Managing the finances for a short-term rental business is far more complex than tracking a simple monthly rent check. You're dealing with variable income streams, fluctuating occupancy rates, booking platform fees, cleaning costs, and transient occupancy taxes, all of which can quickly overwhelm a standard spreadsheet. While a manual approach using something like a basic spreadsheet, or by carefully crafting a creating a business income worksheet for financial planning, can offer basic insights, it quickly becomes cumbersome for the complexities of an STR business. This manual process is not only time-consuming but also highly susceptible to errors that can impact your profitability and tax compliance.

This is where dedicated short term rental accounting software becomes essential. These platforms are built to handle the unique financial demands of the vacation rental industry. They automate income and expense tracking, sync directly with your booking platforms like Airbnb and Vrbo, and provide clear, real-time insights into your portfolio's performance.

In this guide, we will analyze the top software solutions available today. We’ll dive deep into their specific features, pricing models, and ideal user profiles to help you find the perfect fit for your business needs. Each review includes direct links and screenshots to give you a clear understanding of the user experience, helping you move beyond spreadsheets and into a more efficient, profitable operation.

1. Intuit QuickBooks Online

As the most recognized small business accounting system, QuickBooks Online (QBO) serves as a powerful, albeit generalist, foundation for many property managers. Its strength lies in its robust, double-entry accounting core and its unparalleled ecosystem of third-party app integrations. This adaptability makes it a premier choice for those seeking a customizable short term rental accounting software solution.

Through its app marketplace, you can connect tools like Hostaway or OwnerRez to automate the import of booking data, including revenue, fees, and taxes from Airbnb and Vrbo. This transforms QBO from a generic platform into a specialized hub for your rental business.

Key Features & Use Cases

- Property-Level P&L: Use the "Classes" or "Locations" features to tag every transaction to a specific property. This allows for granular Profit & Loss reporting on a per-unit basis, which is crucial for performance analysis.

- Trust Accounting: By setting up specific liability and bank accounts, QBO can manage owner funds, hold security deposits, and track payouts, ensuring compliance and clear financial separation.

- Scalability: Plans range from Simple Start for single-property hosts to Advanced for multi-entity management firms, ensuring the software grows with your portfolio.

While QBO is a powerhouse, it’s not built exclusively for STRs. For a broader perspective on general-purpose tools, you can explore other top options for the best accounting software for small businesses.

Best For: Hosts and managers who want an industry-standard, scalable accounting system and are willing to use integrations to build a tailored workflow.

2. Xero (US)

Often seen as QuickBooks' primary global competitor, Xero offers a beautifully designed, user-friendly cloud accounting platform. Its strength for property managers lies in its clean interface and powerful bank reconciliation engine, which simplifies the process of categorizing income and expenses from multiple channels. For those prioritizing a modern user experience, Xero is an excellent choice for a short term rental accounting software foundation.

Similar to QBO, Xero's power is unlocked through its app marketplace. You can connect it to property management systems or use direct integration tools to pull in detailed booking revenue from Airbnb, Vrbo, and other platforms, streamlining your financial data entry.

Key Features & Use Cases

- Property-Level Reporting: Xero’s "Tracking Categories" are perfect for STRs. You can create a category called "Property" and assign each unit as an option, allowing you to filter reports like the P&L for individual rental performance.

- Automated Receipt & Bill Capture: With its integrated Hubdoc feature, you can forward invoices or snap photos of receipts for maintenance and supplies, and the system will automatically extract the data, reducing manual entry.

- Streamlined Bank Feeds: Xero excels at bank reconciliation. You can create rules to automatically categorize recurring transactions, like utility bills for a specific property or cleaning fee payouts, saving significant time each month.

While its US app ecosystem is growing, it is sometimes considered secondary to QuickBooks in terms of the sheer number of direct STR integrations available.

Best For: Tech-savvy hosts and managers who prefer a clean, modern user interface and robust bank reconciliation features, and are comfortable leveraging its strong app marketplace.

3. OwnerRez

OwnerRez is a comprehensive Property Management System (PMS) first, but it includes powerful, built-in financial tools specifically designed for vacation rentals. It stands out by embedding trust accounting principles directly into its booking and management workflows, making it a robust operational hub that also handles complex financial distributions. It’s not a standalone general ledger but offers one of the deepest QuickBooks integrations available.

The platform is engineered to automate the entire financial lifecycle of a booking. From collecting payments and holding security deposits to calculating owner commissions and generating detailed payout statements, OwnerRez handles the niche financial tasks that general accounting software often misses.

Key Features & Use Cases

- Integrated Trust Accounting: OwnerRez manages owner funds, taxes, and security deposits in a compliant manner within its system, automatically generating the necessary statements and tracking payouts.

- Deep QuickBooks Online Integration: It syncs detailed financial data, including individual invoices, payments, and refunds as deposits into QBO, providing a complete audit trail without manual data entry. Note this is a premium, per-property add-on.

- Automated Owner Statements: The software automatically calculates management commissions, subtracts expenses, and generates clear, professional statements for property owners, streamlining communication and payments.

Best For: Property managers who need a powerful PMS with built-in, STR-specific financial and trust accounting features and plan to use QuickBooks Online for their general ledger.

4. Guesty

Guesty is a full-stack property management platform designed for scale, offering a comprehensive suite of tools that includes a powerful accounting module. While known for its enterprise-grade features, Guesty provides a pathway for hosts at various stages, from a few properties to hundreds. Its integrated nature means accounting is not an afterthought but a core component of the operational workflow.

The platform consolidates channel management, a direct booking engine, and operational tools with financial tracking. This all-in-one approach simplifies the tech stack, making it a compelling piece of short term rental accounting software for professional managers focused on growth and efficiency.

Key Features & Use Cases

- Integrated Accounting Module: Available on Pro and Enterprise tiers, this module automates revenue allocation, tracks expenses, and generates detailed owner statements directly within the platform, eliminating the need for complex third-party software.

- Owner Portal & Payouts: Provide property owners with a dedicated portal to view performance reports, block dates, and access financial statements. Guesty's system manages complex payout calculations and distributions.

- Unified Financial Reporting: Because Guesty handles bookings, payments, and expenses, it can produce holistic financial reports that give a clear, real-time view of your entire portfolio's profitability without manual data reconciliation.

While the most robust accounting features are reserved for higher-tier plans, which require a custom quote and may include onboarding fees, its Lite plan offers an accessible entry point for smaller operators.

Best For: Professional property management companies and ambitious hosts who need an all-in-one, scalable platform where accounting is deeply integrated with daily operations.

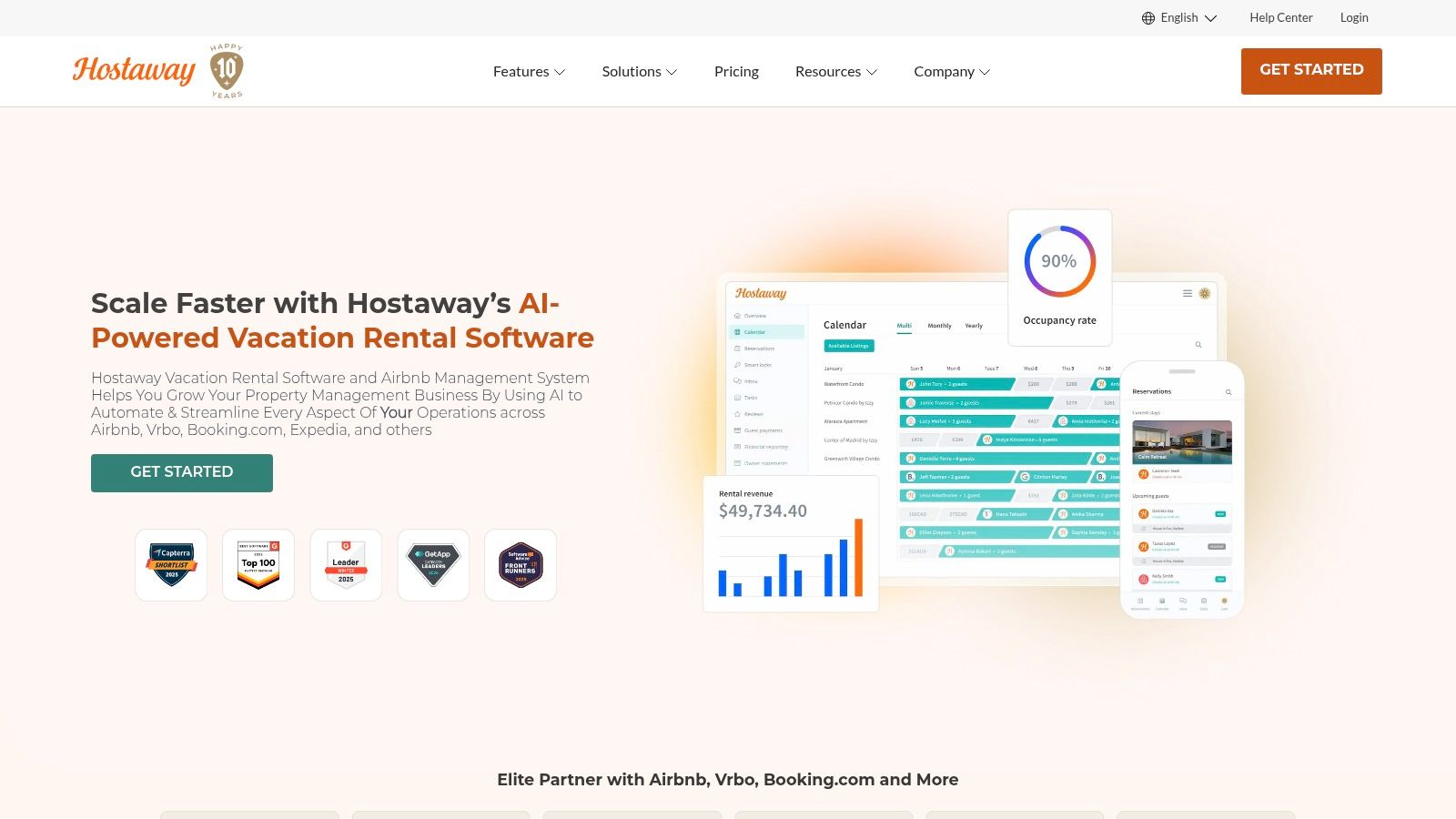

5. Hostaway

While not a standalone accounting system, Hostaway operates as a powerful property management software (PMS) that forms the central nervous system for your rental operations. Its strength lies in its robust channel management and extensive integration capabilities, particularly with its dedicated QuickBooks Online connector. This makes it a critical component for creating an automated short term rental accounting software ecosystem.

The platform syncs all your booking information from channels like Airbnb, Vrbo, and your direct booking site, then pushes detailed financial data directly into QuickBooks. This automation saves hours of manual data entry and ensures accuracy by posting every reservation, fee, and tax as a separate line item.

Key Features & Use Cases

- QuickBooks Connector: Available via the Hostaway Marketplace, this integration automatically creates invoices in QBO for each reservation, streamlining your bookkeeping and financial reporting.

- Financial Reporting & Analytics: Generate detailed reports on revenue, occupancy, and other key performance indicators directly within the Hostaway dashboard for quick operational insights.

- Unified Invoicing: All financial data from multiple channels is consolidated, allowing for a single, reliable source of truth before it's sent to your primary accounting software.

Hostaway’s pricing is available by quote and there is no free trial, so it requires a direct engagement to get started. However, its 24/7 support and dedicated onboarding services are highly valued by its user base.

Best For: Growing property managers who need a scalable PMS to centralize operations and want a seamless, automated data pipeline into QuickBooks Online.

6. Lodgify

Lodgify is primarily a property management system (PMS) and website builder, but its robust feature set extends into financial management, making it a comprehensive operational tool. Its core strength lies in centralizing reservations, payments, and owner communications, which streamlines the data needed for accurate accounting. While not a standalone accounting system, its ability to connect with platforms like QuickBooks makes it a valuable part of a modern short term rental accounting software stack.

The platform generates essential financial reports and offers an owner portal for transparent statements. For detailed bookkeeping, users can leverage middleware like Zapier or Zoho Flow to push booking revenue, channel fees, and payment data directly into their accounting software of choice, automating a significant portion of the reconciliation process.

Key Features & Use Cases

- Centralized Reporting: Generate reports on bookings, payments, and taxes from all channels (direct, Airbnb, Vrbo) in one place, providing a clean data source for your accounting system.

- Owner Portal & Statements: Automate the creation of owner statements, detailing income, expenses, and net payouts. This feature is crucial for property managers who need to maintain transparent financial communication.

- Automated Payment Processing: Integrates with Stripe and PayPal to handle guest payments, refunds, and security deposits automatically, simplifying cash flow management.

Best For: Hosts and property managers who need an all-in-one PMS that includes direct booking website creation and can feed financial data into a separate, dedicated accounting system via integrations.

7. Stessa

Stessa is a real estate investor platform with a strong focus on asset management and simplified financial tracking. While designed for long-term rentals, its tools are easily adapted for short-term rental accounting, particularly for US-based hosts focused on tax preparation and performance dashboards. Its standout feature is a generous free plan that covers the core needs of many individual property owners.

The platform streamlines income and expense tracking by connecting directly to your bank accounts and automatically categorizing transactions. This automation is a significant time-saver, helping you maintain accurate records with minimal effort. Its reporting capabilities are tailored specifically for real estate, making tax time much smoother for property investors.

Key Features & Use Cases

- Tax-Ready Reporting: Stessa excels at generating reports needed for tax season, including an IRS Schedule E helper and a comprehensive tax package. This simplifies collaboration with your CPA.

- Performance Dashboards: At a glance, you can view key metrics like net operating income, cash flow, and appreciation for each property, helping you monitor your portfolio’s health.

- Document Management: Use the platform to store all your important documents, from booking receipts to maintenance invoices, keeping everything organized and accessible on a per-property basis.

It's important to note Stessa is not a full double-entry accounting system like QuickBooks. It’s a specialized tool for property financial management rather than a complete business general ledger.

Best For: US-based hosts and investors with one or more properties who need a free, straightforward tool for tracking performance and preparing tax-ready financial reports.

8. Tallybreeze

Tallybreeze is not a standalone accounting system but a powerful automation bridge designed specifically to connect Airbnb and Vrbo with QuickBooks Online or Xero. It excels at translating complex reservation data into detailed, accurate accounting entries, effectively transforming your general ledger into a specialized short term rental accounting software powerhouse. This focus on deep integration makes it ideal for hosts who demand granular financial control without manual data entry.

The platform creates itemized invoices and bills for each reservation, breaking down revenue, cleaning fees, channel commissions, and taxes. This meticulous approach supports accrual-based and trust accounting methods, ensuring every dollar is tracked correctly from booking to payout.

Key Features & Use Cases

- Detailed Transaction Syncing: Automatically creates detailed invoices within your accounting software for each booking, mapping revenue, taxes, and fees to the correct accounts and properties for pristine bookkeeping.

- Payout Reconciliation: Simplifies the process of matching bulk payouts from channels like Airbnb to the individual reservations they cover, highlighting any discrepancies instantly.

- Flexible Rule Mapping: Offers a high degree of control over how data is synced. You can manage multiple channel accounts and sync them to different entities within QuickBooks or Xero, which is ideal for property managers with diverse portfolios.

While it adds a monthly fee per listing on top of your accounting software subscription, its ability to automate complex STR-specific entries is invaluable for maintaining accurate, property-level financial reports.

Best For: Property managers and hosts using QuickBooks or Xero who need to automate detailed, accrual-based accounting entries for maximum accuracy and reporting depth.

9. Amaka

Amaka is not a standalone accounting platform but a critical integration provider that bridges the gap between your booking platforms and your general ledger. It specializes in creating reliable, accountant-grade syncs between systems like Airbnb and accounting software such as Xero or QuickBooks, ensuring data flows accurately and automatically. This makes it a key component for property managers who have a preferred accounting system but need a robust way to import transactional data without manual entry.

Its strength lies in the precision of its data mapping. You can configure the integration to post daily sales summaries or individual line items, giving you control over the level of detail that appears in your books. This transforms a standard accounting setup into a more specialized short term rental accounting software solution.

Key Features & Use Cases

- Flexible Data Mapping: Customize how Airbnb revenue, cleaning fees, taxes, and host fees are categorized in your accounting software, ensuring your chart of accounts remains clean and organized.

- Automated Reconciliation: The sync posts daily sales summaries that match the payout deposits from Airbnb, dramatically simplifying the bank reconciliation process.

- Guided Onboarding: Amaka offers a guided setup process with CPA-trained support to ensure the integration is configured correctly from day one, preventing common mapping errors.

- Historical Data Sync: For new users, Amaka can back-sync up to 12 months of historical transaction data, providing a complete financial picture without tedious manual work.

Best For: Hosts and managers already using Xero or QuickBooks who need a dedicated, reliable integration tool to automate the flow of financial data from Airbnb.

10. Bookkeep

For short-term rental operators with diverse revenue streams, Bookkeep offers a specialized automation layer that sits between your payment processors and your primary accounting system. It excels at accurately recording sales and payout data from sources like Stripe, Shopify, or Square, making it an essential tool for hosts who also sell merchandise, experiences, or use direct booking payment gateways.

This platform automates the tedious process of reconciling daily sales summaries, ensuring that every transaction, fee, and tax is correctly posted to QuickBooks Online, Xero, or Zoho Books. This function is crucial for maintaining accurate books when managing high-volume, small-ticket ancillary sales alongside accommodation revenue.

Key Features & Use Cases

- Ancillary Revenue Tracking: Automatically syncs sales data from platforms like Shopify or Square, ideal for hosts selling welcome baskets, branded merchandise, or local tours.

- Accurate Payout Reconciliation: Connects directly to payment processors like Stripe to post daily summary journal entries, perfectly matching batch deposits to your bank account.

- Multi-Platform Integration: Serves as a central hub for various payment sources, consolidating them into a single, clean feed for your general ledger, reducing manual data entry.

While Bookkeep is a powerful reconciliation tool, it is not a standalone short term rental accounting software. It complements a core system like QuickBooks by handling the specific challenge of e-commerce and payment processor data. Pricing is tiered based on your monthly revenue.

Best For: STR operators using direct booking sites with Stripe or managing ancillary e-commerce revenue streams who need to automate sales reconciliation into QuickBooks or Xero.

11. Zeevou

Zeevou is a comprehensive Property Management System (PMS) that stands out with its accounting-first approach, built around a deep, direct integration with Xero. This focus makes it a powerful short term rental accounting software for hosts who prioritize automated bookkeeping and financial accuracy. The platform is designed to handle the entire guest journey while ensuring every financial transaction is correctly logged.

Unlike platforms where accounting is an afterthought, Zeevou’s connection with Xero is core to its functionality. It syncs charts of accounts, tax schemas, and tracking categories, automatically posting booking invoices and expenses. This significantly reduces manual data entry and potential for error, streamlining the entire accounting workflow from booking to reconciliation.

Key Features & Use Cases

- Direct Xero Integration: Automate the posting of all income and expenses directly into Xero. This creates a seamless flow of data, ensuring your accounting records are always up-to-date with minimal effort.

- Trust Accounting & Owner Statements: Manage owner funds with dedicated trust accounting features. The platform generates detailed financial statements, providing owners with transparent reports on property performance and payouts.

- Unified Operations: Zeevou is a full-fledged PMS that includes 2-way OTA synchronization, housekeeping modules, and an owner portal, centralizing all management tasks within a single system.

The most robust accounting features are reserved for Zeevou's mid to high-tier plans, and its primary focus on Xero means QuickBooks users will need to look elsewhere.

Best For: Property managers who use Xero and want a fully integrated PMS that automates bookkeeping and provides robust trust accounting capabilities.

12. Smoobu

Smoobu is an all-in-one property management system (PMS) designed for hosts with smaller portfolios, offering a suite of tools that extend beyond core accounting. Its value lies in its combination of operational management features and the ability to generate financial data that can be exported or connected to dedicated accounting platforms. This makes it a great starting point for those who need a PMS first and a short term rental accounting software solution second.

While it handles invoicing and basic financial reporting internally, its primary accounting function is as a data source. Using integrations via tools like Zapier, you can create automated workflows that push booking revenue, taxes, and fee data directly into QuickBooks or Xero, bridging the gap between property management and professional bookkeeping.

Key Features & Use Cases

- Integrated Invoicing: Generate and send professional invoices directly to guests from the platform, keeping all booking-related financial communications in one place.

- Data Export for Accountants: Easily export financial reports in CSV format, providing a clean data set for your accountant to import into any standard accounting system for tax preparation.

- Zapier Connectivity: Automate the transfer of financial data to external software. For example, create a "zap" that logs every new booking in Smoobu as a sales receipt in QuickBooks Online.

Best For: New hosts or managers with 1-20 properties who need an affordable, user-friendly PMS that can feed financial data into a separate, more robust accounting system.

Short-Term Rental Accounting Software Comparison

| Product | Core Features/Capabilities | User Experience & Quality ★★★★☆ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points ✨ | Price Points 💰 |

|---|---|---|---|---|---|---|

| Intuit QuickBooks Online | Double-entry accounting, bank feeds, app ecosystem | Industry standard, scalable, multi-user permissions | Scales from single host to enterprise | STR hosts, managers, multi-entity | Huge app marketplace, strong reporting | Higher tiers cost more |

| Xero (US) | Bank reconciliation, 1099 management, receipt capture | Modern UI, strong reconciliation, growing payments stack | Strong app marketplace, clear analytics | STR managers needing clean UI | Native US tax tools, receipt capture | Mid-range, some features costly |

| OwnerRez | Trust accounting, payouts, QuickBooks integration | STR-specific workflows, solid documentation | Per-property pricing scales with portfolio size | STR managers, property managers | Channel management, owner payout statements | Paid QuickBooks integration |

| Guesty | Accounting, owner portal, distribution hub | Enterprise-grade, detailed analytics | Plans from small hosts to enterprise scale | Small to enterprise STR hosts | Advanced workflows, robust payment solutions | Quotes & onboarding fees apply |

| Hostaway | Financial reporting, QuickBooks connector | Strong support, 24/7 assistance | Built for scale with many US case studies | Large portfolios, enterprises | Large marketplace, onboarding services | Quote-based pricing |

| Lodgify | Website builder, PMS, dynamic pricing | Easy to use, transparent plans | Good for direct bookings plus channels | Small to medium hosts | Dynamic pricing add-on, site builder | Transparent, add-ons extra |

| Stessa | Bank feeds, tax reporting, budgeting | Free plan, straightforward tax tools | Free tier appeals to individual hosts | Individual investors, landlords | Schedule E reporting, free essentials plan | Free + paid tiers |

| Tallybreeze | Invoice posting, payout reconciliation | STR-specific accounting accuracy | Reduces manual errors, detailed templates | STR hosts/managers needing accuracy | Rollback syncs, multi-account support | Monthly fee + requires QuickBooks/Xero |

| Amaka | Sales sync, flexible mapping, CPA support | Reliable syncs, good documentation | Free plans for some integrations | STR tech stacks, accountants | Broad integrations beyond STR | Variable, depends on plan |

| Bookkeep | Automated posting, tax filing add-on | Scales with revenue, supports unlimited users | Reduces manual reconciliation | STR operators with multiple revenue | Payout splitting, category-level mapping | Revenue-tiered pricing |

| Zeevou | Xero integration, trust accounting, operations modules | Accounting-first PMS, owner portal | Reduces bookkeeping time | Mid-sized to large STR managers | Deep Xero integration, operations & housekeeping | Mid to high-tier plans |

| Smoobu | PMS, invoicing, dynamic pricing add-on | Good value for small portfolios, easy adoption | Clear pricing, 14-day trial | Small hosts, starter portfolios | Affordable, multi-currency pricing | Affordable, add-ons paid |

Choosing the Right Stack for Your STR Business

Navigating the landscape of short-term rental accounting software can feel overwhelming, but the right tools are essential for transforming a passion project into a profitable, scalable business. As we've explored, the market offers a diverse range of solutions, from all-in-one property management systems like Guesty and OwnerRez to dedicated accounting powerhouses like QuickBooks Online and Xero. The key isn't finding a single "best" platform, but rather building the ideal technology stack for your specific operational needs and portfolio size.

A solo host managing a single property has vastly different requirements than an investor with a growing portfolio across multiple states. Your decision-making process should be a strategic one, balancing automation, integration capabilities, and cost. Don't overlook the importance of a tool that can grow with you. What works for one property might become a bottleneck at five, and what suffices for five may be inefficient for twenty.

Final Takeaways for Selecting Your Software

The most critical insight is that no single piece of software is a silver bullet. The most successful short-term rental operators build a cohesive "stack" of tools that communicate seamlessly. An all-in-one PMS might handle your bookings and guest communication, but an integration tool like Amaka or Bookkeep is the crucial bridge that ensures every transaction is accurately reflected in your accounting ledger.

Before you commit, consider these final factors:

- Integration is Non-Negotiable: Your chosen short term rental accounting software must integrate flawlessly with your PMS, online travel agencies (OTAs), and bank accounts. Manual data entry is not only time-consuming but a primary source of costly errors.

- Scalability Matters: Think about your one-year and five-year goals. Will this software support multi-property reporting, trust accounting, or owner payouts if you expand your portfolio or begin co-hosting? Choose a solution that anticipates your future needs.

- Implementation and Support: How steep is the learning curve? A powerful tool is useless if you can't figure out how to use it. Evaluate the quality of customer support, the availability of onboarding resources, and community forums.

Your Actionable Next Steps

Armed with this information, your path forward is clear. Begin by mapping out your current accounting workflow, identifying the most significant pain points and time sinks. Are you struggling with reconciling payouts? Are you manually categorizing expenses? Use this list to shortlist two or three platforms that directly address these challenges.

Take advantage of free trials and product demos to get a hands-on feel for the user interface and functionality. This is your opportunity to test drive the software and confirm it aligns with your operational style. Remember, the goal is to find a solution that simplifies your financial management, freeing you up to focus on what truly drives revenue: providing an exceptional guest experience. Investing in the right short term rental accounting software is an investment in your business's long-term health and success.

Ready to take the next step from managing your finances to optimizing your entire investment strategy? Chalet provides a comprehensive platform for STR investors to analyze properties, forecast revenue, and connect with experienced, short-term rental specialized real estate agents. Discover your next profitable investment by visiting Chalet today.