Introduction

Dallas, Texas, a vibrant city known for its rich history, diverse culture, and booming economy, has seen a significant rise in the popularity of short-term rentals, particularly on platforms like Airbnb.

This guide delves deep into the current state of the short-term rental market in Dallas, providing insights, and statistics, and answering some of the most frequently asked questions about the city.

Market Overview

To understand the dynamics of the short-term rental market in Dallas, let’s delve into some key statistics and figures.

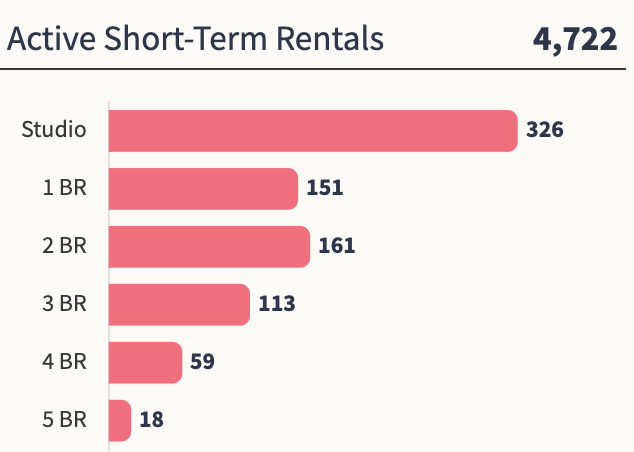

Supply

AS of July 2025, the most popular homes are Studio homes, comprising 26.36% of inventory. This is followed by 2 and 1-bedroom homes at 20.60% and 20.32% of the total inventory, respectively.

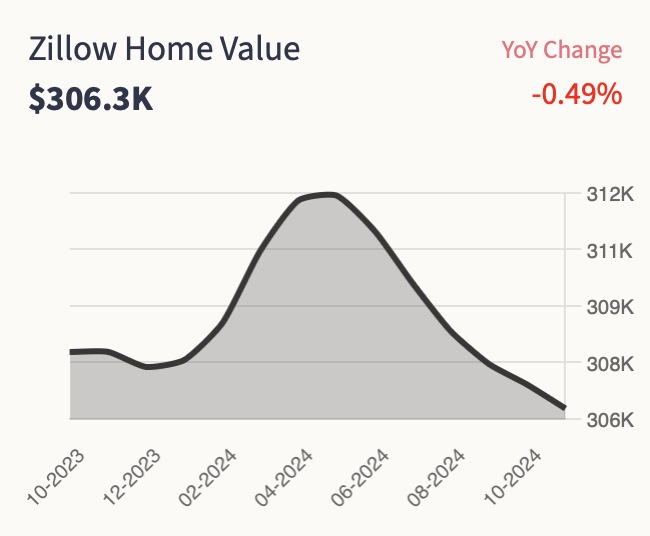

Homes Appreciation

AS of July 2025, according to Zillow, homes in Dallas experienced an appreciation of –0.49%. This data indicates a significant increase in property values.

Median Home Value

As of January of 2025, Homes in Dallas have depreciated by -0.49%. The median home value in Dallas is $306,300 as reported by Zillow. This figure highlights the city’s robust real estate market and the potential for long-term property appreciation.

Active Short Term Rentals

AS of July 2025, Dallas boasts a significant Airbnb rental market, with approximately 4,722 active rentals. This abundance of available properties provides ample opportunities for investors and homeowners looking to capitalize on the tourism demand.

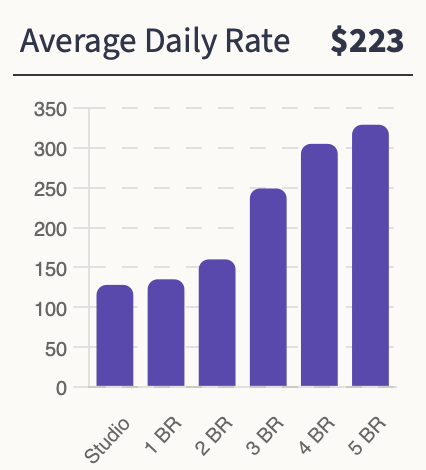

Average Daily Rate

The median ADR for the market is $223. The Average Daily Rate is the highest for 5-bedroom homes $329, followed by 4-bedrooms and 3 bedrooms at $305 and $249 respectively.

Occupancy Rate

Chalet data reveals an occupancy rate of 59.19% for Airbnb rentals in Dallas. This high demand ensures a consistent stream of income for property owners and investors.

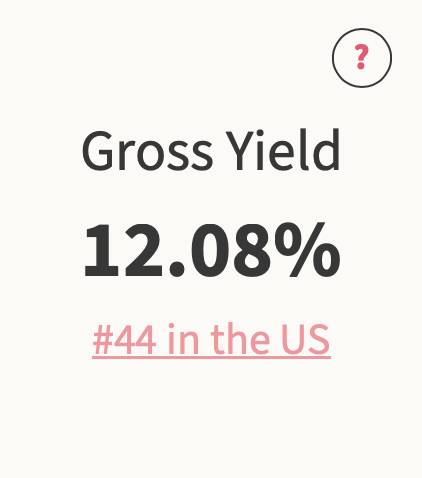

How Profitable is Airbnb in Dallas ?

AS of July 2025, the average gross yield, which represents the annual income generated by a property as a percentage of its value, is 12.08% in Dallas. This figure suggests that short-term rentals in the city offer a favorable return on investment. Dallas is ranked #35 by return on investment on Airbnb rentals in the United States.

Annual Revenue

According to Chalet, short-term rentals in Dallas earn an average of $27,533 annually, highlighting the strong investment potential in the city’s market. You can evaluate your properties using our free Airbnb calculator.

Top Places for Airbnb in Dallas

Dallas top submarkets for Airbnb investments include areas like ZIP code 75236, which has the highest gross yield at 23% and an annual revenue of $62,892. In contrast, ZIP code 75212 offers more extensive opportunities with 248 full-time listings, but a lower gross yield of 21%.

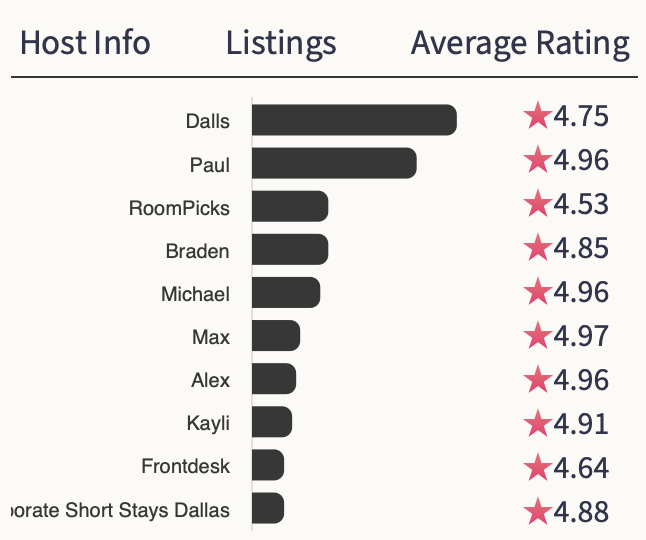

Hosts

The market is dominated by property management firms. The largest host is Dalls with 4.75% of the total inventory and an average review of 4.77⭐️s .

Property Tax

According to SmartAsset, the average property tax in Dallas is 1.81%. This relatively moderate tax rate is an important consideration for those looking to invest in short-term rental properties.

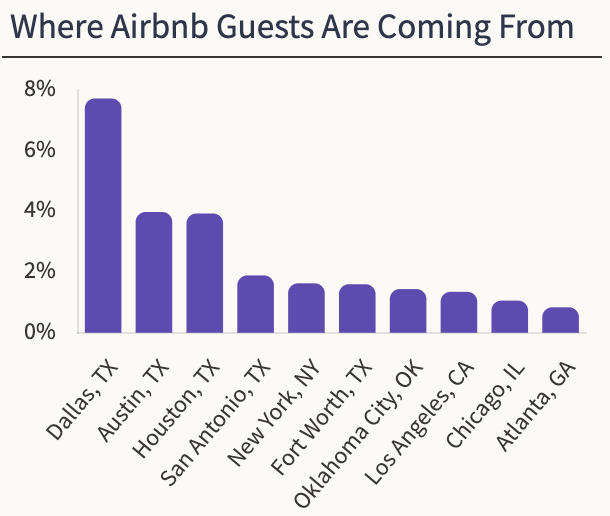

Guests

The majority of the guests in Dallas come from Texas and are within driving distance. 7.90% of all guests are from Nashville followed by Austin with 4.00%.

Regulations

Dallas short-term rental regulations are somewhat investor-friendly, with different zoning regulations and limitations in place. Understanding these regulations is crucial for potential investors to ensure compliance and a smooth operation.