Buying an Airbnb rental from another host sounds like a shortcut into the vacation rental market. The property is already furnished, guests are already booking it, and reviews are already flowing. You skip years of setup and jump straight into collecting income.

Here's what most buyers miss: you're not buying "an Airbnb account."

You can't take over the seller's profile, transfer their reviews, or assume their bookings will automatically become yours. Airbnb's Terms of Service explicitly states you may not transfer your account to someone else, and the platform makes clear there's no way to merge accounts or move bookings between hosts.

So what are you actually buying when someone advertises a "turnkey Airbnb"?

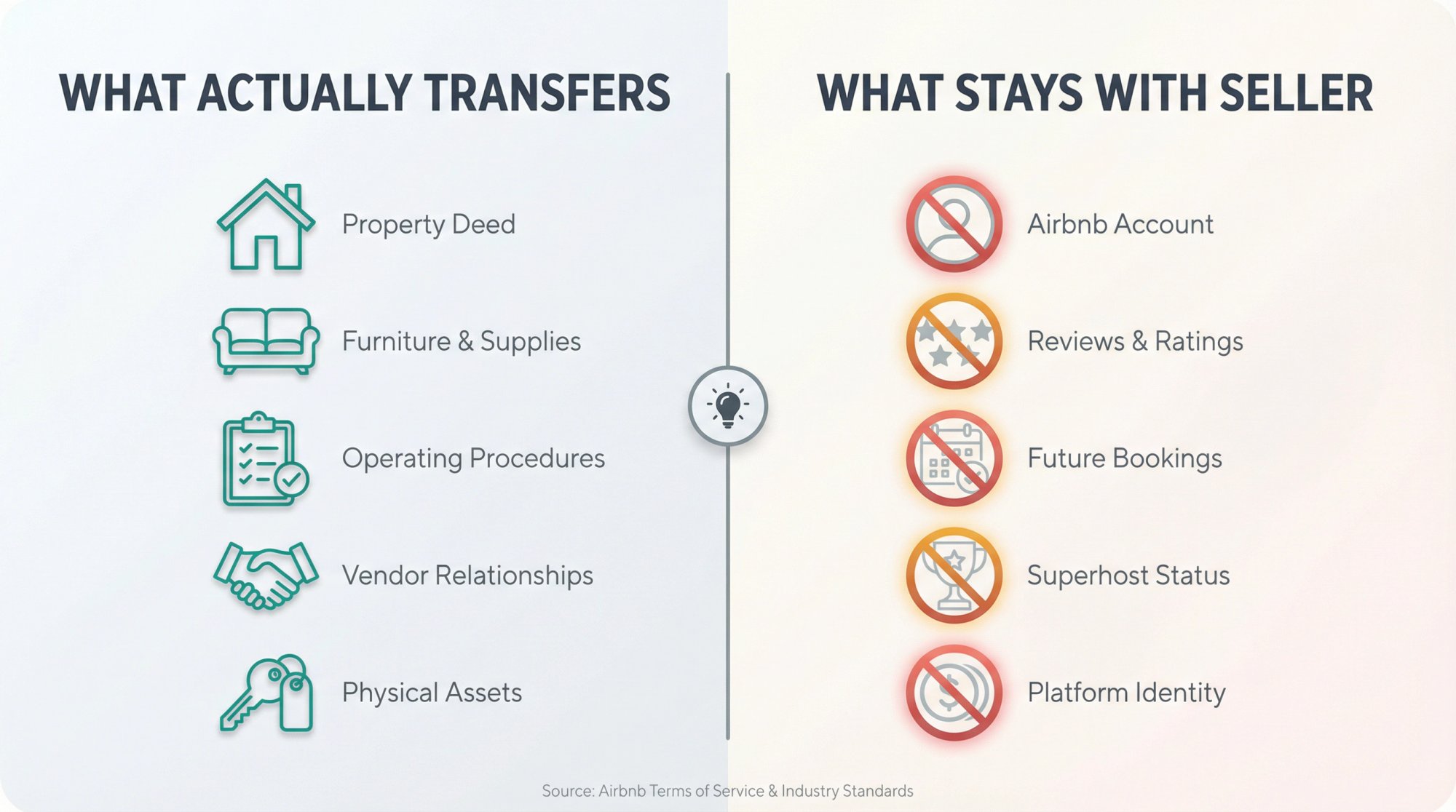

Usually, you're purchasing a short-term rental (STR) property that happens to have been operating as an Airbnb, plus the furniture, systems, and vendor relationships that made it work. Sometimes you're also buying a transition plan that keeps things running smoothly. But the listing itself, the reviews, and the platform identity? Those stay with the seller.

This guide breaks down the real pros and cons of buying an existing Airbnb from another host, what actually transfers (and what doesn't), and the exact due diligence steps you need to protect yourself from expensive surprises.

What You Actually Get When Buying an Airbnb From Another Host

The confusion around "buying an Airbnb" comes from mixing up three different things:

1. The real estate (the physical property)

2. The STR business (furniture, operations, vendor relationships)

3. The platform presence (Airbnb listing, reviews, bookings)

You can definitely buy #1 and #2. Number three? That's where things get complicated.

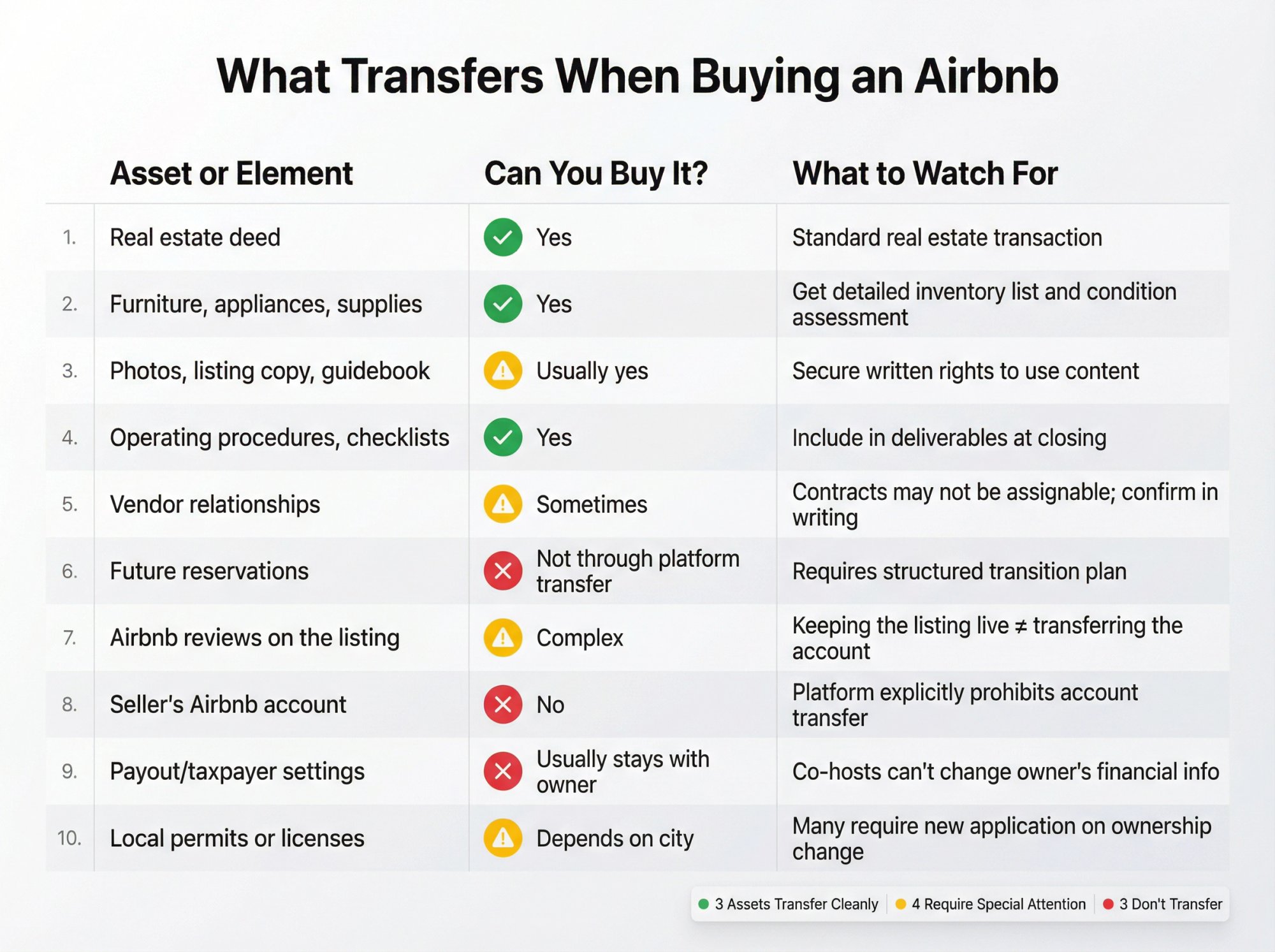

Here's the practical breakdown of what typically transfers when you purchase an Airbnb property from another host:

| Asset or Element | Can You Buy It? | What to Watch For |

|---|---|---|

| Real estate deed | Yes | Standard real estate transaction |

| Furniture, appliances, supplies | Yes | Get detailed inventory list and condition assessment |

| Photos, listing copy, guidebook | Usually yes | Secure written rights to use content |

| Operating procedures, checklists | Yes | Include in deliverables at closing |

| Vendor relationships | Sometimes | Contracts may not be assignable; confirm in writing |

| Future reservations | Not through platform transfer | Requires structured transition plan |

| Airbnb reviews on the listing | Complex | Keeping the listing live ≠ transferring the account |

| Seller's Airbnb account | No | Platform explicitly prohibits account transfer |

| Payout/taxpayer settings | Usually stays with owner | Co-hosts can't change owner's financial info |

| Local permits or licenses | Depends on city | Many require new application on ownership change |

The key principle: The more value the seller claims is in "the Airbnb," the more carefully you need to verify what part of that value is actually transferable to you.

6 Key Advantages of Buying an Established Airbnb Rental

Despite the complexity of account transfers, there are real advantages to buying a property that's already operating as a successful short-term rental.

Skip the Setup Phase: Why Existing Airbnbs Save You 6+ Months

A seasoned host has already made the expensive mistakes. They've figured out what breaks, what guests complain about, what needs to be stocked, and what the cleaner forgets unless you put it on a checklist.

This operational maturity is genuine value. You're not spending six months learning the hard way that the shower drain clogs constantly or that guests can't figure out the TV remote. The property has been battle-tested through hundreds of stays.

Verified Revenue History vs Optimistic Projections

When researchers analyzed STR purchases, they found that properties with 12 to 24 months of booking history give buyers something rare in real estate: evidence instead of optimistic projections.

But the data is only valuable if you verify it properly. Before trusting the seller's numbers, you should run your own analysis using market data and ROI calculations to separate genuine performance from inflated claims.

Established Vendor Relationships That Actually Matter

If the cleaner, handyman, hot tub tech, and snow removal service already know the property, your early months can be dramatically smoother. These relationships represent real value because finding reliable STR-specific vendors is often one of the hardest parts of operating a short-term rental.

Industry experts who study STR transitions note that smart sellers "share vendor contacts and even service contracts" to help buyers hit the ground running. Just be aware that cleaners or contractors might request rate adjustments when working with a new owner.

The Property Is Already Proven for High-Volume Hospitality Use

A standard home inspection checks for structural issues and major system failures. But it won't reveal the kinds of problems that only emerge when a property hosts 200 stays per year.

An active Airbnb has already been through the hospitality stress test. If the HVAC system was going to fail under heavy use, it probably already did. If the water heater couldn't handle back-to-back guest turnovers, you'd see it in the maintenance records.

Speed to Market: 30 Days vs 120 Days to First Booking

If you're working within a tight timeline (maybe a 1031 exchange deadline or trying to catch peak season), buying something that already operates can be significantly faster than building from zero.

Setting up a new STR typically takes 60 to 120 days between closing, furnishing, permitting, and launching. An existing property can often be operational under new ownership in 30 days or less, assuming you solve the transition challenges we'll discuss.

For 1031 exchange buyers: The speed advantage matters even more when you're racing IRS identification and closing deadlines. Being able to generate rental income quickly can affect your debt service coverage ratio calculations and financing approval. Learn more about 1031 exchange strategies for STR investors.

Proven Systems and Documentation Worth Thousands

A well-run Airbnb comes with documented procedures: cleaning checklists, restocking lists, guest communication templates, house rules that actually work, and pricing strategies that have been refined through trial and error.

This knowledge transfer can save you months of experimentation. You're essentially getting a playbook that's already proven to work for that specific property.

7 Major Risks When Buying an Airbnb From Another Host

Now for the challenges. These aren't necessarily deal-breakers, but they're real issues that cost unprepared buyers significant money and stress.

You Cannot Transfer the Airbnb Account or Login

This is the single biggest misconception, and it trips up buyers constantly.

Airbnb's Terms of Service states clearly: "You may not transfer your account to someone else and you may not share your login credentials." The platform also explicitly confirms there's no way to move bookings between accounts and no way to transfer ownership of an Airbnb account.

Any plan that depends on "the seller gives me their login" is a plan that can blow up later. If Airbnb discovers shared credentials, they can suspend or terminate the account, taking your entire business offline instantly.

Reviews Stay With the Seller's Profile, Not the Property

Here's where Airbnb's "Primary Host" system creates confusion for buyers.

When a listing's primary host changes, the name shown on the listing updates immediately and reservations stay unchanged. That sounds good, right? You become the visible host while keeping the bookings.

The catch: guest reviews for home listings only appear on the listing owner's profile, not co-hosts. So you can be designated as "the host" while the listing owner still retains the profile-level reputation, payout control, and tax identity.

This works as a short-term transition tool. It's not a clean long-term ownership transfer.

Most buyers end up creating a completely new listing under their own account, starting from zero reviews even though the property itself has a strong track record.

STR Permits Often Don't Transfer to New Owners

This issue causes more deal failures than any other, and most buyers don't discover it until after they've signed a contract.

Many cities tie STR permits to the owner, not the property. When you take ownership, the permit doesn't automatically come with you. Understanding local rental regulations is critical before making an offer.

Real examples:

• Many jurisdictions require new owners to obtain a new initial certificate, apply within 15 days of the sale, and undergo a fresh inspection. The certificates are explicitly non-transferable and non-assignable.

• Some cities make permits non-transferable, requiring a new application within 14 days of any ownership change.

• Other areas have adopted emergency moratoriums, temporarily blocking all new STR license applications. If you bought a property there with a grandfathered permit, you might not be able to reapply.

You might be buying a property that's "grandfathered" under the seller but completely blocked under you.

Seller Financial Reports Are Often Misleading

Most sellers present their numbers in the most favorable light possible without technically lying. Common presentation issues:

• Cleaning fees shown as "pass-through income" even though you still need to pay for labor and re-cleans

• Repairs and replacements excluded because "that was a one-time thing"

• Owner labor ignored (guest messaging, mid-stay issues, restocking, coordination)

• Seasonality hidden by showing only peak months or annualizing one great quarter

This is why running independent market analysis and conservative underwriting is essential. A Reddit host who went through an STR sale noted that the "goodwill" or reputation doesn't really transfer because the new owner creates their own listing from scratch, which can make the premium price hard to justify.

You Inherit Guest Expectations You Didn't Set

If you keep the same listing live through a co-host transition, guests are booking based on the seller's reputation, communication style, and service standards.

If you run it differently, or if you're not as responsive, or if you don't include the same amenities, your first 10 reviews under the new setup can swing hard and damage your listing's performance.

The Property Has More Wear Than a Traditional Rental

Everything from pricing rules to minimum-night requirements to house rules was optimized for the seller's goals and management style, not yours.

Maybe they priced for maximum occupancy while you want to target fewer bookings at higher rates. Maybe their house rules were extremely permissive while you want tighter controls. Unwinding these decisions while managing active bookings is tricky.

Budget for Higher Replacement Costs Than Expected

Property management experts note that hosting means dealing with broken or damaged items regularly. A home that's hosted 200+ stays will likely have:

• Carpets and paint with more wear than an owner-occupied home

• Appliances with higher usage cycles

• Furniture and mattresses compressed from constant use

• Small but annoying damage (scuffed walls, sticky cabinet hardware, loose doorknobs)

Budget for immediate maintenance and plan for a higher ongoing replacement reserve than you would with a traditional rental.

STR Permits: Critical Due Diligence Most Investors Skip

If you buy an Airbnb without confirming your ability to legally operate it under your ownership, you're speculating, not investing.

Your non-negotiable checklist:

1. Confirm the legal path for a new owner

Do you need a new permit? A new inspection? A new locally responsible party on file?

2. Confirm timing risk

If the city takes 30 to 90 days to process your application, can you survive that downtime without rental income?

3. Confirm cap and moratorium risk

If the market has a permit cap or can pause approvals, you could buy the property and then get stuck unable to operate.

Investors who bought properties in December 2025 expecting to get permits in January 2026 suddenly found themselves blocked in some markets.

4. Confirm HOA and condo rules separately

A city permit doesn't override private association restrictions. Get HOA approval in writing before closing.

5. Confirm tax registrations

Lodging taxes, sales taxes, and business licenses often require new owner setup even when the address stays the same.

Practical rule: Treat "permit included" as marketing language until the local jurisdiction confirms in writing what happens on transfer.

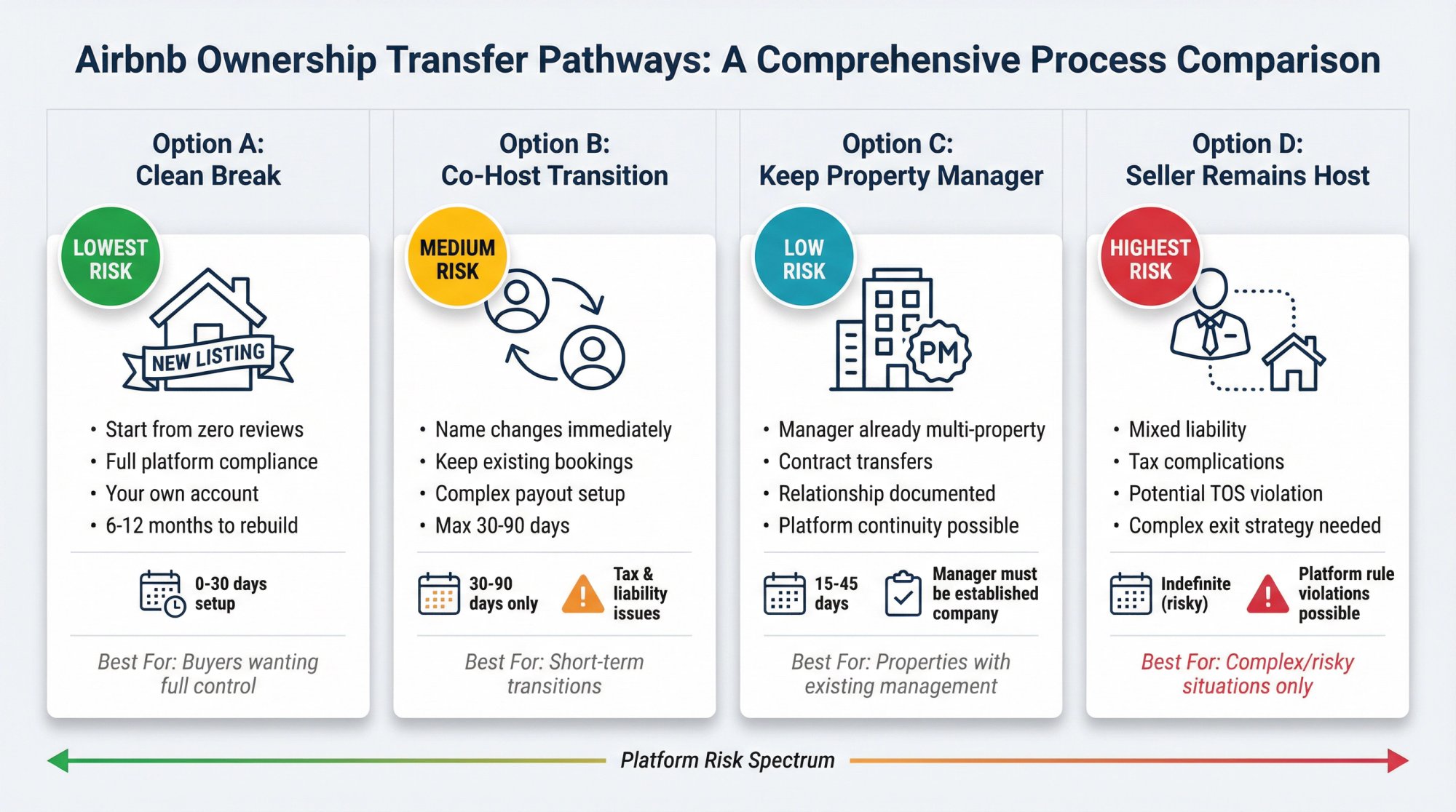

4 Proven Ways to Transfer an Airbnb After Purchase

Since you can't simply log into the seller's account, here are the real-world pathways investors use. None are perfect, but some are much safer than others.

| Transition Option | Platform Risk | Review Continuity | Best For |

|---|---|---|---|

| Option A: Clean Break | Lowest | Zero (start fresh) | Buyers who want full control |

| Option B: Co-Host Period | Medium | Partial (name changes) | Short-term transitions (30-90 days) |

| Option C: Same Manager | Low | Depends on structure | Properties with established management |

| Option D: Seller Stays On | Highest | Full (seller's account) | Complex/risky situations only |

Option A: Clean Break With New Listing (Lowest Platform Risk)

What it is: You close on the property, build your own listing on your account, and start from zero on reviews.

Why it's clean: It aligns with Airbnb's stance that accounts and bookings aren't transferable between hosts.

What you lose: Listing-level history, social proof, and potentially some conversion rate in early months.

How to reduce the pain:

• Launch with the seller's best assets: professional photos, tested amenities, proven house rules

• Keep pricing conservative early to earn strong initial reviews quickly

• Over-communicate expectations in the listing description

When to use it: If you're buying primarily for the real estate and operations, not the platform presence. If you have time to build a new reputation. If you want zero platform rule violations.

Option B: Use Co-Host Transition Period (30-90 Days Maximum)

What it is: The seller keeps ownership of the listing but adds you as a co-host with full access and designates you as the primary host.

When the primary host changes, the name shown on the listing updates immediately and reservations remain unchanged. To guests browsing Airbnb, you appear as the host.

The catch most buyers miss: Only the listing owner can set up or edit co-host payouts, and co-hosts cannot change the listing owner's payout method or taxpayer information.

So you need crystal-clear agreements on:

• Who receives payouts from Airbnb

• How revenue gets shared or transferred

• Who's responsible for taxes and reporting

• Who's liable if a guest dispute or damage claim happens

This is a transition tool, not a permanent ownership solution. It can work for 30 to 90 days while you prepare your own listing, but you can't run it indefinitely without creating tax and liability complications.

Option C: Keep the Same Professional Property Manager

This can work if:

• The property is managed by an established company (not the owner personally)

• The manager already operates listings on behalf of multiple owners

• The manager's contract is with the property/business entity, not the individual

• The relationship is documented and transferable

Just know that Airbnb has disabled the ability to create new hosting teams, so you can't assume you can set up a new team structure as part of your acquisition plan. If you need professional management support, explore STR property management options to find qualified operators.

Option D: Seller Stays On as Host (The Risky Path)

This is the option that creates the most problems.

You're mixing:

• Someone else's platform identity

• Your property

• Your liability exposure

If you do it, treat it like a formal management agreement with explicit terms, proper insurance, and tax professional guidance. And have an exit plan for when you want full control of the listing.

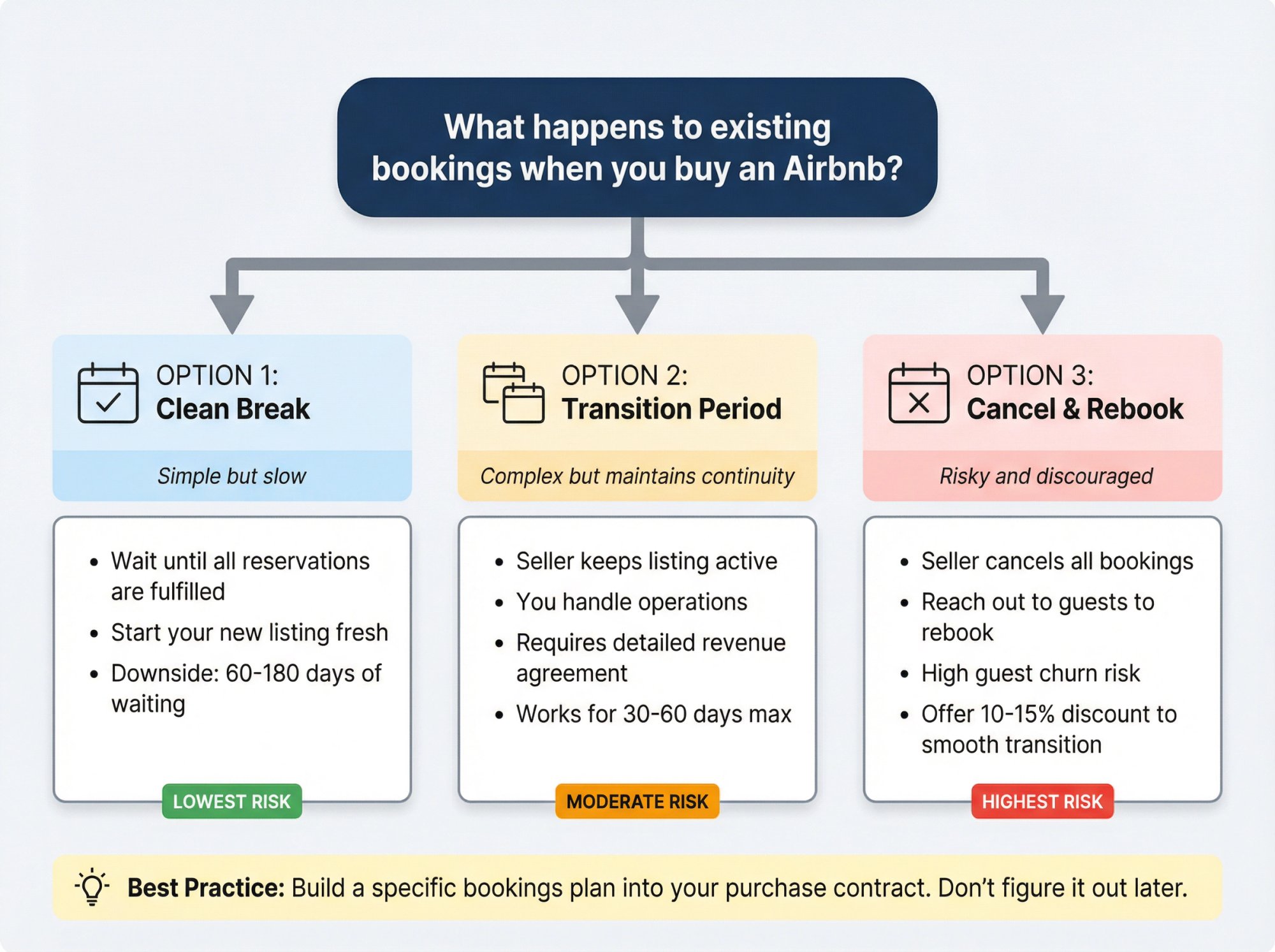

What Happens to Existing Bookings When You Buy an Airbnb?

This is where most "turnkey" listings fall apart at closing.

Airbnb clearly states you cannot move bookings between accounts. So you typically have three choices:

1. Close after the calendar clears (simple but slow)

• Wait until all existing reservations are fulfilled

• Start your new listing with a clean slate

• Downside: Could mean waiting 60 to 180 days to close

2. Honor bookings under the seller's listing during a transition (complex but maintains continuity)

• Seller keeps their listing active through the booked dates

• You handle operations but bookings stay in their account

• Requires detailed agreement on revenue flow, cleaning responsibility, guest communication

• Can work for 30 to 60 days but gets messy beyond that

3. Cancel and rebook (risky and discouraged)

• Seller cancels existing bookings

• You reach out to guests asking them to rebook with your new listing

• High guest churn risk

• Airbnb warns against hosts canceling without valid reason and may impose penalties

Industry experts suggest offering affected guests a 10 to 15% discount to smooth the rebooking process, but even then, expect to lose some reservations.

The high-safety approach: Build your purchase contract around a specific bookings plan, including revenue proration, cleaning responsibility, and guest communication ownership. Don't assume you'll "figure it out later."

Complete Due Diligence Checklist for Buying an Airbnb

Your job is to separate three things:

1. Property fundamentals (the building and location)

2. Market fundamentals (what similar rentals actually earn)

3. Operator skill (why the seller's numbers look the way they do)

Here's the diligence list that does exactly that.

Financial Documents (Ask for Proof, Not Screenshots)

Request at least 12 months, ideally 24 months:

• Airbnb transaction history export and payout reports (the actual CSV files from the platform)

• Channel breakdown if they use multiple platforms (Airbnb, Vrbo, Booking.com)

• Monthly P&L showing all expenses, not just revenue summaries

• Utility bills for the past year (electric, gas, water, trash, internet)

• Maintenance and repair logs with receipts

• Cleaning invoices or cleaner payout history

• Insurance premium history and claims history if they'll share

• Property tax bills and any special assessments

• HOA dues and recent special assessment notices

Non-negotiable principle: If the seller's "net income" can't be tied back to platform payouts and bank deposits, it's not verified.

Operational Diligence (You're Buying a Machine, Not Just a House)

Request:

• Inventory list: Every room, every item of value, every smart device with login details

• Turnover checklist and restock checklist (what happens between guests)

• Cleaner schedule and backup cleaner contact

• Maintenance vendor list with contacts, rates, and service history

• Hot tub and pool service records if applicable

• Pest control schedule

• Smart lock and access control map (who has codes, how systems reset)

• House manual and guest messaging templates

Platform Diligence (What Will the Guest Experience Look Like?)

Request:

• Listing URL (review it like a prospective guest)

• House rules and fee structure

• Cancellation policy currently used

• Guest requirements (minimum age, party rules, noise monitoring setup)

• Review themes: What do guests consistently praise and complain about?

Then ask the seller directly: "What part of the guest experience is dependent on you, personally?"

If the seller is the product (incredible communication, free upgrades, custom local recommendations, personal touches), the business may not transfer cleanly to you.

Regulatory Diligence (Do This Before You Fall in Love)

• City/county STR permit status, registration ID, and renewal date

• Whether the permit is transferable on ownership change (often it's not)

• Required inspections and timelines (many jurisdictions require a new inspection on ownership change)

• Occupancy limits and parking rules enforced by the city

• HOA or condo association rules and any enforcement history

• Neighbor complaints or city enforcement notices (these are often public record)

Pro move: Ask for written confirmation from the city, not just "the seller said it's fine."

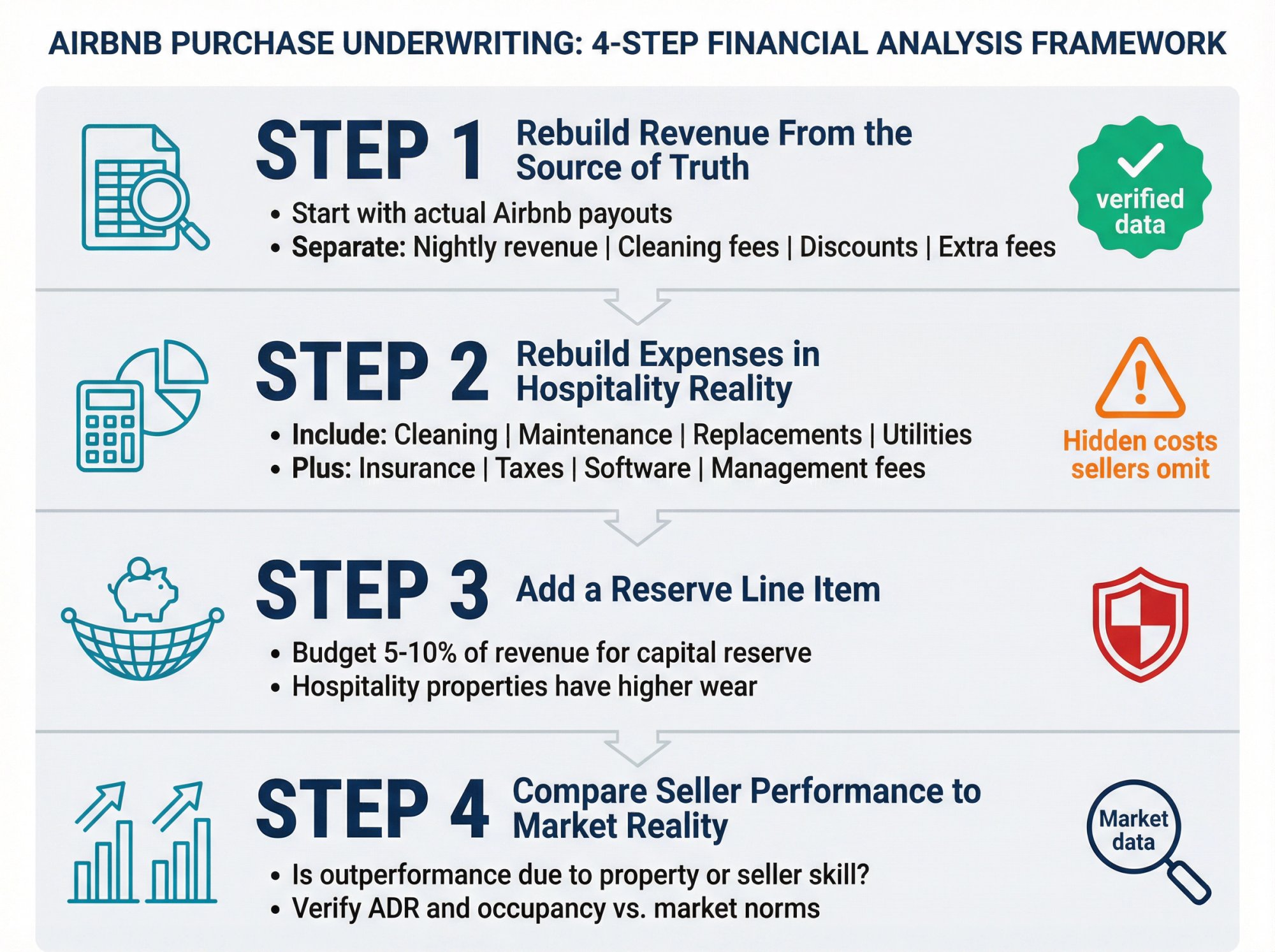

How to Underwrite the Seller's Numbers Without Getting Fooled

From first principles, profit is:

Revenue from bookings minus the costs required to produce those bookings.

Sounds obvious, but many seller pro formas quietly ignore the costs required to keep reviews high and guests happy.

Use this framework:

Step 1: Rebuild Revenue From the Source of Truth

Start with actual Airbnb payouts and booking history, not "average monthly income" claims.

Separate:

• Nightly revenue (base room rate)

• Cleaning fees collected

• Discounts and refunds given

• Extra fees (pet fees, extra guest charges)

Step 2: Rebuild Expenses in Hospitality Reality

At minimum, include:

• Cleaning: Not just the cleaner's invoice, but consumables (soap, paper products), laundry if outsourced, and inevitable re-cleans

• Maintenance and repairs: Average monthly expense, not "last month was quiet"

• Replacements: Small appliances die, towels wear out, furniture needs refreshing

• Utilities and internet: Year-round average, not cherry-picked months

• Insurance: STR-specific policies cost more than standard homeowner coverage

• Taxes and licenses: Lodging tax, business license, permit renewal fees

• HOA dues if applicable

• Software subscriptions: Property management systems, dynamic pricing tools

• Property management fee: Even if you self-manage, your time has economic value

Step 3: Add a Reserve Line Item

Hospitality properties have more wear than long-term rentals. Budgeting 5 to 10% of revenue for a capital reserve isn't pessimism, it's acknowledging physics.

Step 4: Compare Seller Performance to Market Reality

Ask: "Is this property outperforming the market because of something unique about the property, or because of the seller's skill?"

If it's skill (exceptional communication, local connections, dynamic pricing expertise), you need to be honest about whether you can replicate that.

This is where Chalet's free market analytics and address-level underwriting tools become invaluable. You can verify whether the seller's average daily rate and occupancy look normal for that neighborhood and property type, or if they're beating the market through sheer operational excellence you may not be able to match.

Run the numbers through our Airbnb calculator with realistic assumptions about what you can achieve, not what the seller achieved.

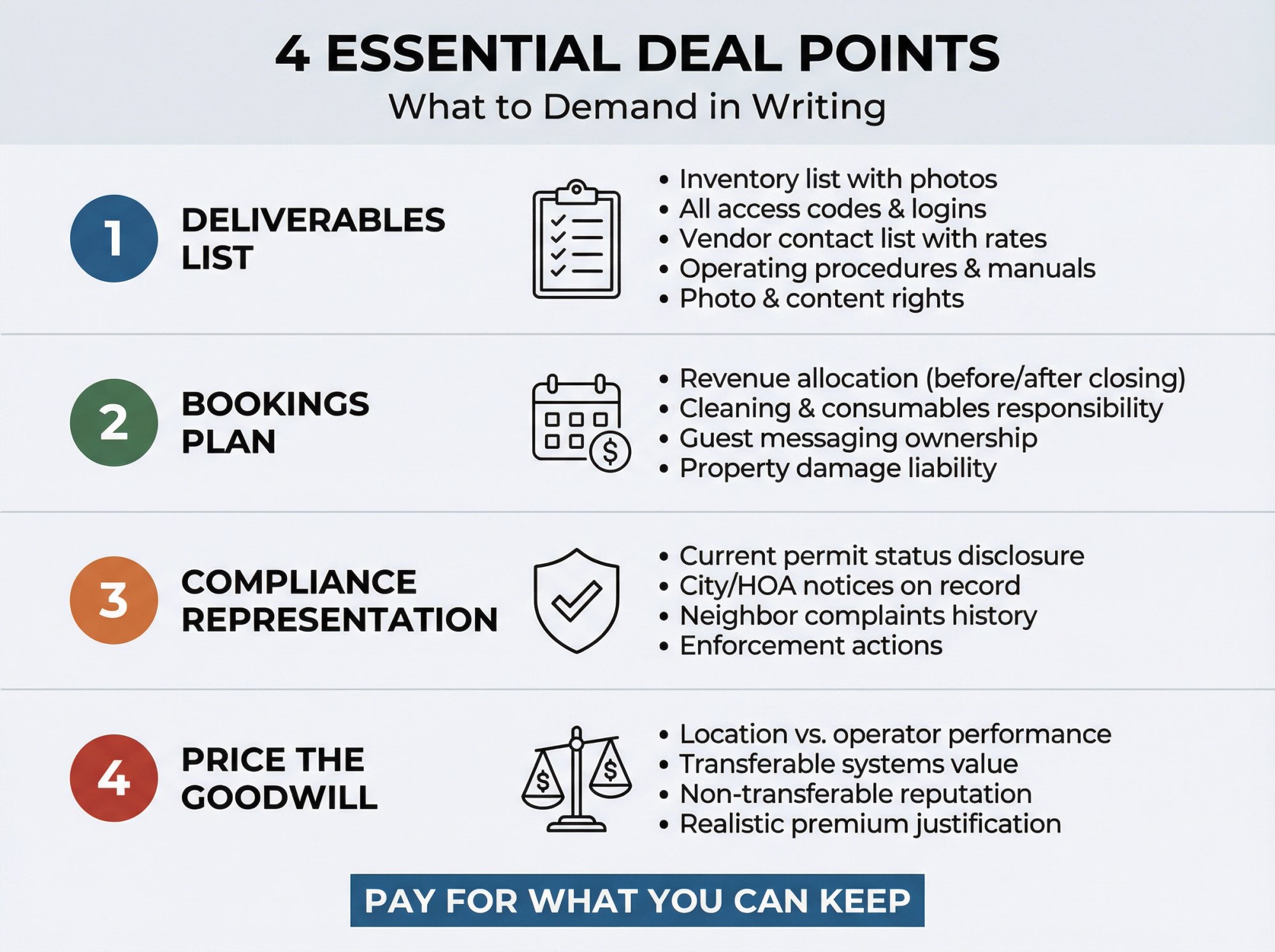

Airbnb Purchase Negotiation: What to Demand in Writing

You're not just buying a house. You're buying a transition.

Here are deal points that protect you without turning your contract into a legal textbook:

1. Attach a Deliverables List to the Contract

Be specific. Include:

• Inventory list with photos showing current condition

• All access codes, system logins, and device ownership transfers

• Complete vendor contact list with current rates

• Standard operating procedures, house manual, messaging templates

• Photo rights and listing copy rights for reuse

2. Write the Bookings Plan Into the Contract

Spell out:

• Who keeps revenue for stays that occur before closing vs after closing

• Who pays for cleaning and consumables for transitional stays

• Who handles guest messaging during the transition period

• What happens if a guest causes property damage during transition

3. Add a Compliance Representation

At minimum, the seller should represent:

• Current permit status and any known violations

• Any notices from the city or HOA

• Any neighbor complaints or enforcement actions they're aware of

This doesn't guarantee you'll have zero problems, but it creates accountability if the seller misrepresented the regulatory status.

4. Price the "Goodwill" Conservatively

If the seller is charging a large premium because "it's a top-performing Airbnb," ask:

• What part of that performance is the location and amenities?

• What part is their process and personal labor?

• What part will reset when you become the operator?

Pay for what you can keep. Don't pay a premium for the seller's Superhost status or five-star reviews if you're starting with a new listing.

How 1031 Exchanges Work When Buying a Furnished Airbnb

If you're doing a 1031 exchange into an STR, the rules matter and timelines are unforgiving.

The IRS explains that like-kind exchanges apply to real property held for business or investment. After the Tax Cuts and Jobs Act, exchanges are limited to real property, not personal property.

Two practical implications for STR buyers:

1. Furniture is not like-kind real property

If you're buying a fully furnished Airbnb, your qualified intermediary and CPA need to guide how the furniture is allocated in the purchase price and reported.

2. Identification timing is strict

IRS Publication 544 requires you to identify replacement property within 45 days after transferring the relinquished property, and you must receive the replacement property by the 180th day (or your tax return due date, whichever comes earlier).

The publication includes an "incidental property" concept for identification purposes, with furniture mentioned in an example using a 15% threshold. But this is about identification mechanics, not about making furniture qualify as like-kind property.

Don't freestyle 1031 exchanges involving furnished STR properties. Get professional guidance before you structure the deal.

For buyers on 1031 timelines, connecting with an agent who understands both exchange requirements and STR operations is critical. Chalet's network of STR-specialist agents includes professionals experienced with exchange transactions who can help you meet tight identification deadlines.

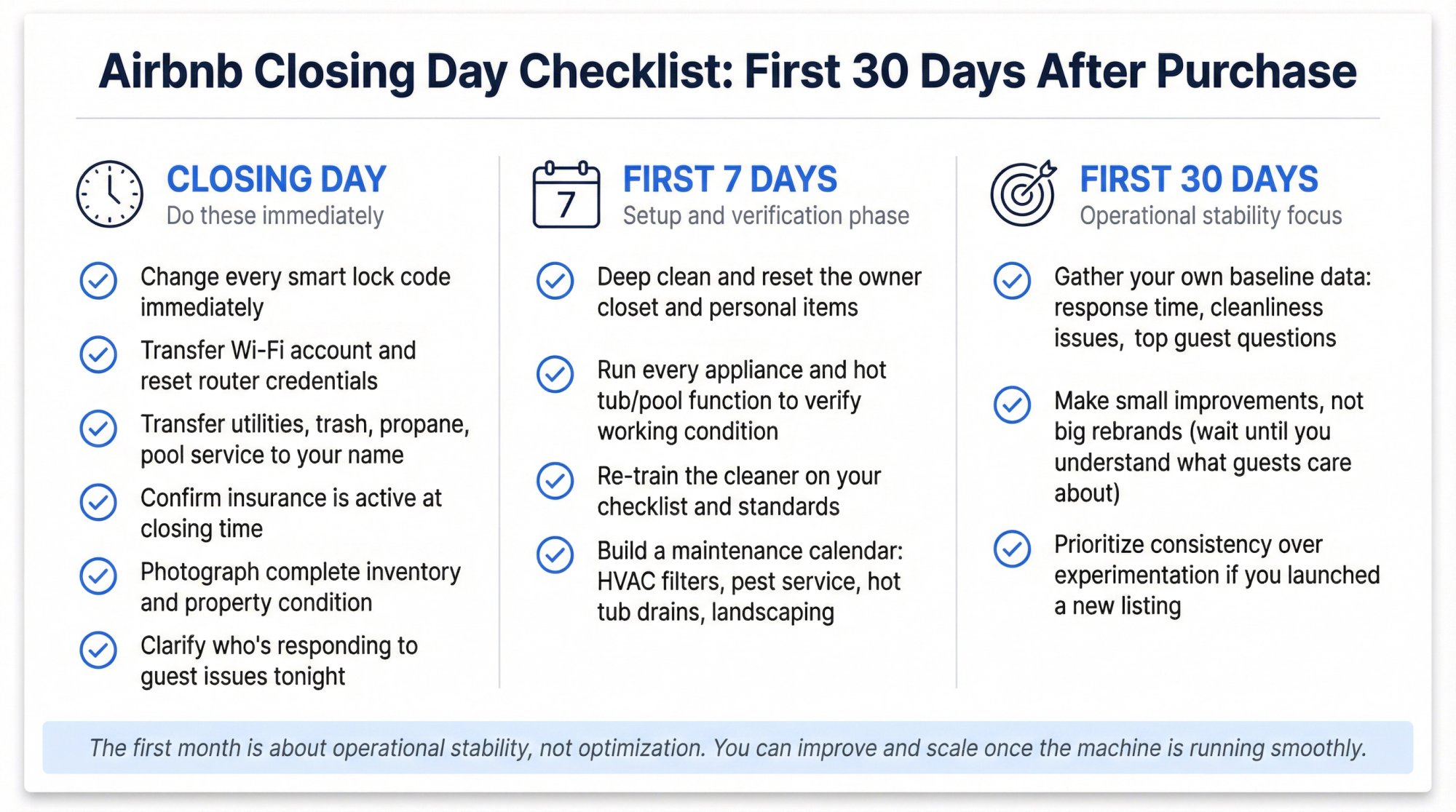

Airbnb Closing Day Checklist: First 30 Days After Purchase

On Closing Day

• Change every smart lock code immediately, not tomorrow

• Transfer the Wi-Fi account and reset router credentials

• Transfer utilities, trash, propane, pool service to your name

• Confirm insurance is active at closing time (not "will be active tomorrow")

• Photograph the complete inventory and property condition like a move-in inspection

• Clarify who's responding to guest issues that night, even if you're not taking bookings yet

First 7 Days

• Deep clean and reset the owner closet and any personal items

• Run every appliance and every hot tub/pool function to verify working condition

• Re-train the cleaner on your checklist and standards, not the seller's habits

• Build a maintenance calendar: HVAC filter changes, pest service, hot tub drain cycles, landscaping

First 30 Days

• Gather your own baseline data: response time, cleanliness issues, top guest questions

• Make small improvements, not big rebrands (wait until you understand what guests actually care about)

• Prioritize consistency over experimentation if you launched a new listing

The first month is about operational stability, not optimization. You can improve and scale once the machine is running smoothly.

How to Simplify Your Airbnb Purchase Process

Throughout this guide, we've mentioned situations where data, expertise, and vetted vendors make the difference between a smart purchase and an expensive mistake.

That's exactly what Chalet is built for.

Chalet provides a complete suite of tools for Airbnb investors, from initial analysis through closing and operations.

When You're Evaluating the Deal

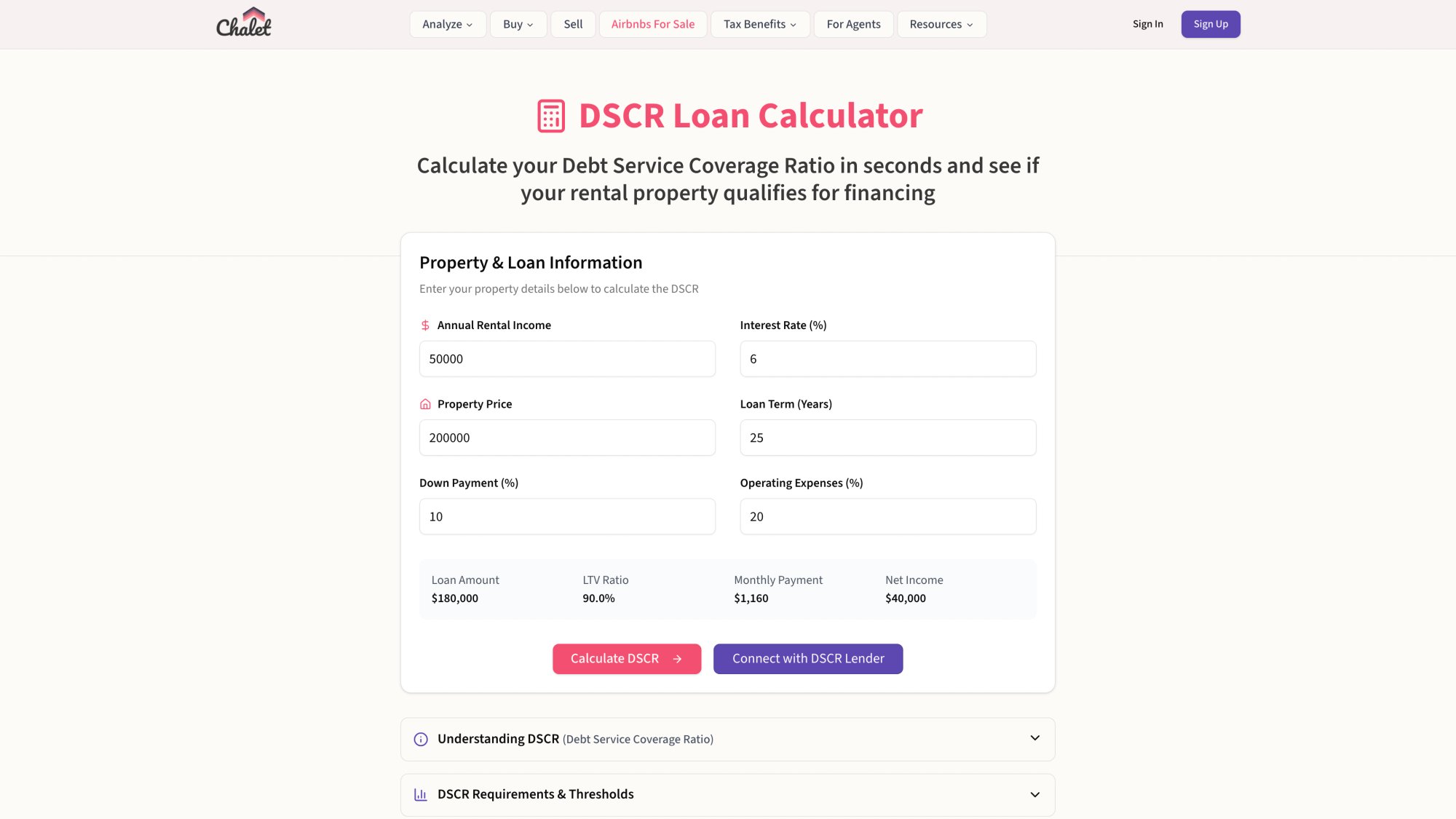

Use our free Airbnb investment calculator to rebuild the seller's numbers with your own assumptions.

The calculator helps you model realistic returns based on your assumptions, not the seller's optimistic projections. Input the purchase price, their claimed revenue, and realistic expense estimates to see your projected cap rate, cash-on-cash return, and DSCR.

Don't trust the seller's pro forma. Run your own numbers with our DSCR calculator to see if the property qualifies for investment property financing.

When You're Verifying Performance

Check our market analytics dashboards to see what similar properties in that neighborhood actually earn. Is the seller's ADR and occupancy in line with market norms, or are they claiming outlier performance?

If they're beating the market significantly, you need to understand why before you assume you'll replicate it.

Our market analytics show you what comparable properties actually earn, helping you verify seller claims with real data.

When You're Researching Regulations

Use our rental regulations library to quickly understand the STR rules for that city. You'll see permit requirements, cap systems, and any recent ordinance changes that might affect transferability.

This research typically takes hours per property. We've already done it.

When You're Ready to Negotiate

Connect with an Airbnb-friendly real estate agent who specializes in STR transactions. These agents understand:

• How to value the business component vs just the real estate

• How to structure contracts with deliverables and transition terms

• How to verify permit transferability before you're under contract

• How to coordinate with lenders who understand STR financing

Working with a specialist agent on your first STR purchase often pays for itself in avoided mistakes.

When You're Setting Up Operations

Browse our partner network for STR-specific vendors: insurance providers, lenders who do DSCR loans on furnished investment properties, and property managers if you need operational support.

Everything you need to go from research to closing to operations, in one place. Explore all Airbnb investment resources.

Buying an Airbnb: Common Questions Answered

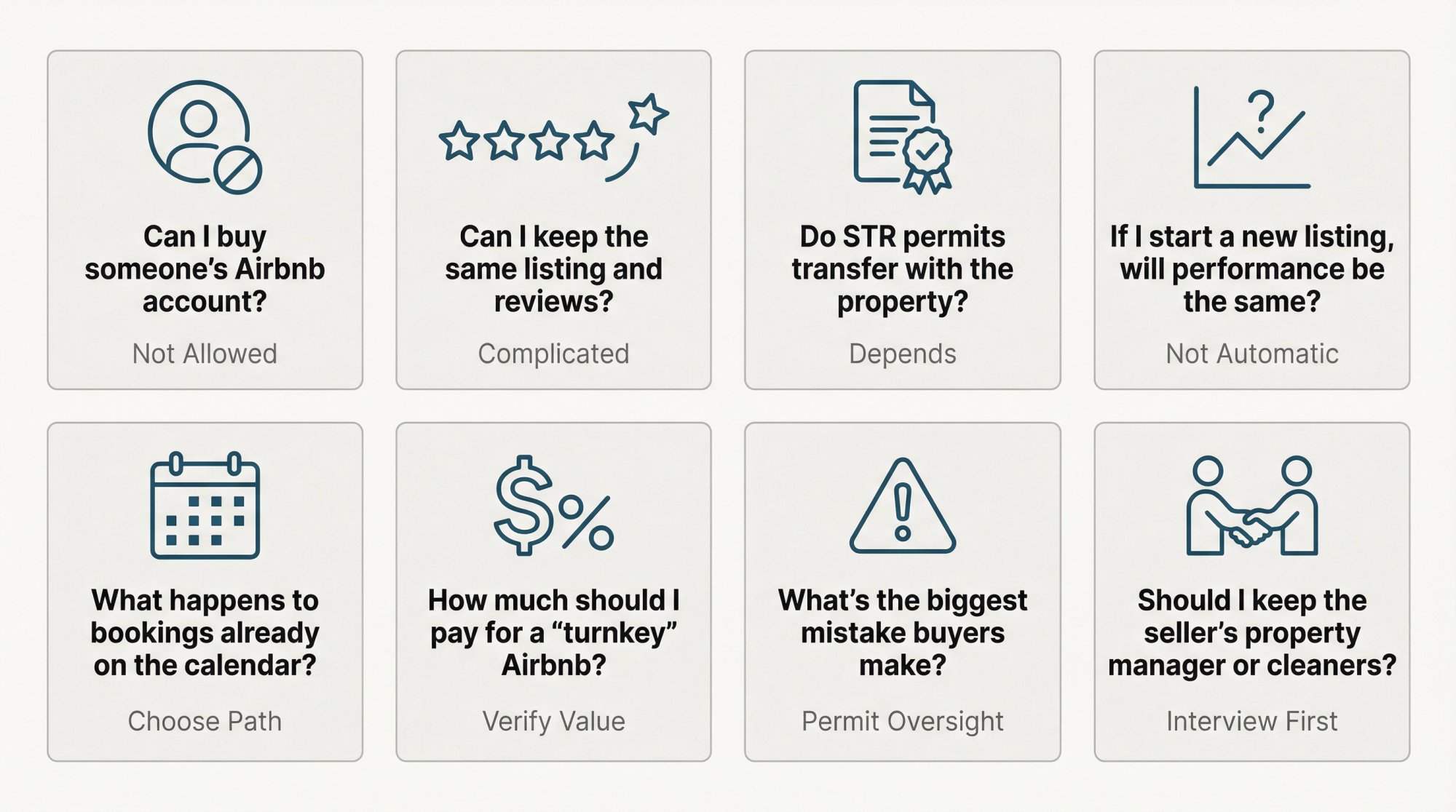

Can I buy someone's Airbnb account?

No. Airbnb's Terms of Service explicitly prohibit transferring your account to someone else or sharing login credentials. Airbnb also states clearly there's no way to transfer ownership of an Airbnb account or move bookings between accounts.

Any plan that depends on sharing credentials violates platform rules and risks account termination.

Can I keep the same listing and reviews?

Sometimes you can maintain continuity through a co-host transition, but that's not an ownership transfer.

Changing a listing's primary host updates who appears as the host and keeps reservations unchanged. But guest reviews for home listings only appear on the profile of the listing owner, not co-hosts. Plus, co-hosts cannot change payout methods or taxpayer information, which stays with the listing owner.

This works as a short-term transition strategy but creates ongoing complications for tax reporting and liability.

Do STR permits transfer with the property?

It depends on your local jurisdiction. Many cities require a new application when ownership changes.

Many jurisdictions explicitly require new owners to obtain a new certificate, apply within 15 days, and undergo a fresh inspection. Others also make permits non-transferable.

Always verify permit transferability in writing from the local authority before closing. Don't rely on the seller's understanding or assumptions.

If I start a new listing, will performance be the same?

Not automatically. You're changing the trust signals (the reviews and hosting history) and potentially the operating system (your management style, communication, service standards).

Underwrite based on market data for similar properties in that area, not just the seller's results. Their performance might reflect personal skill or attention you can't immediately replicate.

What happens to bookings already on the calendar?

Airbnb doesn't allow moving bookings between accounts. You'll typically either:

• Close after the calendar clears (simple but slow)

• Have the seller honor bookings while you handle operations (complex but maintains continuity)

• Cancel and attempt to rebook guests under your listing (risky and often results in lost revenue)

Build a specific bookings plan into your purchase contract to avoid confusion.

How much should I pay for a "turnkey" Airbnb?

The premium depends on what's actually transferable. Don't pay extra for:

• Platform reviews (they stay with the seller's account)

• Superhost status (it doesn't transfer)

• Claimed goodwill if you'll create a new listing

Do value:

• Quality furniture and functioning systems

• Documented procedures and vendor relationships

• Transferable permits (if you've verified this)

• Real performance data that helps you underwrite accurately

Work with an agent who specializes in STR transactions to properly value the business components vs just the real estate. You can also use our calculator to run different valuation scenarios.

What's the biggest mistake buyers make?

Assuming the permit will transfer without verifying. Buyers fall in love with the property and the income history, then discover after closing that they can't legally operate it under their ownership.

Verify permit transferability in writing before you remove contingencies. Check local regulations as a starting point, then confirm directly with the local jurisdiction.

Should I keep the seller's property manager or cleaners?

Interview them just like you would any new hire. Ask:

• What's their experience with the property?

• What maintenance issues should you know about?

• What do they wish the previous owner had done differently?

• Are they willing to work with a new owner at the same rates?

Industry experts recommend interviewing current vendors whether you're the seller or buyer, because they often have the most honest assessment of the property's condition and operational needs.

Don't automatically keep vendors just because they're in place. But if they're good and know the property well, that relationship has real value. If you need to find new STR-specific service providers, browse our vendor directory.

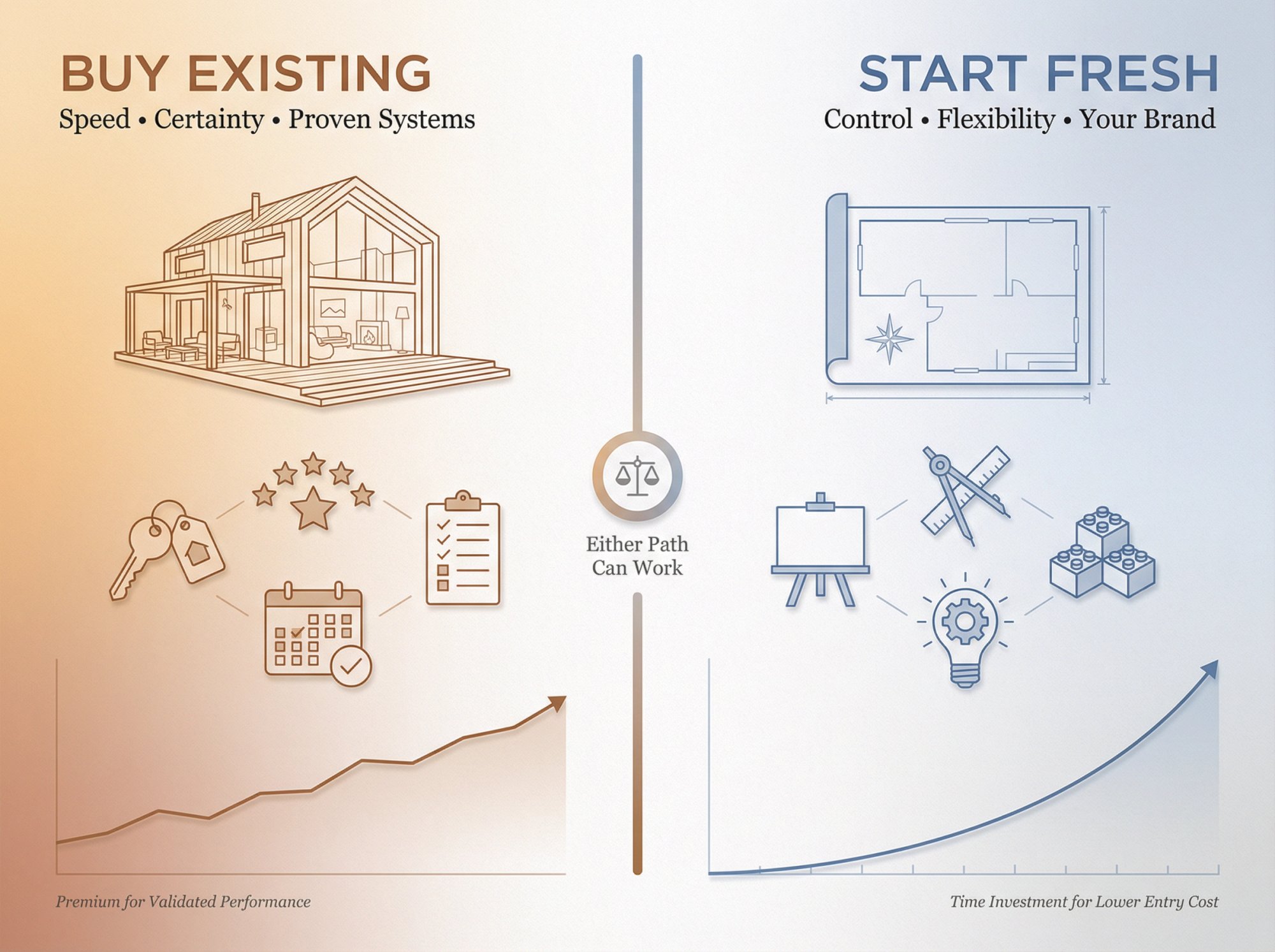

Should You Buy an Airbnb From Another Host?

Buying an existing Airbnb can be a strategic shortcut to owning a profitable short-term rental, but it's more complex than buying a typical investment property. You're not just evaluating real estate. You're evaluating a business, a platform presence, regulatory status, and an operational system.

Consider buying from another host if:

• You value speed and certainty over lower upfront cost

• You're comfortable paying a reasonable premium for validated performance

• You have the skills to verify financial claims and regulatory status

• You can accept starting with a new listing (no reviews) or managing a complex transition

• The local market allows you to legally operate under new ownership

Consider starting fresh instead if:

• You're on a tight budget and can't justify the premium

• You prefer building your own systems and brand from day one

• The seller's permit situation is uncertain or non-transferable

• You have time to gradually build up the business

• You want full creative control over design and operations

Either path can work. The key is understanding what you're actually buying and what work you'll still need to do.

For many first-time STR investors, buying a turnkey property is a great learning opportunity and a way to reduce risk. For experienced investors, it's a quick way to add a proven asset to a growing portfolio. Learn more about getting started with short-term rentals.

Ready to Buy an Airbnb? Your Next Steps

If you're seriously evaluating a turnkey Airbnb purchase:

1. Verify the opportunity with real data

Don't trust the seller's numbers blindly. Run your own analysis using our free calculator to model realistic income, expenses, and returns. Input conservative assumptions about what you can achieve.

2. Research the regulatory environment thoroughly

Check local regulations to understand the rules in that specific city. Then verify directly with the local jurisdiction how permits work on ownership changes.

3. Connect with an expert who understands STR transactions

General real estate agents often miss critical STR considerations. Work with an Airbnb-friendly agent who can spot red flags, value the business properly, and structure contracts that protect you during the transition.

Connect with agents who understand STR valuations, permit transfers, and complex transition planning.

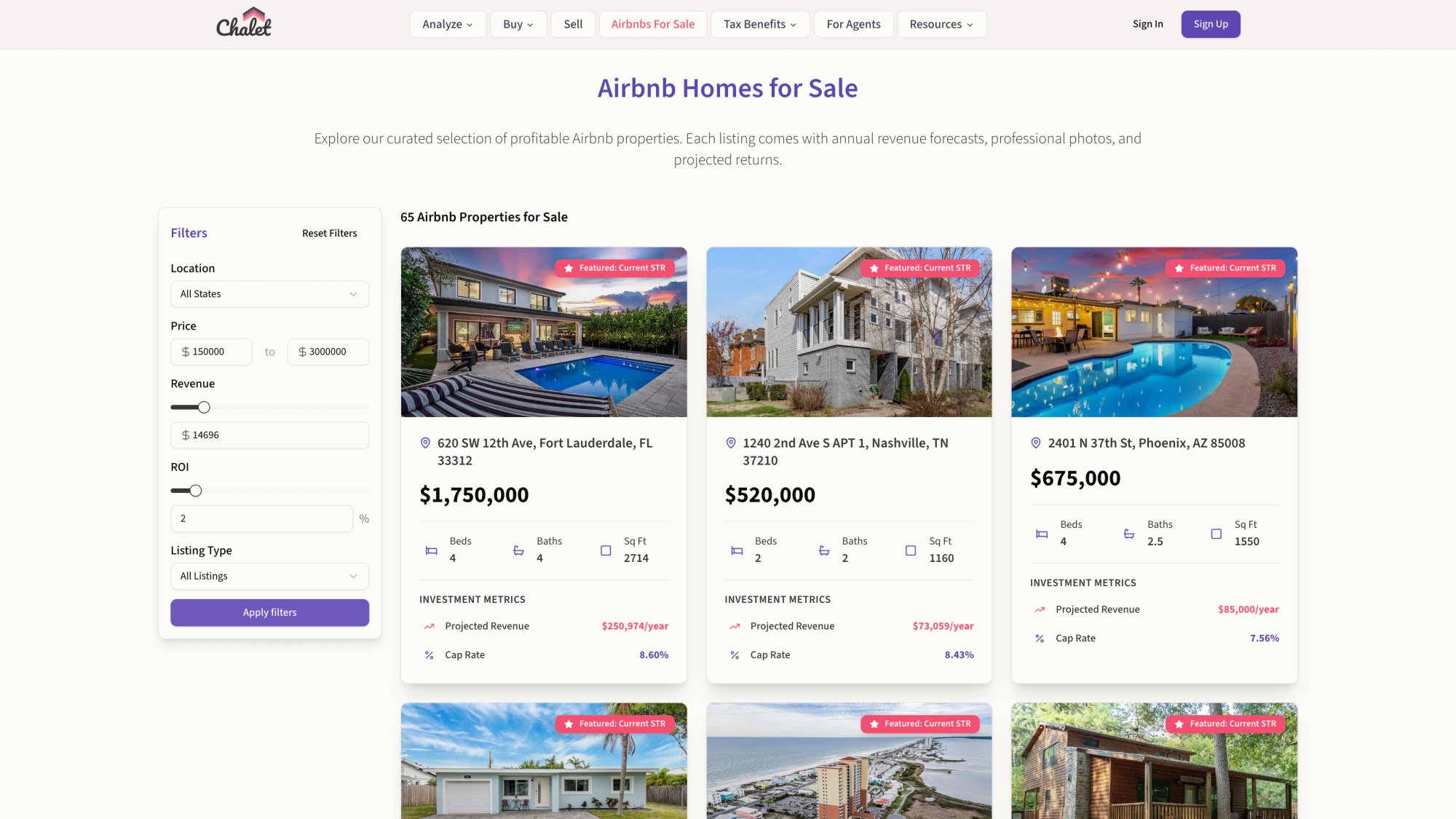

4. Browse available turnkey properties

Not sure where to find STR properties for sale? Check out our curated listings of Airbnbs for sale in markets across the country. We highlight properties with existing permits, performance history, and solid fundamentals.

Our marketplace highlights properties with verified permits, documented revenue, and strong fundamentals.

5. Prepare your financing

If you'll need a loan, talk to lenders who understand STR financing early. Properties sold as operating businesses sometimes require specialized loan products (like DSCR loans) that factor in rental income differently than conventional mortgages. Calculate your DSCR qualification before you start shopping.

The DSCR calculator shows whether the property's rental income qualifies for investment financing.

6. Understand your tax planning options

If you're considering a 1031 exchange, explore exchange-friendly markets and timelines to see which properties meet IRS requirements and can close within your deadlines.

Buying an Airbnb from another host can absolutely set you up with an income-producing asset and a proven playbook for success. Just go in with realistic expectations, verify everything, and build the right team around you.

The opportunity is real. Just make sure you understand what you're actually buying.