Buying an Airbnb rental isn't like buying a regular house. You're really buying a short-term rental business with real estate attached. When people search "best time to buy," they usually want the cheapest month. But in STR investing, the answer is more complex. It's about aligning (1) housing market seasonality, (2) your target market's travel season, and (3) your ability to get permitted, insured, furnished, and live before the peak booking months hit.

This guide walks you through the data-backed patterns that repeat year after year, the specific windows that work for different investor goals, and the execution framework that turns timing knowledge into actual results. It's written for first-time Airbnb buyers, 1031 exchangers, and portfolio builders who want to make smart, informed decisions.

What's the Best Time to Buy an Airbnb Property?

There's no magic month that works for everyone.

But here's what the data actually shows:

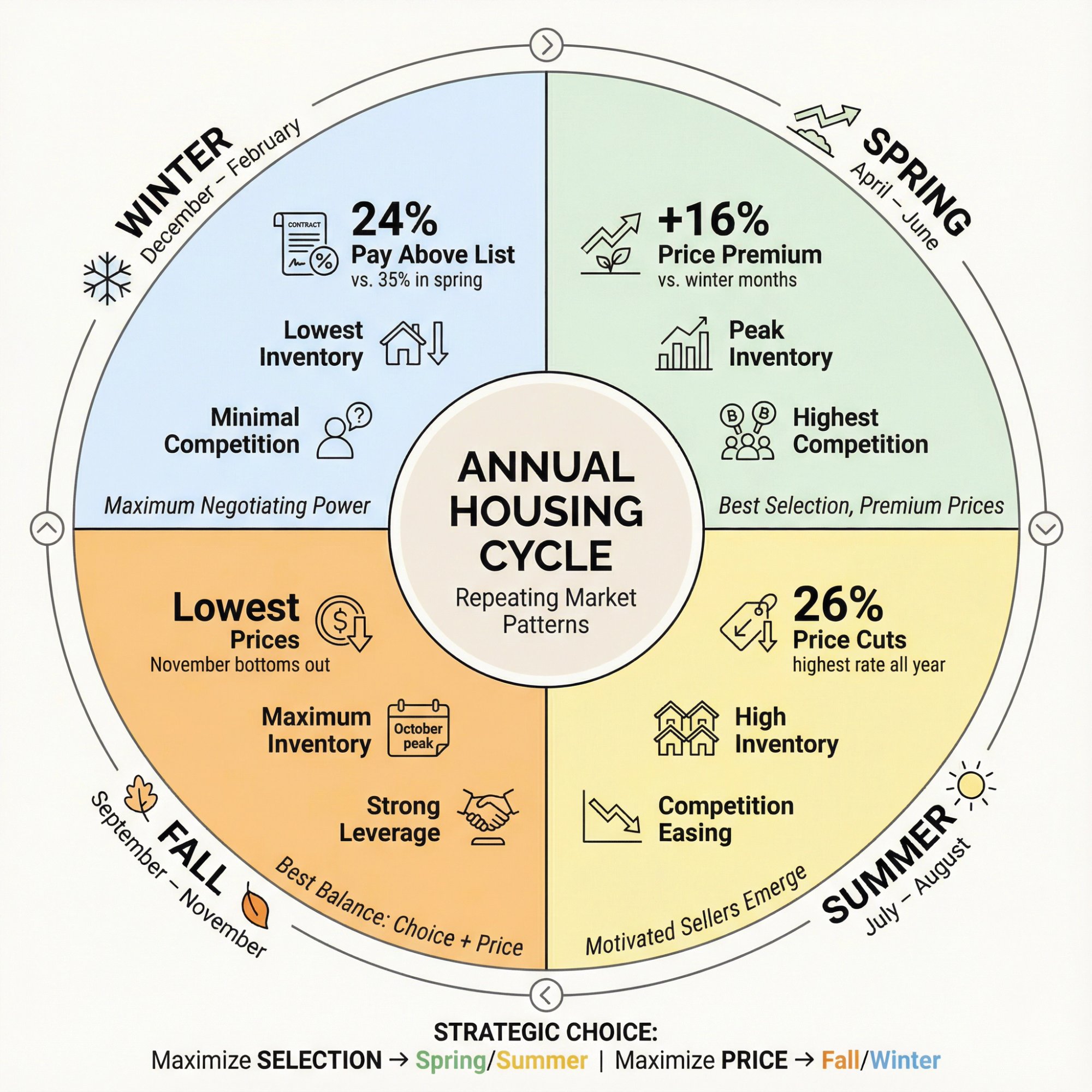

For balanced selection + negotiating power: Late September through October tends to be the sweet spot nationally. Realtor.com's 2025 analysis identified October 12 to 18 as the best week to buy, with prices typically 3.4% below seasonal peaks and inventory about 14.7% higher than an average week.

For maximum negotiation leverage: November through February often wins. Fewer buyers means less competition. Zillow's 2024 sales data shows buyers paid above list 35% of the time in May and June versus only 24% in January. That's real negotiating power.

For fastest path to cash flow: The best time is whichever window gets you live before your market's peak travel season, even if it's not the cheapest month to purchase.

If you're thinking "so I'll just wait until October," pause. That's the trap most investors fall into. Timing helps, but deal quality, regulatory compliance, and execution speed matter more than the calendar date.

Why People Search "Best Time to Buy an Airbnb"

Most people aren't actually asking about a specific month.

They're trying to reduce one (or more) of these five core risks:

① Overpaying (buying at peak competition, losing in bidding wars, paying above asking)

② Regulatory failure (buying a property that can't legally operate as an STR)

③ Missing revenue season (closing too late, losing the high-demand months)

④ Underwriting errors (annualizing peak-season income, ignoring seasonality curves)

⑤ Execution collapse (can't line up insurance, financing, repairs, furnishing, or management in time)

Success looks like this:

→ You pick a buying window that matches your market's demand curve

→ You negotiate from a position of strength because you understand seller psychology

→ You close with vendors already lined up (lender, insurance, property manager, cleaners, furnishers)

→ You launch at the optimal moment, and your first 90 days set up your entire year

That's what "best time" really means.

Why Housing Market Timing Changes Your Odds

Everything here is supply, demand, and human behavior.

How Seasonal Patterns Impact Home Prices

Families move when school lets out. Weather affects showings and moving logistics. Holidays disrupt schedules. These patterns create predictable swings in activity. The National Association of Realtors notes that pending home sales typically rise in spring, peak around early summer, and then slow considerably in late fall and winter.

More listings in spring and summer. Fewer in late fall and winter. That's the rhythm.

How Many Other Buyers Are Competing?

When fewer competing offers exist, sellers become more flexible on:

-

Price concessions

-

Repair credits

-

Closing cost coverage

-

Timeline adjustments

-

Contingency acceptance

It's not complicated. Less competition gives you leverage.

Why STR Revenue Seasonality Matters More Than Purchase Price

A 2% to 4% better purchase price is valuable. But missing your market's peak booking season can cost more than that in lost revenue. It can also weaken your DSCR (Debt Service Coverage Ratio, the metric lenders use to determine if rental income covers your mortgage) if you're financing the property with a DSCR loan.

Critical insight: A 2% to 4% purchase discount is valuable, but missing your market's peak season can cost you more in lost revenue than you saved on price. STR investors must think in two calendars: housing seasonality and travel seasonality.

That's why Airbnb investors have to think in two calendars: housing seasonality and travel seasonality. Generic real estate advice misses this completely.

The Three Clocks Every Airbnb Buyer Must Align

Clock 1: National Housing Seasonality (Selection vs. Leverage)

Realtor.com's "best time to buy" methodology tries to balance multiple factors:

-

Inventory levels (how many homes are available)

-

Pricing relative to seasonal peaks

-

Days on market (how fast homes sell)

-

Buyer demand and competition

-

Frequency of price reductions

The methodology also notes that interest rates don't follow seasonal patterns, so they're excluded from the timing model. You can't time rates with a calendar.

Key takeaway: Early fall often gives you both reasonable inventory and negotiating leverage, not just one or the other.

Clock 2: Your Market's Travel Season (Your Revenue Calendar)

Here's a concrete data point that shows why seasonality matters:

In July 2025, U.S. short-term rentals averaged 67.4% occupancy with an average nightly rate of $351.67, and approximately 1.77 million listings were active nationwide.

Summer is a massive demand month in many markets.

You don't need July to be your market's peak. You just need to know what your peak actually is. A ski market peaks in December through February. A beach market peaks in June through August. An event-driven market (think college football towns) peaks around home game weekends.

Your buying timeline should work backward from your peak season, not forward from today's date. Use Chalet's free market analytics to identify exactly when your target market experiences peak occupancy and rates.

Clock 3: Your Execution Timeline (Financing, Insurance, Permits, Setup)

Most investors drastically underestimate how long "close to launch" actually takes, especially in regulated markets or HOA-heavy communities.

If you want to be live and accepting bookings before your peak season, you need to work backward:

Peak season starts ← 90 days ← Furnishing/photography ← 30 days ← Repairs/permits ← 45 days ← Closing

That's a minimum 165-day window from contract to first booking in many markets. Some markets take longer.

If you're not thinking about execution timelines, you're not ready to optimize buying timing. This is where working with STR-specialist agents who understand these timelines becomes critical.

How Housing Seasonality Works: What to Expect Each Season

The U.S. housing market follows a predictable annual rhythm. Spring brings a surge of both listings and buyers. Winter is quiet. Understanding this rhythm helps you know when you have leverage and when you're fighting the crowd.

Spring (April to June): The prime selling season. Research shows homes sold in June typically command about 16% higher prices than homes sold in December through February. You'll see the most new listings, which is great for selection. But buyer demand also peaks, leading to bidding wars and premium prices. Families want to move when school is out, so demand surges in spring. You'll need to act fast and potentially pay above asking if you're competing in a hot market.

Summer (July to August): The market stays active with high inventory levels. But by late summer, motivation shifts. Sellers who listed in spring and didn't sell start cutting prices. In 2024, about 26% of listings had price reductions in July and August, the highest rate all year. Buyer competition begins easing as summer ends.

Fall (September to November): The spring/summer frenzy subsides. Sellers who've been on the market for months become more negotiable as they don't want to carry the property into winter. Inventory remains robust. October often has the most homes for sale because it includes leftover summer listings plus new autumn listings. Prices tend to cool off, with sale prices nationally hitting their low point around November.

Winter (December to February): The slowest period of the year. Few people want to move during holidays and cold months, so February typically has the lowest number of homes for sale. But the flip side? Minimal competition. Only truly motivated buyers and sellers are active. Sellers listing in winter are often highly motivated and willing to accept lower offers or provide concessions to close the deal. Far fewer buyers pay over asking in winter. In January, only 24% paid above list compared to 35% in May and June.

The pattern: If maximizing choice is your priority, late spring and summer offer the most listings. If getting the best price is your goal, fall and winter generally tilt in your favor.

How to Choose Your Best Buying Window Based on Goals

Use this table as a decision filter for your situation:

| Your Primary Goal | Typical Best Window | Why It Works | The Tradeoff |

|---|---|---|---|

| Best balance of selection + leverage | Late September through October | Inventory is high, competition is lower than spring, prices often ease versus peak | Still a competitive season in hot metros |

| Lowest competition | November through February | Fewer buyers shopping, more negotiation room | Fewer new listings, weather slows inspections and repairs |

| Most price cuts to target | July through August | Price cuts spike mid to late summer in many markets | Competition can still be elevated |

| Maximum inventory | Often October | Carryover listings plus late-season listings boost total inventory | Not always the cheapest month |

| Fastest STR cash flow | X days before your peak season | You capture peak months immediately after launch | You may pay more if that overlaps spring/summer |

You can't optimize for everything simultaneously. Pick what matters most to your situation.

When to Buy in Spring: High Season, High Competition

April through June is traditional home-selling season. For Airbnb property buyers, this period feels like a seller's market. You'll see the largest influx of new listings (great for selection), but also the fiercest competition from other buyers.

In hot markets, multiple offers are common in spring. Homes sell quickly. Buyers often bid aggressively. Statistically, spring buyers are far more likely to pay above asking than winter buyers. This is partly because families prefer to move in summer when school is out, and nice weather makes properties especially attractive.

What this means for you: If you're buying your first Airbnb or STR in spring, prepare to move fast and potentially pay a premium. Make sure your financing is lined up. Get pre-approved before you start touring properties.

Consider using Chalet's free ROI calculator to ensure a property still meets your investment criteria even at a higher price point. While you might not score a bargain in spring, you will have plenty of options to choose from. This is useful if your criteria are very specific (certain neighborhood, property type, amenities). Just know that the price tags will be on the higher end of the yearly range.

When to Buy in Late Summer and Fall: The Sweet Spot

As summer winds down and fall begins, the market dynamic shifts in favor of buyers. August through October is often the sweet spot for purchasing an investment property like an Airbnb.

Here's why:

Ample Inventory

By late summer, total homes for sale are near yearly highs. October in particular tends to have the most listings nationwide, since it includes houses that didn't sell in spring/summer plus new fall listings. For buyers, this means plenty of choice. You get both fresh opportunities and properties that have been sitting for a few months, which signals potential negotiation opportunities.

Cooling Demand

Buyer traffic usually drops off once school starts in the fall. Families have settled in for the year, and the urgency of summer fades. Fewer buyers in the market means less competition for you. You're less likely to get into bidding wars. In fall 2023, about one in five homes on the market had a price drop by October, and over a third of sellers were offering concessions to attract buyers.

Price Cuts and Negotiation

Late summer is when you start seeing more price reductions on listings. Many sellers initially list high in spring. If their home is still unsold by August, they often cut the price to get it sold before the holidays. In 2024, the highest rate of price cuts occurred in July and August (26% of listings). By fall, you can find homes that have been marked down from their peak asking prices.

Sellers become increasingly open to negotiating on price and terms as days on market add up. This might mean you can get a home below its spring value, or negotiate perks like seller-paid closing costs or included furnishings (great if you plan to use the furniture for your Airbnb rental).

Quality Listings for Vacation Rentals

Uniquely for vacation rental properties, late summer and early fall often bring new quality listings to market. Many vacation home owners earn their income during peak season (think summer at a beach house). They're reluctant to sell while they can still collect high Airbnb rents or enjoy the property themselves. That's why post-Labor Day is a popular time to list a vacation home. Few owners will sell during peak summer, but many put their vacation properties up for sale around Labor Day once the high season ends. For an investor, this is prime time to find an Airbnb-ready property in a vacation hotspot.

When to Buy in Winter: Hidden Opportunities and Challenges

November through February is typically the slowest time for real estate. For Airbnb investors, this off-season can offer hidden opportunities if you know how to navigate it. But it comes with trade-offs.

Advantages of Buying in Winter

Motivated Sellers and Lower Prices

With fewer buyers shopping, sellers can't be picky. Homes on the market in November/December often belong to sellers who need to sell (job move, financial need, year-end closing for tax reasons). They're more likely to entertain lower offers or add incentives.

Historical data backs this up. Winter sees the fewest home sales, so any seller listing during the holidays is probably eager, which can translate into a better deal for you. Sale prices in many markets hit their annual low in the winter months. If you find the right property, you might snag it for a price that would have been impossible in spring.

Less Competition

Many buyers drop out of the market in winter. Families don't want to uproot during the school year or holidays. Casual shoppers pause their search. If you're house-hunting in January, you might be one of very few offers on a given property or the only offer. You won't have to race others or waive contingencies like you might in June. This gives you breathing room to negotiate and do thorough due diligence (always important, especially for an STR purchase).

Faster Closings

With lower transaction volume, everyone from lenders to appraisers has more bandwidth in winter. You might close on the property faster and with less stress. By closing before December 31, there could even be tax perks (in the U.S., you could start depreciating the property for that year).

Drawbacks to Consider

Limited Inventory

The biggest downside is simply finding the right property in winter. Inventory is at its lowest in late winter (February). Fewer new listings appear since many sellers wait until spring. Your choices will be limited. You might have to compromise on some criteria or be patient until more listings appear. If you have very specific requirements for your Airbnb (certain location, property size), the winter market might not have what you need.

Property Evaluation Challenges

In cold climates, winter weather can complicate home inspections and viewing. It's hard to assess a roof under snow, gauge landscaping, or test a pool in January. Make sure to get as much information as possible (ask for summer photos, maintenance records). Also factor in that any outdoor repairs or improvements might have to wait until spring. If you buy a lake house in December and the ground is frozen, you might not be able to start driveway paving or dock repair immediately.

Carrying Costs Before High Season

When you buy off-season, you'll potentially hold the property for a few months before the peak rental season kicks in. Buy a beach cottage in December and you likely won't see strong Airbnb income until Memorial Day. Be prepared for that lull in revenue.

The flip side is you get time to renovate and furnish the place. Many investors purposely buy in fall/winter so they can use the offseason to do upgrades. The goal: have it rental-ready by the time bookings surge.

One piece of advice from seasoned vacation rental owners: if you buy in fall, immediately start lining up contractors you need, because the off-season window is shorter than you think. Depending on your area, weather or rules (like winter road weight limits in some mountain towns) can limit how much work you can do in deep winter. Aim to have your Airbnb property fully ready by late spring so you can maximize income when the season arrives.

In summary, winter can be the best time to snag a bargain on an Airbnb, but you have to be both patient and prepared. If the right deal isn't there, don't force it. It might be worth waiting for early spring listings. But if you do find a gem, jump on it confidently knowing the data supports you: you're likely getting it at a relative low point in price. Just budget for a few extra mortgage payments before the renters arrive.

What Most "Best Time to Buy" Articles Miss About STR

Most real estate timing advice assumes you're buying a primary home.

As an STR buyer, you have two extra dynamics working for you:

Why Vacation Home Sellers List After High Season

Think about a beach market. Summer is the revenue season. Owners collect those high nightly rates, then many list their properties in fall. Same pattern in ski towns after winter season ends.

This creates a high-quality buying window for you:

→ You get motivated sellers (they're done hosting for the season and ready to move on)

→ You still have runway to renovate and prepare the property to launch before the next peak season

Why Touring During Peak Season Leads to Bad Deals

If you tour a property during peak season, your brain anchors on peak nightly rates and "fully booked weekends." Then you annualize that performance in your head. That's how investors overpay.

A smarter approach:

• Underwrite using trailing twelve-month performance if data exists

• If it doesn't, underwrite with seasonality curves (monthly occupancy and ADR), not one great weekend

• Never assume peak-season performance is sustainable year-round

This is where Chalet's free market analytics become valuable. You can see actual occupancy and revenue patterns across different months, not just a snapshot. That prevents you from making the classic rookie mistake of buying a property based on July performance and expecting it in February.

Season-by-Season Playbook for Airbnb Investors

This is the part you can actually execute. Here's what each season tends to offer and what STR-specific moves you should consider.

| Season | What Tends to Be True | STR-Specific Move | Watch-Outs |

|---|---|---|---|

| Winter (Dec-Feb) | Fewer buyers shopping; sellers often more motivated; negotiate repairs/credits more aggressively | Buy if your target market peaks in spring/summer – gives you time for permits, furnishing, listing setup before busy booking months | Storm-prone regions: insurance logistics can get complicated. Atlantic hurricane season: June 1 to November 30. Plan insurance early. |

| Spring (Mar-May) | More new listings come online; buyer demand rises; better selection but increased competition | Great time to buy for fall/winter peak markets (mountain, ski). Renovate during shoulder season, be ready for winter tourism rush. Browse Airbnb properties for sale in mountain markets. | Permit-heavy cities: spring can mean longer processing queues. Research local STR regulations early. |

| Summer (Jun-Aug) | Competition stays elevated; mid to late summer brings more price cuts on spring listings that didn't sell; 26% price cut rate in July/August (Zillow 2024) | Best time to buy in winter-peaking vacation markets – launch and establish listing before next winter season | If home is currently an operating STR, it may have future bookings. Decide how to handle them before contract (transfer, honor, or cancel). Build this into negotiation. |

| Early Fall (Sep-Oct) | Realtor.com's 2025 study highlighted Oct 12-18 as best week: prices ~3.4% below peak, inventory ~14.7% higher than average week, up to 32.6% more active listings vs. start of year | Often best time to buy in summer-peak resort markets – buying right after their revenue season ends. Sellers motivated, you have 6-8 months to prepare for next summer. | N/A |

| Late Fall (Nov) | Zillow notes sale prices tend to bottom out in November; NAR notes slower activity | If you want to negotiate hard, this is your window. Be realistic about vendor schedules around holidays. Closing late December = may not get contractors/cleaners/furnishers until January. | N/A |

What "Timing" Can and Cannot Do in 2026

If you're waiting for a magical month where prices collapse and rates drop to 3%, that's not a strategy. That's wishful thinking.

Here's what the big forecasters are actually saying heading into 2026:

• Zillow's December 2025 forecast projected modest home value growth in 2026 (about 1.7%) and existing home sales rising to approximately 4.3 million as mortgage rates ease slightly and inventory accumulates

• Zillow's 2026 predictions also stated mortgage rates are unlikely to fall below 6% in 2026, and builders may continue using incentives like rate buydowns in softer markets

So your edge won't come from perfectly guessing the best month.

Your edge comes from:

✓ Buying in a market where the STR business model actually works

✓ Not overpaying for a story or projected "potential"

✓ Executing fast and clean with the right vendors lined up

This is where Chalet becomes valuable. You get free market dashboards showing real occupancy and revenue trends across dozens of markets. You can run ROI and DSCR scenarios with our free calculator. And when you're ready to move, you get connected to STR-specialist agents, lenders, and insurance providers who understand this business.

Timing matters. But data-driven decision-making matters more.

Best Time to Buy an Airbnb with a 1031 Exchange

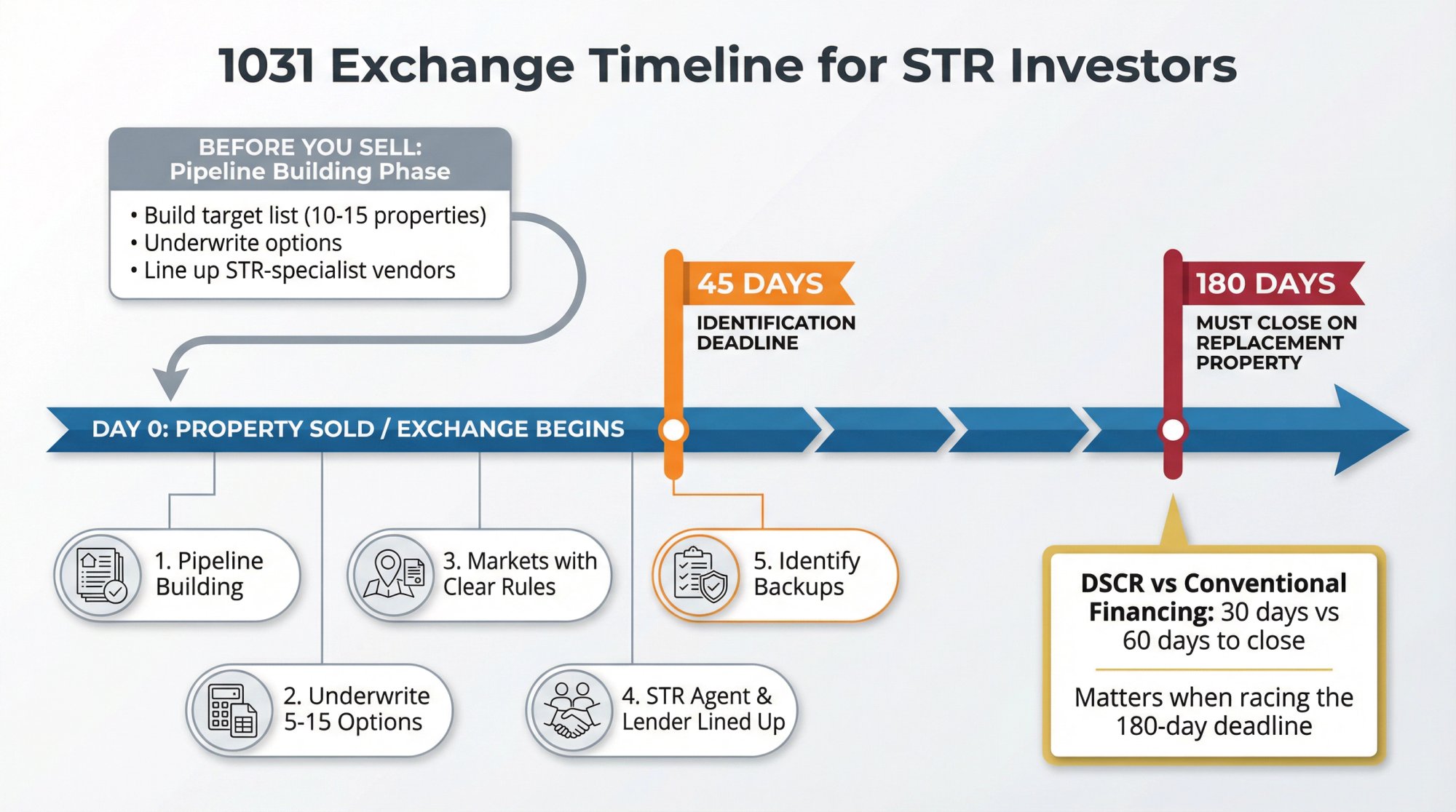

A 1031 exchange lets you defer capital gains taxes by rolling proceeds from one investment property into another. It's a powerful tool for building wealth, but it compresses your timeline significantly.

You do not get to wait for the perfect October buying window if your 45-day identification clock ends in March.

The IRS timing rules that matter most:

• You generally must identify replacement property within 45 days after transferring the relinquished property

• You generally must receive the replacement property within 180 days (or earlier if your tax return due date forces it, unless extended)

These deadlines are strict. No extensions because "the market wasn't good."

How to Time a 1031 Exchange for STR Investments

① Start Pipeline Building Before You Sell (Not After)

Don't wait until after you close on your relinquished property to start looking. Build your target list of replacement properties before you sell. Have 10 to 15 options underwritten and ready. Then narrow once your clock starts. Learn more about using 1031 exchanges for STR investments.

② Underwrite 5 to 15 Options Fast, Then Narrow

Speed matters, but so does quality. Don't rush into a bad deal just because your 45-day window is closing. Build a robust pipeline so you can afford to walk away from deals that don't work. Read our guide on avoiding common 1031 exchange mistakes.

③ Prioritize Markets with Clear Rules and Predictable Permitting

Regulatory delays can kill exchange timelines. If a market has permit caps, lottery systems, or multi-month approval processes, that's risk. Factor that into your identification list. Check 1031-friendly markets with clear STR regulations.

④ Line Up an STR-Specialist Agent and Lender Upfront

Don't learn what DSCR financing is mid-exchange. Find lenders and agents who understand 1031 exchanges and short-term rental underwriting before your clock starts. Otherwise you're learning on the job while deadlines loom.

Chalet's network of STR-specialist agents includes professionals experienced with 1031 exchanges. They understand the urgency and can move faster than generalist agents. We also connect you with DSCR lenders who understand exchange timelines.

⑤ Identify Backups

People mess up exchanges by identifying only one "perfect" deal. What happens if inspection reveals major issues? What if the seller backs out? Always have backup properties identified within your 45-day window. Explore multiple investment property options for your exchange.

Critical insight: The choice between DSCR and conventional financing can determine whether you close in 30 days or 60, which matters enormously when you're racing a 1031 deadline. Read about building an Airbnb empire with DSCR loans.

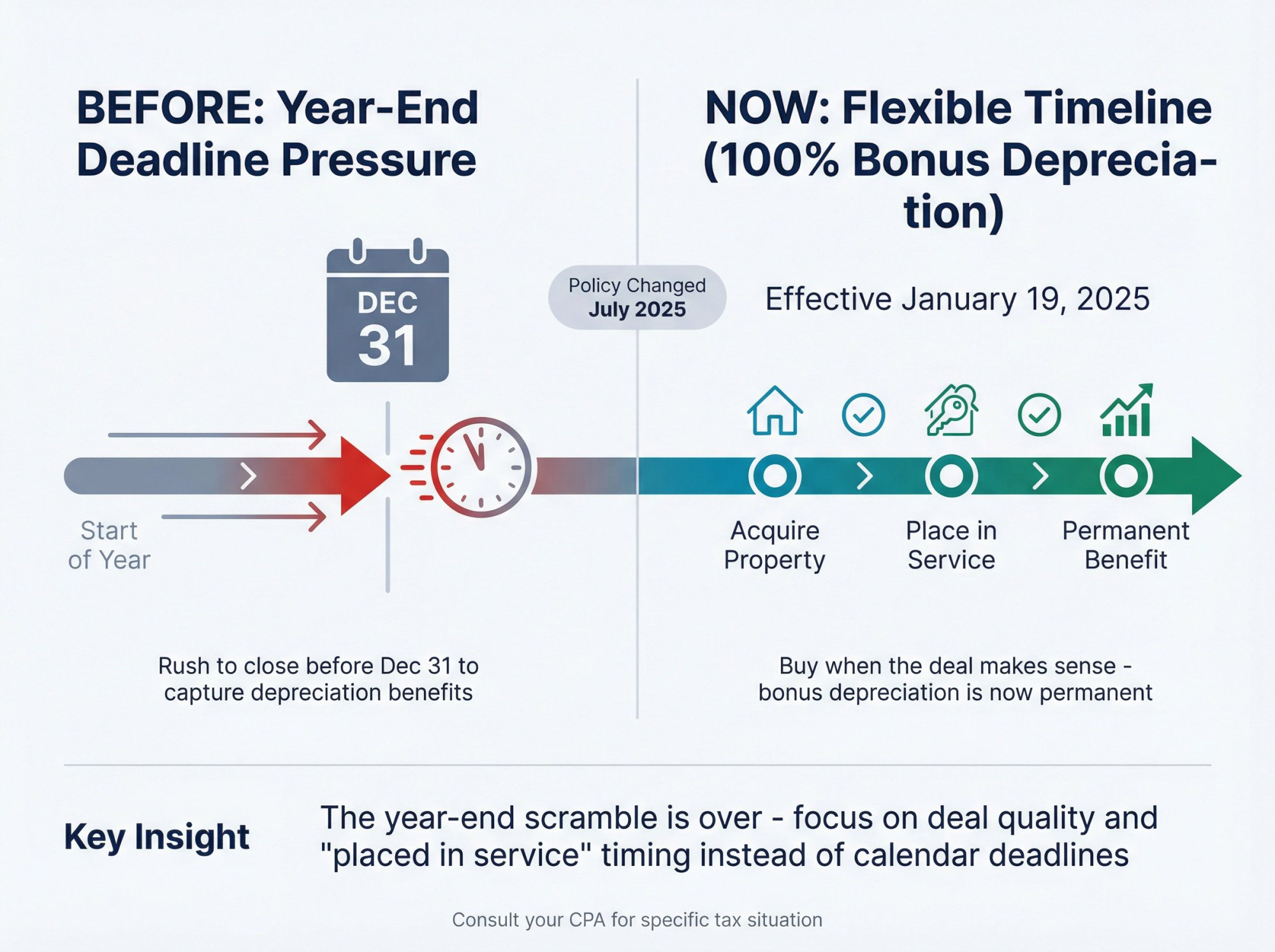

Do I Need to Buy Before Year-End for Tax Benefits?

This is where a lot of investors either over-optimize or miss real opportunities.

What's actually true:

• Tax rules can make "placed in service" timing matter (when the property is ready and available for rent)

• "Placed in service" doesn't just mean closing. It means the property is ready to generate income

What changed recently:

• The IRS announced that legislation signed July 4, 2025 reinstated 100% bonus depreciation for qualifying property acquired and placed in service after January 19, 2025, and made it permanent

This means the year-end scramble isn't as critical as it used to be. You still benefit from accelerated depreciation, but the window isn't just December 31. Learn more about 2025 tax season bonus depreciation.

Practical takeaway:

• Year-end can still matter for your specific tax plan, but it's not the only window anymore

• Coordinate with your CPA on what counts as "placed in service" for your situation

• Don't rush into a bad deal just to hit a year-end deadline if the tax benefit doesn't justify the risk

Non-Obvious Timing Risks Airbnb Buyers Should Plan Around

These are the factors that blindside people who only think "mortgage rate + housing seasonality."

① Insurance Timing in Catastrophe-Prone Regions

The Issue: Moratoriums can temporarily stop new policies or changes ahead of major disasters. If you're buying in hurricane regions, know the Atlantic hurricane season runs June 1 to November 30. Don't leave insurance to the last week before closing.

In wildfire-prone areas, regulatory actions like non-renewal moratoriums exist. The broader point: insurance availability can change quickly in high-risk zones.

What to Do: Line up your insurance quote early in your buying process, especially if closing during or near disaster seasons. Don't wait until three days before closing to discover you can't get coverage.

② Regulations and Permits Don't Care About Your Closing Date

Some markets have permit caps, lottery systems, spacing rules between STRs, or enforcement pushes that can happen anytime. The "best month" to buy doesn't matter if the city just implemented a new permit freeze.

What to Do: Treat regulation research as a gating item, not an afterthought. Use resources like Chalet's regulation library to understand local rules before you make an offer. Factor permit timelines into your execution plan. Check out our guides on navigating local STR regulations and favorable regulation markets.

③ HOAs and Condos Can Override Local Legality

HOA rules can ban short-term rentals even if the city allows them. The "best month" to buy is irrelevant if the HOA prohibits rentals under 30 days.

What to Do: Read HOA docs and CC&Rs (Covenants, Conditions & Restrictions) before you make an offer. Ask the seller for the full HOA rules package. Have your attorney review it if there's any ambiguity about rental restrictions.

④ Existing Bookings on a Running STR

If the property is currently operating as an STR, it may have bookings on the calendar extending months into the future.

What to Do: Decide whether you'll honor those bookings, cancel them, or require the seller to clear the calendar before closing. This isn't just operational. It impacts your revenue ramp and guest reviews (canceling bookings creates bad reviews). Build this negotiation into your purchase agreement upfront.

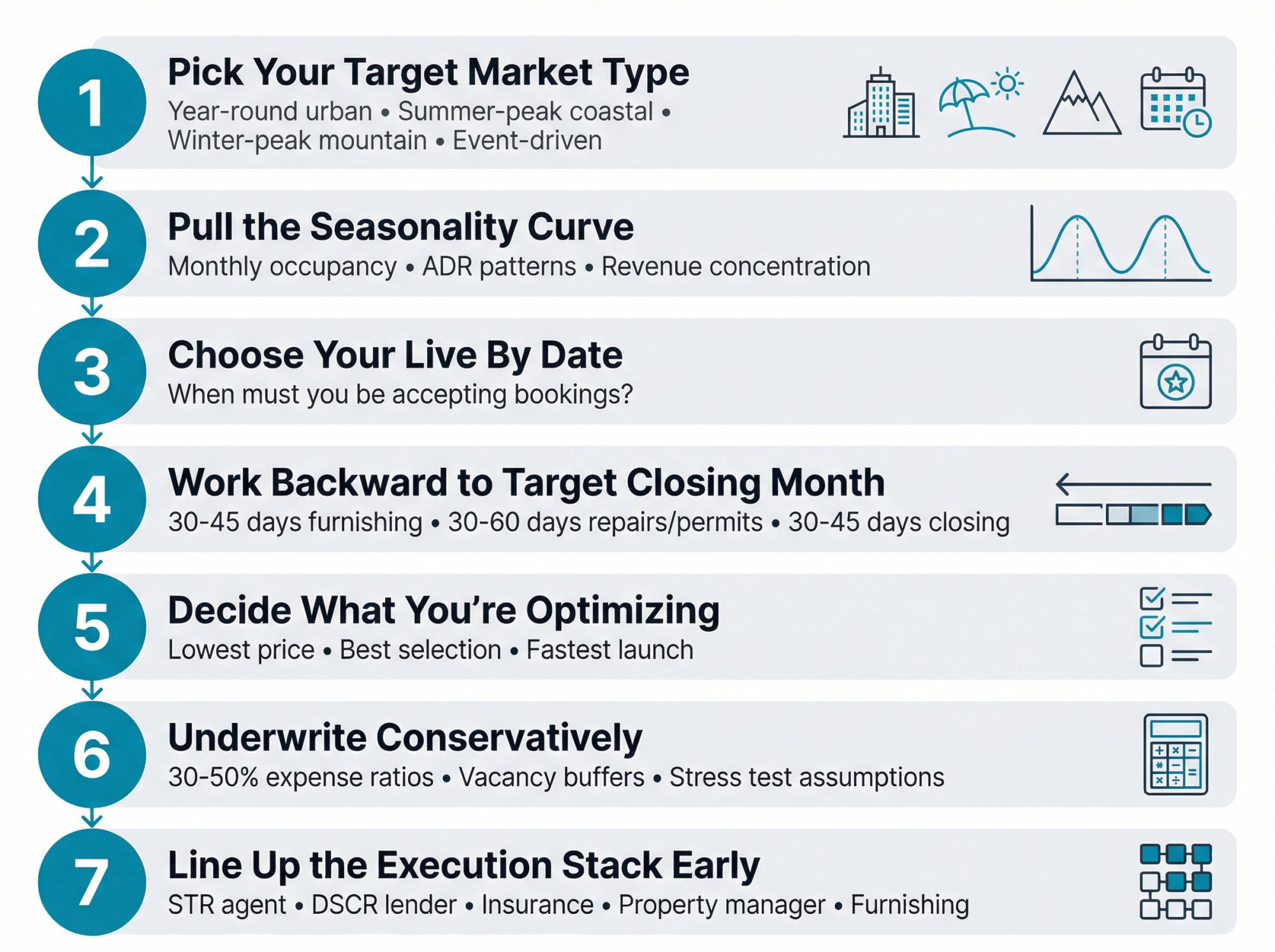

How to Choose Your Best Buying Window in 7 Steps

This is the exact process that keeps you out of "calendar superstition" and into data-driven decisions.

Step 1: Pick Your Target Market Type

Are you targeting:

• Year-round urban (business travel, city tourism)

• Summer-peak coastal or lake (beach towns, lakefront properties)

• Winter-peak mountain/ski (ski resorts, mountain towns)

• Event-driven (festival towns, college football cities, conference destinations)

Your market type determines your revenue calendar, which determines your optimal buying timeline. Use Chalet's market analysis tools to compare different market types.

Step 2: Pull the Seasonality Curve

Get data on:

• Monthly occupancy rates (what percentage of nights are booked each month)

• Monthly ADR (average nightly rate by month)

• Revenue concentration (how much of annual revenue comes from 3 to 4 peak months)

Chalet's market dashboards show this data for free across dozens of markets. You can see exactly when demand surges and when it drops. Don't guess. Look at the data.

Step 3: Choose Your "Live By" Date

This is the date your listing must be ready and accepting bookings to capture the first big demand wave in your market.

Work backward from your market's peak season start date. If your market peaks in July, your "live by" date might be May 15 to capture advance bookings.

Step 4: Work Backward to a Target Closing Month

From your "live by" date, subtract:

• 30 to 45 days for furnishing, photography, listing optimization

• 30 to 60 days for repairs, inspections, permit processing (varies widely by market)

• 30 to 45 days for contract to close

That gives you your target closing month. Then factor in how long it typically takes to find and go under contract on a property in your target market.

Step 5: Decide What You're Optimizing

You can't maximize all three at once:

• Lowest purchase price (winter buying, limited selection)

• Best property for your criteria (spring/summer buying, more competition)

• Fastest launch timeline (buy whenever, but may pay premium)

Be honest about your priority. That determines your buying window.

Step 6: Underwrite Conservatively

Don't annualize peak-season weekends. Don't assume 100% occupancy. Don't ignore maintenance, cleaning, and vacancy.

Include realistic:

• Expense ratios (30% to 50% of gross revenue depending on market and property type)

• Vacancy and turnover (gaps between bookings, seasonal lulls)

• Reserves (for repairs, emergencies, off-season carrying costs)

Run multiple scenarios with Chalet's ROI and DSCR calculator. Stress-test your assumptions. Make sure the numbers work even if occupancy is 10% to 15% lower than your base case.

Step 7: Line Up the Execution Stack Early

Before you start making offers, have these vendors identified and ready:

• STR-specialist real estate agent (not a generalist who's never dealt with vacation rentals)

• DSCR or conventional lender who underwrites STR income

• STR-friendly insurance provider (many standard homeowners policies exclude short-term rentals)

• Property manager or cleaning service (if you're not self-managing)

• Furnishing vendor or designer (if you're buying unfurnished)

Chalet's vendor network includes vetted professionals in all these categories. We only work with providers who specialize in short-term rentals and understand the execution timeline pressures investors face.

When you have your stack lined up, you can move fast when the right deal appears. You're not scrambling to find a lender or insurance provider while under contract.

How Chalet Helps You Time Your Purchase and Execute Flawlessly

Timing is only valuable if you can execute. Chalet is the one-stop platform for short-term rental investors, combining free analytics with a vetted vendor network so you can research, buy, finance, insure, set up, and manage your rental in one place.

Free Market Analytics for Seasonality Research

Our market dashboards show you actual occupancy rates, average nightly rates, and revenue patterns by month across dozens of U.S. markets. You can see exactly when demand peaks and when it drops. That's how you align your buying timeline with your revenue calendar.

ROI and DSCR Calculator for Conservative Underwriting

Use our free calculator to run ROI, cap rate, and DSCR scenarios before you make an offer. Input your purchase price, financing terms, estimated revenue, and expenses. See whether the deal actually works under realistic assumptions. Stress-test it. Don't rely on seller projections or best-case scenarios.

Vetted Vendor Network (Agents, Lenders, Insurance, Property Managers)

When you're ready to move, we connect you to:

• STR-specialist real estate agents who understand vacation rental markets and 1031 exchanges

• DSCR and conventional lenders who underwrite short-term rental income

• STR-friendly insurance providers who won't drop you when they discover it's a vacation rental

• Property managers and cleaners in your target market

• Furnishing vendors who specialize in vacation rentals

These aren't random referrals. We vet every provider for STR expertise and execution speed.

1031-Friendly Market Identification

If you're doing a 1031 exchange, we can help you identify markets with:

• Strong STR fundamentals (occupancy, ADR, revenue trends)

• Clear regulatory environments (no surprise permit freezes mid-exchange)

• Proven agent and lender networks who understand exchange timelines

Learn about transitioning from long-term rentals to STRs via 1031.

Regulation Research Capability

Our regulation library covers permit requirements, occupancy limits, registration processes, and enforcement patterns across major STR markets. Don't discover the city has a permit cap after you're under contract. Research regulations upfront.

End-to-End Execution Support

From initial market research to closing to launching your listing, we help you execute every step. That's the difference between knowing when to buy and actually closing on time, getting permits, securing insurance, and going live before your peak season.

Ready to Find Your Optimal Buying Window?

→ Explore market analytics to understand seasonality in your target area

→ Run ROI scenarios to stress-test your assumptions

→ Connect with STR-specialist agents who can execute on your timeline

→ Browse Airbnb rentals for sale in markets you're considering

We pair free, credible analytics with the vendors you'll actually need so your investment moves from research to reality with less guesswork and fewer hand-offs.

Summary: What You Need to Remember About Timing

If you only remember one thing, remember this:

Buy when you can combine reasonable purchase leverage with a launch window that captures your market's peak demand.

Early fall often gives you leverage plus inventory. Winter often gives you negotiation power. But your market's travel season decides whether that timing turns into actual cash flow.

The investors who win aren't the ones who perfectly time the housing market. They're the ones who:

✓ Understand their market's revenue seasonality

✓ Work backward from peak season to determine closing timeline

✓ Underwrite conservatively with real data, not best-case projections

✓ Have their execution stack ready before they start shopping

✓ Move decisively when the right deal appears

That's how timing becomes a competitive advantage instead of calendar superstition.

FAQ

Is October always the best time to buy an Airbnb?

October often looks good nationally because it balances inventory and easing competition, but STR buying also depends on your market's travel season. In a ski market, buying in spring or summer can be smarter so you're live for the winter peak. Use the framework in this guide to determine your optimal window based on your specific market and goals. Check best Airbnb markets to invest for market-specific insights.

Should I wait for rates to drop before buying?

Rates matter, but they're hard to time and don't follow clean seasonal patterns. Focus on buying a deal that works under today's rates, with upside potential if rates improve later. Waiting for rates to hit some magic number often means missing good deals. If the property cash flows at 6.5% rates, it cash flows even better if rates drop to 5.5% and you can refinance. Learn about refinancing into a DSCR loan.

What if I'm buying in a beach market?

Beach markets typically peak in summer (June through August). The ideal pattern: buy in fall or winter after the summer revenue season ends. This gives you motivated sellers (they just finished their money season) and runway to renovate and launch before the next summer. But verify local permit timelines and insurance availability before assuming you can execute that quickly. Explore best beach markets for STR investment.

What if I'm buying in a ski or mountain market?

Ski markets typically peak in winter (December through February). Consider buying in spring or summer after ski season ends. You get motivated sellers, and you have time to renovate and prepare for the next winter season. Watch out for renovation constraints in mountain towns (some have seasonal road restrictions that limit when contractors can deliver materials).

What if I'm doing a 1031 exchange?

Your IRS deadlines drive your timing, not seasonal patterns. You have 45 days to identify replacement properties and 180 days to close. Build your pipeline before you sell, underwrite multiple options, prioritize markets with predictable permitting, and work with STR-specialist agents and lenders who understand exchange timelines. Read our comprehensive 1031 exchange timeline guide.

How do I know my market's peak season?

Look at historical occupancy and ADR (average daily rate) data by month. Chalet's market dashboards show this for free across dozens of markets. You'll see exactly when occupancy surges and when rates spike. That's your peak season. Don't guess based on when you would vacation there. Look at actual booking data. Read our comprehensive market analysis guide.

What's more important: buying price or launch timing?

Both matter, but in different ways. A 2% to 4% better purchase price is valuable. But missing three months of peak season can cost you more in lost revenue than you saved on purchase price. Plus, if you're financing with a DSCR loan, missing peak season weakens your income coverage ratio. Ideally, you optimize for both. But if forced to choose, I'd rather pay 3% more and capture a full peak season than save 3% and miss it.

How long does it take to get an STR ready after closing?

It varies widely by market and property condition. Minimum: 60 to 90 days for a turnkey property (furnishing, photography, listing optimization, basic operational setup). Typical: 90 to 120 days if you need minor repairs, paint, some furnishing. Extended: 120 to 180+ days if you need major renovations, permits, or if you're in a slow-permitting market. Work backward from your target launch date and add buffer. Most investors underestimate this timeline.