Selling your home and rolling the proceeds into an Airbnb rental without paying capital gains tax sounds perfect. The IRS's 1031 exchange program lets real estate investors defer taxes by swapping one property for another, but there's a catch: it only applies to business or investment properties, not personal homes.

Does that mean you're stuck if your property is your primary residence?

Not necessarily.

There are legal strategies to convert a primary home into a rental (or vice versa) so you can use a 1031 exchange while using homeowner tax breaks too. This guide walks through exactly how to do it using 2025 rules, in plain English.

Reading tip: This is a detailed roadmap for homeowners and investors. We break down key concepts, timelines, and IRS rules, then show how to safely combine the primary-home tax exclusion with a 1031 exchange. Short on time? Skip to the "Quick Strategies" sections for step-by-step guidance.

Can You Do a 1031 Exchange on a Primary Residence?

A 1031 like-kind exchange (named for Section 1031 of the U.S. tax code) lets you defer capital gains tax when you sell one investment or business property and quickly buy another of equal or greater value.

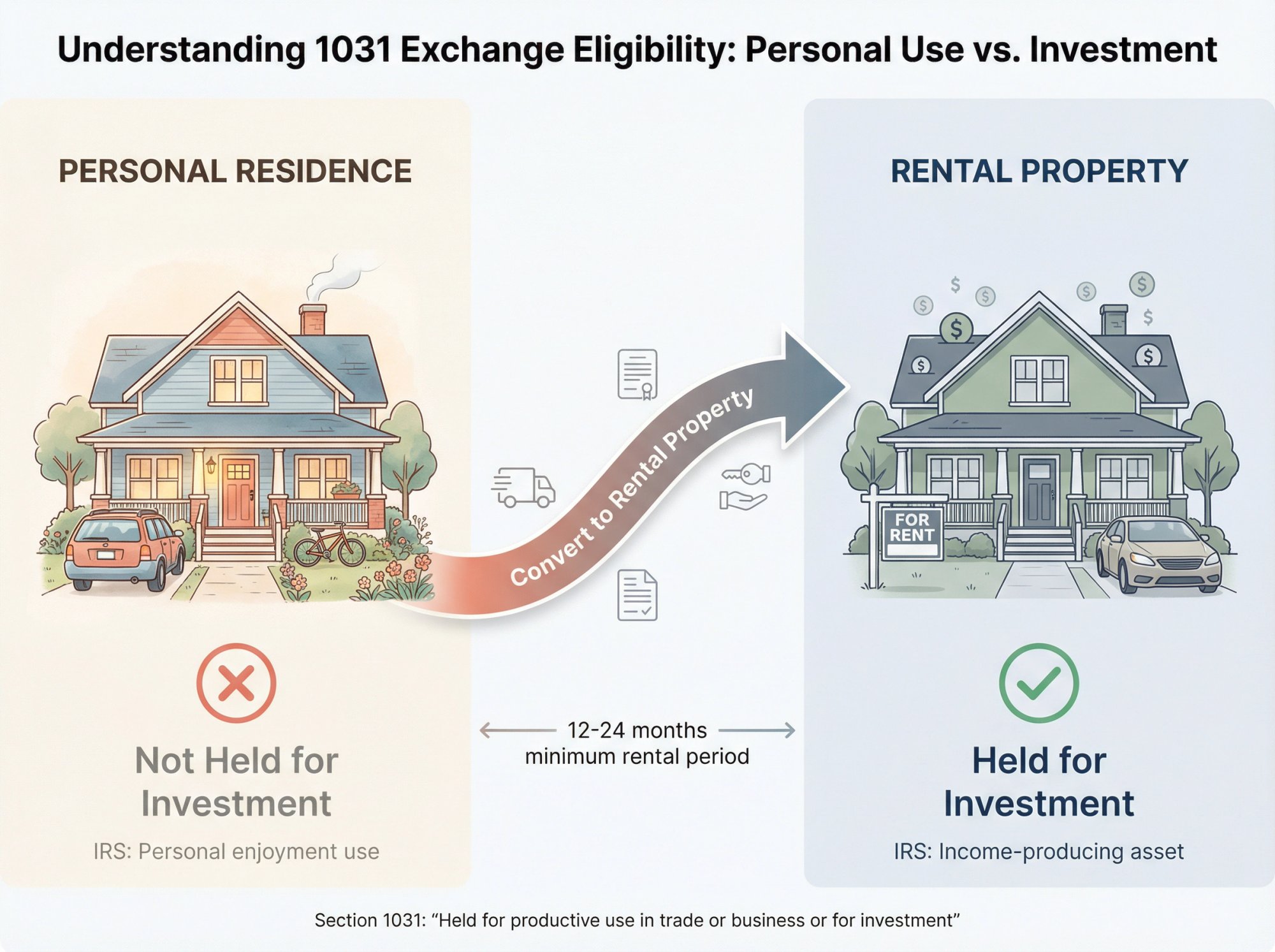

The key phrase is "held for productive use in a trade or business or for investment."

In simple terms, the property you're selling must be an investment or business asset. Think rental property, commercial building, or land held for appreciation. Personal-use real estate does not qualify.

Your main home, second home, or any property you live in full-time is viewed by the IRS as held for personal enjoyment rather than for income or business purposes.

Bottom line: If you live in a house and never rent it out or use it for business, you cannot directly do a 1031 exchange on that home sale.

From the IRS's perspective, your home isn't "like-kind" to an investment property because it wasn't used as an investment.

But this doesn't mean homeowners are left without any tax break. There's a generous primary residence exclusion that may cover a big chunk of your gain when selling a home. And for those with gains above that limit (or those who plan carefully), there are ways to legally turn a personal home into a 1031-eligible property.

What Is the Section 121 Primary Residence Exclusion?

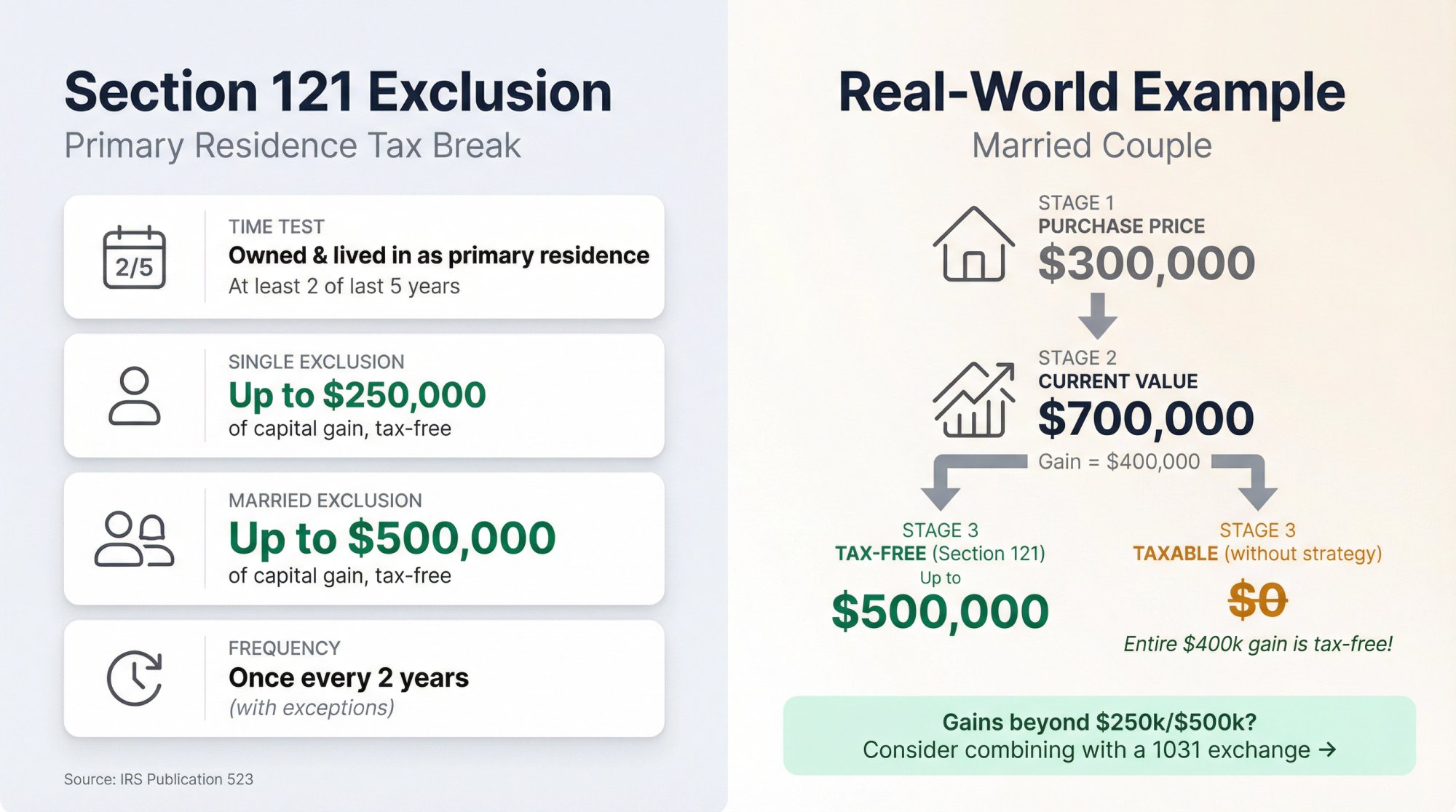

Before diving into creative exchange strategies, understand Section 121 of the tax code. This rule lets you sell your main home and pay $0 in capital gains tax on a large portion of your profit, as long as you meet certain tests.

Here's how it works:

| Requirement | Details |

|---|---|

| Time Test | Owned and lived in property as primary residence for at least 2 of 5 years before sale |

| Exclusion Amount (Single) | Up to $250,000 of capital gain, tax-free |

| Exclusion Amount (Married) | Up to $500,000 of capital gain, tax-free |

| Frequency Limit | Once every 2 years (with some exceptions for unforeseen circumstances) |

| Years Requirement | Don't have to be consecutive; short absences still count |

Example Scenario

Say you bought your home years ago for $300,000 and it's now worth $700,000. If you're married, up to $500,000 of that $400k gain could be completely tax-free under Section 121.

If you're single, up to $250k is tax-free.

Any gain beyond that would be taxable at capital gains rates unless you use a 1031 exchange or another deferral strategy on the excess.

Important: The Section 121 exclusion won't apply if the home was recently converted to rental use or wasn't your primary residence for at least 2 of the last 5 years. It's meant for personal residences.

The primary-home exclusion is straightforward and doesn't require purchasing another property. If your home's appreciation is within these limits, you likely won't owe any capital gains tax just by claiming the exclusion.

But what if your gains exceed $250k/$500k, or you want to reinvest the proceeds into an income property like a rental or Airbnb?

That's when we look at combining the homeowner exclusion with a 1031 exchange.

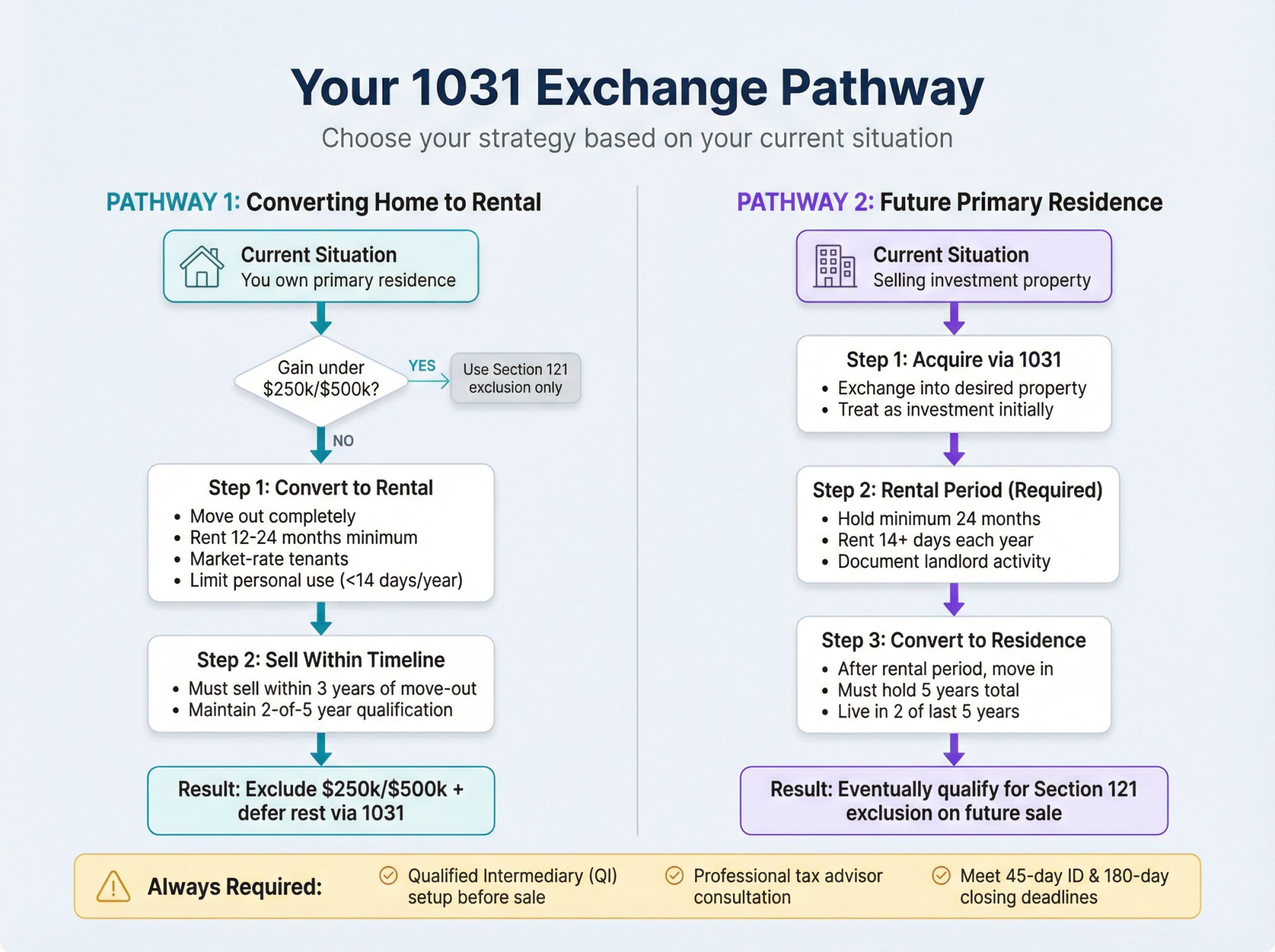

How to Convert a Primary Residence into a Rental Property

What if you're sitting on a highly appreciated home above those Section 121 limits? Or you simply want to defer all taxes and roll the entire sale into a new investment property?

One option is to convert your primary residence into an investment property before selling, so that it meets the 1031 exchange requirements at the time of sale.

You have to change the property's use from personal to investment. Here's how to do that step by step.

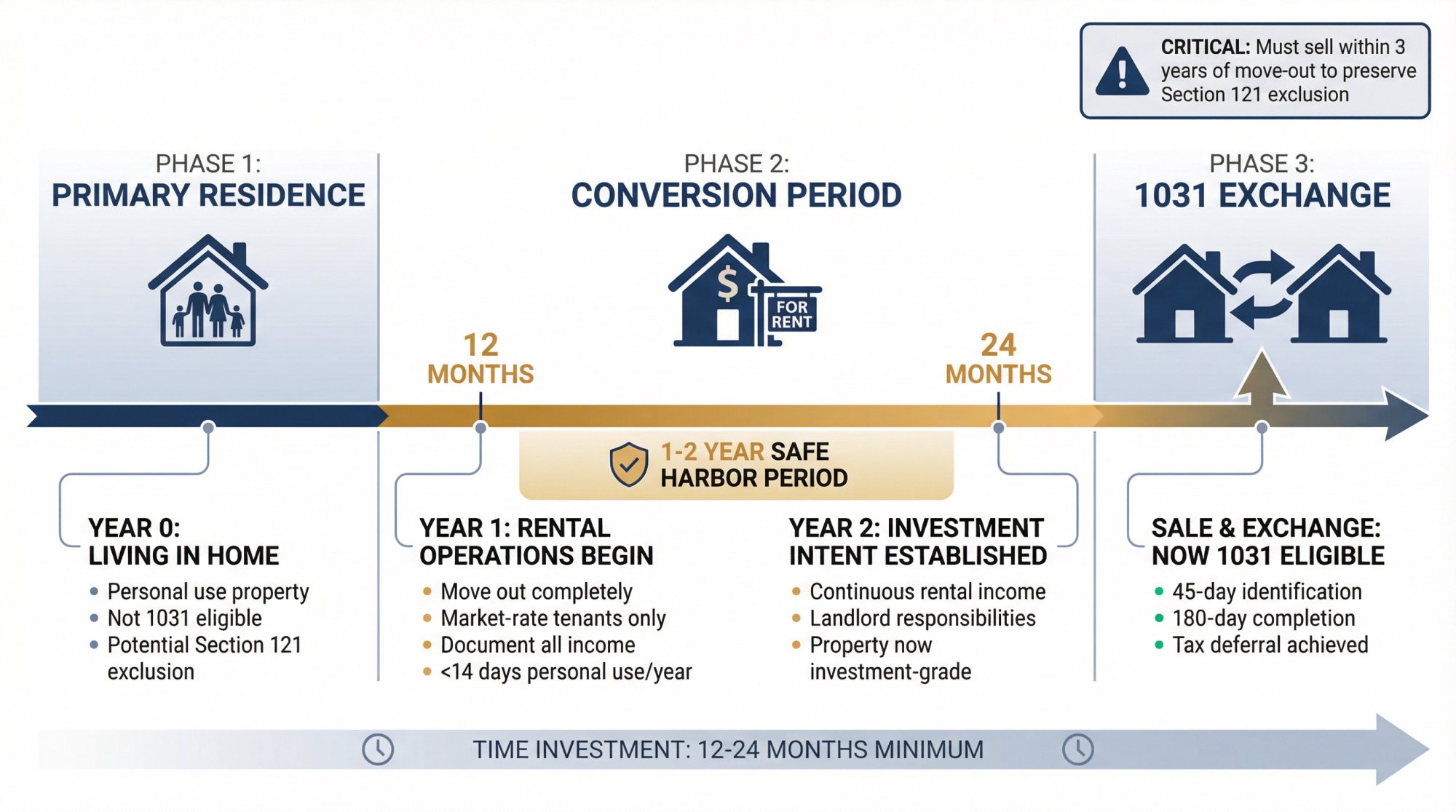

Strategy 1: "Rent First, Then Exchange" (Primary Residence → Rental → 1031)

① Move Out and Stop Personal Use

You need to stop using the home as your residence. That means moving out (or at least significantly reducing your personal use if it's a second home).

The goal is to abandon its status as your primary residence and transition it to a business/investment asset. Any continued personal use can muddy the waters, so treat it as strictly not your home going forward.

② Rent the Property at Fair Market Value

Find tenants and start renting the house at a market-rate rent to an unrelated person. Collect rental income and report it on your tax return.

This shows the IRS you're holding the property for income production, not personal enjoyment.

How long should you rent it? While tax law doesn't specify a minimum ownership or rental period for 1031 qualification, tax advisors commonly recommend renting it out for at least 1-2 years before sale.

In fact, the IRS provided a safe-harbor guideline for converting vacation homes which many experts apply here: If you rent it for at least 14 days in each of two consecutive years and limit your own use, the property will be deemed held for investment.

In practice, a two-year rental period with bona fide tenants is a conservative approach that demonstrates intent.

③ Limit Personal Use to Almost Zero

During this rental period, avoid staying in the home yourself.

The IRS safe harbor rule says your personal use should not exceed 14 days per year (or 10% of the days rented, whichever is greater).

In other words, treat it truly as a rental property, not a part-time vacation home. Any significant personal use beyond those thresholds could disqualify the property from exchange treatment by indicating you still treated it as personal-use property.

④ Document Everything

Keep thorough records to prove your intent was to convert the home to an investment. This includes:

• Copies of lease agreements showing market-rate rents to unrelated tenants

• Advertisements or listings proving you marketed it as a rental

• Rental income receipts and bank statements documenting income flow

• Maintenance records showing landlord responsibilities

If you made the conversion in preparation for a 1031 sale, be extra careful. The IRS will scrutinize whether this was a genuine change of use or a scheme just to avoid taxes.

Proper documentation and actually operating as a landlord are key to showing the conversion was legitimate.

⑤ Sell via a 1031 Exchange

Once you've rented the property for a sufficient period (again, at least a year, preferably two tax years to be safe), you can proceed to sell it and do a 1031 exchange into your next property.

At this point, the home should qualify as being "held for investment," allowing you to defer capital gains tax on the sale as long as you follow all 1031 exchange rules (like using a qualified intermediary and completing the exchange within IRS deadlines).

By executing this "rent first, then exchange" strategy, you essentially recharacterize your former home as an investment property, making it eligible for a 1031 exchange.

Many savvy homeowners have used this approach when their gains exceed the $250k/$500k exclusion or when they want to preserve all of their equity for buying a new property.

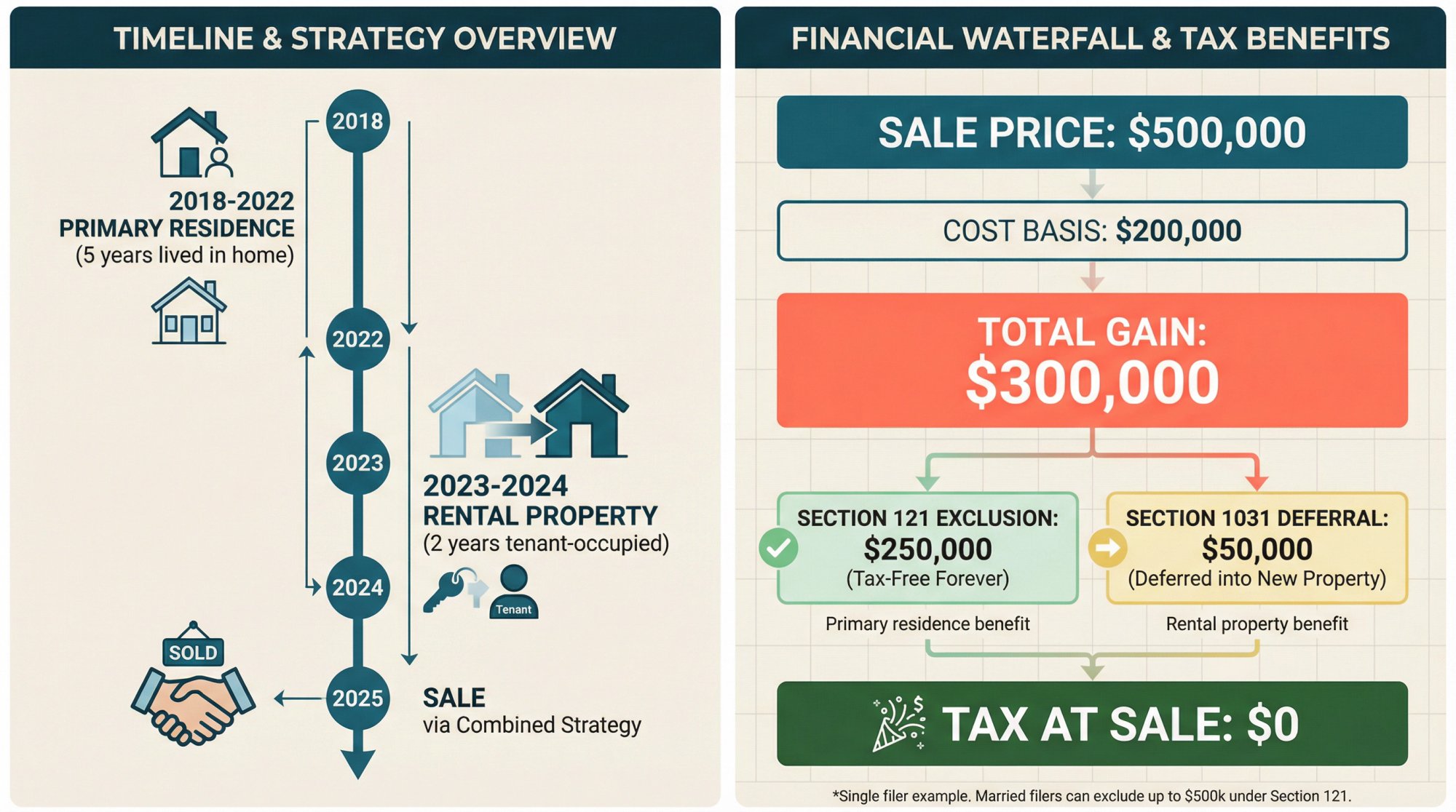

Real-World Example: Combining Exclusion and Exchange

Imagine you bought a house 15 years ago for $200,000 that's now worth $900,000. Your gain is $700,000.

If you sell it as your primary home, you could exclude $500k and owe tax on $200k.

Instead, you move out and rent it for two years, then sell. Now the property qualifies for a 1031 exchange. You could exclude $500k of gain under Section 121 (because you met the 2-out-of-5 rule) and defer the remaining $200k of gain by exchanging into a portfolio of Airbnb rentals.

You've just avoided immediate tax on the entire $700k gain. Part permanently (Section 121) and the rest deferred (Section 1031).

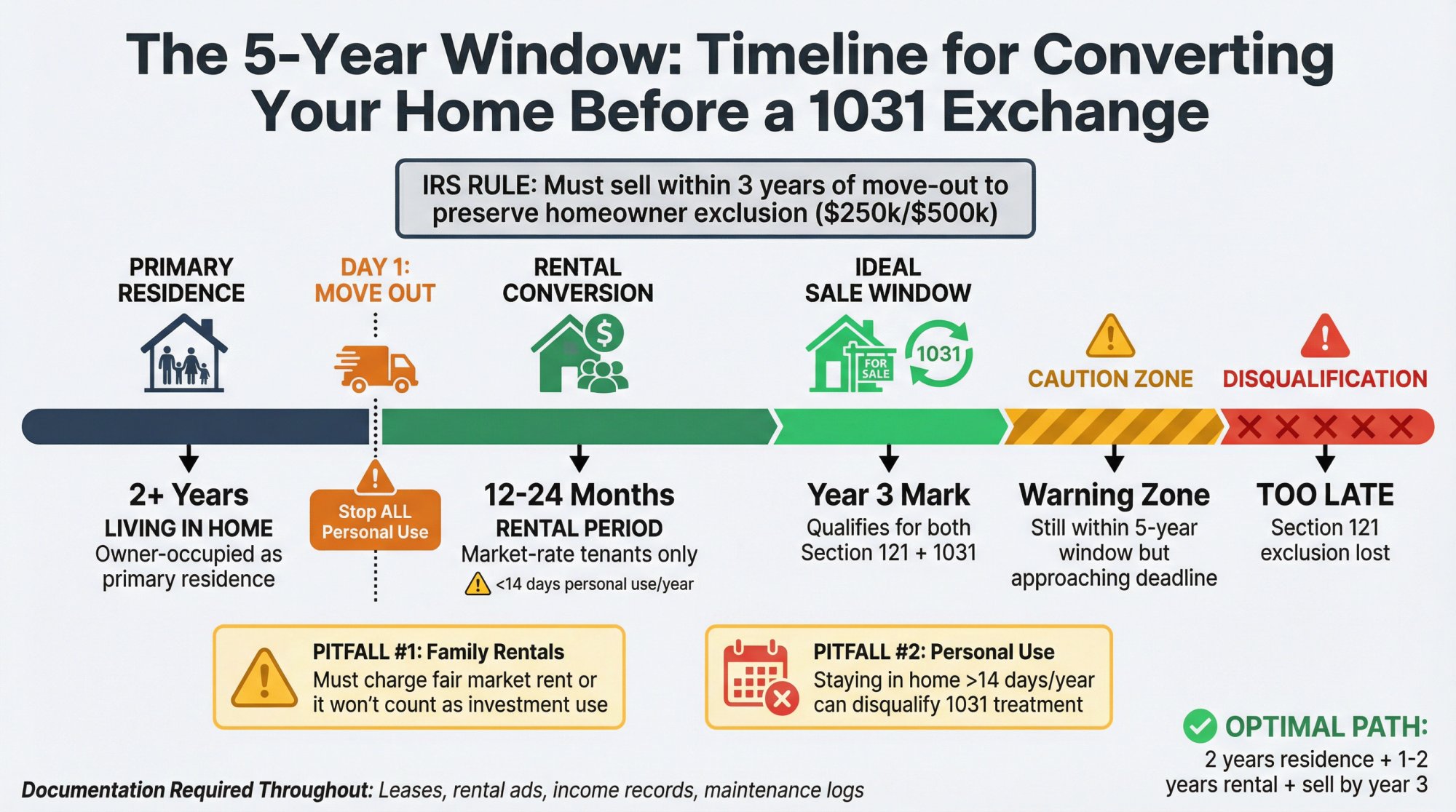

How Long to Rent Your Home Before a 1031 Exchange

The 5-Year Window

How long can you rent it out and still use the homeowner exclusion (Section 121)?

Remember, to claim the exclusion you must sell within 3 years of moving out. The rule is "2 years of use in the last 5 years."

If you move out and become a landlord for longer than 3 years, you'll fall outside the 5-year window and lose the exclusion.

Plan accordingly: a 1-2 year rental period is best to establish the investment intent but still stay within that 5-year window for the exclusion. Sell by the 3-year mark after move-out to be safe.

(If you go longer, you could still do a 1031, you just wouldn't get any tax-free exclusion. You'd be deferring all gain instead.)

Avoiding "Non-Qualified Use" Issues

The IRS doesn't let you abuse the system by living in a house for 10 years, renting it for 1 year, and then excluding most of the gain.

Any period after 2008 that the property was not used as a primary residence is considered "non-qualified use" and its portion of the gain can't be excluded under Section 121.

But there's a special carve-out in the law that says rental use after you've moved out of your primary home (within the 5-year window) is not counted as non-qualified use for the exclusion.

This means if you followed our strategy (lived in it 2+ years, then rented for up to 3 years), you can still apply your full $250k/$500k exclusion to the gain attributable to your years of living there.

In short, the rental period right before the sale won't reduce your exclusion, as long as you sell within 5 years of moving out.

But any depreciation claimed during the rental period cannot be excluded. You'll owe tax on that portion (we'll address depreciation recapture shortly).

Common Pitfalls to Avoid

Renting to Family Below Market

If you rent the house to a family member for a token $100/month (or let them live rent-free), the IRS won't count that as legitimate rental use.

Rentals to family must be at fair market rent and for their primary residence use to count. Otherwise it's treated as your personal use. Always charge a market-rate rent and document that it's paid, especially if the tenant has any personal relationship to you.

Giving In to Personal Use

It can be tempting to stay at your old home occasionally (maybe between tenants or for holidays), but resist the urge.

Even incidental personal use beyond the allowed 14 days per year can jeopardize the investment intent. When in doubt, keep it strictly rented. Use this time as a trial run of being a landlord. After all, you're planning to invest in a rental property next!

Summary of Timing:

Converting a primary residence to a rental property requires careful timing and discipline.

| Phase | Timeline | Action Required |

|---|---|---|

| Move-out | Day 1 | Stop all personal use |

| Rental Period | 12-24 months minimum | Market-rate tenants, <14 days personal use/year |

| Sale Window | Within 3 years of move-out | Maintain 2-of-5 year qualification |

| Documentation | Throughout | Leases, ads, income records, maintenance logs |

Plan on at least 12-24 months of rental operations with minimal personal use to safely qualify for a 1031. Keep your rental period within 3 years if you want to also use the homeowner gain exclusion.

Maintain solid records to prove it was truly held for investment.

Can You Use Section 121 and Section 1031 Together?

Here's the real magic: You may be able to use both Section 121 and Section 1031 on the same transaction.

In other words, part of your home sale gain can be excluded tax-free, and the rest can be deferred via an exchange.

The IRS allows this, and even provides an order of operations for it: the home sale exclusion applies first to any eligible gain, and then the 1031 deferral applies to the remaining amount.

To pull this off, you must meet the requirements for both Section 121 and 1031, as we've been discussing. That typically means:

• You used the property as a primary residence for 2 of 5 years (Section 121 qualified)

• By the time of sale, you had converted it to investment use (1031 qualified)

If you satisfy both, you truly get the "best of both worlds" tax-wise.

Concrete Example: $300k Gain

You bought a house in 2019 and lived there as your primary home through 2023 (5 years). In 2024 and 2025, you rent it out to tenants at fair market rent, fully converting it to a rental property.

Now it's early 2026 and you decide to sell the property for $500,000. Your adjusted cost basis is $200,000. The total gain is $300,000.

What happens:

• Because you lived there 2+ years and are selling within 5 years of moving out, you qualify for the Section 121 exclusion. As a single filer you can exclude $250,000 of that gain tax-free.

• That leaves $50,000 of gain that is still taxable. But since the property is now an investment property (you've rented it for 2 years), the sale is eligible for a 1031 exchange.

• You arrange a 1031 exchange for the full $500,000 sale. The first $250k of gain is absorbed by the exclusion, and the remaining $50k of gain is deferred by being reinvested into your replacement property.

Result: You pay zero tax at sale. $250k of your profit is permanently tax-free, and the other $50k is kicked down the road (deferred into the new property). You've kept your entire $500k working for you.

Critical insight: The IRS spells out that when both Sections 121 and 1031 apply, the exclusion is used first, then the exchange defers the rest. Any boot (cash you received that isn't reinvested) would only be taxable to the extent it exceeds the excluded amount.

What If Only Part of the Property Was Rental (Duplex or ADU Scenario)?

The example above assumes you sequentially converted the entire property. There's another scenario: you have a mixed-use property, for instance, a duplex or a home with a basement apartment.

In such cases, one part of the property was your residence and another part was rented out concurrently.

When you sell, you can actually split the tax treatment: the portion of the property that was your home can use the Section 121 exclusion, and the portion that was a rental can go into a 1031 exchange.

For example, say you own a duplex, live in one unit and rent out the other unit. If you sell the whole building, you'd allocate the sales price and basis between the two units.

The gain on the owner-occupied unit could be excluded up to $250k/$500k, and the gain on the rental unit could be deferred with a 1031 into a new investment property.

This is completely allowable. It's essentially treating it as two sales (one personal, one investment).

As you can imagine, the bookkeeping gets complex. You'll want a tax professional to help allocate basis, depreciation, and gain correctly between the parts of the property.

But done right, this combined strategy lets you walk away from a multi-use property sale with minimal immediate tax: you exclude what you can from the personal portion and defer the rest from the investment portion.

Quick note: The IRS has issued detailed guidance on various scenarios of combining 121 and 1031 for partial rentals, vacation homes, etc.

The main point is that yes, you can use both, but you must strictly satisfy each section's rules for the respective portion of the property.

Don't try to stretch the truth on what portion was rental vs personal. Document it (e.g. if you had a home office or a rented room, get advice on whether that portion truly counts as separate space for 1031 purposes).

Generally, an entire separate unit or separate dwelling is easier to deal with than say one room in a house.

Don't Forget Depreciation Recapture

If you did have a rental portion (either in sequence or part of the property), you likely took depreciation deductions while it was rented. When you eventually sell, depreciation recapture tax is due on all the depreciation you claimed (or could have claimed).

A 1031 exchange defers capital gains and defers depreciation recapture as well, but the recapture doesn't just vanish. It carries over into the new property's cost basis.

And if you use the Section 121 exclusion, note that the exclusion does not apply to depreciation. The IRS explicitly says you must pay tax on any depreciation as unrecaptured Section 1250 gain, even if the rest of the gain is excluded under Section 121.

In plain terms: you don't get to avoid paying taxes on depreciation taken just because you lived in the home later. That portion will be taxed at 25% (the special rate for real estate depreciation) either now or eventually.

So plan for that when selling a former rental. A 1031 will let you continue deferring it, but if you ever cash out, the IRS will ask for that piece.

Can You Move Into a 1031 Exchange Property Later?

So far we've focused on selling a primary residence and buying an investment (or multiple short-term rental investments). But what about the opposite?

Some investors ask: "Can I do a 1031 exchange on my rental, buy a new property, and then move into that new property as my home?"

This is a common long-term play. For example, exchange out of one rental into a nicer property in a place you'd like to retire, rent it out for a while, then eventually make it your residence.

Yes, it's possible to convert a 1031 replacement property into your primary residence, but there are strict rules to prevent abuse.

You cannot use a 1031 to acquire a house and immediately move in. That would violate the "held for investment" requirement.

The IRS safe harbor for this scenario says you should own the replacement property for at least 24 months and actually rent it out for at least 14 days in each of the first two years before converting it to personal use.

This mirrors the earlier rule but in reverse. It proves you genuinely acquired it as an investment initially. After satisfying that, you can move in and make it your home.

Even then, you cannot immediately sell it tax-free.

If you acquired a property via 1031 exchange and later make it your primary, the tax code requires that you own it for at least five years total before you can claim the homeowner exclusion on a sale.

And you must still live in it for 2 of the last 5 years as usual. This is often called the "5-Year Rule."

It's there to stop someone from swapping into a house and flipping it as a personal residence to cash out gains tax-free. So plan to hold the property long term.

Only after that five-year mark (and two years of occupancy) could you potentially sell it and use the $250k/$500k exclusion.

And remember, any gain that accrued while it was an investment (non-qualified use) can't be excluded. You'll prorate the exclusion amount by the ratio of personal-use years to total ownership years.

In practice, if it was rental for say 2 years and then your home for 3 years (5 total), 2/5 of the gain would be taxable (non-excludable) under those rules. Depreciation from the rental period will also be taxable when you sell, as discussed.

The takeaway:

A 1031 exchange can be part of a long-game plan to eventually own your dream home with a big tax break, but you must rent it out for a couple years first and then live in it for at least two (and hold 5) years before selling.

Many investors do exactly this: keep trading investment properties until they acquire one they'd like to retire in. They rent it out for say 2-3 years, move in, live there 2+ years, then when they sell, they exclude some gain and only pay tax on the earlier investment portion.

It's not a 100% tax escape, but it can significantly reduce the bill.

And if you never sell and instead leave the property to heirs, the deferred gains may get wiped out by the step-up in basis (an estate planning perk often dubbed "swap 'til you drop" strategy).

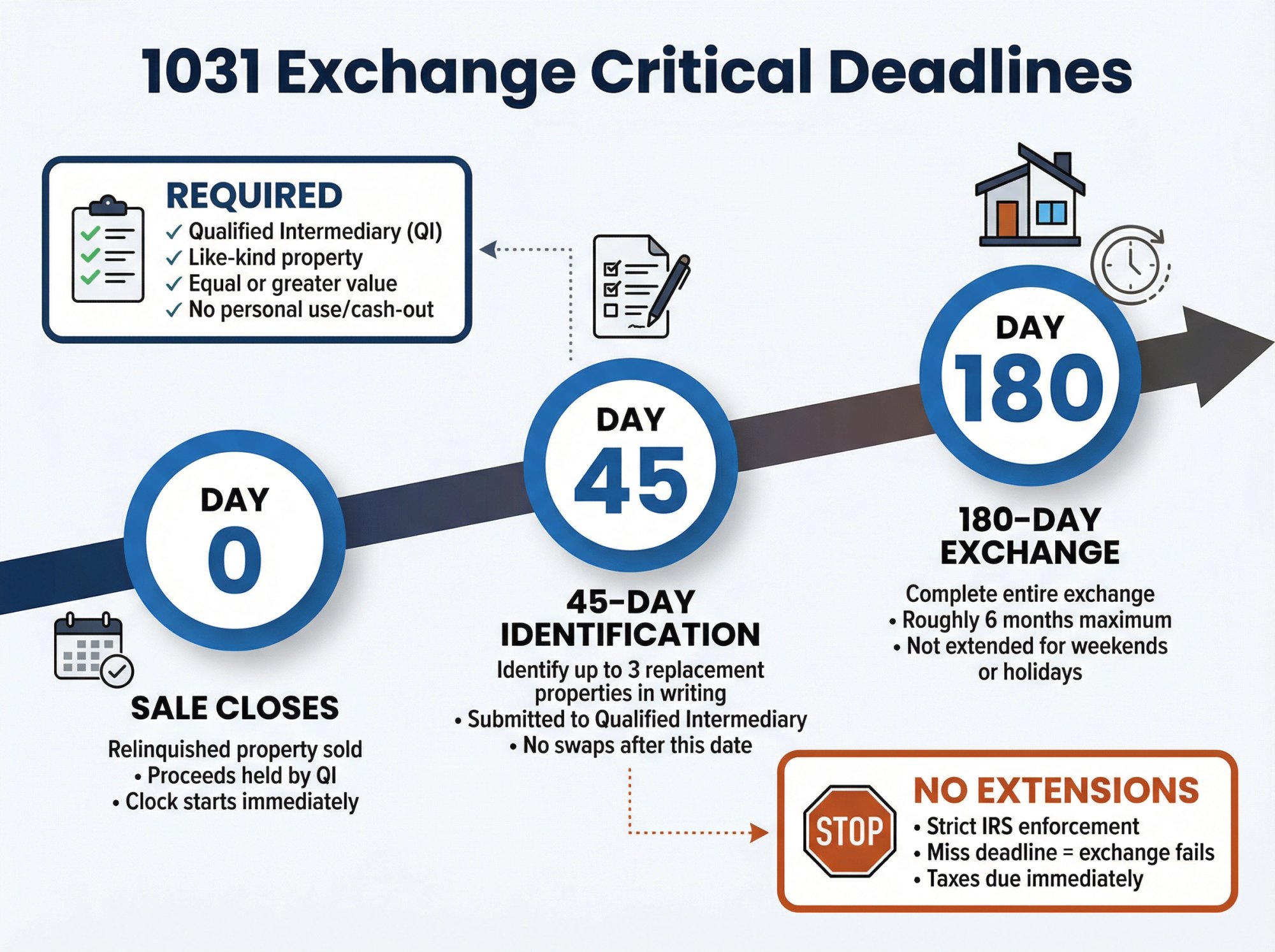

1031 Exchange Deadlines You Must Know

Whether you're exchanging out of a former home or any investment property, you must follow the standard 1031 exchange rules to the letter. Failing these will blow up your tax deferral, so it's worth a quick refresher:

The Critical Deadlines

| Deadline | Timeline | Requirements |

|---|---|---|

| 45-Day Identification | From sale close date | Identify up to 3 replacement properties in writing to QI |

| 180-Day Exchange | From sale close date | Complete entire exchange (roughly 6 months maximum) |

| No Extensions | Strict enforcement | Not extended for weekends, holidays, or tax filing deadlines |

45-Day Identification Period

From the day you sell your old property, you have 45 days to identify potential replacement properties in writing.

This list (often given to your qualified intermediary) can typically name up to three properties. There are alternate rules if you identify more, but stick to the basics if possible.

You cannot swap after 45 days. Your targets must be locked in by then.

180-Day Exchange Period

The entire exchange must be completed within 180 days of the sale of the relinquished property. This is roughly six months.

Importantly, 180 days is the max. It's not extended for weekends, holidays, or even if that date falls after your tax filing deadline.

Plan closings accordingly with some cushion. If something delays your purchase beyond 180 days, the exchange fails and you'll owe taxes.

Must Use a Qualified Intermediary (QI)

You can't touch the sale proceeds in the interim. The funds must be held by a neutral third-party exchange accommodator and used to acquire the new property.

If the money hits your bank account, even briefly, the IRS will consider it a taxable sale.

Set up the QI before you close the sale of your property.

Like-Kind Property

The replacement property must also be for investment or business use, and generally of equal or greater value to fully defer tax.

Fortunately, all real estate is pretty much "like-kind" to other real estate (with the exception that after 2018, 1031 is only for real property, not personal property).

You could sell a rental condo and buy a short-term rental single-family home, or sell land and buy an Airbnb investment. Those are like-kind.

But you could not 1031 exchange your personal residence into a rental property, as we've established, because the old property wasn't like-kind investment real estate.

No Personal Benefit or Cash-Out

The exchange should be a swap of investment assets only. If you receive any cash "boot" or non-like-kind property in the exchange, that portion of the gain will be taxable.

Also, you can't pull out cash for yourself or buy a property you intend to immediately live in (violating the investment use requirement). Keep it all business.

If your intent or facts show you really just sold and bought a personal asset, the IRS can disallow the exchange.

How Chalet Helps You Execute 1031 Exchanges Fast

When doing a 1031 exchange, speed and coordination are everything. You need to find suitable replacement properties fast, often in unfamiliar markets, and line up financing quickly.

This is where Chalet can help. Our platform connects you with Airbnb-friendly real estate agents experienced in 1031 timelines, as well as lenders who understand DSCR loans and other financing for investment properties.

We even provide free market data to help you identify exchange-friendly short-term rental markets.

In short, we help you go from sale to identifying replacement properties within 45 days and closing within 180 days, without scrambling.

Here's what makes Chalet different for 1031 buyers:

① Free Analytics to Identify Markets Fast

You need to identify compliant, high-performing markets quickly. Chalet's market dashboards show you ADR, occupancy rates, and revenue projections across top STR markets. No subscription required.

② 1031-Savvy Agents Ready to Move

Our vetted real estate agent network includes professionals who've worked with dozens of 1031 buyers. They understand the urgency and know how to find compliant properties that close on time.

③ DSCR Lenders Who Understand Exchange Timelines

DSCR loans are perfect for STR investors because they qualify based on property cash flow, not personal income. Our lender partners know 1031 timelines and can close in 30-45 days.

④ One Platform for Everything

From ROI calculators to regulation databases to vendor coordination, Chalet keeps your exchange on track.

We know 1031 buyers can't afford to waste time or risk a failed exchange.

Next Steps: Converting Your Home for a 1031 Exchange

Using a 1031 exchange with a primary residence isn't simple, but as we've seen, it is doable with careful planning.

Here's a quick recap of strategies:

If You're Selling a Primary Home

First, see if the tax-free $250k/$500k exclusion covers your gain. If yes, you might not need a 1031 at all. You already have a great tax break.

But if your gain is larger, or you want to reinvest the full proceeds, plan to convert the home to a rental for at least 1-2 years before sale. This lets you qualify for a 1031 exchange.

When you sell, use Section 121 to exclude what you can, and 1031 exchange the rest into your next investment.

Essentially, don't leave money on the table. Use both tax benefits where possible.

If You're Buying a New Property and Eventually Want to Live in It

Acquire it as a rental first via a 1031 exchange, rent it out for a couple of years (per safe harbor), then convert it to your residence.

To get the primary home exclusion later, remember the 5-year ownership rule. Hold the property at least 5 years before any sale, and expect to pay taxes on the portion of gain from the rental period.

This is a longer play, but it can fit into retirement or relocation plans.

Always Consult Professionals

These transactions cross real estate and tax law, so involve your CPA or tax advisor early. Also, use a reputable 1031 exchange intermediary. They're an absolute requirement and can guide you on the process.

A small mistake (like missing a deadline or improper title holding) can invalidate the whole exchange. Professional guidance is worth its weight in gold here.

Plan Your Next Investment Wisely

If you're selling your home and moving capital into a rental investment, do thorough research on your target market.

For example, if you're aiming to buy a vacation rental or Airbnb, make sure you understand the local short-term rental laws. Chalet offers a Short-Term Rental Regulations database to help with that.

Ensure the numbers make sense. Use tools like Chalet's ROI and Airbnb income calculator to project returns, so your exchange yields a profitable investment.

Remember, a 1031 exchange defers tax, but it doesn't eliminate it unless you keep exchanging indefinitely. So you want to exchange into a property that will perform well to justify the deferral.

In conclusion:

A 1031 exchange on a primary residence is a nuanced maneuver, but armed with the right knowledge, you can make it work to your advantage.

It boils down to changing the property's character (from personal to investment) or structuring the sale if it was dual-purpose.

By using both the homeowner exclusion and the 1031 deferral, you can potentially sell your home, pay little to nothing in immediate taxes, and reinvest almost all your equity into income-generating property.

That's a powerful wealth-building move for those willing to plan ahead.

Start Your 1031 Exchange with Chalet Today

If you're considering a 1031 exchange as part of selling your home and investing in rentals, Chalet is here to help make it seamless.

We can connect you with vetted 1031-savvy real estate agents who specialize in short-term rental investments, as well as lenders and tax advisors who understand the unique needs of 1031 timelines.

You can also start browsing Airbnb rentals for sale right now on our platform to identify potential replacement properties that fit your goals.

With free market analytics and a curated network of pros, Chalet simplifies the process from research to ROI to exchange to operation, all in one place.

Next Steps:

📞 Connect with a 1031-Savvy Agent

Get introduced to an experienced local agent who has helped 1031 exchange buyers find short-term rental properties in compliant markets. They'll guide you on what listings can meet your 45-day ID window and have strong rental potential.

🔎 Explore Airbnb Investment Properties

Ready to see what you could buy with your exchange funds? Check out Airbnb rentals for sale across top-performing markets. Use Chalet's free analytics to compare cap rates and projected income, so you invest with confidence.

Use Chalet's ROI and DSCR calculator to understand what you can afford and what returns to expect from potential replacement properties.

Frequently Asked Questions

Can I do a 1031 exchange on my primary residence?

No, not directly. The IRS requires the property being exchanged to be held "for productive use in a trade or business or for investment." Your primary residence doesn't qualify because it's for personal use.

But you can convert your primary residence into a rental property by moving out, renting it to tenants at fair market value for 1-2 years, and then selling via a 1031 exchange. This legitimate conversion changes the property's character from personal to investment.

How long do I need to rent out my home before doing a 1031 exchange?

While the IRS doesn't specify an exact minimum, tax advisors typically recommend renting your former home for at least 12-24 months before selling.

The IRS safe harbor guideline suggests renting for at least 14 days in each of two consecutive years with minimal personal use (less than 14 days per year or 10% of rental days).

A two-year rental period with legitimate tenants at market rates is a conservative approach that clearly demonstrates investment intent.

Can I use both the $250k/$500k home sale exclusion and a 1031 exchange?

Yes! This is one of the most powerful strategies.

If you meet the requirements for both Section 121 (lived in the home 2 of the last 5 years) and Section 1031 (converted to rental before sale), you can use the home sale exclusion first to eliminate up to $250k (single) or $500k (married) of gain, then defer the remaining gain with a 1031 exchange.

For example, if you have $700k in gains, you could exclude $500k and defer $200k into your next property, paying zero tax at sale.

What happens if I rent my home to a family member?

Renting to family members is risky. The IRS requires rentals to be at fair market value to count as legitimate investment use.

If you rent to family for below-market rates (or free), the IRS will treat this as personal use, not investment use, which could disqualify your 1031 exchange.

If you must rent to family, charge full market rent, document everything thoroughly, and treat it as a true arm's-length transaction.

How does depreciation recapture work with a 1031 exchange?

When you convert your home to a rental, you can claim depreciation deductions. But this depreciation must eventually be "recaptured" and taxed at 25% when you sell.

A 1031 exchange defers this depreciation recapture tax along with capital gains, but it doesn't eliminate it. The recapture carries over into your new property's basis.

Note that the Section 121 home sale exclusion does NOT apply to depreciation, you'll owe tax on depreciation even if other gains are excluded.

Can I move into a property I acquired through a 1031 exchange?

Yes, but not immediately.

The IRS safe harbor requires you to hold the replacement property as a rental for at least 24 months, renting it for at least 14 days in each of those two years before converting it to personal use.

Also, if you later want to sell it and use the home sale exclusion, you must own it for at least 5 years total and live in it for 2 of the last 5 years. This is called the "5-Year Rule."

What are the 1031 exchange deadlines I need to know?

There are two critical deadlines:

45-Day Identification Period: You must identify potential replacement properties in writing within 45 days of closing on your old property. Typically you can identify up to three properties.

180-Day Exchange Period: You must close on your replacement property within 180 days of selling your original property. These deadlines are strict and not extended for weekends, holidays, or tax filing deadlines.

Missing either deadline means the exchange fails and you'll owe immediate taxes.

What is a qualified intermediary and why do I need one?

A qualified intermediary (QI) is a neutral third party who holds your sale proceeds during the 1031 exchange process.

You cannot touch the money between selling your old property and buying the new one, if you do, the IRS considers it a taxable sale.

The QI ensures you remain compliant with IRS rules. You must set up your QI before closing on the sale of your property. This is a legal requirement, not optional.

Can I do a 1031 exchange from a primary residence into multiple rental properties?

Yes. Once your primary residence qualifies as investment property (after the rental conversion period), you can exchange into one or more replacement properties.

Many investors use this strategy to diversify into multiple Airbnb rentals or short-term rental properties across different markets.

The total value of replacement properties must equal or exceed the value of the property you're selling to fully defer all taxes.

What happens if my home's gains are less than $250k/$500k?

If your gains are within the Section 121 exclusion limits, you likely don't need a 1031 exchange at all. You can simply sell your primary residence and take the tax-free exclusion without converting it to a rental first.

But if you want to reinvest all proceeds into rental properties (not just shield gains from tax), you might still choose to convert and use a 1031 exchange to maintain maximum buying power for your next investment.

How does Chalet help with 1031 exchanges?

Chalet provides a complete ecosystem for 1031 exchange investors:

• Free market analytics to quickly identify high-performing STR markets within your 45-day identification window

• Vetted real estate agents experienced with 1031 timelines who can help you find and close on compliant properties fast

• DSCR lenders who understand investment property financing and can close in 30-45 days

• ROI calculators to quickly underwrite potential replacement properties

• Regulation databases to ensure your target markets allow short-term rentals

We help you execute your exchange on time without scrambling.