If you’re searching for “75 Airbnb in HOA community risks,” you’re probably trying to answer one of these questions:

- “Can I legally operate an Airbnb rental in this neighborhood, or will the HOA shut me down?”

- “How do I catch the hidden deal breakers before I buy?”

- “If the HOA changes the rules, am I protected or exposed?”

- “How do I underwrite this risk so my numbers don’t blow up later?”

This guide is built for investors (first-time buyers, 1031 exchangers, and portfolio builders) who want the unglamorous truth: an HOA can act like a private regulator. Even if the city allows hosting, HOA rules can still block or crush your short-term rental (STR) business model.

Disclaimer: This is educational content, not legal advice. HOA enforceability varies by state and by the exact language in the recorded documents.

Can You Run an Airbnb in an HOA Community?

Most people hear “HOA allows rentals” and assume they’re good. You’re not.

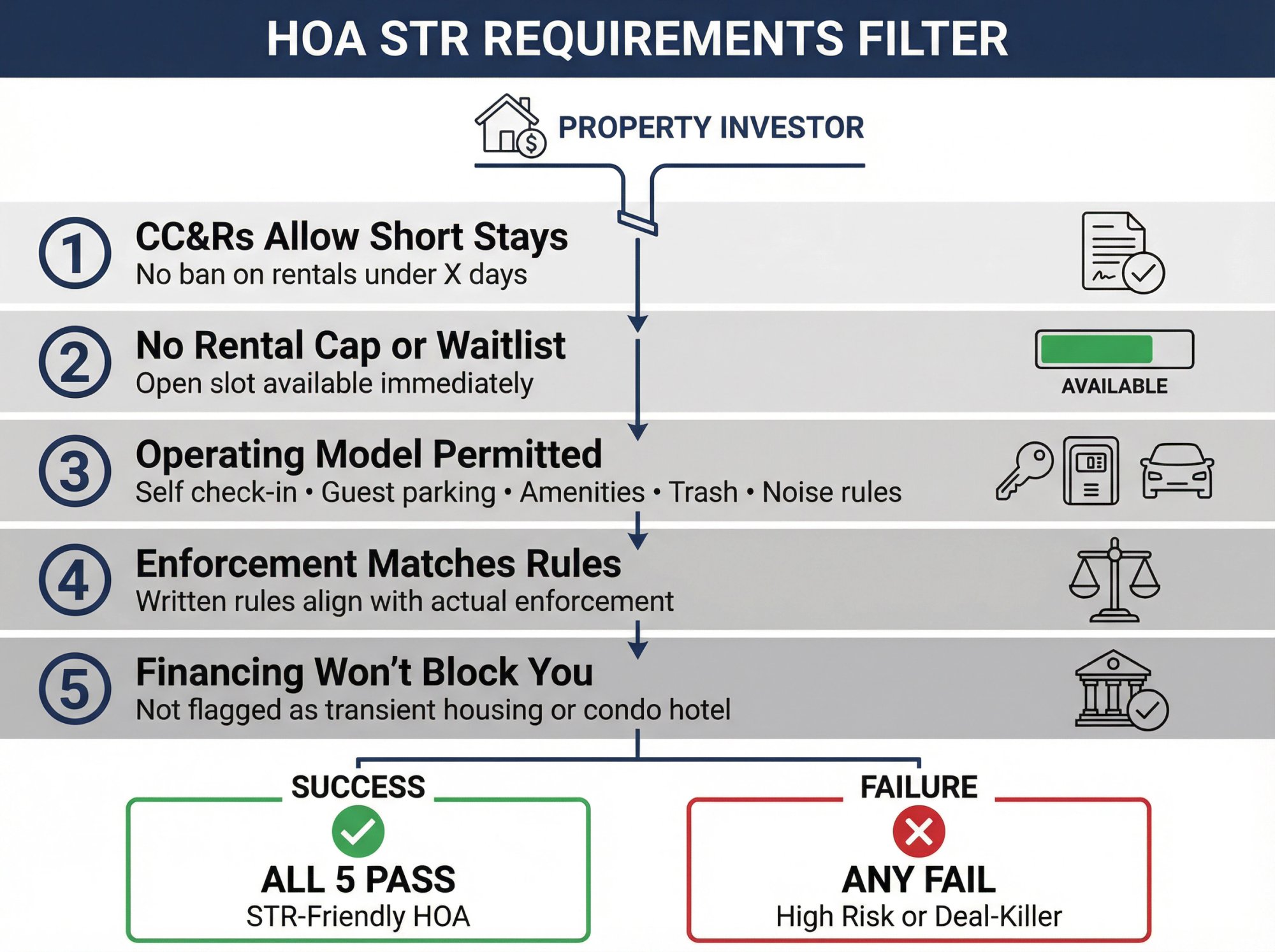

For an Airbnb rental, “friendly” usually needs all of the following to be true:

① The declaration (CC&Rs) doesn’t ban rentals under X days.

② There’s no rental cap or waitlist that locks you out.

③ Rules allow your operating model (self check-in, guest parking, amenity use, trash, noise).

④ The HOA’s enforcement behavior matches the paper rules (what they actually enforce matters).

⑤ Financing doesn’t get weird (especially condos). Some projects become loan-ineligible if they look like transient housing or “condo hotel” style operations. Fannie Mae’s Selling Guide flags these as red flags.

Why HOA Restrictions Affect Most STR Investors

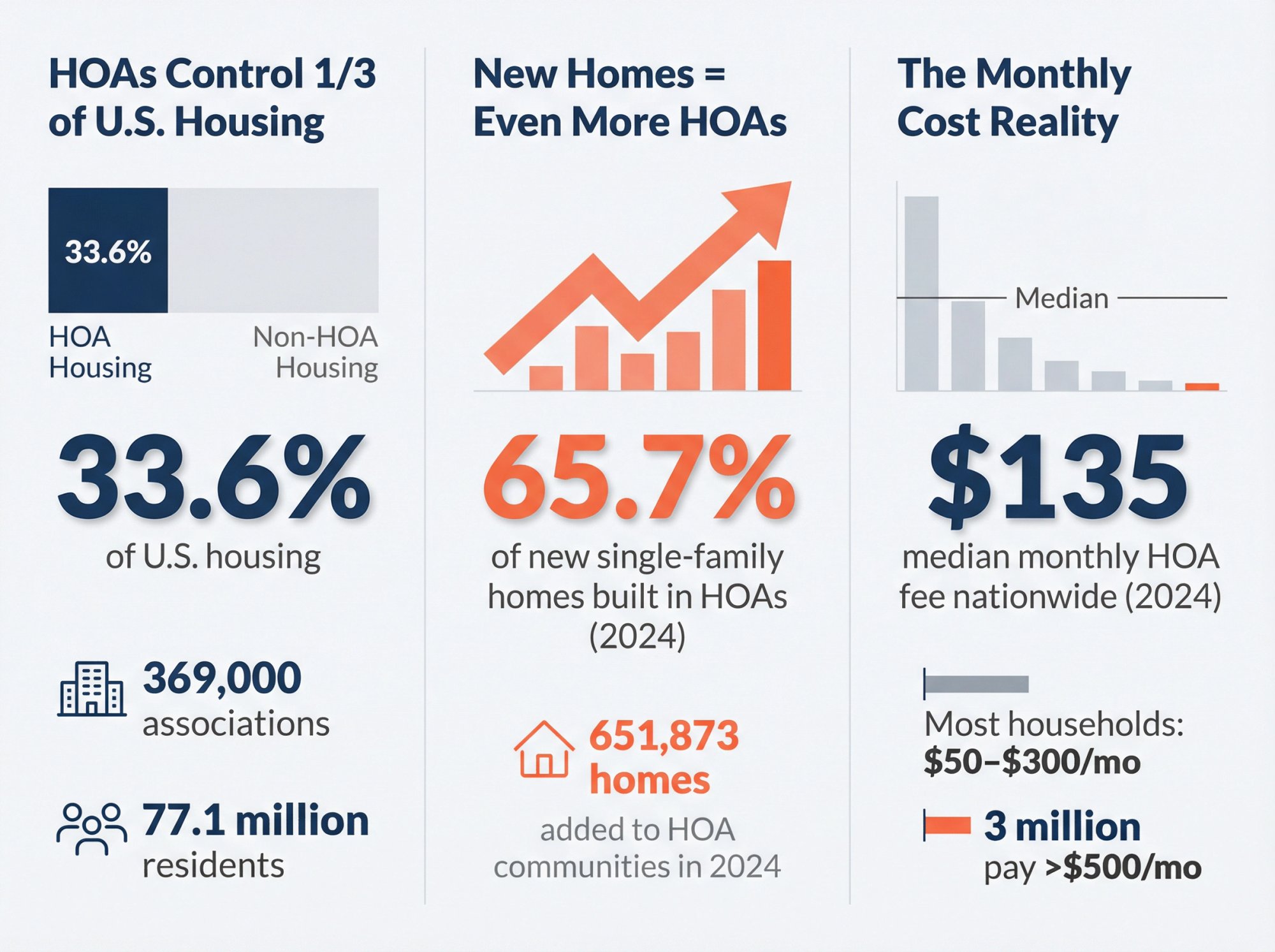

HOAs aren’t rare. They’re a major chunk of U.S. housing.

About one third (33.6%) of U.S. housing is in a community association (planned communities, condos, co-ops). Research from the Foundation for Community Association Research estimates 369,000 associations serving 77.1 million residents.

In 2024, the National Association of Home Builders reports 65.7% of new single-family homes were built in a community or homeowners association (651,873 homes).

According to the U.S. Census Bureau, 21.6 million of 86.6 million owned households paid condo or HOA fees in 2024, with a national median monthly fee of $135. About 3 million households paid more than $500/month.

Translation: if you invest in popular STR markets, you’ll run into HOA governance and HOA fees constantly. You need a repeatable way to evaluate it.

How HOAs Control Short-Term Rentals (Legal Framework)

From first principles, an HOA is basically a contract attached to the property.

When you buy, you typically agree to the HOA’s recorded covenants (often called CC&Rs or a “declaration”). These are recorded against the property and “run with the land.”

The HOA can also have bylaws, rules and regulations, architectural guidelines, and policies.

The enforceability of each layer depends on:

- What the documents say

- What state law allows

- Sometimes what courts consider “reasonable” or “foreseeable”

Two Examples That Show How State Law Can Matter

Florida condos: Florida statutes state that an amendment prohibiting rentals or changing rental duration generally applies only to owners who consent and those who buy after the amendment’s effective date (Florida Statutes § 718.110(13)).

Arizona: Arizona courts have limited an HOA’s ability to impose entirely new restrictions via broad amendment language unless owners had sufficient notice in the original declaration. This “foreseeability/notice” concept was discussed in Kalway v. Calabria Ranch HOA (2022).

Critical insight: You can’t rely on generic blog advice. You must check your state and your documents.

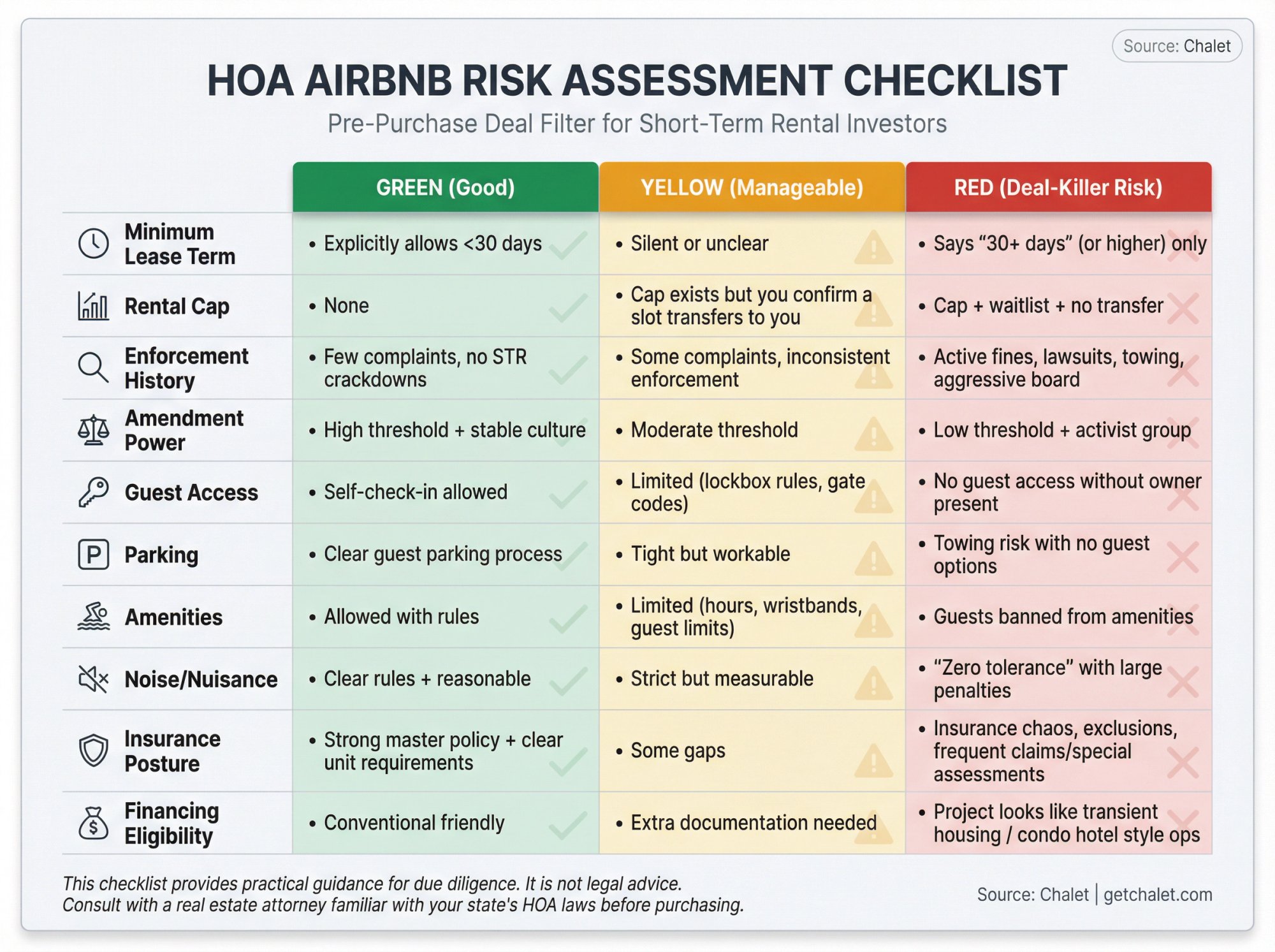

HOA Airbnb Risk Assessment Checklist (Pre-Purchase)

Below is a fast filter. It’s not “legal,” but it’s brutally practical.

| What you check | Green (good) | Yellow (manageable) | Red (deal-killer risk) |

|---|---|---|---|

| Minimum lease term | Explicitly allows <30 days | Silent or unclear | Says “30+ days” (or higher) only |

| Rental cap | None | Cap exists but you confirm a slot transfers to you | Cap + waitlist + no transfer |

| Enforcement history | Few complaints, no STR crackdowns | Some complaints, inconsistent enforcement | Active fines, lawsuits, towing, aggressive board |

| Amendments power | High threshold + stable culture | Moderate threshold | Low threshold + activist group |

| Guest access | Self-check-in allowed | Limited (lockbox rules, gate codes) | No guest access without owner present |

| Parking | Clear guest parking process | Tight but workable | Towing risk with no guest options |

| Amenities | Allowed with rules | Limited (hours, wristbands, guest limits) | Guests banned from amenities |

| Noise/nuisance | Clear rules + reasonable | Strict but measurable | “Zero tolerance” with large penalties |

| Insurance posture | Strong master policy + clear unit requirements | Some gaps | Insurance chaos, exclusions, frequent claims/special assessments |

| Financing eligibility (condos esp.) | Conventional friendly | Extra documentation needed | Project looks like transient housing / condo hotel style ops |

The 75 HOA Community Risks (And How to Reduce Each One)

These are grouped so you can scan fast, then go deep where it matters.

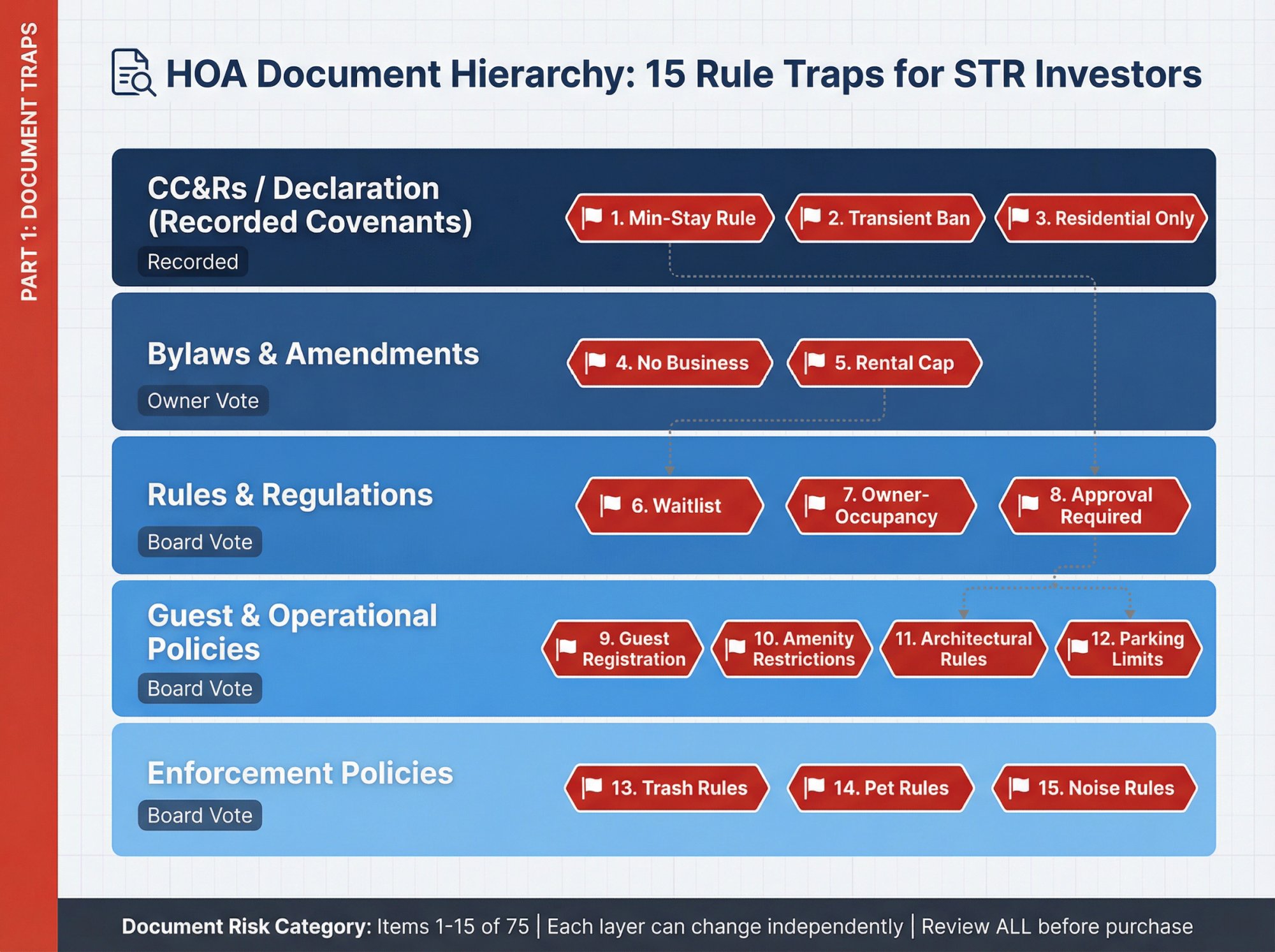

A. Document and Rule Risks (1-15)

1. Minimum-stay rule quietly bans your model.

Mitigation: Find the exact minimum lease term in the declaration and rules. If it says “30 days minimum,” assume Airbnb is dead.

2. The HOA bans “transient” or “hotel-like” use using vague wording.

Mitigation: Ask how they define transient. For condos, this can also impact loan eligibility per Fannie Mae’s guidelines.

3. “Residential use only” isn’t a clear yes or no.

Mitigation: Look for explicit rental term language. Where it’s ambiguous, you’re buying litigation risk.

4. Rules say “no business activity,” and the HOA argues hosting is a business.

Mitigation: Ask for past enforcement examples. Also assume neighbors may weaponize this clause.

5. Rental cap (percentage or fixed number) blocks you.

Mitigation: Get written confirmation of whether a rental slot transfers with the unit or is personal to the owner.

6. Waitlist risk.

Mitigation: Demand the current waitlist length and the average time to clear. If they refuse, treat as red.

7. Owner-occupancy requirement kills non-owner investing.

Mitigation: Confirm whether the owner must live on-site, and how “owner occupied” is defined.

8. Rules require HOA approval for each tenant.

Mitigation: Ask if they approve “guests” for short stays. Some HOAs won’t, which becomes a de facto ban.

9. Guest registration requirements conflict with your operations.

Mitigation: Check if they require IDs, car details, wristbands, or advance notice.

10. Amenity restrictions make the listing less competitive.

Mitigation: If pool/gym access is restricted, your ADR assumptions should come down.

11. Architectural rules block operational basics (cameras, smart locks, lockboxes, signage).

Mitigation: Verify what’s allowed on doors, exterior, and common hallways.

12. Parking rules are too tight for guest turnover.

Mitigation: Count legal guest spots and overflow options. Towing risk is real.

13. Trash rules create repeated violations (pickup days, bin storage, bulk trash).

Mitigation: Build guest instructions and consider paid trash valet if allowed.

14. Pet rules conflict with your listing strategy.

Mitigation: If the HOA bans certain breeds/weights or limits pets, don’t advertise “pet friendly.”

15. Noise rules are subjective and easy to weaponize.

Mitigation: Put quiet hours and occupancy limits in your house rules, plus consider noise monitoring where legal and permitted.

B. Governance and “Rules Can Change” Risks (16-30)

16. The HOA changes rules after you buy.

Mitigation: Understand amendment thresholds and local law. Some states limit retroactive rental bans in certain contexts (example: Florida condo statute).

17. A new board gets elected on an anti-Airbnb platform.

Mitigation: Read meeting minutes and newsletters for sentiment trends.

18. Your neighbors form a voting bloc against rentals.

Mitigation: Check owner-occupancy ratio and investor concentration.

19. “Policy” changes happen faster than declaration changes.

Mitigation: Identify what can be changed by board vote vs what needs owner vote.

20. Selective enforcement risk.

Mitigation: If enforcement is inconsistent, you can still get singled out after one complaint.

21. The HOA creates an STR permit process that’s slow, costly, or arbitrary.

Mitigation: Ask for a written timeline, fees, and rejection reasons.

22. The HOA bans key operational tools (self-check-in, door codes, contractors after hours).

Mitigation: Confirm access rules for cleaners and maintenance.

23. The HOA requires you to use a specific on-site rental program or manager.

Mitigation: Huge red flag for condo financing. Mandatory rental pooling and hotel-like management can trigger loan ineligibility per Fannie Mae.

24. HOA revenue-sharing from rentals creates “commercial” characteristics.

Mitigation: If the HOA takes a cut, that can look like hotel-style operation for lenders.

25. HOA bans or limits advertising, which affects guest directions and check-in.

Mitigation: Ensure you can share gate codes, parking maps, and instructions without violating rules.

26. Association-wide litigation or conflict distracts the board and increases risk.

Mitigation: Ask for pending litigation disclosures. This also matters for lending.

27. The HOA’s financial stress drives aggressive fine collection.

Mitigation: Review budget, delinquencies, reserve funding, and special assessment history.

28. Special assessments spike your monthly carrying cost.

Mitigation: Underwrite dues + reserves + realistic special assessment risk, not just current dues.

29. Insurance crisis in the association increases dues or triggers special assessments.

Mitigation: Ask for master policy summary, deductibles, and recent premium changes.

30. Rules are silent, and you assume silence equals permission.

Mitigation: Silence is ambiguity. Ambiguity becomes enforcement risk.

C. Enforcement and Legal Risks (31-42)

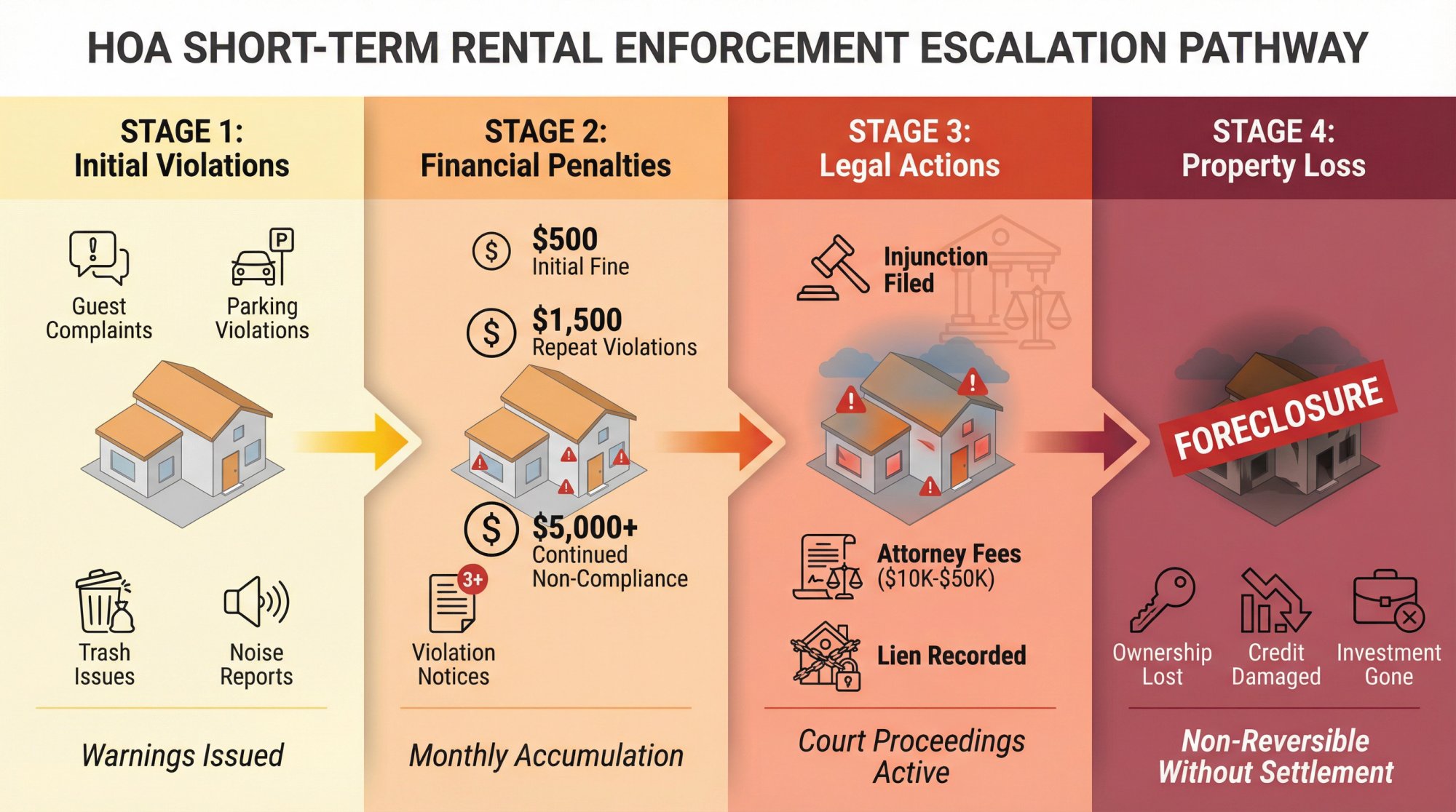

31. Fines escalate faster than you expect.

Mitigation: Get the fine schedule in writing and ask about real examples.

32. The HOA can seek injunctions (court orders) to stop rentals.

Mitigation: Treat this as “business interruption” risk, not just a nuisance.

33. Attorney-fee shifting risk.

Mitigation: Many governing docs include attorney-fee clauses. Losing can be expensive.

34. The HOA records a lien for unpaid fines or assessments.

Mitigation: Never ignore notices. Build a compliance response process.

35. The HOA threatens foreclosure for unpaid assessments.

Mitigation: Separate cash reserves for HOA obligations.

36. Guests trigger repeated violations you never personally witness.

Mitigation: Use exterior cameras where allowed, noise monitoring where legal, and fast response systems.

37. Neighbor harassment and “gotcha” reporting.

Mitigation: Proactively communicate your rules and rapid response plan.

38. Security gate issues cause repeated conflicts with guards or residents.

Mitigation: Confirm guest entry process with the property manager.

39. HOA demands guest information that creates privacy or platform-policy issues.

Mitigation: Clarify what’s required and what you can legally provide.

40. Claims of nuisance (noise, parking, trash) become chronic.

Mitigation: Reduce party risk: strict occupancy, age minimums, minimum stay rules where possible.

41. Fair housing and discrimination risk (screening).

Mitigation: Be consistent. Avoid “vibes-based” rejection.

42. You assume “everyone else does it” means it’s safe.

Mitigation: Enforcement can change overnight after one incident.

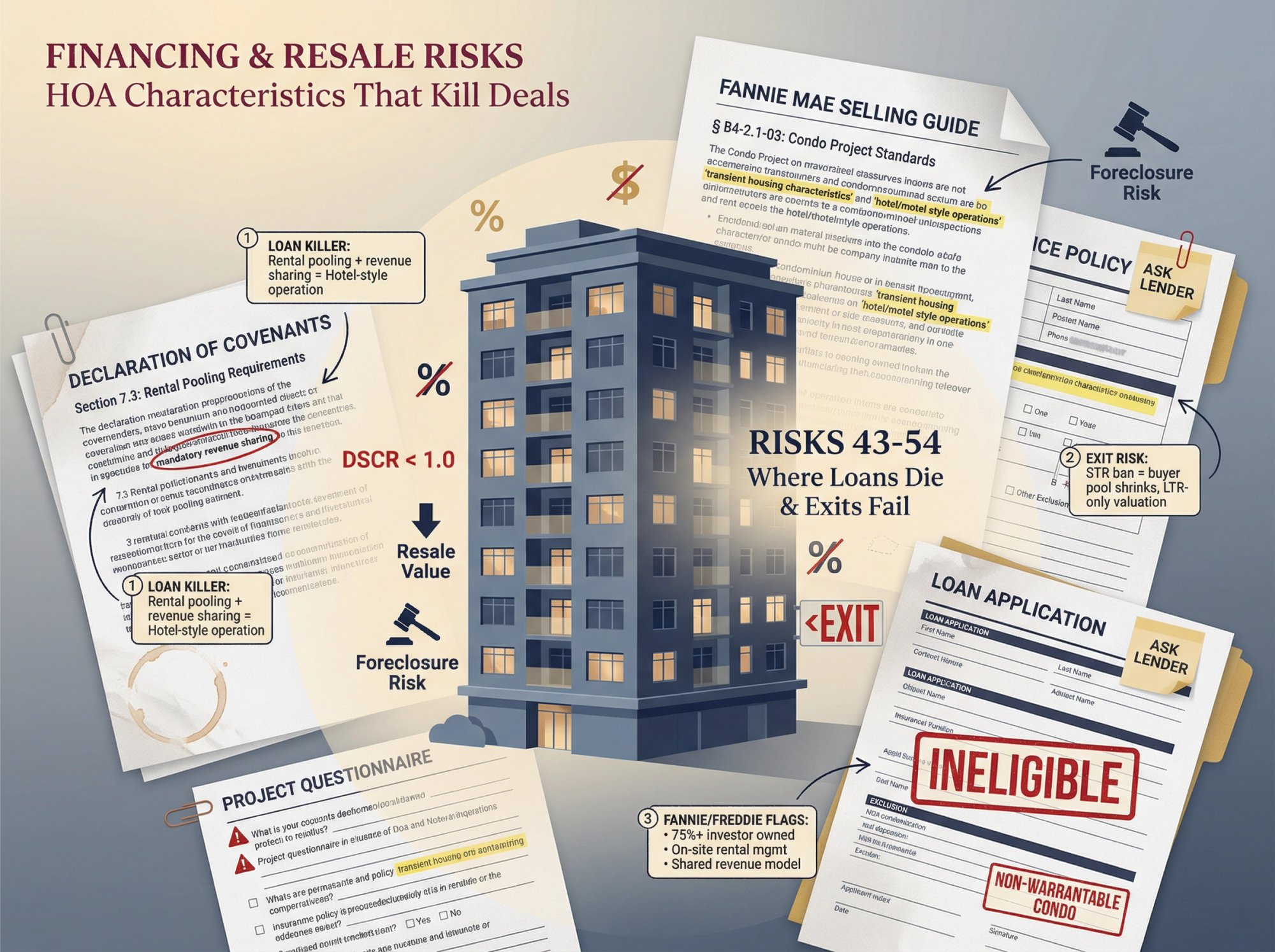

D. Financing and Resale Risks (43-54)

This category is the one most HOA-Airbnb articles miss, and it can quietly ruin exits.

43. Condo project becomes ineligible for conventional loans.

Mitigation: If the project looks like a hotel or transient housing, Fannie Mae can deem it ineligible per their Selling Guide.

44. Project has rental pooling or required revenue sharing.

Mitigation: These are listed as hotel/motel style characteristics in Fannie Mae guidance.

45. The HOA or management offers hotel-type services.

Mitigation: Registration services, daily cleaning, key systems, concierge-like services can be red flags.

46. Too many units are investor-owned or second homes.

Mitigation: Fannie Mae flags projects where 75%+ units are investment/second homes as a red flag that triggers more lender due diligence.

47. Your buyer pool shrinks if the HOA bans STRs later.

Mitigation: Your exit might be forced into long-term rental buyers only.

48. HOA dues increase faster than rent growth.

Mitigation: Model dues increases, not just current dues.

49. Special assessments destroy DSCR.

Mitigation: Keep cash reserves, and stress test DSCR with a higher HOA payment.

50. Condo questionnaire delays kill timelines.

Mitigation: Start condo doc collection early. For 1031 buyers, do it before you get emotionally attached.

51. Freddie Mac “condominium hotel” or transient housing concerns.

Mitigation: Freddie Mac notes that finding short-term rentals advertised online doesn’t automatically make a project ineligible, but lenders must analyze whether the HOA or property management facilitates transient use or receives revenue/taxes tied to it.

52. Insurance deductibles and master policy gaps raise lender concerns.

Mitigation: Review master policy limits, deductibles, and claims history.

53. Unresolved critical repairs or structural issues trigger financing blocks.

Mitigation: For condos, lenders increasingly scrutinize inspections and repair obligations.

54. Your refinance plan fails because the project’s status changes.

Mitigation: Treat refi as optional upside, not guaranteed strategy.

E. Insurance and Liability Risks (55-64)

55. Your personal homeowners policy may not cover STR activity.

Mitigation: Ask your insurer in writing. Hosting can be treated as business activity, which many policies exclude. Reuters reports on this coverage gap.

56. You rely on platform protection as “insurance.”

Mitigation: Airbnb states AirCover “is not a substitute for personal insurance.”

57. You misunderstand what platform protection covers.

Important: Airbnb lists AirCover as including $3M host damage protection and $1M host liability insurance, but that doesn’t replace the right policy for your situation.

58. The HOA master policy doesn’t play nice with STR exposure.

Mitigation: Ask if the HOA has considered STR risk, claims, and whether rules require extra coverage.

59. HOA demands you carry higher liability limits or name them in coverage.

Mitigation: Ask for written insurance requirements before you list.

60. Guest injury in common areas creates messy liability.

Mitigation: Clarify what the HOA covers vs what you cover.

61. Property damage extends to neighbors (water leaks, fire).

Mitigation: Ensure you have the right unit policy and liability coverage.

62. You don’t have business interruption coverage for a forced shutdown.

Mitigation: Consider risk reserves. Many policies won’t “pay you” for HOA bans.

63. You host higher-risk guest types accidentally.

Mitigation: Use reservation screening, deposits where permitted, and minimum age rules.

64. Your cleaner or contractor causes damage, and liability routes back to you.

Mitigation: Use insured vendors and keep certificates.

F. Operations, Guest Experience, and Community Friction Risks (65-72)

65. Bad reviews from HOA-driven friction (parking, gates, wristbands).

Mitigation: Put HOA constraints in the listing description and house rules.

66. You can’t respond fast enough to complaints.

Mitigation: Local co-host or property manager with 24/7 response.

67. You underestimate the “rules training” burden for guests.

Mitigation: Create a simple rules card and reinforce before arrival.

68. Event and party risk triggers HOA crackdown.

Mitigation: Set hard limits, minimum stay, no events policy, and enforcement tools.

69. Occupancy violations from “extra guests.”

Mitigation: Exterior cameras where allowed, plus clear penalties in house rules.

70. Amenity misuse becomes the neighbor’s proof that STRs are harmful.

Mitigation: If you can’t control it, consider banning amenity access in your listing.

71. Trash and recycling violations become chronic.

Mitigation: Paid trash service or concierge pickup if allowed, and very clear instructions.

72. Maintenance scheduling conflicts with HOA quiet hours and access rules.

Mitigation: Ensure vendor access procedures are compliant.

G. Platform and Strategy Risks (73-75)

73. Your whole model depends on a single channel.

Mitigation: Build direct booking gradually or diversify platforms where allowed.

74. Regulation changes outside the HOA still hit you (city/county).

Mitigation: Always check local rental regulations in parallel with HOA rules.

75. You buy a deal that only works as an Airbnb rental, not as a long-term rental.

Mitigation: Always underwrite a “plan B” rent and exit.

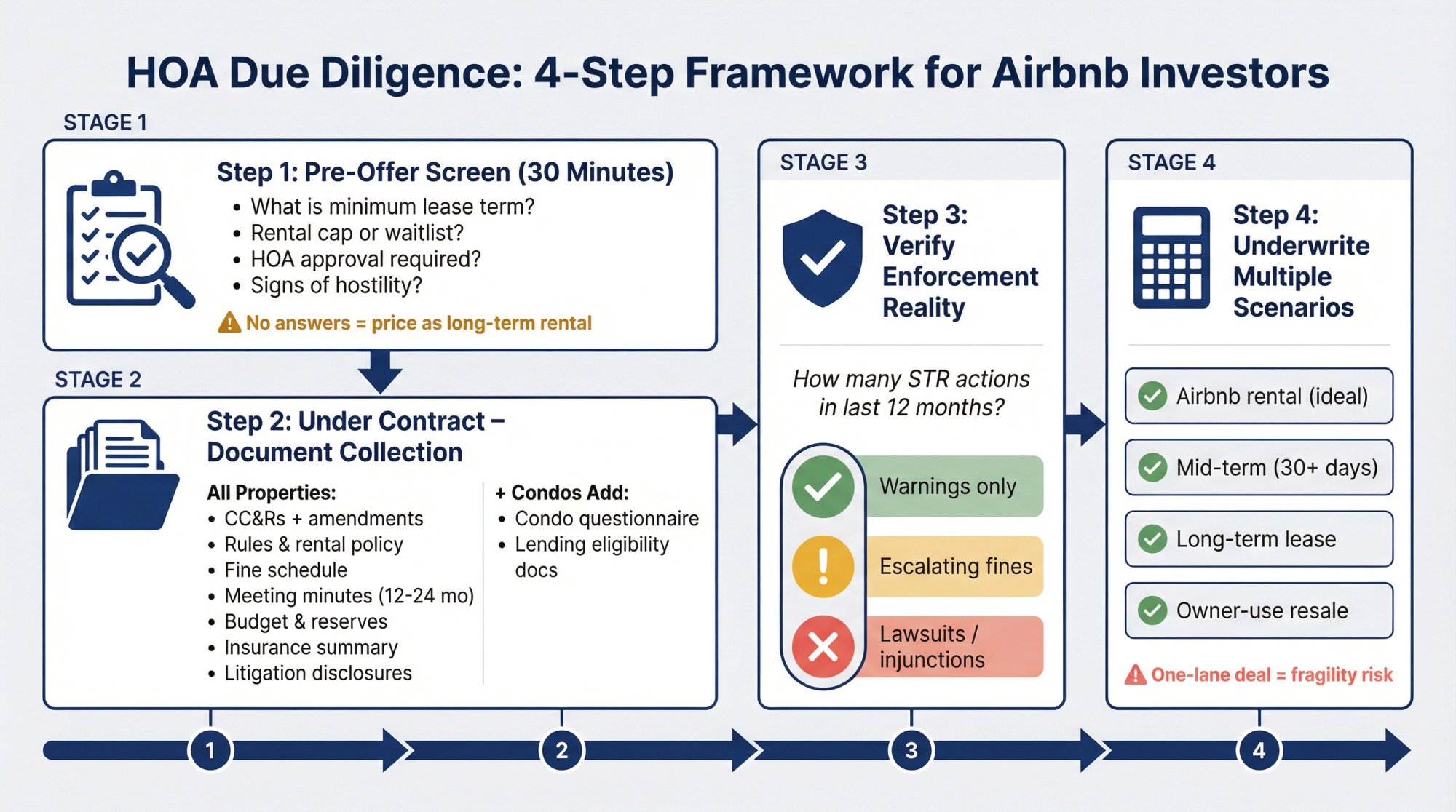

HOA Due Diligence Process to Prevent Airbnb Disasters

Here’s the workflow that actually catches problems.

Step 1: Pre-Offer “Screen in 30 Minutes”

Before you write an offer, try to answer:

→ What is the minimum lease term?

→ Is there a rental cap or waitlist?

→ Does the HOA require approval, registration, or screening?

→ Are there signs of hostility (recent complaints, “no short-term rentals” language in listings)?

If you can’t get answers fast, treat the offer price as if the property will be a long-term rental.

Chalet next step: Run ROI/DSCR for this address at Chalet’s free calculator.

Step 2: Under Contract “Collect the Paper Trail”

Request, at minimum:

• Declaration (CC&Rs) + all recorded amendments

• Rules and regulations + rental policy

• Fine schedule and enforcement policy

• Meeting minutes (last 12-24 months)

• Budget, reserves, special assessments history

• Master insurance summary

• Litigation disclosures (if any)

• Written statement of current rental cap usage and waitlist (if applicable)

If it’s a condo, add:

• Condo questionnaire

• Any disclosures tied to lending eligibility and project status

Step 3: Confirm Enforcement Reality

Ask: “How many STR enforcement actions occurred in the last 12 months?”

Then ask: “What happened?”

You’re listening for:

- Warnings only (yellow)

- Escalating fines (orange)

- Lawsuits or injunctions (red)

Step 4: Underwrite with a “Shutdown Scenario”

Your underwriting should include:

→ Airbnb rental scenario (what you want)

→ Mid-term scenario (30+ days)

→ Long-term scenario (traditional lease)

→ Owner-use resale scenario (if you have to stop renting)

If the deal only works in one narrow lane, you’re buying fragility.

Chalet next step: Analyze markets at Chalet’s analytics platform.

How Chalet Helps You Navigate HOA Risks

HOA due diligence is overwhelming. Between CC&Rs, board politics, financing complications, and local regulations, most investors feel like they’re juggling five balls at once.

Chalet helps you make smarter decisions faster by giving you the tools and network to evaluate HOA properties properly.

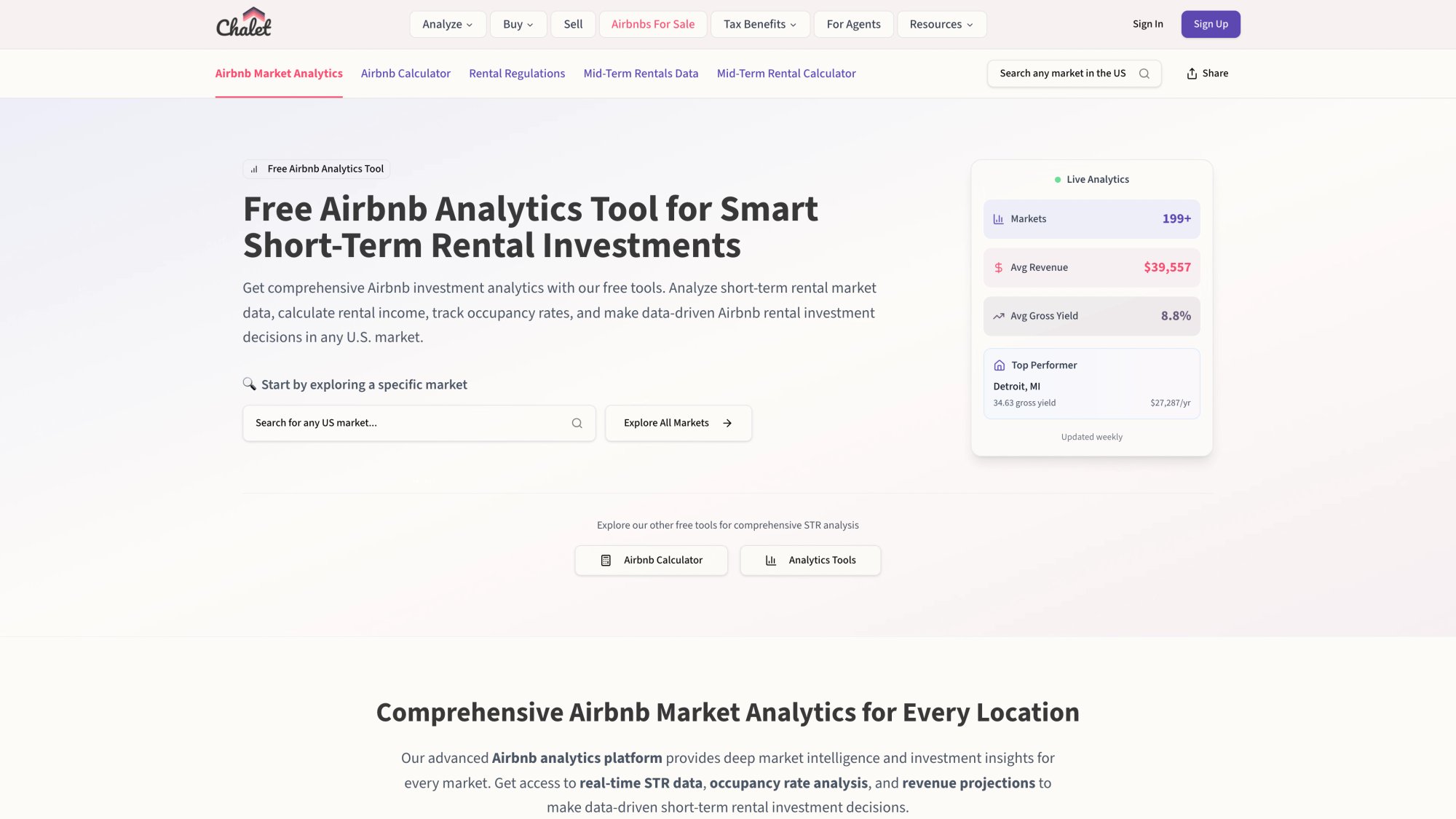

Free Analytics to Evaluate Markets Pre-Purchase

Before you even look at HOA documents, you need to know if the STR economics make sense in that market.

Chalet’s market dashboards show you ADR, occupancy, and revenue trends across multiple cities. You can compare markets side-by-side to see where STR demand is actually strong, not just where someone told you it’s a “hot market.”

This helps you avoid wasting time on properties in markets where the numbers don’t pencil out, even if the HOA is friendly.

ROI Calculator for Dual Scenarios

One of the biggest mistakes investors make is only modeling the Airbnb scenario. If the HOA bans STRs later, can the property still work as a long-term rental?

Chalet’s free ROI calculator lets you model both:

- Airbnb rental scenario (your ideal case)

- Long-term rental fallback (your Plan B if the HOA changes rules)

You can include HOA dues, special assessment risk, and financing costs to stress test whether the property can survive a rule change. If it only works as an Airbnb, you know you’re taking on extra risk.

Rental Regulations Library

Remember: you need to comply with both HOA rules and city/county regulations. Many investors check one but not the other.

Chalet’s rental regulations library shows you local STR rules by market. You can see permit requirements, occupancy taxes, minimum stay rules, and zoning restrictions before you buy.

This double-layer check (HOA + local government) prevents the painful scenario where you’re HOA-compliant but the city bans you, or vice versa.

Network of STR-Savvy Real Estate Agents

Not all agents understand HOA + STR diligence. You need someone who’s done this before and knows which communities are hostile vs friendly.

Chalet’s network of real estate agents specializes in short-term rentals. They can:

→ Get HOA documents fast (critical for 1031 timelines)

→ Interpret CC&Rs to spot deal-killer clauses

→ Know which boards are anti-STR and which are investor-friendly

→ Navigate condo questionnaires and financing issues

If you’re doing a 1031 exchange, working with an agent who understands HOA timelines can save your identification period.

Vendor Coordination (One-Stop Platform)

Beyond buying the property, you need:

- DSCR or conventional lenders who understand STR

- Insurance specialists for HOA environments

- Property managers experienced with HOA rules

- Cleaning services, furnishing, tax professionals

Chalet’s vendor directory connects you with vetted professionals who’ve worked in HOA communities. Instead of calling 10 different vendors and explaining your HOA situation each time, you get pre-screened providers who understand the complexities.

This coordination is especially valuable when HOAs require specific insurance coverage, master policy integration, or on-site management approvals.

Browse Pre-Vetted Properties

If you’re still shopping for the right property, Chalet’s listings of Airbnb rentals for sale let you filter by market and characteristics.

You can avoid the HOA headache entirely by focusing on properties in STR-friendly communities or standalone homes where you control the rules.

Bottom line: Chalet doesn’t eliminate HOA risk, but it helps you evaluate it properly so you don’t buy a property that becomes a money pit when the board changes its mind.

1031 Exchange Note: HOA Risk Is a Timeline Risk

If you’re doing a 1031, your biggest enemy is time. HOA diligence is slow because you rely on third parties (HOA manager, board, escrow).

Practical rule: Treat HOA approval and document review like a financing contingency. Start collecting HOA docs before your identification list is final.

Chalet next step: Meet an Airbnb-friendly agent at Chalet’s agent network (ask for someone who has done HOA STR diligence before).

If You Already Own and the HOA Is Coming for You

Do this in order:

① Stop guessing. Get the exact documents and the exact violation letter.

② Document everything. Every communication, every complaint, every response.

③ Shift to compliance-first mode. Remove the easy triggers: parking, trash, quiet hours, occupancy.

④ Evaluate pivot options: 30+ day rentals, corporate housing, traveling nurse demand, insurance housing.

⑤ Get professional help. This is where a local real estate attorney who knows HOAs can save you money.

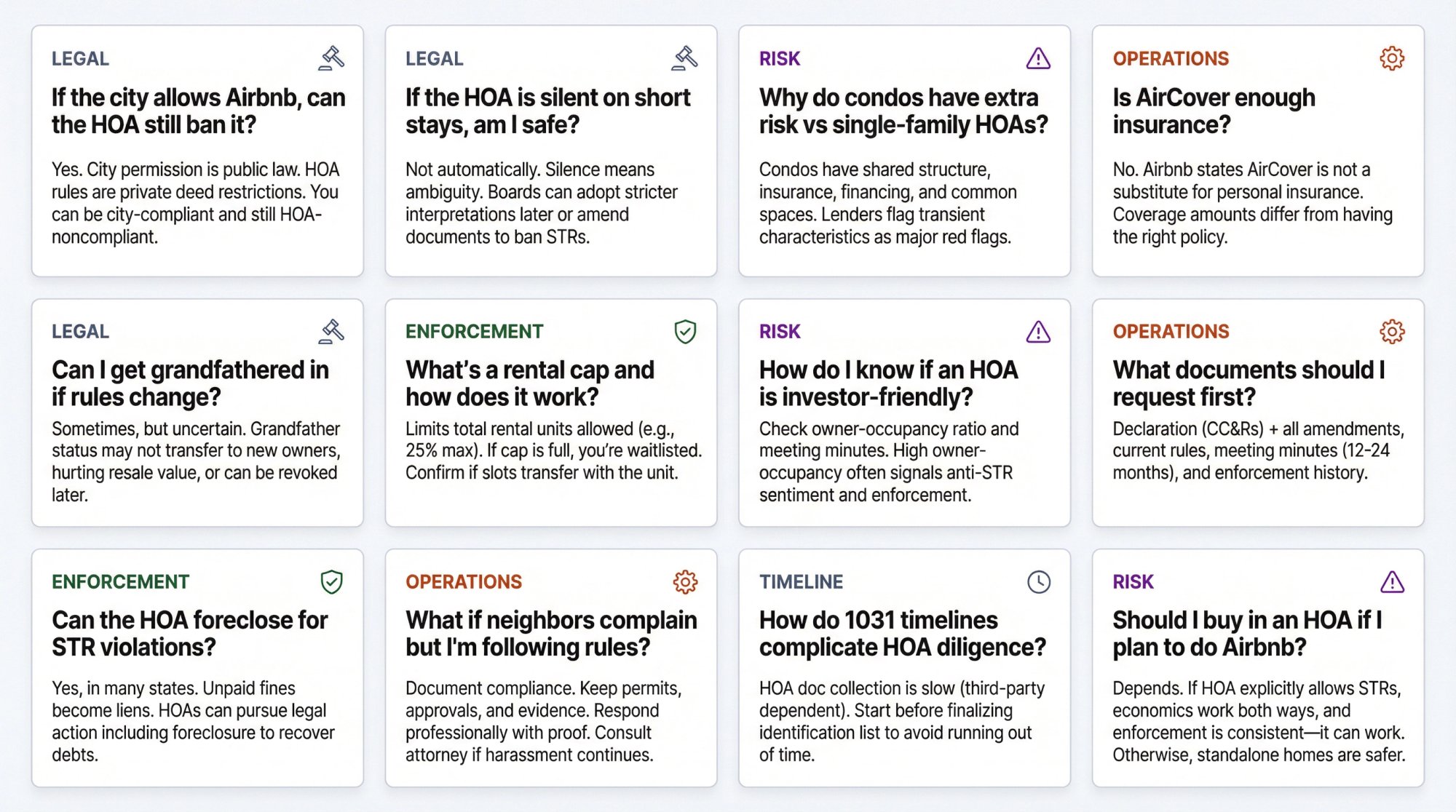

Frequently Asked Questions

“If the city allows Airbnb, can the HOA still ban it?”

Often, yes. City permission is public law. HOA rules are private restrictions tied to your deed. Your risk is that you’re compliant with the city and still noncompliant with the HOA.

“If the HOA is silent on short stays, am I safe?”

Not automatically. Silence can still mean ambiguity, and ambiguity becomes enforcement risk, especially if a board later adopts a stricter interpretation or amends documents.

“Why do condos have extra risk vs single-family homes in HOAs?”

Because condos have shared structure, shared insurance, shared financing eligibility, and common spaces. Mortgage guidelines may treat transient or hotel-like characteristics as a major red flag.

“Is AirCover enough?”

Airbnb’s own statement: AirCover is not a substitute for personal insurance. The coverage amounts listed aren’t the same thing as having the right policy for your property and strategy.

“Can I get grandfathered in if rules change?”

Sometimes, but it’s uncertain. Grandfather status might be lost when you sell the property (new owner can’t STR), which could hurt your sale value. Or the HOA might revisit and revoke the grandfathering later if pressure mounts.

“What’s a rental cap and how does it work?”

A rental cap limits how many units in the community can be rented at any given time (example: “no more than 25% of units may be rented”). If the cap is full, you’re on a waitlist. Get written confirmation of whether a rental slot transfers with the unit or is personal to the owner.

“How do I know if an HOA is investor-friendly?”

Check the owner-occupancy ratio. If most units are owner-occupied (not investor-owned), the HOA culture tends to be more residential and potentially hostile to STRs. Review meeting minutes for anti-rental sentiment and ask about recent enforcement actions.

“What documents should I request first?”

Start with the Declaration (CC&Rs) and all amendments, plus the current rules and regulations. These tell you the baseline rules. Then get meeting minutes from the last 12-24 months to see enforcement trends.

“Can the HOA foreclose on my property for STR violations?”

Yes, in many states. Unpaid HOA fines or assessments can become a lien on your property, and the HOA can eventually take legal action to foreclose to recover what you owe.

“What if neighbors complain but I’m following all the rules?”

Document that you’re compliant. Keep records of your permits, HOA approval (if required), and evidence you’re following rules. Respond professionally to each complaint with proof of compliance. If harassment continues, consult an attorney.

“How do 1031 timelines complicate HOA diligence?”

HOA diligence is slow (third-party dependent on managers, boards, escrow). If you wait until you’re under contract to request HOA docs, you might run out of time in your 45-day identification period. Start collecting documents early.

“Should I buy in an HOA if I plan to do Airbnb?”

It depends. If the HOA explicitly allows STRs, the economics work in multiple scenarios (STR + long-term fallback), and enforcement is consistent, it can work. But if any of those are unclear or hostile, standalone homes are less risky.

Next Step: Turn This Into a Safe Purchase Decision

If you’re evaluating an HOA deal right now, here’s the simplest high-signal path:

① Run the numbers two ways (Airbnb rental + long-term fallback) using Chalet’s calculator.

② Check local STR regulations for the market at Chalet’s regulation library.

③ Find a local pro who has done HOA STR deals via Chalet’s real estate agents.

④ Plan your operations stack (cleaning, turnover, furnishing, insurance) via Chalet’s directory.

⑤ If you’re still shopping, see Airbnb rentals for sale at Chalet.

The HOA gauntlet is real, but you don’t have to navigate it blind. With the right data, the right professionals, and a clear-eyed view of the risks, you can make a decision that protects your capital and your sanity.