So, how much does property management actually cost? The short answer is that typical fees run anywhere from 8% to 12% of the monthly rent. Some managers, however, prefer a flat monthly fee, which usually lands between $100 and $300.

Of course, the final number on your contract will depend on your property’s location, the specific services you need, and the pricing model you end up choosing.

What Landlords Actually Pay for Property Management

When you hand over the keys to a property manager, you’re doing more than just paying a fee. You're investing in a service designed to protect your asset and, just as importantly, buy back your time.

Think of it like hiring a CEO for your rental property. Their job is to run the whole operation—from marketing empty units and screening tenants to collecting rent and dealing with those dreaded late-night emergency repair calls.

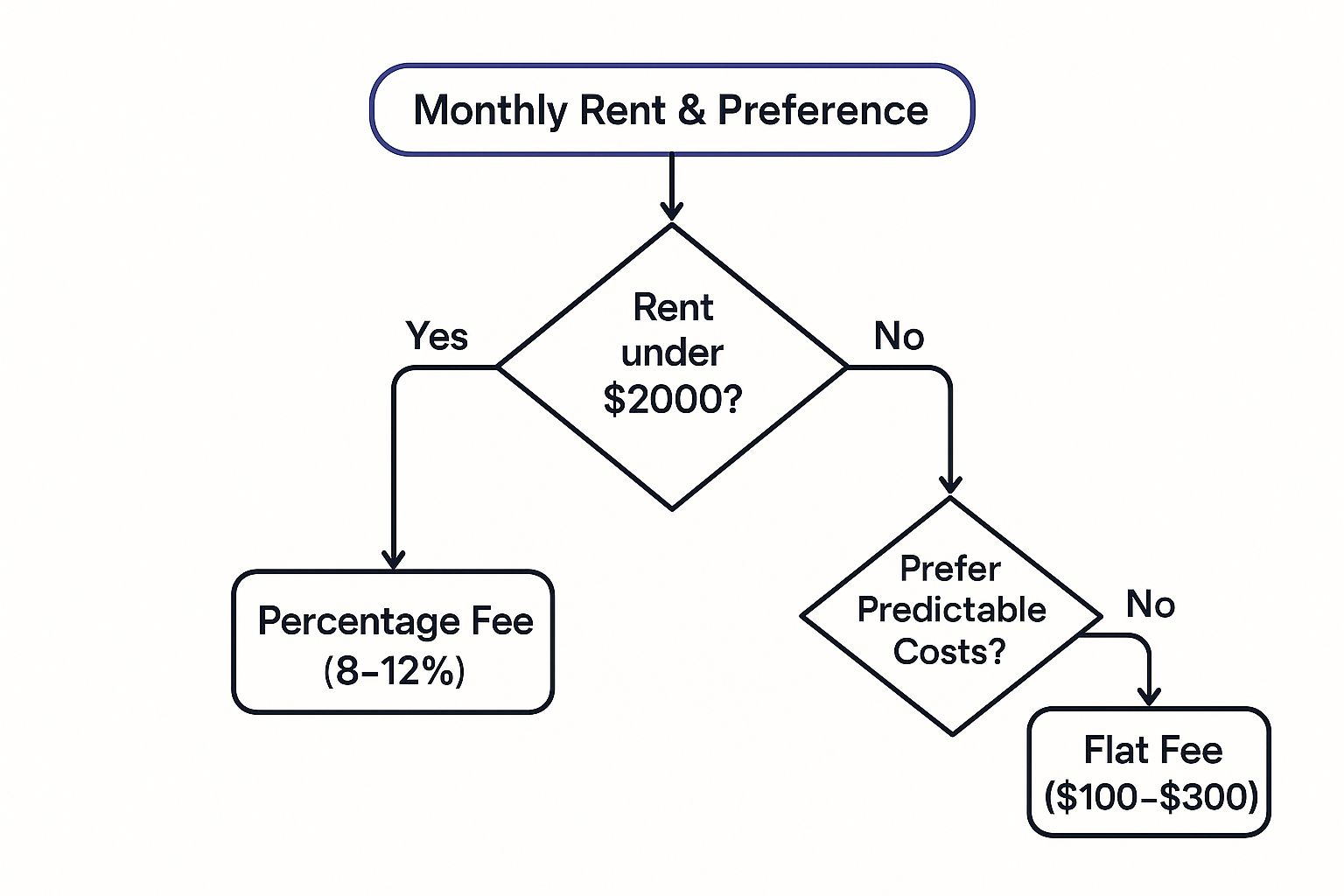

To pay for these services, you'll generally come across two common structures. The first is a percentage-based model, where the fee is simply a slice of the monthly rent collected. The second is a flat-fee model, which gives you a predictable, fixed cost every single month, no matter what the rent is. Each has its own strategic advantage depending on your property's income and how you like to budget.

Choosing Your Fee Structure

Picking the right model is one of the first big decisions you'll make. A percentage fee is great because it aligns your manager's goals with yours—they make more money only when you make more money. It keeps everyone motivated.

On the other hand, a flat fee offers stability, which can be a huge relief, especially if you own a high-rent property where a percentage-based cut might start to feel a little steep. To really get a feel for which is right for you, it helps to dig into a clear guide to property management services cost that breaks down the pros and cons of each option.

This decision often comes down to a trade-off between maximizing income and ensuring predictable costs.

As you can see, owners of lower-rent properties often find the percentage fee more attractive. Meanwhile, landlords who prioritize budget certainty tend to gravitate toward a flat fee.

For most residential properties in major markets like the United States and Australia, those percentage fees almost always fall somewhere between 8% to 12% of the monthly rent. But for landlords with pricier properties, those flat monthly fees—often between $100 and $300 per unit—are becoming a much more popular alternative.

Choosing Your Fee Model: Percentage vs. Flat-Rate

When you're trying to figure out how property management fees will hit your bottom line, the first fork in the road is the pricing structure. It almost always comes down to two models: a percentage of the rent or a fixed flat fee.

Each has its own logic, and the right one for you really depends on what your property brings in each month and how you like to manage your own finances.

The classic approach, and still the most common, is the percentage-based fee. It’s simple: your manager takes a slice of the monthly rent they collect, which is usually somewhere between 8% and 12%.

Think of it like a sales commission. This structure creates a really powerful alignment—your property manager is directly motivated to keep your property filled with a paying tenant and to get the highest rent possible. If you don't get paid, they don't get paid. That lights a fire under them to minimize vacancies and chase down any late payments.

The Percentage-Based Model in Action

Let’s run the numbers on a real-world example. Say your property rents for $2,000 a month, and your management company charges a 10% fee.

- Your monthly fee would be: $2,000 x 10% = $200

- If the rent goes up to $2,200: Your fee bumps up to $220

As you can see, the model scales right alongside your property's performance. It’s a great fit for landlords with mid-range rentals where the fee stays a totally reasonable chunk of the income.

On the other side of the coin is the flat-rate fee. This works more like a monthly subscription for their services. You pay a fixed amount every month, no matter what the rent is or if it's even collected. This fee typically lands between $100 and $300 per unit.

The biggest win here is predictability. You know exactly what your management cost will be month in and month out, which makes budgeting a breeze. This kind of consistency is a huge draw for owners of high-end, expensive rental properties.

When a Flat-Rate Fee Makes Sense

Imagine you own a luxury apartment that rents for $5,000 a month. A standard 10% percentage fee would set you back $500 every single month. But a flat fee of, say, $250 cuts that cost in half and protects your cash flow from getting eaten up by a disproportionately high management bill.

The core difference really boils down to risk and reward. A percentage fee means you and your manager share both the risk of an empty unit and the reward of high rent. A flat fee makes your management cost a fixed line item, which can be far more cost-effective for properties at the higher end of the market.

While percentage-based fees are still the industry standard, the push for more transparency has definitely made other models more popular. We're seeing more and more firms offer flat monthly rates, especially for those higher-value properties where it just makes more sense for the landlord. You can dive deeper into property management costs and trends to see how the industry is evolving.

Ultimately, figuring out how much a property management fee is going to cost you means running the numbers on both of these models. Do the math for your specific rental income and see which structure leaves more money in your pocket while still getting you the quality service your investment deserves.

Uncovering the Hidden Costs in Your Contract

That monthly management fee you see advertised? It's the headline number, but it rarely tells the whole story.

Think of it like buying a car. The sticker price looks great, but the final cost only comes into focus after you add the packages, upgrades, and service plans. To really get a handle on what a property manager will cost, you have to look past that initial percentage and dig into the contract’s fine print.

Too many landlords get blindsided by extra charges that pop up, inflating their monthly expenses way beyond what they budgeted for. These aren't always "hidden" in a sneaky way, but they're separate line items that only get triggered by specific events. If you don't know what they are, your profit margins can disappear fast.

Before you sign anything, it's smart to get familiar with what a standard contract looks like. Checking out a comprehensive guide to property management agreements will arm you with the right questions to ask and help you compare offers on an even playing field.

Common Fees Hiding in Plain Sight

So, what exactly are these extra costs you should be looking for? Every company structures their fees a little differently, but there are a few usual suspects that show up in most agreements. Knowing them is the first step to avoiding a surprise bill.

- Tenant Placement or Leasing Fee: This is probably the biggest and most common add-on. It covers all the legwork of finding a new tenant—advertising, showing the property, screening applicants, and drafting the lease. Expect this to be anywhere from 50% to 100% of the first month's rent.

- Lease Renewal Fee: Got a great tenant who wants to stay? Fantastic. Some companies will still charge a fee to handle the renewal paperwork. It's usually a flat fee, often landing between $100 and $300.

- Maintenance Markups: When a repair is needed, your manager will coordinate it. But for their trouble, they might add a surcharge on top of the contractor's invoice. This markup is typically around 10% to 15% of the repair bill.

- Eviction Service Charges: Evictions are a worst-case scenario, and unfortunately, they're not free. If you have to go down this road, the management company will charge you for their time, administrative costs, and any legal fees involved.

The single best way to protect yourself is to ask for a full fee schedule upfront. This document should list every single potential charge, from routine admin fees to emergency call-out costs. It’s all about transparency.

These fees are a normal part of the business, but a good, trustworthy manager will be completely upfront about them from day one. When you're vetting potential partners, don't get fixated on the monthly percentage alone. Scrutinize the entire fee structure to get a clear picture of your total potential costs. Doing that homework upfront ensures you find a partner who offers real value and won't leave you with unpleasant financial surprises.

How Property Type and Location Shape Your Fees

There’s no single, universal answer to the question, "how much is a property management fee?" Why? Because not all properties are created equal. The type of building you own and where it’s located are two of the biggest factors that will shape the final quote you get from a management company.

Think of it like car insurance. The premium for a sports car in a busy city is going to be wildly different from one for a minivan in a quiet suburb. The same logic applies here—the risk, effort, and expertise needed to manage different properties vary dramatically, and the fees reflect that.

The Impact of Property Type

The complexity of managing your asset is directly tied to its type. A single-family home brings a completely different set of challenges than a sprawling apartment complex or a commercial storefront, and managers price their services accordingly.

-

Single-Family Homes: These often land at the higher end of the percentage scale, typically in the 8% to 12% range. While it's just one unit, all the management effort is concentrated. There are no economies of scale, meaning the manager handles everything from a leaky roof to an overgrown lawn for that single income stream.

-

Multifamily Buildings: As you add more doors, the per-unit cost often goes down. For larger apartment complexes, it's not uncommon to see fees drop into the 4% to 7% range. The manager can handle maintenance, leasing, and admin for dozens of units from one location, creating some serious operational efficiencies.

-

Commercial Properties: Managing retail centers or office buildings is a different ballgame entirely. Leases are longer, tenants are businesses, and the responsibilities are more focused on major facility upkeep and complex lease administration. Fees for commercial assets often land between 4% and 8%, reflecting the larger scale and unique management demands.

For a clearer picture, let's look at how these fees stack up side-by-side.

Fee Variations by Property Type and Market

The table below breaks down the typical fee ranges you can expect based on your property type and the kind of market it's in. Notice how scale and complexity directly influence the numbers.

| Property Type | Typical Fee Range (% of Rent) | Key Management Considerations |

|---|---|---|

| Single-Family Home | 8% – 12% | Concentrated effort on one unit; no economies of scale. Full-service from leasing to maintenance. |

| Small Multifamily (2-4 Units) | 6% – 10% | Some efficiency gains over single-family, but still requires hands-on management for each unit. |

| Large Multifamily (5+ Units) | 4% – 7% | Significant economies of scale. On-site staff may be involved. Focus on occupancy and tenant retention. |

| Commercial (Retail/Office) | 4% – 8% | Longer lease terms, business tenants, complex lease negotiations, and facility management. |

| Short-Term/Vacation Rental | 15% – 30% | High-touch service. Constant turnover, marketing, guest communication, and cleaning coordination. |

As you can see, the higher the management intensity—like the constant guest turnover in a vacation rental—the higher the fee. In contrast, large-scale properties with stable, long-term tenants benefit from lower percentages due to streamlined operations. You can find more detailed breakdowns on how property type influences management costs to see exactly where your investment fits.

How Location Dictates Your Rate

Just as important as what you own is where you own it. A property’s location affects everything from rental demand and tenant quality to the local cost of labor and pesky regulations. A manager’s fee has to account for all these market-specific variables.

For instance, a property in a high-demand, high-rent urban center like Seattle or New York might come with a lower percentage fee. Even though the percentage is smaller, the sky-high rent means the manager's total take-home pay is still substantial.

A property manager in a dense city might charge 8% on a $4,000/month apartment ($320), while a manager in a suburban town might charge 10% on a $2,000/month house ($200). The urban manager's lower percentage still yields a higher dollar fee because of the market's rent values.

On the flip side, properties in lower-rent or more challenging neighborhoods may see higher percentage fees. Managers charge more to compensate for the extra time and effort they'll spend on tenant screening, rent collection, and property oversight.

At the end of the day, your property's type, condition, and location create a unique profile that every management company will use to build your quote.

Negotiating Your Management Fees Like a Pro

Here's something a lot of new investors don't realize: the fee structure a property manager hands you isn't always their final offer. Far from it. Many parts of a management agreement are up for discussion, especially when you walk in prepared.

Think of it less like accepting a price tag and more like building a partnership. The goal isn't just to slash costs for the sake of it, but to find a fair arrangement that delivers the best value for your specific property and goals. Your power in this conversation comes from the value you bring to the table. A well-kept property in a great area, or even better, a portfolio of multiple units, makes you a highly desirable client. That gives you leverage.

Don't be shy about asking questions or suggesting changes. Any professional management company worth its salt expects savvy owners to scrutinize the contract. They’ll be ready for a reasonable conversation about the terms.

Key Points You Can Negotiate

While the main monthly management percentage can be tough to budge, many of the other charges are surprisingly flexible. Focusing your energy on these specific line items is often the smartest way to control your overall costs.

Here are the most common areas where you can successfully negotiate:

- Multi-Property Discounts: If you're bringing more than one rental to a manager, you're their ideal client. This is your biggest bargaining chip. Always ask for a volume discount. A 1% to 2% reduction on the management fee for each unit is a standard and very reasonable ask.

- Tenant Placement Fees: This one is almost always negotiable. Instead of a full month's rent, propose a lower percentage (50-75%) or a simple flat fee. This is an especially easy win if your property is in a hot market where it’s likely to rent out in a flash.

- Lease Renewal Fees: Some owners have great success getting this fee waived entirely. Your argument is simple: a great tenant who renews saves the manager a ton of work finding, vetting, and placing someone new. Why should you pay a hefty fee for a little bit of paperwork?

- Maintenance Markup Caps: You can absolutely request a cap on how much a manager marks up maintenance and repair costs. For example, ask them to waive any surcharge on repairs under $100, or request that they lower their markup from a typical 15% down to 10%.

Your best negotiation tool is knowledge. Before you sign anything, get detailed quotes from at least three different management companies. This doesn't just show you the going market rate; it signals to a potential manager that you’ve done your homework and you know what’s fair.

In the end, a good negotiation results in an agreement where both you and your property manager feel like you've won. By tackling these points head-on, you can build a partnership that protects your bottom line and sets your investment up for success from day one.

Seeing the True Value Behind the Management Fee

When you first ask, "how much are property management fees," it's easy to get fixated on the number. But here's a lesson learned the hard way by countless investors: the cheapest option is almost never the best one.

A great property manager isn't just another expense line on your spreadsheet. Think of them as a partner—someone actively invested in protecting your asset and maximizing its long-term profitability.

Once you shift your mindset from cost to value, you start to see the real return on your investment. A professional manager's expertise shows up on your bottom line in very real ways. They’re masters of tenant screening, which means higher-quality residents, lower turnover, and less time your property sits empty bleeding money.

Their proactive approach to maintenance also saves you a fortune. They catch the small leaks before they become catastrophic floods, preventing minor issues from snowballing into budget-destroying repairs.

More Than Just Money—It's Peace of Mind

Beyond the dollars and cents are the intangible benefits, and honestly, they're just as valuable. Professional management is your shield against legal headaches, keeping you compliant with the labyrinth of ever-changing landlord-tenant laws. This protection alone can save you thousands in potential fines and court battles.

The real win is reclaiming your time and eliminating stress. A manager is the one fielding late-night emergency calls, chasing down rent, and dealing with difficult tenants so you don’t have to.

This isn't a niche service; it's the backbone of a massive and growing industry. The global property management sector is worth over $119 billion, with the U.S. market alone projected to hit $98.88 billion by 2029. That kind of growth reflects a universal demand for professional, efficient oversight. You can discover more insights about property management statistics to see just how big this industry is.

Ultimately, paying the right fee doesn't just buy you a service. It secures a partner dedicated to the stability and growth of your rental investment.

Your Top Questions About Management Fees, Answered

Even after breaking down the numbers, you probably have a few practical questions about how these fees play out in the real world. Let's dig into some of the most common ones that come up for landlords.

Can I Deduct Property Management Fees on My Taxes?

Yes, you absolutely can. Think of property management fees as a necessary operating expense for your rental business, just like repairs or insurance.

This means the entire cost—from the monthly management percentage to any one-off tenant placement fees or maintenance charges—is fully tax-deductible. This helps lower your taxable income at the end of the year. Just be sure to keep meticulous records and loop in your tax professional to make sure you're capturing every deduction you're entitled to.

What Is a Fair Tenant Placement Fee?

A fair tenant placement fee (sometimes called a leasing fee) usually lands somewhere between 50% to 100% of the first month's rent. What’s considered "fair" really comes down to your local market.

If you're in a hot rental market where units are filled in a matter of days, a fee closer to 50% or a predictable flat rate is common and often something you can negotiate. On the other hand, in a slower market that demands more advertising, countless showings, and extra legwork, it's standard practice to see that fee creep closer to a full month's rent.

The most important thing here is transparency. A good property manager will spell this fee out clearly in your agreement and be able to justify it based on the work it takes to find and vet a top-notch tenant for your property.

How Do I Know if I Am Overpaying?

Figuring out if you're overpaying requires looking past that single monthly percentage. Your first step should be to get quotes from at least three different property management companies in your area. This will give you a solid baseline for how much a property management fee should be.

Next, lay those quotes side-by-side and compare what's actually included. A slightly higher fee might be a bargain if it covers services like regular property inspections or lease renewal processing, which other companies might bill for separately. If you find your current manager's fees are well above the local average without delivering better service or more value, it might be time to open a conversation about your rates or start looking for a new partner.