Your Airbnb rental looked perfect on paper. Great location, solid financing, and you'd seen the income projections that made it seem like easy money. Then reality showed up: platform fees you didn't fully account for, repairs that came faster than expected, rising interest rates, and a market that went from "hot" to "saturated" almost overnight.

Now you're staring at monthly statements that tell an uncomfortable story. Your short-term rental (STR) isn't just underperforming. It's actively losing money.

If you're thinking about selling, you're not alone. Recent market analysis shows that while U.S. short-term rental bookings hit record highs in 2022, many individual owners saw their profits tumble due to stiffer competition and oversupply in certain markets. The overall industry grew, but not every host benefited equally.

The reality for many STR investors: Your property might be bleeding cash not because you failed, but because the market shifted. This guide will help you exit strategically without getting crushed on price.

This guide is built for investors, not casual hosts. We're going to walk you through how to exit an unprofitable Airbnb without getting crushed on price. You'll learn how to diagnose the real problem, pick the right buyer audience, build a compelling case despite weak numbers, and execute a clean sale that protects your equity and sets you up for better opportunities.

Is Your Airbnb Losing Money from Operations or Just Bad Financing?

Most owners skip this step and pay for it at the negotiating table.

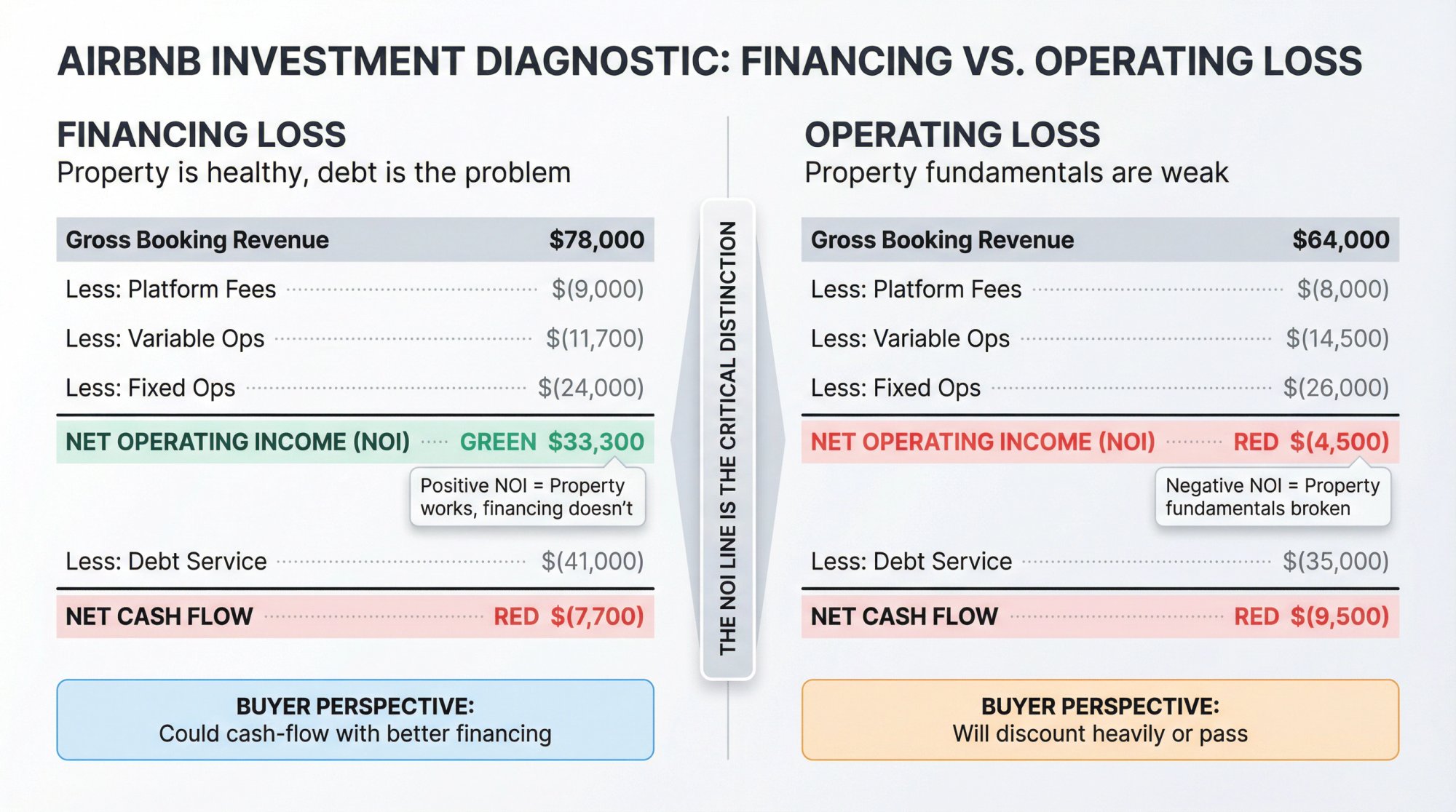

When your Airbnb isn't profitable, there's a critical distinction you need to make: Is the property the problem, or is your financing the problem?

These feel identical (negative cash flow every month), but they mean completely different things to buyers. And if you can't explain which one you're facing, buyers will assume the worst.

The Distinction That Protects Your Price

Operating loss means the property itself is unhealthy. Even before your mortgage payment, the business is weak. Low occupancy, high expenses, regulatory restrictions, or fundamental market issues.

Financing loss means the property could actually work fine for someone else. Maybe you bought at peak prices with minimal down payment. Maybe rates jumped after you closed. Maybe you underutilized it (personal use ate up peak season weeks). The asset could cash-flow for a buyer with different circumstances.

Buyers care deeply which scenario they're buying into.

Build Your Profitability Bridge

Run this simple waterfall to understand what's really happening:

| Line Item | What It Means | Example |

|---|---|---|

| Gross booking revenue | Nightly rate × booked nights | $78,000 |

| Less: Platform fees | Airbnb/Vrbo service charges | $(3,000) to $(12,000) |

| Less: Variable ops | Cleaning, supplies, turnovers | $(11,700) |

| Less: Fixed ops | Insurance, utilities, HOA, taxes, repairs | $(24,000) |

| = Net Operating Income (NOI) | Cash the property produces before debt | $30,000 |

| Less: Debt service | Mortgage principal + interest | $(38,000) |

| = Net Cash Flow | What you actually keep | $(8,000) |

This is your truth table. Share it with buyers. It tells them exactly where the pain is coming from.

Critical note on fees: Airbnb's fee structures changed significantly in recent years. Most hosts operate under a split-fee model where hosts pay 3% and guests pay 14-16%. But Airbnb has been rolling out a single-fee structure where the entire fee (often 15.5%) comes out of the host payout, especially for hosts using property management software. This can dramatically impact your net revenue if you didn't account for it properly.

Property management fees also eat more than many new owners expect. Industry research puts typical vacation rental management fees in the 15% to 40% range, with averages around 25-30%.

The Quick Test

Look at your NOI line:

If NOI is positive but you're still bleeding cash → You have a financing problem. The property might work for a buyer who pays cash, refi's at a better rate, or has more equity.

If NOI is negative → You have an operations or market problem. The property's fundamentals (pricing, occupancy, costs, or regulations) aren't working.

Either way, you now have a story you can explain to buyers without hand-waving.

Want to run your own numbers? Use Chalet's free Airbnb calculator to model your property's NOI and cash flow under different scenarios. It shows exactly where your property stands and what a buyer with different financing might achieve.

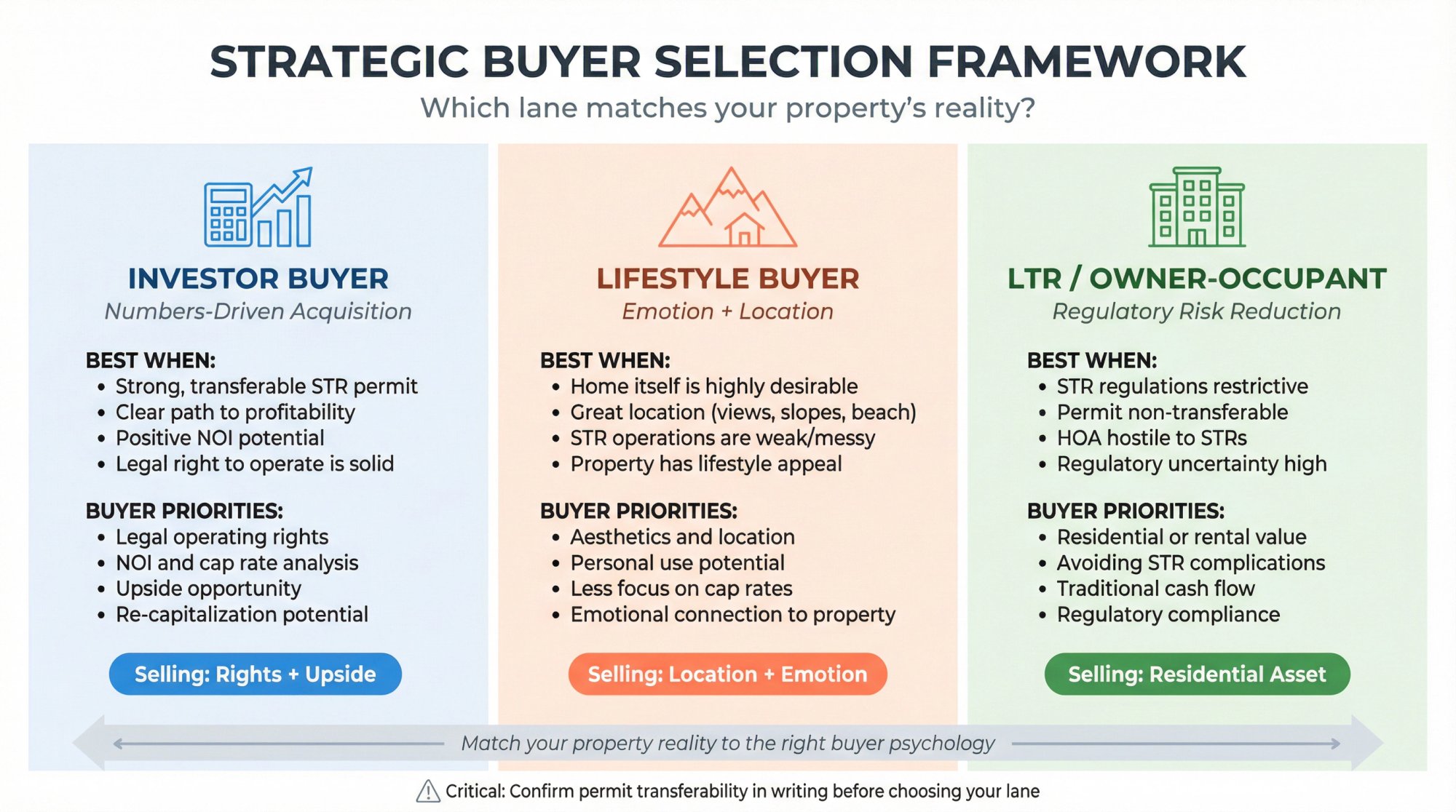

Who Should Buy Your Unprofitable Airbnb?

Here's the trap most sellers fall into: they market an unprofitable Airbnb exclusively to "turnkey investors."

That's often the wrong audience.

The Three Buyer Lanes

When your STR isn't profitable, you need to think strategically about who you're actually selling to. There are three distinct lanes, and picking the right one determines your price, timeline, and negotiation power.

→ Lane 1: Investor buyer

Best when the property has clean STR rights and a believable path back to profitability. These buyers are running numbers. They'll scrutinize your NOI, but if they see opportunity, they'll pay for the legal right to operate plus the upside potential.

→ Lane 2: Second-home or lifestyle buyer

Best when your STR story is weak but the home itself is desirable. These buyers pay for emotion and location. They might operate it as an Airbnb occasionally, or they might just use it personally. They care less about your cap rate and more about mountain views and proximity to slopes.

→ Lane 3: Long-term rental buyer or owner-occupant

Best when STR regulations are restrictive, non-transferable, or when the HOA is hostile. If the "right to operate" as an STR is shaky, you're better off positioning it as a rental property or primary residence and avoiding the regulatory discount entirely.

The Decision Matrix

Use this to pick your primary audience:

| Your Reality | Best Lane | Why |

|---|---|---|

| STR permit is strong and transferable | Investor | You're selling "legal right + upside" |

| The house is amazing but ops are messy | Second-home | They pay for emotion and location |

| Rules are shaky, HOA hostile, permit unclear | LTR buyer | Reduces regulatory risk discount |

| NOI positive but cash flow negative | Investor | Buyer can re-capitalize |

| Many future bookings you can't keep | Second-home or LTR | Avoids messy transition |

Critical point: In many markets, the right to operate is the real asset. If your permit is non-transferable or the city has enacted a moratorium since you bought, your investor lane shrinks dramatically. Don't guess on this. Confirm the current rules and transferability in writing.

Check your local regulations using Chalet's STR regulation library. It covers permit requirements, transferability rules, and occupancy caps across major STR markets. Knowing your regulatory position protects you from surprises during due diligence.

How Do Investors Value Unprofitable Short-Term Rentals?

This is where sellers accidentally sabotage themselves.

Buyers Don't Pay for Your Pain

Every dollar you poured into this property. Every weekend you spent driving up to fix things. Every guest complaint. Every late-night maintenance call. Those are sunk costs. To buyers, they're irrelevant.

Buyers underwrite based on forward-looking economics:

• Expected revenue (average daily rate × occupancy × seasonality)

• Expected operating expenses (their cost structure, not yours)

• Risk adjustments (regulations, HOA restrictions, competition, insurance)

• Their financing reality (down payment, rate, DSCR requirements)

That means if your Airbnb is unprofitable because of your mortgage, a buyer might still pay fair market value. If it's unprofitable because of bad fundamentals, you either need to fix them or price it as a regular home without the STR premium.

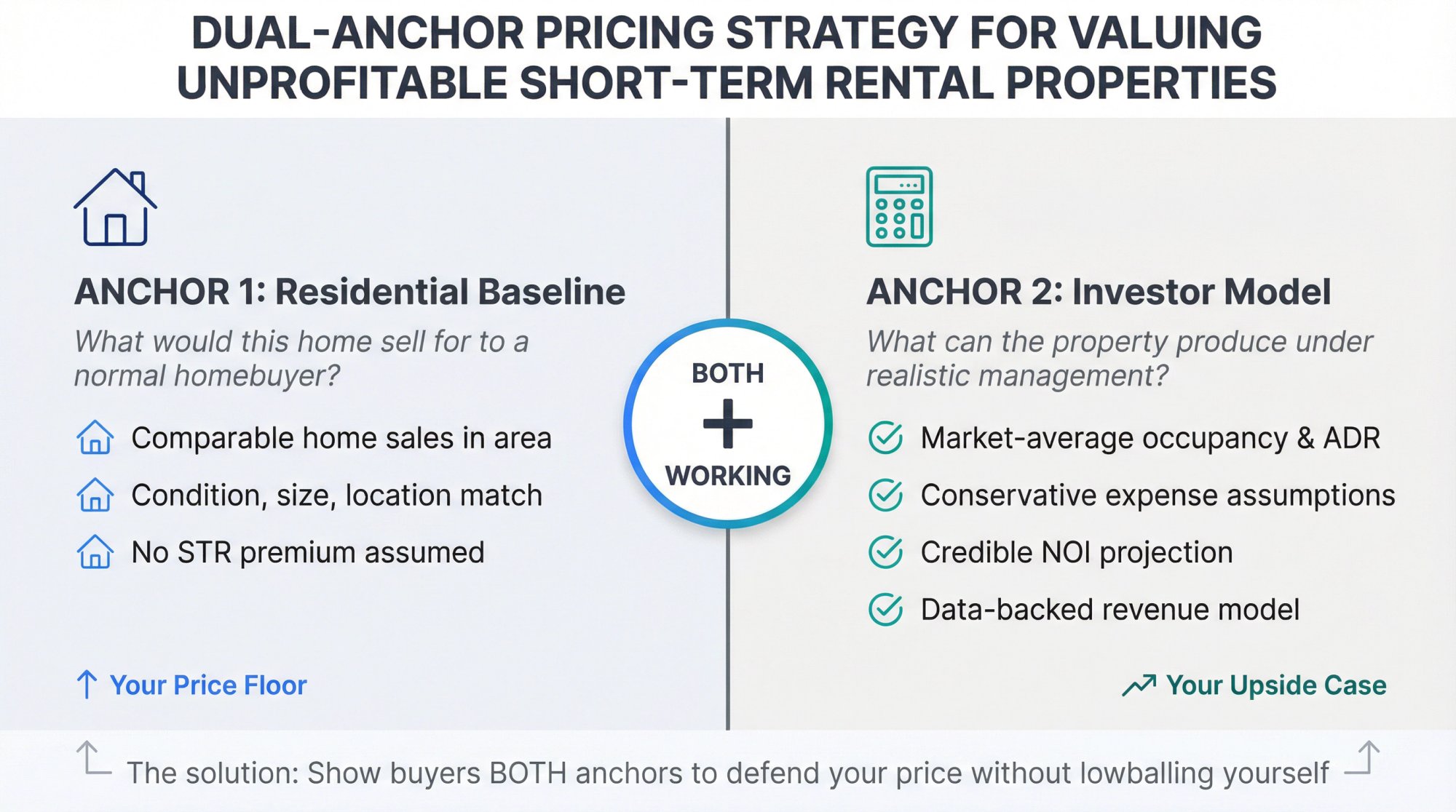

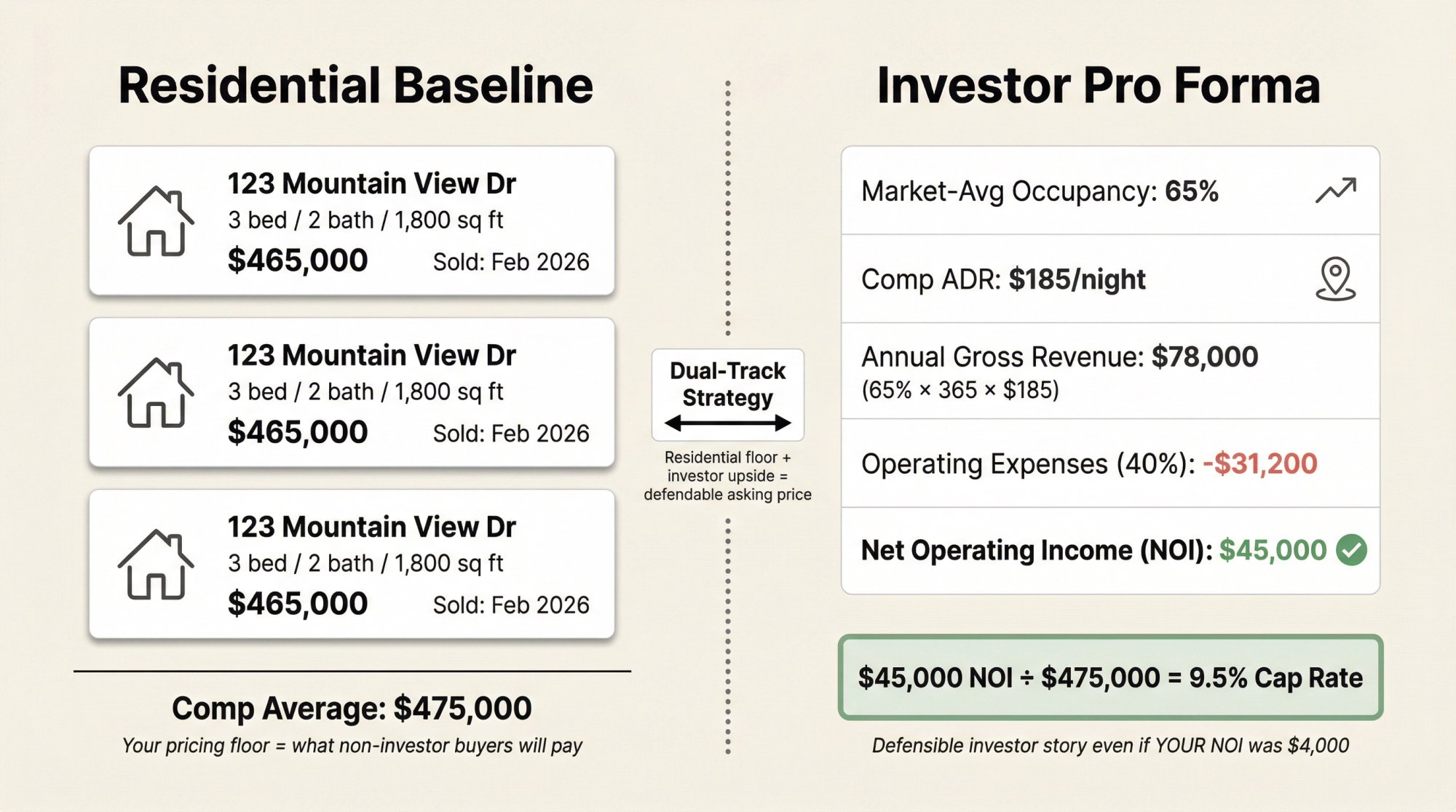

Your Pricing Should Anchor to Two Things

You want both working in your favor:

1. Residential comparables → What would this home sell for to a normal homebuyer who doesn't care about Airbnb?

2. Investor underwriting → A credible financial model showing how the property can produce positive NOI under realistic management.

If you only show weak Airbnb history, you invite lowball offers. If you only show residential comps and dodge STR questions, you invite fear, which becomes immediate price cuts.

The solution is to arm buyers with both. Show them comparable home sales to establish a baseline. Then show them a data-backed revenue model to prove upside potential. Even if your results were weak, market data from Chalet's analytics can demonstrate that similar properties in your area achieve occupancy and ADR that would make this profitable under competent management.

That's how you defend your price without lying about your own performance.

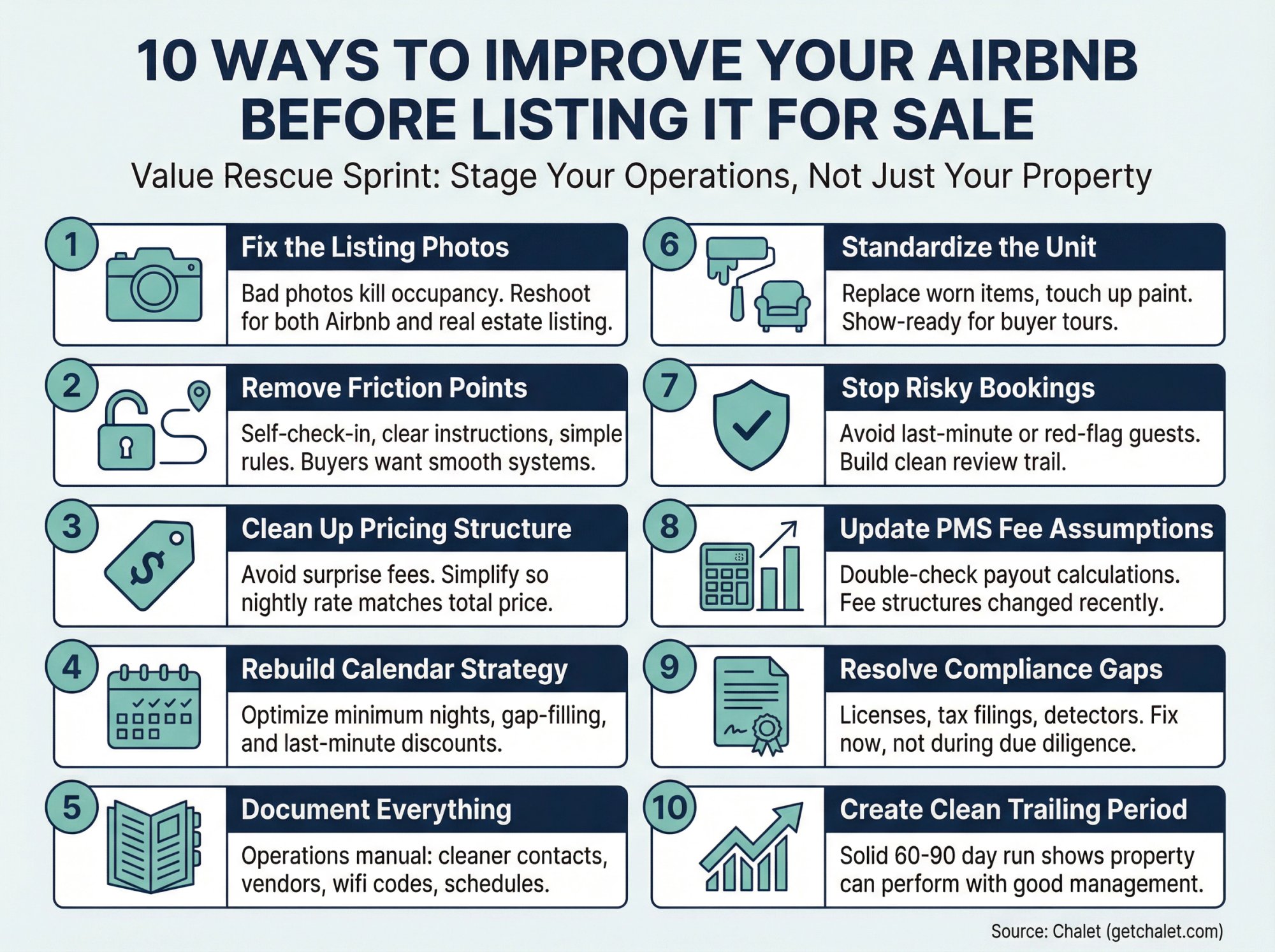

10 Ways to Improve Your Airbnb Before Listing It for Sale

Even if you're selling, you should run a short "value rescue" sprint. Not to turn the business around forever, but to remove obvious red flags and boost buyer confidence.

Think of this like staging a home, except you're staging the operations.

The 10 Highest-Leverage Moves

① Fix the listing photos

Bad photos kill conversion and occupancy. If your Airbnb underperformed partly because guests couldn't visualize the space properly, reshoot. These photos will also go into your real estate listing.

② Remove friction points

Self-check-in, clear arrival instructions, simple house rules. Eliminate confusing processes that hurt reviews and repeat bookings. Buyers want systems that run smoothly.

③ Clean up your pricing structure

Avoid surprise fees that inflate the total price. Airbnb now defaults to showing total price upfront, which makes fee-heavy listings less competitive. Simplify so your nightly rate is more of what guests actually pay.

④ Rebuild your calendar strategy

Look at minimum night requirements, gap-filling rules, and last-minute discounts. Many underperforming STRs leave money on the table because the calendar blocks out too many nights or prices weekdays poorly.

⑤ Document everything

Create a simple operations manual: cleaner contact info, vendor list, maintenance schedule, wifi password, thermostat codes. This becomes part of your investor packet and makes the property feel turnkey.

⑥ Standardize the unit

Replace worn linens, touch up scuffed paint, swap out anything that signals "cheap" or "neglected." You don't need a full renovation, but the space should show well for buyer tours.

⑦ Stop accepting risky bookings

If reviews are your problem, stop taking last-minute bookings from brand-new accounts or guests with red flags. A strong trailing 60-90 days of clean reviews helps your case.

⑧ Update PMS fee assumptions

If you use property management software, double-check your payout calculations. Airbnb's fee structures vary by integration, and the shift toward single-fee models may have changed your net revenue more than you realized.

⑨ Resolve compliance gaps

Licenses, tax filings, smoke/CO detectors, any outstanding permit issues. Buyers will check this in due diligence. Fix it now so it doesn't become a negotiation point.

⑩ Create a clean trailing period

Even a solid 60-90 day run helps. You're not hiding your overall track record, but you want buyers to see that the property can perform when managed correctly. It shifts the narrative from "this property is a dud" to "the previous owner had some struggles we can overcome."

Important: Don't juice results in ways that mislead buyers. You want a clean narrative that survives scrutiny. Temporary discounts or blocking personal-use weeks can help, but outright manipulation backfires during due diligence.

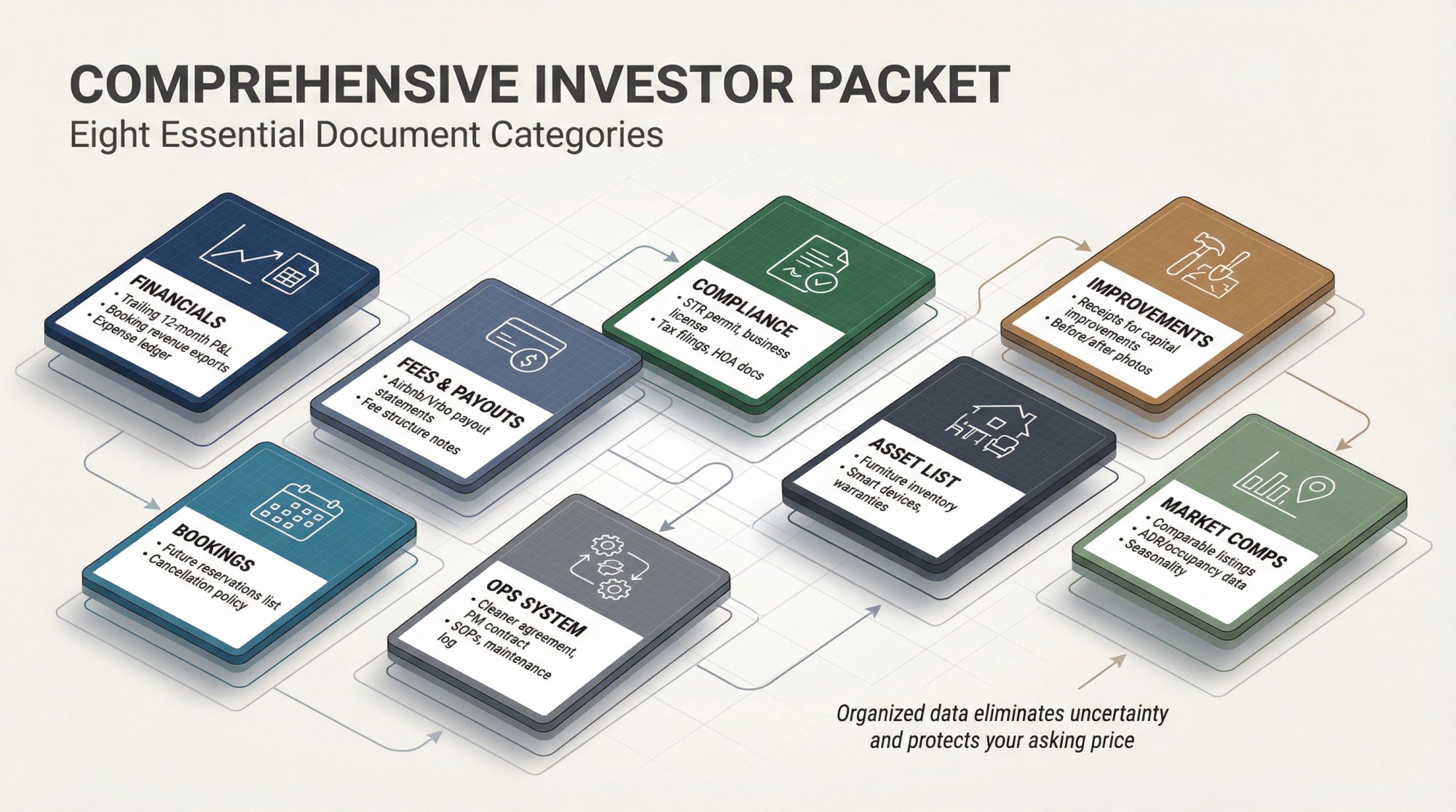

What Documents Do Buyers Need to See for an Unprofitable STR?

If your Airbnb is unprofitable, uncertainty is your enemy. Uncertainty becomes discounts.

So you eliminate uncertainty with data. Lots of it. Organized, transparent, and packaged in a way that says "I'm a professional seller, not a stressed host trying to unload a problem."

The Comprehensive Investor Packet

Create a folder (Google Drive or Dropbox) with these sections:

| Folder | What to Include | Why It Matters |

|---|---|---|

| Financials | Trailing 12-month P&L, booking revenue exports, expense ledger | Buyers underwrite fast with good data |

| Fees & Payouts | Airbnb/Vrbo payout statements, notes on fee structure changes | Net income is what matters, not gross bookings |

| Bookings | Future reservations list, cancellation policy notes | Transition risk assessment |

| Compliance | STR permit, business license, tax filings, HOA approval docs | Legal right to operate |

| Ops System | Cleaner agreement, PM contract (if any), SOPs, maintenance log | Shows turnkey value |

| Asset List | Furniture inventory with approximate value, smart devices, warranties | What conveys vs. what doesn't |

| Improvements | Receipts for capital improvements, before/after photos | Builds credibility |

| Market Comps | Comparable Airbnb listings, ADR/occupancy data, seasonality notes | Supports pro forma revenue |

The 1-Page Deal Summary Template

Put this at the front of your packet. It's your elevator pitch:

Property Basics

→ Beds, baths, sleeps, parking

Legal Status

→ "STR allowed? Permit #123, renewed annually, transferable upon sale" (or whatever your reality is)

Performance Summary

• TTM revenue: $72,000

• TTM expenses: $68,000

• TTM NOI: $4,000

(Yes, show the real numbers. Transparency builds trust.)

Why It Underperformed

→ 2-3 factual bullets. Example: "Owner self-managed remotely from 500 miles away. Slow response times hurt reviews and repeat bookings. Last four months under local PM show 22% occupancy improvement."

Upside Plan

→ 3 specific actions a buyer can take. Example: "Optimize pricing with dynamic tools. Expand to Vrbo (currently Airbnb-only). Improve photos and listing copy to match top performers in area."

What Conveys

→ "All furnishings, smart locks, Ring doorbell, professional photography files, cleaner/handyman contact list."

Transition Plan

→ "No bookings past [closing date]. Buyer will create new Airbnb listing. Seller will provide operations manual and vendor introductions."

This one-pager does more to protect your price than any marketing spin. It shows buyers you're serious, you've done the work, and you're not hiding anything.

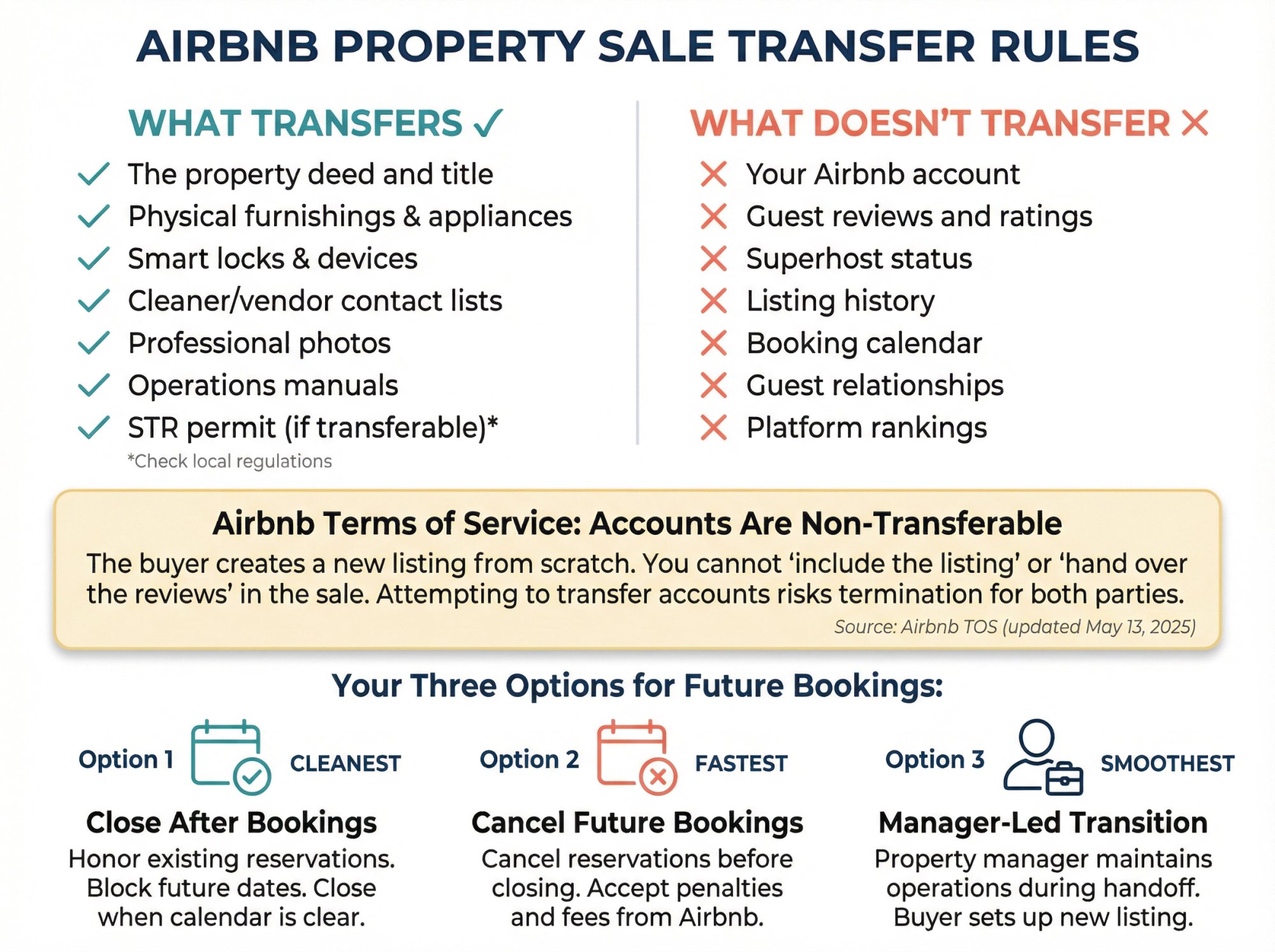

Can You Sell Your Airbnb Account with the Property?

This section prevents disasters.

You Cannot Sell Your Airbnb Account

The most important fact: Airbnb's Terms of Service explicitly state that you may not transfer your account to someone else.

According to Airbnb's Terms of Service (last updated May 13, 2025), accounts are non-transferable. Period.

What this means:

• You're selling the property, not your Airbnb profile

• You can't "include the listing" or "hand over the reviews"

• The buyer will need to create their own listing from scratch

Multiple vacation rental sources confirm this: Airbnb and Vrbo do not allow listing transfers. The new owner starts with a blank slate.

This is non-negotiable, so don't promise it to buyers and don't structure your asking price around "transferring a 5-star listing with 100 reviews." You can't deliver it, and trying to do so risks account termination for both you and the buyer.

Your Three Options for Future Bookings

So what do you do about reservations on your calendar?

Option 1: Close after all existing bookings finish

The cleanest approach. Block your calendar for dates past your planned closing window. Let current reservations run their course. Honor them, provide good experiences, and close when the calendar is clear.

Option 2: Cancel future bookings before closing

Fast but painful. Airbnb has penalties for host cancellations, including fees and potential suspension. Only do this if you absolutely must close quickly and are willing to absorb the financial and reputational hit.

Option 3: Sell with a manager-led transition plan

You can keep operations stable by lining up a property manager to take over after closing. This doesn't "transfer the account" (the buyer still creates a new listing), but it ensures guests are taken care of and the property stays operational while the new owner sets up their listing. It reduces downtime and adds value.

If you need help setting up a transition plan with vetted vendors (property managers, cleaners, insurance, furnishing), Chalet's STR directory connects you with STR-specialist service providers in your market. Having this vendor network ready to hand off is something investors value.

Guest Communication Script

If you have bookings during your listing period and buyers want to tour:

"Hi [Guest Name], just a heads-up: the home is in the process of being sold. Your reservation is still confirmed, and nothing changes about your stay, check-in, or the home you booked. If anything changes before your arrival, I'll notify you immediately through Airbnb. Thanks for your understanding."

Keep it calm, factual, and in-platform. Most guests won't care as long as their trip is unaffected.

How to Price an Unprofitable Airbnb for Sale

If your Airbnb is losing money, buyers will approach your listing with assumptions.

They'll assume either:

-

It's mismanaged and they can fix it, or

-

It's fundamentally weaker than nearby alternatives

Your pricing and marketing need to make the first narrative win.

Make Your Pricing Tell the Right Story

Start with residential comparables. What do similar homes (same size, condition, location) sell for when STR income isn't part of the equation? That's your floor.

Then build an investor underwriting model. Show what the property could produce under realistic management:

• Comp ADR from similar nearby Airbnbs

• Achievable occupancy based on market averages (not your weak performance)

• Conservative expense assumptions

• A credible NOI projection

Example: "At the asking price of $475,000, with market-average occupancy of 65% and ADR of $185, this property can generate $45,000 in annual NOI. That's an 9.5% cap rate before financing."

Even if your NOI was $4,000, market data proves the potential. Use Chalet's market analytics to pull occupancy and rate data for comparable properties in your area. That's your evidence.

Negotiation Leverage Beyond Price Cuts

When buyers push back citing your weak revenue, don't just drop your price. Offer value that reduces their perceived risk:

• A complete investor packet (you've already built it)

• Vendor contact list (proven cleaner, handyman, inspector)

• Fresh inspection report (shows no hidden issues)

• Furniture bill of sale (faster time to launch)

• Quick-close timeline (if they need it)

• Operations manual (everything documented and ready to hand off)

These reduce friction and uncertainty. That raises offers without sacrificing your net proceeds.

Post-2024 Commission Reality

If you're selling in the U.S., be aware: practice changes took effect in August 2024 after the NAR settlement. Offers of compensation to buyer agents are now prohibited on most REALTOR-owned MLSs (though compensation can still be negotiated off-MLS). Buyer agents must also enter written buyer agreements before touring properties.

What this means for you: Your listing agent may structure concessions or buyer agent compensation differently than "how it used to work." Have that conversation up front so there are no surprises at closing.

Want an agent who understands STR-specific underwriting and objections? Meet an Airbnb-friendly real estate agent through Chalet. Our network includes agents who've closed STR transactions and know how to position properties with weak historical performance for maximum value.

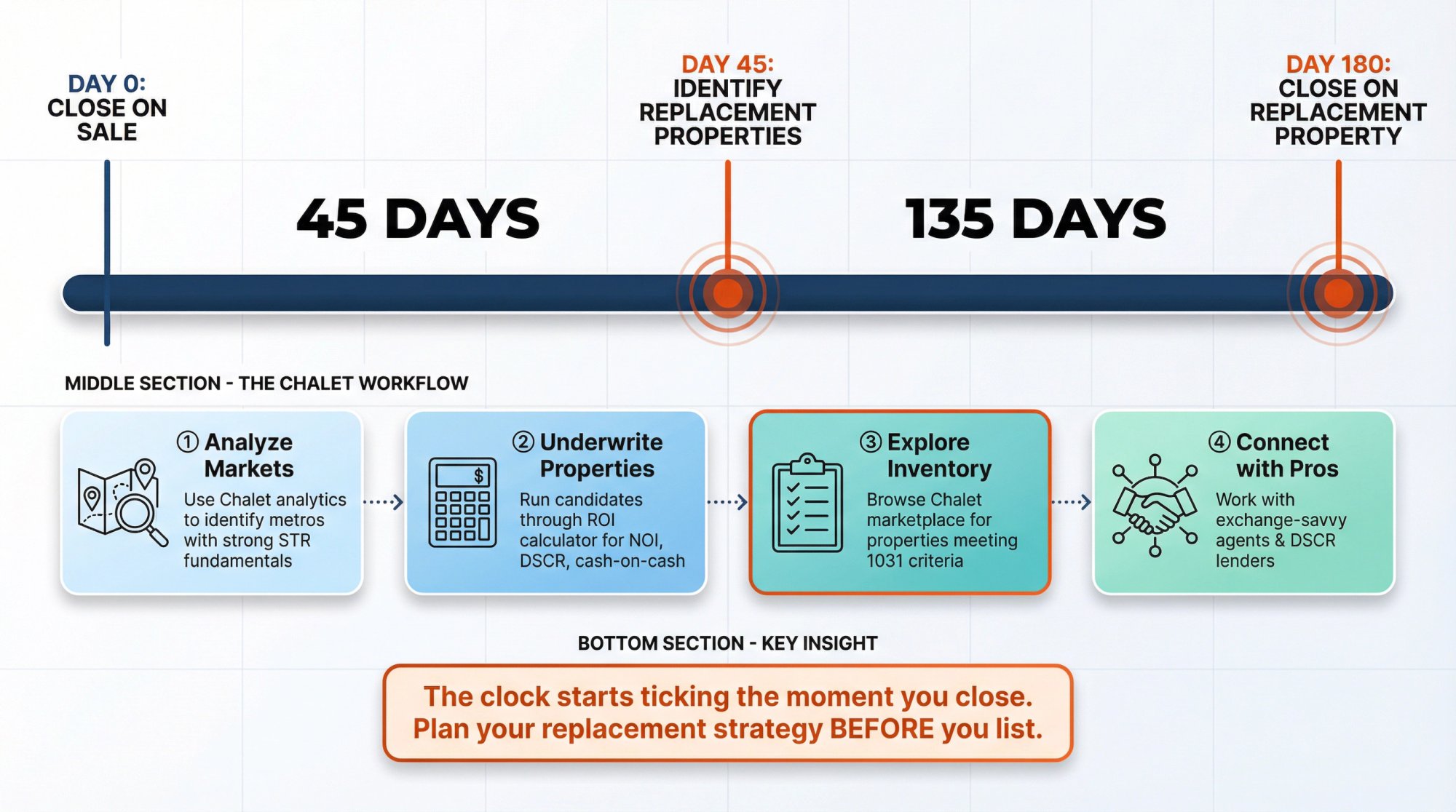

Should You Use a 1031 Exchange When Selling a Losing Airbnb?

Many owners selling an unprofitable Airbnb aren't done with real estate investing. They're rotating into a better market, a more operator-friendly property, or lower-maintenance assets.

A 1031 like-kind exchange lets you defer capital gains tax by rolling your proceeds into replacement property. But if you're selling because you're stressed, a 1031 can make that stress worse unless you plan correctly.

The IRS Timing Rules

According to IRS Instructions for Form 8824 (2025):

• Section 1031 applies only to real property held for investment or business use (not property held primarily for sale)

• You must identify replacement property within 45 days after closing

• You must receive the replacement property within 180 days (or by your tax return due date, whichever is earlier)

That's tight. If you list your unprofitable STR and it sells in 30 days, you now have 45 days to identify 1-3 replacement properties and 180 days total to close on one.

The clock starts ticking the moment you close on your sale.

1031 Seller Checklist

☑ Engage a qualified intermediary before listing (they hold your proceeds during the exchange)

☑ Choose your buyer lane and list with speed in mind (you need a quick sale to maximize your replacement search window)

☑ Build your identification list using data-driven market research

☑ Underwrite replacements with a consistent financial model so you're comparing apples to apples

☑ Assemble an STR-savvy vendor team (agent, lender, PM) who can execute on tight timelines

Learn more about the complete 1031 exchange timeline and how to use a 1031 to transition from long-term rentals to short-term rentals.

The Chalet 1031 Workflow

Here's how we help investors execute clean exchanges:

① Analyze markets: Use Chalet's Airbnb analytics to identify metro areas with strong STR fundamentals, favorable regulations, and growth trends

② Underwrite specific addresses: Run every candidate property through Chalet's ROI calculator to model NOI, DSCR, and cash-on-cash returns

③ Explore inventory: Browse active STR listings on Chalet's marketplace to find properties that meet your 1031 identification criteria

④ Connect with exchange-savvy pros: Work with agents and lenders who've closed 1031 transactions and understand DSCR loan timelines

If you're rotating out of an underperforming market into a stronger one, the 1031 structure can save you tens of thousands in taxes. Just don't leave it to chance. Plan your replacement strategy before you list.

Additional resources:

→ 5 Common Mistakes to Avoid in 1031 Exchanges

→ Can I Use a 1031 Exchange to Purchase a Short-Term Rental Property?

→ Best and Worst States for 1031 Exchanges

How Chalet Helps You Exit Strategically and Find Your Next Winner

Selling an unprofitable Airbnb isn't just about getting out. It's about positioning yourself for the next opportunity that will work.

Chalet is built specifically for this: helping short-term rental investors research, buy, finance, operate, and optimize properties with free analytics and a vetted vendor network.

Here's how we help at each stage of your exit and pivot:

Diagnose Your Current Property

Free analytics mean you're not guessing about why your Airbnb failed. Use Chalet's market dashboards to see how your property's occupancy and ADR stack up against local comps. See seasonality patterns. Identify whether you were fighting market headwinds or operational issues.

ROI and DSCR calculator at getchalet.com/airbnb-calculator lets you model your property under different scenarios: What if you'd had a property manager? What if you'd priced differently? What would a buyer's cash flow look like with 25% down? Run the numbers so you understand exactly what went wrong.

Sell Strategically

Regulation library at getchalet.com/resources/rental-regulations confirms whether your STR permit is transferable, what occupancy caps exist, and how regulations have changed since you bought. This determines your buyer lane strategy.

Sell Your STR platform: List your property on Chalet's marketplace for sellers to reach qualified STR investors actively looking for opportunities. We connect you with real estate agents who specialize in STR transactions. They know how to market underperforming properties, build investor packets, and position exit strategies that protect your equity. They've seen dozens of these situations and know what works.

Research Replacement Properties

If you're doing a 1031 exchange or just want to try again in a better market:

Market analytics show you which metro areas have the best STR fundamentals. Compare markets side-by-side. See occupancy trends, ADR growth, regulation environments, and seasonality patterns. Identify where investors are succeeding so you don't repeat your mistake.

Check out market-specific analysis:

→ Are Airbnbs Profitable? A Market-Based Analysis

→ Average Airbnb Occupancy Rates by City

→ Never Buy an Unprofitable Airbnb Again

Airbnbs for Sale directory at getchalet.com/airbnbs-for-sale gives you access to active STR listings with performance data, photos, and seller contacts. You can explore properties that meet your 1031 identification criteria or just browse to see what's available in stronger markets.

Execute Your Next Buy

Vetted vendor network: Once you've identified your replacement property, Chalet's STR directory connects you with property managers, cleaners, furnishing companies, insurance providers, and other STR-specialist service providers. Set up your operations stack before you even close.

DSCR lenders and financing guidance: We work with lenders who understand short-term rental underwriting and can close on investment-property timelines. If you're doing a 1031, speed matters. Our lender partners know the game.

The Platform Positioning

Think of Chalet as your one-stop platform for everything STR:

• Free analytics (no subscription, no paywall)

• Underwriting tools (calculators, market data, regulation library)

• Vendor marketplace (agents, lenders, managers, service providers)

• Inventory access (properties for sale)

From researching your exit → executing the sale → identifying your next property → setting up operations, we handle it in one place. You're not piecing together five different platforms or paying for three data subscriptions.

If you failed with one STR, that doesn't mean you're done investing. It means you need better data, better execution, and a better market selection process. That's what we built Chalet to provide.

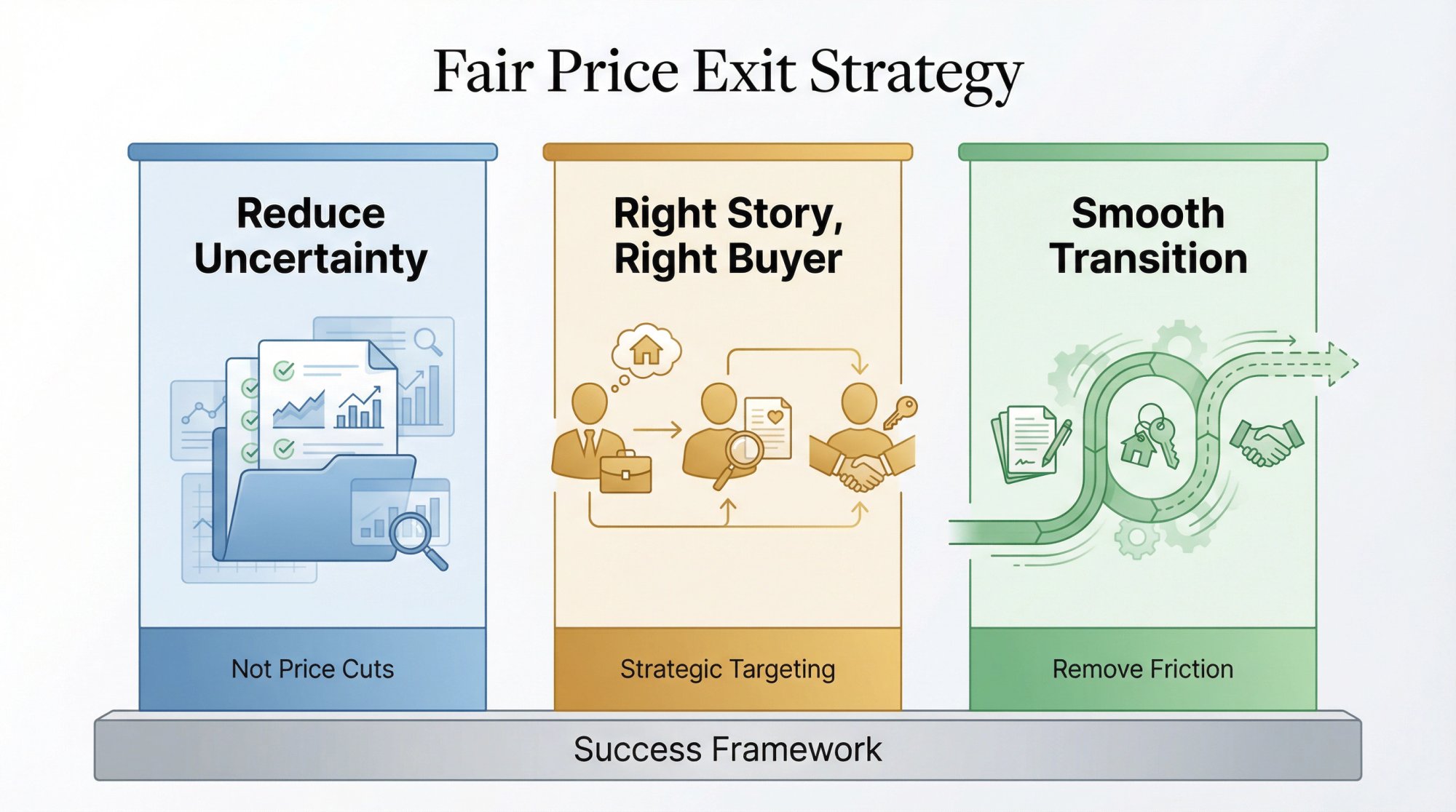

What Makes Selling an Unprofitable Airbnb Go Well

The difference between getting a fair price and taking a beating? How well you reduce buyer uncertainty, tell the right story to the right audience, and smooth the transition.

If you want the "I got a fair price even though it was unprofitable" outcome, focus on three things:

1. Reduce buyer uncertainty more than you reduce price

The investor packet is your leverage. Comprehensive financials, transparent performance data, clear regulatory status, documented operations, and a credible upside model eliminate the guesswork that creates lowball offers.

When buyers can underwrite your property confidently, they pay closer to your asking price. When they're guessing, they discount heavily to protect themselves.

2. Sell the right story to the right buyer

You don't need every buyer to want your property. You need the right buyer lane to want it.

If you've got strong STR rights and a believable turnaround story, target investors. If the house is beautiful but your ops were weak, target second-home buyers who'll pay for location and lifestyle. If regulations are hostile, pivot to LTR buyers and price it as a residential investment.

Match your marketing to your reality. Don't try to sell a regulatory nightmare to Airbnb investors. Don't pitch weak cash flow to purely-financial buyers.

3. Remove the transition cliff

Bookings, permits, vendors, operations. These are the things that blow up deals in the final week.

Solve them in advance:

• Clear booking calendar or have a transition plan

• Confirm permit status and transferability in writing

• Document vendor relationships and create handoff materials

• Build an operations manual so the buyer can launch smoothly

The easier you make the transition, the less buyers discount for perceived hassle.

Frequently Asked Questions

Can I sell my Airbnb listing with the reviews?

No. Airbnb's Terms of Service prohibit account transfers. You're selling the property, not your Airbnb profile. The buyer will create a new listing and start from zero reviews. You can provide your professional photos, listing copy, and operating know-how, but the reviews and account stay with you (and become inactive once the property is no longer yours).

Should I sell the property furnished?

Usually, yes (especially if targeting investors or second-home buyers). Furnishings reduce the buyer's time-to-launch. But be realistic about value. Used furniture resells poorly (25 cents on the dollar is common). Include a detailed inventory list and treat furnishings as "convenience value," not significant additional price. What matters more: smart locks, professional photos, cleaning systems, and vendor relationships.

Do I have to disclose that the property loses money?

Disclosure laws vary by state (consult a local real estate attorney). Practically, hiding weak performance backfires during due diligence. Buyers will see your payout statements, occupancy reports, and tax returns. A better approach: disclose factually and show why it underperformed and how it can improve. Transparency builds trust. Opacity invites suspicion and steeper discounts.

What if my STR permit is non-transferable?

Then your investor lane may collapse. Pivot to second-home buyers or long-term rental buyers and price accordingly (closer to residential comps, without STR premium). Many cities have non-transferable permits or permit caps. If yours does, acknowledge it up front. Buyers will find out in due diligence anyway. Better to control the narrative from the start.

What if I have a great location but terrible performance?

That's often a management issue, not an asset issue. Run the 30-day stabilization sprint. Get fresh photos, optimize pricing, improve your listing copy, and generate a strong trailing 60-90 days. Then package it with market data from Chalet's analytics showing what comparable properties achieve in your area. Position it as "underutilized asset with proven market demand." That story sells.

How do I handle a property manager contract?

Most PM contracts are month-to-month or have 30-60 day cancellation clauses. Check yours. If the buyer wants to keep your property manager, coordinate an introduction and contract transfer. If they want to self-manage or use someone else, give notice and terminate cleanly. Some buyers value inheriting a good PM relationship. Others see it as a cost they'd rather eliminate.

What about existing bookings during the sale period?

Three choices (covered earlier): Honor them and close after they complete, cancel them (with penalties), or use a property manager to maintain continuity. Most buyers prefer to take possession without active bookings so they can set up their own listing from scratch. Coordinate with your agent to block the calendar appropriately.

Can I use a 1031 exchange if I'm selling at a loss?

If you're selling at a true capital loss (sale price below your adjusted cost basis), there's no gain to defer, so a 1031 doesn't help. But if your property appreciated but your cash flow was negative, you can absolutely use a 1031 to defer the gain and roll into a better investment. Talk to your CPA to understand your specific situation. Learn more about 1031 exchanges and what they are.

How long does it typically take to sell an unprofitable STR?

It varies widely by market, price, and buyer lane. In hot vacation markets with strong demand, even underperforming STRs can sell in 30-60 days if priced correctly and marketed to the right audience. In softer markets or with complicated regulatory situations, expect 90-180 days. Quality of your investor packet, strength of your agent, and how well you've positioned the property all matter.

Should I try to improve performance first or sell immediately?

Run the 30-day stabilization sprint regardless. If your issues are truly fixable (bad photos, poor pricing, no systems), three months of solid management might boost your confidence and your sale price. But if you're burned out, facing regulatory headwinds, or have identified better opportunities, don't delay just to "prove it works." Sometimes the best move is a clean exit. Opportunity cost matters.

Your Next Move: Exit Smart, Position Strong

Selling a rental property that didn't work out is never fun. But it's also not a failure. It's a data point, a learning experience, and (if you execute this correctly) a strategic repositioning into something better.

You now have the playbook:

• Diagnose whether it's an operating problem or a financing problem

• Choose the right buyer lane for your situation

• Build an investor packet that reduces uncertainty

• Handle bookings and account transfer correctly

• Price based on data, not emotion

• Plan your 1031 if you're reinvesting

Every successful investor has properties that didn't work. The difference is what you do next.

Ready to Move Forward?

If you're selling an underperforming Airbnb:

→ Run your property through Chalet's ROI calculator to understand exactly what's driving the loss

→ Check your market's STR regulations to confirm permit transferability and pick your buyer lane

→ Connect with an Airbnb-friendly agent who knows how to market STRs with weak performance data

→ List your property on Chalet's seller platform to reach qualified STR investors

If you're planning a 1031 into a better market:

→ Explore Chalet's market analytics to identify metros with strong STR fundamentals

→ Browse active inventory on Chalet's marketplace to start building your replacement property list

→ Set up your vendor stack with Chalet's STR directory before you even close

→ Read The Ultimate Guide to Selling Your Short-Term Rental for additional strategies

One bad investment doesn't define you. How you handle the exit does. Make it clean, make it strategic, and set yourself up for the next one that will work.

Visit Chalet to get started.