgia, assume additional state adjustments until proven otherwise.

Research confirms that California continues to decouple from bonus depreciation rules.

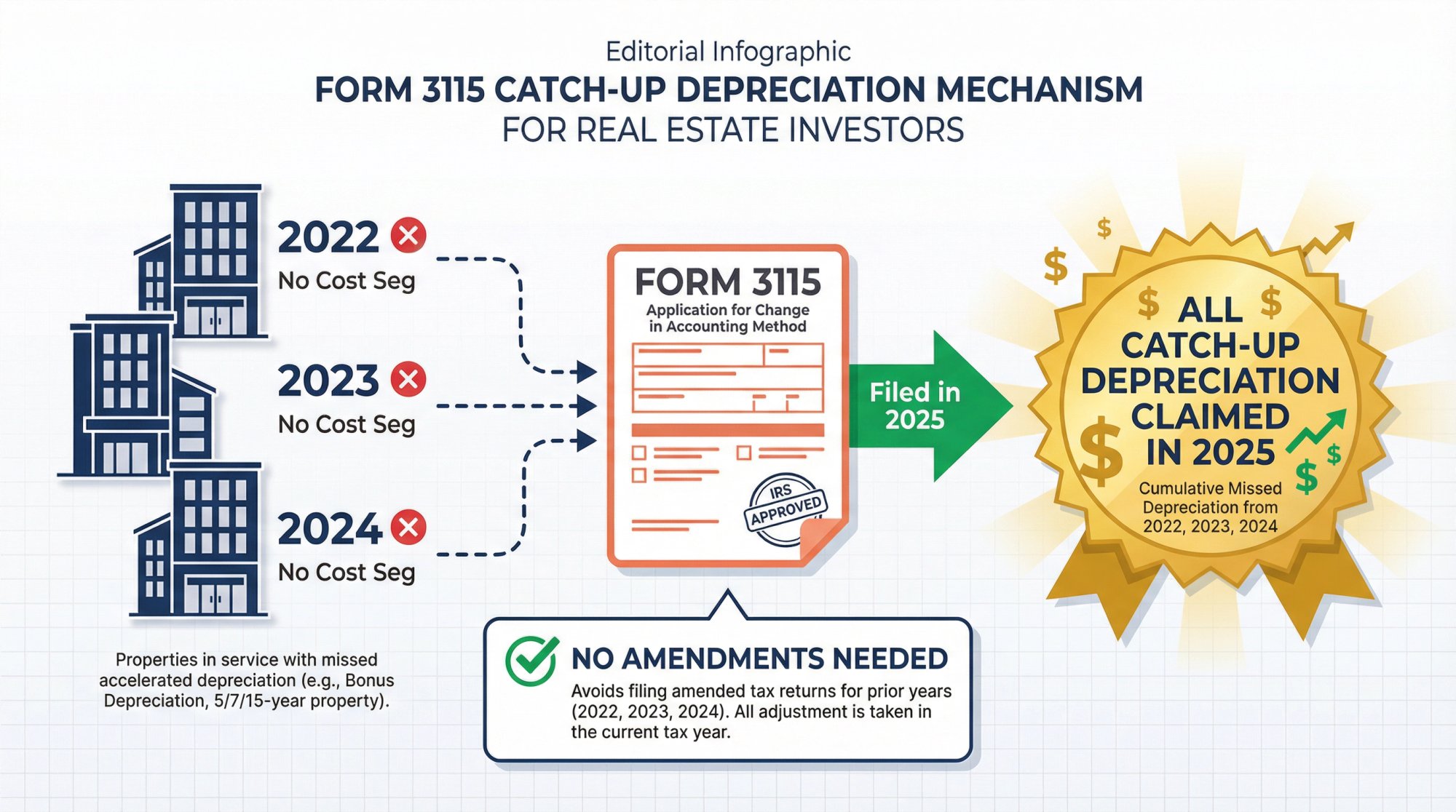

How to Catch Up on Missed Cost Segregation from Prior Years

Here's a high-value move for portfolio builders:

If you placed a property in service in a prior year but never did cost segregation, many providers and CPAs use a "look-back" study and claim catch-up depreciation using Form 3115 (change in accounting method).

This approach doesn't require amending multiple old returns. Instead, you claim the catch-up depreciation in the current year.

Research explains that this can create a large deduction in the current year based on depreciation you were entitled to but didn't claim.

Important: The applicable bonus depreciation rate depends on the underlying rules for those assets and years. Don't assume every catch-up is 100%.

We have a complete FAQ on cost segregation that covers the catch-up approach in more detail.

How to Execute Your STR Tax Strategy with Free Tools

Use Chalet's free ROI calculator to model cash flow, cap rate, and debt service coverage before executing your tax strategy.

If your goal is "buy or optimize an STR and not screw up the tax upside," you want two parallel tracks:

Step 1: Make Sure the Deal Works Without Tax Magic

Before you get excited about tax deductions, make sure the property works as an investment:

Run ROI and DSCR on any address: Use Chalet's free calculator to model cash flow, cap rate, and debt service coverage ratio.

Compare markets with free dashboards: Chalet's analytics platform shows ADR, occupancy, and revenue trends across 100+ markets.

See Airbnb rentals for sale: Browse STR properties listed for sale in markets you're evaluating.

Step 2: Execute the Tax Strategy with Proper Documentation

Once you know the deal works, execute the tax strategy properly:

Bonus depreciation hub: Chalet's bonus depreciation guide explains how bonus depreciation works for STRs.

Cost segregation for STRs: Connect with vetted cost segregation providers through Chalet's vendor network.

Material participation deep dive: Read our complete guide to material participation requirements.

If You're Still Shopping for Your First STR

Meet an Airbnb-friendly agent: Connect with real estate agents who specialize in STRs through Chalet's platform.

Check local regulations: Use Chalet's regulation library to understand permit requirements and operating rules in your target market.

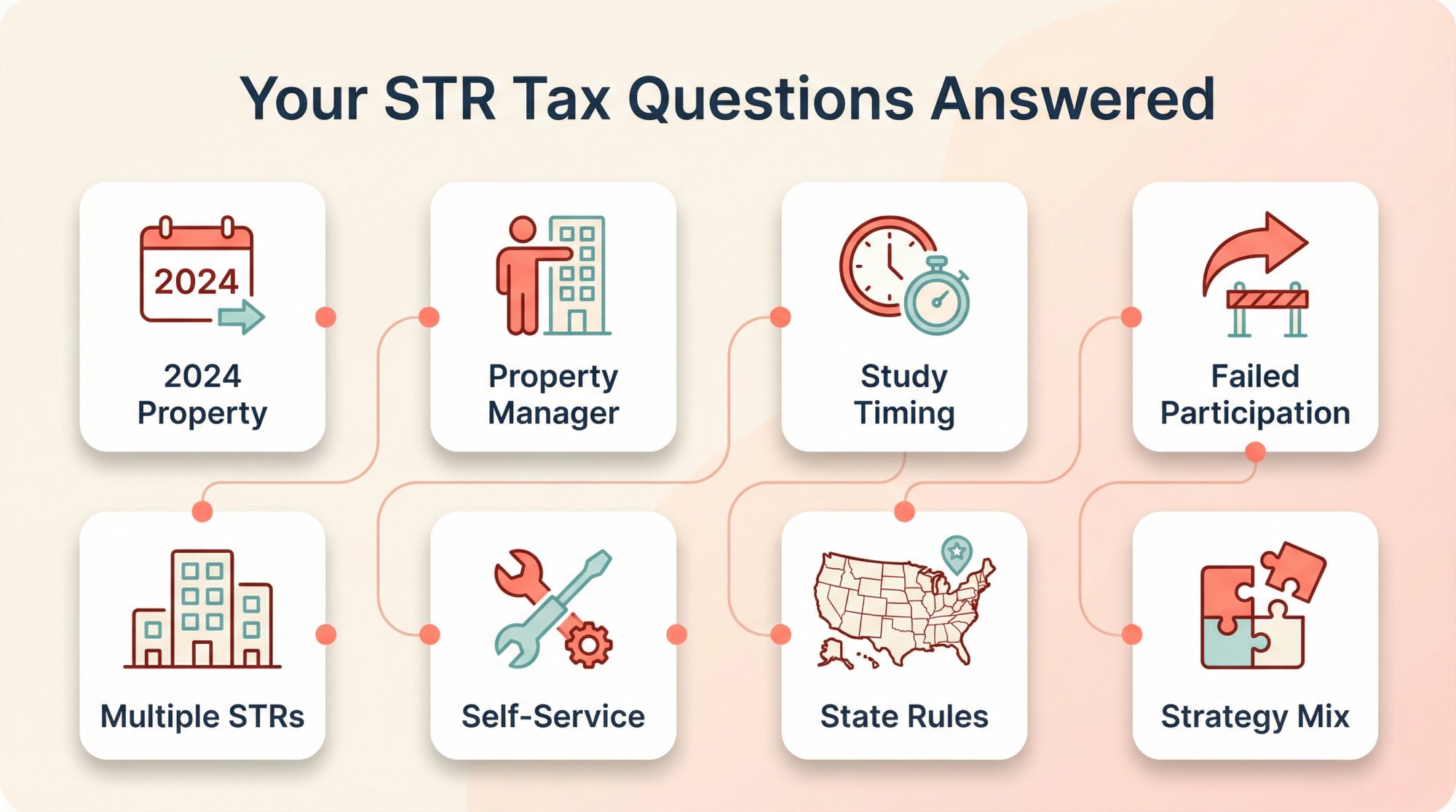

Frequently Asked Questions

Frequently Asked Questions

Can I still take bonus depreciation if I bought my STR in 2024?

Yes, but the rate depends on when you placed it in service. If you placed it in service in 2024, you were subject to the old phase-down schedule (60% for most 2024 assets). If you placed it in service in 2025, the rules in this guide apply. Learn more about bonus depreciation for different years.

What if I use a property manager? Can I still materially participate?

Using a property manager doesn't automatically disqualify you from material participation. But if the property manager logs more hours than you, you'll need to meet a different test (like the 500-hour test) or restructure responsibilities.

How long does a cost segregation study take?

Most cost segregation studies take 2-4 weeks to complete, depending on the property complexity and the provider's workload. During busy tax season (February-March), some providers can have longer lead times.

What happens if I fail material participation this year?

If you fail material participation, your depreciation losses will be treated as passive. They don't disappear. They carry forward and can be used in future years when you have passive income or when you dispose of the property.

Do I need a cost segregation study for every STR I own?

Yes, cost segregation is property-specific. Each property needs its own study. But some providers offer portfolio pricing if you're getting studies done on multiple properties at once.

Can I do cost segregation myself to save money?

Technically, the IRS doesn't require you to hire a professional. But a proper cost segregation study requires engineering knowledge, understanding of IRS depreciation rules, and the ability to defend your classifications in an audit. Most investors hire specialists through Chalet's vetted network and consider it part of their investment cost.

What if I'm in a state that doesn't conform to federal bonus depreciation?

You'll need to make state tax adjustments. Your federal return will show the full bonus depreciation, but your state return will add back some or all of that deduction. This creates a timing difference. You still get federal benefits, but state benefits can be deferred.

Can I combine the STR loophole with other real estate tax strategies?

Yes. Many investors combine STR material participation with 1031 exchanges, opportunity zone investments, and other strategies. But these combinations add complexity. Work with a CPA who understands all the moving pieces.

Sources and References

This guide is based on current IRS guidance and professional tax research:

The IRS issued Notice 2026-11 confirming permanent 100% bonus depreciation for eligible property acquired after January 19, 2025.

• IRS News Release IR-2026-06 (January 14, 2026) on permanent 100% bonus depreciation

• IRS One Big Beautiful Bill Provisions (last reviewed February 9, 2026)

• IRS Notice 2026-11 on Section 168(k) guidance

• IRS Draft Instructions for Form 1065 on rental activity definitions

• IRS Publication 925 on passive activity and material participation

• IRS Topic No. 414 on rental income reporting

• Georgia Department of Revenue on federal tax changes

Chalet is the one-stop platform for short-term rental investors. We pair free market analytics with a vetted vendor network (STR-specialist real estate agents, lenders, insurance, cost segregation providers, and more) so you can research, buy, and operate in one place. Explore the data and connect with pros at Chalet.com.