You're analyzing which booking platform costs less for your short-term rental. Platform fees can swing your cash flow by thousands per year. The answer isn't obvious anymore.

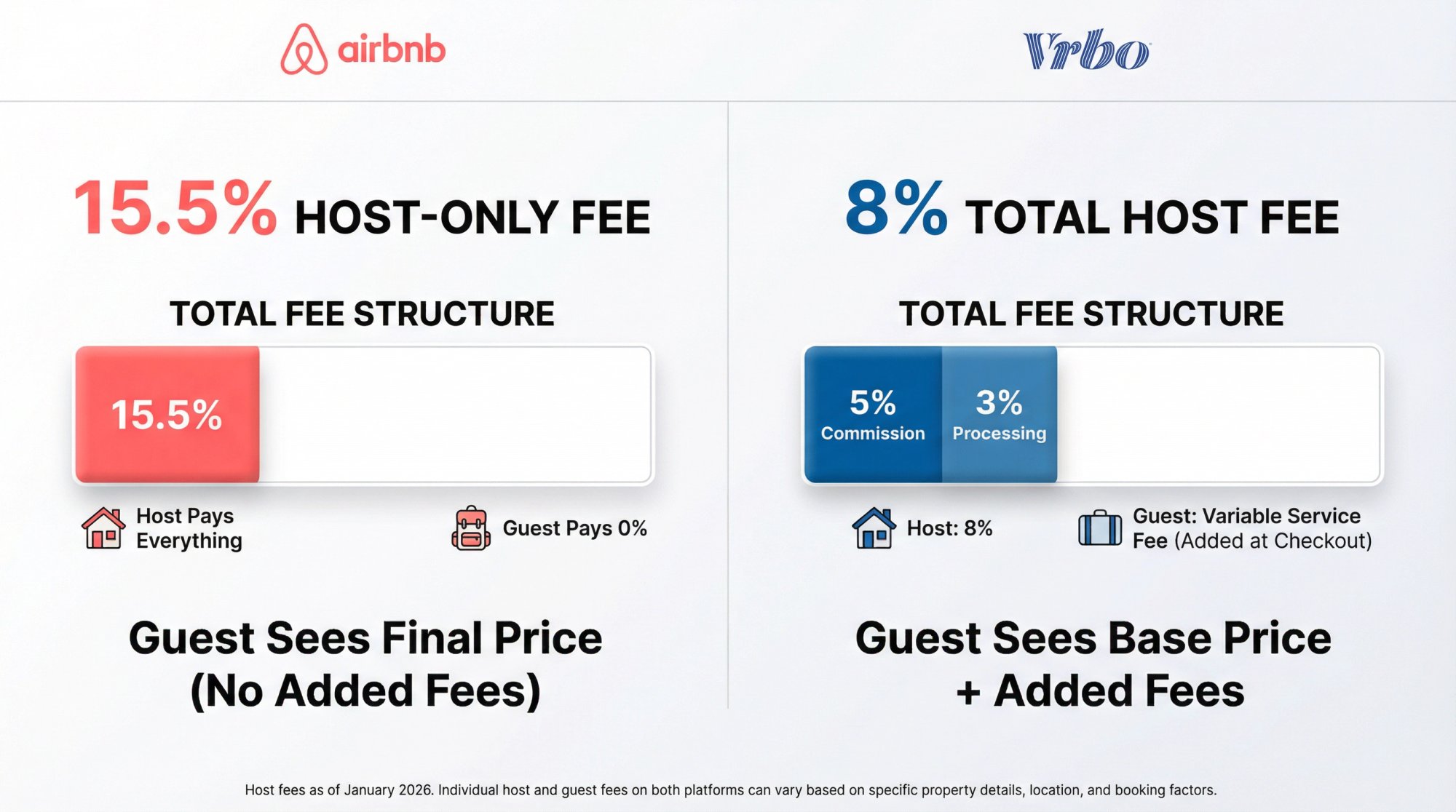

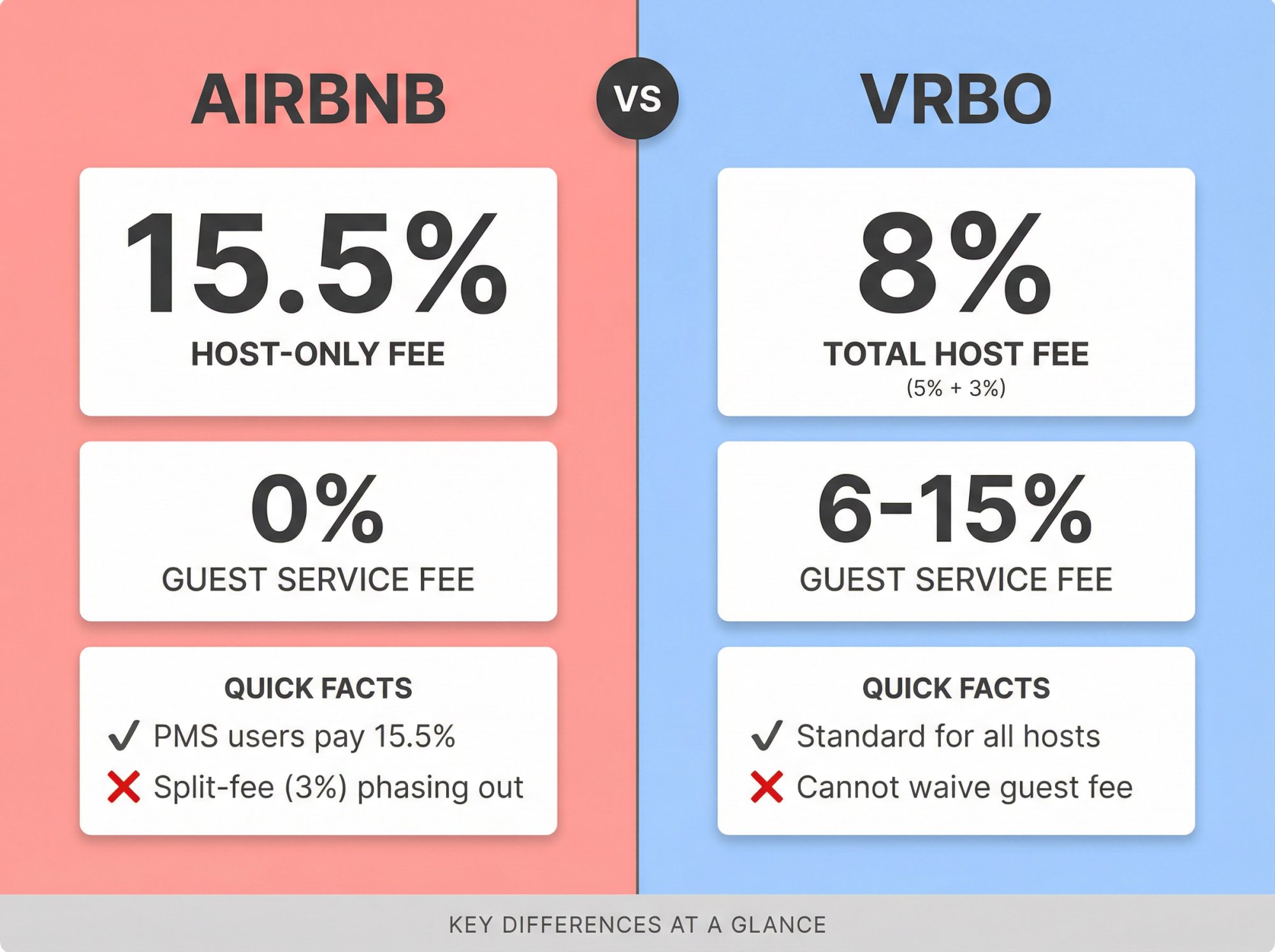

Airbnb moved most hosts to a 15.5% host-only fee in late 2025. Vrbo charges about 8% total (5% commission plus 3% processing) under its pay-per-booking model. But the fee you pay depends on your setup, whether you use property management software, and how you want to balance host costs vs guest checkout friction.

This comparison uses official platform documentation accessed January 2026, plus both research drafts provided. We'll show you exactly what each fee structure does to your payout, when exceptions apply, and how to model fees in your STR underwriting.

Why Do Platform Fees Matter for STR Investors?

Platform fees are essentially the commission booking sites take from each reservation. They directly reduce your net income, which affects:

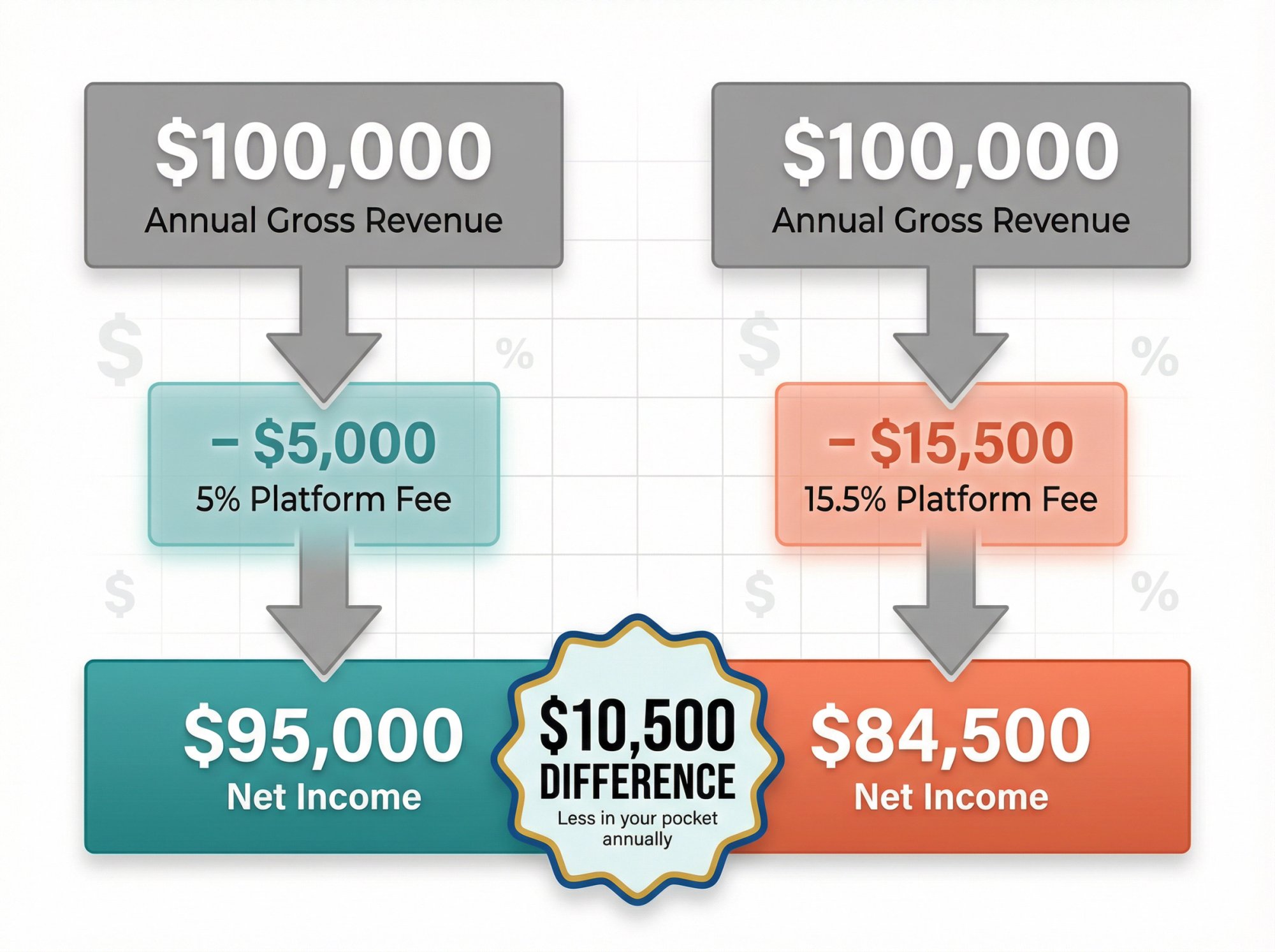

Your profit margins. A 5% vs 15.5% fee difference on a $100,000 annual gross could mean $10,500 less in your pocket.

Your pricing strategy. Fee differences may require adjusting nightly rates on each platform. You might price 8% higher on Airbnb to offset the bigger commission cut.

Guest behavior. Fees can be split between host and guest. A platform with lower guest-facing fees may attract more bookings (reduced sticker shock at checkout). Higher guest fees might deter price-sensitive travelers.

For investors buying Airbnb rentals, this isn't academic. Your DSCR calculation depends on net revenue after platform take. Even a few percentage points difference compounds across hundreds of bookings.

What Are Airbnb Host Fees in 2026?

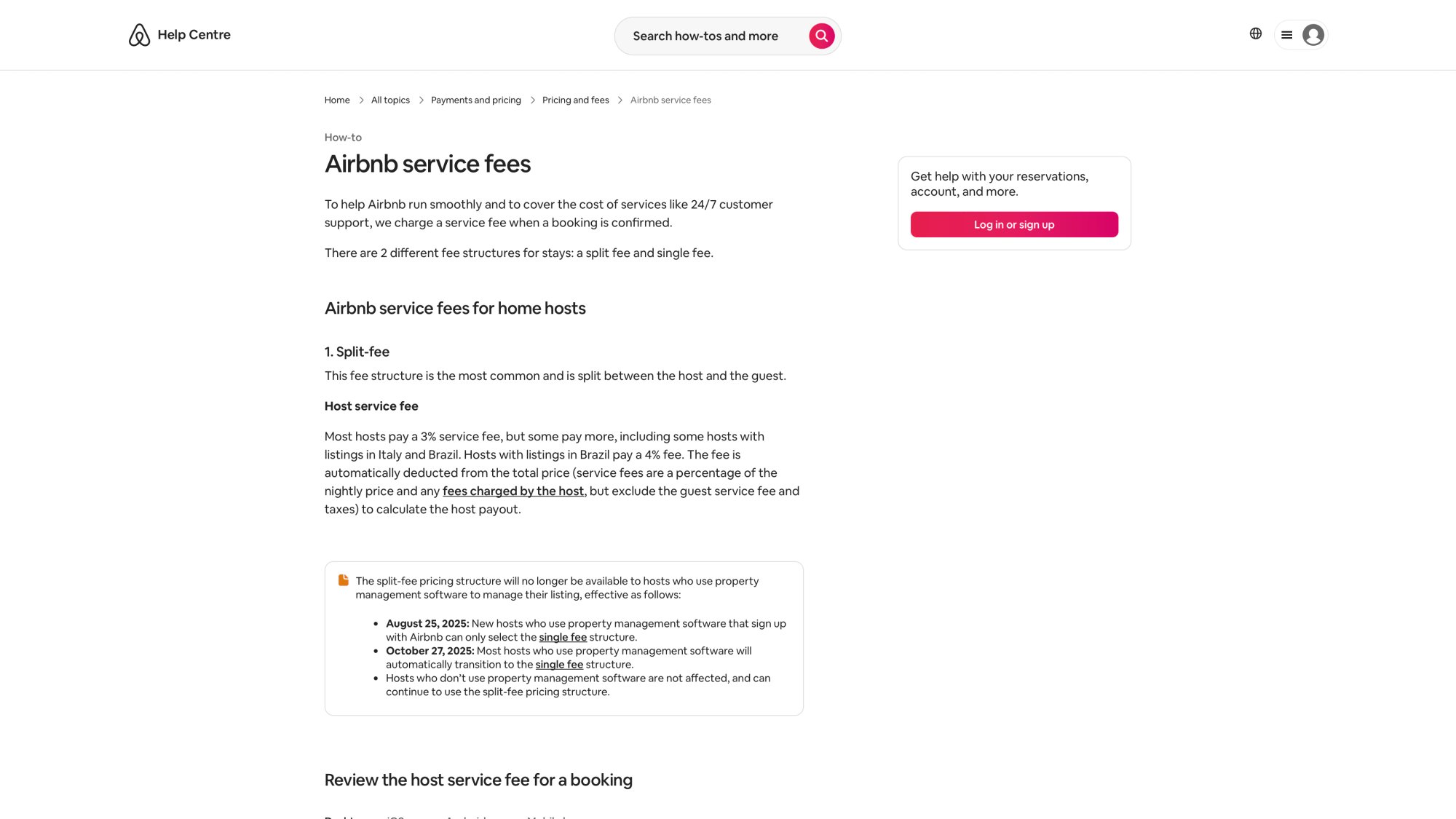

Airbnb's official help center spells out two fee structures for home stays: split-fee and single fee (host-only).

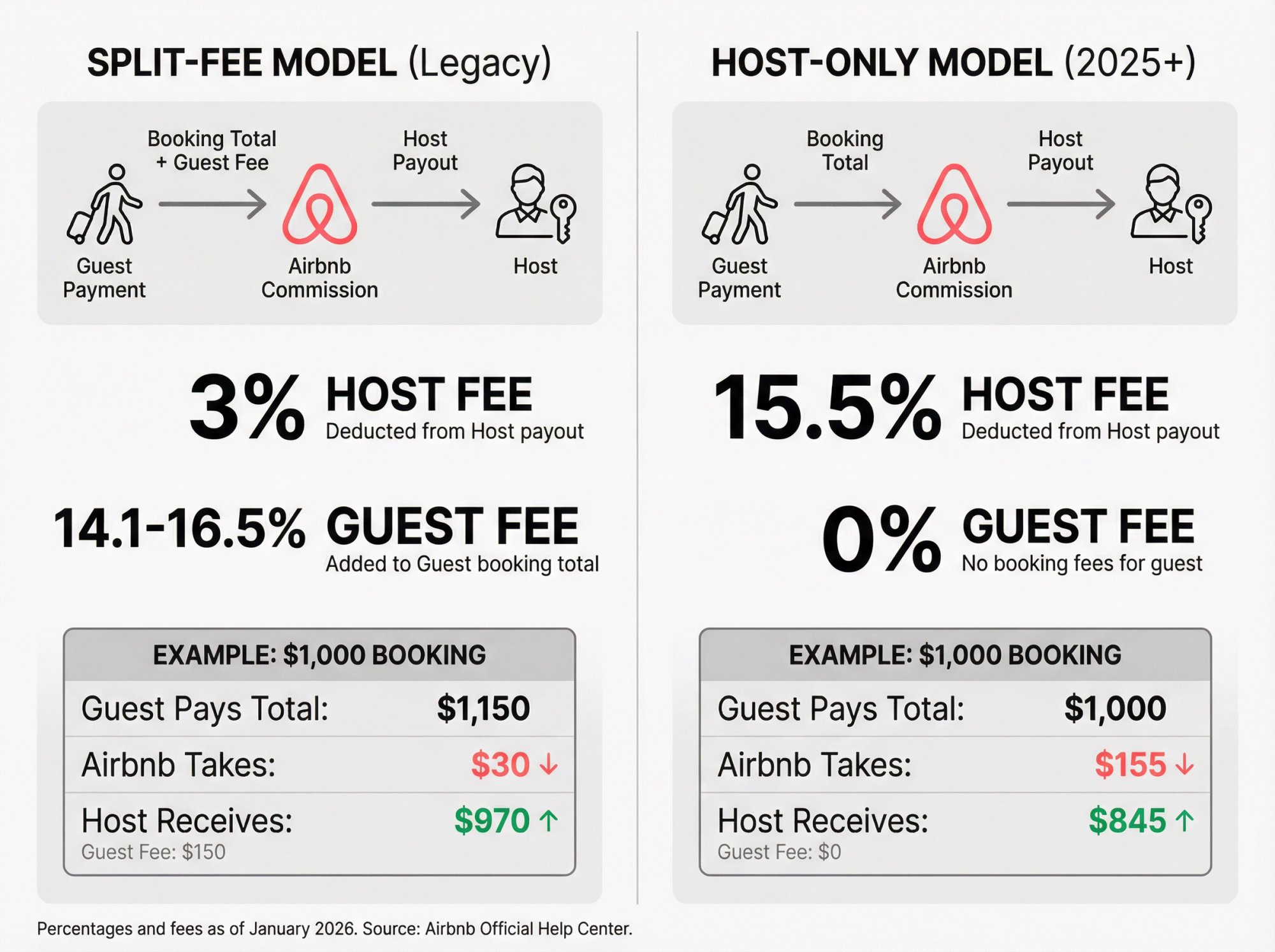

Airbnb Split-Fee: 3% Host + 15% Guest Fee

This was Airbnb's legacy approach. It's still available for some independent hosts.

Host pays: Typically 3% of the booking subtotal, automatically deducted from your payout. The subtotal includes nightly rate plus any host-charged fees like cleaning (excludes taxes and guest service fee).

Guest pays: 14.1% to 16.5% of the booking subtotal as a separate service fee at checkout. Cross-currency bookings can push this to 16.5%.

Example: $1,000 booking (nightly + cleaning, before taxes). Airbnb takes $30 from you. Guest also pays ~$150 in service fees that go to Airbnb, not you.

Your payout: $970 (before any tax handling).

Who gets this: Most independent hosts not using property management software. But Airbnb has been migrating hosts away from this structure.

Airbnb Host-Only Fee: 15.5% From Host

This is where Airbnb moved the industry in 2025.

Host pays: 15.5% of the booking subtotal in most cases (Brazil pays 16%). This entire service fee is deducted from your payout.

Guest pays: 0%. Guests see the price you set (nightly rate plus cleaning and fees) with no additional service charge at checkout.

Example: Same $1,000 booking. Airbnb takes $155 from your payout. Guest pays exactly $1,000 total.

Your payout: $845.

Who gets this (mandatory for many):

-

Hosts using property management software (PMS) or channel managers like Guesty, Hostaway, etc.

-

Split-fee became unavailable for most PMS-connected hosts starting August 25, 2025, with full transition by October 27, 2025.

-

Hospitality-style listings (hotels, boutique properties).

-

Most new listings created after late 2025.

Important exceptions:

-

Super Strict cancellation policies: Add +2% (so 17.5% total).

-

Extended stays (28+ nights): Fee "may be less" but Airbnb doesn't specify the exact reduction.

-

VAT considerations: In some jurisdictions, VAT may apply on top of the 15.5%.

Critical for PMS users: If you're using a property manager or software, you're almost certainly on the 15.5% structure now. This is a significant jump from 3%. You'll want to adjust your Airbnb pricing upward to maintain the same net payout.

How to Check Which Airbnb Fee Structure You're On

Airbnb makes this easy. Go to Earnings → select any reservation code → under Host payout, look at host service fee.

If it's around 3%, you're on split-fee. If it's around 15.5%, you're on host-only.

What Are Vrbo Host Fees in 2026?

Vrbo, part of Expedia Group, still uses a split model between host and guest. There are two main structures (though one is being phased out).

Vrbo Pay-Per-Booking: 8% Total (5% + 3%)

This is the default for all new Vrbo listings.

① 5% commission fee: Charged on rental amount plus any mandatory host-charged fees (cleaning, pet fees, boat fees, etc.).

② 3% payment processing fee: Charged on the total payment you receive, which includes:

-

Rental amount

-

Host-charged fees

-

Taxes

-

Refundable damage deposits (but Vrbo refunds the 3% processing when you refund the deposit)

Total host cost: About 8% of the booking in most cases.

| Fee Component | Applies To | Example on $1,000 Booking |

|---|---|---|

| 5% Commission | Rental + host fees | $50 |

| 3% Processing | Total payment (incl. taxes) | $33.60 (on $1,120 w/ taxes) |

| Total Host Pays | Combined | $83.60 |

| Your Net Payout | After fees | $1,036.40 |

Additional nuances:

-

If you use certain property management software with Vrbo, they sometimes charge the 5% commission but handle payment processing separately. The exact configuration varies, but your net cost is similar.

-

Vrbo warns that bookings from "expanded distribution partners" may have higher fees.

- In some regions (Europe, Australia, New Zealand), PMS-connected hosts may be charged 12% to 15% instead of the standard 5% commission.

What Is Vrbo's Guest Service Fee?

Vrbo also charges travelers a service fee at checkout that doesn't come out of your payout.

Amount: Varies by reservation size, typically 6% to 15% of the reservation subtotal (before taxes).

-

Smaller bookings incur higher percentage fees.

-

Vrbo removed its cap on guest service fees. Expensive stays can incur very high dollar amounts.

Example: On a $1,000 booking, a guest might pay an extra $100 to $120 in service fees (10-12%).

Key point: You can't waive or reduce this fee. Vrbo includes it in the upfront total shown to travelers.

Vrbo Annual Subscription: $699/Year (Legacy Only)

Vrbo historically offered hosts an option to pay a flat annual fee upfront instead of per-booking commissions.

Cost: $699 per year per listing (as of 2024-2025 industry sources).

What you pay per booking: Only the 3% payment processing fee. You don't pay the 5% commission.

Who can get it: Legacy partners only. Vrbo discontinued new subscriptions. Only hosts with an existing active subscription can renew it. New Vrbo hosts must use pay-per-booking.

Break-even math: The subscription makes financial sense if your rental revenue exceeds ~$14,000/year (roughly $699 ÷ 5% = $13,980). Otherwise, the 8% pay-per-booking costs less than the upfront fee.

Since new subscriptions aren't available and Vrbo may retire this entirely, most comparisons focus on the pay-per-booking structure.

Airbnb vs Vrbo Fees Compared Side-by-Side

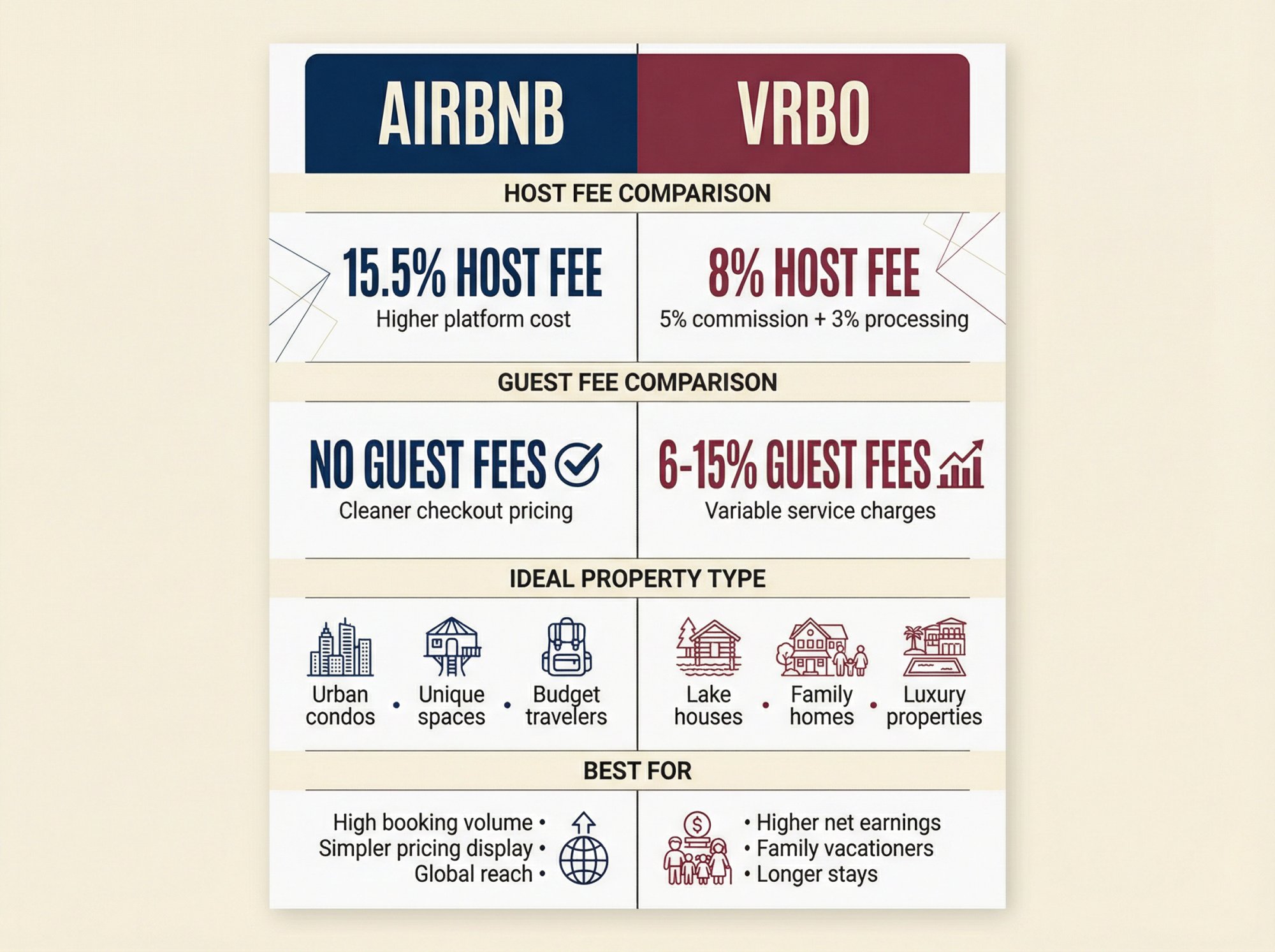

At first glance, Vrbo's host fee is significantly lower: ~8% versus 15.5%. But Airbnb has no guest fee now, whereas Vrbo still charges travelers a hefty fee on top of your rate.

To truly compare platforms, consider both the host fee (what you pay) and the guest fee (what your guest pays, which influences booking volume).

Host Fees Compared: Airbnb vs Vrbo

| Platform | Host Fee | What It Applies To |

|---|---|---|

| Airbnb Split-Fee | ~3% | Nightly + host-charged fees (excludes taxes) |

| Airbnb Host-Only | ~15.5% (most cases) | Booking subtotal (nightly + host fees, excludes taxes) |

| Vrbo Pay-Per-Booking | 5% commission + 3% processing | 5% on rent + host fees; 3% on total including taxes + refundable deposits |

Guest Fees Compared: Airbnb vs Vrbo

| Platform | Guest Fee | Notes |

|---|---|---|

| Airbnb Split-Fee | 14.1% to 16.5% | On booking subtotal (before taxes) |

| Airbnb Host-Only | 0% | Guests pay no additional service fee |

| Vrbo | ~6% to 15% (varies) | On reservation total (before taxes); host can't waive |

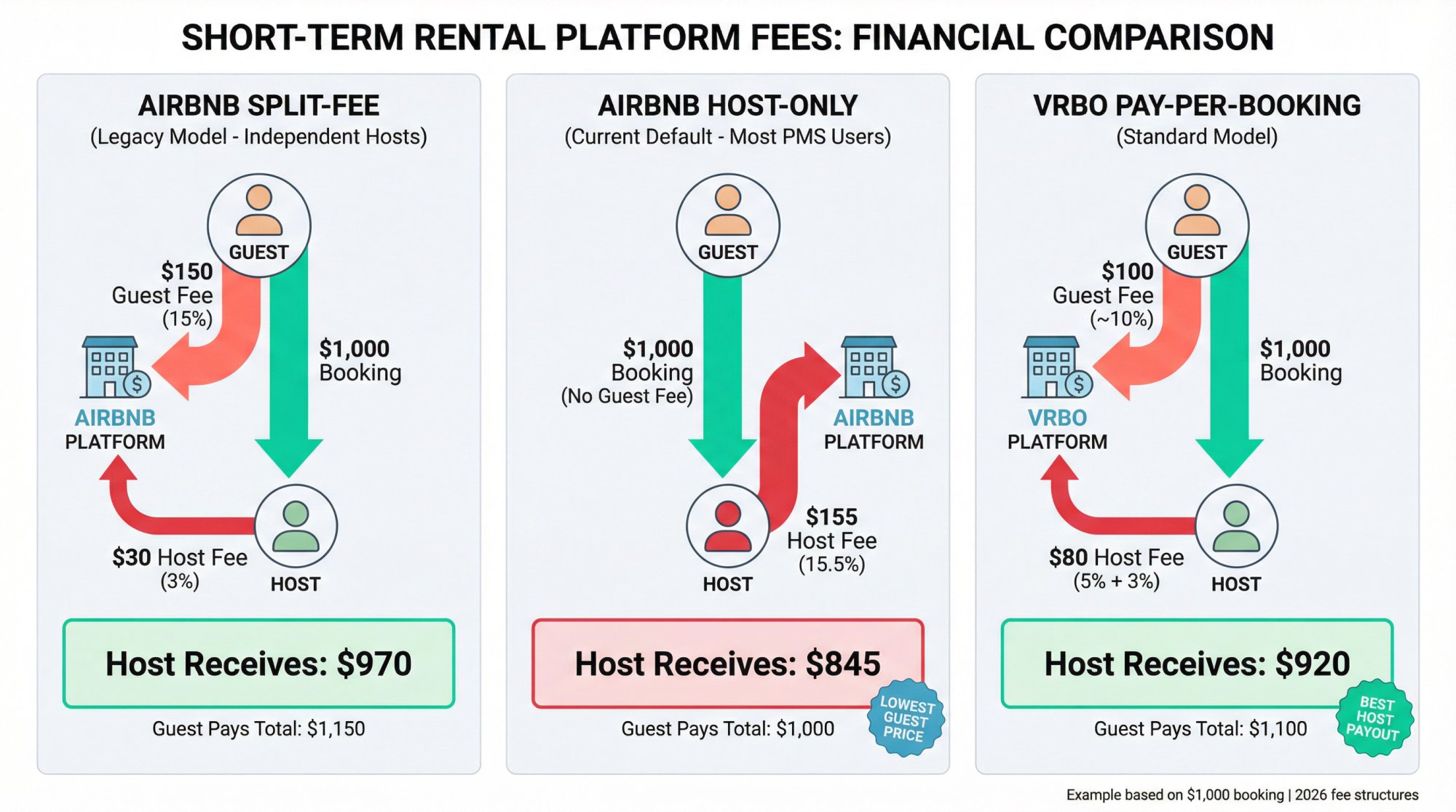

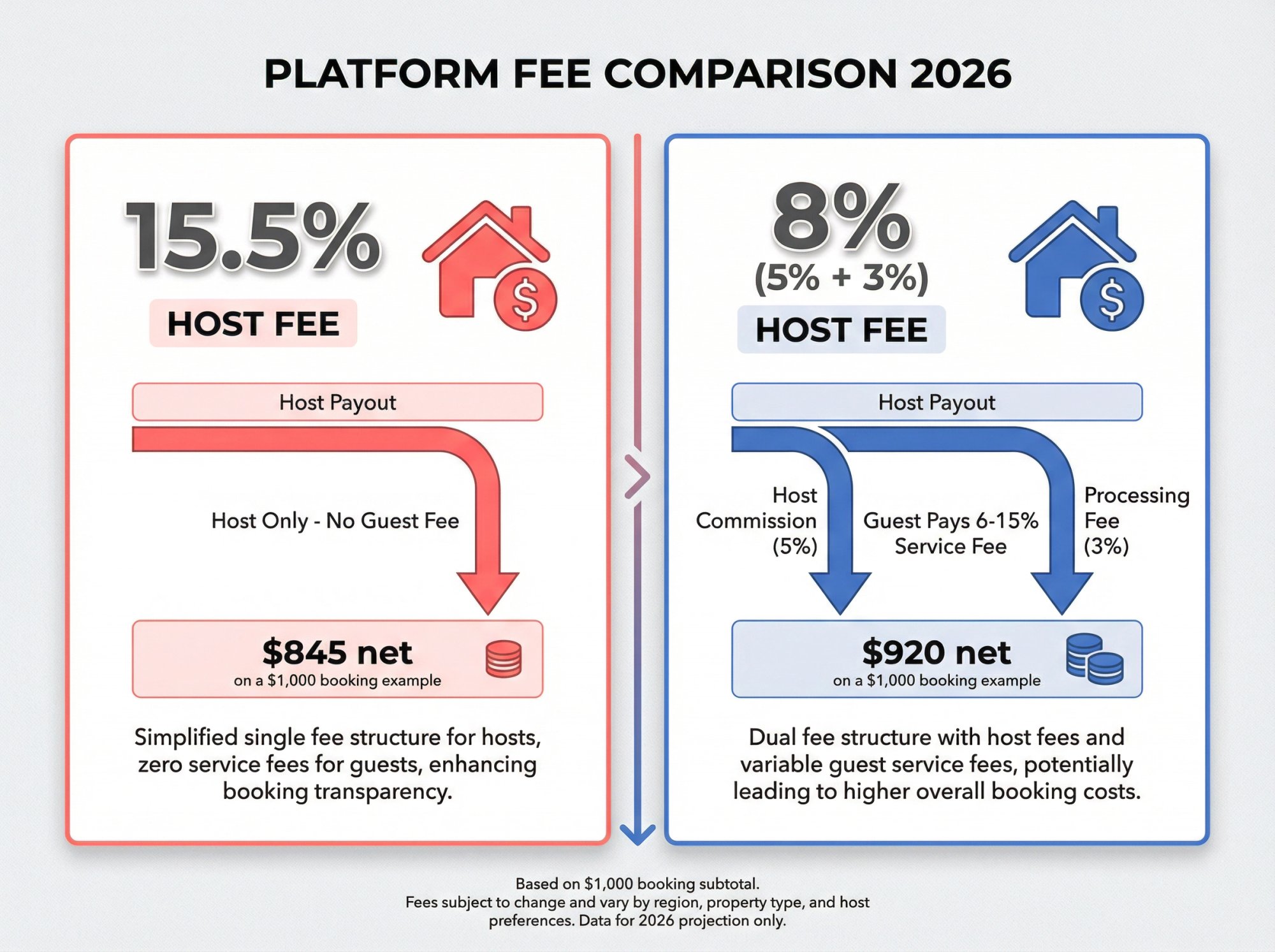

Real Booking Example: $1,000 Stays Compared

| Scenario | Guest Pays Total | Platform Takes From Host | Host Receives Net |

|---|---|---|---|

| Airbnb Split-Fee | $1,150 ($1,000 + ~$150 guest fee) | $30 | $970 |

| Airbnb Host-Only | $1,000 (no guest fee) | $155 | $845 |

| Vrbo Pay-Per-Booking | $1,100 ($1,000 + ~$100 guest fee) | $80 | $920 |

Analysis:

→ From the host's perspective: Vrbo is cheapest ($920 net), then Airbnb split-fee ($970), then Airbnb host-only ($845).

→ From the guest's perspective: Airbnb host-only is cheapest ($1,000), then Vrbo ($1,100), then Airbnb split-fee ($1,150).

→ Total platform take (host + guest fees combined): Airbnb host-only = 15.5%. Vrbo = ~18% (8% host + 10% guest). Airbnb split-fee = ~18% (3% host + 15% guest).

In many cases, Airbnb's new structure is slightly more efficient overall (15.5% vs ~18%), but it shifted the entire burden to hosts. Vrbo's model shares the burden between host and guest.

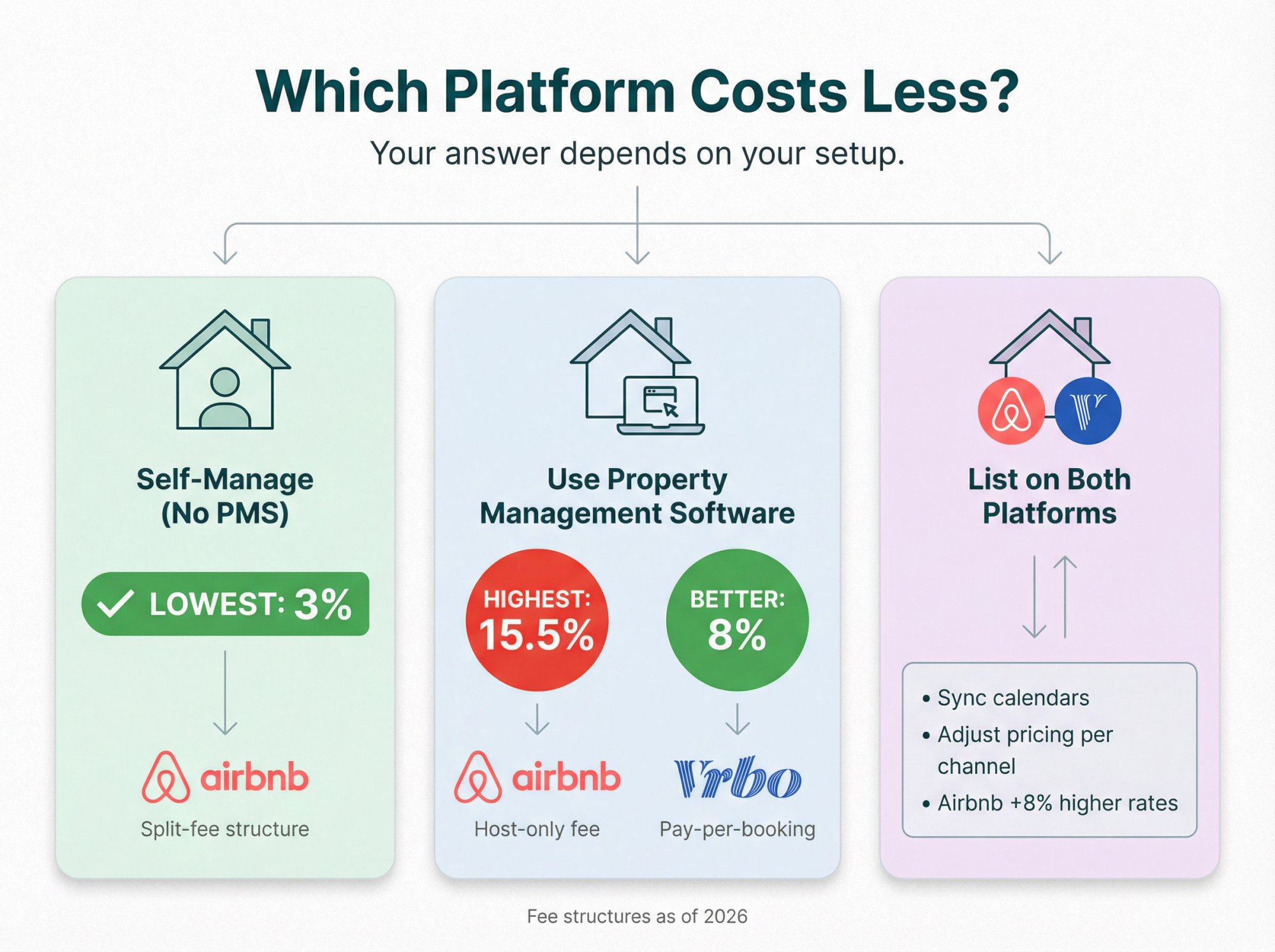

Which Platform Costs More for Hosts?

The "cheapest" platform depends on what you measure and how you operate.

If You Self-Manage Without PMS

You're likely on Airbnb split-fee (3% host). This is clearly the lowest host fee.

But guests see higher total prices on Airbnb due to the 14-16% guest service fee. This could reduce your booking volume compared to identical pricing on other platforms.

If You Use Property Management Software

You're almost certainly on Airbnb host-only (15.5%). This is the highest host fee in the comparison.

Vrbo's 8% pay-per-booking is materially cheaper for you, though guests on Vrbo pay more at checkout.

If You List on Both Airbnb and Vrbo

Many hosts list on both Airbnb and Vrbo to maximize exposure. If you do this:

① Synchronize calendars to avoid double bookings (use a channel manager or software).

② Adjust pricing per channel to account for fee differences. You might:

-

Set Airbnb rates 8% higher than Vrbo rates to compensate for the 15.5% cut

-

Or keep base rates identical and accept lower net margins on Airbnb in exchange for higher booking volume

③ Goal: Keep your final payout roughly equal regardless of where the booking originates, while staying competitive for guests on each site.

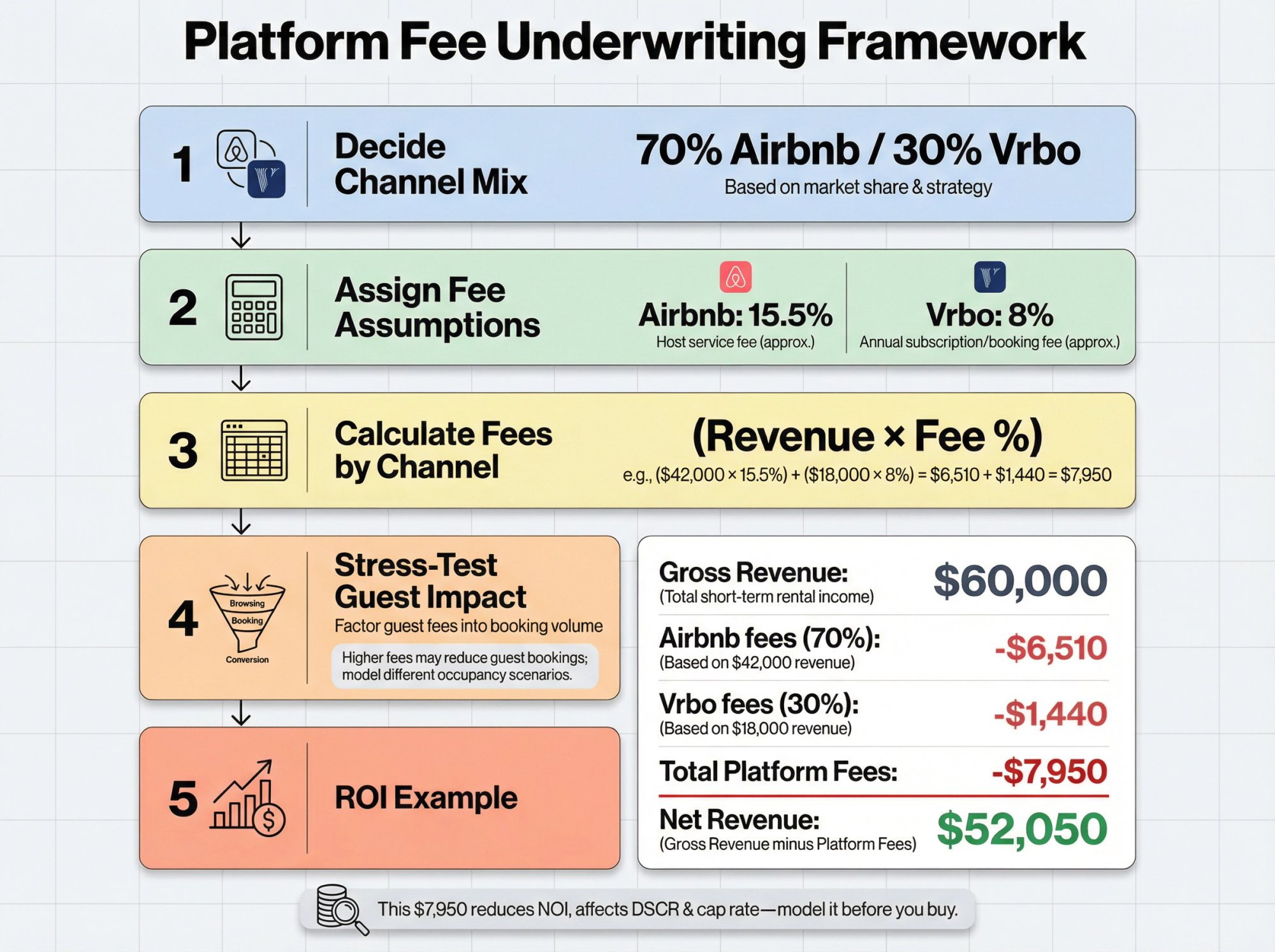

How to Model Platform Fees in STR Underwriting

If you're buying a short-term rental property, don't guess your platform fee impact. Build it directly into your pro forma.

① Decide Your Expected Channel Mix

Example:

-

70% Airbnb

-

30% Vrbo

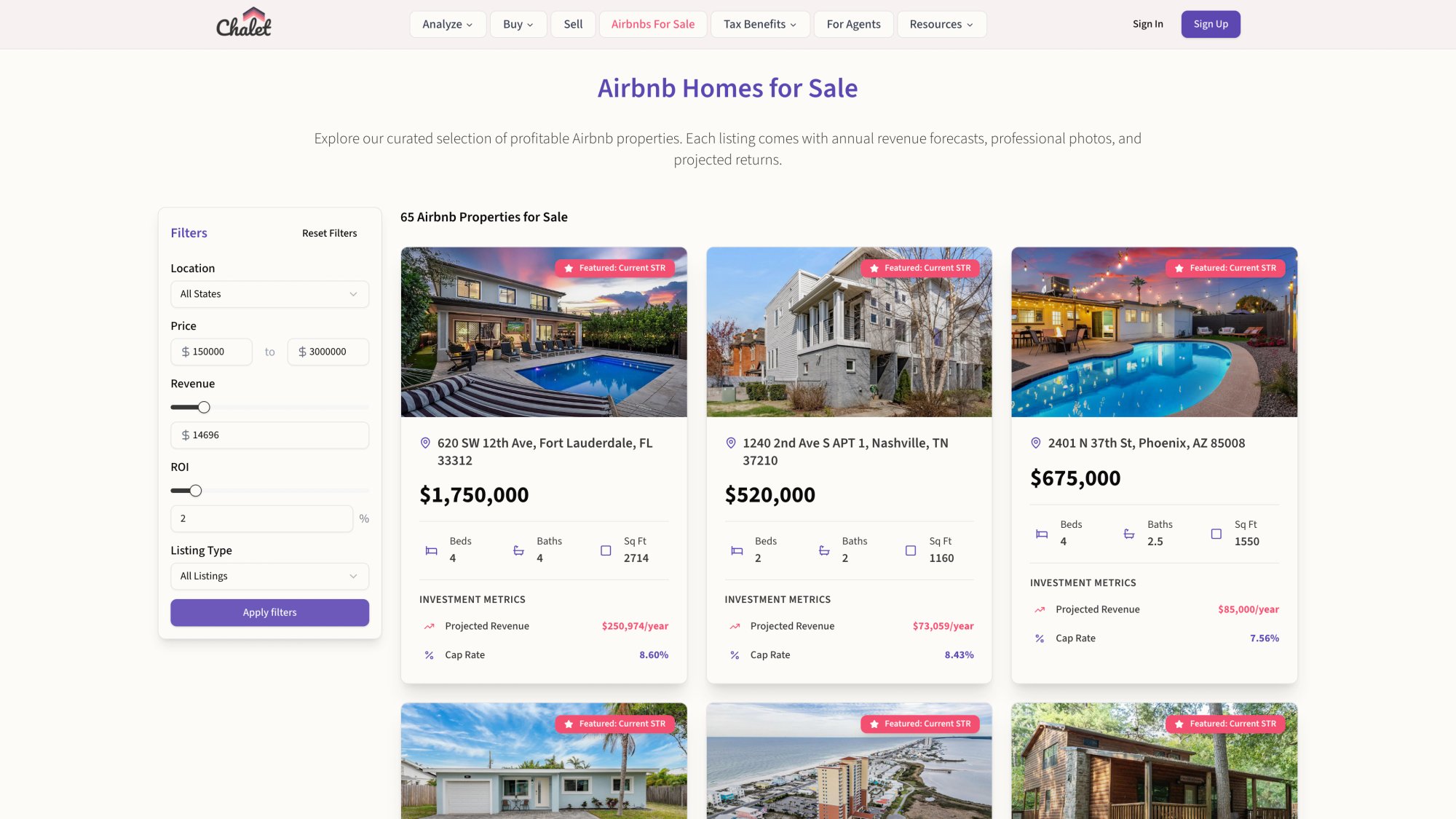

If you don't know, start with 80/20 Airbnb-dominant and stress-test. Use Chalet's market analytics to see which platform dominates in your target market.

② Assign Fee Assumptions Based on Operating Plan

-

Self-manage, no PMS: Assume Airbnb split-fee (3%) if you qualify.

-

Using a manager or PMS: Assume Airbnb host-only (15.5%).

-

Vrbo: Assume 8% host-side (5% + 3%) unless your PMS agreement or region changes it.

③ Calculate Platform Fees as % of Gross Booking Subtotal

Simple version:

Platform fees = (Airbnb channel revenue × Airbnb host fee %) + (Vrbo channel revenue × Vrbo host fee %)

Don't forget: Vrbo's processing fee includes taxes and refundable deposits in its base. If you don't want to model that complexity, be conservative and keep Vrbo at 8% of booking subtotal.

④ Stress-Test Occupancy, Not Just Fee %

Guest fees can reduce conversion. Airbnb split-fee adds 14.1% to 16.5% on top of your subtotal. Vrbo's guest service fee also adds ~10% at checkout.

When you run market comps, compare guest total price (what they actually pay), not just nightly rate. Use Chalet's free market analytics to see what guests are really paying across channels in your target market.

⑤ Example: Running ROI with Fees Included

| Component | Value |

|---|---|

| Gross annual rental revenue | $60,000 |

| Channel mix | 70% Airbnb / 30% Vrbo |

| Airbnb revenue @ 15.5% | $42,000 → $6,510 in fees |

| Vrbo revenue @ 8% | $18,000 → $1,440 in fees |

| Total platform fees | $7,950/year |

| Net revenue after fees | $52,050 |

This $7,950 is a real operating expense that reduces your NOI. It affects your DSCR, your cap rate, and your cash flow. Model it before you buy.

You can run precise calculations for any property using Chalet's Airbnb ROI calculator, which factors in platform fees, management costs, taxes, and more.

Common Platform Fee Mistakes to Avoid

These are the mistakes that make investors think "the platform took way more than I expected."

1. Cleaning Fees Get Hit by Platform Fees

Airbnb: Host fee is a % of nightly + host-charged fees, which includes your cleaning fee.

Vrbo: Commission is charged on rental + additional host fees like cleaning and pet fees.

If you charge a $200 cleaning fee, both platforms take their cut. Don't assume platform fees only apply to nightly rate.

2. Tax Handling Is Different

Vrbo: Processing fee (3%) is charged on the total you receive, including taxes. So if you collect $120 in occupancy tax, Vrbo's 3% processing applies to that $120 too.

Airbnb: Fee calculation excludes taxes from the host fee base.

3. PMS Can Flip Your Fee Structure

Airbnb: Split-fee isn't available for most PMS-connected hosts (2025 rollout). Connecting a property manager to your account may automatically move you to host-only 15.5%.

Vrbo: Processing fee may not apply with PMS, but some regions charge 12% to 15% commission instead of 5%.

4. Cross-Currency Bookings Increase Guest Fees on Airbnb

Airbnb notes cross-currency bookings can push guest service fee up to 16.5% of subtotal. This doesn't affect your payout directly, but it increases what international guests pay. That can impact booking volume.

5. Distribution Partners Can Change Vrbo Fees

Vrbo explicitly warns that bookings from "expanded distribution partners" may have higher fees. If you're part of Expedia's extended network, verify your actual fee structure in your dashboard.

Should You Choose Airbnb or Vrbo?

When deciding between Airbnb and Vrbo (or using both), consider these factors:

Net Earnings

If you only care about your net and don't mind adjusting prices, you can earn more per booking on Vrbo thanks to the lower host fee.

Luxury and high-rate properties often favor Vrbo's model because the guest fee becomes a smaller percentage on large totals. Meanwhile, the host still only pays ~8%. Airbnb taking 15.5% on a high-dollar reservation feels steep.

Booking Volume & Audience

Airbnb has a larger global user base and now a cleaner pricing display (no add-on fees at checkout). This could lead to higher conversion and more bookings, especially for budget-conscious travelers.

Vrbo's audience skews toward family vacationers, whole-home rentals, and longer stays. Those guests might be more accustomed to service fees.

Depending on your property type and target market, one platform might simply generate more demand even if fees are higher.

Example: A unique city condo might thrive on Airbnb. A large lake house might do equally well on Vrbo despite the guest fee.

Use Chalet's market analytics to see which platform dominates in your specific area before you commit to one channel.

High-Volume Hosts with Legacy Vrbo Subscription

If you're lucky enough to have a legacy Vrbo subscription, evaluate if renewing at $699/year is worth it.

Break-even: If your Vrbo bookings would incur more than $699 in 5% commissions over a year, the subscription pays for itself.

Math: $699 ÷ 0.05 = $13,980. If your Vrbo-driven rental revenue (rent + host fees) exceeds ~$14,000/year, subscription wins.

Keep in mind Vrbo has raised subscription prices over time (from $499 to $699). There's no guarantee this option will remain long-term. Always run the numbers based on your booking history.

Other Fees and Taxes

Neither Airbnb nor Vrbo charges "extra" fees for standard use beyond these commissions, but there are ancillary considerations:

-

VAT: Airbnb's 15.5% service fee may have VAT applied in certain countries (EU, etc.). European hosts might effectively pay 15.5% + VAT. Vrbo's 3% processing fee is also subject to VAT where applicable.

-

Lodging taxes: Both platforms collect lodging taxes from guests in many jurisdictions and remit them automatically. Those taxes aren't commissions, but they increase the guest's total price.

-

Cancellation penalties: If a host must cancel a booking, platforms may impose penalties separate from these service fees.

How Chalet Helps You Maximize Returns Across Channels

Managing platform fees is just one piece of running a profitable STR. At Chalet, we've built a one-stop platform to help investors research, buy, and operate Airbnb rentals with confidence.

Free Market Analytics & ROI Tools

Don't guess whether a market can support your pricing strategy. Use our free Airbnb analytics dashboards to see:

-

Revenue per available rental (RevPAR)

-

How your property type performs

Then model your exact cash flow using the Airbnb ROI & DSCR calculator. Factor in platform fees (Airbnb 15.5%, Vrbo 8%), management costs, cleaning, taxes (everything that affects your net).

Vetted Vendor Network

Once you've found a property, you need execution speed. Chalet connects you with:

-

Airbnb-specialist real estate agents who understand STR markets and can advise on channel mix

-

DSCR lenders who can close in 30 days (critical if you're in a 1031 exchange)

-

STR-focused insurance, property managers, furnishing services, and more

All vetted, all in one place. No endless Google searches or trial-and-error with vendors who don't understand short-term rentals.

Browse Airbnb Rentals for Sale

Looking for your next investment? See Airbnb properties for sale across markets, filter by ROI, and connect with agents who can help you close.

Transparent, Free Tools

We don't charge for market data or calculators. Chalet earns referral fees when you work with our network vendors. All analytics and tools are 100% free. No paywalls, no subscriptions, no upsells.

FAQ: Airbnb vs Vrbo Host Fees

Does Airbnb "always" charge hosts 3%?

No. Airbnb says "most hosts pay a 3% service fee" under split-fee, but there are exceptions. PMS-connected hosts and hospitality listings often move to host-only (15.5%).

Is Airbnb's 15.5% host-only fee optional?

Often no, especially if you use property management software or run hospitality-style listings. Airbnb mandated host-only for traditional hospitality listings and most PMS-connected hosts as of late 2025.

Does Vrbo charge hosts 8% on every booking?

For standard pay-per-booking in most cases, yes (5% commission + 3% processing). But the bases matter (processing includes taxes and refundable deposits). PMS connections or certain regions can change what applies.

Can I waive Vrbo's guest service fee to close more bookings?

No. Vrbo says hosts cannot waive or reduce the service fee. It's included in the upfront total shown to travelers.

Is Vrbo subscription still available?

For legacy partners who already have it, yes. For new partners, Vrbo says pay-per-subscription is no longer available.

Which platform is better for luxury properties?

It depends. Vrbo's lower host fee (8% vs 15.5%) can mean better margins for high-dollar properties. But Airbnb's larger audience and zero guest fees might drive more bookings. Test both and measure actual conversion using Chalet's market data.

Should I adjust my nightly rates differently on each platform?

Yes, if you want to maintain consistent net payouts. Many hosts price Airbnb ~8% higher than Vrbo to offset the 15.5% fee. Use channel-specific pricing in your PMS to automate this.

How do I calculate DSCR with platform fees included?

Net rental income = Gross bookings – Platform fees – Operating expenses. Then DSCR = Net rental income ÷ Annual debt service. Use Chalet's DSCR calculator to model this precisely.

Final Takeaway: Plan for Fees Before You Buy

Both Airbnb and Vrbo provide massive exposure to travelers, but they monetize that exposure differently. As of 2026:

The reality: Airbnb charges hosts 15.5% (if you use PMS or are on host-only) and has eliminated guest fees. Vrbo charges hosts ~8% (5% commission + 3% processing) and still charges guests a variable service fee.

Neither model is "free." Smart investors adapt by:

① Building fees into pro formas. Don't underwrite gross revenue. Underwrite net revenue after platform take. Use tools like Chalet's ROI calculator to model fees before you buy.

② Optimizing pricing. Consider channel-specific rate adjustments to maintain target margins after fees. The goal is competitive guest pricing and healthy net margins. Use pricing data from target markets to stay competitive.

③ Monitoring future changes. The STR industry evolves constantly. Airbnb's fee overhaul was a big change. Vrbo may tweak its structure in response to competition. Stay informed and adjust your strategy accordingly.

Ultimately, neither Airbnb's nor Vrbo's fees are "bad" (they're the cost of accessing millions of travelers). By understanding the true cost of each platform, you can smartly set prices and maximize income across channels.

Next Steps

Ready to put this knowledge into action?

→ Run the numbers: Use our Airbnb ROI & DSCR Calculator to project your rental's cash flow after platform fees, management costs, and more. It's free and helps ensure your deal still works with Airbnb's 15.5% cut.

→ Get expert advice: If you're evaluating where to list or how to invest, connect with an Airbnb-savvy agent through Chalet. Our vetted agents can advise on market-specific trends (like whether local guests favor Airbnb or Vrbo) so you can strategize accordingly.

→ Explore dual-listing tools: Check out our STR resources directory for channel managers and pricing tools. The right software can automate price adjustments between Airbnb and Vrbo, keeping your listings optimized across platforms.

→ Check regulations: Before you commit to any platform or property, verify local STR rules. Use Chalet's rental regulations database to ensure your market allows short-term rentals.

→ Browse properties: See Airbnb rentals for sale across markets and filter by estimated ROI. Connect with local STR-specialist agents to find your next investment property.

→ Consider 1031 exchanges: If you're selling a long-term rental and want to roll gains into an STR property, explore 1031 exchange-friendly markets and connect with exchange-savvy agents who can execute on tight timelines.

All fee information here is current as of January 2026. Airbnb and Vrbo may update policies. Always verify the latest fee structures in your dashboard before making pricing decisions. By staying informed and proactive, you'll turn fees from a painful cost into a manageable part of your business strategy (keeping more income in your pocket).