If you're buying your first Airbnb rental (or short-term rental, also called an STR), you're probably trying to answer one boring question that decides whether your cash flow survives: how much money should I set aside for repairs?

The tricky bit is that short-term rentals behave more like tiny hotels than traditional rentals. More guests, more turnover, more things breaking. A leaky faucet in January, a broken AC in July, and a water heater that decides to quit the week before Thanksgiving. Welcome to STR ownership.

This guide gives you a simple number you can use today, plus a framework that stays solid when your property (and your market) changes.

How Much Should I Set Aside for Airbnb Repairs?

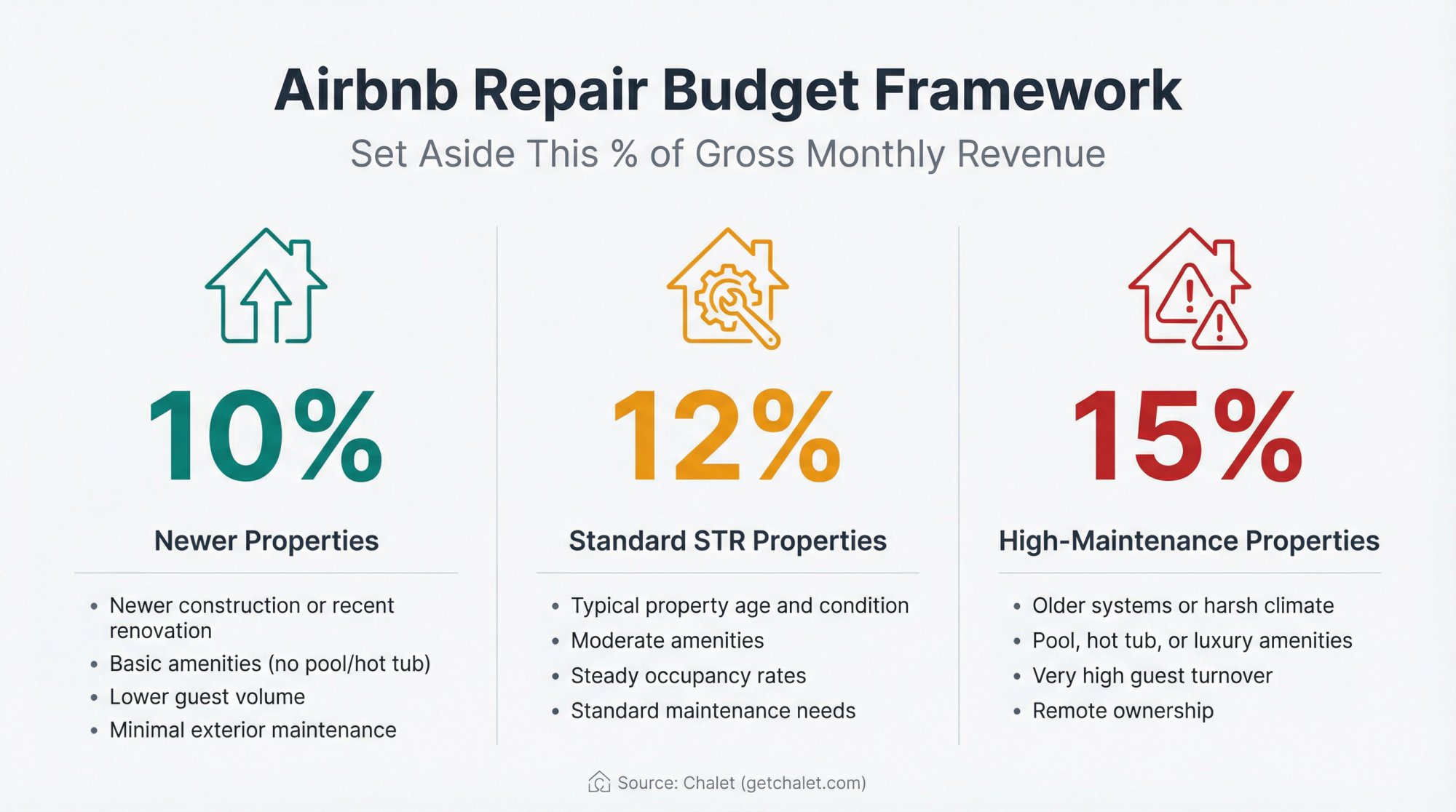

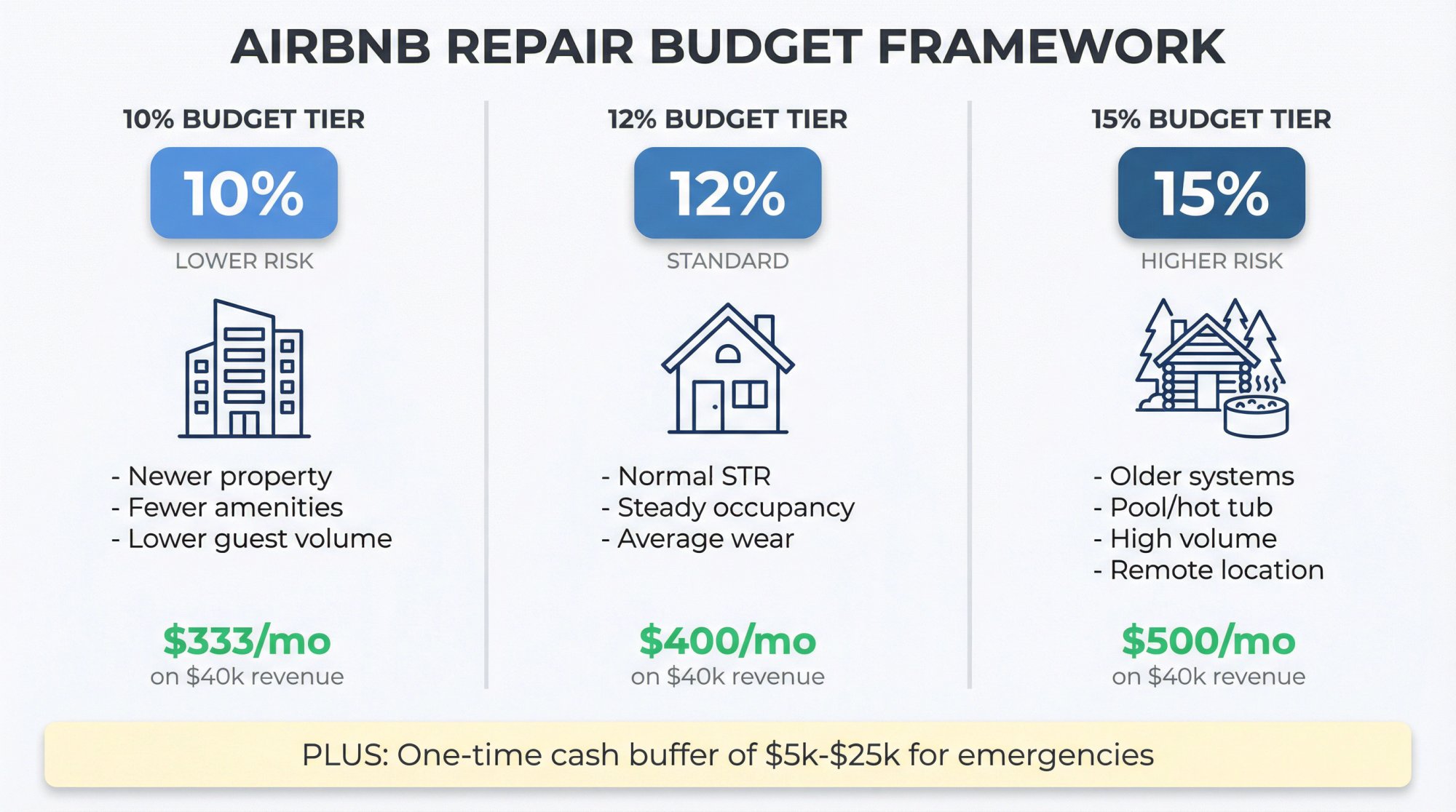

Most hosts set aside 10% to 15% of gross booking revenue for repairs, maintenance, and replacements.

Use that range like this:

10% if you've got a newer place, fewer amenities, and lower guest volume

12% for a "normal" STR with steady occupancy

15% for older homes, properties with hot tubs or pools, high guest volume, remote ownership, or harsh weather conditions

You'll also want a one-time cash buffer so you can pay for big issues immediately. Expensive repairs don't wait for your next payout. Recent data from Bankrate estimated average annual home maintenance at $8,808 in 2025 (separate from things like property taxes or insurance), which should remind you that upkeep isn't pocket change.

Airbnb Repair Budget Calculator (Monthly)

| Annual Gross Revenue | 10% Reserve (Monthly) | 12% Reserve (Monthly) | 15% Reserve (Monthly) |

|---|---|---|---|

| $40,000 | $333 | $400 | $500 |

| $60,000 | $500 | $600 | $750 |

| $80,000 | $667 | $800 | $1,000 |

| $120,000 | $1,000 | $1,200 | $1,500 |

These numbers might look high if you're used to long-term rental math. But STR properties get hammered harder. You're running a small hotel, and hotels spend serious money on upkeep for a reason.

Why You Need a Dedicated Airbnb Repair Fund

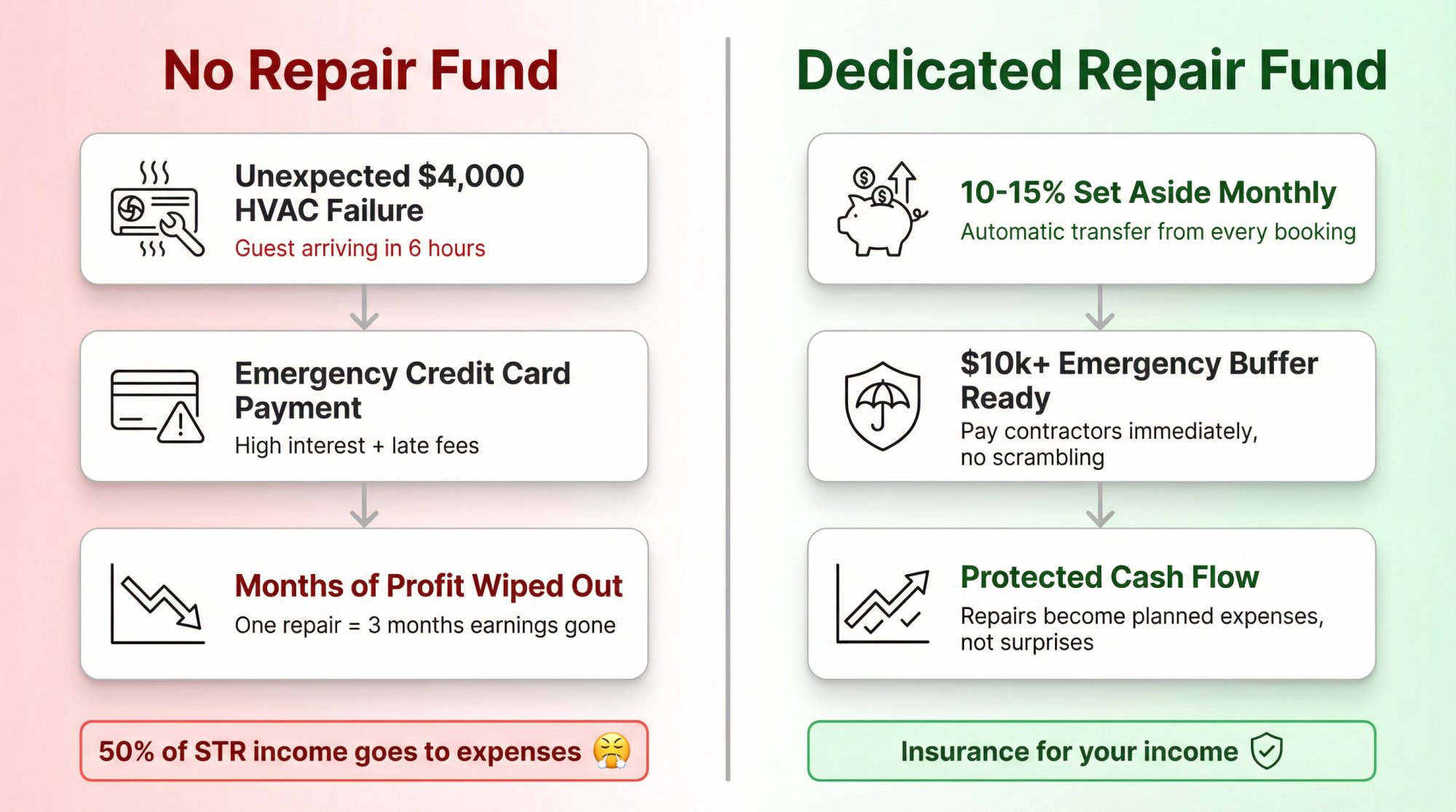

New hosts sometimes think they can "deal with repairs when they happen." That's a fast way to watch your profits evaporate.

Running a short-term rental isn't just collecting rent. You're dealing with wear and tear from rotating guests, fixing things that break at the worst possible times, and making sure each new arrival finds everything in working order.

According to property investment research, nothing tanks your return on investment faster than underestimating maintenance expenses. A single major repair (broken water heater, HVAC failure, roof leak) can wipe out months of profit if you haven't built a reserve.

The numbers tell the story. Our analysis at Chalet shows that operating costs for short-term rentals are significantly higher than traditional long-term rentals. You're paying for frequent cleanings, supplies, furnishings, and more frequent repairs since the property gets used more intensively by rotating guests.

All told, expenses like cleaning, utilities, and repairs can eat up around 50% of your gross rental income for an STR (versus roughly 35% for a long-term rental).

If you don't plan ahead, those costs will eat into your earnings fast.

What Does Airbnb Insurance Cover for Repairs?

Something that surprises new hosts: Airbnb's AirCover insurance doesn't cover routine wear and tear or upkeep.

AirCover might reimburse clear-cut guest damages like a shattered window, but it's on you as the host to budget for the less dramatic but inevitable tasks. Replacing air filters, fixing wobbly doorknobs, repainting scuffed walls, dealing with clogged drains? All you.

Think of your repair fund like insurance for your income. It smooths out the financial bumps. The alternative is scrambling to cover a $4,000 HVAC repair with your personal credit card while guests arrive in six hours.

Airbnb Repair Costs vs. Capital Expenses (CapEx)

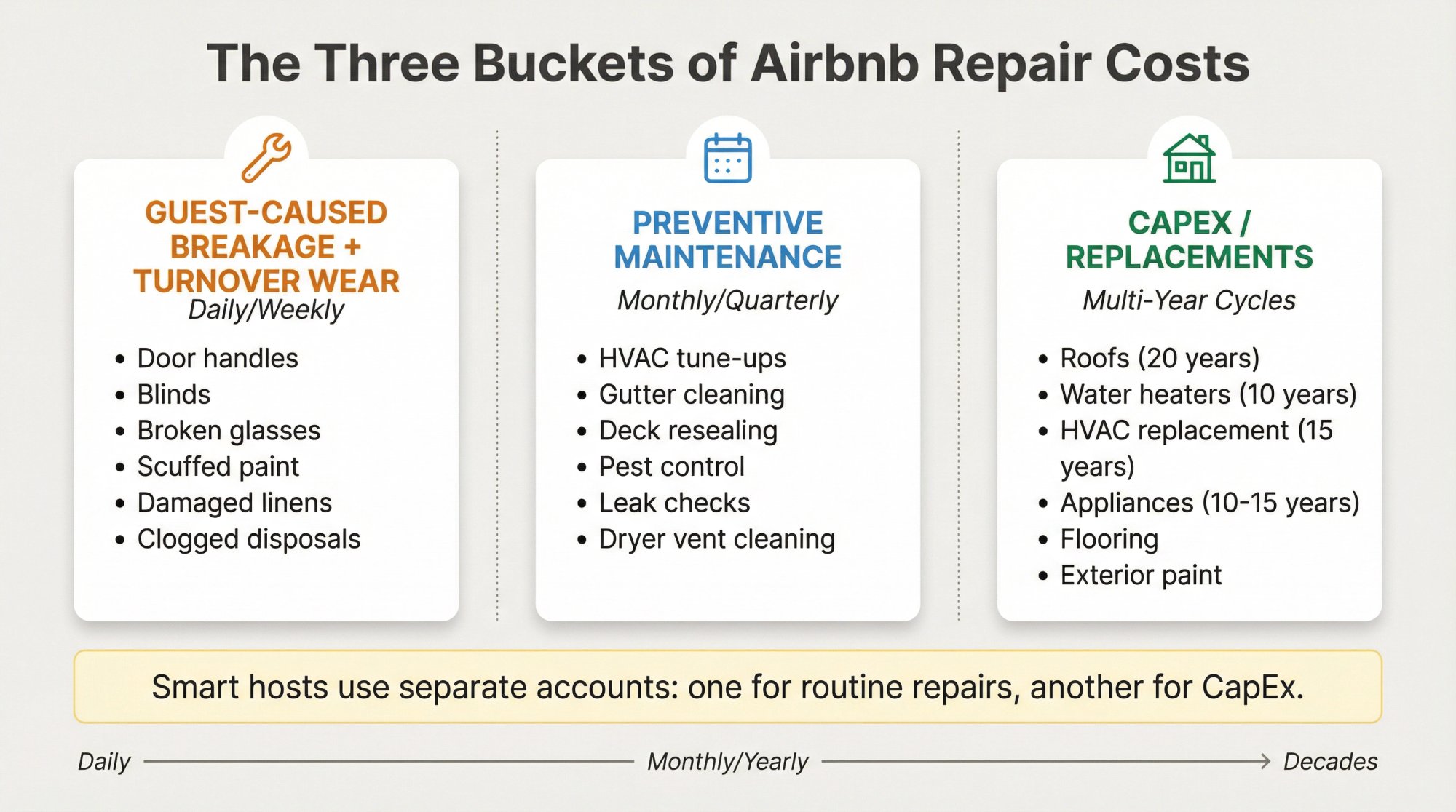

People say "repairs" but you're actually covering three different buckets:

1. Guest-Caused Breakage + Turnover Wear

Door handles, blinds, broken glasses, scuffed paint, damaged linens, clogged disposals. This is the stuff that happens because people use your property.

2. Preventive Maintenance

HVAC tune-ups, gutter cleaning, resealing decks, pest control, checking for leaks, dryer vent cleaning. The boring stuff that prevents expensive emergencies.

3. CapEx / Replacements

Roofs, water heaters, appliances, furniture refreshes, flooring, exterior paint, HVAC replacement. The big-ticket items that come in multi-year cycles.

Why this matters: If you don't mentally split these buckets, it's easy to spend your "future roof money" on today's small fixes and then act surprised later when you can't afford the replacement.

Some smart hosts even use separate accounts. One for routine repairs and maintenance, another specifically for capital expenditures. When your water heater turns 8 years old and you know replacement is coming, that CapEx account should already have funds waiting.

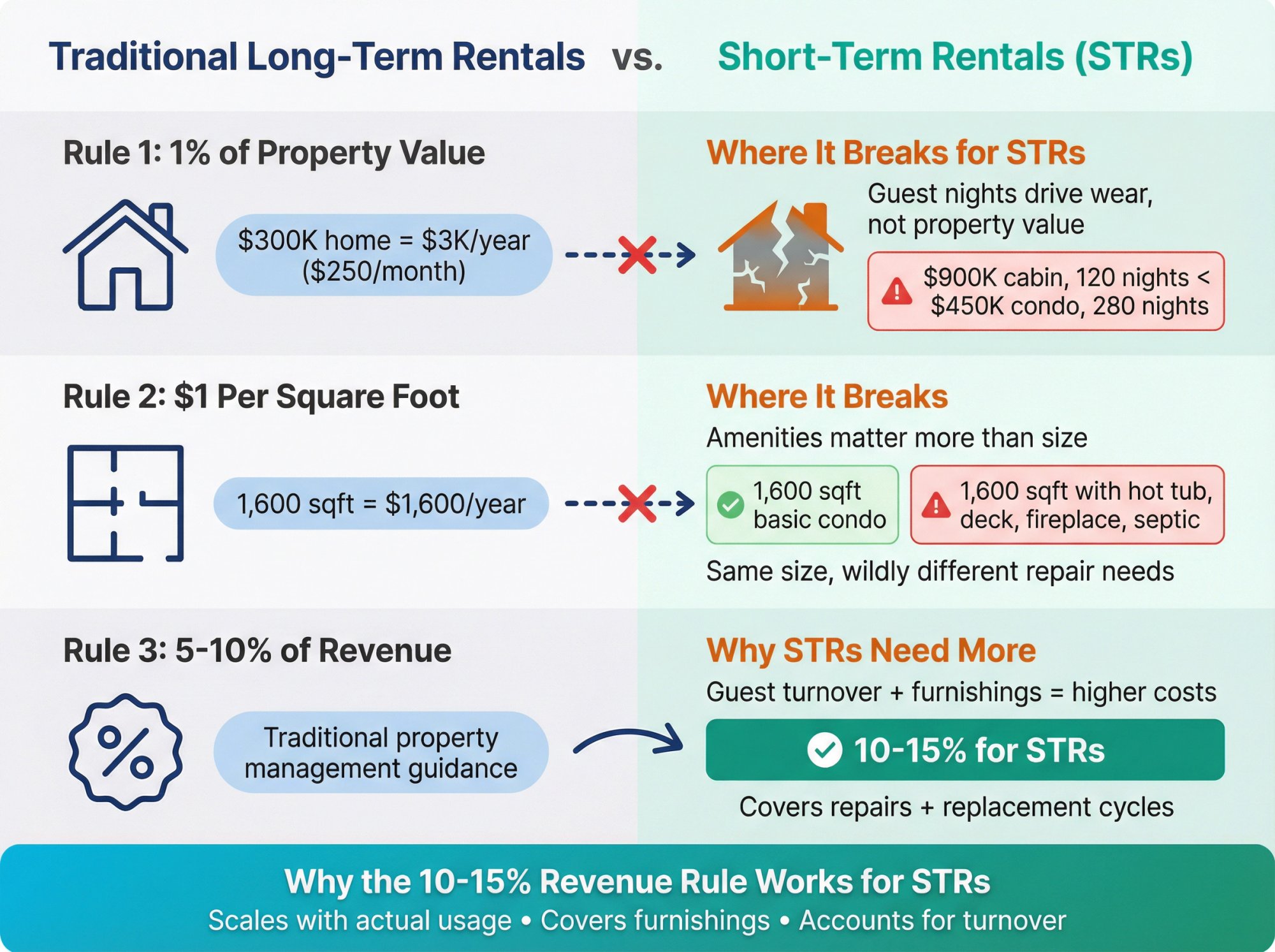

Why Traditional Repair Rules Don't Work for STRs

You'll see three common rules of thumb floating around. They're all fine starting points, but each has blind spots for short-term rentals.

Rule 1: "1% of Property Value Per Year"

This is common in long-term rental land. For a $300,000 home, that's about $3,000 annually (roughly $250 a month).

Where it breaks for STRs: Property value doesn't directly drive wear. Guest nights do. A $900k cabin might get fewer bookings than a $450k city condo, but the condo could take more abuse because it's occupied 280 nights a year.

The 1% rule is a decent starting point, but don't treat it as gospel.

Rule 2: "$1 Per Square Foot Per Year"

Also simple. A 1,600 square foot home would budget $1,600 annually for maintenance.

Where it breaks: Two 1,600 sqft homes can have wildly different repair profiles if one has a hot tub, deck, fireplace, and septic system while the other is a basic condo with exterior maintenance covered by the HOA.

Rule 3: "5% to 10% of Revenue"

Some traditional property management guidance suggests 5% to 10% of annual rental income for routine maintenance and repairs.

Where it breaks for STRs: Short-term rentals often need more cushion because of guest turnover and furnishings/amenities that don't exist in many long-term rentals. You're maintaining not just the property but everything inside it too.

That's why the 10% to 15% range is so common for vacation rentals. It implicitly covers both ongoing fixes and replacement cycles.

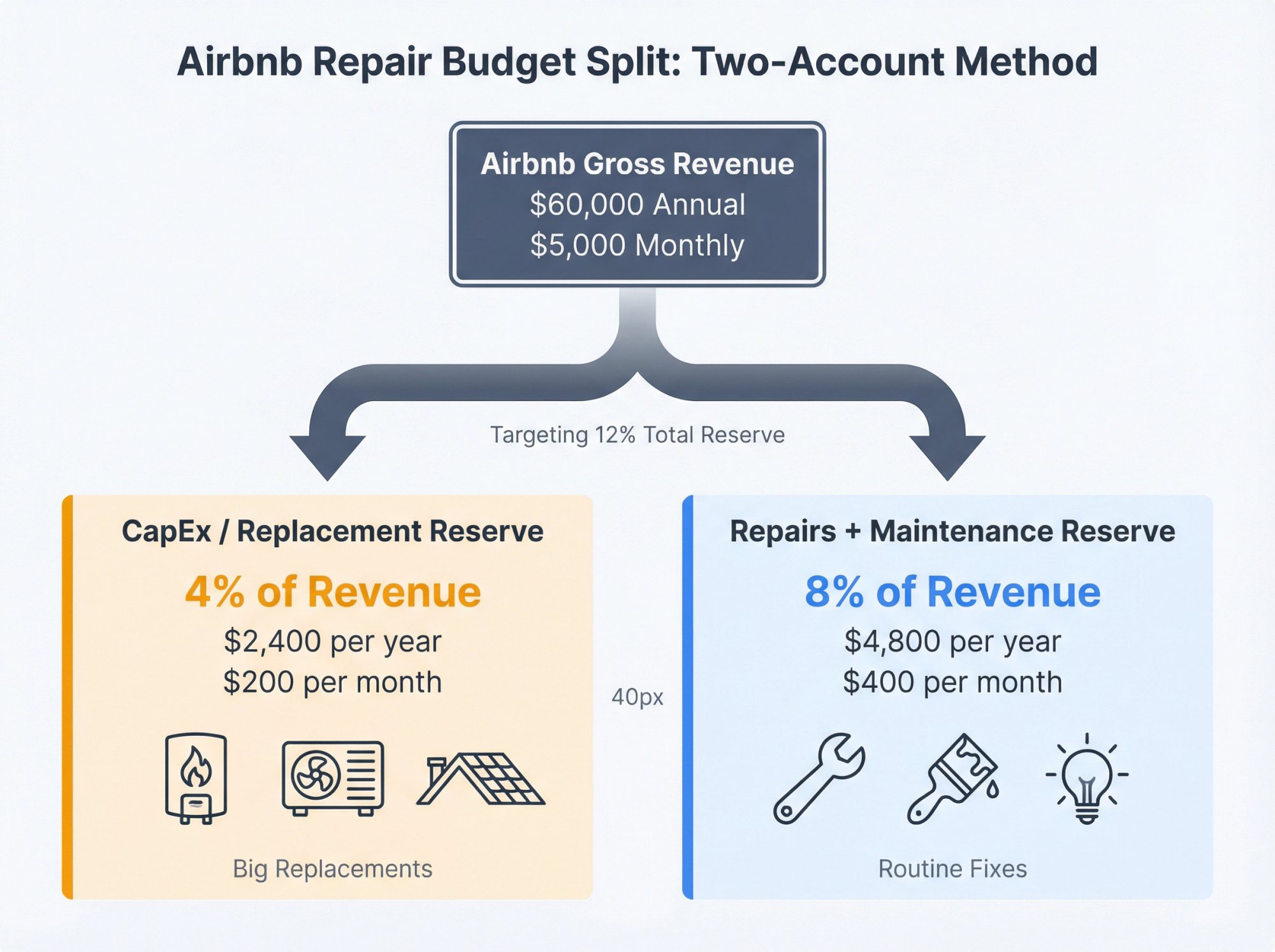

How to Split Your Airbnb Repair Budget (Two-Account Method)

Multiple STR-focused sources recommend 10% to 15% of gross income for maintenance, repairs, and capital reserves. General rental expense guidance also suggests 10% to 15% of rental income for repairs and unexpected costs.

Here's a practical way to use this that prevents "reserve theft" (where you accidentally spend replacement money on small repairs):

Use a Two-Account Mindset

CapEx / Replacement Reserve: Roughly 4% of gross revenue

Repairs + Maintenance Reserve: The remaining 6% to 11% (so your total stays in the 10% to 15% band)

Is 4% "the" perfect number? No. It's just a clean starting line that forces you to save for replacements instead of pretending they won't happen.

Say your Airbnb brings in $60,000 annually and you're targeting 12% total:

• $2,400/year ($200/month) goes to CapEx savings

• $4,800/year ($400/month) goes to repairs and maintenance

When your water heater dies after 10 years, you've already got $2,000+ waiting in the CapEx account. You're not scrambling or dipping into next month's mortgage payment.

How to Choose 10% vs. 15% for Your Airbnb Property

Use this like a pre-flight check. Every "yes" pushes you toward the higher end.

Push Toward 15% If You Have:

• Hot tub / pool / sauna / fireplace / boat dock / game room

• Older systems (roof, HVAC, plumbing) or you don't know their age

• Very high booked nights (lots of turnover, lots of wear)

• Remote ownership (you pay more for urgent dispatch and coordination when you're not local)

• Freeze/thaw cycles, coastal salt air, high humidity, or frequent storms in your climate

Push Toward 10% If You Have:

• Newer condo or townhome with fewer exterior systems

• No high-maintenance amenities

• Lower guest volume or more mid-length stays (less turnover)

• Strong local vendor relationships and fast response times

Real-world example: At Chalet, we analyzed a small beach condo (worth around $400K, renting for roughly $3,300 gross monthly) that set aside $200 per month for maintenance. That worked out to $2,400 annually, which was about 6% to 7% of annual rental income. Given that it was a newer condo in good condition, that landed on the lower end of our recommended range.

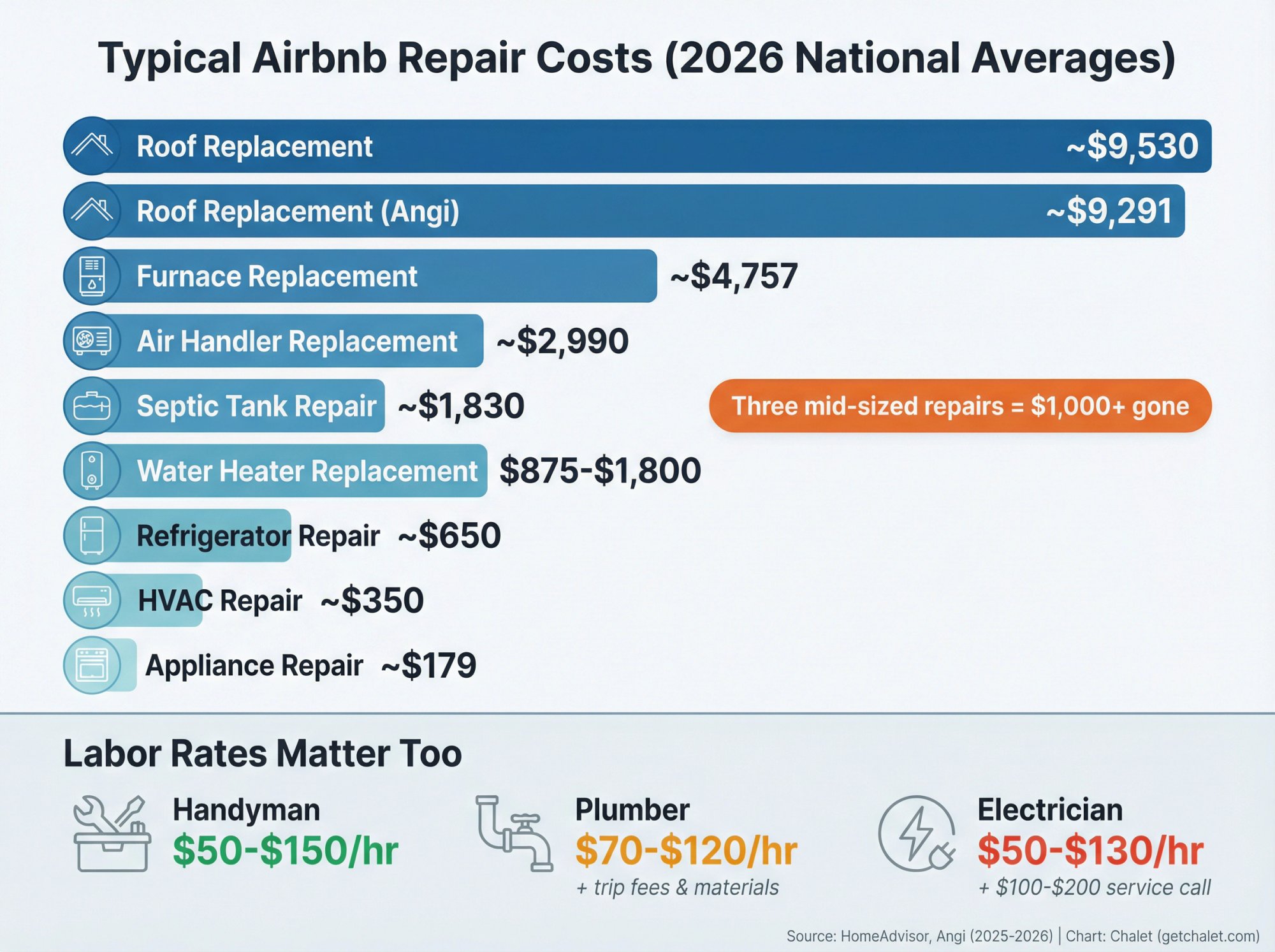

Typical Airbnb Repair Costs in 2026

The point here isn't to predict your exact bill. It's to show why reserves matter: a few "normal" failures can erase a month (or a season) of profit.

Here are national averages for common repairs based on recent data:

| Repair Item | Typical Cost (National) | Source |

|---|---|---|

| Roof replacement | Avg ~$9,530 | HomeAdvisor (Apr 2025) |

| Roof replacement | Avg ~$9,291 | Angi (Nov 2025) |

| Water heater replacement | $875 to $1,800 | HomeAdvisor (Nov 2025) |

| Furnace replacement | Avg ~$4,757 | HomeAdvisor (Nov 2025) |

| HVAC repair | Avg ~$350 | Angi (Nov 2025) |

| Air handler replacement | Avg ~$2,990 | HomeAdvisor (Aug 2025) |

| Septic tank repair | Avg ~$1,830 | HomeAdvisor (Oct 2025) |

| Appliance repair | Avg ~$179 (typical $108 to $250) | HomeAdvisor (Feb 2025) |

| Refrigerator repair | Avg ~$650 (range $200 to $1,300) | HomeAdvisor (Jun 2025) |

Even a "quick fix" can easily run $200 to $400 once you factor in the service call, labor, and parts. Three of those in a month and you've burned through $1,000.

Labor Rates Matter Too

Because "small" fixes often come with a minimum service call:

• Handyman: $50 to $150/hr

• Plumber: $45 to $200/hr, with many charging $70 to $120/hr before trip fees and materials

• Electrician: $50 to $130/hr plus $100 to $200 service call fee for the first hour

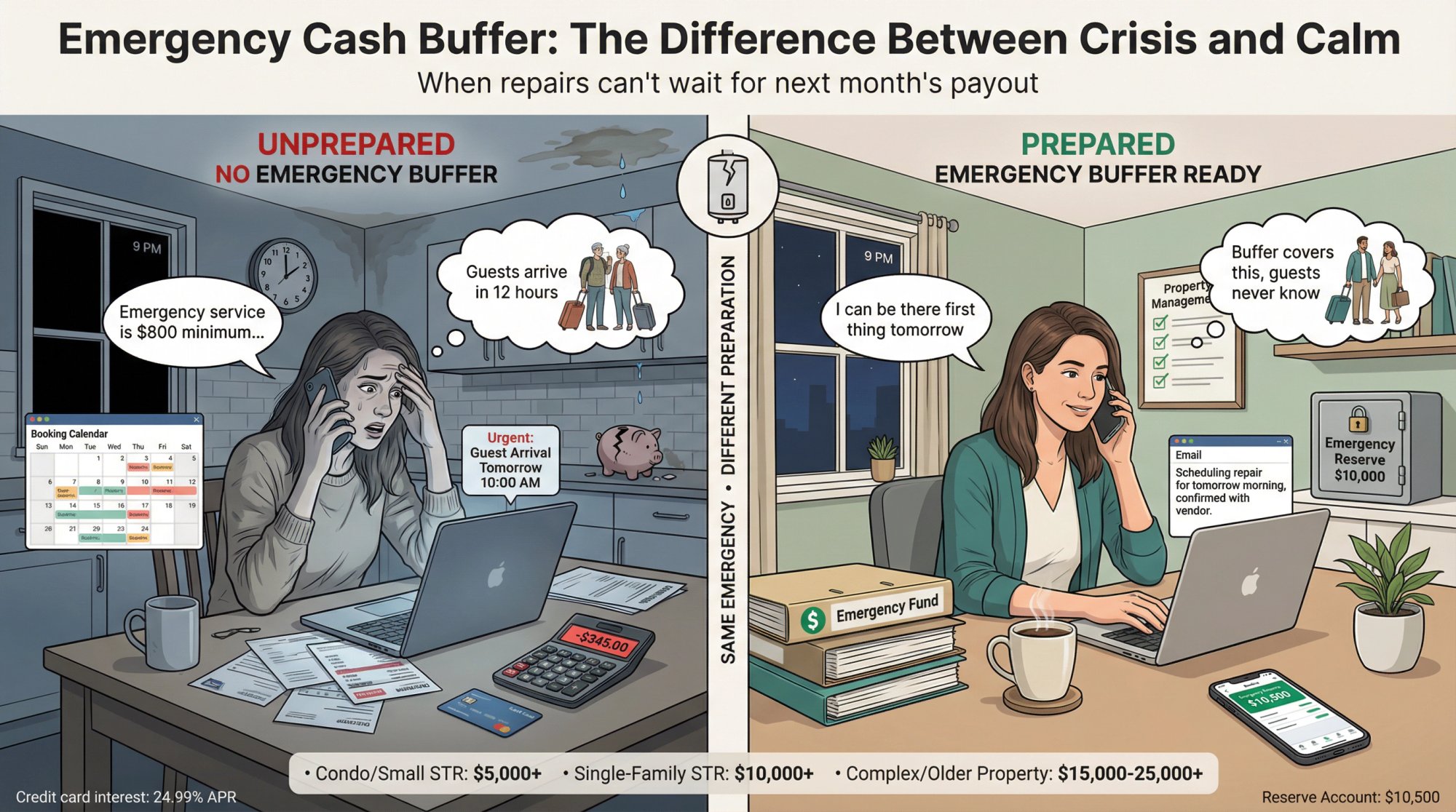

Emergency Cash Buffer for Airbnb Owners

Monthly set-asides are great. But when something breaks, you usually have to pay now, not after six more payouts.

Think of it this way:

• Your monthly reserve handles predictable, steady expenses

• Your cash buffer handles sudden emergencies (water heater, HVAC failure, emergency plumbing)

Why this matters: Recent coverage citing Hippo's HousePower report notes that nearly half of homeowners faced $5,000+ in unplanned repair expenses in the prior year.

When your water heater dies at 9pm on a Friday before a weekend full of bookings, you don't have time to "save up." You need a plumber there tomorrow morning, and you need the cash to pay them.

Practical Starting Buffer Targets

• Condo / smaller STR: $5k+

• Typical single-family STR: $10k+

• Older homes, septic, hot tub/pool, mountain/coastal exposure: $15k to $25k+

You can build toward this over time if you don't have it on day one. But don't run an STR with $0 in the tank. That's gambling with your business.

What Affects Your Airbnb Maintenance Budget

Not all rentals are created equal, and neither are their repair needs. While the rules of thumb give a general target, you should fine-tune your reserve based on the specifics of your property.

Property Age and Condition

Older homes or units with outdated systems will typically need more upkeep. An older HVAC system or water heater might be nearing replacement. The roof might have a shorter remaining life. Older plumbing or wiring can be temperamental.

If your Airbnb is a vintage cabin or a 50-year-old house, err well above the 1% rule. Maybe 2% of property value annually.

Conversely, a brand-new build or recently gut-renovated condo might have a honeymoon period of lower repairs. Though you should still save at least the minimum, because new doesn't mean immune to problems.

Usage and Occupancy Rate

How hard is your property working? A heavily booked rental (consistently 80%+ occupied with back-to-back guests) experiences more use of appliances, plumbing, furniture, everything.

Higher occupancy means faster wear and tear on everything from the couch cushions to the hot water tank. If you're in a booming market with constant turnover, plan for the higher end of maintenance costs.

On the other hand, if you only host occasionally or have slow seasons with breaks, you might not hit those items as hard. Though even sitting vacant has its costs (running HVAC to avoid mold, for example).

Use common sense: more guest-nights equals more minor damages, more lightbulbs burning out, more linens to replace.

Amenities and Features

Certain amenities add to maintenance demands:

Do you have a pool or hot tub? Budget extra for their regular servicing and the eventual pump or heater fixes.

Big landscaped yard? Consider lawn care, sprinkler repairs, tree trimming.

Cabin with a wood-burning fireplace? There's chimney cleaning and firewood to think about.

Even high-end kitchen appliances or an HVAC with smart home integrations might mean specialized (read: pricier) repairs when something goes wrong.

List out the special features of your rental and make sure you've earmarked funds for their upkeep. It's often wise to set aside a little extra cushion for any "luxury" features, as they can be costly to fix or replace.

Climate and Location

Certain locations inherently cause more wear.

A beachfront cottage deals with corrosive salt air. Appliances rust faster. Exterior paint wears quicker.

A mountain cabin might face deep snow (roof and deck need extra reinforcement and inspection) or hungry wildlife. Yes, bear break-ins happen.

In humid climates, you might battle mold or AC strain. Desert homes might see sun-cracked exteriors and need more frequent painting or HVAC filters due to dust.

Consider your local climate stresses. Also, local regulations could require safety upgrades (like seismic retrofits in earthquake zones or flood-proofing). Not exactly "repairs," but costs you should be prepared for.

Guest Profile and Seasonality

Think about who your typical guests are and how they use the space.

A party pad or large home that often hosts groups might see more damage (accidental or otherwise) compared to a small unit rented to solo business travelers.

Families with kids might put more strain on certain items. Extra fingerprints on walls. Maybe the occasional crayon art or broken lamp.

If you allow pets, expect the occasional scratched floor or chewed furniture leg. Budget for it.

Seasonality plays a role too. If you have an off-season, that might be when you schedule larger preventative projects (like repainting or deep maintenance), so you need funds on hand by then.

Critical insight: Adjust your repair budget to your situation. If multiple risk factors stack up (older large home + coastal weather + high occupancy + lots of amenities), absolutely err on the high side. Even beyond 1% or 10% may be prudent. Perhaps 2% of property value or 15% of revenue.

How to Automate Your Airbnb Repair Fund

The best repair reserve is the one you don't have to "remember" to fund.

The Simple System

① Open a separate bank account (or sub-account) labeled "Repairs + CapEx"

② Auto-transfer a percentage of every payout (or weekly). Set it and forget it.

③ Give yourself a rule:

Routine fixes come from the repairs bucket.

Replacements come from the CapEx bucket.

④ Log every repair (date, category, cost, vendor). After 6 to 12 months, your own data beats internet rules.

Treat maintenance as a non-negotiable expense. For example, if you determined that 10% of gross bookings will go to maintenance, then every time you get a payout from Airbnb, automatically siphon 10% into a separate savings account.

This "pay yourself (or rather, your property) first" approach keeps you disciplined. Many hosts set up an auto-transfer or use bank rules to whisk that percentage out of their checking account the moment guest payments hit.

By doing this, you'll never be tempted to spend the full income and then come up short when the water heater fails.

Keep Funds Separate and Accessible

It's wise to hold your maintenance reserve in a dedicated account (such as a high-yield savings account or an online bank account earmarked for property expenses).

Separating it from your personal finances or general business account prevents accidentally dipping into it. It also gives you a clearer picture of how much you've accumulated for repairs at any given time.

Importantly, ensure the money is liquid. A cash account, not tied up in a long-term investment. When the roof springs a leak, you need to be able to pay the roofer now, not wait 60 days to cash out a CD or mutual fund.

The goal is quick access for unexpected outlays.

Best Practices for Managing Your Reserves

Deciding on a number to set aside is step one. Actually putting that reserve fund to work consistently is step two.

Plan for Big-Ticket Replacements

Regular small repairs are one thing. But every so often you'll face capital expenditures. The big items like replacing the roof, the HVAC system, or all the kitchen appliances. These tend to occur on multi-year cycles.

It's smart to create a capital expense schedule for your property. Note the age and expected lifespan of major components:

-

Roof: 20 years

-

Water heater: 10 years

-

HVAC: 15 years

-

Kitchen appliances: 10 to 15 years

Then estimate their replacement costs. Ensure your savings rate accounts for these.

For example, if the HVAC is 15 years old and likely to need a $5,000 replacement within 5 years, that alone justifies setting aside $1,000 per year toward it. This can be part of your 1% per year or on top of it.

Some hosts even create a separate sinking fund for capital projects while using the main repair fund for smaller routine fixes.

Either way, don't be caught by surprise. You know these big costs are coming eventually. Smoothing them out by saving in advance will prevent a budget shock later.

Be Proactive (Spend to Save)

One of the best ways to control your repair costs is to willingly spend on preventative maintenance.

Regular servicing and inspections can catch problems early or extend the life of expensive assets.

Research shows that spending roughly $200 on an HVAC tune-up now can prevent a $5,000 emergency AC replacement during peak summer. Similarly, a $150 roof inspection and minor fix could avert a $15,000 water damage repair later.

These examples illustrate that your maintenance fund isn't just for reacting to things after they break. You should also use it for preventative care that saves money in the long run.

Many top hosts schedule seasonal check-ups:

• HVAC service twice a year

• Gutter cleaning before and after fall

• Pest inspection quarterly

• Plumbing check annually

The data is clear: properties with well-maintained systems not only avoid big repair bills, but also enjoy higher guest satisfaction and can command better nightly rates.

One study noted that hosts who follow a structured maintenance plan (around 1% to 2% of property value annually) generated 30% to 40% higher lifetime rental income compared to those who were purely reactive.

The message? Invest a bit continuously, and your property will reward you.

Track Your Actual Expenses and Adjust

After you've been renting for a year or more, take the time to review how much you actually spent on repairs and maintenance.

Did you end up using the full amount you set aside? More? Less?

Analyze where the money went. Was it all little fixes, or did one big issue skew the total?

This historical insight is gold for refining your budget. If you notice, say, that you spent 8% of revenue on upkeep in a year where nothing major broke, then keeping a 10% reserve is probably wise. The extra covers the "bad year" scenario.

Alternatively, if you barely touched the fund, you might still keep saving at the same rate (rolling it over for future big projects), but you'll know you have a healthy safety margin.

It's good practice to recalibrate each year. As your property ages or if you add new amenities (you install a hot tub, or you start allowing pets), adjust your maintenance saving percentage accordingly.

Your reserve strategy isn't set in stone. It should evolve with your experience and any changes to the property's risk profile.

Don't Rely on Guest Damage Deposits or AirCover

Some new hosts think that requiring a security deposit from guests or having Airbnb's AirCover policy means they don't need a large repair fund.

This is a dangerous misconception.

Security deposits and AirCover can help in certain situations (like a guest who blatantly breaks something and you can prove it). But many types of wear and tear or minor damage won't be covered as they are considered normal use.

For example, if a guest wears out your 2-year-old carpet with heavy foot traffic, that's not something you can file a claim for. It's on you.

Also, pursuing damage claims is not always straightforward. It can take time and there's no guarantee of full reimbursement.

It's far better to have your own funds ready. Think of any recovered money from a guest or Airbnb insurance as a bonus, not your primary plan.

Hope for help from deposits and insurance, but plan as if you'll get nothing. Because often you won't for general maintenance issues.

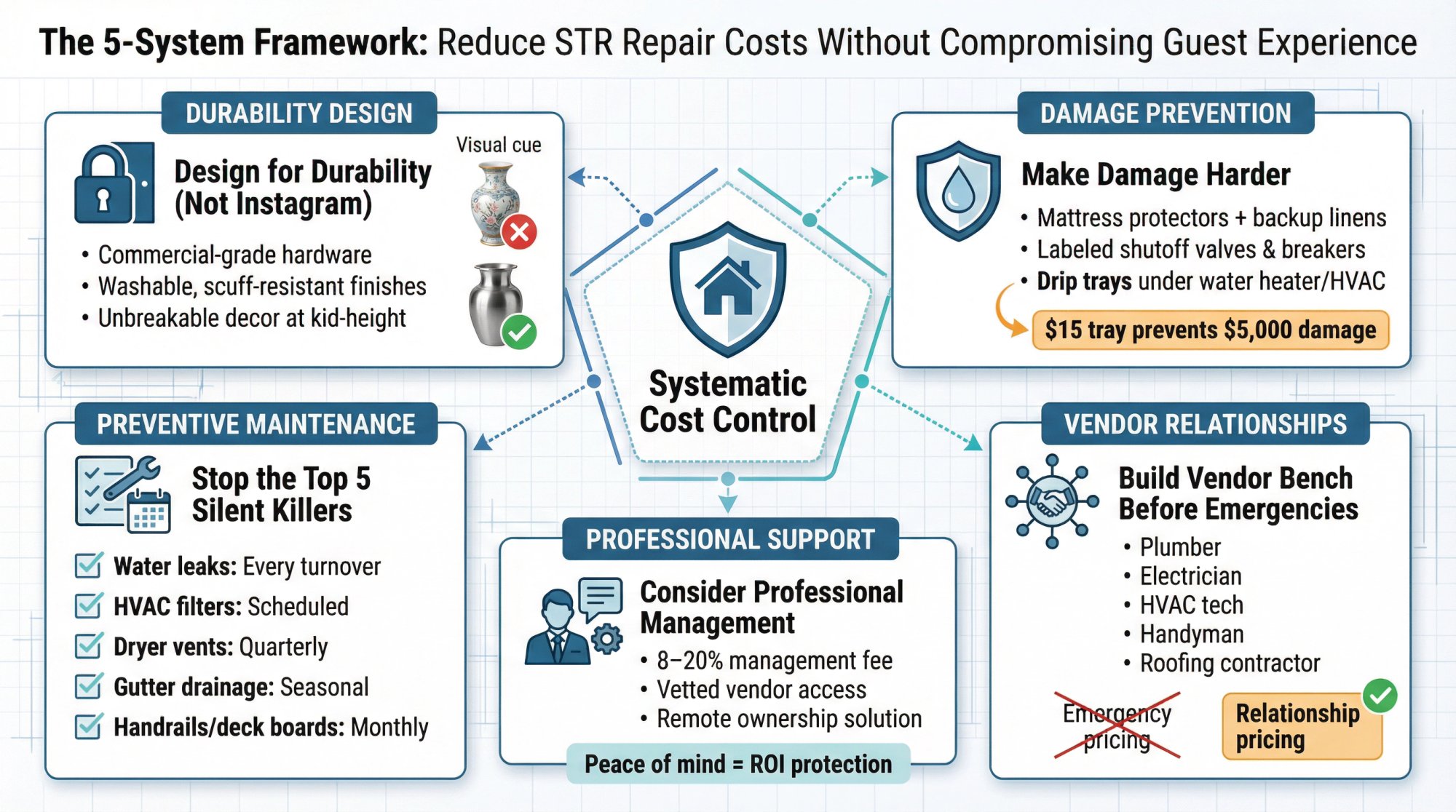

How to Reduce Airbnb Repair Costs Without Hurting Guests

Repairs feel "random" only if you don't run systems. Here are high-impact moves that reduce your repair costs:

1. Design for Durability (Not Instagram)

→ Commercial-grade locks and door hardware. The cheap stuff breaks constantly with heavy use.

→ Washable paint, scuff-resistant trim, and rugs you can replace cheaply. Skip the designer finishes that show every mark.

→ Avoid fragile decor at kid-height. That vintage vase? It's getting knocked over. Use unbreakable alternatives.

Think hotel durability, not HGTV aesthetics. Your guests won't notice the difference, but your maintenance budget will.

2. Make Damage Harder

→ Mattress protectors + backup linen set on-site. Spills happen. Make them easy to handle.

→ Labeled shutoff valves (water) and breakers (electric). In an emergency, your cleaner or guest can act fast instead of calling you in a panic.

→ Drip trays under water heater and HVAC condensate lines in risk areas. A $15 tray can prevent $5,000 in water damage.

3. Prevent the Top 5 Silent Killers

Water leaks: Check under sinks every turnover. A slow drip can rot an entire cabinet before you notice.

HVAC filters: Set a schedule. Dirty filters kill systems and spike your utility bills.

Dryer vents: Fire risk plus slow drying equals guest complaints. Clean them quarterly.

Gutter drainage: Clogged gutters lead to water intrusion, foundation issues, and landscaping damage.

Loose handrails and deck boards: Safety liability waiting to happen. Check them monthly.

4. Build a Vendor Bench Before You Need It

When your only move is "call whoever answers," you pay emergency pricing and lose time.

Build relationships with local pros before something breaks:

• Plumber

• Electrician

• HVAC tech

• General handyman

• Roofing contractor

Get quotes. Check reviews. Meet them in person if possible.

At Chalet, we help connect hosts with vetted cleaning and maintenance professionals who specialize in short-term rentals. So you're not scrambling to find help when something goes wrong.

Having experts on call can be well worth it, especially as your portfolio grows or if you don't live near your Airbnb.

5. Consider Professional Management or Help

If managing maintenance feels overwhelming (especially if you're not local to the property), remember that you can outsource some of this.

Hiring a property manager or reliable local handyman/contractor can ensure things are fixed promptly and preventative checks are done, albeit at a cost.

Many full-service property managers will handle routine maintenance and emergency calls for you, in exchange for a percentage of your income (typically 8% to 20%).

If you go this route, factor the management fee into your operating budget in addition to maintenance reserves. The fee covers the manager's service, but you often still pay for the actual repairs and upkeep materials.

Alternatively, build a network of go-to vendors you trust. It's wise to research and even meet these pros before you desperately need them.

The peace of mind from having experts on call can be well worth it.

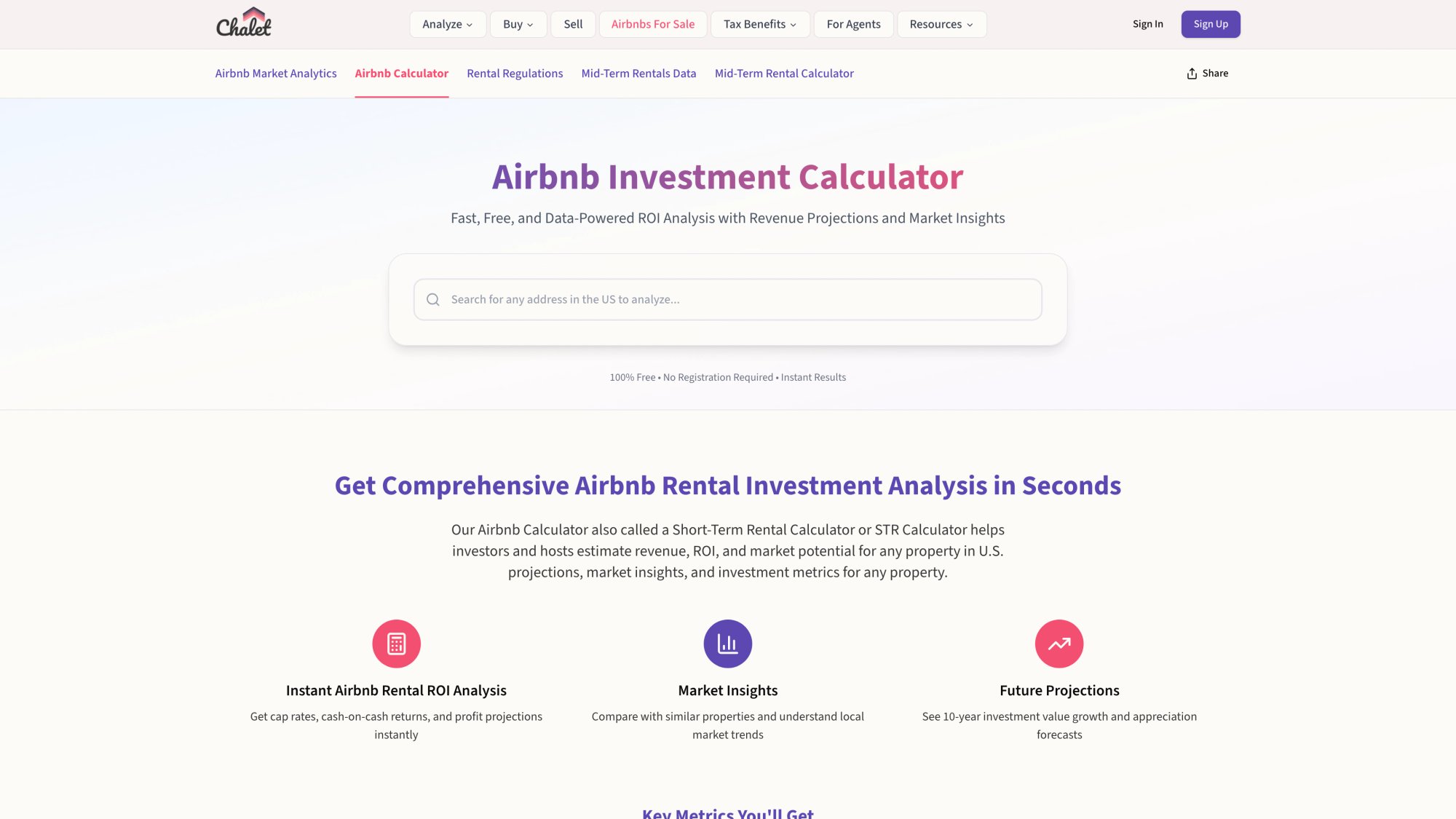

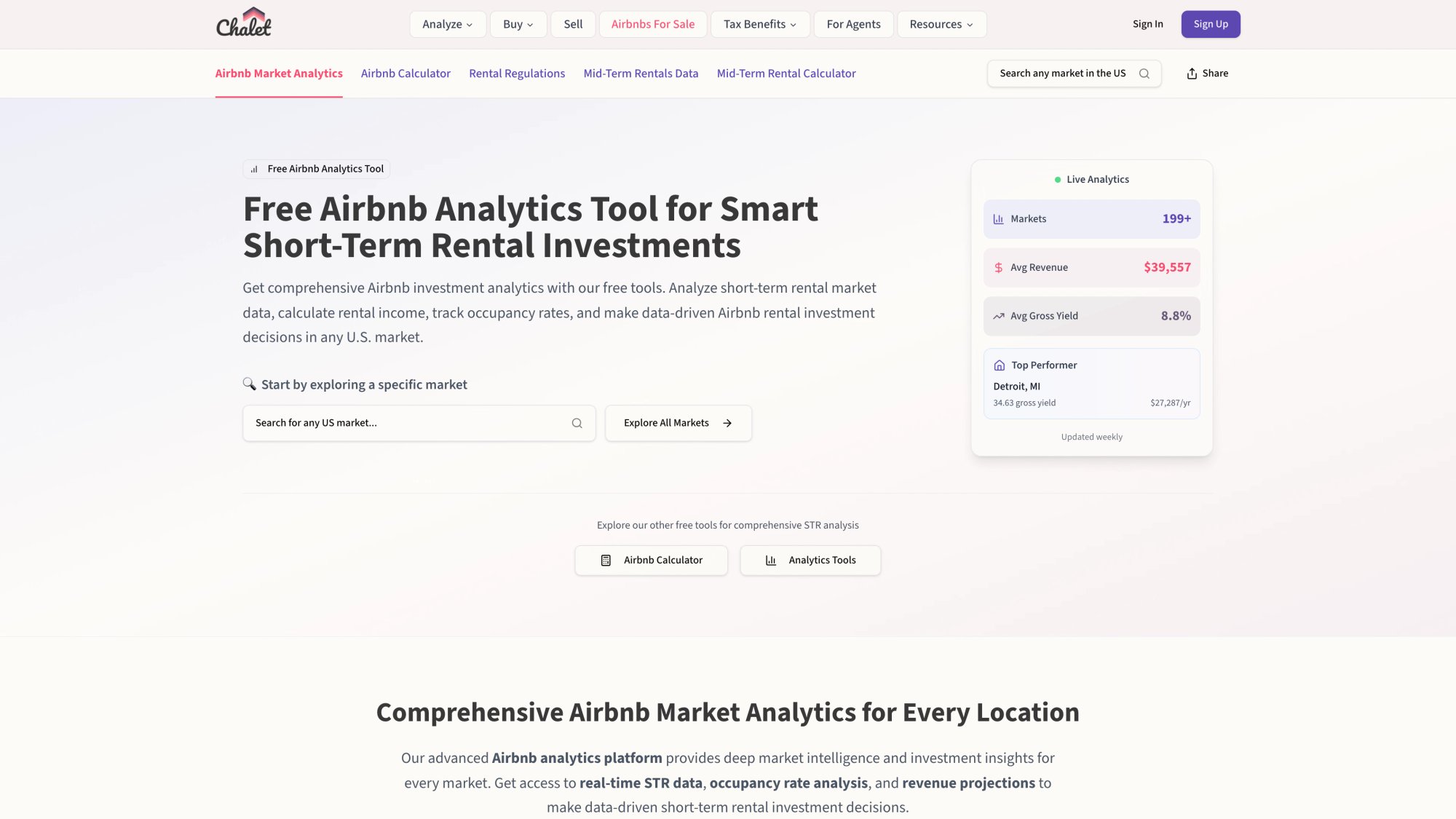

How Chalet Helps You Budget Smarter for STR Maintenance

If you're underwriting a deal or managing an existing property, your repair reserve should be a line item in your financial model. Not a "hope."

Chalet's free STR analytics platform helps you plan smarter:

Run ROI and DSCR assumptions (including repairs) for any address with our Airbnb Calculator. Factor in real operating costs before you buy.

The calculator lets you model repair reserves as part of your overall operating budget. Plug in your expected revenue, set your repair percentage (10% to 15%), and see how it impacts your cash flow and DSCR before you commit to the property.

Compare markets and stress-test revenue assumptions using our Market Analytics Dashboard. See which cities have the strongest fundamentals.

The analytics dashboard shows you real-time ADR, occupancy, and revenue trends across dozens of markets. Use it to identify where your repair budget will have the biggest impact on ROI.

Connect with pros for the heavy lifting. Need help with management, cleaning, maintenance, or furnishing? Our STR Directory connects you with vetted professionals who specialize in short-term rentals.

Find the right property. Browse Airbnb rentals for sale and work with agents who understand STR investing.

Check permit risk before you buy. Use our Rental Regulations tool to research local STR rules so you don't buy a property you can't legally operate.

We built Chalet to be the one-stop platform for STR investors. Free analytics paired with a vetted vendor network, so you can research, buy, and operate in one place.

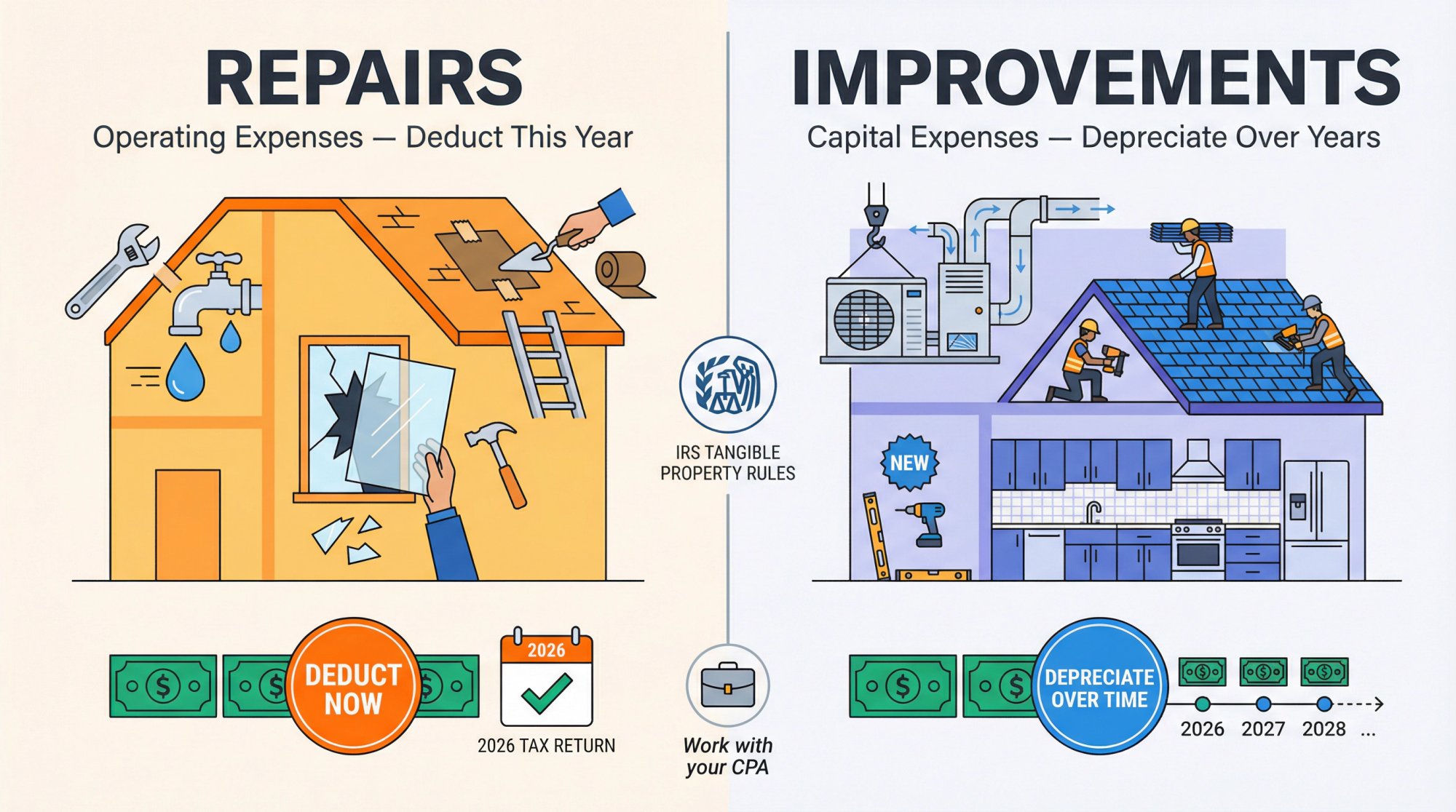

Tax Basics: "Repair" vs. "Improvement" (Don't Break Your Bookkeeping)

I'm not your tax pro, but here's the basic idea:

Repairs generally keep the property in efficient operating condition. Fixing a leaky faucet, replacing a broken window, patching the roof. These are typically deductible as operating expenses in the year you pay for them.

Improvements generally add value, prolong life, or adapt the property to a new use. New roof, new HVAC system, kitchen renovation. These are often capitalized and depreciated over time.

The IRS has guidance on how to think about capitalizing versus expensing under the tangible property regulations, including safe harbors.

If you're doing big upgrades (especially right after purchase), it's worth aligning with a CPA so your books match reality. The rules can get complex, and getting it right saves you money and headaches during an audit.

Wrapping Up: Protect Your Investment by Planning Ahead

Repair costs aren't the most fun part of owning an Airbnb rental, but they're absolutely a crucial part of the equation for success.

The exact amount to set aside will depend on your property and situation, but the consensus is clear:

Plan on roughly 1% of the property's value or about 10% to 15% of your rental income going toward maintenance and repairs each year.

By budgeting proactively, you turn potential surprises into planned expenses. You'll sleep easier (and so will your guests, literally and figuratively) knowing that when something inevitably needs fixing, the money is there.

Remember, it's always better to over-budget for repairs than to under-budget. If you end up with extra funds in your reserve after a smooth year, consider it a win. You can roll it into upgrades that increase your rental's appeal or simply carry it forward as a larger safety net.

In the long run, a well-maintained property not only avoids losses but can actually boost your returns through higher nightly rates and occupancy.

As the saying goes, take care of your property, and it will take care of you.

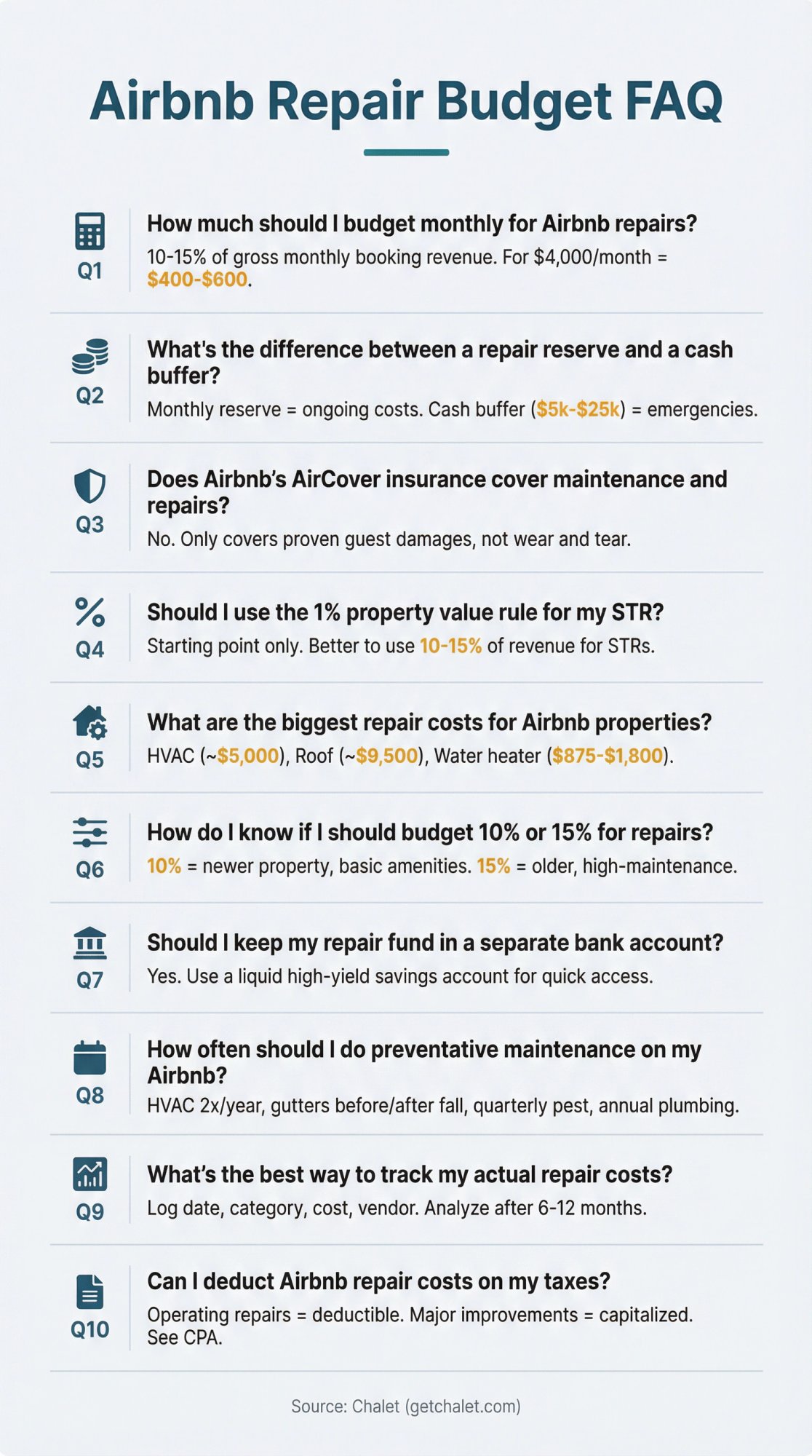

Frequently Asked Questions About Airbnb Repair Budgets

How much should I budget monthly for Airbnb repairs?

Most hosts should set aside 10% to 15% of gross monthly booking revenue. For a property earning $4,000 per month, that means $400 to $600 going into your repair fund. Adjust higher if you have older systems, luxury amenities like pools or hot tubs, or high guest turnover.

What's the difference between a repair reserve and a cash buffer?

Your monthly repair reserve handles predictable, ongoing maintenance costs. Your cash buffer (typically $5k to $25k depending on property size and complexity) handles sudden emergencies like HVAC failures or water heater replacements that require immediate payment.

Does Airbnb's AirCover insurance cover maintenance and repairs?

No. AirCover only covers clear guest damages you can prove, not routine wear and tear or general upkeep. Don't count on insurance or security deposits to fund your maintenance needs.

Should I use the 1% property value rule for my STR?

The 1% rule (setting aside 1% of property value annually) is a decent starting point, but it has blind spots for STRs. Guest volume drives wear more than property value. A better approach for short-term rentals is to budget based on revenue (10% to 15% of gross bookings) since that scales with actual usage.

What are the biggest repair costs for Airbnb properties?

Major expenses include HVAC replacement (~$5,000), roof replacement (~$9,500), water heater replacement ($875 to $1,800), and appliance repairs or replacements ($200 to $1,300 per item). Even "small" repairs like plumbing fixes can easily run $300 to $500 with service calls and labor.

How do I know if I should budget 10% or 15% for repairs?

Start at 10% if you have a newer property with basic amenities and moderate guest volume. Move toward 15% if you have older systems, high-maintenance amenities (pools, hot tubs), very high occupancy rates, remote ownership requiring coordination, or harsh climate conditions.

Should I keep my repair fund in a separate bank account?

Yes. Separating your repair funds into a dedicated account prevents accidentally spending them and gives you a clear picture of your reserves. Use a liquid account (like a high-yield savings account) so you have quick access when emergencies happen.

How often should I do preventative maintenance on my Airbnb?

Schedule HVAC service twice annually, gutter cleaning before and after fall, quarterly pest inspections, and annual plumbing checks. Preventative maintenance typically costs a few hundred dollars but can prevent thousands in emergency repairs. Properties with structured maintenance plans generate 30% to 40% higher lifetime rental income.

What's the best way to track my actual repair costs?

Keep a simple log with date, category, cost, and vendor for every repair. After 6 to 12 months, analyze your actual spending. This historical data helps you refine your budget better than any rule of thumb and reveals patterns in what breaks most often.

Can I deduct Airbnb repair costs on my taxes?

Repairs that keep the property in operating condition are typically deductible as operating expenses. Major improvements that add value or prolong life are often capitalized and depreciated. The IRS has specific rules under the tangible property regulations, so work with a CPA to get it right.

Ready to run the numbers on your next STR investment? Use Chalet's free ROI calculator to factor in realistic repair costs before you buy. Or explore our market analytics to find markets with the strongest fundamentals for your first (or next) short-term rental.

Data currency note: Cost ranges and benchmarks in this guide are based on sources updated in 2025 and early 2026. Local labor markets, weather risk, and property condition can move your real numbers significantly. Use this as your baseline, then tighten it with inspections and local quotes.