A 1031 exchange into a short-term rental? The inspection contingency feels like protection and threat wrapped into one messy situation.

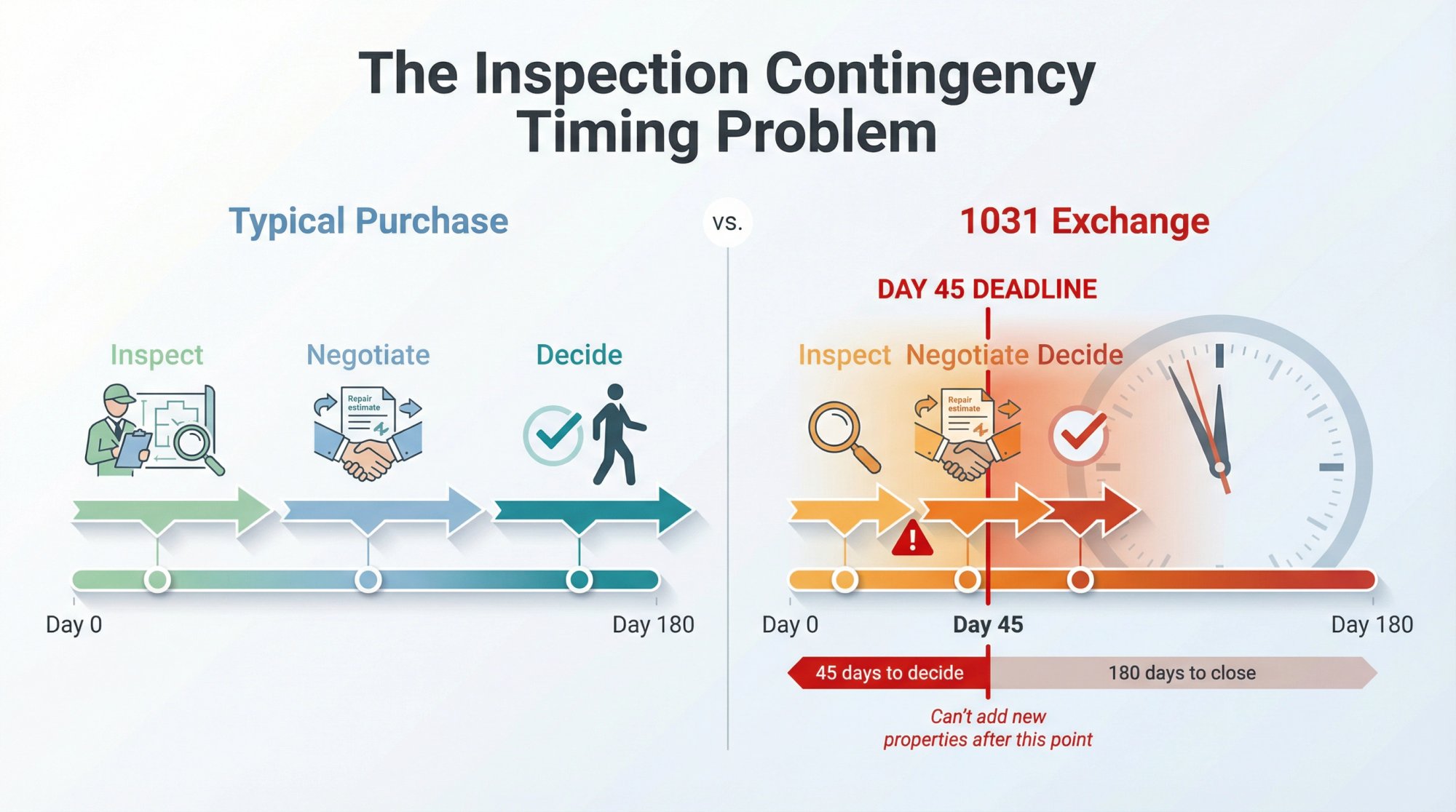

Here's why it gets complicated. A typical purchase lets you inspect first, negotiate repairs, and then decide whether you're in. A 1031 exchange forces you to formally identify replacement properties by Day 45 before you can fully know what inspections will reveal. That timing mismatch creates a failure pattern we see constantly:

• You identify one "perfect" replacement property

• The inspection uncovers serious foundation issues

• The deal dies after Day 45

• You can't add new properties after Day 45, so your exchange fails or turns into a scramble

This guide shows you how to keep the protection of inspections without blowing up your 1031 timeline. We'll also cover the part most articles skip: how inspection negotiations on the property you're selling can quietly create taxable boot or delay your entire exchange.

Quick terminology note for those new to the space: many buyers are exchanging into an Airbnb rental, which we also call an STR (short-term rental). Throughout this guide, we'll use these terms interchangeably since the 1031 rules apply the same way regardless of what you call the asset class.

Critical disclosure: This guide is for education. A 1031 exchange is a tax-driven transaction with strict IRS rules and timelines. You need to work with a qualified intermediary (QI), CPA, and real estate attorney who understand your specific situation. We're providing framework and strategy, not legal or tax advice.

Why 1031 Exchange Inspection Contingency Issues Matter

When someone searches "1031 Exchange Inspection Contingency Issues," they're usually trying to answer one of these specific questions:

"Can I even have an inspection contingency in a 1031 exchange?"

Yes. The inspection contingency is a purchase contract term, not an IRS rule. The real issue is managing inspection timing inside the 45-day and 180-day IRS deadlines.

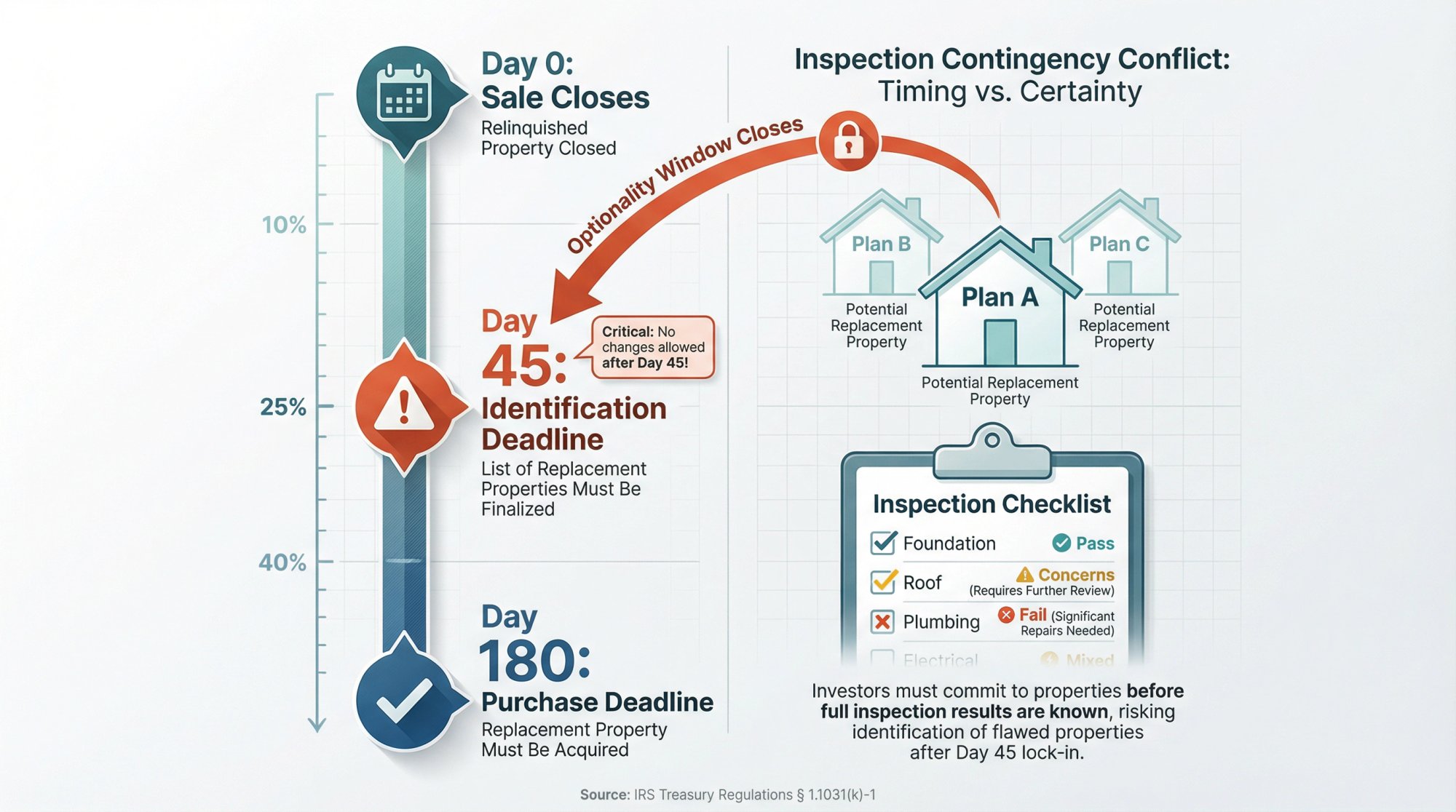

"What happens if inspection findings force me to cancel?"

The critical detail is when you cancel relative to Day 45. If you cancel after Day 45 and didn't identify backup properties, you might have no compliant replacement left and your exchange could fail.

"Do I have to waive inspections just to compete in this market?"

Maybe not. There are smarter ways to structure competitive offers without taking blind property risk (we'll show you those strategies).

"How do I avoid losing my tax deferral because inspections take too long?"

This gets to the heart of it. You need inspection information before your "optionality window" closes on Day 45.

IRS 1031 Exchange Rules That Create Inspection Problems

Let's start with the mechanics that matter most, explained in plain English (not tax code):

1031 Exchange Day 45 and Day 180 Deadlines

Day 45: You must identify replacement property by midnight on the 45th day after you close on your relinquished property. Treasury Regulations specify the identification requirements.

Day 180: You must receive (close on) the replacement property by midnight on the earlier of:

• the 180th day after your sale closes, or

• your tax return due date (including extensions) for that tax year

This "earlier of 180 days or return due date" rule is why people who sell late in the year often file tax extensions to preserve the full 180 days.

How to Properly Identify 1031 Exchange Replacement Property

A valid identification requires:

Written and signed documentation

Unambiguous property description (street address, legal description, or distinguishable name)

Delivery to the correct party (typically your QI, escrow company, title company, or the person obligated to transfer the replacement property) before Day 45 ends

1031 Exchange 3-Property Rule and Backup Properties

Most investors should operate within the 3-property rule: you may identify up to three replacement properties, regardless of their total value.

You can identify more using the 200% rule or 95% rule, but those create complexity and risk. Here's the killer detail most people miss:

If you identify more properties than allowed by the identification rules, you can be treated as if you identified nothing (unless you satisfy the 95% rule, which is extremely difficult)

Can You Change 1031 Exchange Property Identification After Day 45?

According to NYSSCPA guidance, identification can be revoked, but the revocation must be in writing and delivered before the end of the 45-day identification period.

1031 Exchange Real Property Requirements for Short-Term Rentals

Under current law, Section 1031 applies only to exchanges of real property held for business or investment. Personal property no longer qualifies after the Tax Cuts and Jobs Act changes.

This matters for short-term rentals because "turnkey furnished" properties include personal property (furniture, appliances, household goods). That's not technically an inspection issue, but it becomes a negotiation challenge when you're structuring what counts as real property versus personal property in your exchange value calculations.

How Inspection Periods and 1031 Exchange Deadlines Conflict

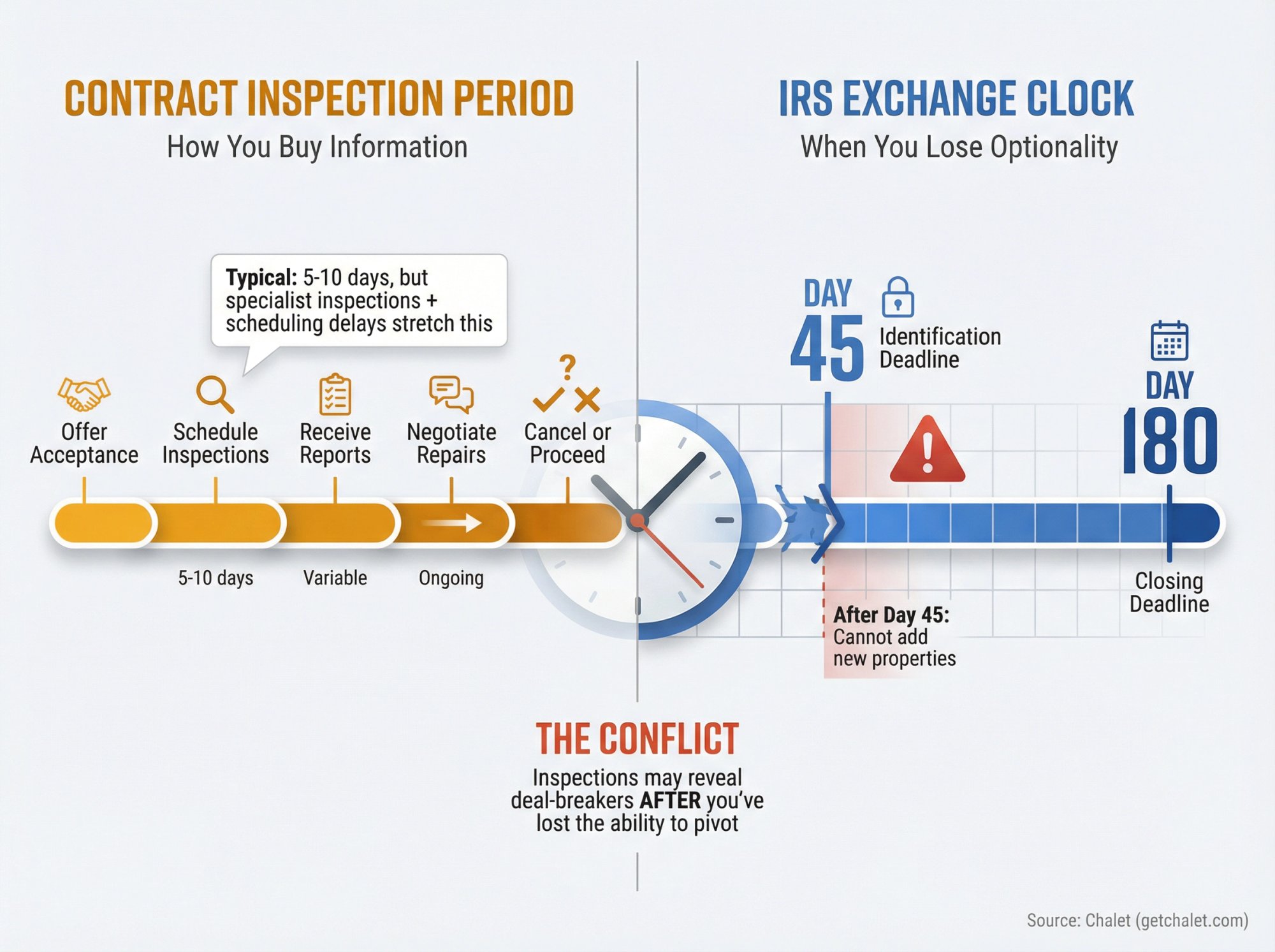

Here's the simplest mental model for understanding the inspection contingency challenge:

Inspection contingency period is how you buy information about the property's condition

Day 45 identification deadline is when you lose optionality to pivot

Your job is to pull information earlier than Day 45, or keep multiple legitimate options alive until you have the information you need.

1031 Exchange Inspection Timeline Reality Check

| Clock | What It Controls | What Can Go Wrong in a 1031 |

|---|---|---|

| Contract inspection period | When you can inspect, renegotiate, or cancel | Inspections get scheduled late; you're still "in due diligence" after Day 45 hits |

| IRS exchange clock | When you must identify (Day 45) and close (Day 180) | If Plan A dies after Day 45 and you didn't identify backups, you may have no compliant replacement properties left |

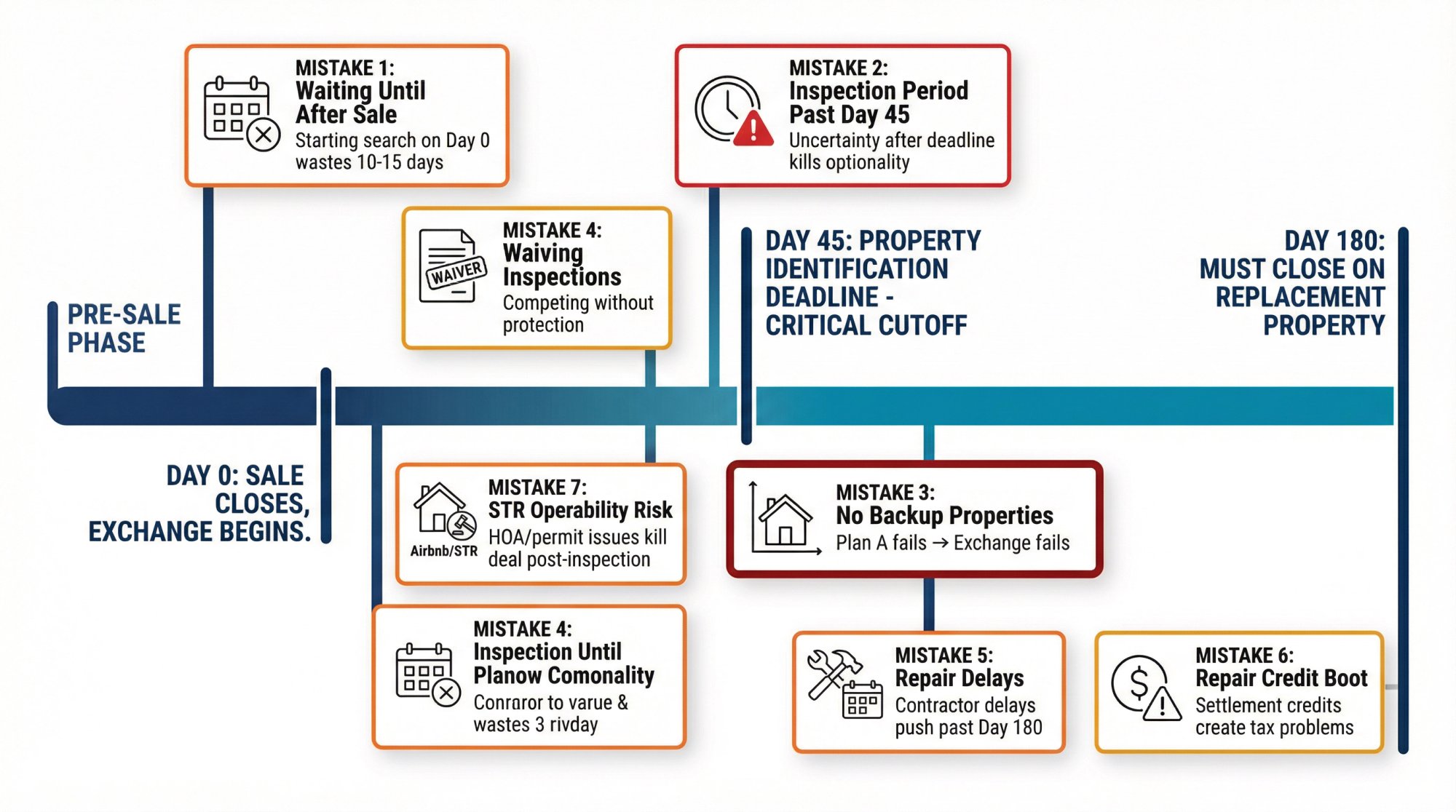

Most Common 1031 Exchange Inspection Contingency Mistakes

Waiting Until After Sale to Start Property Search

This is the most expensive assumption people make:

"I'll start shopping seriously once my sale closes and I have the proceeds sitting with my QI."

Wrong timing. You can shop before you sell. You can get under contract before you sell. You can often complete inspections before Day 0 even starts, as long as you don't close on the replacement before you transfer your relinquished property (unless you're doing a reverse exchange, which is a different structure).

Fix: Start replacement property shopping and due diligence as early as you possibly can. Treat your relinquished property sale close as a deadline trigger, not a starting gun.

How Chalet helps:

Analyze multiple markets quickly with free Airbnb analytics dashboards, then underwrite specific addresses with our ROI and DSCR calculator so you can move fast once your sale is under contract.

Inspection Period Extending Past 1031 Day 45 Deadline

In many markets, inspection periods run 5 to 10 days from contract acceptance. But scheduling delays happen. Specialist inspections (roof certification, sewer scope, structural engineer, septic system, mold testing) take additional time. If your inspection uncertainty stretches past Day 45, you're forced to identify properties you're not confident about.

Fix: Build a "Day 45 plan" that forces inspection clarity earlier in your timeline.

Rule of thumb we recommend: Try to have your core inspection findings and repair decisions made by Day 30 of your exchange clock. That gives you 15 days to pivot and re-identify if needed.

Identifying Only One Replacement Property Without Backups

This is the classic inspection contingency failure pattern:

• You identify one perfect property

• Inspection finds a deal-breaker (foundation movement, extensive water damage, roof replacement needed immediately)

• Seller refuses repairs or credits

• You cancel the contract after Day 45

• You have no compliant backup property identified

• Your exchange is now at serious risk

Fix: Use the 3-property rule the way it was designed to be used:

| Backup Strategy | Purpose | Why It Works |

|---|---|---|

| Plan A | Your top choice property | The one you're most excited about |

| Plan B | A true backup you would actually purchase and operate | Protects against Plan A inspection failures |

| Plan C | Another real backup option | Extra insurance against unforeseen issues |

This isn't "being indecisive." This is hedging against unknowns that inspections exist to reveal. You're not required to close on all three. You're protecting yourself against information you don't have yet on Day 45.

Waiving Inspection Contingency in Competitive 1031 Markets

This pressure is real and documented. According to the National Association of REALTORS® Confidence Index data, approximately 18% of buyers waived the inspection contingency (and 19% waived appraisal contingency) in recent market conditions.

Waiving an inspection isn't just property condition risk. In a 1031 exchange, it creates timeline risk because post-closing surprises are harder to handle when you're trying to preserve tax deferral and reinvest most of your exchange proceeds before Day 180.

Fix: If you need to compete, use one of these strategies instead of a blind inspection waiver:

→ Pre-offer "walk-and-talk" inspection (shorter, faster, sometimes same-day with the right inspector)

→ Compressed inspection period (3 to 5 days instead of 10)

→ Informational inspection only (you inspect but contractually agree not to request repairs)

→ Higher earnest money with normal inspection rights

→ Stronger closing certainty (lender fully underwritten before offer, flexible closing date that fits your Day 180 deadline)

Repair Negotiations Delaying 1031 Day 180 Closing

Repairs take time. Contractor access takes time. Re-inspection takes time. Insurance binding after repairs takes time. Permit approvals for major repairs take time.

Remember: you must receive the replacement property by Day 180 (or earlier if your tax return due date hits first).

Fix: When you request repairs during inspection negotiations, structure them for speed:

• Prioritize health, safety, and insurability repairs required for financing or insurance binding

• Push cosmetic items into a price adjustment at closing, or plan to handle them after close with non-exchange funds

• Set repair completion deadlines that are 7 to 10 days earlier than your scheduled closing date

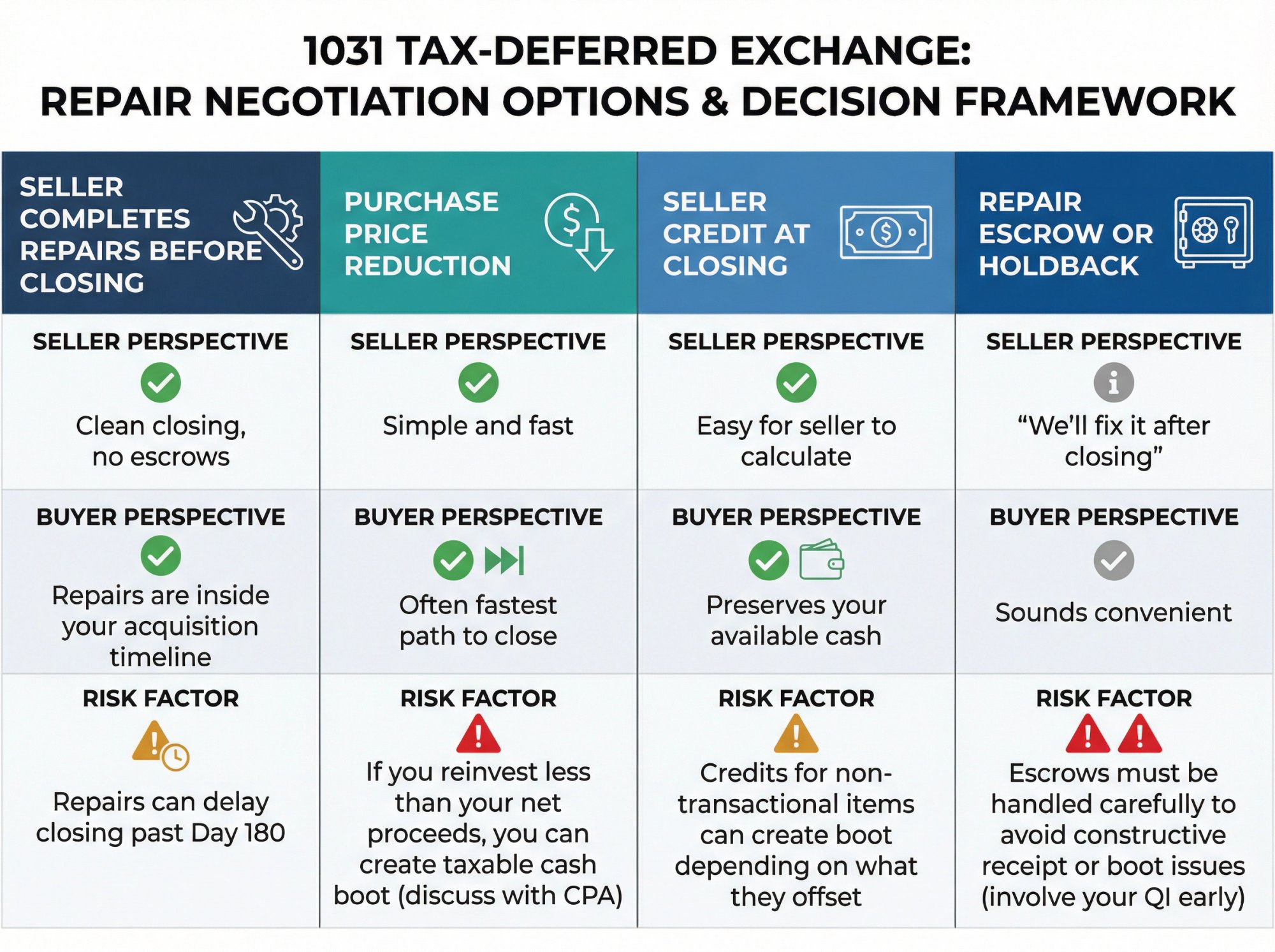

How Repair Credits Create Taxable Boot in 1031 Exchanges

This is where inspection contingencies collide with tax mechanics in ways most investors don't expect.

Two common "I didn't know that would be taxable" moments:

Non-transactional expenses paid from exchange proceeds can create taxable boot. Examples include utility bills, repair invoices, or other operating expenses that aren't standard closing costs.

Credits or offsets for income-like items can create boot in a 1031 sale if handled the "normal" way on the settlement statement. Examples: prepaid rent, security deposits, or tenant damage deposits.

The practical inspection contingency connection:

Inspection findings often lead to repair credits, holdbacks, or "we'll escrow money for repairs post-closing" structures. Those arrangements can have tax consequences depending on how funds move and what they pay for.

Critical tax rule: If the payment is a routine closing cost (title fees, recording, standard prorations), it's more likely safe to pay from exchange funds. If the payment is an operating expense or repair invoice (not a standard closing cost), it's more likely to create taxable boot if paid from exchange proceeds.

Fix: Treat repair and credit structure as part of your 1031 planning, not a last-minute closing statement detail. Have your qualified intermediary review the preliminary settlement statement early (at least 10 days before closing), not the morning of signing.

Short-Term Rental Operability Risks Beyond Property Inspection

A short-term rental property has extra layers of inspection-like due diligence that can kill the deal even if the home inspection technically passes:

HOA or condo rules that restrict or ban short-term rentals

Local STR permitting requirements (some cities have caps, waiting lists, or neighborhood restrictions)

Safety issues that are manageable for owner-occupants but risky for guest turnover: missing handrails, deck safety concerns, pool barriers, egress window problems, smoke detector placement

Fix: Run a parallel "STR operability inspection" during your physical inspection window.

How we help at Chalet:

Check local rules quickly with our rental regulations database, then line up operational vendors (property management, cleaning services, furnishing) through our STR directory so you know the property can actually operate before you identify it.

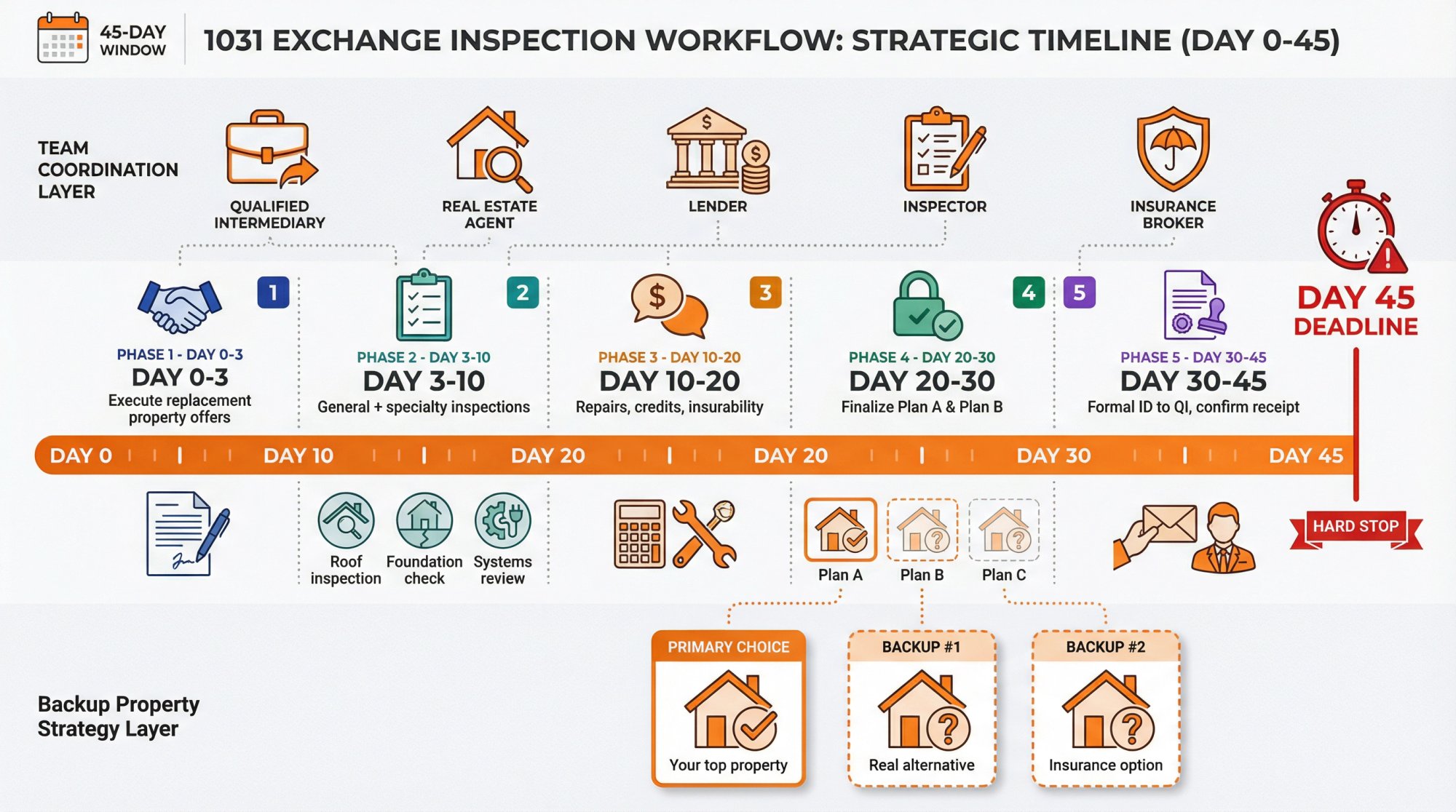

1031 Exchange Inspection Strategy for Short-Term Rentals

This is the "do it the same way every time" workflow that reduces surprises and keeps you on track.

Build Your 1031 Exchange Team Before Listing Property

If you wait until your sale is under contract to assemble your team, you're already behind the timeline.

Minimum team roster:

• Qualified intermediary (QI)

• Exchange-savvy real estate agent who understands 45/180 timelines

• Lender (DSCR or conventional, depending on your qualification profile)

• Home inspector plus specialist bench (roof, sewer scope, structural engineer, septic/well, mold/environmental)

• Insurance broker familiar with short-term rental policies

Chalet can connect you with Airbnb-friendly agents who specialize in 1031 exchanges into STR properties.

Start 1031 Replacement Property Search Before Day 0

Your IRS exchange clock starts when you transfer (close on) your relinquished property. But your shopping, analysis, and inspections don't need to wait until then.

Your goal is to walk into Day 0 with:

• A shortlist of 3 to 5 viable replacement properties you've already analyzed

• Inspection capacity lined up and ready

• Lender underwriting already in motion (or pre-qualification completed)

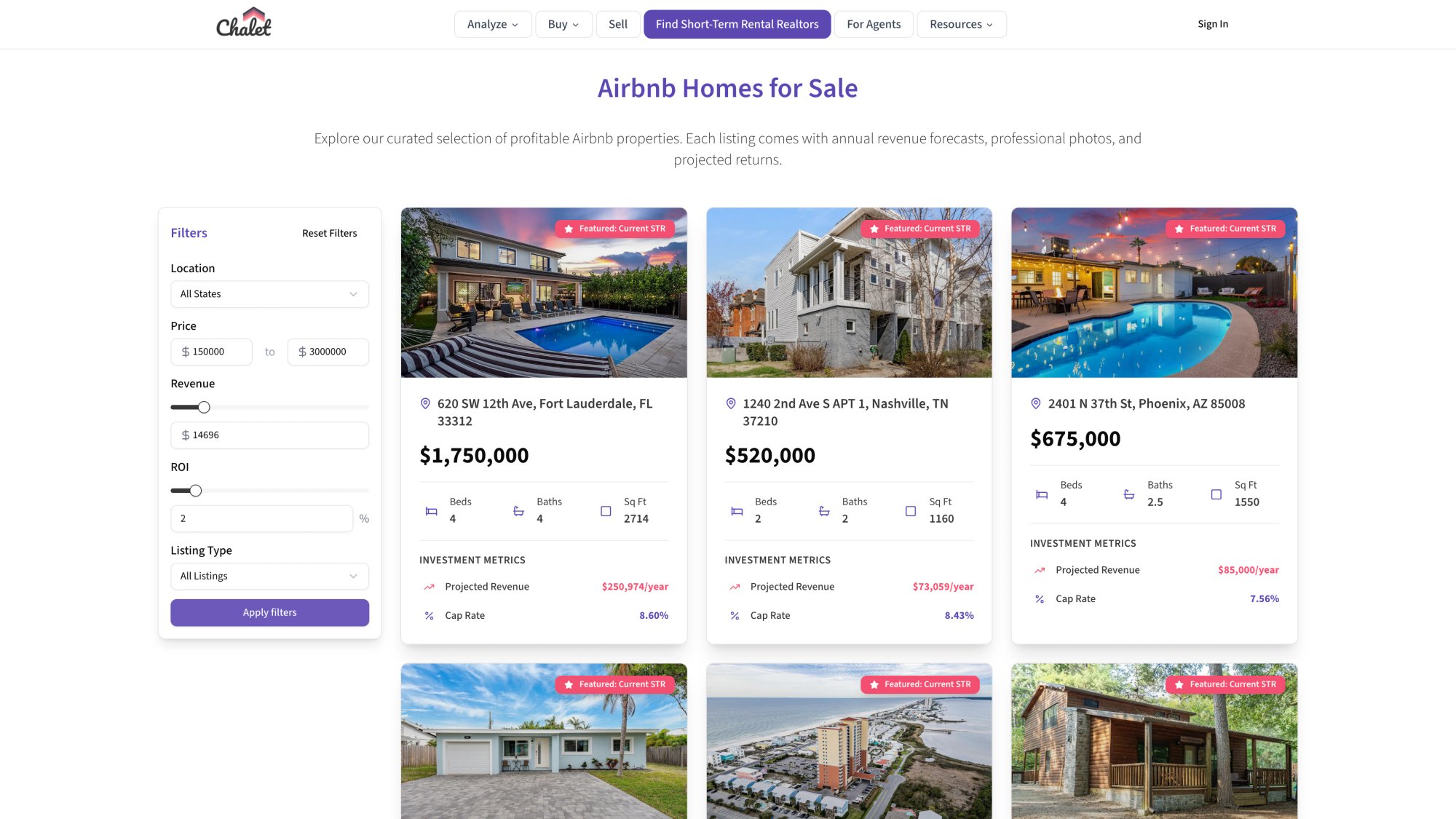

How Chalet accelerates this:

See Airbnb rentals actively for sale in your target markets, then run ROI and DSCR assumptions for specific addresses so you can build your shortlist before your relinquished property even closes.

Schedule Property Inspections Before Day 45 Deadline

Here's a practical "Day 0 to Day 45" calendar to aim for:

| Exchange Day | What You Should Be Doing | Why It Matters |

|---|---|---|

| Day 0–3 | Execute replacement property offers already in motion | You can't inspect until you have contract access and seller cooperation |

| Day 3–10 | General home inspection plus highest-risk specialty inspections | You need real condition information early, not late |

| Day 10–20 | Negotiate repairs or credits, confirm insurability | Repair structure affects timeline and potential boot risk |

| Day 20–30 | Lock in Plan A and Plan B decisions, prepare formal written identifications | You want backups that are real options, not "paper backups" |

| Day 30–40 | Submit formal identifications to your QI, confirm receipt | Most identification failures happen from last-minute admin errors |

| Day 45 | Hard stop deadline | Identification must be written, signed, and delivered by midnight Day 45 |

How to Identify 1031 Backup Properties Correctly

Best default approach: Use the 3-property identification rule.

When choosing your backups, follow these two principles:

① Backups must be "closeable."

If you genuinely wouldn't buy and operate the property, don't list it as an identified backup just to fill the form. That defeats the purpose.

② Backups must be "inspectable fast."

If it's tenant-occupied with limited access windows, or requires complex HOA approval processes, or needs extensive specialist inspections that take weeks to schedule, it might be a weak backup option.

Writing Inspection Contingency Clauses for 1031 Exchanges

You're not looking for a fancy custom clause here. You're looking for speed and control.

Tell your real estate agent and attorney what you need:

Fast inspection window (shorter than typical market standard, if competitive conditions allow)

Clear inspector access rights for general inspector and specialists

1031 cooperation clause (seller acknowledges the exchange structure and agrees to cooperate with contract assignment to your qualified intermediary at no additional cost)

(Note: On the 1031 mechanics side, your contract purchase rights are typically assigned to your intermediary, and parties are formally notified in writing before closing to fit the QI safe harbor structure. Your agent and QI will handle this, but you should understand why it matters.)

How to Handle Property Inspection Issues in 1031 Exchange

Not every defect is a reason to cancel. But in a 1031 exchange, slow indecision creates its own risk.

Use this triage framework:

| Category | Action | Examples |

|---|---|---|

| Walk-away triggers | Cancel immediately | Structural movement, environmental contamination, active water intrusion with mold risk, insurance deal-breakers |

| Negotiate before closing | Request repairs or credits | Safety items for financing/insurance, deferred maintenance causing rapid failure |

| Handle post-closing | Plan with non-exchange funds | Cosmetic upgrades, furnishing, décor, smart locks, operational setup |

Best Repair Negotiation Options for 1031 Exchanges

Inspection contingency negotiations typically end in one of these outcomes. Here's how each structure tends to impact your 1031 timeline and tax posture.

| Repair Outcome | Why Sellers Like It | Why 1031 Buyers Like It | 1031 Risk to Watch |

|---|---|---|---|

| Seller completes repairs before closing | Clean closing, no escrows | Repairs are "inside" your acquisition timeline | Repairs can delay closing past Day 180 |

| Purchase price reduction | Simple and fast | Often fastest path to close | If you reinvest less than your net proceeds, you can create taxable cash boot (discuss with CPA) |

| Seller credit at closing | Easy for seller to calculate | Preserves your available cash | Credits for non-transactional items can create boot depending on what they offset |

| Repair escrow or holdback | "We'll fix it after closing" | Sounds convenient | Escrows must be handled carefully to avoid constructive receipt or boot issues (involve your QI early) |

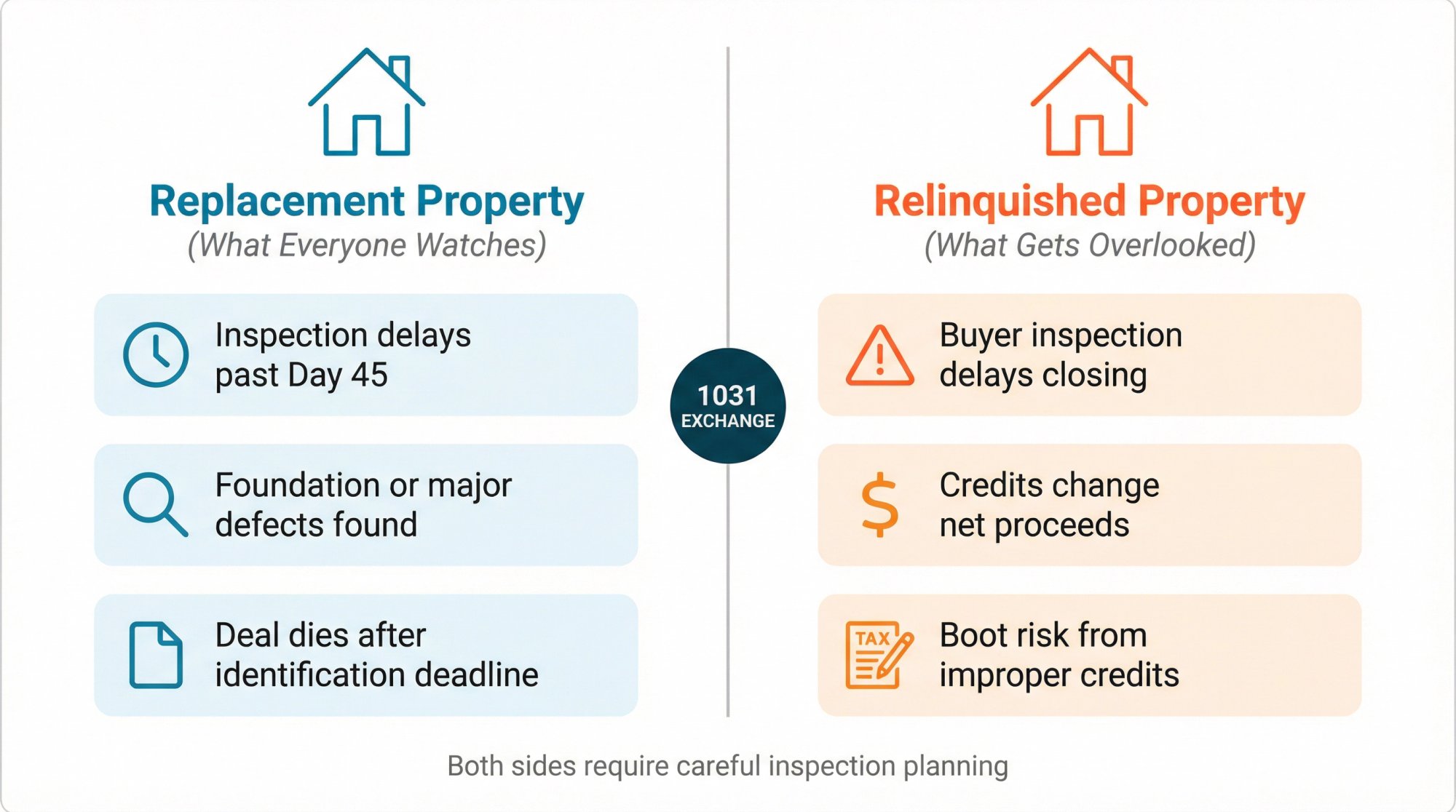

Inspection Contingency Issues When Selling Your Relinquished Property

Most people only think about inspection contingencies on the replacement property purchase.

But your relinquished property sale has its own inspection risk profile:

• Your buyer's inspection requests can delay your closing

• Credits and repair negotiations can change your net proceeds

• Certain credits on the settlement statement can create unintended boot if handled incorrectly

Two common closing-statement issues that show up in inspection-driven renegotiations:

1. Security deposits and prepaid rent

In a normal closing, sellers typically credit these amounts to the buyer. In a 1031 exchange sale, that credit structure can create taxable boot if not handled correctly. A common fix is paying these items outside the closing (directly to tenant or buyer) so they don't touch exchange proceeds.

2. Repair escrows and "outstanding issues" escrows

If money is held back from your sale proceeds for repairs or unresolved inspection items, your qualified intermediary should review the escrow agreement language. When funds are released later, they need to be paid correctly so you avoid constructive receipt problems.

Bottom line: Your buyer's inspection negotiations aren't "just normal real estate drama." They can affect your exchange timing and tax results if you treat the closing statement as an afterthought.

Do Weekends Extend 1031 Exchange Day 45 and Day 180 Deadlines?

You'll see conflicting opinions about this online.

The conservative, investor-safe approach is:

Don't rely on weekend or holiday extensions

Deliver your identification paperwork early and treat the 45th calendar day as a hard stop

A detailed analysis from NYSSCPA notes that IRC Section 7503 (which provides extensions for certain tax-related acts falling on weekends/holidays) generally doesn't apply to extend the 1031 identification and exchange periods based on cited IRS guidance.

Even if a technical argument exists in specific circumstances, it's a terrible risk to bet your entire tax deferral on it. Just deliver early.

What Happens to 1031 Exchange Funds After Day 45 Deal Failure

Here's another surprise most investors don't anticipate:

When you're using a qualified intermediary safe harbor structure, the exchange agreement typically restricts when you can receive your exchange funds. If you've identified replacement property, your rights to receive funds are generally limited until you actually receive the replacement property, or until specific conditions occur after the identification period ends.

This is why "just cancel everything and regroup" isn't always simple in a 1031 exchange. Your best strategy is to avoid being forced into that corner by identifying real backup properties and finishing inspections early enough to make informed decisions.

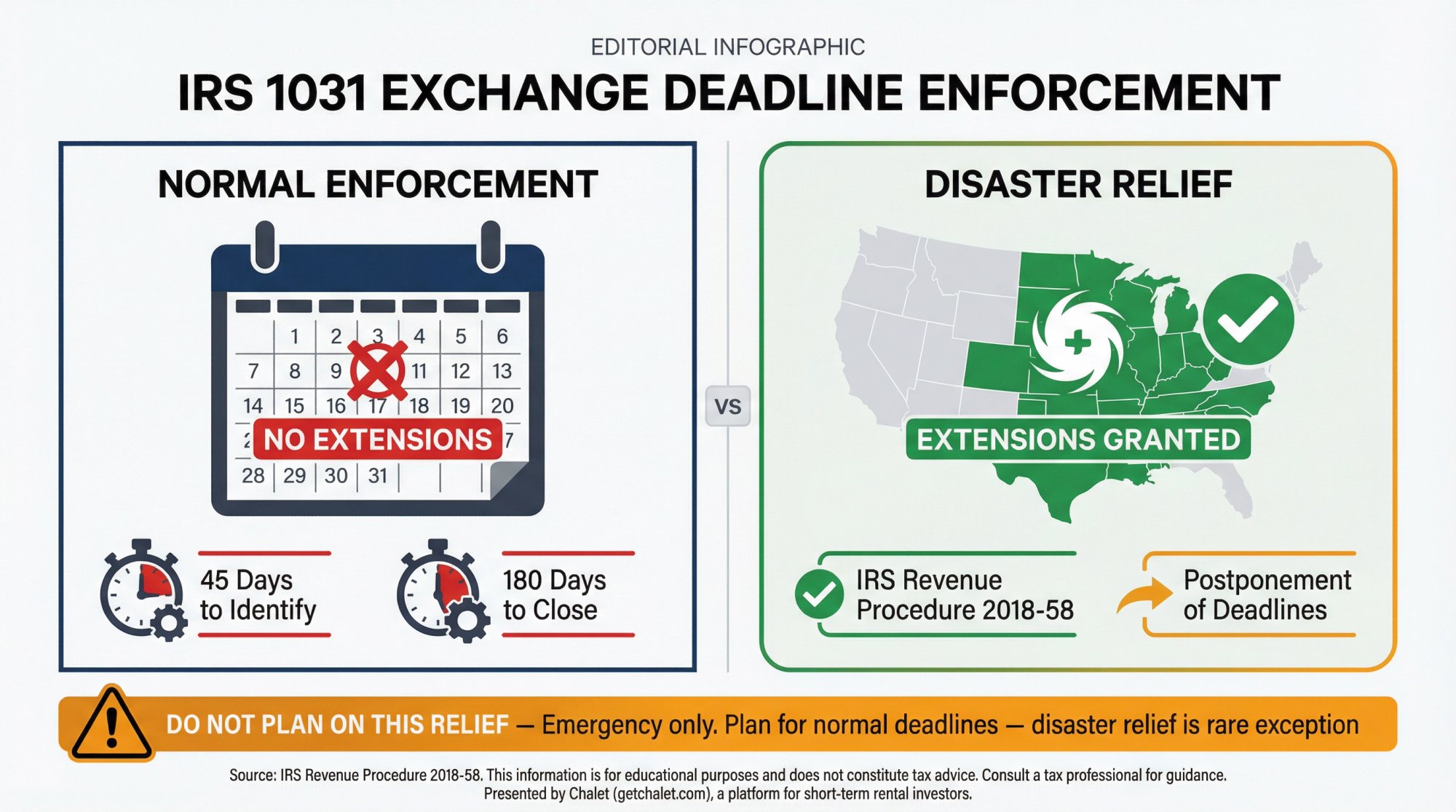

IRS Disaster Extensions for 1031 Exchange Deadlines

Most of the time, the 45-day and 180-day deadlines are strictly enforced with no exceptions.

But in federally declared disaster areas, the IRS can grant deadline relief. A recent example: The IRS provided 1031 deadline extensions for affected taxpayers in areas impacted by Hurricane Helene in 2024, relying on Revenue Procedure 2018-58 frameworks.

Don't plan your exchange strategy around this possibility. Treat it as emergency-only relief that might exist if your area experiences a federally declared disaster, but never count on it in your base-case timeline planning.

How Chalet Helps 1031 Exchange Investors Find Short-Term Rentals

When you're racing a 45-day identification deadline and a 180-day closing deadline, speed and vendor coordination matter as much as finding the right property.

That's exactly why we built Chalet the way we did.

We solve the three biggest 1031 exchange coordination problems:

Problem #1: Market analysis takes too long when you're comparing multiple cities

Most investors waste the first 10 to 15 days of their exchange timeline manually researching markets, pulling comps, and trying to estimate STR performance across different cities.

How we solve it: Our free Airbnb analytics dashboards show you ADR, occupancy, and revenue trends across hundreds of markets instantly. You can compare Nashville, Austin, and Denver in 10 minutes instead of 10 days.

Problem #2: Underwriting individual properties is slow and inconsistent

You find a property that looks good. Now you need to run ROI, cap rate, and DSCR calculations to know if it actually works. Most people either skip this step (dangerous) or spend hours in spreadsheets for each property.

How we solve it: Our Airbnb calculator lets you run full ROI and DSCR projections on any address in minutes. Enter the property details, and we show you estimated revenue, expenses, cash flow, and debt service coverage so you can make fast, confident identification decisions.

Problem #3: Finding exchange-experienced vendors under time pressure

You've identified your replacement property. Now you need a lender who understands DSCR loans and 1031 timelines, an insurance broker who writes STR policies, maybe a property manager, furnishing help, cleaners, and a CPA who knows how to structure your closing statement to avoid boot.

Finding all of those people in 30 days while coordinating inspections and negotiations? That's where deals fall apart.

How we solve it: Chalet connects you with Airbnb-friendly agents who specialize in 1031 exchanges, plus our full STR vendor directory for everything from insurance to property management to furnishing services. One platform, all the pros you need, already vetted and STR-experienced.

The complete 1031 workflow on Chalet:

→ Analyze markets with free analytics

→ Browse Airbnb rentals for sale in your target markets

→ Run ROI and DSCR on specific addresses with our calculator

→ Check local STR regulations with our rental regulations database

→ Connect with exchange-savvy agents

→ Set up operations with STR-specialist vendors

All in one place. All free for investors to use. No subscription, no paywall, no data limits.

We only earn when you choose to work with one of our referred pros (agent, lender, insurance, etc.), so our incentives are aligned with yours: we want you to close a property that actually works, on time, with all the right vendors coordinated.

Frequently Asked Questions

Can I include an inspection contingency in a 1031 exchange contract?

Yes. The inspection contingency is a purchase contract term between you and the seller. The IRS doesn't prohibit it. The challenge is managing inspection timing and findings inside the 45-day and 180-day framework so you don't lose your optionality or miss deadlines.

Can I change my identified properties after Day 45?

As a practical matter, assume no. You can revoke and replace identifications only before the 45-day identification period ends, and revocation must be in writing and properly delivered. Once Day 45 passes, you're locked into the properties you identified (or didn't identify).

What's the single best way to reduce inspection risk in a 1031 exchange?

Start replacement property due diligence before Day 0, and identify backup properties you would genuinely be willing to purchase and operate. Don't treat backups as "paper placeholders." The 3-property rule exists specifically to give you real optionality when inspection findings surprise you.

Does 1031 still work for short-term rentals in 2026?

Yes, if the property is held for business or investment (not personal use) and you follow the exchange rules. Section 1031 applies to real property held for business or investment.

(Note: There are additional "held for investment" considerations if you plan to use the property yourself for vacation purposes. That gets into the 14-day personal use rules and Augusta Rule planning. Talk to your CPA about your specific use intentions.)

What happens if I can't close by Day 180 because of inspection-driven repair delays?

If you miss Day 180, your exchange typically fails and any untransferred proceeds become taxable. There are very few exceptions (federally declared disasters being the main one). This is why repair negotiation structure and timeline matter so much. Always build repair completion deadlines that are earlier than your closing date, and prioritize price adjustments over seller-completed repairs when you're tight on time.

Should I identify properties before or after I complete inspections on them?

Ideally, complete core inspections before Day 45 so you're identifying properties you're confident about. In reality, that's not always possible in fast markets. The compromise strategy: identify your top choice (Plan A) plus two genuine backups (Plan B and C) that you've at least toured and analyzed. Then complete inspections on all three during Days 3 to 30. If Plan A fails inspection, you have compliant backups already identified. If Plan A passes, you proceed with it and let the other contracts expire.

Can my qualified intermediary help with inspection contingency strategy?

Your QI's primary job is handling the exchange mechanics, holding funds, preparing documents, and ensuring IRS compliance. Some QIs provide strategic guidance on timing and coordination, but they're not typically managing your inspection scheduling or repair negotiations (that's your agent's role). Your QI should be consulted early about how repair credits and escrows are structured on closing statements to avoid boot issues.

Execute Your 1031 Exchange With Proper Inspection Planning

A 1031 exchange into a short-term rental already has tight timelines and coordination challenges. Inspection contingencies don't have to make it worse if you plan for them correctly from the start.

The playbook is straightforward:

• Build your team before you list

• Start replacement property analysis before Day 0

• Compress inspections into the front of your timeline

• Identify real backup properties (not paper placeholders)

• Structure repair negotiations for speed and tax safety

Chalet helps you move from research to execution faster by putting the analytics, property inventory, and vendor network all in one place.

Ready to find your replacement property?

→ Browse Airbnb rentals for sale in exchange-friendly markets

→ Connect with an Airbnb-specialist agent who understands 1031 timelines

→ Analyze markets with free dashboards to identify your target cities

→ Run ROI and DSCR projections on specific addresses

→ Check local STR regulations before you identify

→ Set up your STR operations with vetted vendors

All free. No subscription. We're here to help you close the right property on time.