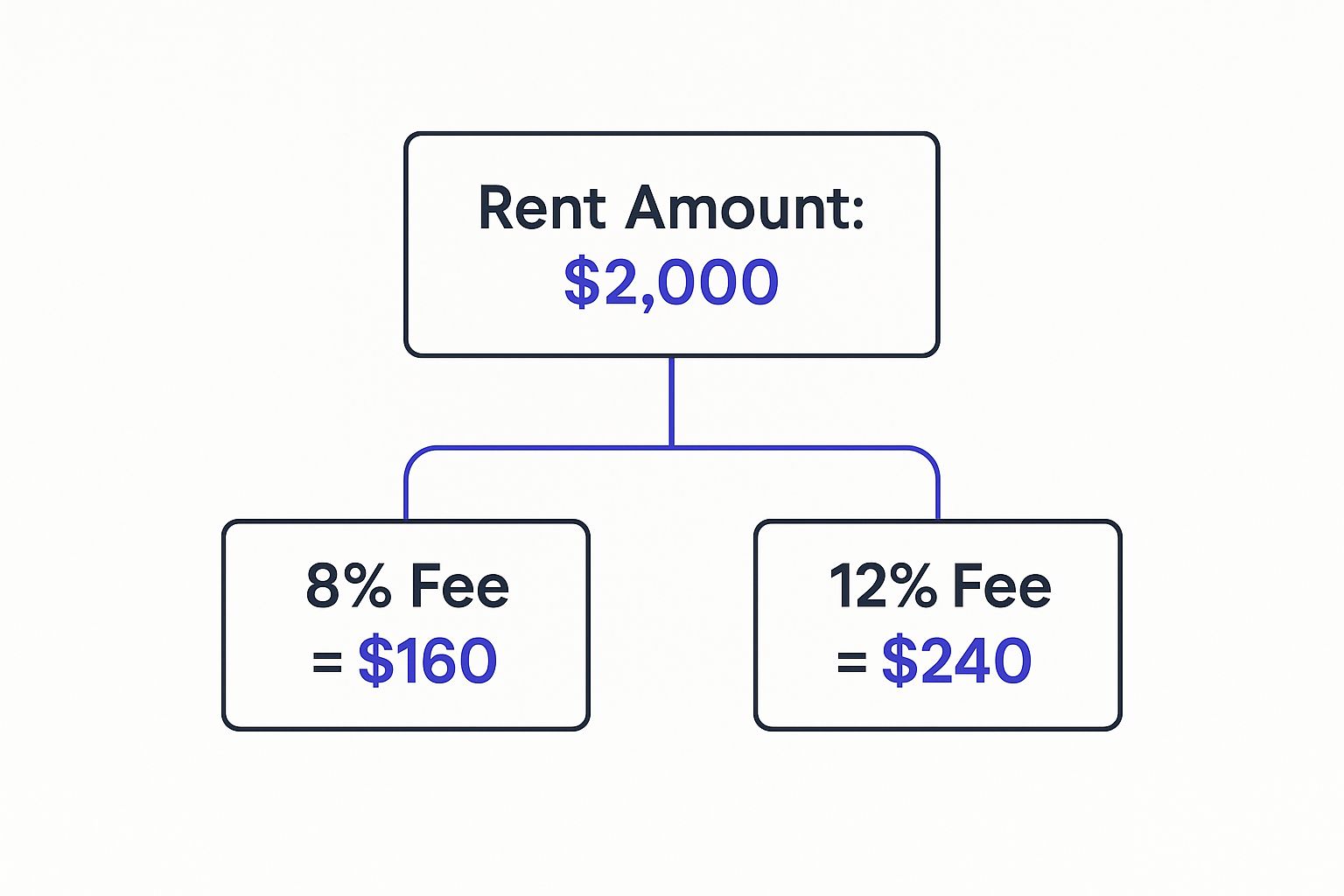

Let's cut straight to the chase. When you hire a property manager, their fee is typically 8-12% of the monthly rent they collect for you.

So, if your property rents for $2,000 a month, you can expect to pay your manager somewhere between $160 and $240. It's that simple.

What to Expect on Your First Management Bill

Think of your property manager as the CEO of your rental business. They’re running the day-to-day operations—from finding tenants to fixing leaky faucets—so you don't have to. Their monthly management fee is how they get paid for keeping your investment running smoothly.

This percentage-based model is the most common one you'll find, and for good reason: it aligns their success with yours. If you're not getting paid, they're not getting paid.

However, it’s not the only way managers charge. Some prefer a flat monthly fee, which gives you a predictable expense no matter what. Getting familiar with both models is the first step to making sure there are no surprises when that first bill arrives.

Breaking Down the Numbers

The fee structure you choose really comes down to what you value more: a fee tied to performance or one that offers budget consistency.

Let's take a quick look at how these two common property management fee structures compare. This table breaks down the essentials to help you see which model might be a better fit for your property.

Common Property Management Fee Structures At a Glance

| Fee Structure | Typical Cost Range | Best For | Services Included |

|---|---|---|---|

| Percentage-Based | 8-12% of collected rent | Owners who want to tie the manager's pay directly to rental income and occupancy. | Full-service management: rent collection, tenant communication, maintenance coordination, etc. |

| Flat-Fee | $100 – $200 per unit | Owners of lower-rent properties or those who prefer a fixed, predictable monthly expense. | Often includes the same core services as percentage-based, but the fee is fixed. |

Ultimately, whether you go with a percentage or a flat fee, the goal is the same: paying an expert to handle the headaches so you can enjoy the rewards of your investment.

You can discover more insights about property management statistics on DoorLoop.com to see how these numbers play out across different markets.

At its core, that monthly fee is you paying for expertise, time, and peace of mind. It covers everything from tenant screening and rent collection to maintenance calls and legal compliance—all the crucial tasks that protect your bottom line.

This infographic breaks down exactly how a percentage-based fee works using our $2,000 rent example.

As you can see, even a small difference in the percentage can add up over a year. This is why it’s so important to not just look at the fee, but to understand exactly what services you're getting for that price. Your first bill will reflect one of these foundational models.

Understanding the Two Main Fee Models

When you're looking at the property management cost per month, it almost always boils down to one of two core pricing structures. Getting a handle on how each model works is the key to picking a partner whose financial incentives line up with your own.

Think of it like hiring a salesperson: do you want someone working on commission or a fixed salary? Both can get the job done, but what drives them is different. The same logic applies here.

The most common approach you'll see is the percentage-based fee. With this model, your manager’s income is directly tied to your property's success.

It's simple math. If your property rents for $2,500 a month and the management fee is 8%, you’ll pay them $200. This setup naturally motivates the manager to push for the highest possible rent and keep the place filled. When you make more money, they make more money.

This model is pretty much the standard globally. For instance, in Europe—which accounts for over 30% of the property management market—residential fees also tend to land in that same 8-12% range.

The Predictability of a Flat-Fee Model

On the other side of the coin, you have the flat-fee model. This structure is all about straightforward predictability, which is a huge plus for owners who want to keep their expenses consistent and easy to budget.

With a flat fee, you pay the exact same amount every single month, no matter what rent is collected. You might pay a fixed $150 per month, and that number doesn't change whether the rent is $2,200 or $2,400. Depending on your contract, you might even pay it when the unit is vacant.

This model makes your monthly financial planning a breeze. You always know exactly what this business expense will be, making it far easier to calculate your cash flow and net operating income without any last-minute surprises.

This consistency is especially attractive if you own properties with lower rental rates, where a percentage-based fee might not be enough to make it worth a management company's time.

Choosing the Right Model for Your Property

So, which one is better? Honestly, there’s no single right answer. It comes down to your specific property, your portfolio, and your personal preferences as an investor.

To help you sort it out, here’s a simple breakdown:

- Percentage-Based Fee: This is for owners who want to ensure their manager is fully motivated to maximize rental income. It’s a "we're in this together" kind of approach.

- Flat-Fee Model: This is the best fit for owners who put budget predictability above everything else. It’s a simple, set-it-and-forget-it expense.

A great way to see these concepts in action is to look at how different companies structure their services. For example, checking out the various Showdigs pricing models can give you a real-world feel for these options.

Ultimately, your choice will define the financial relationship you have with your property manager. The best model is the one that supports your investment strategy, so weigh the pros and cons carefully before you sign anything.

What Factors Drive Your Final Price

Ever wonder why your neighbor with a similar rental pays an 8% management fee, while your quote comes in at 12%? It’s not random. The final price tag is a direct reflection of the unique demands of your property, which dictate the manager's workload and risk.

Think of it like car insurance. A brand-new sedan is cheaper to insure than a vintage sports car. The asset is similar—it's a car—but the risk, potential for costly repairs, and specialized knowledge required are worlds apart. The same logic applies to managing rental properties.

When a company gives you a quote, they’re estimating the time, resources, and expertise needed to keep your investment profitable and well-maintained. A simple, modern single-family home in a quiet suburb is just a different ballgame than a historic triplex in a bustling downtown core.

Property Type and Size

The biggest factor, by far, is the type of property you own. Each one comes with its own set of management challenges.

- Single-Family Homes: These are generally the most straightforward to manage and often land at the lower end of the fee spectrum. You have one lease, one family to communicate with, and a simple maintenance schedule. Easy peasy.

- Multi-Family Properties: Once you get into duplexes, triplexes, or small apartment buildings, complexity skyrockets. You're juggling multiple leases, more tenant phone calls, and maintaining common areas. All that extra work means a higher management fee.

- Short-Term Rentals: Vacation rentals like Airbnbs demand the highest fees, often clocking in at 15% to 40% of revenue. Why so much? Because it's basically hotel management—constant guest communication, frequent cleanings, and dynamic pricing strategies. It’s an intense, hands-on job.

The number of units also plays a role, thanks to economies of scale. A manager can often give you a better per-unit rate for a 50-unit building than for five separate single-family homes scattered across town because everything is centralized.

Location and Market Conditions

Where your property is located has a massive impact on the management cost. A rental in a high-demand urban center with fierce competition needs more aggressive marketing and tenant screening than one in a sleepy suburban market where tenants stay for years.

A property manager’s fee is directly influenced by the local rental landscape. In competitive markets, managers must work harder to fill vacancies, handle complex local regulations, and manage higher tenant expectations, justifying a higher fee.

For example, a property in a dense city might face higher maintenance costs from older infrastructure and stricter building codes. On the flip side, a rural property could also have higher fees if there’s only one qualified plumber in a 50-mile radius, forcing the manager to pay a premium for repairs.

Scope of Services Required

Finally, what do you actually want the property manager to do? Your cost is directly tied to the services you choose. Not all management agreements are created equal.

A full-service package is the "set it and forget it" option. It covers everything from marketing and tenant screening to 24/7 emergency maintenance calls and detailed financial reporting. This all-inclusive approach naturally commands a higher fee.

Alternatively, you could go with a partial-service or "à la carte" model. Maybe you're willing to handle maintenance coordination yourself to save some cash. Your choices here directly shape the final quote you receive.

Uncovering the Costs Beyond the Monthly Fee

The percentage or flat fee you pay each month is the foundation of your property management cost per month, but it’s rarely the whole story.

Think of it like the base price of a car. The sticker price gets you the vehicle, but the features you really want—like heated seats or a premium sound system—come at an extra cost. The same idea applies to property management services.

To really get a handle on your expenses, you need to look past the recurring management fee and dig into the "à la carte" charges that can pop up on your owner statement. These are usually one-time fees for specific, labor-intensive tasks. If you don't know what they are, you could be in for a nasty surprise when a bill comes in much higher than expected.

Common Additional Service Fees

These fees are how managers get compensated for major events that fall outside of routine, day-to-day duties. They're standard in the industry, but the amounts can vary wildly from one company to the next, so always read your contract with a fine-tooth comb.

Here are some of the most common charges you'll see:

- Tenant Placement Fee: This covers the entire process of finding and placing a new tenant—from marketing and showings to screening applications and drafting the lease. Expect to pay anywhere from 50% to 100% of the first month's rent.

- Lease Renewal Fee: When a great tenant’s lease is up, the manager handles all the negotiation and paperwork to convince them to stay. This fee, often a smaller flat rate like $200, is a bargain compared to the cost of a full tenant turnover.

- Vacancy Fee: Some managers charge a flat monthly fee (say, $50 per month) if a unit sits empty. This helps cover the ongoing costs of marketing the property and keeping it secure while it's not bringing in any income.

Navigating Maintenance and Legal Charges

Maintenance and legal issues are another category of variable costs that can really impact your bottom line. Frankly, these are often the most unpredictable expenses you'll face as a landlord.

A common practice is the maintenance markup. This is where a manager adds a surcharge, typically around 10%, to vendor invoices. That extra bit covers their administrative work—finding contractors, scheduling appointments, managing payments, and making sure the job gets done right.

Eviction fees are another critical cost to be aware of. If a tenant needs to be removed, your manager will charge for handling the complex legal process. This can be a flat fee of $500 or more, plus any court costs that come up.

To give you a clearer picture, here’s a breakdown of what these additional fees often look like.

Sample Breakdown of Additional Property Management Fees

| Fee Type | Common Cost Structure | What It Covers | When It's Charged |

|---|---|---|---|

| Tenant Placement | 50% – 100% of one month's rent | Marketing, showings, screening, lease prep | At the start of a new tenancy |

| Lease Renewal | Flat fee (e.g., $200) or % of rent | Negotiating terms, drafting renewal docs | When an existing tenant renews their lease |

| Vacancy Fee | Flat fee (e.g., $50/month) | Marketing, security checks, basic upkeep | Monthly, while the property is unoccupied |

| Maintenance Markup | 10% – 15% of the vendor's invoice | Coordinating repairs, vetting contractors | When any maintenance work is performed |

| Eviction Fee | Flat fee (e.g., $500 + court costs) | Serving notices, court filings, legal coordination | When an eviction process is initiated |

| Annual Admin Fee | Flat fee (e.g., $100 – $300) | Year-end statements, tax document prep | Annually, as specified in the contract |

This table should help you anticipate costs beyond the monthly management percentage, making your financial projections far more accurate.

Beyond your property manager's fees, you also have to navigate the complexities of rental income tax. For a deeper dive, this guide on UK Property Rental Income Tax Explained for Landlords is a fantastic resource. Understanding every potential cost—from tenant placement to taxes—is the key to seeing the true profitability of your investment.

Calculating the True Value of a Property Manager

It’s easy to look at the property management cost per month and see it as just another expense draining your cash flow. But that's the wrong way to look at it. The right management partner isn't a cost—they're an investment, and a good one delivers a serious return.

Getting your head around this mindset shift is the key. A great manager’s value isn’t just in the tasks they tick off a list; it's in the expensive headaches they prevent before they ever happen. They save you money in ways you might not even see.

And it seems a lot of investors are catching on. The global property management market is set to explode, growing from USD 24.01 billion in 2025 to a whopping USD 52.99 billion by 2033. Why? More and more owners are realizing that professional oversight pays for itself. You can dig into more details about the property management market's rapid growth on startus-insights.com.

Beyond the Monthly Fee: The Hidden Savings

The real return on your investment (ROI) isn't just about collecting rent on time. It's about how a manager optimizes every part of your property’s performance while shielding you from the financial landmines of being a landlord.

Their expertise shows up in your bank account, even if it's not obvious at first glance.

- Shorter Vacancies: A pro knows how to market your unit. We're talking professional photos, compelling listings, and a smooth showing process that gets your property rented faster. Every day a unit sits empty is money down the drain.

- Higher-Quality Tenants: This one is huge. A rigorous screening process—credit checks, background checks, employment verification—is your best defense against the nightmare scenario of late payments, property damage, and evictions.

- Lower Repair Bills: When a pipe bursts at 2 AM, who are you going to call? An experienced manager already has a list of vetted, reliable, and reasonably priced vendors. You won't be stuck overpaying for a last-minute emergency fix from a stranger you found online.

The most valuable asset a property manager protects is your time. They handle the late-night emergency calls, the tedious paperwork, and the difficult tenant conversations. They give you back hours of your life to focus on finding the next deal—or just relaxing.

A Practical Example of Positive ROI

Let's run the numbers on a real-world scenario to see how this plays out.

Imagine your property manager charges a flat $200 monthly fee. On the surface, that’s a $2,400 annual expense. But let’s look at what you got for that money.

This month alone, they saved you an estimated 15 hours you would have otherwise spent coordinating repairs, chasing down rent, and dealing with bookkeeping. If you value your time at a conservative $50 per hour, that’s $750 right there.

But here’s the kicker. Their diligent screening process weeded out a potential tenant who had a history of non-payment. That one move helped you dodge a $2,000 eviction process down the road.

So, in a single month, your $200 investment delivered a net positive return of $2,550 when you factor in saved time and avoided costs ($750 + $2,000 – $200). That’s when the true value becomes impossible to ignore.

Common Questions About Management Costs

Digging into property management fees can feel like reading the fine print on a credit card statement. A few questions pop up constantly, and getting straight answers is the only way to make a smart decision and avoid nasty surprises later on.

Think of this as your quick-reference guide. We’re breaking down the most common points of confusion to help you review management contracts with a sharper eye and a clear understanding of your true property management cost per month.

Do I Pay Management Fees if My Property Is Vacant?

This is a huge one, and the answer comes down to your specific management agreement. Some companies structure their fees as a genuine partnership—if you're not getting paid, they're not getting paid. This model is great because it aligns their goals with yours, giving them every reason to fill that vacancy fast.

On the other hand, some companies charge a smaller flat fee when a unit is empty. This fee is meant to cover the work they’re still doing, like marketing the property, running showings, and making sure the home is secure. The key is to find the "vacancy fee" clause in your contract and know exactly what you’re signing up for.

Are Property Management Fees Tax Deductible?

Yes, they absolutely are. In most places, property management fees are treated as a standard operating expense for your rental business, which means you can deduct them from your rental income. This is a massive benefit that significantly lowers the net cost of hiring a manager.

Key Takeaway: The ability to write off management fees—along with other costs like repairs and insurance—directly cuts down your tax bill. It’s one of the main reasons hiring a pro is often a smart investment, not just another expense.

Of course, tax laws are notoriously tricky. We always suggest chatting with a qualified tax professional to make sure you're claiming every deduction you’re entitled to for your situation.

Can I Negotiate Property Management Fees?

You bet. While the big national firms might have rigid, take-it-or-leave-it pricing, you often have wiggle room with local or regional companies. Your negotiating power gets a lot stronger if you have more to offer.

Here are a few scenarios where you’ve got a strong hand to play:

- Multiple Properties: If you own a portfolio, you're a very attractive client. You can often get a lower percentage rate by giving them all your business.

- High-Rent Properties: For a property with premium rent, the manager makes a healthy fee even at a slightly lower percentage. It doesn’t hurt to ask.

- Negotiating Specific Charges: You can also target individual fees. Try asking to cap maintenance markups or waive lease renewal fees altogether.

Just make sure you come to the conversation prepared. Do your homework on what competitors are charging and be ready to explain why your property is a great, easy-to-manage asset for them.

What Is the Difference Between a Property Manager and an Asset Manager?

This is a common mix-up, but their jobs are worlds apart.

A property manager is the boots-on-the-ground operator for your rental. They handle all the day-to-day stuff: collecting rent, screening tenants, calling the plumber, and handling late-night tenant calls. Their entire focus is on keeping the property running smoothly.

An asset manager, in contrast, operates at a 30,000-foot view. They’re like a CFO for your entire real estate portfolio, focused on big-picture financial strategy. They analyze market trends, advise you on when to buy or sell, and work to maximize the long-term value of your investments. For most individual rental owners, a top-notch property manager is exactly what you need.

Ready to take the next step in your short-term rental investment journey? Chalet is your all-in-one platform to analyze markets, find expert agents, and connect with vetted service providers. Start making data-backed decisions today at https://www.getchalet.com.