You want to scale your Airbnb portfolio, but your personal debt-to-income ratio just hit a wall. Maybe you're self-employed with complex tax returns. Maybe you already own three rentals and conventional lenders keep saying "no more mortgages for you."

This is exactly why DSCR loans exist.

Debt-Service Coverage Ratio (DSCR) loans let you qualify based on the property's rental income instead of your W-2s or tax returns. If the Airbnb rental can cover its own mortgage payment, you can often get approved. No income verification required.

We've helped hundreds of STR investors navigate DSCR financing at Chalet, so we're breaking down exactly what lenders look for, which documents you actually need, and how to position yourself for approval in 2026.

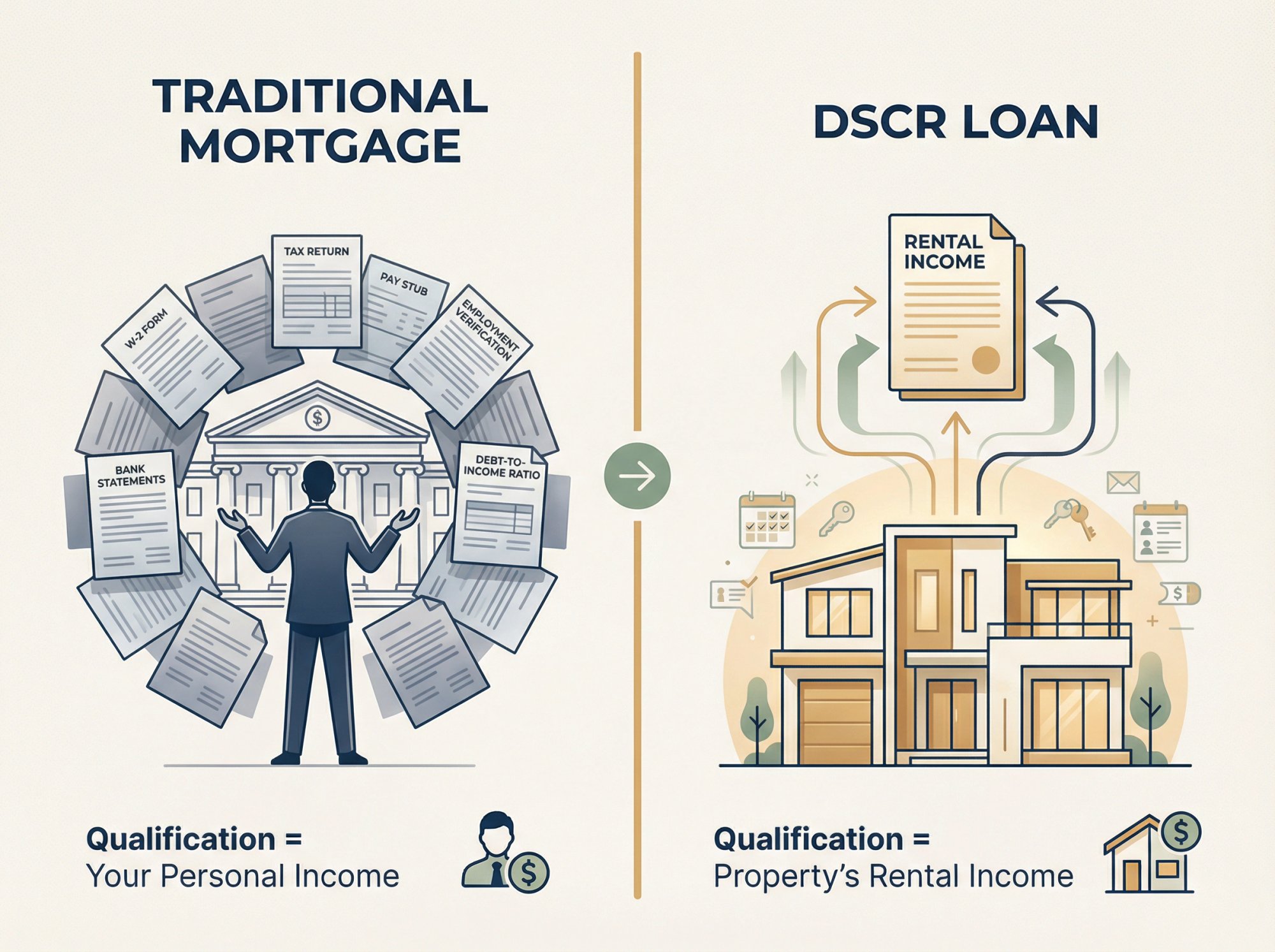

What Makes DSCR Loans Different from Regular Mortgages?

Traditional mortgages care about your personal income. DSCR loans care about one thing: Will the property's rent cover the loan payment?

This shift matters because:

The property qualifies you, not your paycheck.

Your rental income becomes your approval ticket. If a property generates $3,000 monthly and the mortgage payment (including taxes, insurance, HOA) is $2,400, you've got a DSCR of 1.25. That's typically solid enough for approval.

You skip the income documentation nightmare.

No digging through tax returns, no explaining business write-offs, no proving stable employment history. Many STR investors have complex finances that look messy on paper but run profitable properties. DSCR loans let the property's numbers speak for themselves.

You can scale faster.

Conventional lending caps most investors at 4-10 financed properties. DSCR loans don't count against those limits since they're portfolio loans.

The DSCR market has exploded. Lenders originated $44 billion in DSCR loans in 2022, up from just $5.6 billion in 2019.

Today, these loans are a standard tool for serious rental investors.

But "no income verification" doesn't mean "no requirements." Let's break down what you actually need to qualify.

DSCR Loan Requirements: What Lenders Look For

DSCR Ratio: The Most Important Qualification Factor

Here's the formula: Monthly Rent ÷ Monthly PITIA (Principal + Interest + Taxes + Insurance + Association fees)

Example calculation:

→ Monthly rent: $3,000

→ Monthly PITIA: $2,400

→ DSCR: 3,000 ÷ 2,400 = 1.25

Most lenders require a minimum DSCR between 1.0 and 1.25.

| DSCR Range | What It Means | Approval Likelihood |

|---|---|---|

| 1.25+ | Property generates 25% cushion above debt | Excellent (qualify almost anywhere) |

| 1.10-1.24 | Property covers debt with modest buffer | Good (most lenders approve) |

| 1.00-1.09 | Property breaks even or barely cash flows | Possible (higher rates, stricter terms) |

| Below 1.00 | Property won't cover its own payment | Difficult (need compensating factors) |

Pro tip from our lending partners: If your DSCR comes in at 0.95-1.0, you might still qualify by increasing your down payment from 20% to 25-30%. A smaller loan means lower payments, which improves your DSCR.

Want to run your numbers before applying? Use Chalet's free DSCR calculator to see exactly where your property stands. It factors in all the PITIA components and shows you what changes would improve your ratio.

Minimum Credit Score for DSCR Loans

Even though DSCR loans don't use your income, lenders still check your credit. But the minimums are surprisingly accessible.

Typical credit score requirements:

• 620-640 → Minimum for most programs

• 660-680 → Standard tier (better rates)

• 700+ → Best pricing and terms

You don't need perfect credit. A 640 FICO can absolutely work, especially with a strong DSCR. The trade-off is you'll pay a higher interest rate (often 1-2% more than someone with a 720 score).

If your score is borderline, focus on these quick wins before applying:

• Pay down credit card balances below 30% utilization

• Fix any reporting errors (surprisingly common)

• Avoid opening new credit accounts in the 60 days before applying

How Much Down Payment Do You Need?

DSCR loans require more skin in the game than owner-occupant mortgages.

Standard down payment expectations:

→ 20% minimum for strong profiles (high DSCR, excellent credit)

→ 25% standard for most investors

→ 30% required for borderline deals (low DSCR, lower credit scores)

Why the bigger down payment?

Risk mitigation. Investment properties default more often than primary residences during economic downturns. More equity protects both you and the lender.

DSCR improvement. A larger down payment creates a smaller loan, which means lower monthly payments. That directly improves your debt coverage ratio.

Let's look at the math:

| Down Payment | Loan Amount | Est. Monthly Payment | DSCR (on $3,000 rent) |

|---|---|---|---|

| 20% ($80k) | $320,000 | $2,560 | 1.17 |

| 25% ($100k) | $300,000 | $2,400 | 1.25 |

| 30% ($120k) | $280,000 | $2,240 | 1.34 |

(Assumes $400k purchase, 8% rate, $300/mo taxes, $100/mo insurance)

That 5% increase in down payment can bump you from marginal to strong approval territory.

Cash Reserve Requirements

Here's where many first-time DSCR applicants stumble. Lenders don't just want the down payment. They want proof you can weather vacancies or unexpected repairs.

Typical reserve requirements:

• 3-6 months of PITIA in liquid accounts after closing

• More reserves required if you already own multiple rentals

• Some assets count (savings, stocks, bonds) while others don't (retirement accounts may count at 60-70% value)

Example: If your monthly PITIA is $2,500, plan on having $7,500-$15,000 in reserves that you don't spend on the down payment.

This isn't just a lending requirement. It's good business. Airbnb income fluctuates seasonally. Having a cushion protects your investment and lets you sleep at night when bookings slow down.

What Property Types Qualify for DSCR Loans?

DSCR loans only work for investment properties. You cannot use them for primary residences or pure vacation homes.

Eligible property types:

• Single-family homes

• Townhouses and condos (with some condo-specific restrictions)

• 2-4 unit properties (duplexes, triplexes, fourplexes)

• Short-term rentals (Airbnb, VRBO properties)

Yes, Airbnb properties absolutely qualify for DSCR loans. The key is proving the rental income.

For STRs, lenders typically:

→ Use appraiser's market rent estimate if it's a new purchase

→ Accept actual Airbnb income statements if you've operated the property 12+ months

→ Sometimes accept rental analysis from market data platforms to support higher income projections

Important note: Even if you expect $6,000/month in peak season, lenders might only count $3,500 if that's what the appraiser says a long-term tenant would pay. Be conservative in your projections, or work with STR-savvy lenders who understand how to properly underwrite Airbnb income.

DSCR Loan Documentation Checklist

DSCR loans require way less paperwork than conventional mortgages, but you still need:

For your identity and entity:

• Driver's license or passport

• If buying in an LLC: Articles of organization, EIN, operating agreement

For the property:

• Purchase contract

• Appraisal (lender orders this, but you pay for it)

• Insurance quote showing coverage amounts and annual premium

• Current lease or rent roll (if property is already rented)

For your finances:

• Recent bank statements (usually 2 months) showing down payment funds and reserves

• Credit report authorization

What you DON'T need:

✗ W-2s or pay stubs

✗ Tax returns (personal or business)

✗ Employment verification

✗ Detailed debt-to-income calculations

That missing paperwork is the whole point. Lenders focus on the property's ability to pay for itself, not your employment history.

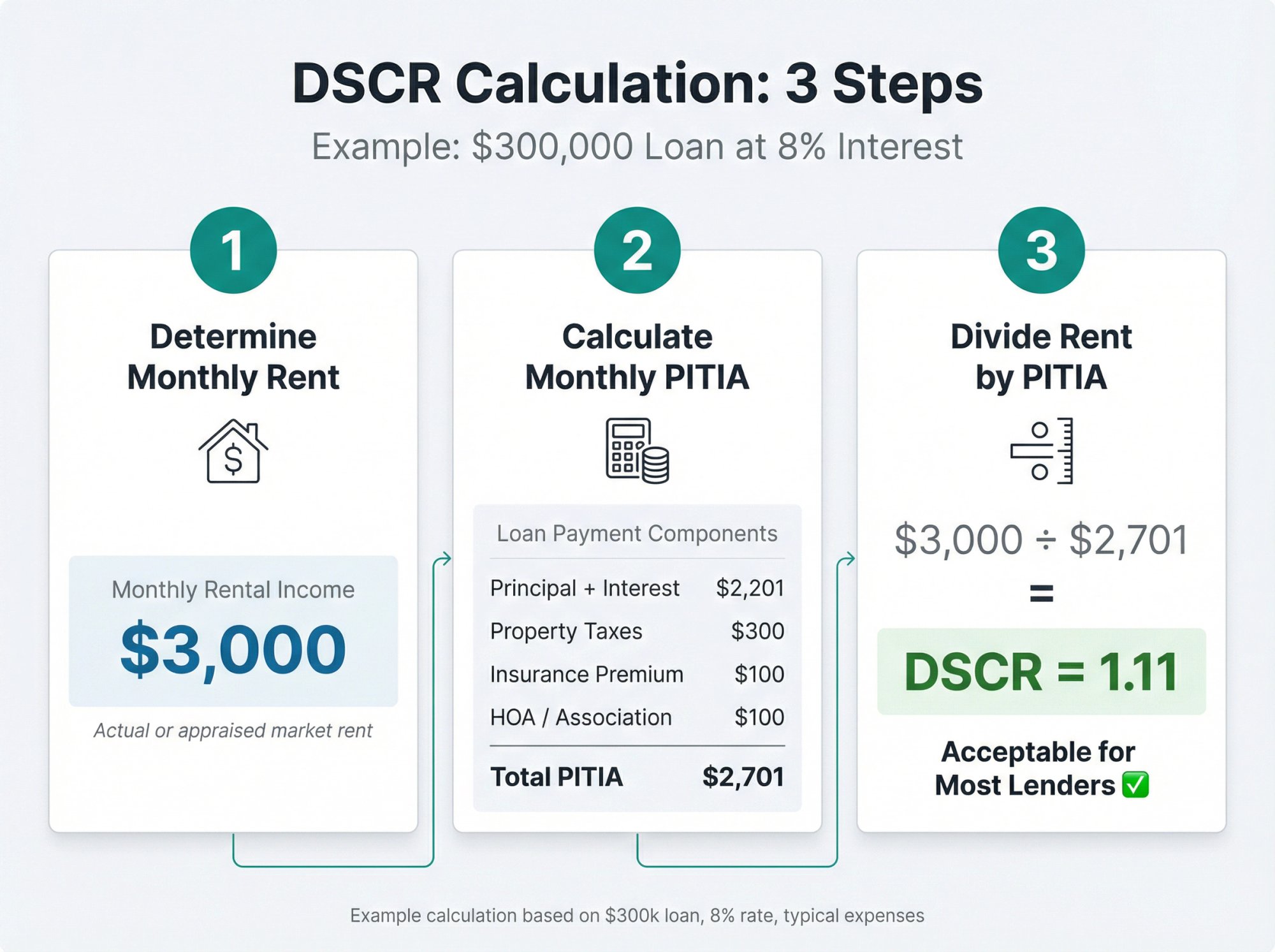

How to Calculate Your DSCR (Step-by-Step)

Every DSCR loan starts with this calculation. Let's walk through it:

① Determine Monthly Rent

→ If already rented: Use current lease amount

→ If vacant: Research comparable rentals in the area (be realistic)

→ For STRs: Use average monthly income (annual gross ÷ 12)

② Calculate Monthly PITIA

Use a mortgage calculator to estimate:

→ Principal + Interest (based on loan amount and current rates)

→ Taxes (annual property tax ÷ 12)

→ Insurance (annual premium ÷ 12)

→ Association fees (HOA, if applicable)

Example numbers for a $300,000 loan at 8% interest:

• P+I: $2,201/month

• Taxes: $300/month

• Insurance: $100/month

• HOA: $100/month

• Total PITIA: $2,701

③ Divide Rent by PITIA

$3,000 rent ÷ $2,701 PITIA = 1.11 DSCR

That's acceptable for most lenders, though not as strong as 1.25+. To improve it, you could:

• Increase down payment (smaller loan = lower payment)

• Find a property with higher rent potential

• Shop for lower insurance rates

• Look in areas with lower property taxes

Before you even start house hunting, plug realistic numbers into Chalet's ROI calculator to see which markets and property types hit your target DSCR.

Reality check: Lenders will use the appraiser's rent estimate if it's lower than your projections. Always run conservative scenarios. A deal that only works with optimistic rent assumptions is a deal that won't get financed.

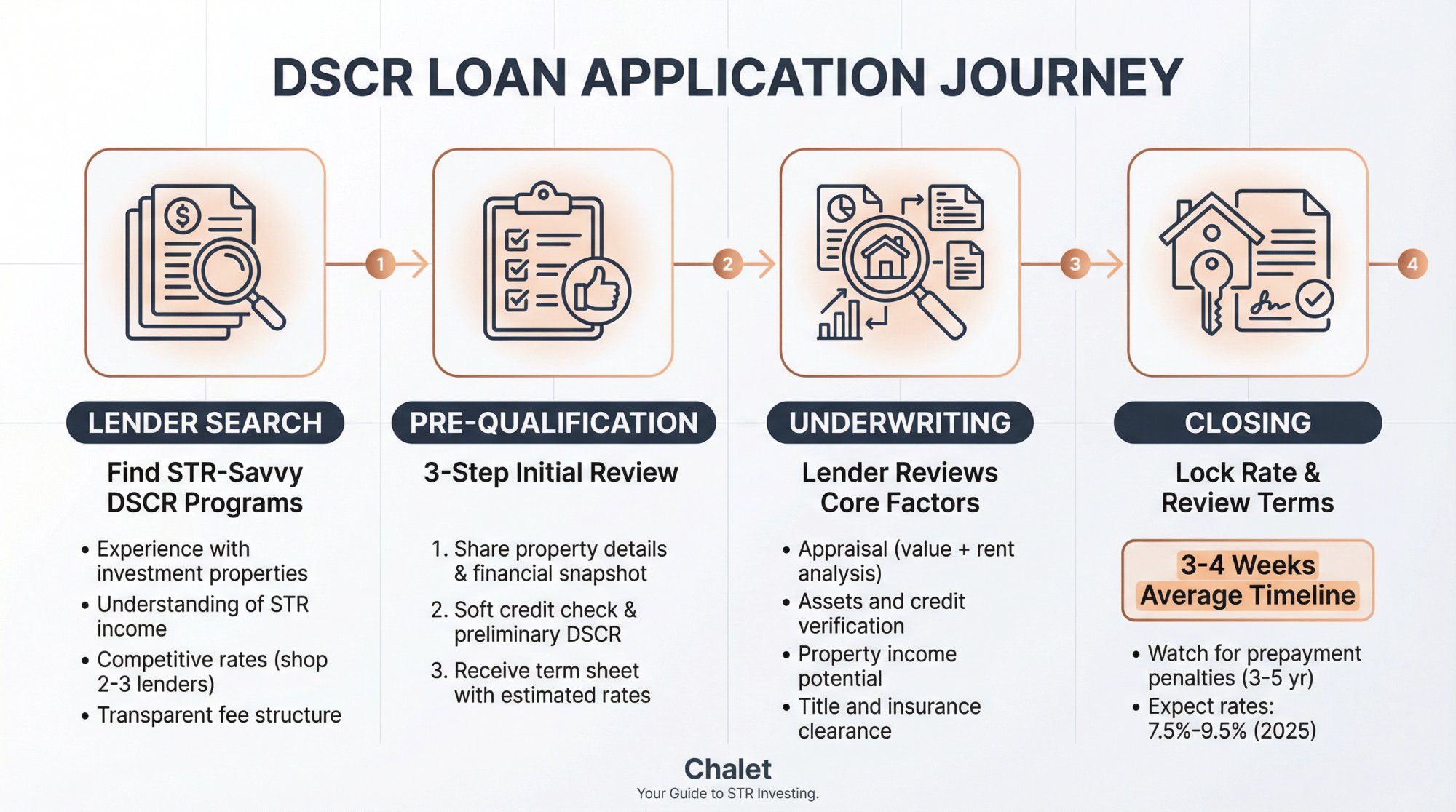

DSCR Loan Application Process: What to Expect

Once you've confirmed your numbers work, here's how DSCR loans typically flow:

How to Find the Right DSCR Lender

Not all banks offer DSCR loans. These are Non-QM (Non-Qualified Mortgage) products, usually offered by specialty lenders, credit unions, or mortgage brokers who aggregate multiple programs.

What to look for in a DSCR lender:

• Experience with investment properties in your target market

• Understanding of short-term rental income (if you're buying an Airbnb)

• Competitive rates (shop at least 2-3 lenders)

• Transparent fee structure

At Chalet, we connect investors with vetted DSCR lenders who specialize in short-term rental financing. They understand how to properly underwrite Airbnb income and which appraisers can support STR valuations.

Pre-Qualification and Application

Step 1: Share property details and your financial snapshot. Lender runs soft credit check and calculates preliminary DSCR.

Step 2: If numbers look good, they issue a prequalification or term sheet showing estimated rate, fees, and loan amount.

Step 3: You submit full application with all documents listed earlier. Lender orders appraisal.

Underwriting and Approval

The underwriter reviews:

• Appraisal (value + rent analysis)

• Your assets and credit

• Property's income potential

• Title and insurance

Because there's no income verification, DSCR loans often move faster than conventional mortgages. Many close within 3-4 weeks if your documents are ready.

Closing

Once approved, you'll lock your rate and review final terms. Key items to watch:

Prepayment penalties. Many DSCR loans include 3-5 year prepayment penalties (fees if you refinance or pay off the loan early). Some lenders offer no-penalty options at a slightly higher rate. Choose based on your timeline.

Interest rates. DSCR loans typically run 0.5-1.5% higher than conventional investment property loans. In late 2024/early 2025, expect rates in the 7.5%-9.5% range depending on your credit and DSCR.

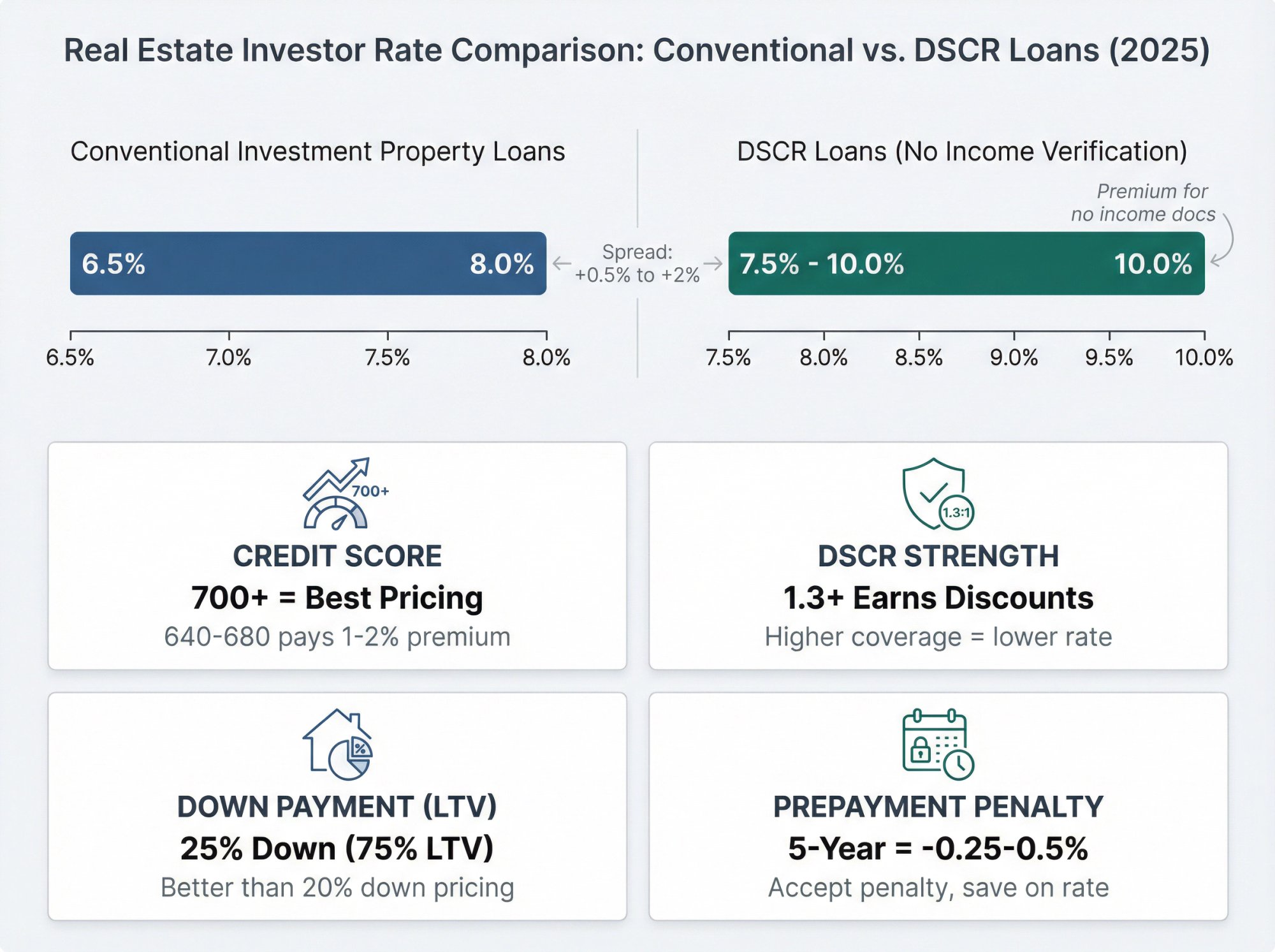

DSCR Loan Interest Rates and Terms for 2026

Let's talk actual numbers. DSCR loans cost more than owner-occupant mortgages, but they're still competitive for investors who can't qualify conventionally.

Current rate environment (2026):

• Conventional investment property loans: ~6.5-8.0%

• DSCR loans: ~7.5-10.0%

The spread exists because DSCR loans carry more risk for lenders. No income verification means they rely entirely on the property's performance.

What influences your specific rate:

Credit score → 700+ gets best pricing; 640-680 pays premium

DSCR strength → 1.3+ often earns rate discounts

LTV ratio → 75% LTV (25% down) beats 80% LTV pricing

Prepayment terms → Accepting a 5-year penalty can save 0.25-0.5% on rate

Loan structure options:

Most DSCR loans offer:

• 30-year fixed (most common, predictable payments)

• 5-7 year ARMs (lower initial rate, adjusts later)

• Interest-only periods (first 10 years, then fully amortizing)

• 40-year amortization (lower payment, slower equity build)

For most Airbnb investors, a 30-year fixed makes sense. STR income already fluctuates with seasons and bookings. A stable mortgage payment removes one variable.

Rate shopping tips:

Compare APR, not just rate. Some lenders advertise low rates but charge 2-3 points upfront. Others have higher rates but minimal fees.

At Chalet, our lending partners compete for your business. We can show you side-by-side rate comparisons from multiple DSCR programs so you're not leaving money on the table.

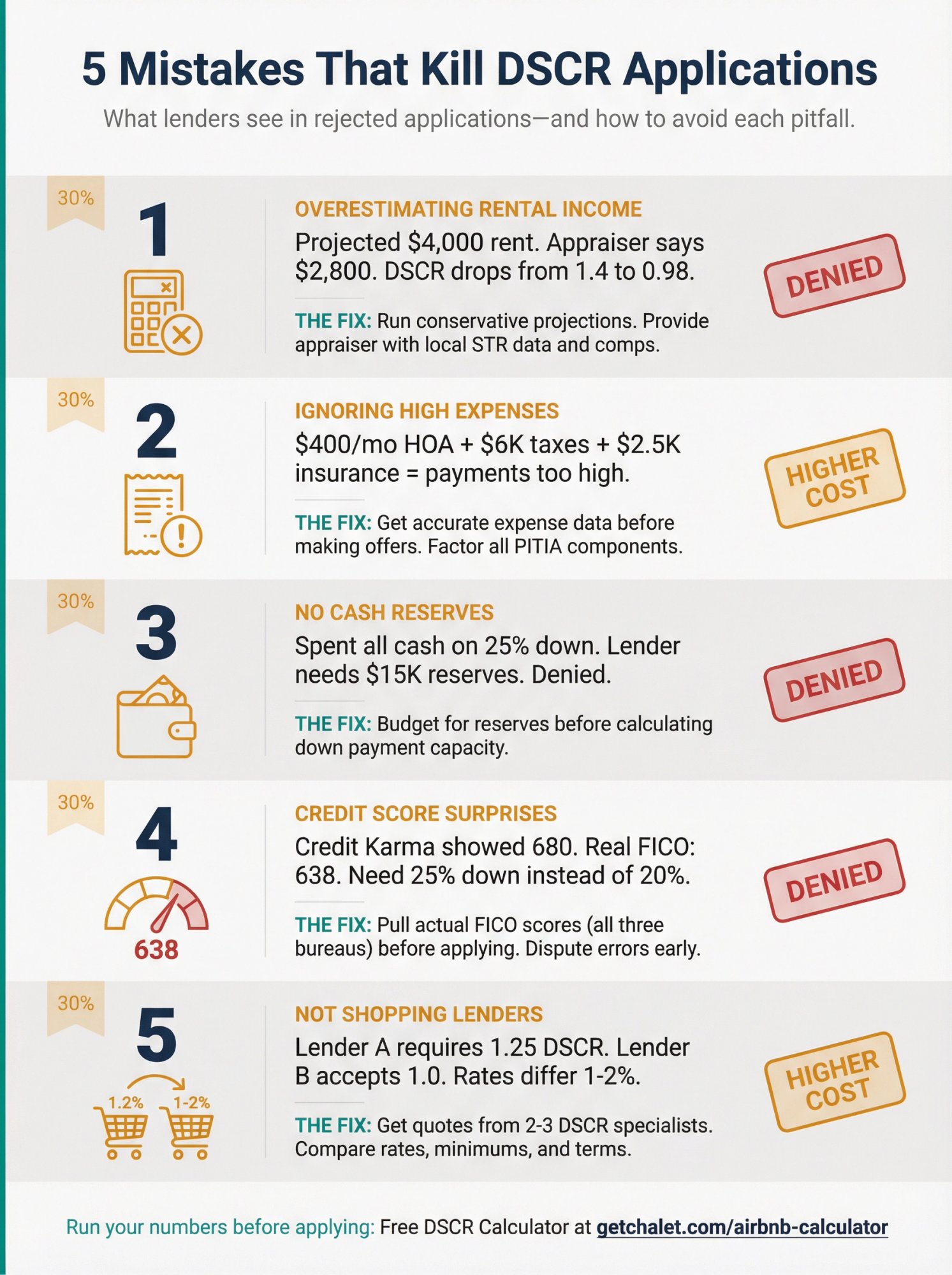

5 Mistakes That Kill DSCR Loan Applications

We've watched hundreds of DSCR deals come together (and a few fall apart). Here's what sinks applications:

Mistake #1: Overestimating Rental Income

The problem: You think a property can rent for $4,000 based on peak Airbnb months. The appraiser says market rent is $2,800 based on comparable long-term leases. Lender uses the lower number. Your DSCR drops from 1.4 to 0.98. Application denied.

The fix: Run conservative projections from day one. If buying an STR, provide the appraiser with local Airbnb data showing actual nightly rates and occupancy. Work with STR-experienced appraisers who understand how to properly value short-term rental income.

Mistake #2: Ignoring High Expenses

Your DSCR looks great until you remember the property has:

• $400/month HOA dues

• $6,000 annual property taxes

• $2,500 annual insurance (coastal or vacation property premiums)

All of that factors into PITIA. Higher expenses = higher monthly payment = lower DSCR.

The fix: When analyzing deals, get accurate expense data before making offers. Some markets have brutal tax rates that kill cash flow. Use Chalet's market analytics to understand local tax and insurance costs.

Mistake #3: No Cash Reserves Left After Down Payment

You scrape together 25% down plus closing costs, then have $1,200 in the bank. Lender asks for 6 months reserves ($15,000). You don't qualify.

The fix: Budget for reserves before calculating how much house you can afford. If you have $100k available, and need $15k in reserves, you really have $85k for down payment and closing costs.

Mistake #4: Credit Score Surprises

You checked Credit Karma and saw 680. Lender pulls your actual FICO and finds 638 because of a late payment you forgot about. Now you need 25% down instead of 20%, or you're denied entirely.

The fix: Pull your actual FICO scores (all three bureaus) before applying. Dispute errors immediately. Don't open new credit or make big purchases during the application period.

Mistake #5: Not Shopping Lenders

DSCR loan terms vary wildly. One lender might require 1.25 DSCR minimum while another accepts 1.0. Rates can differ by 1-2% for the same borrower profile.

The fix: Get quotes from at least 2-3 DSCR specialists. Or work with a platform like Chalet that connects you to multiple pre-vetted lenders at once.

How Chalet Simplifies the Entire DSCR Process

If you've made it this far, you understand DSCR qualification. Now here's how we help you execute it faster:

→ Free analytics to find properties that actually qualify

Before you even talk to a lender, use Chalet's market dashboards to identify markets where rental income supports DSCR minimums. See actual occupancy rates, average daily rates, and revenue estimates based on real Airbnb data.

→ DSCR calculator that shows you exactly where you stand

Our ROI and DSCR calculator lets you plug in any property address and see:

→ Estimated rental income (long-term and STR projections)

→ Expected PITIA breakdown

→ Calculated DSCR

→ Cash-on-cash return

→ Whether you'll likely qualify for financing

→ Connections to vetted STR-friendly lenders

Not all DSCR lenders understand short-term rentals. The ones in Chalet's lending network do. They know how to:

• Properly underwrite Airbnb income

• Work with appraisers who understand STR valuations

• Get deals closed on tight timelines (critical for 1031 exchanges)

→ One platform for everything else you'll need

Once you secure financing, Chalet also connects you to:

• Real estate agents who specialize in investment properties

• Insurance providers who cover STRs (often tricky to find)

• Property managers and cleaning services

• Furnishing and setup vendors

• CPAs who understand STR tax strategies (including cost segregation)

It's everything you need to go from research to revenue-generating rental in one place.

Your DSCR Loan Pre-Qualification Action Plan

Here's your action plan:

① Run your numbers

Use Chalet's free DSCR calculator to see if your target property hits lender minimums. Adjust down payment or find higher-income properties if needed.

② Check your financial readiness

• Pull credit reports (aim for 660+ if possible)

• Calculate available cash for down payment + reserves

• Gather 2 months of bank statements

③ Connect with a DSCR lender

Get introduced to Chalet's lending partners who specialize in Airbnb financing. They can prequalify you in days and show you realistic rates based on your scenario. Want a direct line? Connect with a DSCR specialist here.

④ Start analyzing properties

Use Chalet's market data to find markets where rentals actually cash flow at current interest rates. Look for properties where the DSCR hits 1.25+ with your down payment capacity.

⑤ Move fast when you find the right deal

DSCR loans can close in 3-4 weeks. Having your documents ready and a lender lined up means you won't lose properties to faster buyers.

The opportunity window for DSCR financing is wide open. More lenders are entering the space, rates are stabilizing, and STR income is increasingly accepted as legitimate underwriting data.

Stop letting your personal finances limit your portfolio growth. Let the property qualify itself.

Ready to explore DSCR financing for your next Airbnb? Connect with our lending team at Chalet and see what you can qualify for today. Or get matched with STR-friendly lenders now.

DSCR Loan Qualification FAQs

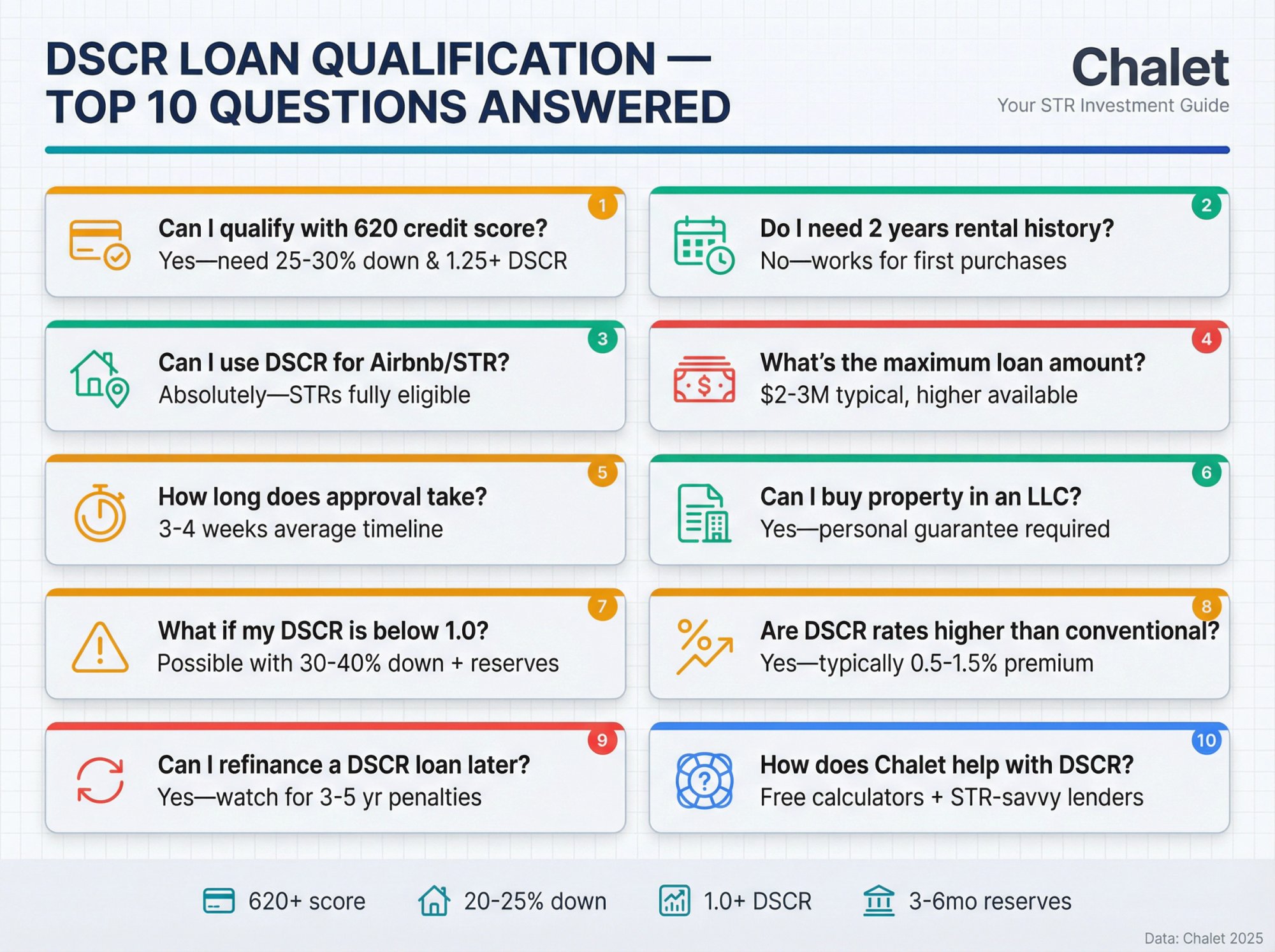

Can I get a DSCR loan with a 620 credit score?

Yes, but it depends on the rest of your profile. Most DSCR lenders set minimums between 620-660. At 620, expect to need:

• Higher down payment (25-30% instead of 20%)

• Stronger DSCR (1.25+ vs. 1.0 minimum)

• Larger cash reserves

• Higher interest rates

If your score is 620-640, focus on improving it to 660+ before applying. Even a 20-point increase can save you thousands in interest over the loan term.

Do I need 2 years of rental history to qualify?

No. That's a common myth.

DSCR loans work for brand new investment property purchases. If the property is vacant or you've never owned a rental, lenders use the appraiser's market rent estimate to calculate DSCR.

If the property is already rented, having an active lease helps support the income number. For existing Airbnbs, 12-24 months of booking history strengthens your application but isn't required.

Can I use a DSCR loan for a short-term rental (Airbnb)?

Absolutely. Short-term rentals are eligible.

The challenge is income documentation. Lenders will either:

→ Use appraiser's long-term market rent (conservative approach)

→ Accept actual Airbnb income if you have 12+ months of history

→ Sometimes consider STR income projections from analytics tools

Work with STR-experienced lenders who know how to properly underwrite vacation rental income. Generic lenders often default to conservative long-term rent figures, which can undervalue your property's true earning potential.

What's the maximum loan amount for DSCR loans?

Most DSCR programs go up to $2-3 million. Some specialty lenders will go higher for experienced investors with strong financials.

There's also typically a minimum loan size of around $100,000. If you're buying a very cheap property, you might not meet the floor.

How long does DSCR loan approval take?

3-4 weeks on average from application to closing.

DSCR loans often move faster than conventional mortgages because there's no employment or income verification. The main timeline factors are:

• Appraisal turnaround (7-14 days typically)

• How quickly you provide documents

• Complexity of the property or your entity structure

Some DSCR lenders offer "rush" underwriting for 1031 exchange investors facing tight deadlines.

Can I put the property in an LLC?

Yes. Most DSCR lenders allow LLC ownership.

You'll need to provide:

• LLC articles of organization

• EIN letter from the IRS

• Operating agreement showing you have authority to act

• Personal guarantee (most DSCR lenders require this)

Keep in mind: even though the LLC owns the property, you'll still personally guarantee the loan in most cases. The lender checks your personal credit and requires you to backstop the debt.

What if my DSCR is below 1.0?

You can still potentially get approved, but expect:

• Much higher down payment (30-40%) to bring the loan payment down

• Significant cash reserves (12+ months)

• Excellent credit (700+)

• Higher interest rates

Some lenders simply won't approve DSCR below 1.0. Those that do want to see clear evidence of why the property makes sense despite negative cash flow (like exceptional appreciation potential or planned rent increases).

Better strategy: Find a property with stronger income, or increase your down payment to improve the DSCR before applying. Use Chalet's calculator to model different scenarios.

Are DSCR loan rates higher than conventional investment property rates?

Yes, typically 0.5-1.5% higher.

In 2026, conventional investment loans might be 6.5-8%, while DSCR loans run 7.5-10%.

The premium reflects the added risk lenders take by not verifying your income. But that trade-off is worth it if:

• You can't qualify conventionally due to DTI limits

• You're self-employed with complex tax returns

• You want to scale beyond conventional lending limits

Calculate whether the slightly higher rate still leaves you with acceptable cash flow. Often it does, especially for high-performing Airbnb properties.

Can I refinance a DSCR loan later?

Yes, but watch for prepayment penalties.

Many DSCR loans include 3-5 year prepayment penalties. If you refinance during that window, you'll owe a fee (often 1-5% of the loan balance depending on how early you exit).

Some lenders offer no-prepayment options if you accept a slightly higher rate. Choose based on how long you plan to hold the property.

After the penalty period expires, you can refinance to a new DSCR loan, conventional loan (if you now qualify), or whatever makes sense at that time.

How does Chalet help with DSCR qualification?

Chalet is built specifically for short-term rental investors like you. We help at every stage:

Before you apply:

→ Free DSCR calculator to model your qualification

→ Market analytics to find properties that cash flow

→ ROI projections so you know if deals work at current rates

During financing:

→ Direct connections to STR-savvy DSCR lenders who understand Airbnb income

→ Lenders experienced with 1031 exchanges (if that's your situation)

→ Rate shopping across multiple programs

After you close:

→ Property management connections

→ Furnishing and setup vendors

→ Insurance providers who actually cover STRs

→ CPA referrals for tax strategy

It's the entire ecosystem in one platform, which means faster execution and fewer dropped balls.

Ready to see what you can qualify for? Get started with Chalet today.