How Do We Rank the Best Airbnb Markets?

Most "best Airbnb markets" lists fail for the same reason: they rank cities by one metric (usually annual revenue) and completely ignore what actually determines your returns.

Your profit depends on five factors working together:

-

Entry price (what you pay for the property)

-

Revenue potential (ADR multiplied by occupancy)

-

Expense drag (taxes, insurance, management, utilities, repairs)

-

Local supply (how much competition exists)

-

Regulatory survivability (can you legally operate, and will that stay true?)

So at Chalet, we rank markets starting with Gross Yield (a fast way to compare revenue relative to purchase price) and then use Cap Rate (an expense-adjusted metric) to keep the list honest.

Key Terms Explained

Before you scan the data tables, here's what each metric means:

| Term | What It Measures | Why It Matters |

|---|---|---|

| Average Daily Rate (ADR) | What hosts collect per booked night, on average | Higher ADR = more revenue per booking, but watch if it's sustainable |

| Occupancy Rate | The share of nights actually booked | Low occupancy can signal seasonality or oversupply |

| Annual Revenue | Market estimate based on ADR x occupancy x 365 | Top-line number, but it's before expenses |

| Gross Yield | Annual Revenue / Home Price | Quick comparison tool, but doesn't account for operating costs |

| Cap Rate | NOI (net operating income) / Home Price | More realistic because it includes expense assumptions |

| Active Listings | Number of short-term rentals in that market | Higher competition means you need stronger differentiation |

A word of caution: These are market-level benchmarks. Your actual returns will depend on your specific property, neighborhood, amenities, management quality, and local regulations. The numbers here are starting points for research, not guarantees.

Tools for Property-Level Analysis

Market averages only get you so far. When you find a specific property, you need to underwrite that address, not the zip code.

Chalet offers free tools to help:

-

Airbnb Calculator: Run ROI, cap rate, and cash flow projections for any address.

-

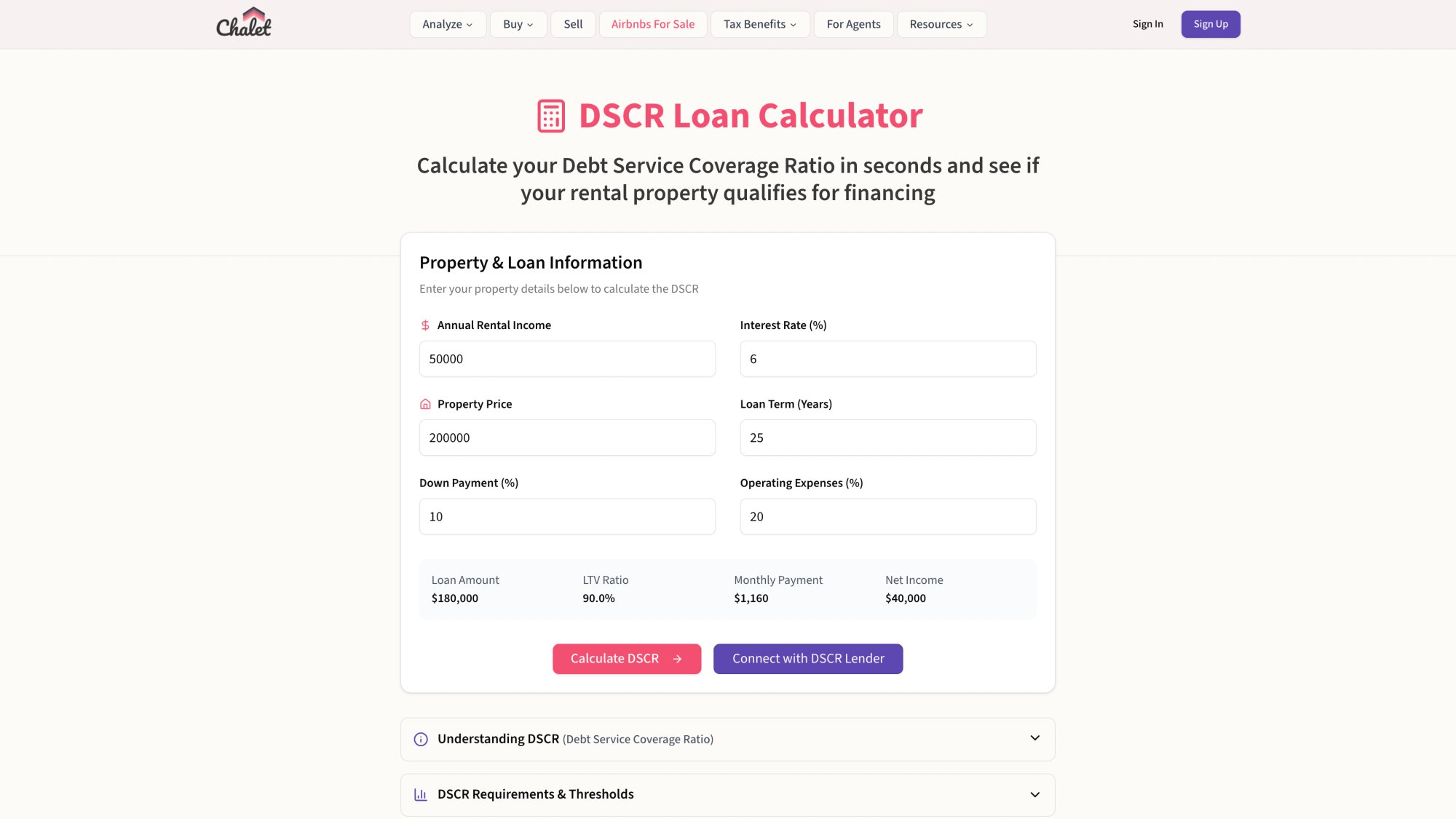

DSCR Calculator: If you're using DSCR financing, check whether your deal pencils before you make offers.

-

Regulations Library: Verify you can legally operate in your target market before you fall in love with a property.

The calculator above lets you stress-test any deal before making offers. Input a specific address and see exactly how the numbers work when you drop ADR by 10% or occupancy by 15%.

For a deeper dive into understanding Airbnb income, check out our comprehensive guide.

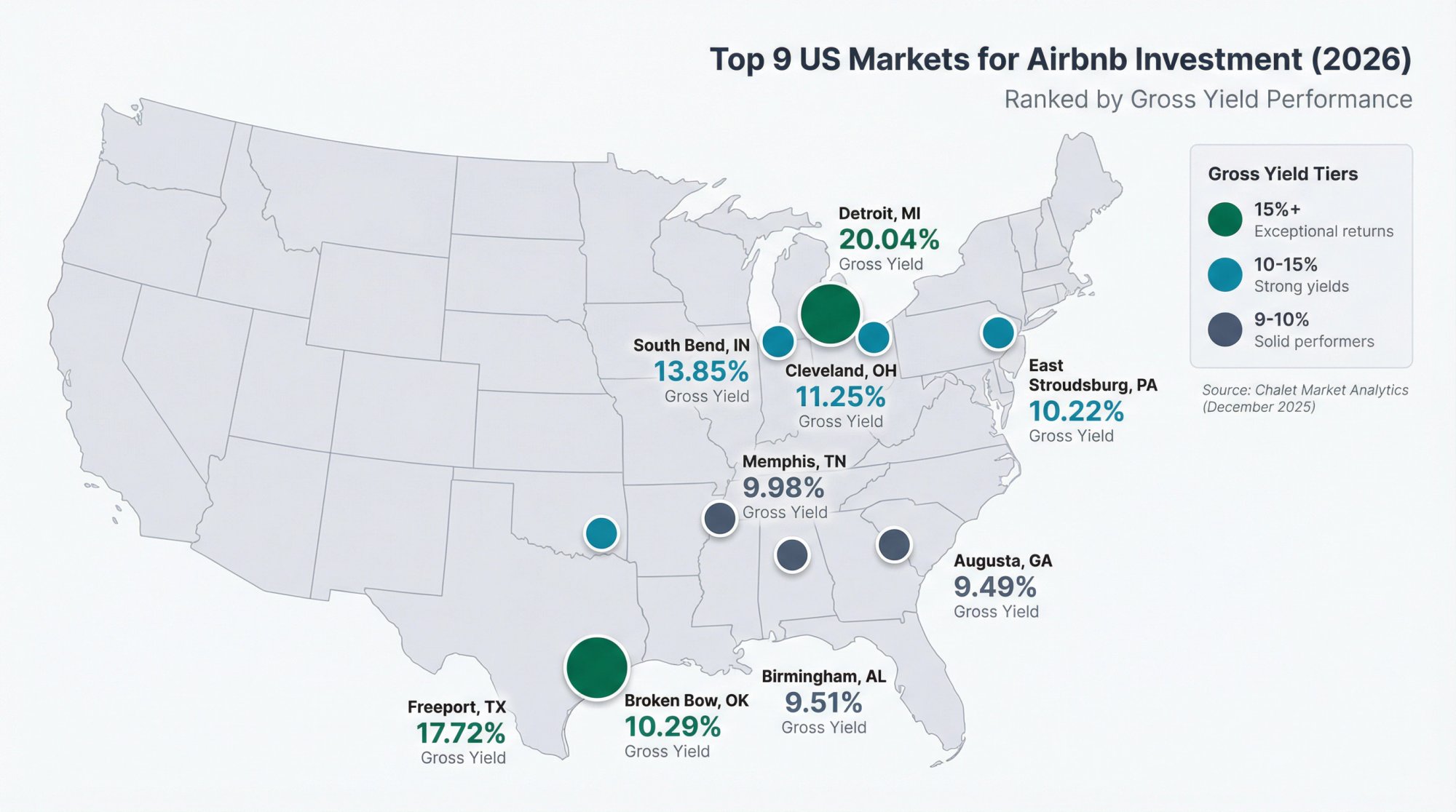

Top 9 Airbnb Markets to Invest in 2026

These markets are ranked by Gross Yield, with cap rate, ADR, occupancy, property taxes, and competition included so you can see exactly why each market made the cut.

Data pulled December 26, 2025 from Chalet's market analytics.

| Market | Avg Home Price | ADR | Occupancy | Annual Revenue | Gross Yield | Cap Rate | Property Tax | Active Listings |

|---|---|---|---|---|---|---|---|---|

| Detroit, MI | $76,088 | $152 | 50% | $15,248 | 20.04% | 12.02% | 1.73% | 890 |

| Freeport, TX | $141,062 | $337 | 36% | $24,997 | 17.72% | 10.63% | 1.76% | 448 |

| South Bend, IN | $183,904 | $339 | 44% | $25,474 | 13.85% | 8.31% | 0.88% | 779 |

| Cleveland, OH | $111,728 | $116 | 54% | $12,574 | 11.25% | 6.75% | 2.18% | 1,732 |

| Broken Bow, OK | $332,583 | $352 | 40% | $34,232 | 10.29% | 6.18% | 0.42% | 2,264 |

| East Stroudsburg, PA | $305,538 | $318 | 43% | $31,233 | 10.22% | 6.13% | 2.01% | 365 |

| Memphis, TN | $143,240 | $147 | 51% | $14,301 | 9.98% | 5.99% | 1.12% | 1,225 |

| Birmingham, AL | $132,690 | $154 | 48% | $12,622 | 9.51% | 5.71% | 0.61% | 615 |

| Augusta, GA | $173,702 | $181 | 49% | $16,482 | 9.49% | 5.69% | 0.96% | 1,117 |

Source: Chalet, December 2025

For an in-depth look at markets with high cap rates, explore our dedicated analysis.

What Do Airbnb Market Numbers Mean for Investors?

Data tables are useful, but they don't tell you what to do. This section breaks down each top market with specific insights and the watch-outs that could make or break your investment.

Detroit, Michigan: 20% Gross Yield Investing

Gross Yield: 20.04% | Cap Rate: 12.02%

Detroit tops the list for one reason: the spread between purchase price and rental income is enormous. You can buy properties for under $80,000 (on average) that generate $15,000+ annually.

Why investors look here:

-

Ultra-low entry pricing relative to revenue benchmarks

-

Highest gross yield and cap rate on this list by a significant margin

-

Enough active listings (890) to show proven STR demand

What to watch:

Property selection in Detroit matters more than almost any market on this list. The city-level average obscures massive variation between neighborhoods. A property in a revitalizing area could outperform projections. A property in the wrong block could struggle to book.

Also, don't ignore property taxes at 1.73%. In markets with low property tax, taxes can eat a larger percentage of your cash flow than you'd expect.

Your next step:

For a deeper dive, read our guide on the best places to invest in Detroit short-term rentals.

Freeport, Texas: High ADR Coastal Market

Gross Yield: 17.72% | Cap Rate: 10.63%

Freeport stands out for its high ADR ($337) combined with a relatively low price point ($141k). This is a coastal leisure market, and the numbers reflect that premium.

Why investors look here:

-

Strong daily rates that suggest guests are willing to pay for beach access

-

Solid yield profile even after expense assumptions

-

Moderate competition (448 active listings)

What to watch:

That 36% occupancy is the flag you can't ignore. Lower occupancy usually means seasonality, weather-driven demand, or a mismatch between supply and what guests actually want. You'll need to understand when bookings happen and plan your cash reserves accordingly.

Coastal properties also carry higher insurance costs and storm-related maintenance risk. Budget conservatively.

Your next step:

For more Texas opportunities, see our best Airbnb markets in Texas guide.

South Bend, Indiana: Low Property Tax Advantage

Gross Yield: 13.85% | Cap Rate: 8.31%

South Bend offers something rare: strong revenue ($25,474 annual benchmark) combined with genuinely low property taxes (0.88%). That tax advantage directly protects your NOI.

Why investors look here:

-

Balanced revenue-to-price ratio without extreme risk in either direction

-

Lower property tax means more of your gross revenue becomes actual profit

-

Notre Dame-related demand provides a built-in event calendar

What to watch:

This is a process market. Success here comes from choosing the right neighborhood, understanding your guest segment (students' families, game-day visitors, corporate travelers), and operating efficiently. You won't win by buying "anything in South Bend."

South Bend is also an excellent college town for Airbnb investing.

Your next step:

Cleveland, Ohio: Highest Occupancy Market

Gross Yield: 11.25% | Cap Rate: 6.75%

Cleveland's appeal is consistency. With 54% occupancy, it's the highest occupancy market on this top list, which translates to steadier booking patterns and less revenue volatility.

Why investors look here:

-

Higher occupancy supports more predictable cash flow

-

Low entry price benchmark relative to coastal or destination markets

-

Strong enough yield to justify the investment thesis

What to watch:

Cleveland has one of the highest property tax rates on this list at 2.18%. Property taxes are a silent killer of STR cash flow because they don't fluctuate with revenue. When occupancy dips, your tax bill stays the same.

Get your taxes and insurance numbers right in your underwriting, or your cap rate will disappoint you.

Your next step:

For neighborhood-level insights, read the best places to invest in Cleveland short-term rentals.

Broken Bow, Oklahoma: Premium Cabin Market

Gross Yield: 10.29% | Cap Rate: 6.18%

Broken Bow is a cabin/retreat market with economics that look different from urban STRs. High ADR ($352) and strong annual revenue ($34,232) reflect the "experience premium" guests pay for getaways.

Why investors look here:

-

Drive-to destination demand from Dallas, Oklahoma City, and surrounding metros

-

Premium pricing power (guests expect and pay for hot tubs, views, and outdoor space)

-

Revenue potential rivals markets with much higher home prices

What to watch:

Competition is real. With 2,264 active listings, Broken Bow is crowded. To win here, you'll need differentiated amenities, strong design, and excellent guest experience. A generic cabin won't cut it.

Retreat markets are also management-intensive. Turnovers, hot tub maintenance, deck upkeep, and outdoor spaces add operational complexity. Consider property management options if you're investing remotely.

Your next step:

East Stroudsburg, Pennsylvania: Low Competition Poconos Market

Gross Yield: 10.22% | Cap Rate: 6.13%

East Stroudsburg offers strong ADR ($318) and solid annual revenue ($31,233) with notably lower competition than many comparable markets.

Why investors look here:

-

Only 365 active listings means less saturation than Broken Bow or bigger metros

-

Proximity to NYC/NJ creates reliable drive-to demand

-

Revenue benchmarks that support real cash flow

This market is part of the larger Poconos region, which remains a popular destination for STR investors.

What to watch:

Pennsylvania property taxes at 2.01% will take a meaningful bite out of your NOI. Paper yield can evaporate if you underestimate taxes and insurance in your underwriting.

Your next step:

Memphis, Tennessee: Value Metro Investing

Gross Yield: 9.98% | Cap Rate: 5.99%

Memphis is a classic "value metro" play. Accessible pricing ($143k average), balanced occupancy (51%), and a yield profile that just barely clears the 10% gross threshold.

Why investors look here:

-

Lower barrier to entry than coastal or destination markets

-

Steady occupancy suggests year-round demand drivers (events, medical, corporate)

-

Cap rate near 6% is respectable for a major metro

What to watch:

In value metros, your returns depend on execution. Renovation scope, guest targeting, listing optimization, and operational discipline matter more here than in markets where demand is nearly automatic.

Your next step:

For more detail, read the best places to invest in Memphis short-term rentals.

Birmingham, Alabama: Ultra-Low Property Taxes

Gross Yield: 9.51% | Cap Rate: 5.71%

Birmingham's low property tax rate (0.61%) is the standout metric here. Combined with accessible pricing, it creates a more durable NOI profile than higher-tax alternatives.

Why investors look here:

-

Lower taxes directly improve your bottom line

-

Entry pricing is approachable for first-time investors

-

Solid yield without extreme competition (615 listings)

What to watch:

Don't assume low price means easy money. You still need regulation compliance, good micro-location selection, and strong operations. The deal matters more than the market.

Your next step:

Augusta, Georgia: Masters Tournament Market

Gross Yield: 9.49% | Cap Rate: 5.69%

Augusta shows balanced fundamentals: $181 ADR, 49% occupancy, and a reasonable tax rate (0.96%). It's also home to The Masters, which creates a significant annual demand spike.

Your next step:

For more Georgia markets, check out the best Airbnb markets in Georgia.

Best Airbnb Markets by Investment Strategy (2026)

Different investors need different market types. Your portfolio constraints, financing, and operational preferences should shape which list you focus on.

Best Big City Airbnb Markets (2026)

If you want year-round demand, professional management options, and resale liquidity, big cities often deliver. The tradeoff is that regulations can be complex and taxes can be steep.

| Market | Avg Home Price | ADR | Occupancy | Annual Revenue | Gross Yield | Cap Rate | Property Tax | Active Listings |

|---|---|---|---|---|---|---|---|---|

| Detroit, MI | $76,088 | $152 | 50% | $15,248 | 20.04% | 12.02% | 1.73% | 890 |

| Cleveland, OH | $111,728 | $116 | 54% | $12,574 | 11.25% | 6.75% | 2.18% | 1,732 |

| Memphis, TN | $143,240 | $147 | 51% | $14,301 | 9.98% | 5.99% | 1.12% | 1,225 |

| Birmingham, AL | $132,690 | $154 | 48% | $12,622 | 9.51% | 5.71% | 0.61% | 615 |

| Saint Louis, MO | $181,509 | $129 | 63% | $15,033 | 8.28% | 4.97% | 1.08% | 1,796 |

| Baltimore, MD | $186,187 | $120 | 60% | $15,146 | 8.13% | 4.88% | 1.51% | 305 |

| Chicago, IL | $308,252 | $183 | 57% | $19,114 | 6.20% | 3.72% | 2.02% | 4,975 |

| Columbus, OH | $242,640 | $134 | 54% | $15,033 | 6.20% | 3.72% | 1.64% | 1,755 |

How to use this list: Big city markets work well for investors who want (a) professional management options, (b) more consistent booking patterns, and (c) resale liquidity. Just verify regulations early. Check STR rules for your target city here.

For more analysis, see our best markets to invest in the Midwestern US guide.

Best Sun Belt Airbnb Markets (2026)

Sun Belt demand can be resilient, but returns often depend on seasonality and insurance costs. Coastal markets in particular carry weather-related risk.

| Market | Avg Home Price | ADR | Occupancy | Annual Revenue | Gross Yield | Cap Rate | Property Tax | Active Listings |

|---|---|---|---|---|---|---|---|---|

| Freeport, TX | $141,062 | $337 | 36% | $24,997 | 17.72% | 10.63% | 1.76% | 448 |

| Birmingham, AL | $132,690 | $154 | 48% | $12,622 | 9.51% | 5.71% | 0.61% | 615 |

| Augusta, GA | $173,702 | $181 | 49% | $16,482 | 9.49% | 5.69% | 0.96% | 1,117 |

| Delray Beach, FL | $338,236 | $280 | 51% | $29,494 | 8.72% | 5.23% | 0.91% | 354 |

| Corpus Christi, TX | $218,331 | $180 | 50% | $18,275 | 8.37% | 5.02% | 1.75% | 1,492 |

| Panama City, FL | $281,794 | $251 | 50% | $23,388 | 8.30% | 4.98% | 0.60% | 2,856 |

| Montgomery, AL | $146,435 | $147 | 57% | $11,708 | 8.00% | 4.80% | 0.38% | 402 |

| Savannah, GA | $327,263 | $233 | 54% | $24,955 | 7.63% | 4.58% | 0.94% | 2,300 |

| New Orleans, LA | $239,043 | $198 | 42% | $17,433 | 7.29% | 4.38% | 0.79% | 4,063 |

For a comprehensive breakdown, read our guide on the best Airbnb markets in the US Sun Belt.

Best Lake and Riverfront Airbnb Markets (2026)

Waterfront properties often command premium ADRs, but occupancy tends to be seasonal. Underwrite with a winter/spring floor assumption, not just peak summer rates.

| Market | Avg Home Price | ADR | Occupancy | Annual Revenue | Gross Yield | Cap Rate | Property Tax | Active Listings |

|---|---|---|---|---|---|---|---|---|

| Pocono Lake, PA | $279,572 | $328 | 48% | $24,241 | 8.67% | 5.20% | 2.01% | 401 |

| Niagara Falls, NY | $166,392 | $206 | 43% | $14,376 | 8.64% | 5.18% | 2.43% | 338 |

| South Haven, MI | $359,399 | $442 | 33% | $31,048 | 8.64% | 5.18% | 1.38% | 702 |

| Osage Beach, MO | $337,067 | $250 | 33% | $18,633 | 5.53% | 3.32% | 0.53% | 851 |

| Lake Arrowhead, CA | $529,784 | $385 | 29% | $28,039 | 5.29% | 3.18% | 0.72% | 594 |

| Lake Ozark, MO | $333,833 | $253 | 25% | $16,005 | 4.79% | 2.88% | 0.53% | 530 |

| Lake Havasu City, AZ | $456,716 | $267 | 36% | $21,201 | 4.64% | 2.79% | 0.51% | 1,247 |

| Tahoe City, CA | $1,182,185 | $480 | 38% | $39,427 | 3.34% | 2.00% | 0.85% | 347 |

For Poconos-specific insights, explore our best mid-term rental markets in the Poconos analysis.

Best Texas Airbnb Markets (2026)

Texas offers a wide menu: coastal leisure markets plus major metros with deeper liquidity and more diverse demand drivers.

| Market | Avg Home Price | ADR | Occupancy | Annual Revenue | Gross Yield | Cap Rate | Property Tax | Active Listings |

|---|---|---|---|---|---|---|---|---|

| Freeport | $141,062 | $337 | 36% | $24,997 | 17.72% | 10.63% | 1.76% | 448 |

| Corpus Christi | $218,331 | $180 | 50% | $18,275 | 8.37% | 5.02% | 1.75% | 1,492 |

| Port Isabel | $257,176 | $206 | 37% | $16,259 | 6.32% | 3.79% | 1.69% | 302 |

| Galveston | $320,448 | $252 | 38% | $19,971 | 6.23% | 3.74% | 1.53% | 3,318 |

| Port Bolivar | $397,671 | $370 | 33% | $24,383 | 6.13% | 3.68% | 1.53% | 774 |

| Dallas | $303,486 | $146 | 56% | $17,242 | 5.68% | 3.41% | 1.73% | 2,926 |

| Houston | $261,730 | $139 | 53% | $14,783 | 5.65% | 3.39% | 1.77% | 6,601 |

| Fort Worth | $293,827 | $165 | 53% | $15,878 | 5.40% | 3.24% | 1.82% | 313 |

Explore 1031 exchange opportunities in Texas to defer capital gains on your next investment.

Best California Airbnb Markets (2026)

California returns often hinge on buying at the right price, offering a unique product, and operating efficiently. The desert markets here show stronger yield profiles than coastal California.

| Market | Avg Home Price | ADR | Occupancy | Annual Revenue | Gross Yield | Cap Rate | Property Tax | Active Listings |

|---|---|---|---|---|---|---|---|---|

| Joshua Tree | $339,070 | $241 | 44% | $23,711 | 6.99% | 4.20% | 0.72% | 1,040 |

| Yucca Valley | $355,896 | $255 | 42% | $24,013 | 6.75% | 4.05% | 0.72% | 728 |

| Lake Arrowhead | $529,784 | $385 | 29% | $28,039 | 5.29% | 3.18% | 0.72% | 594 |

| Big Bear City | $396,801 | $266 | 27% | $19,947 | 5.03% | 3.02% | 0.72% | 1,003 |

| Palm Springs | $620,302 | $408 | 35% | $30,425 | 4.90% | 2.94% | 0.86% | 3,049 |

| Twentynine Palms | $245,749 | $210 | 36% | $10,291 | 4.19% | 2.51% | 0.72% | 431 |

| Big Bear Lake | $551,246 | $293 | 28% | $21,867 | 3.97% | 2.38% | 0.72% | 2,444 |

| Mammoth Lakes | $800,946 | $300 | 44% | $31,016 | 3.87% | 2.32% | 0.68% | 2,311 |

For state-specific guidance, see our best Airbnb markets in California and explore California 1031 exchange options.

FIFA World Cup 2026 Host City Markets

Big events can spike bookings and ADRs. But the smart approach is to treat events as upside, not your base case. Underwrite your deal to cash flow without the World Cup, then let the event boost be a bonus.

| Market | Avg Home Price | ADR | Occupancy | Annual Revenue | Gross Yield | Cap Rate | Property Tax | Active Listings |

|---|---|---|---|---|---|---|---|---|

| Kansas City, MO | $242,550 | $140 | 56% | $15,691 | 6.47% | 3.88% | 1.19% | 1,050 |

| Dallas, TX | $303,486 | $146 | 56% | $17,242 | 5.68% | 3.41% | 1.73% | 2,926 |

| Houston, TX | $261,730 | $139 | 53% | $14,783 | 5.65% | 3.39% | 1.77% | 6,601 |

| Miami, FL | $575,173 | $184 | 57% | $20,562 | 3.57% | 2.14% | 0.85% | 7,877 |

| Atlanta, GA | $386,567 | $173 | 46% | $10,269 | 2.66% | 1.59% | 0.91% | 5,139 |

| Philadelphia, PA | $228,933 | $128 | 43% | $5,571 | 2.43% | 1.46% | 0.86% | 2,513 |

| Seattle, WA | $840,957 | $176 | 60% | $19,135 | 2.28% | 1.37% | 0.85% | 5,178 |

The right mindset for event investing: Build an operations plan that can handle surge demand without guest experience falling apart. If the event doesn't materialize the way you hoped, you still own a property that pencils.

Explore market analytics for host cities: Kansas City, Dallas, Houston, Miami, and Atlanta.

How to Go From Airbnb Market Research to Revenue

You've got the market data. Now what?

This is where most investors stall. They spend weeks (or months) doing research, then realize they don't know how to actually execute. Finding the right agent takes time. Understanding DSCR requirements takes time. Verifying regulations takes time. Coordinating insurance, management, and setup takes time.

Chalet is built to compress that timeline.

Free Analytics Without Paywalls

Every market dashboard, every data point, every chart you've seen in this guide comes from Chalet's free analytics platform. You can compare markets, track trends, and download data without paying a subscription.

Property-Level Underwriting

Once you've picked a market, use the Airbnb Calculator to run ROI projections on specific addresses. Stress test your assumptions. See what breaks when you drop ADR by 10% or occupancy by 15%.

If you're financing, the DSCR Calculator helps you verify that your deal will actually qualify before you're deep into due diligence.

Regulation Research

Before you fall in love with a property, check whether you can legally operate it. Chalet's regulations library covers permit requirements, zoning rules, occupancy limits, and enforcement context for markets across the country.

The regulations library above lets you verify operational legality before you're under contract. Search your target market to understand permits, caps, owner-occupancy rules, and enforcement posture.

Vetted Vendor Network

This is where Chalet really stands out: it's not just data. It's execution support.

When you're ready to move, you can connect with:

-

STR-specialist real estate agents who understand STR underwriting and can source appropriate inventory

-

DSCR and conventional lenders who specialize in investment properties

-

STR insurance providers who know the difference between landlord policies and proper short-term rental coverage

-

Property managers, cleaners, furnishing specialists, and cost segregation experts to help you set up and optimize operations

Everything you need to go from "I found a market I like" to "my first guest just checked in." Access all vendor categories through our STR vendor directory.

Chalet pairs free, credible analytics with a vetted vendor network, so your first (or next) Airbnb investment moves from research to reality with less guesswork and fewer hand-offs.

Which Airbnb Market Is Right for Your Investor Profile?

This is where most investors waste months. They pick a "hot market" based on headlines, then realize it doesn't fit their constraints.

Use this instead.

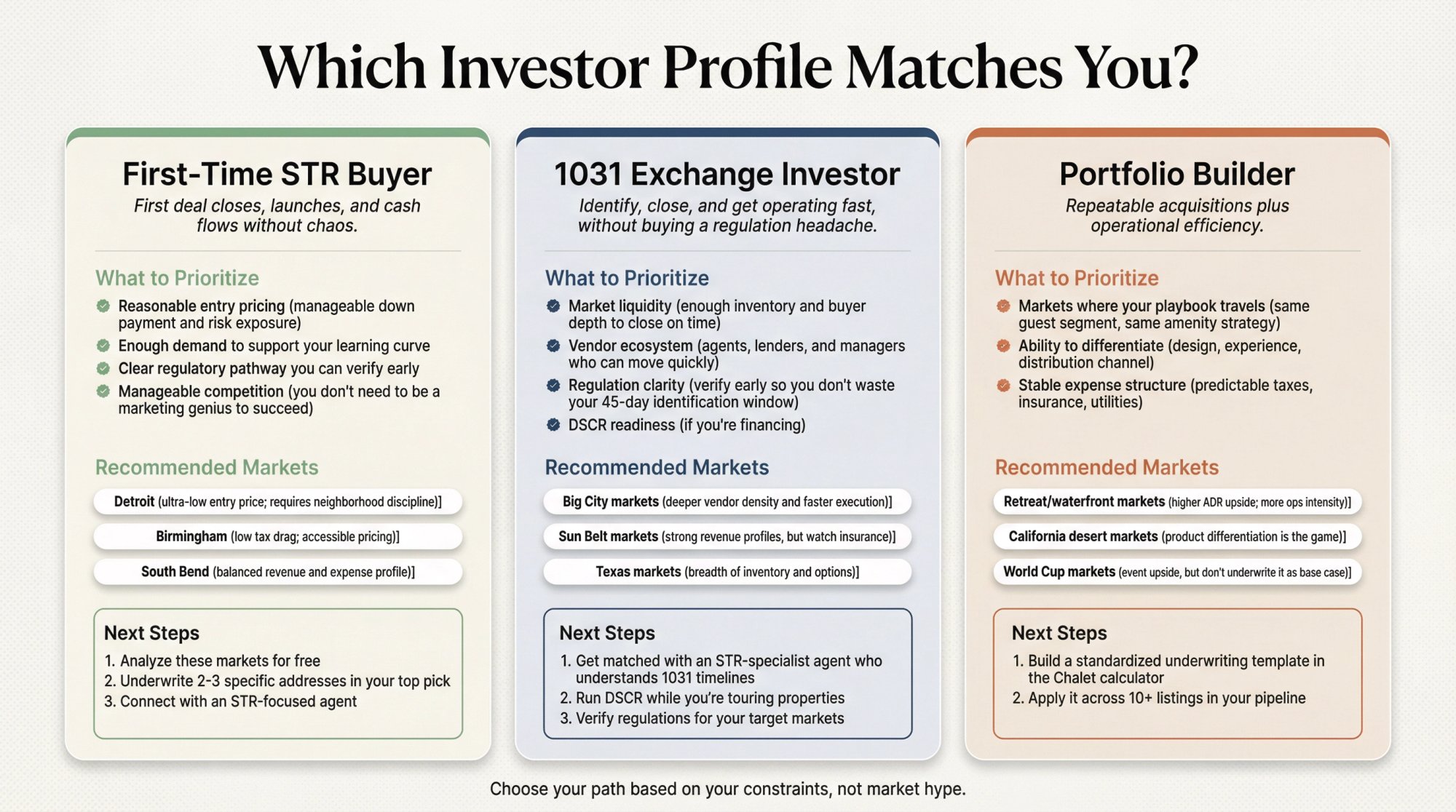

If You're a First-Time STR Buyer

Your success metric isn't "highest yield on paper." It's: first deal closes, launches, and cash flows without chaos.

What to prioritize:

-

Reasonable entry pricing (manageable down payment and risk exposure)

-

Enough demand to support your learning curve

-

Clear regulatory pathway you can verify early

-

Manageable competition (you don't need to be a marketing genius to succeed)

For additional guidance, explore our resources on budget-friendly Airbnb rental markets.

Recommended markets from this guide:

-

Detroit (ultra-low entry price; requires neighborhood discipline)

-

Birmingham (low tax drag; accessible pricing)

-

South Bend (balanced revenue and expense profile)

Your next steps:

If You're Doing a 1031 Exchange

Your success metric is: identify, close, and get operating fast, without buying a regulation headache.

What to prioritize:

-

Market liquidity (enough inventory and buyer depth to close on time)

-

Vendor ecosystem (agents, lenders, and managers who can move quickly)

-

Regulation clarity (verify early so you don't waste your 45-day identification window)

-

DSCR readiness (if you're financing)

For guidance on the 1031 process, read our comprehensive guide to Airbnb rentals and 1031 exchanges and learn about common mistakes to avoid in 1031 exchanges.

Recommended approaches from this guide:

-

Big City markets (deeper vendor density and faster execution)

-

Sun Belt markets (strong revenue profiles, but watch insurance)

-

Texas markets (breadth of inventory and options)

Your next steps:

-

Get matched with an STR-specialist agent who understands 1031 timelines

If You're a Portfolio Builder

Your success metric is: repeatable acquisitions plus operational efficiency.

What to prioritize:

-

Markets where your playbook travels (same guest segment, same amenity strategy)

-

Ability to differentiate (design, experience, distribution channel)

-

Stable expense structure (predictable taxes, insurance, utilities)

For tax optimization strategies, explore bonus depreciation for STR investors.

Recommended approaches from this guide:

-

Retreat/waterfront markets (higher ADR upside; more ops intensity)

-

California desert markets (product differentiation is the game)

-

World Cup markets (event upside, but don't underwrite it as base case)

Your next step:

Build a standardized underwriting template in the Chalet calculator and apply it across 10+ listings in your pipeline. Use the STR underwriting tool for advanced analysis.

Airbnb Investment Underwriting Checklist for 2026

Copy this. Use it. Don't skip steps.

Step 1: Confirm You Can Legally Operate

Before you do anything else:

-

Look up your target market in Chalet's regulation library

-

Identify permit requirements, caps, owner-occupancy rules, and zoning restrictions

-

Note enforcement posture if available

-

Document it before you make offers

Too many investors fall in love with a property, go under contract, and then discover they can't get a permit. Don't be that investor.

Step 2: Validate the Market AND the Micro-Market

Market averages are starting points. Your property lives in a neighborhood.

Questions to answer:

-

What's the dominant guest segment? (work travel, leisure, events, medical)

-

Is your property type common or differentiated in that area?

-

Is supply concentrated in one pocket or spread across the market?

Start with the market dashboard, then drill into specific addresses.

Step 3: Underwrite the Actual Address

Run the specific property through:

-

Revenue estimate (realistic ADR x occupancy)

-

Expense model (taxes, insurance, management, utilities, repairs, reserves)

-

NOI and cap rate

-

Sensitivity test: drop ADR by 10% and occupancy by 15%, then see what breaks

Use the Airbnb Calculator to stress test before you offer.

Step 4: If Financing, Verify DSCR Before You Negotiate Hard

DSCR loans are underwritten based on property cash flow, not personal income. That's the advantage. But it also means your deal needs to pencil.

If DSCR is tight, you may need a different price, higher down payment, or a different property entirely.

Don't discover this after inspections. Run the numbers first with the DSCR Calculator. Then connect with STR lenders who understand investment property financing.

The DSCR calculator above shows you whether your deal will qualify for financing before you submit offers. Input your expected revenue and expenses to see if you hit the lender's minimum debt service coverage ratio.

Step 5: Budget Launch Costs Like an Operator

Typical items investors underestimate:

-

Furnishing and setup (furniture, decor, kitchen supplies)

-

Smart locks, noise monitors, and guest tech

-

Consumables, linens, and owner closet setup

-

Professional photography

-

Day-one deep clean and maintenance prep

If you're not ready to operationalize, your first 90 days will underperform your projections.

Step 6: Decide Your Operating Model

Self-manage vs. property manager is the question, and it affects your market choice:

-

If you're remote, you need reliable cleaning, maintenance, and guest communication systems.

-

If speed matters (hello, 1031 investors), consider vendor readiness a core criterion.

-

If you're scaling, you may need a PM with capacity to add units.

Browse property management options by market or find turnover and cleaning services in your target area.

Step 7: Build Your Execution Team Early

Don't wait until you're under contract to find your team. Line them up now:

-

Agent who understands STR underwriting

-

Lender who can underwrite STR income (if financing)

-

Insurance that specifically covers short-term rental use

-

Cleaner, handyman, and property manager (if needed)

Start with an STR-specialist agent match: Find one here.

Airbnb Investment FAQs (2026)

Are these the "most profitable" Airbnb markets?

They're the highest-ranked by gross yield in Chalet's dataset, with cap rate included to account for expenses. Profitability on your specific deal still depends on property selection, actual expenses, and regulatory compliance.

For a data-driven analysis, read are Airbnbs profitable: a market-based analysis.

Why do some high-revenue markets rank lower on this list?

Because price matters. A market can generate strong annual revenue but still produce lower yield if home values are high. That's why we rank by yield (revenue relative to price), not just raw revenue. For markets with the highest absolute revenue, see our best Airbnb markets with high annual revenue guide.

Should I target markets where home values dropped year-over-year?

Price declines can improve entry yields, but don't treat YoY price change as a guarantee of future appreciation (or further declines). Use it as context for your decision, not a prediction.

What if I want to buy a property that's already a short-term rental?

You can browse curated STR listings on Chalet's Airbnbs for Sale page, then run the address through the Airbnb Calculator to verify the seller's claims against market benchmarks.

How do I know if STR regulations will change in my target market?

You can't predict the future, but you can start informed. Chalet's regulations library covers current rules, permit requirements, and enforcement context. For higher-stakes decisions, consider consulting a local attorney who tracks municipal STR policy.

How accurate is this market data?

The data here reflects Chalet's analytics as of December 26, 2025. Market conditions change. Always re-check the market dashboard and re-run your address-level underwriting before you submit offers.

What's the difference between gross yield and cap rate?

Gross yield is annual revenue divided by home price. It's a quick comparison tool but doesn't account for operating costs.

Cap rate is NOI (net operating income, which subtracts expenses) divided by home price. It's more realistic because it accounts for taxes, insurance, management, and other costs.

Both are useful. Gross yield for initial screening, cap rate for more serious analysis. For more terminology, visit our STR glossary.

Do I need to visit a market before investing?

It depends on your risk tolerance and operational plan. Many investors successfully buy remotely with strong local teams. But if you're new to STR investing, visiting at least once can help you understand neighborhoods, guest experience, and local dynamics better than any spreadsheet.

Your Next Step

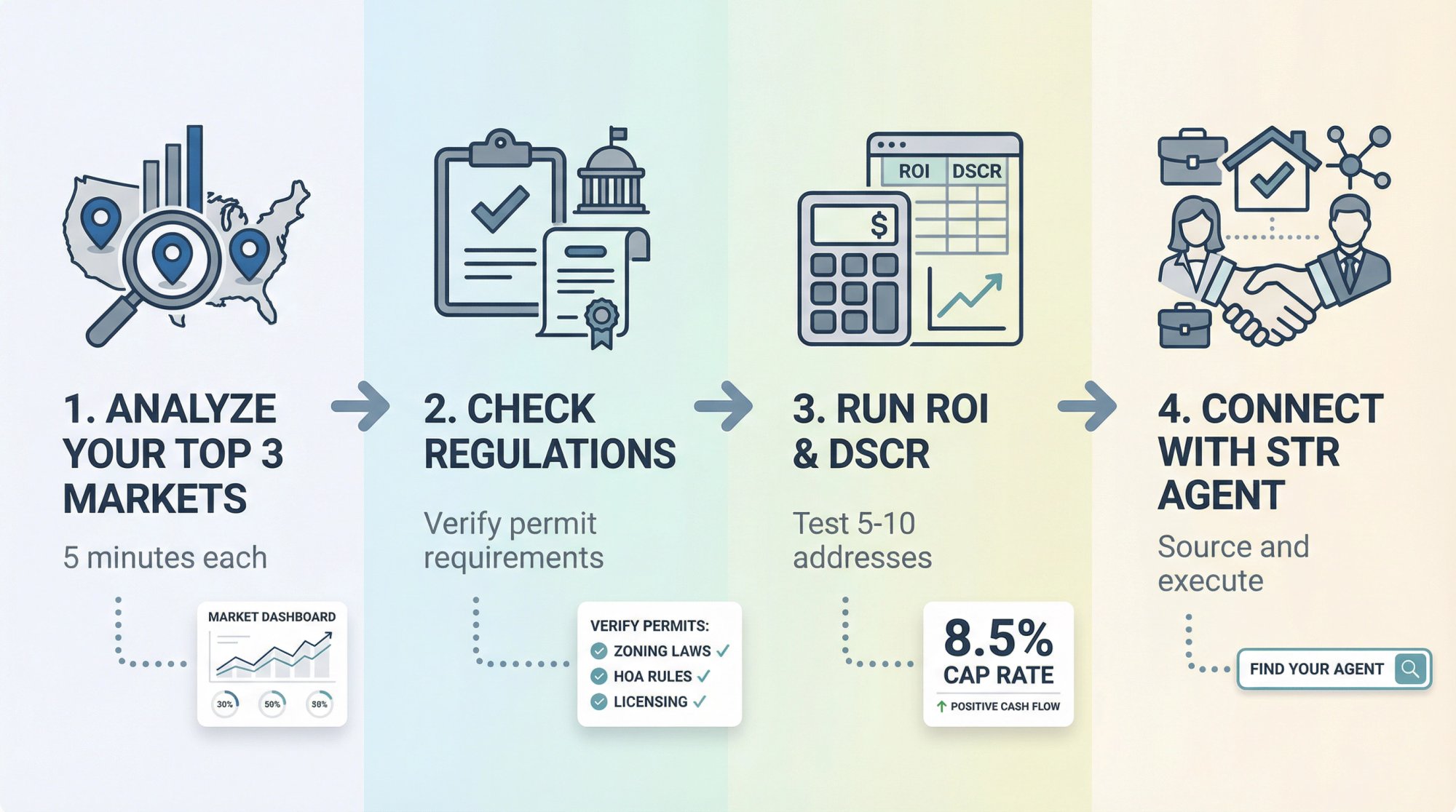

If you want to turn this guide into a real purchase pipeline, do this in order:

1. Analyze your top 3 markets (5 minutes each)

2. Check regulations for those markets

3. Run ROI and DSCR on 5-10 addresses

→ Airbnb Calculator

→ DSCR Calculator

4. Connect with an Airbnb-friendly agent to source and execute

Data Currency Note

All market prices and performance benchmarks above reflect Chalet's latest available analytics as of December 26, 2025. Markets move quickly. Re-check the market dashboard and re-run your address underwriting before you submit offers.

Chalet is the one-stop platform for short-term-rental investors. We pair free market analytics with a vetted vendor network so you can research, buy, and operate in one place. Explore the data and connect with pros at Chalet.