So, is an Airbnb a good investment? The short answer is yes, but it's definitely not for everyone.

While a short-term rental can pull in way more revenue than a traditional long-term lease, it also demands far more of your time and attention. It comes with a unique set of risks that can vaporize your profits if you aren't prepared for them.

The Real Answer to “Is Airbnb a Good Investment?”

Think of an Airbnb less like a passive real estate holding and more like running a small hospitality business. Success isn’t just about buying a property; it's about mastering the art of the guest experience, nailing your pricing strategy, and keeping the operational side of things running smoothly.

The potential for a powerful income stream is undeniable. But getting there requires a clear-eyed approach that balances the exciting upside with the demanding day-to-day realities. You're not just a landlord collecting rent—you're a host creating a temporary home for travelers. This one distinction is the key to understanding both the profit potential and the challenges ahead.

The Core Pillars of a Successful STR Investment

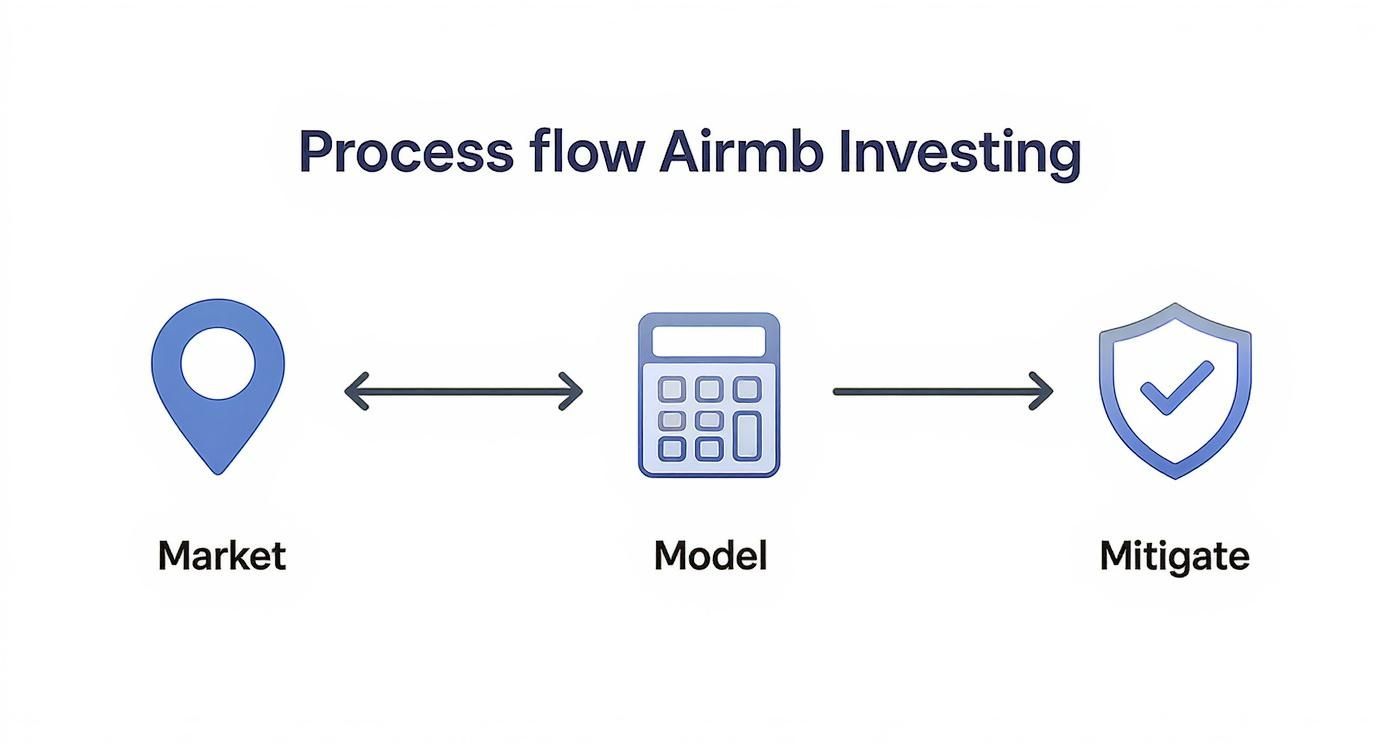

To get past the social media hype and build a real, durable short-term rental business, you need to lock in three foundational pillars:

- Strategic Market Selection: This is the single most important decision you'll make. A beautiful property in an over-saturated or legally restrictive market is a recipe for failure.

- Accurate Financial Modeling: You have to be able to confidently project your revenue, account for all expenses (especially the hidden ones), and calculate your true return on investment.

- Proactive Risk Mitigation: From navigating local regulations to getting the right insurance, protecting your asset is just as crucial as generating income from it.

The global demand for unique travel experiences just keeps growing. Industry data shows that the Airbnb user base has surged past 275 million users, and hosts globally earned an average of $44,235 annually. In fact, 62% of hosts use this income to help offset their own rising living costs, which shows the real financial impact a well-run rental can have. You can find more details on global trends in short-term rentals on oysterlink.com.

Ultimately, whether an Airbnb is profitable for you comes down to preparation. For a deep dive into the numbers, check out our article on how owning an Airbnb can be profitable with a financial breakdown.

A successful Airbnb investment is built on data, not just dreams. Understanding your market's performance, local laws, and true operational costs is the difference between a high-yield asset and a high-stress liability.

Before we go deeper, here’s a quick overview comparing the primary pros and cons of adding a short-term rental to your portfolio.

Airbnb Investing at a Glance: The Pros and Cons

| Key Aspect | Potential Upside | Potential Downside |

|---|---|---|

| Income Potential | Significantly higher monthly revenue compared to long-term rentals. | Income can be inconsistent and highly dependent on seasonality. |

| Flexibility | Ability to use the property for personal stays between guest bookings. | Personal use can complicate taxes and reduce available rental days. |

| Management | Direct control over property standards, pricing, and guest experience. | Requires active, hands-on management—it's a part-time job. |

| Regulations | Favorable in some markets, allowing for a straightforward business setup. | Constantly changing local laws can restrict or even ban operations. |

| Wear and Tear | More frequent professional cleanings can keep the property in top shape. | High guest turnover leads to more wear on furnishings and fixtures. |

This table gives you a snapshot, but as you can see, every upside has a corresponding challenge you need to be ready for.

How to Accurately Calculate Your Airbnb Profits

Jumping into an Airbnb investment without running the numbers is like flying a plane without an instrument panel. You have to get past the flashy revenue estimates and build a real financial forecast to know if a deal truly makes sense.

This means treating the property less like a piece of real estate and more like a small business, with its own profit and loss statement.

First things first: you need to project your potential revenue. This isn't just guesswork; it's a data-driven process. The goal is to analyze what similar, comparable properties are actually making in your target area. Look hard at their average daily rates (ADR) and occupancy rates throughout the year, especially noting the seasonal peaks and valleys. A ski cabin in Colorado has a completely different revenue curve than a beach house in Florida, and your numbers need to reflect that reality.

Once you have a solid revenue estimate, the real work begins. You have to meticulously subtract every single operating expense. This is where so many new investors stumble—they dramatically underestimate the true cost of running a short-term rental.

This simple flow chart breaks down the core stages of a smart Airbnb investment strategy. It starts with market selection, moves to the financial modeling we're discussing here, and ends with mitigating risks.

This framework isn't just about crunching numbers; it's a disciplined approach that separates successful investments from the ones that bleed cash.

Tallying Up Your Operating Expenses

To get a true picture of your profit, you have to account for both the obvious and the hidden costs. Think of it like peeling back the layers of an onion—each layer reveals another expense eating into your bottom line. Your list needs to be exhaustive, covering everything from the mortgage payment down to the cost of replacing coffee pods.

Here’s a breakdown of common expenses you absolutely must factor in:

- Financing and Property Costs: This is the big stuff—your monthly mortgage principal and interest, property taxes, and homeowners' insurance.

- Utilities: Don't forget electricity, gas, water, sewer, trash, and especially high-speed internet. Guests expect these to be fast and flawless.

- STR-Specific Services: This category can be a budget-killer. It includes professional cleaning fees (often your largest operational cost), landscaping, and pest control.

- Supplies and Consumables: You'll be constantly restocking toiletries, coffee, paper towels, and cleaning supplies. These small costs add up surprisingly fast.

- Maintenance and Repairs: Things will break. It’s not an if, but a when. A good rule of thumb is to set aside 1-2% of the property's value each year for routine upkeep.

- Platform and Management Fees: Airbnb takes a 3% host fee off the top. If you hire a property manager to handle the day-to-day, expect their fees to run between 20-30% of your gross revenue.

Key Metrics to Measure Your Return

With your revenue and expenses mapped out, you can finally calculate the two most important metrics for any real estate investment: Cap Rate and Cash-on-Cash Return.

Capitalization Rate (Cap Rate) is your property's profitability relative to its purchase price. It’s a clean way to see your potential return if you bought the property with all cash.

Cap Rate Formula: Net Operating Income (NOI) / Property Purchase Price

Your Net Operating Income (NOI) is your total annual revenue minus all operating expenses before you factor in your mortgage payment. A higher cap rate generally signals a more profitable investment.

Cash-on-Cash (CoC) Return is arguably the most critical number for investors using a loan. It measures the annual cash profit you get back relative to the actual cash you pulled out of your own pocket to buy the place.

CoC Return Formula: Annual Cash Flow / Total Cash Invested

Here, Annual Cash Flow is your NOI minus your annual mortgage payments. Total Cash Invested is your down payment, closing costs, and any initial money spent on furniture and repairs. This metric tells you exactly how hard your money is working for you.

Running these numbers can feel complicated, but it's a non-negotiable step in your due diligence. To make it easier, you can use our free Airbnb profit calculator to model different scenarios and get a crystal-clear picture of a property's true potential. A good tool helps ensure your final decision is based on sound data, not just gut feeling.

Understanding the Hidden Risks of Airbnb Investing

The high-return potential of an Airbnb is what gets everyone excited, but it comes with a unique set of risks that can turn a profitable investment into a financial nightmare. Knowing these challenges isn't meant to scare you off; it's about making you smarter. The best investors don't just react to problems—they see them coming and build a plan to sidestep them from the start.

The biggest mistake new investors make is thinking they can just buy a property, list it, and watch the money roll in. That’s a fantasy. The reality is that short-term rentals are a dynamic business where regulations, market demand, and operational problems can flip on a dime. Protecting your investment means being proactive, not reactive.

Navigating the Regulatory Maze

The single biggest threat to any Airbnb investment is regulatory risk. Cities and counties all over the country are constantly changing the rules. A property that’s a cash cow one day can become illegal to operate the next with a single vote from the city council.

This isn’t some far-off possibility; it happens all the time. Imagine putting $75,000 down on a property, furnishing it, and then six months later, the local government bans rentals that aren't owner-occupied. Just like that, your entire business model is wiped out.

This is why your due diligence before buying is non-negotiable. Before you even think about making an offer, you have to become an expert on the local laws.

- Zoning Ordinances: You need to personally confirm that the property's specific zoning code allows for short-term rentals. Don't take the seller's or even your agent's word for it. Call or visit the local planning department yourself.

- Licensing and Permits: Get the full picture of what it takes to get and renew a short-term rental license. Are there limits on how many are issued? What are the annual fees and inspection rules?

- HOA Restrictions: If the property is in a community with a Homeowners Association, you must read the covenants and bylaws cover to cover. Many HOAs have strict prohibitions or severe limits on any kind of short-term renting.

Getting a handle on these rules can be a real headache. To help you out, we put together a detailed guide on how to navigate local regulations and short-term rental licensing that walks you through the critical steps.

Never assume a property can be used as an Airbnb. Verify its legal status directly with the city or county authorities before you invest a single dollar. This one step can save you from a catastrophic financial mistake.

Market Volatility and Seasonality

Unlike a long-term rental that brings in a steady check every month, an Airbnb's income can swing wildly. This volatility is driven by seasonality, local events, and the economy at large. A beach house in Florida might print money from March to August, but see its occupancy crash in the fall.

Relying on peak-season income to carry you through the whole year is a recipe for disaster. You have to underwrite your deal based on a conservative, year-round average. Dig into historical market data to get a realistic picture of occupancy and nightly rates during both the high and low seasons. That financial cushion is what will get you through the slow months and keep your property profitable.

The Headaches of Daily Operations

Let's be clear: an Airbnb is not a passive investment. It’s an active hospitality business that demands constant attention. The operational risks are very real and can quickly burn out an unprepared host.

- Problem Guests: Most guests are great, but it only takes one bad one to cause thousands in damages or create a nightmare with noise complaints from your neighbors.

- Maintenance Surprises: When a water heater bursts or the AC dies in the middle of a guest's stay, it's not just an inconvenience. It’s a threat to your five-star reviews and an emergency expense you have to handle immediately.

- Insurance Gaps: Your standard homeowner's insurance policy will not cover commercial activity. You absolutely need specialized short-term rental insurance to protect you from liability claims and property damage.

The only way to manage these risks is by building solid systems from day one. That means thorough guest screening, a reliable team of cleaners and handymen on speed dial, and the right insurance coverage. If you’re not prepared for the operational grind, even a great property can turn into a bad investment.

How to Find a Profitable Market for Your Airbnb

Let’s get one thing straight: your property's location is the single most important factor in whether your Airbnb will make you money or cost you money. You could have the most beautifully designed home in the world, but if it’s in a weak market, it's a financial dead end. On the flip side, even an average property can become a cash-flow machine in a high-demand area.

Finding that perfect market is more than just picking a popular tourist town. It’s a strategic, data-driven hunt.

Think of yourself as a scout for a pro sports team. You’re not just looking for a good player; you’re looking for the right player who fits your team’s specific needs. In the same way, you need to find a market that lines up with your financial goals and what you’re willing to risk. That means digging into the numbers that reveal a market’s true health.

This screenshot from Chalet’s market data platform gives you a glimpse of the kind of intel you need. It lays out revenue potential, occupancy rates, and even regulatory risk side-by-side. This is how you move past guesswork and start making decisions based on what’s actually happening on the ground.

Analyzing the Core Market Metrics

To really get what makes a market tick, you have to look past the buzz and dive into the key performance indicators (KPIs) that professional hospitality investors live by. These numbers tell the true story of supply and demand.

Three of the most important metrics are:

- Average Daily Rate (ADR): This is the average price your rental earns per booked night. A high ADR means you have strong pricing power.

- Occupancy Rate: Simply, the percentage of available nights that are actually booked. High occupancy signals consistent demand.

- Revenue Per Available Room (RevPAR): Calculated by multiplying ADR by the occupancy rate, RevPAR is the gold standard. It gives you the clearest, most balanced view of a market's ability to generate revenue.

Here’s why it matters. A market with a sky-high ADR but low occupancy is probably too seasonal, which can lead to painful cash flow gaps in the off-season. And a place with high occupancy but a rock-bottom ADR suggests the market is saturated, forcing hosts into a race to the bottom on price. The sweet spot is a market with a healthy, balanced RevPAR—that’s where you find both strong demand and solid nightly rates.

Beyond the Numbers: Qualitative Factors

Data is king, but it doesn’t tell the whole story. The best markets have strong qualitative factors backing up the numbers. Think of these as the "moat" around your investment, protecting its long-term value.

You need to be a bit of a detective and investigate:

- Local Event Calendars and Attractions: Are there year-round demand drivers? Look for convention centers, universities, major concert venues, or annual festivals that keep heads in beds long after the peak tourist season ends.

- Economic Stability: Seek out markets with diverse economies and job growth. A town that relies on a single seasonal industry is far riskier than one with multiple economic engines.

- Regulatory Landscape: This is a non-negotiable, make-or-break factor. You have to confirm the local zoning laws, permit requirements, and taxes. A "friendly" regulatory environment is one of your most valuable assets. To get a handle on this, mastering hotel competitive analysis can give you invaluable market intelligence.

The ideal Airbnb market is a blend of art and science. It requires robust data showing strong performance metrics combined with on-the-ground research that confirms a stable, business-friendly environment with year-round appeal.

Established Markets vs. Emerging Opportunities

When picking a spot, you’ll often face a choice: go with a proven, high-revenue market or bet on an up-and-coming, high-growth location. An established market—think major tourist hubs—offers proven demand, but it usually comes with sky-high property prices and fierce competition.

Emerging markets, on the other hand, can offer a lower cost of entry and a much higher potential for appreciation. The number of active Airbnb listings worldwide recently hit 7.7 million, and the real story is where the growth is happening. Supply in suburban and rural areas jumped by 18% and 23% year-over-year, respectively. This shows that fantastic opportunities are popping up far beyond the traditional city centers.

Smart Financing and Tax Strategies for Investors

Finding the right property is a huge win, but how you finance and manage it financially is what truly determines your profit. The answer to "is Airbnb a good investment?" often hinges on the strength of your financial strategy—from the loan you pick to the tax deductions you claim.

Think of it this way: your financing and tax planning are the engine of your investment. A well-tuned engine gets you to your destination faster and with less fuel. A poor financial plan, on the other hand, is like driving with the emergency brake on; you're just fighting yourself the whole way.

Finding the Right Loan for Your Rental

Buying an investment property isn't like buying your own home. You can't just walk into a bank and expect the same type of loan. Lenders see these properties as higher risk, which means they tighten their requirements.

Most investors go down one of two main paths:

- Conventional Investment Property Loans: These feel a lot like a standard mortgage, but you'll need a much larger down payment—typically 20-25%—and a higher credit score. Lenders will put your personal finances under a microscope to make sure you can easily cover the mortgage.

- DSCR (Debt Service Coverage Ratio) Loans: For many investors, these loans are a game-changer. Instead of digging into your personal income, lenders qualify you based on the property's projected rental income. As long as the numbers show the property can pay for itself, you're likely to get approved.

Leveraging Powerful Tax Advantages

This is where running your Airbnb like a business really starts to pay off. For investors, mastering financial management is just as important as watching market trends because the tax code is packed with benefits for real estate owners.

One of the most powerful tools in your arsenal is depreciation. The IRS lets you deduct a portion of your property's value each year to account for wear and tear. The best part? You can do this even if your property is actually gaining value. It's a "phantom expense" that lowers your tax bill without you spending a dime.

Beyond depreciation, you can deduct pretty much every ordinary and necessary expense that comes with running your rental.

Think of your property as a small business with its own P&L. Every legitimate expense—from the mortgage interest you pay to the coffee pods you stock for guests—is a potential tax deduction that pads your bottom line.

The list of deductible expenses is long and can make a huge difference in your returns.

- Operating Costs: This covers the big stuff like mortgage interest, property taxes, and insurance premiums.

- Guest Supplies: Everything you buy for your guests counts, from soap and shampoo to paper towels and snacks for the welcome basket.

- Utilities: Your internet, electricity, water, and gas bills are all part of the cost of doing business.

- Services: Professional cleaning, landscaping, pest control, and any property management fees are fully deductible.

- Repairs and Maintenance: The cost to fix a leaky faucet or get the HVAC serviced can be written off.

Getting a handle on these benefits is critical. For a deeper dive, check out our guide on short-term rental tax deduction strategies to make sure you're not leaving money on the table. A smart tax plan is what turns a good investment into a great one.

So, Is an Airbnb Investment Right for You?

We've crunched the numbers, walked through the risks, and outlined the strategies. But the big question is still on the table: is an Airbnb a good investment for you?

The answer isn't hiding in a spreadsheet or a market report. It really comes down to a gut-check on your own goals, what you're willing to put in, and your personality as an investor.

The trade-off is pretty straightforward. An Airbnb can potentially generate significantly more income than a traditional rental, but it’s not a sit-back-and-collect-checks kind of deal. It demands a lot more hands-on effort and comes with its own unique set of headaches. This is an active small business, not a passive asset. For the right person in the right place, it can be an absolute powerhouse for building wealth.

A Quick Self-Assessment

Before you jump in, ask yourself these questions. Be honest—the answers will tell you if this path truly fits your life.

- How hands-on do I really want to be? Are you ready to field guest messages at 10 PM or scramble to find an emergency plumber? Or does the thought of that make you want to stick with a completely hands-off investment?

- What’s my actual tolerance for income swings? Can your finances weather a slow season where revenue dips by 50% or more? Or do you need the steady predictability of a fixed monthly rent check?

- Do I have the cash to get started? Think beyond the down payment. Do you have enough set aside for furniture, initial supplies, and a six-month emergency fund to cover all your expenses while you ramp up?

An Airbnb can be an incredibly rewarding venture, but it rewards preparation and proactive management above all else. Success depends on treating it like the hospitality business it is, not just another piece of real estate.

If you find yourself nodding "yes" to these questions, then your next steps are clear. It's time to stop wondering and start validating.

Find a real property on the market that catches your eye and run the numbers through an Airbnb profit calculator. Give your city’s planning department a call to get the real story on local short-term rental rules. Taking these concrete steps is how you turn a vague idea into a real, tangible investment plan.

Of course. Here is the rewritten section, designed to sound like an experienced human expert and match the provided examples.

Final Questions Before You Jump In

Even with a solid plan, a few nagging questions can hold you back. Let's tackle the common uncertainties investors face right before they pull the trigger on a short-term rental. Getting these last few points straight is the key to moving forward with real confidence.

How Much Cash Do I Really Need to Start?

There’s no magic number here, since everything depends on your market and the type of property you're buying. But a good rule of thumb is to plan for much more than just the down payment.

For starters, lenders typically want 20-25% down on an investment property, so that’s your biggest upfront cost.

But don't stop there. You'll also need cash for:

- Closing Costs: Plan for another 2-5% of the purchase price to cover all the fees, taxes, and paperwork.

- Furnishing and Setup: This is a big one. It can run you anywhere from $10,000 for a small, simple condo to well over $30,000 to outfit a larger home that guests will love.

- "Sleep-at-Night" Money: I always recommend new investors have at least six months of total operating expenses (mortgage, utilities, insurance, the works) socked away in a reserve fund. This is your safety net for a slow season or an unexpected repair.

Is an Airbnb Actually More Profitable Than a Long-Term Rental?

From a pure revenue standpoint? Absolutely. In a decent market, it's not unusual for a short-term rental to bring in two to three times the gross monthly income of a traditional year-long lease. This is the main reason everyone's asking if Airbnb is a good investment these days.

But gross revenue is only half the story. The real question is whether it's more profitable after you account for the much higher operating costs of running a hospitality business.

The trade-off is simple: higher revenue potential in exchange for higher expenses and more hands-on effort. A well-run Airbnb will almost always beat a long-term rental on cash-on-cash return, but only if you manage it efficiently and keep it booked.

What Amenities Actually Drive More Bookings?

A great location gets you on the map, but the right amenities are what make guests click "book" and pay a premium for your property. Today’s travelers have high expectations, and investing in the features they’re actively searching for is one of the fastest ways to boost your revenue and stack up five-star reviews.

Think about adding these game-changers:

- Hot Tubs and Pools: These are consistently the top-searched amenities on booking sites. Adding one can instantly elevate your property and justify a much higher nightly rate, especially in vacation markets.

- Pet-Friendly Policies: A huge slice of the traveling public wants to bring their furry friends along. By saying "yes" to pets, you open your doors to a massive and often underserved market of grateful guests.

- A Real Workspace: With so many people working remotely, a dedicated desk, a comfortable ergonomic chair, and blazing-fast Wi-Fi are no longer just nice-to-haves. For many guests, they're non-negotiable.

Ready to stop wondering and start analyzing? At Chalet, we provide the data, tools, and expert connections you need to find and vet your next short-term rental investment. Explore real-time market data and find your next deal at https://www.getchalet.com.