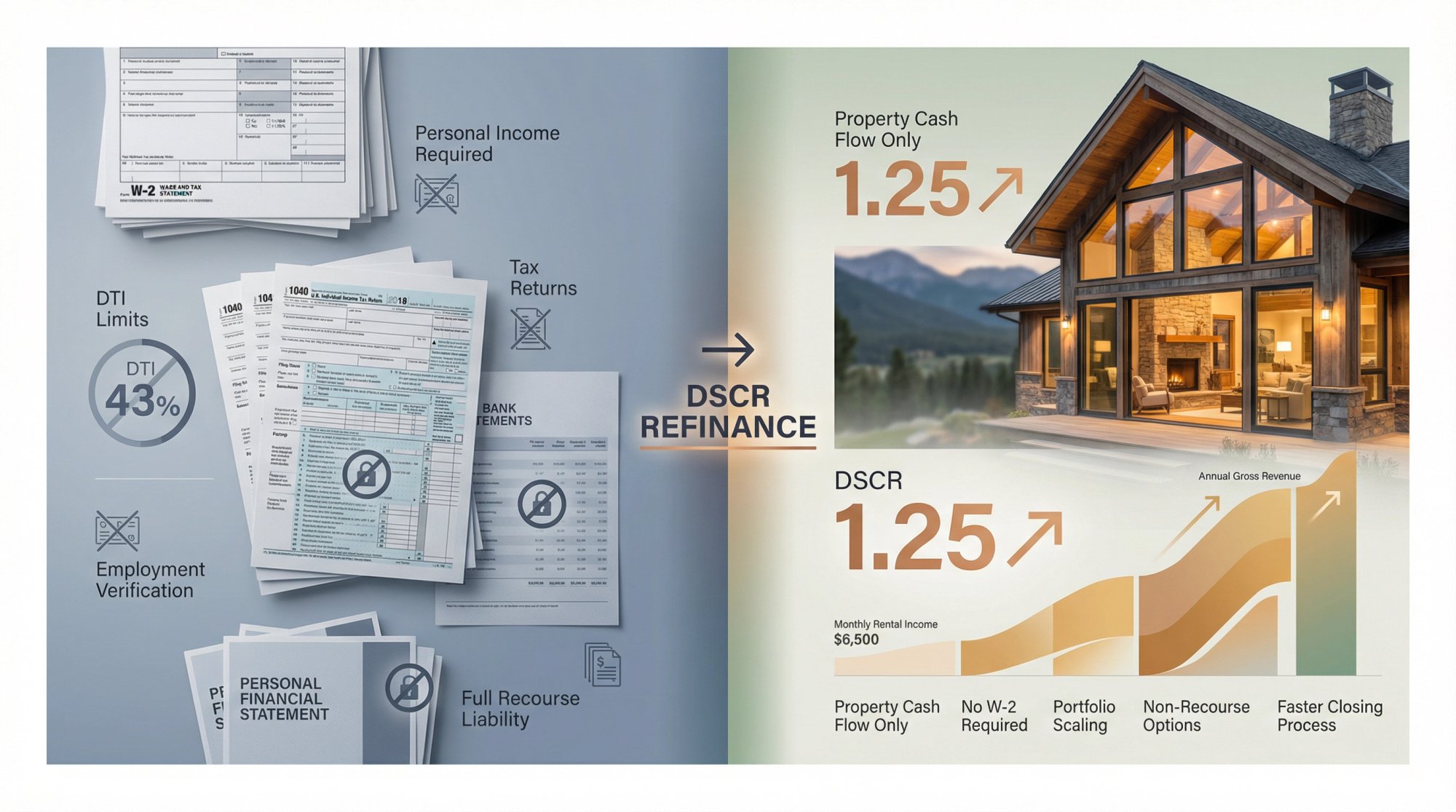

Refinancing an Airbnb rental into a DSCR loan (Debt Service Coverage Ratio loan) isn't just possible. It can be one of the smartest financial moves you make as a short-term rental investor. Instead of qualifying based on your personal W-2 income, tax returns, or debt-to-income ratio, DSCR loans focus entirely on whether your property generates enough rental income to cover the mortgage. This makes them exceptionally popular with Chalet users who are self-employed, scaling portfolios, or simply need more flexible financing.

But refinancing into a DSCR loan isn't automatic. You need to understand how lenders calculate your property's cash flow, what loan-to-value (LTV) limits apply, and how short-term rental income is actually underwritten. Many Airbnb owners discover too late that their lender uses long-term market rent instead of actual STR revenue, which can derail the entire deal.

This guide explains everything you need to refinance your short-term rental (STR) into a DSCR loan successfully. You'll learn the exact requirements, common pitfalls, and practical steps to get from application to closing without surprises.

What Is a DSCR Loan and Why Does It Work for Airbnb?

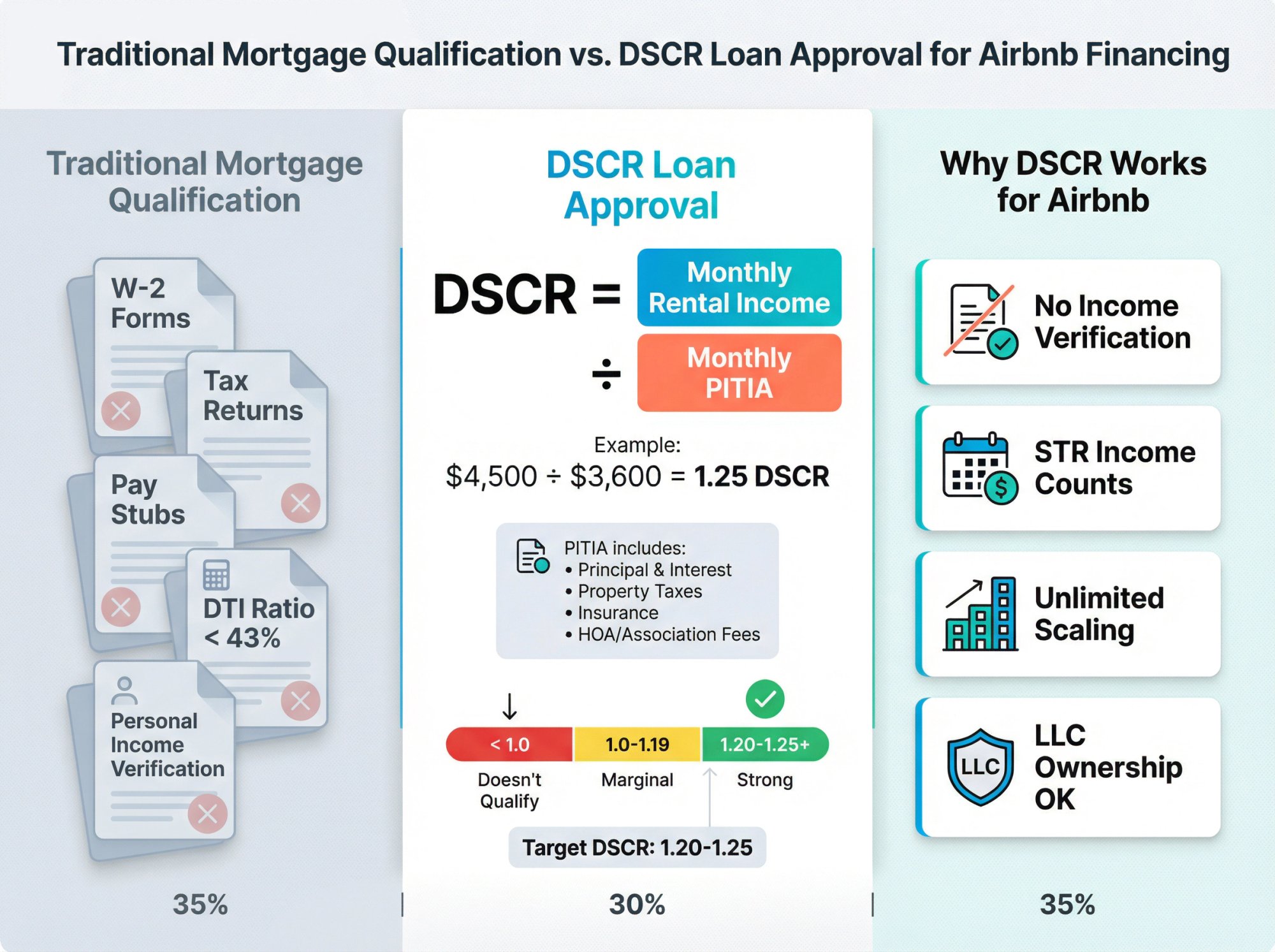

A DSCR loan is investment property financing that bases approval on a single number: the ratio between your property's rental income and its debt obligations.

The calculation looks like this:

DSCR = Monthly Rental Income ÷ Monthly PITIA

PITIA includes:

• Principal and interest

• Property taxes

• Insurance

• HOA/association fees (if any)

Most lenders want a DSCR around 1.20 to 1.25, meaning your rental income exceeds the payment by 20-25%. Some programs accept ratios as low as 1.0 (break-even), especially if you have strong credit or lower leverage.

For Airbnb investors, this structure offers major advantages:

No personal income verification: Your W-2s and tax returns don't matter. Self-employed hosts often show minimal taxable income due to depreciation and write-offs, which traditionally kills mortgage applications. DSCR lenders look past that entirely.

STR income counts: Traditional banks often ignore short-term rental income or apply heavy discounts. DSCR lenders understand the Airbnb model and many will use your actual booking revenue, seasonal projections, or third-party data to calculate qualifying income.

Portfolio scalability: Each property stands on its own cash flow. You're not limited by Fannie Mae's 10-loan cap or crushing DTI ratios as you scale. Chalet connects you with lenders who specialize in this exact scenario.

Flexible entity structures: Many DSCR programs let you close in an LLC (with personal guarantee), which simplifies asset protection and business structuring.

Why Should You Refinance Your Airbnb Into a DSCR Loan?

Investors refinance STRs into DSCR loans for specific strategic reasons:

How to Replace Expensive Short-Term Financing

Maybe you bought your cabin with a hard money loan at 10-12% interest, or used a bridge loan to close fast during renovation. Those loans often have balloon payments due in 12-24 months.

Refinancing into a DSCR loan gets you a stable 30-year fixed mortgage (often 8-9% in today's market) with no balloon. You trade high-rate stress for predictable long-term debt. Some DSCR lenders even offer interest-only periods to improve early cash flow.

How to Pull Equity Out for Growth

If your Airbnb has appreciated or you've built equity through paydown, a cash-out refinance lets you tap that equity without selling. Most DSCR lenders allow up to 75% LTV on cash-out refis, sometimes 70% for short-term rentals.

You can use those proceeds to:

→ Buy another Airbnb (explore available properties with Chalet's Airbnb listings)

→ Diversify into new markets

Better yet, cash-out refinance proceeds are not taxable income. You're borrowing against equity, not realizing gains.

How to Escape DTI Hell

Conventional lenders cap how many mortgages you can carry and scrutinize your personal debt-to-income ratio. If you've hit that wall, DSCR loans bypass it completely. As long as each property's cash flow works, you can keep financing acquisitions.

How to Align Financing With Rental Use

Some owners originally bought their property with a second-home loan or personal mortgage and later converted it to full-time Airbnb. That violates occupancy clauses in many mortgage documents.

Refinancing into a DSCR loan officially reclassifies the property as an investment, so you're no longer at risk of triggering loan acceleration or fraud issues. Yes, DSCR rates are higher than owner-occupied rates, but you gain legal clarity and operational flexibility.

How to Lower Your Payment or Lock Better Terms

If you originally financed with a private loan or adjustable-rate product, refinancing into a fixed DSCR loan at today's rates might save you money over time. Even if rates haven't dropped dramatically, switching from a risky ARM to a stable 30-year fixed can be worth the move.

Always compare your existing rate, payment, and terms against the new DSCR loan's numbers. If you locked in a 3.5% rate in 2021, refinancing today at 8% probably doesn't make sense unless you need cash-out or are hitting other constraints.

What Are DSCR Refinance Requirements?

Refinancing into a DSCR loan has different rules than conventional mortgages. Here's what lenders evaluate:

1. Debt Service Coverage Ratio (DSCR)

This is the most important number in your application.

Target DSCR: Most lenders want 1.20-1.30 for short-term rentals. Some programs accept 1.0-1.10 if you have excellent credit or lower leverage.

Example: Your new mortgage payment will be $3,000/month (PITI). The lender requires 1.25 DSCR. You need to show at least $3,750/month in average rental income.

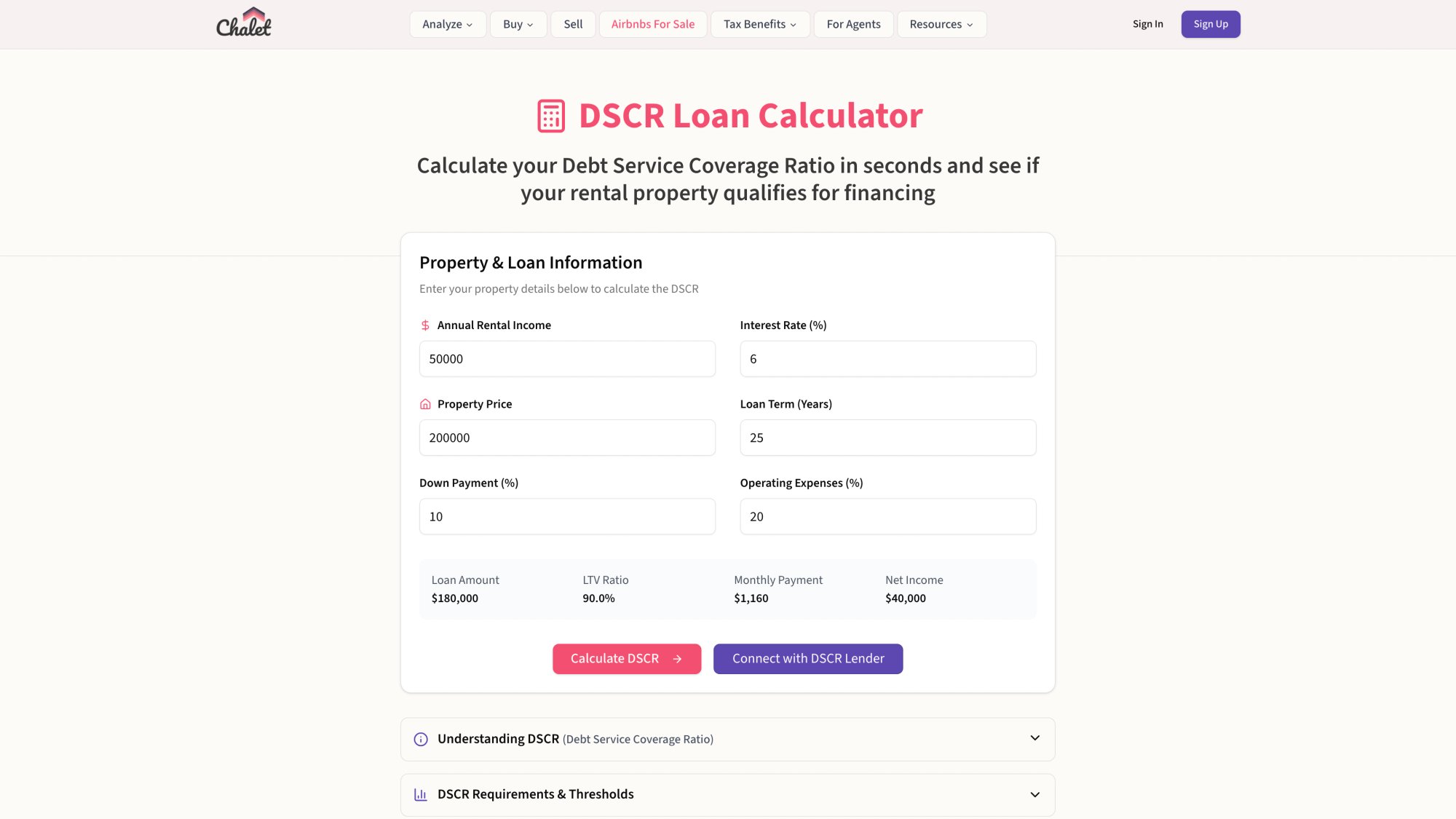

Use Chalet's DSCR Calculator to plug in your numbers before applying. If your DSCR falls short, consider reducing the loan amount or boosting income through better pricing and occupancy strategies.

2. Rental Income Documentation

How you prove income matters enormously. DSCR lenders use one of three methods:

| Income Method | Description | Best For | Pros | Cons |

|---|---|---|---|---|

| Long-term market rent | Appraiser provides Form 1007 showing traditional rental comps | Conservative lenders, properties with weak STR data | Simple, standardized | Undervalues high-performing STRs |

| Historical STR income | Last 12 months of actual Airbnb statements/deposits | Properties with solid 12+ month track record | Reflects real performance | Requires full year of data |

| Projected STR income | Third-party data or market analytics | Newer STRs or vacation markets | Flexible, forward-looking | Lender-dependent acceptance |

Method 1: Long-term market rent (most conservative)

The appraiser provides a rent schedule (Form 1007) showing what the property would rent for as a traditional long-term rental. The lender uses that number in DSCR calculations.

Problem: If your Airbnb earns $6,000/month but market rent is $2,500/month, your DSCR might fail even though the property crushes it as an STR.

Method 2: Historical STR income (most common with track record)

Lenders review your last 12 months of Airbnb statements, bank deposits, or P&L and use actual operating income (often with a haircut like 75-80% to account for variability).

Best for: Owners with a full year of solid performance data.

Method 3: Projected STR income (most flexible)

Some lenders use third-party data or market analytics to project short-term rental revenue. This is especially common in vacation markets where long-term comps don't reflect reality.

Best for: Newer STRs or properties without 12 months of history. Chalet's market analytics can help you build a defensible income projection for lenders who accept this approach.

Pro tip: Ask lenders upfront which method they use. This single question prevents weeks of wasted underwriting.

3. Credit Score

DSCR loans are more forgiving than conventional mortgages, but credit still matters.

| Credit Range | Program Availability | Rate Impact |

|---|---|---|

| 620-680 | Limited programs, higher rates | Premium pricing |

| 680-720 | Standard programs | Moderate rates |

| 720+ | Best pricing, full flexibility | Optimal terms |

Minimum: Most programs require 680+ (some go as low as 620-640 with higher rates)

Sweet spot: 720+ typically unlocks better pricing and more program flexibility

Unlike conventional loans, lenders won't dig through your personal debts or income. But they'll still check your credit report for recent delinquencies, bankruptcies, or foreclosures. Clean up any late payments before applying.

4. Equity and Loan-to-Value (LTV)

DSCR lenders require more equity than conventional loans.

| Refinance Type | Typical Max LTV |

|---|---|

| Rate/term refi | 75-80% |

| Cash-out refi (STR) | 65-75% |

You'll need at least 20-25% equity after refinancing. If you're currently at 85% LTV, you probably can't refi into DSCR yet without paying the loan down or waiting for appreciation.

5. Cash Reserves

Lenders want proof you can weather slow months. Common requirements:

• 3-6 months of PITIA saved (standard)

• 6-12 months for STRs (higher due to seasonality)

Reserves don't need to be cash. Stocks, bonds, and other liquid assets usually count. Just make sure you have enough saved before pulling equity out. Cash-out proceeds typically can't count toward reserve requirements.

6. Property Must Be Investment Use Only

DSCR loans are strictly for investment properties. You can't owner-occupy or use the home as a primary residence or second home.

When refinancing, you'll sign documents confirming the property will be tenant-occupied or actively rented. Occasional personal stays are fine (blocking a week for family vacation), but you can't live there half the year and call it a rental.

7. Property Type and Condition

Most lenders prefer:

→ Single-family homes

→ Condos and townhouses

→ 2-4 unit multifamily

Unique properties, condotels, or homes in areas with heavy STR restrictions can be harder to finance. Some programs also require proof the property is legally permitted for short-term rental use.

Use Chalet's regulation library to check your local STR rules before applying.

8. Seasoning Requirements

Seasoning refers to how long you've owned the property. Many lenders have minimum ownership periods before allowing cash-out refinances:

| Seasoning Period | Typical Lender | Cash-Out Availability |

|---|---|---|

| No seasoning | Aggressive programs | Immediate |

| 3 months | Many lenders | Common minimum |

| 6 months | Standard requirement | Most programs |

| 12 months | Conservative lenders | Required |

Rate/term refinances (no cash-out) often have shorter or no seasoning requirements.

How to Refinance Your Airbnb Into a DSCR Loan

Ready to start the process?

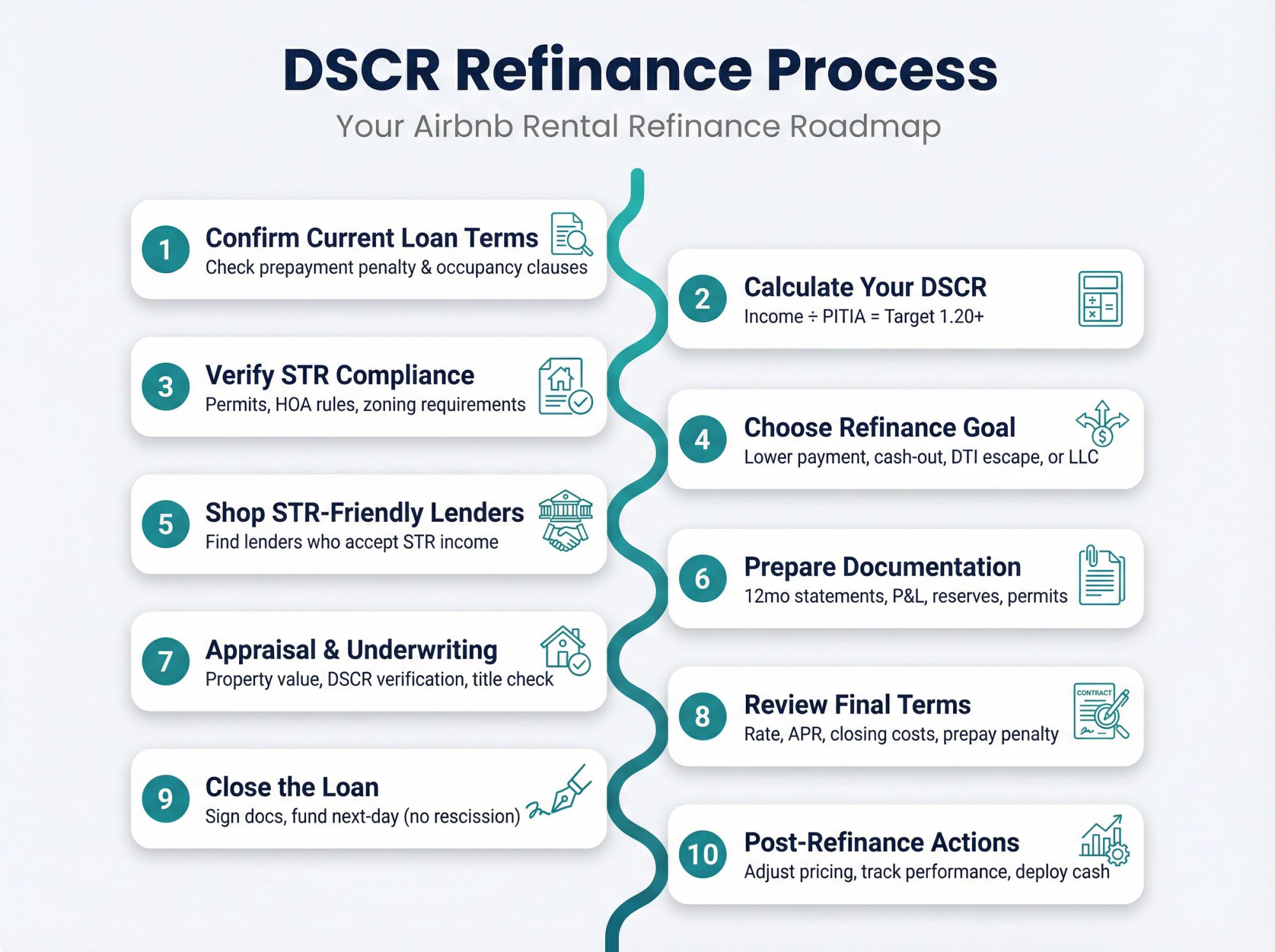

Follow these ten steps to navigate your DSCR refinance smoothly:

Step 1: Confirm Your Current Loan Terms

Before starting, check if your existing mortgage has:

Prepayment penalty: Some investor loans and hard money loans charge 1-5% if you pay off early

Occupancy clauses: If you originally financed as owner-occupied or second home, switching to full-time STR use may violate your mortgage terms. Get clean documentation for the refinance.

Step 2: Calculate Your DSCR

Run your numbers before talking to lenders. You need:

① Average monthly rental income: Use actual data if you have 12+ months, or project using Chalet's Airbnb Calculator

② Estimated new mortgage payment: Plug your target loan amount and current rates into a calculator

③ Monthly property taxes, insurance, HOA: Don't forget these in your total payment

Formula: Monthly Income ÷ Total Monthly Payment = DSCR

If your DSCR comes in below 1.20, reduce your loan amount or increase projected income through pricing optimization.

Step 3: Verify STR Compliance

More lenders are requiring proof that your Airbnb is legally permitted. Check:

→ Local short-term rental permits/licenses

→ HOA rules (many ban STRs)

→ Zoning requirements

→ Occupancy limits

Chalet's rental regulation database covers major markets and provides links to local ordinances.

Step 4: Choose Your Refinance Goal

Pick one primary objective:

• Lower payment: Refinance to reduce monthly obligations

• Cash-out: Pull equity for another purchase or renovation

• Switch to DSCR: Escape DTI limits or personal income requirements

• LLC structure: Close in an entity for asset protection

Your goal determines which program and LTV makes sense.

Step 5: Shop STR-Friendly DSCR Lenders

Not all DSCR lenders understand short-term rentals. Work with specialists who:

• Accept STR income using Method 2 or 3 (not just market rent)

• Have experience with vacation rental markets

• Offer competitive terms on investment properties

Chalet connects you with vetted DSCR lenders who specialize in Airbnb financing. You'll get matched with 2-3 lenders who understand STR underwriting and can provide quotes within days.

When comparing lenders, ask about:

| Question | Why It Matters |

|---|---|

| Which income method do you use? | Determines if your STR revenue actually counts |

| Max LTV for STR cash-out? | May be lower than standard investment properties |

| Prepayment penalty structure? | Impacts flexibility if you sell or refi again |

| Reserve requirements? | Some lenders require 12+ months for STRs |

| Seasoning period? | Affects timing if you recently acquired |

Step 6: Prepare Your Documentation

DSCR loans require less paperwork than conventional mortgages, but you'll still need:

Property information:

• Current mortgage statement (shows balance and rate)

• Property address and estimated value

• HOA dues or special assessments (if applicable)

Rental income evidence:

• 12 months of Airbnb/Vrbo payout statements

• Profit & loss statement

• Bank statements showing rental deposits

• Schedule E from tax returns (if available)

Borrower documents:

• Driver's license or ID

• Credit authorization

• LLC documents (if closing in an entity)

Insurance and taxes:

• Homeowner's insurance declarations page

• Property tax statements

• Proof of short-term rental permit (if required in your market)

Asset statements for reserves:

• Recent bank statements

• Brokerage account statements

• Any liquid assets (stocks, bonds, etc.)

The more organized your package, the faster you'll close. Many DSCR refis close in 3-4 weeks when documentation is tight.

Step 7: Appraisal and Underwriting

Once you apply, the lender orders an appraisal to:

→ Determine property value (for LTV calculation)

→ Estimate market rent (may use Form 1007)

If your lender accepts STR income, share your revenue data and any third-party projections with the appraiser. This helps justify higher income than traditional rental comps.

During underwriting, the lender verifies:

• Your DSCR meets their minimum

• Title is clear (no unexpected liens)

• Insurance coverage is adequate

• Property condition supports the value

Many DSCR lenders don't scrutinize every credit inquiry or bank deposit like conventional underwriters. The process focuses on property income and LTV.

Step 8: Review Final Terms

Before closing, confirm:

Check every detail:

• Interest rate and APR: Make sure it matches your initial quote

• Closing costs: Typically 1-3% of loan amount

• Prepayment penalty: Most DSCR loans have 3-5 year step-down penalties

• Monthly payment: Verify it fits your cash flow

If something doesn't match expectations, ask questions now. Don't sign until you're comfortable with all terms.

Step 9: Close the Loan

Investment property refinances don't have a 3-day rescission period, so funding usually happens the next business day after signing.

You'll sign:

• New promissory note (shows loan amount, rate, term)

• Mortgage or deed of trust (recorded against property)

• Closing disclosure (itemizes costs and payoffs)

If you're doing a cash-out refi, you'll receive those funds via wire or check shortly after closing.

Step 10: Post-Refinance Actions

After your refi closes:

Adjust operations: If your payment increased (due to cash-out), verify your pricing strategy supports the new payment. Use Chalet's market analytics to track your ADR and occupancy against local comps.

Track performance: Keep detailed records of rental income. This helps if you ever refinance again or add more properties.

Mind the prepayment penalty: Set a calendar reminder for when your penalty period expires (usually 3-5 years). If rates drop significantly, you can refinance again after the penalty window.

Deploy cash strategically: If you pulled equity, put it to work immediately. Whether that's buying your next STR, funding renovations, or building reserves, make sure the investment returns more than your interest cost.

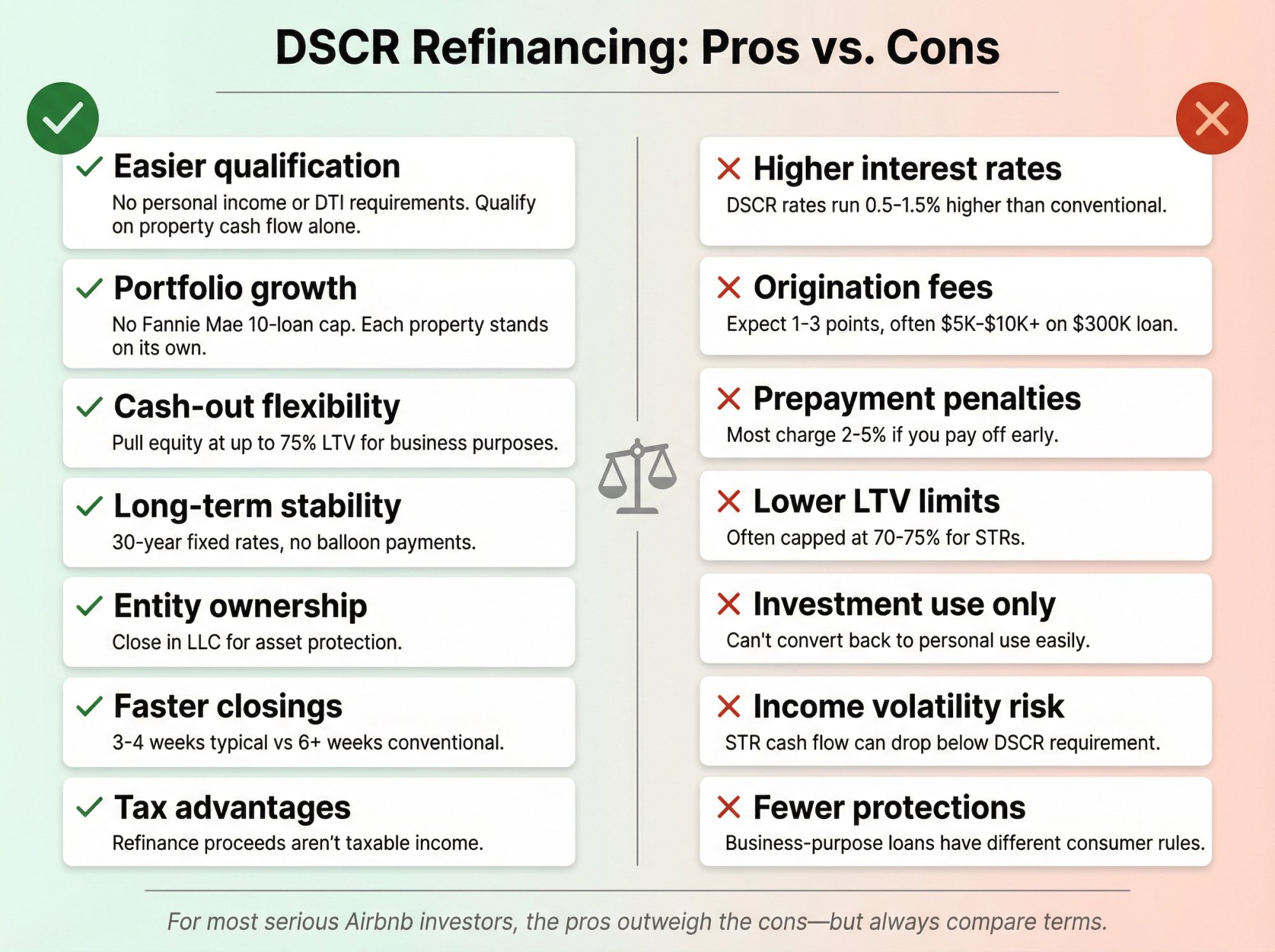

DSCR Refinancing: Pros and Cons

Before you commit, understand both sides:

Advantages

✓ Easier qualification: No personal income or DTI requirements. Self-employed hosts and portfolio investors qualify based purely on property cash flow.

✓ Portfolio growth: Each property stands on its own. No loan limits like Fannie Mae's 10-mortgage cap.

✓ Cash-out flexibility: Pull equity for business purposes at up to 75% LTV, often higher than conventional programs.

✓ Long-term stability: 30-year fixed rates with no balloon payments. Some programs offer interest-only periods.

✓ Entity ownership: Close in an LLC for cleaner asset protection and business structure.

✓ Faster closings: Less documentation means 3-4 week closes are common vs 6+ weeks for conventional refinances.

✓ Tax advantages: Refinance proceeds aren't taxable. You extract equity without triggering capital gains. (Learn more about STR tax strategies.)

Disadvantages

✗ Higher interest rates: DSCR rates typically run 0.5-1.5% higher than conventional mortgages. That gap compounds over 30 years.

✗ Origination fees: Expect 1-3 points in closing costs, often $5,000-$10,000+ on a $300k loan.

✗ Prepayment penalties: Most programs charge 2-5% if you pay off early. This limits flexibility to refinance if rates improve.

✗ Lower LTV limits: Can't extract as much equity as some other programs. Often capped at 70-75% for STRs.

✗ Investment use only: Can't convert back to personal use without refinancing again.

✗ Income volatility risk: If STR regulations change or travel demand drops, your cash flow could fall below the DSCR requirement. You're still obligated to pay the mortgage.

✗ Fewer consumer protections: DSCR loans are business-purpose loans, so some homeowner protections don't apply.

For most serious Airbnb investors, the pros outweigh the cons. But always compare DSCR terms against conventional options if you qualify for both.

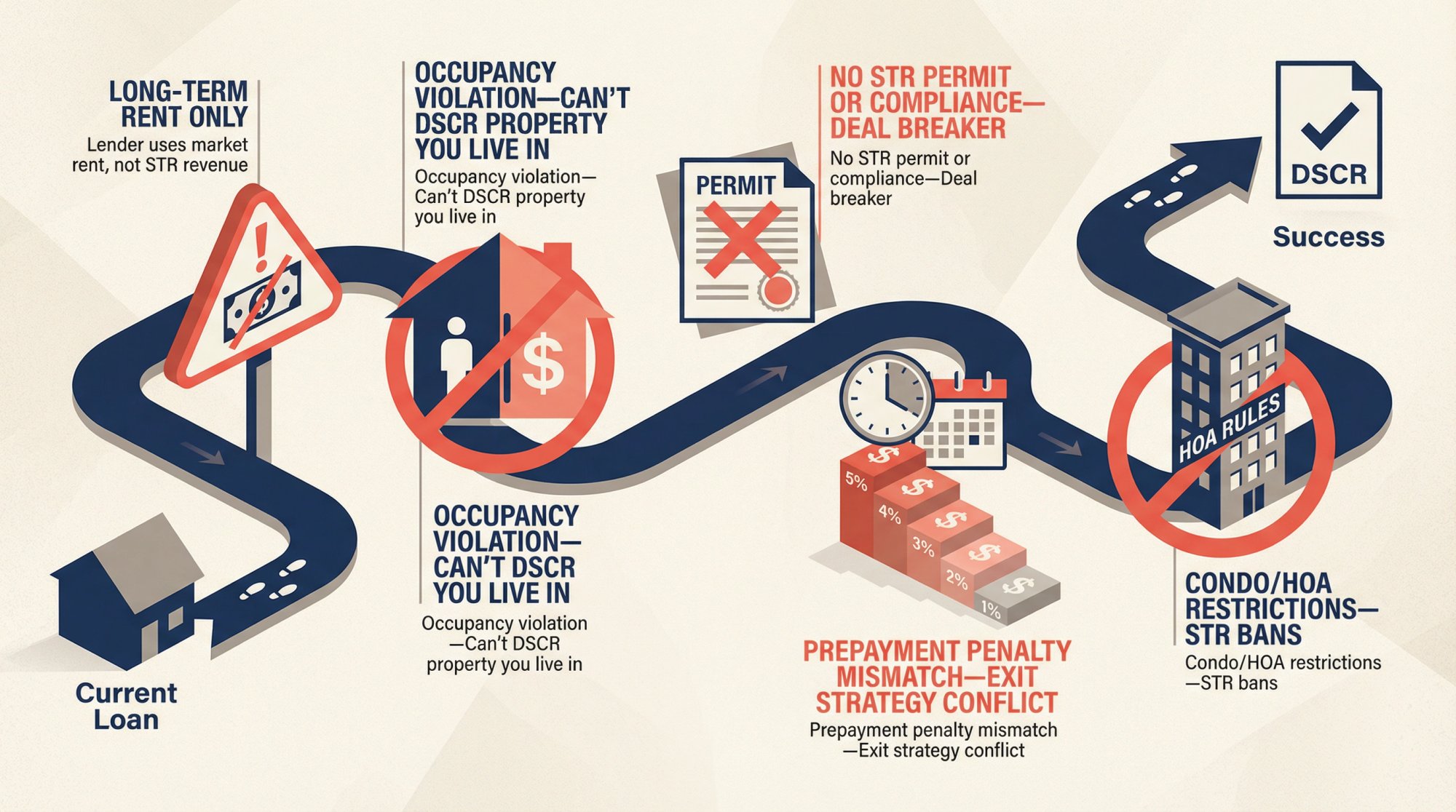

What Mistakes Kill DSCR Refinances?

Lender Uses Long-Term Rent (Not STR Income)

This is the number one surprise. Some programs require rent schedules and ignore your Airbnb revenue completely.

Fix: Ask about income methodology on day one. If they won't use STR income, find a different lender.

You're Trying to DSCR a Property You Live In

DSCR loans are for non-owner-occupied investment properties only. If you live there part-time or use it as a second home, you'll need a different product.

Property Isn't STR-Compliant

If your Airbnb operates without permits or violates local rules, some lenders will decline the loan.

Fix: Verify compliance using Chalet's regulation library before applying.

Prepayment Penalty Doesn't Match Exit Strategy

Many DSCR loans have 5-year step-down penalties (5%/4%/3%/2%/1%). If you plan to sell or refinance within 2-3 years, that penalty could cost thousands.

Fix: Look for programs with shorter penalties (3-year or opt-out options) or factor the penalty into your analysis.

Condo/HOA Issues

Some condo buildings, especially condotels with hotel-style operations, are hard to finance. Others ban short-term rentals outright.

Fix: Disclose building type upfront and confirm the lender accepts your property type.

Frequently Asked Questions

Can I refinance into a DSCR loan if I'm self-employed?

Yes. That's one of the main benefits. DSCR lenders don't require W-2s, tax returns, or verification of personal income. They care about property cash flow only.

What if my Airbnb hasn't been operating for 12 months?

Some lenders accept projected income from data providers or market analytics tools. Others require full operating history. Ask about income methodology when shopping lenders.

What DSCR ratio do I need?

Common targets are 1.20-1.25 for STRs. Some programs accept 1.0-1.10 with adjustments to rate or LTV. Higher DSCR generally unlocks better terms.

Can I do a cash-out refinance?

Yes, most DSCR programs allow cash-out up to 70-75% LTV (sometimes lower for STRs). You'll need to meet seasoning requirements, which vary by lender (often 3-6 months minimum ownership).

Do DSCR loans have prepayment penalties?

Usually yes. Typical structures are 3-5 year step-down penalties. Some lenders offer no-penalty options with slightly higher rates.

Can I close in an LLC?

Often yes, with a personal guarantee. Check with your specific lender about entity ownership policies.

I financed as a primary residence. Can I refinance to DSCR now?

Maybe, but you need to respect your current mortgage's occupancy requirements. Most conventional mortgages require you to occupy the home for about a year. If you've met that obligation and want to convert to full-time rental, refinancing into DSCR makes the transition clean.

What if my DSCR is below 1.0?

You might still find a program, but terms will be tighter. Expect lower LTV, higher reserves, or higher rates. Often it's better to increase equity or boost income to hit 1.20+.

Do I need to own the property for 6 months before refinancing?

It depends. Some programs have no seasoning, others require 3-6 months, some want 12 months for cash-out. Ask your lender about specific seasoning policies.

How long does a DSCR refinance take?

Typically 3-4 weeks if your documentation is organized and the appraisal comes in on time. This is faster than conventional refis because there's less personal income verification.

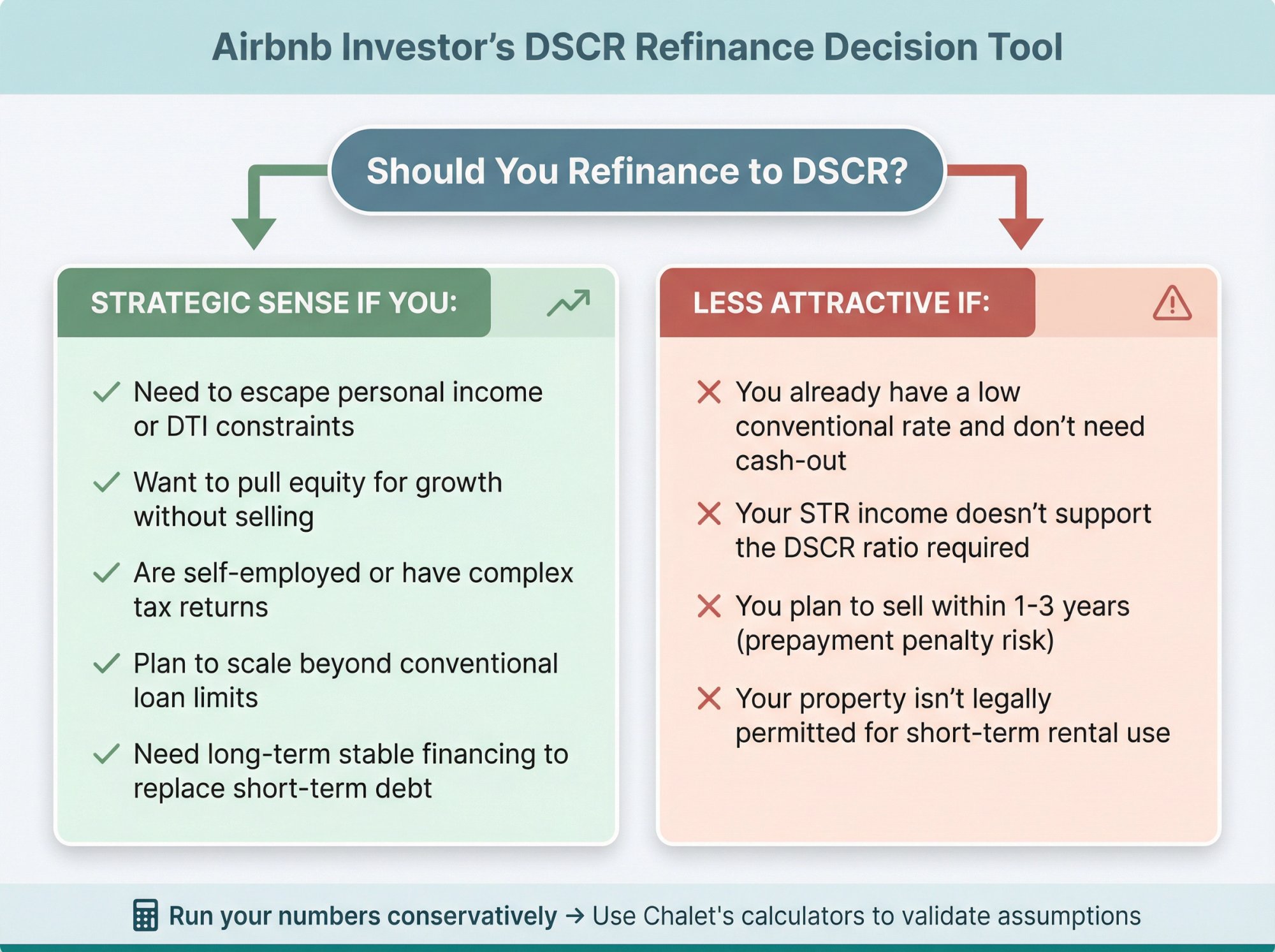

Is a DSCR Refinance Right for You?

Refinancing your Airbnb into a DSCR loan makes strategic sense if you:

→ Need to escape personal income or DTI constraints

→ Want to pull equity for growth without selling

→ Are self-employed or have complex tax returns

→ Plan to scale beyond conventional loan limits

→ Need long-term stable financing to replace short-term debt

It's less attractive if:

→ You already have a low conventional rate and don't need cash-out

→ Your STR income doesn't support the DSCR ratio required

→ You plan to sell within 1-3 years (prepayment penalty risk)

→ Your property isn't legally permitted for short-term rental use

Run your numbers conservatively before committing. Use Chalet's calculators and market data to validate assumptions and ensure the math works.

Next Steps: Get Your DSCR Refinance Started

If you're ready to explore refinancing your Airbnb rental into a DSCR loan:

1. Calculate your DSCR and projected terms using Chalet's DSCR Calculator

2. Validate your income assumptions with free market data at Chalet's Analytics Platform

3. Check local STR compliance with Chalet's Regulation Library

4. Connect with STR-specialist DSCR lenders through Chalet's financing network

5. Explore your next acquisition while you're refinancing with Chalet's Airbnb listings

Chalet pairs free analytics with a vetted vendor network, so you can research, finance, and operate your Airbnb portfolio in one place. Whether you're refinancing your first STR or scaling to property number ten, our platform connects you with the lenders, data, and tools you need to execute confidently.

Ready to refinance smarter? Start with Chalet's free DSCR calculator and see what terms your property supports today.