If you're dreaming of owning a portfolio of Airbnb rentals but worry that traditional financing will hold you back, you're not alone. Most short-term rental investors hit a frustrating wall after one or two properties. Why? Because conventional mortgages rely on your personal income and strict debt-to-income limits. Buy one Airbnb, maybe two, and suddenly banks look at your mounting mortgage debt and say "no more."

But there's a different path. A financing strategy has emerged that lets even self-employed or highly leveraged investors keep buying properties without hitting that income ceiling: Debt-Service Coverage Ratio (DSCR) loans. These loans qualify you based on the property's income, not your paycheck.

That changes everything.

In this guide, we'll break down what DSCR loans actually are, why they're transforming the way people build Airbnb rental portfolios, and how you can use them to scale from one STR to many. We'll also be honest about the risks and show you how to use DSCR financing smartly (not recklessly).

Ready to learn how to build your own short-term rental empire? Let's get into it.

What Is a DSCR Loan for Airbnb Investors?

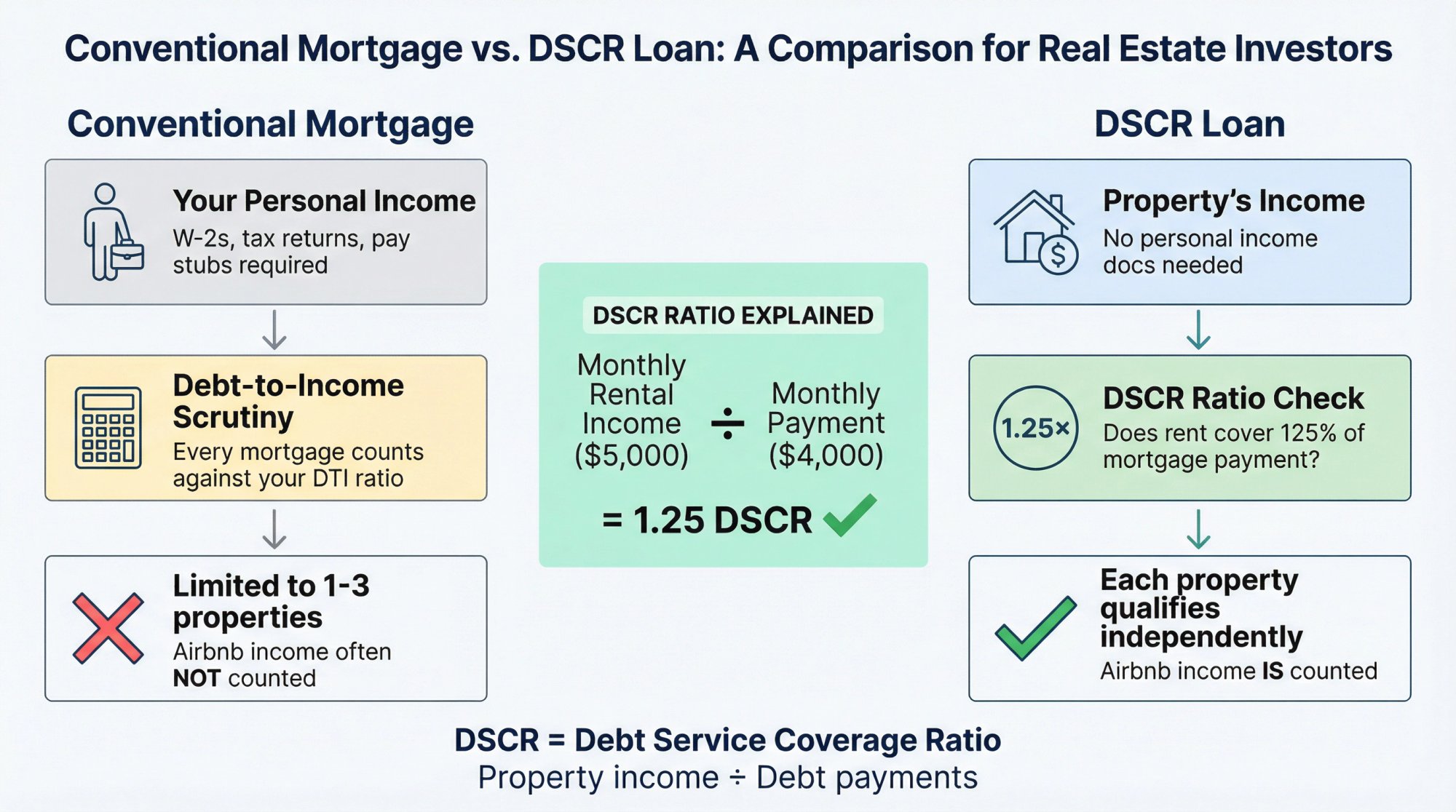

A DSCR loan is a real estate loan that qualifies you based on the property's ability to generate income rather than your personal salary or W-2. DSCR stands for Debt Service Coverage Ratio. It's the ratio of a property's rental income to its debt payments.

In simple terms, lenders ask: Does this rental property earn enough to pay its own mortgage?

If the answer is yes (typically by at least 20-30%), you can get the loan. Research shows that while the average American submits mountains of income paperwork for a mortgage, DSCR borrowers skip that entirely. No tax returns. No pay stubs. No employment verification.

This is a stark contrast to conventional mortgages, where underwriters scrutinize your personal debt-to-income (DTI) ratio. With conventional loans, your salary has to justify every mortgage you hold.

With DSCR loans, the rental income justifies the mortgage.

Why DSCR Loans Work Better for Short-Term Rentals

Traditional banks have a problem with Airbnb income. Many won't even count it when you apply for a conventional mortgage. They might recognize long-term rental income (often at a discount), but nightly rental income from Airbnb or VRBO? That's too unpredictable for their comfort.

DSCR lenders are different. Specialized STR DSCR programs will actually consider your property's projected rental income or past Airbnb performance. These loans use the property's income potential as the qualification metric. Some lenders even incorporate market data to determine if the loan makes sense.

The focus isn't on your job. It's on the deal's cash flow.

As long as the property's expected income covers the mortgage by a healthy margin (usually a 1.2–1.3 DSCR, meaning $1.20+ of income for every $1 of payment), you're likely approved. This opens the door for self-employed investors, business owners, or anyone with multiple mortgages who wouldn't qualify through traditional channels.

What Are the Requirements for DSCR Loans?

No personal income verification. You typically don't document your personal earnings or DTI. Lenders skip the "financial colonoscopy" of bank statements and employment letters. They focus on the property's ability to pay for itself. This makes DSCR loans uniquely accessible to investors with irregular income or flexible borrower situations.

Qualification based on cash flow. If the property's projected rent (or nightly rates for Airbnbs) comfortably exceeds the mortgage payment and expenses, that's often enough. For example, a property generating $5,000/month in rental income could qualify for a loan with a ~$4,000/month payment (1.25× coverage). You can run these numbers before applying to see if a deal qualifies.

Flexible ownership. DSCR loans are business-purpose loans, which means they can be made to an LLC or investor entity, not just individuals. This is great if you want liability protection or to hold properties professionally. It also means these loans don't count against conventional mortgage limits in your name.

Long-term financing options. Despite being a "commercial" loan, many DSCR loans offer 30-year fixed terms (sometimes with interest-only periods). You're not stuck with a short-term balloon loan. You can lock in a rate and hold the property long-term, just like a traditional mortgage.

Typical requirements. You'll still need skin in the game. Expect:

• 20–25% down (similar to other investment property loans)

• Credit score minimums often start around 620, though 700+ will get you better terms

• Lenders like to see cash reserves (6–12 months of payments saved) as a cushion for vacancies

Why DSCR Loans Are Growing in Popularity

DSCR loans aren't new, but they've exploded in popularity. Between 2019 and 2022, DSCR loans grew from just 22% to nearly 50% of all non-traditional investor mortgages. By 2023, lenders were originating billions of dollars in DSCR loans annually.

Real estate investors ranging from mom-and-pop landlords to social media influencers have used DSCR loans to rapidly buy up properties and build mini-empires of rentals, often without the usual scrutiny from bank underwriters.

This boom has been fueled by one simple fact: DSCR loans make it easier and faster to buy an Airbnb property.

DSCR Loans vs Conventional Mortgages: Which Is Better for Scaling?

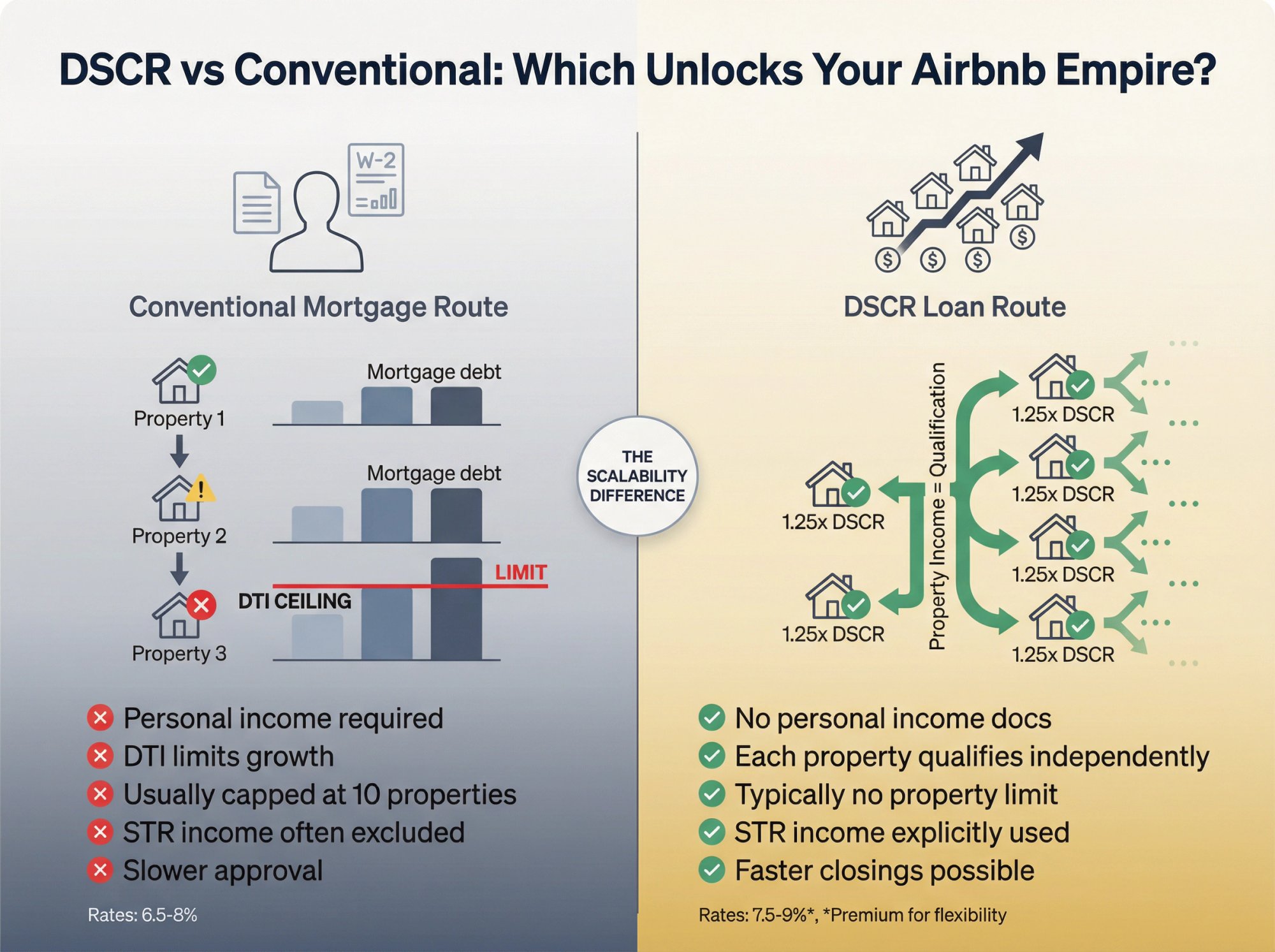

So why not just stick with regular mortgages? The answer comes down to one word: scalability.

A traditional mortgage relies on your personal income and DTI. Every new property's mortgage gets added to your debt load. Unless your personal income rises accordingly, it becomes harder to qualify for the next one. Lenders also cap how many mortgages you can have (often around 10), and they frequently won't count short-term rental income in those calculations.

This means if you try to buy multiple Airbnbs back-to-back with conventional loans, you'll likely hit a ceiling fast. Even if those rentals are wildly profitable.

How Many Properties Can You Finance with DSCR Loans?

DSCR loans let each property stand on its own financially. The loan for Property A is approved based on Property A's income. Property B's loan is based on Property B's income. Your personal debt load is largely irrelevant because the lender isn't making a decision based on your paycheck.

There's also typically no hard limit on the number of properties or DSCR loans you can have simultaneously. As long as you have the down payments and each property meets the coverage ratio, you can keep adding more.

This is how investors go from one or two rentals to a dozen or more using STR financing.

DSCR vs Conventional Mortgage Comparison

Let's illustrate the contrast:

| Financing Aspect | Conventional Route | DSCR Route |

|---|---|---|

| Qualification | Based on personal income and DTI | Based on property's rental income |

| Income Documentation | W-2s, tax returns, pay stubs required | No personal income docs needed |

| Scalability | Limited by personal income and DTI | Each property qualifies independently |

| Property Limit | Usually capped at 10 mortgages | Typically no limit |

| STR Income Recognition | Often not counted or heavily discounted | Explicitly used for qualification |

| Entity Ownership | Must be in personal name (usually) | Can be in LLC or business entity |

| Approval Speed | Slower (more paperwork) | Faster (streamlined) |

| Interest Rates (2026) | ~6.5–8% | ~7.5–9% |

The trade-off is clear. Conventional loans might have slightly lower rates, but DSCR loans remove the scalability bottleneck.

Real-World Example: Conventional vs DSCR Growth

Conventional route: You earn $80k/year from your job. You buy one Airbnb with a conventional loan. When you try for a second, the bank looks at your DTI. Now you have two mortgages to cover with the same salary (and they likely aren't counting your Airbnb's full income). Your DTI becomes too high. You might top out after 1–3 properties.

DSCR route: You buy the first Airbnb with a DSCR loan. The lender cares that this Airbnb generates 1.25× the monthly payment in income. If it does, you're approved. You find a second property. As long as Property #2's numbers also meet the DSCR criteria, you get another DSCR loan. No cumulative DTI problem. You could continue to a third, fourth, fifth property the same way.

Of course, you still need down payments for each purchase (20-25% each time) and decent credit. But the major bottleneck (personal income) is removed.

Are DSCR Loan Interest Rates Higher?

Many DSCR lenders offer 30-year fixed rates, similar to conventional loans. You can lock in a rate for each property and eliminate refinance risk. In 2026, DSCR loan rates tend to be about 0.5–1% higher than conventional mortgage rates to account for the increased flexibility.

For example, if a conventional investment loan is ~7% today, a DSCR loan might be around 7.5–8%. Many investors gladly pay slightly more interest in exchange for the ability to keep buying properties without hitting a wall. And as an investor, you can often offset a higher rate by choosing high-demand markets with strong cash flow or optimizing your listing.

The bottom line: Conventional loans might get you started, but DSCR loans can take you much further. By qualifying on rental income rather than personal income, DSCR financing unlocks your scalability.

Top Benefits of Using DSCR Loans for Multiple Airbnbs

Let's break down the specific advantages that make DSCR loans such a powerful tool for investors building multiple Airbnb properties:

→ Easier Qualification (No W-2 Needed)

DSCR loans don't ask for traditional proof of income like W-2 forms, pay stubs, or extensive employment history. The property's income is what matters. This is huge if you're self-employed, retired, or have a non-traditional financial situation.

→ No DTI or Personal Debt Limit

Unlike conventional mortgages, there's no strict debt-to-income requirement for the borrower. A high DTI or multiple existing loans won't automatically stop you from getting another DSCR loan as long as each property's cash flow is solid. Each property finances itself.

→ Unlimited Number of Properties

DSCR loans aren't a "one-and-done" program. You could finance 5, 10, 20 rentals over time using DSCR loans if you have the capital and each deal makes sense. There's typically no cap like the Fannie Mae 10-loan limit.

→ Own Properties in an LLC

Most DSCR lenders allow (even prefer) loans made to LLCs or business entities. This is great for liability protection and bookkeeping. If you plan to operate a professional Airbnb business with multiple properties, holding each in an LLC compartmentalizes your risk.

→ Faster, Streamlined Closings

With less documentation scrutiny, DSCR loan approvals can be faster. Many lenders advertise closings in just a few weeks, and some can issue pre-approvals very quickly because the underwriting model is straightforward.

→ Flexible Use (Short-Term or Long-Term)

DSCR loans can finance all types of income property. Whether you're buying a beach house to list on Airbnb, a long-term rental duplex, or even a mixed-use property, there's likely a DSCR program for it. Many lenders now explicitly offer DSCR loans tailored to vacation rentals.

→ High LTV (Leverage to Scale)

You can typically borrow up to 75–80% of the property's value with a DSCR loan. That means only 20-25% down. High leverage allows you to buy more properties with limited cash. Instead of paying all cash for one rental, you could put 25% down on four rentals using DSCR loans.

→ Interest-Only Options

Many DSCR loans offer an interest-only period (the first 5 or 10 years). During that phase you pay only interest, which boosts your cash flow significantly. Higher cash flow can help when you're scaling because you might need that extra income for reserves or additional down payments.

→ Refinance & Cash-Out Ability

DSCR loans are great for refinancing and pulling out cash from properties that have appreciated. Many investors follow the "BRRRR" strategy (Buy, Rehab, Rent, Refinance, Repeat), and DSCR loans are an excellent refinancing tool. You can pull equity out without income verification hassles, then use that cash as down payments for more purchases.

In short, DSCR financing is built for investors in a way that conventional loans simply aren't. It offers the flexibility, speed, and repeatability you need to scale from one Airbnb to a portfolio.

How to Qualify for a DSCR Loan (Requirements & Criteria)

Before you start planning to acquire 10 properties in 2 years, let's make sure you understand the actual qualifications. While DSCR loans are lenient on personal income, they do have their own criteria.

What Is the Minimum DSCR Ratio Required?

Lenders usually require the property's Debt Service Coverage Ratio to be at least 1.2–1.3. In plain language, the expected rental income should be 20-30% higher than the monthly debt payments.

Some programs allow slightly lower ratios if you put more money down or pay a higher rate, but 1.25× is a common benchmark. Use our DSCR calculator to see if your property qualifies.

Example: If your mortgage (plus taxes/insurance) will be $2,000/month, they might want to see at least ~$2,500/month in projected rental income.

For Airbnb properties, lenders handle income projections differently. Some will use a rental appraisal estimating long-term tenant rent. Others may accept Airbnb income projections from market data or previous actuals. It's important to work with an STR-savvy DSCR lender who knows how to underwrite short-term rental income realistically.

How Much Down Payment for DSCR Loans?

Expect to put 20% to 25% down on the purchase. A few lenders offer 15% down DSCR loans, but those are rare and usually come with higher rates. Plan on 20% minimum equity.

You'll also need cash for closing costs and reserves, not just the down payment.

What Credit Score Do You Need for DSCR Loans?

620 is around the minimum in many cases, but realistically, aim for 700+ for the best pricing. A low score will bump you into higher rates or make qualification harder. Generally, these loans are more forgiving on credit than banks, but every 20-point increase in your score might reduce your interest rate or fees.

What Are Current DSCR Loan Interest Rates?

As mentioned, DSCR loans carry higher interest than conforming mortgages. As of 2026, typical DSCR 30-year fixed rates are in the 7.5% to 9% range, whereas conventional investment loans might be 6.5–8%.

The exact rate depends on your credit, loan-to-value, DSCR, and market conditions. Rates have moderated somewhat by 2025–2026 after spiking in 2022.

You can often choose between fixed or adjustable. If you plan to hold long-term, locking a fixed rate is usually the safer bet. Connect with specialized lenders to compare current rates.

What Loan Terms Are Available for DSCR Loans?

Most DSCR loans are 30-year terms. Some offer interest-only for an initial period (first 5 or 10 years interest-only, then 20-25 years amortizing). A few lenders have 5, 7, or 10-year ARM options that adjust after that period.

Make sure you understand if there's any prepayment penalty. Many DSCR loans include prepayment penalties for the first 3–5 years. A common structure is a "5-4-3-2-1" declining penalty (5% of loan if paid off in year 1, 4% in year 2, etc.). This isn't usually a big issue unless you plan to sell or refinance very quickly.

How Much Cash Reserves Do You Need?

It's common for DSCR lenders to require cash reserves equal to 6 months worth of payments (sometimes more). This ensures you can cover the loan during vacancies or unforeseen events. Reserves don't have to be in cash; many will accept stock portfolios or other liquid assets.

What Property Types Qualify for DSCR Loans?

Most DSCR programs will finance single-family homes, condos, townhouses, 2-4 unit properties, etc. The property typically needs to be in rentable condition (no major disrepair). If you're buying a fixer-upper, you might need a renovation DSCR loan.

Also, location matters. A few lenders shy away from very rural properties. And STR-specific note: Some lenders are hesitant with markets that have unclear Airbnb regulations. Make sure the city permits short-term rentals legally, or the lender might only underwrite it as a long-term rental, which could limit the loan size.

What Documentation Is Required for DSCR Loans?

Even though you don't provide personal income docs, you will need: purchase contract, an appraisal, a rental income analysis, proof of your down payment funds, LLC documents if buying in an entity, and standard ID and credit pull.

If the property has been operated as a short-term rental already, providing its income history (Airbnb statements, etc.) can bolster your case. Some lenders will use that to qualify if it's strong. If it's a new rental, they'll rely on market data.

DSCR Loan Requirements Summary Table

| Requirement | Typical Standard |

|---|---|

| Minimum DSCR | 1.2–1.3× (property income ÷ debt payments) |

| Down Payment | 20–25% |

| Credit Score | 620 minimum, 700+ preferred |

| Interest Rate (2026) | 7.5–9% (30-year fixed) |

| Loan Term | 30 years (fixed or interest-only options) |

| Cash Reserves | 6–12 months of payments |

| Property Types | Single-family, condos, 2-4 units, some multifamily |

| Documentation | Contract, appraisal, rental analysis, LLC docs, ID |

| Prepayment Penalty | Often 3–5 years (declining structure) |

Knowing these requirements upfront helps you prepare. If you're short in any area, you can address it before applying or adjust your strategy.

How to Build an Airbnb Portfolio with DSCR Loans Step-by-Step

So how do you actually go from one Airbnb to several, using DSCR loans as your engine? It's not magic. It requires planning, execution, and recycling your capital. Here's a step-by-step roadmap:

① How to Buy Your First STR Property with a DSCR Loan

Every empire starts with one property.

Identify a promising Airbnb investment in a market with strong demand. Analyze its income potential using market data to estimate ADR (average daily rate) and occupancy. Ensure the deal looks likely to meet that ~1.25 DSCR coverage by running it through our ROI calculator.

Then line up DSCR financing. Shop around or use our platform to find an STR-savvy lender, or connect with a lender directly to start the conversation. Get prequalified so you know how much you can afford. When you close on this first property using a DSCR loan, you've broken the seal. You now own an Airbnb rental without tying up your personal debt capacity, and you've set the foundation for scaling.

② How to Optimize Cash Flow After Purchase

Once the first Airbnb is up and running, focus on making it successful.

The goal is to maximize its income above that mortgage payment. Furnish thoughtfully. Create an appealing listing. Use dynamic pricing to boost revenue. Maintain great guest reviews. If you need help with operations, check out our STR vendor directory for property managers, cleaners, and furnishing services.

After a few months, you'll have a clear picture of whether it's hitting income projections. If it's exceeding them, great. You're building equity and a track record. If it's underperforming, identify why (seasonality? too-high expenses? need better marketing?) and address it.

A reliable income stream from Property #1 is the springboard to Property #2. Many DSCR lenders want to see a few months of successful rental income if you plan to do a cash-out refinance later, so keep good records.

③ How to Get Down Payment for Your Next Property

Scaling requires capital. With DSCR loans, your limiting factor is usually the down payment.

There are four main ways to accumulate down payments for each new acquisition:

a) Save the cash flow from Property #1. If it's generating profit each month after expenses, set that aside in a "next property fund." It might take time, but the income from your existing rentals can partially fund new ones.

b) Cash-out refinance Property #1 after it appreciates. If the market or your improvements increase its value, a DSCR refinance could allow you to pull out $50k-$100k of equity (tax-free). That money goes straight into the down payment for Property #2. The refinance will increase the loan balance on #1, so double-check it will still cash flow at the new amount using our calculator.

c) Bring in partners or investors. Some folks team up with family or friends who have idle cash. Since DSCR loans don't check your personal income, the main concern is both parties meeting credit and down payment requirements. Partnerships can accelerate scaling if structured right.

d) 1031 Exchange from another property. If you already own a long-term rental or any investment property, you could sell it and roll the proceeds into multiple Airbnbs (using the 1031 tax-deferred exchange). Each new purchase could then be financed with a DSCR loan to maximize leverage.

However you obtain the capital, the idea is to recycle it back into new acquisitions. Many empire-builders use a combination of saving rental profits and periodic cash-out refinances. For example, every 12–24 months, do a cash-out refi on a property that's gone up in value, and use that equity to fund the next purchase.

④ Repeat Process for Properties 2, 3, and Beyond

Now go after Property #2 with a new DSCR loan, using the funds you've prepared.

The process will feel easier the second time. You already know what lenders expect. One thing to watch as you add properties is your overall financial picture. Lenders might check that you aren't stretching too thin. They'll pull your credit each time, so large new debts could scare them even if the DSCR is fine.

Keep your credit score healthy and don't over-leverage outside of your rental loans.

Assuming Property #2 is secured, get it making money using our vendor directory for setup help, then move to Property #3, and so on. Each new Airbnb should ideally add more surplus cash flow that you can channel into the next venture.

⑤ How to Monitor Your Growing Portfolio Performance

As you grow to 3, 5, 10 properties, managing them becomes a bigger task.

Ensure you have good systems for operations. You might hire a property manager or use software once you can afford it. Maintaining quality is crucial so the income stays strong.

Regularly review your loans and equity. Could you refinance some at a better rate? Is one property underperforming and perhaps better to sell and reinvest elsewhere? Savvy investors continuously optimize.

DSCR loans give you flexibility here. For instance, you might bundle several properties into a portfolio DSCR loan down the road, which could simplify payments (one loan covering multiple houses). Portfolio loans often require strong overall metrics, but they can be useful for seasoned investors.

Always keep an eye on regulations in your markets too. An Airbnb empire can crumble if a city bans short-term rentals, so diversify markets or have backup strategies (like mid-term rentals for traveling professionals) if needed. Use our mid-term rental calculator to explore this alternative income strategy.

⑥ How to Scale Smart Without Overextending

It's exciting to keep acquiring, but ensure each purchase is sound.

In a booming market it might've been easy to buy anything and see it appreciate, but as some DSCR-funded landlords have learned, overly aggressive growth can backfire. Aim for quality properties with durable income by using data-driven market selection.

It's often better to have 5 highly profitable rentals than 10 marginal ones. Your end goal might be financial freedom, not just a unit count.

Remember that expenses and effort scale with more properties. At some point you may need a team (cleaners, handymen, maybe a virtual assistant for guest communications). Plan for those operational aspects so that your empire doesn't become a burden.

By following these steps, you can methodically grow from one Airbnb to many. Plenty of investors have done it. And unlike in the past, you don't have to be a millionaire or have a huge salary to achieve it. You do need to be diligent, informed, and a little creative with financing. DSCR loans handle the creative financing part; you handle the diligence and execution.

How Chalet Helps You Scale with DSCR Loans

At Chalet, we've built our entire platform around one idea: making it easier for investors to research, finance, and operate short-term rentals in one place.

DSCR loans are a powerful tool for scaling your Airbnb portfolio. But here's the problem most investors face: finding the right lender who actually understands short-term rental income. Most traditional DSCR lenders underwrite properties as long-term rentals, which often underestimates the income potential of a well-run Airbnb. That can make a great deal look marginal (or worse, not qualify at all).

We solve that problem.

Where to Find STR-Specialist DSCR Lenders

Through Chalet's lender network, we connect you with DSCR lenders who specialize in short-term rentals. These aren't generic commercial lenders. They're pros who understand Airbnb income, seasonality, and how to use realistic projections (not conservative long-term rental comps) to underwrite your deal.

We vet every lender in our network. We only work with those who:

→ Have experience financing STR properties

→ Use realistic Airbnb income data for underwriting

→ Offer competitive terms and transparent pricing

→ Can close quickly (important when you're scaling)

When you're ready to apply for a DSCR loan, you're not stuck calling dozens of lenders hoping one "gets it." We introduce you to the right people from the start.

Connect with STR-friendly DSCR lenders →

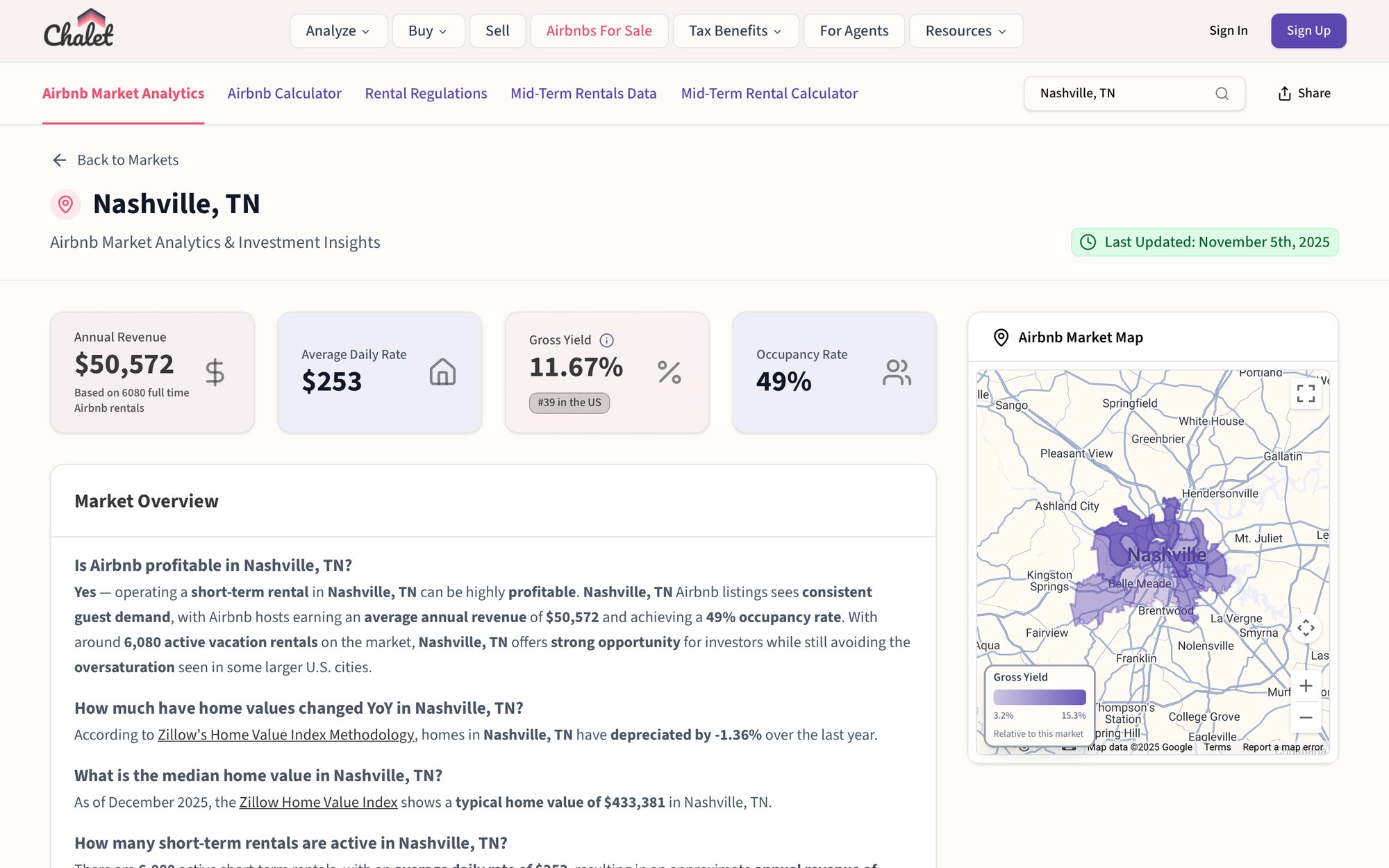

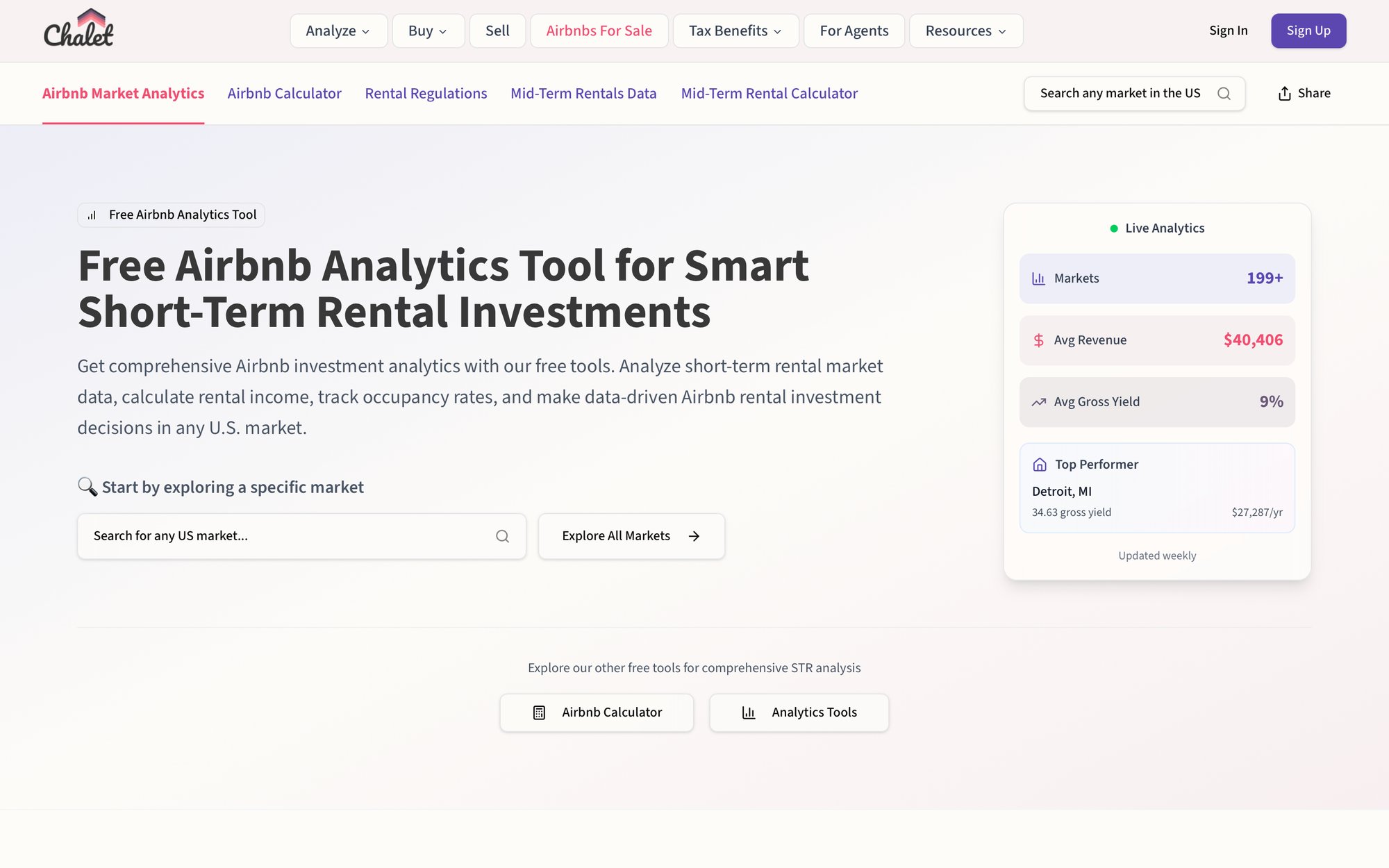

Free Market Analytics for Deal Underwriting

Before you even apply for financing, you need to know if a deal makes sense. That's where our free market analytics come in.

We provide dashboards showing ADR (average daily rate), occupancy rates, and RevPAR (revenue per available room) for markets across the country. You can see which cities have the income potential to support a DSCR loan (remember, you need that 1.25× coverage).

Want to compare Nashville vs. Austin vs. Denver for your next Airbnb? Our data shows you the real performance metrics. No paywall. No subscription. Just free, transparent analytics.

This is huge when you're scaling. Instead of guessing which market to enter next, you can make data-backed decisions about where to deploy capital.

Free ROI and DSCR Calculator

Once you've found a property you like, you need to run the numbers.

Our ROI/DSCR calculator lets you model a deal before you apply for financing. Plug in the purchase price, down payment, estimated income, and expenses. The calculator shows you:

→ Whether the property meets DSCR requirements (1.25×+)

→ Your projected ROI and cash-on-cash return

→ Monthly cash flow estimates

If the calculator shows a property doesn't hit the DSCR threshold, you can adjust variables (larger down payment, higher income projections, etc.) to see what it would take to make the deal work.

This pre-qualification step saves you time. You won't waste energy on deals that won't qualify or properties that barely break even.

Complete Airbnb Investment Platform: Research to Operations

Here's the real power of Chalet: everything you need is in one place.

• Research markets with free data

• Connect with DSCR lenders who understand STRs

• Find real estate agents who specialize in investment properties, or connect directly with an agent

• Get insurance tailored for short-term rentals

• Hire property managers, cleaners, and furnishing services

• Check local regulations to ensure your market allows STRs

We're not a lender ourselves. We're a platform that coordinates all the professionals and data you need to execute. Think of us as your Airbnb investment command center.

How Chalet Works: Nashville Example

Let's say you're considering buying an Airbnb in Nashville. Here's how we help:

1. Market research: You pull up Nashville on our analytics dashboard. You see that 3-bedroom homes are generating ~$65k/year with 70% occupancy. Solid numbers.

2. Deal analysis: You find a property listed for $400k. You run it through our calculator with 25% down ($100k), a 7.5% DSCR loan, and projected income of $5,400/month. The calculator shows a 1.3× DSCR. You'll qualify.

3. Financing: You submit an inquiry through our lender network. Within 48 hours, you're connected with an STR-savvy DSCR lender who uses your Airbnb income projections (not conservative long-term comps). They pre-approve you.

4. Closing and setup: You close the deal. Now you use our vendor directory to find a local property manager, furniture provider, and cleaner. Everything coordinated through one platform.

That's the power of an integrated system. Speed, confidence, and efficiency.

Why This Matters for Scaling Your Portfolio

When you're trying to build an empire, time and confidence are everything.

• Speed: Don't waste months finding the right lender or researching markets manually. We've already done that work.

• Confidence: Make data-backed decisions. Know a deal will qualify before you even apply.

• Efficiency: One platform instead of 10 websites. Less friction means more properties acquired.

• Success rate: Work with people who understand STRs. Higher approval rates, better terms, smoother closings.

We've seen investors use our platform to go from one Airbnb to five in under 18 months. Not because they got lucky. Because they had the right data, the right lenders, and the right support system.

If you're serious about scaling your short-term rental portfolio with DSCR loans, start with Chalet. We'll help you find the deals, secure the financing, and set up operations so you can focus on growing your empire.

What Are the Risks of DSCR Loans? (And How to Avoid Them)

Up to now we've highlighted the advantages, but no financing strategy is without downsides. DSCR loans allow rapid scaling, which also means rapidly accumulating debt.

It's important to be aware of the risks so you can mitigate them while you build your Airbnb empire.

Are DSCR Loan Interest Rates Too High?

The convenience of DSCR loans comes at a price. Rates are typically 0.5–1% higher than conventional, which means thinner profit margins.

If you're only just meeting the DSCR minimum (1.2× coverage), a higher rate could push you to barely break even each month. Always run conservative projections with the higher interest in mind using our calculator.

Additionally, closing costs or lender fees might be slightly higher (and remember those possible prepayment penalties). These costs mean your rentals need to perform well to truly profit.

Mitigation: Buy properties in high-yield markets. Use conservative income estimates. Don't assume perpetually low rates. Focus on deals that still work at today's financing costs.

What Happens If Your Airbnb Income Drops?

DSCR underwriting assumes the property can pay for itself. But what if that changes?

A downturn in travel, an economic recession, or simply new competition can reduce your Airbnb income. If your DSCR was barely 1.2 and revenue falls 20%, you'll dip below 1.0 (meaning the rent no longer covers the debt). That's when investors get in trouble.

In fact, there are warning signs. By the end of 2024, about 3% of DSCR loans were delinquent (90+ days late), up from ~2% the year before. Many of these troubled loans were in over-saturated vacation rental markets.

A recent analysis showed that serious delinquencies on DSCR loans nearly quadrupled in the past three years as some landlords found their "easy loans" weren't so easy to pay back when cash flow slowed.

Mitigation: Don't overestimate income. Use realistic market data or even conservative numbers when buying. Keep adequate cash reserves (most lenders require it, but you should have it for your own sanity too) to weather slow seasons or unexpected repairs. Diversify markets if possible. Five cabins in one small town might all suffer simultaneously in a downturn, whereas 5 rentals across different cities spreads risk.

Can You Scale Too Fast with DSCR Loans?

A DSCR loan won't stop an inexperienced investor from buying 5 properties in 6 months. But maybe it should.

Be cautious not to scale faster than your knowledge and infrastructure. Managing multiple Airbnbs is a business that requires time and expertise (or hiring someone with expertise from our vendor directory).

We've all seen the social media pitches to "leverage up quickly and buy a dozen Airbnbs." But some of those stories turned sour, with investors admitting they over-leveraged on optimistic projections and ended up with negative cash flow.

Mitigation: Don't rush into a deal just because you can get financing. Ensure you have a plan for management and a realistic profit margin on each property. Grow deliberately. Build systems first.

What If STR Regulations Change in Your Market?

Short-term rental laws can change, and DSCR lenders typically don't consider regulatory risk in underwriting.

If a city outlaws STRs, your Airbnb's income could plummet, jeopardizing your DSCR loan. Always choose markets with stable or permissive STR regulations. Chalet's rental regulations library can help you check local rules.

Also consider properties that could work as medium-term or long-term rentals if needed. Having a "plan B" for income can save you if laws change.

Mitigation: Your empire should be built on solid legal ground. Diversify across markets with different regulatory environments. Have backup rental strategies ready.

What Are the Refinance Risks with DSCR Loans?

If you took an ARM or a short-term DSCR loan, you face refinance risk.

Some DSCR loans in the past had 5-year terms or balloon payments (though most now are 30-year fixed). If you choose an adjustable rate to get a lower teaser rate, remember it will eventually reset.

As one investor lamented, a property that cash flowed great with a 4% interest rate became a money pit when the rate jumped to 7% upon refinancing. He planned for it, but many didn't.

Mitigation: Lock in long-term financing when possible. If you do use an ARM, have an exit or refi strategy ready if rates rise. The good news: plenty of lenders do offer fixed DSCR loans. Strongly consider the fixed options for peace of mind, especially as your portfolio grows.

Are DSCR Loans Risky If Property Values Drop?

Real estate is not a liquid asset. With multiple DSCR loans, you might find it's easy to get in, but not as easy to get out quickly.

If market conditions change or you need to unload properties, selling several homes fast can be challenging (and might require paying those loan prepayment penalties if within a few years).

Also, high leverage means if values drop, you could end up with loans higher than property values (though as long as you can cash flow and pay the mortgage, you can ride it out).

Mitigation: Always keep an eye on your loan-to-value (LTV) across your portfolio. Avoid maxing out leverage on every single property. Leaving a bit of equity or extra cash invested can be a buffer against price fluctuations. Basically, don't stretch every deal to the absolute limit. That leaves no margin for error.

The Truth About DSCR Loan Risk

DSCR loans themselves aren't "risky." How people use them can be.

As one industry veteran said, "It's still a great product." The problems came when some investors (and a few sketchy lenders) stretched the guidelines, assumed sky-high rents, or skipped proper due diligence.

Use DSCR loans prudently. Ensure each property truly has strong rental potential using market data. Keep some cash in reserve. Don't bet on endless home price appreciation. If you do that, you can reap the benefits of scaling without being one of the cautionary tales.

Common Questions About DSCR Loans for Airbnb Investing

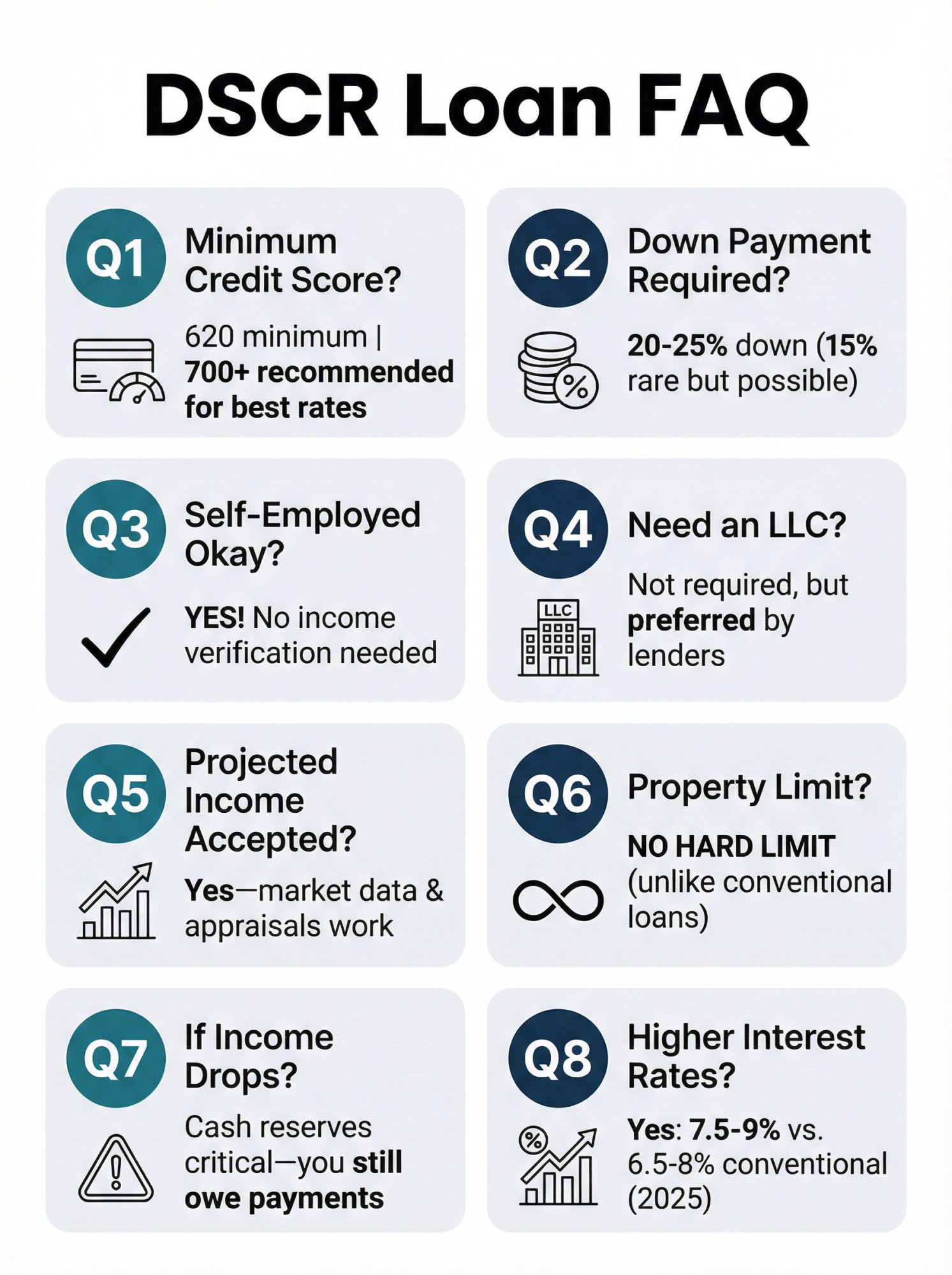

Q1: What is the minimum credit score for a DSCR loan?

A: 620 is around the minimum in many cases, but realistically, you should aim for 700+ to get the best rates and terms. Lower credit scores will result in higher interest rates or more stringent requirements.

Q2: How much down payment do I need for a DSCR loan?

A: Most DSCR lenders require 20–25% down. Some programs offer 15% down, but those are less common and typically come with higher rates. Plan on putting at least 20% equity into each purchase.

Q3: Can I use DSCR loans if I'm self-employed?

A: Yes! That's one of the main advantages. DSCR loans don't require personal income verification, so being self-employed, having irregular income, or running your own business won't disqualify you. The property's income is what matters.

Q4: Do I need an LLC to get a DSCR loan?

A: Not required, but allowed. Most DSCR lenders actually prefer to lend to LLCs or business entities because these are business-purpose loans. Holding properties in an LLC can provide liability protection and is perfectly acceptable for DSCR financing.

Q5: What if my Airbnb income is projected, not actual?

A: That's totally fine. Lenders use market data and rental appraisals to project income for properties that aren't yet operating as STRs. Some lenders incorporate data from platforms or similar sources. If the property already has Airbnb history, you can provide those statements to strengthen your case.

Q6: How many properties can I finance with DSCR loans?

A: There's typically no hard limit. Unlike conventional mortgages (which often cap at 10), you can finance as many properties as you want with DSCR loans, as long as each one meets the DSCR requirements and you have the down payments and credit to support them.

Q7: What happens if my rental income drops below the DSCR requirement after closing?

A: Once the loan is closed, you still owe the mortgage regardless of income fluctuations. This is why cash reserves are critical. If income drops temporarily due to seasonality, vacancies, or market changes, you'll need reserves to cover the payments. Lenders don't continuously monitor your DSCR after closing, but you're still obligated to make payments. Plan conservatively and keep a cushion.

Q8: Are DSCR loan rates higher than conventional mortgages?

A: Yes. DSCR loans typically carry rates that are 0.5–1% higher than conventional mortgages. This is the trade-off for easier qualification and greater scalability. As of 2026, expect DSCR rates around 7.5–9% versus conventional investment loans at 6.5–8%.

Start Building Your Airbnb Portfolio with DSCR Loans Today

Building an Airbnb empire is absolutely achievable in 2026 thanks to financing tools like DSCR loans.

They've democratized access to rental property investing. You no longer need a huge salary or dozens of bank conversations to acquire multiple cash-flowing homes. By qualifying based on the property's income, DSCR loans allow you to go from one STR to many, as long as you buy smart and manage wisely.

The formula is straightforward: find properties that pay for themselves, finance them through DSCR loans, and repeat the process using the equity and income you build along the way.

Many investors have scaled portfolios in a few years that would have taken decades using traditional loans. With interest rates stabilizing and plenty of specialized lenders in the market, now is as good a time as any to get started or to expand your holdings.

Remember that an empire is only as strong as its foundation. Educate yourself. Run the numbers carefully using our calculator. Maintain discipline in your growth. If you combine the right knowledge, the right properties, and the right financing, you can achieve the financial freedom that a well-run short-term rental portfolio provides.

And you don't have to do it alone.

Chalet is here to help aspiring and seasoned Airbnb investors alike. Whether it's providing free market data to identify high-ROI rental markets, or matching you with vetted DSCR lenders who understand vacation rental underwriting, our platform is built to support your journey from the first purchase to an entire portfolio.

Ready to take the next step?

→ Explore our Airbnb analytics tools to find lucrative markets

→ Connect with STR-friendly DSCR lenders who can finance your vision

→ Get matched with a lender now to start your financing conversation

→ Calculate your deal's ROI and DSCR before you apply

→ Check local STR regulations to ensure your market is legal

With the right strategy and partners, you can turn a single Airbnb property into a thriving short-term rental empire – one property at a time.