When you hear investors talk about cap rate, what they're really asking is: "How hard is this property's cash flow working for me?"

At its core, cap rate is a simple metric that shows a property's potential yearly return if you were to buy it with all cash. Think of it as a quick profitability snapshot, a way to level the playing field and compare different investments apples-to-apples.

Understanding Cap Rate Without the Jargon

Imagine you're looking at two different savings accounts. One offers a 1% annual yield, and the other offers 5%. You instantly know the 5% account gives you a better return. Cap rate does the same job for real estate investments.

It’s calculated by taking the property's yearly income after expenses (Net Operating Income) and dividing it by its purchase price or current market value. This simple formula is its greatest strength.

To help you get a handle on the key terms, here’s a quick breakdown.

Cap Rate At a Glance

| Component | What It Means |

|---|---|

| Net Operating Income (NOI) | The property's total annual income minus all operating expenses (like taxes, insurance, and utilities). |

| Property Value / Purchase Price | How much the property is worth or what you paid for it. |

| Cap Rate (NOI ÷ Value) | The unleveraged annual return on your investment. |

The cap rate gives you an "unleveraged" return, which just means it ignores any mortgage or financing you might have. This lets you analyze a property’s raw performance, helping you decide if it’s worth a deeper look before you dive into the complexities of loan terms and interest rates. It answers the fundamental question: Is this a good deal on its own merits?

Breaking Down the Cap Rate Formula

At its core, the cap rate formula is refreshingly simple: you just divide your Net Operating Income (NOI) by the property's market value. But like anything in real estate, the devil is in the details.

So, let's unpack what those two terms really mean for an investor.

Net Operating Income (NOI)

Think of Net Operating Income as your property’s true annual profit before you pay your mortgage or income taxes. It’s not just the gross rental revenue you collect; it’s what's left after you cover all the essential, recurring costs of keeping the property running.

These operating costs typically include:

- Property taxes and insurance

- Maintenance and a budget for future repairs

- Property management fees

- Utilities, landscaping, and other routine expenses

Subtract these from your gross income, and you’ve got your NOI. It’s the purest measure of a property's profitability.

Property Market Value

This one is more straightforward. The Property Market Value is simply what the property is worth on the open market today. This could be the price you’re about to pay for it, or it could be its most recent appraised value.

The Formula: Cap Rate = Net Operating Income / Property Market Value

While cap rate is a fantastic metric for the property's raw, unleveraged return, it's always smart to look at it alongside other numbers. Comparing it with metrics like rental yields can give you an even fuller financial picture of your potential investment.

What a Cap Rate Number Actually Tells You

So, you’ve run the numbers and have a cap rate staring back at you. What does that percentage actually mean for your investment?

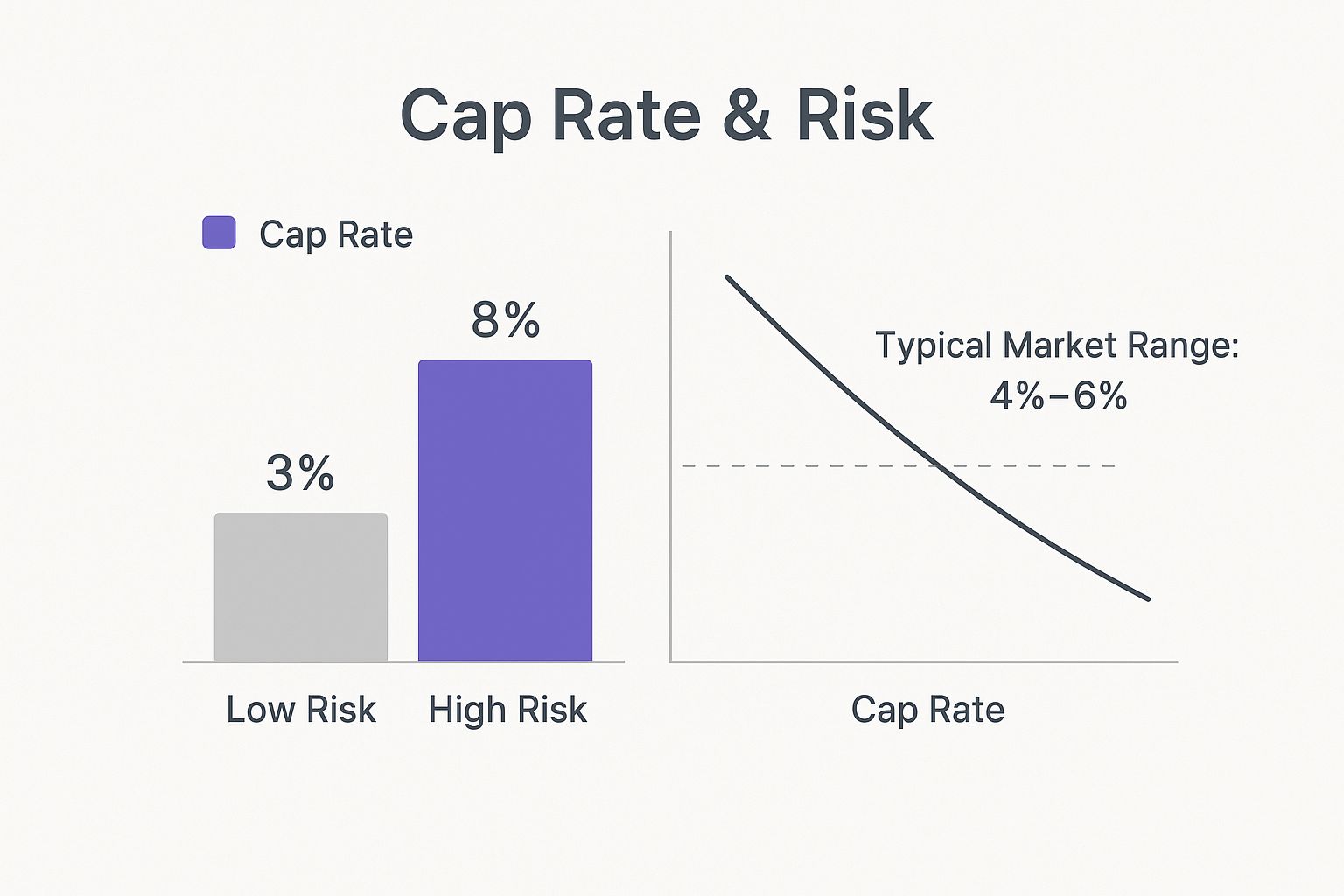

Think of cap rate as a quick way to gauge the relationship between risk and return. It’s a simple but powerful snapshot. There's a crucial inverse relationship here: as the cap rate goes up, the potential annual return gets higher, but the perceived risk often climbs right alongside it.

A lower cap rate, typically in the 4-6% range, often points to a safer, more stable property. These are usually in prime, high-demand locations where you pay a premium for predictability. Think of it as the blue-chip stock of real estate.

On the flip side, a higher cap rate—say, 8% or more—suggests a property with greater potential reward, but it comes with higher risk. Maybe it’s in an up-and-coming neighborhood or requires a bit more hands-on management. It has the potential for a bigger payoff, but it’s not a sure thing.

This infographic breaks down how different cap rates can signal different levels of investment risk and return.

Ultimately, there’s no single "good" cap rate. The right number depends entirely on your personal investment strategy and how much risk you’re comfortable taking on.

Seeing Cap Rate In Real World Scenarios

Theory is one thing, but seeing how cap rates play out in the real world is everything. Numbers on a spreadsheet don't tell the whole story until you attach them to actual properties.

Let's break down two completely different investment scenarios to see how cap rate helps an investor make a quick, informed decision.

Cap Rate Calculation Comparison

To really see this in action, let's put two properties head-to-head. Property A is a stable, lower-risk asset, while Property B represents a higher-risk, higher-potential-reward opportunity.

| Metric | Property A (Low-Risk) | Property B (High-Risk) |

|---|---|---|

| Property Type | Stable downtown apartment building | Commercial property in a developing area |

| Purchase Price | High | Lower |

| Income Stream | Consistent and reliable | Higher potential but less certain |

| Cap Rate | ~4.5% | ~8% |

| Implied Risk | Lower | Higher |

| Implied Return | Lower but more stable | Higher but more volatile |

For Property A, the 4.5% cap rate signals a safe, steady investment—the kind you buy for reliable, long-term income. It’s not going to produce explosive returns, but it’s dependable.

In contrast, Property B’s 8% cap rate points to a much higher potential return, but it comes with more uncertainty. This is the kind of deal that could pay off big or fall flat. By comparing these two simple figures, an investor can instantly see which property aligns with their risk tolerance and goals.

What Cap Rate Does Not Tell You

Think of cap rate as a quick snapshot, not the full-length movie. It’s an essential first-pass filter for comparing properties, giving you a clear picture of an asset's performance at a single moment in time. But it definitely doesn't tell the whole story.

For instance, cap rate completely ignores how financing and leverage can supercharge your returns—a factor better measured by metrics like Cash-on-Cash Return. It also doesn't account for future potential, like rising rents in a hot market or the value you could add to a fixer-upper with a smart renovation. Major one-time costs, like replacing a roof, aren't baked into the initial calculation either.

It's important to distinguish cap rate from other property investment metrics, such as understanding what is rental yield and how it differs. Use cap rate to quickly compare deals, but always dig deeper before making a final decision.

Common Questions About Cap Rate

Now that we've covered the basics, let's dig into a few common questions investors run into when working with cap rates. These will help lock in the core concepts and clear up some of the finer points.

What Is a Good Cap Rate?

This is the million-dollar question, and the answer is always: it depends. There’s no single “good” cap rate that works for every property or every investor.

A rate of 4-6% might be fantastic for a stable, low-risk property in a prime urban market, while an investor targeting a higher-risk asset in an up-and-coming area might aim for 8-12%.

Instead of searching for a magic number, think about what aligns with your investment goals, your tolerance for risk, and the realities of the local market. The right number for you is entirely about your strategy.

How a Mortgage Affects Cap Rate

Here’s a simple one: it doesn’t. The cap rate formula is an unlevered metric, which is a fancy way of saying it calculates a property’s return as if you bought it with all cash.

This is by design. It strips out financing to give you a clean, apples-to-apples way to compare the raw profitability of different properties. If you want to see how your specific mortgage impacts your personal returns, you’d look at a different metric called Cash-on-Cash Return.

Key Takeaway: A cap rate measures the property's performance on its own merits, not the quality of your loan. It’s the first step in analyzing the asset itself.

Can a Cap Rate Be Negative?

Yes, but it's a huge red flag. A negative cap rate means the property’s operating expenses are higher than its income. In plain English, the property is losing money before you even factor in a mortgage payment.

An investor would only touch a property like this if they had a rock-solid, immediate plan to either slash expenses or dramatically increase income—and fast. Otherwise, it’s a money pit from day one.

Ready to stop guessing and start analyzing? Chalet provides free, AI-driven tools to help you estimate property-level revenue and project cap rates for short-term rentals across the country. Make your next investment decision with data, not doubts. Explore Chalet's analytics tools today.