Introduction

Carlsbad, California, known for its stunning coastline, vibrant cultural scene, and pleasant climate, has become a hotspot for short-term rentals, particularly through platforms like Airbnb. With its picturesque beaches, thriving tourism industry, and proximity to major attractions, Carlsbad offers an enticing opportunity for property owners to capitalize on the burgeoning vacation rental market. In this blog post, we’ll delve into the intricacies of the short-term rental market in Carlsbad, examining key data points, market trends, and factors influencing the industry’s growth.

Market Overview

To understand the dynamics of the short-term rental market in Carlsbad, let’s delve into some key statistics and figures.

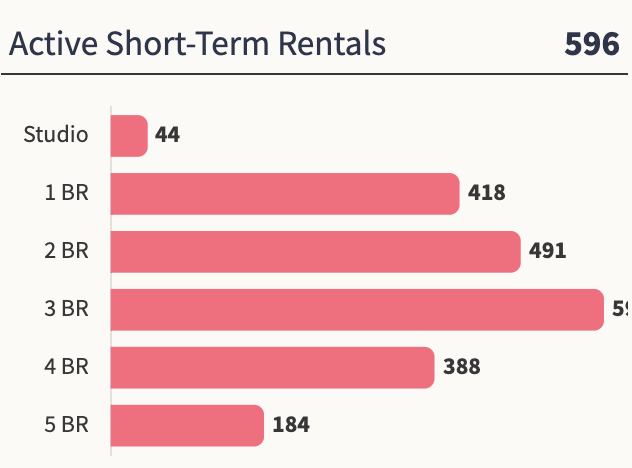

Supply

AS of July 2025, the most popular homes are 3-bedroom homes, comprising 26.36% of inventory. This is followed by 2 and 1-bedroom homes at 20.60% and 20.32% of the total inventory, respectively.

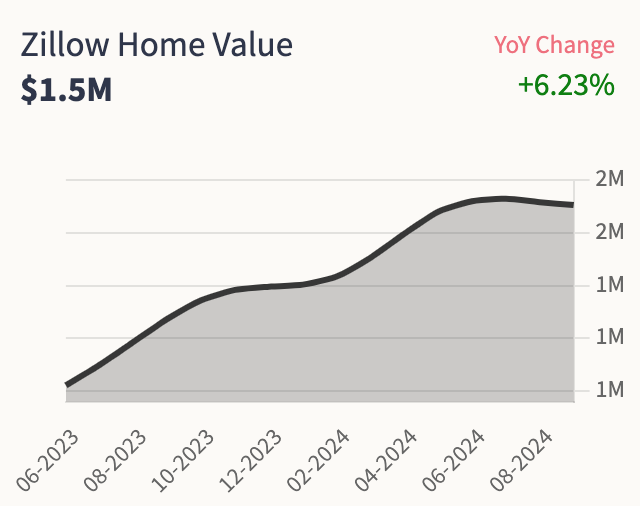

Homes Appreciation

AS of July 2025, according to Zillow, homes in Carlsbad experienced an appreciation of 6.23%. This data indicates a significant increase in property values.

Median Home Value

As of November of 2024, Homes in Encinitas have depreciated by 6.23%. The median home value in Encinitas is $1,500,000 as reported by Zillow. This figure highlights the city’s robust real estate market and the potential for long-term property appreciation.

Active Short Term Rentals

AS of July 2025, Carlsbad boasts a significant Airbnb rental market, with approximately 397 active rentals. This abundance of available properties provides ample opportunities for investors and homeowners looking to capitalize on the tourism demand.

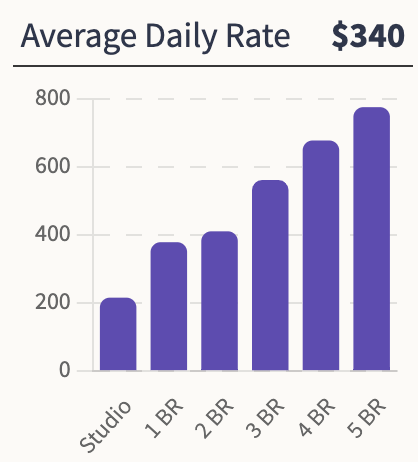

Average Daily Rate

The median ADR for the market is $340. The Average Daily Rate is the highest for 5-bedroom homes $776, followed by 4-bedrooms and 3 bedrooms at $678 and $562 respectively.

Occupancy Rate

Chalet data reveals an occupancy rate of 68% for Airbnb rentals in Carlsbad. This high demand ensures a consistent stream of income for property owners and investors.

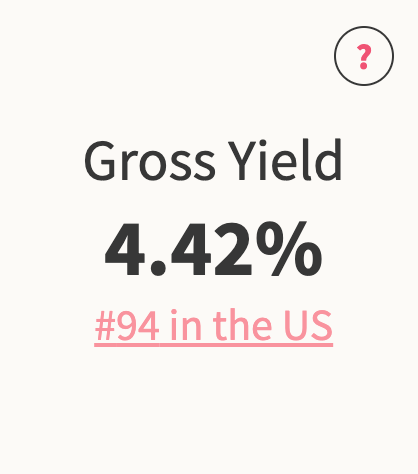

How Profitable is Airbnb in Carlsbad ?

AS of July 2025, the average gross yield, which represents the annual income generated by a property as a percentage of its value, is 4.42% in Carlsbad. This figure suggests that short-term rentals in the city offer a favorable return on investment. Carlsbad is ranked #94 by return on investment on Airbnb rentals in the United States.

Annual Revenue

According to Chalet, short-term rentals in Carlsbad earn an average of $67,436 annually, highlighting the strong investment potential in the city’s market. You can evaluate your properties using our free Airbnb calculator.

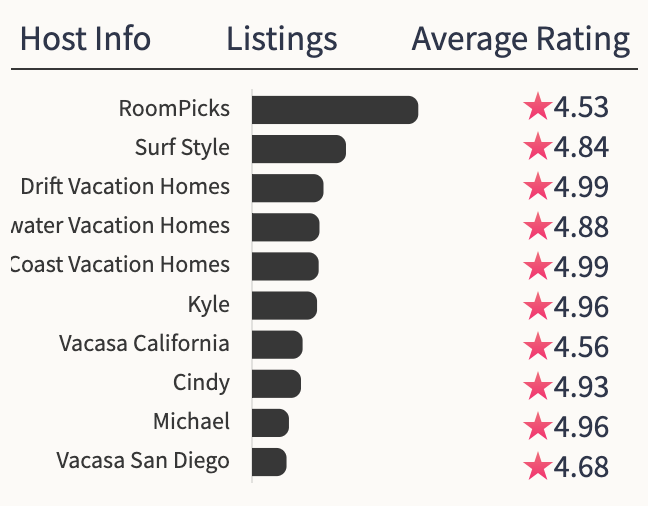

Hosts

The market is dominated by property management firms. The largest host is RoomPicks with 4.53% of the total inventory and an average review of 4.77⭐️s .

Property Tax

According to SmartAsset, the average property tax in Carlsbad is 0.75%. This relatively moderate tax rate is an important consideration for those looking to invest in short-term rental properties.

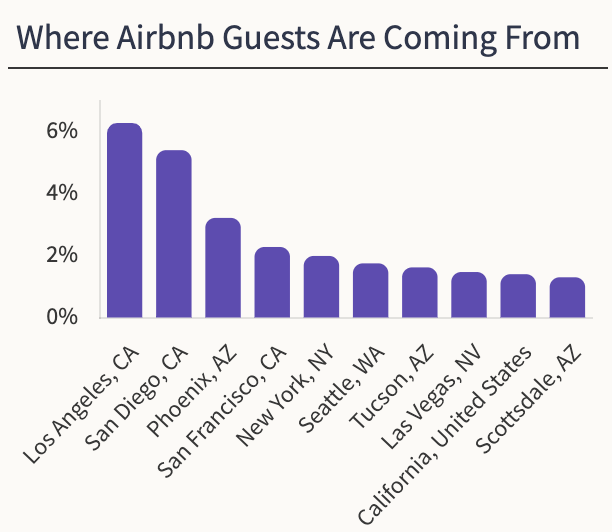

Guests

The majority of the guests in Carlsbad come from California and are within driving distance. 6.29% of all guests are from Los Angeles followed by San Diego with 5.41%.

Top Places for Airbnb in Carlsbad

Carlsbad top submarkets for Airbnb investments include areas like ZIP code 92008, which has the highest gross yield at 4% and an annual revenue of $63,460. ZIP code 92009 has the 3% gross yield and an annual revenue of $45,126.

Regulations

Carlsbad’s short-term rental regulations are somewhat investor-friendly, with different zoning regulations and limitations in place. Understanding these regulations is crucial for potential investors to ensure compliance and a smooth operation.