Introduction

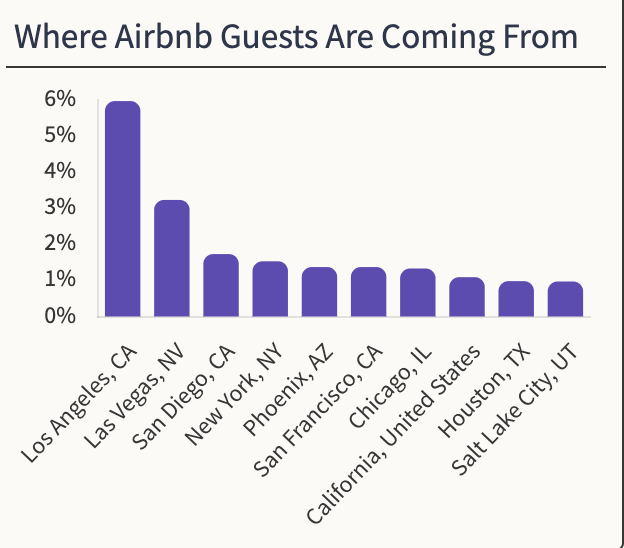

Las Vegas, Nevada, renowned globally as the entertainment capital of the world, has long been a beacon for tourists seeking glitz, glamour, and the thrill of the casino floors. However, beyond the famous Strip lies a bustling short-term rental market, offering visitors a more personalized and immersive experience during their stay. In this comprehensive guide, we delve into the intricacies of the Airbnb landscape in Las Vegas, exploring key statistics, market trends, and essential insights for both potential hosts and guests.

Market Overview

To understand the dynamics of the short-term rental market in Las Vegas, let’s delve into some key statistics and figures.

Supply

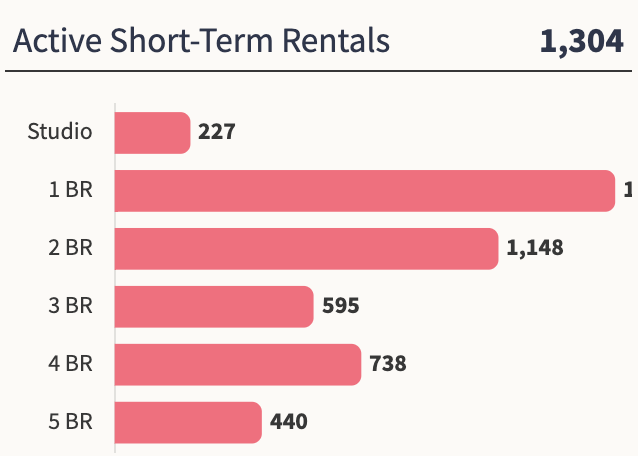

The most popular homes are 1-bedroom homes, comprising 40.15% of inventory. This is followed by 2 and 4-bedroom homes at 35.62% and 23.28% of the total inventory, respectively.

Homes Appreciation

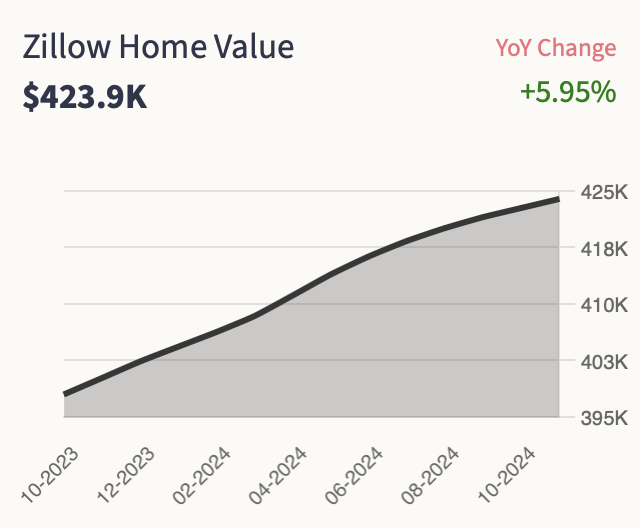

AS of July 2025, according to Zillow, homes in Las Vegas experienced an appreciation of 5.95%. This data indicates a significant decrease in property values.

Median Home Value

As of January of 2025, Homes in Las Vegas have depreciated by 5.95%. The median home value in Las Vegas is $423,900 as reported by Zillow. This figure highlights the city’s robust real estate market and the potential for long-term property appreciation.

Active Short Term Rentals

AS of July 2025, Las Vegas boasts a significant Airbnb rental market, with approximately 869 active rentals. This abundance of available properties provides ample opportunities for investors and homeowners looking to capitalize on the tourism demand.

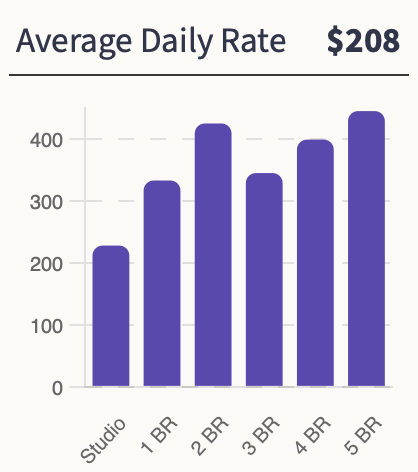

Average Daily Rate

The median ADR for the market is $208. The Average Daily Rate is the highest for 5-bedroom homes ($283) followed by 1-bedrooms and 4 bedrooms at $227 and $148 respectively.

Occupancy Rate

Chalet data reveals an occupancy rate of 57% for Airbnb rentals in Las Vegas. This high demand ensures a consistent stream of income for property owners and investors.

How Profitable is Airbnb in San Antonio ?

AS of July 2025, the average gross yield, which represents the annual income generated by a property as a percentage of its value, is 8.42% in Las Vegas. This figure suggests that short-term rentals in the city offer a favorable return on investment. Las Vegas is ranked #70 by return on investment on Airbnb rentals in the United States.

Annual Revenue

According to Chalet, short-term rentals in Las Vegas earn an average of $36,758 annually, highlighting the strong investment potential in the city’s market. You can evaluate your properties using our free Airbnb calculator.

Property Tax

According to SmartAsset, the average property tax in Las Vegas is 0.57%. This relatively moderate tax rate is an important consideration for those looking to invest in short-term rental properties.

Regulations

Las Vegas’s short-term rental regulations are somewhat investor-friendly, with different zoning regulations and limitations in place. Understanding these regulations is crucial for potential investors to ensure compliance and a smooth operation.

Top Places for Airbnb in Las Vegas

Las Vegas top submarkets for Airbnb investments include areas like ZIP code 89134, which has the highest gross yield at 20% and an annual revenue of $96,838. In contrast, ZIP code 89103 offers more extensive opportunities with 761 full-time listings, but a lower gross yield of 11%.

Home values also vary significantly, with properties ranging from $493.1K in 89134 to $279.7K in 89103, making each submarket unique in terms of investment potential and entry cost.