You've been putting money into your 401(k) for years. The stock market has treated you reasonably well. But now you're wondering if there's a better way to build wealth, and you keep hearing about people making serious cash from Airbnb rentals.

So which is it? Should you stick with stocks, or is buying a short-term rental (STR) the smarter play?

The honest answer is that both can make you wealthy, but they work completely differently. And the "right" choice depends on factors that are specific to you: how much time you have, how much cash you can tie up, and whether you want your investments to feel like a business or a background process.

We're going to break down the real numbers, the actual risks, and the honest trade-offs between Airbnb rentals and stock market investing so you can make a decision that fits your life. This isn't a pitch for one or the other. It's a framework for figuring out what makes sense for you.

Airbnb vs. Stocks: Real Returns Compared

Most people care about one thing first: how much money can each investment make?

Historical Stock Market Returns (S&P 500)

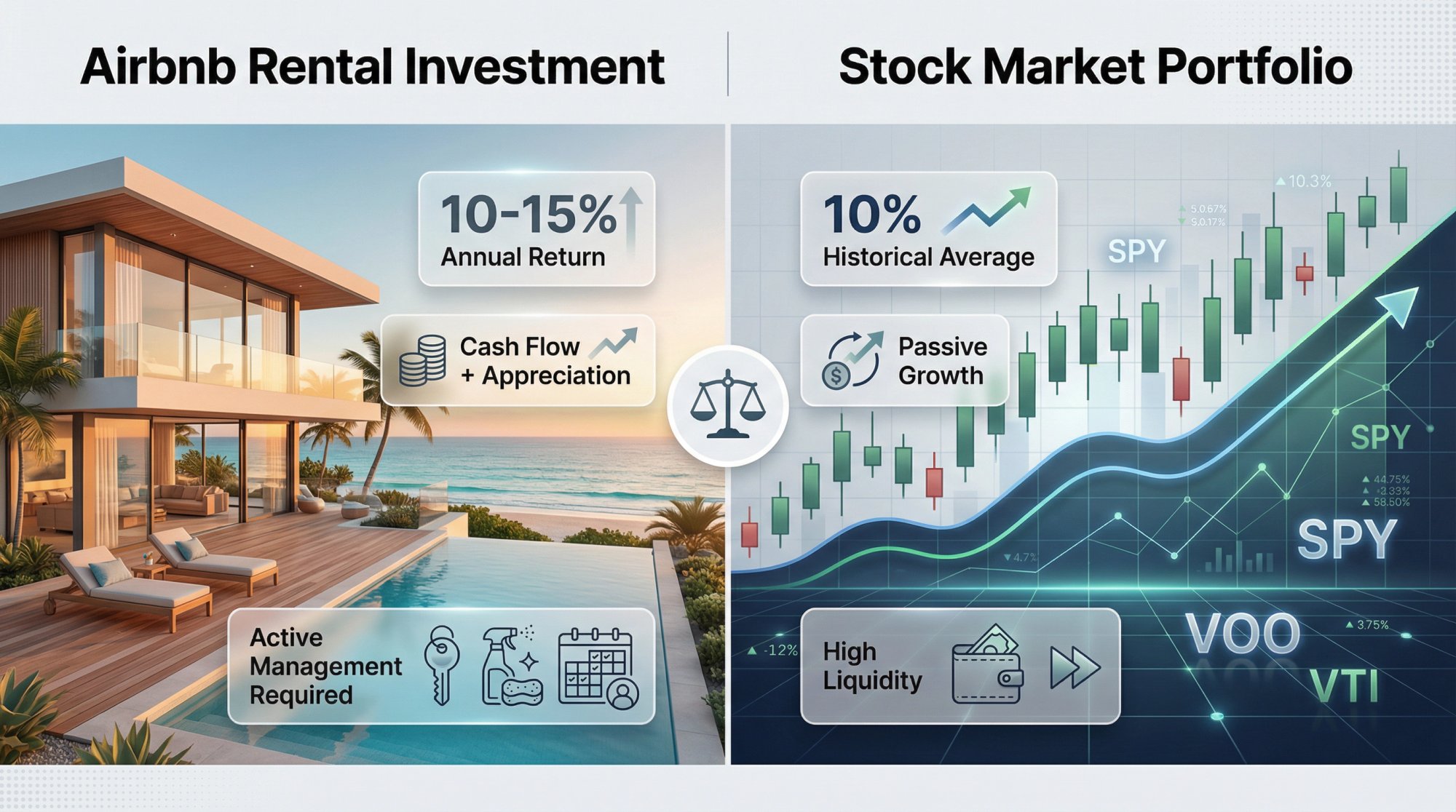

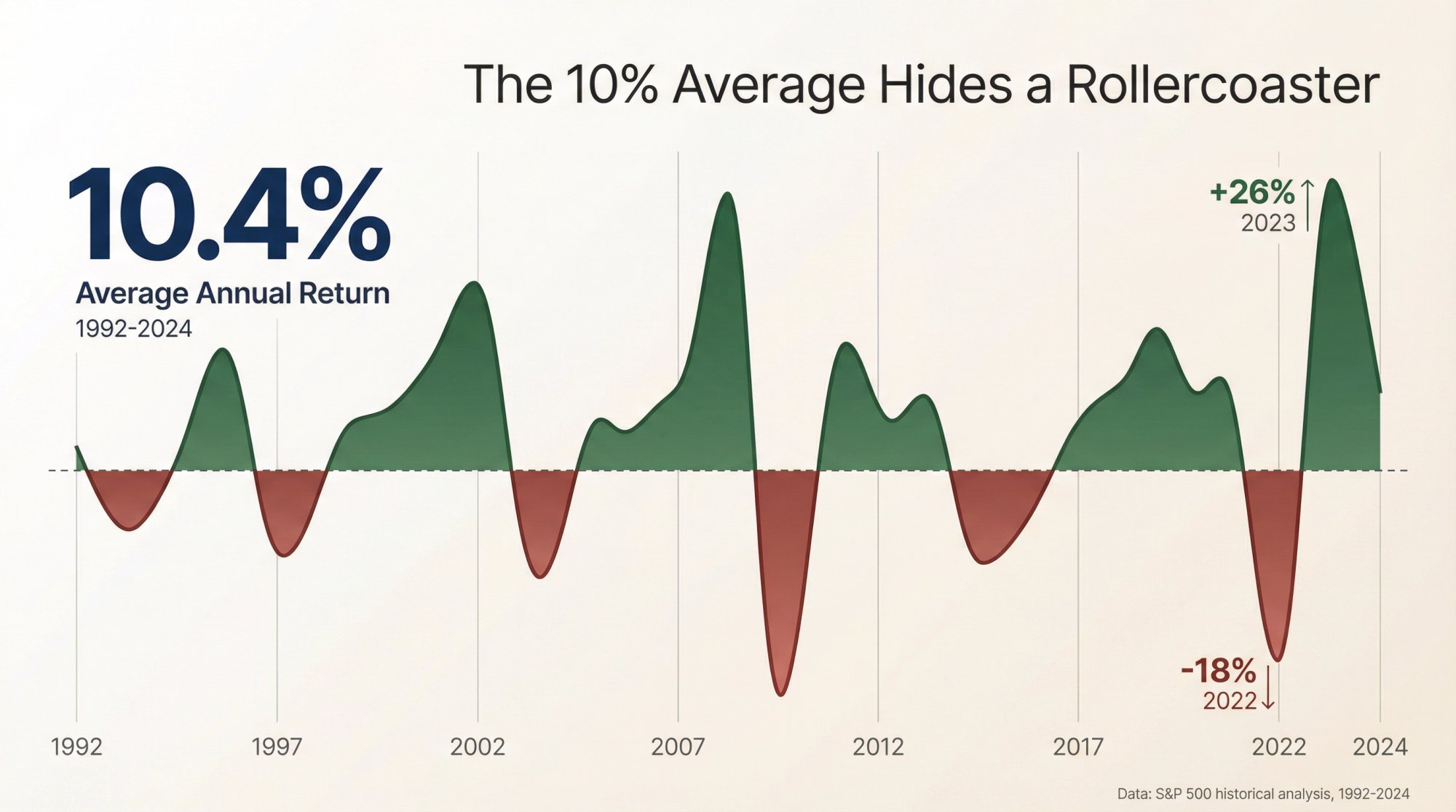

The S&P 500, the benchmark most people use for "the stock market," has delivered about 10% average annual returns over the long haul, according to historical analysis from NerdWallet. That's before inflation, but it's still a solid number.

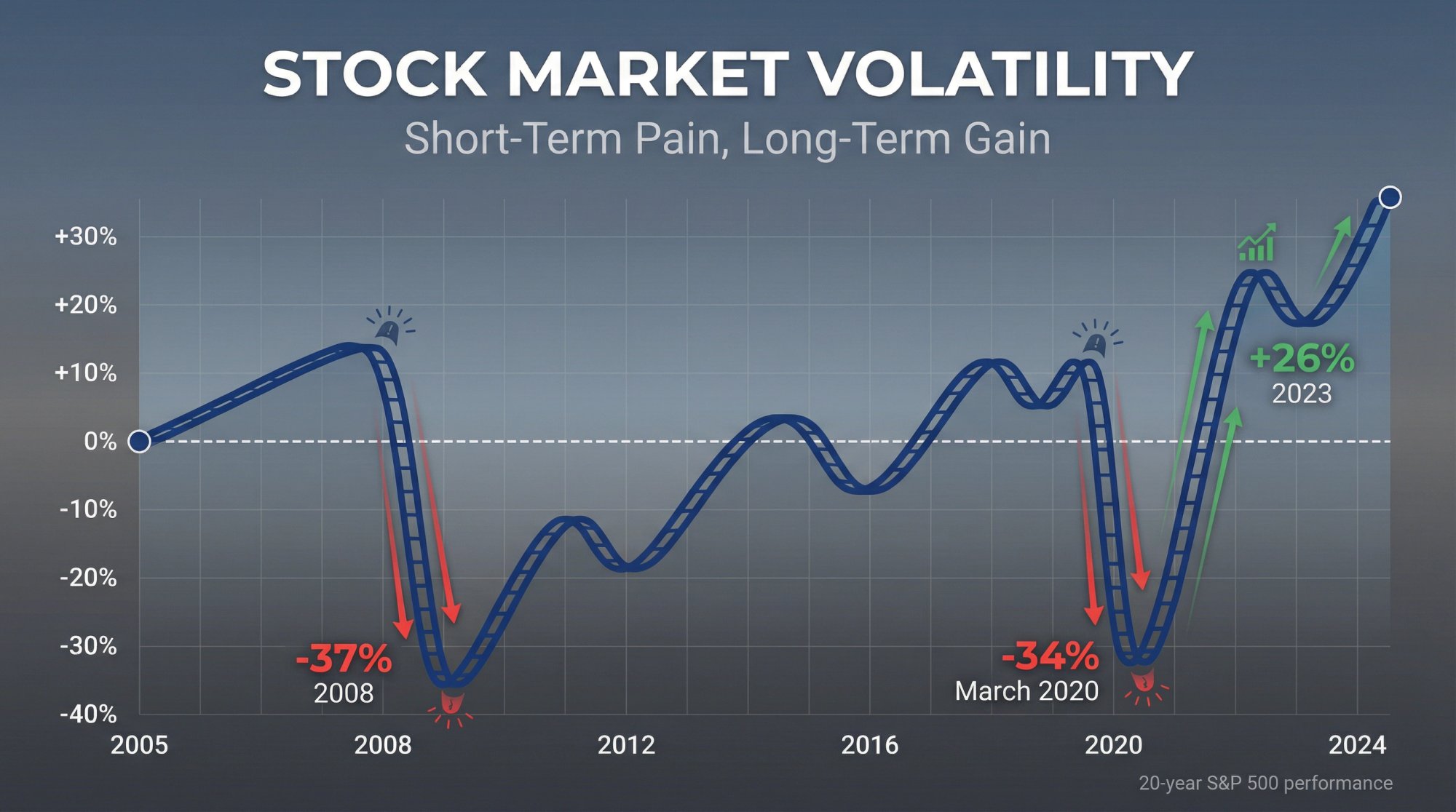

The catch? That "average" hides a lot of volatility. The S&P 500 returned +26% in 2023 after dropping -18% in 2022. In any given year, you might see gains of 20%, losses of 20%, or something in between. Over longer periods (think 20+ years), the stock market has been remarkably consistent. Over shorter periods, it can feel like a rollercoaster.

From 1992 through 2024, Investopedia reports that the S&P 500 averaged roughly 10.4% per year including dividends. U.S. housing prices, by comparison, grew about 5.5% annually over that same period.

On pure appreciation, stocks win.

How Much Do Airbnb Rentals Actually Make?

Airbnb properties don't just appreciate. They also generate income from guests staying in your property. When you combine appreciation with cash flow, the picture changes.

Research shows that well-chosen short-term rental properties often target 8-12% annual returns as a net operating yield. In strong vacation markets, gross yields can hit 10-15% per year. Traditional long-term rentals (year-long leases) typically generate lower returns in the 4-10% range, which is why the short-term rental strategy appeals to investors looking for higher income.

A 10% gross yield is considered a solid benchmark for STR properties. Some markets exceed this, and others fall short. Your actual returns depend heavily on location, property type, and how well you manage the operation.

What Expenses Cut Into Airbnb Profits?

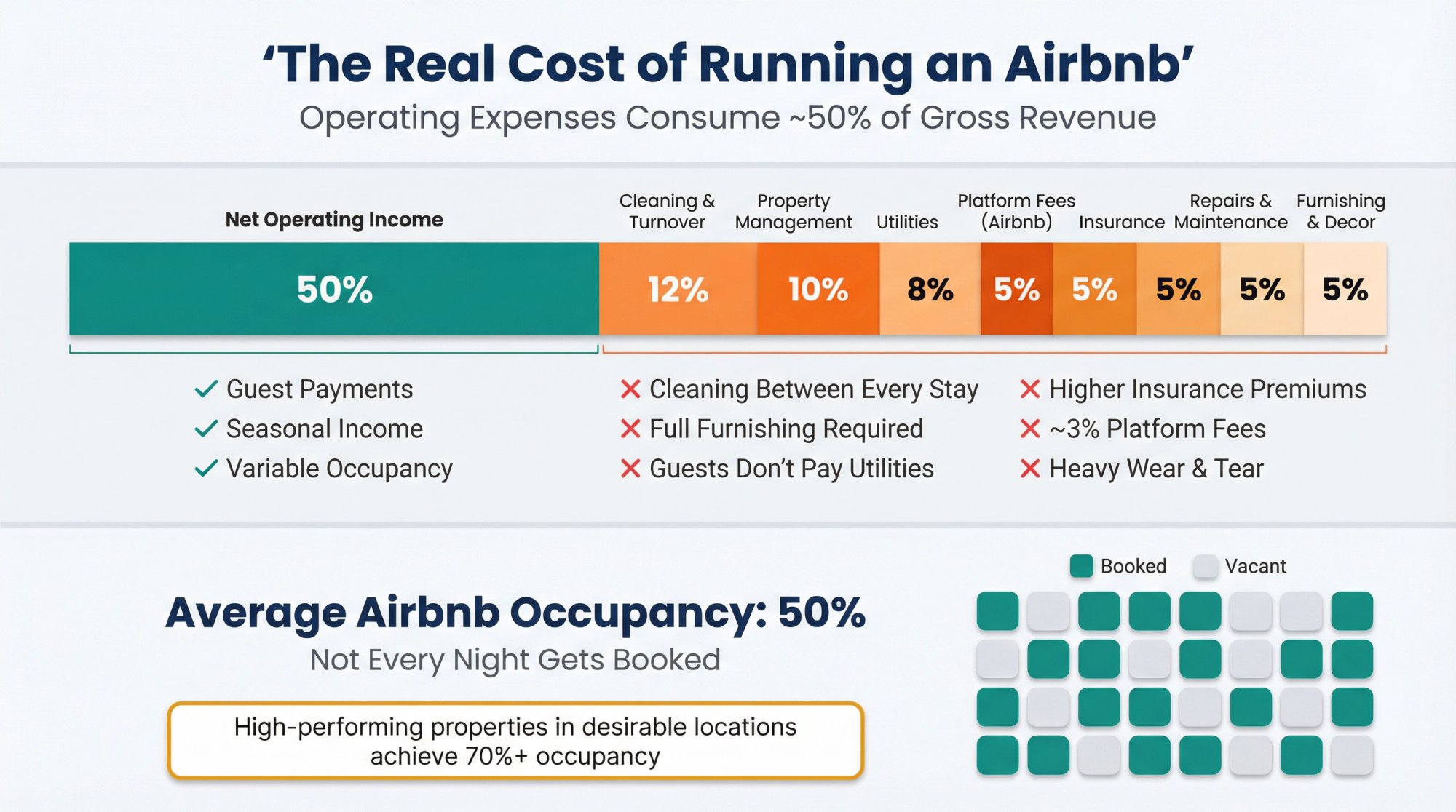

This is where the Airbnb math gets trickier. Operating costs for short-term rentals are substantially higher than traditional rentals.

You're paying for:

-

Cleaning between every guest stay

-

Furnishing and decorating the entire property

-

Utilities (guests don't pay these separately)

-

Higher insurance premiums

-

Platform fees (Airbnb takes roughly 3%)

-

Property management (if you hire help)

-

Repairs and maintenance (used more heavily than a primary residence)

These costs can consume about 50% of your gross rental revenue. That's significantly higher than the roughly 35% expense ratio for long-term rentals.

And then there's occupancy. Not every night gets booked.

Current market data shows that average U.S. Airbnb occupancy hovers around 50%, though this varies significantly by market. That means the average Airbnb is only occupied half the time. High-performing properties in desirable locations do much better (70%+ occupancy), but these numbers show you can't assume full calendars. You can check occupancy rates by city to understand what's realistic for your target market.

$100,000 in Stocks vs. Airbnb: Which Grows Faster?

Here's how this plays out in practice.

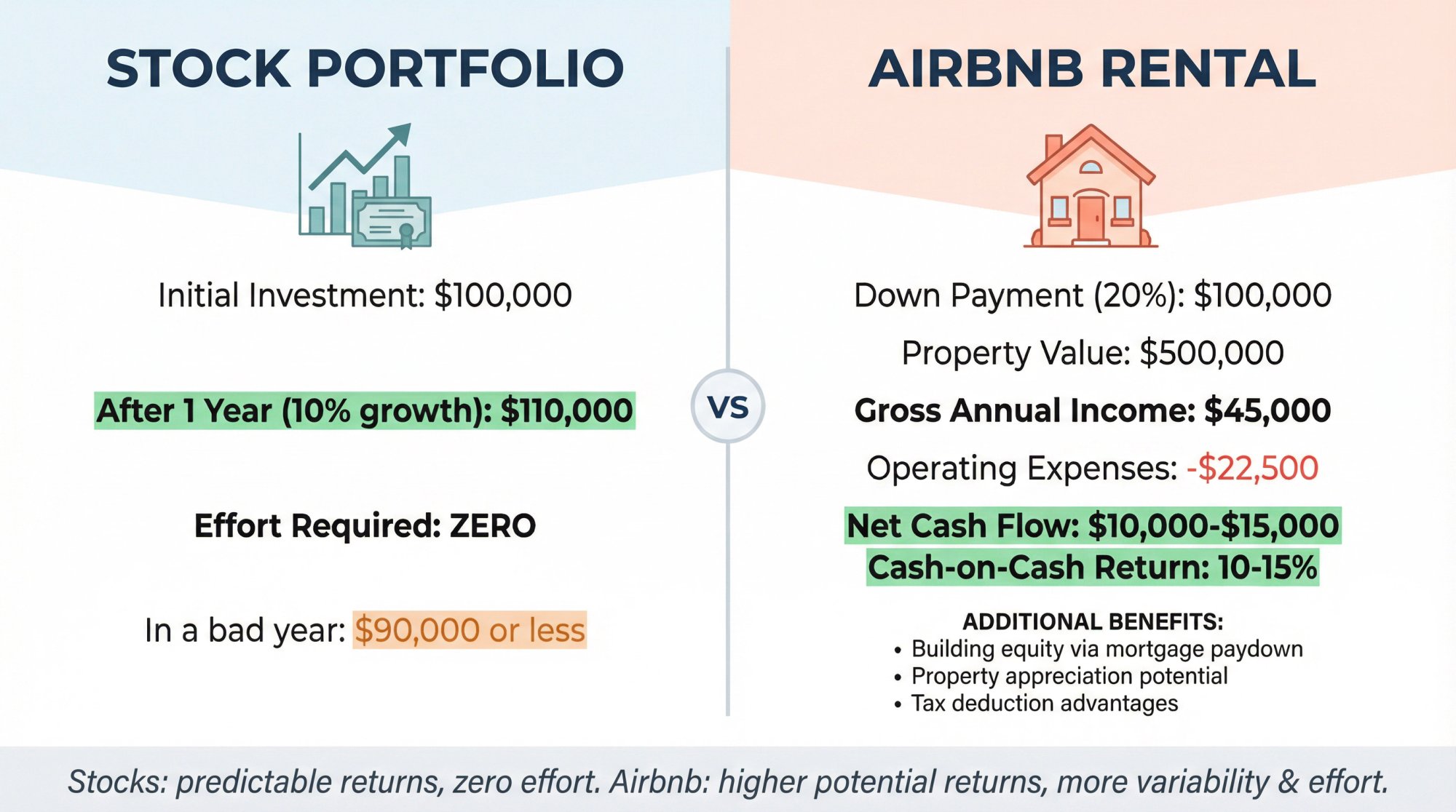

Stock portfolio scenario: You invest $100,000 in an S&P 500 index fund. After a typical year with 10% growth, you have about $110,000. Zero effort required. But if the market has a bad year, you might be looking at $90,000 or less.

Airbnb property scenario: You use $100,000 as a down payment on a $500,000 rental property (20% down, with a mortgage for the rest). Say the property generates $45,000 in gross rental income over the year. After operating expenses (roughly $22,500), mortgage payments, and taxes, you might net $10,000-$15,000 in cash flow, depending on your interest rate and local costs. That's a 10-15% cash-on-cash return on your $100,000 investment.

But you're also:

-

Building equity as the mortgage gets paid down (by renters' money)

-

Potentially gaining from property appreciation

-

Creating tax deductions that shelter some of that income

In a best-case scenario, total returns (cash flow + equity + appreciation) could exceed 20% annually on your cash investment. In a worst-case scenario (low occupancy, expensive repairs, market decline), you could lose money.

Use Chalet's free Airbnb calculator to run real numbers on specific properties and see projected returns before you invest.

The bottom line: Stocks offer more predictable average returns with less work. Airbnb rentals offer higher potential returns, but with more variability and significantly more effort.

Airbnb vs. Stock Market: Risk Comparison

Returns don't tell the whole story. You also need to understand what can go wrong.

How Volatile Is the Stock Market?

The stock market's biggest risk is obvious: prices swing dramatically in the short term. A 20% drop in a single year isn't unusual. During the 2008 financial crisis and the early weeks of the 2020 pandemic, markets plunged 30% or more in weeks.

If you can stomach the swings and hold through downturns, stocks have historically recovered and continued climbing. The key phrase is "if you can stomach it." Many investors panic-sell during drops and lock in losses, which is how you turn temporary volatility into permanent damage.

What Are the Hidden Risks of Owning Real Estate?

Property values don't swing daily like stock prices. You won't see your net worth change every time you refresh your phone. Real estate prices move slowly, typically taking months or years to adjust significantly.

The 2008 housing crash was dramatic, but crashes of that magnitude are rarer in real estate than in stocks. That stability can be comforting.

But short-term rentals have their own volatility: income volatility.

Your cash flow from an Airbnb depends on people booking your property. If travel demand drops, if a bunch of new rentals flood your market, or if it's simply off-season, your income can decline quickly. A beach rental might be packed in summer and nearly empty in winter. Your property value might hold steady while your bank account tells a very different story month to month.

What Risks Are Unique to Airbnb Investing?

Here's where things get specific to short-term rentals:

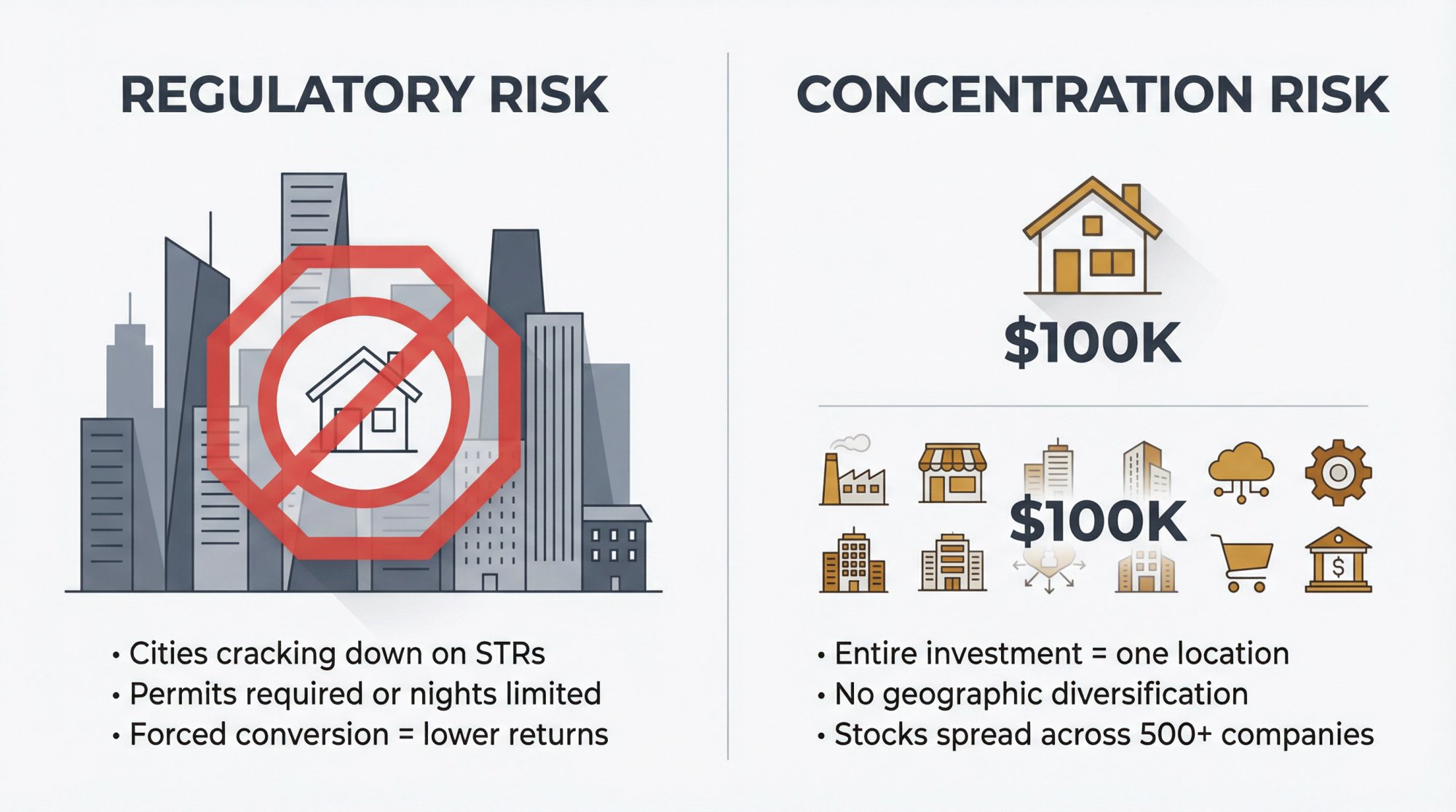

Regulatory risk is the elephant in the room. Cities across the country have been cracking down on Airbnb-style rentals. Some require permits. Others limit how many nights per year you can rent. A few have essentially banned non-owner-occupied short-term rentals entirely.

If you buy a property banking on Airbnb income and your city later restricts STRs, you could be forced to convert to a long-term rental (with lower returns) or sell (possibly at a loss, since other investors will see the same restriction).

Concentration risk is another factor. Your entire real estate investment might be one property in one location. If that neighborhood declines or the local economy struggles, you can't diversify your way out of it. With stocks, you can easily spread $100,000 across 500 companies and multiple industries. With physical real estate, $100,000 buys you a piece of one property.

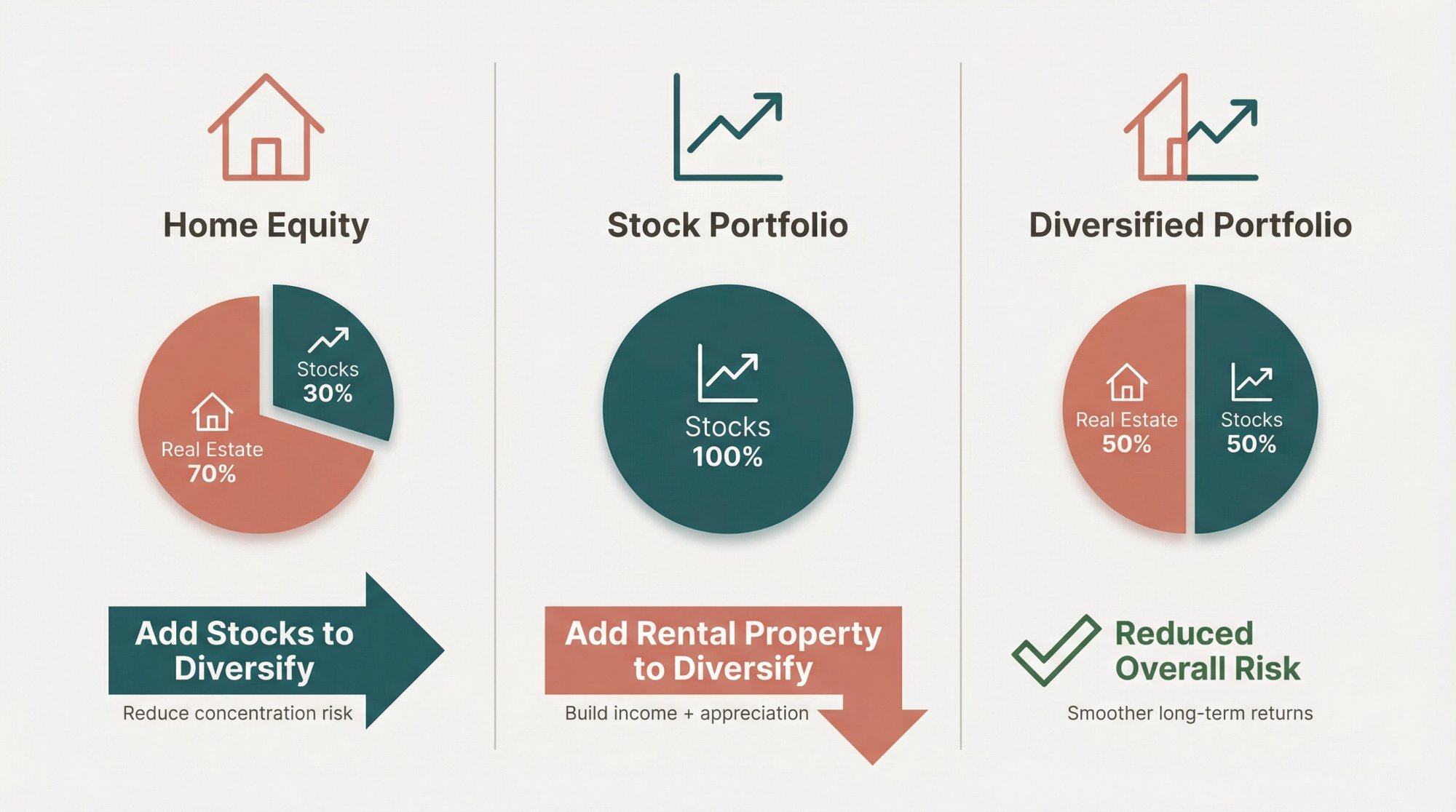

Should You Own Both Stocks and Airbnb Rentals?

Financial analysis shows that stocks and real estate aren't highly correlated. When one zigs, the other often zags. This means holding both can actually reduce your overall portfolio risk, not because either is safer individually, but because they don't move in lockstep.

Key insight: The "safer" choice depends on what kind of risk keeps you up at night. Stock market crashes happen fast and feel dramatic. Real estate problems build slowly but can be just as damaging. Neither is truly safe. Both can build serious wealth over time.

Time Investment: Passive Stocks vs. Active Airbnb

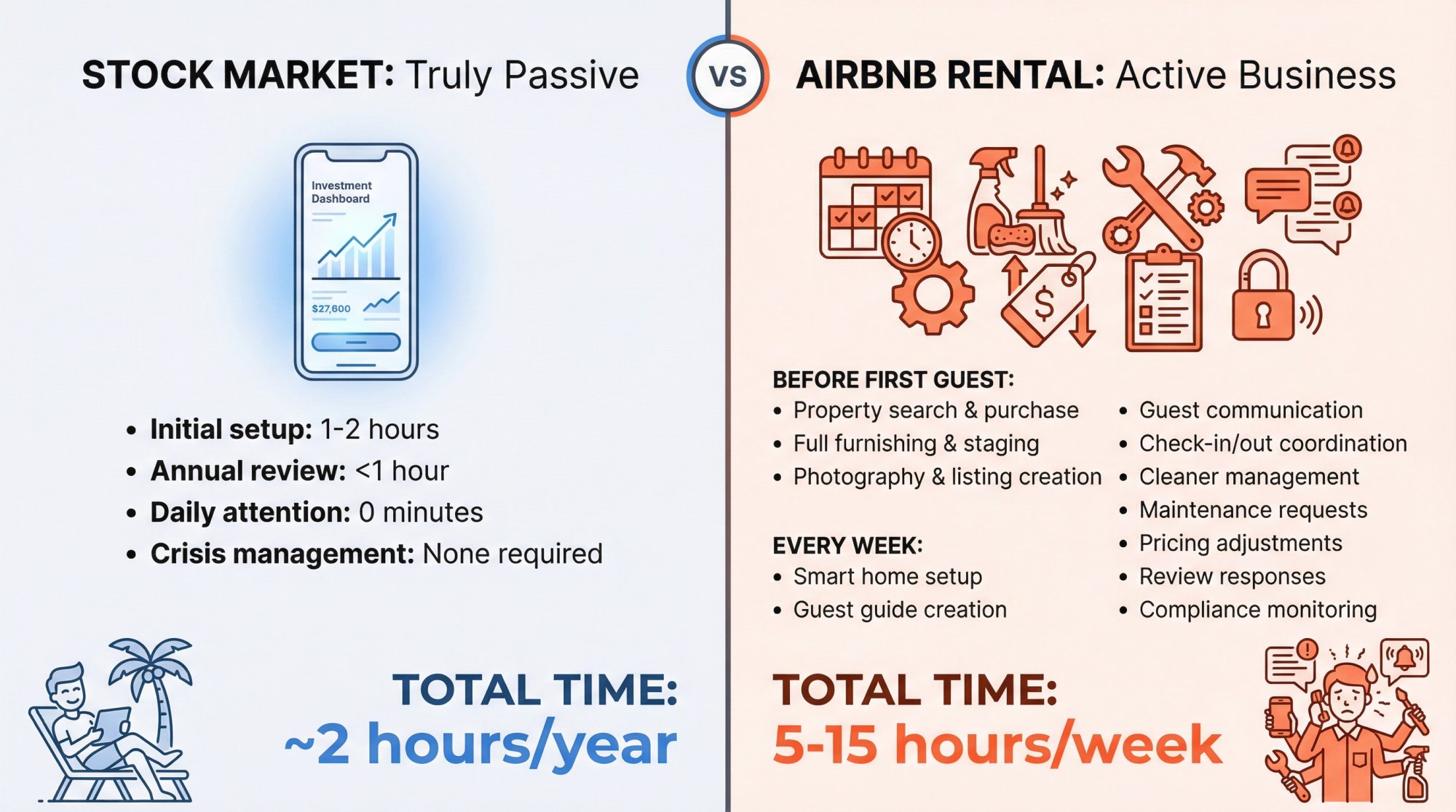

This might be the most important section for people who've never owned rental property. The time and effort difference between stocks and Airbnb rentals is massive.

How Much Work Is Running an Airbnb?

Owning a vacation rental property isn't like owning a stock that happens to be in the real estate sector. It's more like running a small hospitality business. Here's what that looks like:

Before you earn a dime:

-

You need to find and buy the property (not trivial)

-

Furnish and decorate everything from beds to kitchen utensils

-

Take professional photos and write compelling listing descriptions

-

Set up your Airbnb and/or Vrbo listings

-

Install smart locks, set up WiFi, create guest guides

Ongoing operations:

-

Respond to guest inquiries and booking questions

-

Coordinate check-ins and check-outs

-

Arrange cleaning between every guest (and manage your cleaners)

-

Handle maintenance issues promptly (a broken AC in summer means bad reviews)

-

Deal with occasional difficult guests, noise complaints, or damage

-

Adjust pricing based on demand, seasons, and local events

-

Stay compliant with local STR regulations and renew any required permits

Even with tools that automate messaging and pricing, you'll spend time each week managing your property. This isn't passive income in the "set it and forget it" sense. It's semi-passive income that requires ongoing attention.

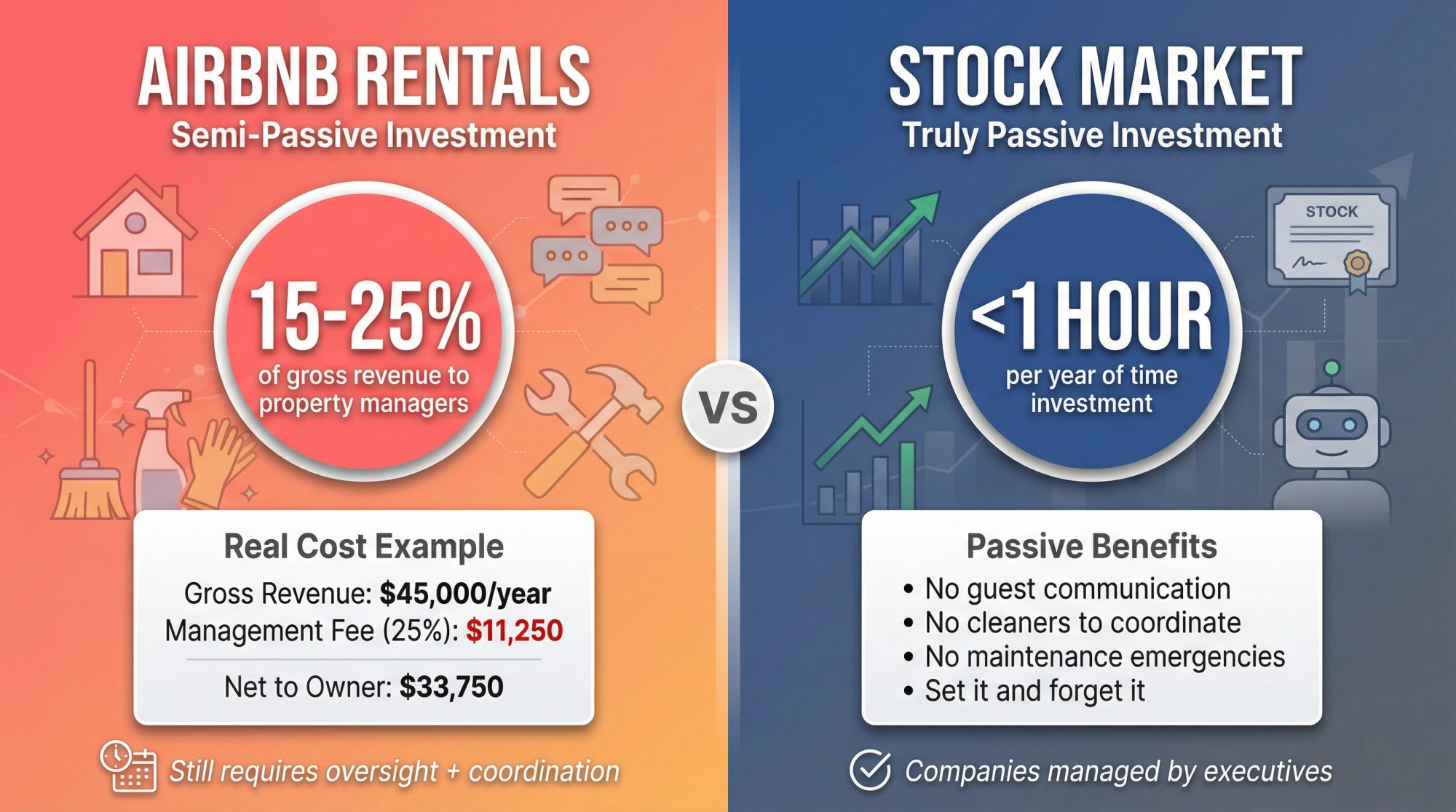

Is Hiring a Property Manager Worth the Cost?

You can outsource most of this work to a property management company. They'll handle guest communication, coordinate cleaners, manage maintenance, and optimize your listing.

The cost? Typically 15-25% of your gross rental revenue. In high-demand vacation areas, this can climb to 30-40%.

That's a significant chunk of your profit. If you're grossing $45,000 per year and paying 25% to management, that's $11,250 coming out before you see a dime. The convenience comes at a real cost, and it makes the math harder (you need higher occupancy or nightly rates to compensate).

Are Stocks Truly Passive Income?

By contrast, investing in stocks is genuinely passive. You open a brokerage account, buy an index fund or a selection of stocks, and you're done. You don't have to respond to anyone's messages. You don't need to coordinate cleaners. Nobody's calling you about a plumbing emergency.

If you use a robo-advisor or set up automatic contributions to a 401(k), you might spend less than an hour per year on your stock investments. The companies you own are being managed by their executive teams. Your job is just to not sell when things get scary.

| Investment Type | Time Commitment |

|---|---|

| Stocks | Truly passive |

| Airbnb | Active business, even with help |

Which Investment Fits Your Lifestyle?

This isn't a judgment call. Some people genuinely enjoy running short-term rentals. They like designing beautiful spaces, creating great guest experiences, and seeing direct results from their efforts. For them, the "work" is actually enjoyable.

Others would rather spend their time on careers, family, travel, or hobbies that have nothing to do with property management. For them, true passivity is worth accepting potentially lower returns.

Be honest with yourself about which camp you're in. If you're ready to start, Chalet's guide to investing in your first STR walks you through the process step by step.

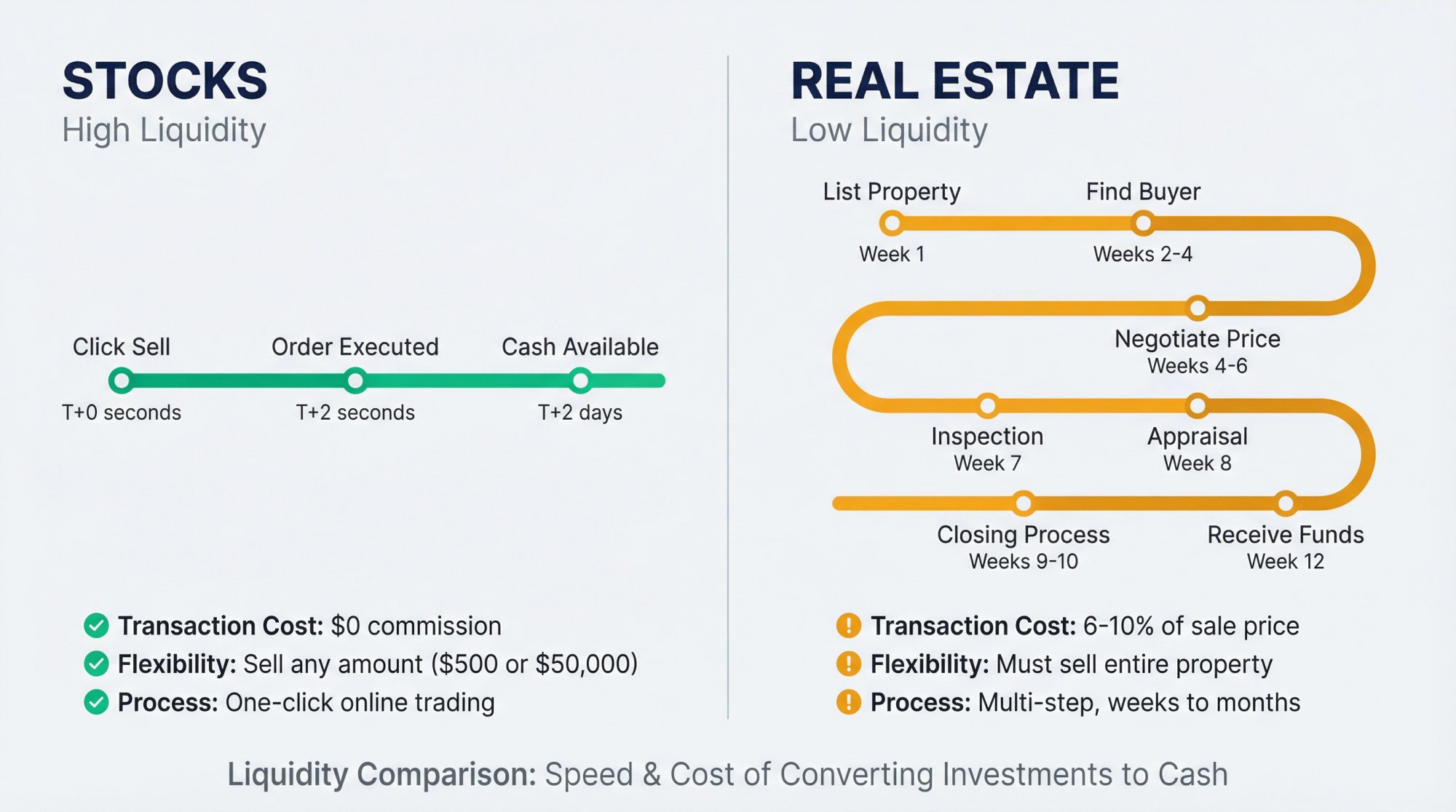

How Quickly Can You Access Your Money?

Liquidity refers to how easily you can access the money you've invested. This matters more than most people realize until they actually need cash.

How Fast Can You Sell Stocks?

Need money from your stock portfolio? You can sell shares in seconds during market hours and have cash in your brokerage account within days. Modern brokers typically charge zero commission for trades. You can sell exactly as much as you need, whether that's $500 or $50,000.

This flexibility is invaluable. If you lose your job, face a medical emergency, or spot a great investment opportunity, you can access your capital quickly and cheaply.

(One caveat: if your stocks are in retirement accounts like a 401(k) or IRA, early withdrawals come with penalties. But that's a self-imposed restriction to encourage long-term saving, not a limitation of stocks themselves.)

How Long Does It Take to Sell an Airbnb Property?

Selling a property is the opposite experience. NerdWallet estimates that transaction costs for selling real estate typically run 6-10% of the sale price when you factor in agent commissions, title fees, closing costs, and potential taxes.

And that's assuming you can sell at all. Finding a buyer, negotiating a price, going through inspections and appraisals, and closing the deal can take weeks or months. In a slow market, it could take even longer.

You can't sell "half" your house if you only need some of the money. You either sell the whole thing or you don't. You can borrow against your equity through a HELOC or cash-out refinance, but that takes time to arrange and adds debt.

Real estate is best for money you don't expect to need for years.

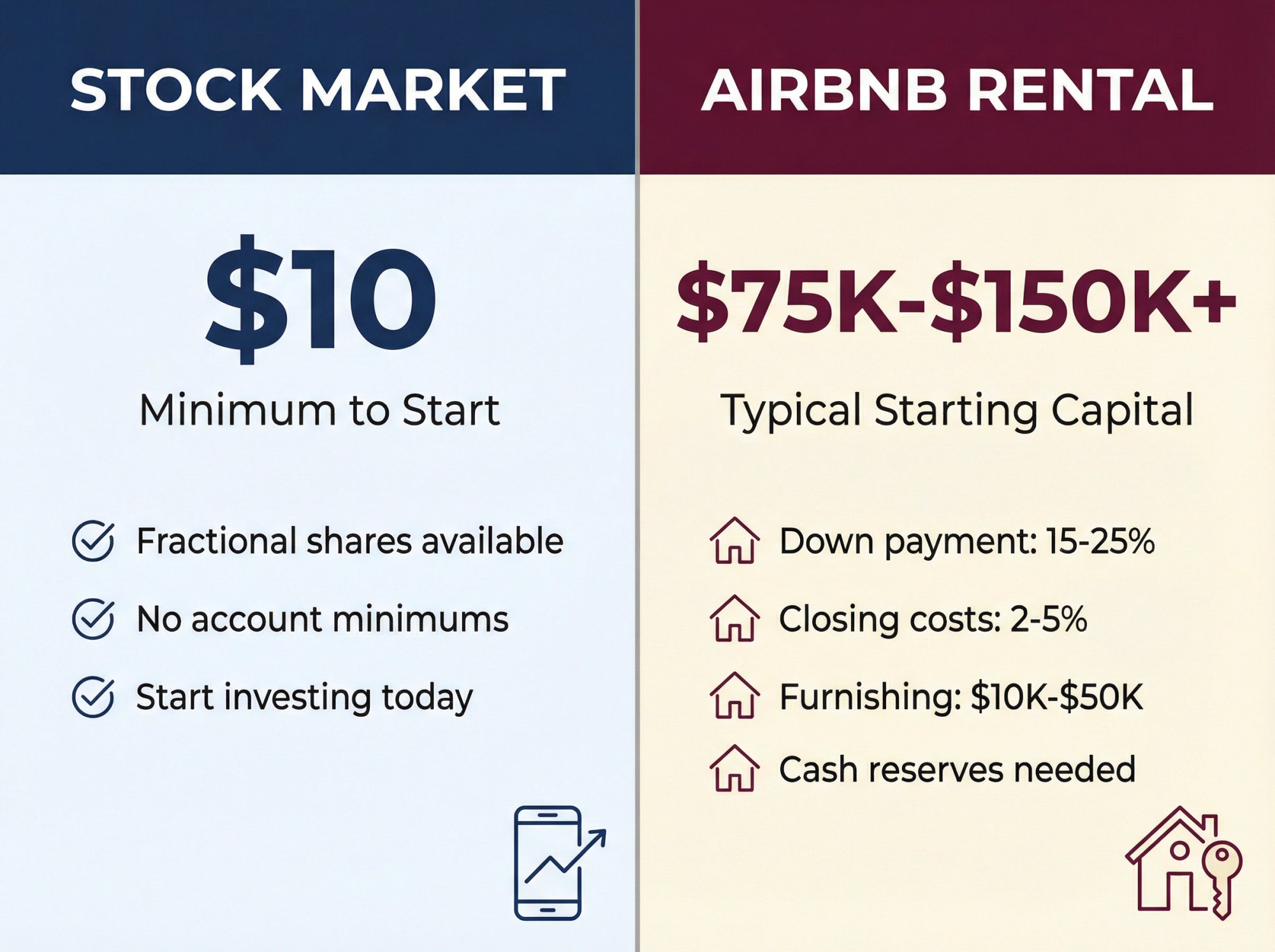

How Much Money Do You Need to Start Each Investment?

The barrier to entry is dramatically different for each investment:

For stocks: You can start with virtually any amount. Many brokers allow fractional shares, meaning you could invest $10 if that's what you have. There's no minimum to open an account and start building wealth.

For an Airbnb rental: You typically need:

-

15-25% down payment (lenders often require more for investment properties)

-

Closing costs (typically 2-5% of purchase price)

-

Furnishing budget ($10,000-$50,000 depending on the property)

-

Cash reserves for emergencies and slow periods

For a $400,000 property, you might need $80,000 down, $15,000 in closing costs, $20,000 for furniture and setup, and $10,000-$20,000 in reserves. That's potentially $125,000+ just to get started.

This high capital requirement is why many people invest in stocks for years before they can realistically consider rental properties. If you're looking into financing options for STR investments, there are several loan types designed specifically for investors.

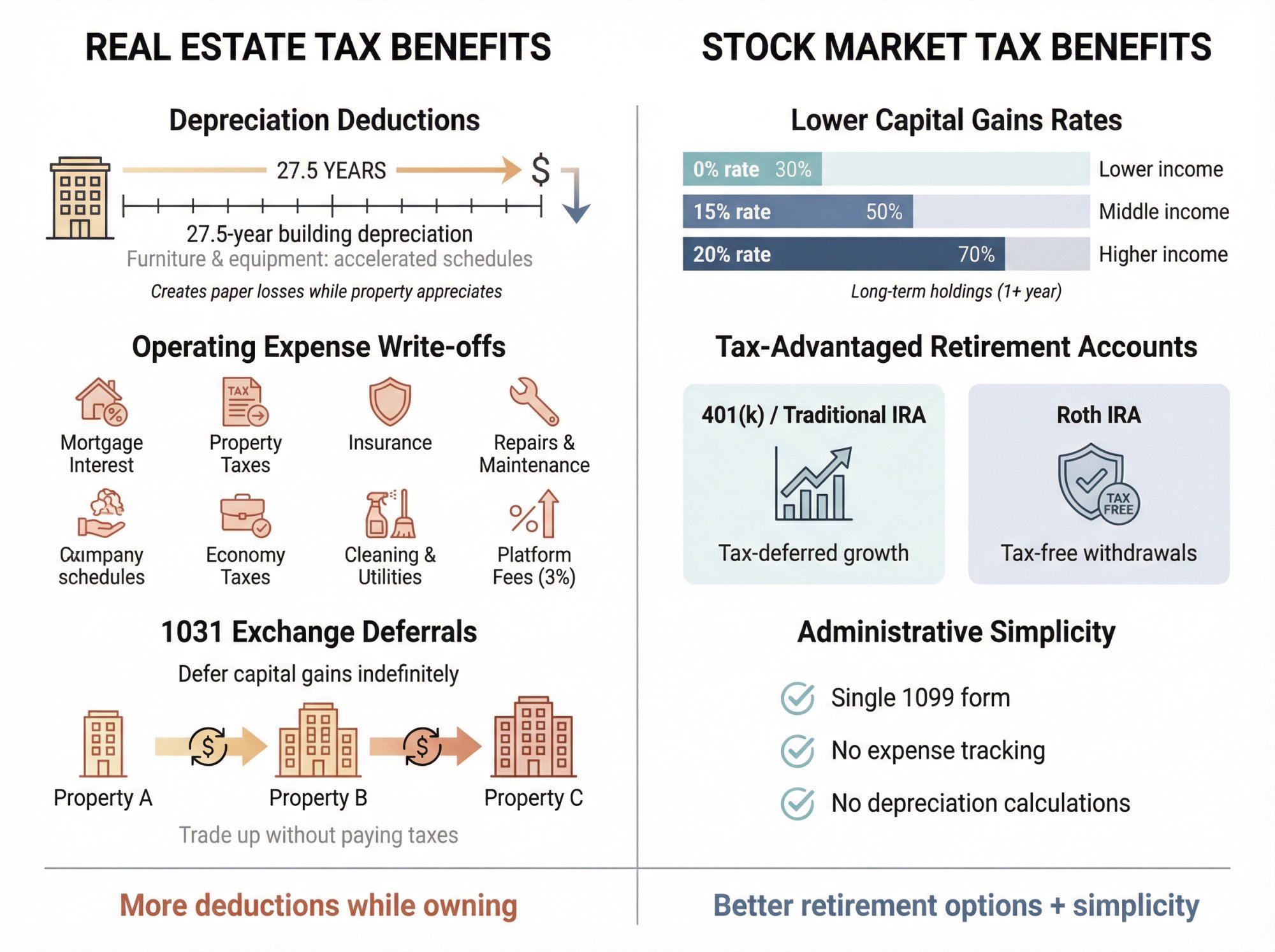

Tax Benefits: Airbnb Rentals vs. Stocks

Both stocks and real estate come with legitimate tax benefits. Understanding them can significantly impact your actual returns.

What Tax Deductions Do Airbnb Owners Get?

Depreciation is arguably the most powerful tax advantage for rental property owners. The IRS allows you to "depreciate" your building (not the land) over 27.5 years. This creates a paper expense that reduces your taxable rental income, even though the building might actually be increasing in value. Learn more about depreciating Airbnb vacation rentals to maximize this benefit.

You can also depreciate furniture, appliances, and other equipment in your rental. Some STR owners can show a taxable loss even while they're generating positive cash flow, especially in the early years of ownership. This is often called the STR tax loophole.

Expense deductions include mortgage interest, property taxes, insurance, utilities, repairs, management fees, cleaning costs, and platform fees. All of these can be written off against your rental income. Here's a guide to short-term rental tax deduction strategies.

1031 exchanges let you defer capital gains taxes indefinitely when you sell one investment property and buy another of equal or greater value. Many rental investors "trade up" multiple times over their careers without ever paying the tax bill. This is exclusive to real estate; stocks don't qualify. Chalet's 1031 exchange resources can help you understand the process.

Potential QBI deduction: Some STR owners structured as businesses may qualify for the Qualified Business Income deduction, which can reduce taxable income by up to 20%.

How Are Stock Market Gains Taxed?

Lower capital gains rates: When you sell stocks held for over a year, profits are taxed at long-term capital gains rates (0%, 15%, or 20% depending on your income bracket). This is typically lower than ordinary income tax rates.

Tax-deferred growth: You only pay capital gains tax when you sell. If your stocks double in value but you don't sell, you owe nothing on those gains. This allows your money to compound more efficiently.

Retirement accounts: This is where stocks have a major advantage. Money in a 401(k) or IRA grows either tax-deferred (Traditional) or completely tax-free (Roth). There's no real equivalent for actively-managed rental property. You can't easily put an Airbnb you're running into a retirement account.

Simpler tax handling: At the end of the year, your broker sends you a 1099 showing your gains, losses, and dividends. You don't need to track dozens of individual expenses or navigate depreciation calculations. The administrative burden is minimal.

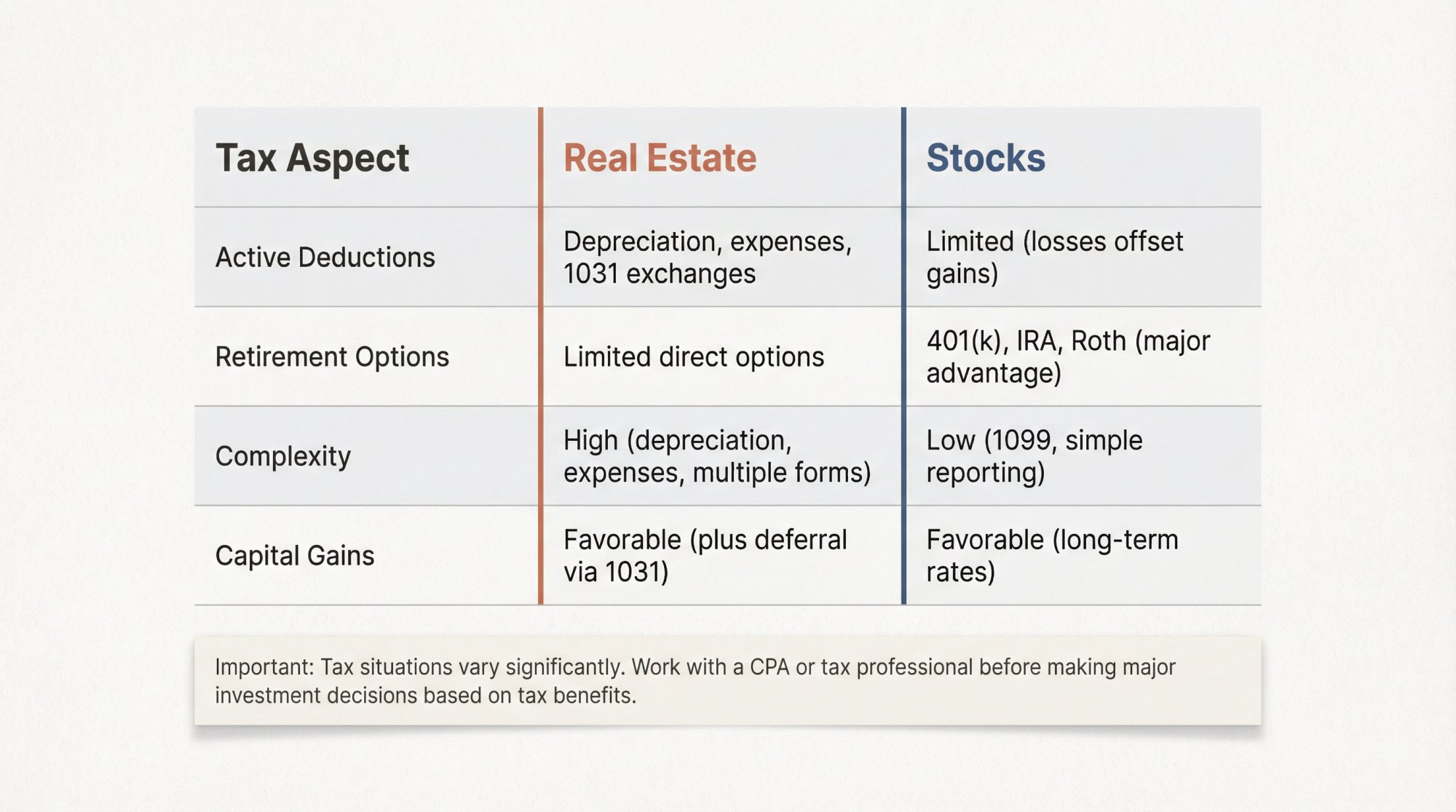

Tax Comparison: Real Estate vs. Stocks

| Tax Aspect | Real Estate | Stocks |

|---|---|---|

| Active Deductions | Depreciation, expenses, 1031 exchanges | Limited (losses offset gains) |

| Retirement Options | Limited direct options | 401(k), IRA, Roth (major advantage) |

| Complexity | High (depreciation, expenses, multiple forms) | Low (1099, simple reporting) |

| Capital Gains | Favorable (plus deferral via 1031) | Favorable (long-term rates) |

Real estate offers more ways to reduce your tax bill while you own the property, particularly through depreciation and expense deductions.

Stocks offer simpler tax planning and better tax-advantaged retirement options.

Both assets get favorable long-term capital gains treatment when you sell. Both pass to heirs with a stepped-up basis, potentially eliminating unrealized gains from taxation.

Important: Tax situations vary significantly by individual circumstances. Work with a CPA or tax professional before making major investment decisions based on tax benefits.

How to Choose Between Airbnb and Stocks

Rather than telling you which investment is "better," here's a framework for thinking through the decision based on your specific situation.

What Is Your Investment Time Horizon?

→ Short-term goal (1-3 years)? Neither investment is ideal. Stocks are too volatile, and real estate is too illiquid. Consider safer options.

→ Medium-term (5-10 years)? Both can work. Stocks will likely grow but could be down when you need the money. Real estate ties up capital but can generate income along the way.

→ Long-term (10+ years)? Both have proven track records for wealth building. The choice comes down to other factors.

How Much Time Can You Commit to Managing Investments?

Be honest. Not aspirational, but realistic.

If you already feel stretched thin with work and family, adding property management responsibilities might break you, not make you money.

If you have time, energy, and genuine interest in real estate, the higher potential returns might be worth pursuing.

What Is Your Risk Tolerance for Investing?

Can you watch your portfolio drop 30% without selling? If yes, you can handle stock market volatility.

Are you comfortable taking on mortgage debt secured by a single property? If that idea makes you nervous, real estate leverage might not be for you.

Do you worry more about market crashes or about tenant issues and regulatory changes? Different risks hit different people differently.

How Much Capital Do You Have to Invest?

With less than $50,000 available to invest, stocks are probably your only realistic option for now. Keep building.

With $100,000+, real estate becomes possible, though you'd be putting a significant portion of your wealth into one asset.

With $200,000+, you have more flexibility to diversify across both stocks and property.

How Diversified Is Your Current Portfolio?

If you already own a home, you have some real estate exposure. Adding stocks would diversify.

If everything is in stocks, adding a rental property would diversify.

If you're heavily concentrated in one or the other, balance might reduce your overall risk.

How Chalet Helps You Invest in Airbnb Rentals

If you're leaning toward Airbnb investing but feeling overwhelmed by the complexity, that's exactly why we built Chalet.

We're not here to convince you that real estate beats stocks. We're here to help you execute on short-term rental investing with confidence if that's the path you choose.

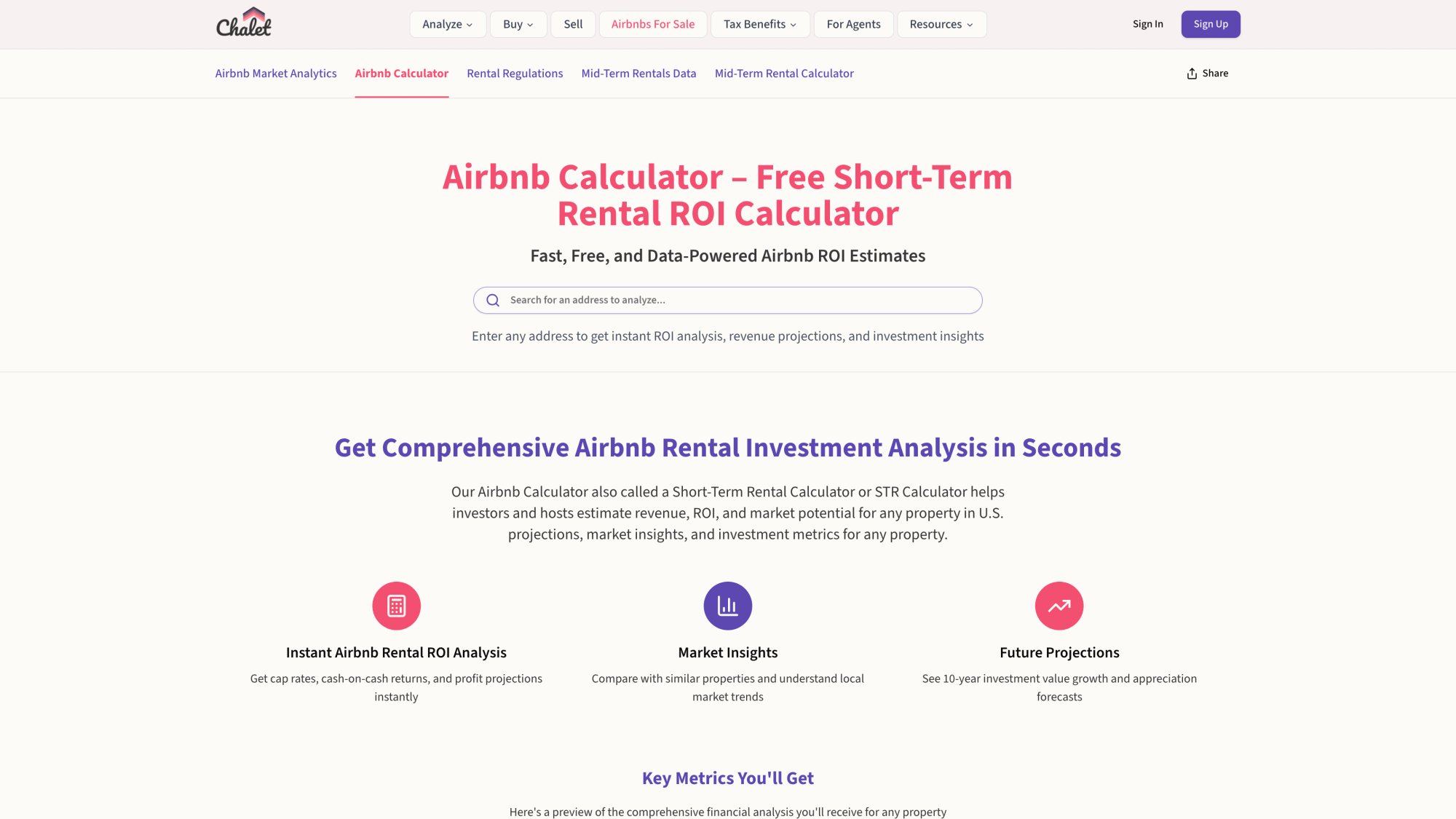

Free Airbnb ROI Calculator and Analytics

Before you commit a single dollar, you need to know what returns are actually realistic for a specific property in a specific market.

Our Airbnb ROI calculator lets you input a property's purchase price, expected rental income, operating expenses, and financing terms. You'll see projected cap rates, cash-on-cash returns, and whether the numbers actually make sense. This isn't vague estimation. It's real analysis you can use to compare STR opportunities against what you'd get in the stock market.

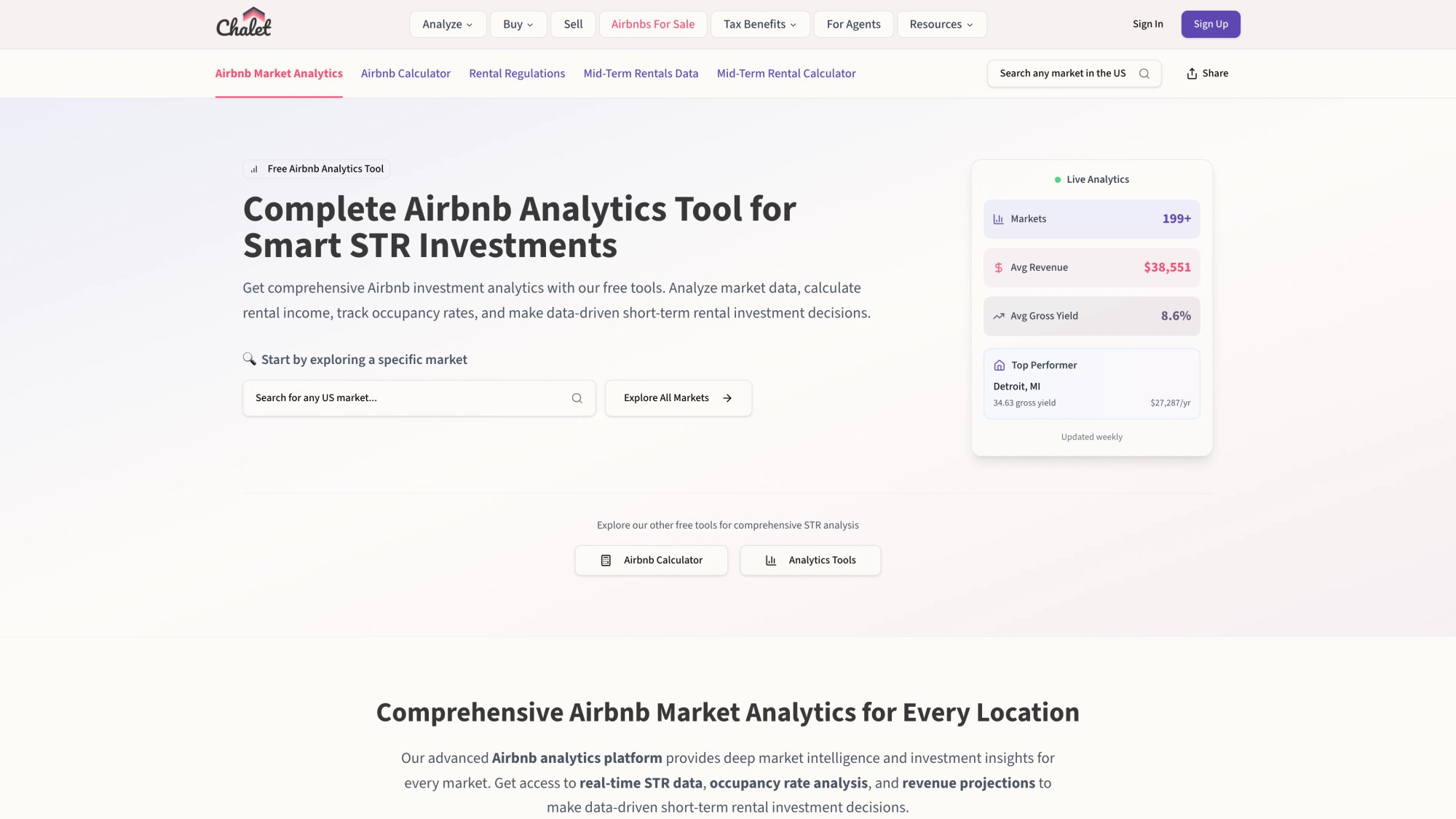

STR Market Research Dashboards

Not all cities are created equal for short-term rentals. Some markets have strong demand, reasonable regulations, and solid returns. Others are oversaturated or heading toward restrictions.

Chalet's market dashboards show you occupancy rates, average daily rates, revenue trends, and seasonality patterns across markets. You can compare cities, understand demand patterns, and identify where your investment dollars would work hardest. Check out our analysis of the best Airbnb markets with high annual revenue to start your research.

Short-Term Rental Regulations by City

Regulatory risk is real, and ignorance isn't protection.

Our rental regulations guide breaks down the rules in markets across the country. Before you buy, you can check whether your target city requires permits, limits rental nights, restricts non-owner-occupied properties, or has pending legislation that could affect your plans.

Knowing the rules upfront can save you from a very expensive mistake. Learn more about navigating local regulations and STR licensing.

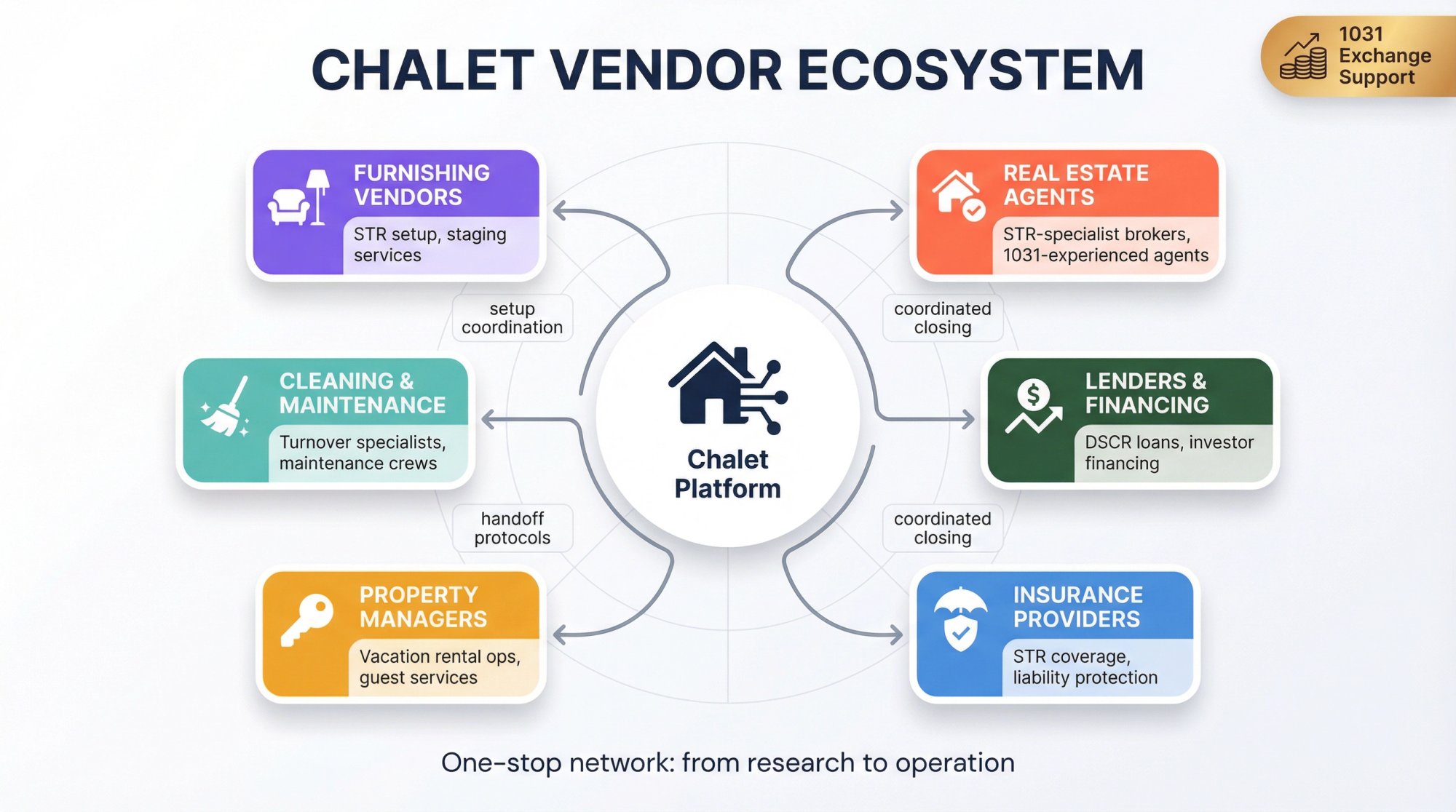

Vetted STR Vendors and Professionals

Even if you understand the market and the math, executing on an STR investment requires working with the right people:

-

Real estate agents who understand investment properties and STR potential

-

Lenders who offer investor-friendly loans (including DSCR loans that qualify based on property income, not just your personal income)

-

Insurance providers who cover short-term rental use

-

Property managers who specialize in vacation rentals

-

Cleaning, furnishing, and maintenance vendors who understand STR needs

Chalet connects you with vetted professionals in all these categories through our STR directory. Instead of finding and vetting everyone yourself, you can tap into a network we've already built.

1031 Exchange Support for STR Investors

If you're rolling gains from another property into a short-term rental, timing matters. The 1031 exchange rules are strict, and you need a team that can move quickly.

We work with 1031-savvy agents and lenders who understand the deadlines and can help you close on schedule. Our platform keeps your underwriting and compliance steps organized so you don't miss critical dates. Learn about common mistakes to avoid in 1031 exchanges.

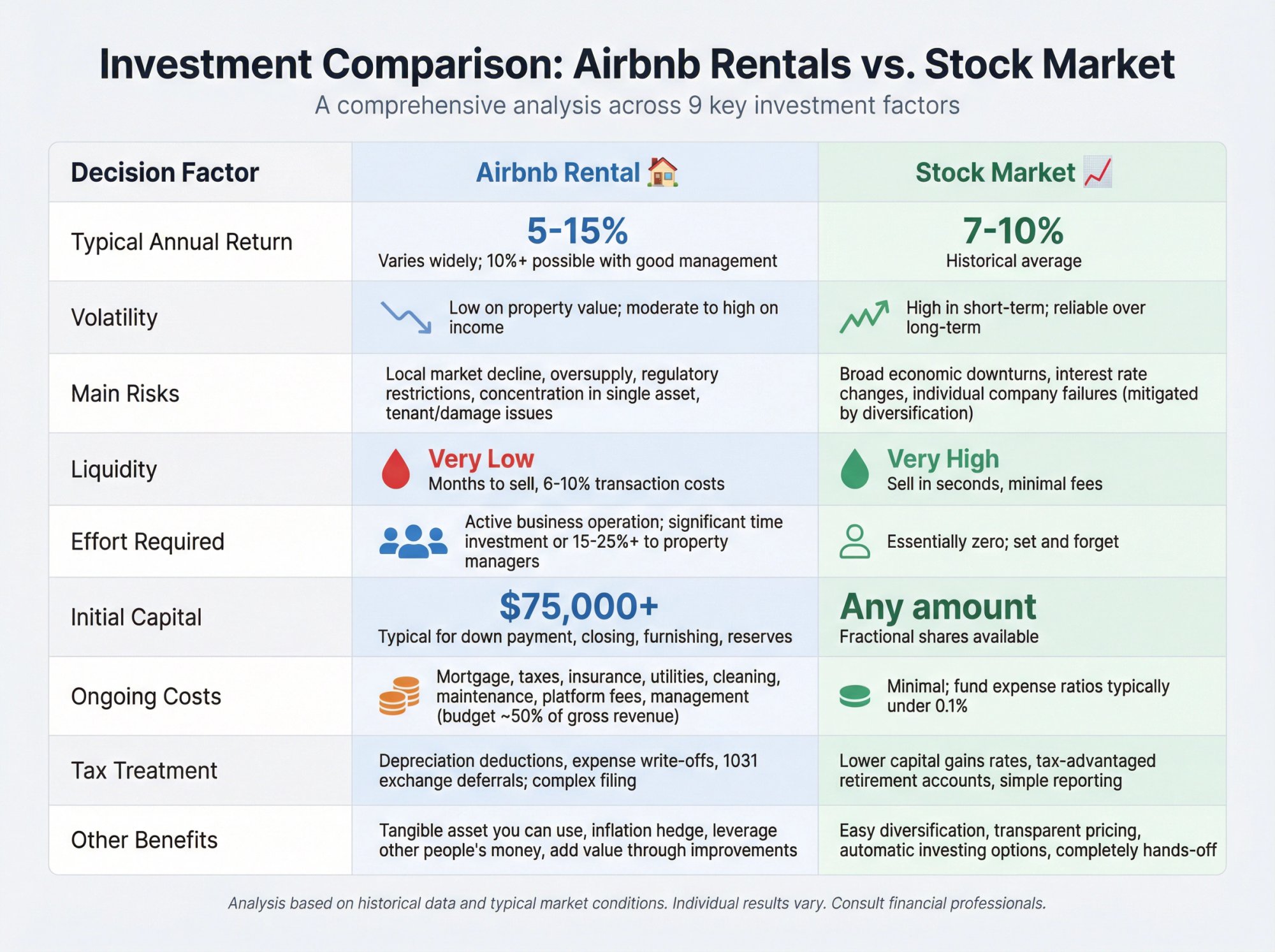

Airbnb vs. Stocks: Full Comparison Table

| Factor | Airbnb Rental | Stock Market Investment |

|---|---|---|

| Typical Annual Return | 5-15% (varies widely; 10%+ possible with good management) | 7-10% historical average |

| Volatility | Low on property value; moderate to high on income | High in short-term; reliable over long-term |

| Main Risks | Local market decline, oversupply, regulatory restrictions, concentration in single asset, tenant/damage issues | Broad economic downturns, interest rate changes, individual company failures (mitigated by diversification) |

| Liquidity | Very low (months to sell, 6-10% transaction costs) | Very high (sell in seconds, minimal fees) |

| Effort Required | Active business operation; significant time investment or 15-25%+ to property managers | Essentially zero; set and forget |

| Initial Capital | High ($75,000+ typical for down payment, closing, furnishing, reserves) | Any amount; fractional shares available |

| Ongoing Costs | Mortgage, taxes, insurance, utilities, cleaning, maintenance, platform fees, management (budget ~50% of gross revenue) | Minimal; fund expense ratios typically under 0.1% |

| Tax Treatment | Depreciation deductions, expense write-offs, 1031 exchange deferrals; complex filing | Lower capital gains rates, tax-advantaged retirement accounts, simple reporting |

| Other Benefits | Tangible asset you can use, inflation hedge, leverage other people's money, add value through improvements | Easy diversification, transparent pricing, automatic investing options, completely hands-off |

Frequently Asked Questions

Can I invest in both Airbnb rentals and stocks?

Absolutely, and many successful investors do exactly this. There's no rule saying you have to choose one or the other. Holding both can actually reduce your overall portfolio risk since stocks and real estate don't always move in the same direction. A common approach is to build a stock portfolio first (for liquidity and diversification), then add investment properties as your capital grows.

How much money do I need to start an Airbnb investment?

Realistically, plan for $75,000-$150,000+ depending on your target market. This covers a 20-25% down payment, closing costs, furnishing, and cash reserves. Some investors get started with less using house hacking (living in part of the property) or by partnering with others. Lower-cost markets can reduce these numbers, but you'll still need significant capital compared to starting a stock portfolio.

Are Airbnb rentals a good hedge against stock market crashes?

They can be. Real estate doesn't correlate perfectly with stocks, so property values often hold steadier during market downturns. That said, severe recessions affect both asset classes. The 2008 crisis hurt stocks and real estate. The 2020 pandemic initially crushed both stock prices and Airbnb bookings. No investment is truly crash-proof. See our analysis on positioning your Airbnb rental for success during economic uncertainty.

What if my city bans short-term rentals after I buy?

This is a real risk and why market research matters so much. If regulations change, you typically have a few options: convert to a long-term rental (usually lower returns), apply for any grandfathered permits if available, or sell (potentially at a reduced price). Checking current regulations and pending legislation before buying is essential.

Is there a way to invest in vacation rentals without managing property?

Yes. REITs (Real Estate Investment Trusts) let you invest in real estate through the stock market. Some REITs focus on hospitality and lodging. Historical data from NerdWallet shows U.S. REITs returned about 11.8% annually from 1972-2019, compared to 10.6% for the S&P 500. You lose the tax benefits and control of direct ownership, but you gain liquidity and zero management headaches.

Real estate crowdfunding platforms offer another option: invest smaller amounts in property deals without doing any work. Your money may be locked up for years, but someone else handles operations.

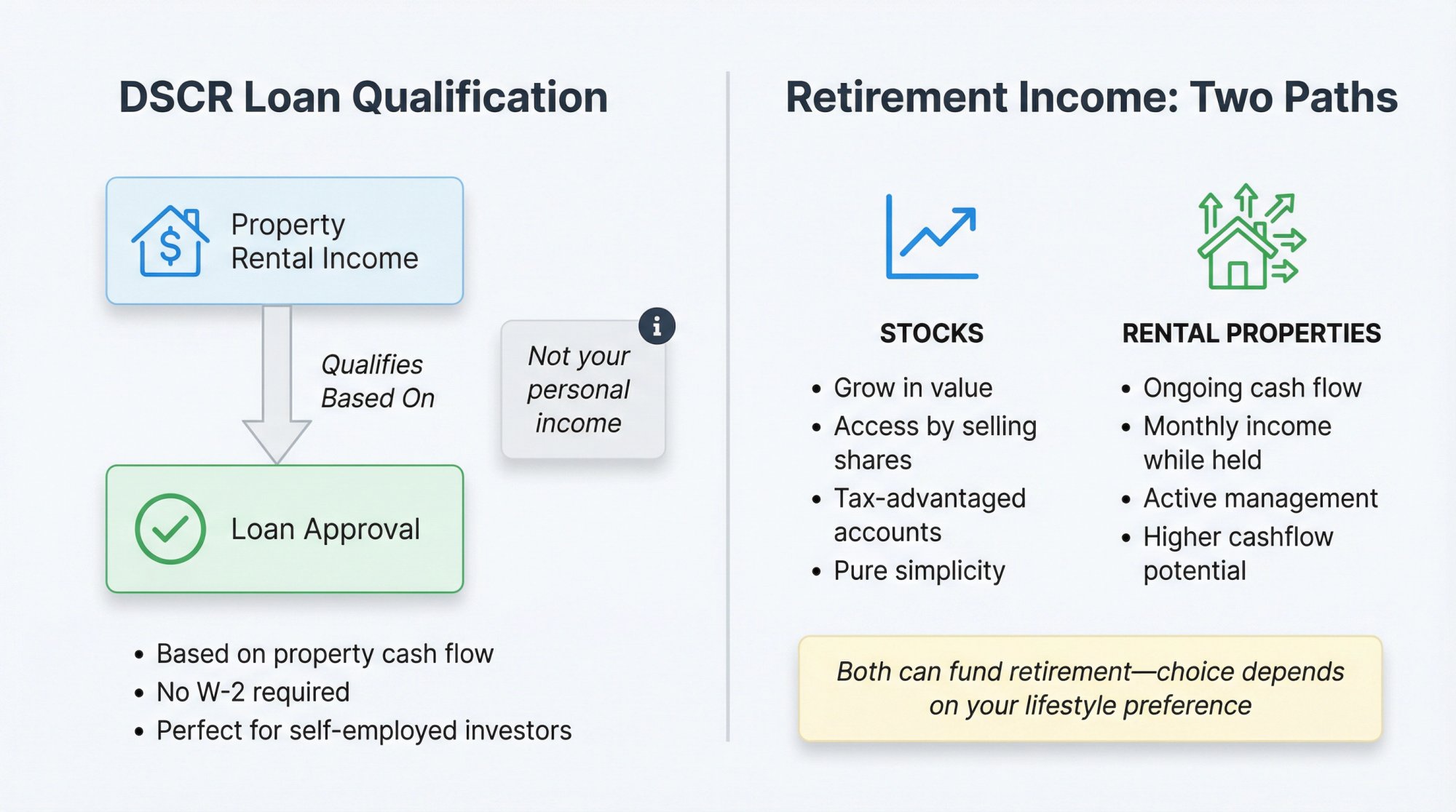

How does a DSCR loan work for Airbnb investments?

A DSCR (Debt Service Coverage Ratio) loan qualifies you based on the property's expected income rather than your personal income. Lenders look at whether the rental income can cover the mortgage payments. This is particularly useful if you're self-employed, already have multiple mortgages, or want to keep your personal finances separate from your investment property. Chalet connects investors with lenders who specialize in DSCR financing and other investor-friendly financing options.

Which is better for retirement income: stocks or rental properties?

It depends on what "income" means to you. Rental properties generate ongoing cash flow while you own them. Stocks primarily grow in value, which you access by selling shares (or through dividends, though these are typically smaller than STR cash flow).

For pure retirement simplicity, stocks in tax-advantaged accounts are hard to beat. For higher cash flow during retirement, STR investments can work well if you've built the portfolio in advance.

Your Next Steps

If this comparison has you thinking seriously about short-term rental investing, here's how to move forward:

Calculate ROI on a Real Airbnb Property

Don't guess whether an Airbnb would beat your stock portfolio. Use Chalet's free ROI calculator to model specific properties you're considering. Input the purchase price, expected rental rates, and expenses. See projected cash-on-cash returns. Compare that number to historical stock market returns.

If the math doesn't work, you've saved yourself from a bad investment. If it does work, you have data to move forward confidently.

Research STR Markets Before You Buy

Location drives STR profitability more than almost any other factor.

Explore occupancy rates, average daily rates, and revenue trends across cities using Chalet's market dashboards. And before committing to any market, check local short-term rental rules to understand permit requirements, restrictions, and any pending legislation.

Connect With an STR-Savvy Real Estate Agent

If you're ready to get serious, talking to an STR-savvy real estate agent can accelerate your timeline and help you avoid expensive mistakes. Chalet's agent network includes professionals who understand the vacation rental market and can identify properties with genuine profit potential.

The "more profitable" investment is ultimately the one that aligns with your goals, fits your lifestyle, and lets you sleep at night.

Both stocks and Airbnb rentals have made people wealthy. Both have risks that can hurt you if you're not careful. The real question isn't which is better. It's which is better for you.

If you decide short-term rentals are worth exploring, Chalet is here to help you go from research to real-world results, with free analytics, vetted vendors, and the support you need to make smart investment decisions.

Happy investing.