Yes, you absolutely can get a mortgage for an Airbnb property. Investors finance short-term rentals (STRs) every day using mortgages designed specifically for rental investments.

The question isn't whether you can get financing. It's understanding which type of mortgage matches how you'll actually use the property.

Here's what determines your options: Will you live there? and Do you need the property's income to qualify? Those two questions shape everything about the loan you can get.

In this guide, we'll walk through exactly how Chalet helps STR investors like you find the right financing path, what each mortgage option actually requires, and how to avoid the traps that kill deals in underwriting.

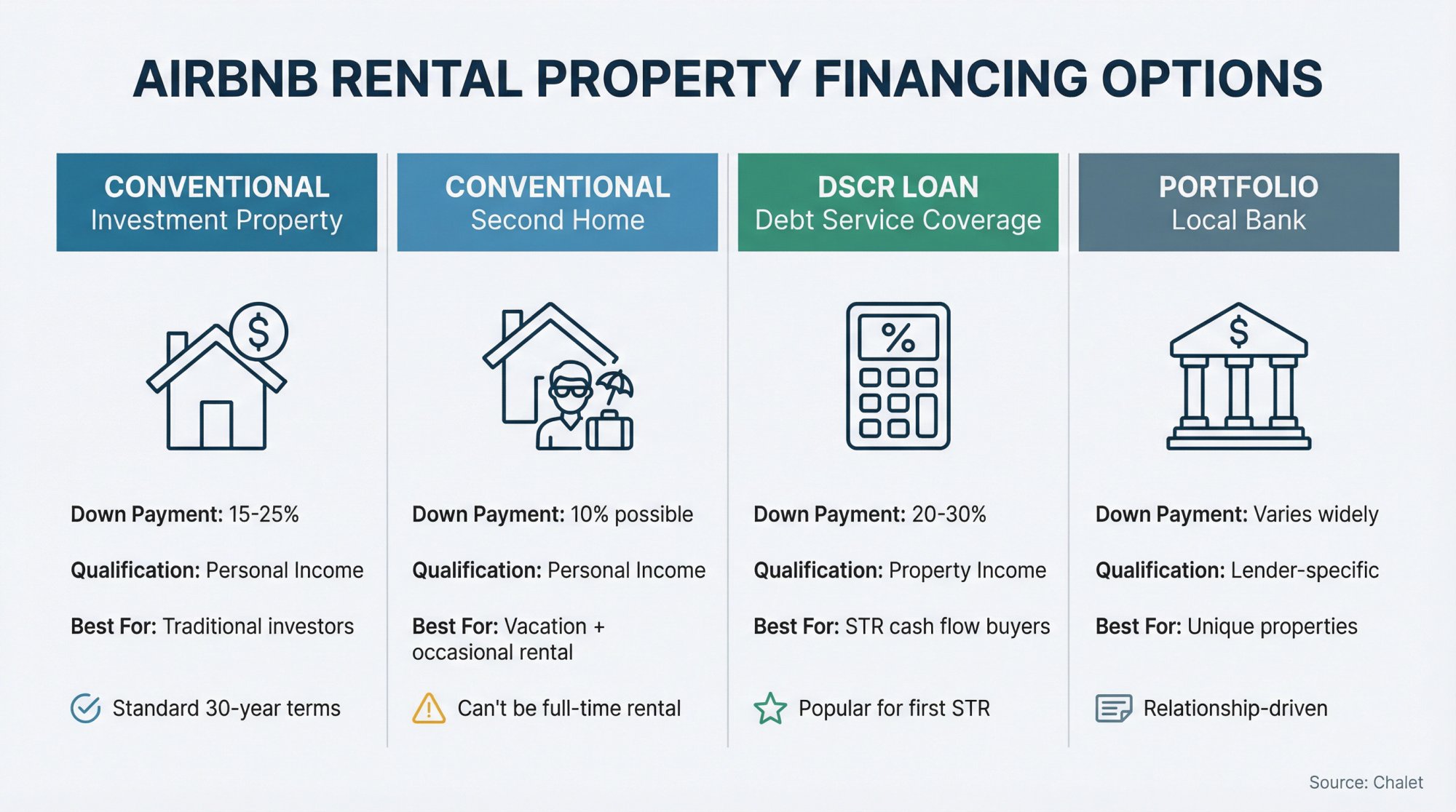

4 Mortgage Options for Airbnb Properties in 2026

When you're buying a property to rent on Airbnb, you have four main financing paths:

1. Conventional mortgage (investment property classification)

This is the traditional route most people think of first. You'll use your personal income to qualify, put down 15-25%, and get a standard 30-year mortgage at investment property rates.

2. Conventional mortgage (second home classification)

This only works if you'll genuinely use the home as a vacation property for yourself. You can rent it occasionally, but the primary purpose must be personal use, not rental income.

3. DSCR loan (debt-service coverage ratio)

Increasingly popular with STR investors because you qualify based on the property's projected income, not your W-2. If the rent covers the mortgage payment (plus taxes and insurance), you can get approved.

4. Portfolio or local bank financing

Common for larger portfolios, unique properties, or situations where agency guidelines don't fit. Terms vary widely based on the lender relationship.

The wrong approach? Trying to squeeze a full-time Airbnb into a primary residence or second-home loan by pretending you won't rent it. That's not clever financing. It's misrepresentation that can blow up during underwriting or trigger your loan terms later.

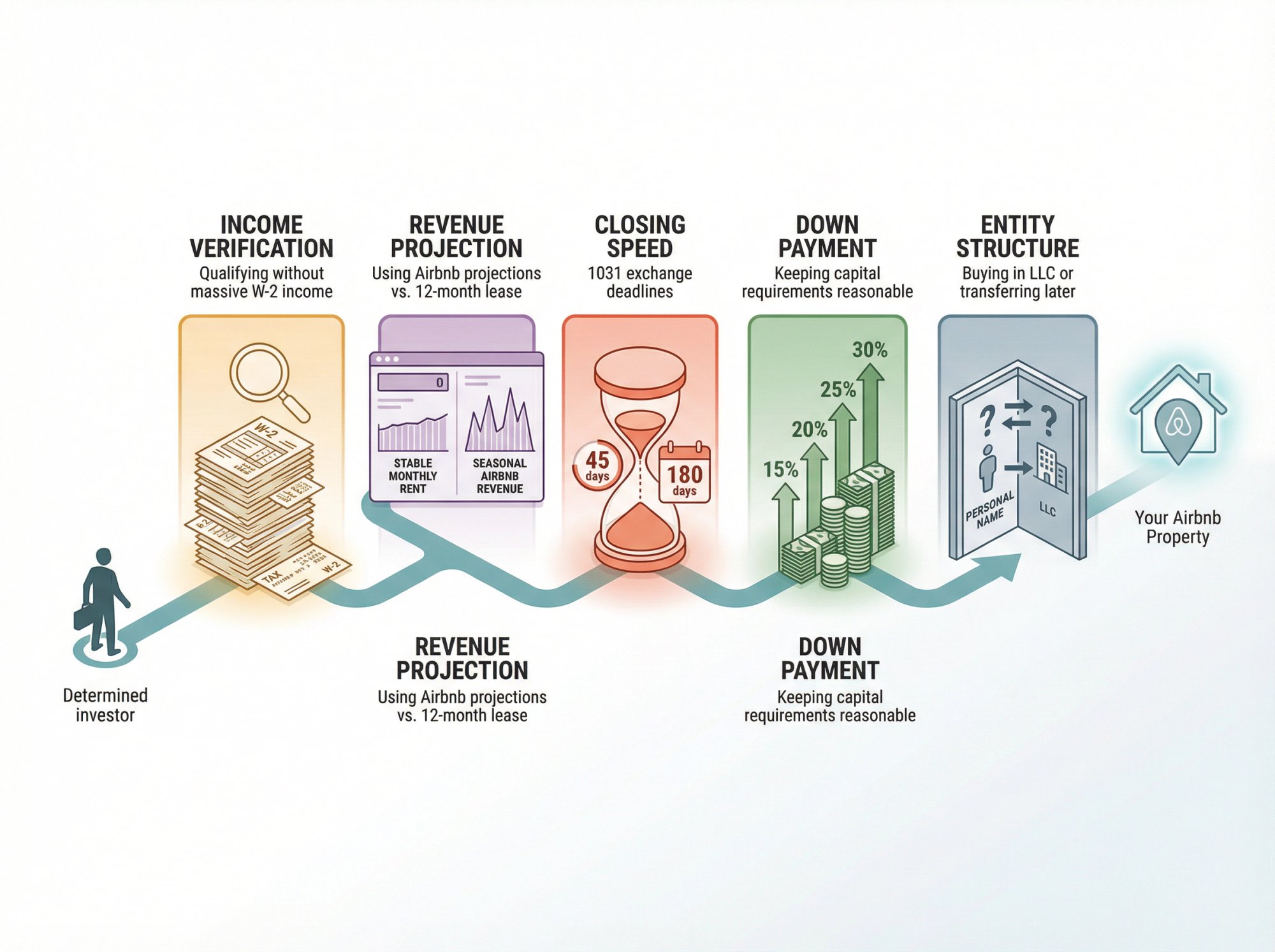

Why Getting an Airbnb Mortgage Feels Complicated

Most people Googling "can you get a mortgage for an Airbnb" aren't just asking if it's possible. They're trying to solve specific problems:

• Get approved even without massive W-2 income

• Use projected Airbnb revenue (not just a 12-month lease) to qualify

• Close quickly, especially for 1031 exchange deadlines

• Keep the down payment reasonable

• Buy in an LLC or transfer to one later

This guide gets you to a plan you can execute with a lender, not just a yes/no answer.

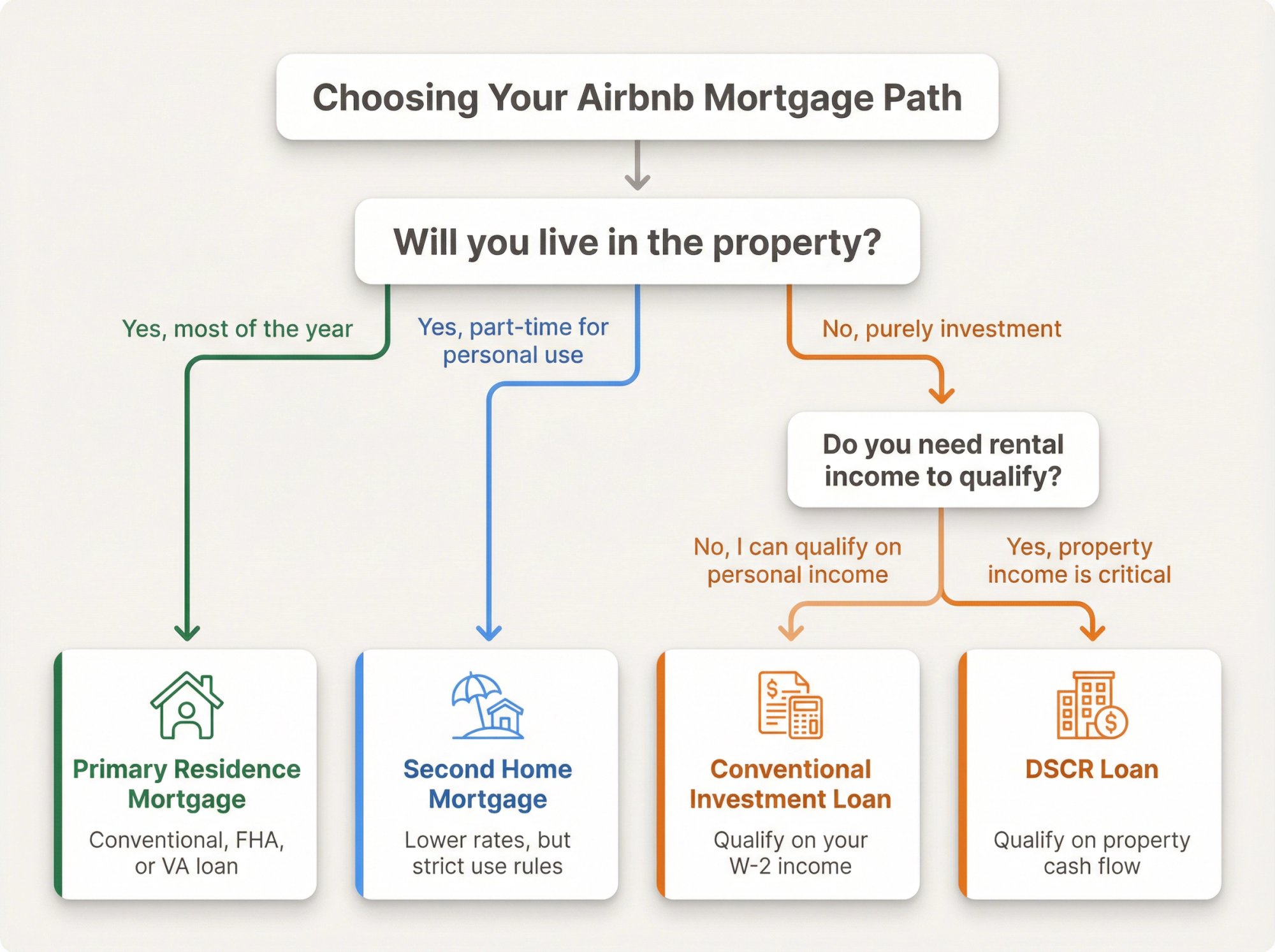

How to Choose the Right Airbnb Mortgage Type

Will you live there?

Yes, most of the year → Primary residence mortgage (conventional, FHA, VA)

You can house-hack by renting rooms or other units, but you must actually occupy the property. Buying a 2-4 unit property and living in one unit while renting the others is a common first-time investor strategy.

Yes, but only part of the year for personal use → Second home mortgage might fit

This works only if it's truly for your vacations. The moment it becomes a managed rental property, lenders classify it differently.

No, this is purely an investment → Investment property or DSCR loan

This is the honest classification for a full-time Airbnb rental. No occupancy requirement, but higher rates and bigger down payments.

Do you need the rental income to qualify?

No, I can qualify on my personal income → Conventional investment loan often works best

You'll get better rates than specialty loans, though you'll still face strict documentation requirements.

Yes, the property income is critical → DSCR loan is usually the cleanest path

This is especially true for first-time Airbnb buyers who don't have 12+ months of documented STR income history yet.

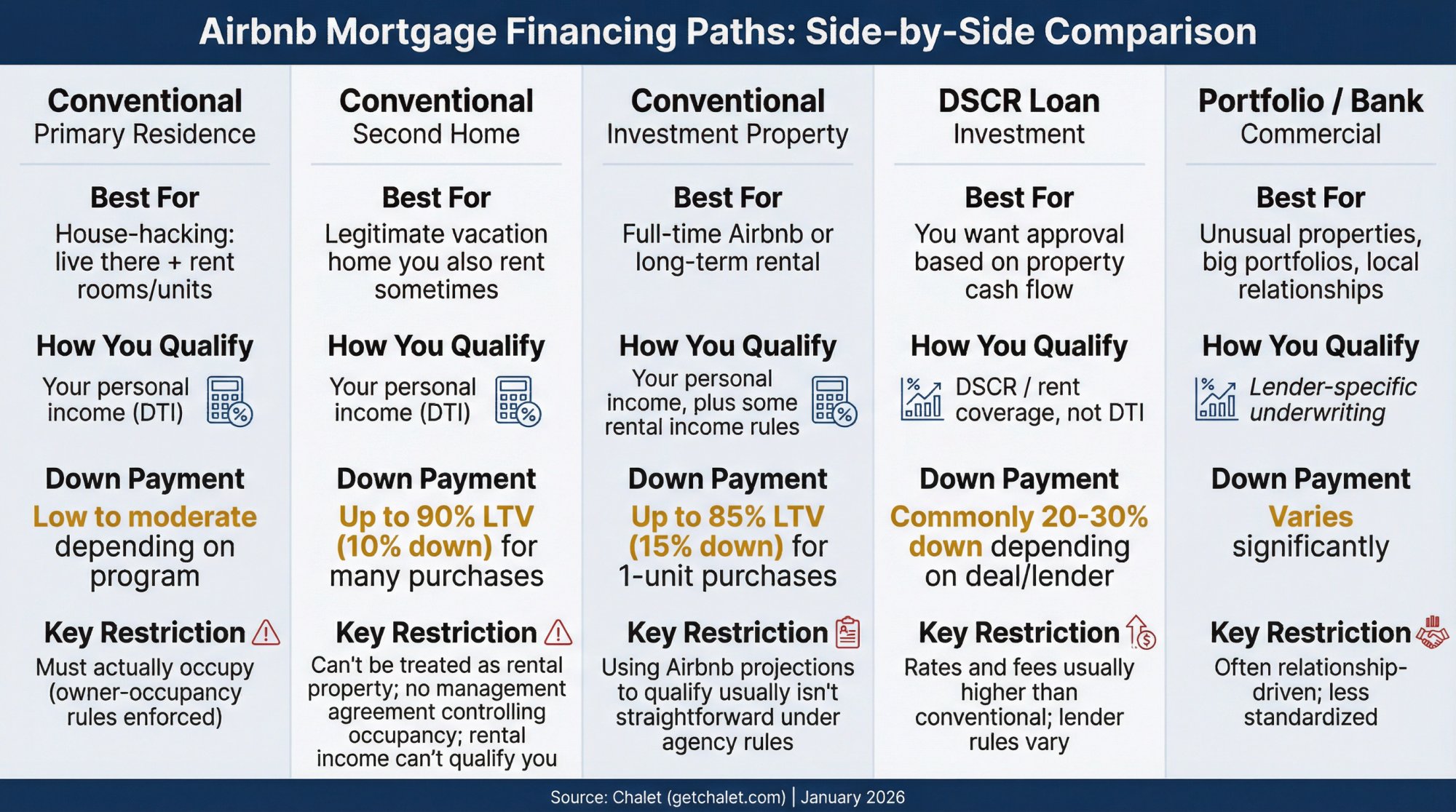

Airbnb Mortgage Options Compared: Which Loan Type Is Best?

Here's how the main financing paths compare for an Airbnb rental:

| Financing Path | Best For | How You Qualify | Down Payment Reality | Key Gotcha |

|---|---|---|---|---|

| Conventional (primary residence) | House-hacking: live there + rent rooms/units | Your personal income (DTI) | Can be low depending on program | Must actually occupy (owner-occupancy rules enforced) |

| Conventional (second home) | Legitimate vacation home you also rent sometimes | Your personal income (DTI) | Agencies allow up to 90% LTV (10% down) for many purchases | Can't be treated as a rental property; no management agreement controlling occupancy; rental income can't qualify you |

| Conventional (investment property) | Full-time Airbnb or long-term rental | Your personal income, plus some rental income rules | Agencies allow up to 85% LTV (15% down) for 1-unit purchases | Using Airbnb projections to qualify usually isn't straightforward under agency rules |

| DSCR loan (investment) | You want approval based on property cash flow | DSCR / rent coverage, not DTI | Commonly 20-30% down depending on deal/lender | Rates and fees usually higher than conventional; lender rules vary |

| Portfolio / bank / commercial | Unusual properties, big portfolios, local relationships | Lender-specific underwriting | Varies significantly | Often relationship-driven; less standardized |

Source: Chalet. Compiled from agency guidance and lender program norms as of January 2026.

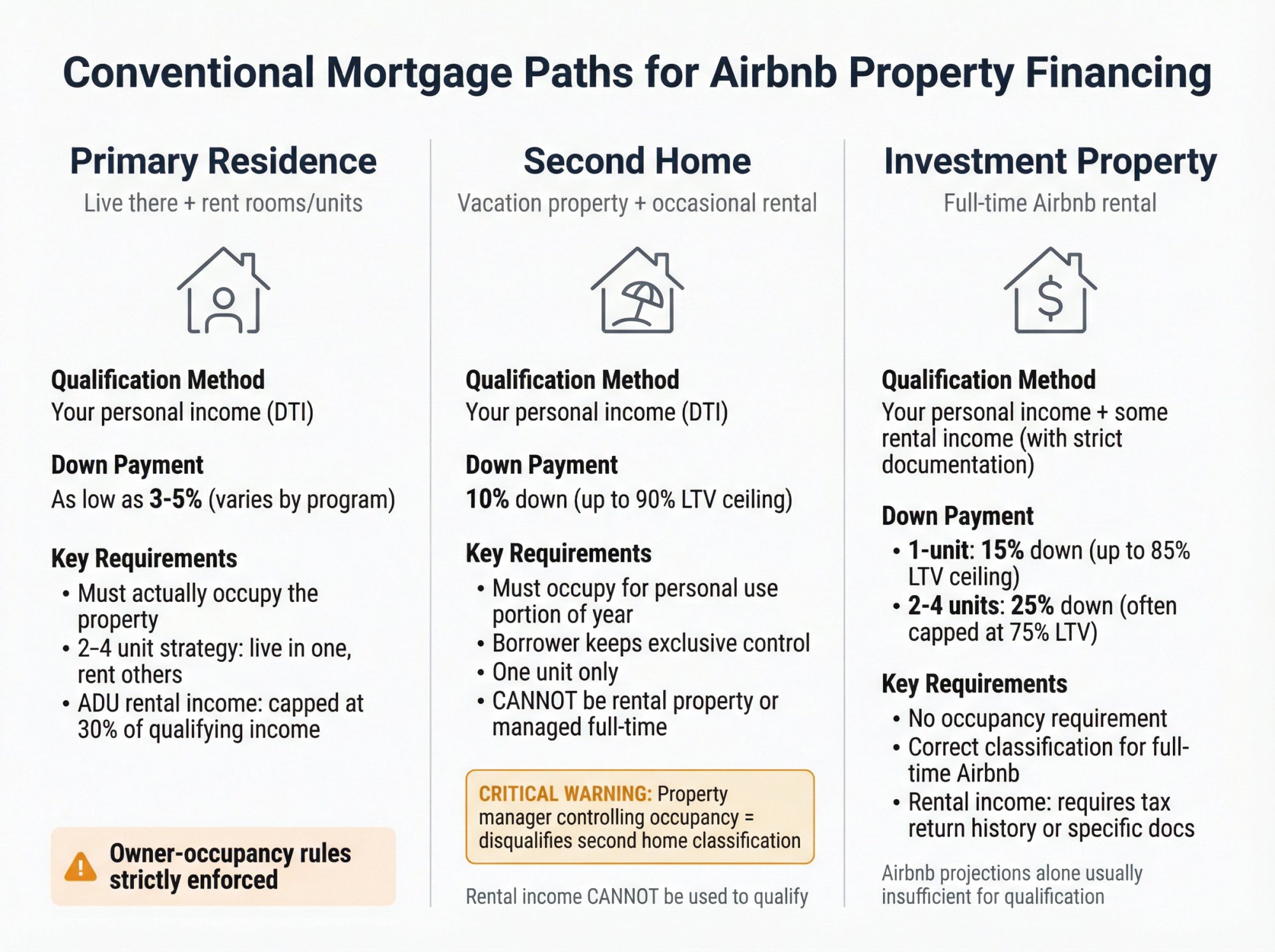

Conventional Loan Requirements for Airbnb Rentals

Conventional loans follow Fannie Mae or Freddie Mac standards. For Airbnb investors, the occupancy classification determines everything.

Can You Get a Conventional Loan If You Live in the Airbnb?

This path works cleanly if you'll actually live in the home and maybe rent out a room, an ADU, or another unit.

Important nuance: Even when you live there, rental income from your one-unit primary residence generally can't qualify you for the mortgage (with limited exceptions like an existing ADU). Fannie is explicit about what rental income is eligible versus ineligible.

The Airbnb-friendly primary residence play:

Buy a 2-4 unit property, live in one unit, rent the others. Fannie explicitly allows rental income from a 2-4 unit primary residence where you occupy one unit.

ADU angle: If your one-unit home has an existing ADU, Fannie allows using ADU rental income to qualify, but caps it at 30% of your total qualifying income.

Can You Get a Second Home Loan for an Airbnb Rental?

People want this classification because pricing is often better than investment property rates. But it's tightly defined.

Fannie's second home requirements include:

• Borrower occupies it for some portion of the year

• One unit only

• Borrower has exclusive control

• Must not be rental property or a timeshare arrangement

• Can't be subject to agreements giving a management firm control over occupancy

Here's the nuance most blogs miss: Fannie also says that if the lender identifies rental income, the loan can still be eligible as a second home as long as that income isn't used for qualifying and the rest of the second-home requirements are met.

What that means in practice:

Occasional renting may be compatible with a second-home loan if you still genuinely use it as a vacation property, you keep control, and you're not handing over occupancy to a manager.

But if it's a professionally managed, full-time Airbnb? Underwriters will treat that as investment use, even if you "plan" to visit once a year.

Critical Second Home Warning: The moment you hand over booking control to a property manager, you're in investment territory. Many Airbnb management contracts effectively control occupancy through pricing, booking, minimum stays, and calendars. That creates a classification mismatch that can trigger loan violations.

Down payment reality: Second-home purchases can go up to 90% LTV (10% down) in many cases. Treat this as the ceiling, not a guarantee, since you'll see lender overlays in practice.

How Much Down Payment for an Airbnb Investment Property?

This is the correct conventional classification for a full-time Airbnb rental.

Down payment reality:

• 1-unit investment purchase: up to 85% LTV (15% down) in many cases

• 2-4 unit investment purchase: often capped at 75% LTV (25% down)

Again, these are ceilings, not promises.

Can You Use Airbnb Income to Qualify on a Conventional Loan?

Sometimes, but it's not as simple as pointing to your market projection that says you'll make $8,000 per month.

Fannie's rental income documentation is built around (source: Fannie Mae Selling Guide):

• Your tax returns (Schedule E / Form 8825), or

• A lease agreement in specific justified scenarios, or

• An appraisal-based rental schedule when the subject property generates rental income

That system was designed for long-term rent. Airbnb income is spiky and seasonal, so conventional underwriters typically want history.

Translation: If you're buying your first Airbnb and you need the Airbnb income to qualify, conventional underwriting is often the wrong tool.

What Is a DSCR Loan and How Does It Work for Airbnbs?

A DSCR loan asks one question: Does this property's income cover the mortgage payment?

Instead of your personal debt-to-income ratio, DSCR underwriting looks at the property as an asset.

The math is straightforward: DSCR = monthly rent ÷ monthly PITIA (principal, interest, taxes, insurance, association dues).

Why DSCR Loans Are Popular for Airbnb Financing

You can often qualify without documenting personal income the way a conventional lender requires. Many DSCR programs are designed specifically for short-term rentals and will consider Airbnb-style income methods.

DSCR Loan Requirements for Airbnb Properties

These vary significantly, but here are ranges you'll see repeatedly:

→ Minimum DSCR: Often falls between 1.0 and 1.25 (higher DSCR generally means easier approval and better pricing)

→ Down payment: Commonly 20-30% depending on the lender, property, and DSCR strength

What DSCR Lenders Use as "Income" for an Airbnb

This is lender-specific, but you'll see a few patterns:

• Some use actual trailing revenue (bank statements, platform statements)

• Some use market data projections (analyzing comparable properties in the area)

Don't assume anything. Ask your lender directly: "For an Airbnb rental, what exact document are you using to determine monthly rent for the DSCR calculation?"

The Honest Tradeoff

DSCR is usually easier on qualification, but the cost is higher: rates and fees are often elevated compared to conventional because these are typically non-QM or business-purpose style loans.

Is the tradeoff worth it? For most first-time STR buyers who need property income to qualify, absolutely. The alternative is not getting financing at all.

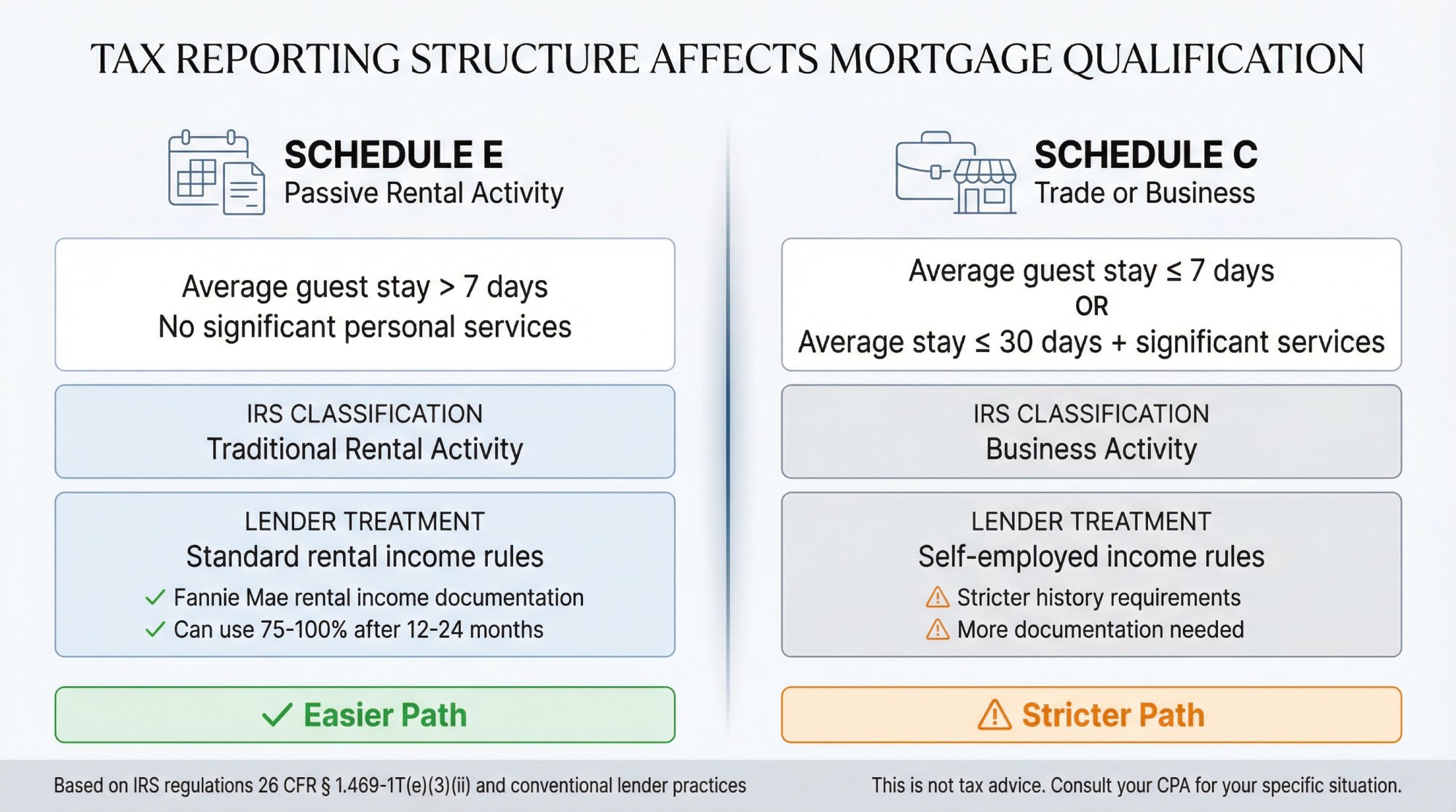

How Tax Reporting Affects Your Airbnb Mortgage Approval

Here's an under-discussed wrinkle: How your Airbnb income appears on your tax return can change how a lender can use it.

For taxes, some short-term rental setups are treated more like a business than a "rental activity." According to IRS regulations (26 CFR § 1.469-1T(e)(3)(ii)), an activity isn't a rental activity if:

• The average period of customer use is 7 days or less, or

• The average period is 30 days or less and you provide significant personal services

Why you should care (even if you're not doing tax gymnastics):

Conventional underwriters often look for rental income on Schedule E and apply specific rental-income rules. If your Airbnb activity ends up on Schedule C (trade/business), some lenders treat that as self-employed income, which can mean stricter history requirements.

This isn't tax advice. It's a heads-up that your tax reporting structure affects your financing options.

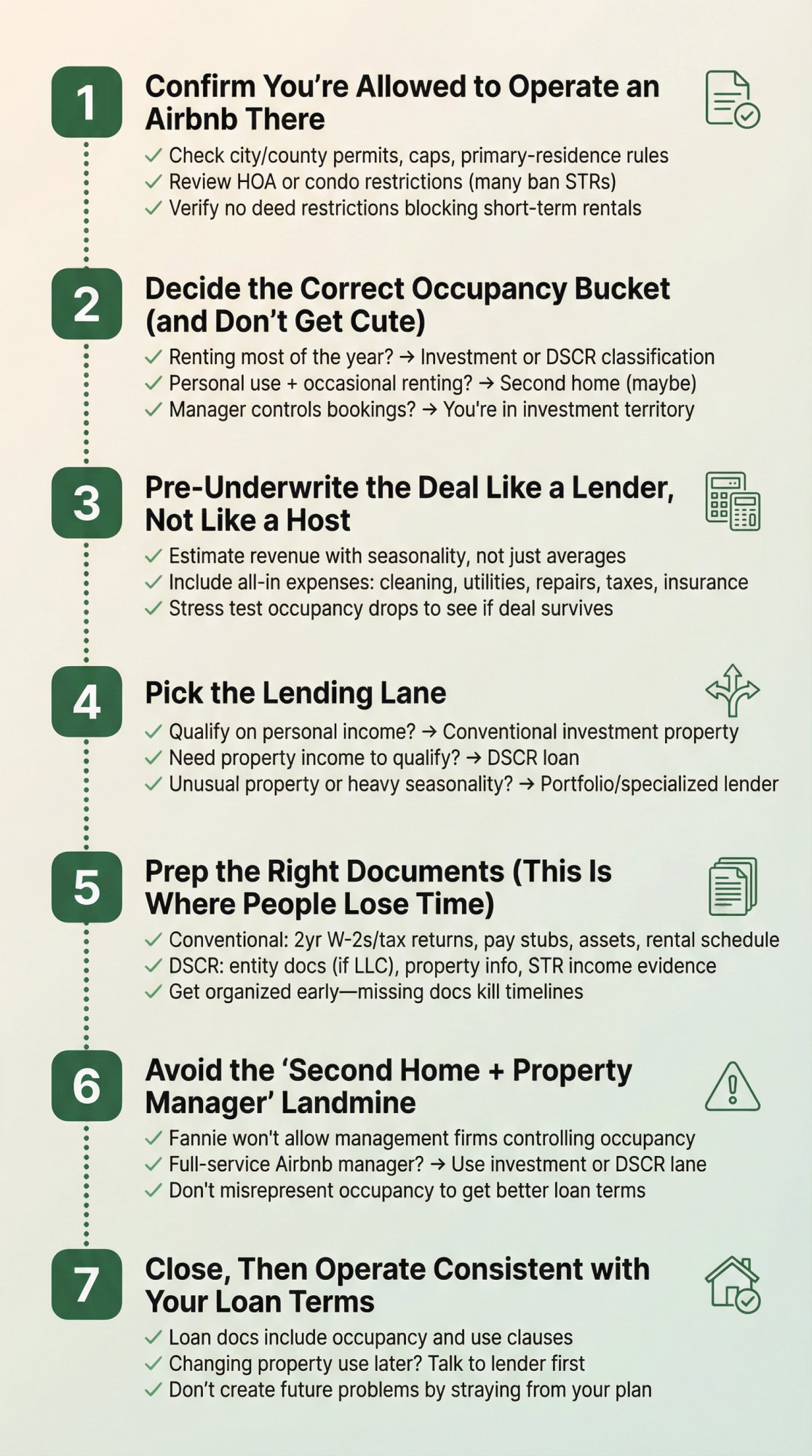

How to Get an Airbnb Mortgage: Step-by-Step Guide

Step 1: Confirm You're Allowed to Operate an Airbnb There

Before you talk loans, confirm the basics:

① City and county rules (permits, caps, primary-residence-only requirements)

② HOA or condo restrictions (many ban or limit short-term rentals)

③ Any property-specific restrictions in the deed

We've built a comprehensive regulation library you can search by market. Check local STR regulations on Chalet to see what's actually allowed before you make an offer.

Step 2: Decide the Correct Occupancy Bucket (and Don't Get Cute)

Use this test:

Renting it most of the year? → Investment property or DSCR classification

Personally using it and renting sometimes, keeping control? → Second home might fit (but don't count rental income to qualify)

The moment you hand over booking control to a property manager, you're in investment territory.

Step 3: Pre-Underwrite the Deal Like a Lender, Not Like a Host

You need to know if the deal survives conservative assumptions.

• Estimate revenue with seasonality, not just "average monthly"

• Include all-in expenses: cleaning, utilities, supplies, software, repairs, property taxes, insurance

• Stress test occupancy drops

Run ROI and DSCR calculations on the actual address with our free calculator. It'll show you whether the numbers work before you're under contract.

Step 4: Pick the Lending Lane

A clean rule of thumb:

→ If you can qualify on your income and want the cheapest long-term capital: Start with conventional investment property

→ If you need the property income to do the heavy lifting: DSCR loan

→ If it's an unusual property (condo hotel vibes, unique zoning, mixed use, heavy seasonality): Portfolio lender or specialized DSCR

Need lender options? Our model is data first, then vetted pros. Connect with STR-specialist lenders through Chalet's directory, or talk to an Airbnb-friendly agent first who can coordinate the financing conversation.

Step 5: Prep the Right Documents (This Is Where People Lose Time)

For conventional investment property (per Fannie Mae guidelines):

• 2 years of W-2s or tax returns

• Recent pay stubs and income proof

• Asset statements

• Existing real estate owned schedule (properties, mortgages, insurance, taxes, HOA)

• If using rental income: the documents Fannie requires (tax returns and/or lease plus required forms depending on scenario)

For DSCR loans:

• Entity documents if borrowing in an LLC (if the lender allows it)

• Property information, insurance quote, appraisal order

• The lender's required short-term rental income evidence (varies by lender)

Step 6: Avoid the "Second Home + Property Manager" Landmine

If you're attempting second home financing, remember: Fannie's requirements say you can't have agreements that give a management firm control over occupancy.

Many Airbnb management contracts effectively control occupancy through pricing, booking, minimum stays, and calendars. That creates a classification mismatch.

If you want a full-service manager handling everything, you're usually safer in an investment or DSCR lane from day one.

Step 7: Close, Then Operate Consistent with Your Loan Terms

Your loan documents will have occupancy and use clauses. If you later change the use (for example, you stop using it as a second home and convert it to a full-time rental), talk to your lender first.

Don't create a problem later by straying from what you told them you'd do.

How Chalet Helps You Finance Your Airbnb Investment

At Chalet, we've built the one-stop platform for short-term rental investors because we kept seeing the same friction points kill deals:

Problem 1: Investors can't tell if the numbers actually work

Solution: We provide free market analytics and ROI calculators so you can stress-test any deal before you commit. No subscription. No paywall. Just transparent data.

Problem 2: Finding lenders who understand STR financing is hard

Solution: Our vetted lender network includes specialists who work with DSCR loans, investment properties, and 1031 exchanges daily. We match you based on your specific situation.

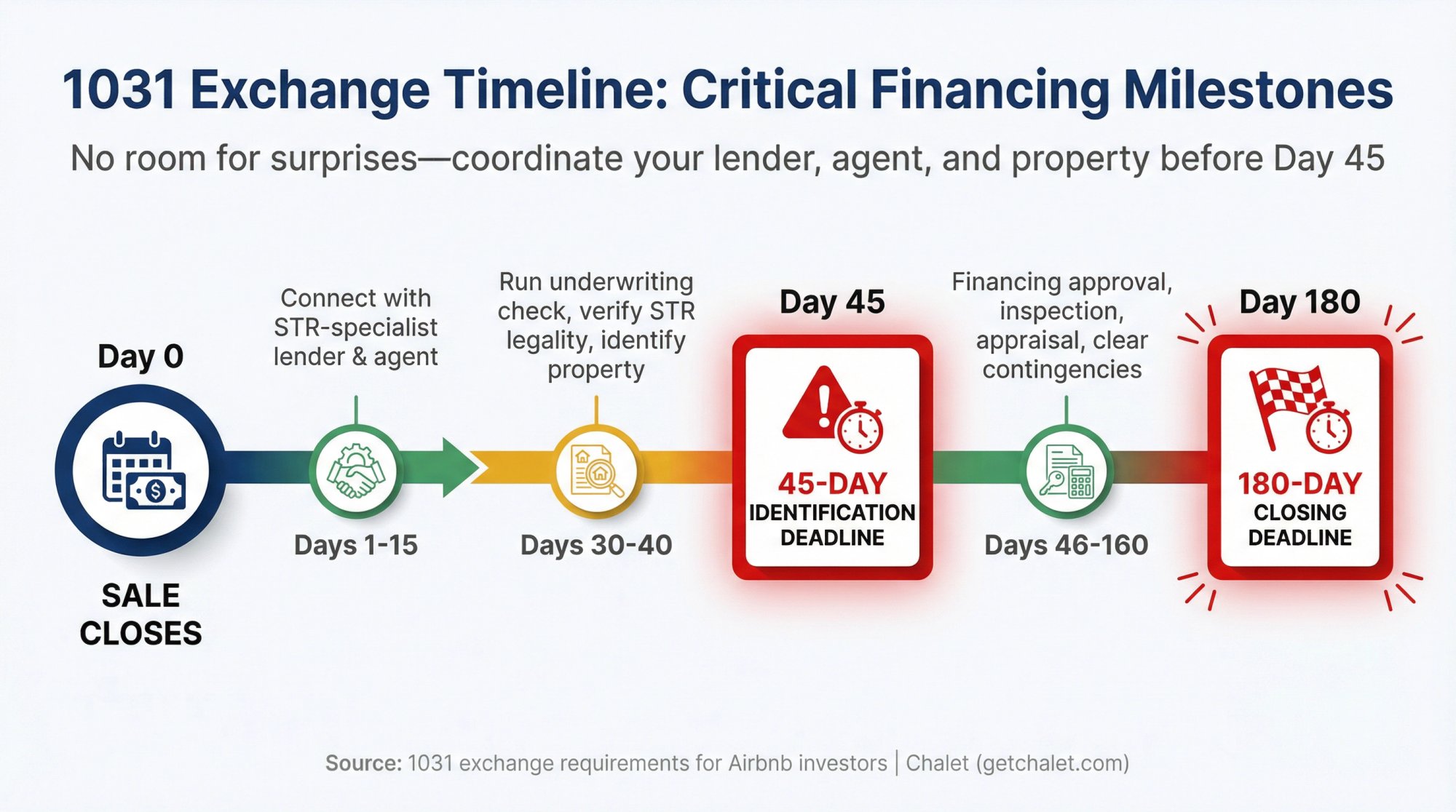

Problem 3: The timeline pressure of 1031 exchanges

Solution: We coordinate exchange-savvy agents and lenders who understand your 45-day identification and 180-day closing deadlines. Speed matters when you're racing the clock.

Problem 4: Nobody tells you the property is illegal to rent until after you close

Solution: Our regulation database shows you permit requirements, caps, and restrictions by market before you make an offer.

Problem 5: Setting up operations after closing feels like starting from scratch

Solution: Our STR directory connects you with insurance, furnishing, cleaning services, property management, and cost segregation specialists who work with Airbnb investors daily.

We're not a property management company. We're not a paid data subscription. We're the platform that pairs free analytics with the vendor network you'll actually need to execute.

Explore the data and connect with pros at Chalet.

First-Time Airbnb Buyer Tips That Save Months

If this is your first Airbnb rental purchase, your success comes down to avoiding three traps:

① Trying to qualify with Airbnb projections on a conventional loan

DSCR is often the correct tool if you need income from the property to qualify. Conventional lenders want documented history, which you don't have yet.

② Buying a property type that's hard to finance

Some condos and resort-style properties are mortgage-hostile. Verify financing feasibility before you fall in love with the listing.

③ Underestimating operating expenses

Cleaning plus utilities plus repairs hit harder on STRs than long-term rentals. Your DSCR needs cushion for reality, not best-case scenarios.

Start with markets, not properties. Use our analytics platform to narrow to regulation-friendly, cash-flowing areas, then browse actual inventory that fits your criteria.

1031 Exchange Mortgage Tips for Airbnb Investors

1031 buyers care about one thing: execution speed.

• Pick a financing path that can close inside your timeline

• Get your lender and agent aligned early

• Don't "discover" STR legality after you're under contract

Meet an Airbnb-friendly agent and run a fast underwriting check with a lender intro through Chalet as soon as you identify your replacement property.

The 45-day identification window doesn't leave room for surprises. Learn more about 1031 exchange strategies for STR investors.

Frequently Asked Questions About Airbnb Mortgages

Can I buy an Airbnb rental with 10% down?

Sometimes, depending on which classification you're in:

• Second home: Agency guidance allows up to 90% LTV for many purchases (10% down)

• Investment property: Agency guidance commonly caps 1-unit purchases at 85% LTV (15% down), with lower maximum LTV for 2-4 units

• DSCR: Many programs require 20-30% down

Can I use Airbnb income to qualify?

Conventional: Usually only if you can document it the ways agency rules allow, which often means tax-return based with specific documentation requirements

DSCR: Often yes, because qualification is based on property cash flow. But the exact method varies by lender.

Can I get a mortgage for an Airbnb rental in an LLC?

Some lenders (especially DSCR and business-purpose lenders) allow it. Others don't. Conventional loans are typically made to individuals, not LLCs. Treat this as a lender-by-lender constraint.

Is it okay to call it a "second home" if I'll rent it most of the year?

If the property is primarily a rental and you're not actually using it as a second home, you're creating a loan classification mismatch. Fannie's second-home requirements are specific, including control, management, and "not a rental property" language.

Don't misrepresent occupancy to get better loan terms. It can come back to haunt you.

Do I need a higher credit score for an Airbnb mortgage?

Generally yes. While conventional investment loans might approve you at 620, you'll get significantly better rates at 700+. For DSCR loans, many lenders prefer 680-700+ for best pricing.

What if local regulations change after I buy?

That's your risk to manage. Lenders won't police local rental laws. It's your responsibility to ensure the property can legally operate as a short-term rental.

Having a backup plan (could you convert to long-term rental? Could you sell?) is smart risk management. Check regulations before you buy, not after.

Can I refinance later to better terms?

Potentially. If you've operated the Airbnb successfully for 12-24 months with documented income, you might qualify for conventional financing with 75-100% of that rental income counting toward your qualification (per Fannie Mae rental income documentation standards). That could lower your rate.

How much cash reserves do lenders want?

Varies by loan type. Conventional investment loans might want 2-6 months of mortgage payments in reserves. DSCR lenders often want 6+ months to cushion against vacancies.

The stronger your reserves, the better your approval odds and pricing.

Next Steps: Get Your Airbnb Mortgage Approved

Getting a mortgage for an Airbnb property is absolutely possible. The path depends on your income situation, how you'll use the property, and whether you need the rental income to qualify.

Here's what to do next:

① Run the numbers on your exact address (ROI and DSCR)

Use our free calculator to see if the property cash flows under conservative assumptions.

② Check if the market is legally workable

Search our regulation database to understand permit requirements and restrictions before you make an offer.

③ Talk to people who do this every week

Meet an Airbnb-friendly agent who can walk properties with financing in mind, and get matched to STR lenders and vendors who understand how these deals actually work.

From research to ROI to real-world action, all in one place. That's what we built Chalet to be.

Data currency note: Program guidelines and underwriting rules referenced here are based on agency guidance and lender program norms available through sources updated through late 2025 and early 2026. Always confirm current lender overlays and pricing before you lock anything in.