Buying an Airbnb isn't just about picking a property; it's about treating it like a business from the absolute get-go. Too many new investors jump straight to browsing listings without a plan. Success starts with defining your financial goals, lining up the right financing, and doing a serious deep-dive into your target market.

This means you need to know your budget inside and out—down payment, renovation costs, and a six-month operating reserve—before you even think about making an offer. This early-stage planning is what separates the profitable hosts from the ones who are constantly scrambling.

Building Your Airbnb Investment Blueprint

Before you even open a real estate app, the first real move is to map out your personal investment blueprint. Forget complex spreadsheets for a moment; this is about getting crystal clear on what a "win" actually looks like for you.

Are you chasing consistent monthly cash flow to pad your income? Or is your eye on long-term appreciation in a market that's about to pop?

Maybe it's a mix of both—a property that basically pays for itself while its value quietly climbs. Nailing down this primary goal from day one will become your north star, guiding every single decision you make. For instance, a cash-flow investor might go for a modest condo in a city with year-round demand, while someone playing the long game might target a bigger home in an up-and-coming vacation spot.

Define Your Financial Readiness

Getting financially ready is about way more than just the down payment. This is where so many first-timers trip up—they completely underestimate the total cash needed to get a short-term rental off the ground. Your blueprint needs to be brutally honest about the full financial picture.

Here are the key funds you absolutely must have mapped out:

- Renovation and Repair Costs: Even a "turnkey" property usually needs some cosmetic love or minor fixes to be truly guest-ready.

- Furnishing and Supplies: This can easily run anywhere from $5,000 to over $15,000, all depending on the property's size and the vibe you're going for.

- Closing Costs: Plan for another 2% to 6% of the purchase price here.

- Operating Reserve: This is your safety net. You need at least six months' worth of all expenses (mortgage, utilities, insurance) socked away to handle slow seasons or that surprise HVAC repair.

Having this financial cushion is non-negotiable. It's what gives you the peace of mind to avoid making panicked decisions during a booking slump, and it’s the key to the long-term health of your investment.

As you build this blueprint, one of the first strategic calls you'll make is how to structure your business. Getting a handle on the differences between an S Corp vs LLC for your small business can have a huge impact on your liability and taxes down the road. When you align your investment with your real-life financial goals, you create a clear roadmap that turns a hopeful purchase into a calculated, professional business move.

How to Find a Profitable Market for Your Airbnb

The old real estate mantra—“location, location, location”—gets turned up to eleven when you're buying an Airbnb. Success isn’t about chasing the buzziest tourist traps. It's about becoming a data nerd and finding markets with the perfect storm of high demand, sane property prices, and friendly local rules.

Your goal here is to become a true market expert, not just another property owner. That means looking past the pretty pictures and identifying areas with consistent, year-round demand. Think beyond the summer beach crowd. Consider cities with major universities, hospitals, or corporate hubs that keep a steady flow of visitors coming in, month after month.

Digging into the Data That Matters

To stop guessing and start making data-backed decisions, you need to get comfortable with a few core metrics. These numbers tell the real story of a market's health and its potential to actually make you money. They let you compare cities—and even neighborhoods within the same city—on an apples-to-apples basis.

Here's what you need to zero in on:

- Average Daily Rate (ADR): This is the average price you can charge per night. A higher ADR means you have strong pricing power in that market.

- Occupancy Rate: The percentage of nights your place is booked. A healthy occupancy rate, usually above 65%, is a clear sign of consistent demand.

- Revenue Per Available Room (RevPAR): Calculated by multiplying your ADR by your occupancy rate, RevPAR is the gold standard for measuring how well a property is generating revenue.

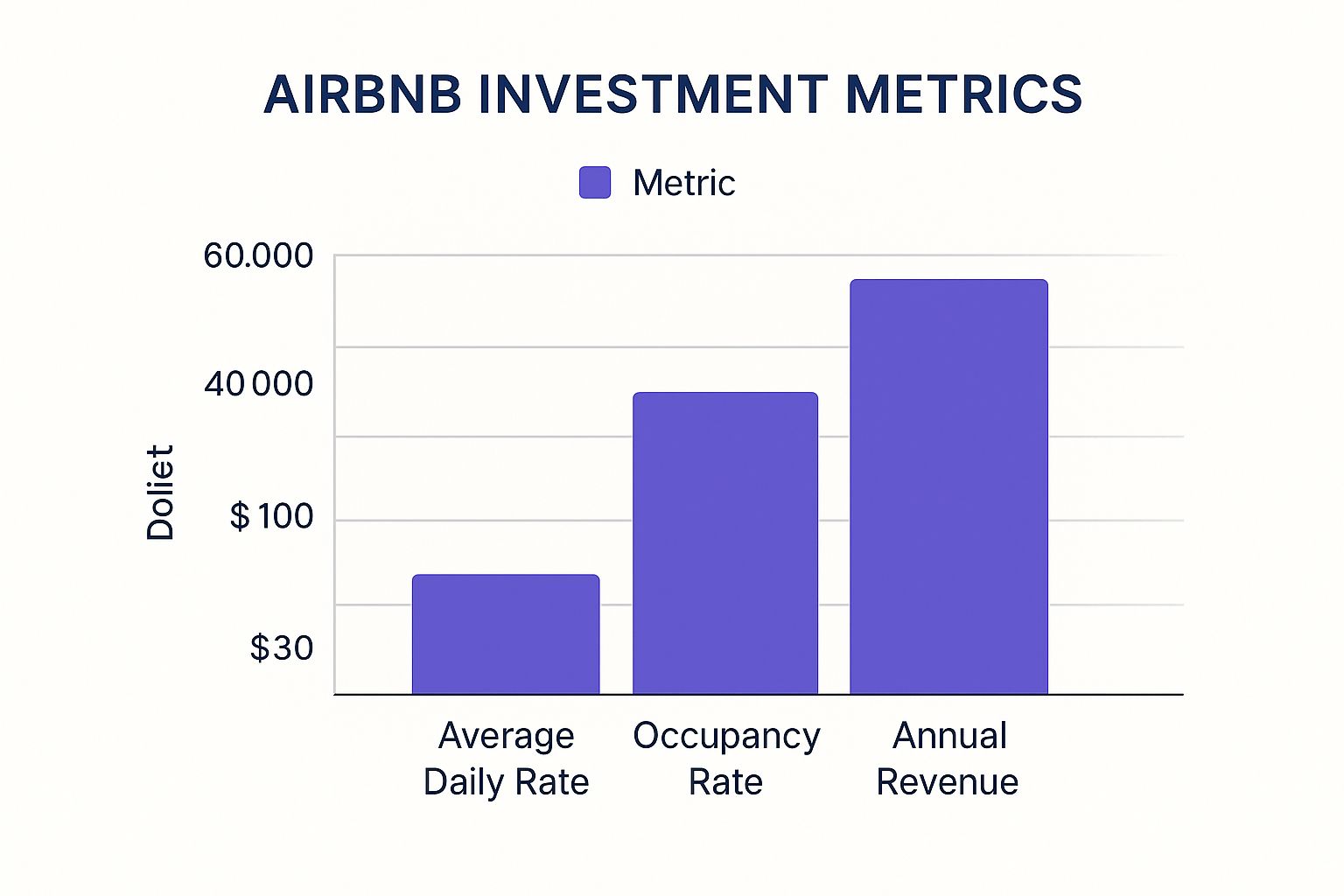

This chart shows you exactly how these metrics work together. It's not about maxing out one; it's about finding the right balance.

As the visual makes clear, big-time annual revenue comes from balancing a strong nightly rate with a consistent flow of bookings.

And the industry itself? It's on solid ground. The global vacation rental market is projected to climb from USD 97.85 billion in 2025 to USD 134.26 billion by 2034, which should give any investor long-term confidence.

We're also seeing a major trend toward suburban and rural spots, where investors are pulling in revenue increases of around 20% compared to oversaturated cities. Take a hotspot like South Padre Island, Texas—properties there average $34,600 in annual revenue, thanks to a high ADR and strong local demand. This proves that success is increasingly about finding unique local draws and sidestepping the tightening regulations in big cities. You can explore more on these trends with an in-depth short-term rental market analysis.

So, before you fall in love with a market's potential earnings, you need to understand the vital metrics that underpin its performance. Below is a quick-glance table breaking down the key data points to look at when you're comparing different locations for your short-term rental investment.

| Key Metrics for Evaluating Airbnb Markets |

| :— | :— | :— |

| Metric | What It Tells You | Ideal Range / Goal |

| Average Daily Rate (ADR) | The average nightly rental price. Indicates pricing power. | Varies by market; compare against local comps. |

| Occupancy Rate | The percentage of booked nights. Signals demand consistency. | Aim for 65% or higher for stable income. |

| Revenue Per Available Room (RevPAR) | The blend of ADR and occupancy. A holistic revenue metric. | Higher is better; used for direct market comparisons. |

| Seasonality | The fluctuation in demand throughout the year. | Low seasonality for consistent cash flow. |

| Median Home Price | The cost to enter the market. Affects your potential ROI. | Low enough to allow for positive cash flow. |

| Regulatory Score | The legal friendliness of the area for STRs. | Low-risk, clear, and stable regulations. |

Using this framework helps you move from a gut feeling to a calculated decision, ensuring you pick a market with a solid foundation for profitability.

Navigating the Regulatory Maze

Finding a market with killer revenue potential is only half the job. The other half—and arguably the more important one—is figuring out the local laws for short-term rentals. A city that looks like a goldmine on paper can quickly become a money pit if you ignore the rules.

City Hall can change its mind fast, and new regulations can impact everything from whether you can operate at all to how much you get to keep. Before you get emotionally invested in a market, you absolutely must do your homework on its legal landscape.

The single biggest mistake new investors make is assuming the rules are the same from one town to the next. They aren't. Regulations are hyper-local. Doing the legwork here will save you from massive legal headaches—and a potential shutdown—down the road.

Start your search on the official city or county government website. Hunt for pages on zoning, business licensing, or specific short-term rental ordinances.

You need definitive answers to these questions:

- Is it even legal? Is hosting an STR flat-out permitted in the neighborhood you're looking at?

- What are the restrictions? Many cities have a "primary residency" rule, meaning you can only rent out the home you live in. Others put a hard cap on the number of nights you can rent per year.

- What permits will I need? Expect to apply for a business license, a special STR permit, and maybe even schedule fire and safety inspections.

- What taxes do I have to pay? Get ready to collect and pay local and state occupancy taxes, sometimes called hotel or lodging taxes.

This is where a great local real estate agent who specializes in investment properties becomes your best friend. They're on the ground, know the regulatory quirks, and can point you toward investor-friendly areas while warning you away from the bureaucratic minefields. This groundwork isn’t optional—it’s a crucial step to buying an Airbnb that will be a winner for years.

Analyzing Properties and Projecting Your Profits

Alright, you’ve found a promising market. Now it’s time to zoom in from the 30,000-foot view to a microscopic one. This is where you put on your detective hat and start dissecting individual properties to see if the numbers actually work. Forget the seller’s flashy sales pitch; we’re building a financial model grounded in cold, hard data.

First things first: you need to build your own revenue projection from scratch. That means completely ignoring the seller's advertised income and doing your own homework. The goal is to find truly comparable properties—same bedroom count, similar vibe and amenities, and right in the immediate neighborhood—to see what they’re pulling in.

This kind of granular analysis is the difference between buying on a gut feeling and making a savvy business decision.

Building Your Revenue Projections

The best way to estimate your potential income is to become a bit of an online stalker. Find at least three to five direct "comps" on Airbnb and Vrbo and dive deep into their calendars. How booked are they over the next few months? This is your real-time glimpse into actual occupancy rates.

Next, study their pricing. Look at how their rates change for weekdays, weekends, holidays, and big local events. This is your key to building a dynamic pricing strategy instead of just setting one flat nightly rate and hoping for the best.

It's also crucial to understand the bigger picture. Industry data shows that while Airbnb's market share jumped from 28% to 44% between 2019 and 2024, a flood of new listings has cranked up the competition. Average U.S. occupancy rates have settled around 50% because of all this new supply. Smart hosts have fought back by raising nightly rates, pushing Revenue per Available Rental (RevPAR) up by 8.1% year-over-year.

For an investor, this tells you one thing: focus on markets with real demand drivers where you can be nimble with your pricing. You can dig into more of these evolving Airbnb growth trends to get a better feel for the landscape.

Accounting for Every Single Expense

An amazing revenue forecast is completely useless if you don't pair it with a brutally honest expense sheet. So many new investors get fixated on the mortgage payment and totally forget about the dozen other costs that chip away at your profit margin. Your mission is to account for every last dollar.

I like to break expenses down into two simple buckets:

- Fixed Costs: These are the bills you pay every month, no matter what. Think mortgage principal and interest, property taxes, insurance, and any pesky HOA fees.

- Variable Costs: These costs go up and down with your occupancy. This is your cleaning fees, restocking supplies (coffee, toilet paper, soap), utilities, and general maintenance.

Don’t forget the hidden costs. Platform fees (typically 3%), credit card processing fees, and a budget for replacing worn-out linens or broken coffee makers are real expenses that must be factored in. A smart move is to set aside 5-10% of your gross revenue for capital expenditures.

Laying it all out like this moves you from a back-of-the-napkin guess to a professional-grade financial analysis.

Calculating the Metrics That Matter

Once you have your revenue and expenses dialed in, you can calculate the key performance indicators (KPIs) that tell you the true financial health of a property. These numbers let you compare different deals apples-to-apples.

For buying an Airbnb, the two most important metrics are Net Operating Income (NOI) and Cash-on-Cash Return.

Net Operating Income (NOI) is your total annual rental income minus all your operating expenses. It shows you how profitable the property is before you factor in your loan. A healthy, growing NOI is the sign of a solid asset.

Cash-on-Cash Return is your annual pre-tax cash flow divided by the total cash you put into the deal. This is the holy grail for most investors because it measures the return on your actual out-of-pocket cash—your down payment, closing costs, and all the money you spent on furniture.

Here’s a quick breakdown of how this looks in the real world:

| Metric | Calculation Breakdown | Example |

|---|---|---|

| Gross Annual Revenue | (Avg. Daily Rate x 365 days) x Occupancy Rate | ($200 x 365) x 65% = $47,450 |

| Total Annual Expenses | Fixed Costs + Variable Costs (Excludes Mortgage) | $12,000 + $8,000 = $20,000 |

| Net Operating Income (NOI) | Gross Revenue – Total Expenses | $47,450 – $20,000 = $27,450 |

| Annual Cash Flow | NOI – Annual Mortgage Payments | $27,450 – $24,000 = $3,450 |

| Total Cash Invested | Down Payment + Closing + Furnishings | $50,000 + $8,000 + $15,000 = $73,000 |

| Cash-on-Cash Return | Annual Cash Flow / Total Cash Invested | $3,450 / $73,000 = 4.7% |

This simple framework turns a property listing into a clear business case. It gives you the power to confidently walk away from deals that don't hit your numbers and go all-in on the ones that do.

How to Secure Financing for Your Airbnb

Getting a loan for an Airbnb is a completely different ballgame than financing your own home. Lenders view investment properties as higher risk, which means the underwriting process is much stricter and requires you to come to the table far more prepared. The first step is just understanding how their perspective shifts when you're buying an income-producing asset.

For starters, you'll need more skin in the game. Most lenders will require a down payment in the 15% to 25% range for an investment property. They’ll also be looking for a strong credit score, usually 700 or above, to give you access to the best interest rates. Your entire financial picture—from your job stability to your debt-to-income ratio—will be put under a microscope.

Exploring Your Loan Options

When you start shopping around for a loan, you'll find there are a few different paths you can take. A conventional investment property loan is the most common route, but it's definitely not your only option.

- Conventional Investment Loans: These are the workhorses of real estate investing. They're straightforward but come with the most stringent requirements for credit scores, down payments, and the amount of cash you have in reserve.

- Portfolio Loans: Some banks and credit unions keep certain loans on their own books instead of selling them off. These lenders often have more flexibility and might be more willing to consider your projected short-term rental income when qualifying you.

- Hard Money Loans: These are short-term, asset-based loans from private investors. They're much faster to secure but come with significantly higher interest rates. This makes them a better fit for quick fix-and-flip scenarios, not a long-term buy-and-hold strategy for an Airbnb.

The real key here is to talk to multiple lenders, especially those with direct experience financing vacation rentals. A good mortgage broker who actually understands the short-term rental market can be a massive asset, connecting you with lenders who get your business model.

Presenting a Rock-Solid Application

To a lender, you’re not just a homebuyer—you’re a business owner launching a new venture. Your loan application needs to reflect that. You have to present a compelling, data-backed case that your property will be a profitable investment. This means going way beyond standard income verification and building a detailed business plan.

Your application package should feel more like a business pitch. Make sure it includes:

- A Detailed Property Analysis: Show your work. Include the full revenue and expense projections you built, complete with data on comparable properties from a tool like AirDNA or Chalet.

- Strong Personal Financials: Have pristine, organized copies of your last two years of tax returns, recent pay stubs, and bank statements ready to go.

- Proof of Cash Reserves: Lenders need to see you have a safety net. This shows them you can cover the mortgage and operating costs during a slow month without breaking a sweat.

Lenders are looking for confidence. When you can hand them a well-researched projection of your property's income potential, you stop being just another applicant and become a credible business partner they want to invest in.

Understanding the different financing avenues allows you to strategically choose the best fit for your situation. Here’s a quick comparison of the most common loan types for an Airbnb property.

Comparing Loan Options for an Airbnb Property

| Loan Type | Typical Down Payment | Pros | Cons |

|---|---|---|---|

| Conventional Loan | 20-25% | Lower interest rates, widely available, standardized process. | Strict credit and DTI requirements, slow approval process. |

| Portfolio Loan | 15-25% | More flexible underwriting, may consider future STR income. | Higher interest rates than conventional, harder to find. |

| Hard Money Loan | 20-30% | Fast closing, less focus on personal credit history. | Very high interest rates, short-term (typically 1-3 years). |

| Cash-Out Refinance | N/A | Access equity from an existing property for your down payment. | Increases debt on your current property, subject to appraisal. |

Ultimately, securing financing is all about preparation and professionalism. By treating the process like a business pitch and not just another home loan application, you immediately position yourself as a low-risk, high-potential borrower. This approach not only helps you get approved but also gives you leverage to negotiate the best possible terms for your investment.

From Closing the Deal to Launching Your Business

Getting your offer accepted feels like the finish line, but really, it’s just the starting gun. Now the real work begins: transforming that property from a real estate deal into a profitable hospitality business. This is where you move out of the theoretical world of spreadsheets and into the practical reality of inspections, furnishing, and marketing.

The time between your accepted offer and the closing table is a critical sprint. It’s your chance to navigate the final hurdles like the home inspection and appraisal, which can—and often do—reveal last-minute surprises. A thorough home inspection isn’t just about checking for a leaky roof; it’s your final opportunity to spot issues that could become expensive headaches for you as a host down the line.

Nailing the Closing Process

A successful closing is a smooth one. During this period, your main job is to be incredibly responsive and organized. Your lender, agent, and title company will flood your inbox with documents and requests. Staying on top of this paperwork is the key to preventing delays that could jeopardize the whole deal.

Remember, the appraisal is for the bank, but the inspection is for you. Pay close attention to the inspector's report on the major systems:

- HVAC: Is the unit old or struggling? An unexpected replacement can easily cost thousands of dollars.

- Roof and Foundation: These are the big-ticket items. Any sign of significant wear or damage needs to be addressed immediately.

- Plumbing and Electrical: Outdated systems aren't just an expense to modernize; they can be a serious safety hazard for your guests.

If the inspection does uncover major issues, don't panic. This is your leverage. Go back to the seller and negotiate for repairs or credits at closing. A few thousand dollars in credit now can save you from a massive out-of-pocket expense later.

Transforming Your Property into a Five-Star Rental

Once you have the keys, it’s time to shift from investor mode to hospitality mode. Your goal is to create an experience that guests will rave about in their reviews. That process starts with thoughtful furnishing and ends with building a reliable team on the ground.

Think durability first, then style. Guest after guest will be using this furniture, so choose pieces that can handle real wear and tear. A flimsy particleboard coffee table might look decent in photos, but it won't last a year. Invest in solid wood, metal, and performance fabrics whenever you can.

Don’t just furnish a space; design an experience. A guest booking a mountain cabin wants a cozy, rustic vibe, not stark, minimalist furniture. Your design choices should echo the very reason people are visiting your market in the first place.

Building a portfolio of properties is a proven path to success here. Early 2025 data shows that while the global Airbnb ecosystem has over 7.7 million active listings, hosts managing portfolios of 3 to 10 units consistently beat single-property owners in both occupancy and revenue. This just underscores the power of scaling your operations efficiently right from the start.

Crafting a Listing That Converts

Your online listing is your single most important marketing tool. It has to do more than just show the property; it has to sell an experience. This is exactly why professional photography is a non-negotiable expense. Grainy smartphone photos will get you scrolled past every single time.

Your listing description is your sales pitch. Lead with what makes your property unique. Is it the jaw-dropping view from the balcony? The fact that you can walk to the best restaurants in town? Use your headline and the first few sentences to hook potential guests immediately.

Your Setup Checklist for a Winning Launch:

- Professional Photography: Hire a real estate photographer who knows how to shoot interiors with great natural light.

- Compelling Copywriting: Write a description that tells a story and highlights the feeling of staying at your place.

- Smart Pricing Strategy: Use a dynamic pricing tool to adjust your rates for weekends, seasons, and local events. Don't set it and forget it.

- Guest Welcome Book: Create a simple guide with Wi-Fi details, house rules, and your personal local recommendations.

- Assemble Your Team: Find your superstar cleaner and a reliable handyman before your first guest ever books.

As you gear up for that first booking, establishing a rock-solid cleaning routine is paramount. Referencing an ultimate Airbnb cleaning checklist is a great way to ensure you meet five-star standards from day one. Your cleaning team is the true backbone of your business—they have a direct impact on your reviews and your long-term success.

By systematically tackling the closing process and thoughtfully setting up your rental, you lay the foundation for a high-performing Airbnb investment. This deliberate approach is what turns a simple real estate purchase into a thriving business with a fully booked calendar.

Common Questions About Buying an Airbnb

Jumping into the world of short-term rentals is exciting, but it also comes with a ton of questions. Getting straight answers is the only way to move forward with confidence when you're ready to buy an Airbnb investment property. Let's break down some of the most common things new investors ask.

How Much Money Do I Really Need to Buy an Airbnb?

The sticker price is just the beginning. While the down payment is the biggest piece of the puzzle—usually 15% to 25% for an investment property loan—it's far from the only upfront cost.

You'll need to have cash ready for a few other major expenses:

- Closing Costs: Set aside another 2% to 5% of the purchase price. This covers things like lender fees, title insurance, and other administrative costs.

- Furnishings and Amenities: This is a big one. Depending on the size of your property and the vibe you're going for, expect to spend anywhere from $5,000 to over $15,000.

- Initial Repairs and Setup: Even a "turnkey" property usually needs some love. Think fresh paint, minor fixes, or installing smart-home tech like keyless entry.

- Cash Reserves: This is non-negotiable. You need a safety net. Plan to have at least six months of operating expenses (mortgage, utilities, insurance) in the bank to handle slow seasons or unexpected repairs.

Do I Need an LLC for My Airbnb?

You don't technically need an LLC to run an Airbnb, but forming one is a smart, strategic move that most serious investors make. Why? The biggest reason is liability protection. An LLC creates a legal wall between your personal finances (like your house and savings) and your business.

So, if a guest has an accident on your property and decides to sue, they'd be suing the LLC, not you personally. It also makes your business finances much cleaner, which is a lifesaver come tax time. For just one property, a solid liability insurance policy might feel like enough, but as soon as you start thinking about scaling your portfolio, an LLC becomes essential.

Think of an LLC as a financial firewall. It’s a bit of administrative work upfront that provides a crucial layer of protection, letting you run your business with a lot more peace of mind.

How Much Can I Realistically Earn on Airbnb?

This is the million-dollar question, and the honest answer is: it completely depends. Your earnings potential is tied directly to your market, the type of property you have, and how well you manage it.

Income can swing wildly based on location, seasonality, and your pricing strategy. Sure, some hosts in prime tourist spots can rake in over $10,000 a month during high season. But a more typical average for hosts in the U.S. is somewhere between $900 and $1,500 per month.

To get a real number for a property you're eyeing, you have to dig into the local comps. Look at their calendars to see how booked they are. Study their nightly rates during different seasons, holidays, and local events. This data-driven approach will give you a much more accurate picture than any national average ever could.

Do I Have to Pay Taxes on My Airbnb Income?

Yes, your Airbnb income is absolutely taxable. In the U.S., if you rent your property for more than 14 days a year, you have to report those earnings on your federal and state tax returns.

But here's the good news: you can also deduct a whole host of business expenses, which lowers your taxable income significantly. Some of the most common write-offs include:

- Mortgage interest and property taxes

- Insurance premiums

- Cleaning and maintenance fees

- Utilities and guest supplies (like coffee and toiletries)

- Airbnb's service fees

- Depreciation on the property itself and all the furnishings

The key is to keep meticulous records of every dollar that comes in and goes out. And I can't stress this enough: work with a tax professional who actually has experience with short-term rentals. They'll save you way more than they cost.

Chalet is your partner for every step of the short-term rental investment process. Our platform provides free, AI-driven analytics, property-level revenue calculators, and connections to expert STR agents and lenders across the country. Analyze markets, find profitable listings, and build your portfolio with confidence. Start making data-backed decisions today at https://www.getchalet.com.