You found it. The perfect Airbnb rental in a market you've been watching for months.

Cap rate looks solid, the numbers work, and you can already picture the bookings rolling in. There's just one problem: you haven't sold your current property yet.

In a traditional 1031 exchange, you'd have to watch that opportunity slip away. But with a reverse 1031 exchange, you can secure that replacement property now and sell your old one later, all while deferring capital gains taxes just like a regular exchange.

This isn't some theoretical tax loophole. It's a legitimate IRS-approved strategy that lets investors buy first, sell later while keeping the tax benefits intact. The catch? It's more complex, requires upfront capital, and comes with strict deadlines that leave zero room for error.

We work with STR investors every day who use reverse exchanges to transition from long-term rentals into short-term rental properties. Some need to move fast in competitive vacation markets. Others want time to prep their old property for sale without rushing. Either way, the mechanics are identical: acquire the replacement, identify what you'll sell within 45 days, close that sale within 180 days, and complete the exchange.

This guide covers everything you need to know about reverse 1031 exchanges, including how they work, financing strategies, common pitfalls, and specific considerations for Airbnb investors. You'll understand whether this strategy fits your situation and how to execute it without blowing the tax deferral.

What Is a Reverse 1031 Exchange?

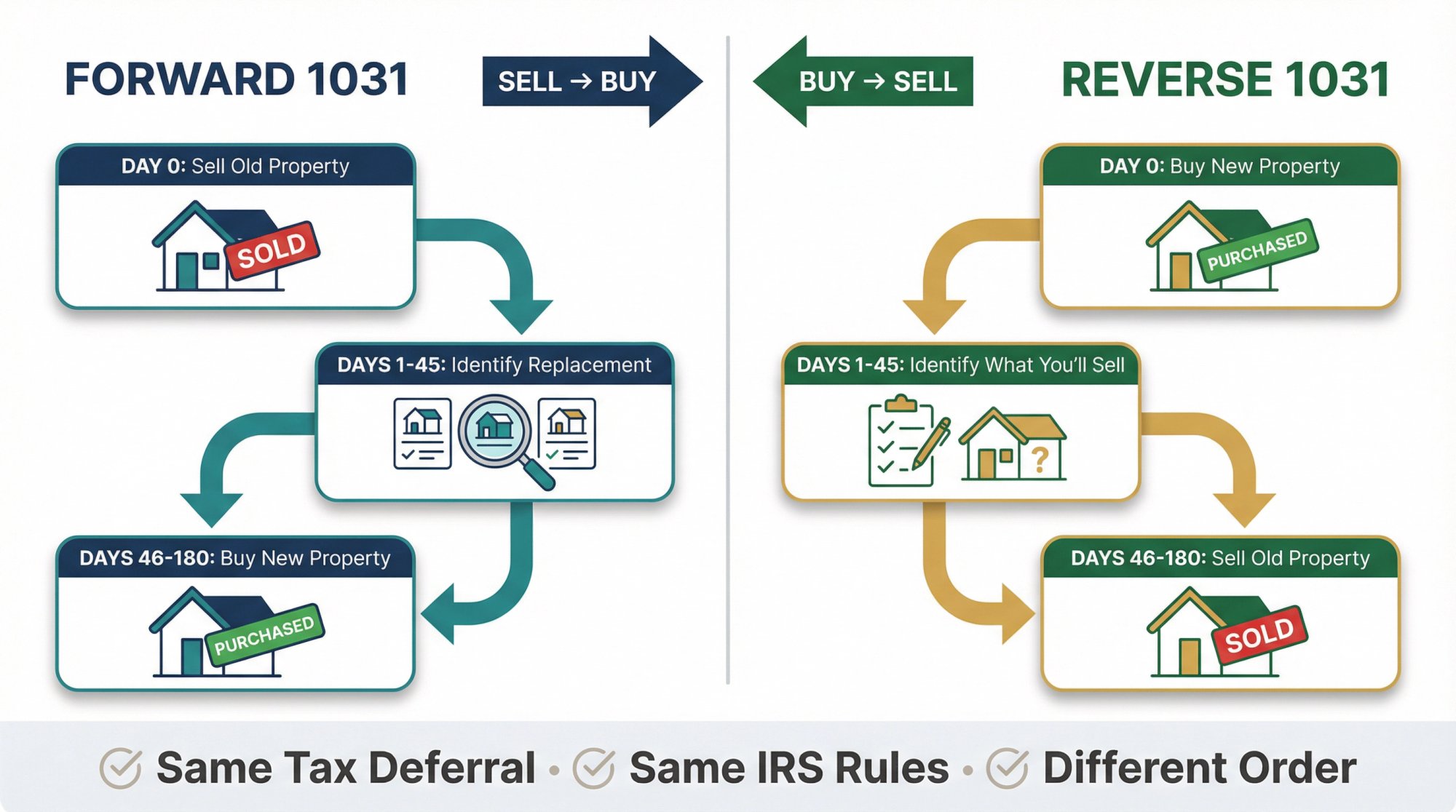

In a standard forward 1031 exchange, you sell your investment property (the "relinquished" property) and then buy a new one (the "replacement" property) within specific time windows. The order is fixed: sell, then buy.

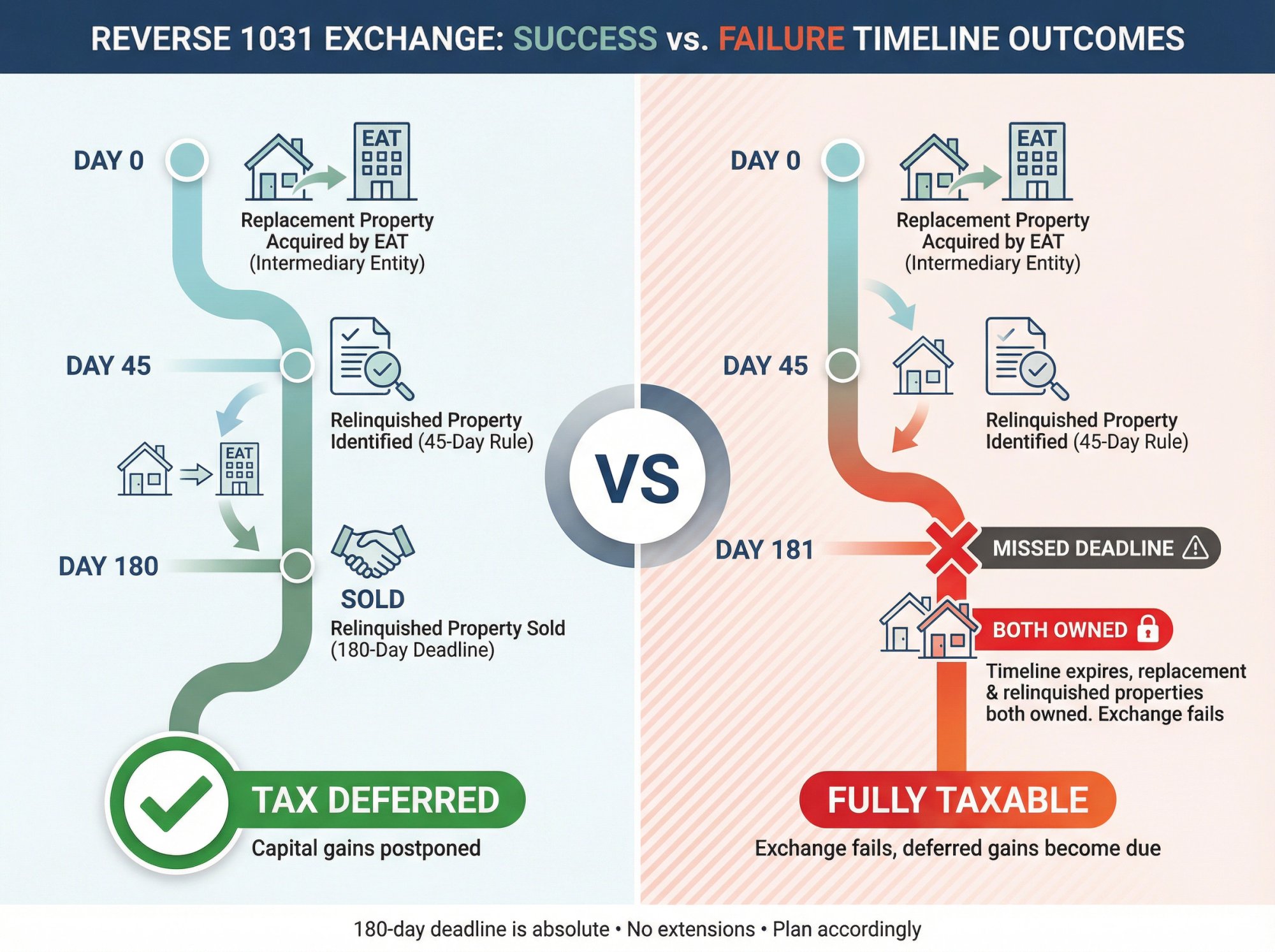

A reverse 1031 flips that sequence. You acquire the replacement property before selling the relinquished property. The timeline looks like this:

→ Day 0: Buy the new property (held by an intermediary)

→ Day 1-45: Identify which property you'll sell

→ Day 46-180: Sell that property and complete the exchange

Same tax deferral as a forward exchange. Same IRS rules about like-kind property. Same requirements to reinvest all proceeds. The only difference is the order of transactions.

When Should You Use a Reverse 1031 Exchange?

Most investors consider a reverse 1031 in three scenarios:

| Scenario | Why Reverse Makes Sense | Example |

|---|---|---|

| Rare Opportunity | Property won't stay on market long | Waterfront cabin with proven rental history, ski condo in supply-constrained resort |

| Property Not Ready | Current property needs repairs or prep time | Up to 180 days to prepare sale properly |

| Market Timing | Buy off-season, sell peak season | Buy during winter lull, sell during summer demand |

The underlying principle: when you must acquire a property immediately but haven't sold your old one yet, a reverse 1031 preserves the tax deferral that would otherwise be lost.

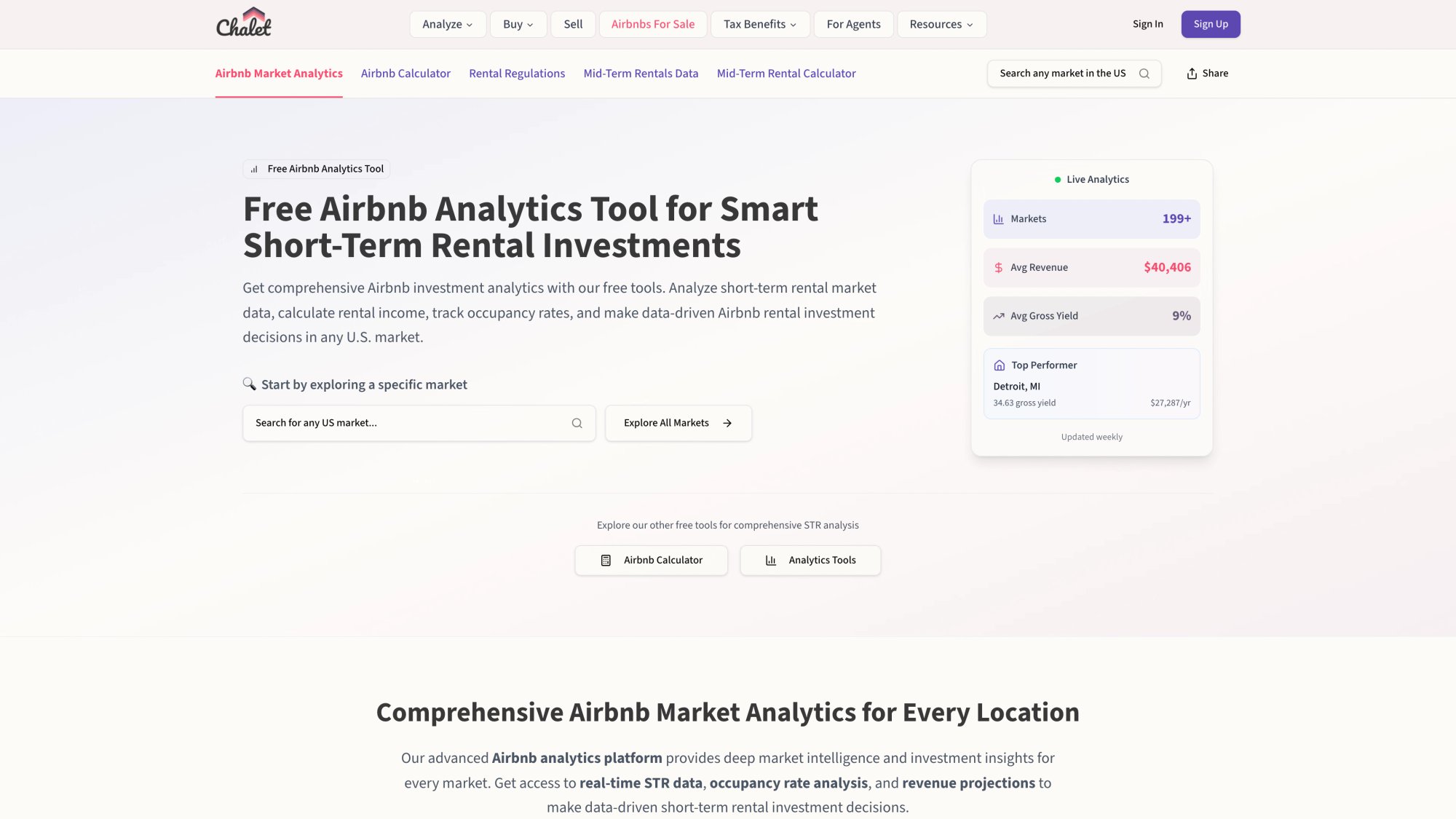

Critical Insight: Use Chalet's market analytics to identify optimal timing windows across different STR markets. The data can reveal when to buy (off-season discounts) and when to sell (peak demand periods).

Reverse 1031 Exchange Requirements You Must Meet

Like any 1031 exchange, certain rules are non-negotiable:

• Both properties must be held for investment or business use (not personal residences)

• The replacement property should be equal or greater in value and debt to defer all taxes

• You must use a Qualified Intermediary (QI) and Exchange Accommodation Titleholder (EAT)

• Strict 45-day identification and 180-day completion deadlines apply

• All proceeds must flow through the intermediary (you can't touch the money)

The difference between forward and reverse exchanges boils down to timeline sequencing and holding structure. The tax benefits and qualification standards remain identical.

But this is what makes reverse exchanges tricky: if your relinquished property doesn't sell within 180 days, the entire exchange fails. You'd own both properties, and when you eventually sell the old one, that sale becomes fully taxable.

So timing and execution become critical.

How Does a Reverse 1031 Exchange Work? (Step-by-Step)

The mechanics of a reverse exchange involve multiple parties and precise timing. This isn't something you can improvise. The IRS provides safe harbor rules under Revenue Procedure 2000-37 that outline exactly how to structure these transactions.

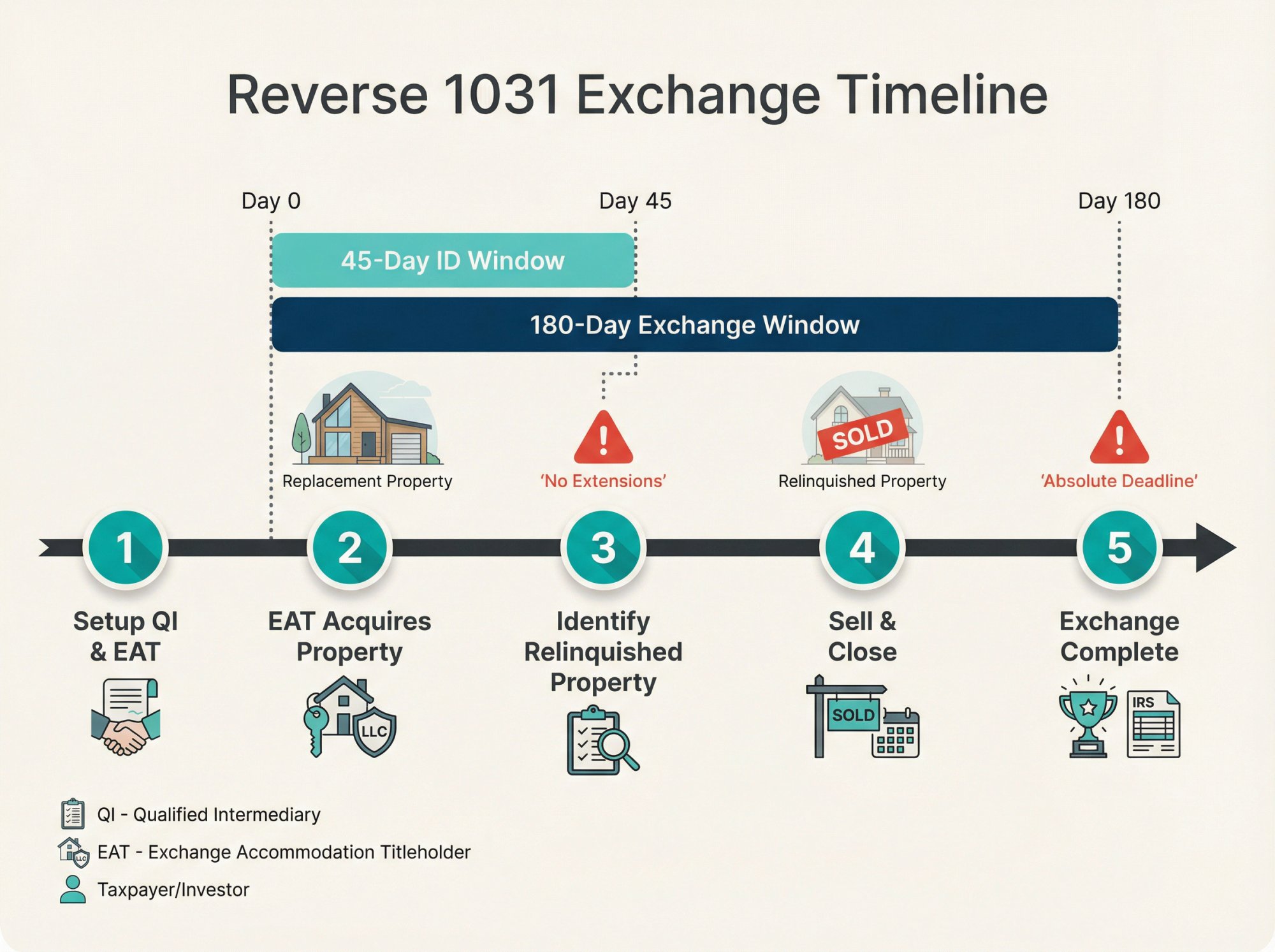

Step 1: Set Up the Intermediary Structure (Before Purchase)

Before you close on the replacement property, you need two key players:

A Qualified Intermediary (QI) handles the exchange paperwork and eventual fund transfers. This is standard for any 1031.

An Exchange Accommodation Titleholder (EAT) temporarily holds legal title to the property you're acquiring. The EAT is typically an LLC created and controlled by your QI specifically for this transaction.

Why do you need an EAT? Because IRS rules prohibit you from holding title to both properties simultaneously during a 1031 exchange. The EAT solves this by "parking" the new property until your sale completes.

You'll sign a Qualified Exchange Accommodation Agreement (QEAA) with the EAT, establishing that they're holding the property on your behalf for 1031 purposes. This must happen at or before closing on the replacement property.

If you close first and then try to set up the exchange structure, you've already blown it.

Step 2: Day 0 (The EAT Acquires the Replacement Property)

On closing day, the EAT takes title to your new property. You provide the purchase funds (cash or financing through specialized lenders), but the EAT is the owner of record.

During the holding period, the EAT typically leases the property back to you. This lets you operate it, rent it out, manage it, and collect income as if you owned it. You're also responsible for all expenses: property taxes, insurance, maintenance, utilities.

From a practical standpoint, you control the property. From a legal standpoint, the EAT owns it temporarily.

This moment starts the clock.

Day 0 begins the 45-day identification period and the 180-day exchange period that run concurrently.

Step 3: Days 1-45 (Identify the Property You'll Sell)

Within 45 days of Day 0, you must formally identify in writing which property or properties you intend to sell as your relinquished property.

Most investors identify just one property (the one they plan to sell). But the rules allow up to three properties, or more under the "200% rule" where total identified value doesn't exceed 200% of the replacement property value.

The identification must be written, signed, and delivered to your intermediary. An email saying "yeah, probably that duplex" doesn't count. You need a formal identification letter with property addresses.

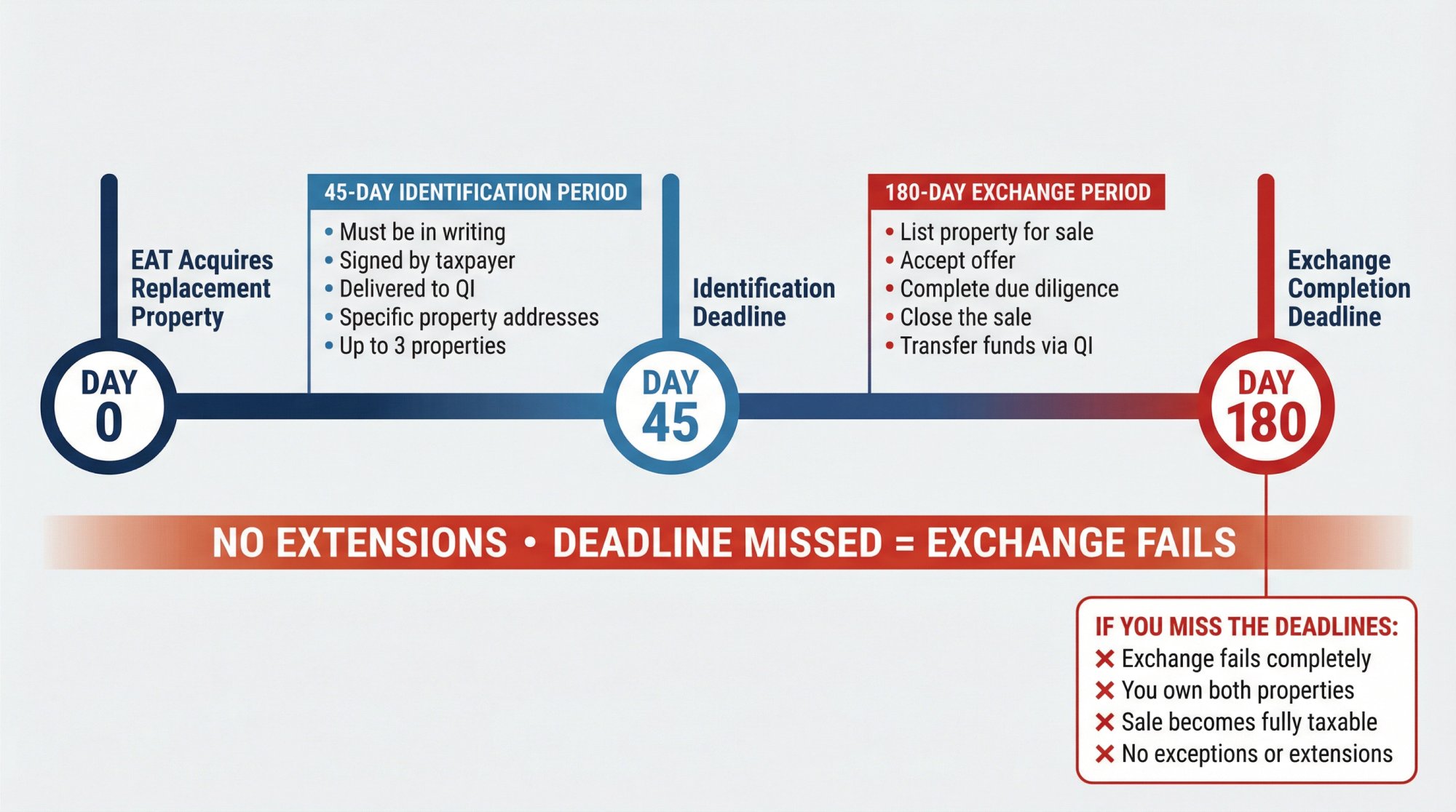

There are no extensions. Miss the 45-day deadline by even one day, and the exchange fails immediately. Natural disasters, financing delays, family emergencies don't matter. The IRS doesn't grant deadline relief for reverse exchanges.

Critical Warning: If you fail to identify a relinquished property within 45 days, you end up owning the replacement property outright (not as part of an exchange), and any later sale of your old property becomes fully taxable.

Step 4: Days 46-180 (Sell the Relinquished Property)

After identification, you have the remainder of the 180-day window to close the sale of your identified property.

This is your sale period. You list the property, negotiate offers, handle inspections, and close the transaction just like any normal real estate sale. Working with an agent who understands 1031 timelines is essential.

The key difference: the sale proceeds go to your Qualified Intermediary, not to you. Touching that money breaks the exchange.

The 180-day deadline is absolute. If Day 180 arrives and your sale hasn't closed, the exchange fails. You still own both properties, but the tax deferral is gone. When you eventually sell the old property, that sale is fully taxable.

Note: There's one additional constraint. If your tax return is due before Day 180 (rare for most exchanges, but possible if you start late in the year), you must close by your tax return due date unless you file an extension. Work with your CPA on this timing.

Step 5: Completing the Exchange

Once your relinquished property sale closes (within the 180-day window), the final paperwork happens:

The QI uses the sale proceeds to purchase the replacement property from the EAT, and then transfers title to you. The EAT exits the picture. You become the legal owner of the new property.

From the IRS's perspective, you've exchanged one investment property for another. The order was reversed, but the substance of a like-kind exchange occurred within the required timeframes.

At this point, you've successfully deferred capital gains tax on the sale of your relinquished property, just as you would in a forward exchange.

Reverse 1031 Exchange Deadlines: What Happens If You Miss Them?

These deadlines aren't suggestions. They're ironclad requirements that determine whether your exchange succeeds or fails.

The 45-Day Identification Period

From the day the EAT acquires your replacement property, you have 45 calendar days to identify which property you'll sell.

Identification requirements:

• Must be in writing

• Must be signed by you (the taxpayer)

• Must be delivered to your QI

• Must include specific property addresses

You can identify up to three properties without regard to value, or any number of properties as long as their combined value doesn't exceed 200% of the replacement property value you acquired.

Most investors simply identify one property, the one they already know they're selling.

Not for natural disasters, not for financing issues, not for anything. Miss this deadline and the entire exchange collapses immediately.

The 180-Day Exchange Period

From Day 0, you have 180 calendar days to complete the sale of your relinquished property and finalize the exchange.

This means:

• Listing and marketing the property

• Accepting an offer

• Completing due diligence

• Closing the sale

• Transferring funds through the QI

All within 180 days. Closing on Day 181 is too late. The exchange fails, you own both properties outright, and the old property sale becomes taxable when it eventually happens.

This is the single biggest risk in a reverse 1031: betting that your property will sell in time.

Market conditions, pricing decisions, buyer financing, and inspection issues can all derail the timeline. If you can't close within 180 days, you lose the tax benefit entirely.

Other Critical Requirements

Like-kind property: Both properties must be held for investment or business use, not personal residences. Swapping a long-term rental for a short-term rental works fine. Swapping a vacation home you use personally doesn't.

For STR investors: keep personal use under 14 days or 10% of rental days per year, whichever is greater, to maintain investment property status. Our regulation database can help you verify occupancy and permitting rules in your target market.

Equal or greater value: To defer all taxes, the replacement property must be equal or greater in value than the property you're selling. If you "trade down" in value or take cash out, that difference is taxable "boot."

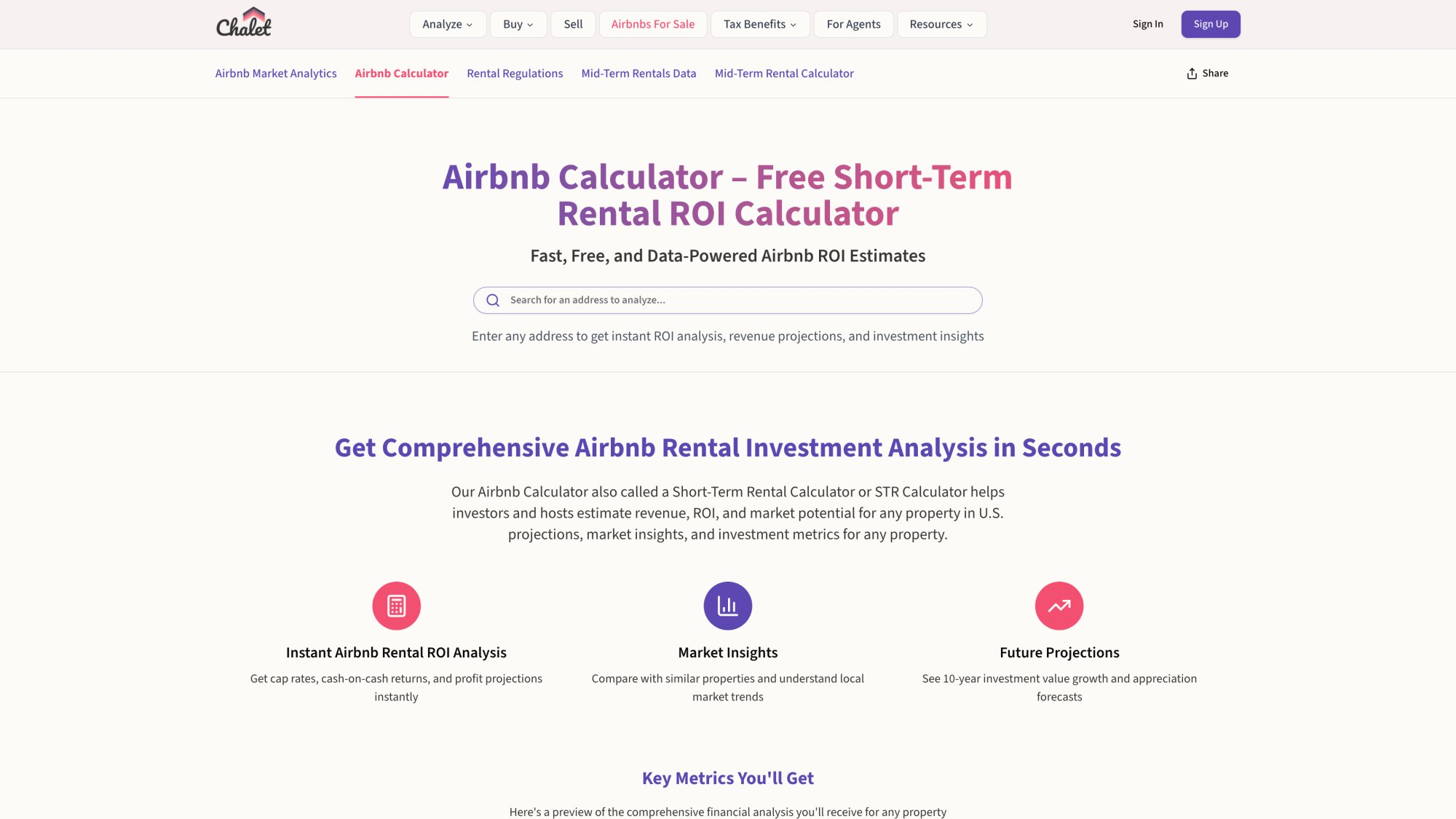

Debt matters too. If your old property had a $200K mortgage and your new one only has $150K, that $50K debt reduction is potentially taxable unless you add $50K of your own cash to offset it. Use our ROI calculator to model different scenarios and ensure your exchange math works.

QI and EAT involvement: You cannot hold direct title to both properties at any point. The EAT must hold the replacement property until the exchange completes. The QI must handle all funds. If you deviate from the safe harbor structure, the IRS may disallow the exchange.

How to Finance a Reverse 1031 Exchange

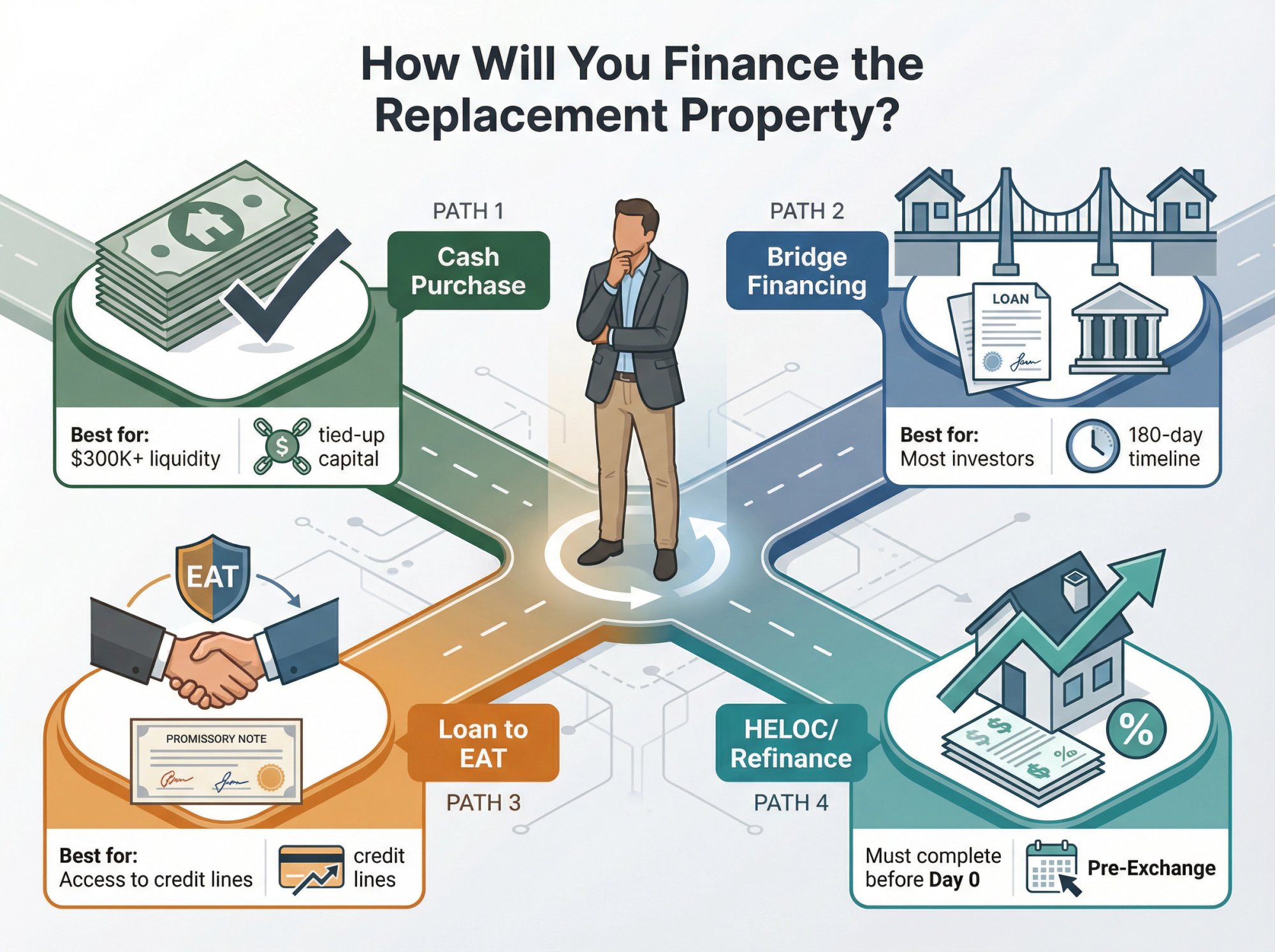

The biggest practical hurdle in a reverse exchange is simple: you need money to buy the new property before getting paid for the old one.

The QI and EAT won't finance the purchase for you. You must provide the funds somehow.

Most investors handle this with one of these approaches:

Most investors handle this with one of these approaches:

| Financing Option | How It Works | Best For | Key Considerations |

|---|---|---|---|

| Cash Purchase | Buy replacement with available liquidity | Investors with $300K+ liquid capital | Simplest approach, but ties up capital for months |

| Bridge Financing | Short-term loan from private lender or bank | Most investors without full cash | Need lender experienced with EAT structure |

| Loan to EAT | You lend directly to EAT; repaid from sale proceeds | Investors with access to credit lines | Must structure carefully with QI |

| HELOC/Refinance | Cash-out on relinquished property before exchange starts | Investors with equity in current property | Must complete before Day 0 |

Option 1: Cash Purchase

If you have sufficient liquidity, buying the replacement property with cash is the simplest approach. You'll get that capital back when your old property sells and the QI distributes funds to you.

But tying up $300K, $500K, or more for several months isn't feasible for most investors.

Option 2: Bridge Financing

Many investors use short-term bridge loans to fund the replacement property purchase. This could be:

• A bridge loan from a private lender

• A bank loan with the EAT as borrower (you as guarantor)

• A HELOC or cash-out refinance on the relinquished property (done before starting the exchange)

• A business line of credit

The structure varies. Sometimes the investor directly loans money to the EAT. Sometimes a bank lends directly to the EAT with the investor guaranteeing the loan. Sometimes the investor borrows elsewhere and then funds the EAT's purchase.

Critical consideration: Work with a lender who has experience with reverse 1031 exchanges. Traditional mortgage lenders often balk at the EAT structure. You need someone who understands that the property is temporarily parked with an intermediary entity, and who can move fast enough to meet the 180-day sale deadline.

At Chalet, our lender network includes specialists in DSCR loans and 1031 transactions. They understand the timing pressures and the intermediary structure. If traditional financing isn't moving fast enough, having backup options (hard money, private lending) becomes essential.

Option 3: Loan from Taxpayer to EAT

You can lend money directly to the EAT to fund the purchase. The EAT issues a promissory note to you. When your old property sells and the QI receives those proceeds, they use them to pay back your loan.

This approach works if you have access to liquidity from other sources (investment accounts, business capital, a line of credit elsewhere). You're essentially bridging your own deal.

Managing Interim Expenses

During the exchange period, you'll carry costs on both properties: insurance, property taxes, utilities, possibly two mortgages.

The upside: the EAT leases the replacement property to you, so you can rent it out immediately. If it's a short-term rental, you can start taking bookings and generating income during the exchange period. That cash flow helps offset carrying costs on both properties.

Budget for a few months of overlap. If the math gets tight, remember that successfully completing the exchange could save you $50K, $100K, or more in taxes. A few thousand in interest and fees is usually worth it.

Why Use a Reverse 1031 Exchange?

Why go through the complexity and expense? Because in the right situation, a reverse exchange solves problems that would otherwise cost you the deal or the tax benefit.

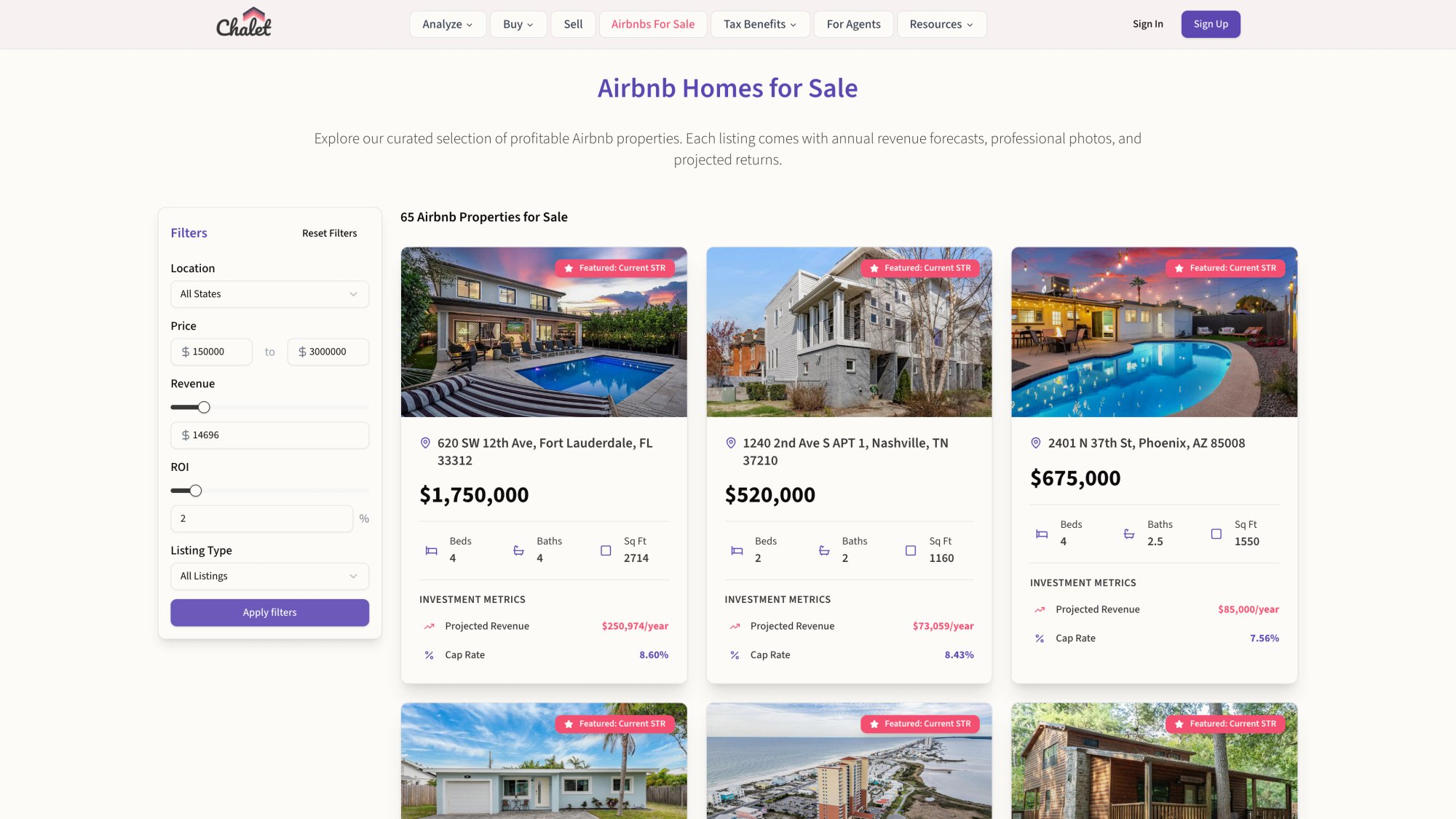

① Secure the Property You Want

In competitive markets, waiting to sell first means losing deals. A reverse exchange lets you act immediately when you find the right property, without the "subject to sale" contingency that makes sellers nervous.

You're effectively a cash buyer (since you've arranged financing independently). That strengthens your negotiating position. Browse current STR properties for sale to see what opportunities are available in your target markets.

② No 45-Day Scramble to Find a Replacement

The worst part of a forward 1031? Selling your property and then having just 45 days to identify a replacement. You feel pressured to buy something just to meet the deadline, even if it's not ideal.

With a reverse exchange, you already own the replacement. No panic searching. No settling for a mediocre property because time ran out. You buy exactly what you want, then sell the old one at your own pace (within 180 days).

③ Time to Prepare Your Sale Properly

A reverse exchange gives you up to 180 days to sell. You can make repairs, stage the property, wait for the right offer, and market it properly instead of accepting lowball offers under time pressure.

④ Earn Income from Both Properties

During the overlap period, you control two rental properties. The new one starts generating bookings and reviews. The old one keeps producing rent until it sells. This can cushion your carrying costs while the exchange progresses.

⑤ Strategic Timing

Buy in the off-season when prices and competition are lower. Sell during peak demand season when buyers are more plentiful. A reverse exchange lets you optimize timing for both transactions instead of being forced into a compressed window. Analyze seasonal patterns in your target markets to plan your timing strategy.

Reverse 1031 Exchange Risks and Downsides

Reverse exchanges aren't for everyone. They come with real challenges that can make or break the transaction.

Higher Costs

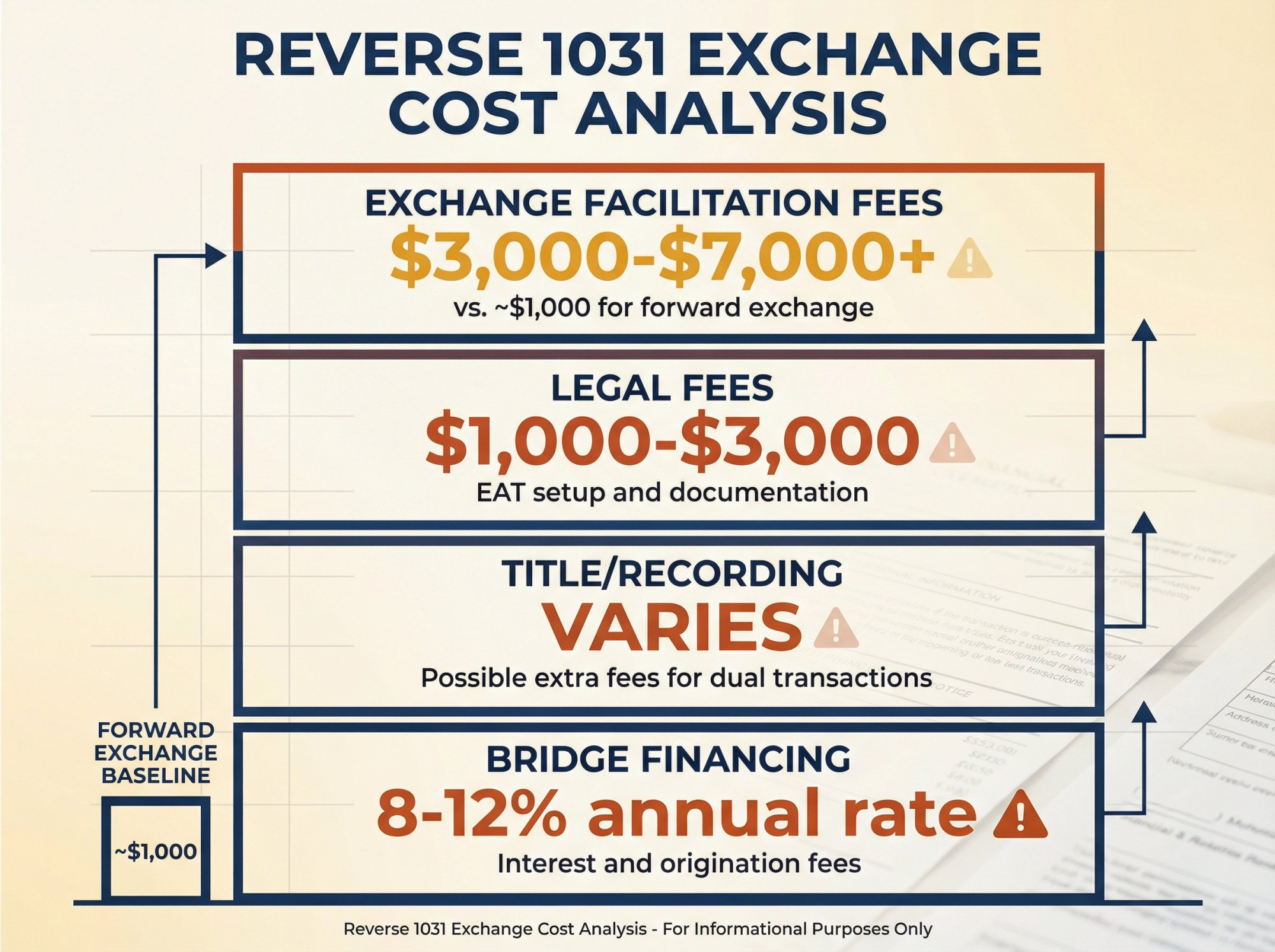

Reverse exchanges are significantly more expensive than forward exchanges. Expect to pay:

| Cost Category | Typical Range | Notes |

|---|---|---|

| Exchange Facilitation Fees | $3,000-$7,000+ | vs. ~$1,000 for forward exchange |

| Legal Fees | $1,000-$3,000 | EAT setup and documentation |

| Title/Recording | Varies | Possible extra fees for dual transactions |

| Bridge Financing | 8-12% annual rate | Interest and origination fees |

Is it worth it? If the alternative is paying capital gains tax on a $200K gain (which could cost you $50K+ in federal and state taxes), then yes. But factor these costs into your decision.

Requires Upfront Capital or Credit

You must have the financial capacity to purchase the replacement property before receiving sale proceeds from the old one. If you can't access cash, financing, or a line of credit, a reverse exchange simply isn't possible.

Risk of Failed Sale

This is the biggest danger.

If your relinquished property doesn't sell within 180 days, the entire exchange fails. You end up owning both properties, and the tax deferral is lost. When you eventually sell the old property, that sale becomes fully taxable.

You're essentially betting that you can find a buyer and close within six months. Market downturns, overpricing, inspection issues, or buyer financing problems can all kill the timeline.

All-or-Nothing Structure

There's no partial credit for "trying." If the exchange fails, it fails completely. The IRS treats it as if you bought the new property outright, and the old property sale (when it eventually happens) is a taxable event.

Complexity with Lenders, Title, and Insurance

The EAT holding title can complicate things. Some title companies or lenders are unfamiliar with the structure. Getting hazard insurance or financing may require extra endorsements or approvals.

Make sure everyone involved (agents, title company, escrow, lenders) understands this is a 1031 reverse exchange before you get to closing.

Carrying Costs on Two Properties

Until your old property sells, you're paying property taxes, insurance, and possibly two mortgages simultaneously. Budget carefully for this overlap period.

How to Execute a Successful Reverse 1031 Exchange

The difference between a successful reverse exchange and a failed one often comes down to planning and urgency.

→ Engage Your QI Before Day 0

Involve an experienced Qualified Intermediary as soon as you're considering a reverse exchange, not after you've already closed on the new property. They'll set up the EAT, prepare the QEAA, and ensure everything is structured correctly from the start.

→ Prep Your Relinquished Property Immediately

Start preparing your old property for sale even before buying the new one. Address deferred maintenance, line up a listing agent (preferably one who understands 1031 deadlines), and have your marketing materials ready.

The goal: list the property as soon as possible after Day 0. Every day you wait is one less day to find a buyer.

→ Work With 1031-Savvy Professionals

Your lender should have reverse exchange experience. Your real estate agent should understand the 180-day deadline is non-negotiable. Your escrow officer should know how to handle QI transactions.

At Chalet, we connect investors with agents and lenders who specialize in 1031 exchanges and short-term rental transactions. Our professional network includes individuals who've closed dozens of exchanges and understand the timing pressures involved.

Inform all parties in writing: "This is a 1031 exchange with a hard 180-day deadline. Extensions are not possible. If we miss this deadline, I lose substantial tax benefits."

→ Price Realistically from the Start

Time is literally money in a reverse exchange. You can't afford to overprice your relinquished property and watch it sit on the market for five months.

Price it competitively from Day 1. Consider offering buyer incentives (credit for closing costs, home warranty, etc.) to attract offers quickly. Taking a slightly lower sale price is far better than losing the exchange entirely and paying full capital gains tax.

Running the numbers? Use our ROI calculator to model different sale price scenarios and see how they impact your overall exchange economics.

→ Act with Urgency, Not Panic

You have 180 days. That sounds like plenty of time until buyer financing falls through on Day 165 and you're scrambling to find another buyer.

Target a 120-day sale to leave a buffer for closing delays. Work aggressively on marketing and showings. Respond to offers quickly. Keep the transaction moving forward constantly.

But don't panic-sell either. You do have some flexibility to wait for a reasonable offer rather than accepting the first lowball bid. Balance urgency with rational decision-making.

→ Meet All Documentation Requirements

Work closely with your QI to ensure:

• The QEAA is signed before Day 0

• Your 45-day identification letter is submitted on time (get written confirmation from the QI)

• All purchase and sale agreements properly assign rights to the intermediary

• Sale proceeds flow to the QI, never to you

Keep copies of everything. If the IRS ever questions the exchange, documentation is your defense.

→ Have a Backup Plan

What if Day 170 arrives and you still don't have a buyer?

Consider dropping the price significantly. Consider offering seller financing. Consider reaching out to your network to see if anyone is interested in buying as an investment.

Some sophisticated investors keep a backup strategy in mind. Know your Plan B before you need it.

Reverse 1031 Exchange for Airbnb and STR Investors

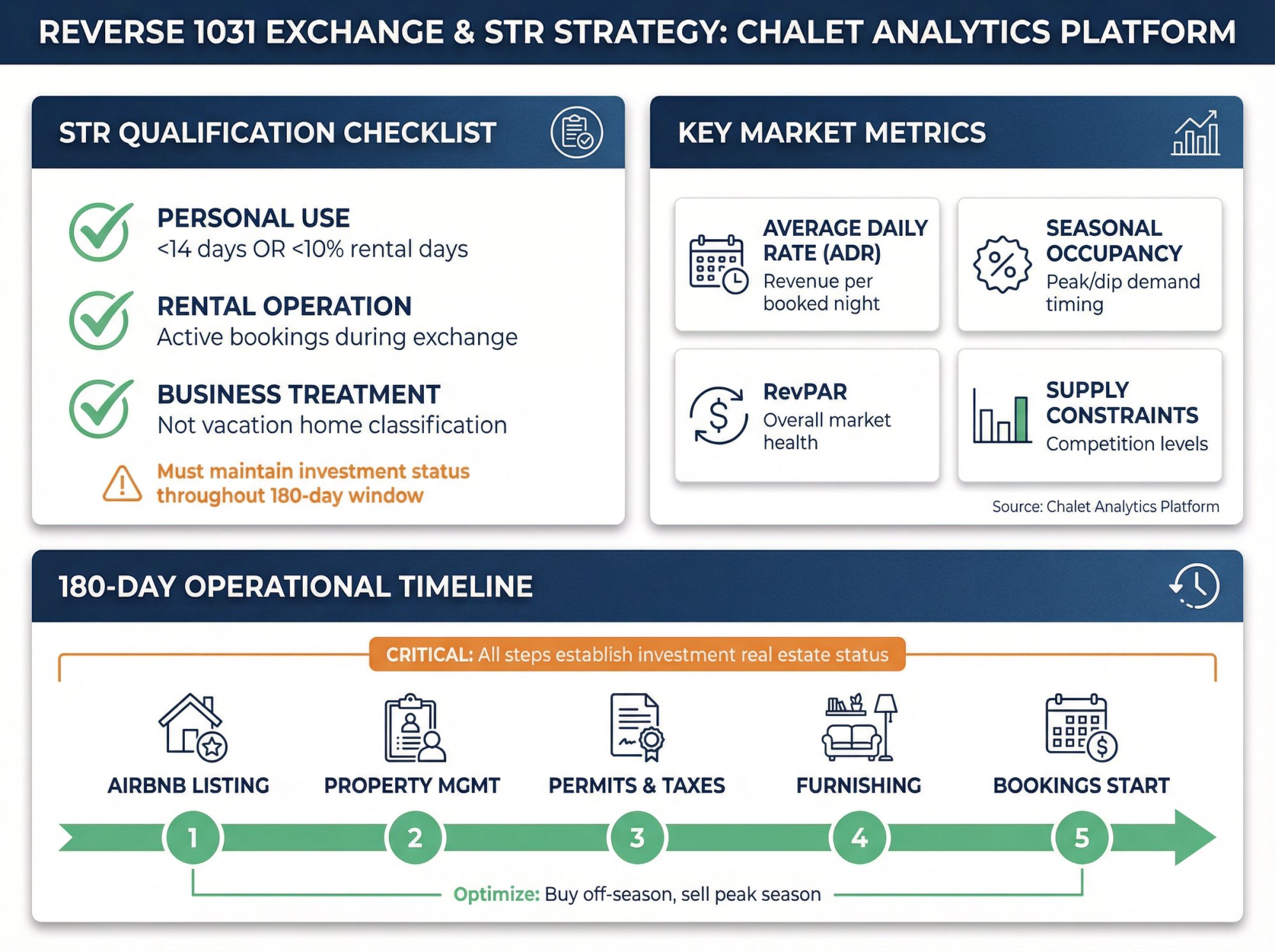

Reverse 1031 exchanges work particularly well for investors transitioning into or between Airbnb and short-term rental properties. What STR investors need to know:

Ensure the Property Qualifies as Investment Real Estate

An Airbnb rental absolutely qualifies as like-kind investment property, but you must limit personal use and treat it as a genuine rental business.

Safe harbor rule: Keep personal use under 14 days or 10% of rental days per year, whichever is greater. Rent it out consistently. Maintain it as a business, not a vacation home.

Plan to rent the property as soon as you acquire it. Start taking bookings during the exchange period. Generate reviews and income while you're still working on selling the old property.

Verify STR Regulations Before Buying

Nothing kills a reverse exchange faster than discovering the property can't legally operate as a short-term rental.

Check local STR regulations before committing to the purchase. Verify:

• STRs are permitted in that zone

• You can obtain the necessary permits

• There are no occupancy restrictions that would make the investment unworkable

Our regulation database covers hundreds of markets and is updated regularly. A quick check could save you from exchanging into a property you can't actually rent.

Research Market Performance

Before committing to a reverse exchange for an STR property, understand the market fundamentals:

| Metric | Why It Matters | Where to Find It |

|---|---|---|

| Average Daily Rate (ADR) | Revenue per booked night | Chalet analytics |

| Seasonal Occupancy | When demand peaks/dips | Market dashboards |

| Revenue per Available Room | Overall market health | Comparative analysis |

| Supply Constraints | Competition levels | Permit data + listings |

Use our free analytics platform to compare markets, analyze specific properties, and run ROI projections. You need confidence that the new property will perform financially, especially if you're taking on bridge financing to fund the purchase.

Work With STR-Specialist Professionals

Our agent network includes professionals who specialize in vacation rental properties. They understand:

• What makes an STR successful (location, layout, amenities)

• Local permit requirements and HOA restrictions

• How to price and market these properties correctly

• The urgency of 1031 exchange timelines

Similarly, our lender partners include DSCR loan specialists who underwrite based on rental income rather than personal income. DSCR loans can make it easier to qualify for vacation rental financing, and these lenders understand the intermediary structure of reverse exchanges.

Start Operating Immediately

Once the EAT acquires the property and leases it to you, start operating it as an STR right away. This means:

① Setting up your Airbnb listing

② Hiring property management or cleaning services

③ Obtaining permits and paying lodging taxes

④ Furnishing and staging the property

⑤ Taking bookings and generating reviews

This accomplishes two things: it establishes the property as investment real estate (critical for 1031 qualification), and it generates income to offset your carrying costs during the exchange period.

Plan Sale Timing Around Seasonality

If possible, structure your reverse exchange to optimize seasonal factors:

Buy a ski property in spring (off-season, better pricing). Sell your city rental in summer (when residential demand peaks).

Or buy a beach rental in fall (end of season). Sell your suburban property in spring (traditional real estate peak).

The 180-day window gives you flexibility to bridge different market cycles. Use it strategically. Explore seasonal data for your target markets to plan optimal timing.

How Chalet Helps You Execute 1031 Exchanges

A reverse 1031 exchange involves multiple moving parts: finding the right replacement property, arranging financing, selling your old property on time, and coordinating with intermediaries, agents, lenders, and title companies.

We built Chalet to be your execution partner for the entire process.

Connect With 1031-Experienced Professionals

Our vetted network includes:

Real estate agents who specialize in short-term rentals and understand 1031 deadlines. Browse our agent directory and connect with someone who's closed dozens of exchange transactions.

Lenders who handle DSCR loans, reverse exchange structures, and fast closings. They know the EAT setup and won't balk at the intermediary holding title temporarily.

Property managers who can start operating your new STR immediately while you're still selling the old property. Find STR service providers in your target market.

Research Markets and Properties

Use our free analytics to:

→ Compare STR markets across occupancy, ADR, and revenue potential

→ Run ROI and DSCR calculations for specific properties

→ Check local regulations to ensure STRs are permitted

→ Browse properties for sale filtered by performance metrics

This intelligence helps you make faster, smarter decisions when you find a property worth pursuing via reverse exchange.

Execute on Time

The 45-day and 180-day deadlines are unforgiving. Our platform helps you:

• Identify exchange-friendly markets where properties move quickly

• Connect with agents who prioritize timeline-sensitive transactions

• Line up financing that can close fast

• Track your deadlines and coordinate all parties

We only succeed when your exchange succeeds. Our entire business model is built around helping you go from research to ROI to closed transaction in one place.

Ready to Make Your Move?

A reverse 1031 exchange is a powerful tool when you've found the right property but haven't sold your current one yet. It lets you secure that opportunity immediately while preserving the tax benefits of a 1031 exchange.

The trade-offs are real: higher costs, upfront capital requirements, and the risk of failing the 180-day sale deadline. But for investors who plan carefully, engage experienced professionals, and execute with urgency, a reverse exchange can unlock deals that would otherwise be impossible.

If you're considering a reverse 1031, start with these steps:

→ Connect with a 1031-savvy agent who can help you find the right replacement property and sell your old one on time

→ Get pre-approved by an exchange-experienced lender who understands the EAT structure and can move fast

→ Research STR markets to identify the best opportunities for your exchange

→ Check regulations in your target market before committing to a purchase

→ Browse investment properties to see what's available in your target markets

→ Calculate your potential returns to ensure the numbers justify the exchange complexity

The most important step? Start early.

Don't wait until you've already found a property to begin planning your exchange structure. Engage a Qualified Intermediary now, understand your financing options, and have your team in place before the clock starts ticking.

At Chalet, we've helped hundreds of investors successfully navigate 1031 exchanges from long-term rentals to short-term rentals. We understand the timeline pressures, the regulatory complexities, and the financing challenges that come with reverse exchanges.

Let's make your next investment your best one yet.

Frequently Asked Questions About Reverse 1031 Exchanges

How much does a reverse 1031 exchange cost?

Expect to pay $3,000-$7,000+ in facilitation fees for a reverse exchange, compared to roughly $1,000 for a standard forward exchange. Additional costs include legal fees for setting up the EAT entity, possible extra title insurance, and any interest or fees on bridge financing you use to fund the replacement property purchase.

While these costs are higher than a forward exchange, they're typically far less than the capital gains taxes you'd pay without the exchange. If deferring tax on a $200K gain (which could cost $50K+), spending $5,000-10,000 in exchange costs is usually worthwhile.

Can you do a reverse 1031 exchange on a primary residence?

No. Properties must be held for investment or business use to qualify for any 1031 exchange, including reverse exchanges. Your primary residence doesn't qualify.

But if you're buying or selling a vacation rental that you also use personally, you can still qualify as long as you limit personal use to fewer than 14 days or 10% of rental days per year, whichever is greater. The property must function primarily as a rental business.

What happens if your property doesn't sell within 180 days?

The exchange fails completely. You end up owning both properties, and you lose the tax deferral benefit. When you eventually sell the old property, that sale becomes a fully taxable event.

There are no extensions, no exceptions, and no partial credit for trying. The 180-day deadline is absolute. This is the primary risk of a reverse 1031 exchange.

Risk Mitigation Strategy: To mitigate this risk, price your property realistically from the start, work with an experienced agent, and have backup strategies ready if you approach Day 170 without a sale pending.

Can you use a reverse 1031 to buy multiple properties?

Yes, as long as the total value of all replacement properties equals or exceeds the value of the property you're selling. You could, for example, sell one large long-term rental and exchange into two smaller short-term rental properties.

The reverse exchange structure remains the same: the EAT would acquire both replacement properties before you identify and sell your relinquished property. You'd need sufficient capital to fund both purchases upfront, but from a tax perspective, it works just like exchanging into a single property.

Browse available STR properties to explore multi-property exchange opportunities in different markets.

Do you need the same Qualified Intermediary for a reverse exchange?

No. You can use any QI you choose. But not all QIs offer reverse exchange services since they're more complex to structure and administer.

When selecting a QI for a reverse exchange, look for:

• Specific experience with reverse exchanges (not just forward exchanges)

• Strong references from other investors who've completed reverse exchanges

• Clear documentation of their EAT setup process

• Transparent fee structures

Ask upfront: "How many reverse 1031 exchanges have you facilitated in the past year?" If the answer is "very few" or "we don't really do those," keep looking.

Can you improve the property during the exchange period?

Yes, and this is actually one advantage of a reverse exchange. Since you control the property via the lease from the EAT, you can make improvements, renovations, or repairs during the exchange period.

For STR investors, this means you can furnish the property, do upgrades, and get it guest-ready while you're still selling the old property. Any improvements you make add to the property's basis, which can be beneficial for tax purposes.

Just coordinate with your QI about how to handle the financing of improvements, since technically the EAT owns the property during this period.

What if the replacement property costs more than your old property?

This is actually the ideal scenario for a 1031 exchange. To defer all taxes, the replacement property should be equal or greater in value than the relinquished property.

If you're "trading up," you'll need to bring additional capital to fund the difference. For example:

• Old property will sell for $400K

• New property costs $500K

• You need to bring $100K in additional funds (or financing) to complete the exchange

This is completely acceptable and doesn't affect your ability to defer taxes on the gain from the old property. You're just adding equity to the new investment. Use our calculator to model the financing and cash flow implications.

The reverse scenario (trading down in value) creates taxable "boot" on the difference, which is why most exchange advisors recommend trading up or sideways rather than down.

Can you start a reverse exchange after closing on a property?

No. The EAT must take title to the replacement property at closing. If you've already closed with yourself as the buyer, you cannot retroactively convert that into a 1031 exchange.

This is why early planning is critical. You must engage your QI and set up the EAT structure before closing on the replacement property, not after.

If you've already purchased a property and are now thinking about doing a 1031 exchange when you sell your old one, you'll need to do a standard forward exchange: sell the old property first (to a QI), then use those proceeds to acquire something new within 45/180 days.

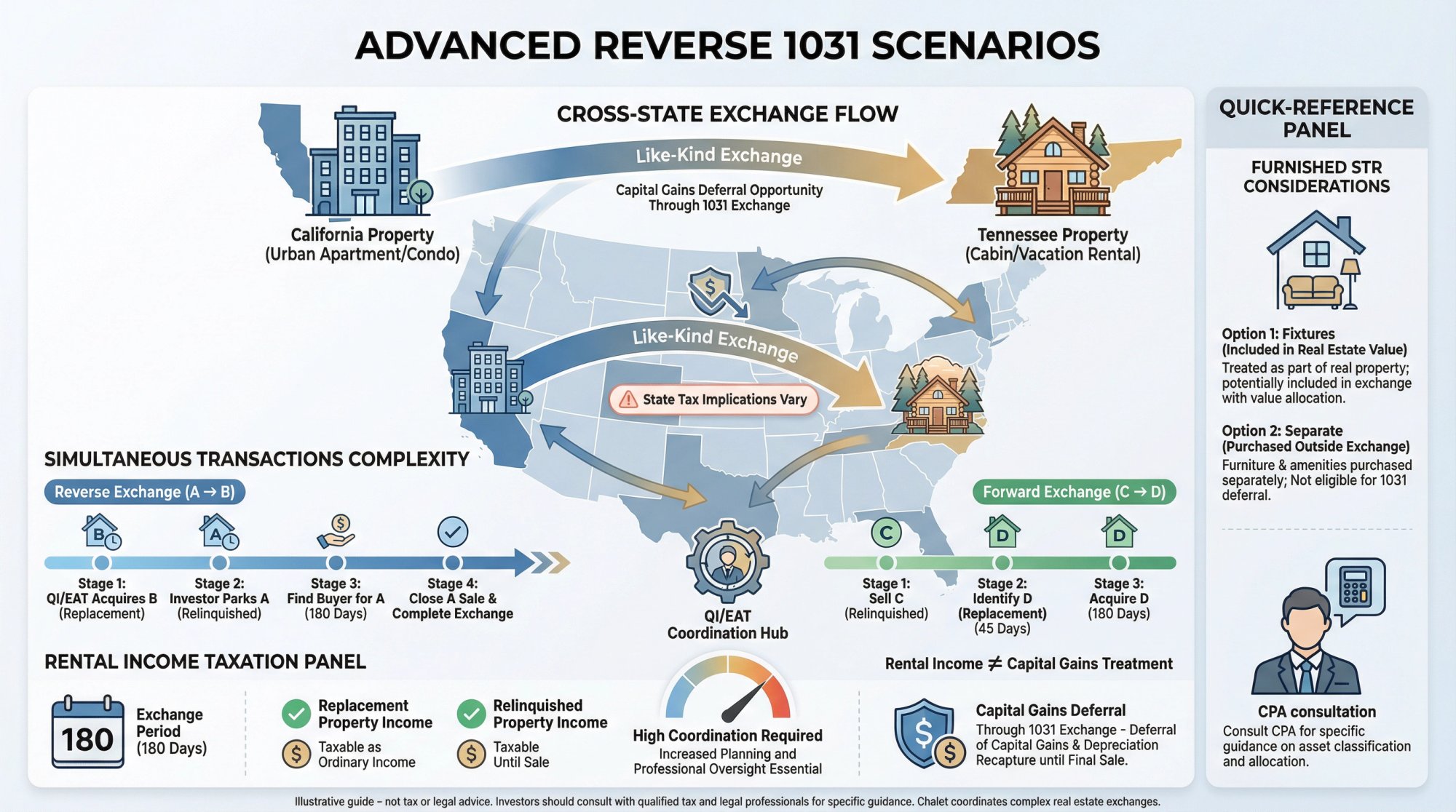

How does a reverse 1031 work with furnished STR properties?

Furnishings and personal property technically don't qualify as like-kind real estate for 1031 purposes. But there are ways to handle this:

Option 1: Include the furnishings as part of the real estate purchase at a nominal value (treating them as fixtures). Most STR purchases that include furniture handle it this way.

Option 2: Separate the furniture value from the real estate value in the purchase agreement. You'd only 1031 exchange the real estate portion. The furniture would be purchased separately (not as part of the exchange).

In practice, most reverse exchanges involving furnished STR properties treat the furnishings as part of the real estate deal, especially if they're integrated fixtures (built-in furniture, attached appliances, etc.).

Consult with your QI and tax advisor about the best way to structure this for your specific situation, particularly if the furniture value is substantial (like a luxury cabin with $50K in furnishings).

Can you do a reverse 1031 exchange across state lines?

Yes. Like-kind exchanges can involve properties in different states. You could sell a long-term rental in California and exchange it for a short-term rental in Tennessee, for example.

But be aware of state-specific tax implications:

• Some states don't fully recognize 1031 exchanges or may have different rules

• You may owe state capital gains tax in your old state even if federal tax is deferred

• Some states require withholding at closing for out-of-state sellers

Work with a tax advisor who understands the rules in both states to ensure you're structuring the exchange correctly and accounting for any state-level tax obligations.

For the federal exchange itself, crossing state lines doesn't change the mechanics. The 45-day and 180-day deadlines, the EAT structure, and the like-kind requirements all remain the same.

Is there a limit on how many 1031 exchanges you can do?

No. You can do unlimited 1031 exchanges throughout your investing career, continually deferring taxes as you trade up from one property to another.

This is one of the most powerful aspects of 1031 exchanges: you can build a portfolio over decades, deferring gains each time you sell, and then ultimately pass properties to heirs with a stepped-up basis (potentially avoiding the deferred tax entirely through estate planning).

Some investors do a dozen or more 1031 exchanges over their careers, continuously upgrading their portfolio without ever paying capital gains tax during their lifetime. Reverse exchanges can be part of this strategy when timing requires buying before selling.

What happens if the sale doesn't appraise?

If you've identified your relinquished property within the 45-day window but then a buyer's appraisal comes in low and kills the deal, you have a few options:

If you're still within the 180-day window: Find another buyer who can close before the deadline. This might mean reducing the price or offering seller financing to attract buyers who aren't relying on traditional financing.

If you identified multiple properties: If you identified backup properties to sell (using the three-property or 200% rule), you could pivot to selling one of those instead.

If none of those work: The exchange fails when the deadline passes. You'd lose the tax deferral and own both properties outright.

This is why realistic pricing from the start is so critical. Don't identify a property at $500K if comparable sales only support $450K. Price it right initially to maximize your chances of closing on time.

Can you do multiple 1031 exchanges simultaneously?

In theory, yes, though this gets extremely complex and is rare in practice. You'd be using a reverse exchange for one swap while simultaneously executing a forward exchange for another.

For example:

• You reverse exchange: buy Property A (new), sell Property B (old)

• You forward exchange: sell Property C (old), buy Property D (new)

Each exchange would have its own QI, EAT (for the reverse), timelines, and documentation. The transactions must be kept completely separate to avoid IRS confusion about which properties are being exchanged for which.

Most investors and CPAs would recommend keeping these separate in time rather than running them concurrently. The complexity and risk of paperwork errors increase substantially when trying to manage multiple exchanges simultaneously.

If you're thinking about this level of portfolio maneuvering, work closely with an experienced CPA and exchange facilitator to structure everything correctly.

Do you pay taxes on rental income during the exchange?

Yes. Rental income you receive during the exchange period is taxable as ordinary income in the year you receive it, just like any other rental income.

This includes income from:

• The replacement property (while the EAT holds it and leases it to you)

• The relinquished property (until it sells)

The 1031 exchange defers capital gains tax on the sale of the relinquished property. It doesn't affect the taxation of rental income you earn while operating either property.

Keep good records of income and expenses during the exchange period, since you'll be reporting it on your tax return for the year. Your CPA will need this documentation to properly account for the exchange and any rental activity that occurred before and after the exchange completed.