Buying a vacation rental property can be a powerful way to generate income and build long-term wealth, but you can’t just stumble into success. It takes a solid plan: identifying a profitable market, lining up the right financing, and knowing how to analyze a deal to ensure it actually makes money.

Get this right, and you turn a potential headache into a high-performing asset.

Is Buying a Vacation Rental a Smart Investment?

So, is buying a short-term rental the right move for you? It’s easy to get lost in the glossy photos and dreams of passive income, but this is a business decision. You need a clear-eyed look at the opportunity, weighing the serious financial upside against the very real work involved.

This isn’t just about buying a second home; it’s about launching a small hospitality business.

The appeal is obvious. A well-chosen property in a hot market can bring in serious cash flow, often blowing traditional long-term rentals out of the water. This income can cover your mortgage, all the operating costs, and still leave a healthy profit in your pocket each month.

And while you’re earning that monthly income, you’re also building equity. You own a physical asset that’s likely to appreciate over the long haul. As you pay down the mortgage and property values climb, your net worth grows right along with it.

The Modern Travel Landscape

The way people travel has fundamentally changed, and that shift has created a massive opportunity for vacation rental investors. The explosion of remote work has untethered millions from the office, sparking the “workcation” trend where people blend a getaway with their workday.

These travelers want longer stays and all the comforts of home—a perfect match for what short-term rentals offer.

This growing hunger for unique, private spaces is a huge driver in the market. More and more, travelers are choosing the space, flexibility, and local feel of a vacation rental over a cookie-cutter hotel room. This isn’t just a fad; it’s fueling major industry growth.

The global vacation rental market hit USD 88.2 billion in 2024 and is on track to reach USD 136.83 billion by 2033. You can dig into more of the data behind this expansion on Straits Research. For investors getting in today, that steady demand provides a very strong foundation.

Acknowledging the Challenges

Of course, it’s not all easy money. The path to a profitable rental is dotted with challenges that demand real strategy and hands-on management. In popular tourist spots, market saturation is a real thing. It can be tough to stand out and keep your calendar full without offering something special.

Perhaps the biggest hurdle for new investors is navigating the tangled web of local regulations. Zoning laws, licensing requirements, and occupancy taxes can be wildly different from one town to the next—and they’re always changing. Getting it wrong can lead to huge fines or even getting shut down completely.

Finally, a vacation rental is definitely not a “set it and forget it” investment. It needs constant attention. You’re juggling bookings, answering guest questions, coordinating cleaners, and dealing with leaky faucets at 10 PM. Even if you hire a great property manager, you’re still the CEO of your investment.

To help you size up the opportunity, it’s useful to see the good and the bad side-by-side. Thinking through these points is a critical first step before you ever start looking at properties.

Pros and Cons of Vacation Rental Ownership

| Potential Advantages | Potential Disadvantages |

|---|---|

| High Cash Flow Potential – Earn significantly more than traditional long-term rentals. | Intensive Management – Requires active involvement in operations, even with a manager. |

| Long-Term Appreciation – Build equity in a valuable real estate asset over time. | Regulatory Hurdles – Navigating complex and changing local laws can be difficult. |

| Personal Use and Perks – Enjoy your own private getaway in a desirable location. | Market Saturation – Increased competition can put pressure on pricing and occupancy. |

| Tax Advantages – Benefit from deductions like mortgage interest and depreciation. | Income Fluctuation – Revenue can be seasonal and less predictable than a fixed lease. |

Ultimately, weighing these pros and cons will help you decide if the rewards of running a short-term rental business align with your financial goals and the amount of time you’re willing to commit.

How to Find a Profitable Vacation Rental Market

Everyone starts with a dream location—that mountain town or beachside spot they love to visit. While buying a vacation rental where you like to travel is a nice perk, it can be a huge mistake to let that drive your investment decision.

Success in this business isn’t about buying where you want to vacation. It’s about finding a market where other people want to vacation, consistently and reliably. This means you need to put on your analyst hat and trade emotion for data.

Start with the Big Picture: Tourism and Demand

Before you even think about specific towns, you need to zoom out. What makes a travel economy healthy? The answer is “demand drivers”—the attractions, events, and features that pull visitors into an area year after year.

These drivers are the engine of your rental income. They can be natural or man-made, and they almost always dictate how seasonal a market will be.

- Natural Attractions: Think timeless draws like beaches, ski mountains, national parks, and trail systems. Places like Steamboat Springs, Colorado, are great examples because their year-round outdoor activities create demand in both winter and summer.

- Major Events: Cities that host huge annual festivals (like Coachella), major sporting events, or big conventions can be gold mines. These events create predictable, high-demand periods where you can command premium rates.

- Business and Education: Don’t overlook areas with major universities, hospitals, or corporate hubs. They bring a steady stream of visitors for graduations, conferences, and business, filling in the gaps left by traditional tourism.

The United States is the largest vacation rental market on the planet, which is great news for domestic investors. The average revenue per user (ARPU) for vacation rentals here is estimated to hit USD 315.88 in 2024, blowing past the global average. This points to strong booking volumes and a willingness to spend, signaling solid revenue potential in many U.S. markets. You can dig into more vacation rental statistics and trends on StayFi.com.

Vet the Local Regulatory Landscape

This is the step that trips up so many new investors. Nothing will kill your investment faster than discovering the town you just bought in has banned short-term rentals. Before you even think about making an offer, you have to become an expert on the local rules. It’s completely non-negotiable.

Many popular destinations have cracked down on vacation rentals to deal with housing shortages or complaints from residents. You absolutely must investigate the specific ordinances for any area you’re considering.

Start by going straight to the source: the official city or county government website. Search for “short-term rental ordinance” or similar terms. You’re looking for specifics on:

- Zoning Restrictions: Is the property in a zone where STRs are even allowed? Some towns limit them to specific commercial or tourist-heavy districts.

- Licensing and Permits: What’s the process for getting a license? More importantly, are there caps on the number of permits available?

- Occupancy Taxes: Find out the local lodging tax rate. This is what you’ll have to collect from guests and send to the government.

- Operational Rules: Are there rules on noise, parking, trash, or the number of guests you can host?

Don’t trust what you read on a blog post from two years ago. Pick up the phone and call the local planning or zoning department. A five-minute conversation can save you from a six-figure mistake.

Use Data to Analyze the Competitive Environment

Okay, so you’ve found a market with strong demand drivers and friendly regulations. Now it’s time to get granular and analyze its actual performance. This is where tools like AirDNA or Mashvisor become indispensable. They give you the hard data you need to see if the numbers really work.

When you’re digging into a market’s data, these are the metrics that matter most:

- Occupancy Rate: On average, what percentage of the time are rentals booked? You really want to see markets with an average occupancy rate of 60% or higher. Anything less, and your cash flow might get pretty inconsistent.

- Average Daily Rate (ADR): What are guests actually paying per night? This number, multiplied by your occupancy rate, is the foundation for projecting your gross revenue.

- Seasonality: How wild are the swings in occupancy and ADR between the high and low seasons? A market with a long peak season—or even better, two distinct peak seasons—is far less risky than a spot that’s only busy for eight weeks a year.

By layering this quantitative data on top of your research into demand and regulations, you build a complete picture. You move past the guesswork and start investing with the confidence that comes from knowing you’ve picked a location primed for success.

Securing the Right Financing for Your Property

Let’s be clear: financing a vacation rental is a completely different ballgame than getting a mortgage for your own home. Lenders see it for what it is—a business transaction. That means the rules are different, the stakes are higher, and you absolutely need to have your ducks in a row.

Honestly, your ability to buy a great vacation rental often comes down to finding the right loan with the right partner. Lenders are going to scrutinize your finances much more closely because, in their eyes, an investment property carries more risk. They need to know you can make the payments even if the property sits empty for a few weeks.

Understanding Your Loan Options

You’ve got a few different paths you can take to finance your purchase, and the best route really depends on your financial situation and long-term goals. While a conventional mortgage is the most common, it’s far from your only option.

- Conventional Investment Property Loans: This is the go-to for most investors. Think of it as a standard mortgage, but with stricter requirements. You should expect to bring a higher down payment to the table, pay a slightly higher interest rate, and go through a much more rigorous underwriting process.

- Portfolio Loans: These are my secret weapon sometimes. Offered by smaller banks or credit unions, these loans are kept “in-house” instead of being sold off. This gives the lender a ton of flexibility on their criteria, which can be a lifesaver if you have a unique financial profile or you’re buying a quirky, non-traditional property.

- HELOC (Home Equity Line of Credit): If you’ve built up significant equity in your primary residence, a HELOC can be an incredibly powerful tool. You can use it to make an all-cash offer on a vacation rental, giving you a massive leg up in a competitive market. After you close, you can simply refinance the new property with a conventional loan to pay back the HELOC.

Each of these has its pros and cons. A conventional loan is straightforward, a portfolio loan offers flexibility, and a HELOC gives you speed and serious negotiating power.

What Lenders Look For

When you apply for an investment property loan, lenders zero in on a few key metrics to figure out how risky you are. Getting these things sorted out before you even start looking at properties will make the entire process smoother and boost your odds of getting approved with great terms.

You’ll need a much stronger financial footing than you did for your first home. Lenders will almost always require a down payment of at least 20-25% for an investment property. This shows you have real skin in the game and lowers their risk.

On top of that, lenders will want to see a strong credit score—usually 700 or higher—to get you the best interest rates. They’ll also dive deep into your debt-to-income (DTI) ratio and expect you to have significant cash reserves. We’re talking enough to cover at least six months of mortgage payments, taxes, and insurance.

Finding an Investor-Friendly Lender

Not all mortgage brokers are created equal, especially when it comes to vacation rentals. I’ve seen deals fall apart because the loan officer was used to standard home purchases and just didn’t get the economics of a short-term rental. It leads to endless frustration and, too often, a denied application.

The trick is to find an investor-friendly lender who lives and breathes this stuff. They understand how to factor in projected rental income, which can be the key to getting you qualified. They just get it.

Here’s how I find the right partners:

- Ask for Referrals: Your best bet is to talk to other real estate investors or your agent. They’ve been in the trenches and can point you to lenders they’ve successfully closed deals with.

- Look for Local Banks: Community banks and local credit unions are often more flexible and willing to build a relationship. They have a vested interest in the local market and are more likely to offer those flexible portfolio loans.

- Interview Potential Lenders: Don’t be shy about shopping around. When you speak to a loan officer, ask them point-blank about their experience with short-term rental financing. If they hesitate or seem unsure, that’s a major red flag. Move on.

Nailing down the right financing is a huge step in this journey. By understanding your options and finding a lender who’s on your team, you’re setting yourself up for a much smoother purchase and a more profitable investment down the road.

Analyzing a Vacation Rental Deal Like a Pro

Finding a promising property in a hot market is a huge win, but it’s just the starting line. Now for the most important part of buying a vacation rental: crunching the numbers. This is the moment you shift from an aspiring host to a sharp investor, making sure a deal actually makes money before you even think about signing a contract.

This process, what the pros call underwriting, is really just a structured way of projecting income and expenses to see what’s left. A simple spreadsheet is your best friend here. The goal is to build a clear, conservative forecast that shows you the property’s real cash flow potential.

Forecasting Your Gross Rental Income

The very first number you need is your Gross Rental Income (GRI). That’s the total cash you’ll bring in from bookings over a year, before a single expense is paid. You can’t just pull this number out of thin air; it has to be grounded in real-world data from the local market.

The formula itself is pretty simple:

Average Daily Rate (ADR) x Occupancy Rate x 365 Days = Gross Rental Income

To get reliable figures for ADR and occupancy, you’ll want to lean on data tools. Platforms like Chalet offer free calculators, while others like AirDNA provide deep market analytics. These resources scrape data from thousands of comparable local properties to give you solid estimates.

For instance, if comps in your target area have an ADR of $350 and an average occupancy of 70%, your projected GRI would be $89,425 ($350 x 0.70 x 365).

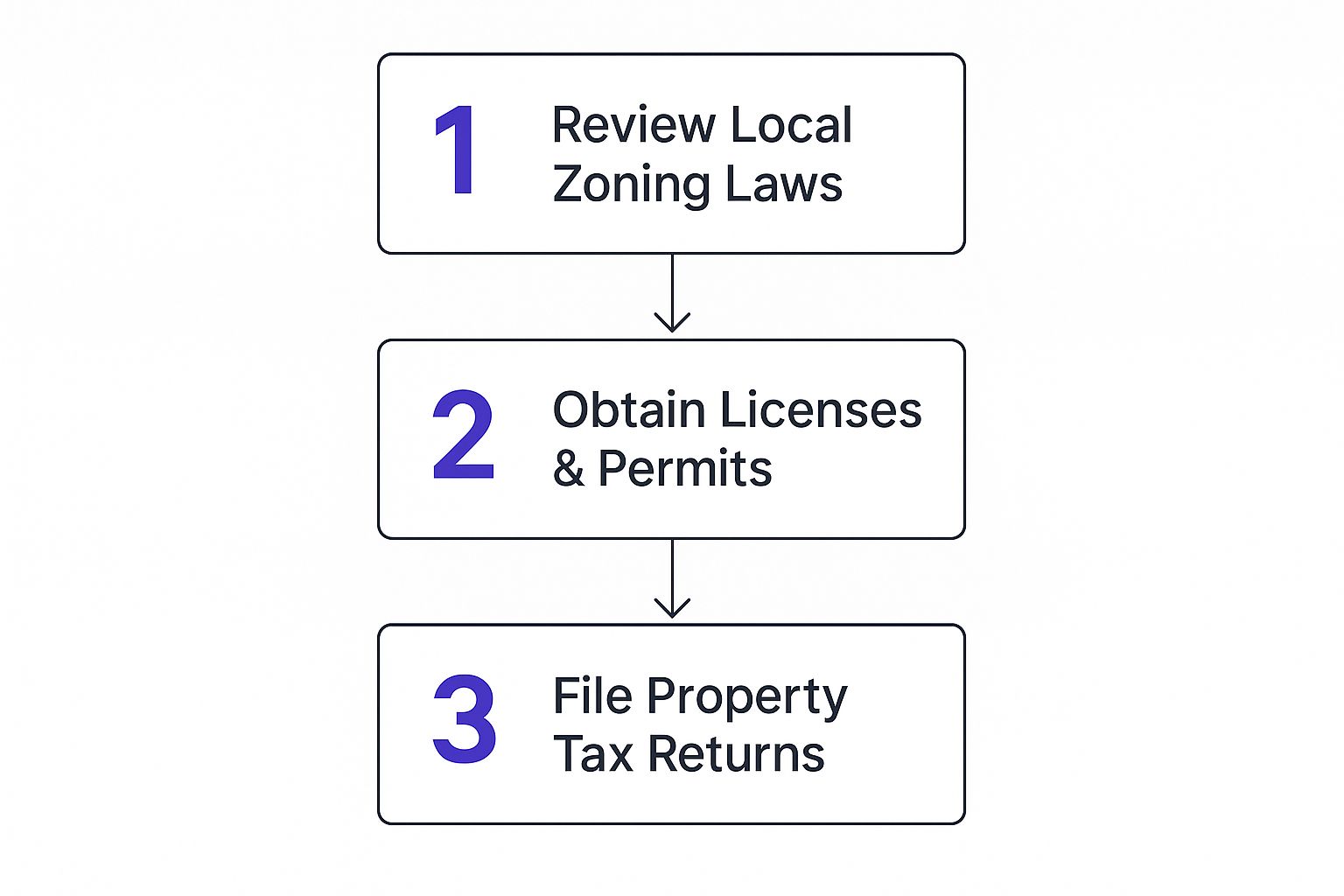

As this image highlights, it’s not just about the purchase. You’ll need to factor in the costs associated with ongoing legal and administrative tasks, like permits and local taxes, which are a critical part of your operational budget.

Detailing Your Operating Expenses

Once you have a solid GRI projection, it’s time to subtract your operating expenses. This is where so many new investors stumble—they get way too optimistic and underestimate costs. You have to be ruthlessly realistic here and account for everything.

Here’s a breakdown of common expenses you can’t afford to forget:

- Property Management Fees: If you hire a pro, this is often your single biggest line item. Expect to pay anywhere from 20% to 30% of your gross rental income.

- Property Taxes and Insurance: You can find exact property tax figures on the county assessor’s website. For insurance, make sure you get a quote for a specific short-term rental policy, not a standard homeowner’s policy—they are not the same.

- Utilities: This covers the basics like electricity, gas, water, and high-speed internet. Your best bet is to look at the property’s history or ask the seller for past utility bills to get an accurate number.

- Maintenance and Repairs: Things will break. A good rule of thumb is to set aside 5% to 10% of your GRI for this fund. You need cash ready for everything from a leaky faucet to a new water heater.

- Supplies and Consumables: This is all the stuff that keeps guests happy, from toilet paper and soap to coffee and welcome snacks. Budgeting 1% to 2% of GRI is a safe starting point.

- Software and Listing Fees: Don’t forget that booking platforms like Airbnb or Vrbo take a cut. You might also be paying for channel management or dynamic pricing software.

To give you a clearer picture, here’s how these expenses might look as a percentage of your total income.

Sample Vacation Rental Expense Breakdown

This table illustrates the common operating expenses you can expect and their typical percentage of gross rental income.

| Expense Category | Estimated Percentage of Gross Income | Example Annual Cost |

|---|---|---|

| Property Management Fees | 20-30% | $17,885 – $26,828 |

| Property Taxes & Insurance | 10-15% | $8,943 – $13,414 |

| Utilities | 5-8% | $4,471 – $7,154 |

| Maintenance & Repairs | 5-10% | $4,471 – $8,943 |

| Supplies & Consumables | 1-3% | $894 – $2,683 |

| Software & Listing Fees | 3-5% | $2,683 – $4,471 |

These percentages can fluctuate based on your market and management style, but they provide a solid framework for building your own projections.

Calculating Your Key Investment Metrics

After you subtract all your operating expenses from your GRI, you’re left with your Net Operating Income (NOI). This is the property’s annual profit before you factor in your mortgage payment.

From here, you can calculate the two metrics that matter most when evaluating any deal.

- Capitalization Rate (Cap Rate): This tells you the annual return you’d get if you bought the property with all cash. The formula is NOI / Purchase Price. A higher cap rate is generally better, with many investors looking for 8% or more.

- Cash-on-Cash Return: This is arguably the most important number because it measures the return on your actual cash investment—your down payment plus closing costs. The formula is Annual Cash Flow / Total Cash Invested. Your Annual Cash Flow is simply your NOI minus your total mortgage payments for the year.

Let’s run through a quick example. Say you’re looking at a $500,000 property that you project will generate $80,000 in GRI. Your total operating expenses add up to $40,000, leaving you with an NOI of $40,000.

- Your Cap Rate would be 8% ($40,000 / $500,000). Not bad at all.

- Now, let’s add financing. If your down payment and closing costs were $125,000 and your annual mortgage payments are $25,000, your annual cash flow would be $15,000 ($40,000 NOI – $25,000 mortgage).

- Your Cash-on-Cash Return would be a very healthy 12% ($15,000 / $125,000).

When you run these numbers on every single property you consider, you take the emotion out of the equation. You stop seeing houses and start seeing investments, giving you the confidence to pull the trigger on a deal that will actually build wealth.

Setting Up Your Rental for Five-Star Reviews

So you’ve closed on your vacation rental. That’s a huge milestone, but honestly, it’s just the starting line. The real work begins now: turning that empty property into a machine that cranks out five-star reviews. This is where you lay the groundwork for repeat bookings, happy guests, and the kind of revenue that made you want to do this in the first place.

You have to think of your rental as a product. The best hosts I know are obsessive about creating a thoughtful, memorable experience from the moment a guest clicks “book” until long after they’ve checked out. It all starts with the space itself—it can’t just be clean and functional; it needs to be inviting. It needs to feel special.

Designing a Standout Space on a Budget

Don’t worry, you don’t need a five-figure interior design budget to create a place that pops in photos and feels even better in person. The goal is what I call “aspirational but attainable.” You want guests to walk in and feel like they’re staying somewhere just a little bit nicer, a clear step up from their everyday lives.

Your design should tell a story that connects to your location. If you’re in a mountain town, lean into those cozy textures, warm woods, and rustic touches. For a beach house, think light, airy colors and natural materials like rattan or linen. This kind of thematic design makes your property stick in people’s minds and helps it stand out in a sea of generic listings.

Focus your budget on the things that have the biggest impact on the guest experience. A fantastic mattress and high-quality bedding will earn you more glowing reviews than an expensive piece of art in the hallway. Prioritize the items guests physically interact with every day.

Here’s how to stretch your budget without looking cheap:

- Invest in a “Hero” Piece: Splurge on one amazing item that becomes the focal point of a room—maybe it’s a unique light fixture, a beautiful sofa, or a great piece of local art.

- Shop Smart: Look for durable, commercial-grade furniture from restaurant supply stores. You can also find incredible, stylish pieces at online retailers like Wayfair or Article, and don’t sleep on Facebook Marketplace for hidden gems.

- Inject Personality with Decor: Use affordable items like throw pillows, blankets, and plants to add color and character. These are easy and cheap to swap out as trends change or things get worn.

Stocking Your Property with Must-Have Amenities

Today’s travelers have high expectations. A well-stocked rental isn’t just a nice-to-have; it shows you’ve anticipated their needs. Forgetting small essentials is one of the fastest routes to a mediocre three- or four-star review.

The kitchen is ground zero for guest happiness. It absolutely has to be fully functional for people who actually want to cook a meal. We’re talking about more than just a few mismatched pots and pans you grabbed from a thrift store.

Essential Kitchen Checklist:

- A complete set of durable pots, pans, and baking sheets.

- Matching dishes, glasses, and silverware for at least twice your maximum guest count. Nobody wants to wash a fork after every meal.

- Quality knives and a decent cutting board.

- Coffee is critical. Offer both a Keurig and a traditional drip coffee maker, plus a toaster and a blender.

- Stock the basics: cooking oil, salt, pepper, and a few common spices.

Beyond the kitchen, think about what makes a stay truly seamless. High-speed Wi-Fi is non-negotiable. Smart TVs loaded with major streaming apps are now the standard expectation, not a luxury.

Leveraging Technology for a Seamless Guest Experience

Technology is a huge differentiator these days. Integrating a few smart home features not only adds a “wow” factor but also makes your life as a host so much easier and more secure.

Smart locks are a game-changer. You can generate a unique entry code for each guest that activates at check-in and expires at check-out. This completely eliminates the nightmare of key exchanges, lost keys, and wondering who still has access to your property.

Of course, technology’s role goes way beyond just the devices in the house. Artificial intelligence and machine learning are now at the core of how rental platforms work. You can find AI-driven tools to help with dynamic pricing, automatically adjusting your rates based on seasonality and local demand to maximize your revenue. If you’re curious about the bigger picture, PrecedenceResearch.com has a deep dive into how AI is shaping the vacation rental industry.

Crafting a Compelling Listing That Sells

Your online listing is your digital storefront. It doesn’t matter how incredible your property is if your listing can’t grab a potential guest’s attention in about five seconds. To do that, you need two things: professional photos and great copy.

Never, ever skimp on photography. Hire a professional real estate photographer who specializes in vacation rentals. They understand how to use lighting, angles, and staging to make your space look its absolute best. Your photos are the single most important factor in a guest’s booking decision. Period.

Finally, your listing description needs to tell a story. Don’t just list features; sell the experience. Instead of saying, “Deck with a grill,” try something like, “Picture yourself grilling burgers on the private deck as you watch the sunset over the mountains.” Paint a vivid picture of the memories they’ll make, and your booking calendar will start filling up fast.

Common Questions About Buying a Vacation Rental

Even with a rock-solid plan, buying a vacation rental stirs up a ton of questions. Suddenly, you’re wrestling with the nitty-gritty details of ownership, management, and legal protection, and it can feel like a lot.

Let’s walk through some of the most common hurdles new investors face. Getting these operational decisions right is just as crucial as finding the perfect property—they’ll shape your experience as an owner and directly hit your bottom line.

What Is the Best Legal Structure to Own a Vacation Rental?

One of the first big forks in the road is deciding how to actually own the property. You can absolutely buy it in your personal name, but many seasoned investors opt to create a legal entity for an extra layer of protection.

The go-to choice for most is a Limited Liability Company (LLC). Holding your vacation rental in an LLC effectively builds a wall between your business assets (the property) and your personal assets (your primary home, savings, car, etc.). If a guest slips and decides to sue, your personal wealth is generally shielded.

But it’s not a simple decision. There are a few trade-offs to keep in mind:

- Financing Hurdles: Some lenders get skittish about giving a mortgage directly to a brand-new LLC. More often, they’ll ask you to secure the loan personally and then transfer the property title into the LLC after closing, which requires their sign-off.

- Extra Costs: Setting up and maintaining an LLC isn’t free. You’ll have state filing fees and, in some cases, annual reporting costs to deal with.

Ultimately, this comes down to your personal risk tolerance and financial picture. I can’t stress this enough: talk to a real estate attorney and a CPA. They can help you figure out the structure that makes the most sense for you.

Do I Really Need a Property Manager?

Ah, the classic debate: active versus passive income. The right answer here hinges entirely on your goals, how close you live to the property, and how much time you’re truly willing to pour into this business.

Hiring a professional property manager is your ticket to a hands-off investment. A great PM handles it all—marketing the listing, managing bookings, coordinating cleaners, and fielding those 2 AM calls from a guest who can’t figure out the thermostat. They are your boots on the ground, especially if you’re hours away.

The trade-off is simple: cost. Full-service property management fees typically run anywhere from 20% to 30% of your gross rental income. That’s a huge chunk of change you have to build into your financial projections from day one.

On the flip side, self-managing means you keep that percentage in your pocket, maximizing your cash flow. If you live nearby and genuinely enjoy the operational side—chatting with guests, vetting plumbers, and being a problem-solver—then self-management can be an incredibly rewarding and profitable path.

What Kind of Insurance Do I Need for a Short-Term Rental?

Pay close attention here, because this is a non-negotiable. A standard homeowner’s insurance policy is absolutely not enough for a vacation rental.

Think about it: you’re running a commercial business. If a guest gets injured and you only have a regular homeowner’s policy, your insurer could deny the claim flat out. That would leave you personally on the hook for medical bills and legal fees. You need a specialized policy.

You’re generally looking for one of two types of coverage:

- Landlord Insurance: This is often the starting point. It provides property and liability coverage specifically for rental properties.

- Commercial Policy: This is a more robust option that explicitly covers business use, including liability for guest injuries and even loss of rental income.

When you’re shopping for a policy, find an agent who specializes in investment properties. They’ll understand the unique risks of the STR market and make sure you’re properly covered for property damage, liability, and lost income from unexpected shutdowns.

At Chalet, we provide the tools and connections you need to navigate every step of this journey with confidence. From our AI-powered market dashboards to our network of vetted, investor-focused real estate agents, we help you analyze, buy, and manage your property like a pro. Start your investment journey at https://www.getchalet.com.