Buying your first (or next) Airbnb rental feels like a simple fork in the road: stay in your state or go out of state.

But that framing hides the real decision.

"In-state" can still mean 9 hours away. "Out-of-state" can mean a 45-minute drive across a border. So the question isn't really about state lines at all.

The real question is: How far away will this property be from you, and how will you operate it?

This guide gives you a decision framework you can actually use, plus the cost math, regulation traps, financing realities, and execution checklists. It's written for people who want to buy a property that runs like a business, not a hobby.

We'll use the terms short-term rental and STR interchangeably throughout because investors use all three (Airbnb rental, short-term rental, STR) to mean the same thing.

Who Should Buy an Airbnb Rental in 2026

First-time buyers who want the simplest path to a stable first Airbnb rental investment

1031 exchange investors who need speed and clean compliance under tight deadlines

Portfolio builders who want to diversify markets without losing operational control

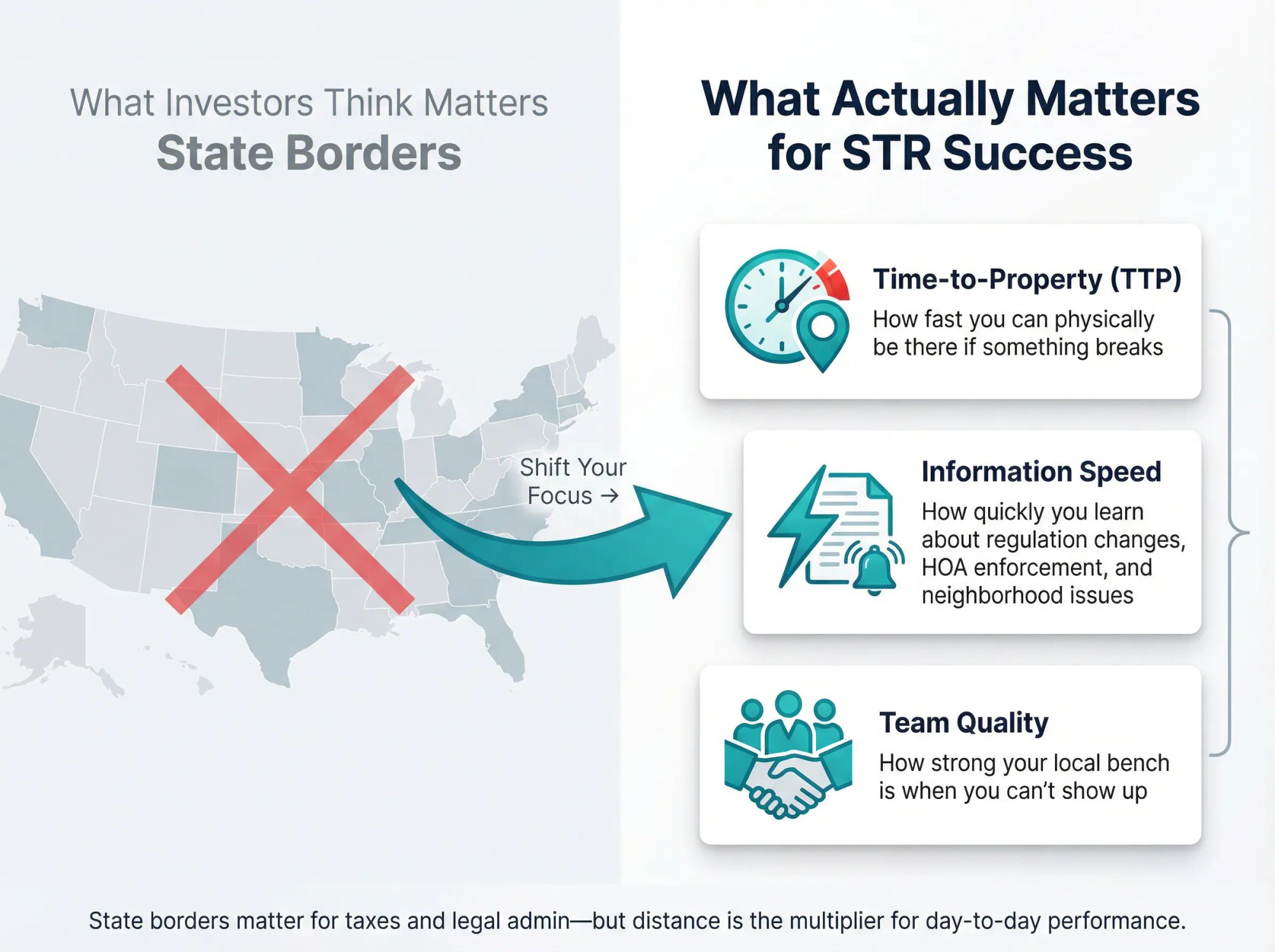

Why State Lines Don't Matter (Distance and Control Do)

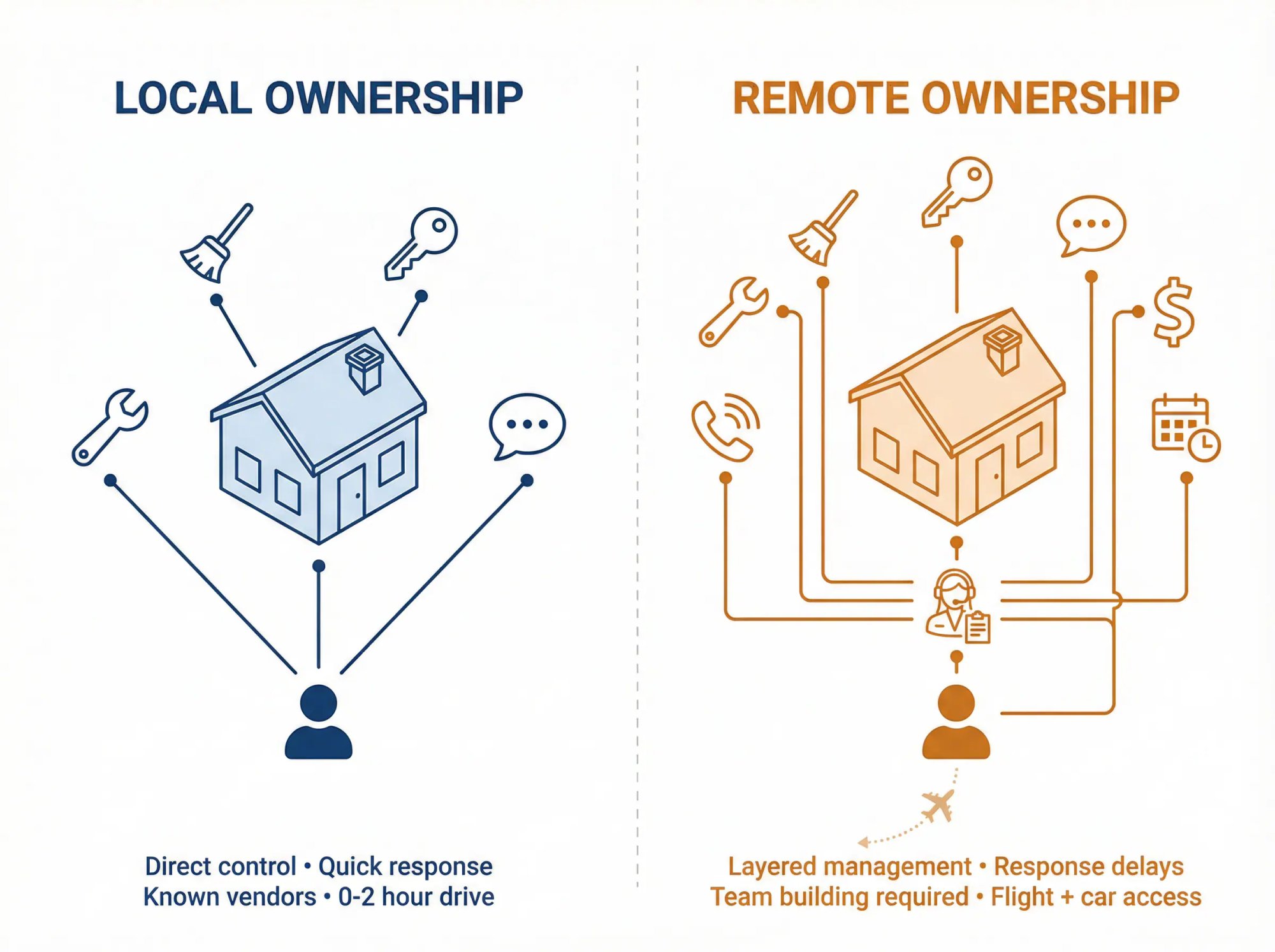

"In-state vs out-of-state" is a proxy for three things:

-

Time-to-property (TTP): how fast you can physically be there if something breaks

-

Information speed: how quickly you learn about regulation changes, HOA enforcement, and neighborhood issues

-

Team quality: how strong your local bench is when you can't show up

State borders matter for taxes and some legal admin. But for day-to-day Airbnb rental performance, distance is the multiplier.

How to Think About Operating Zones (Not Just Geography)

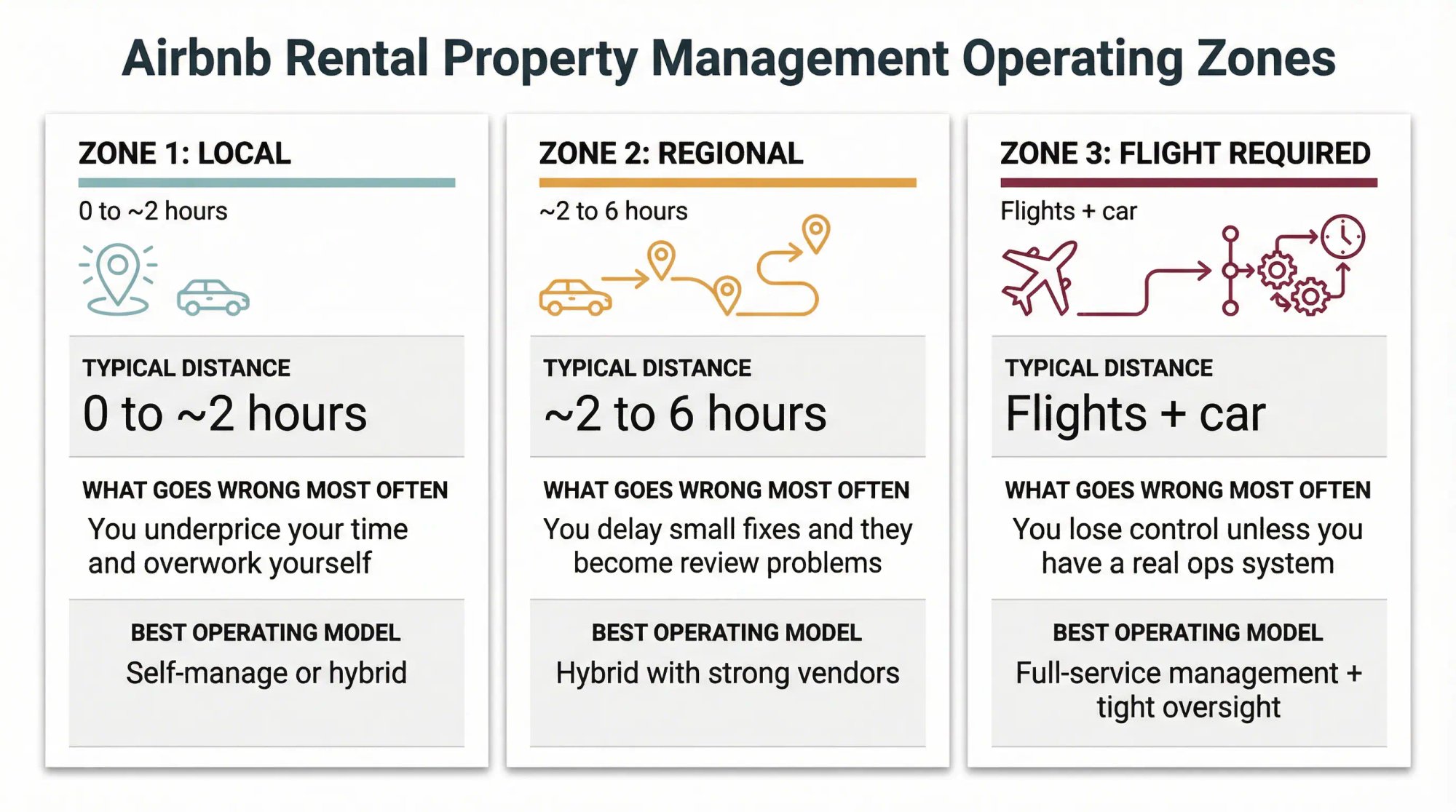

Think in "operating zones," not state lines:

| Zone | Typical Distance | What Goes Wrong Most Often | Best Operating Model |

|---|---|---|---|

| Zone 1: Local | 0 to ~2 hours | You underprice your time and overwork yourself | Self-manage or hybrid |

| Zone 2: Regional | ~2 to 6 hours | You delay small fixes and they become review problems | Hybrid with strong vendors |

| Zone 3: Flight required | Flights + car | You lose control unless you have a real ops system | Full-service management + tight oversight |

Rule of thumb: If it's Zone 3, plan like you'll never be there. If your model collapses without visits, it's not a Zone 3 model.

Should You Buy an Airbnb in Your State? Quick Decision Guide

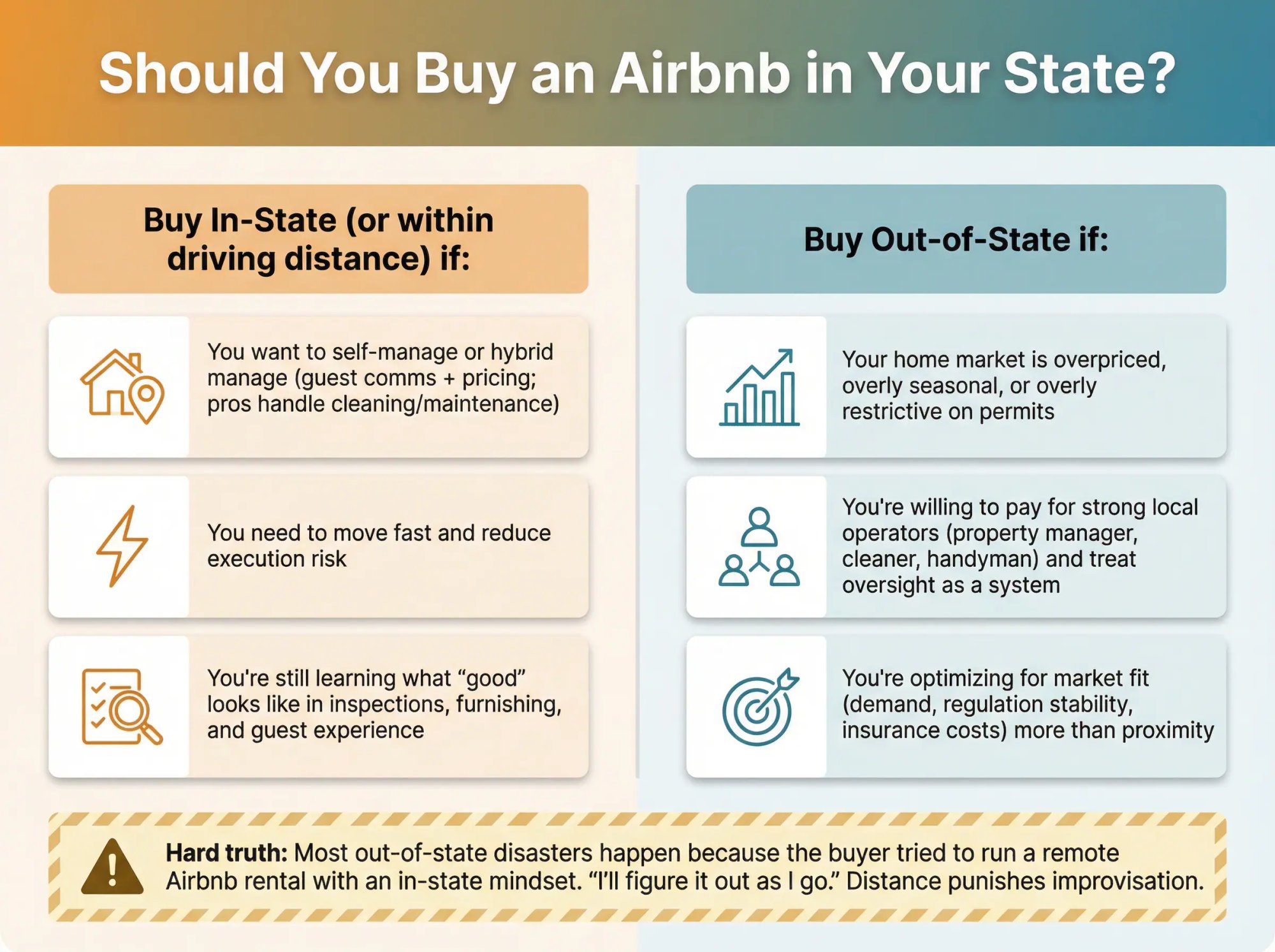

Buy in-state (or within driving distance) if:

• You want to self-manage or "hybrid manage" (you handle guest comms and pricing; pros handle cleaning and maintenance)

• You need to move fast and reduce execution risk

• You're still learning what "good" looks like in inspections, furnishing, and guest experience

Buy out-of-state if:

• Your home market is overpriced, overly seasonal, or overly restrictive on permits

• You're willing to pay for strong local operators (property manager, cleaner, handyman) and treat oversight as a system

• You're optimizing for market fit (demand, regulation stability, insurance costs) more than proximity

Hard truth: Most out-of-state disasters happen because the buyer tried to run a remote Airbnb rental with an in-state mindset. "I'll figure it out as I go." Distance punishes improvisation.

Benefits of Buying an Airbnb in Your Home State

Sticking to your local market (within your state) is a common starting point for first-time Airbnb investors. There are clear advantages to buying a property in your own backyard.

Why Local Knowledge Gives You an Edge

You know your area's neighborhoods and tourism draw better than anyone. Research shows that investing in your "backyard" means you have better knowledge of the streets, you're physically there to see what's happening in the market, and you probably have more contacts (vendors, agents) to lean on.

This local insight helps you pick the right neighborhood and set the right rates. It's also easier to personally check on the property, handle guest needs, or perform maintenance when the rental is a short drive away.

How Self-Management Works Better Locally

Managing a short-term rental is simpler when you're nearby. If a pipe leaks or a guest gets locked out at 10 pm, you (or someone you trust) can respond quickly.

You can personally ensure the property is clean and maintained, giving many owners peace of mind. You'll also already be familiar with your state's landlord/tenant laws and taxes, which means fewer new rules to learn compared to managing a property across state lines.

How Your Network Saves Time and Money

Keeping your investment in-state means you likely have an existing network. You may know reliable local contractors, cleaners, handypeople, or even friendly neighbors who can help.

You're also more likely to find a real estate agent or lender you've worked with before. This saves time vetting completely new people. Your local vendors will have context about the area (seasonal challenges, local guest expectations) that out-of-town professionals might not.

When Staying In-State Doesn't Make Sense

Buying an Airbnb in your state isn't always the best choice if your area isn't ideal for short-term rentals.

What to Do When Your Market Has Low Demand

Not every hometown is a vacation hotspot. If your current city or state isn't a popular destination or has low travel demand, an Airbnb there may struggle to get bookings.

Some local markets simply don't offer high returns. For example, investors living in high-cost states like California or New York might struggle to break even on a rental property without looking elsewhere.

If home prices and taxes are steep but vacation rental rates are moderate, the math might not work out. In that case, staying local could mean tying up your money in a low-ROI deal when a better opportunity exists elsewhere. Compare markets to find stronger opportunities.

How Local Regulations Can Kill Your Returns

Local laws can make or break an STR business. It's possible that short-term rentals in your city are outright illegal or heavily regulated.

Many areas (especially big cities or tourist towns) have imposed permit requirements, night limits, extra taxes, or even bans on non-owner-occupied Airbnbs. Operating under such rules could cap your income or add hassle.

If your own state or municipality has restrictive STR regulations (for example, allowing rentals for only part of the year or requiring the host to live on-site), that's a big mark against investing locally. Another state might have a friendlier legal environment (or none of those constraints at all).

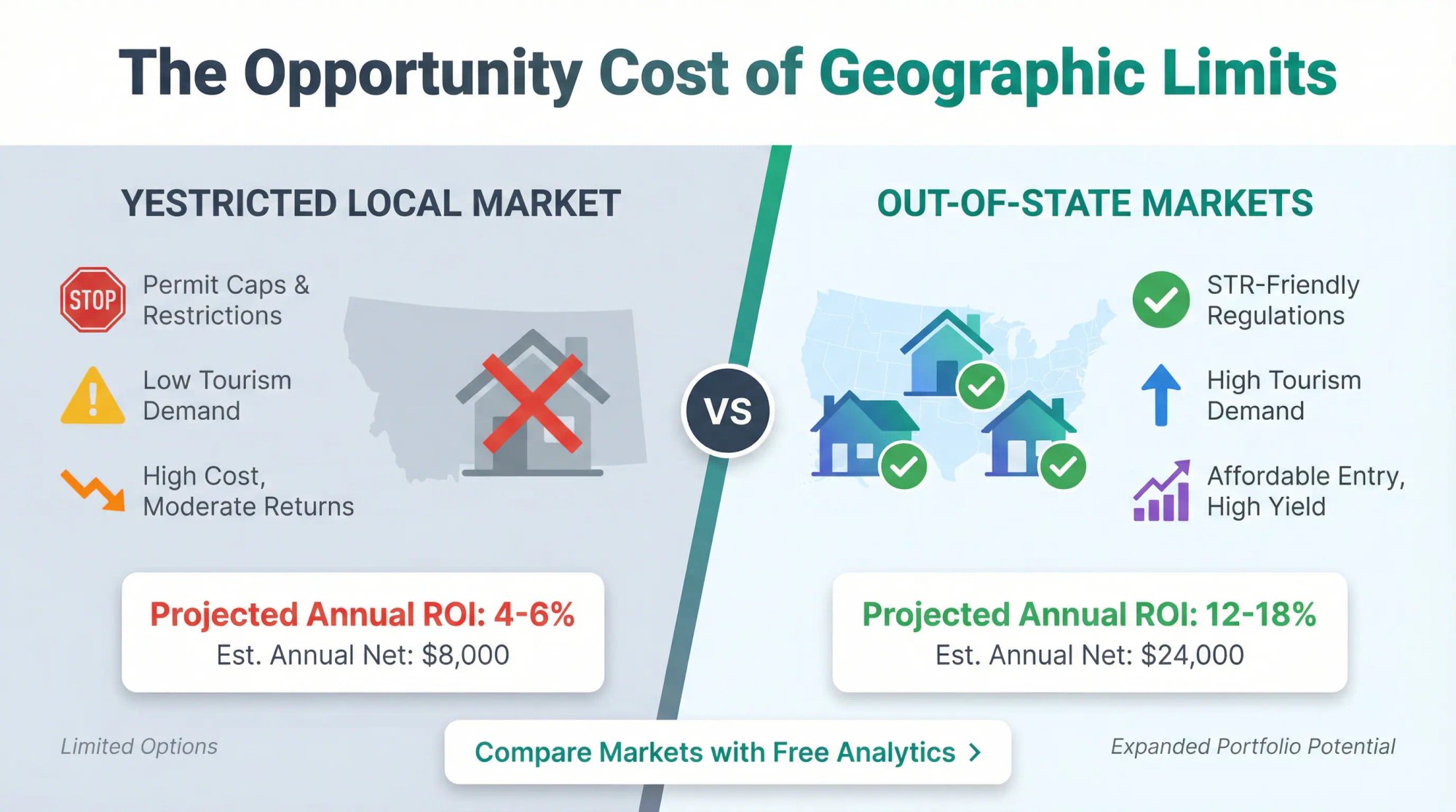

Why Geographic Limits Hurt Your Returns

By only looking in-state, you might miss out on markets with significantly better cash flow or appreciation. The U.S. is a big country. The best opportunity for you might be several states away.

Limiting yourself geographically means fewer options to find the ideal combination of affordable price and high rental income. You also won't benefit from diversification (owning properties in different regions).

All your "eggs" remain in one market basket. If your local economy or tourism takes a dip, all your STR income could dip with it.

Why Buying an Out-of-State Airbnb Makes Sense

Now let's consider buying an Airbnb out-of-state (in a market located far from where you live). This approach can unlock opportunities that you'd never find at home, though it also introduces new challenges.

Many successful STR investors purchase properties remotely, and some even build portfolios across multiple states.

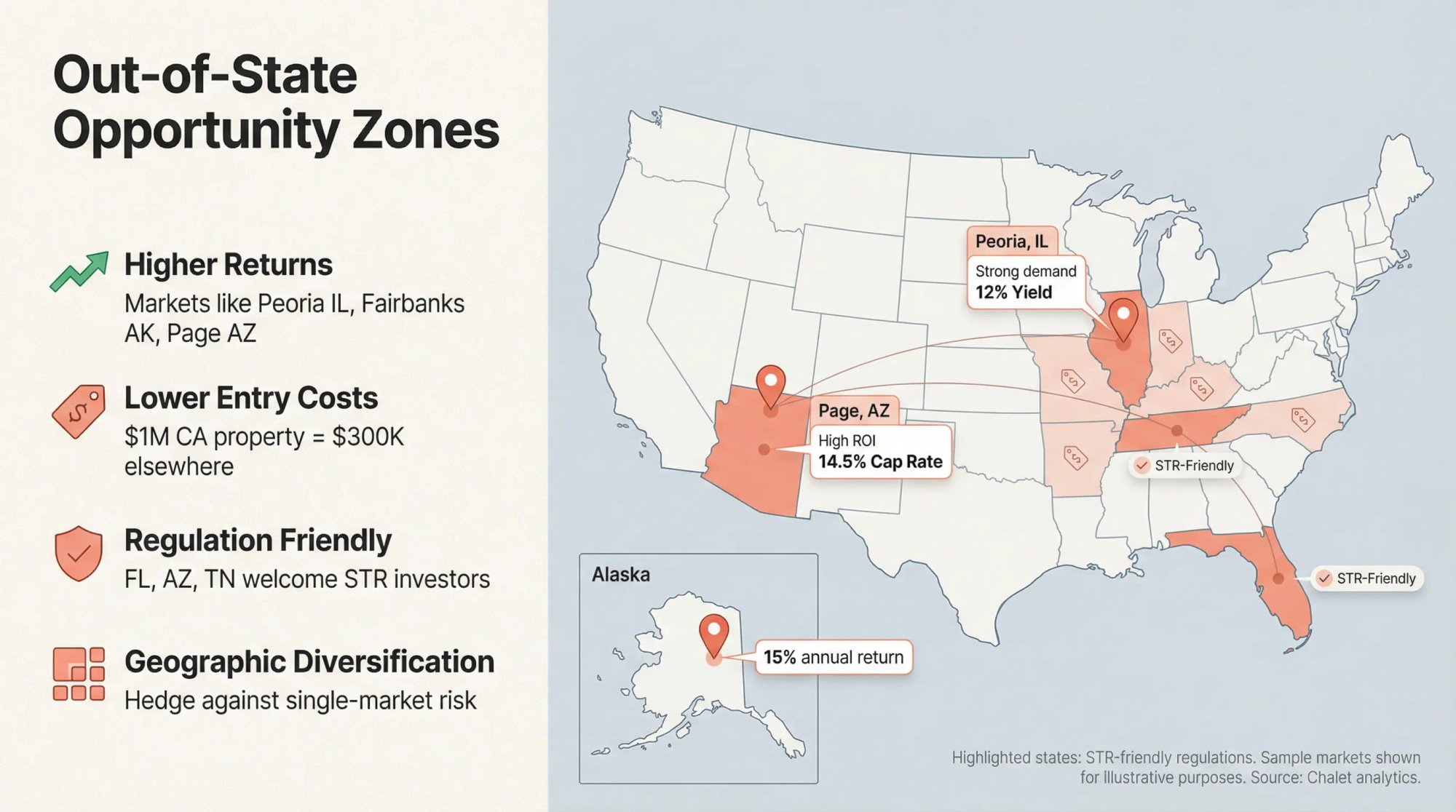

How to Find Markets with Better Returns

The biggest reason to look beyond your state is to find greener pastures for returns. Real estate values and vacation demand vary hugely across the country.

Why limit yourself to your immediate area when a better market for STRs might exist elsewhere? Perhaps there's a city with booming tourism, a ski town or beach destination, or a small college town with year-round demand.

By expanding your search, you could discover an area with stronger occupancy rates or nightly rates than home. In fact, research shows markets like Peoria (IL), Fairbanks (AK), and Page (AZ) offer excellent profit potential. Markets you may never have considered, but which offer excellent returns.

Investing out-of-state lets you capitalize on such opportunities rather than being stuck with the hand your local market deals you.

Where to Find More Affordable Investment Properties

You might live in an expensive region where even fixer-uppers cost a fortune. By contrast, plenty of Midwest and Southern markets have far lower entry prices for homes.

Going out-of-state can dramatically lower your upfront costs to buy. For example, a California or New York investor might find that a $1 million duplex back home could be replaced by a similar property for a fraction of that price in another state.

Lower purchase prices mean lower mortgage payments, making it easier to turn a profit from Airbnb income. This is one reason out-of-state investing is popular: it opens the door for people priced out of their local housing market to still become STR owners.

How to Escape Restrictive Local Regulations

Some investors are practically forced to go out-of-state because their home city has banned or choked short-term rentals. Choosing an STR-friendly market can be a game-changer.

Rather than constantly worrying about fines or looming bans, you can invest in a place known to welcome Airbnb operators (often these are vacation towns or states with landlord-friendly laws).

States like Florida, Arizona, or Tennessee have earned reputations for accommodating STR investors, with relatively light regulation and tax advantages (no state income tax in some cases).

If you currently live somewhere like a strict HOA community or a city with draconian Airbnb rules, picking an out-of-state location with lenient STR regulations can maximize your occupancy and income potential. In short, you go where the rules allow you to thrive.

Why Portfolio Diversification Matters

Investing out-of-state also spreads your risk. Real estate markets can fluctuate due to regional economies, seasonality, or legal changes.

If all your rentals are in one state, a single law change or tourism slump there could hit you hard. Owning properties in different states creates a hedge: if one market underperforms, another might be doing great.

"Don't put all your eggs in one basket" applies here. Diversifying geographically can reduce your overall risk profile. A downturn or regulatory hit in one state won't sink your entire portfolio.

Many experienced investors with multiple STRs purposefully buy in varied locations (mountains vs. beach, different states) to balance their income year-round.

What Makes Remote Airbnb Ownership Harder

Despite these advantages, buying far from home comes with serious challenges that you must plan for.

Why You Need to Research Everything from Scratch

When you purchase in a market you don't know intimately, you have to research everything from scratch. Which neighborhoods are safe and desirable? What season is high vs. low for bookings? How are the local property taxes and insurance costs?

You'll need to spend time studying the new area's dynamics and maybe even learning a new city's "culture" of travel. There's a risk of making a mistake (for example, buying on the "wrong side of town") simply due to unfamiliarity.

Thorough due diligence (including online research and ideally an in-person visit) is critical before you buy remotely. Use market analytics to understand demand patterns and neighborhood performance.

How to Manage an Airbnb from Hundreds of Miles Away

Managing a property from a distance isn't impossible (thousands do it), but it requires different strategies. All the little upkeep tasks that are easy when you live nearby become more complicated from a distance.

Pipes will burst, AC units will fail, guests will need help, and you might be 500+ miles away when it happens. You basically have two choices: hire help, or hop on a plane frequently.

Many out-of-state owners hire a local property manager or co-host to handle guest communications, cleaning, and maintenance. This can be a lifesaver, but of course it costs money.

Property management services typically charge a percentage of your revenue. A significant hit to your profit margin. This management fee could undercut the higher ROI that enticed you to go out-of-state in the first place.

The alternative is to self-manage remotely with the help of technology and a few on-call local contractors. While certainly doable (especially with smart locks, cameras, and automated messaging), it can feel like death by a thousand cuts if you're constantly arranging maintenance and troubleshooting from afar.

Realistically, expect to relinquish some control and budget for professional help when investing out-of-state, unless you plan to travel there regularly yourself.

How to Build a Local Team from Zero

Starting fresh in a new state means finding new trusted people. You likely won't have pre-existing connections with cleaners, handymen, or reliable contractors in that area.

You'll need to vet and build a team long-distance. The same goes for finding an investor-friendly real estate agent and an STR-savvy lender licensed in that state.

It takes effort to assemble a support network from scratch. Until you have that team, you might feel a bit "on your own" compared to investing in a community where you know everyone.

Chalet can help by connecting you with vetted Airbnb agents and vendors in various markets, but it still requires coordination.

What You Need to Know About Different State Laws

Every state (and city) has its own legal framework for rentals. From landlord-tenant law to tax rates, you must get up to speed on a new set of rules.

Eviction procedures, permit requirements, or occupancy taxes may be very different from what you're used to at home. Some states require short-term rental licenses; others might have hospitality taxes or insurance quirks.

You may need to file income taxes in the rental's state as a non-resident, which can mean extra paperwork or accountant fees. While none of this is insurmountable, it adds complexity.

Many out-of-state investors mitigate this by hiring a local attorney or CPA to ensure they stay compliant. It's just one more item (and cost) to plan for when venturing into another jurisdiction.

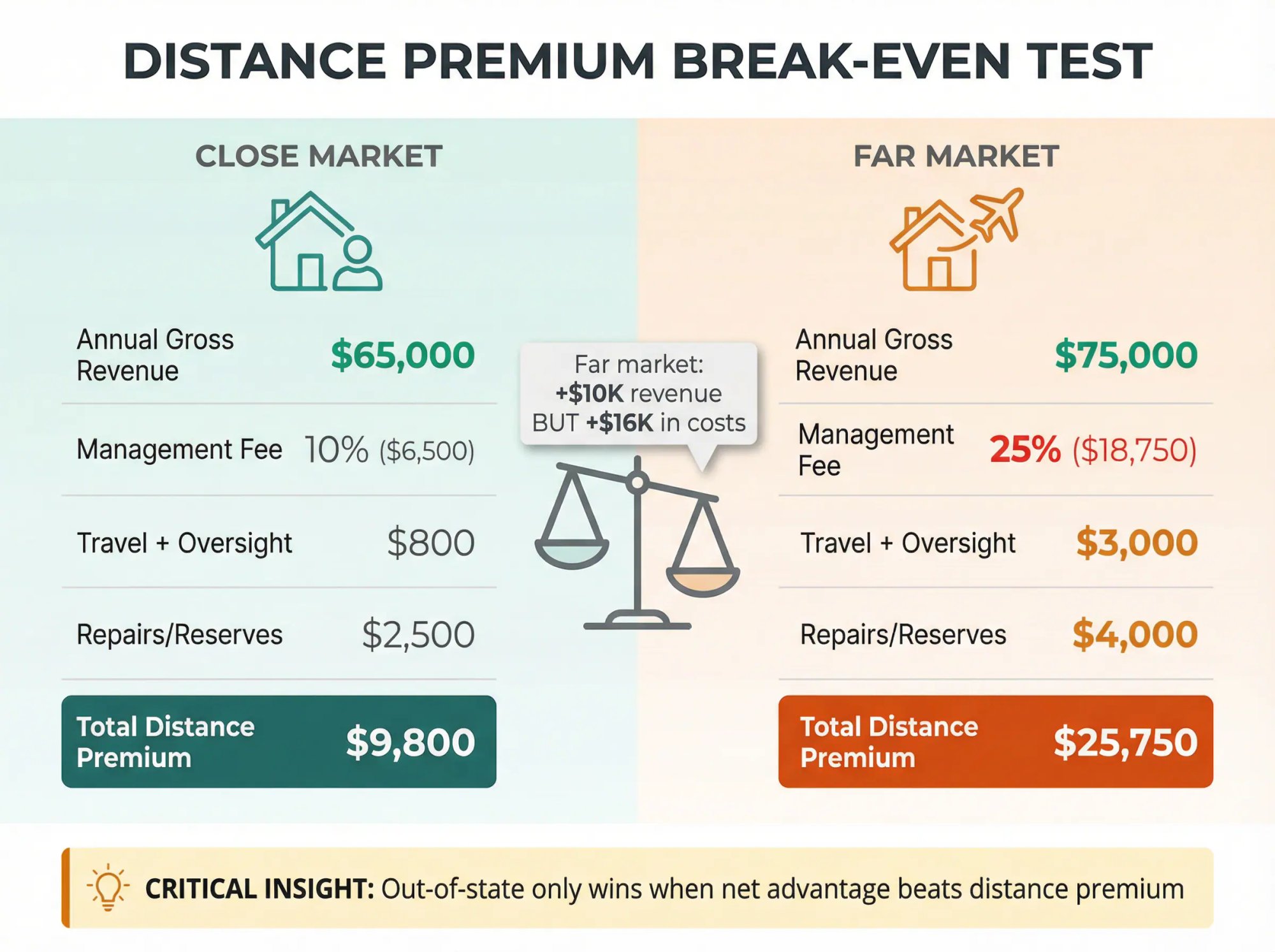

What Out-of-State Really Costs (The Distance Premium)

Out-of-state can absolutely be the right move, but you have to price in the distance premium.

How to Calculate Your Distance Premium

Common extra costs when you're not local:

① Higher management layer

Property management services vary widely in cost. Management fees typically range from 10% to 40% of rental income depending on service level.

If you self-manage locally, your "fee" is time. Remote, you often pay real dollars.

② Travel and on-site resets

Even with great management, most owners do periodic visits (deep maintenance, refresh furniture, verify condition).

③ Slower fixes create review damage

One unresolved issue can become a string of lower ratings. Ratings affect conversion and pricing power.

④ Higher vendor pricing for "emergency" work

Same-day labor costs more, and remote owners tend to approve work faster because they can't inspect.

How to Run a Distance Premium Break-Even Test

This is illustrative math, not a promise. Assume Market A (close) and Market B (far) have similar purchase prices.

| Item | Close Market | Far Market |

|---|---|---|

| Annual gross revenue | $65,000 | $75,000 |

| Management fee | 10% ($6,500) | 25% ($18,750) |

| Extra travel + oversight | $800 | $3,000 |

| Extra repairs/reserves | $2,500 | $4,000 |

| Estimated "distance premium" | $9,800 | $25,750 |

In this example, the far market makes $10,000 more gross, but costs ~$16,000 more in management + distance overhead. It loses on cash flow even before you price in stress.

Takeaway: Out-of-state only wins when its net advantage beats your distance premium. Run the numbers for your specific scenarios.

How to Score Markets: The 8-Factor Decision Framework

Use this scorecard to decide rationally. Don't trust vibes.

How to use it:

① Pick your top 2 candidate markets (one closer, one farther)

② Score each category from 1 (bad) to 5 (great)

③ Multiply by weight

④ The higher total wins. If it's close, choose the simpler execution path

| Factor | Weight | What "5" Looks Like | Why It Matters More Out-of-State |

|---|---|---|---|

| Regulation clarity + stability | 20% | Clear permit path, consistent enforcement | Remote buyers miss changes faster |

| Local team strength | 20% | Great PM/cleaning/handyman coverage | Your "hands" are your vendors |

| Unit economics | 15% | Strong revenue potential vs fixed costs | Distance adds extra costs |

| Property risk profile | 10% | Low capex surprises, easy maintenance | Remote surprises cost more |

| Insurance + hazard costs | 10% | Insurable at sane cost | Some markets are brutal to insure |

| Seasonality + demand diversity | 10% | Demand not dependent on 1 season | Remote cash crunch is harder |

| Your time + travel tolerance | 10% | You can visit on your schedule | Emergencies are expensive |

| Exit liquidity | 5% | Strong resale demand and financing availability | You may need to sell fast |

Pro tip: Chalet's free market dashboards help you compare revenue drivers, and the regulations pages keep you honest about permit friction. Chalet's analytics are refreshed every two days.

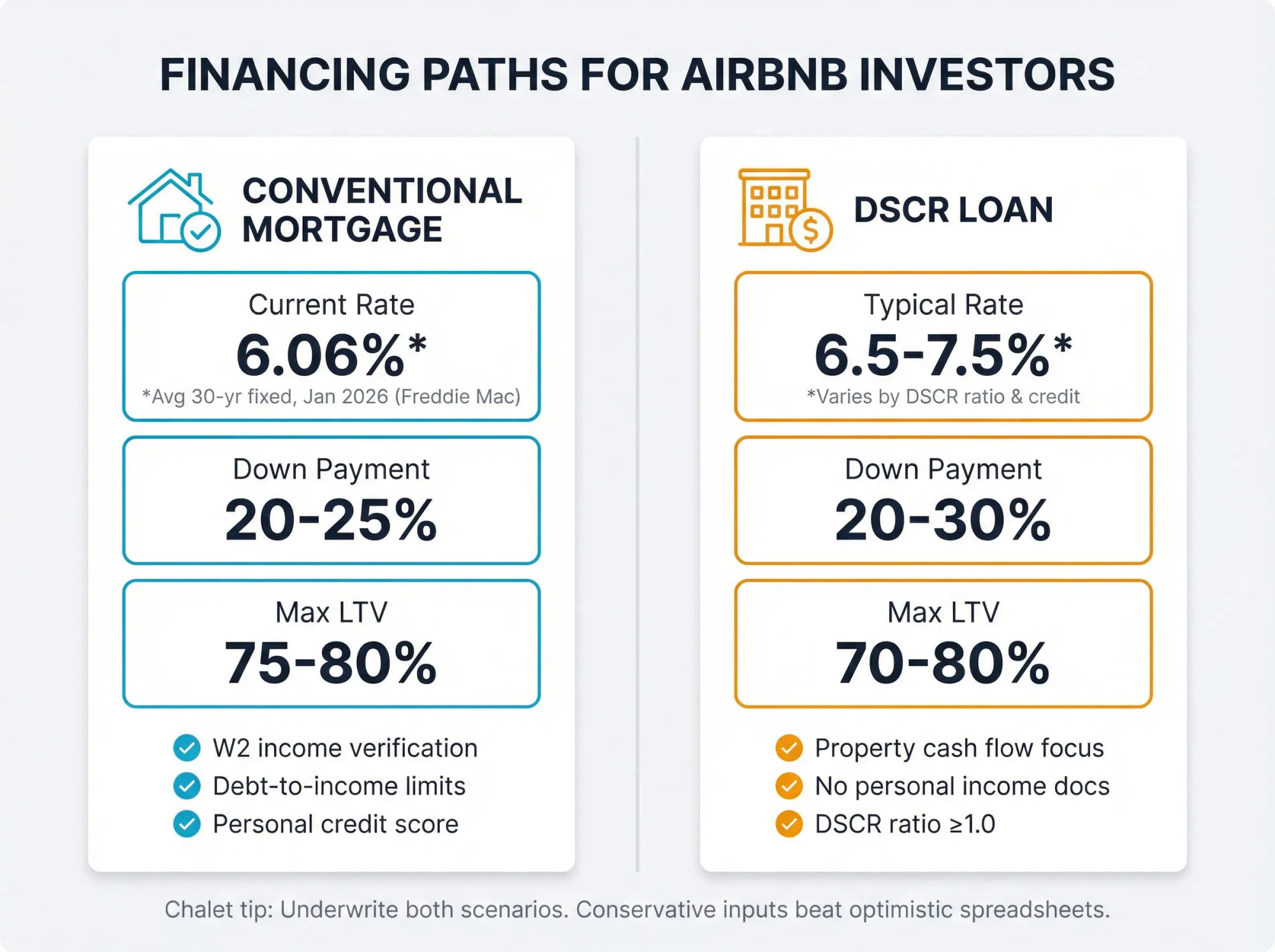

How to Finance Your Airbnb: What Actually Matters

Your state line usually doesn't change your mortgage approval. Your property type, intended use, and loan product matter more.

What Current Mortgage Rates Look Like (Mid-January 2026)

Freddie Mac's Primary Mortgage Market Survey showed the average 30-year fixed-rate mortgage at 6.06% as of 01/15/2026 (and 7.04% a year earlier).

Two important caveats:

• That's an average survey rate, not your quote

• Investment property pricing is often higher than owner-occupied pricing

When DSCR Loans Make Sense for STR Investors

A DSCR loan (Debt Service Coverage Ratio) underwrites the deal mainly on the property's cash flow vs the mortgage payment. That can matter a lot if:

• you're self-employed

• your W2 income doesn't "look" strong on paper

• or you're scaling multiple properties

Real lender guidelines show why DSCR is popular:

• Lenders typically offer max LTV ranges of 70% to 80% depending on property type, credit, and DSCR, which implies a meaningful down payment

• Some programs offer up to 80% LTV on purchase for rental loans and highlight "no personal income requirements"

• Others explicitly state a minimum down payment of 20% for purchases and max 80% LTV on acquisitions (with lower max LTV in some rural cases)

What this means for the in-state vs out-of-state decision:

Out-of-state buyers often lean on DSCR because it's built for investors and can be easier to scale. But it's not "easier" in the way people hope.

You still need: reserves, strong property income assumptions, and clean documentation.

If you're comparing loan options, your best move is to underwrite the deal both ways: conventional and DSCR. Then pick the one that survives a conservative stress test.

(Chalet tip: run both scenarios through an ROI/DSCR calculator and keep assumptions visible. Conservative inputs beat optimistic spreadsheets.)

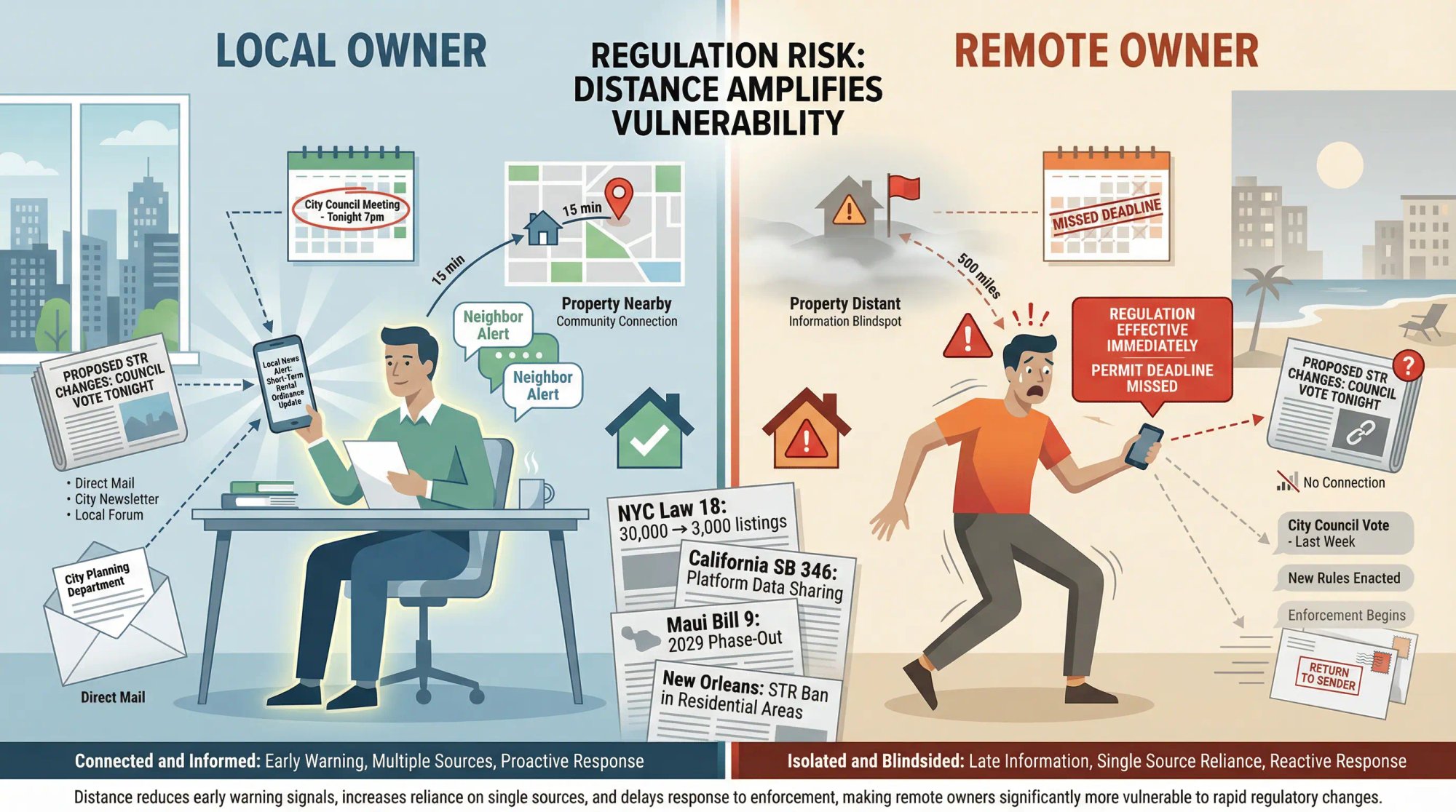

Why Distance Increases Your Regulation Risk

Regulations are the #1 reason "great" Airbnb rentals turn into dead deals.

Why distance matters:

• You are less likely to hear about rule changes early

• You are more likely to trust a single person's interpretation

• You are more likely to miss HOA enforcement and neighbor pressure

What Happens When Regulations Change Fast

New York City is a dramatic example. NYC's Office of Special Enforcement reported that after Local Law 18's registration and platform verification regime, the city went from tens of thousands of illegal listings historically to about 3,000 active short-term rental registrations, with booking platforms required to verify registration before processing bookings.

That is not a "small tweak." That's an entire market structure shift.

California is another signpost for where enforcement can go next. A law firm alert notes California's SB 346 took effect January 1, 2026, enabling cities (if they adopt an ordinance) to compel platforms to share listing information such as physical address, which can strengthen enforcement of local short-term rental rules and transient occupancy taxes.

And then there are markets where future legality can be sunset, not just restricted. Honolulu Civil Beat reported Maui's Bill 9 was signed into law in December 2025, requiring certain apartment-zoned vacation rentals to phase out over time with dates in 2029 and 2031 depending on area.

Critical insight: Your underwriting must include "regulation volatility" as a real risk, especially out-of-state.

What to Check Before Making Any Offers

① Confirm the permit pathway in writing (city or county source)

② Check zoning and license caps (some areas cap permits, bedrooms, or nights)

③ Verify minimum stay rules (30+ day rules can kill nightly revenue)

④ Check HOA/COA bylaws and enforcement history

⑤ Ask: what changed in the last 12 months?

⑥ Ask: what's being proposed right now? (agenda items, council proposals)

⑦ Map taxes: state, county, city (not just "Airbnb collects it")

Chalet can help you start with a regulation library by market, but you still confirm with the local authority before you close.

What You Need to Know About STR Taxes Across State Lines

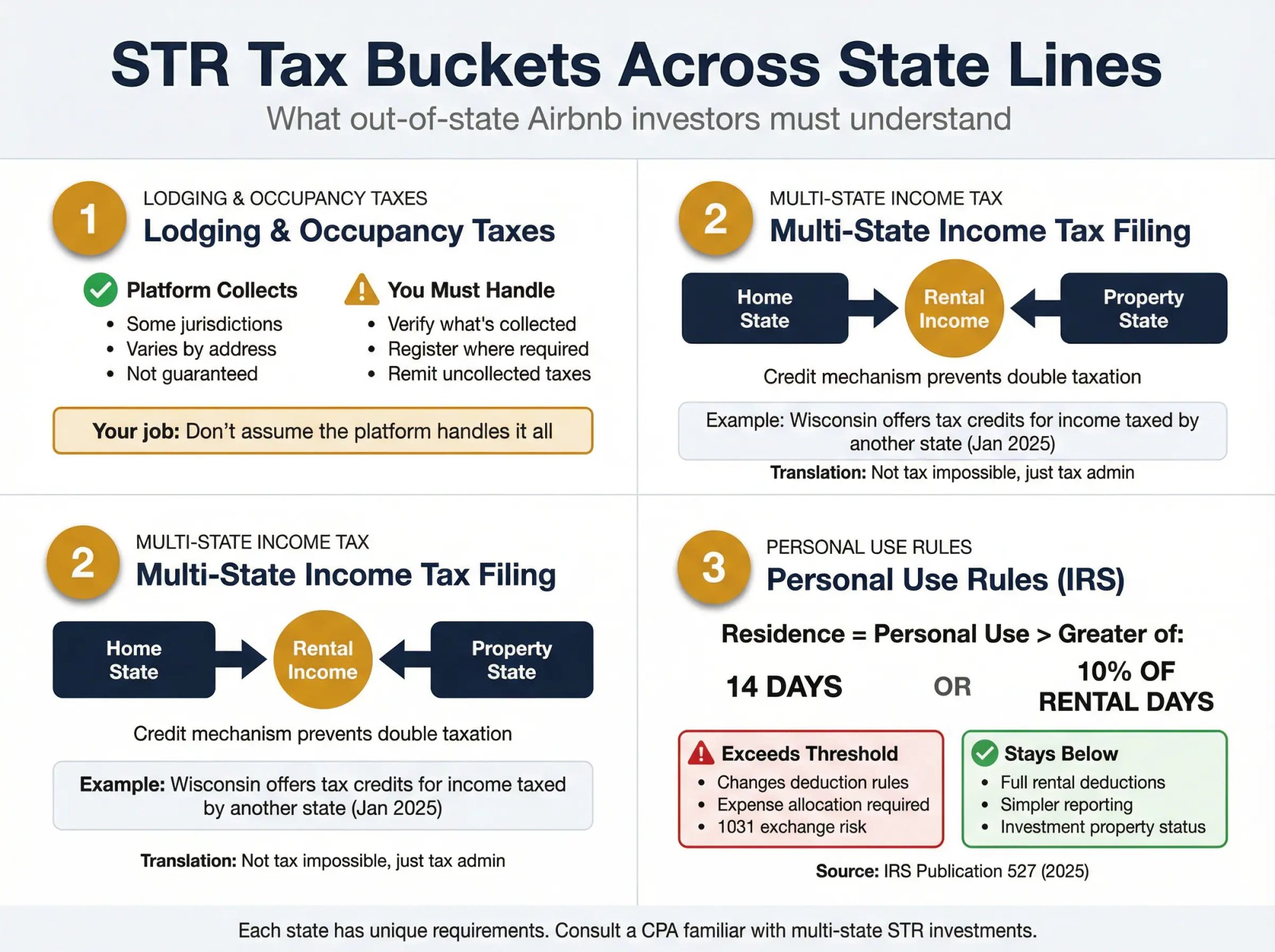

There are three tax buckets that surprise out-of-state buyers:

How Lodging and Occupancy Taxes Work

Airbnb says it automatically collects and remits certain taxes in some jurisdictions, but hosts may still need to manually collect and remit other applicable taxes, and the address you enter affects which taxes apply.

So your job is not "hope the platform handles it." Your job is:

• verify what is collected

• register where required

• and remit anything that isn't automatically handled

How Multi-State Income Tax Filing Works

If your Airbnb rental is in a different state, you may have to file in that state. Your resident state may tax your worldwide income but often offers a credit mechanism to avoid double taxation.

A concrete example: Wisconsin's Department of Revenue publication on "Credit for Tax Paid to Another State" (January 2025) includes examples involving rental income and explains the concept of claiming credit for net tax paid to another state when income is taxed by both.

Translation: out-of-state is not "tax impossible." It's "tax admin."

What Personal Use Rules Mean for Your STR

If you plan to use the property personally, you need to understand how the IRS treats "personal use of a dwelling unit."

IRS Publication 527 (2025) explains the general rule that you're considered to use a dwelling as a residence if your personal use exceeds the greater of 14 days or 10% of the days rented at a fair rental price.

Why this matters:

• It can change how you deduct expenses and report activity.

• It affects how you think about "free vacations" from your Airbnb rental.

If you're doing a 1031 exchange into an Airbnb rental you also want to use personally, you need to be even more careful (next section).

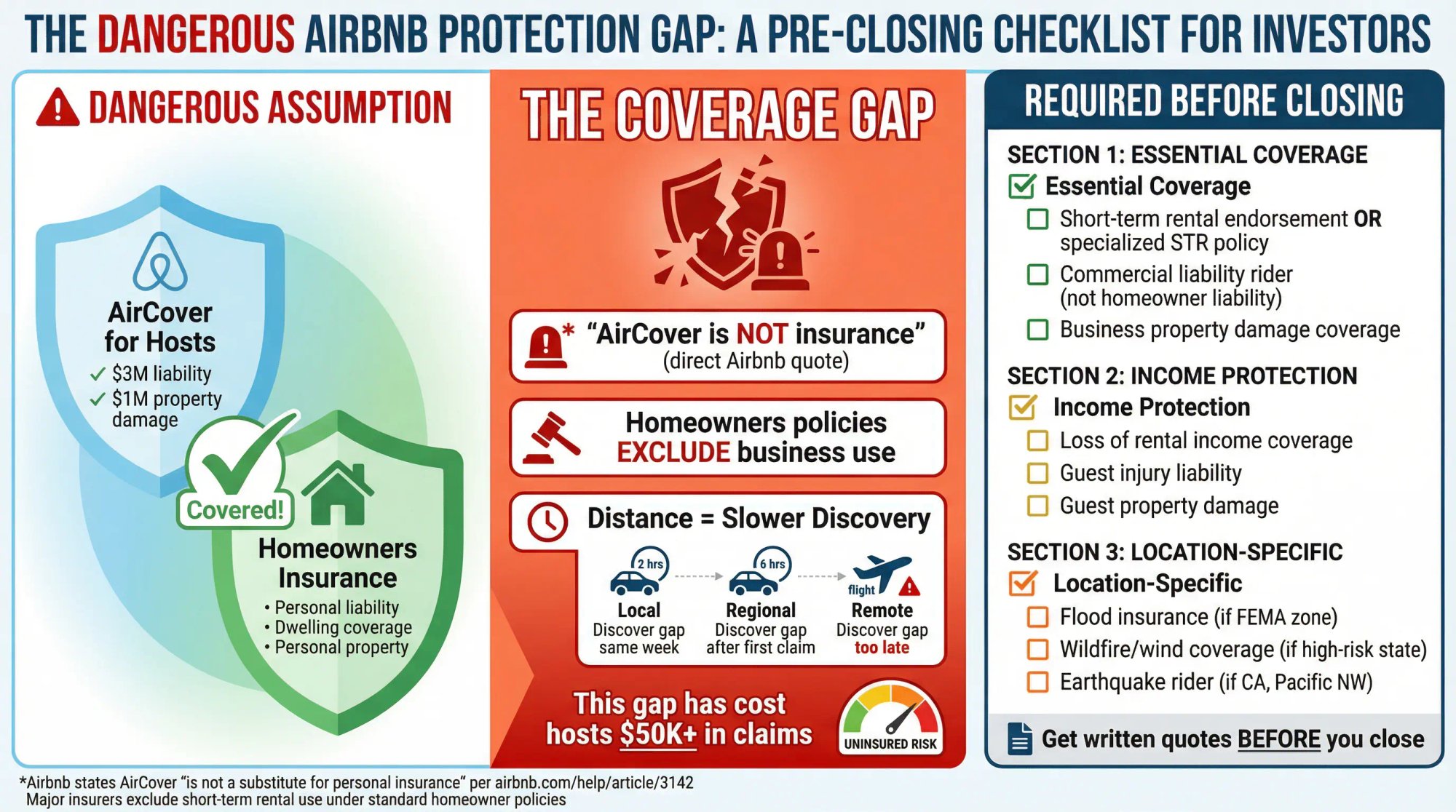

What Airbnb Insurance Actually Covers (and Doesn't)

This is a common (and expensive) misunderstanding.

Airbnb's AirCover for Hosts is helpful, but Airbnb explicitly says it's not a substitute for personal insurance and you should talk to your insurer about overlap.

And major insurers explain the underlying issue: homeowners insurance generally does not cover short-term renting like Airbnb because it's considered business use.

In-state vs out-of-state takeaway: Distance doesn't change the policy language, but it changes how fast you find out you had a coverage gap.

Before you close, get:

• a written quote for a policy that allows short-term rental use

• clarity on liability, property damage, and loss of income

• and (if relevant) flood/wildfire coverage and deductibles

Why 1031 Exchange Investors Should Prioritize Speed Over Geography

If you're doing a 1031 exchange, your biggest enemy is time, not geography.

IRS instructions for Form 8824 state the key timeline for deferred exchanges:

• identify replacement property within 45 days

• receive replacement property within 180 days (or by the tax return due date including extensions, whichever is earlier)

So the practical question becomes: Which market can you buy in with the least friction and the most certainty of closing?

Often that means:

• choosing markets with strong inventory and investor-friendly lending

• using exchange-savvy agents and lenders

• prioritizing clean permitting paths

Also remember: 1031 requires property "held for investment." Mixing in heavy personal use can create issues. IRS Rev. Proc. 2008-16 provides a safe harbor concept for limited personal use in certain dwelling unit scenarios, but it's dated and fact-specific, so you use it as guidance and confirm with your tax pro.

Learn more about 1031 exchange timelines and strategies for STR investors.

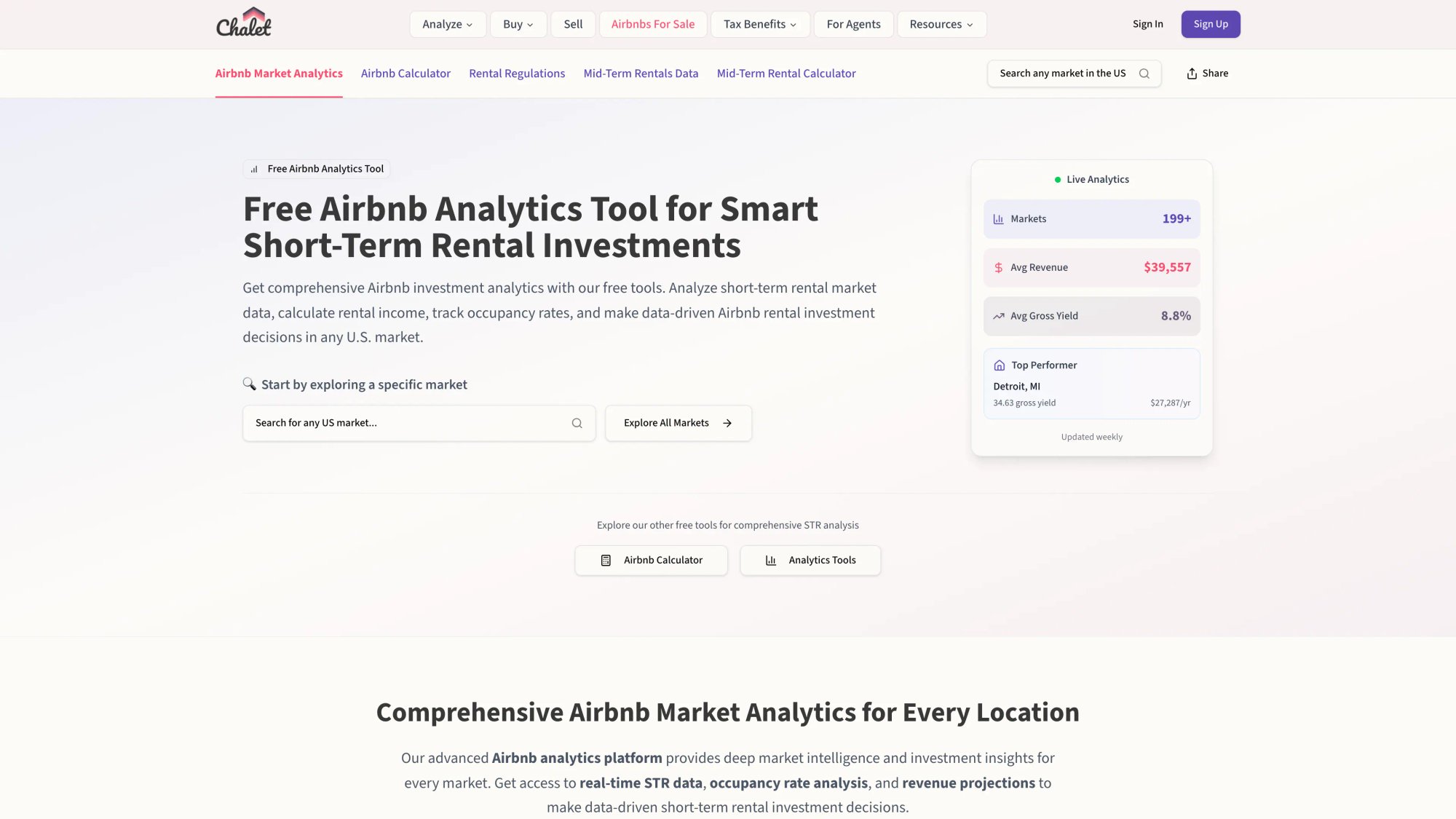

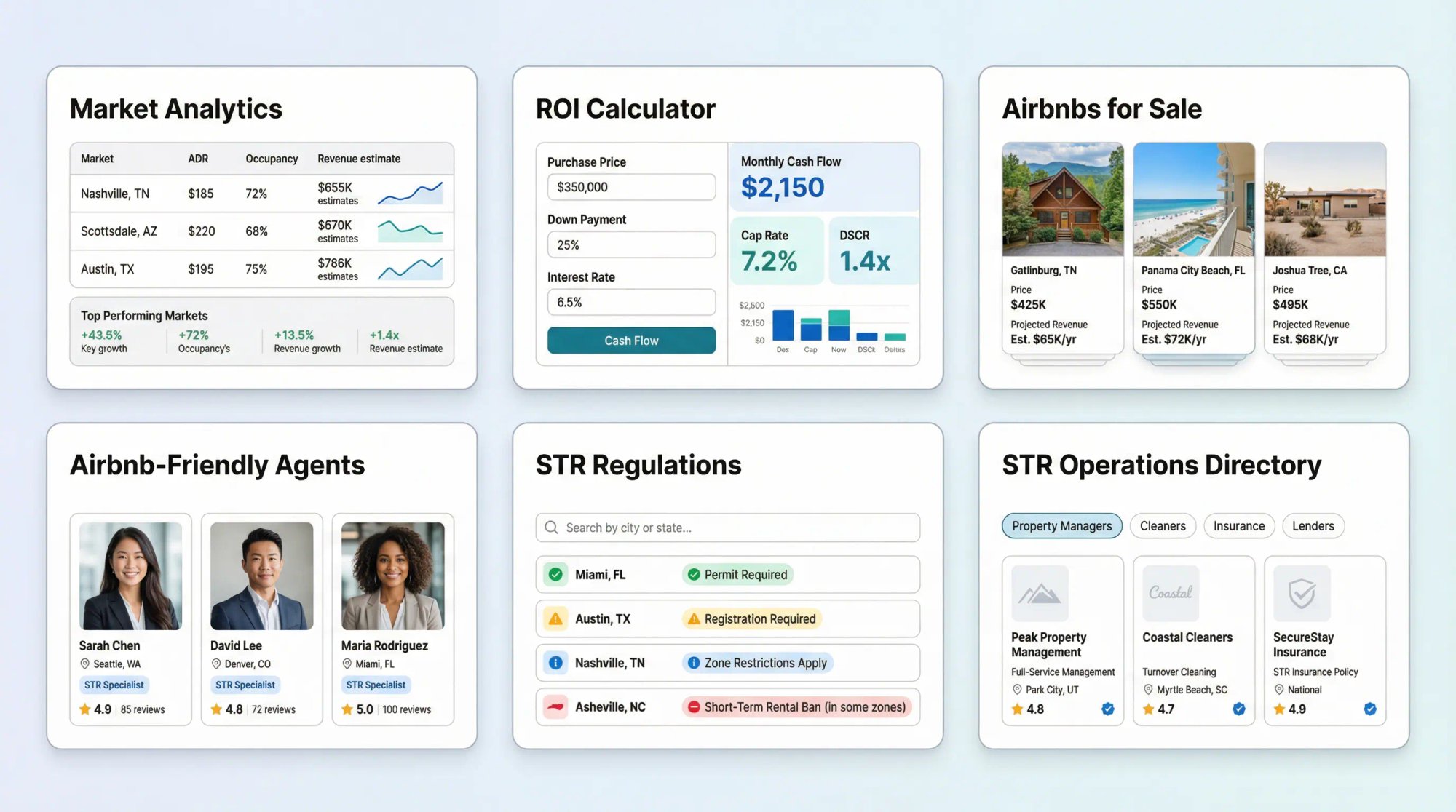

How Chalet Makes Your In-State vs Out-of-State Decision Easier

Making the in-state or out-of-state choice feels overwhelming when you're juggling market data, regulation research, vendor coordination, and financing options all at once.

Chalet is built to solve exactly this problem.

We're a one-stop platform for Airbnb and short-term rental investors. We pair free analytics with a vetted vendor network so you can research, buy, finance, insure, set up, and operate your rental in one place.

Here's what that looks like in action:

How to Compare Markets Side-by-Side with Free Data

Chalet's market dashboards show you ADR, occupancy, and revenue trends across multiple markets. You can compare your local market against out-of-state opportunities with real data (refreshed every two days, per our analytics comparison).

No paywalls. No subscription upsells. Just transparent data.

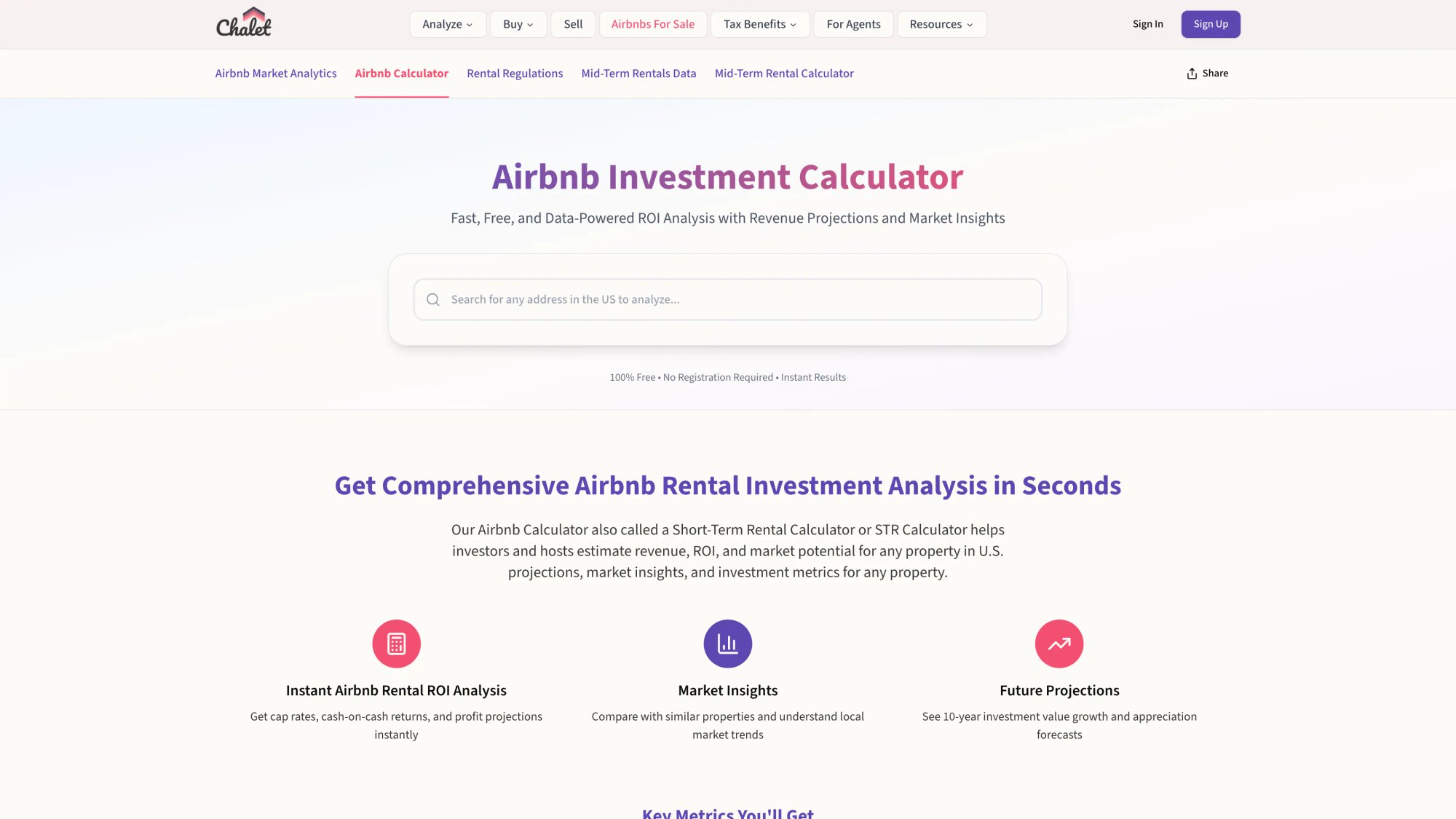

How to Run ROI Calculations for Any Address

Want to test the distance premium math we discussed earlier? Chalet's Airbnb calculator lets you run ROI/DSCR projections on specific addresses.

Plug in your assumptions (down payment, interest rate, management fee, occupancy) and see if the far market actually beats the close one after costs.

How to Research STR Regulations Before You Buy

Before you make an offer, check Chalet's STR regulation guides for your target city. We break down permit paths, zoning rules, and compliance requirements so you don't walk into a regulatory trap.

How to Find Airbnb-Friendly Real Estate Agents

Need boots on the ground in an unfamiliar market? Meet an Airbnb-friendly real estate agent through Chalet.

Our network includes STR-specialist agents who understand the unique diligence an Airbnb investor needs (cash flow analysis, permit verification, property manager connections).

Where to Find DSCR Lenders and Property Managers

Out-of-state buyers lean heavily on DSCR financing. Chalet connects you with lenders who specialize in investor loans.

We also help you find property managers, cleaners, and vendors in your target market so you can build your remote team before closing.

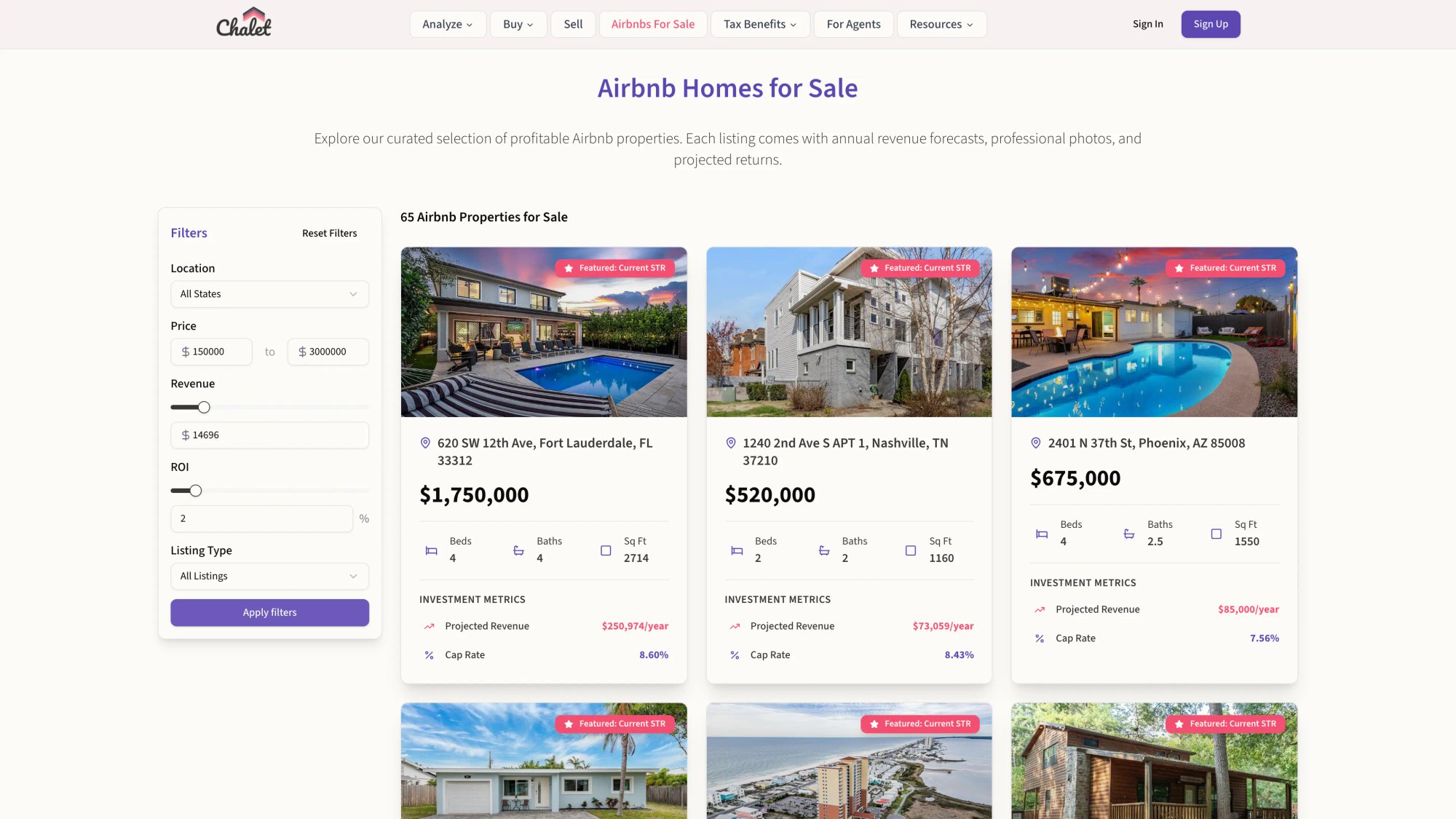

Where to See Airbnb Properties for Sale

Ready to see what's actually available? Explore Airbnb rental properties for sale on Chalet's platform.

Filter by market and see projected income for many listings. This is how you turn research into action.

How to Set Up Your STR Operations

From property management to cleaning, furnishing, insurance, and tax pros, Chalet's resource directory helps you coordinate everything you need to operate successfully.

Why this matters for the in-state vs out-of-state decision:

When you can compare markets with free data, underwrite deals with transparent calculators, verify regulations before offers, and connect with vetted local teams, distance becomes less scary.

You're not flying blind into an unfamiliar market. You have a platform that gives you the tools and connections to execute confidently.

Chalet turns the out-of-state question from "too risky" to "let's run the numbers and build the right team."

How to Execute: In-State Buying Strategy

Goal: maximize learning and control, minimize hidden risk.

① Pick a Zone 1 or Zone 2 market you can reach easily

② Start with a simple property type (avoid quirky maintenance)

③ Hybrid manage for the first 6 to 12 months

→ You learn pricing, guest issues, seasonality

→ Vendors handle turnover and repairs

④ Build your bench

→ cleaner, handyman, HVAC, plumber

→ back-ups for each (one vendor is not a system)

⑤ Document everything

→ check-in, cleaning, maintenance, supplies, guest messaging

When you're ready, you can either:

• scale locally with the same ops playbook, or

• go out-of-state with a proven system

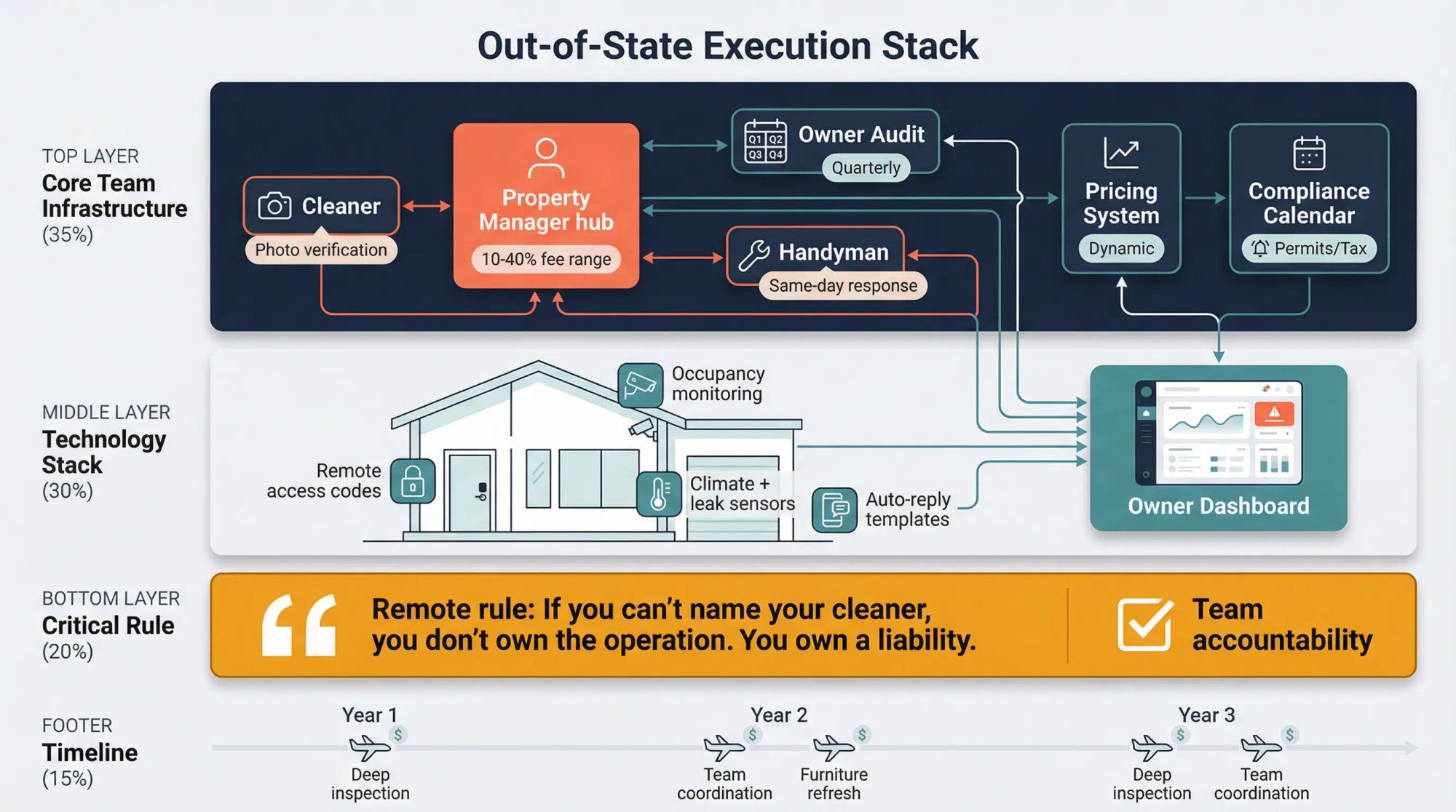

How to Execute: Out-of-State Buying Strategy

Goal: replace "me being nearby" with "the business running."

Minimum viable remote stack:

① Full-service property manager (or a very strong hybrid model)

→ Expect management costs to vary widely; fees typically range from 10% to 40% depending on service level

② Cleaner with photo-based turnover verification

③ Handyman who can do same-day fixes

④ Quarterly owner audit (in-person or via a trusted third party)

⑤ Pricing system (dynamic pricing or a manager who is truly revenue-minded)

⑥ Permit + tax compliance calendar (renewals, filings, inspections)

Remote rule: If you can't name your cleaner, you don't own the operation. You own a liability.

How to Use Technology for Remote Management

Equip your property with smart locks (so you can remotely manage access codes for guests and contractors), security cameras or doorbell cameras (to monitor occupancy and safety), and smart thermostats or leak sensors (to prevent disasters).

Use dynamic pricing tools to keep your rates optimized even when you're asleep. Utilize messaging templates or management software to promptly respond to guests (some tools can auto-reply to common questions).

Essentially, automate whatever you can. This not only saves you time but also keeps the guest experience consistent.

Why You Should Budget for Travel

No matter how turnkey your setup, you'll likely want to visit the property periodically. You might schedule a trip once or twice a year to do a deep inspection, replace items, meet your team, and experience the stay as a guest would.

These trips help catch issues that might not be reported and re-establish personal connection with the asset you own.

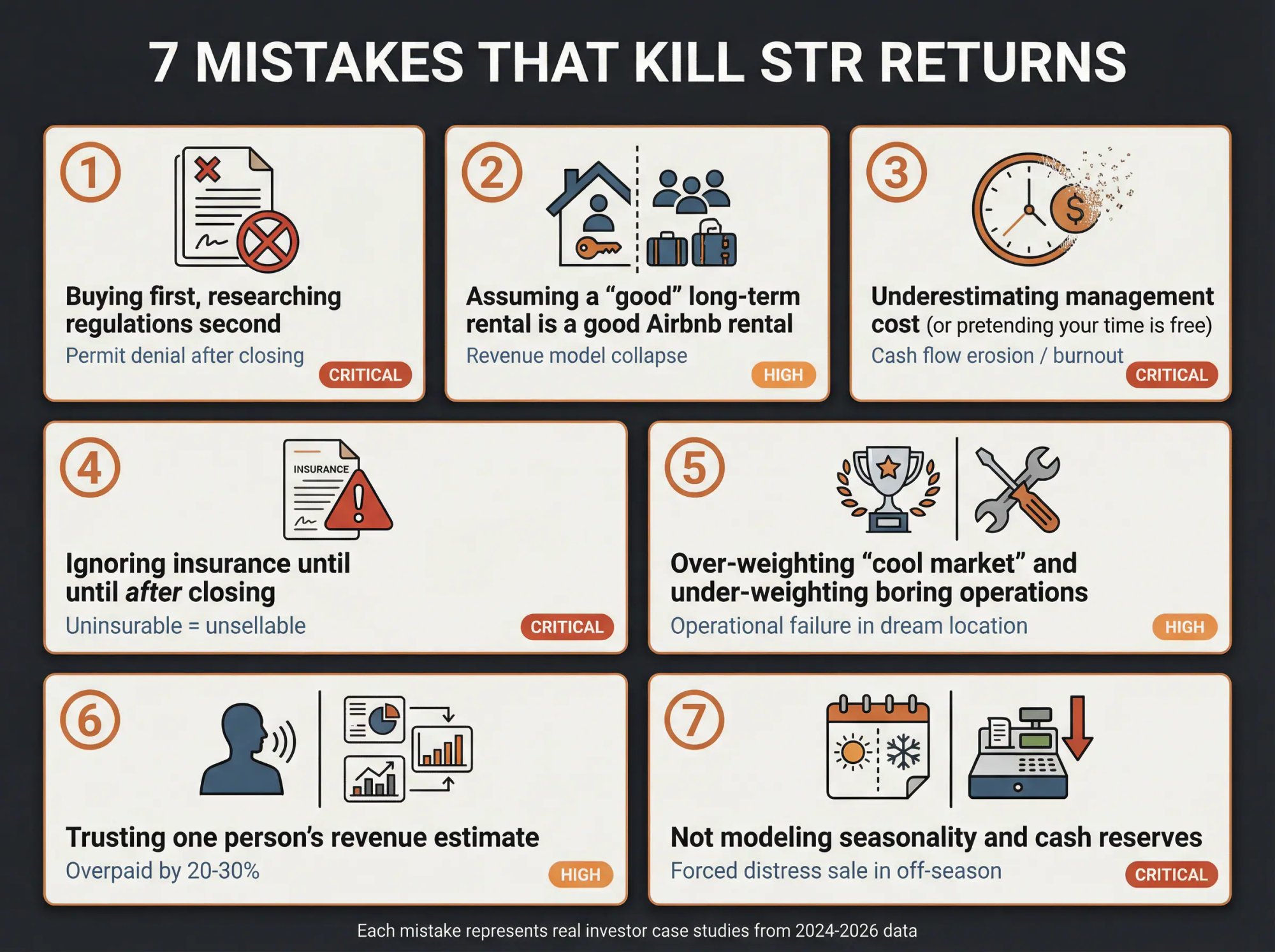

7 Mistakes That Kill STR Returns

① Buying first, researching regulations second

② Assuming a "good" long-term rental is a good Airbnb rental

③ Underestimating management cost (or pretending your time is free)

④ Ignoring insurance until after closing

⑤ Over-weighting "cool market" and under-weighting boring operations

⑥ Trusting one person's revenue estimate

⑦ Not modeling seasonality and cash reserves

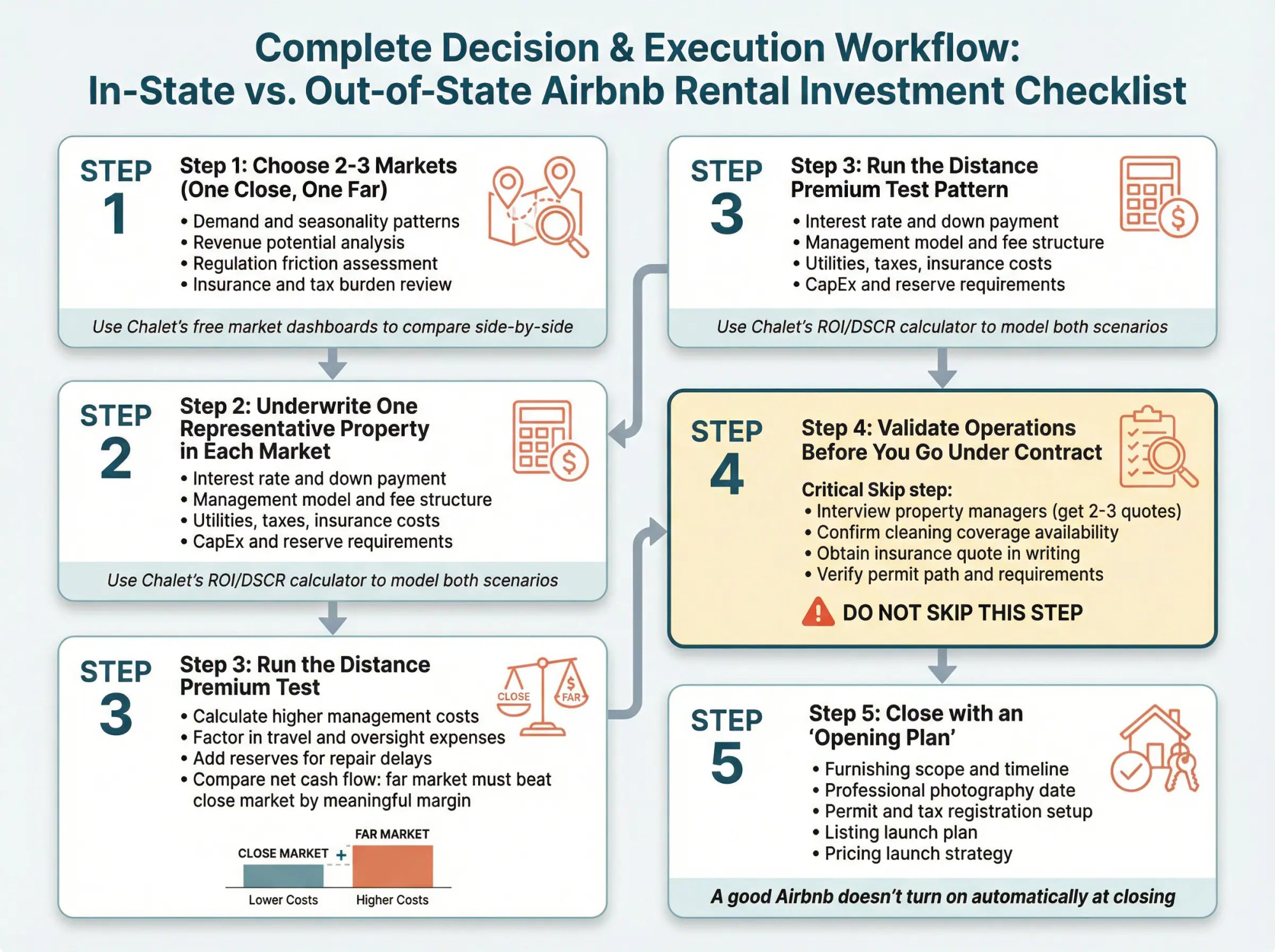

How to Decide and Execute: Step-by-Step

Step 1: Choose 2 to 3 Markets (One Close, One Far)

Use market analytics to shortlist based on:

• demand and seasonality

• revenue potential

• regulation friction

• insurance and tax burden

(Chalet's free market dashboards can help you compare side-by-side.)

Step 2: Underwrite One Representative Property in Each Market

Keep assumptions consistent:

• interest rate and down payment

• management model and fee

• utilities, taxes, insurance

• capex and reserves

(Use Chalet's ROI/DSCR calculator to model both scenarios.)

Step 3: Run the Distance Premium Test

Out-of-state must beat in-state by enough to cover:

• higher management

• travel and oversight

• added reserves for delays

Step 4: Validate Operations Before You Go Under Contract

• interview managers

• get cleaning coverage confirmed

• get insurance quote confirmed

• verify permit path (Chalet's regulation guides are a good starting point)

Step 5: Close with an "Opening Plan"

A good Airbnb rental doesn't "turn on" automatically at closing. You need:

• furnishing scope and timeline

• photography date

• permit and tax setup

• listing launch plan

• pricing launch strategy

What to Do Next

If you want to move from "thinking" to "doing," here are the clean next actions:

→ Analyze markets with Chalet's free dashboards

→ Run ROI/DSCR for a specific address

→ See Airbnb rentals for sale in your target markets

→ Meet an Airbnb-friendly agent who understands STR-specific diligence

→ Check local STR regulations for your target city

→ Set up your STR operations (property management, cleaning, furnishing, insurance, tax pros)

Chalet is built for exactly this: free analytics plus a vetted network of pros so you can research, buy, and operate in one place.

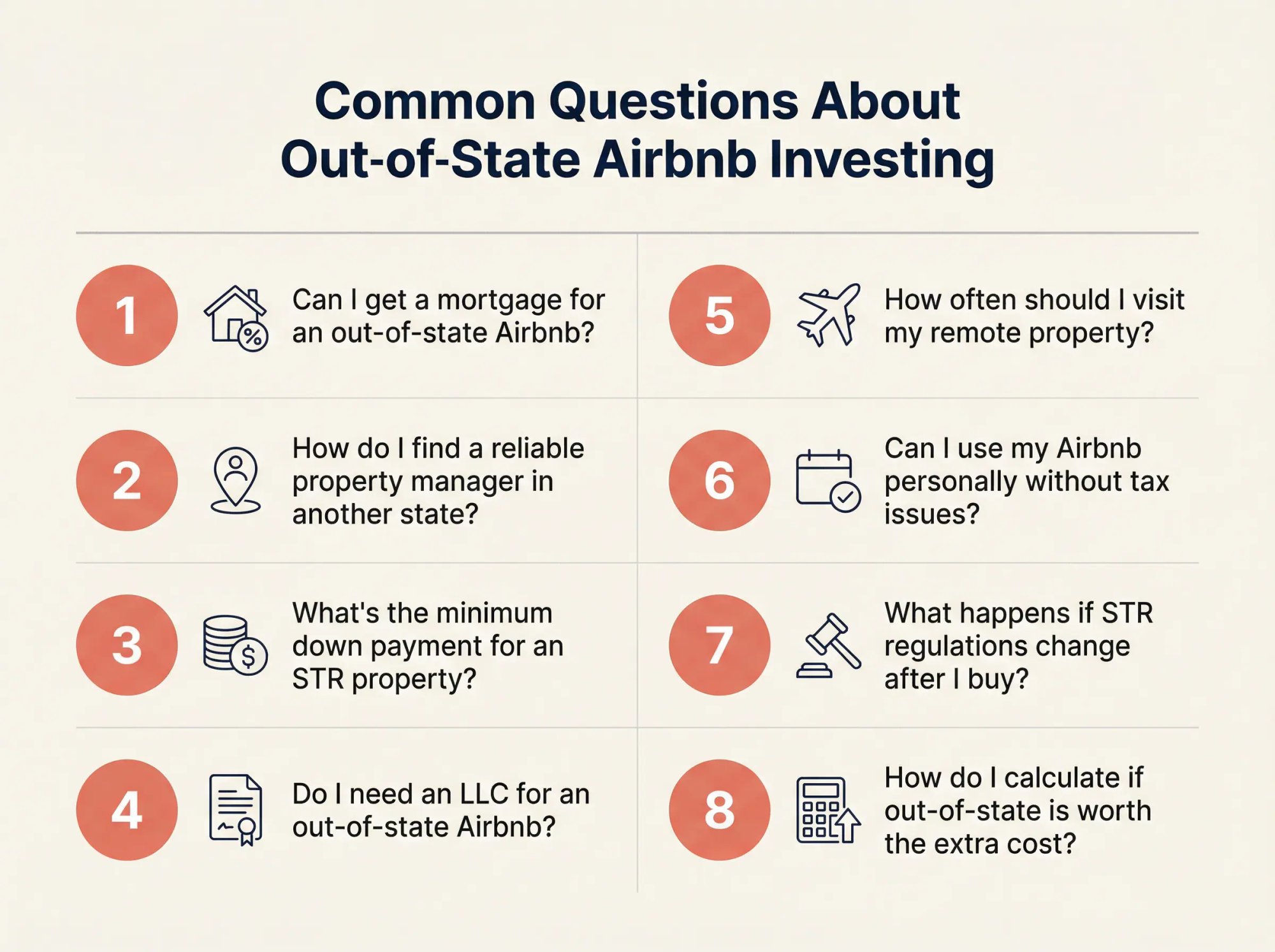

Common Questions About Buying Airbnbs Across State Lines

Can I get a mortgage for an out-of-state Airbnb?

Yes. Your state line usually doesn't change your mortgage approval. What matters is the property type, your intended use, and the loan product.

Many national lenders work across state lines. If you're self-employed or scaling multiple properties, consider a DSCR loan (Debt Service Coverage Ratio), which underwrites based on the property's cash flow rather than your W2 income.

Make sure you're pre-approved for loans in the state where you're buying, and budget for typical down payments of 20% to 25% for investment properties.

How do I find a reliable property manager in another state?

Start by asking for referrals from local Airbnb-focused real estate agents or investor groups in that market. Chalet connects you with vetted property managers who specialize in short-term rentals.

When vetting candidates, ask about:

• Their fee structure (typically 10% to 40% of revenue depending on services)

• How they handle emergencies and maintenance

• Whether they provide photo-based turnover verification

• Their local vendor network (cleaners, handymen, contractors)

Interview at least 2 to 3 managers before making a decision, and check references from other remote owners.

What's the minimum down payment for an STR property?

For investment properties, most lenders require 20% to 25% down for conventional financing.

If you're using a DSCR loan, you'll typically see similar requirements. For example, lenders commonly require a minimum 20% down payment, while others often require 20% to 30% depending on the property and your credit profile.

Some programs may go as high as 80% LTV (loan-to-value), meaning you'd put down 20%, but expect stricter requirements and potentially higher rates.

Budget conservatively. A larger down payment reduces your monthly mortgage and makes cash flow easier.

Do I need an LLC for an out-of-state Airbnb?

You don't need an LLC, but many investors choose to form one for liability protection and tax benefits.

An LLC can shield your personal assets if a guest gets injured or if legal issues arise. It can also simplify accounting if you're managing multiple properties.

But LLCs add costs (formation fees, annual filings, registered agent requirements in the state where the property is located) and complexity (separate bank accounts, tax filings).

Consult with a CPA and an attorney who specialize in real estate to determine if an LLC makes sense for your situation. The answer often depends on your risk tolerance, number of properties, and tax strategy.

How often should I visit my remote property?

Most successful remote owners visit 1 to 2 times per year for deep inspections, furniture refreshes, and team coordination.

Some visit quarterly if they're hands-on or if the property is in a high-maintenance area. Others visit only annually if they have a rock-solid local team.

Budget for these trips as part of your operating costs (flights, hotels, meals). The good news: travel expenses for business purposes are typically tax-deductible. Talk to your CPA to confirm.

If you can't visit regularly, consider hiring a local "boots on the ground" contact (a trusted friend, neighbor, or professional inspector) to do periodic check-ins on your behalf.

Can I use my Airbnb personally without tax issues?

Yes, but the IRS has specific rules about personal use.

IRS Publication 527 explains that you're considered to use a dwelling as a residence if your personal use exceeds the greater of 14 days or 10% of the days rented at a fair rental price.

If you cross that threshold, it changes how you deduct expenses and report the activity. You may lose some deductions or have to allocate expenses between personal and rental use.

If you're doing a 1031 exchange, heavy personal use can jeopardize your tax deferral. Consult with a CPA before planning personal vacations in your STR.

What happens if STR regulations change after I buy?

Regulation changes are one of the biggest risks in STR investing, especially for remote owners who may not hear about changes early.

To protect yourself:

• Subscribe to local city council agendas and STR-related newsletters for your market

• Join local STR investor groups or Facebook communities

• Build relationships with your property manager and local vendors who can alert you to proposed changes

• Budget a reserve fund for potential compliance costs (new permits, licensing fees, property modifications)

• Consider exit strategies: can you convert to long-term rental if STR gets banned?

Chalet tracks regulation changes by market, but you should also confirm directly with local authorities before making major decisions.

How do I calculate if out-of-state is worth the extra cost?

Use the distance premium test:

Step 1: Estimate your total annual costs for the close market (mortgage, taxes, insurance, utilities, management, maintenance, reserves).

Step 2: Estimate the same for the far market, adding the distance premium:

• Higher management fee (typically 10% to 15% more for full-service)

• Travel costs for periodic visits

• Extra reserves for slower fixes and emergency vendor pricing

Step 3: Compare net cash flow:

• Close market net = (gross revenue) – (total costs)

• Far market net = (gross revenue) – (total costs + distance premium)

If the far market's net cash flow is higher by a meaningful margin (at least $5,000 to $10,000 annually to make the extra hassle worthwhile), it may be worth it.

Use Chalet's ROI calculator to model both scenarios side-by-side with consistent assumptions.

The bottom line: Whether you buy in-state or out-of-state depends on where you can get the best outcome for your goals with an acceptable level of effort and risk.

If you're lucky enough to live in or near a strong short-term rental market (and you value simplicity), then starting local may be your best bet. You'll learn the ropes in a familiar environment and can always expand later.

On the other hand, if your local market's numbers just don't work or regulations shut you out, don't be afraid to look farther afield. Some of the highest returns are in places you might never have considered until you researched them.

Thanks to modern tech and platforms like Chalet, out-of-state investing is very achievable today, even for first-timers, provided you do your homework and build the right team.

Many investors ultimately pursue a hybrid strategy: leveraging local knowledge where it exists, but not hesitating to go out-of-state when the deal is right.

By staying flexible and data-driven, you can seize opportunities wherever they arise. Remember, an Airbnb investment is a business venture. You want the location that best fits your business plan, whether that's 10 minutes down the road or a four-hour flight away.