You've sold an investment property and want to defer the tax bill with a Section 1031 like-kind exchange. Smart move. But here's what catches many investors off guard: where you exchange into matters just as much as what you buy.

Federal rules for 1031 exchanges are uniform across the country. The IRS doesn't care if your replacement property is next door or across state lines. State tax codes, though? They're a patchwork. Some states will let you roll your short-term rental profits forward indefinitely. Others will track your deferred gain for years and eventually demand their cut.

The good news is that as of 2023, all 50 states now recognize 1031 exchanges for state tax purposes. Pennsylvania was the last holdout, and that changed in 2022. So you can execute a 1031 anywhere.

The question is: should you?

This guide breaks down the best and worst states for 1031 exchanges if you're investing in Airbnb rentals or other STR properties. We'll cover tax rates, clawback provisions, and the strategies savvy investors use to maximize their after-tax returns.

How State Tax Laws Affect Your 1031 Exchange

A 1031 exchange lets you defer capital gains tax when you sell an investment property and reinvest the proceeds into another. At the federal level, that's straightforward. But state income taxes add complexity.

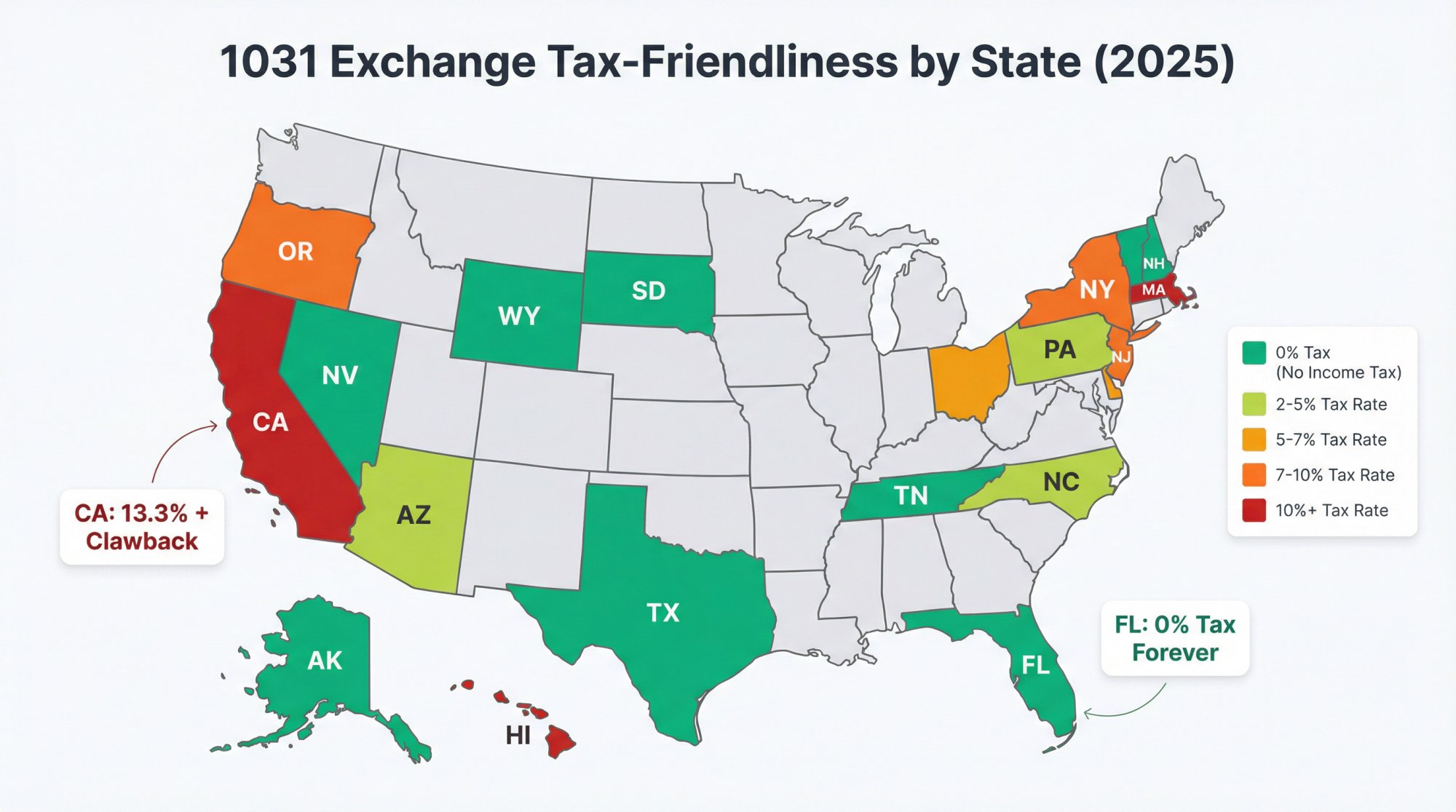

State capital gains rates range from 0% to over 13%, and most states tax real estate gains as ordinary income. Whether your state conforms to federal 1031 rules determines how much that rate will bite you, and when.

Three key state-level factors you need to understand:

What Are 1031 Exchange Clawback Provisions?

Some states let you defer their tax when you exchange out. But if you later sell the replacement property in a different state without doing another exchange, the original state comes back for its share.

What this means in practice: You can move your investment from California to Nevada and defer California tax. But when you eventually sell that Nevada property for cash, California will demand taxes on the gain that originally accrued there.

States with clawback provisions include:

-

California (annual reporting required)

-

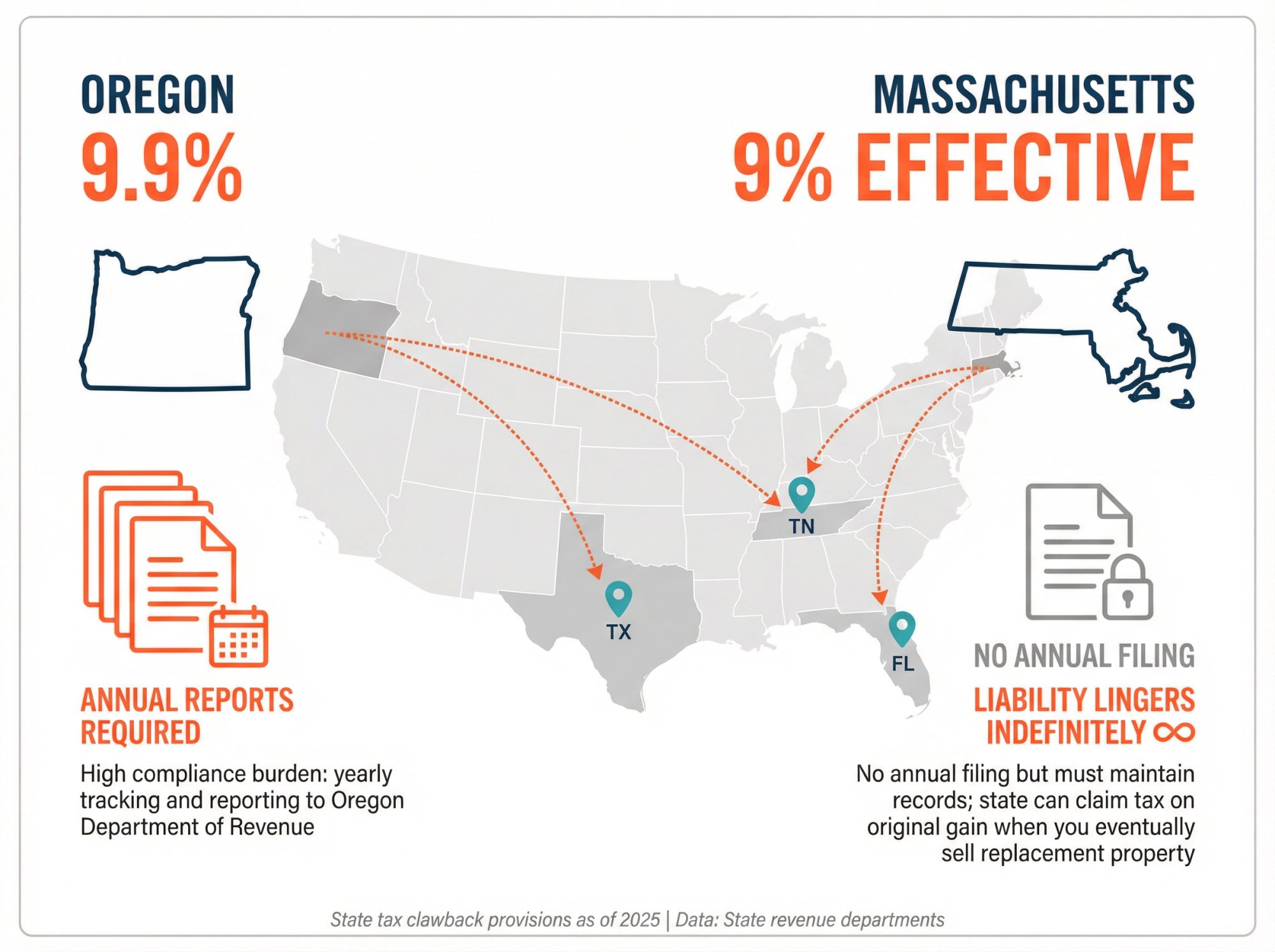

Oregon (annual reporting required)

-

Massachusetts (no annual reporting)

-

Montana (no annual reporting)

How Non-Resident Withholding Affects 1031 Exchanges

Many states require a portion of sale proceeds to be withheld when a non-resident sells property. States with these provisions include New York, Georgia, and New Jersey.

The good news: if you're completing a valid 1031 exchange, most states allow an exemption. You fill out the right paperwork at closing, and nothing gets held back. Extra forms, yes, but it prevents cash from being tied up during your 45/180-day window.

State Capital Gains Tax Rates for Real Estate

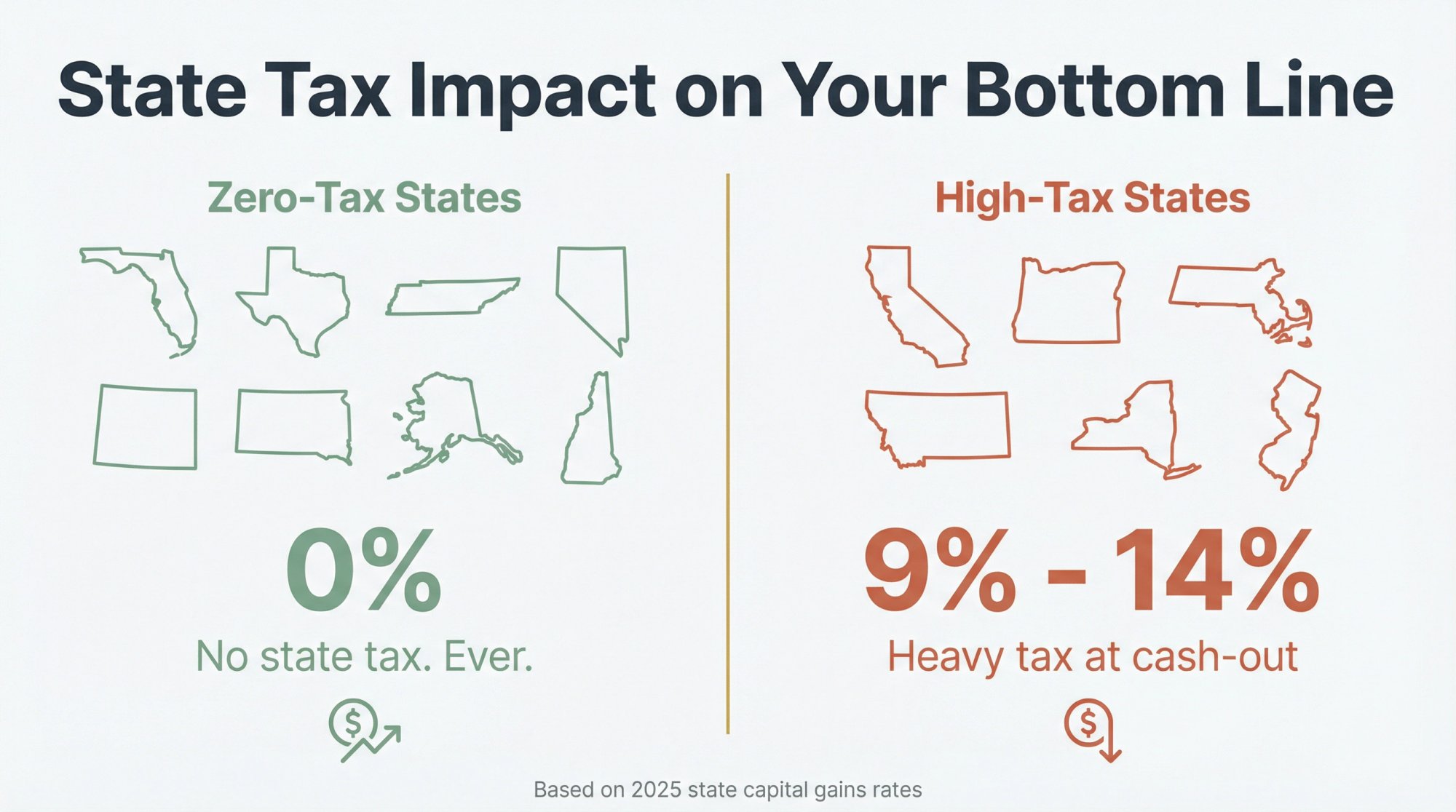

Eight states have no income tax at all. Others approach 14%. If you're planning to eventually cash out, where you sell makes a massive difference.

The bottom line: A 1031 exchange works in every state. But the best states let you defer more and potentially avoid state tax entirely. The worst ones will either tax you heavily at cash-out or follow you across state lines to collect later.

Best States for 1031 Exchanges: No-Tax and Low-Tax Options

From a tax perspective, the best states are those that impose little to no state tax on your real estate gains. These are also popular destinations for investors rolling long-term rentals into Airbnb properties.

No Income Tax States for 1031 Exchanges

Eight states have zero personal income tax on wages or investment income:

If your replacement property lands in one of these states, you won't owe any state tax when you eventually sell. Not at the time of exchange. Not at final sale. Never.

Washington State deserves a note: it has no general income tax but recently enacted a capital gains tax on certain high-value stock sales. Real estate sales remain exempt. So for STR investors, Washington functions like a no-tax state.

The practical impact: When you finally break the 1031 chain and cash out, the only capital gains tax you'll face is federal. That's a significant advantage for wealth-building.

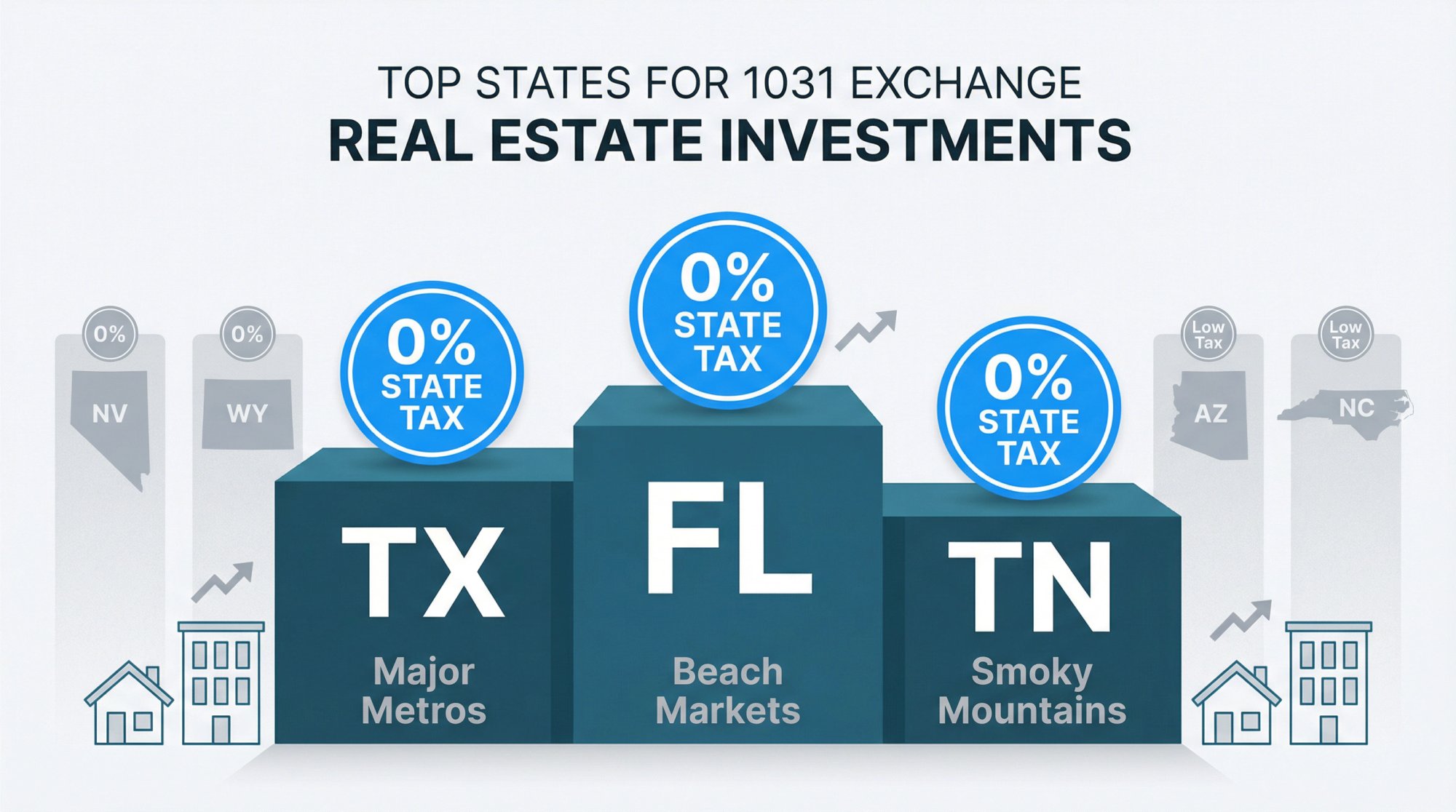

Florida: Zero State Tax and Strong STR Markets

Florida gets its own spotlight for good reason. With zero state income tax and a massive vacation rental market, it's one of the most 1031-friendly states in the country.

An investor selling in New York or Illinois can exchange into a Florida beach rental and immediately eliminate state tax on future gains. The tourism infrastructure is already there. Theme parks, beaches, coastal towns, golf communities. Strong demand year-round.

In 2024, Florida was a top destination for investors exiting Pennsylvania, New Jersey, and New York. The combination of tax advantages and large property inventory makes it easier to identify replacement properties within the 45-day window.

One caveat: Local STR regulations vary widely in Florida. Some counties welcome vacation rentals. Others restrict them heavily. Before you identify a property, check the local regulations to confirm you can actually operate it as intended.

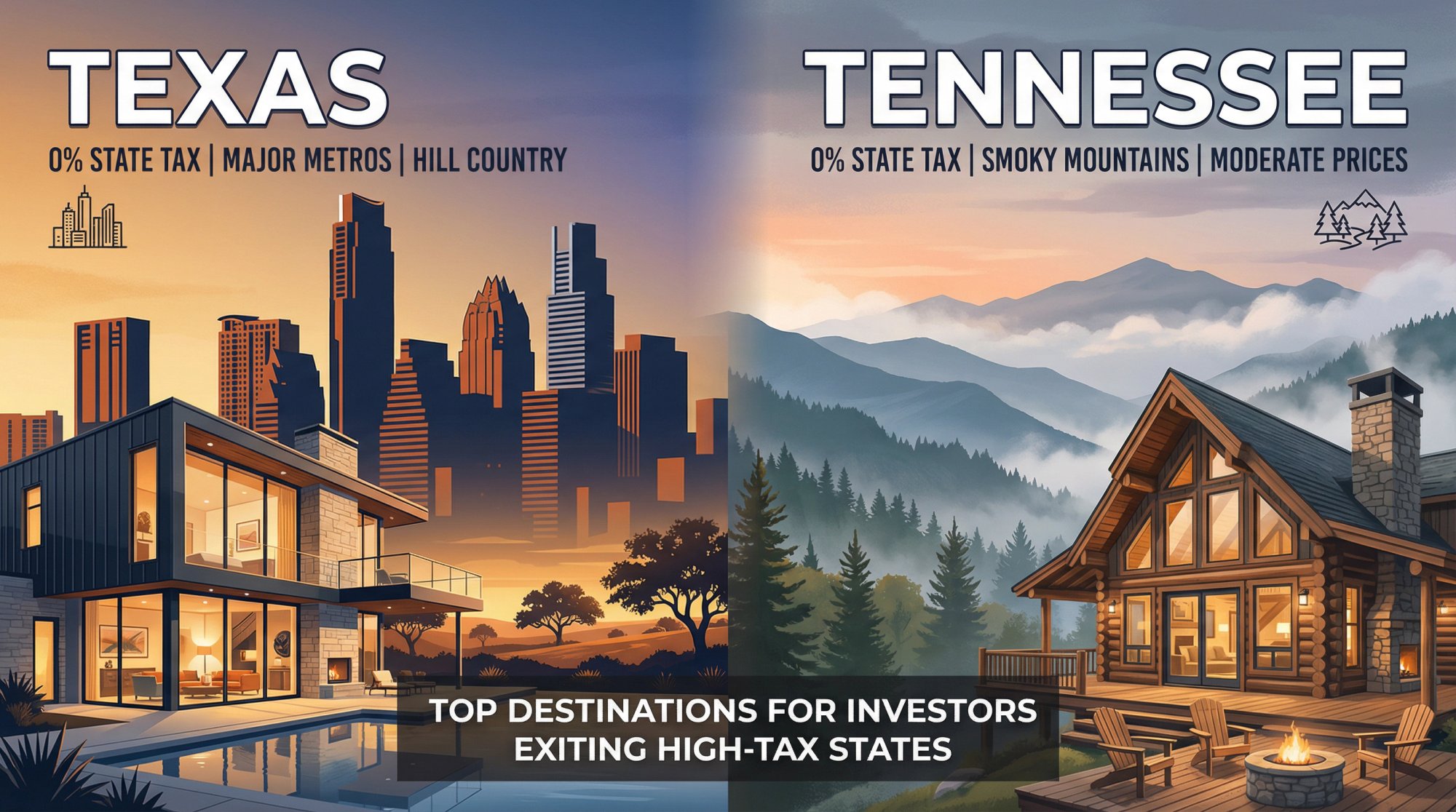

Texas: No State Income Tax and Investor-Friendly Laws

Texas charges no state income tax, which means a final sale in Texas carries no state capital gains hit. Combined with its booming economy and population growth, it's a prime destination for exchange investors.

The major metros (Austin, Dallas, Houston, San Antonio) and resort areas (Hill Country, Galveston, coastal regions) offer diverse investment options. We've seen significant exchange activity from investors leaving Oregon and California for Texas properties.

Texas also tends to be landlord-friendly with plenty of inventory.

Local rules to watch: Austin has some STR restrictions. Dallas has permit requirements. Always confirm local ordinances before buying a short-term rental.

Tennessee: No State Tax and Smoky Mountain Vacation Rentals

Tennessee phased out its tax on interest and dividends by 2021, making it effectively a zero-income-tax state. Combined with the wildly popular Great Smoky Mountains vacation market, it's extremely attractive for 1031 exchanges.

Gatlinburg. Pigeon Forge. Sevierville. These mountain towns generate strong tourism-driven rental income. An investor can sell a rental in a high-tax state, swap into a Tennessee cabin, and defer all taxes. When they eventually sell that cabin, no state will tax the gain.

Tennessee ranked among the top destinations for investors leaving states like Oregon in 2024. Beyond tax benefits, the state offers moderate home prices and reasonable property taxes.

Other Low-Tax States for 1031 Investors

Even if a state isn't completely tax-free, some have flat rates low enough to be compelling:

| State | Tax Rate | STR Market Highlights |

|---|---|---|

| Arizona | 2.5% flat | Scottsdale, Sedona, Phoenix |

| North Carolina | 4.75% (dropping to 3.99%) | Blue Ridge Mountains, Outer Banks |

| Pennsylvania | 3.07% flat | Poconos, Lake regions |

These states combine lower tax burdens with growing rental markets. They're worth considering, especially if the no-tax states don't have the property type or location you're targeting.

Best States for 1031 Exchanges: Side-by-Side Comparison

| State | Income Tax Rate | Clawback? | Annual Report? | Why Investors Choose It |

|---|---|---|---|---|

| Florida | 0% | No | No | Beach/theme park STR markets, high inventory |

| Texas | 0% | No | No | Major metros, landlord-friendly, population growth |

| Tennessee | 0% | No | No | Smoky Mountain vacation rentals, moderate prices |

| Nevada | 0% | No | No | Las Vegas, Lake Tahoe, proximity to CA |

| Wyoming | 0% | No | No | Ski resorts, ranch properties |

| South Dakota | 0% | No | No | Lower property prices |

| Arizona | 2.5% | No | No | Scottsdale, Sedona luxury markets |

| North Carolina | 4.75% | No | No | Mountain and coastal vacation rentals |

Worst States for 1031 Exchanges: High Taxes and Clawback Rules

No state forbids 1031 exchanges anymore. But "worst" here means states that hit you with high taxes or complicate your exchange with extra rules. If you're selling or buying in these states, go in with eyes open.

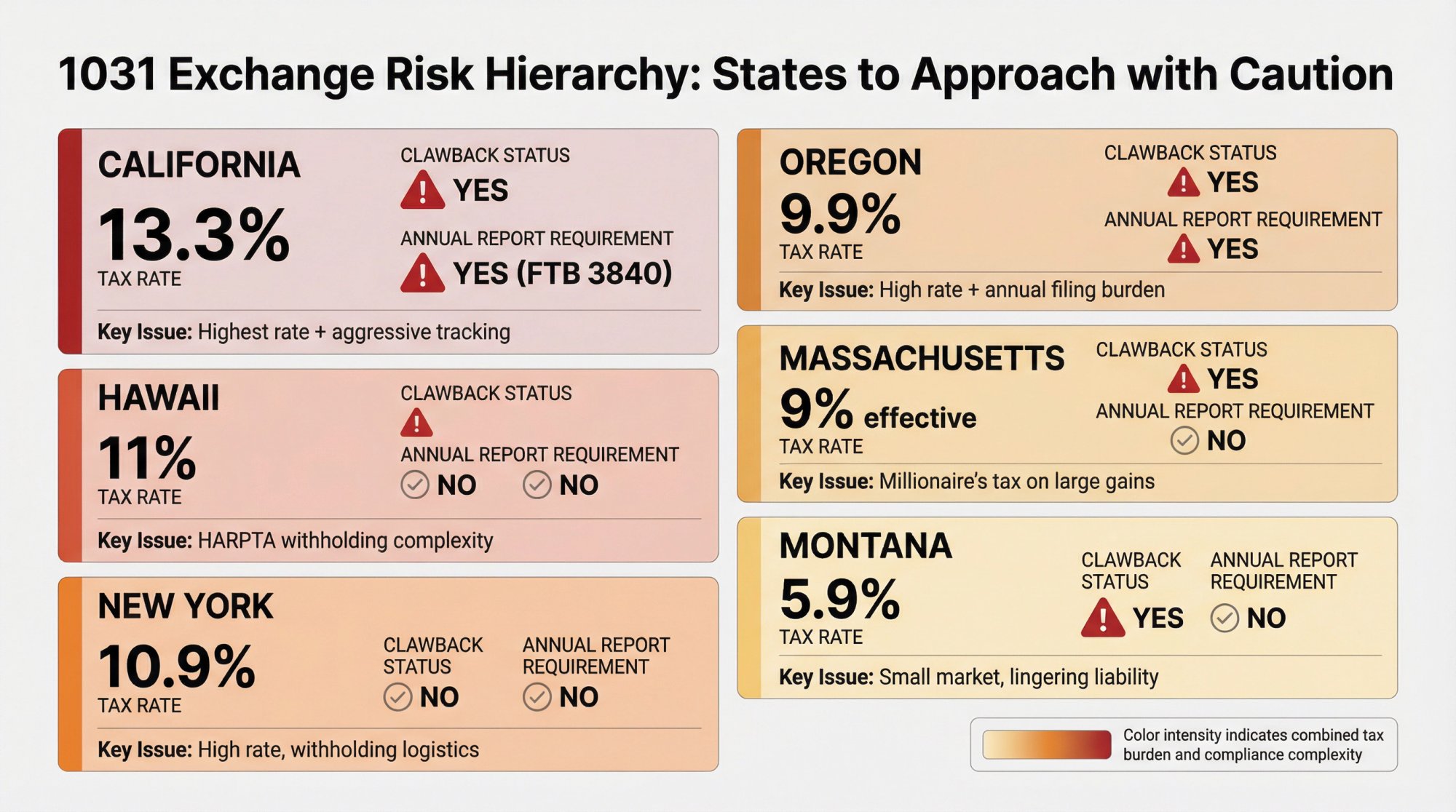

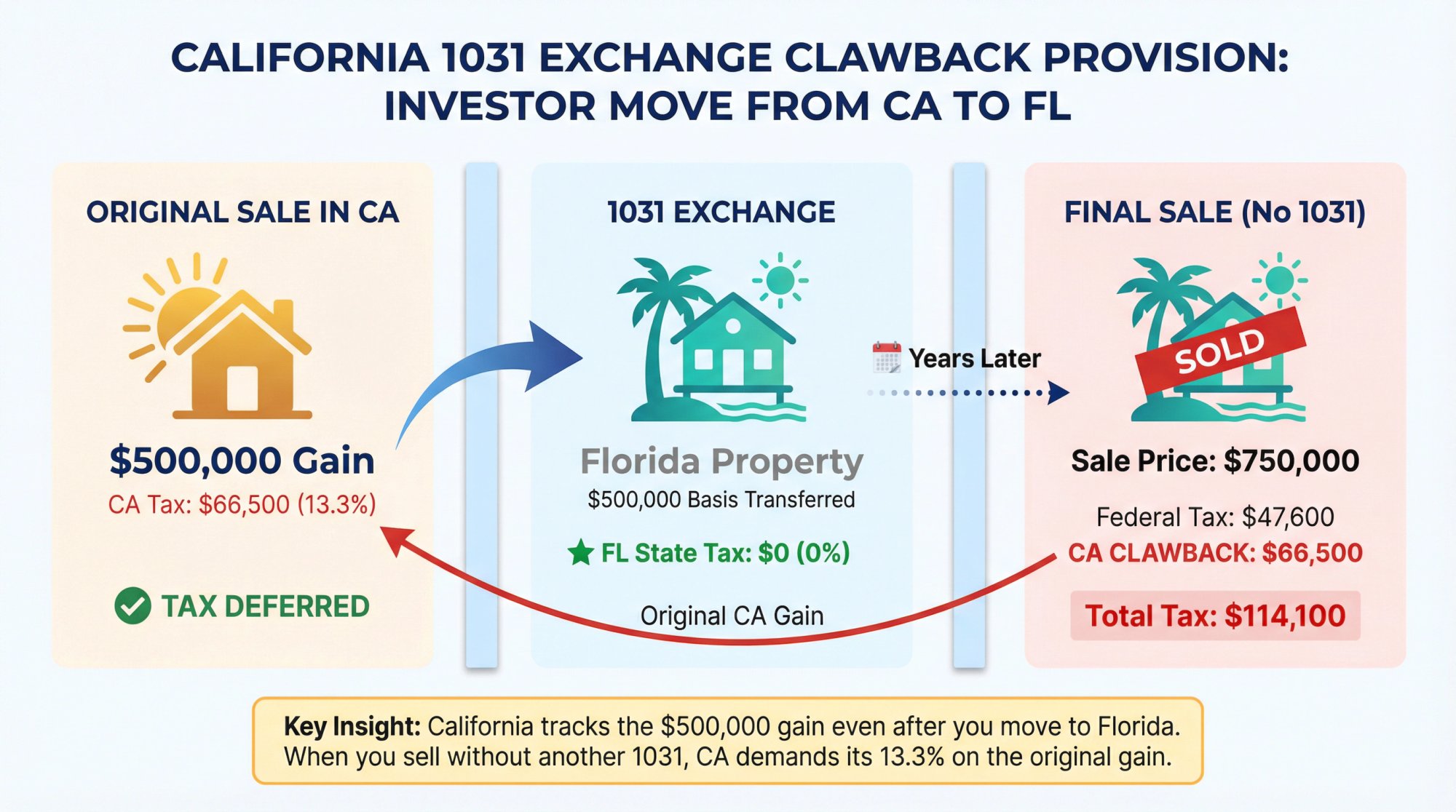

California: Highest Taxes and Strict Clawback Rules

California earns its reputation as the least 1031-friendly state in the country.

First, it has the highest state income tax rate at 13.3%. If you ever cash out of a California investment without another exchange, that's a significant hit.

Second, its clawback provision means you can't escape by moving your investment out of state. Sell a California property and exchange into Nevada? California lets you defer its tax at the exchange. But when you later sell the Nevada property, California will "claw back" and charge you tax on the gain that originally accrued in CA.

Third, California requires annual filings (Form FTB 3840) to track 1031 funds that leave the state.

The only way to completely avoid California's tax? Keep exchanging until death (when heirs may get a step-up in basis, potentially wiping out the gain). Not exactly a simple strategy.

If you're exiting California properties, work closely with a 1031-savvy CPA. And don't miss those annual filings. Failure to file can void your deferral entirely.

Oregon: High Taxes and Clawback Provisions

Oregon mirrors California's pitfalls. The state levies up to 9.9% tax on income and has a clawback rule.

If you exchange out of Oregon, you must file an annual report. Oregon will tax the deferred gain when you finally sell a future property outside the state.

Oregon saw significant outbound 1031 activity recently, with investors trading Oregon properties for ones in Idaho, Texas, and Tennessee. The state is also known for strict tenant laws and local rental regulations (particularly in Portland), which add operational complexity.

Massachusetts: Clawback Rules and 9% Effective Tax Rate

Massachusetts has a 5% flat income tax on most income. But in 2023, it added a 4% surtax on annual income over $1 million, making the effective tax on large gains 9%.

For 1031 exchangers, Massachusetts enforces a clawback provision. Selling Massachusetts property and buying elsewhere defers MA tax initially. But if you later sell the new asset, Massachusetts will still seek the tax on your original MA gain.

Unlike California and Oregon, Massachusetts doesn't require annual filings. But you must keep records because the liability lingers indefinitely.

Swapping that Boston rental for a Florida beach house only postpones Massachusetts tax. One day when you sell the Florida property, Massachusetts comes knocking.

Montana: Lower Rates but Hidden Clawback Rules

Montana's top income tax rate sits around 5.9%. Not extreme. But it does have a clawback.

If you exchange out of Montana, you'll owe Montana's tax on that original gain when you eventually sell the replacement property. There's no yearly report required, but the deferred state tax remains your obligation.

Montana has a smaller real estate market (aside from vacation areas like Bozeman or Flathead Lake), so it may not be on most investors' radar anyway. But if you own property there, be aware: an exchange only defers Montana's cut. It doesn't forgive it.

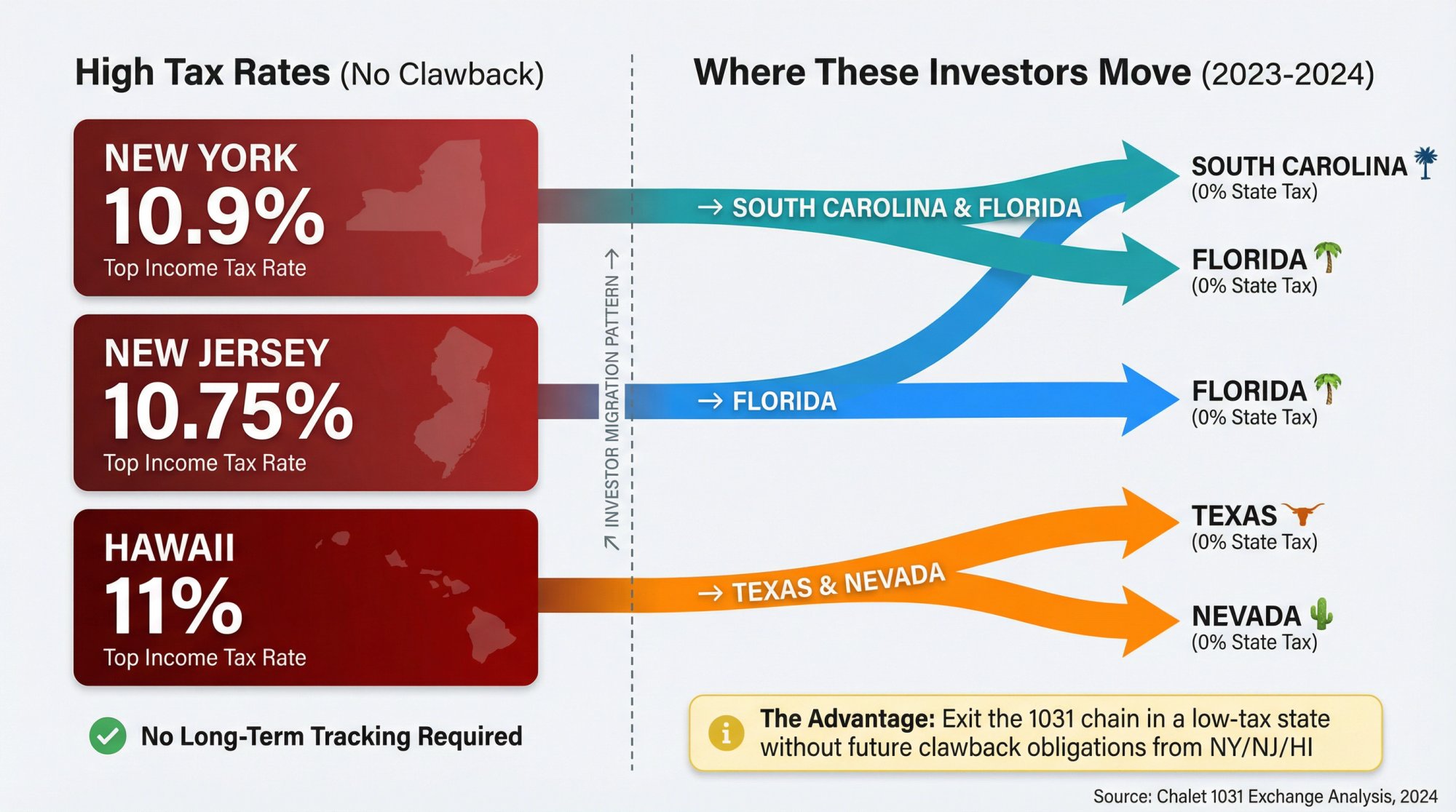

New York and New Jersey: High Taxes Without Clawback

New York State's income tax climbs to 10.9%. New Jersey hits 10.75%. Both rank among the highest in the country.

The good news: Neither state has a clawback provision. If you sell property in New York via 1031 and buy in another state, New York doesn't pursue you for tax years later. Your future gains will be taxed by whatever state you eventually sell in.

The catch: When selling in these states, plan for logistics. New York requires non-resident sellers to pre-pay estimated tax unless it's a 1031 deal. You must file the right exemption form to avoid withholding.

Always coordinate with your closing agent to ensure your 1031 status is documented. Otherwise, you might see a chunk of proceeds sent to the state.

We've seen significant New York money flow into South Carolina and Florida rentals in recent years. Investors want to eventually exit the 1031 chain in a tax-friendly jurisdiction.

Other High-Tax States for 1031 Exchanges

A few others warrant caution:

-

Hawaii: Taxes up to 11%. Honolulu has a withholding requirement for non-resident sellers (HARPTA), though 1031 exchanges are exempt with proper filing.

-

Pennsylvania: Now honors 1031 deferrals with a flat 3.07% rate. Relatively low, no clawback.

-

District of Columbia: 10.75% top rate. Comparable to New Jersey.

Any state with a high tax rate could be considered "worst" for ending your 1031 chain.

Worst States for 1031 Exchanges: Side-by-Side Comparison

| State | Tax Rate | Clawback? | Annual Report? | Key Issues |

|---|---|---|---|---|

| California | 13.3% | Yes | Yes (FTB 3840) | Highest rate + aggressive tracking |

| Oregon | 9.9% | Yes | Yes | High rate + annual filing burden |

| Massachusetts | 9% effective | Yes | No | "Millionaire's tax" on large gains |

| Montana | 5.9% | Yes | No | Small market, lingering liability |

| New York | 10.9% | No | No | High rate, withholding logistics |

| New Jersey | 10.75% | No | No | High rate |

| Hawaii | 11% | No | No | HARPTA withholding complexity |

How to Execute a 1031 Exchange Into Short-Term Rentals

A 1031 exchange into short-term rentals involves tight deadlines and coordinating multiple professionals. You have 45 days to identify replacement properties and 180 days to close. That's not much time to research markets, vet properties, line up financing, and confirm local regulations.

At Chalet, we've built a platform specifically for STR and Airbnb investors to streamline this process.

Free market analytics: You can analyze Airbnb markets across the country, comparing ADR, occupancy, cap rates, and revenue potential. All 100% free, no subscription required. When you're evaluating whether to exchange into Tennessee vs. Florida vs. Texas, data should drive that decision.

1031-savvy agent network: We connect you with real estate agents who specialize in STR investments and understand 1031 timelines. They know which markets have strong vacation rental demand, which neighborhoods allow short-term rentals, and how to move fast when deadlines loom.

Regulation research: Use our STR Regulations Library to check local rules before you identify a property. State tax friendliness doesn't matter if the city bans Airbnb-style rentals.

ROI analysis: Run the numbers on specific properties with our ROI and DSCR calculator. Understand what a property should generate before making an offer.

Vendor coordination: Beyond agents, you'll need lenders (many exchanges use DSCR loans), insurance, property management, and potentially cost segregation specialists. We maintain a vetted network across all these categories.

The 1031 investor's dilemma: You need to find, analyze, and close on replacement properties within strict federal deadlines, while navigating state tax rules. Our job is to compress that timeline and connect you with the right professionals.

Ready to get started? Meet an Airbnb-friendly agent who can help you identify properties in 1031-friendly markets and close within your deadline.

Multi-State 1031 Exchange Strategies That Save You Taxes

If your 1031 journey spans different states, a bit of planning will maximize your benefits.

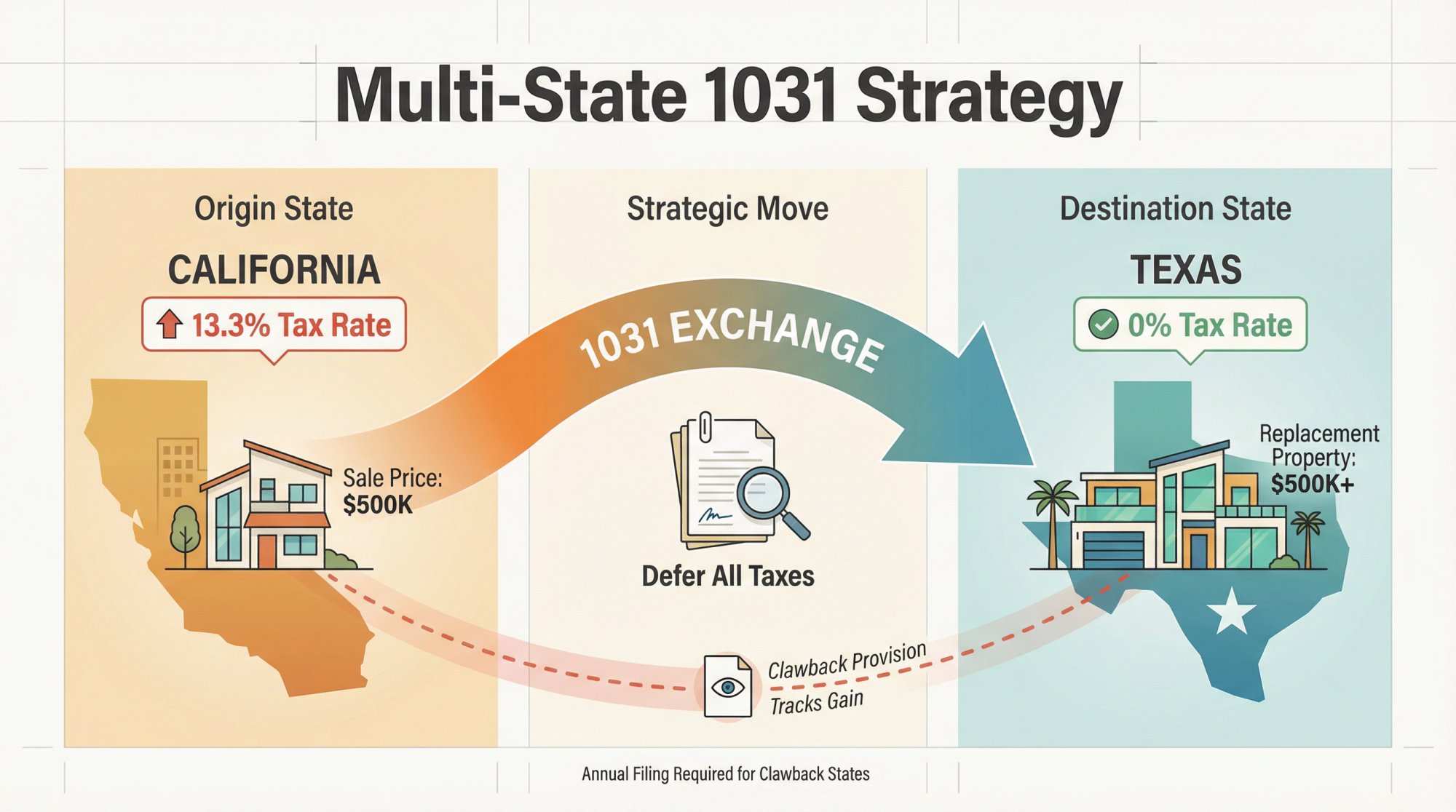

How to Move Investments to No-Tax States

It's perfectly legal to sell an investment in a high-tax state and buy a replacement in a no-tax state to reduce your eventual tax burden.

Sell in California. Buy in Texas. When you finally cash out in Texas, you'll only pay federal capital gains tax.

But there's a catch for clawback states. California will still want its cut from the original sale. This strategy works best if:

-

Your original state doesn't have a clawback (NY, NJ), or

-

You plan to keep exchanging indefinitely, or

-

You've already moved your basis out of clawback states in prior exchanges

Always consult a tax advisor before executing this. A misstep could accidentally trigger taxes.

How to Track Deferred Gains in Clawback States

Say you perform a 1031 exchange selling in Massachusetts and buying in North Carolina. You've deferred Massachusetts tax, but that liability doesn't vanish.

The burden is on you (or your accountant) to document:

-

The amount of gain deferred

-

Which state it originated in

-

Which new property it attached to

Years later, when you sell without another exchange, you'll need to file a Massachusetts return and settle up.

California and Oregon actively track via required annual filings. Don't neglect those filings. Failure can void your deferral and make the tax due immediately.

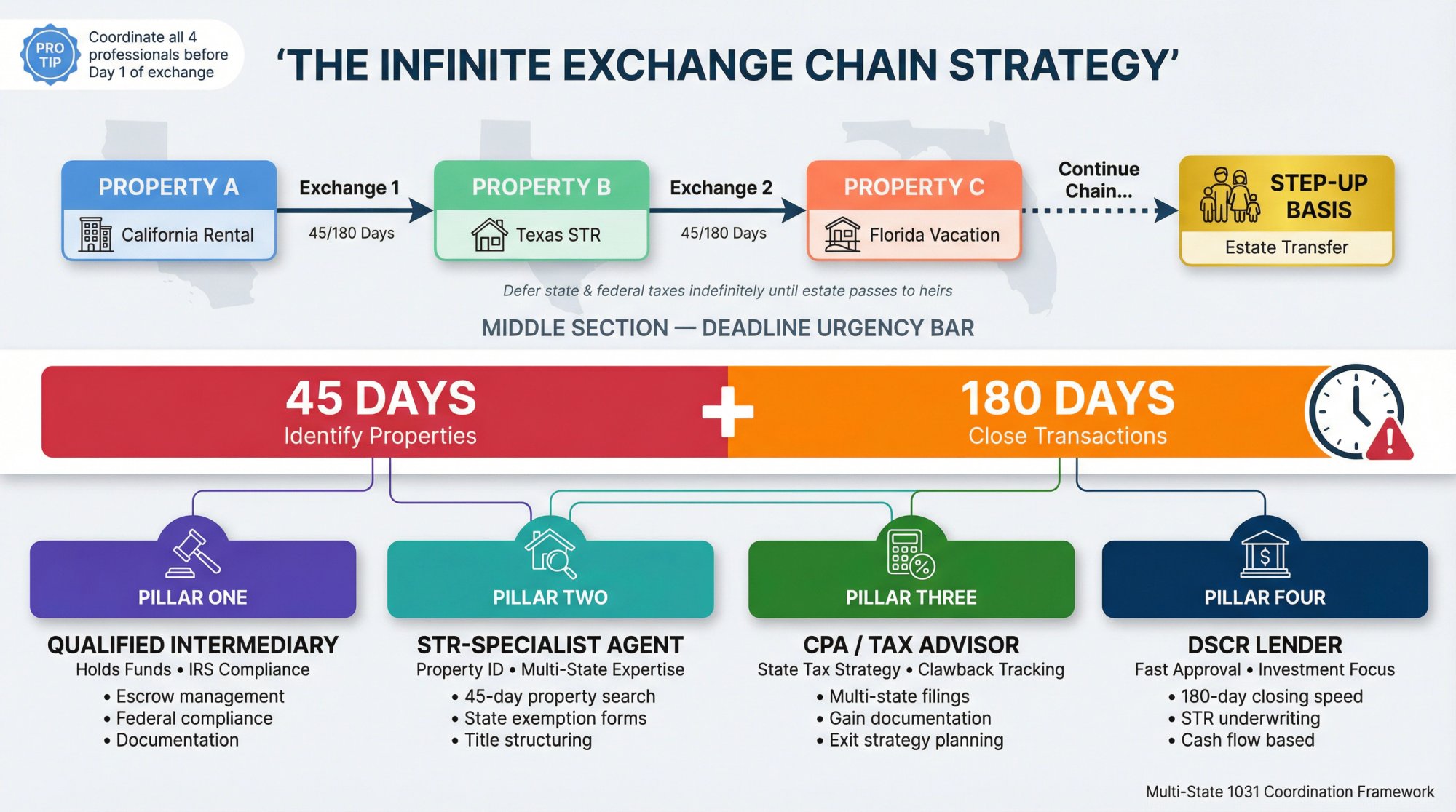

How to Chain 1031 Exchanges to Defer Taxes Indefinitely

One way savvy investors avoid ever paying state tax: never break the chain.

Exchange property A for B. Then B for C. Then C for D. Continue until your estate passes to your heirs.

At death, the property's tax basis gets stepped up to market value under current federal law. This potentially wipes out the accumulated capital gain for tax purposes. Neither federal nor state capital gains tax would apply.

It's an advanced strategy that relies on tax laws not changing. But it explains why some investors are comfortable owning California real estate via 1031, knowing they can defer indefinitely.

If you go this route, make sure your heirs understand the situation. Tax laws could change.

Why Local STR Regulations Matter for 1031 Exchanges

State tax friendliness doesn't automatically mean local rental friendliness.

Buying a vacation rental in Florida is great for taxes. But if that home is in a town that prohibits short-term rentals, your investment strategy falls apart.

Before you identify a replacement property, research the local rules. Use Chalet's STR Regulations Library or ask your agent. An "exchange-friendly" market should minimize taxes and let you operate legally.

How to Find 1031-Savvy Real Estate Professionals

The clockwork timing (45 days to identify, 180 to close) means you can't afford delays or mistakes, especially across multiple states.

Engage a qualified intermediary (QI) to hold funds and ensure IRS compliance. Work with a real estate agent experienced in 1031 exchanges. They'll file the right state exemption forms, structure titles correctly, and line up suitable properties fast.

A good agent in your target state can have a list of properties ready that meet your criteria and timeline. At Chalet, we can introduce you to vetted agents who understand 1031 deadlines and the nuances of investing across state lines.

Next Steps to Maximize Your 1031 Exchange

Finding the best and worst states for 1031 exchanges comes down to balancing tax implications with investment potential.

Tax-friendly states like Florida, Texas, and Tennessee let you defer state taxes entirely. When you eventually sell, only federal tax applies. That's a huge advantage for long-term wealth building.

High-tax or clawback states demand more careful planning. But even there, a 1031 exchange can save you tens of thousands in immediate taxes and give you more capital to reinvest. You just need to track obligations and plan your exit strategy.

As you plan your next move:

-

Consider where you ultimately want your profits to end up. A no-tax state can amplify your gains when you eventually sell.

-

If you're exiting a high-tax or clawback state, factor in lingering obligations so you're not caught off guard years later.

-

Use Chalet's free analytics tools to compare short-term rental markets and identify promising areas for your exchange.

-

Most importantly, get the right help. A seasoned agent who has handled 1031 deals will streamline your search and transactions within the tight deadlines.

Deferring taxes is a smart way to build your portfolio faster. Doing it in the right state is how you keep more of what you earn.

When you're ready to find the ideal market and team for your 1031 exchange, meet an Airbnb-friendly agent and start your search in an investor-friendly market today.

Frequently Asked Questions

Do All States Recognize 1031 Exchanges?

Yes. As of 2023, all 50 states recognize Section 1031 like-kind exchanges for state tax purposes. Pennsylvania was the last holdout, changing its law in 2022. So you can execute a 1031 exchange involving property in any state. The differences lie in tax rates and whether states have clawback provisions that track deferred gains across state lines.

What Is a Clawback Provision in a 1031 Exchange?

A clawback provision allows a state to collect taxes on capital gains that were originally deferred when you exchanged property out of that state. For example, if you sell California property and exchange into a Nevada rental, California lets you defer its state tax at the time. But when you eventually sell the Nevada property without another exchange, California will "claw back" and collect tax on the gain that originated there. States with clawback provisions include California, Oregon, Massachusetts, and Montana.

Which States Have No Capital Gains Tax on Real Estate?

Eight states have no personal income tax, which means no state capital gains tax on real estate: Florida, Texas, Tennessee, Nevada, Wyoming, South Dakota, Alaska, and New Hampshire. Washington State has no income tax but enacted a capital gains tax on certain stock sales, though real estate sales remain exempt. Investors often target these states for their final sale to avoid state taxes entirely.

Can I Do a 1031 Exchange From California to Florida?

Absolutely. You can sell investment property in California and exchange into a Florida property under federal 1031 rules. Both states recognize the exchange. The catch is California's clawback provision. California will defer its state tax at the time of exchange, but when you eventually sell the Florida property without doing another exchange, California will collect the tax on the gain that originally accrued there. So while you can defer, you may not escape California's tax permanently unless you keep exchanging indefinitely.

How Do I Avoid California's Clawback Tax on a 1031 Exchange?

The only ways to avoid California's clawback tax are to keep doing successive 1031 exchanges (never breaking the chain) or hold the property until death, when heirs may receive a stepped-up basis that wipes out the accumulated gain. You must also file Form FTB 3840 annually to report out-of-state replacement properties, or risk losing your deferral. For most investors, the strategy is to defer as long as possible rather than avoid the tax entirely.

What Happens If I Miss California's Annual 1031 Filing?

If you exchange out of California property and fail to file the required annual Form FTB 3840, you risk voiding your deferral. California could determine that the deferred tax is due immediately. The filing requirements exist specifically to track 1031 funds that leave the state. Missing these filings can turn a successful deferral into an immediate tax bill, so compliance is essential if you're exiting California investments.

How Can Chalet Help With My 1031 Exchange?

Chalet helps 1031 investors by providing free market analytics to compare short-term rental opportunities across states, connecting you with real estate agents experienced in 1031 transactions, offering a regulation library to verify local STR rules, and providing ROI calculators to analyze potential investments. Our network includes 1031-savvy professionals who understand the 45-day identification and 180-day closing deadlines. Whether you're exiting a high-tax state or identifying replacement properties quickly, we can help streamline the process.