If you own an Airbnb rental (often called a short-term rental or STR), 2026 is the first year in a while where refinancing actually makes sense again for a lot of investors.

Not because rates are amazing. They're not. But the math is finally working in specific situations: owners who locked in high rates during 2023 to 2024, owners coming out of prepayment-penalty windows, and owners whose cash flow got squeezed by rising insurance and taxes who need payment relief to protect their DSCR.

This guide helps you make one clear decision: whether refinancing improves your investment after costs and risk.

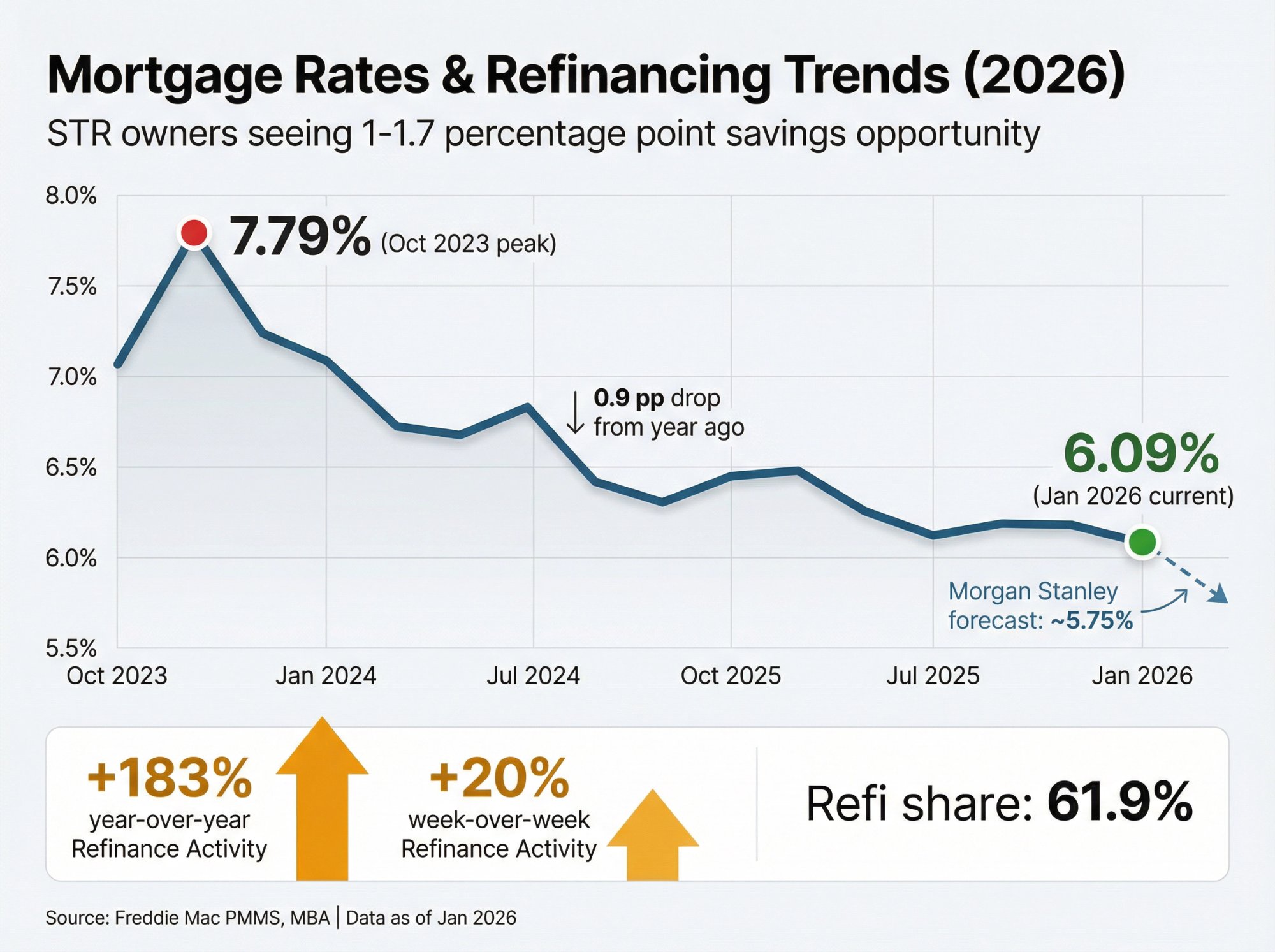

Current Mortgage Rates and Refinancing Trends (2026)

Here's what's driving the refinancing wave right now.

| Metric | Current Data (Early 2026) | Why It Matters for STR Owners |

|---|---|---|

| 30-year fixed mortgage average | 6.09% (week ending Jan 22, 2026) | Roughly 0.9 percentage points lower than a year ago (6.96%). Lower debt service means better DSCR and more breathing room. |

| Recent cycle peak (Oct 2023) | 7.79% | Many investor deals were financed near this level. A move from ~7.8% to ~6.1% creates significant payment savings. |

| Refinance share of applications | 61.9% (mid-January 2026) | Tells you lenders are actively competing for refi volume right now. |

| Refinance index change | +20% week-over-week; +183% year-over-year | Refinancing demand is materially higher than last year. |

| Morgan Stanley 2026 forecast | ~5.75% average for 30-year fixed | Markets are pricing steady-to-lower rates, not a return to 3 to 4%. |

| Fannie Mae 2026 forecast | $917 billion in refinance originations | Big institutions expect refi volume to be meaningfully higher this year. |

Sources: Freddie Mac, MBA Weekly Survey, Federal Reserve, Fannie Mae Housing Forecast, Morgan Stanley

When Does Refinancing Make Sense? (The Math)

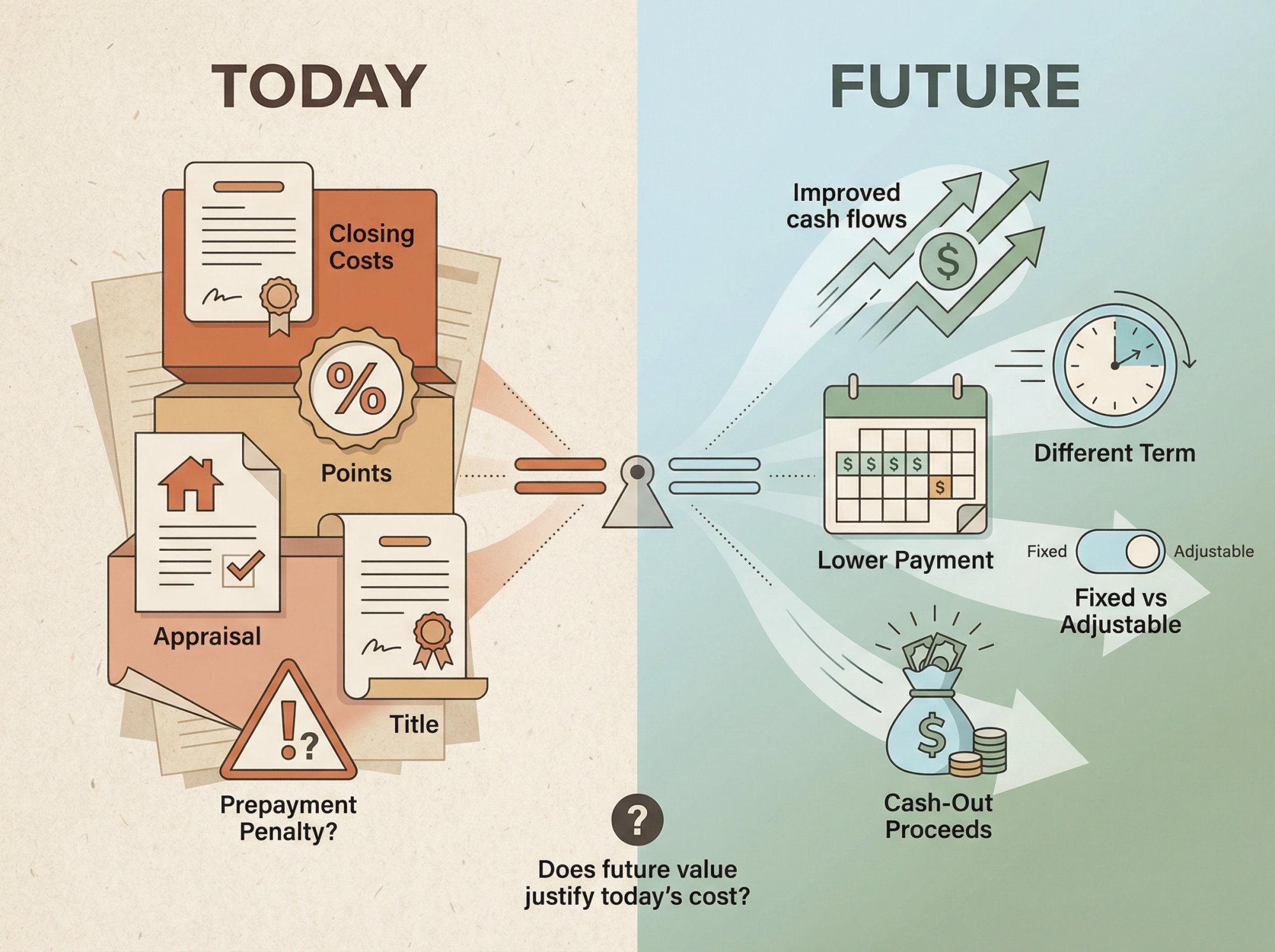

Refinancing is a trade.

You pay one-time costs today (closing costs, points, appraisal, title, sometimes a prepayment penalty).

To change your future cash flows (lower payment, different term, fixed vs adjustable, cash-out proceeds).

The core question isn't "did rates drop?"

It's: Does the new loan increase the value of your future cash flow and reduce your risk enough to justify the costs?

Everything else in this guide helps you answer that.

9 Reasons to Refinance Your Airbnb Rental in 2026

Lower Your Mortgage Payment to Improve DSCR

Short-term rentals are unusually sensitive to fixed costs because your revenue is seasonal and your expenses aren't.

In 2025, many owners got hit from multiple angles:

• Insurance premiums rising

• Property taxes re-assessing

• Higher labor costs for cleaning and maintenance

• More competition in many markets (more listings chasing similar demand)

One lever you can control? Debt service. That's why refinancing shows up as a "cash flow rescue" move.

Real pressure points: The U.S. Treasury's Federal Insurance Office found average homeowners insurance premiums increased 8.7% faster than inflation (2018 to 2022), with premiums much higher in higher-risk zip codes. J.D. Power reports that 47% of customers experienced a premium increase in the past year.

What this means in practice: if your net operating income is flat but your payment drops, your DSCR improves immediately.

Take Advantage of Increased Lender Competition

You don't refinance in a vacuum. You refinance in a market.

As of mid-January 2026, the MBA reports:

• Refis are 61.9% of applications

• The refinance index is up 20% week-over-week

• Up 183% year-over-year

That matters because competition shows up as:

→ Better pricing for strong borrowers

→ More flexible programs (especially investor-focused)

→ Faster turn times

At Chalet, we're seeing this translate into real options for STR investors. Our vetted lender network has expanded their STR-specific programs significantly in early 2026, with better terms than we saw throughout 2024 and most of 2025.

Refinance Your 2023 High-Rate Mortgage

Freddie Mac's PMMS shows:

• 7.79% for the week ending Oct 26, 2023

• 6.09% for the week ending Jan 22, 2026

That's a big move in mortgage math.

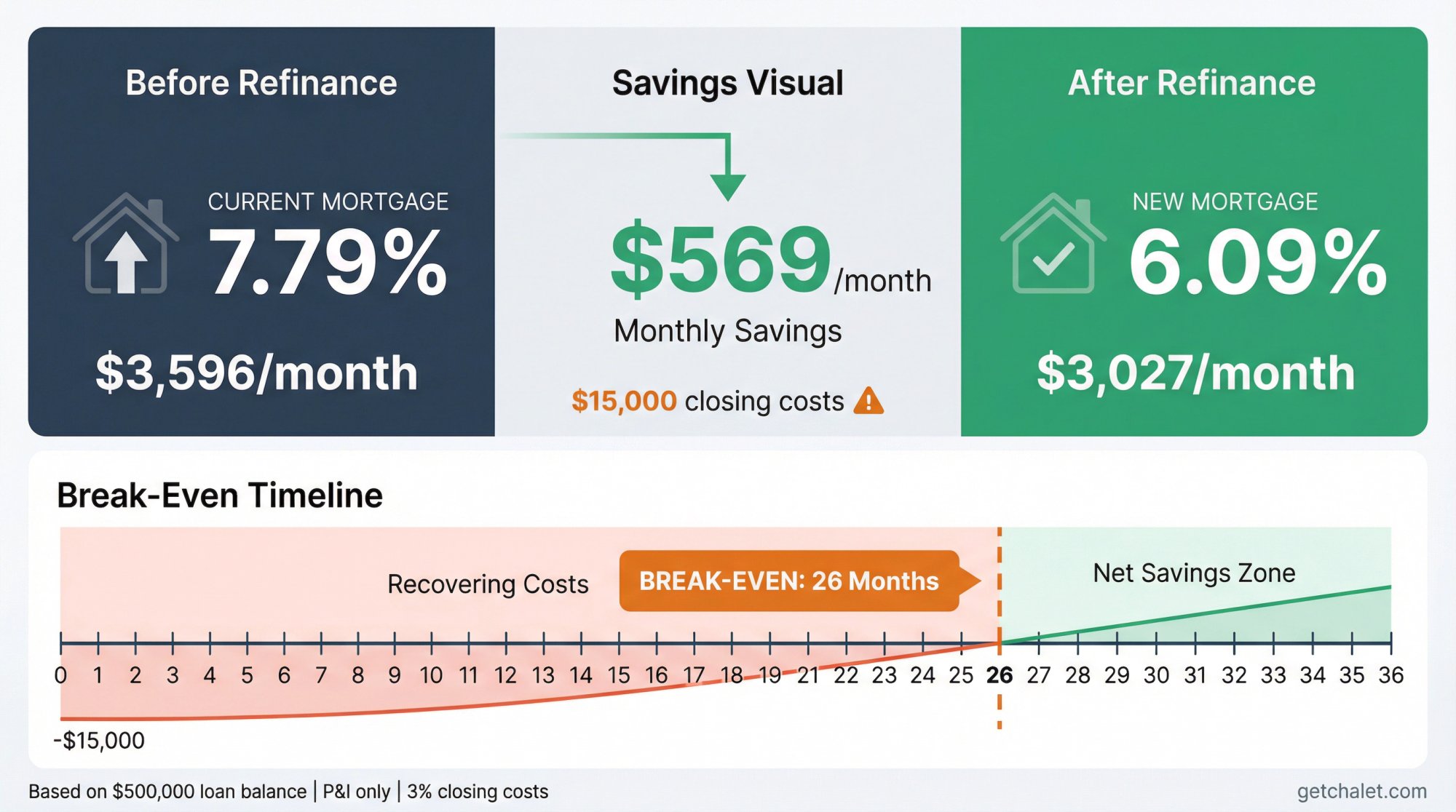

Example (principal + interest only):

$500,000 loan, 30-year amortizing

→ At 7.79%: about $3,596/month

→ At 6.09%: about $3,027/month

→ Difference: about $569/month savings

That's not a guarantee you'll get those exact terms (investor rates vary), but it shows why people are paying attention again.

Escape Your Prepayment Penalty Window

A lot of investor-focused loans (especially non-QM / DSCR-style products) come with prepayment penalties. You'll often see step-down structures like 3-2-1, where the penalty shrinks each year.

Even if rates fell in 2025, many owners couldn't refinance cheaply yet. 2026 is when more of those clocks hit zero.

If you're not sure, pull your note and look for:

• "Prepayment penalty"

• "Yield maintenance"

• "Defeasance"

• The exact penalty term and calculation

Prepayment penalties are common in DSCR loans, so don't assume yours is "standard."

Lock In Fixed Rates Before Your ARM Resets

When rates are high, some borrowers choose adjustable-rate mortgages (ARMs) or interest-only periods to keep early payments lower.

The MBA's weekly survey shows ARMs were 7.1% of application activity in mid-January 2026.

If your loan is:

• An ARM approaching reset, or

• Interest-only that's about to convert to amortizing

Refinancing can be less about saving money and more about removing uncertainty.

Switch to a Better Loan Type for Your Situation

A few common "switch" stories for short-term rental owners:

DSCR → Conventional/Jumbo

You bought using a property-cash-flow loan, then later your personal income/credit improved and you can qualify conventionally at better terms.

Conventional → DSCR

Your personal income is messy (self-employed, multiple properties, write-offs), but the property cash flow is strong, so you refinance into a DSCR program that underwrites the asset.

Adjustable → Fixed

You're done gambling with resets.

Important underwriting reality: If you financed as a "second home," agencies care how the property is represented. Fannie Mae notes that a property can still be considered a second home even if rental income is present, as long as rental income is not used to qualify and other second-home requirements are met.

Don't wing this. Misrepresenting occupancy is a fast way to get your loan called a problem.

Cash-Out Refinance for High-ROI Property Improvements

Cash-out is tempting. Sometimes it's smart. Sometimes it's leverage cosplay.

For short-term rentals, the best cash-out reasons are usually defensive or high-leverage operational:

• Replacing roof/HVAC before peak season

• Adding safety upgrades (handrails, exterior lighting, cameras where legal)

• Fixing guest experience killers (water pressure, AC, noise, mattresses)

• Furnishing refresh when reviews show decay

Sometimes it's simply funding higher insurance deductibles or mitigation work in risk-prone areas (roof, defensible space), because the insurance market is moving.

Use Equity to Buy Your Next STR Property

Portfolio builders refinance to recycle capital:

• Pull equity from Property A

• Use it as down payment for Property B

• Keep both

This can work, but only if:

→ Your DSCR remains healthy after the new payment

→ You keep reserves (real reserves, not vibes)

→ You're not relying on perfect occupancy to survive

Ready to explore your next STR investment? Browse Airbnb rentals for sale or connect with STR-specialist real estate agents.

Consolidate Multiple Loans Into One Payment

A lot of short-term rental deals were stitched together:

• Higher-rate mortgage

• Plus furnishing financed separately

• Plus a HELOC

• Plus a high-interest personal loan for setup

A refinance can consolidate that stack into one payment and one maturity, even if the rate isn't dramatically lower.

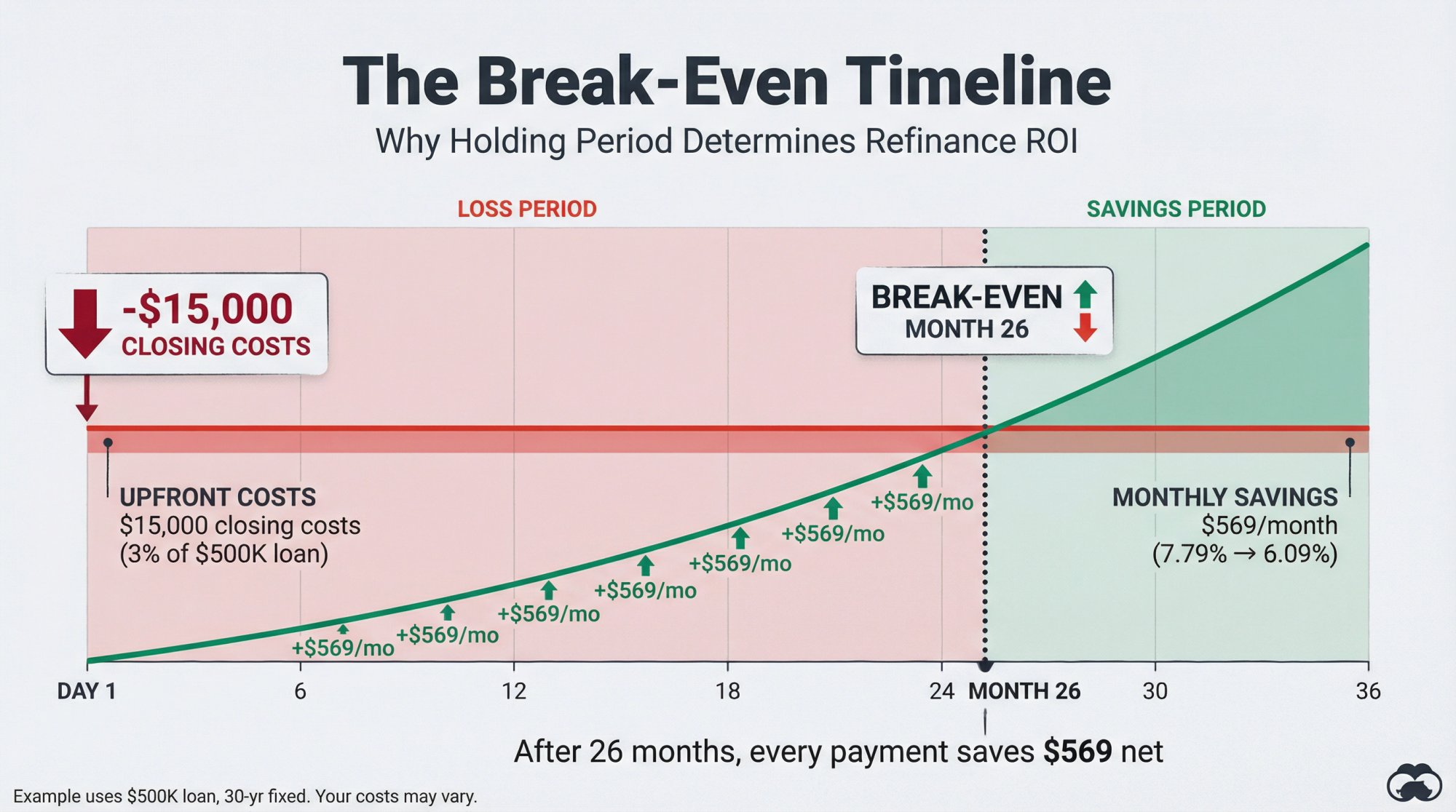

How to Calculate If Refinancing Is Worth It

The Two Numbers You Should Calculate Before You Do Anything

1. Monthly payment change (principal + interest, then full PITI if you can)

2. Break-even months = total refinance costs ÷ monthly savings

If you sell or refinance again before break-even, you probably lit money on fire.

Why the "1% Lower Rule" Doesn't Work Anymore

Closing costs are real. Fortune cites a common range of 2% to 6% of the loan amount.

So the needed rate drop depends on:

• Your loan size

• Your closing costs

• How long you'll keep the loan

• Whether you're extending the term (which can lower payment but increase total interest)

The Consumer Financial Protection Bureau shows a concrete example: a drop from 7.25% to 6.5% saves about $200/month on a $400,000 loan with a similar term.

That's helpful because it shows the savings per basis point is real, but it also shows why costs can dominate if you won't hold long.

Break-Even Example You Can Copy

| Item | Example Value |

|---|---|

| Remaining loan balance | $500,000 |

| Current rate | 7.79% |

| New rate | 6.09% |

| Monthly P&I (current) | ~$3,596 |

| Monthly P&I (new) | ~$3,027 |

| Monthly savings | ~$569 |

| Estimated closing costs (3%) | $15,000 |

| Break-even time | ~26 months |

Notes: This is principal + interest only. Taxes/insurance/HOA can change your real result. Closing costs vary widely by state, loan type, and whether you pay points.

Quick gut check: If you believe you'll keep the property and this loan for 3+ years, a 26-month break-even can be totally reasonable. If you're likely to sell in 12 to 18 months, it's probably not.

Want to run your own numbers? Use Chalet's free ROI/DSCR calculator to see how different refinance scenarios affect your cash flow.

Above: Chalet's ROI and DSCR calculator lets you model different refinance scenarios with your actual property data. Input your address, current loan terms, and proposed new terms to see break-even timing and cash flow impact.

Best STR Refinance Options in 2026

| Option | Best For | Watch-Outs |

|---|---|---|

| Rate-and-term refinance | Lowering payment, fixing ARM risk, resetting term | Resetting to a new 30-year can "feel" good monthly but slow payoff. Compare total interest and break-even. |

| Cash-out refinance | Funding CapEx, buying another property, consolidating debt | Leverage risk; appraisal risk; may tighten DSCR; cash-out rules vary by program |

| HELOC / home equity loan | Keeping a great first mortgage and tapping equity | Rates often variable; fewer lenders offer these on investment properties |

| DSCR-style refinance | Qualifying primarily on property cash flow | Pricing can be higher; prepayment penalties are common; underwriting of STR income varies by lender |

| Portfolio/blanket loan | Bundling multiple rentals | Cross-collateralization can spread risk; read covenants carefully |

Exploring DSCR refinancing options? Learn more about how to qualify for a DSCR loan or browse short-term rental loans for 2025.

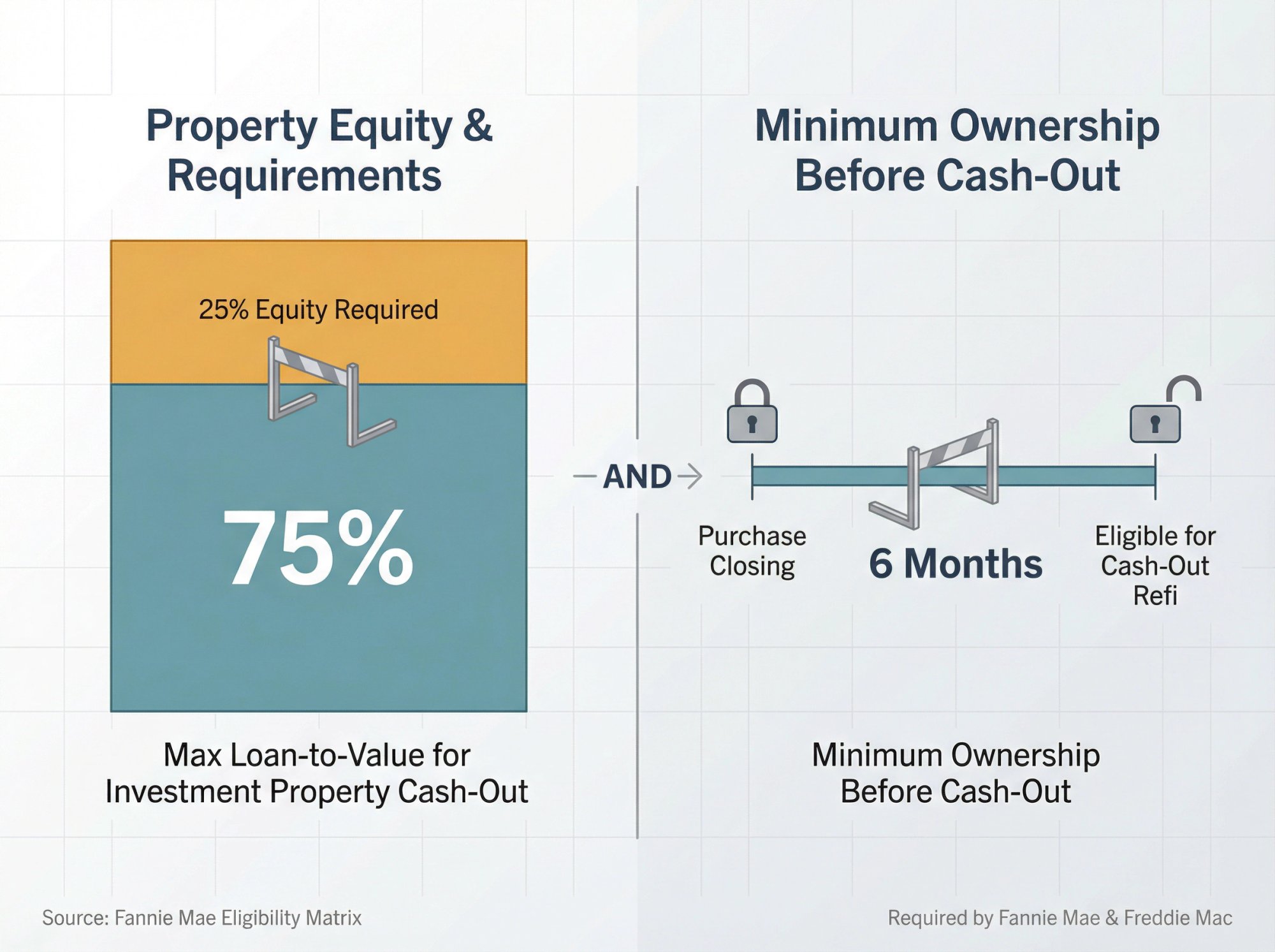

Cash-Out Refinance Limits for Investment Properties

If you're aiming for conventional cash-out, you'll run into two common constraints.

Maximum LTV for Investment Properties

Fannie Mae's eligibility matrix shows investment property cash-out refinance max LTV can be 75% for a 1-unit property (fixed or ARM), with other caps depending on the scenario.

Ownership Seasoning Requirements

Fannie Mae's cash-out refinance guidance requires at least one borrower to have been on title for at least six months prior to the disbursement date (with specific exceptions).

Freddie Mac also describes a six-month ownership requirement for cash-out.

This is why many investors refinance in waves: buy, stabilize operations, season, then refi.

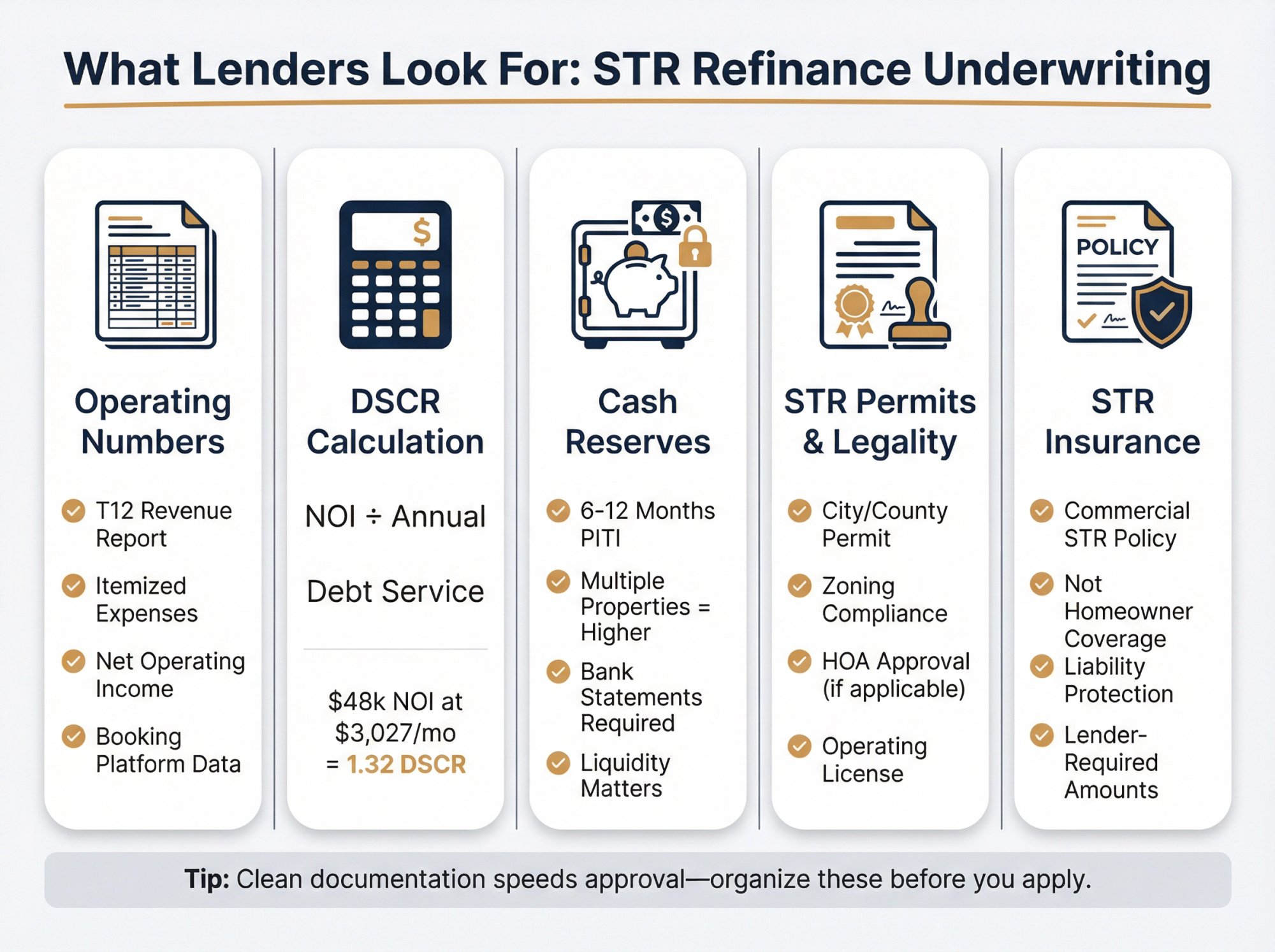

What Lenders Look For When Underwriting STR Refinances

Even if your personal finances are strong, Airbnb rentals still get treated differently because income is variable and regulation risk is local.

Here's what to prep.

Document Your Real Operating Numbers

You want a clean trailing 12 months (T12) that shows:

• Gross booking revenue

• Cleaning fees (and whether you keep them)

• Refunds and chargebacks

• Management fees

• Utilities, internet, yard care

• Repairs + maintenance

• Supplies + consumables

• Taxes + insurance (these are big)

• HOA (if applicable)

Tip: If your books are messy, don't guess. Export from your channel manager/PMS and reconcile deposits.

Need help running your numbers? Try Chalet's free ROI calculator to see ROI and DSCR based on your actual address.

How DSCR Affects Your Refinance Approval

Debt-service coverage ratio is basically:

DSCR = Net Operating Income ÷ Annual Debt Service

Lower the payment → DSCR rises.

Simple example:

If your property produces $48,000/year in net operating income:

→ At ~$3,596/mo P&I, annual debt service ≈ $43,151 → DSCR ≈ 1.11

→ At ~$3,027/mo P&I, annual debt service ≈ $36,321 → DSCR ≈ 1.32

That DSCR swing can be the difference between:

• Getting approved vs not

• Better pricing vs worse pricing

• Being forced to bring cash to closing vs pulling cash out

Calculate your DSCR quickly to see where you stand.

Reserve Requirements for STR Refinancing

Short-term rentals are seasonal. Lenders know that. Expect reserve requirements, especially if you own multiple financed properties.

Fannie Mae explicitly flags that second-home/investment borrowers with multiple financed properties can be subject to additional reserve requirements.

Verify STR Permits Before Refinancing

STR legality is local. Some lenders (and almost all insurers) care whether you're operating legally.

Want to verify your local rules before you refinance? Check Chalet's regulation library by market.

Get STR-Specific Insurance Coverage

Owners get burned when they carry a "regular homeowners" policy while operating a rental. Talk to an insurance specialist who understands short-term rentals, and make sure coverage matches usage.

(The broader insurance market has been tightening and getting more expensive, so assume this line item stays important.)

Looking for STR-savvy insurance? Browse Chalet's verified vendor directory for specialists.

Step-by-Step: How to Refinance Your Airbnb Rental

Here's a clean, execution-first plan.

Step 1: Find Your Prepayment Penalty and Current Terms

Look for:

• Current rate + remaining term

• Prepayment penalty details

• Whether it's fixed, ARM, or interest-only

• Escrow rules (tax/insurance)

• Assumption/transfer rules (LLC transfers can matter)

Step 2: Set Your Refinance Trigger

Don't obsess over headlines. Pick a trigger based on your math.

Examples:

→ "I refinance when break-even is under 30 months"

→ "I refinance when I can improve DSCR by 0.15+"

→ "I refinance when I can remove my ARM reset risk"

Step 3: Organize Your Documentation

Typical items:

• Mortgage statement

• Insurance declarations page

• Property tax bill

• Trailing 12-month P&L

• Bank statements (reserves)

• Lease/booking statements (depends on loan type)

• Entity docs if you own in an LLC

Step 4: Compare 3 Lenders on These Key Terms

Don't just compare rate.

Compare:

• APR

• Points / lender fees

• Prepayment penalty on the new loan

• Required reserves

• Appraisal type (full vs waiver)

• Underwriting method for income (actual vs projected)

Ready to explore loan options? Connect with STR-specialist lenders through Chalet.

Step 5: Update Your Cash Flow Forecast After Closing

After closing:

• Update your cash flow forecast

• Rebuild reserves (cash-out isn't "free money")

• Decide whether to reinvest savings into CapEx or payoff speed

Want to analyze your market before you expand? Use Chalet's free market analytics.

Above: Chalet's market analytics tool provides free STR performance data by market. Check revenue benchmarks, occupancy trends, and regulatory status before expanding your portfolio or refinancing for acquisition.

5 Costly STR Refinancing Mistakes to Avoid

1. Ignoring the prepayment penalty

It can wipe out the first year of savings.

2. Doing a "lower payment" refi that resets the clock

If you restart a 30-year amortization after paying for years, you may lower monthly payment but increase lifetime interest. Run both scenarios.

3. Paying points without holding long enough

Points are just prepaid interest. If you won't hold past the points break-even, skip them.

4. Underestimating insurance + taxes going forward

Those lines are not stable in many markets.

5. Cash-out with no plan

Cash-out should have a job: CapEx that protects revenue, debt consolidation at a meaningfully better blended cost, or a disciplined acquisition plan with reserves.

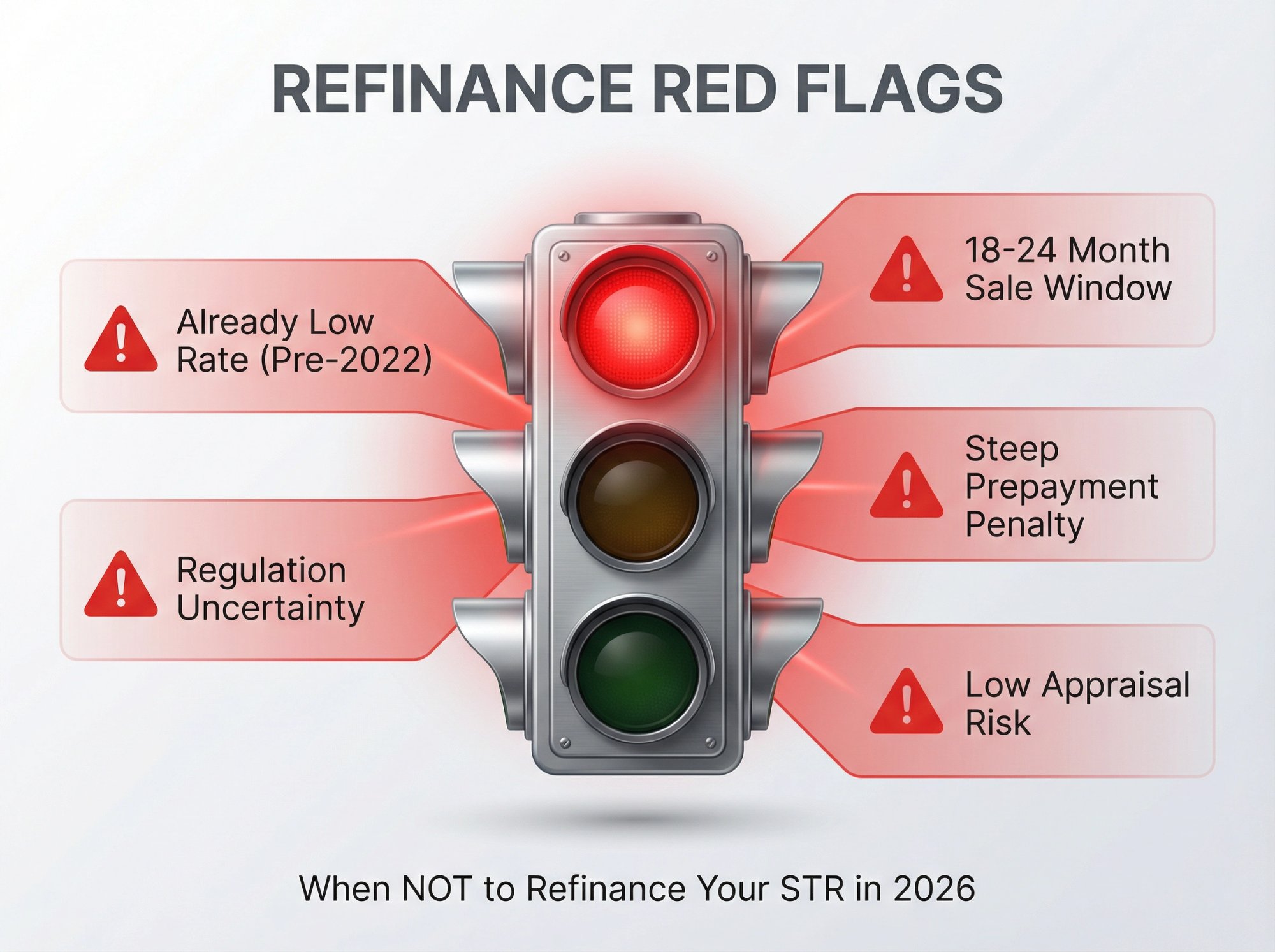

When NOT to Refinance Your STR in 2026

• You'll sell within ~18 to 24 months and you can't hit break-even first

• Your current loan has a steep prepayment penalty that makes net savings negative

• You're already on a very low rate and you'd be trading into something higher (common for pre-2022 loans)

• Your market has regulation uncertainty and you might lose the ability to operate short-term (don't add leverage into uncertainty)

• Your property value is questionable and you're likely to appraise low (cash-out especially)

How Chalet Helps STR Owners Navigate Refinancing

Chalet exists to make short-term rental investing less guesswork and more execution.

Here's how we help with refinancing decisions:

Free Analytics to Run Your Numbers

Before you talk to any lender, you need to know your own math.

→ ROI/DSCR Calculator: Run scenarios with different rates and see how they impact your cash flow and coverage ratios.

→ Market Analytics: See how your property's revenue stacks up against market benchmarks. If your income is trending down, refinancing for payment relief makes more sense.

→ Regulation Library: Check local STR rules before you lock in new debt. Adding leverage into a market with uncertain legality is risky.

Vetted STR-Specialist Lenders

Not all lenders understand Airbnb rentals. Many still underwrite STRs using long-term rent comps, which can leave money on the table.

Chalet's lender network includes:

• DSCR lenders who underwrite on actual STR cash flow

• Conventional lenders who work with portfolio investors

• Lenders experienced with 1031 exchanges into STRs

• Fast-close options for time-sensitive refinances

All vetted, all STR-focused.

Above: Chalet's lender directory connects STR investors with vetted mortgage specialists who understand short-term rental cash flow. Filter by loan type, experience level, and closing speed to find the right financing partner.

Operations Setup After You Close

Refinancing is just one piece of running a profitable short-term rental.

After you lock in better terms, we connect you with:

• Property managers who specialize in STRs

• Furnishing and setup services

• Insurance specialists who understand short-term rentals

• Cleaners, maintenance, and guest experience pros

Above: Chalet's platform combines free analytics tools with a curated network of STR-specialist professionals. From market research to lender connections to operations setup, everything an STR investor needs in one place.

Why Work With Chalet

We pair free, credible analytics with the vendors you'll actually need. So your refinance decision moves from "thinking about it" to "executing" with less guesswork and fewer hand-offs.

Explore the platform: getchalet.com

Next Steps

If you want to move from "thinking about it" to "knowing," do these in order:

1. Run ROI + DSCR on your actual address

2. Stress-test your DSCR with a rate change and a 10 to 15% revenue dip

3. Check your city/county rules before you lock in new debt

4. Talk to an investor-friendly lender who understands short-term rentals

5. If you're planning the next purchase, meet an Airbnb-friendly agent

FAQ: STR Refinancing in 2026

What's the minimum rate drop that makes refinancing worthwhile?

There's no magic number like "1% lower." It depends on your loan size, closing costs, and how long you'll hold the loan. Calculate your break-even point: divide total closing costs by monthly savings. If you'll keep the loan longer than break-even, it typically makes sense. Use Chalet's calculator to run your specific numbers.

Can I refinance if my property is held in an LLC?

Yes. Many DSCR lenders and portfolio lenders work with LLC-owned properties. Conventional loans (Fannie/Freddie) typically require individual ownership, but investor-focused programs are designed for entity ownership. Talk to STR-specialist lenders who understand LLC structures.

How do lenders verify Airbnb income for refinancing?

It varies by loan type. DSCR lenders typically accept:

• Last 12 months of booking statements from Airbnb/VRBO

• Property P&L showing gross revenue and operating expenses

• Market rental projections from platforms

• Tax returns showing rental income (Schedule E)

Some lenders use a blend of actual performance and market data. The key is having clean documentation.

Will refinancing hurt my ability to buy another property soon?

Potentially. If you do a cash-out refinance, you're increasing your debt load, which affects your debt-to-income ratio for future loans. But if the refinance improves your DSCR on the existing property, that can actually help you qualify for the next one (especially with DSCR lenders who underwrite on property cash flow, not personal income). Plan the sequencing carefully.

What's the typical timeline for an STR refinance in 2026?

• Rate shopping and quotes: 1 to 2 weeks

• Application to clear-to-close: 30 to 45 days for most loans

• DSCR loans: Often faster (25 to 35 days) because less documentation

• Conventional with complications: Can stretch to 60 days

Pro tip: Get your documents organized before you start. Clean books and ready paperwork can shave 1 to 2 weeks off the timeline.

Should I pay points to buy down the rate?

Only if you'll hold the loan long enough to recoup the cost. Each point (1% of loan amount) typically lowers your rate by ~0.25%. Calculate the monthly savings from that rate drop, then divide the point cost by monthly savings to find break-even. If you're unsure about hold time, skip the points and take the higher rate with lower closing costs.

What happens to my refinance if property values drop?

If your property appraises lower than expected, it can:

• Kill a cash-out refinance (if you can't hit the required LTV)

• Require you to bring cash to closing (to hit LTV targets)

• Force you into a higher rate tier (if LTV crosses a threshold)

In a softening market, consider getting a pre-appraisal or BPO (broker price opinion) before you commit to costs. Some lenders offer appraisal waivers if you have strong equity and credit.

Can I refinance if I just bought the property?

Most conventional cash-out refis require 6 months of seasoning (Fannie Mae, Freddie Mac). Rate-and-term refis may allow shorter seasoning. DSCR lenders vary, but many have similar 6-month rules. If you need to refinance sooner, look for portfolio lenders with more flexible seasoning requirements.

What if my STR operates in a market with regulation uncertainty?

Don't add leverage into uncertainty. If your city is considering new STR restrictions, permit caps, or outright bans, refinancing (especially cash-out) increases your risk. Wait for regulatory clarity, or at minimum, ensure your current cash flow can cover the new payment even if STR operations become restricted. Check Chalet's regulation library for your market's current status.

How do prepayment penalties work, and how do I avoid them?

Many investor loans (especially DSCR and commercial products) have prepayment penalties for the first 1 to 5 years. Common structures:

• Step-down: 3% year 1, 2% year 2, 1% year 3, then $0

• Flat: Fixed % for a set period

• Yield maintenance: Complex calculation tied to treasury rates

Pull your note and look for these terms. If you're still in the penalty window, calculate whether the penalty wipes out your refi savings. Sometimes waiting 6 to 12 months makes sense. Sometimes paying the penalty is still net positive. Run the numbers both ways.

Should I refinance into a 15-year or 30-year term?

It depends on your cash flow and goals.

30-year:

• Lower monthly payment

• Better cash flow for seasonal revenue

• More total interest paid over life of loan

• Most STR investors choose this for flexibility

15-year:

• Higher monthly payment

• Faster equity build-up

• Significantly less total interest paid

• Makes sense if cash flow is very strong and you want faster payoff

With rates down in 2026, some investors are finding they can refi into a 20-year or 15-year term with a similar payment to their old 30-year at 7%+. Run both scenarios in Chalet's calculator.

What closing costs should I expect for a refinance?

Typically 2 to 6% of the loan amount, depending on:

• Appraisal fee: $400 to $800

• Title insurance and search: $1,000 to $3,000+

• Lender fees (origination, underwriting, processing): 0.5 to 2% of loan

• Recording fees, transfer taxes: Varies by state

• Points (if you buy down the rate): 1% of loan per point

Fortune notes the wide range. Get a Loan Estimate upfront and compare across lenders. Some lenders advertise "no closing cost" refis, but they're building costs into a higher rate. Do the math to see which path saves more over your expected hold period.

Can I refinance if my credit score has dropped since I bought the property?

Yes, but your rate will reflect your current score. Most lenders want:

• 740+ for best pricing

• 680 to 739 for standard pricing

• 620 to 679 for subprime or higher rates

If your score dropped, focus on:

• Paying down revolving balances

• Disputing any errors

• Waiting 6 to 12 months while rebuilding

Even with a lower score, refinancing can still make sense if payment relief improves your financial stability. Just expect to pay more in rate.