Looking to buy your first Airbnb rental in a major metro? The math has to work, regulations need to cooperate, and you need to actually be able to execute (financing, setup, operations). This guide is built for that exact problem.

It's also built for 1031 exchange buyers who need a shortlist of markets that can pencil fast, and for operators looking to scale with clear, comparable numbers. We're using one dataset: Chalet's big-city market snapshot from January 2026, sorted by gross yield.

Think of gross yield as a "fast screen" for where your dollar buys the most revenue today. It's not a promise of profit (more on that in a second), but it's still the fastest way to shrink your shortlist down to 3-5 markets before you get into address-level underwriting.

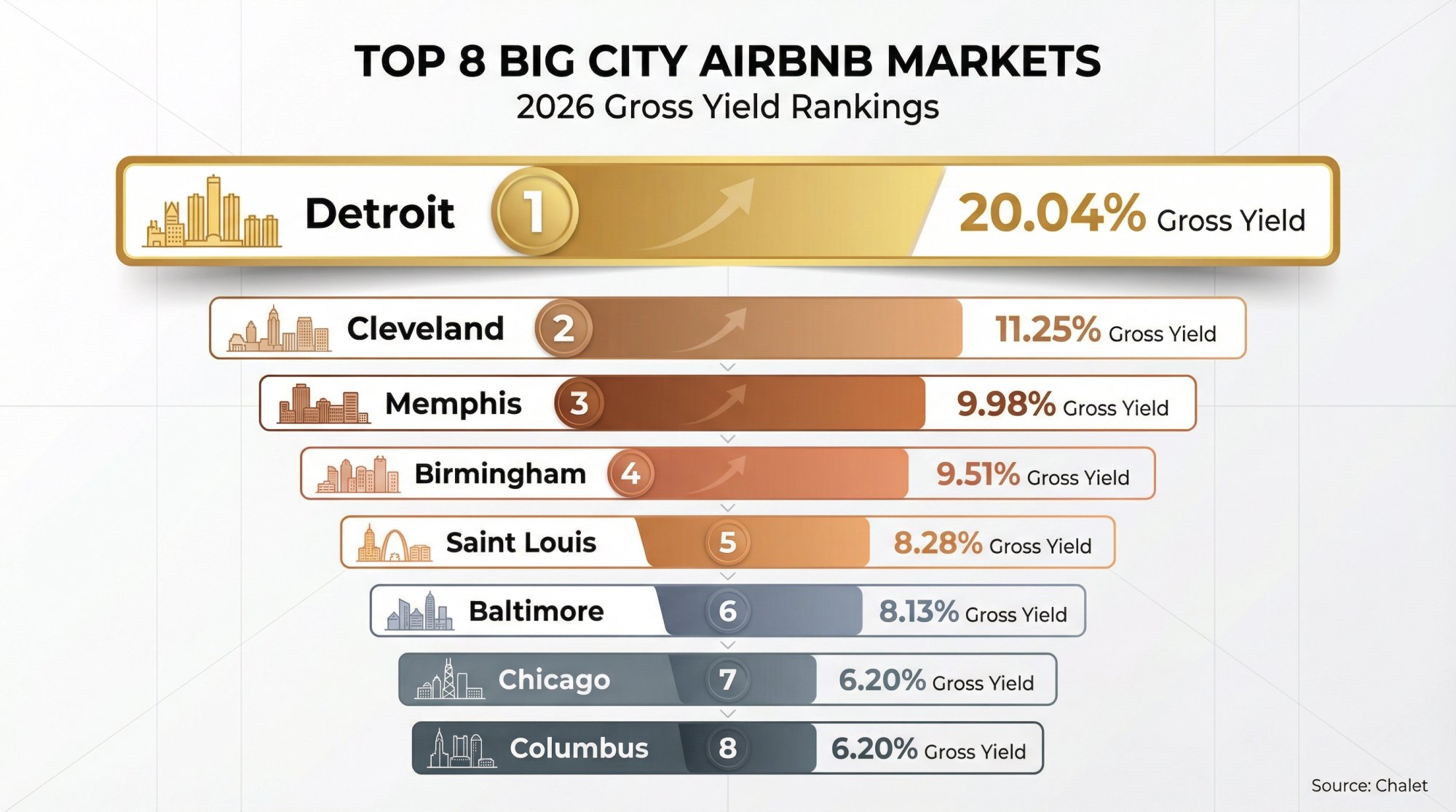

Top 8 Big City Airbnb Markets by Gross Yield (2026)

Highest to lowest gross yield:

-

Detroit, MI

-

Cleveland, OH

-

Memphis, TN

-

Birmingham, AL

-

Saint Louis, MO

-

Baltimore, MD

-

Chicago, IL

-

Columbus, OH

Source: Chalet, January 2026 snapshot.

Big City Airbnb Market Data Comparison (January 2026)

| Market | State | Home Value YoY | Avg Home Price | Active Listings | ADR | Occupancy | Annual Revenue | Gross Yield | Cap Rate | Property Tax |

|---|---|---|---|---|---|---|---|---|---|---|

| Detroit | Michigan | -1.51% | $76,088 | 890 | $151.55 | 50% | $15,248 | 20.04% | 12.02% | 1.73% |

| Cleveland | Ohio | -0.88% | $111,728 | 1,732 | $115.62 | 54% | $12,574 | 11.25% | 6.75% | 2.18% |

| Memphis | Tennessee | -1.41% | $143,240 | 1,225 | $147.03 | 51% | $14,301 | 9.98% | 5.99% | 1.12% |

| Birmingham | Alabama | -2.59% | $132,690 | 615 | $153.52 | 48% | $12,622 | 9.51% | 5.71% | 0.61% |

| Saint Louis | Missouri | +1.10% | $181,509 | 1,796 | $129.13 | 63% | $15,033 | 8.28% | 4.97% | 1.08% |

| Baltimore | Maryland | +0.60% | $186,187 | 305 | $120.11 | 60% | $15,146 | 8.13% | 4.88% | 1.51% |

| Chicago | Illinois | +1.78% | $308,252 | 4,975 | $183.26 | 57% | $19,114 | 6.20% | 3.72% | 2.02% |

| Columbus | Ohio | +0.49% | $242,640 | 1,755 | $134.03 | 54% | $15,033 | 6.20% | 3.72% | 1.64% |

Source: Chalet, January 2026

Why This Market List Helps (And What It Won't Tell You)

People searching for the best big city Airbnb markets typically want to:

-

Avoid overpaying in markets where returns are compressed

-

Find places with steady demand that support year-round rentals

-

Screen out cities where taxes or competition crush margins

-

Move faster from market research to making actual offers

This list handles the first job well: it shrinks your universe.

But it doesn't answer the hardest question: "Will this specific address cash flow, legally, with my financing, after real expenses?" That requires address-level underwriting.

The right mental model:

Use gross yield to shortlist markets. Use cap rate to sanity-check expense drag. Then go deal-by-deal with an address calculator and local execution (agent, lender, insurance, ops).

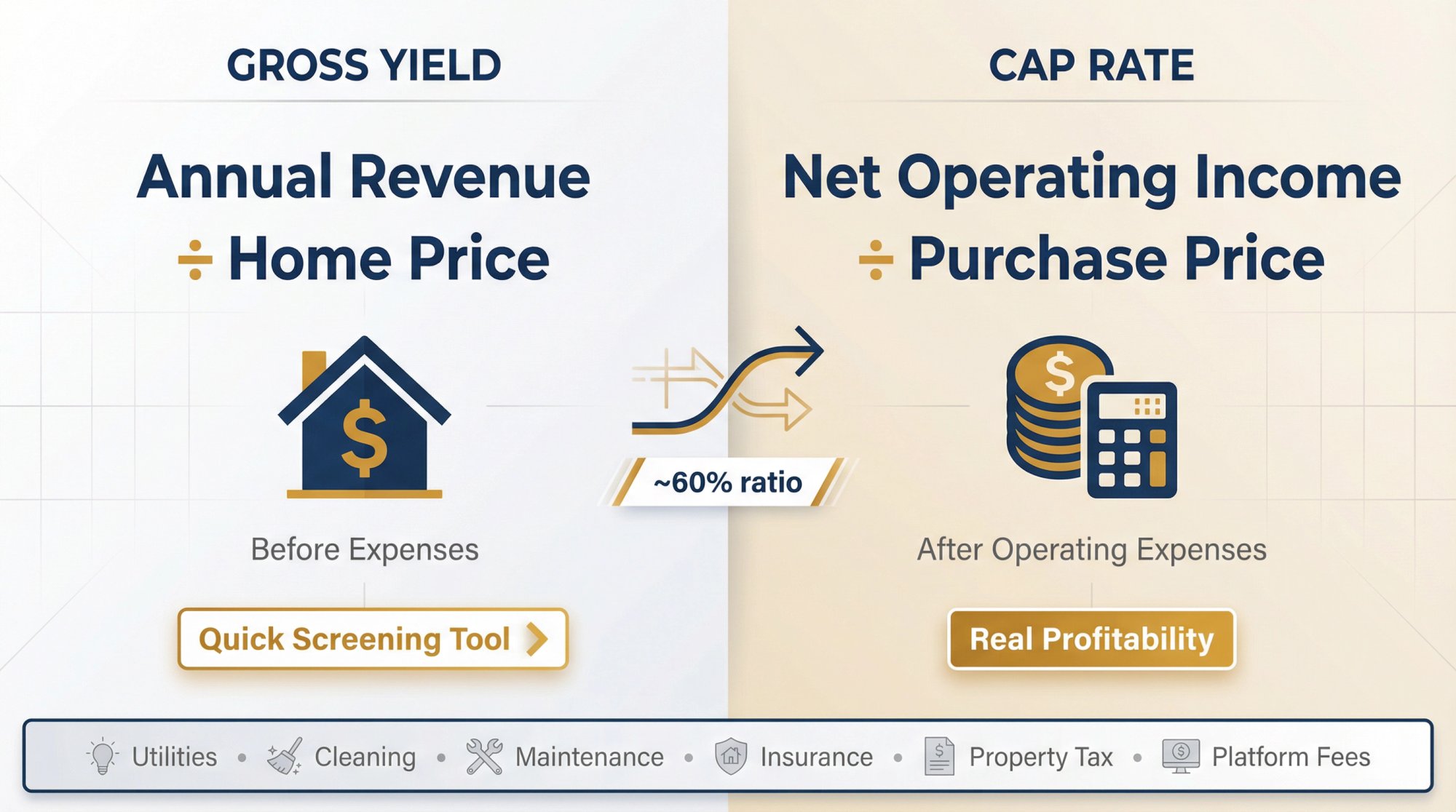

What Is Gross Yield and How Does It Work?

Gross yield is straightforward math:

Gross Yield = Annual Revenue / Home Price

It's called "gross" because it doesn't account for operating expenses: utilities, cleaning, supplies, maintenance, insurance, property tax, platform fees, repairs, capex, or compliance costs. It also ignores your mortgage payment entirely.

So why use it? Because it answers the most common early-stage investor question:

"If I spend roughly $X to buy in this city, how much gross revenue does the average listing generate?"

That's the fastest way to spot markets where purchase prices are low relative to revenue potential.

Why Cap Rate Matters for Real Profitability

Cap rate gets closer to actual performance:

Cap Rate = Net Operating Income (NOI) / Purchase Price

NOI is income after operating expenses but before mortgage payments. Markets with high cap rates aren't perfect either (expenses vary wildly by property type and how you operate), but cap rate is a better "profit-adjacent" signal than gross yield alone.

Pattern worth noting: In this dataset, cap rate runs at roughly 60% of gross yield across every market. That suggests consistent expense assumptions in the model. You'll still want to confirm the exact methodology inside each market dashboard before you underwrite any deal.

Gross Yield Comparison: All 8 Markets Ranked

Here's what the numbers look like when you line them up:

| Market | Gross Yield |

|---|---|

| Detroit | 20.04% |

| Cleveland | 11.25% |

| Memphis | 9.98% |

| Birmingham | 9.51% |

| Saint Louis | 8.28% |

| Baltimore | 8.13% |

| Chicago | 6.20% |

| Columbus | 6.20% |

The "why" is obvious: Detroit's average home price is dramatically lower than everywhere else on this list, while annual revenue stays competitive with several other markets. Mathematically, that explodes gross yield.

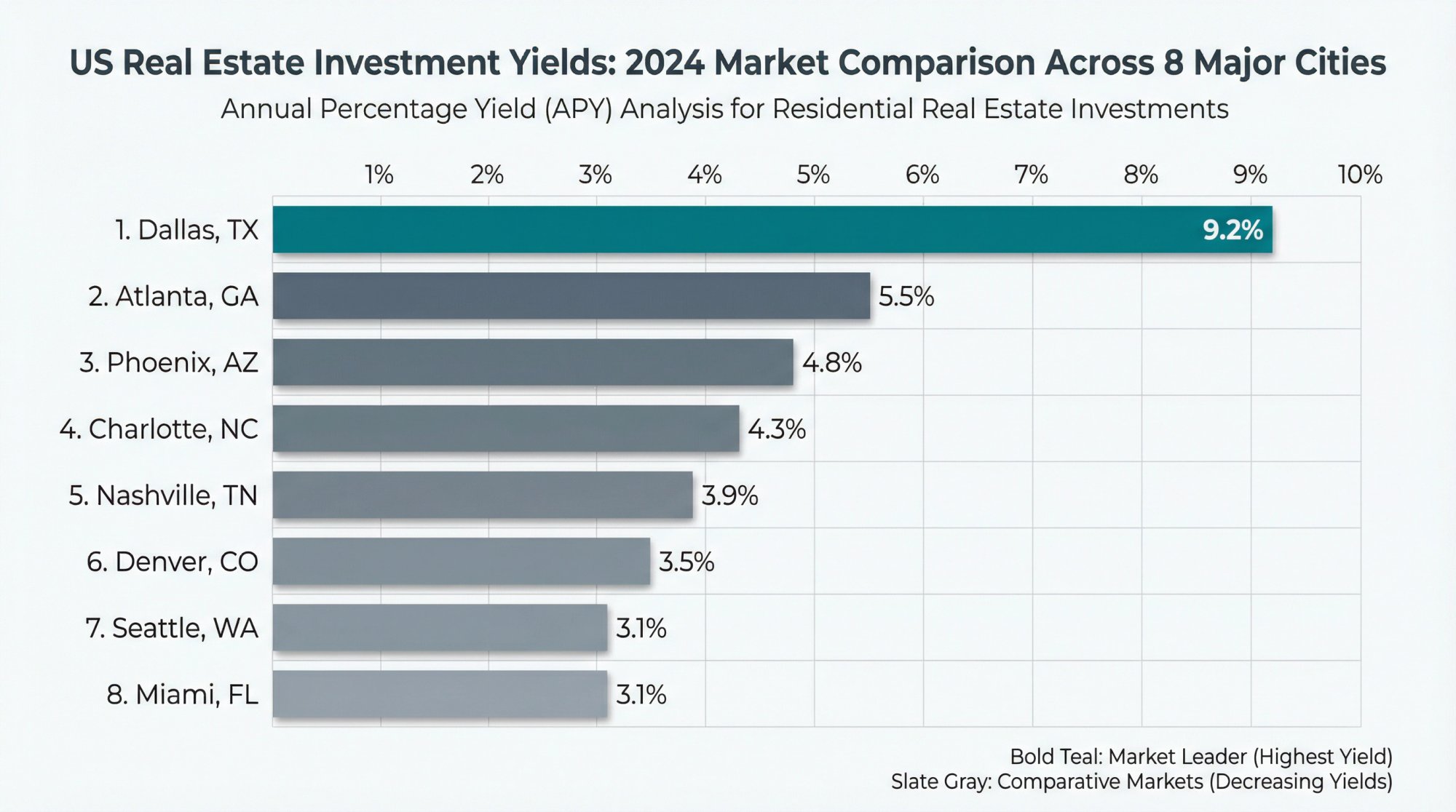

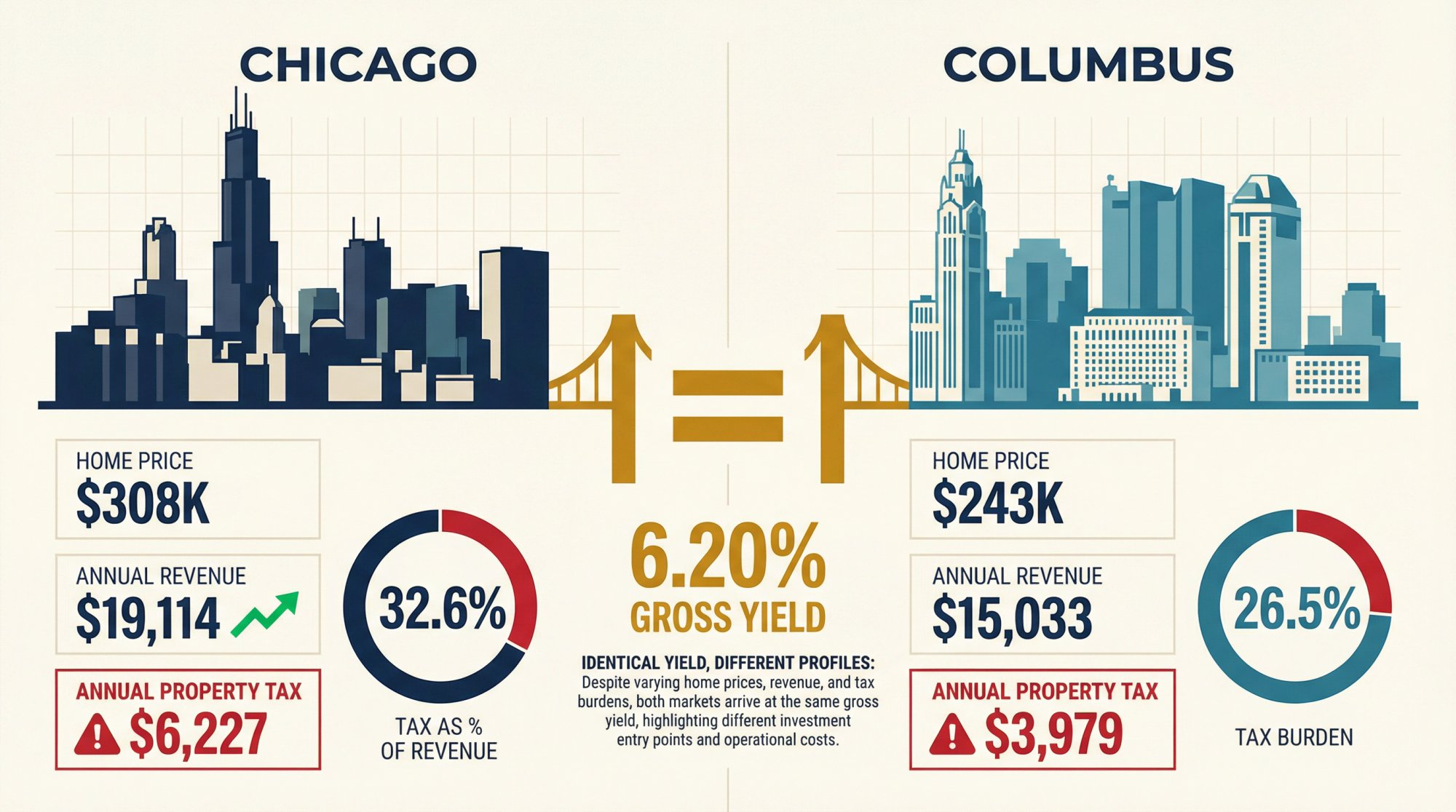

Property Tax Impact on Airbnb Returns (2026)

Property taxes aren't your only cost, but they're a clean, recurring line item that too many investors gloss over. In big cities, tax rates can be chunky enough to flip a deal from "works" to "doesn't work."

Markets with low property tax tend to offer stronger net returns, all else being equal. Here's a useful lens: estimated annual property tax as a share of annual revenue.

| Market | Annual Revenue | Est. Annual Tax | Tax as % of Revenue |

|---|---|---|---|

| Chicago | $19,114 | $6,227 | 32.6% |

| Columbus | $15,033 | $3,979 | 26.5% |

| Cleveland | $12,574 | $2,436 | 19.4% |

| Baltimore | $15,146 | $2,811 | 18.6% |

| Saint Louis | $15,033 | $1,960 | 13.0% |

| Memphis | $14,301 | $1,604 | 11.2% |

| Detroit | $15,248 | $1,316 | 8.6% |

| Birmingham | $12,622 | $809 | 6.4% |

Source: Chalet, January 2026

How to use this: When comparing two markets with similar revenue, taxes can quietly flip the winner. This is especially true once you layer in insurance, utilities, and maintenance. Taxes also affect DSCR underwriting because they reduce your net operating income.

Market-by-Market Breakdown

Each market below includes key metrics, what those numbers typically mean for investor decisions, and your next action.

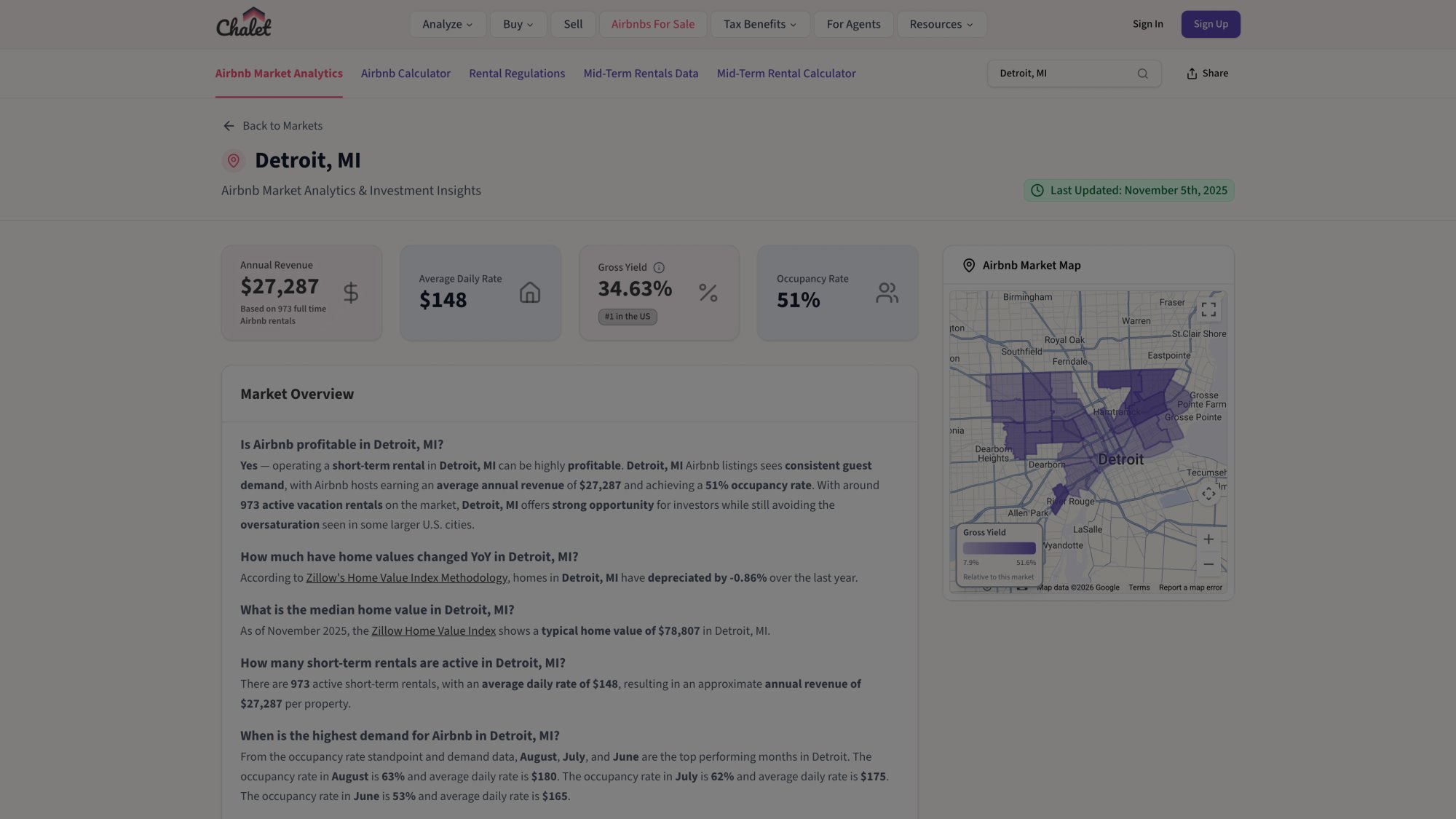

1. Detroit, MI: Highest Gross Yield for Airbnb Investors

Detroit is a classic "price-to-revenue" outlier. When your buy-in hovers around $76k and gross revenue hits $15k, gross yield spikes. The trade-off? You need to underwrite carefully at the property level.

| Metric | Value | Context |

|---|---|---|

| Average home price | $76,088 | Lowest on this list |

| Annual revenue | $15,248 | Competitive with higher-priced markets |

| Gross yield | 20.04% | Rank #1 |

| Cap rate | 12.02% | Rank #1 |

| ADR | $151.55 | Solid nightly rate |

| Occupancy | 50% | Room to optimize |

| Active listings | 890 | Moderate competition |

| Property tax rate | 1.73% | Mid-range |

Small operational mistakes matter less when prices are low, but maintenance, compliance, and neighborhood-specific demand swings can matter more. Don't assume the "average" listing represents your listing.

Before making offers: Check the Detroit rental regulations.

→ Your move: Open the Detroit dashboard and focus on revenue distribution (not just the average), listing density by neighborhood, and your expense assumptions before touching financing. Then run a specific address through Chalet's calculator. For deeper neighborhood analysis, see our guide on the best places to invest in Detroit short-term rentals.

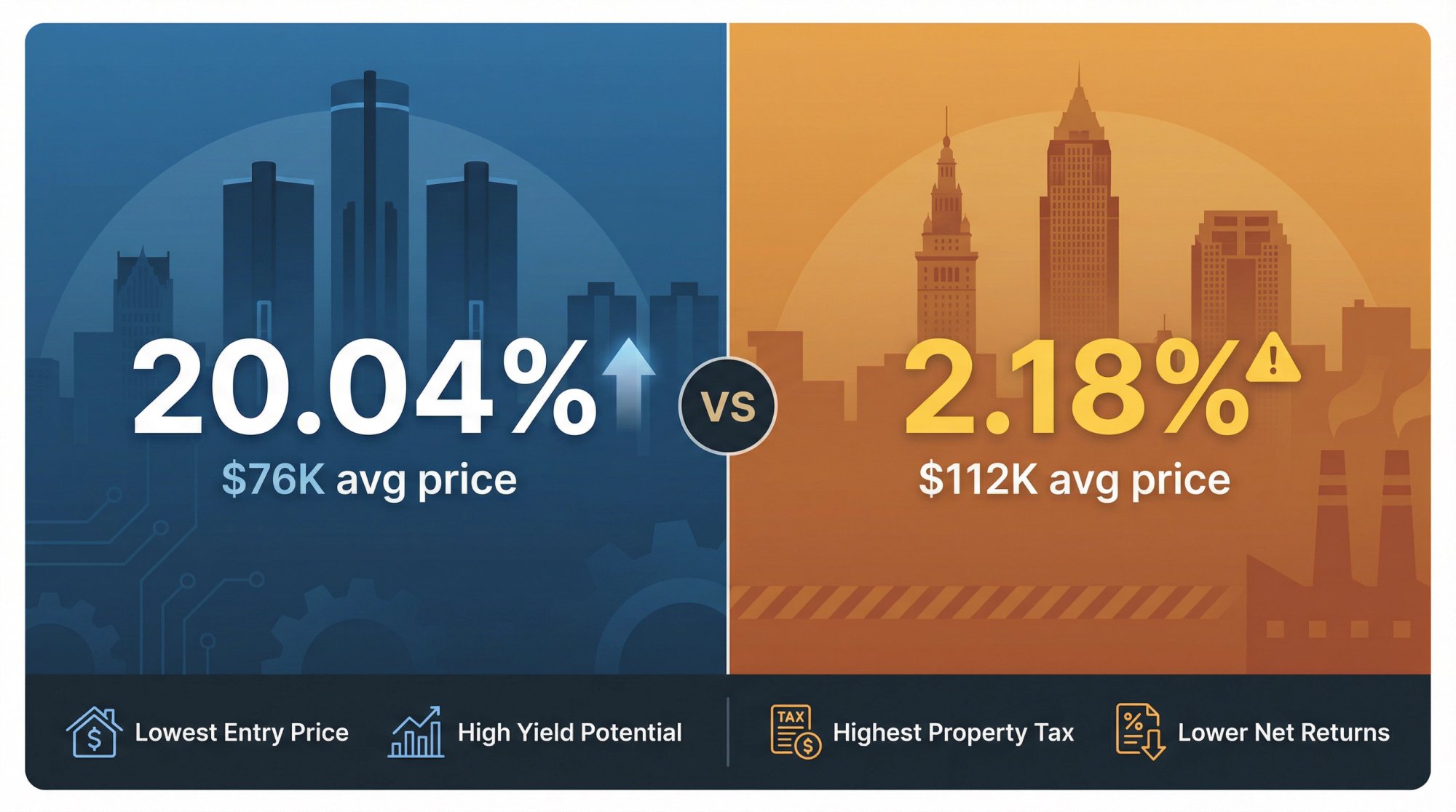

2. Cleveland, OH: High Property Tax Market for STR Investors

Cleveland's yield is driven by relatively low home prices. But there's a catch.

Tax warning: Cleveland has the highest property tax rate (2.18%) on this list. For DSCR buyers, taxes can be the difference between "passes" and "fails" once you add insurance and utilities.

The numbers:

-

Home price: $111,728

-

Revenue: $12,574 annually

-

Gross yield: 11.25%

-

Cap rate: 6.75%

-

Occupancy: 54%

-

Active listings: 1,732

The lower ADR ($115.62) combined with high taxes means you need a conservative expense model and strong comps. Review the Cleveland rental regulations to understand permit requirements before making offers.

→ Your move: Treat Cleveland as "high tax, lower ADR." Check the Cleveland dashboard, then use the ROI calculator to stress-test your numbers. For neighborhood-level insights, see best places to invest in Cleveland short-term rentals.

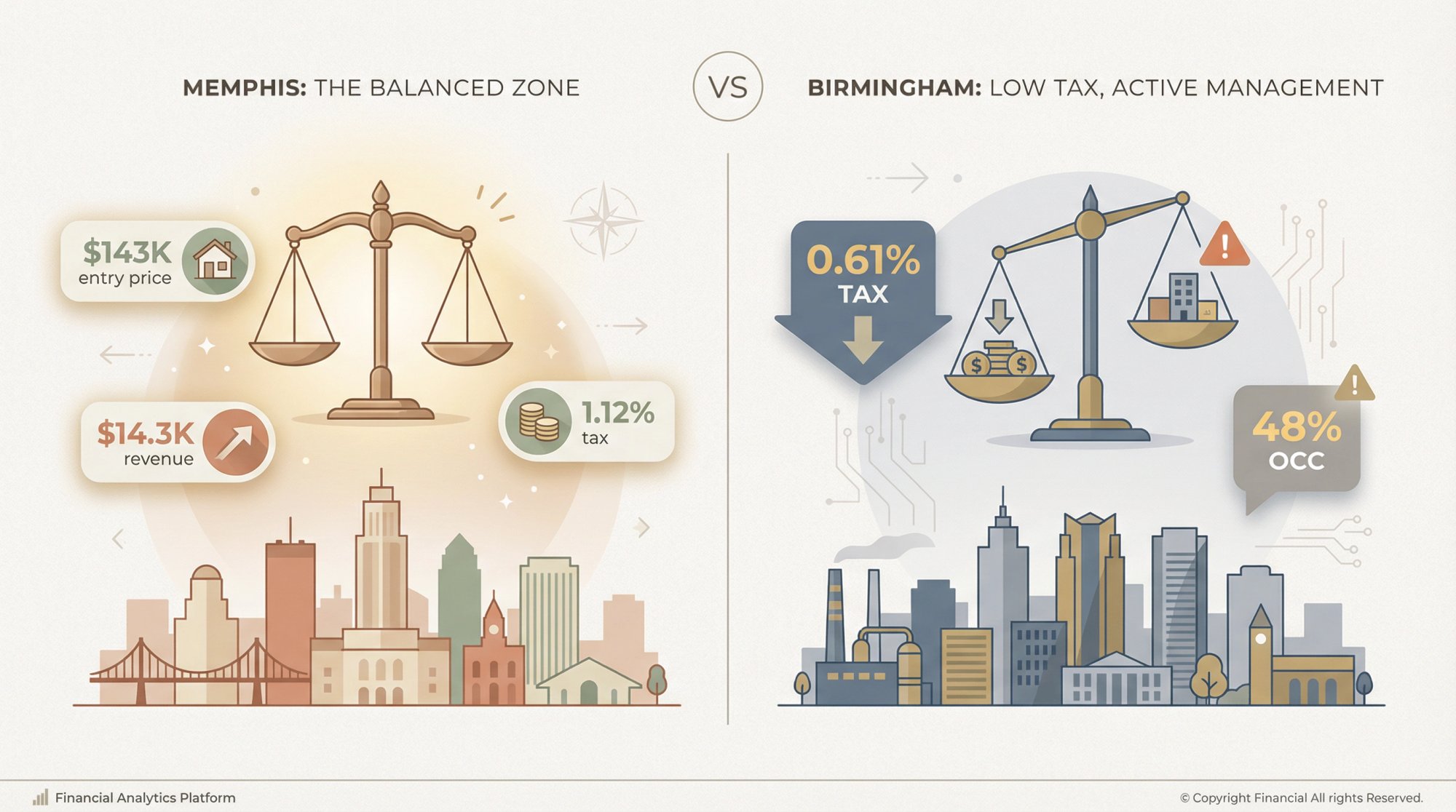

3. Memphis, TN: Balanced Airbnb Investment Market

Memphis sits in what you might call the balanced zone: home prices are meaningfully higher than Detroit or Cleveland, but revenue is also higher, and taxes are moderate.

Three things define this market:

① Mid-priced entry ($143,240 average)

② Solid revenue ($14,301 annually, with $147.03 ADR)

③ Reasonable tax burden (1.12%)

Gross yield lands at 9.98% with a 5.99% cap rate. Not the highest, not the lowest. If you're looking for a market where micro-location and property type selection often make or break the deal, this is it.

Check the Memphis rental regulations for permit and licensing requirements.

→ Your move: Use the Memphis dashboard to identify what "average" really means (top quartile vs. median), then underwrite 3-5 specific addresses. For more on Tennessee markets, see our best Airbnb markets in Tennessee guide. Also check out best places to invest in Memphis short-term rentals.

4. Birmingham, AL: Lowest Property Tax Short-Term Rental Market

Birmingham has two standout characteristics that pull in opposite directions:

The good: Property tax rate of just 0.61% (lowest on this list). Combined with a solid ADR of $153.52, this keeps more revenue in your pocket.

The challenge: Occupancy sits at 48% (lowest on this list). Your strategy (property type, minimum stays, pricing, marketing) has to do more of the heavy lifting here.

| What you get | What you trade |

|---|---|

| $132,690 avg home price | 48% occupancy |

| 9.51% gross yield | Only 615 active listings (fewer comps) |

| 0.61% property tax | Demand requires more active management |

| $153.52 ADR | Lower annual revenue ($12,622) |

Review Birmingham rental regulations before proceeding with any deals.

→ Your move: Sanity-check seasonality and see if revenue concentrates in specific pockets using the Birmingham dashboard. Connect with a local Birmingham real estate agent who understands STR dynamics.

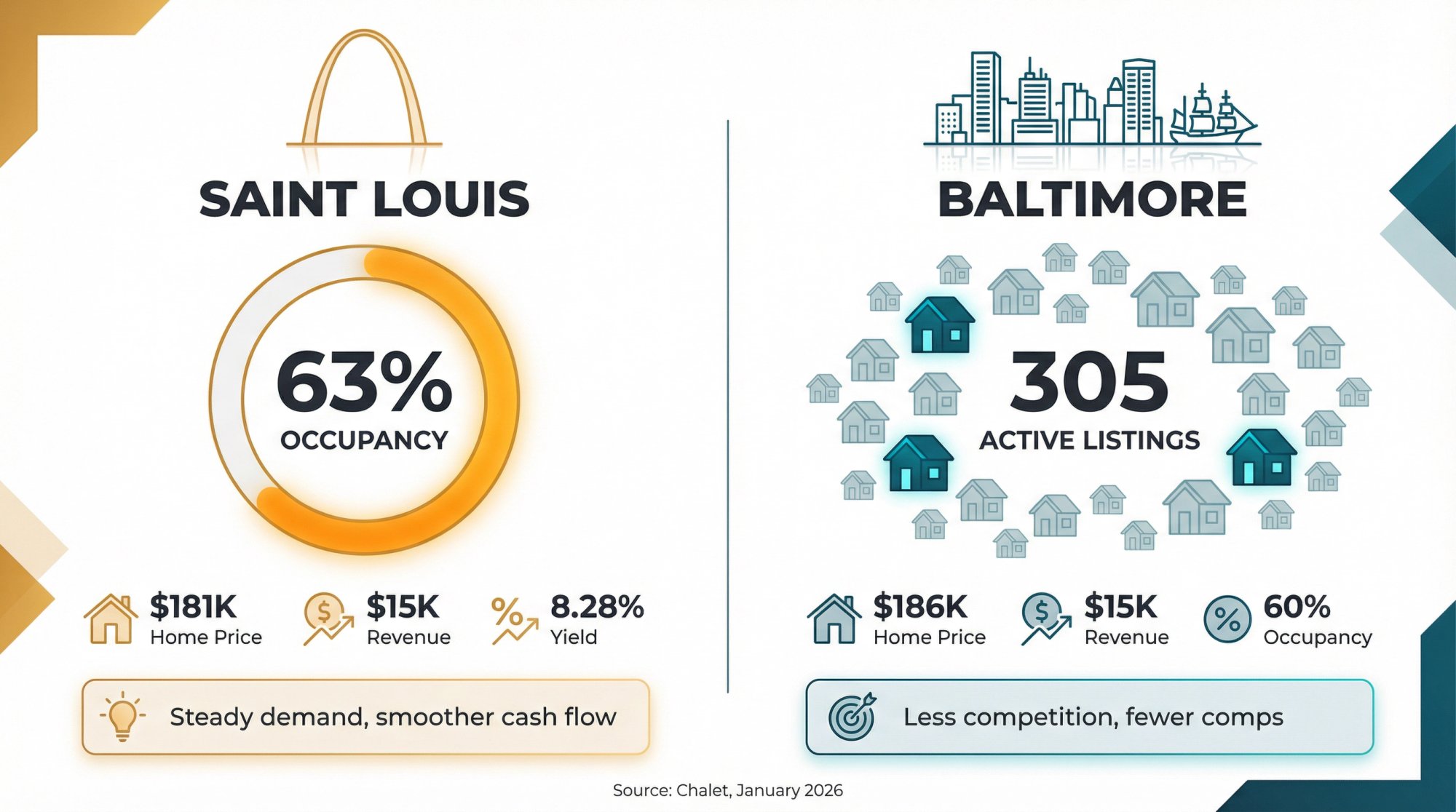

5. Saint Louis, MO: Highest Occupancy Airbnb Market

Saint Louis stands out on occupancy, not ADR.

The headline number: 63% occupancy (highest on this list)

In plain English: demand looks steadier relative to the price point. That can be attractive if you value smoother cash flow and less dependence on peak-night pricing games.

-

Home price: $181,509

-

Annual revenue: $15,033

-

Gross yield: 8.28%

-

Cap rate: 4.97%

-

ADR: $129.13

-

Property tax: 1.08%

-

Active listings: 1,796

Check the Saint Louis rental regulations to understand local requirements.

If you hate volatility, start here. Validate whether the neighborhoods you can actually buy in match the occupancy profile driving the average.

→ Your move: Explore the Saint Louis dashboard. For agent support, connect with a Saint Louis real estate agent.

6. Baltimore, MD: Low Competition Airbnb Market

Baltimore pairs solid occupancy (60%) with the lowest active listing count on this list: just 305.

What does that mean for you?

Potential upside: Less direct competition in the market.

Potential risk: Fewer comps when underwriting, and potentially less room for error if regulations or neighborhood rules are strict.

| Metric | Value |

|---|---|

| Home price | $186,187 |

| Revenue | $15,146 |

| Gross yield | 8.13% |

| Cap rate | 4.88% |

| ADR | $120.11 |

| Occupancy | 60% |

| Property tax | 1.51% |

This is a market where you want a strong local agent who knows what's actually operable.

→ Your move: Start with an agent intro through Chalet's Baltimore page, then go address-level. You can also explore other markets at Chalet's analytics hub.

7. Chicago, IL: Highest Revenue Airbnb Market (Most Competition)

Chicago is a "premium revenue" market. The average listing makes $19,114 annually (highest on this list). But that comes with trade-offs you can't ignore.

What makes Chicago expensive:

-

Highest average home price: $308,252

-

Highest property tax in dollar terms: $6,227/year (32.6% of revenue)

-

Most competition: 4,975 active listings

-

Complex regulations

| The upside | The reality check |

|---|---|

| $19,114 annual revenue | $308k+ buy-in |

| $183.26 ADR (highest) | Taxes eat 1/3 of gross revenue |

| 57% occupancy | Nearly 5,000 competitors |

Chicago can still work. But it tends to reward investors who can buy right (not just buy) and operate efficiently in competitive markets. Review the Chicago rental regulations carefully, as they're among the more complex in the Midwest.

→ Your move: If you're set on Chicago, don't stop at averages. Focus on revenue distribution, the property tax line item, realistic expense assumptions, and your financing terms. Use the Chicago dashboard and then run addresses through the calculator. Connect with a Chicago real estate agent who specializes in STR properties.

8. Columbus, OH: Mid-Yield Market with High Property Taxes

Columbus matches Chicago's yield (6.20%) and cap rate (3.72%) in this dataset, but with a lower home price and lower revenue. The headline here? Taxes.

-

Home price: $242,640

-

Revenue: $15,033

-

Est. annual property tax: $3,979 (26.5% of revenue)

-

ADR: $134.03

-

Occupancy: 54%

-

Active listings: 1,755

Nearly $4k/year in property taxes on the average home price. That's not fatal, but it's not background noise either.

Review Columbus rental regulations to understand permit requirements.

→ Your move: Treat Columbus as "middle yield, meaningful tax." Underwrite your insurance and utilities carefully, and don't rely on best-case occupancy. See the Columbus dashboard. Connect with a Columbus real estate agent for local market expertise.

How to Choose the Right Airbnb Market for Your Situation

First-Time Airbnb Buyer: How to Pick Your First Market

Your goal isn't the highest yield on paper. Your goal is the highest chance of a clean first win.

Use this filter:

-

Can I operate legally? Check rules, permits, HOA restrictions using Chalet's rental regulations database.

-

Can I get financing that fits the deal? Conventional vs. DSCR loans, down payment, reserves.

-

Does the deal still work after boring expenses? Taxes, insurance, utilities, maintenance, management.

-

Is execution simple enough that I won't mess it up? Property type, cleaning logistics, guest demand consistency.

From the data above, a beginner-friendly shortlist often starts with markets where the math isn't razor-thin. That usually means higher yield and/or higher occupancy. On this list, that points toward Detroit, Cleveland, Memphis, Birmingham, Saint Louis. Then you narrow by legal feasibility and property-level reality.

Your workflow:

Explore markets at Chalet's analytics hub

Run deals through the ROI calculator

Connect with an Airbnb-friendly agent via Chalet's agent network

1031 Exchange Investors: Best Markets for Fast Execution

Your enemy is time. You need a process that creates options fast.

What matters most:

-

Markets where you can quickly get comps and identify properties

-

Predictable underwriting (taxes and expenses don't surprise you late)

-

A local team that can execute in days, not weeks (agent, lender, insurance, PM)

The 1031 exchange timeline is unforgiving: 45 days to identify, 180 days to close. Each of the markets on this list has dedicated 1031 exchange resources:

Use the dataset like this:

-

Start with 3 markets, not 1. You need backups.

-

Focus on markets where the numbers don't require perfection to work.

-

Immediately build your team in each market. Chalet exists for exactly this coordination.

Your workflow:

Find listings at Airbnbs for Sale

Meet an agent through Chalet's agent network

Build your ops stack via the STR directory

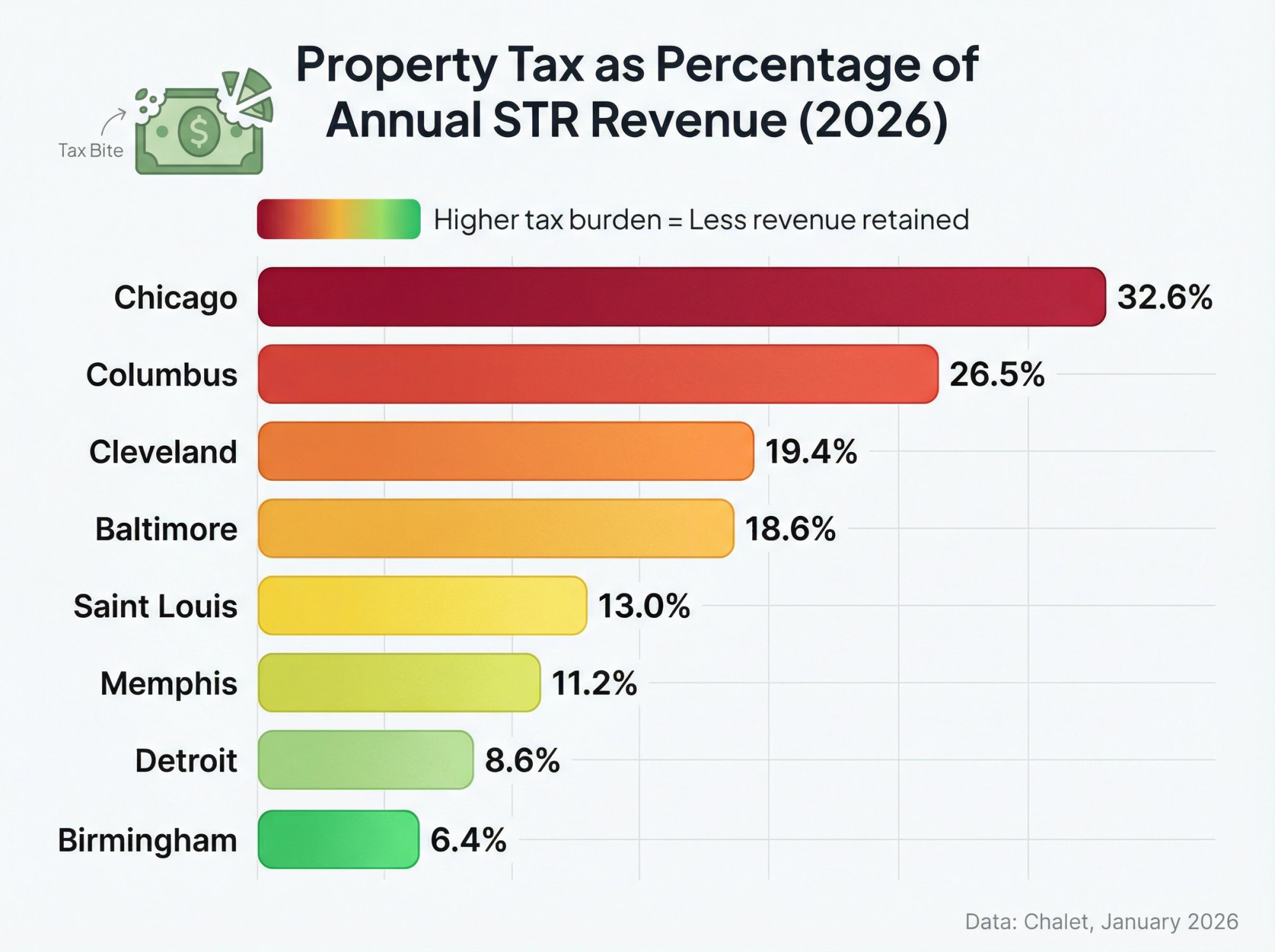

Portfolio Builders: Scaling Airbnb Investments Across Markets

You already know the basics. Your edge comes from repeatable selection and operations.

Use this list to pick what you're optimizing for:

| Optimization Goal | Market Leader |

|---|---|

| Highest yield on purchase price | Detroit (20.04% gross yield) |

| Highest annual revenue | Chicago ($19,114) |

| Smoothest demand signal | Saint Louis (63% occupancy) |

| Lowest direct competition | Baltimore (305 listings) |

Your real edge isn't "best city." It's best neighborhood + best property type + best ops playbook. For broader regional analysis, check out best markets to invest in the Midwestern US.

→ Next step: Standardize your underwriting at Chalet's calculator and compare deals across markets apples-to-apples. Consider cost segregation to accelerate depreciation benefits across your portfolio.

Step-by-Step: From Market Research to Closing on Your Airbnb

Here's how to turn a list like this into a real purchase without getting lost.

Step 1: Pick 3-5 markets from the table

Start with yield, occupancy, and taxes as your first screen.

Step 2: Open each market dashboard and define your buy box

Target property type, price ceiling, and minimum revenue needed. Use Chalet's market dashboards.

Step 3: Pull 10 addresses per market

Don't fall in love with one listing. Create options.

Step 4: Run every address through the same underwriting

Do this with the Chalet calculator. Keep assumptions consistent: management, utilities, maintenance, reserves.

Step 5: Pressure test taxes and insurance early

Taxes are in the table above. Insurance varies property-to-property. Don't wait until you're under contract to find out the numbers are ugly.

Step 6: Build the execution stack before you're in escrow

Agent, lender, insurance, manager, cleaning, furnishing. Start with Chalet's agent network and the STR directory.

How Chalet Helps You Execute

Chalet is a one-stop platform for short-term rental investors. We pair free market analytics with a vetted vendor network so you can research, buy, and operate in one place.

What you get:

-

Free market dashboards: ADR, occupancy, revenue trends, and yield metrics for cities across the U.S.

-

ROI and DSCR calculators: Underwrite specific addresses before you make an offer.

-

Vetted vendor network: STR-specialist real estate agents, lenders, insurance providers, property managers, cleaners, furnishing pros, cost segregation specialists, and CPAs.

-

1031 coordination: Exchange-savvy agents and lenders who understand tight timelines.

Whether you're a first-time buyer trying to get your numbers right or a 1031 exchanger racing a deadline, Chalet helps you move from research to real-world action without the hand-off chaos.

Frequently Asked Questions

What's the best city for Airbnb investment in 2026?

Based on gross yield (revenue relative to purchase price), Detroit leads this list at 20.04%. But "best" depends on your goals. If you're focused on occupancy stability, Saint Louis tops the list at 63%. If you want the highest raw revenue, Chicago leads at $19,114 annually. The right market depends on your risk tolerance, financing, and operational capacity.

Why is gross yield important for Airbnb investors?

Gross yield shows how much gross revenue you generate per dollar spent on the property. It's a quick screening tool to compare markets, but it doesn't account for expenses like taxes, insurance, maintenance, or management. Always pair gross yield with cap rate analysis and address-level underwriting.

How do property taxes affect short-term rental returns?

Property taxes reduce your net operating income, which directly impacts cap rate and cash flow. In some markets (like Chicago), taxes can eat over 30% of annual revenue. In others (like Birmingham), taxes take less than 7%. These differences compound over time and can flip a deal from profitable to marginal. See our guide on markets with low property tax.

Is Detroit really a good Airbnb market?

Detroit offers exceptional gross yield because home prices are dramatically lower than other big cities while revenue stays competitive. The trade-off is that you need to underwrite carefully at the property level. Neighborhood-specific demand, maintenance costs, and compliance requirements can vary significantly. For more details, see best places to invest in Detroit short-term rentals.

What's the difference between gross yield and cap rate?

Gross yield is annual revenue divided by home price (before expenses). Cap rate is net operating income (after expenses, before mortgage) divided by purchase price. Cap rate is a more realistic profitability signal, but both are simplified metrics. Real underwriting requires address-specific expense modeling using tools like Chalet's calculator.

Which markets are best for 1031 exchange buyers?

1031 exchange buyers need speed and predictability. Markets with cleaner underwriting (lower tax complexity, straightforward regulations) and available inventory work well. From this list, markets like Memphis, Saint Louis, and Birmingham offer solid yields without the complexity of higher-tax metros like Chicago or Cleveland. Learn about the 1031 exchange timeline to plan your execution.

How many listings are in each market?

Active listing counts vary widely. Baltimore has the fewest (305), which can mean less competition but also fewer comps. Chicago has the most (4,975), which means more competition but also more data to work with. Listing count alone doesn't determine market quality, but it affects how you underwrite and operate.

What occupancy rate should I expect?

Occupancy varies by market and property. Saint Louis leads this list at 63%. Most other markets range from 48% (Birmingham) to 60% (Baltimore). Your actual occupancy depends on property type, pricing strategy, minimum stays, and how well you optimize listings.

How do I get started with short-term rental investing?

Start by narrowing your market list using gross yield and occupancy. Then explore specific market dashboards at Chalet, run addresses through the ROI calculator, and connect with an STR-focused agent via Chalet's network. Build your team (lender, insurance, manager) before you're under contract. Explore the STR directory for vetted vendors.