Buying a short-term rental isn't just another real estate transaction—it's more like launching a startup. Success in this game comes from treating it like a business from day one. That means digging into market data, navigating the maze of local laws, and, most importantly, creating an experience that guests will rave about. This guide is your end-to-end roadmap for buying a property that doesn't just look good, but actually generates consistent returns.

Your Roadmap to a Profitable Vacation Rental

Let's face it, the way people travel has completely changed. Thanks to flexible work and a hunger for unique, local experiences, the short-term rental (STR) market is absolutely booming. Travelers aren't just looking for a place to sleep anymore. They want homes with character, amenities that fit their lifestyle, and a location that offers something a standard hotel never could.

This massive shift is a golden opportunity for smart investors. Buying a vacation rental has quickly become a go-to strategy for building wealth, tapping into a market with some serious growth behind it. The global short-term rental market was valued at over USD 140.08 billion in 2025 and is projected to explode to USD 408.63 billion by 2035. This growth is being supercharged by remote work culture and better booking technology. You can explore the full market analysis to see what's driving these numbers.

The most successful STR investors think like hospitality entrepreneurs, not just landlords. They obsess over the guest experience—from the quality of the linens to the speed of the Wi-Fi—because they know that five-star reviews are the currency of this business.

Moving From Idea to Investment

Think of this guide as your complete playbook. We're going to take you from high-level strategy right down to the nitty-gritty of getting your property up and running. We'll skip the fluff and focus on the practical steps you need to take to make a smart, profitable investment. Forget guesswork; our approach is all about data, expert insights, and real-world application.

Here’s a peek at what we'll cover:

- Market Analysis: How to find and vet promising locations using key metrics like occupancy rates, seasonality, and revenue per available room (RevPAR).

- Financial Planning: A clear breakdown of how to structure your deal, from getting the right financing to accurately forecasting your revenue and cash flow.

- Regulatory Deep Dive: Practical steps for researching local laws, zoning rules, and HOA restrictions to avoid any nasty, expensive surprises down the road.

- Operational Setup: The blueprint for turning an empty house into a booking machine, covering everything from furniture and smart tech to building your local boots-on-the-ground team.

By the time you're done here, you'll have the confidence and the tools to navigate the entire process of buying a short term rental property. This is your map to not just buying a property, but launching a real hospitality business that can thrive. Let's get started.

Finding Markets Primed for Success

The old real estate mantra "location, location, location" is dialed up to eleven when you're buying a short-term rental property. Your success isn't just about finding a nice house; it's about finding that house in a market with consistent, high-paying demand. This is where you have to move beyond gut feelings and really dig into the data to see what a market's true potential is.

Forget casting a wide, generic net. The goal here is to pinpoint specific locations where your property can punch above its weight class. That means looking at key performance indicators that signal a healthy, profitable rental ecosystem. Start by analyzing metrics like average occupancy rates, the swing of seasonality, and Revenue Per Available Room (RevPAR)—a vital metric you get by multiplying the Average Daily Rate (ADR) by the occupancy rate.

Uncovering Local Demand Drivers

A strong market isn't just a one-trick pony; it's fueled by a diverse set of demand drivers that keep visitors coming all year round. Sure, a single major attraction like a theme park or a ski resort is great, but markets with multiple reasons to visit are far more resilient.

Look for a healthy mix of the following:

- Major Tourist Attractions: Being close to national parks, beaches, ski slopes, or historical landmarks creates a steady baseline of visitor traffic. A cabin near Zion National Park, for instance, will always have a stream of hikers and nature lovers.

- Consistent Event Schedules: Cities with convention centers, major sports venues, or big annual events (like music or film festivals) create predictable demand spikes that can seriously boost your revenue.

- Business and Institutional Hubs: Don't overlook proximity to major universities, hospitals, or corporate headquarters. These can attract traveling professionals, academics, and families visiting students or patients, often filling your calendar during what would otherwise be the off-season.

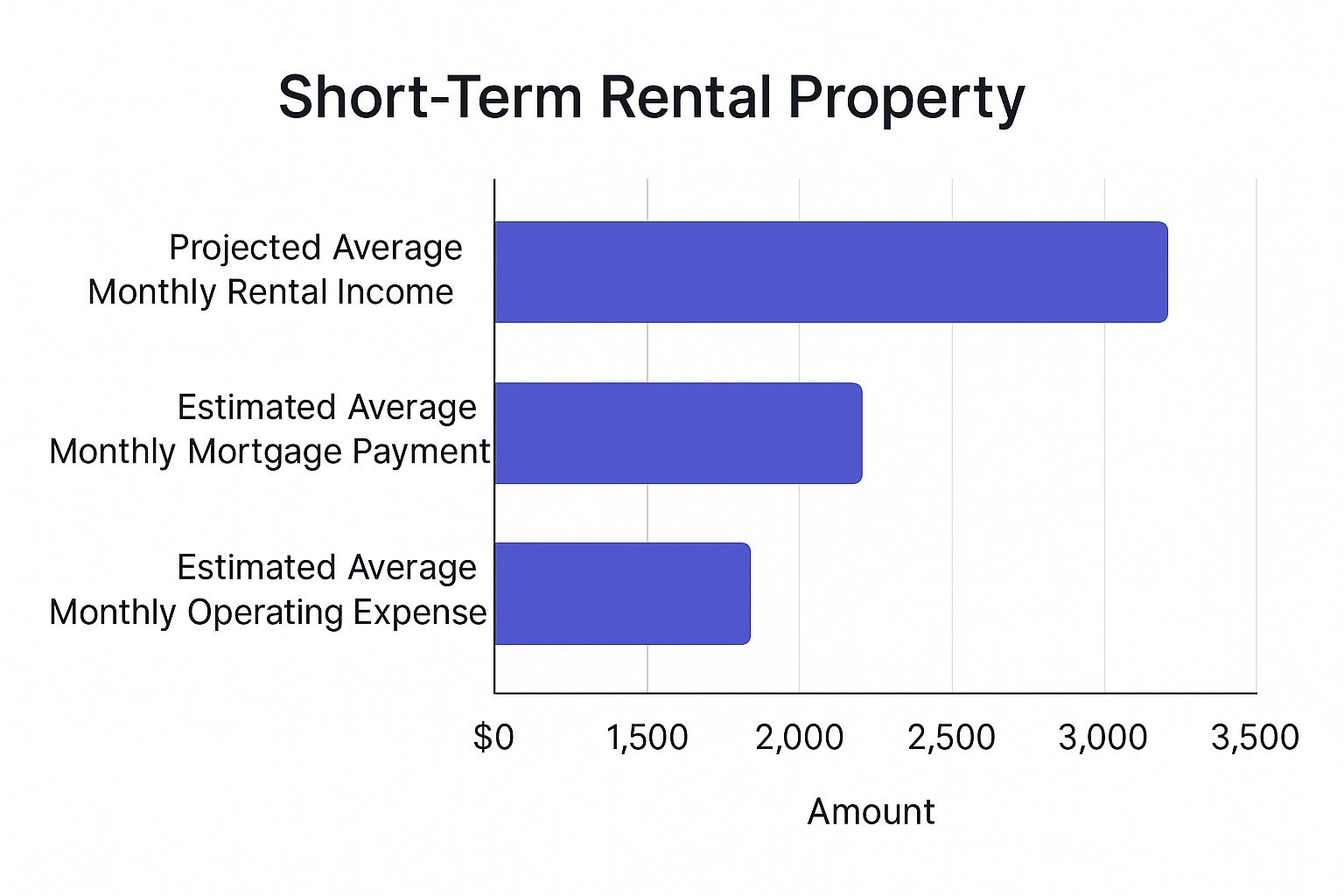

This chart gives a simplified financial picture, comparing potential monthly income against core expenses for a hypothetical property.

The key insight here is that gap between your rental income and total expenses. That represents your potential cash flow, before you factor in taxes and other variables.

Analyzing the Competition and Supply Trends

Knowing what drives demand is only half the battle. You also need to understand what's already on the market. A place can have sky-high demand, but if it's oversaturated with listings, you’ll find yourself in a race to the bottom on nightly rates. This is where tools like Chalet’s analytics dashboard or AirDNA are indispensable for assessing the existing supply of rentals.

This isn't just a local game, either. Global trends matter. From December 2023 to December 2024, the global market saw a 9% increase in listings. Guest capacity in emerging hotspots like Asia and Africa shot up by 22% and 25%, respectively. While growth was slower in established regions, this data shows a dynamic and expanding market. You can discover more insights about short-term rental market trends to see how these supply shifts might impact your investment strategy.

A common mistake I see is investors choosing a market based on its peak-season glamour. The most durable investments perform well across all four seasons, not just for a few peak weeks. Always analyze the "shoulder seasons"—the periods just before and after peak season—to gauge a market's true year-round strength.

Before you dive deep into a market, it's crucial to understand the data points that truly matter. Here's a breakdown of the key metrics you should be looking at.

Key Metrics for Short Term Rental Market Analysis

| Metric | What It Tells You | Where to Find It |

|---|---|---|

| Occupancy Rate | The percentage of booked nights. High, stable occupancy signals consistent demand. | Chalet, AirDNA, Rabbu |

| Average Daily Rate (ADR) | The average rental revenue per booked night. It indicates the market's pricing power. | Chalet, AirDNA, PriceLabs |

| RevPAR | Revenue Per Available Room (ADR x Occupancy). This is the gold standard for measuring performance. | Calculated from ADR & Occupancy |

| Seasonality | The variance in demand between high and low seasons. Low seasonality means more stable income. | Market data tools, local tourism boards |

| Number of Active Listings | The competitive landscape. A rapid increase can signal saturation and price pressure. | Chalet, AirDNA, Inside Airbnb |

| Regulation Score | The risk of future restrictions. A low score indicates a friendlier regulatory environment. | Chalet, local city/county websites |

This table isn't just a checklist; it's your roadmap. By evaluating each of these metrics, you can move from a broad idea of a "good" market to a data-backed list of locations with proven potential.

Pinpointing In-Demand Property Features

Once you've narrowed your focus to a market, the final piece of the puzzle is figuring out which specific property features guests will pay a premium for. This isn't about your personal taste; it's about what the data shows. In a mountain town like Steamboat Springs, a hot tub and ski-in/ski-out access are revenue-generating machines. Head to a desert destination like St. George, and a pool with an outdoor fire pit becomes a non-negotiable.

Drill down into the top-performing listings in your target area and hunt for patterns:

- Amenity Trends: Do the top 10% of listings all have game rooms, dedicated workspaces, or pet-friendly policies?

- Bedroom and Bathroom Counts: What's the sweet spot for property size? Often, a 3 or 4-bedroom home that can host families or small groups commands the highest RevPAR.

- Unique Experiences: Things like stunning views, unique architectural character, or being able to walk downtown can be powerful differentiators that let you command a higher nightly rate.

By layering data on market demand, competitive supply, and desirable property features, you stop speculating and start making a strategic, data-backed decision when buying your short-term rental.

Structuring the Finances for Your Investment

A profitable short-term rental is a business, and like any good business, it needs a rock-solid financial foundation. It's easy to get swept up in the excitement of browsing listings, but before you do, you have to map out a clear financial strategy. This goes way beyond the sticker price of the property; it means building a realistic, comprehensive budget that accounts for every single dollar.

Too many first-time investors get tunnel vision on the down payment and mortgage. The reality is, the true startup costs for a vacation rental are much, much broader. A detailed plan prevents nasty surprises and sets your new venture on the path to profitability from day one.

Budgeting Beyond the Purchase Price

The purchase price is just the starting line. To get ready to buy a short-term rental, you need to account for a whole host of upfront expenses. Skimping on these details can strain your finances and seriously delay your launch.

Your initial budget should absolutely include these key items:

- Closing Costs: Plan for 3-5% of the home's purchase price. This covers all the usual suspects: appraisal fees, inspection costs, title insurance, and loan origination.

- Furnishing and Setup: This is a big one. Expect to spend anywhere from $10,000 to $30,000+, depending on the property's size and how luxe you want to go. This covers furniture, linens, kitchenware, decor—everything a guest expects.

- Professional Photography and Listing Setup: High-quality photos aren't optional; they're essential. Budget for a pro photographer and any fees for optimizing your listing or hiring a copywriter.

- Initial Supplies and Stocking: Think of everything from cleaning supplies and toiletries to coffee and a few welcome basket items for your first guests.

- Licensing and Permitting: Do your homework and budget for any local business licenses or STR permits required in your target market.

A critical piece of the puzzle is building a cash reserve. Smart investors set aside 3-6 months of total operating expenses—mortgage, insurance, utilities, taxes—to cover unforeseen maintenance, seasonal lulls, or a slow start. This financial cushion is your safety net. Don't skip it.

Forecasting Your Revenue and Cash Flow

Once you have a firm grip on costs, the next step is building an accurate financial projection. This isn't about wishful thinking; it's about using real market data to estimate your potential revenue, occupancy, and, ultimately, your cash flow. This is where tools like Chalet's analytics dashboard become your best friend.

For instance, a high-end 4-bedroom home in a prime market like Steamboat Springs might pull in $131,400 to $197,100 in gross annual revenue. But that's the top-line number. Your projection has to subtract all the costs: property management fees (often 25-30%), cleaning, utilities, insurance, property taxes, and a healthy budget for ongoing maintenance.

A realistic forecast helps you underwrite the deal properly. It tells you whether a property can genuinely produce positive cash flow or if it's more of a break-even play where you build equity through appreciation. Both are valid investment strategies, but you need to know which game you're playing before you sign on the dotted line.

Exploring Your Financing Options

Securing the right financing is a make-or-break moment when buying a short-term rental property. Traditional lenders often see investment properties as higher risk than a primary residence, so you should expect different requirements.

Generally, you'll need:

- A higher down payment, typically 20-25% of the purchase price.

- A strong credit score, usually 720 or higher.

- Proof of cash reserves that go beyond your down payment and closing costs.

Conventional mortgages are the most common path, but they aren't your only choice. One of the most powerful financing tools for STR investors is the Debt Service Coverage Ratio (DSCR) loan. Instead of focusing on your personal income, these loans look at the property's income potential. Lenders use projected rental income to confirm it can cover the mortgage, making it a fantastic option for self-employed investors or those scaling a portfolio. You can get the full rundown by exploring this guide to DSCR loans for short-term rentals and Airbnb properties.

Other options, like portfolio loans (for investors buying multiple properties) or even private money lenders, can also be a great fit depending on your situation. The key is to work with a lender who actually understands the short-term rental market. The Chalet network connects investors with experienced lenders who specialize in these exact types of deals, ensuring you find a financing structure that lines up perfectly with your goals.

Navigating Short Term Rental Regulations

Nothing will kill your dream of owning a short-term rental faster than a surprise letter from the city. Local regulations aren’t just a minor detail; they're the absolute foundation of a viable STR business. A property that looks perfect on paper can become a financial nightmare if it's in an area with a ban or severe restrictions.

This is a critical due diligence step you must take before you even think about making an offer. The regulatory landscape is a complex patchwork that varies dramatically from one city—or even one neighborhood—to the next. What’s perfectly legal on one side of the street can be prohibited on the other.

Starting Your Regulatory Research

Your investigation should always begin at the most local level possible. Start by visiting the official website for the city or county where you're looking to invest. Search for terms like "short-term rental ordinance," "vacation rental permit," or "lodging tax" to find the relevant documents and departments.

When you're looking at a property, the local rules are everything. In the U.S., cities like New York and San Antonio have regulations that completely reshaped their markets. New York City’s Local Law 18, for example, put such tight restrictions on STRs that it led to a huge drop in Airbnb listings. You have to navigate these local rules carefully to make sure you're compliant and your investment pays off.

This initial search helps you understand the basics: Is a license required? Are there limits on the number of days you can rent per year? Do you need to live there?

Don't just read the rules—call the city planning or zoning department directly. Speaking with a real person can clarify ambiguities and often reveals unwritten rules or upcoming changes that aren't yet on the website. This simple phone call can save you thousands.

A Deeper Dive into Local Laws

Once you have a general understanding, it’s time to dig into the specific rules that could hit your operations and profitability. Local laws can get incredibly granular, so creating a checklist is the best way to make sure you don't miss anything critical.

Your regulatory due diligence checklist should include:

- Zoning Restrictions: Confirm that the specific property address is zoned for short-term rental use. Some neighborhoods, especially those in master-planned communities, may have outright bans. For instance, in St. George, Utah, smart investors look for communities specifically zoned for nightly rentals near attractions like Sand Hollow Resort to avoid issues.

- Permit and Licensing Requirements: What’s the process for getting an STR license? Note the costs, renewal periods, and any required inspections (like fire safety checks).

- Occupancy Limits: Many cities restrict the number of guests allowed based on the number of bedrooms or total square footage.

- Tax Obligations: Identify all applicable taxes. This often includes transient occupancy taxes (TOT), sales taxes, and local lodging taxes that you’ll be responsible for collecting from guests and remitting to the authorities.

As you get into the legal side of things, it's essential to stay current with local ordinances. For a comprehensive guide on how one popular city handles this, check out this resource on San Diego's new short-term rental regulations.

Don't Forget About HOAs

Even if the city gives you the green light, a Homeowners Association (HOA) can still stop you in your tracks. HOA bylaws and Covenants, Conditions, and Restrictions (CC&Rs) supersede city ordinances. It is absolutely essential to get a copy of the full HOA governing documents during your due diligence period.

Look for specific clauses that mention "rentals," "leases," or "transient use." Many HOAs have minimum lease terms (e.g., 30 days or longer), which effectively ban short-term rentals. Violating these rules can lead to hefty fines or even legal action from the association.

Investing without a complete understanding of the regulatory environment is a gamble you can't afford to take. By doing your homework thoroughly, you can invest with confidence, knowing your business is built on a solid, legal foundation.

Setting Up Your Property for Five-Star Reviews

Once the keys are in your hand, the real work begins. You've moved past the spreadsheets and financial models, and now it's all about hospitality. This is your chance to turn an empty property into a memorable experience that fuels a steady stream of five-star reviews—the lifeblood of any successful short-term rental.

Every single decision you make from here on out, from the couch you pick to the brand of coffee you stock, directly shapes the guest experience. This isn't the place to cut corners. Top-performing rentals stand out because of their thoughtful design, killer amenities, and smooth-as-silk operations.

Furnishing for Style and Durability

Furnishing a rental is a delicate dance between creating an Instagram-worthy vibe and choosing pieces that can handle the wear and tear of a revolving door of guests. Your mission is to find that perfect balance where beautiful design meets commercial-grade toughness.

When you’re picking out furniture, think form and function. A sleek, modern sofa looks great, but one with a washable, stain-resistant cover is a lifesaver. Lean into materials that are a breeze to clean and maintain, like faux leather headboards, solid wood tables, and flooring that doesn’t scuff at the first sign of a suitcase.

The most common mistake new hosts make is furnishing their rental like their own home. Instead, think like a boutique hotelier. Invest in high-quality, comfortable mattresses and durable linens that can handle frequent washing. A great night's sleep is one of the most commented-on aspects of a guest's stay.

Stocking Amenities That Matter

Amenities are huge. They're a major reason someone clicks "book," and they heavily influence the review they leave behind. While you might be tempted to load up on every gadget imaginable, a smarter approach is to nail the essentials and then add a few standout items that deliver that "wow" factor.

A fully-stocked kitchen is completely non-negotiable. And that means more than just plates and forks. We're talking quality cookware, a coffee maker with a starter supply of good coffee, cooking oil, and basic spices. If you're targeting families, having a high chair and a pack-and-play on hand can be the single thing that wins you the booking over a competitor.

Here’s a quick look at the amenities that cover the basics versus the ones that can help you command higher rates and earn glowing reviews.

Essential vs. Standout Amenities Checklist

| Amenity Category | Essential Items (Must-Haves) | Standout Items (Wow Factor) |

|---|---|---|

| Kitchen | Full set of pots, pans, dishes; coffee maker; toaster; basic cooking essentials (oil, salt, pepper). | High-end espresso machine; blender; specialty cookware (e.g., waffle maker); welcome basket with local treats. |

| Living/Entertainment | High-speed Wi-Fi; smart TV with streaming access; comfortable seating for all guests. | Bluetooth speaker; collection of board games and books; dedicated workspace with an ergonomic chair. |

| Outdoor | Clean and safe patio or balcony space with seating. | Hot tub; fire pit with seating; high-quality BBQ grill; outdoor games like cornhole. |

| Family | Pack-and-play; high chair. | Toy chest; kids' dinnerware; outlet covers; baby gate for stairs. |

Getting these details right shows you care about the guest experience, and believe me, guests notice.

Creating a Listing That Converts

Think of your online listing as your digital storefront. It doesn't matter how incredible your property is if the listing can't grab a potential guest's attention and hold it. And that all starts with professional photos.

Seriously, your iPhone pictures aren't going to cut it in a competitive market. Hiring a professional real estate photographer is one of the best investments you'll make, full stop. They understand lighting and angles, and they know how to make your space look like a destination. Great photos lead to more clicks, more views, and ultimately, more bookings.

Your listing description needs to do more than just list features; it needs to tell a story.

- Craft a Catchy Headline: Instead of a generic "3BR/2BA Home," go for something like "Mountain-View Retreat with Hot Tub, 2 Miles to Slopes."

- Focus on the Experience: Don't just say you have a kitchen. Describe the feeling of "sipping morning coffee on the private deck while watching the sunrise."

- Be Honest and Transparent: Always mention potential drawbacks, like a shared driveway or a lot of stairs. Building trust upfront prevents nasty surprises and negative reviews later.

Assembling Your Boots-on-the-Ground Team

Unless you live around the corner, you can’t run a top-tier rental on your own. You absolutely need a reliable local team to manage the day-to-day and make sure every guest has a five-star experience. This team is your most valuable asset, right after the property itself.

Your non-negotiable local partners are:

- A Top-Notch Cleaner: Your cleaner is the MVP of your team. They’re your eyes and ears, responsible not just for making the place sparkle but also for spotting damage, reporting low supplies, and flagging maintenance issues.

- A Go-To Handyman: Things break. It's a fact of life. Having a handyman you can trust to quickly fix a leaky faucet or a sticky door is critical for keeping guests happy.

- Specialized Technicians: Don't wait for a plumbing emergency at 10 PM to start looking for a plumber. Have a list of trusted plumbers, electricians, and HVAC pros ready to go.

The Chalet partner network is a fantastic resource for this, connecting you with vetted, local professionals who know the ins and outs of the short-term rental world. Building this team before your first guest checks in means you're prepared for anything and ready to deliver the kind of service that keeps your calendar booked solid.

Common Questions About STR Investing

Getting into short-term rental investing is exciting, but it definitely brings up a lot of questions. Getting good answers is the only way to move forward feeling confident instead of just hoping for the best. Let's tackle some of the most common things people ask when they're thinking about buying their first STR.

How Much Cash Do I Really Need to Get Started?

This is usually the first question on everyone's mind, and the answer is always, "More than just the down payment." The down payment is the big one, of course—plan for 20-25% on an investment property loan. But it’s all the other costs that can sneak up on you if you haven't budgeted for them.

Think of it like launching any small business. You need enough cash on hand to get the doors open and run smoothly from day one.

Your actual startup capital needs to cover a few key areas:

- Closing Costs: A good rule of thumb is 3-5% of the purchase price. This covers all the transaction fees like appraisals, inspections, and title insurance.

- Furnishing Budget: This is a major line item. Depending on the size of the home and the vibe you're going for, this can easily run from $10,000 to over $30,000.

- Initial Setup: Don't forget professional photography (this is non-negotiable), a deep clean to start fresh, and any local permit or licensing fees you need to operate legally.

- Essential Reserves: This is your safety net. You absolutely need a cash reserve that can cover 3-6 months of your core operating expenses—mortgage, utilities, insurance, the works. This cushion is what protects you during a slow season or when an unexpected repair pops up.

Can I Manage a Short Term Rental Property Myself from a Distance?

Yes, you absolutely can. Remote self-management is more doable now than ever before, but your success really boils down to having the right systems and a fantastic local team. You can't just buy a place hundreds of miles away and cross your fingers; you need a solid operational plan.

Technology is your best friend for this. Smart home devices are pretty much essential. A smart lock makes check-ins a breeze, a video doorbell adds a layer of security, and a smart thermostat can save you a ton of money on energy bills when the property is empty.

But honestly, the most critical piece of the remote management puzzle isn't the tech—it's the people. Your cleaner is the MVP of your entire operation. They are your eyes and ears on the ground, doing more than just cleaning. A great cleaner will report back on the property's condition, let you know when supplies are low, and give you a heads-up on any maintenance issues. Without a reliable cleaner and a go-to handyman, trying to manage from a distance becomes a nightmare.

What Is a More Important Metric Occupancy Rate or Average Daily Rate?

It’s easy to get fixated on one of these two numbers, but focusing on either one alone can seriously mislead you. A super-high occupancy rate doesn't mean much if your nightly rate is so low you're not making any real profit. On the flip side, a massive Average Daily Rate (ADR) is just a vanity metric if the property sits empty most of the time.

The one metric that truly tells the story of your property's performance is Revenue Per Available Room (RevPAR).

RevPAR cuts through the noise by blending both ADR and occupancy (ADR x Occupancy Rate = RevPAR). This single number gives you a much clearer, more honest look at how your property is actually doing financially. It forces you to find that perfect balance between your pricing and your booking calendar.

For example, a property with a $400 ADR and 50% occupancy has a RevPAR of $200. Another property might have a lower $300 ADR but a much higher 75% occupancy, giving it a RevPAR of $225. Even with the lower nightly rate, the second property is the stronger performer.

Ultimately, when you manage your business to maximize RevPAR, you're naturally creating a balanced strategy. It pushes you to be smart with dynamic pricing and to fill your calendar effectively, all to get the highest possible revenue out of your investment. That's the number that really defines success in this business.

Ready to stop guessing and start making data-driven decisions? The tools at Chalet provide the market analysis, property-level revenue projections, and connections to expert agents you need to confidently buy your first short-term rental property. Explore your next investment with Chalet today.