If you're researching Sun Belt markets for an Airbnb rental, you're probably not looking for "cool cities to visit." You want to know which markets can actually cash-flow as a short-term rental (STR) without bad assumptions, hidden costs, or regulatory surprises derailing your investment.

We ranked Sun Belt markets using Chalet's proprietary dataset and built this guide to help you go from research to offer without the usual spinning. Whether this is your first deal, you're racing a 1031 clock, or you're scaling a portfolio, the data below will give you a clear starting point.

A quick note on terminology: "Airbnb rental," "short-term rental," and "STR" are used interchangeably throughout this guide.

A note on data: All stats reflect Chalet's 2026 dataset. Markets move fast, so treat these numbers as a starting point for your own underwriting.

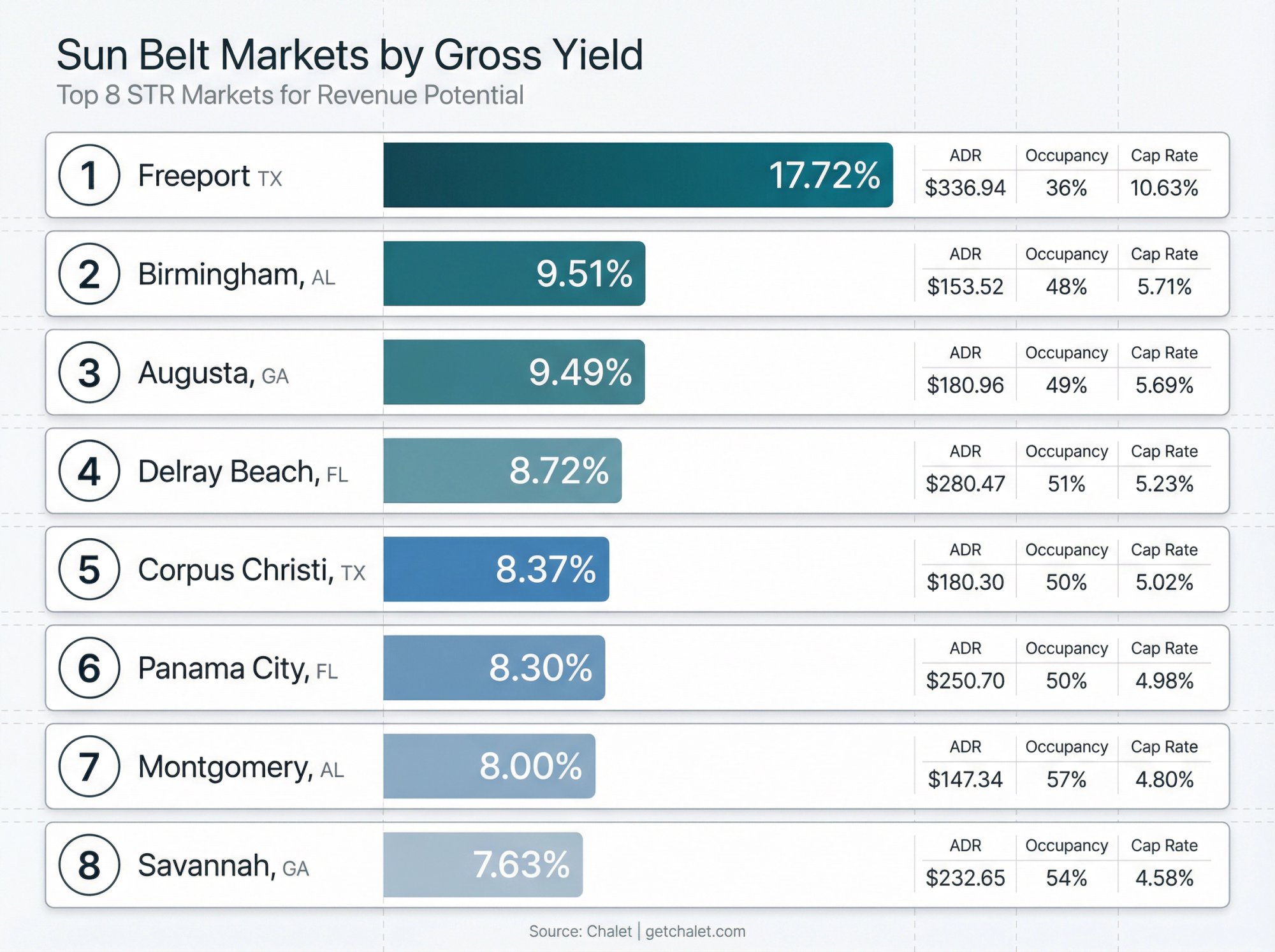

Which Sun Belt Markets Have the Highest Gross Yield?

Gross yield answers one question: How much top-line revenue does this market generate per dollar of home price?

Higher gross yield can mean faster cash payback, if expenses, regulation, and operations cooperate. Here's how the Sun Belt stacks up.

| Rank | Market | State | Avg Home Price | ADR | Occupancy | Annual Revenue | Gross Yield | Cap Rate | Property Tax |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Freeport | TX | $141,062 | $336.94 | 36% | $24,997 | 17.72% | 10.63% | 1.76% |

| 2 | Birmingham | AL | $132,690 | $153.52 | 48% | $12,622 | 9.51% | 5.71% | 0.61% |

| 3 | Augusta | GA | $173,702 | $180.96 | 49% | $16,482 | 9.49% | 5.69% | 0.96% |

| 4 | Delray Beach | FL | $338,236 | $280.47 | 51% | $29,494 | 8.72% | 5.23% | 0.91% |

| 5 | Corpus Christi | TX | $218,331 | $180.30 | 50% | $18,275 | 8.37% | 5.02% | 1.75% |

| 6 | Panama City | FL | $281,794 | $250.70 | 50% | $23,388 | 8.30% | 4.98% | 0.60% |

| 7 | Montgomery | AL | $146,435 | $147.34 | 57% | $11,708 | 8.00% | 4.80% | 0.38% |

| 8 | Savannah | GA | $327,263 | $232.65 | 54% | $24,955 | 7.63% | 4.58% | 0.94% |

Source: Chalet

Bonus Market Worth Watching:

| Market | State | Avg Home Price | ADR | Occupancy | Annual Revenue | Gross Yield | Cap Rate |

|---|---|---|---|---|---|---|---|

| New Orleans | LA | $239,043 | $197.58 | 42% | $17,433 | 7.29% | 4.38% |

New Orleans didn't crack the top 8 by gross yield, but with 4,063 active listings, it offers a massive ecosystem for comps and market research.

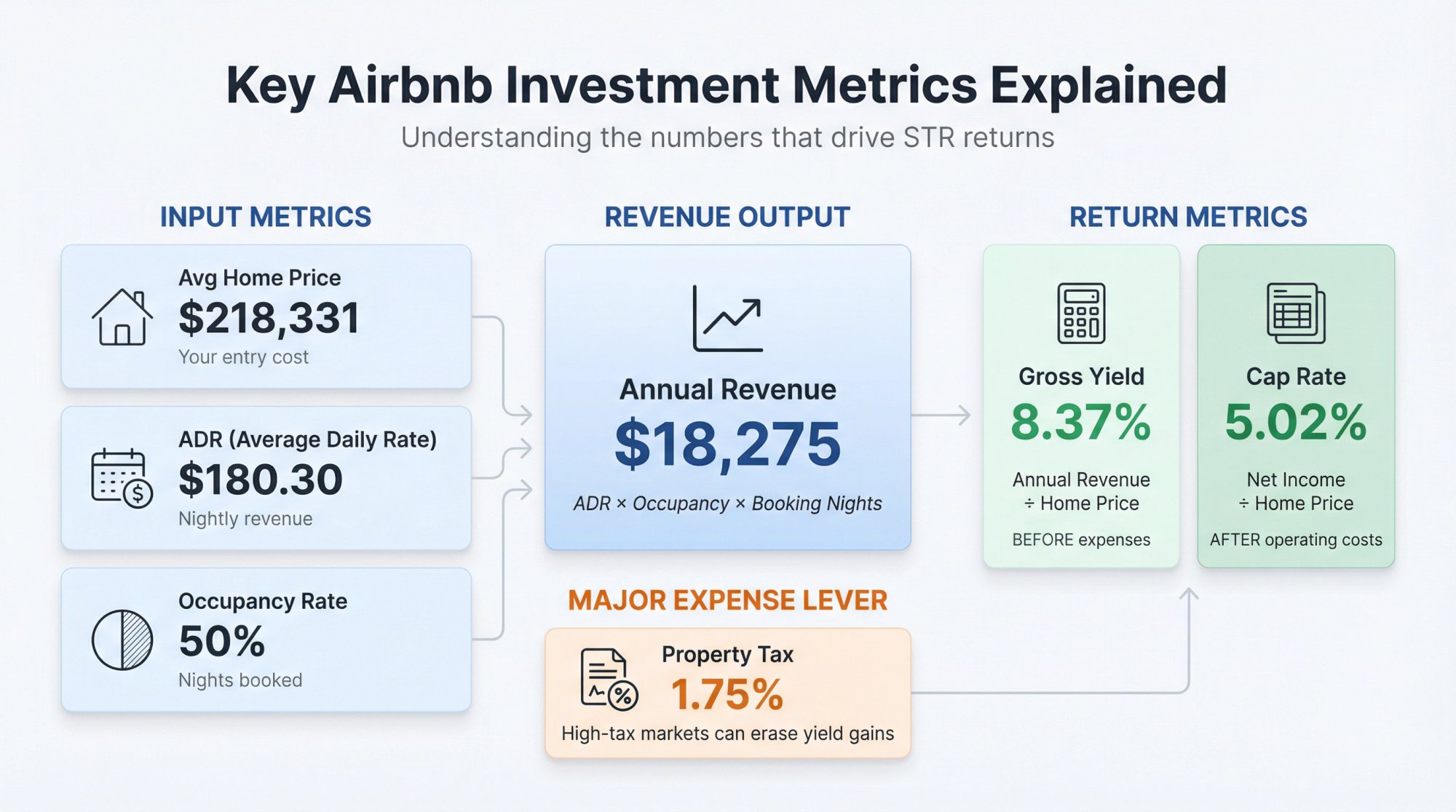

What Do Gross Yield and Cap Rate Mean for Airbnb Investors?

Before you get too excited about a 17% gross yield, you need to understand what you're looking at.

How to Read ADR, Occupancy, and Gross Yield

Avg Home Price (Zillow): Your entry cost. Cheaper doesn't automatically mean better, but it changes the math quickly.

ADR (Average Daily Rate): What hosts charge on booked nights. Higher ADR can cover a lot of operational sins, if you can stay booked. Learn more about average Airbnb occupancy rates by city.

Occupancy Rate: The percentage of nights booked. High occupancy often means steadier cash flow and simpler underwriting.

Annual Revenue: Top-line revenue estimate for a typical listing in that market, as modeled in Chalet's market analytics.

Gross Yield: Annual revenue divided by average home price. This is before any expenses.

Cap Rate: A net return estimate after operating costs but before financing. This matters because expenses are real. See which markets have high cap rates.

Property Tax: A major lever. High-tax markets can look great on gross yield and then disappoint on actual returns. Explore markets with low property tax.

How to Calculate Gross Yield for Any Market

Gross Yield = Annual Revenue / Avg Home Price

Take Freeport, TX as an example:

-

Annual Revenue: $24,997

-

Avg Price: $141,062

-

Gross Yield: $24,997 / $141,062 = 17.72%

That's why Freeport leads this list by a wide margin.

Why Doesn't ADR x Occupancy x 365 = Annual Revenue?

People often try to multiply ADR and occupancy together and get confused when numbers don't match. Real datasets can diverge because of:

-

Listings not being available all 365 days (owner use, blocked calendars)

-

Seasonality and rate swings (ADR is an average, not the rate every night)

-

Listing churn (new listings, inactive listings)

-

Different property mixes affecting ADR and revenue differently

Use the dataset fields as the authoritative values for this ranking and treat ADR plus occupancy as "drivers," not a perfect calculator.

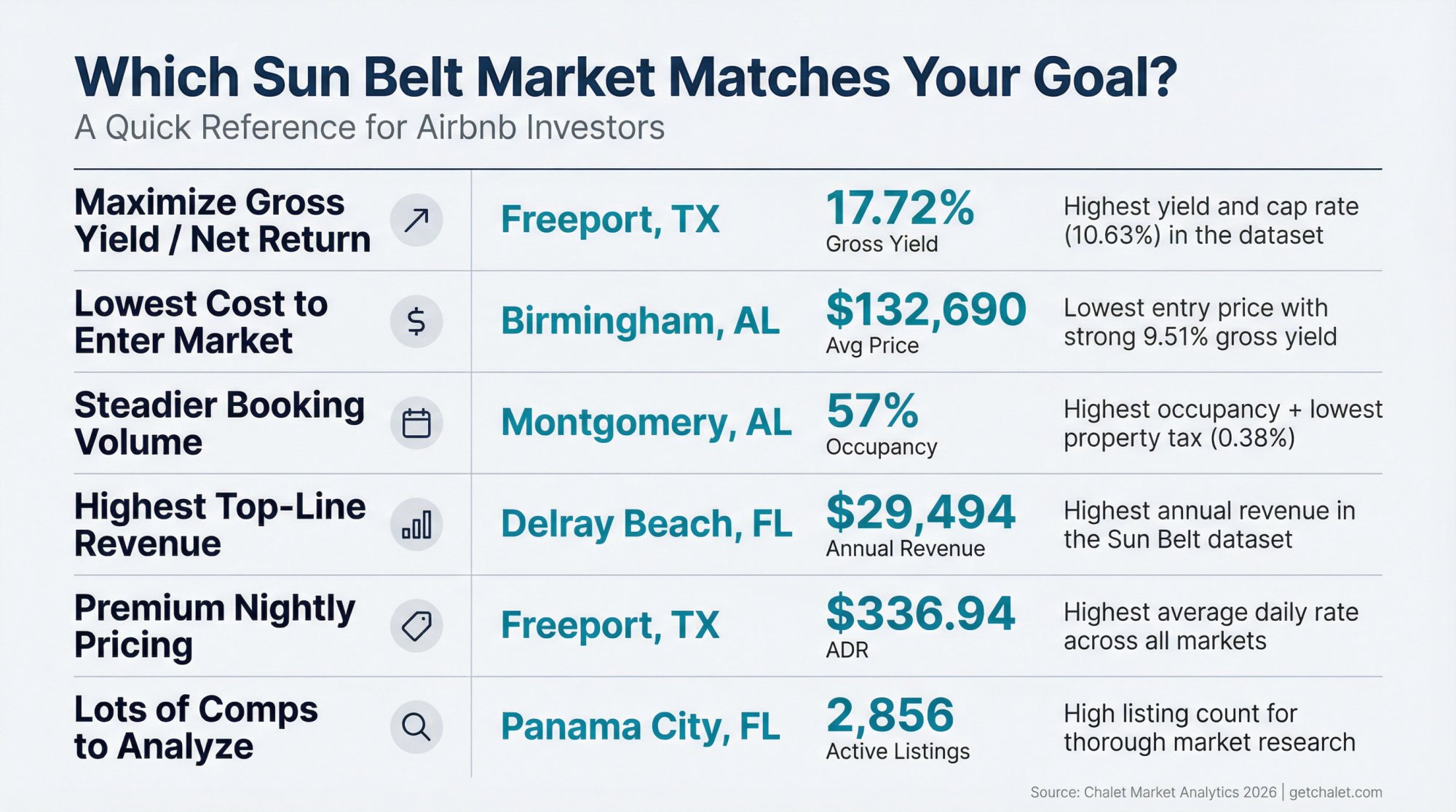

Which Sun Belt Market Is Best for Your Investment Goal?

Not every investor has the same priorities. Here's a quick cheat sheet based on what you're optimizing for.

| If Your Goal Is… | Start With… | Why |

|---|---|---|

| Maximize gross yield / net return potential | Freeport, TX | Highest gross yield (17.72%) and highest cap rate (10.63%) |

| Lowest cost to enter the market | Birmingham, AL | Lowest avg price ($132,690) with 9.51% gross yield |

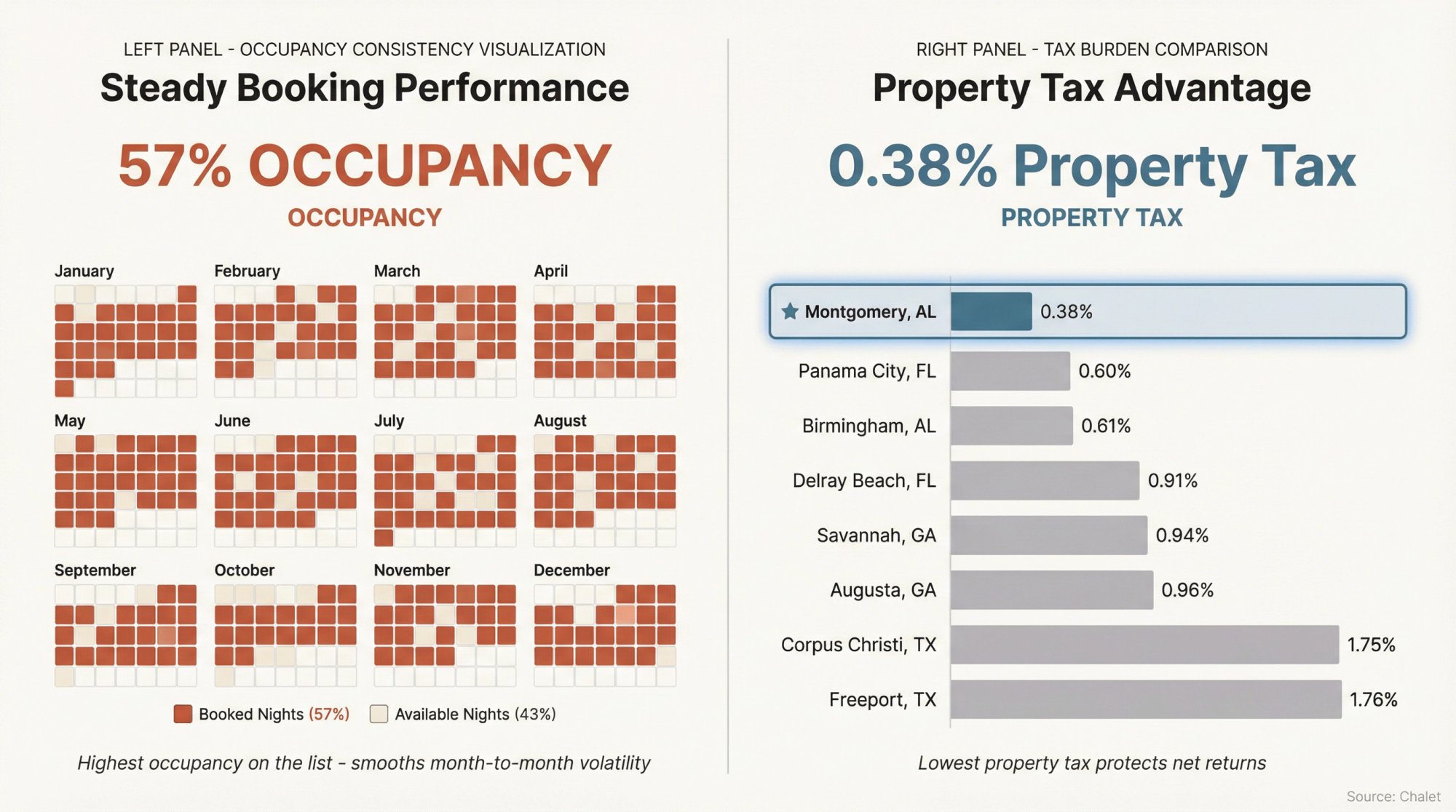

| Steadier booking volume | Montgomery, AL | Highest occupancy (57%) + lowest property tax (0.38%) |

| Highest top-line revenue | Delray Beach, FL | Highest annual revenue ($29,494) |

| Premium nightly pricing | Freeport, TX | Highest ADR ($336.94) |

| Lots of comps to analyze | Panama City, FL / Savannah, GA | High active listings (2,856 / 2,300) |

Use this to shortlist, then do the real work: regulations, comps, underwriting, and ops planning.

Freeport, Texas: Highest Gross Yield (17.72%)

The Numbers:

-

Avg Price: $141,062 (Zillow YoY: +4.44%)

-

ADR: $336.94 | Occupancy: 36%

-

Annual Revenue: $24,997

-

Gross Yield: 17.72% | Cap Rate: 10.63%

-

Property Tax: 1.76% | Active Listings: 448

Why It Works:

Freeport is the outlier on this list. Very low entry price paired with very high ADR is how you get a 17%+ gross yield. That combination is rare in any market.

What to Watch:

36% occupancy is the lowest on this list. High ADR with low occupancy usually means you're living in a world of peaks, troughs, and revenue management. You'll need a conservative underwriting stance and an operator mindset to make this work.

Best Fit For:

→ Portfolio builders who can manage seasonality and pricing

→ First-timers only if they're comfortable being hands-on or hiring a strong manager

Next Steps:

Birmingham, Alabama: Lowest Entry Price ($132,690)

| Metric | Value |

|---|---|

| Avg Price | $132,690 (Zillow YoY: -2.59%) |

| ADR | $153.52 |

| Occupancy | 48% |

| Annual Revenue | $12,622 |

| Gross Yield | 9.51% |

| Cap Rate | 5.71% |

| Property Tax | 0.61% |

| Active Listings | 615 |

Why It Works:

This is the classic "low cost of entry" play. Even with modest ADR, the price point keeps yield strong. Property tax is also relatively low, which helps your net returns. For investors looking for budget-friendly Airbnb markets, Birmingham is a strong contender.

What to Watch:

Annual revenue is lower in absolute dollars than the beach markets. You're playing a margin-plus-affordability game here, not a luxury ADR game.

Best Fit For:

-

First-time buyers who want a smaller check size

-

1031 exchange buyers looking for smoother underwriting with moderate occupancy

Next Steps:

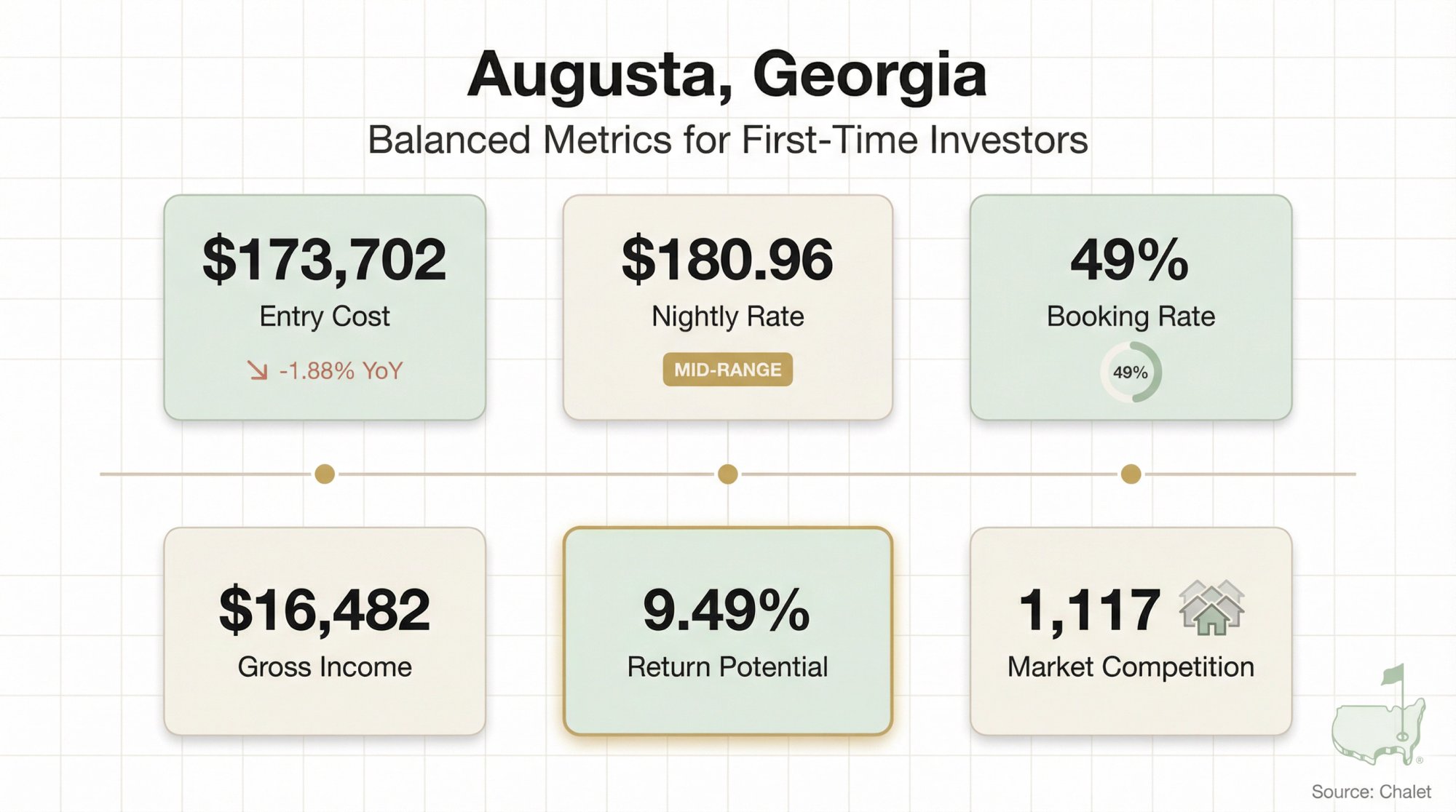

Augusta, Georgia: Balanced Metrics for First-Timers

The Numbers: Avg Price $173,702 (YoY: -1.88%) | ADR $180.96 | Occupancy 49% | Annual Revenue $16,482 | Gross Yield 9.49% | Cap Rate 5.69% | Property Tax 0.96% | Active Listings 1,117

Why It Works:

Augusta has a balanced profile: mid-range price, mid-range ADR, near-50% occupancy, and strong yield. It's the kind of market where underwriting feels less "binary" than super-seasonal markets. For more Georgia STR opportunities, explore the state-level data.

What to Watch:

Active listings are higher than Birmingham, so comps and competition matter more. You'll need a clear differentiation plan (size, amenities, layout, guest type).

Key consideration: Augusta's balanced metrics make it forgiving for first-timers, but 1,117 active listings means you can't just "list it and forget it."

Best Fit For:

① First-timers who want balance across all metrics

② Portfolio builders who like repeatable operations

Next Steps:

Delray Beach, Florida: Highest Annual Revenue

The Numbers:

-

Avg Price: $338,236 (Zillow YoY: -7.84%)

-

ADR: $280.47 | Occupancy: 51%

-

Annual Revenue: $29,494 (highest on this list)

-

Gross Yield: 8.72% | Cap Rate: 5.23%

-

Property Tax: 0.91% | Active Listings: 354

Why It Works:

Delray Beach is the "top-line revenue" play. It has the highest annual revenue in the dataset and strong occupancy above 50%. If you're looking at markets with high annual revenue, Delray Beach should be on your list.

What to Watch:

It's also one of the highest entry prices, and it had the biggest YoY price decline in the dataset. That's not automatically bad, but you should underwrite with discipline and plan for slower appreciation.

Best Fit For:

→ 1031 investors who can deploy more capital and want higher revenue potential

→ Portfolio builders aiming for premium positioning

Next Steps:

Corpus Christi, Texas: Middle Ground for Balanced Returns

| Metric | Value |

|---|---|

| Avg Price | $218,331 (Zillow YoY: -3.12%) |

| ADR | $180.30 |

| Occupancy | 50% |

| Annual Revenue | $18,275 |

| Gross Yield | 8.37% |

| Cap Rate | 5.02% |

| Property Tax | 1.75% |

| Active Listings | 1,492 |

Why It Works:

Corpus Christi sits in the middle of the road on price with clean demand signals (50% occupancy) and solid revenue. It's one of the best Airbnb markets in Texas for investors seeking balanced returns.

What to Watch:

Property tax is high relative to many other markets here, which is exactly why cap rate matters for your real returns. Also, active listings are high, so competition is real.

Best Fit For:

-

First-timers who want a "not too cheap, not too expensive" entry point

-

Portfolio builders who can compete on quality and operations

Next Steps:

Panama City, Florida: High Revenue in a Competitive Market

The Numbers: Avg Price $281,794 (YoY: -0.74%) | ADR $250.70 | Occupancy 50% | Annual Revenue $23,388 | Gross Yield 8.30% | Cap Rate 4.98% | Property Tax 0.60% | Active Listings 2,856

Why It Works:

Strong ADR combined with 50% occupancy gives you high annual revenue. Property tax is also relatively low. Panama City is a top pick among Florida's best Airbnb markets.

What to Watch:

2,856 active listings is one of the highest in the dataset. That can mean strong demand, but it also means you need a sharp "why you" story: location, beds/baths, amenities, photos, and pricing discipline.

In high-competition markets, your property, design, and operational quality determine whether you perform above or below the averages in this dataset.

Best Fit For:

① Portfolio builders who know how to compete

② 1031 buyers who want lots of comparable listings to underwrite against

Next Steps:

Montgomery, Alabama: Highest Occupancy (57%)

The Numbers:

| Metric | Value | Notes |

|---|---|---|

| Avg Price | $146,435 | YoY: -0.54% |

| ADR | $147.34 | Lowest on this list |

| Occupancy | 57% | Highest on this list |

| Annual Revenue | $11,708 | |

| Gross Yield | 8.00% | |

| Cap Rate | 4.80% | |

| Property Tax | 0.38% | Lowest on this list |

| Active Listings | 402 |

Why It Works:

Montgomery is the "steady occupancy plus low tax" market. You won't get flashy ADR here, but high occupancy can smooth out the month-to-month volatility.

What to Watch:

With lower ADR and revenue, you need to be cost-conscious on furnishing and ongoing ops. Don't build a luxury cost structure for a mid-rate market. Learn how to transition from full-service property management to self-management to maximize margins.

Best Fit For:

→ First-timers who want stability and simpler operations

→ Investors prioritizing predictability over "moonshot" ADR

Next Steps:

Savannah, Georgia: Scale-Worthy Revenue Profile

The Numbers:

-

Avg Price: $327,263 (Zillow YoY: -3.20%)

-

ADR: $232.65 | Occupancy: 54%

-

Annual Revenue: $24,955

-

Gross Yield: 7.63% | Cap Rate: 4.58%

-

Property Tax: 0.94% | Active Listings: 2,300

Why It Works:

Savannah combines high occupancy with high annual revenue. It's a "scale-worthy" profile on the revenue side.

What to Watch:

Active listings are very high. This isn't a market where "list it and pray" works. Your property, design, and operational quality need to be above average to stand out. Understand how to navigate local regulations before committing.

Best Fit For:

-

Portfolio builders who can consistently execute at a high level

-

1031 buyers who want a higher-revenue market and can handle competition

Next Steps:

New Orleans, Louisiana: Best for Market Research

The Numbers:

-

Avg Price: $239,043 (Zillow YoY: -2.57%)

-

ADR: $197.58 | Occupancy: 42%

-

Annual Revenue: $17,433

-

Gross Yield: 7.29% | Cap Rate: 4.38%

-

Property Tax: 0.79% | Active Listings: 4,063 (highest in the dataset)

Why It's Worth Watching:

4,063 active listings means a huge existing ecosystem and plenty of comps to study. The market didn't crack the top 8 by gross yield, but it has a massive short-term rental infrastructure already in place.

Why It Didn't Make the Top 8:

Lower occupancy in this snapshot (42%) and a lower yield/cap rate relative to the other markets.

Next Steps:

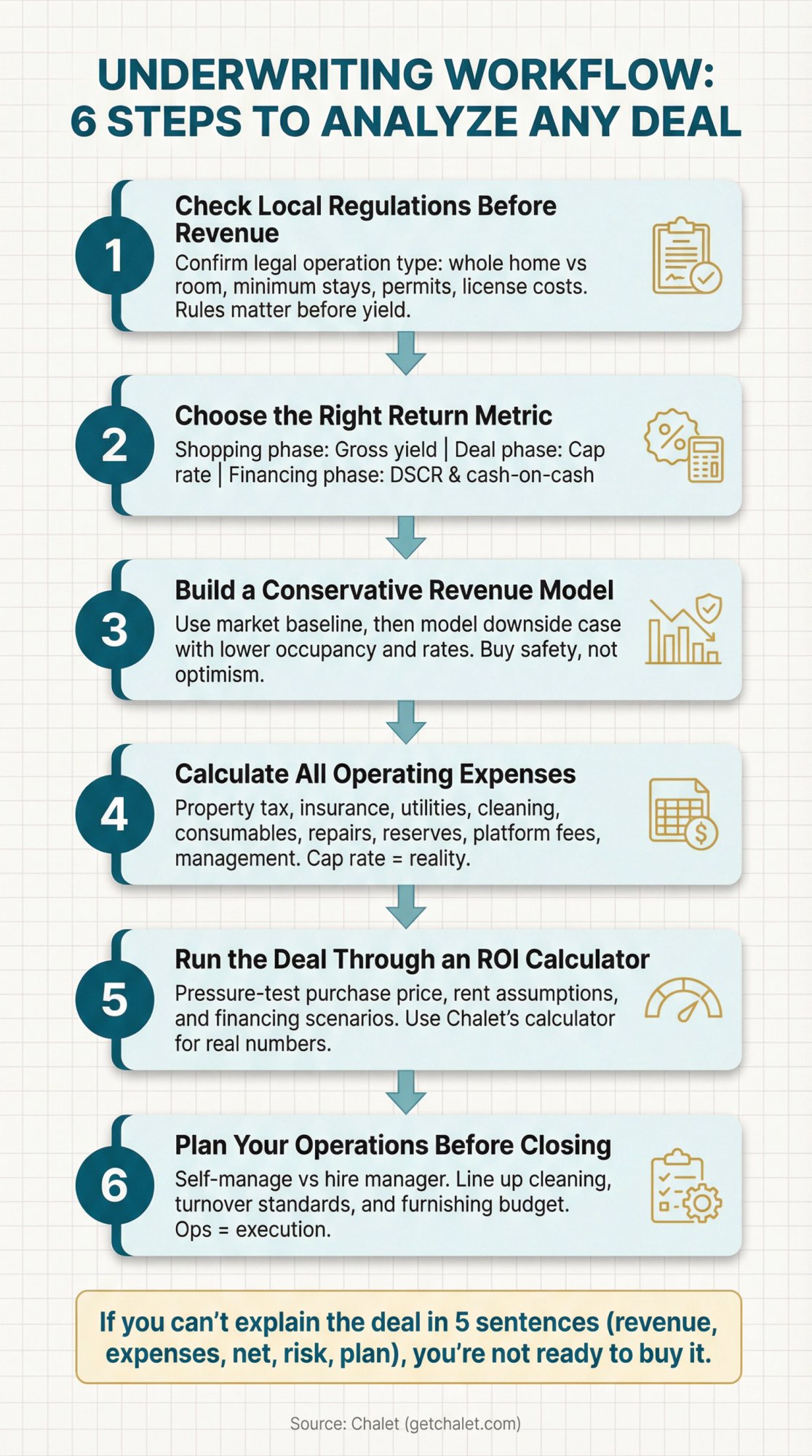

How to Underwrite Sun Belt Markets Before You Buy

This is the process that prevents expensive mistakes. Use it whether you're buying your first place or your tenth.

Step 1: Check Local Regulations Before Revenue

Before you fall in love with a market's gross yield, confirm you can legally operate the type of short-term rental you want. Whole home vs room, minimum stays, permits, license costs. Start here: Check local STR regulations

Step 2: Choose the Right Return Metric

Different phases of analysis call for different metrics:

→ Shopping phase: Gross yield is fine for narrowing markets

→ Deal phase: Cap rate (net) matters more

→ Financing phase: DSCR and cash-on-cash matter most. Learn about DSCR financing for short-term rentals.

Step 3: Build a Conservative Revenue Model

Use the market's annual revenue as a baseline, then build a downside case with lower occupancy and lower rates. You're not being pessimistic. You're buying safety.

Step 4: Calculate All Operating Expenses

At minimum: property tax, insurance, utilities, cleaning, consumables, repairs, reserves, platform fees, and management if you're using one. The whole point of cap rate is acknowledging these costs exist. Consider cost segregation analysis to offset some of your tax burden.

Step 5: Run the Deal Through an ROI Calculator

Use Chalet's ROI Calculator to pressure-test purchase price, rent assumptions, and financing.

Step 6: Plan Your Operations Before Closing

Self-manage vs hire a manager. Line up cleaning and turnover standards. Build your furnishing budget. Chalet's directory is built for this step: Set up your ops stack

Step 7: Write Your Offer Last, Not First

If you can't explain the deal in 5 sentences (revenue, expenses, net, risk, plan), you're not ready to buy it.

How to Choose Your First Airbnb Market

If you're buying your first Airbnb rental, your goal isn't to maximize theoretical return. Your goal is to avoid a deal that breaks you.

A practical "first deal" filter using this dataset:

→ Lower entry price (easier reserves, easier mistakes)

→ Decent occupancy (more forgiving than highly seasonal cash flow)

→ Reasonable property tax (protects net returns)

Based on those criteria, your first shortlist usually starts with:

Birmingham, AL: Lowest entry price plus strong yield

Montgomery, AL: Highest occupancy plus lowest property tax

Augusta, GA: Balanced profile across all metrics

Your next step: Pick one market and do real comps, not vibes. Start with Chalet's market analytics and then run specific addresses through the calculator.

1031 Exchange: How to Find Sun Belt Markets in 45 Days

1031 exchange success is mostly project management. You don't have time for "maybe." Understand the 1031 exchange timeline before you start.

The Playbook:

Days 1-3: Pick 2-3 markets from this list that match your capital (price point) and return target (cap rate).

Days 4-10: Build a buy box (property type, budget, must-have features).

Days 11-20: Line up vendors: agent, lender, insurance, manager. Start here: Meet an Airbnb-friendly agent

Days 21-45: Identify properties and run each one through the ROI calculator.

Days 46+: Execute with your chosen vendor stack.

Markets that often fit "move fast" behavior based on dataset characteristics:

-

Higher active listings can mean more data to underwrite and compare (Panama City, Savannah, New Orleans)

-

Higher annual revenue can make underwriting easier if expenses are controlled (Delray Beach)

But if local rules don't work, none of the revenue matters.

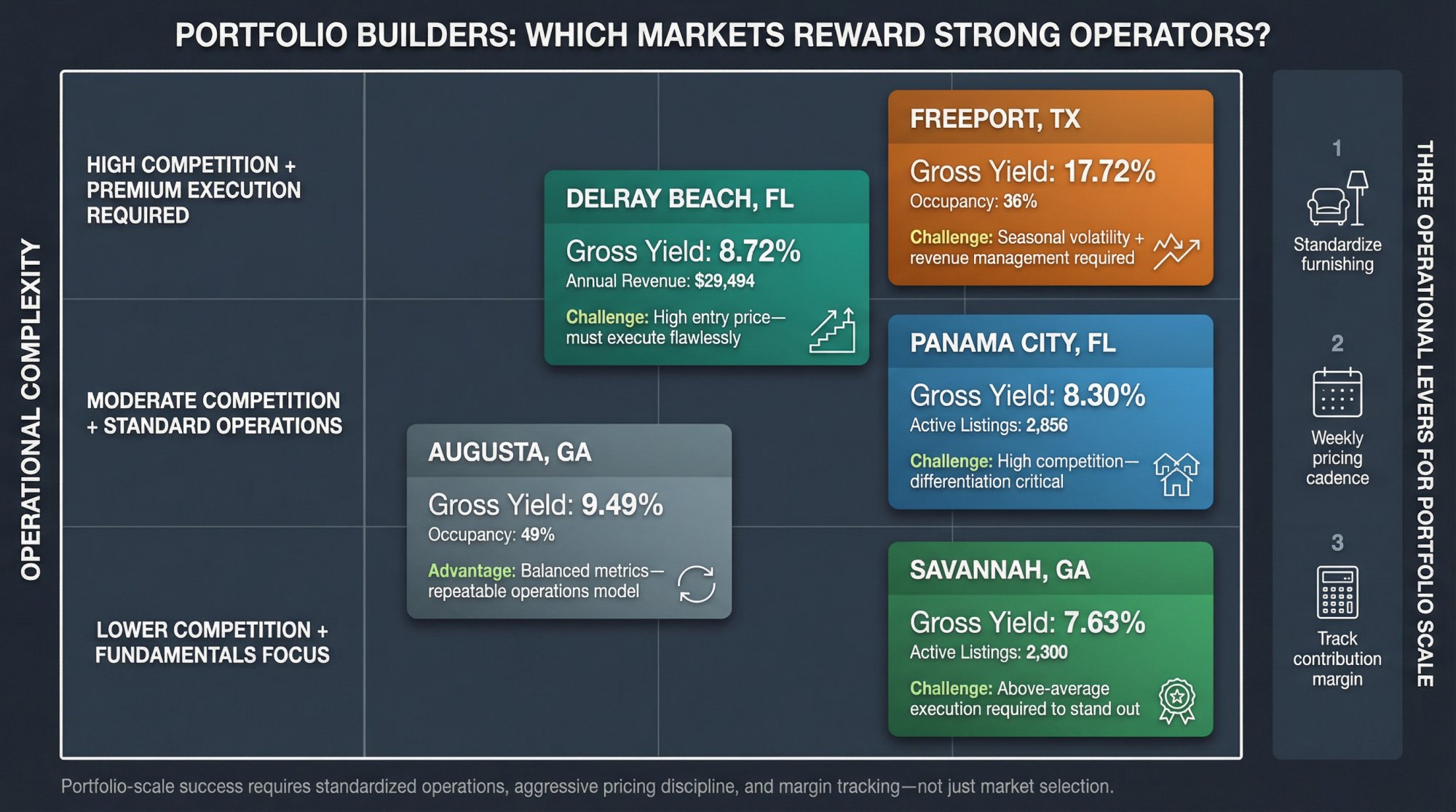

Portfolio Builders: Which Markets Reward Strong Operators?

Once you own 1-5 STRs, the next unlock is repeatability:

① Standardize furnishing and turnover to reduce variability

② Get ruthless about pricing cadence (weekly review, not monthly)

③ Track contribution margin (net after variable costs), not just revenue

Markets in this dataset that tend to reward strong operators:

Freeport, TX: Huge gross yield, but you need to manage low occupancy risk

Panama City, FL and Savannah, GA: High active listings means competition. Ops and positioning matter.

Delray Beach, FL: High revenue potential, but the entry price pushes you to execute well

For advanced strategies, explore building an Airbnb empire with DSCR loans.

Why Use Chalet for Sun Belt Market Research?

We built Chalet to solve a problem we saw over and over: investors spending weeks bouncing between data tools, agent calls, lender introductions, and regulation research.

Chalet brings everything you need into one platform. Here's what the actual interface looks like when you use it.

What you get with Chalet:

→ Free market analytics: ADR, occupancy, revenue trends across markets. No paywall, no subscription upsell. Explore the dashboards

The analytics dashboard shows you real market data without any subscription fees. You can compare markets, track trends, and export data for your own analysis.

→ ROI and DSCR calculators: Pressure-test any address before you make an offer. Run your numbers

→ Vetted vendor network: STR-specialist agents, lenders, insurance, property managers, cleaning, furnishing. All in one place. Meet a specialist

→ Regulation library: Check local short-term rental rules before you fall in love with a market. Verify local rules

We pair free analytics with the vendors you'll actually need, so you can move from research to reality without the typical handoff chaos.

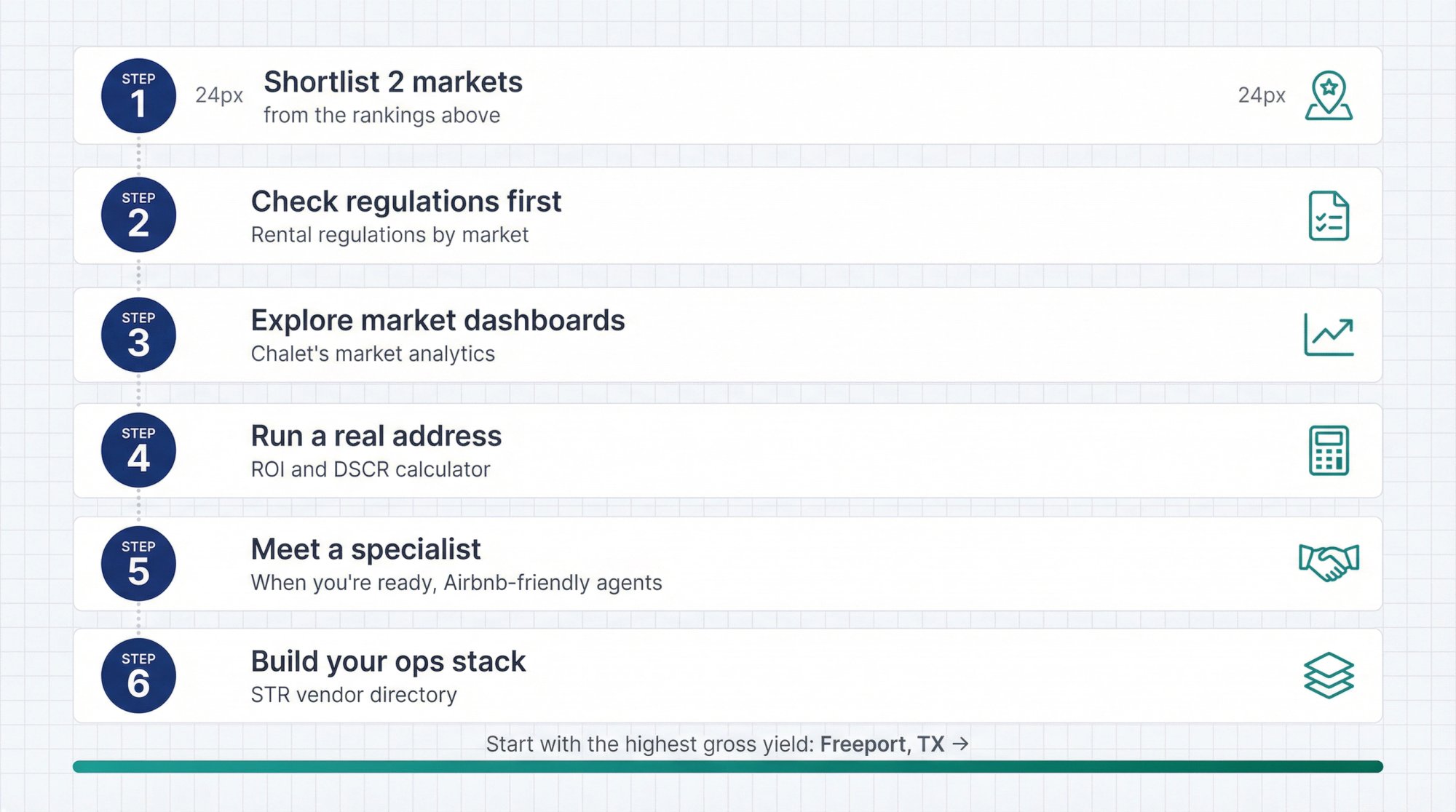

Next Steps: Start Your Sun Belt Market Search

① Shortlist 2 markets from the rankings above

② Check regulations first: Rental regulations by market

③ Explore market dashboards: Chalet's market analytics

④ Run a real address: ROI and DSCR calculator

Use Chalet's calculator to model your returns before making an offer. Input purchase price, estimated revenue, and operating expenses to see projected cash flow and return metrics.

⑤ When you're ready, meet a specialist: Airbnb-friendly agents

⑥ Build your ops stack: STR vendor directory

And if you want to start with the highest-ranked market by gross yield: Explore Freeport, TX

FAQ: Sun Belt Airbnb Investment Questions

Are these returns guaranteed?

No. These are market averages from Chalet's dataset. Your exact property, micro-location, amenity set, and operations can beat or miss these numbers. Use them as a starting point for your own underwriting.

What's the difference between gross yield and cap rate?

Gross yield tells you "top-line power for the price" and it's great for screening markets. Cap rate tells you "net reality after expenses" and it's better for actual buying decisions. If you're new to STR investing, don't fall in love with gross yield alone. Check out whether Airbnbs are profitable: a market-based analysis.

What does "active listings" mean for me as an investor?

Active listings is a competition proxy. More listings equals more comps and more competition. It doesn't automatically mean good or bad. It means you need a plan to differentiate your property. See markets with more than 2,000 listings for context.

Why do some markets have high ADR but lower occupancy?

That pattern often shows up when demand is peak-heavy or when pricing is premium and nights are harder to fill. Treat it as a flag to underwrite conservatively and invest in revenue management.

How often is this data updated?

The data in this guide reflects Chalet's 2026 dataset. For real-time market data, explore the market analytics dashboards directly.

Can I use Chalet's data for free?

Yes. Chalet's market dashboards, ROI calculator, and regulation library are 100% free. No paywall, no subscription required.

How do I know which market is right for my first STR?

Start with the "First-Time Buyers" section above. Focus on lower entry prices, decent occupancy, and reasonable property tax. Birmingham, Montgomery, and Augusta typically top that list.

What if regulations change after I buy?

Regulations are a real risk. That's why we recommend checking local rules before you fall in love with a market. Chalet's regulation library is a good starting point, but you should also consult local attorneys and licensing offices before closing.