On July 4, 2025, President Trump signed the "One Big Beautiful Bill Act" into law. If you own or plan to own an Airbnb rental, this legislation deserves your full attention. After a narrow Congressional vote, this sweeping tax reform extends key provisions from 2017, restores some benefits that were fading away, and permanently locks in others that were set to expire.

The short version? Short-term rental investors just got a significantly more favorable tax environment. We're talking about permanent 20% deductions on business income, the return of full bonus depreciation, protection of 1031 exchanges, and a quadrupled SALT cap that makes high-tax markets more attractive again. According to Newsweek's analysis of the housing market impact, these changes could benefit real estate investors substantially, though critics argue the bill favors higher-income buyers over first-time homeowners.

For STR owners who understand how to use these provisions, the potential savings are real. And the window to act is now. Here's what changed, what it means for your vacation rental business, and how you can capitalize before these benefits phase out.

Is the 20% QBI Deduction Now Permanent for Airbnb Owners?

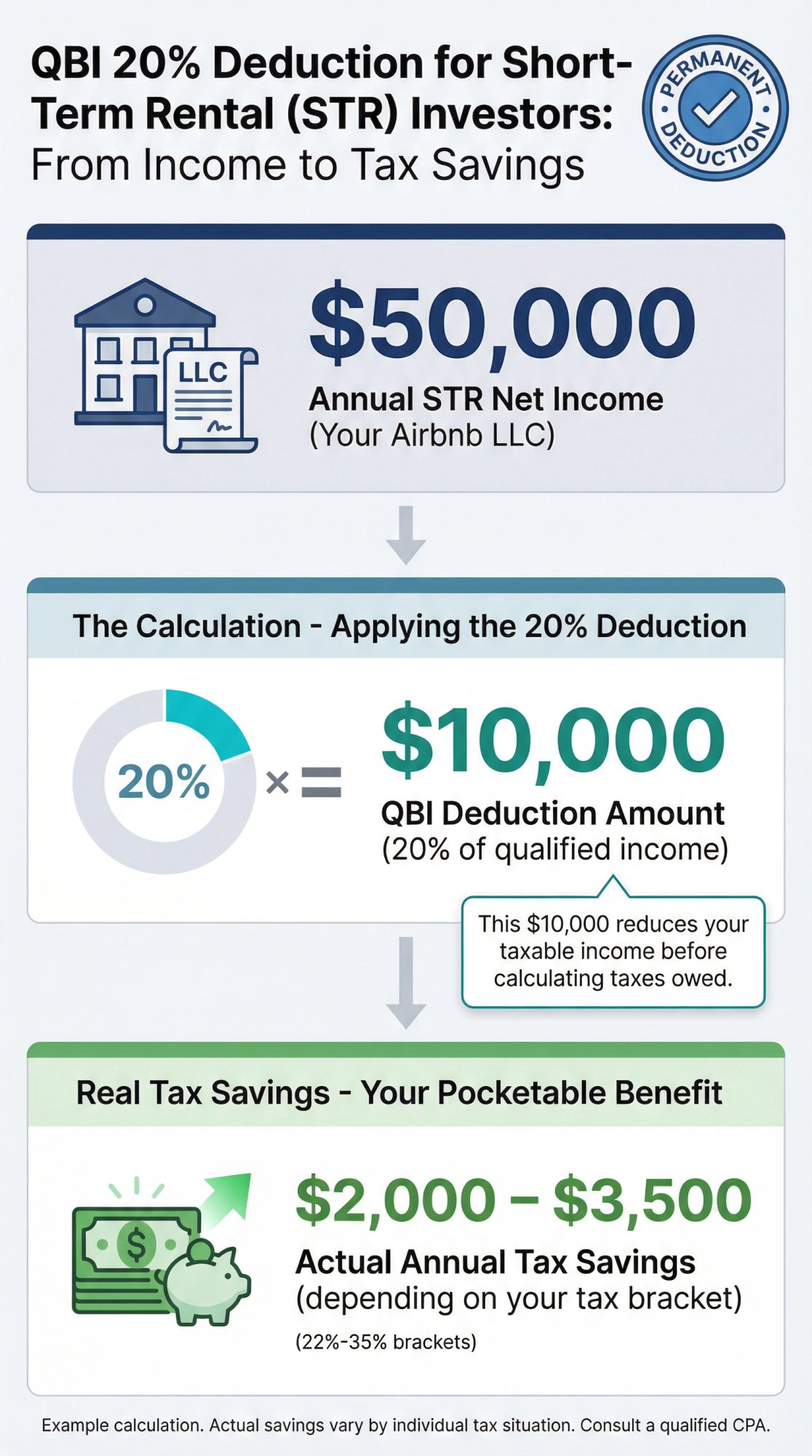

One of the most significant wins for vacation rental owners is this: the Qualified Business Income (QBI) deduction is no longer temporary. According to the National Association of Realtors' in-depth analysis, this provision, which was originally set to sunset at the end of 2025, has been made permanent.

What does QBI actually do for you? If you operate your rentals through a pass-through entity (think LLC, sole proprietorship, S-Corp, or partnership), you can deduct 20% of your qualified rental income from your taxable income each year.

What this looks like in practice: If your Airbnb LLC generates $50,000 in net income, you can potentially deduct $10,000. Depending on your tax bracket, that translates to roughly $2,000 to $3,500 in actual tax savings, every single year.

Hiltzik CPA's analysis of the bill confirms that real estate investors operating through pass-through structures will continue to benefit from this deduction indefinitely. Making it permanent prevents what would have been a meaningful tax increase hitting millions of real estate investors in 2026.

For professional hosts and multi-property operators, this solidifies a major long-term benefit. The deduction rewards running your rentals like a formal business rather than treating them as passive investments. If you haven't already, consider structuring your rental activity through an LLC to ensure you qualify. This change increases the appeal of treating short-term rentals as a business venture.

One important note: Not every rental automatically qualifies for QBI treatment. Your activity needs to rise to the level of a trade or business, which is often the case for actively managed STRs. Confirm with your CPA whether your specific situation meets the threshold.

What Does 100% Bonus Depreciation Mean for STR Investors?

This is arguably the biggest immediate tax benefit for Airbnb hosts in the entire bill.

Here's what happened: The 2017 tax law allowed investors to fully expense certain property components in Year 1. But that bonus depreciation had been phasing out. According to Anderson Advisors' breakdown, the allowance dropped to 60% in 2024, was scheduled to fall to 40% in 2025, and would have disappeared entirely by 2027.

The Big Beautiful Bill reverses that completely. Full 100% bonus depreciation is now restored for qualifying assets placed in service after January 19, 2025.

In plain terms: if you buy or improve a rental property in 2025 or later, you can immediately deduct 100% of the cost of many shorter-life assets. This includes:

-

Appliances (refrigerators, washers, dryers)

-

Furniture (beds, couches, dining sets)

-

Equipment (HVAC systems, hot tubs)

-

Land improvements (fencing, landscaping, paving)

-

Many renovation costs

Instead of depreciating these items over 5, 7, or 15 years, you write them all off in year one.

How Does Cost Segregation Maximize Your Tax Savings?

With a cost segregation study, an engineering analysis identifies which portions of a property's cost fall into these shorter-life categories. The impact can be substantial:

| Scenario | Purchase Price | Qualifying Assets | Tax Savings (35% bracket) |

|---|---|---|---|

| Mountain cabin STR | $400,000 | $80,000 | ~$28,000 |

| Beach condo STR | $500,000 | $120,000 | ~$42,000 |

| Luxury vacation home | $750,000 | $180,000 | ~$63,000 |

That's money you keep in year one, which you can reinvest into your next property, upgrades, or simply improved cash flow. Learn more about how cost segregation works for Airbnb rentals and see a real-world case study with the Big Beautiful Bill.

How the STR Loophole Offsets W-2 Income

Here's where things get really interesting for short-term rental owners specifically.

Normally, rental losses are considered "passive" and can only offset other passive income. You can't use them against your W-2 salary or business income. But short-term rentals have a special exception.

According to Anderson Advisors' explanation of how STRs avoid W-2 taxes, if your average guest stay is 7 days or less and you materially participate in managing the property, the IRS treats it as an active business rather than a passive rental. In that case, losses (including massive depreciation deductions) can offset your regular income. For a deeper dive, read our guide on material participation for Airbnb rentals and the STR loophole demystified.

What this means: If you have a $200,000 W-2 job and your STR generates a $60,000 paper loss from bonus depreciation, you could potentially offset that income and owe significantly less in taxes. With 100% bonus depreciation restored, the first-year deductions are larger than ever.

Bonus Depreciation Timeline: Key Dates to Know

| Milestone | Date/Year |

|---|---|

| 100% bonus begins | Assets placed in service after Jan 19, 2025 |

| Full benefit period | Through end of 2029 |

| What happens after | Unless extended, may phase down again |

Important caveats to know:

State conformity varies. California, for example, doesn't conform to federal bonus depreciation rules. You might save big on federal taxes but still owe more at the state level.

Timing matters. Assets must be placed in service (not just purchased) after January 19, 2025 to get the 100% write-off.

Work with a qualified CPA. Cost segregation studies and large deductions have nuances, and ensuring you qualify for the STR loophole requires careful documentation of material participation.

According to Engineered Tax Services, if you paused or delayed property improvements during the phase-down years, now is the time to resume. You have at least another 5 years of full bonus depreciation to capture. Check out our guide on who should not apply for cost segregation in 2025 to make sure you qualify.

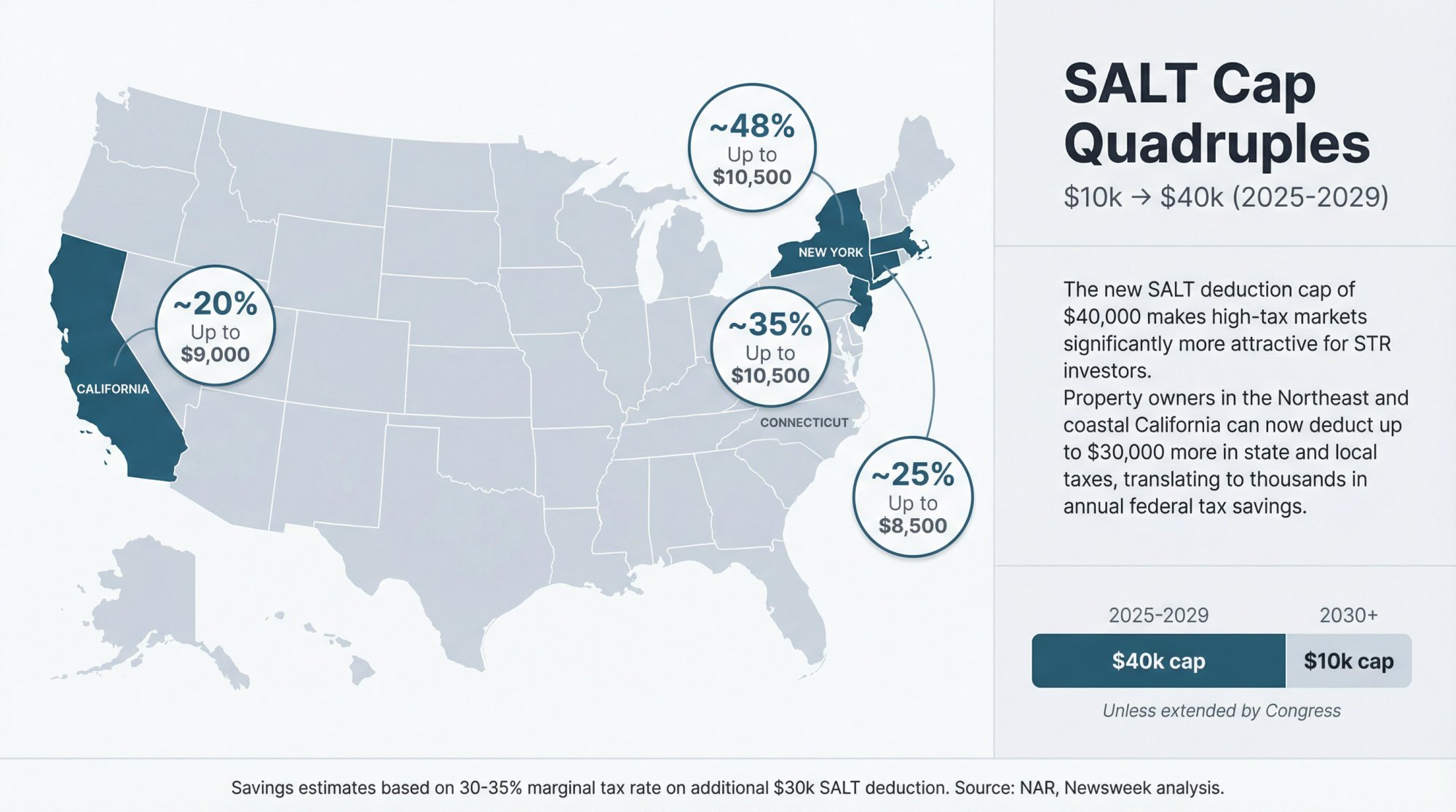

How the $40,000 SALT Cap Helps High-Tax State Investors

For investors in high-tax states, this change is a big deal.

The State and Local Tax (SALT) deduction had been capped at $10,000 since 2017, which hurt homeowners and investors in places like New York, New Jersey, and California. According to the NAR's analysis, the new law quadruples that cap to $40,000 for 2025 through 2029.

Newsweek reports this could mean saving thousands of dollars in annual taxes for wealthy investors in high-tax areas. Here's how the states break down:

| State | % of Homes with Property Tax > $10k | Potential Annual Savings |

|---|---|---|

| New Jersey | ~40% | Up to $10,500 |

| New York (metro) | ~48% | Up to $10,500 |

| California | ~20% | Up to $9,000 |

| Connecticut | ~35% | Up to $9,500 |

| Massachusetts | ~25% | Up to $8,500 |

Savings estimates based on 30-35% marginal tax rate on additional $30k SALT deduction.

This makes owning property in the Northeast and coastal California more tax-efficient, at least for the next five years. If you've been avoiding these markets purely because of the SALT cap, it's worth running the numbers again using our Airbnb ROI calculator.

A few things to keep in mind:

-

The $40,000 cap is temporary. It reverts to $10,000 in 2030 unless Congress extends it.

-

Ultra-high earners (income over $500,000) see a phase-down of the allowance.

-

This primarily affects your personal residence and state income tax deduction. If your STR is a business, property taxes were always deductible as a business expense on Schedule E.

One notable victory: a proposal to limit business property tax deductions was dropped from the final bill after industry pushback.

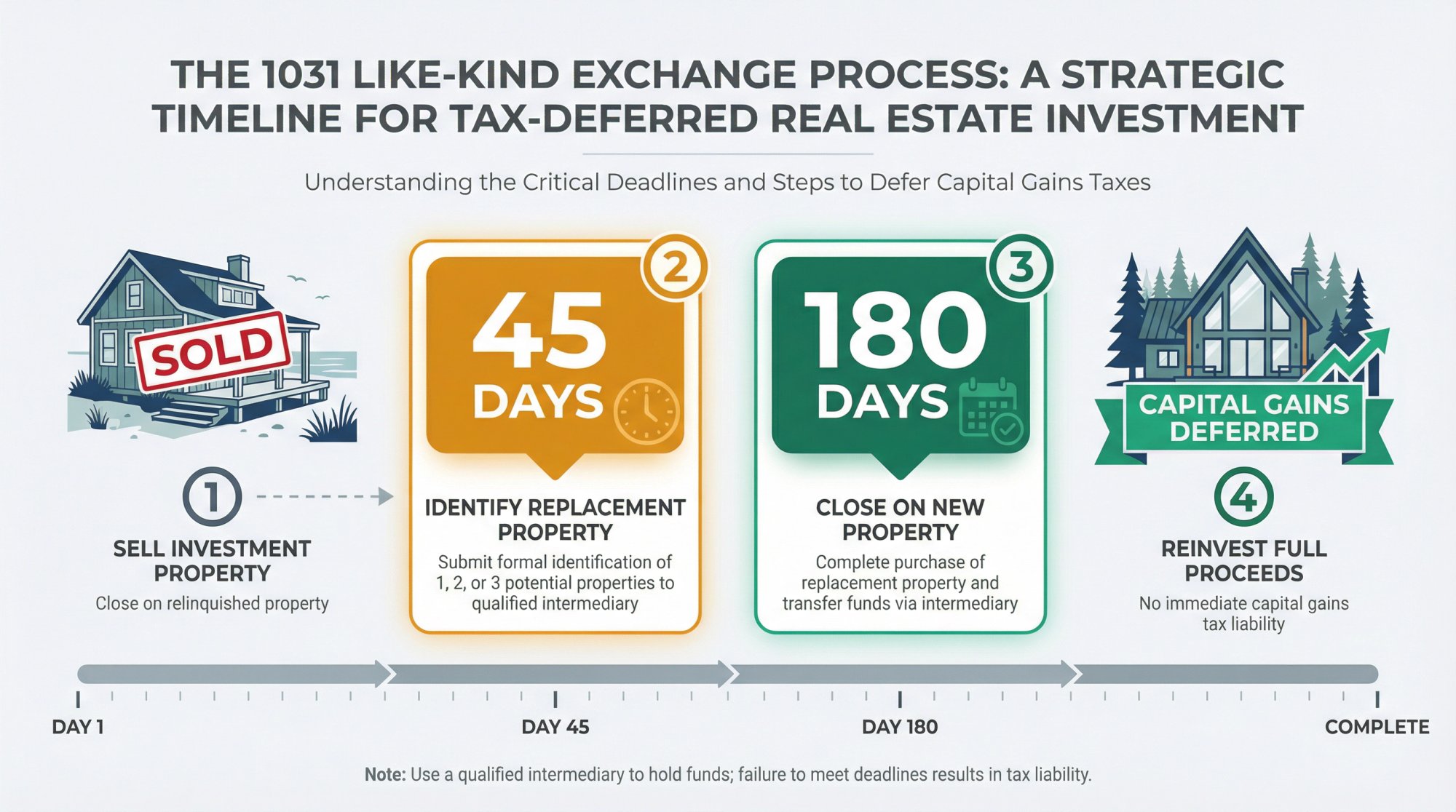

Can You Still Do a 1031 Exchange Under Trump's Tax Bill?

If you're planning to grow your STR portfolio by trading up from one property to another, here's the news you needed to hear: 1031 like-kind exchanges are completely intact.

Despite some lawmakers pushing to limit or eliminate 1031 exchanges as a revenue-raiser, the final bill did not touch this provision. According to Hiltzik CPA, this powerful tax strategy remains in place, allowing investors to keep building wealth through property swaps without immediate tax hits.

How 1031 works (quick refresher):

① You sell an investment property

② Within 45 days, you identify a replacement property (or properties)

③ Within 180 days, you close on the new property

④ Capital gains taxes are deferred indefinitely

This lets you reinvest your full profits into a bigger or better property without losing 15-20% or more to capital gains taxes. Many investors use 1031s to move from a single condo to a duplex, shift from one market to another, or consolidate multiple properties into one larger asset. Learn more about what a 1031 exchange is and how it works.

Why this matters for STR investors specifically: The vacation rental market is evolving constantly. Regulations change, some markets saturate, new hotspots emerge. 1031 exchanges give you the flexibility to reposition without a tax penalty. Sold your cabin in a market that just banned STRs? Roll those proceeds into a new property in a more favorable jurisdiction. Check out the best and worst states for 1031 exchanges to plan your strategy.

Pro tip: While 1031 exchanges are protected federally, always check your specific state's rules. Some states tax exchanges that the federal government doesn't. Read our comprehensive 1031 exchange guide for STR investors in 2025.

At Chalet, we connect investors with real estate agents who specialize in 1031 exchanges and understand the tight timelines involved. If you're considering a swap, having the right team makes the 45/180-day windows much more manageable.

What Happened to Personal Tax Rates and Standard Deductions?

Beyond the rental-specific provisions, the Big Beautiful Bill also extends the general individual tax cuts that were set to expire. According to NAR's analysis, this means:

-

Middle-income tax brackets remain reduced

-

The standard deduction stays nearly doubled (meaning more income is tax-free)

-

The top individual rate stays at 37% instead of reverting to 39.6%

What's the practical impact? You keep more of your rental income after taxes. The 2017 cuts were substantial, and having them expire would have meant a meaningful tax increase for most investors. That didn't happen.

This stability also helps with planning. When you're evaluating a potential Airbnb purchase using Chalet's free ROI calculator, you can assume current tax rates hold going forward rather than trying to guess at future changes. That makes your projections more reliable.

As Realtor.com's senior economist noted (per Newsweek's coverage), these tax cuts offer meaningful support to higher-income buyers and real estate investors, fueling more investment in both residential and commercial property.

Are Mortgage Interest Deductions Still Available for STRs?

There were concerns that Congress might further restrict the mortgage interest deduction. That didn't happen. According to NAR's analysis, the deduction remains intact as set by the 2017 reforms:

-

Interest on up to $750,000 of mortgage debt remains deductible for primary and second homes

-

For rental properties, interest is a business expense and remains 100% deductible from rental income

-

No new caps or eliminations were introduced

The bill also reinstated the deduction for private mortgage insurance (PMI) premiums. If you financed an STR with less than 20% down and are paying PMI, you can again deduct those premiums (subject to income phase-outs).

Also, limits on business interest deductions were loosened for larger real estate operations. This primarily affects companies with over $27 million in average annual receipts, so most individual STR investors won't encounter these limits. But if you're scaling significantly, it's a helpful adjustment.

So what does this all mean? Using debt to finance STR investments remains a tax-efficient strategy. You can finance an Airbnb purchase using DSCR loans and deduct the interest, making your cost of capital effectively cheaper. Learn more about DSCR financing for short-term rentals.

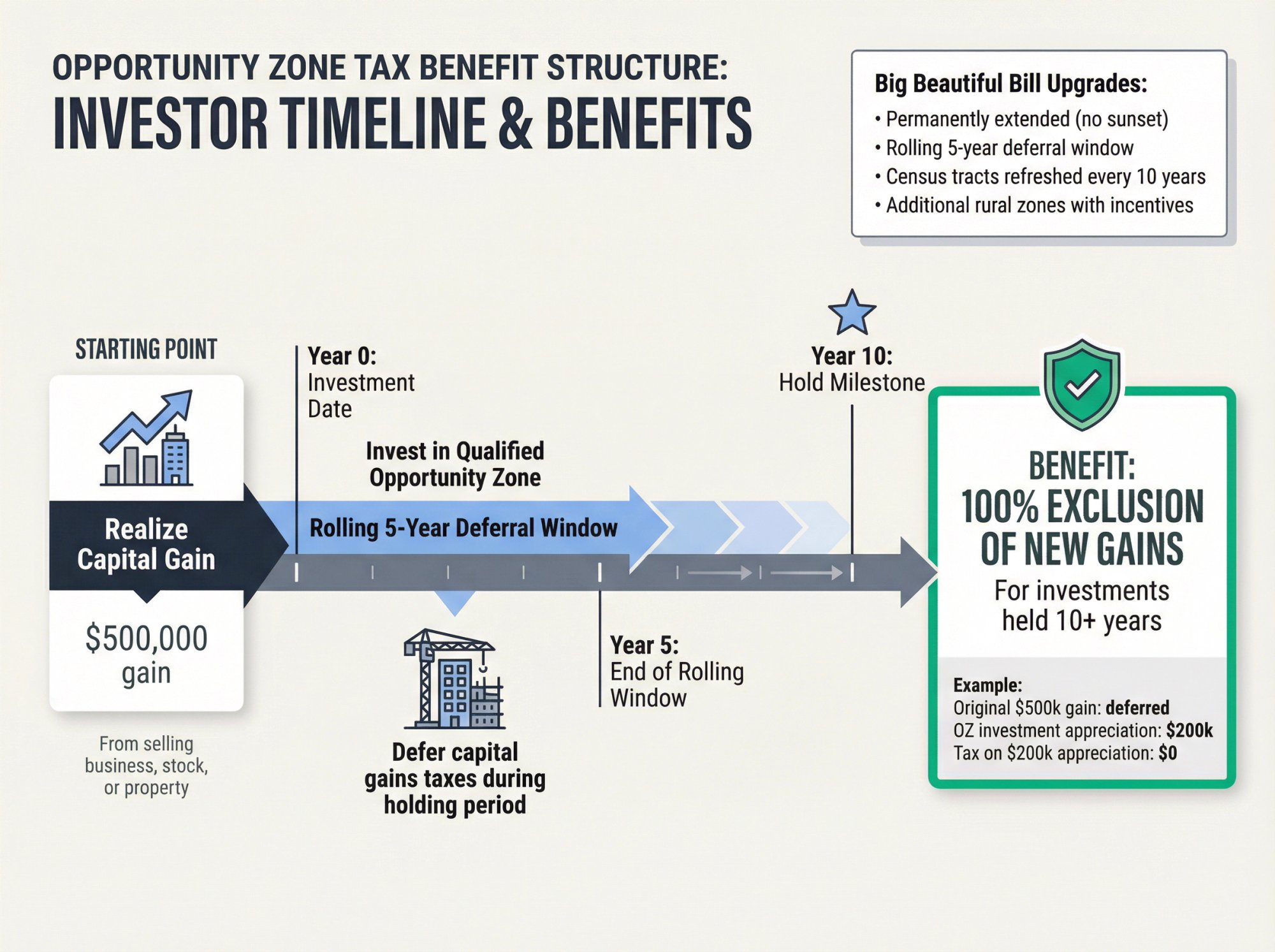

How Opportunity Zones Work for Real Estate Investors

The Opportunity Zone program, which allows investors to defer and reduce capital gains taxes by investing in designated low-income areas, received a significant upgrade.

According to NAR's analysis, the Big Beautiful Bill:

-

Permanently extends the OZ program (no more looming sunset dates)

-

Introduces a rolling 5-year deferral window instead of fixed deadlines

-

Maintains the 100% exclusion of new gains for investments held 10+ years

-

Allows OZ census tracts to be refreshed every 10 years, potentially opening new areas

Additional rural Opportunity Zones with special incentives are also coming online.

For most STR investors, Opportunity Zones aren't a primary strategy. They're more commonly used for development projects or major rehab investments. But if you're facing a large capital gain (from selling a business, stock, or property) and you're not doing a 1031 exchange, OZs offer another path to defer that tax hit. With the program now permanent, it's a flexible tool that will be available whenever you need it.

What Is the New $15 Million Estate Tax Exemption?

Building a vacation rental portfolio that you plan to pass on to your children? The estate tax changes in this bill provide significant relief.

According to NAR's analysis, the federal estate and gift tax exemption is now permanently set at $15 million per person (plus inflation adjustments). This was a critical fix. The exemption had been scheduled to drop back to around $5 million in 2026, which could have forced heirs of even moderately successful real estate portfolios to pay 40% estate tax on amounts above that threshold.

What this means in practice:

-

A married couple can now shield roughly $30 million from federal estate tax

-

Most family-owned STR businesses won't face any estate tax on transfer

-

You don't need complex trust structures just to avoid a tax cliff in 2026

Hiltzik CPA notes this provides immediate planning relief. If you're building generational wealth through vacation rentals, you can focus on growing the portfolio rather than elaborate strategies to avoid estate tax.

One caveat: State estate taxes are separate and often have much lower thresholds. Massachusetts, for example, has a $1 million exemption. Wealthy STR investors should still account for state-level estate planning where applicable.

What Did Trump's Tax Bill Leave Out?

Not everything in the bill is a win for investors. Here are a few notable omissions and cutbacks:

Energy Credits Phasing Out

The energy-efficient home credit (45L) will expire after 2026. If you were planning to build an eco-friendly STR or install solar panels primarily for the tax credit, you'll want to complete those projects before the incentives disappear. This was a trade-off to help offset the cost of the bill's other provisions.

Section 179 Expanded to $2.5 Million

On a positive note, Section 179 expensing increased to $2.5 million (up from the previous ~$1 million range). This mostly affects larger operations, but practically means you're unlikely to hit any cap when furnishing or equipping your rentals. Combined with bonus depreciation, most STR investors can write off essentially all their setup costs immediately.

No Changes to 27.5-Year Depreciation Schedule

The standard 27.5-year depreciation timeline for residential property remains unchanged. Some had hoped for shorter recovery periods, but that wasn't included. The good news is that cost segregation and bonus depreciation allow you to accelerate most components anyway.

No New Taxes on Investment Income

Proposals to raise Social Security/Medicare taxes on investment income or increase capital gains rates for certain investors did not make it into the Act. For STR owners, this means continued favorable treatment when you eventually sell and cash out. Understand the tax implications of selling your Airbnb before making any moves.

How Chalet Helps You Maximize These Tax Benefits

Understanding tax law is one thing. Actually executing on these opportunities is another. That's where Chalet comes in.

We built a one-stop platform for short-term rental investors because we know the journey from "interested in Airbnb investing" to "running a profitable STR portfolio" involves a lot of moving pieces. With this new tax bill, having the right team and tools is critical.

Here's how we help:

Free Analytics and ROI Tools

Before you can calculate your tax savings, you need to know what a property will actually earn. Our free Airbnb ROI calculator lets you project revenue, expenses, and returns for any address. Now you can factor in bonus depreciation and QBI deductions to see your true after-tax ROI.

Airbnbs for Sale with Revenue Data

Browse vacation rentals currently on the market complete with revenue projections. When you're trying to time acquisitions to maximize bonus depreciation, seeing what's available right now saves time.

STR-Friendly Real Estate Agents

Not every agent understands short-term rentals, and even fewer know how to navigate 1031 exchanges under tight deadlines. We connect you with agents who specialize in STR transactions and can coordinate with your 1031 intermediary. Learn about the benefits of working with an investor-friendly realtor.

Vetted Vendor Network

Beyond buying, we connect you with the professionals you'll need: CPAs who understand the STR loophole, cost segregation firms that can maximize your bonus depreciation, insurance providers, property managers, and more. Everyone in our network has been vetted for STR expertise.

Regulation Research

These federal tax benefits are great, but they mean nothing if local regulations block you from operating. Our regulation library helps you check the rules before you buy, so you don't end up with a property you can't legally rent. Read our guide on how to navigate local regulations and STR licensing.

The tax landscape in 2025 is arguably the most favorable it's been in years for STR entrepreneurs. But capturing these benefits requires action, the right timing, and the right professionals. Chalet connects you with all of that in one place.

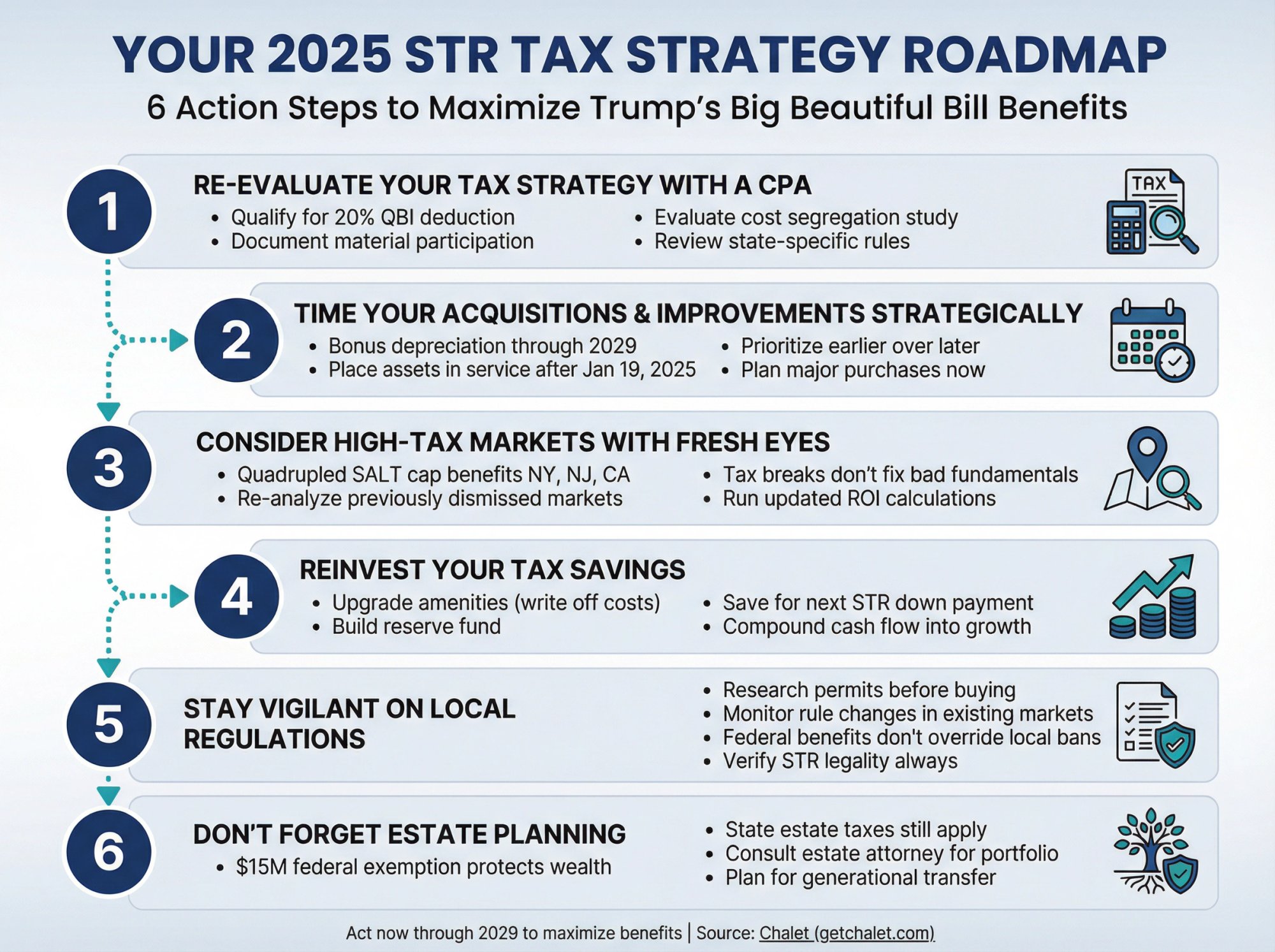

6 Action Steps for STR Investors in 2025

With all these changes, here's what you should actually do to capitalize:

1. Re-evaluate Your Tax Strategy with a CPA

Schedule time with a CPA who understands short-term rentals. Discuss:

-

Whether you qualify for the 20% QBI deduction

-

How to document material participation for the STR loophole

-

Whether a cost segregation study makes sense for your properties

-

State-specific implications (especially if you're in California or another non-conforming state)

2. Time Your Acquisitions and Improvements Strategically

The 100% bonus depreciation window runs through 2029, but earlier is often better. Any property or renovation placed in service after January 19, 2025 qualifies. If you've been sitting on the fence about buying or upgrading, now's the time to move. Use Chalet's ROI calculator to analyze potential deals and explore our market analytics to find the right location.

3. Consider High-Tax Markets with Fresh Eyes

The quadrupled SALT cap makes places like New York, New Jersey, and California more attractive (at least through 2029). Markets you previously dismissed might now pencil out better after-tax. Just don't let the tax tail wag the dog. A tax break doesn't make a bad deal good, so analyze the fundamentals first.

4. Reinvest Your Tax Savings

Lower taxes mean more cash flow. Consider putting that money back into the business: upgrade amenities (and write off the cost), build a reserve fund, or save for a down payment on your next STR. That cash flow bump helps fuel growth.

5. Stay Vigilant on Local Regulations

Federal tax breaks are only one side of the coin. Many cities are tightening STR rules with permit caps, occupancy taxes, and even outright bans in some neighborhoods. Always research local regulations before buying, and keep an eye on changes in markets where you already operate. A favorable federal climate shouldn't lead you blindly into hostile local legal territory. Explore our guide on top favorable STR regulation markets in FL, TX, and AZ.

6. Don't Forget Estate Planning

If you're building an STR portfolio for generational wealth, the $15 million estate exemption gives you breathing room. But state estate taxes can still bite. Talk to an estate attorney about your specific situation, especially if your properties are in states with lower exemption thresholds.

Frequently Asked Questions

Is 1031 exchange still available after Trump's tax bill?

Yes. The 1031 like-kind exchange was fully protected in the final legislation. You can continue to sell one investment property and buy another while deferring capital gains taxes, as long as you follow the 45-day identification and 180-day closing timelines. Read more about using a 1031 exchange to purchase a short-term rental property.

When does 100% bonus depreciation expire?

The 100% bonus applies to qualifying assets placed in service after January 19, 2025 through the end of 2029. After that, unless Congress extends it again, the allowance may phase down or disappear. If you're planning major purchases or renovations, try to complete them within this window. Get the details in our 2025 tax season bonus depreciation timeline guide.

Can I offset my W-2 income with STR losses?

Potentially, yes. If your average guest stay is 7 days or less and you materially participate in managing the property, the IRS treats your STR as an active business rather than a passive rental. In that case, losses (including depreciation) can offset your W-2 or other active income. This is sometimes called the "short-term rental loophole." Work with a CPA to document your participation properly.

Does the QBI deduction apply to my Airbnb LLC?

It can, if your rental activity rises to the level of a trade or business. Actively managed short-term rentals often qualify. The deduction is 20% of your qualified business income and is now permanent. Your CPA can confirm whether your specific situation meets the requirements. Learn more about tax deduction strategies for short-term rentals.

What's the SALT cap for 2025?

The State and Local Tax deduction cap increased from $10,000 to $40,000 for 2025 through 2029. This primarily benefits investors in high-tax states like New York, New Jersey, and California. Note that it phases down for individuals with income over $500,000, and it reverts to $10,000 in 2030 unless extended.

Do these federal tax changes apply in every state?

Not necessarily. Some states (notably California) don't conform to federal bonus depreciation rules. You might save significantly on federal taxes while still owing more at the state level. Always check your state's specific treatment of these provisions with a qualified tax professional. See our California-specific regulations page for more details.

Should I do a cost segregation study?

A cost segregation study makes the most sense for properties worth $300,000 or more, or those with significant improvements. The study identifies which components of your property qualify for accelerated depreciation. With 100% bonus depreciation back, the first-year tax savings can be substantial. Read our guide on whether cost segregation is worth it and see a real example of how one Florida STR boosted cash flow by $28,000. Chalet can connect you with cost segregation specialists who focus on STRs.

When should I act to maximize these benefits?

Now. Several provisions (bonus depreciation, SALT cap) run through 2029, giving you a multi-year window. But real estate transactions take time, and locking in purchases or renovations earlier gives you more years to capture the benefits. The sooner you acquire and place assets in service, the sooner you start saving. Get started by exploring Airbnbs for sale or running numbers on the Airbnb calculator.

What This Means for Short-Term Rental Investors in 2025

Trump's "One Big Beautiful Bill Act" has created what may be the most investor-friendly tax environment for short-term rentals in recent memory. The permanent QBI deduction, restored bonus depreciation, protected 1031 exchanges, and quadrupled SALT cap all tilt the playing field toward those who invest in and actively manage vacation rentals.

But these benefits don't capture themselves. You need to understand the rules, work with qualified professionals, time your moves correctly, and always verify local regulations before buying. The window is open now through 2029 for many of these provisions. Acting sooner gives you more years to compound the savings.

If you're ready to analyze your next deal, browse properties on the market, or connect with STR-specialized agents and CPAs, Chalet is here to help. Our free analytics, vetted vendor network, and regulation library give you everything you need to turn these tax changes into real, tangible returns.

The opportunity is here. The math just got better. Now it's time to make your move.