Most investors budget for 8–12% of gross rent on residential management and 4–12% on commercial. Add in leasing, renewal, and inspection fees, and those line items quickly become a major line in your operating budget. Understanding these figures up front prevents unwelcome surprises down the road.

Quick Answer On Property Management Fees

Sarah, a rental investor, discovered her manager charged a 10% base fee plus 75% of the first month’s rent for leasing and $150 per inspection. Once she spotted those add-ons in Q1, she switched to a more transparent partner—and ended up saving $2,400 in just one year.

For most residential landlords, the typical fee breakdown looks like this:

- Base management: 8–12% of monthly rent

- Leasing/placement: 50–100% of one month’s rent

- Lease renewals: $300–$800 or 15–25% of monthly rent

- Inspections: $100–$200 per visit

Keeping this structure in mind helps you forecast costs accurately.

Before diving deeper, here’s a quick snapshot to bookmark:

Quick Fee Summary

| Service Type | Fee Range | Additional Notes |

|---|---|---|

| Residential | 8–12% of monthly rent | Excludes leasing and renewal fees |

| Commercial | 4–12% of monthly rent | Larger portfolios often land toward the low end |

| Leasing Fee | 50–100% of first month | One-time tenant placement charge |

| Inspection Fee | $100–$200 per visit | Typically billed separately |

Use this table to set realistic budgets and compare potential partners side by side.

Why Fee Transparency Matters

- It drives more accurate cash-flow projections and tighter budget planning.

- Hidden charges can shave 5–10% off your net returns each year.

- Clear terms foster trust between you and your manager, smoothing out the partnership.

“Clarity on fee structures is crucial if you want to maximize ROI on your rental investments.”

Common Fee Components

At its core, the base management fee covers essentials like rent collection, tenant communications, and maintenance coordination. On top of that, you’ll often see:

- Leasing Fees: A one-time charge to find and place a tenant.

- Renewal Fees: A fee for handling lease extensions—usually 15–25% of rent or a flat $300–$800.

- Inspection Fees: Property checks, safety reviews, and compliance visits, typically $100–$200 each.

For commercial assets, expect additional line items such as facility management, advanced tenant screening, and specialized reporting. Those extra services can lower the percentage rate but increase total costs because you’re managing larger properties.

Investors can benchmark these rates in real time using Chalet’s comparison tools. That way, you can anticipate add-on costs and negotiate from a position of knowledge.

This quick guide lays out standard fee ranges so you can choose confidently—and protect your rental ROI from hidden drains. In the next section, we’ll unpack what drives these fees and how to model their impact on your returns.

Understanding Key Concepts

Think of your property manager as a seasoned pilot charting a course from takeoff to touchdown. They run pre-flight checks—tenant screening, maintenance coordination—and keep everything on track midair. This analogy shows why each fee you pay matters at different stages of the journey.

- Base Management Fee covers rent collection, tenant communications, and routine maintenance coordination.

- Leasing Fee is a one-time cost for marketing the property and securing a new tenant.

- Renewal Fee applies when extending a lease, usually a flat charge or a small percentage of rent.

- Inspection Fee pays for periodic walkthroughs and compliance checks.

- Setup Fee funds the initial onboarding, property prep, and all the paperwork.

Most firms prefer percentage-based fees because they flex with rent levels, keeping managers focused on performance. Flat rates exist, but they can short-change managers on high-value assets or leave you paying too much when markets dip.

By 2025, residential property management fees have coalesced around 8–12% of monthly rent, with a national average of 8.49%. Leasing fees typically hit 70–100% of one month’s rent, renewal fees run $500–$1,000 or about 20% of rent, and inspection visits cost about $110 each. Learn more about these 2025 findings on Belong Home.

Percentage Vs Flat Rates

Percentage fees rise and fall with your rent, so your manager has skin in the game. Flat fees offer cost certainty but may not reflect market swings—either leaving you overpaying or undercompensating your manager. This framework lays the groundwork for detailed examples ahead.

Check our glossary of terms for quick definitions and deeper context.

Key Insight: A transparent fee structure is like a flight itinerary—clear checkpoints and costs at every stage.

Why Fee Components Matter

Each fee aligns with a phase in your rental’s lifecycle, making sure no detail is overlooked.

Base management fees keep day-to-day operations humming, while leasing fees fuel marketing and tenant vetting. Renewal fees reward tenant retention and cut down on vacancies. Inspection and setup fees ensure safety, compliance, and a seamless move-in process.

- Takeoff Stage: Tenant screening, marketing strategy, and lease execution

- Cruise Stage: Routine management, financial reporting, and upkeep

- Descent Stage: Lease renewals and compliance inspections

- Maintenance Loop: On-demand repairs and onboarding tasks

With this pilot-style breakdown, you’ll feel confident comparing and negotiating fee structures. In the next section, we’ll unpack real-world fee scenarios for long-term and short-term rentals.

Using Chalet’s dashboard, you can simulate fee impacts on your net yield instantly. Plug in rent projections and fee assumptions to visualize cash flow and ROI over time.

This hands-on modeling lets you fine-tune fee percentages before signing any contract. Next up: actual fee structures and market-specific ranges backed by data charts. Armed with these concepts, you’re ready to analyze sample fee breakdowns and enjoy smoother forecasting ahead.

Factors That Affect Property Management Fees

The world of property management feels more like tuning an orchestra than flipping a switch. Every feature you add and each rule you comply with can push fees up or pull them down.

Think of your rental portfolio as a greenhouse. A row of resilient succulents barely needs your attention, but a mix of orchids, vines, and tropical blooms demands careful humidity control, precise lighting, and specialized soil blends.

In property terms, a sprawling multifamily building with diverse layouts and high-end perks will naturally command a higher management fee than a standalone single-family home.

As your real estate ecosystem gets more complex, you’ll need a manager equipped with the right tools and expertise. Here are the top factors to watch:

- Property Type: Short-term rentals (STR) usually involve higher turnover, cleaning, and marketing costs than long-term leases.

- Location: Urban hotspots with fierce competition—and strict regulations—tend to carry steeper management fees.

- Unit Count: More doors mean more inspections, tenant communications, and logistical coordination.

- Service Scope: Features like 24/7 guest support, online portals, or bundled maintenance plans can add to your base rate.

Market And Regulation Impact

Local rules and supply-and-demand dynamics can tilt fees in surprising ways. Strict rent-control ordinances or complex building codes often drive managers to raise rates to cover compliance headaches.

On the flip side, markets brimming with licensed property managers can force fees downward as companies vie for your business.

Fact The U.S. property management market is projected to reach $134.2 billion by 2025, growing at a 1.9% CAGR over five years. For a deeper look, see IBISWorld’s Property Management Industry Report.

Technology choices and portfolio size round out the picture. A savvy manager using modern software can shave hours off manual tasks, translating into lower fees. Some firms charge extra for proprietary platforms, while others include an online portal at no additional cost. And if your portfolio is sizable, you can often negotiate a discounted percentage.

- Inventory your required services and align them with managers’ fee tiers—so you only pay for what you truly need.

- Survey three to five local managers to benchmark base rates, add-ons, and premium offerings across comparable properties.

- Simulate different scenarios on Chalet’s fee calculator using your property type, location, and unit count.

Tips For Predicting Your Fees

Mapping your property’s details in a simple spreadsheet is the fastest way to forecast management costs. Plug in variables like unit count, rent levels, and expected occupancy to see how fees shift.

| Factor | Typical Fee Range |

|---|---|

| Single-Family Home | 8–10% of monthly rent |

| Multi-Unit Complex | 10–12% of monthly rent |

| Short-Term Rental | 15–25% of gross rental income |

For instance, a 10-unit apartment building in a regulated market might incur roughly 11% in base fees plus $150 per scheduled inspection. Bundling routine inspections and basic maintenance can often knock 0.5–1% off your effective rate—boosting net returns with minimal effort.

Tip: Use Chalet’s free analytics dashboard to run fee simulations in minutes and compare multiple management scenarios side by side.

By balancing property complexity, market forces, and service options, you can project fees accurately and safeguard your ROI. Next, we’ll break down fee models for different property types and rental strategies to help you refine your budget.

Actionable Next Steps

- Create a side-by-side chart listing each fee driver and estimate its monthly impact.

- Share your findings with potential managers to lock in transparent terms and predictable rates.

Now you’re ready to negotiate with confidence—and ensure your management fees match the level of service your portfolio demands.

Typical Property Management Fee Structures And Ranges

We’ll walk through the most common fee setups for residential, long-term, and short-term rental (STR) properties. By the end, you’ll understand what drives costs, see how different services stack up, and learn how to use Chalet’s tools to find the best deal.

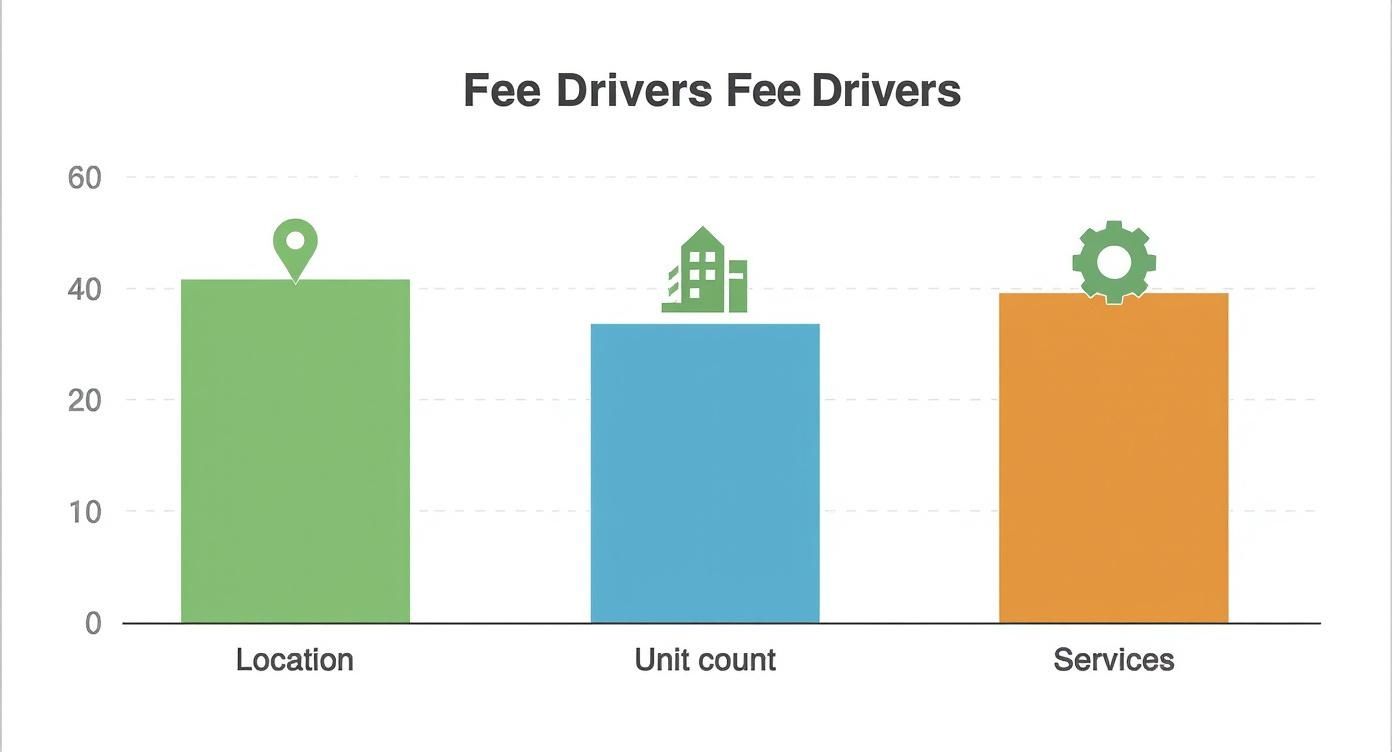

Below, you’ll find a quick overview of the top factors—location, unit count, and level of service—that shape management fees.

This graphic highlights how each driver pushes pricing up or down. You’ll notice that adding specialized services often raises your overall bill—but can boost net income by improving occupancy and tenant satisfaction.

Residential And Long-Term Rental Fees

Managing a single-family home or long-term lease typically costs 8%–12% of monthly rent.

Common extra charges include:

- Leasing Fees: Often 50–100% of one month’s rent

- Renewal Fees: Generally $300–$800 or 15–25% of monthly rent

- Inspection Fees: Around $100–$200 per visit

Many managers will bundle inspections or offer discounts on renewals if you entrust them with multiple properties.

Short-Term Rental Fees

Because STRs demand frequent turnovers, marketing, and 24/7 guest support, expect higher base rates—usually 15%–25% of gross income.

On top of that, cleaning, key exchange, and extra guest services can tack on another 5%–10%.

“Short-term rentals justify higher fees with dynamic pricing tools, professional photography, and constant guest care,” notes one seasoned operator.

Some firms also add a one-time onboarding fee between $100 and $500, though it’s often waived for larger portfolios.

Commercial Fee Structures

Commercial buildings follow a different scale: you’ll see 4%–12% of monthly rent, depending on property size and service scope.

Smaller, local managers tend to charge 6%–8%, while national firms hover at the top end due to more comprehensive offerings.

Fee Structure Comparison

Here’s a snapshot of how management charges break down by property type:

| Property Type | Base Fee | Leasing Fee | Inspection Fee |

|---|---|---|---|

| Single-Family Home | 8%–10% | 50–100% of one month | $100–$200 per visit |

| Multi-Unit Apartment | 10%–12% | 75–100% of one month | $120–$250 per visit |

| Short-Term Rental | 15%–25% | Included in base fee | $150 per turnover |

| Commercial Portfolio | 4%–12% | 50–100% of one month | Custom per contract |

This table makes it easy to compare how fees shift between residential, long-term, STR, and commercial setups. Notice how STRs bundle leasing but charge more for inspections tied to guest turnover.

Budgeting For Single-Family And Multi-Unit

Let’s put real numbers to these percentages:

• Single-Family Annual Cost

– Base Fee: 9% of $2,000 × 12 = $2,160

– Inspections & Renewals = $600

– Total ≈ $2,760

• Multi-Unit Annual Cost

– Base Fee: 11% of $1,500 × 10 × 12 = $19,800

– Inspections = $800

– Total ≈ $20,600

As you add more units, fees scale quickly—making it worthwhile to negotiate lower rates for larger portfolios.

Check out our detailed guide on forecasting and comparing property management services at Chalet: https://www.getchalet.com/property-management

To see how other firms price out their offerings, you can also explore various property management pricing models.

Setup And Onboarding Details

Most managers tack on a one-time setup fee for marketing, listing creation, and vendor coordination. These usually land between $100 and $500, though high-volume clients often secure waivers or discounts.

Using Chalet Tools For Fee Comparison

Chalet’s free comparison dashboard lets you plug in rent amounts, service levels, and location data. In seconds, you’ll see side-by-side proposals that expose hidden costs—like lease renewal surcharges or extra inspection fees—so you can align your choices with your target net yield.

How To Compare And Negotiate Property Management Fees

Putting your detective hat on is the first step. Dive into each proposal line by line and expose any hidden costs before they erode your profits.

Vet Proposals Thoroughly

Begin by listing every service and fee. This gives you a clear view of what you’re paying for—and what you aren’t.

Use a side-by-side checklist to spot the differences at a glance.

Ask:

- What’s included? Rent collection, maintenance calls, guest handling.

- Which platforms do they use? Online dashboards, mobile alerts or both?

- How do you exit? Notice periods and penalty fees can sneak up on you.

- When will you see reports? Monthly, weekly—or in real time?

Apply Negotiation Strategies

Once proposals are on the table, it’s time to bargain like a pro.

- Bundle services. Combine management, cleaning or marketing for a volume discount.

- Gather three bids. More quotes mean more leverage.

- Tie fees to performance. Ask for occupancy or response-time guarantees.

Use Tools For Fee Comparison

Manual comparisons can take hours—sometimes days. Automated dashboards do the heavy lifting.

With Chalet’s comparison tool, you plug in rent levels, fee tiers and service options. Then you:

- Import proposals for a true head-to-head view.

- Filter by fee range, termination terms and reporting cadence.

- Export ready-to-share tables for partners or stakeholders.

Key Takeaway Thorough vetting and negotiation can cut fees by up to 2% of rent.

Learn more about fee variations in our guide on comparing different property management styles for short-term rentals.

Inspecting proposals with a fine-tooth comb arms you with data. From there, you forecast costs and guard your bottom line.

Short-term rentals often carry sneaky fees for cleaning or platforms. Detective-style vetting is your best defense.

With Chalet’s free analytics and proposal comparison tools, you can speed through the process in seconds.

Start by requesting at least three written quotes. See how each vendor prices similar properties.

Next, schedule a call to dig into fee caps, emergency response fees and add-on services.

Then, negotiate by proposing trial periods or performance incentives tied to booking targets.

Finally, capture every detail in writing. A transparent contract leaves no room for surprises.

Negotiating fees is like fine-tuning your sails. A few smart adjustments and you’re cruising toward better returns.

Download Chalet’s proposal comparison template to kick off your detective-style fee audit.

You’ll save time, protect revenue and ensure you only pay fair fees for top-notch management.

Property Management Cost Breakdown And ROI Examples

It’s one thing to talk percentages. It’s another to see them translate into dollars you pull into your pocket. These case studies walk you through a single-family home and a small multifamily property, laying out every fee, inspection charge, and renewal cost. Then we model annual management expenses side by side with simple versus pro services—so you can spot how a slightly higher fee might actually boost your cash flow.

Case studies translate percentage fees into tangible dollars and investor outcomes.

Single-Family Annual Cost Example

Imagine a standalone rental pulling in $2,500 a month. Here’s how the numbers break down over a year:

- Base Management Fee: 9% × $2,500 × 12 = $2,700

- Inspections & Renewals: 4 visits × $150 + $500 = $1,100

- Total Annual Management Cost: ≈ $3,800

That clear line-item view gives us a foundation for modeling your ROI.

We often see two trends:

- Single-family homes carry lower overall fees but only modest vacancy improvements.

- Multifamily portfolios can leverage per-unit discounts, unlocking larger savings at scale.

Small Multifamily Annual Cost Example

Now picture a 5-unit building with each unit renting for $1,800 per month:

- Base Management Fee: 11% × $1,800 × 5 units × 12 = $11,880

- Inspection Visits: 6 per year × $120 = $720

- Total Annual Management Cost: ≈ $12,600

As you add more units, complexity—and savings potential—both go up.

Industry Growth Context

Stepping back, property management is set to grow from $27.8 billion in 2025 to $28 billion by 2028 at a 7.5% CAGR. You can learn more in the global property management market report from Cognitive Market Research.

When you benchmark fees against these market trends, you gain leverage in negotiations and a clearer forecast for future expenses.

Actionable Takeaways

- Benchmark your base fee against market growth to set realistic targets.

- Factor in regional demand shifts to anticipate fee fluctuations.

- Align rent and occupancy projections with that 7.5% CAGR.

- Negotiate onboarding-fee waivers to cut upfront costs.

- Review management performance annually and adjust terms as needed.

ROI Comparison With And Without Management

| Metric | With Management | Self-Managed |

|---|---|---|

| Occupancy Rate | 95% | 85% |

| Average Vacancy Days | 18 days | 45 days |

| Net Annual Income | $26,100 | $23,100 |

| ROI | 10.8% | 9.6% |

This side-by-side table makes it obvious where professional oversight drives value.

Understanding ROI Components

True ROI goes beyond just the fee percentage. You need to factor in:

- Occupancy: each extra booked night adds to net yield.

- Fee percent: it cuts gross income, but can improve efficiency if service quality is high.

- Maintenance savings: timely repairs often offset higher management costs over time.

In our multifamily example, a proactive maintenance team (funded by a slightly higher fee) trimmed emergency repair bills by $1,200 each year. Chalet’s dashboard can simulate these effects using live market data.

Key Insights From Case Studies

- Higher base fees can slash vacancy by up to 40%.

- Professional coordination often trims maintenance overspend by 15%.

- Proactive lease renewals boost tenant retention rates.

- Operational oversight cuts emergency repair costs by up to 20%.

- Transparent reporting simplifies audits and builds investor trust.

Investing in experienced management can reduce vacancy periods by up to 30%, boosting annual returns.

For more detail on baseline costs, check out what hosts really pay for property management per month.

Next Steps With Chalet Tools

Ready to plug in your own numbers? Try Chalet’s free Airbnb calculator at Chalet Airbnb calculator. Use these case studies alongside our analytics to refine fee assumptions and maximize long-term returns. Once you’ve run a few simulations, schedule calls with potential managers to validate your projections and lock in the best terms.

Key Takeaways And FAQs On Property Management Fees

Tracking property management fees is your best defense against a shrinking ROI. When you break costs into management, leasing, renewals, inspections and setup, you gain true visibility. With that clarity, you can negotiate from a position of strength.

- Base Management Fee covers rent collection, daily operations and tenant communication.

- Leasing Fee pays for marketing, tenant screening and lease paperwork.

- Renewal Fee handles lease extensions and rewards tenant retention.

- Inspection Fee funds routine walkthroughs and compliance checks.

- Setup Fee underwrites onboarding tasks and initial listing creation.

Major Fee Drivers

Location, unit count and service scope largely determine your overall costs. In general:

- Short-Term Rentals run about 15–25% of gross income.

- Long-Term Leases sit in the 8–12% range of monthly rent.

To optimize your expenses:

- Compare multiple bids to benchmark local rates.

- Bundle services for volume discounts.

- Audit existing contracts each year to catch hidden surcharges.

“Getting clear on each fee can boost your net yield by up to 2%,” says an experienced rental strategist.

Think of a transparent fee schedule like a road map—you know every checkpoint cost before you set off.

Actionable Steps For Better Terms

A side-by-side comparison table can be your secret weapon. List every fee line, its percentage or flat charge, then tally up the annual cost.

- Gather at least three written quotes.

- Highlight add-ons like inspection and renewal fees.

- Propose performance-based incentives (for example, rebates if vacancy stays below 5%).

- Negotiate trial periods or fee caps into your contract.

| Step | Purpose |

|---|---|

| Get Quotes | Benchmark market rates |

| Compare Fees | Uncover hidden costs and unexpected surcharges |

| Negotiate Terms | Lock in lower percentages and bundled services |

| Review Annually | Ensure fees match your portfolio’s evolving needs |

FAQs On Management Fees

What Fees Apply During Vacancies?

Most managers pause the base management fee when a unit is empty. Some still charge a holding fee—typically 1–2% of rent—while others waive fees until a new tenant moves in.

How Do Short-Term And Long-Term Fees Differ?

Short-term rentals include guest turnover, cleaning and dynamic pricing, which pushes fees higher. Long-term management focuses on lease renewals and inspections, so rates tend to be lower.

Can Fee Structures Be Customized?

Yes. Many firms offer tiered plans—basic rent collection, mid-level services or full-service management. Larger portfolios often unlock volume discounts or tailored terms.

How Do Technology Platforms Affect Costs?

Modern software can cut manual work by 30%. Some managers bundle platform fees at no extra charge, while others pass along a fee—usually $10–$25 per month.

Key Takeaway Regularly audit your fee structure to keep costs aligned with actual services rendered.

Final Checklist For Investors

- Review the past 12 months of management statements for irregular or one-off charges.

- Confirm fee cap thresholds and contract termination terms.

- Test Chalet’s comparison tool for a clear side-by-side analysis.

- Reassess fee models annually to stay current with market shifts.

Use these steps to negotiate confidently, boost net income and share your findings with stakeholders. Start your audit today.

Ready to streamline your fee analysis and maximize returns?

Try Chalet at getChalet.com